|

|

| THIRD QUARTER 2015 |

| SUPPLEMENTAL FINANCIAL INFORMATION |

|

| | |

| FIRST | | |

| POTOMAC | | |

REALTY TRUST | | www.first-potomac.com |

|

| | |

| | Index to Supplemental Information

|

|

| |

| | Page |

Company Information | 2 |

| Earnings Release | 3 |

| Consolidated Statements of Operations | 12 |

| Consolidated Balance Sheets | 14 |

| Same Property Analysis | 15 |

| Highlights | 16 |

| Quarterly Financial Results | 17 |

| Quarterly Supplemental Financial Results | 18 |

| Quarterly Financial Measures | 19 |

| Capitalization and Selected Ratios | 20 |

| Outstanding Debt | 21 |

| Debt Maturity Schedule | 22 |

| Selected Debt Covenants | 23 |

| Net Asset Value Analysis | 24 |

| Investment in Joint Ventures | 25 |

| Portfolio Summary | 26 |

| Leasing and Occupancy Summary | 27 |

| Portfolio by Size | 28 |

| Top Twenty-Five Tenants | 29 |

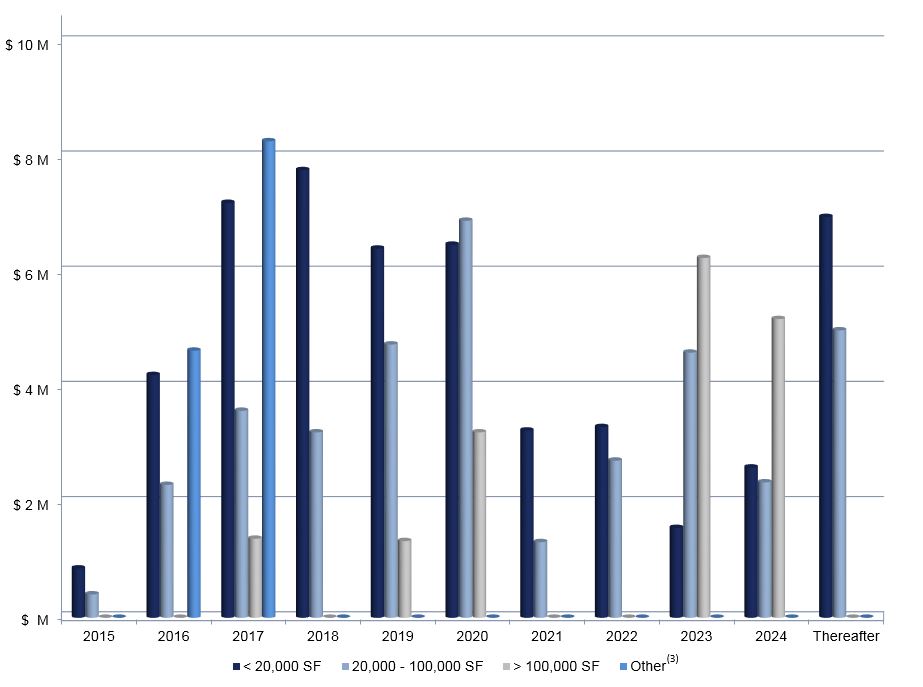

| Annual Lease Expirations | 30 |

| Quarterly Lease Expirations | 31 |

| Leasing Analysis | 32 |

| Retention Summary | 33 |

| Office Properties | 34 |

| Business Park / Industrial Properties | 35 |

| Management Statements on Non-GAAP Supplemental Measures | 36 |

First Potomac Realty Trust is a leader in the ownership, management, development and redevelopment of office and business park properties in the greater Washington, D.C. region. Our focus is on acquiring properties that can benefit from our intensive property management and repositioning properties to increase their profitability and value.

|

| | | |

| Corporate Headquarters | | 7600 Wisconsin Avenue |

| | | 11th Floor |

| | | Bethesda, MD 20814 |

| | | | |

| New York Stock Exchange | | | |

| | |

| | | | |

| Website | | www.first-potomac.com |

| | | | |

| Investor Relations | | Jaime N. Marcus |

| | | Director, Investor Relations |

| | | (240) 223-2735 |

| | | jmarcus@first-potomac.com |

The forward-looking statements contained in this press release, including statements regarding our 2015 Core FFO guidance and related assumptions, potential dispositions and the timing and pricing of such dispositions, future acquisition and growth opportunities and the repurchase of our common shares, are subject to various risks and uncertainties. Although we believe the expectations reflected in such forward-looking statements are based on reasonable assumptions, there can be no assurance that our expectations will be achieved. Certain factors that could cause actual results to differ materially from our expectations include changes in general or regional economic conditions; our ability to timely lease or re-lease space at current or anticipated rents; changes in interest rates; changes in operating costs; our ability to complete acquisitions and dispositions on attractive terms, or at all; our ability to manage our current debt levels and repay or refinance our indebtedness upon maturity or other required payment dates; our ability to maintain financial covenant compliance under our debt agreements; our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures; any impact of the informal inquiry initiated by the SEC; our ability to obtain debt and/or financing on attractive terms, or at all; changes in the assumptions underlying our earnings and Core FFO guidance and other risks detailed in our Annual Report on Form 10-K and described from time to time in our filings with the SEC. Many of these factors are beyond our ability to control or predict. Forward-looking statements are not guarantees of performance. For forward-looking statements herein, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. We assume no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

Note that certain figures are rounded to the nearest thousands or to a tenth of a percent throughout the document, which may impact footing and/or crossfooting of totals and subtotals.

|

| | | | |

| Company Contact: | | | | First Potomac Realty Trust |

| Jaime N. Marcus | | | | 7600 Wisconsin Avenue |

| Director, Investor Relations | | | 11th Floor |

| (301) 986-9200 | | | Bethesda, MD 20814 |

| jmarcus@first-potomac.com | | | | www.first-potomac.com |

FIRST POTOMAC REALTY TRUST REPORTS

THIRD QUARTER 2015 RESULTS

Successfully Executing Strategic Plan to Improve Performance and Enhance Shareholder Value

BETHESDA, MD. (October 29, 2015) - First Potomac Realty Trust (NYSE: FPO), a leader in the ownership, management, development and redevelopment of office and business park properties in the greater Washington, D.C. region, reported results for the three and nine months ended September 30, 2015.

Third Quarter 2015 Highlights

| |

| • | Reported Core Funds From Operations of $15.3 million, or $0.25 per diluted share. |

| |

| • | Increased same property net operating income by 3.1% on an accrual basis and 5.2% on a cash basis compared with the same period in 2014. |

| |

| • | Increased occupied percentage to 89.9% from 87.0% at September 30, 2014, which is the highest level of occupancy achieved since the first quarter of 2006. |

| |

| • | As part of our plan to accelerate the sale of at least $200 million of assets, retained sales brokers to market nine properties in Northern Virginia, as well as Storey Park, a development site in the NoMa sub-market in Washington, D.C., and identified Cedar Hill in Northern Virginia as a disposition candidate. |

| |

| • | As previously disclosed, in July, sold Rumsey Center, a four-building, 135,000 square foot, single-story business park, for net proceeds of $15.0 million, bringing aggregate net proceeds from dispositions in 2015 to $68.7 million, which is in addition to the anticipated sale of at least another $200 million of assets. |

| |

| • | Repurchased 924,198 common shares, at a weighted-average share price of $10.99, utilizing a portion of the proceeds from the sale of Rumsey Center. |

Douglas J. Donatelli, Chief Executive Officer of First Potomac Realty Trust, stated, “During the third quarter, we made significant progress on our strategic initiatives, delivered a solid quarter from an operating perspective, and continued to actively manage our portfolio and balance sheet. We increased our occupancy to nearly 90%, delivered positive net absorption, and had strong same property NOI growth on both a GAAP and cash basis. We also completed the sale of Rumsey Center, and used a portion of the proceeds to fund share repurchases, in addition to engaging sales brokers to market ten properties, as part of our plan to sell at least $200 million of assets. Looking forward, we will remain focused and act with urgency to continue to further improve performance and create long-term value for our shareholders.”

Third Quarter Results

Funds From Operations (“FFO”) available to common shareholders increased to $15.3 million, or $0.25 per diluted share, for the three months ended September 30, 2015, from

|

| | |

| | Earnings Release - Continued |

$14.0 million, or $0.23 per diluted share, as the three months ended September 30, 2014 was adversely impacted by the incurrence of $1.5 million of acquisition costs related to the purchase of 11 Dupont Circle, NW.

Core FFO was relatively flat at $15.3 million, or $0.25 per diluted share, for the three months ended September 30, 2015, compared with $15.4 million, or $0.25 per diluted share, for the same period in 2014. Core FFO for the three months ended September 30, 2015 reflects an increase in interest expense and a reduction in interest and other income compared with the same period in 2014, which was the result of the prepayment of the America’s Square mezzanine loan in the first quarter of 2015. The aggregate increase in interest expense, and decrease in interest and other income, was almost entirely offset by an increase in net operating income during the period.

FFO available to common shareholders and Core FFO increased for the nine months ended September 30, 2015 compared with the same period in 2014. FFO available to common shareholders was $45.6 million, or $0.75 per diluted share, for the nine months ended September 30, 2015, compared with $39.5 million, or $0.65 per diluted share, for the same period in 2014. Core FFO for the nine months ended September 30, 2015 was $44.9 million, or $0.74 per diluted share, compared with $43.3 million, or $0.71 per diluted share, for the same period in 2014. FFO and Core FFO increased for the nine months ended September 30, 2015 compared with the same period in 2014 due to an increase in net operating income, primarily as a result of higher occupancy in our portfolio.

A reconciliation between Core FFO and FFO available to common shareholders for the three and nine months ended September 30, 2015 and 2014 is presented below (in thousands, except per share amounts):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | Amount | | Per diluted share | | Amount | | Per diluted share | | Amount | | Per diluted share | | Amount | | Per diluted share |

| Core FFO | $ | 15,277 |

| | $ | 0.25 |

| | $ | 15,441 |

| | $ | 0.25 |

| | $ | 44,929 |

| | $ | 0.74 |

| | $ | 43,258 |

| | $ | 0.71 |

|

Yield maintenance payment(1) | — |

| | — |

| | — |

| | — |

| | (2,426 | ) | | 0.04 |

| | — |

| | — |

|

| Personnel separation costs | — |

| | — |

| | — |

| | — |

| | 405 |

| | (0.01 | ) | | — |

| | — |

|

| Loss on debt extinguishment | — |

| | — |

| | — |

| | — |

| | 489 |

| | (0.01 | ) | | — |

| | — |

|

Deferred abatement and straight-line amortization(2) | — |

| | — |

| | — |

| | — |

| | 854 |

| | (0.01 | ) | | 1,045 |

| | (0.02 | ) |

| Acquisition costs | — |

| | — |

| | 1,488 |

| | (0.02 | ) | | — |

| | — |

| | 2,667 |

| | (0.04 | ) |

| FFO available to common shareholders | $ | 15,277 |

| | $ | 0.25 |

| | $ | 16,929 |

| | $ | 0.23 |

| | 44,251 |

| | $ | 0.75 |

| | $ | 46,970 |

| | $ | 0.65 |

|

| Net income | $ | 3997 |

| | | | $ | 49 |

| | | | $ | 4,965 |

| | | | $ | 16,941 |

| | |

Net income (loss) attributable to common shareholders per diluted common share(3) | $ | 0.01 |

| | | | $ | (0.05 | ) | | | | $ | (0.07 | ) | | | | $ | 0.12 |

| | |

| |

(1) | On February 24, 2015, the owners of America’s Square, a 461,000 square foot office complex located in Washington, D.C., prepaid a mezzanine loan that had an outstanding balance of $29.7 million, which was scheduled to mature on May 1, 2016. We received a yield maintenance payment of $2.4 million associated with the prepayment of the loan. |

| |

(2) | As a result of the sale of the Richmond portfolio in March 2015, and the sale of Girard Business Center and Gateway Center in January 2014, we accelerated the amortization of straight-line rents and deferred rent abatements related to those properties. |

| |

(3) | Reflects amounts attributable to noncontrolling interests and the impact of dividends on our preferred shares to arrive at net income (loss) attributable to common shareholders. |

|

| | |

| | Earnings Release - Continued |

A reconciliation of net income to FFO available to common shareholders and Core FFO, as well as definitions and statements of purpose, are included below in the financial tables accompanying this press release and under “Non-GAAP Financial Measures,” respectively.

Operating Performance

At September 30, 2015, our consolidated portfolio consisted of 108 buildings totaling 7.8 million square feet. Our consolidated portfolio was 91.0% leased and 89.9% occupied at September 30, 2015, compared with 91.0% leased and 89.1% occupied at June 30, 2015, and 90.6% leased and 87.0% occupied at September 30, 2014. Year-over-year, we achieved a 40 basis-point increase in our leased percentage and a 290 basis-point increase in our occupied percentage across our consolidated portfolio. The increase in occupancy during the third quarter of 2015, compared with the same period in 2014, is primarily a result of the GSA taking occupancy of 82,000 square feet of space in the second quarter of 2015 at Atlantic Corporate Park, a two-building, 219,000 square foot office property located in Sterling, Virginia.

During the third quarter of 2015, we executed 132,000 square feet of leases, which consisted of 71,000 square feet of new leases and 61,000 square feet of renewal leases. New leases executed during the quarter included an office lease totaling 24,000 square feet at Windsor at Battlefield in Northern Virginia, which brought the property to 95.2% leased at September 30, 2015. In addition, new leases executed during the quarter included 18,500 square feet at Greenbrier Towers and Greenbrier Business Park, both located in Southern Virginia. The 61,000 square feet of renewal leases in the quarter reflected a tenant retention rate of 54%, and we experienced positive net absorption of 32,000 square feet in the third quarter of 2015.

For the nine months ended September 30, 2015, we executed 657,000 square feet of leases, including 291,000 square feet of new leases, achieved a tenant retention rate of 55% and had negative net absorption of 45,000 square feet, which was driven by two known move-outs in Northern Virginia in the second quarter that totaled 78,000 square feet.

Same Property Net Operating Income (“Same Property NOI”) increased 3.1% and 4.0% on an accrual basis for the three and nine months ended September 30, 2015, respectively, compared with the same periods in 2014. More specifically, Same Property NOI increased 12.0% in Washington, D.C., 9.0% in Southern Virginia and 0.5% in Northern Virginia for the three months ended September 30, 2015 compared with the same period in 2014. These increases were partially offset by a 2.3% decrease in Same Property NOI in Maryland. The decrease in Same Property NOI for the Maryland region was primarily a result of a decrease in occupancy at Ammendale Business Park.

For the three months ended September 30, 2015, the increase in Same Property NOI was primarily due to increases in occupancy at the following properties: Atlantic Corporate Park, located in Northern Virginia; 1211 Connecticut Avenue, NW, located in Washington, D.C.; TenThreeTwenty, located in Maryland; and Crossways Commerce Center and Greenbrier Business Park, which are both located in Southern Virginia. For the nine months ended September 30, 2015, the increase in Same Property NOI compared with the same period in 2014 was primarily due to increases in occupancy across the portfolio.

|

| | |

| | Earnings Release - Continued |

A reconciliation of net income to Same Property NOI and a definition and statement of purpose are included below in the financial tables accompanying this press release and under “Non-GAAP Financial Measures,” respectively.

A list of our properties, as well as additional information regarding our results of operations, and our definition of “strategic hold,” “value add” and “non-core” as they relate to our portfolio, can be found in our Third Quarter 2015 Supplemental Financial Information Report, which is posted on our website, www.first-potomac.com.

Dispositions

As previously announced, on July 28, 2015, we sold Rumsey Center, a four-building, single-story business park, located in Maryland, totaling 135,000 square feet, for net proceeds of $15.0 million. We utilized a portion of the net proceeds from the sale of Rumsey Center to repurchase our common shares and the remainder to repay a portion of the outstanding balance of our unsecured revolving credit facility.

Consistent with our previously announced plan to accelerate the sale of at least $200 million of assets, we engaged Holiday Fenoglio Fowler, L.P. in September 2015 to market the following assets in Northern Virginia: Newington Business Park Center, Enterprise Center, Gateway Centre Manassas, Herndon Corporate Center, Linden Business Center, Prosperity Business Center, Reston Business Campus, Van Buren Office Park and Windsor at Battlefield. We also engaged Sage Capital Advisors to strategically monetize our majority ownership interest in Storey Park, a development site located in the NoMa sub-market in Washington, D.C. Further, we identified Cedar Hill, a 103,000 square foot office property in Tyson’s Corner, Virginia as a disposition candidate. We are working with JLL to market Cedar Hill, and we have begun the process of identifying potential buyers for the property. We anticipate completing the sale of Cedar Hill in the first quarter of 2016. However, we can provide no assurances regarding the timing or pricing of the sale, or that such sale will ultimately occur.

In September 2015, we entered into a non-binding contract to sell Newington Business Park Center, a seven-building, 256,000 square foot industrial property, located in Northern Virginia. The sale is expected to be completed in the fourth quarter of 2015 or early in the first quarter of 2016. However, we can provide no assurances regarding the timing or pricing of the sale, or that such sale will ultimately occur. At September 30, 2015, we classified Newington Business Park Center as “held-for-sale” on our consolidated balance sheet. The operating results of Newington Business Park Center are reflected in continuing operations in our consolidated statements of operations for each of the periods presented in this press release.

Financing Activity

On July 21, 2015, we prepaid, without penalty, the $64.2 million outstanding balance on our Jackson National Life Loan, which had a fixed interest rate of 5.19%, and was scheduled to mature in August 2015. The loan was secured by the following properties: Plaza 500, Van Buren Office Park, Greenbrier Technology Center II, Norfolk Business Center, Snowden Center and Rumsey Center, which was sold on July 28, 2015. We prepaid the loan with a draw from our unsecured revolving credit facility. The draw from our unsecured revolving credit facility was subsequently paid down when we entered into a $66.8 million mortgage loan, which encumbers our 11 Dupont Circle, NW property, on August 7, 2015. The new loan, which is interest only until September 1, 2025, has a fixed interest rate of 4.05%, matures on September 1, 2030 and is prepayable in full, without penalty, on or after August 8, 2025.

|

| | |

| | Earnings Release - Continued |

On September 1, 2015, we entered into a construction loan that is collateralized by a to-be-constructed 167,000 square foot office building currently in development in Northern Virginia. The building was pre-leased and is expected to be completed in the summer of 2016. The construction loan has a borrowing capacity of up to $43.7 million, of which we have borrowed $9.2 million as of the date of this release. The construction loan has a variable interest rate of LIBOR plus a spread of 1.85% and matures on September 1, 2019. We can repay all or a portion of the construction loan, without penalty, at any time during the term of the loan.

Share Repurchase Program

In July 2015, our Board of Trustees authorized a share repurchase program that allows the Company to acquire up to five million of our common shares in open market transactions at prevailing prices or in negotiated private transactions through July 2016. We are not obligated to acquire a particular amount of common shares and the share repurchase program may be suspended by the Board of Trustees at any time. During the quarter ended September 30, 2015, we repurchased 924,198 shares at a weighted-average share price of $10.99. As of the date of this release, we had 57.8 million common shares outstanding.

Balance Sheet

We had $768.2 million of debt outstanding at September 30, 2015, of which $249.8 million was fixed-rate debt, $300.0 million was hedged variable-rate debt and $218.4 million was unhedged variable-rate debt.

Dividends

On October 27, 2015, we declared a dividend of $0.15 per common share, equating to an annualized dividend of $0.60 per common share. The dividend will be paid on November 16, 2015 to common shareholders of record as of November 9, 2015. We also declared a dividend of $0.484375 per share on our Series A Preferred Shares. The dividend will be paid on November 16, 2015 to preferred shareholders of record as of November 9, 2015.

|

| | |

| | Earnings Release - Continued |

Core FFO Guidance

We are increasing our full-year 2015 Core FFO guidance to $0.95 to $0.99 per diluted share. Our revised guidance reflects all completed share repurchases and capital recycling activities as of the date of this release. The following is a summary of the assumptions that we used in arriving at our guidance (unaudited, amounts in thousands except percentages and per share amounts):

|

| | | | | | | | |

| | | Expected Ranges |

Portfolio NOI(1)(2) | | $ | 107,000 |

| - | $ | 108,500 |

|

Interest and Other Income(3) | | $ | 4,000 |

| - | $ | 4,500 |

|

| FFO from Unconsolidated Joint Ventures | | $ | 5,500 |

| - | $ | 6,000 |

|

| Interest Expense | | $ | 26,500 |

| - | $ | 27,500 |

|

G&A(4) | | $ | 19,500 |

| - | $ | 20,500 |

|

| Preferred Dividends | | $12,400 |

Weighted Average Shares and OP Units(5) | | 60,350 |

| - | 60,850 |

|

Year-End Occupancy | | 90.0 | % | - | 91.0 | % |

Same Property NOI Growth - Accrual Basis(1) | | 2.5 | % | - | 3.5 | % |

| |

(1) | Assumes the Richmond portfolio and Rumsey Center are the only 2015 dispositions. No additional acquisitions or dispositions are assumed in 2015. |

| |

(2) | The range excludes the acceleration of $0.9 million of deferred rent abatements and straight-line rent amortization associated with the Richmond portfolio disposition in March 2015. |

| |

(3) | The range excludes the yield maintenance payment of $2.4 million we received in conjunction with the repayment of the America’s Square mezzanine loan that occurred on February 24, 2015. |

| |

(4) | The range excludes personnel separation costs of $0.4 million that were recorded in the first quarter of 2015. |

| |

(5) | Assumes no additional share repurchases under the share repurchase program other than the 924,198 shares repurchased in the third quarter of 2015. |

Our guidance is also based on a number of other assumptions, many of which are outside our control and all of which are subject to change. We may change our guidance as actual and anticipated results vary from these assumptions.

|

| | | | | | | | |

| Guidance Range for 2015 | | Low Range | | High Range |

| Net loss attributable to common shareholders per diluted share | | $ | (0.08 | ) | | $ | (0.06 | ) |

Real estate depreciation(1) | | 1.06 |

| | 1.07 |

|

Net gain attributable to noncontrolling interests and items excluded from Core FFO per diluted share(2) | | (0.03 | ) | | (0.02 | ) |

| Core FFO per diluted share | | $ | 0.95 |

| | $ | 0.99 |

|

| | | | | |

| |

(1) | Includes our pro-rata share of depreciation from our unconsolidated joint ventures and depreciation related to disposed properties. |

| |

(2) | Items excluded from Core FFO consist of the gains or losses associated with disposed properties, loss on debt extinguishment, personnel separation costs, acceleration of deferred rent abatements and straight-line rent amortization associated with the Richmond portfolio sale and the yield maintenance payment we received in conjunction with the America’s Square mezzanine loan repayment. |

|

| | |

| | Earnings Release - Continued |

Investor Conference Call and Webcast

We will host a conference call on October 30, 2015 at 9:00 AM ET to discuss third quarter 2015 results. The conference call can be accessed by dialing (877) 705-6003 or (201) 493-6725 for international participants. A replay of the call will be available from 12:00 Noon ET on October 30, 2015, until midnight ET on November 6, 2015. The replay can be accessed by dialing (877) 870-5176 or (858) 384-5517 for international callers, and entering pin number 13612957.

A live broadcast of the conference call will also be available online at our website, www.first-potomac.com, on October 30, 2015, beginning at 9:00 AM ET. An online replay will follow shortly after the call and will continue for 90 days.

About First Potomac Realty Trust

First Potomac Realty Trust is a self-administered, self-managed real estate investment trust that focuses on owning, operating, developing and redeveloping office and business park properties in the greater Washington, D.C. region. FPO common shares (NYSE: FPO) and preferred shares (NYSE: FPO-PA) are publicly traded on the New York Stock Exchange. As of September 30, 2015, our consolidated portfolio totaled 7.8 million square feet. Based on annualized cash basis rent, our portfolio consists of 64% office properties and 36% business park and industrial properties. A key element of First Potomac's overarching strategy is its dedication to sustainability. Over one million square feet of First Potomac property is LEED Certified and approximately half of the portfolio's multi-story office square footage is LEED or Energy Star Certified.

Non-GAAP Financial Measures

Funds from Operations - Funds from operations (“FFO”), which is a non-GAAP measure used by many investors and analysts that follow the public real estate industry, represents net income (computed in accordance with U.S. generally accepted accounting principles (“GAAP”)), excluding gains (losses) on sales of rental property and impairments of rental property, plus real estate-related depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures. We also exclude from our FFO calculation, the impact related to third parties from our consolidated joint venture. FFO available to common shareholders is calculated as FFO less accumulated dividends on our preferred shares for the applicable periods presented.

We consider FFO and FFO available to common shareholders useful measures of performance for an equity real estate investment trust (“REIT”) as they facilitate an understanding of the operating performance of our properties without giving effect to real estate depreciation and amortization, which assume that the value of rental property diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, we believe that FFO provides a meaningful indication of our performance. We also consider FFO an appropriate supplemental performance measure given its wide use by investors and analysts. We compute FFO in accordance with standards established by the National Association of Real Estate Investment Trusts (“NAREIT”), which may differ from the methodology for calculating FFO, or similarly title measures, utilized by other equity REITs and, accordingly, may not be comparable to such other REITs. Further, FFO does not represent amounts available for our discretionary use because of needed capital replacement or expansion, debt service obligations or other commitments and

|

| | |

| | Earnings Release - Continued |

uncertainties, nor is it indicative of funds available to fund our cash needs, including our ability to make distributions. Our methodology for computing FFO adds back noncontrolling interests in the income from our Operating Partnership in determining FFO. We believe this is appropriate as common Operating Partnership units are presented on an as-converted, one-for-one basis for shares of stock in determining FFO per diluted share. FFO available to common shareholders is calculated as FFO less accumulated dividends on our preferred shares for all periods presented.

Our presentation of FFO in accordance with the NAREIT’s definition should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity.

Core FFO - We believe that the computation of FFO in accordance with NAREIT’s definition includes certain items that are not indicative of the results provided by our operating portfolio and affect the comparability of our period-over-period performance. These items include, but are not limited to, gains and losses on the retirement of debt, legal costs associated with the informal U.S. Securities and Exchange Commission’s (“SEC”) inquiry, personnel separation costs, contingent consideration charges, acceleration of deferred abatement and straight-line amortization, gains on the receipt of yield maintenance payments from the prepayment of a note receivable and acquisition costs. Core FFO is presented less accumulated dividends on our preferred shares for all the periods presented.

Neither our presentation of FFO in accordance with the NAREIT’s definition, nor our presentation of Core FFO, should be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity. Our FFO and Core FFO calculations are reconciled to net income (loss) in our Consolidated Statements of Operations included in this release.

NOI - We believe net operating income (“NOI”) is a useful measure of our property operating performance. We define NOI as property revenues (rental, and tenant reimbursements and other revenues) less property operating expenses (property operating, and real estate taxes and insurance expenses). Other REITs may use different methodologies for calculating NOI, and accordingly, our NOI may not be comparable to other REITs.

Since NOI excludes general and administrative expenses, interest expense, depreciation and amortization, gains and losses from property dispositions, discontinued operations and extraordinary items, it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating commercial real estate properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing perspective not immediately apparent from net income. We use NOI to evaluate our operating performance since NOI allows us to evaluate the impact that factors such as occupancy levels, lease structure, lease rates and tenant base have on our results, margins and returns. In addition, we believe that NOI provides useful information to the investment community about our property and operating performance when compared to other REITs since NOI is generally recognized as a standard measure of property performance in the real estate industry. However, NOI should not be viewed as a measure of our overall financial performance since it does not reflect general and administrative expenses, interest expense, depreciation and amortization costs, the level

|

| | |

| | Earnings Release - Continued |

of capital expenditures and leasing costs necessary to maintain the operating performance of our properties. Our NOI calculations are reconciled to total revenues and total operating expenses at the end of this release.

Same Property NOI - Same Property Net Operating Income (“Same Property NOI”), defined as property revenues (rental and tenant reimbursements and other revenues) less property operating expenses (real estate taxes, property operating and insurance expenses) from the consolidated properties owned by us and in-service for the entirety of the periods presented, is a primary performance measure we use to assess the results of operations at our properties. Same property NOI is a non-GAAP measure. As an indication of our operating performance, Same Property NOI should not be considered an alternative to net income calculated in accordance with GAAP. A reconciliation of our Same Property NOI to net income from our consolidated statements of operations is presented below. The Same Property NOI results exclude corporate-level expenses, as well as certain transactions, such as the collection of termination fees, as these items vary significantly period-over-period, thus impacting trends and comparability. Also, we eliminate depreciation and amortization expense, which are property level expenses, in computing Same Property NOI as these are non-cash expenses that are based on historical cost accounting assumptions and management believes these expenses do not offer the investor significant insight into the operations of the property. This presentation allows management and investors to determine whether growth or declines in net operating income are a result of increases or decreases in property operations or the acquisition or disposition of additional properties. While this presentation provides useful information to management and investors, the results below should be read in conjunction with the results from the consolidated statements of operations to provide a complete depiction of our total performance.

Forward Looking Statements

The forward-looking statements contained in this press release, including statements regarding our 2015 Core FFO guidance and related assumptions, potential dispositions and the timing and pricing of such dispositions, future acquisition and growth opportunities and the repurchase of our common shares, are subject to various risks and uncertainties. Although we believe the expectations reflected in such forward-looking statements are based on reasonable assumptions, there can be no assurance that our expectations will be achieved. Certain factors that could cause actual results to differ materially from our expectations include changes in general or regional economic conditions; our ability to timely lease or re-lease space at current or anticipated rents; changes in interest rates; changes in operating costs; our ability to complete acquisitions and dispositions on attractive terms, or at all; our ability to manage our current debt levels and repay or refinance our indebtedness upon maturity or other required payment dates; our ability to maintain financial covenant compliance under our debt agreements; our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures; any impact of the informal inquiry initiated by the SEC; our ability to obtain debt and/or financing on attractive terms, or at all; changes in the assumptions underlying our earnings and Core FFO guidance and other risks detailed in our Annual Report on Form 10-K and described from time to time in our filings with the SEC. Many of these factors are beyond our ability to control or predict. Forward-looking statements are not guarantees of performance. For forward-looking statements herein, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. We assume no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

|

| | |

| | Earnings Release - Continued |

Consolidated Statements of Operations

(unaudited, amounts in thousands, except per share amounts)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2014 | | 2014 |

| Revenues: | | | | | | | |

| Rental | $ | 34,828 |

| | $ | 31,915 |

| | $ | 104,051 |

| | $ | 93,967 |

|

| Tenant reimbursements and other | 8,026 |

| | 8,140 |

| | 25,690 |

| | 24,758 |

|

| Total revenues | 42,854 |

| | 40,055 |

| | 129,741 |

| | 118,725 |

|

| Operating expenses: | | | | | | | |

| Property operating | 10,901 |

| | 10,564 |

| | 34,676 |

| | 32,825 |

|

| Real estate taxes and insurance | 4,815 |

| | 4,059 |

| | 14,668 |

| | 12,431 |

|

| General and administrative | 4,605 |

| | 4,955 |

| | 15,110 |

| | 15,370 |

|

| Acquisition costs | — |

| | 1,488 |

| | — |

| | 2,667 |

|

| Depreciation and amortization | 16,758 |

| | 15,217 |

| | 49,909 |

| | 44,357 |

|

| Impairment of rental property | — |

| | — |

| | — |

| | 3,956 |

|

| Total operating expenses | 37,079 |

| | 36,283 |

| | 114,363 |

| | 111,606 |

|

| Operating income | 5,775 |

| | 3,772 |

| | 15,378 |

| | 7,119 |

|

| Other expenses (income): | | | | | | | |

| Interest expense | 6,589 |

| | 6,116 |

| | 20,222 |

| | 17,884 |

|

| Interest and other income | (995 | ) | | (1,684 | ) | | (5,797 | ) | | (5,112 | ) |

| Equity in earnings of affiliates | (432 | ) | | (412 | ) | | (1,235 | ) | | (385 | ) |

| Gain on sale of rental property | (3,384 | ) | | — |

| | (3,384 | ) | | (21,230 | ) |

| Total other expenses (income) | 1,778 |

| | 4,020 |

| | 9,806 |

| | (8,843 | ) |

| Income from continuing operations | 3,997 |

| | (248 | ) | | 5,572 |

| | 15,962 |

|

| Discontinued operations: | | | | | | | |

| Income (loss) from operations | — |

| | 297 |

| | (975 | ) | | (359 | ) |

| Loss on debt extinguishment | — |

| | — |

| | (489 | ) | | — |

|

| Gain on sale of rental property | — |

| | — |

| | 857 |

| | 1,338 |

|

| Income (loss) from discontinued operations | — |

| | 297 |

| | (607 | ) | | 979 |

|

| Net income | 3,997 |

| | 49 |

| | 4,965 |

| | 16,941 |

|

| Less: Net (income) loss attributable to noncontrolling interests | (38 | ) | | 131 |

| | 189 |

| | (327 | ) |

| Net income attributable to First Potomac Realty Trust | 3,959 |

| | 180 |

| | 5,154 |

| | 16,614 |

|

| Less: Dividends on preferred shares | (3,100 | ) | | (3,100 | ) | | (9,300 | ) | | (9,300 | ) |

| Net income (loss) attributable to common shareholders | $ | 859 |

| | $ | (2,920 | ) | | $ | (4,146 | ) | | $ | 7,314 |

|

| Depreciation and amortization: | | | | | | | |

| Rental property | 16,758 |

| | 15,217 |

| | 49,909 |

| | 44,357 |

|

| Discontinued operations | — |

| | 783 |

| | 1,222 |

| | 2,853 |

|

| Unconsolidated joint ventures | 1,006 |

| | 1,004 |

| | 3,049 |

| | 3,307 |

|

| Impairment of rental property | — |

| | — |

| | — |

| | 3,956 |

|

| Gain on sale of rental property | (3,384 | ) | | — |

| | (4,241 | ) | | (22,568 | ) |

| Net income (loss) attributable to noncontrolling interests in the Operating Partnership | 38 |

| | (131 | ) | | (186 | ) | | 327 |

|

| Funds from operations available to common shareholders | $ | 15,277 |

| | $ | 13,953 |

| | $ | 45,607 |

| | $ | 39,546 |

|

|

| | |

| | Earnings Release - Continued |

Consolidated Statements of Operations

(unaudited, amounts in thousands, except per share amounts)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| Funds from operations (FFO) | $ | 18,377 |

| | $ | 17,053 |

| | $ | 54,907 |

| | $ | 48,846 |

|

| Less: Dividends on preferred shares | (3,100 | ) | | (3,100 | ) | | (9,300 | ) | | (9,300 | ) |

| FFO available to common shareholders | 15,277 |

| | 13,953 |

| | 45,607 |

| | 39,546 |

|

| Yield maintenance payment | — |

| | — |

| | (2,426 | ) | | — |

|

| Personnel separation costs | — |

| | — |

| | 405 |

| | — |

|

| Loss on debt extinguishment | — |

| | — |

| | 489 |

| | — |

|

| Deferred abatement and straight-line amortization | — |

| | — |

| | 854 |

| | 1,045 |

|

| Acquisition costs | — |

| | 1,488 |

| | — |

| | 2,667 |

|

| Core FFO | $ | 15,277 |

| | $ | 15,441 |

| | $ | 44,929 |

| | $ | 43,258 |

|

| Basic and diluted earnings per common share: | | | | | | | |

| Income (loss) from continuing operations available to common shareholders | $ | 0.01 |

| | $ | (0.05 | ) | | $ | (0.06 | ) | | $ | 0.10 |

|

| (Loss) income from discontinued operations available to common shareholders | — |

| | — |

| | (0.01 | ) | | 0.02 |

|

| Net income (loss) available to common shareholders | $ | 0.01 |

| | $ | (0.05 | ) | | $ | (0.07 | ) | | $ | 0.12 |

|

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 57,961 |

| | 58,167 |

| | 58,155 |

| | 58,137 |

|

| Diluted | 58,045 |

| | 58,167 |

| | 58,155 |

| | 58,209 |

|

| FFO available to common shareholders per share - basic and diluted | $ | 0.25 |

| | $ | 0.23 |

| | $ | 0.75 |

| | $ | 0.65 |

|

| Core FFO per share - diluted | $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.74 |

| | $ | 0.71 |

|

| Weighted average common shares and units outstanding: | | | | | | | |

| Basic | 60,580 |

| | 60,798 |

| | 60,779 |

| | 60,767 |

|

| Diluted | 60,664 |

| | 60,882 |

| | 60,857 |

| | 60,839 |

|

|

| | |

| | Earnings Release - Continued |

Consolidated Balance Sheets

(Amounts in thousands, except per share amounts)

|

| | | | | | | |

| | September 30, 2015 | | December 31, 2014 |

| | (unaudited) | | |

| Assets: | | | |

| Rental property, net | $ | 1,276,960 |

| | $ | 1,288,873 |

|

| Assets held-for-sale | 12,011 |

| | 59,717 |

|

| Cash and cash equivalents | 12,875 |

| | 13,323 |

|

| Escrows and reserves | 1,699 |

| | 2,986 |

|

| Accounts and other receivables, net of allowance for doubtful accounts of $1,171 and $1,207, respectively | 8,882 |

| | 10,587 |

|

| Accrued straight-line rents, net of allowance for doubtful accounts of $141 and $104, respectively | 40,725 |

| | 34,226 |

|

| Notes receivable, net | 34,000 |

| | 63,679 |

|

| Investment in affiliates | 48,490 |

| | 47,482 |

|

| Deferred costs, net | 45,707 |

| | 43,991 |

|

| Prepaid expenses and other assets | 8,021 |

| | 7,712 |

|

| Intangible assets, net | 37,154 |

| | 45,884 |

|

| Total assets | $ | 1,526,524 |

| | $ | 1,618,460 |

|

| Liabilities: | | | |

| Mortgage and Construction loans | $ | 313,217 |

| | $ | 305,139 |

|

| Unsecured term loan | 300,000 |

| | 300,000 |

|

| Unsecured revolving credit facility | 155,000 |

| | 205,000 |

|

| Liabilities held-for-sale | 227 |

| | 4,562 |

|

| Accounts payable and other liabilities | 39,026 |

| | 41,113 |

|

| Accrued interest | 1,594 |

| | 1,720 |

|

| Rents received in advance | 6,286 |

| | 7,971 |

|

| Tenant security deposits | 5,822 |

| | 5,891 |

|

| Deferred market rent, net | 2,360 |

| | 2,827 |

|

| Total liabilities | 823,532 |

| | 874,223 |

|

| Noncontrolling interests in the Operating Partnership | 30,663 |

| | 33,332 |

|

| Equity: | | | |

| Preferred Shares, $0.001 par value, 50,000 shares authorized; Series A Preferred Shares, $25 liquidation preference, 6,400 shares issued and outstanding | 160,000 |

| | 160,000 |

|

| Common shares, $0.001 par value, 150,000 shares authorized; 57,835 and 58,815 shares issued and outstanding, respectively | 58 |

| | 59 |

|

| Additional paid-in capital | 906,274 |

| | 913,282 |

|

| Noncontrolling interests in a consolidated partnership | 800 |

| | 898 |

|

| Accumulated other comprehensive loss | (4,283 | ) | | (3,268 | ) |

| Dividends in excess of accumulated earnings | (390,520 | ) | | (360,066 | ) |

| Total equity | 672,329 |

| | 710,905 |

|

| Total liabilities, noncontrolling interests and equity | $ | 1,526,524 |

| | $ | 1,618,460 |

|

|

| | |

| | Earnings Release - Continued |

Same Property Analysis

(unaudited, dollars in thousands)

|

| | | | | | | | | | | | | | | |

Same Property NOI(1) | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| Total base rent | $ | 31,946 |

| | $ | 31,019 |

| | $ | 88,307 |

| | $ | 86,132 |

|

| Tenant reimbursements and other revenue | 7,421 |

| | 7,306 |

| | 23,189 |

| | 22,250 |

|

Property operating expense(2) | (9,548 | ) | | (9,521 | ) | | (28,200 | ) | | (27,969 | ) |

| Real estate taxes and insurance expense | (4,135 | ) | | (3,888 | ) | | (11,459 | ) | | (11,328 | ) |

| Same Property NOI - accrual basis | 25,684 |

| | 24,916 |

| | 71,837 |

| | 69,085 |

|

| | | | | | | | |

| Straight-line revenue, net | 47 |

| | (439 | ) | | 58 |

| | (980 | ) |

| Deferred market rental revenue, net | 31 |

| | 14 |

| | (38 | ) | | 2 |

|

| Same Property NOI - cash basis | $ | 25,762 |

| | $ | 24,491 |

| | $ | 71,857 |

| | $ | 68,107 |

|

| | | | | | | | |

| Change in same property NOI - accrual basis | 3.1 | % | | | | 4.0 | % | | |

| Change in same property NOI - cash basis | 5.2 | % | | | | 5.5 | % | | |

| | | | | | | | |

| Same property percentage of total portfolio (sf) | 96.3 | % | | | | 93.1 | % | | |

| | | | | | | | |

| Reconciliation of Consolidated NOI to Same Property NOI | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Total revenues(3) | $ | 42,854 |

| | $ | 40,055 |

| | $ | 129,741 |

| | $ | 118,725 |

|

Property operating expense(3) | (10,901 | ) | | (10,564 | ) | | (34,676 | ) | | (32,825 | ) |

Real estate taxes and insurance expense(3) | (4,815 | ) | | (4,059 | ) | | (14,668 | ) | | (12,431 | ) |

| NOI | 27,138 |

| | 25,432 |

| | 80,397 |

| | 73,469 |

|

| Less: Non-same property NOI | (1,454 | ) | | (516 | ) | | (8,560 | ) | | (4,384 | ) |

| Same Property NOI - accrual basis | $ | 25,684 |

| | $ | 24,916 |

| | $ | 71,837 |

| | $ | 69,085 |

|

| | | | | | | | |

| Change in Same Property NOI (accrual basis) | | | | | | | |

| By Region | Three Months Ended September 30, 2015 | | Percentage of Base Rent | | Nine Months Ended September 30, 2015 | | Percentage of Base Rent |

| Washington, D.C. | 12.0 | % | | 18 | % | | 8.3 | % | | 15 | % |

| Maryland | (2.3 | )% | | 27 | % | | 0.3 | % | | 29 | % |

| Northern Virginia | 0.5 | % | | 36 | % | | 3.7 | % | | 36 | % |

| Southern Virginia | 9.0 | % | | 19 | % | | 6.7 | % | | 20 | % |

| | | | | | | | |

| By Type | | | | | | | |

| Business Park / Industrial | 1.9 | % | | 36 | % | | 2.4 | % | | 38 | % |

| Office | 3.8 | % | | 64 | % | | 5.1 | % | | 62 | % |

| |

(1) | Same property comparisons are based upon those consolidated properties owned and in-service for the entirety of the periods presented. Same property results for the three and nine months ended September 30, 2015 and 2014 exclude the operating results of the following non same-properties that were owned as of September 30, 2015: 440 First Street, NW, Storey Park, and 11 Dupont Circle, NW. Same property results for the nine months ended September 30, 2015 and 2014 also exclude 1401 K Street, NW and 1775 Wiehle Avenue. |

| |

(2) | Same property operating expenses have been adjusted to reflect a normalized management fee in lieu of an administrative overhead allocation for comparative purposes. |

| |

(3) | For a reconciliation of total revenues, property operating expense, and real estate taxes and insurance expense to net income, see the Consolidated Statements of Operations in this release. |

|

| | |

| | Highlights (unaudited, dollars in thousands, except per share data) |

|

| | | | | | | | | | | | | | | | | | | |

| Performance Metrics | Q3-2015 | | Q2-2015 | | Q1-2015 | | Q4-2014 | | Q3-2014 |

FFO available to common shareholders(1) | $ | 15,277 |

| | $ | 15,227 |

| | $ | 15,103 |

| | $ | 16,410 |

| | $ | 13,953 |

|

Core FFO(1) | $ | 15,277 |

| | $ | 15,227 |

| | $ | 14,425 |

| | $ | 16,424 |

| | $ | 15,441 |

|

| FFO available to common shareholders per diluted share | $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.27 |

| | $ | 0.23 |

|

| Core FFO per diluted share | $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.24 |

| | $ | 0.27 |

| | $ | 0.25 |

|

| | | | | | | | | | |

| Operating Metrics | | | | | | | | | |

| Change in Same-Property NOI | | | | | | | | | |

| Accrual Basis | 3.1 | % | | 5.2 | % | | 3.0 | % | | 6.4 | % | | 1.4 | % |

| Cash Basis | 5.2 | % | | 7.0 | % | | 3.9 | % | | 6.8 | % | | 2.3 | % |

| | | | | | | | | | |

| Assets | | | | | | | | | |

| Total Assets | $ | 1,526,524 |

| | $ | 1,537,482 |

| | $ | 1,534,448 |

| | $ | 1,618,460 |

| | $ | 1,628,737 |

|

| | | | | | | | | | |

| Debt Balances | | | | | | | | | |

| Unhedged Variable-Rate Debt | | | | | | | | | |

Hedged Variable-Rate Debt(2) | $ | 218,393 |

| | $ | 206,216 |

| | $ | 197,216 |

| | $ | 259,216 |

| | $ | 258,493 |

|

Fixed-Rate Debt(3) | 300,000 |

| | 300,000 |

| | 300,000 |

| | 300,000 |

| | 300,000 |

|

| Total | 249,824 |

| | 248,366 |

| | 249,650 |

| | 254,421 |

| | 255,929 |

|

| | $ | 768,217 |

| | $ | 754,582 |

| | $ | 746,866 |

| | $ | 813,637 |

| | $ | 814,422 |

|

| Leasing Metrics | | | | | | | | | |

Net Absorption (Square Feet)(4) | 32,133 |

| | (71,390 | ) | | (5,410 | ) | | 91,798 |

| | 107,508 |

|

| Tenant Retention Rate | 54 | % | | 49 | % | | 59 | % | | 70 | % | | 79 | % |

| Leased % | 91.0 | % | | 91.0 | % | | 91.8 | % | | 91.3 | % | | 90.6 | % |

| Occupancy % | 89.9 | % | | 89.1 | % | | 88.0 | % | | 87.9 | % | | 87.0 | % |

| Total New Leases (Square Feet) | 71,000 |

| | 92,000 |

| | 128,000 |

| | 139,000 |

| | 389,000 |

|

| Total Renewal Leases (Square Feet) | 61,000 |

| | 105,000 |

| | 200,000 |

| | 113,000 |

| | 344,000 |

|

| | | | | | | | | | |

| |

(1) | See page 18 for a reconciliation of our net income (loss) attributable to common shareholders to FFO available to common shareholders and Core FFO. |

| |

(2) | As of September 30, 2015, we had fixed LIBOR at a weighted averaged interest rate of 1.5% on $300.0 million of our variable rate debt through eleven interest rate swap agreements. |

| |

(3) | For the three months ended December 31, 2014 and September 30, 2014, we included fixed-rate debt that encumbered properties within the Richmond portfolio, which was sold on March 19, 2015. |

| |

(4) | Net absorption includes adjustments made for pre-leasing, deals signed in advance of existing lease expirations and unforeseen terminations. |

|

| | |

| | Quarterly Financial Results (unaudited, dollars in thousands) |

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | September 30, 2015 | | June 30, 2015 | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 |

| OPERATING REVENUES | | | | | | | | | |

| Rental | $ | 34,828 |

| | $ | 34,844 |

| | $ | 34,379 |

| | $ | 34,260 |

| | $ | 31,915 |

|

| Tenant reimbursements and other | 8,026 |

| | 8,195 |

| | 9,470 |

| | 8,668 |

| | 8,140 |

|

| | 42,854 |

| | 43,039 |

| | 43,849 |

| | 42,928 |

| | 40,055 |

|

| PROPERTY EXPENSES | | | | | | | | | |

| Property operating | 10,901 |

| | 10,661 |

| | 13,113 |

| | 10,427 |

| | 10,564 |

|

| Real estate taxes and insurance | 4,815 |

| | 4,811 |

| | 5,042 |

| | 4,928 |

| | 4,059 |

|

| NET OPERATING INCOME | 27,138 |

| | 27,567 |

| | 25,694 |

| | 27,573 |

| | 25,432 |

|

| OTHER (EXPENSES) INCOME | | | | | | | | | |

| General and administrative | (4,605 | ) | | (4,979 | ) | | (5,526 | ) | | (5,787 | ) | | (4,955 | ) |

| Acquisition costs | — |

| | — |

| | — |

| | (14 | ) | | (1,488 | ) |

| Interest and other income | 995 |

| | 974 |

| | 3,828 |

| | 1,687 |

| | 1,684 |

|

| Equity in earnings of affiliates | 432 |

| | 456 |

| | 346 |

| | 390 |

| | 412 |

|

| EBITDA | 23,960 |

| | 24,018 |

| | 24,342 |

| | 23,849 |

| | 21,085 |

|

Depreciation and amortization(1) | (16,758 | ) | | (16,817 | ) | | (16,335 | ) | | (17,439 | ) | | (15,217 | ) |

| Interest expense | (6,589 | ) | | (6,725 | ) | | (6,908 | ) | | (6,812 | ) | | (6,116 | ) |

Gain on sale of rental property(2) | 3,384 |

| | — |

| | — |

| | — |

| | — |

|

| Income (loss) from continuing operations | 3,997 |

| | 476 |

| | 1,099 |

| | (402 | ) | | (248 | ) |

Discontinued Operations(3) | | | | | | | | | |

| (Loss) income from operations | — |

| | — |

| | (975 | ) | | 505 |

| | 297 |

|

| Loss on debt extinguishment | — |

| | — |

| | (489 | ) | | — |

| | — |

|

| Gain on sale of rental property | — |

| | — |

| | 857 |

| | — |

| | — |

|

| (Loss) income from discontinued operations | — |

| | — |

| | (607 | ) | | 505 |

| | 297 |

|

| NET INCOME | 3,997 |

| | 476 |

| | 492 |

| | 103 |

| | 49 |

|

| Less: Net (income) loss attributable to noncontrolling interests | (38 | ) | | 114 |

| | 112 |

| | 128 |

| | 131 |

|

| NET INCOME ATTRIBUTABLE TO | | | | | | | | | |

| FIRST POTOMAC REALTY TRUST | 3,959 |

| | 590 |

| | 604 |

| | 231 |

| | 180 |

|

| Less: Dividends on preferred shares | (3,100 | ) | | (3,100 | ) | | (3,100 | ) | | (3,100 | ) | | (3,100 | ) |

| NET INCOME (LOSS) ATTRIBUTABLE TO COMMON | | | | | | | | | |

| SHAREHOLDERS | $ | 859 |

| | $ | (2,510 | ) | | $ | (2,496 | ) | | $ | (2,869 | ) | | $ | (2,920 | ) |

| |

(1) | During the fourth quarter of 2014, we accelerated the amortization of lease-level intangible assets and liabilities associated with a tenant at 1401 K Street, NW, who vacated effective January 2015. The accelerated amortization for the three months ended December 31, 2014 resulted in a net increase in depreciation and amortization expense of $0.1 million, which included a $0.6 million decrease in depreciation and amortization related to the aggregate deferred market rent assets and liabilities. |

| |

(2) | For the three months ended September 30, 2015, the gain on sale of rental property related to the sale of Rumsey Center is included within continuing operations as the sale did not qualify to be classified as discontinued operations. |

| |

(3) | All periods presented include the operating results of the Richmond portfolio, which was sold during the first quarter of 2015. The sale of our Richmond portfolio represented a strategic shift away from a geographical market, as we exited the Richmond market, and, therefore, qualified to be classified as discontinued operations. For three months ended March 31, 2015, discontinued operations include a $0.9 million gain on the sale of the Richmond portfolio and $0.5 million of debt extinguishment charges associated with repaying the debt encumbering certain Richmond properties. |

|

| | |

| | Quarterly Supplemental Financial Results (unaudited, dollars in thousands) |

|

| | | | | | | | | | | | | | | | | | | |

| Quarterly Supplemental Financial Results Items: | | | | | | | | | |

| The following items were included in the determination of net income: | | | | |

| | Three Months Ended |

| | September 30, 2015 | | June 30, 2015 | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 |

Supplemental Operating Items(1) | | | | | | | | | |

| Termination fees | $ | 2 |

| | $ | 11 |

| | $ | 42 |

| | $ | 654 |

| | $ | 334 |

|

| Capitalized interest | 471 |

| | 449 |

| | 411 |

| | 481 |

| | 937 |

|

Snow and ice removal costs (excluding reimbursements)(2) | 2 |

| | 26 |

| | (2,028 | ) | | (30 | ) | | 3 |

|

| Reserves for bad debt expense | (131 | ) | | (92 | ) | | (350 | ) | | (245 | ) | | (395 | ) |

| | | | | | | | | | |

Dispositions in Continuing Operations(3) | | | | | | | | | |

| Revenues | $ | 890 |

| | $ | 1,235 |

| | $ | 1,296 |

| | $ | 1,242 |

| | $ | 1,279 |

|

| Operating expenses | (299 | ) | | (418 | ) | | (505 | ) | | (447 | ) | | (529 | ) |

| Depreciation and amortization expense | (98 | ) | | (295 | ) | | (321 | ) | | (400 | ) | | (530 | ) |

| Interest expense, net of interest income | (24 | ) | | (109 | ) | | (110 | ) | | (110 | ) | | (111 | ) |

Gain on sale of rental property(4) | 3,384 |

| | — |

| | — |

| | — |

| | — |

|

| | $ | 3,853 |

| | $ | 413 |

| | $ | 360 |

| | $ | 285 |

| | $ | 109 |

|

| | | | | | | | | | |

Dispositions in Discontinued Operations(5) | | | | | | | | | |

Revenues(6) | $ | — |

| | $ | — |

| | $ | 877 |

| | $ | 1,983 |

| | $ | 1,949 |

|

| Operating expenses | — |

| | — |

| | (638 | ) | | (613 | ) | | (802 | ) |

| Depreciation and amortization expense | — |

| | — |

| | (1,222 | ) | | (809 | ) | | (783 | ) |

| Interest expense, net of interest income | — |

| | — |

| | 8 |

| | (56 | ) | | (67 | ) |

Loss on debt extinguishment(7) | — |

| | — |

| | (489 | ) | | — |

| | — |

|

Gain on sale of rental property(8) | — |

| | — |

| | 857 |

| | — |

| | — |

|

| | $ | — |

| | $ | — |

| | $ | (607 | ) | | $ | 505 |

| | $ | 297 |

|

`

| |

(1) | Includes the operations of properties that were sold or classified as held-for-sale, and did not have their operating results classified as discontinued operations. |

| |

(2) | We recovered approximately 60% to 65% of these costs for the periods presented. |

| |

(3) | Represents the operating results of properties that were sold or classified as held-for-sale, and did not meet the criteria to be classified as discontinued operations. All periods presented include the operating results of Newington Business Park Center, which was classified as held-for-sale at September 30, 2015, and Rumsey Center, which was sold on July 28, 2015. The three months ended December 31, 2014 and September 30, 2014, include the operating results of Owings Mills Business Park, which was sold in October 2014. |

| |

(4) | For the three months ended September 30, 2015, the gain on sale of rental property is related to Rumsey Center. |

| |

(5) | All periods presented include the operating results of the Richmond portfolio, which was sold during the first quarter of 2015. The sale of our Richmond portfolio represented a strategic shift away from a geographical market, as we exited the Richmond market, and, therefore, qualified to be classified as discontinued operations. |

| |

(6) | For the three months ended March 31, 2015, we accelerated $0.9 million of unamortized straight-line rent and deferred abatement costs due to the sale of the Richmond portfolio in March 2015. |

| |

(7) | Reflects costs associated with charges related to our prepayment of mortgage loans in connection with the sale of the Richmond portfolio. |

| |

(8) | For the three months ended March 31, 2015, the gain on sale of rental property is related to the sale of the Richmond portfolio. |

|

| | |

| | Quarterly Financial Measures (unaudited, amounts in thousands, except per share data) |

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| FUNDS FROM OPERATIONS ("FFO") AND CORE FFO | September 30, 2015 | | June 30, 2015 | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 |

| | | | | | | | | | |

| Net income (loss) attributable to common shareholders | $ | 859 |

| | $ | (2,510 | ) | | $ | (2,496 | ) | | $ | (2,869 | ) | | $ | (2,920 | ) |

| Depreciation and amortization: | | | | | | | | | |

Rental property(1) | 16,758 |

| | 16,817 |

| | 16,335 |

| | 17,439 |

| | 15,217 |

|

| Discontinued operations | — |

| | — |

| | 1,222 |

| | 809 |

| | 783 |

|

| Unconsolidated joint ventures | 1,006 |

| | 1,032 |

| | 1,011 |

| | 1,159 |

| | 1,004 |

|

| Gain on sale of rental property | (3,384 | ) | | — |

| | (857 | ) | | — |

| | — |

|

| Net income (loss) attributable to noncontrolling interests in the Operating Partnership | 38 |

| | (112 | ) | | (112 | ) | | (128 | ) | | (131 | ) |

| FFO available to common shareholders | 15,277 |

| | 15,227 |

| | 15,103 |

| | 16,410 |

| | 13,953 |

|

| Dividends on preferred shares | 3,100 |

| | 3,100 |

| | 3,100 |

| | 3,100 |

| | 3,100 |

|

| FFO | $ | 18,377 |

| | $ | 18,327 |

| | $ | 18,203 |

| | $ | 19,883 |

| | $ | 17,053 |

|

| FFO available to common shareholders | 15,277 |

| | 15,227 |

| | 15,103 |

| | 16,410 |

| | 13,953 |

|

Loss on debt extinguishment(2) | — |

| | — |

| | 489 |

| | — |

| | — |

|

Personnel separation costs(3) | — |

| | — |

| | 405 |

| | — |

| | — |

|

Deferred abatement and straight-line amortization(4) | — |

| | — |

| | 854 |

| | — |

| | — |

|

| Acquisition costs | — |

| | — |

| | — |

| | 14 |

| | 1,488 |

|

Yield maintenance payment(5) | — |

| | — |

| | (2,426 | ) | | — |

| | — |

|

| Core FFO | $ | 15,277 |

| | $ | 15,227 |

| | $ | 14,425 |

| | $ | 16,424 |

| | $ | 15,441 |

|

| ADJUSTED FUNDS FROM OPERATIONS ("AFFO") | | | | | | | | | |

| Core FFO | $ | 15,277 |

| | $ | 15,227 |

| | $ | 14,425 |

| | $ | 16,424 |

| | $ | 15,441 |

|

| Non-cash share-based compensation expense | 807 |

| | 830 |

| | 700 |

| | 914 |

| | 1,128 |

|

Straight-line rent, net(6) | (40 | ) | | (154 | ) | | (419 | ) | | (574 | ) | | (258 | ) |

| Deferred market rent, net | 54 |

| | 48 |

| | 30 |

| | 29 |

| | 12 |

|

Non-real estate depreciation and amortization(7) | 364 |

| | 353 |

| | 347 |

| | 331 |

| | 344 |

|

| Debt fair value amortization | (125 | ) | | (128 | ) | | (196 | ) | | (134 | ) | | (140 | ) |

| Amortization of finance costs | 409 |

| | 423 |

| | 359 |

| | 387 |

| | 309 |

|

Tenant improvements(8) | (4,303 | ) | | (2,950 | ) | | (4,795 | ) | | (4,560 | ) | | (2,910 | ) |

Leasing commissions(8) | (871 | ) | | (784 | ) | | (1,312 | ) | | (1,159 | ) | | (990 | ) |

Capital expenditures(8) | (2,140 | ) | | (817 | ) | | (897 | ) | | (2,696 | ) | | (1,842 | ) |

| AFFO | $ | 9,432 |

| | $ | 12,048 |

| | $ | 8,242 |

| | $ | 8,962 |

| | $ | 11,094 |

|

| Total weighted average common shares and OP units: | | | | | | | | | |

| Basic | 60,580 |

| | 60,902 |

| | 60,856 |

| | 60,819 |

| | 60,798 |

|

| Diluted | 60,664 |

| | 60,982 |

| | 60,986 |

| | 60,898 |

| | 60,882 |

|

| FFO available to common shareholders and unitholders per share: | | | | | | | | |

| FFO - basic and diluted | $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.27 |

| | $ | 0.23 |

|

| Core FFO - diluted | $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.24 |

| | $ | 0.27 |

| | $ | 0.25 |

|

| AFFO per share: | | | | | | | | | |

| AFFO - basic and diluted | $ | 0.16 |

| | $ | 0.20 |

| | $ | 0.14 |

| | $ | 0.15 |

| | $ | 0.18 |

|

| |

(1) | During the fourth quarter of 2014, we accelerated the amortization of lease-level intangible assets and liabilities associated with a tenant at 1401 K Street, NW, who vacated effective January 2015. The accelerated amortization for the three months ended December 31, 2014 resulted in a net increase in depreciation and amortization expense of $0.1 million, which included a $0.6 million decrease in depreciation and amortization related to the aggregate deferred market rent assets and liabilities. |

| |

(2) | Reflects costs associated with charges related to our prepayment of mortgage loans in connection with the sale of the Richmond portfolio. |

| |

(3) | During the first quarter of 2015, we recorded $0.4 million of personnel separation costs as a result of moving to a vertically integrated structure with a greater focus on high quality D.C. office properties. |

| |

(4) | During the first quarter of 2015, we accelerated $0.9 million of unamortized straight-line rent and deferred abatement costs due to the sale of the Richmond Portfolio in March 2015. |

| |

(5) | In February 2015, the owners of America's Square prepaid a mezzanine loan that had an outstanding balance of $29.7 million. We received a yield maintenance payment of $2.4 million along with the repayment of the loan. |

| |

(6) | Includes our amortization of the following: straight-line rents and associated uncollectable amounts, rent abatements and lease incentives. |

| |

(7) | Most non-real estate depreciation is classified in general and administrative expense. |

| |

(8) | Does not include first-generation costs, which we define as tenant improvements, leasing commissions and capital expenditure costs that were taken into consideration when underwriting the purchase of a property or incurred to bring the property to operating standard for its intended use. |

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| First-generation costs | September 30, 2015 | | June 30, 2015 | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 |

| Tenant improvements | $ | 4,930 |

| | $ | 2,627 |

| | $ | 9,188 |

| | $ | 3,655 |

| | $ | 1,751 |

|

| Leasing commissions | 234 |

| | 136 |

| | 228 |

| | 1,912 |

| | 373 |

|

| Capital expenditures | 1,021 |

| | 935 |

| | 972 |

| | 2,238 |

| | 2,090 |

|

| Total first-generation costs | 6,185 |

| | 3,698 |

| | 10,388 |

| | 7,805 |

| | 4,214 |

|

| Development and redevelopment | 5,159 |

| | 3,985 |

| | 2,807 |

| | 1,437 |

| | 1,737 |

|

| | $ | 11,344 |

| | $ | 7,683 |

| | $ | 13,195 |

| | $ | 9,242 |

| | $ | 5,951 |

|

|

| | |

| | Capitalization and Selected Ratios (unaudited, amounts in thousands, except per share data, percentages and ratios) |

|

| | | | | | |

| Total Market Capitalization |

| | | | Percent of Total Market Capitalization |

| Common Shares and Units | | | |

| Total common shares outstanding | 57,835 |

| | |

| Operating Partnership ("OP") units held by third parties | 2,619 |

| | |

| Total common shares and OP units outstanding | 60,454 |

| | |

| | | | |

| Market price per share at September 30, 2015 | $ | 11.00 |

| | |

| | | | |

| Market Value of Common Equity | $ | 664,994 |

| | 41.7 | % |

| Preferred Shares | | | |

| Total Series A Preferred Shares outstanding | 6,400 |

| | |

| | | | |

| Market price per share at September 30, 2015 | $ | 25.47 |

| | |

| | | | |

| Market Value of Preferred Equity | $ | 163,008 |

| | 10.1 | % |

| Debt | | | |

| Fixed-rate debt | $ | 249,824 |

| | 15.7 | % |

Hedged variable-rate debt(1) | 300,000 |

| | 18.8 | % |

| Unhedged variable-rate debt | 218,393 |

| | 13.7 | % |

| | | | |

| Total debt | $ | 768,217 |

| | 48.2 | % |

| | | | |

| Total Market Capitalization | $ | 1,596,219 |

| | 100.0 | % |

|

| | | | | | | | | | | | | | | | | | | |

| Selected Ratios |

| | Three Months Ended |

| | | | | | | | | | |

| | September 30, 2015 | | June 30, 2015 | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 |

| COVERAGE RATIOS | | | | | | | | | |

| Interest Coverage Ratio | | | | | | | | | |

EBITDA, excluding acquisition costs(2) | $ | 23,960 |

| | $ | 24,018 |

| | $ | 24,342 |

| | $ | 23,863 |

| | $ | 22,573 |

|

| Interest expense | 6,589 |

| | 6,725 |

| | 6,908 |

| | 6,812 |

| | 6,116 |

|

| | 3.64x |

| | 3.57x |

| | 3.52x |

| | 3.50x |

| | 3.69x |

|

| EBITDA to Fixed Charges | | | | | | | | | |

EBITDA, excluding acquisition costs(2) | $ | 23,960 |

| | $ | 24,018 |

| | $ | 24,342 |

| | $ | 23,863 |

| | $ | 22,573 |

|

Fixed charges(3) | 10,867 |

| | 11,060 |

| | 11,231 |

| | 11,118 |

| | 10,406 |

|

| | 2.20x |

| | 2.17x |

| | 2.17x |

| | 2.15x |

| | 2.17x |

|

| | | | | | | | | | |

| OVERHEAD RATIO | | | | | | | | | |

| G&A to Real Estate Revenues | | | | | | | | | |

General and administrative expense(4) | $ | 4,605 |

| | $ | 4,979 |

| | $ | 5,120 |

| | $ | 5,787 |

| | $ | 4,955 |

|

| Total revenues | 42,854 |

| | 43,039 |

| | 43,849 |

| | 42,928 |

| | 40,055 |

|

| | 10.7 | % | | 11.6 | % | | 11.7 | % | | 13.5 | % | | 12.4 | % |

| | | | | | | | | | |

| LEVERAGE RATIOS | | | | | | | | | |

| | | | | | | | | | |

| Debt/Total Market Capitalization | | | | | | | | | |

| Total debt | $ | 768,217 |

| | $ | 754,582 |

| | $ | 746,866 |

| | $ | 813,637 |

| | $ | 814,422 |

|

| Total market capitalization | 1,596,219 |

| | 1,550,605 |

| | 1,640,573 |

| | 1,738,486 |

| | 1,705,245 |

|

| | 48.1 | % | | 48.7 | % | | 45.5 | % | | 46.8 | % | | 47.8 | % |

| | | | | | | | | | |

| Debt/Undepreciated Book Value | | | | | | | | | |

| Total debt | $ | 768,217 |

| | $ | 754,582 |

| | $ | 746,866 |

| | $ | 814,422 |

| | $ | 814,422 |

|

| Undepreciated book value | 1,515,255 |

| | 1,519,569 |

| | 1,520,263 |

| | 1,504,372 |

| | 1,572,075 |

|

| | 50.7 | % | | 49.7 | % | | 49.1 | % | | 54.1 | % | | 51.8 | % |

| |

(1) | At September 30, 2015, we had fixed LIBOR at a weighted average interest rate of 1.5% on $300.0 million of our variable rate debt through eleven interest rate swap agreements. |

| |

(2) | Acquisition costs were omitted due to their variability, which impacted the comparability of period-over-period results. |

| |

(3) | Fixed charges include interest expense, debt principal amortization and quarterly accumulated dividends on our preferred shares. For the three months ended September 30, 2015, debt principal amortization amounts exclude the repayment of our Jackson National Life Loan, which was prepaid in July 2015. For the three months ended March 31, 2015, debt principal amortization amounts exclude the repayment of mortgage loans that encumbered properties within the Richmond Portfolio, which was sold on March 19, 2015. |

| |

(4) | Excludes personnel separation costs of $0.4 million for the three months ended March 31, 2015, which was the result of moving to a vertically integrated structure with a greater focus on high quality D.C. office properties. |

|

| | |

| | Outstanding Debt (unaudited, dollars in thousands)

|

|

| | | | | | | | | | | | | | | |

| Fixed-Rate Debt | Effective Interest Rate | | Balance at September 30, 2015 | | Annualized Debt Service | | Maturity Date | | Balance at Maturity |

| Encumbered Properties | | | | | | | | | |

Gateway Centre Manassas Building I(1) | 5.88% | | $ | 269 |

| | $ | 239 |

| | 11/1/2016 | | $ | — |

|

Hilside I and II(1) | 4.62% | | 12,644 |

| | 945 |

| | 12/6/2016 | | 12,160 |

|

| Redland Corporate Center Buildings II and III | 4.64% | | 64,866 |

| | 4,014 |

| | 11/1/2017 | | 62,064 |

|

| 840 First Street, NE | 6.01% | | 36,054 |

| | 2,722 |

| | 7/1/2020 | | 32,000 |

|

| Battlefield Corporate Center | 4.40% | | 3,568 |

| | 320 |

| | 11/1/2020 | | 2,618 |

|

| 1211 Connecticut Avenue, NW | 4.47% | | 29,257 |

| | 1,823 |

| | 7/1/2022 | | 24,668 |

|

| 1401 K Street, NW | 4.93% | | 36,386 |

| | 2,392 |

| | 6/1/2023 | | 30,414 |

|

11 Dupont Circle(2) | 4.22% | | 66,780 |

| | 3,849 |

| | 9/1/2030 | | 60,449 |

|

| Total Fixed-Rate Debt | 4.74%(3) | | $ | 249,824 |

| | $ | 16,304 |

| | | | $ | 224,373 |

|

| Unamortized fair value adjustments | | | (221 | ) | | | | | | |

| Total Principal Balance | | | $ | 249,603 |

| | | | | | |

| | | | | | | | | | |

Variable-Rate Debt(4) | | | | | | | | | |

| | | | | | | | | | |

440 First Street, NW Construction Loan(5) | LIBOR + 2.50% | | 32,217 |

| | 867 |

| | 5/30/2016 | | 32,217 |

|

Storey Park Land Loan(6) | LIBOR + 2.50% | | 22,000 |

| | 592 |

| | 10/16/2016 | | 22,000 |

|

Northern Virginia Construction Loan(7) | LIBOR + 1.85% | | 9,176 |

| | 187 |

| | 9/1/2019 | | 9,176 |

|

| Unsecured Revolving Credit Facility | LIBOR + 1.70% | | 155,000 |

| | 2,930 |

| | 10/16/2017 | | 155,000 |

|

| Unsecured Term Loan | | | | | | | | |

|

| Tranche A | LIBOR + 1.65% | | 100,000 |

| | 1,840 |

| | 10/16/2018 | | 100,000 |

|

| Tranche B | LIBOR + 1.80% | | 100,000 |

| | 1,990 |

| | 10/16/2019 | | 100,000 |

|

| Tranche C | LIBOR + 2.05% | | 100,000 |

| | 2,240 |

| | 10/16/2020 | | 100,000 |

|

| Total Unsecured Term Loan | 2.07%(3) | | $ | 300,000 |

| | $ | 6,070 |

| | | | $ | 300,000 |

|

| | | | | | | | | | |

| Total Variable-Rate Debt | 3.08%(3)(8) | | $ | 518,393 |

| | $ | 10,646 |

| | | | $ | 518,393 |

|

| | | | | | | | | | |

| Total Debt at September 30, 2015 | 3.62%(3)(8) | | $ | 768,217 |

| | $ | 26,950 |

| (9) | | | $ | 742,766 |

|

| |

(1) | The balance includes the fair value impacts recorded at acquisition upon assumption of the mortgages encumbering these properties. |

| |

(2) | The loan is interest only until September 1, 2025. |

| |

(3) | Represents the weighted average interest rate. |

| |

(4) | All of our variable rate debt is based on one-month LIBOR. For the purposes of calculating the annualized debt service and the effective interest rate, we used the one-month LIBOR rate at September 30, 2015, which was 0.19%. |

| |