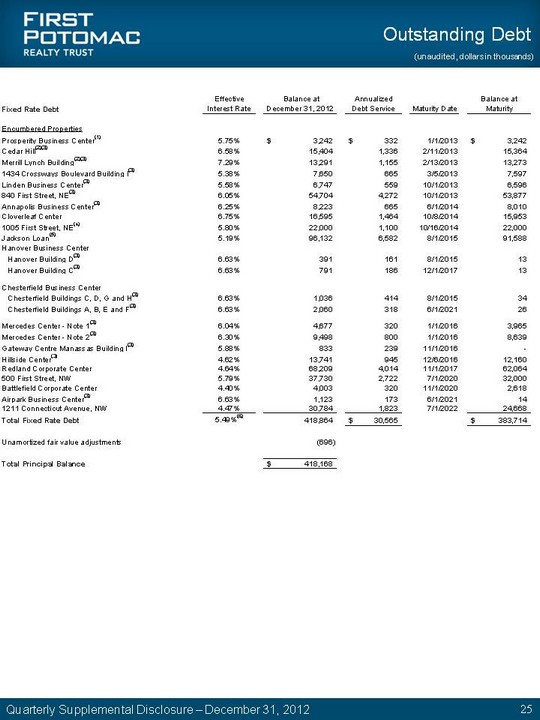

| Outstanding Debt - Continued (unaudited, dollars in thousands) (1)The loan was repaid in January 2013 with borrowings under the Company's unsecured revolving credit facility. (2)On February 7, 2013, the Company entered into a senior secured multi-tranche term loan facility (the "Facility") and borrowed $30.0 million to repay the mortgage loans encumbering Cedar Hill and Merrill Lynch. The Facility has a variable interest rate of LIBOR plus a spread of 2.15% and matures in November 2013, with a three-month extension at the Company's option. (3)The balance includes the fair value impacts recorded at acquisition upon assumption of the mortgages encumbering these properties. (4)The loan incurs interest at a variable rate of LIBOR plus a spread of 2.75% (with a floor of 5.0%) and matures in October 2014, with a one-year extension at the Company's option. (5)At December 31, 2012, the loan was secured by the following properties: Plaza 500, Van Buren Office Park, Rumsey Center, Snowden Center, Greenbrier Technology Center II, Norfolk Business Center, Northridge and 15395 John Marshall Highway. The terms of the loan allow the Company to substitute collateral as long as certain debt-service coverage and loan-to-value ratios are maintained. (6)Represents the weighted average interest rate (7)All of the Company's variable rate debt is based on one-month LIBOR. For the purposes of calculating the annualized debt service and the effective interest rate, the Company used the one-month LIBOR rate at December 31, 2012, which was 0.21%. (8)On January 1, 2013, the loan's applicable interest rate increased to LIBOR plus 5.50%. (9)The unsecured revolving credit facility matures in January 2014 with a one-year extension at the Company's option, which it intends to exercise. (10)As of December 31, 2012, the borrowing base for the Company's unsecured bank debt included the following properties: 13129 Airpark Road, Virginia Center Technology Park, Glenn Dale Business Center, Campus at Metro Park North, Crossways II, Reston Business Campus, Cavalier Industrial Park, Gateway Centre Manassas (Building II), Enterprise Parkway, Diamond Hill Distribution Center, Linden Business Center (Building I), 1000 Lucas Way, River's Bend Center, Crossways I, Sterling Park Business Center, Sterling Park Land, 1408 Stephanie Way, Gateway 270, Gateway II, Greenbrier Circle Corporate Center, Greenbrier Technology Center I, Pine Glen, Ammendale Commerce Center, River's Bend Center II, Park Central, Hanover AB, Herndon Corporate Center, 6900 English Muffin Way, 4451 Georgia Pacific, Patrick Center, West Park, Worman's Mill Court, Girard Business Center, Girard Place, Owings Mills Commerce Center, 4200 Tech Court, Triangle Business Center, Corporate Campus at Ashburn Center, Enterprise Center, Interstate Plaza, 4212 Tech Court, Atlantic Corporate Park, Indian Creek, Greenbrier Towers, 403 & 405 Glenn Drive, 4612 Navistar Drive, Norfolk Commerce Park, Windsor at Battlefield, Davis Drive, Three Flint Hill, 440 First Street, One Fair Oaks, 1434 Crossways Boulevard Building II, Newington Business Park Center and Crossways Commerce Center. (11)At December 31, 2012, the Company had fixed LIBOR on $350.0 million of it variable rate debt through twelve interest rate swap agreements. The effective interest rate reflects the impact of the Company's interest rate swap agreements. (12)During 2012, the Company paid approximately $7.9 million in principal payments on its consolidated mortgage debt, which excludes $126.2 million related to mortgage debt that was repaid in 2012. Quarterly Supplemental Disclosure - December 31, 2012 26 |