UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21407 |

|

Nuveen Diversified Dividend and Income Fund |

(Exact name of registrant as specified in charter) |

|

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606 |

(Address of principal executive offices) (Zip code) |

|

Kevin J. McCarthy Nuveen Investments 333 West Wacker Drive Chicago, IL 60606 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 917-7700 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2012 | |

| | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO SHAREHOLDERS

Nuveen Investments

Closed-End Funds

Seeks High Current Income and Total Return from a Portfolio of Dividend-Paying

Common Stocks, REIT Stocks, Emerging Markets Debt, and Senior Loans.

Annual Report

December 31, 2012

Nuveen Diversified

Dividend and Income Fund

JDD

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you'll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

Chairman's Letter to Shareholders | | | 4 | | |

Portfolio Managers' Comments | | | 5 | | |

Fund Leverage and Other Information | | | 11 | | |

Common Share Distribution and Price Information | | | 13 | | |

Performance Overview | | | 16 | | |

Report of Independent Registered Public Accounting Firm | | | 17 | | |

Portfolio of Investments | | | 18 | | |

Statement of Assets & Liabilities | | | 33 | | |

Statement of Operations | | | 34 | | |

Statement of Changes in Net Assets | | | 35 | | |

Statement of Cash Flows | | | 36 | | |

Financial Highlights | | | 38 | | |

Notes to Financial Statements | | | 40 | | |

Board Members & Officers | | | 52 | | |

Glossary of Terms Used in this Report | | | 57 | | |

Additional Fund Information | | | 59 | | |

Chairman's

Letter to Shareholders

Dear Shareholders,

Despite the global economy's ability to muddle through the many economic headwinds of 2012, investors continue to have good reasons to remain cautious. The European Central Bank's decisions to extend intermediate term financing to major European banks and to support sovereign debt markets have begun to show signs of a stabilized euro area financial market. The larger member states of the European Union (EU) are working diligently to strengthen the framework for a tighter financial and banking union and meaningful progress has been made by agreeing to centralize large bank regulation under the European Central Bank. However, economic conditions in the southern tier members are not improving and the pressures on their political leadership remain intense. The jury is out on whether the respective populations will support the continuing austerity measures that are needed to meet the EU fiscal targets.

In the U.S., the Fed remains committed to low interest rates into 2015 through its third program of Quantitative Easing (QE3). Inflation remains low but a growing number of economists are expressing concern about the economic distortions resulting from negative real interest rates. The highly partisan atmosphere in Congress led to a disappointingly modest solution for dealing with the end-of-year tax and spending issues. Early indications for the new Congressional term have not given much encouragement that the atmosphere for dealing with the sequestration legislation and the debt ceiling issues, let alone a more encompassing "grand bargain," will be any better than the last Congress. Over the longer term, there are some encouraging trends for the U.S. economy: house prices are beginning to recover, banks and corporations continue to strengthen their financial positions and incentives for capital investment in the U.S. by domestic and foreign corporations are increasing due to more competitive energy and labor costs.

During 2012 U.S. investors have benefited from strong returns in the domestic equity markets and solid returns in most fixed income markets. However, many of the macroeconomic risks of 2012 remain unresolved, including negotiating through the many U.S. fiscal issues, managing the risks of another year of abnormally low U.S. interest rates, sustaining the progress being made in the euro area and reducing the potential economic impact of geopolitical issues, particularly in the Middle East. In the face of these uncertainties, the experienced investment professionals at Nuveen Investments seek out investments that are enjoying positive economic conditions. At the same time they are always on the alert for risks in markets subject to excessive optimism or for opportunities in markets experiencing undue pessimism. Monitoring this process is a critical function for the Fund Board as it oversees your Nuveen Fund on your behalf.

As always, I encourage you to communicate with your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

February 22, 2013

Nuveen Investments

4

Portfolio Managers' Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor's Group, Moody's Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Nuveen Diversified Dividend and Income Fund (JDD)

JDD features portfolio management by teams at four separate sub-advisers. Each sub-adviser has a strategic asset allocation of approximately 25% of the Fund's assets.

NWQ Investment Management Company, LLC, (NWQ), an affiliate of Nuveen Investments, invests its portion of the Fund's assets primarily in dividend-paying common stocks. Jon Bosse, Chief Investment Officer of NWQ, and James Stephenson lead the team.

The real estate portion of the Fund's investment portfolio is managed by a team at Security Capital Research & Management Incorporated (Security Capital), a wholly-owned subsidiary of JPMorgan Chase & Co. Anthony R. Manno Jr., Kenneth D. Statz and Kevin Bedell lead the team.

Symphony Asset Management LLC (Symphony), an affiliate of Nuveen Investments, invests its portion of the Fund's assets primarily in senior loans. The Symphony team is led by Gunther Stein, Symphony's Chief Investment Officer.

Wellington Management Company, LLP, (Wellington Management), invests its portion of the Fund's assets in emerging markets sovereign debt. James W. Valone, CFA, heads the team.

Here representatives from NWQ, Security Capital, Symphony and Wellington Management discuss the general market conditions, their management strategies and the performance of the Fund for the twelve-month period ended December 31, 2012.

What were the general market conditions and trends over the course of this reporting period?

During this period, the U.S. economy's progress toward recovery from recession continued at a moderate pace. The Federal Reserve (Fed) maintained its efforts to improve the overall economic environment by holding the benchmark fed funds rate at the record low level of zero to 0.25% that it established in December 2008. The central bank decided during its December 2012 meeting to keep the fed funds rate at "exceptionally low levels" until either the unemployment rate reaches 6.5% or expected inflation goes above 2.5%. The Fed also affirmed its decision, announced in September 2012, to purchase $40 billion of mortgage-backed securities each month in an effort to stimulate the housing market. In addition to this new, open-ended stimulus program, the Fed plans to continue its program to extend the average maturity of its holdings of U.S. Treasury securities through the end of December 2012. The goals of these actions, which together will increase the Fed's holdings of longer-term securities by approximately $85 billion a month through the end of the year, are to put downward

Nuveen Investments

5

pressure on longer-term interest rates, make broader financial conditions more accommodative and support a stronger economic recovery as well as continued progress toward the Fed's mandates of maximum employment and price stability.

In the fourth quarter 2012, the U.S. economy, as measured by the U.S. gross domestic product (GDP), decreased at an estimated annualized rate of 0.1%, down from a 3.1% increase in the third quarter. This slight decline was due to lower inventory investment, federal spending and net exports. The Consumer Price Index (CPI) rose 1.7% year-over-year as of December 2012, after a 3.0% increase in 2011. The core CPI (which excludes food and energy) increased 1.9% during the period, staying just within the Fed's unofficial objective of 2.0% or lower for this inflation measure. As of January 2013, the national unemployment rate was 7.9%, slightly higher than the 7.8% unemployment rate for December 2012 but below the 8.3% level recorded in January 2012. The housing market continued to show signs of improvement, with the average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rising 5.5% for the twelve months ended November 2012 (most recent data available at the time this report was prepared). This was the largest year-over-year price gain since August 2006. The outlook for the U.S. economy remained clouded by uncertainty about global financial markets and the continued negotiations by Congress regarding potential spending cuts and tax policy reform.

The U.S. equity markets delivered impressive gains in 2012 despite significant market volatility and overarching economic uncertainty brought on by the European credit crisis, combined with the presidential election and its ultimate impact on the fiscal cliff. The government averted the fiscal cliff with a piecemeal measure that leaves the bulk of the issues, particularly structural entitlement reform, to be addressed in the future. Asset flows continued into bonds from equities, and into passive equity strategies away from active managers. The move to fiscal austerity has reduced monetary stimulus globally with no meaningful increase in interest rates or inflationary expectations.

Along with broader U.S. equity markets, Real Estate Investment Trust (REIT) stocks endured a choppy end-of-year, but generated highly attractive returns for 2012 as a whole amidst emerging hopeful signs for a U.S. housing recovery, easing concerns regarding European financial markets and enthusiasm for continuing stimulus by the Fed.

Emerging markets debt proved to be one of the best performing asset classes in 2012 as positive fundamental trends and attractive valuations continued to draw new investors to the market. Credit spread movements were the primary driver of returns. Global risk appetite was positive at the start of 2012 on the back of a pickup in global growth momentum, exceptionally supportive policy settings and easier liquidity and financial conditions. Investor sentiment turned negative after elections stoked fears of a possible Greek exit from the euro zone, concerns renewed about the European banking system and global economic data deteriorated. Investor sentiment improved later in the period as three major central banks: The Fed, European Central Bank and Bank of Japan all provided additional liquidity to the market. Toward the end of the period, international markets turned cautious due to concerns related to the looming U.S. fiscal cliff, however, emerging markets ultimately finished the year on a high note generating positive returns despite macroeconomic uncertainty.

Nuveen Investments

6

Prices in the secondary senior loan market continued to be impacted by supply and demand. Senior loan issuance remained steady throughout the period, as demand remained robust from both retail and institutional investors. Steady demand for loan assets led to positive momentum for the senior loan market throughout the period ended December 31, 2012.

What were the key strategies used to manage the Fund during this reporting period?

The Fund's investment objectives are high current income and total return. In its efforts to achieve these objectives, the Fund invests primarily in 1) U.S. and foreign dividend paying common stocks, 2) dividend paying common stocks issued by real estate companies, 3) emerging markets sovereign debt, and 4) senior secured loans. The Fund expects to invest at least 40%, but no more than 70%, of its assets in equity security holdings and at least 30%, but no more than 60%, of its assets in debt security holdings. Under normal circumstances, the Fund's target weighting is approximately 50% equity and 50% debt.

For the dividend paying equity portion of the Fund's portfolio during this reporting period, managed by NWQ, we continued to employ an opportunistic, bottom-up strategy that focused on identifying undervalued companies possessing favorable risk/reward characteristics as well as emerging catalysts that can unlock value or improve profitability. These catalysts included management changes, restructuring efforts, recognition of hidden assets or a positive change in the underlying fundamentals. We also focused on trying to manage downside risk exposure, and focused on each company's balance sheet and cash flow statement, not just the income statement. We believe that cash flow analysis offers a more objective and truer picture of a company's financial position than an evaluation based on earnings alone.

In managing the real estate portion of the portfolio, Security Capital sought to maintain significant property type and geographic diversification while taking into account company credit quality, sector and security-type allocations. Investment decisions are based on a multi-layered analysis of the company, the real estate it owns, its management and the relative price of the security, with a focus on securities that we believe will be best positioned to generate sustainable income and potential price appreciation over the long-run.

The emerging market debt portion of the Fund is managed by Wellington Management. During the first half of 2012, the portfolio's beta was kept at a slightly defensive to neutral level, balancing our positive outlook and expectations for emerging markets countries with concerns about the broader global environment. During the second half of the year we adopted a modestly pro-risk stance in portfolios, reflecting our positive view of fundamentals and an improving global environment. Throughout the year we remained overweight Latin America, but favored corporate and quasi-sovereign issuers over many sovereigns. Throughout the period we increased our exposure to corporate debt and decreased our exposure to sovereign debt in Latin America. We favored countries such as Brazil, Colombia and Mexico as we believe that these countries were well-positioned to weather weaker growth. We have reduced our overweight to Argentina and moved closer to neutral as fundamentals deteriorate and the risk of technical default

Nuveen Investments

7

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that share-holders may have to pay on Fund distributions or upon the sale of Fund shares.

For additional information, see the Performance Overview for the Fund in this report.

* Since Inception returns are from 9/25/03.

** Refer to Glossary of Terms Used in this Report for definitions. Indexes are not available for direct investment.

has continued to remain relatively high. We remained underweight Central European countries given the risks from Western Europe; however, we have increased our exposure to Hungary and moved to a modest overweight as we expected more progress in negotiations with the European Union. We avoided those Middle Eastern countries still sorting their way through difficult political transitions, such as Egypt, but we continued to hold exposure in Qatar and United Arab Emirates, two high quality countries with attractive valuations. We were willing to accept less liquidity for certain smaller issuers where the fundamentals remain relatively sound, such as Azerbaijan, Ivory Coast and Latvia. We remained underweight in Asia on the basis of tight valuations. During the period, our local interest rate exposure was light and largely concentrated in Latin America and South Africa. We have gradually added to currency exposure, spread across the three main regions, and look for opportunities to take exposure higher, assuming current conditions hold.

In the senior loan and other debt portion of the Fund's portfolio, the Symphony team continued to manage and monitor senior loan market risks. Investors who took credit risk were rewarded during the reporting period. Defaults averaged below 2% for the senior loan market. Any weaknesses were in very specific areas, such as the coal-mining sector. The Fund's capital remained invested in assets offering attractive current income and yield, whose issuers have relatively strong credit profiles among non-investment grade debt.

How did the Fund perform during this twelve-month reporting period ended December 31, 2012?

The performance of the Fund, as well as for a comparative benchmark and index, is presented in the accompanying table.

Average Annual Total Returns on Common Share Net Asset Value

For periods ended 12/31/12

| | 1-Year | | 5-Year | | Since

Inception* | |

JDD | | | 18.45 | % | | | 3.82 | % | | | 7.25 | % | |

Comparative Benchmark** | | | 15.75 | % | | | 7.25 | % | | | 9.42 | % | |

S&P 500® Stock Index** | | | 16.00 | % | | | 1.66 | % | | | 6.00 | % | |

For the twelve-month period ended December 31, 2012 the total return on common share net asset value (NAV) for the Fund outperformed both its comparative benchmark and the general market index.

Within the dividend paying equity portion of the Fund, performance results for the year mostly reflects the strength of holdings in the consumer discretionary, finance and producer staple sectors, partially offset by declines in various positions in the energy and materials (gold mining) sectors. Unprofitable investments in Best Buy and Hewlett-Packard were also detrimental to results, as was the Fund's small exposure to utilities, an area where NWQ found valuations less attractive.

Several investments contributed to the Fund's outperformance, including Citigroup, which appreciated given an attractive valuation and improving fundamentals. The company appointed Michael Corbat as its new CEO during the year and has announced

Nuveen Investments

8

a formal cost cutting initiative of $1.1 billion starting in 2014, which was well received by investors. We believed that U.S. financials were in better shape than skeptics acknowledged given much stronger tangible equity capital ratios and loss reserves built since the credit crisis in 2008.

General Motors appreciated as the government began scaling back its stake in the company, removing a significant overhang on the stock. In December, the U.S. Treasury sold 200 million shares back to the company, and gave indications that it will liquidate its remaining 19% stake in an orderly fashion over the next 12-15 months. We believe the valuation of the stock remains attractive.

Ingersoll Rand Company also contributed to performance. The company performed well during the period given early indications of a cyclical recovery in housing and construction markets after being depressed for the last three years.

Lastly, Wells Fargo & Company increased its dividend and share buyback plans after successfully passing the Federal Reserve's Comprehensive Capital Analysis Review (CCAR). The bank's balance sheet has substantially improved over the past several years, as reflected by increased levels of capital, reserves and liquidity. Settlement with the states' Attorney Generals regarding mortgage foreclosure and servicing practices has also removed an overhang on the stock price.

Several positions detracted from performance, including Hewlett-Packard. While there was an opportunity to create value from the combination of shareholder activism (activist on the board), cost cuts and asset sales, this restructuring opportunity was overwhelmed by weak fundamentals and a major problem/shortfall in profitability in its EDS (electronic data systems) services business. Hewlett Packard was eliminated from the Fund's holdings during the period.

Best Buy Co. declined as margins continued to narrow as the company combated increased competition from online retailers such as Amazon.com. Despite the near-term uncertainty, several bright spots remain, including the appointment of a new CEO, positive traction in a new store prototype and ongoing cost reduction initiatives.

Lastly, our gold mining stocks AngloGold Ashanti and Barrick Gold performed poorly for the period. Gold companies have been negatively impacted by project cost overruns, structural cost inflation, grade degradation and sovereign (host country) renegotiation over the past several years. We believe that much of this has run its course, and while the price of gold has roughly doubled over the past five years, many gold equities are flat or even down over the same period. We believe our holdings have extremely attractive valuations, can meet expectations and have visibility to generate significant cash flow in the intermediate timeframe.

Looking at portfolio additions over the period, the Fund purchased American International Group, Inc., Applied Materials, Capital One Financial and Ericsson. The Fund also eliminated several positions including Genworth Financial, Intersil Corporation, Hewlett-Packard, Canadian Natural Resources Limited, Exxon Mobil, Freeport McMoran Copper & Gold, Goldman Sachs, Lincoln National, Loews Corp., Motorola Solutions and Nielsen Holdings given more attractive investment opportunities.

Nuveen Investments

9

We also wrote (sold) call options on individual stocks, while investing in those same stocks, to enhance returns while foregoing some upside potential. The effect on performance for the period was a very small positive.

In the real estate portion of the Fund managed by Security Capital, the portfolio's industrial, self-storage and lodging equity investments contributed positively to performance. On the negative side, the Fund's performance was held back by equity investments in multi-family, diversified and office investments.

In the emerging markets debt portion of the portfolio managed by Wellington Management, security selection was the main driver of positive performance, though country rotation strategies were also modestly accretive. Among country rotation strategies, a lack of exposure to Lebanon, an underweight to China and an overweight exposure to Ivory Coast contributed to overall performance, while overweight exposure to Indonesia and Chile, as well as an underweight to Croatia detracted. Security selection contributed to total returns during the period. Positioning in Russia, Mexico and Venezuela contributed to overall performance, while security selection in Indonesia, Kazakhstan and Turkey detracted. We also used foreign currency exchange contracts, buying currencies expected to appreciate and selling currencies we expected to depreciate. These contracts had a small positive impact on performance during the period.

The senior loan portion of the Fund managed by Symphony benefited from conditions that were favorable for senior loans, including positive flows and fundamentals. Our positions in U.S. Foodservice and First Data Corp. performed well during the period. Detracting from performance was Frac Tech International, whose natural gas related businesses have been hurt by pricing pressure. Additionally, exposure to Travelport lagged the overall market despite releasing numbers late in the period that were largely ahead of expectations.

Nuveen Investments

10

Fund Leverage

and Other Information

IMPACT OF THE FUND'S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the return of the Fund relative to its benchmarks was the Fund's use of financial leverage through the use of bank borrowings. The Fund uses leverage because its managers believe that, over time, leveraging provides opportunities for additional income and total return for common shareholders. However, use of leverage also can expose common shareholders to additional volatility. For example, as the prices of securities held by the Fund decline, the negative impact of these valuation changes on common share net asset value and common shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance common share returns during periods when the prices of securities held by the Fund generally are rising. Leverage had a positive impact on the performance of the Fund over this reporting period. During the period, the Fund entered into forward starting interest rate swap contracts, which have yet to become effective, in order to hedge future leverage costs. The combination of those forward starting swaps along with the existing interest rate swap contracts that were previously entered into in order to hedge a portion of the Fund's leverage costs partially detracted from the overall positive contribution of leverage. Short-term floating interest rates remained below the existing fixed swap rates for the period which increased realized leverage costs and exceeded the combined positive mark-to-market impact of unrealized gains.

RISK CONSIDERATIONS

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Shares of closed-end funds are subject to investment risks, including the possible loss of principal invested. Past performance is no guarantee of future results. Fund common shares are subject to a variety of risks, including:

Investment, Market and Price Risk. An investment in common shares is subject to investment risk, including the possible loss of the entire principal amount that you invest. Your investment in common shares represents an indirect investment in the corporate securities owned by the Funds, which generally trade in the over-the-counter markets. Shares of closed-end investment companies like the Fund frequently trade at a discount to their net asset value (NAV). Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Leverage Risk. The Fund's use of leverage creates the possibility of higher volatility for the Fund's per share NAV, market price and distributions. Leverage risk can be introduced through regulatory leverage (issuing preferred shares or debt borrowings at the Fund level) or through certain derivative investments held in the Fund's portfolio.

Nuveen Investments

11

Leverage typically magnifies the total return of the Fund's portfolio, whether that return is positive or negative. The use of leverage creates an opportunity for increased common share net income, but there is no assurance that the Fund's leveraging strategy will be successful.

Tax Risk. The tax treatment of Fund distributions may be affected by new IRS interpretations of the Internal Revenue Code and future changes in tax laws and regulations. This is particularly true for funds employing a managed distribution program.

Common Stock Risk. Common stock returns often have experienced significant volatility.

Issuer Credit Risk. This is the risk that a security in the Fund's portfolio will fail to make dividend or interest payments when due.

Illiquid Securities Risk. This is the risk that the Fund may not be able to sell securities in its portfolio at the time or price desired by the Fund.

Below-Investment Grade Risk. Investments in securities below investment grade quality are predominantly speculative and subject to greater volatility and risk of default.

Non-U.S. Securities Risk. Investments in non-U.S securities involve special risks not typi- cally associated with domestic investments including currency risk and adverse political, social and economic development. These risks often are magnified in emerging markets.

Real Estate Risk. The Fund may invest in various types of securities issued by Real Estate Investment Trusts (REITs), linking an investment in the Fund to the performance of the real estate markets.

Derivatives Risk. Derivative securities include, but are not limited to, calls, puts, warrants, swaps and forwards. The Fund's use of derivatives involves risks different from, and possibly greater than, the risks associated with the underlying investments. The derivatives market is largely unregulated.

Unrated Investment Risk. In determining whether an unrated security is an appropriate investment for the Fund, the portfolio manager will consider information from industry sources, as well as its own quantitative and qualitative analysis, in making such a determination. However, such a determination by the portfolio manager is not the equivalent of a rating by a rating agency.

Dividend Income Risk. There is no guarantee that the issuers of common stocks in which the Fund invests will declare dividends in the future or that, if declared, they will remain at current levels or increase over time.

Risks from Unsecured Adjustable Rate Loans or Insufficient Collateral Securing Adjustable Rate Loans. Some of the adjustable rate loans in which the Fund may invest will be unsecured or insufficiently collateralized, thereby increasing the risk of loss to the Fund in the event of issuer default.

Value Stock Risks. Value stocks are securities that the portfolio manager believes to be undervalued, or mispriced. If the manager's assessment of a company's prospects is wrong, the price of the company's common stock or other equity securities may fall, or may not approach the value that the manager has placed on them.

Reinvestment Risk. If market interest rates decline, income earned from the Fund's portfolio may be reinvested at rates below that of the original bond that generated the income.

Nuveen Investments

12

Common Share Distribution

and Price Information

Distribution Information

The following information regarding the Fund's distributions is current as of December 31, 2012, and likely will vary over time based on the Fund's investment activities and portfolio investment value changes.

During the current reporting period, the Fund made no changes to its quarterly distribution to common shareholders. Some of the important factors affecting the amount and composition of these distributions are summarized below.

The Fund employs financial leverage through the use of bank borrowings. Financial leverage provides the potential for higher earnings (net investment income), total returns and distributions over time, but also increases the variability of common shareholders' net asset value per share in response to changing market conditions.

The Fund has a managed distribution program. The goal of this program is to provide common shareholders with relatively consistent and predictable cash flow by systematically converting the Fund's expected long-term return potential into regular distributions. As a result, regular common share distributions throughout the year are likely to include a portion of expected long-term gains (both realized and unrealized), along with net investment income.

Important points to understand about the managed distribution program are:

• The Fund seeks to establish a relatively stable common share distribution rate that roughly corresponds to the projected total return from its investment strategy over an extended period of time. However, you should not draw any conclusions about the Fund's past or future investment performance from its current distribution rate.

• Actual common share returns will differ from projected long-term returns (and therefore the Fund's distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value.

• Each distribution is expected to be paid from some or all of the following sources:

• net investment income (regular interest and dividends),

• realized capital gains, and

• unrealized gains, or, in certain cases, a return of principal (non-taxable distributions).

Nuveen Investments

13

*** The Fund elected to retain a portion of its realized long-term capital gains for the tax years ended December 31, 2007 and December 31, 2006, and pay required federal corporate income taxes on these amounts. As reported on Form 2439, Common shareholders on record date must include their pro-rata share of these gains on their applicable federal tax returns, and are entitled to take offsetting tax credits, for their pro-rata share of the taxes paid by the Fund. The total returns "Including retained gain tax credit/refund" include the economic benefit to Common shareholders on record date of these tax credits/refunds. The Fund had no retained capital gains for the tax years ended December 31, 2012 through December 31, 2008 or for the tax years ended prior to December 31, 2006.

• A non-taxable distribution is a payment of a portion of the Fund's capital. When the Fund's returns exceed distributions, it may represent portfolio gains generated, but not realized as a taxable capital gain. In periods when the Fund's returns fall short of distributions, the shortfall will represent a portion of your original principal, unless the shortfall is offset during other time periods over the life of your investment (previous or subsequent) when the Fund's total return exceeds distributions.

• Because distribution source estimates are updated during the year based on the Fund's performance and forecast for its current fiscal year (which is the calendar year for the Fund), estimates on the nature of your distributions provided at the time the distributions are paid may differ from both the tax information reported to you in your Fund's IRS Form 1099 statement provided at year end, as well as the ultimate economic sources of distributions over the life of your investment.

The following table provides information regarding the Fund's common share distributions and total return performance for the year ended December 31, 2012. This information is intended to help you better understand whether the Fund's returns for the specified time period were sufficient to meet the Fund's distributions.

As of 12/31/12 (Common Shares) | | JDD | |

Inception date | | 9/25/03 | |

Fiscal year (calendar year) ended December 31, 2012: | |

Per share distribution: | |

From net investment income | | $ | 0.96 | | |

From long-term capital gains | | | 0.00 | | |

From short-term capital gains | | | 0.00 | | |

Return of capital | | | 0.04 | | |

Total per share distribution | | $ | 1.00 | | |

Distribution rate on NAV | | | 8.05 | % | |

Average annual total returns: | |

Excluding retained gain tax credit/refund***: | |

| 1-Year on NAV | | | 18.45 | % | |

| 5-Year on NAV | | | 3.82 | % | |

Since inception on NAV | | | 7.25 | % | |

Including retained gain tax credit/refund***: | |

| 1-Year on NAV | | | 18.45 | % | |

| 5-Year on NAV | | | 3.82 | % | |

Since inception on NAV | | | 7.53 | % | |

Nuveen Investments

14

Common Share Repurchases and Price Information

During November 2012, the Nuveen Funds Board of Directors/Trustees reauthorized the Fund's open-market share repurchase program, allowing the Fund to repurchase an aggregate of up to approximately 10% of its outstanding common shares.

As of December 31, 2012, and since the inception of the Fund's repurchase program, the Fund has cumulatively repurchased and retired its common shares as shown in the accompanying table.

| | | Common Shares

Repurchased and Retired | | % of Outstanding

Common Shares | |

JDD | | | 265,122 | | | | 1.3 | % | |

During the current reporting period, the Fund did not repurchase any of its outstanding common shares.

As of December 31, 2012, the Fund's common share price was trading at a discount of -6.68% to its common share NAV, compared with an average discount of -4.03% for the entire twelve-month period.

Nuveen Investments

15

Fund Snapshot

Common Share Price | | $ | 11.60 | | |

Common Share Net Asset Value (NAV) | | $ | 12.43 | | |

Premium/(Discount) to NAV | | | -6.68 | % | |

Current Distribution Rate1 | | | 8.62 | % | |

Net Assets Applicable to

Common Shares ($000) | | $ | 247,826 | | |

Leverage

Regulatory Leverage | | | 30.31 | % | |

Effective Leverage | | | 30.31 | % | |

Portfolio Composition

(as a % of total investments)2,3

Real Estate Investment Trust | | | 26.6 | % | |

Emerging Markets Debt | | | 23.9 | % | |

Pharmaceuticals | | | 6.9 | % | |

Media | | | 5.3 | % | |

Insurance | | | 3.0 | % | |

Health Care Providers & Services | | | 2.8 | % | |

Oil, Gas & Consumable Fuels | | | 2.7 | % | |

Software | | | 2.4 | % | |

Hotels, Restaurants & Leisure | | | 2.1 | % | |

Diversified Financial Services | | | 1.8 | % | |

Food Products | | | 1.6 | % | |

Short-Term Investments | | | 2.0 | % | |

Other | | | 18.9 | % | |

Real Estate Investment Trust

Top Five Sub-Industries

(as a % of total investments)2,3

Retail | | | 5.8 | % | |

Residential | | | 4.9 | % | |

Specialized | | | 4.9 | % | |

Office | | | 4.8 | % | |

Diversified | | | 1.9 | % | |

Emerging Markets Debt

and Foreign Corporate Bonds

Top Five Countries

(as a % of total investments)2,3

Brazil | | | 2.2 | % | |

Russia | | | 2.0 | % | |

Indonesia | | | 1.7 | % | |

Mexico | | | 1.5 | % | |

Turkey | | | 1.2 | % | |

Average Annual Total Returns

(Inception 9/25/03)

| | | On Share Price | | On NAV | |

| 1-Year | | | 22.99 | % | | | 18.45 | % | |

| 5-Year | | | 6.08 | % | | | 3.82 | % | |

Since Inception | | | 6.80 | % | | | 7.25 | % | |

Average Annual Total Return4

(Including retained gain tax credit/refund)

| | | On Share Price | | On NAV | |

| 1-Year | | | 22.99 | % | | | 18.45 | % | |

| 5-Year | | | 6.08 | % | | | 3.82 | % | |

Since Inception | | | 7.08 | % | | | 7.53 | % | |

JDD

Performance

OVERVIEW

Nuveen Diversified Dividend and Income Fund

December 31, 2012

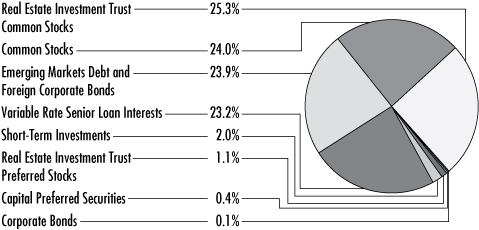

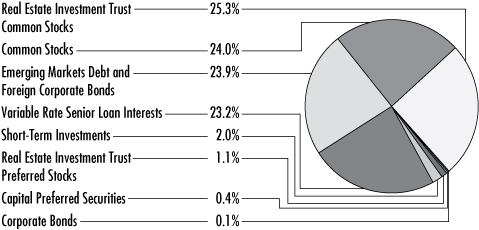

Portfolio Allocation (as a % of total investments)2,3,5

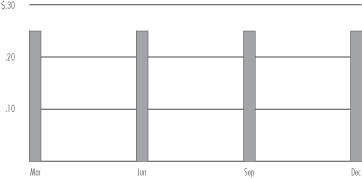

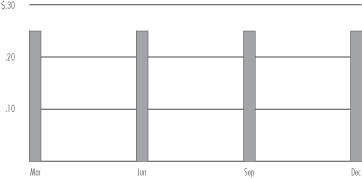

2012 Distributions Per Common Share

Common Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized quarterly distribution divided by the Fund's current market price. REIT distributions received by the Fund are generally comprised of investment income, long-term and short-term capital gains and a REIT return of capital. The Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the investments in Fund's distributions, a return of capital for tax purposes.

2 Excluding investments in derivatives.

3 Holdings are subject to change.

4 As previously explained in the Common Share Distribution and Price Information section of this report, the Fund elected to retain a portion of its realized long-term capital gains for the tax years ended December 31, 2007 and December 31, 2006, and pay required federal corporate income taxes on these amounts. These standardized total returns include the economic benefit to Common shareholders of record of this tax credit/refund. The Fund had no retained capital gains for the tax years ended December 31, 2012 through December 31, 2008, or for the tax years ended prior to December 31, 2006.

5 68.8% of the Fund's total investments (excluding investments in derivatives) are U.S. Securities.

Nuveen Investments

16

Report of INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Trustees and Shareholders

Nuveen Diversified Dividend and Income Fund

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of Nuveen Diversified Dividend and Income Fund (the "Fund") as of December 31, 2012, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund's internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2012, by correspondence with the custodian, counterparty, selling or agent banks, and brokers or by other appropriate auditing procedures where replies from selling or agent banks and brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Nuveen Diversified Dividend and Income Fund at December 31, 2012, and the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Chicago, Illinois

February 27, 2013

Nuveen Investments

17

Nuveen Diversified Dividend and Income Fund

Portfolio of Investments

December 31, 2012

Shares | | Description (1) | | | | | | | | Value | |

| | | | | Common Stocks – 34.6% (24.0% of Total Investments) | | | | | | | | | | | | | | | |

| | | | | Aerospace & Defense – 0.6% | | | | | | | | | | | | | | | |

| | 25,000 | | | | | | | Raytheon Company | | | | | | | | | | | | | | $ | 1,439,000 | | |

| | | | | Automobiles – 0.9% | | | | | | | | | | | | | | | |

| | 77,000 | | | | | | | General Motors Company, (2) | | | | | | | | | | | | | | | 2,219,910 | | |

| | | | | Building Products – 0.5% | | | | | | | | | | | | | | | |

| | 35,400 | | | | | | | Masonite Worldwide Holdings | | | | | | | | | | | | | | | 1,168,200 | | |

| | | | | Chemicals – 0.5% | | | | | | | | | | | | | | | |

| | 23,000 | | | | | | | Mosaic Company | | | | | | | | | | | | | | | 1,302,490 | | |

| | | | | Commercial Banks – 1.3% | | | | | | | | | | | | | | | |

| | 91,800 | | | | | | | Wells Fargo & Company | | | | | | | | | | | | | | | 3,137,724 | | |

| | | | | Communications Equipment – 1.3% | | | | | | | | | | | | | | | |

| | 144,800 | | | | | | | Cisco Systems, Inc. | | | | | | | | | | | | | | | 2,845,320 | | |

| | 44,000 | | | | | | | LM Ericsson Telefonaktiebolaget, Sponsored ADR | | | | | | | | | | | | | | | 444,400 | | |

| | | | | Total Communications Equipment | | | | | | | | | | | | | | | 3,289,720 | | |

| | | | | Consumer Finance – 1.0% | | | | | | | | | | | | | | | |

| | 44,100 | | | | | | | Capital One Financial Corporation | | | | | | | | | | | | | | | 2,554,713 | | |

| | | | | Diversified Financial Services – 2.4% | | | | | | | | | | | | | | | |

| | 78,000 | | | | | | | Citigroup Inc. | | | | | | | | | | | | | | | 3,085,680 | | |

| | 68,000 | | | | | | | JPMorgan Chase & Co. | | | | | | | | | | | | | | | 2,989,960 | | |

| | | | | Total Diversified Financial Services | | | | | | | | | | | | | | | 6,075,640 | | |

| | | | | Diversified Telecommunication Services – 0.3% | | | | | | | | | | | | | | | |

| | 181,200 | | | | | | | Frontier Communications Corporation | | | | | | | | | | | | | | | 775,536 | | |

| | | | | Energy Equipment & Services – 0.4% | | | | | | | | | | | | | | | |

| | 26,500 | | | | | | | Halliburton Company | | | | | | | | | | | | | | | 919,285 | | |

| | | | | Food & Staples Retailing – 1.0% | | | | | | | | | | | | | | | |

| | 50,000 | | | | | | | CVS Caremark Corporation | | | | | | | | | | | | | | | 2,417,500 | | |

| | | | | Industrial Conglomerates – 0.4% | | | | | | | | | | | | | | | |

| | 45,500 | | | | | | | General Electric Company | | | | | | | | | | | | | | | 955,045 | | |

| | | | | Insurance – 4.3% | | | | | | | | | | | | | | | |

| | 88,600 | | | | | | | American International Group, (2) | | | | | | | | | | | | | | | 3,127,580 | | |

| | 120,000 | | | | | | | Hartford Financial Services Group, Inc. | | | | | | | | | | | | | | | 2,692,800 | | |

| | 37,500 | | | | | | | MetLife, Inc. | | | | | | | | | | | | | | | 1,235,250 | | |

| | 63,000 | | | | | | | Symetra Financial Corporation | | | | | | | | | | | | | | | 817,740 | | |

| | 132,500 | | | | | | | Unum Group | | | | | | | | | | | | | | | 2,758,650 | | |

| | | | | Total Insurance | | | | | | | | | | | | | | | 10,632,020 | | |

Nuveen Investments

18

Shares | | Description (1) | | | | | | | | Value | |

| | | | | Machinery – 0.7% | | | | | | | | | | | | | | | |

| | 18,800 | | | | | | | Ingersoll Rand Company Limited, Class A | | | | | | | | | | | | | | $ | 901,648 | | |

| | 17,400 | | | | | | | PACCAR Inc. | | | | | | | | | | | | | | | 786,654 | | |

| | | | | Total Machinery | | | | | | | | | | | | | | | 1,688,302 | | |

| | | | | Media – 3.9% | | | | | | | | | | | | | | | |

| | 147,000 | | | | | | | Interpublic Group Companies, Inc. | | | | | | | | | | | | | | | 1,619,940 | | |

| | 16,393 | | | | | | | Metro-Goldwyn-Mayer, (3) | | | | | | | | | | | | | | | 618,836 | | |

| | 107,600 | | | | | | | National CineMedia, Inc. | | | | | | | | | | | | | | | 1,520,388 | | |

| | 32,400 | | | | | | | News Corporation, Class A | | | | | | | | | | | | | | | 827,496 | | |

| | 50,300 | | | | | | | Time Warner Inc. | | | | | | | | | | | | | | | 2,405,849 | | |

| | 51,000 | | | | | | | Viacom Inc., Class B | | | | | | | | | | | | | | | 2,689,740 | | |

| | | | | Total Media | | | | | | | | | | | | | | | 9,682,249 | | |

| | | | | Metals & Mining – 1.8% | | | | | | | | | | | | | | | |

| | 67,800 | | | | | | | AngloGold Ashanti Limited, Sponsored ADR | | | | | | | | | | | | | | | 2,126,886 | | |

| | 49,500 | | | | | | | Barrick Gold Corporation | | | | | | | | | | | | | | | 1,732,995 | | |

| | 14,600 | | | | | | | Newmont Mining Corporation | | | | | | | | | | | | | | | 678,024 | | |

| | | | | Total Metals & Mining | | | | | | | | | | | | | | | 4,537,905 | | |

| | | | | Oil, Gas & Consumable Fuels – 2.4% | | | | | | | | | | | | | | | |

| | 9,900 | | | | | | | Occidental Petroleum Corporation | | | | | | | | | | | | | | | 758,439 | | |

| | 31,700 | | | | | | | Royal Dutch Shell PLC, Class A | | | | | | | | | | | | | | | 2,185,715 | | |

| | 65,000 | | | | | | | Talisman Energy Inc. | | | | | | | | | | | | | | | 736,450 | | |

| | 43,900 | | | | | | | Total SA, Sponsored ADR | | | | | | | | | | | | | | | 2,283,239 | | |

| | | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 5,963,843 | | |

| | | | | Pharmaceuticals – 6.4% | | | | | | | | | | | | | | | |

| | 69,000 | | | | | | | GlaxoSmithKline PLC, Sponsored ADR | | | | | | | | | | | | | | | 2,999,430 | | |

| | 60,000 | | | | | | | Merck & Company Inc. | | | | | | | | | | | | | | | 2,456,400 | | |

| | 178,100 | | | | | | | Pfizer Inc., (4) | | | | | | | | | | | | | | | 4,466,748 | | |

| | 94,500 | | | | | | | Sanofi-Aventis, ADR | | | | | | | | | | | | | | | 4,477,410 | | |

| | 40,200 | | | | | | | Teva Pharmaceutical Industries Limited, Sponsored ADR | | | | | | | | | | | | | | | 1,501,068 | | |

| | | | | Total Pharmaceuticals | | | | | | | | | | | | | | | 15,901,056 | | |

| | | | | Semiconductors & Equipment – 0.4% | | | | | | | | | | | | | | | |

| | 80,000 | | | | | | | Applied Materials, Inc. | | | | | | | | | | | | | | | 915,200 | | |

| | | | | Software – 2.2% | | | | | | | | | | | | | | | |

| | 142,500 | | | | | | | CA Technologies, Inc. | | | | | | | | | | | | | | | 3,132,150 | | |

| | 83,000 | | | | | | | Microsoft Corporation | | | | | | | | | | | | | | | 2,218,590 | | |

| | | | | Total Software | | | | | | | | | | | | | | | 5,350,740 | | |

| | | | | Specialty Retail – 0.2% | | | | | | | | | | | | | | | |

| | 41,000 | | | | | | | Best Buy Co., Inc. | | | | | | | | | | | | | | | 485,850 | | |

| | | | | Tobacco – 0.8% | | | | | | | | | | | | | | | |

| | 25,000 | | | | | | | Philip Morris International | | | | | | | | | | | | | | | 2,091,000 | | |

| | | | | Wireless Telecommunication Services – 0.9% | | | | | | | | | | | | | | | |

| | 85,000 | | | | | | | Vodafone Group PLC, Sponsored ADR | | | | | | | | | | | | | | | 2,141,150 | | |

| | | | | Total Common Stocks (cost $79,312,486) | | | | | | | | | | | | | | | 85,644,078 | | |

Nuveen Investments

19

Nuveen Diversified Dividend and Income Fund (continued)

Portfolio of Investments December 31, 2012

Shares | | Description (1) | | | | | | | | Value | |

| | | | | Real Estate Investment Trust Common Stocks- 36.4% (25.3% of Total Investments) | | | | | | | | | | | | | | | |

| | | | | Diversified – 2.8% | | | | | | | | | | | | | | | |

| | 154,550 | | | | | | | Colonial Properties Trust | | | | | | | | | | | | | | $ | 3,302,734 | | |

| | 43,750 | | | | | | | Vornado Realty Trust | | | | | | | | | | | | | | | 3,503,500 | | |

| | | | | Total Diversified | | | | | | | | | | | | | | | 6,806,234 | | |

| | | | | Hotels, Restaurants & Leisure – 2.5% | | | | | | | | | | | | | | | |

| | 197,342 | | | | | | | Host Hotels & Resorts Inc. | | | | | | | | | | | | | | | 3,092,349 | | |

| | 53,450 | | | | | | | Starwood Hotels & Resorts Worldwide, Inc. | | | | | | | | | | | | | | | 3,065,892 | | |

| | | | | Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 6,158,241 | | |

| | | | | Industrial – 1.3% | | | | | | | | | | | | | | | |

| | 90,498 | | | | | | | Prologis Inc. | | | | | | | | | | | | | | | 3,302,272 | | |

| | | | | Mortgage – 0.4% | | | | | | | | | | | | | | | |

| | 56,000 | | | | | | | Redwood Trust Inc. | | | | | | | | | | | | | | | 945,840 | | |

| | | | | Office – 6.9% | | | | | | | | | | | | | | | |

| | 194,500 | | | | | | | BioMed Realty Trust Inc. | | | | | | | | | | | | | | | 3,759,685 | | |

| | 31,350 | | | | | | | Boston Properties, Inc. | | | | | | | | | | | | | | | 3,317,144 | | |

| | 130,900 | | | | | | | Douglas Emmett Inc. | | | | | | | | | | | | | | | 3,049,970 | | |

| | 136,500 | | | | | | | Mack-Cali Realty Corporation | | | | | | | | | | | | | | | 3,564,015 | | |

| | 45,900 | | | | | | | SL Green Realty Corporation | | | | | | | | | | | | | | | 3,518,235 | | |

| | | | | Total Office | | | | | | | | | | | | | | | 17,209,049 | | |

| | | | | Residential – 7.1% | | | | | | | | | | | | | | | |

| | 130,876 | | | | | | | Apartment Investment & Management Company, Class A | | | | | | | | | | | | | | | 3,541,505 | | |

| | 45,375 | | | | | | | AvalonBay Communities, Inc. | | | | | | | | | | | | | | | 6,152,396 | | |

| | 84,700 | | | | | | | Equity Residential | | | | | | | | | | | | | | | 4,799,949 | | |

| | 130,850 | | | | | | | UDR Inc. | | | | | | | | | | | | | | | 3,111,613 | | |

| | | | | Total Residential | | | | | | | | | | | | | | | 17,605,463 | | |

| | | | | Retail – 8.4% | | | | | | | | | | | | | | | |

| | 44,560 | | | | | | | General Growth Properties Inc. | | | | | | | | | | | | | | | 884,516 | | |

| | 154,900 | | | | | | | Kimco Realty Corporation | | | | | | | | | | | | | | | 2,992,668 | | |

| | 57,491 | | | | | | | Macerich Company | | | | | | | | | | | | | | | 3,351,725 | | |

| | 74,600 | | | | | | | Regency Centers Corporation | | | | | | | | | | | | | | | 3,515,152 | | |

| | 41,785 | | | | | | | Simon Property Group, Inc. | | | | | | | | | | | | | | | 6,605,791 | | |

| | 129,750 | | | | | | | Weingarten Realty Trust | | | | | | | | | | | | | | | 3,473,407 | | |

| | | | | Total Retail | | | | | | | | | | | | | | | 20,823,259 | | |

| | | | | Specialized – 7.0% | | | | | | | | | | | | | | | |

| | 92,400 | | | | | | | Extra Space Storage Inc. | | | | | | | | | | | | | | | 3,362,436 | | |

| | 79,000 | | | | | | | HCP, Inc. | | | | | | | | | | | | | | | 3,569,220 | | |

| | 58,650 | | | | | | | Health Care REIT, Inc. | | | | | | | | | | | | | | | 3,594,658 | | |

| | 24,324 | | | | | | | Public Storage, Inc. | | | | | | | | | | | | | | | 3,526,007 | | |

| | 52,650 | | | | | | | Ventas Inc. | | | | | | | | | | | | | | | 3,407,508 | | |

| | | | | Total Specialized | | | | | | | | | | | | | | | 17,459,829 | | |

| | | | | Total Real Estate Investment Trust Common Stocks (cost $66,739,849) | | | | | | | | | | | | | | | 90,310,187 | | |

Shares | | Description (1) | | Coupon | | | | | | Value | |

| | | | | Real Estate Investment Trust Preferred Stocks- 1.6% (1.1% of Total Investments) | | | | | | | | | | | | | | | |

| | | | | Residential – 1.6% | | | | | | | | | | | | | | | |

| | 151,450 | | | | | | | Equity Lifestyle Properties Inc. | | | 6.750 | % | | | | | | | | | | $ | 3,884,692 | | |

| | | | | Total Real Estate Investment Trust Preferred Stocks (cost $3,843,751) | | | | | | | | | | | | | | | 3,884,692 | | |

Nuveen Investments

20

Shares | | Description (1) | | Coupon | | | | Ratings (5) | | Value | |

| | | | | Capital Preferred Securities – 0.6% (0.4% of Total Investments) | | | | | | | | | | | | | | | |

| | | | | Food Products – 0.6% | | | | | | | | | | | | | | | |

| | 15 | | | | | | | HJ Heinz Finance Company, 144A | | | 8.000 | % | | | | | | BBB- | | $ | 1,569,375 | | |

| | | | | Total Capital Preferred Securities (cost $1,310,000) | | | | | | | | | | | | | | | 1,569,375 | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity (6) | | Ratings (5) | | Value | |

| | | | | Variable Rate Senior Loan Interests – 33.4% (23.2% of Total Investments) (7) | | | | | | | | | | | | | | | |

| | | | | Aerospace & Defense – 0.2% | | | | | | | | | | | | | | | |

$ | 438 | | | | | | | Hamilton Sundstrand, Term Loan B | | | 5.000 | % | | 12/05/19 | | B+ | | $ | 441,913 | | |

| | | | | Airlines – 0.2% | | | | | | | | | | | | | | | |

| | 500 | | | | | | | Delta Air Lines, Inc., Term Loan B1 | | | 5.250 | % | | 10/18/18 | | Ba2 | | | 504,532 | | |

| | | | | Auto Components – 1.1% | | | | | | | | | | | | | | | |

| | 1,300 | | | | | | | Federal-Mogul Corporation, Tranche B, Term Loan | | | 2.148 | % | | 12/29/14 | | B1 | | | 1,197,153 | | |

| | 663 | | | | | | | Federal-Mogul Corporation, Tranche C, Term Loan | | | 2.148 | % | | 12/28/15 | | B1 | | | 610,792 | | |

| | 1,000 | | | | | | | Goodyear Tire & Rubber Company, Term Loan, Second Lien | | | 4.750 | % | | 4/30/19 | | Ba1 | | | 1,008,500 | | |

| | 2,963 | | | | | | | Total Auto Components | | | | | | | | | | | | | | | 2,816,445 | | |

| | | | | Biotechnology – 0.4% | | | | | | | | | | | | | | | |

| | 884 | | | | | | | Grifols, Inc., Term Loan | | | 4.500 | % | | 6/01/17 | | BB | | | 893,671 | | |

| | | | | Chemicals – 0.8% | | | | | | | | | | | | | | | |

| | 1,011 | | | | | | | Ashland, Inc., Term Loan | | | 3.750 | % | | 8/23/18 | | Baa3 | | | 1,024,545 | | |

| | 980 | | | | | | | Univar, Inc., Term Loan | | | 5.000 | % | | 6/30/17 | | B+ | | | 979,727 | | |

| | 1,991 | | | | | | | Total Chemicals | | | | | | | | | | | | | | | 2,004,272 | | |

| | | | | Commercial Services & Supplies – 0.8% | | | | | | | | | | | | | | | |

| | 1,000 | | | | | | | ADS Waste Holdings, Inc., Term Loan B | | | 5.250 | % | | 10/09/19 | | B+ | | | 1,013,750 | | |

| | 985 | | | | | | | KAR Auction Services, Inc., Term Loan | | | 5.000 | % | | 5/19/17 | | BB- | | | 995,466 | | |

| | 1,985 | | | | | | | Total Commercial Services & Supplies | | | | | | | | | | | | | | | 2,009,216 | | |

| | | | | Communications Equipment – 0.4% | | | | | | | | | | | | | | | |

| | 979 | | | | | | | Avaya, Inc., Term Loan | | | 3.062 | % | | 10/27/14 | | B1 | | | 960,882 | | |

| | | | | Consumer Finance – 0.3% | | | | | | | | | | | | | | | |

| | 750 | | | | | | | Springleaf Financial Funding Company, Term Loan | | | 5.500 | % | | 5/10/17 | | B3 | | | 746,954 | | |

| | | | | Containers & Packaging – 0.8% | | | | | | | | | | | | | | | |

| | 1,595 | | | | | | | Reynolds Group Holdings, Inc., Term Loan | | | 4.750 | % | | 9/28/18 | | B+ | | | 1,616,351 | | |

| | 357 | | | | | | | Sealed Air Corporation, Term Loan B1 | | | 4.000 | % | | 10/03/18 | | Ba1 | | | 362,483 | | |

| | 1,952 | | | | | | | Total Containers & Packaging | | | | | | | | | | | | | | | 1,978,834 | | |

| | | | | Diversified Financial Services – 0.2% | | | | | | | | | | | | | | | |

| | 451 | | | | | | | Pinafore LLC, Term Loan | | | 4.250 | % | | 9/29/16 | | BB | | | 454,359 | | |

| | | | | Diversified Telecommunication Services – 0.3% | | | | | | | | | | | | | | | |

| | 856 | | | | | | | Intelsat Jackson Holdings, Ltd., Term Loan B1 | | | 4.500 | % | | 4/02/18 | | BB- | | | 863,781 | | |

| | | | | Electric Utilities – 0.7% | | | | | | | | | | | | | | | |

| | 2,312 | | | | | | | TXU Corporation, 2014 Term Loan | | | 3.746 | % | | 10/10/14 | | B2 | | | 1,764,397 | | |

| | | | | Electrical Equipment – 0.3% | | | | | | | | | | | | | | | |

| | 394 | | | | | | | Sensata Technologies B.V., Term Loan B | | | 3.750 | % | | 5/12/18 | | BB+ | | | 396,561 | | |

| | 295 | | | | | | | Sensus Metering Systems, Inc., Term Loan, First Lien | | | 4.750 | % | | 5/09/17 | | Ba3 | | | 295,917 | | |

| | 689 | | | | | | | Total Electrical Equipment | | | | | | | | | | | | | | | 692,478 | | |

Nuveen Investments

21

Nuveen Diversified Dividend and Income Fund (continued)

Portfolio of Investments December 31, 2012

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity (6) | | Ratings (5) | | Value | |

| | | | | Food Products – 1.7% | | | | | | | | | | | | | | | |

$ | 1,000 | | | | | | | AdvancePierre Foods, Inc., Term Loan, First Lien | | | 5.750 | % | | 7/10/17 | | B1 | | $ | 1,013,125 | | |

| | 1,255 | | | | | | | Michael Foods Group, Inc., Term Loan | | | 4.250 | % | | 2/25/18 | | Ba3 | | | 1,264,990 | | |

| | 1,953 | | | | | | | U.S. Foodservice, Inc., Extended Term Loan | | | 5.750 | % | | 3/31/17 | | B2 | | | 1,963,709 | | |

| | 4,208 | | | | | | | Total Food Products | | | | | | | | | | | | | | | 4,241,824 | | |

| | | | | Health Care Equipment & Supplies – 0.6% | | | | | | | | | | | | | | | |

| | 1,485 | | | | | | | Kinetic Concepts, Inc., Term Loan C1 | | | 5.500 | % | | 5/04/18 | | Ba2 | | | 1,503,562 | | |

| | | | | Health Care Providers & Services – 4.0% | | | | | | | | | | | | | | | |

| | 4 | | | | | | | Community Health Systems, Inc., Extended Term Loan | | | 3.811 | % | | 1/25/17 | | BB | | | 4,274 | | |

| | 1,000 | | | | | | | DaVita, Inc., New Term Loan B2 | | | 4.000 | % | | 11/01/19 | | Ba2 | | | 1,009,163 | | |

| | 1,960 | | | | | | | DaVita, Inc., Tranche B, Term Loan | | | 4.500 | % | | 10/20/16 | | Ba2 | | | 1,976,170 | | |

| | 1,969 | | | | | | | Golden Living, Term Loan | | | 5.000 | % | | 5/04/18 | | B1 | | | 1,856,016 | | |

| | 76 | | | | | | | HCA, Inc., Tranche B2, Term Loan | | | 3.561 | % | | 3/31/17 | | BB | | | 76,227 | | |

| | 903 | | | | | | | Kindred Healthcare, Term Loan | | | 5.250 | % | | 6/01/18 | | Ba3 | | | 884,107 | | |

| | 798 | | | | | | | MultiPlan, Inc., Term Loan B | | | 4.750 | % | | 8/26/17 | | Ba3 | | | 804,101 | | |

| | 993 | | | | | | | Select Medical Corporation, Tranche B, Term Loan A | | | 5.500 | % | | 6/01/18 | | BB- | | | 1,001,184 | | |

| | 1,410 | | | | | | | United Surgical Partners International, Inc., Extended Term Loan | | | 5.250 | % | | 4/19/17 | | B1 | | | 1,416,847 | | |

| | 805 | | | | | | | Universal Health Services, Inc., Term Loan B | | | 3.750 | % | | 11/15/16 | | BB+ | | | 809,249 | | |

| | 9,918 | | | | | | | Total Health Care Providers & Services | | | | | | | | | | | | | | | 9,837,338 | | |

| | | | | Health Care Technology – 0.4% | | | | | | | | | | | | | | | |

| | 990 | | | | | | | Emdeon Business Services LLC, Term Loan B1 | | | 5.000 | % | | 11/02/18 | | BB- | | | 1,001,280 | | |

| | | | | Hotels, Restaurants & Leisure – 3.1% | | | | | | | | | | | | | | | |

| | 1,950 | | | | | | | 24 Hour Fitness Worldwide, Inc., New Term Loan | | | 7.500 | % | | 4/22/16 | | Ba3 | | | 1,969,012 | | |

| | 182 | | | | | | | Venetian Casino Resort LLC, Delayed Term Loan | | | 2.760 | % | | 11/23/16 | | BBB- | | | 182,764 | | |

| | 578 | | | | | | | Venetian Casino Resort LLC, Tranche B, Term Loan | | | 2.760 | % | | 11/23/16 | | BBB- | | | 579,605 | | |

| | 1,391 | | | | | | | Dunkin Brands, Inc., Term Loan B2 | | | 4.000 | % | | 11/23/17 | | B | | | 1,402,772 | | |

| | 500 | | | | | | | MGM Resorts International, Term Loan B | | | 4.250 | % | | 12/20/19 | | Ba2 | | | 506,094 | | |

| | 1,970 | | | | | | | Seaworld Parks and Entertainment, Inc., Term Loan B | | | 4.000 | % | | 8/17/17 | | BB- | | | 1,987,845 | | |

| | 1,015 | | | | | | | Six Flags Theme Parks, Inc., Term Loan B | | | 4.000 | % | | 12/20/18 | | BB+ | | | 1,021,880 | | |

| | 7,586 | | | | | | | Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 7,649,972 | | |

| | | | | Household Durables – 0.4% | | | | | | | | | | | | | | | |

| | 1,000 | | | | | | | AOT Bedding Super Holdings LLC, Term Loan B | | | 5.000 | % | | 10/01/19 | | B+ | | | 1,002,847 | | |

| | | | | Industrial Conglomerates – 1.2% | | | | | | | | | | | | | | | |

| | 2,948 | | | | | | | U.S. Foodservice, Inc., Term Loan, First Lien | | | 5.750 | % | | 3/31/17 | | B2 | | | 2,962,238 | | |

| | | | | Internet & Catalog Retail – 0.3% | | | | | | | | | | | | | | | |

| | 706 | | | | | | | Burlington Coat Factory Warehouse Corporation, Term Loan B1 | | | 5.500 | % | | 2/23/17 | | B | | | 713,342 | | |

| | | | | Internet Software & Services – 0.1% | | | | | | | | | | | | | | | |

| | 173 | | | | | | | Go Daddy Operating Co. LLC, Term Loan, Tranche B1 | | | 5.500 | % | | 12/17/18 | | Ba3 | | | 173,608 | | |

| | | | | IT Services – 0.3% | | | | | | | | | | | | | | | |

| | 398 | | | | | | | SunGard Data Systems, Inc., Term Loan B | | | 1.959 | % | | 2/28/14 | | BB | | | 399,944 | | |

| | 274 | | | | | | | Frac Tech International LLC, Term Loan | | | 8.500 | % | | 5/06/16 | | B+ | | | 228,246 | | |

| | 672 | | | | | | | Total IT Services | | | | | | | | | | | | | | | 628,190 | | |

| | | | | Leisure Equipment & Products – 0.5% | | | | | | | | | | | | | | | |

| | 1,329 | | | | | | | Cedar Fair LP, Term Loan | | | 4.000 | % | | 12/15/17 | | BB | | | 1,343,241 | | |

| | | | | Media – 3.6% | | | | | | | | | | | | | | | |

| | 538 | | | | | | | Nielsen Finance LLC, Term Loan C | | | 3.463 | % | | 5/02/16 | | Ba2 | | | 541,826 | | |

| | 1,564 | | | | | | | Univision Communications, Inc., Term Loan | | | 4.462 | % | | 3/31/17 | | B+ | | | 1,541,100 | | |

| | 1,000 | | | | | | | UPC Broadband Holding BV, Term Loan N | | | 3.714 | % | | 12/31/17 | | Ba3 | | | 999,250 | | |

Nuveen Investments

22

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity (6) | | Ratings (5) | | Value | |

| | | | | Media (continued) | | | | | | | | | | | | | | | |

$ | 1,515 | | | | | | | Yell Group PLC, Term Loan, (8) | | | 0.000 | % | | 7/31/14 | | N/R | | $ | 347,888 | | |

| | 613 | | | | | | | Bresnan Broadband Holdings LLC, Term Loan B | | | 4.500 | % | | 12/14/17 | | BB+ | | | 617,285 | | |

| | 993 | | | | | | | Cequel Communications LLC, Term Loan | | | 4.000 | % | | 2/14/19 | | Ba2 | | | 998,565 | | |

| | 990 | | | | | | | Cumulus Media, Inc., Term Loan B, First Lien | | | 4.500 | % | | 9/18/18 | | Ba2 | | | 994,611 | | |

| | 750 | | | | | | | Cumulus Media, Inc., Term Loan, Second Lien | | | 7.500 | % | | 9/16/19 | | B2 | | | 774,375 | | |

| | 1,246 | | | | | | | Interactive Data Corporation, Term Loan B | | | 4.500 | % | | 2/11/18 | | Ba3 | | | 1,254,637 | | |

| | 500 | | | | | | | Tribune Company, Exit Term Loan B, WI/DD | | | TBD | | | TBD | | BB+ | | | 500,062 | | |

| | 438 | | | | | | | WideOpenWest Finance LLC, Term Loan B | | | 6.250 | % | | 7/12/18 | | B1 | | | 443,512 | | |

| | 10,147 | | | | | | | Total Media | | | | | | | | | | | | | | | 9,013,111 | | |

| | | | | Metals & Mining – 0.3% | | | | | | | | | | | | | | | |

| | 637 | | | | | | | FMG Resources, Ltd., Term Loan B | | | 5.250 | % | | 10/18/17 | | BB+ | | | 643,018 | | |

| | | | | Oil, Gas & Consumable Fuels – 1.4% | | | | | | | | | | | | | | | |

| | 500 | | | | | | | El Paso Corporation, Tranche B1, Term Loan | | | 5.000 | % | | 5/24/18 | | Ba3 | | | 504,196 | | |

| | 1,160 | | | | | | | Energy Transfer Partners LP, Term Loan B | | | 3.750 | % | | 3/24/17 | | BB | | | 1,170,785 | | |

| | 1,000 | | | | | | | Plains Exploration and Production Company, Term Loan | | | 4.000 | % | | 10/15/19 | | Ba1 | | | 1,004,583 | | |

| | 833 | | | | | | | Samson Investment Company, Initial Term Loan, Second Lien | | | 6.000 | % | | 9/25/18 | | B+ | | | 842,187 | | |

| | 3,493 | | | | | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 3,521,751 | | |

| | | | | Pharmaceuticals – 3.5% | | | | | | | | | | | | | | | |

| | 500 | | | | | | | Bausch & Lomb, Inc., Delayed Draw, Term Loan | | | 4.750 | % | | 9/30/15 | | B+ | | | 504,688 | | |

| | 1,493 | | | | | | | Bausch & Lomb, Inc., Term Loan B | | | 5.250 | % | | 5/17/19 | | B+ | | | 1,507,958 | | |

| | 1,000 | | | | | | | ConvaTec Healthcare, Incremental Term Loan B | | | 5.000 | % | | 12/22/16 | | Ba3 | | | 1,015,000 | | |

| | 914 | | | | | | | Par Pharmaceutical Companies, Inc., Term Loan B | | | 5.000 | % | | 9/30/19 | | B+ | | | 915,613 | | |

| | 750 | | | | | | | Quintiles Transnational Corporation, Term Loan B, WI/DD | | | TBD | | | TBD | | BB- | | | 756,093 | | |

| | 1,990 | | | | | | | Valeant Pharmaceuticals International, Inc., Tranche B, Term Loan D | | | 4.250 | % | | 2/13/19 | | BBB- | | | 2,004,095 | | |

| | 282 | | | | | | | Warner Chilcott Company LLC, Term Loan B1 Additional | | | 4.250 | % | | 3/15/18 | | BBB- | | | 284,591 | | |

| | 744 | | | | | | | Warner Chilcott Corporation, Term Loan B1 | | | 4.250 | % | | 3/15/18 | | BBB- | | | 749,377 | | |

| | 372 | | | | | | | Warner Chilcott Corporation, Term Loan B2 | | | 4.250 | % | | 3/15/18 | | BBB- | | | 374,688 | | |

| | 511 | | | | | | | Warner Chilcott Corporation, Term Loan B3 | | | 4.250 | % | | 3/15/18 | | BBB- | | | 515,196 | | |

| | 8,556 | | | | | | | Total Pharmaceuticals | | | | | | | | | | | | | | | 8,627,299 | | |

| | | | | Real Estate Investment Trust – 0.4% | | | | | | | | | | | | | | | |

| | 964 | | | | | | | iStar Financial, Inc., Term Loan | | | 5.750 | % | | 10/15/17 | | BB- | | | 976,031 | | |

| | | | | Real Estate Management & Development – 0.5% | | | | | | | | | | | | | | | |

| | 886 | | | | | | | Capital Automotive LP, Tranche B | | | 5.250 | % | | 3/11/17 | | Ba3 | | | 897,239 | | |

| | 372 | | | | | | | LNR Property Corporation, Term Loan | | | 4.750 | % | | 4/29/16 | | BB+ | | | 374,432 | | |

| | 1,258 | | | | | | | Total Real Estate Management & Development | | | | | | | | | | | | | | | 1,271,671 | | |

| | | | | Road & Rail – 0.2% | | | | | | | | | | | | | | | |

| | 568 | | | | | | | Swift Transportation Company, Inc., Term Loan, Tranche B2 | | | 5.000 | % | | 12/21/17 | | BB | | | 574,893 | | |

| | | | | Semiconductors & Equipment – 1.1% | | | | | | | | | | | | | | | |

| | 981 | | | | | | | Freescale Semiconductor, Inc., Term Loan, Tranche B1 | | | 4.464 | % | | 12/01/16 | | B1 | | | 964,225 | | |

| | 750 | | | | | | | NXP Semiconductor LLC, Incremental Term Loan C | | | 4.750 | % | | 12/06/19 | | B+ | | | 754,453 | | |

| | 983 | | | | | | | NXP Semiconductor LLC, Term Loan | | | 4.500 | % | | 3/03/17 | | B2 | | | 992,478 | | |

| | 2,714 | | | | | | | Total Semiconductors & Equipment | | | | | | | | | | | | | | | 2,711,156 | | |

| | | | | Software – 1.3% | | | | | | | | | | | | | | | |

| | 875 | | | | | | | Datatel Parent Corp, Term Loan B | | | 6.250 | % | | 7/19/18 | | B+ | | | 886,985 | | |

| | 871 | | | | | | | Infor Enterprise Applications, Term Loan B | | | 5.250 | % | | 4/05/18 | | Ba3 | | | 880,289 | | |

| | 1,241 | | | | | | | SS&C Technologies, Inc./ Sunshine Acquisition II, Inc., Funded Term Loan B1 | | | 5.000 | % | | 6/07/19 | | BB- | | | 1,255,263 | | |

| | 128 | | | | | | | SS&C Technologies, Inc./ Sunshine Acquisition II, Inc., Funded Term Loan B2 | | | 5.000 | % | | 6/07/19 | | BB- | | | 129,333 | | |

| | 3,115 | | | | | | | Total Software | | | | | | | | | | | | | | | 3,151,870 | | |

Nuveen Investments

23

Nuveen Diversified Dividend and Income Fund (continued)

Portfolio of Investments December 31, 2012

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity (6) | | Ratings (5) | | Value | |

| | | | | Specialty Retail – 1.9% | | | | | | | | | | | | | | | |

$ | 985 | | | | | | | J Crew Group, Term Loan | | | 4.500 | % | | 3/07/18 | | B1 | | $ | 990,404 | | |

| | 1,768 | | | | | | | Jo-Ann Stores, Inc., Term Loan | | | 4.750 | % | | 3/16/18 | | B+ | | | 1,777,647 | | |

| | 998 | | | | | | | Pilot Travel Centers LLC, First Amendment, Tranche B, Term Loan | | | 4.250 | % | | 8/07/19 | | BB | | | 1,006,438 | | |

| | 952 | | | | | | | Tempur-Pedic International, Inc., Term Loan B, WI/DD | | | TBD | | | TBD | | BB | | | 965,674 | | |

| | 4,703 | | | | | | | Total Specialty Retail | | | | | | | | | | | | | | | 4,740,163 | | |

| | | | | Wireless Telecommunication Services – 0.1% | | | | | | | | | | | | | | | |

| | 442 | | | | | | | Clear Channel Communications, Inc., Tranche B, Term Loan | | | 3.862 | % | | 1/29/16 | | CCC+ | | | 367,797 | | |

$ | 84,362 | | | | | | | Total Variable Rate Senior Loan Interests (cost $83,775,503) | | | | | | | | | | | | | | | 82,787,936 | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Ratings (5) | | Value | |

| | | | | Corporate Bonds – 0.2% (0.1% of Total Investments) | | | | | | | | | | | | | | | |

| | | | | Media – 0.1% | | | | | | | | | | | | | | | |

$ | 132 | | | | | | | Clear Channel Communications, Inc., 144A | | | 9.000 | % | | 12/15/19 | | CCC+ | | $ | 120,780 | | |

| | | | | Metals & Mining – 0.1% | | | | | | | | | | | | | | | |

| | 215 | | | | | | | Southern Copper Corporation | | | 7.500 | % | | 7/27/35 | | BBB+ | | | 276,014 | | |

$ | 347 | | | | | | | Total Corporate Bonds (cost $380,583) | | | | | | | | | | | | | | | 396,794 | | |

Principal

Amount (000) (9) | | Description (1) | | Coupon | | Maturity | | Ratings (5) | | Value | |

| | | | | Emerging Markets Debt and Foreign Corporate Bonds- 34.5% (23.9% of Total Investments) | | | | | | | | | | | | | | | |

| | | | | Argentina – 0.6% | | | | | | | | | | | | | | | |

| | 130 | | | | | | | City of Buenos Aires, Argentina, 144A | | | 12.500 | % | | 4/06/15 | | B- | | $ | 127,400 | | |

| | 80 | | | | | | | Republic of Argentina | | | 8.750 | % | | 6/02/17 | | B | | | 70,800 | | |

| | 324 | | | | | | | Republic of Argentina | | | 8.280 | % | | 12/31/33 | | CC | | | 231,754 | | |

| | 390 | | | | | | | Republic of Argentina | | | 8.280 | % | | 12/31/33 | | B- | | | 267,327 | | |

| | 2,105 | | | | | | | Republic of Argentina | | | 2.500 | % | | 12/31/38 | | CC | | | 755,695 | | |

| | | | | | | | | Total Argentina | | | | | | | | | | | | | | | 1,452,976 | | |

| | | | | Azerbaijan – 0.2% | | | | | | | | | | | | | | | |

| | 465 | | | | | | | Azerbaijan State Oil Company, Reg S | | | 5.450 | % | | 2/09/17 | | BBB- | | | 510,338 | | |

| | | | | Brazil – 3.2% | | | | | | | | | | | | | | | |

| | 300 | | | | | | | Banco BTG Pactual SA Cayman, 144A | | | 5.750 | % | | 9/28/22 | | Ba1 | | | 307,500 | | |

| | 170 | | | | | | | Banco do Brasil, Reg S | | | 8.500 | % | | | N/A (10) | | | Baa2 | | | 206,550 | | |

| | 255 | | | | | | | Banco do Nordeste do Brasil, 144A | | | 3.625 | % | | 11/09/15 | | BBB | | | 263,925 | | |

| | 36 | | | BRL | | | | Brazil Notas do Tesouro Nacional | | | 6.000 | % | | 5/15/15 | | Baa2 | | | 430,278 | | |

| | 300 | | | | | | | Centrais Eletricas Brasileiras S.A, 144A | | | 5.750 | % | | 10/27/21 | | BBB | | | 322,500 | | |

| | 400 | | | | | | | Centrais Eletricas Brasileiras S.A, Reg S | | | 5.750 | % | | 10/27/21 | | BBB | | | 430,000 | | |

| | 695 | | | BRL | | | | Companhia Energetica de Sao Paulo, 144A | | | 9.750 | % | | 1/15/15 | | Ba1 | | | 512,619 | | |

| | 115 | | | | | | | Federative Republic of Brazil | | | 6.000 | % | | 1/17/17 | | BBB | | | 135,700 | | |

| | 136 | | | | | | | Federative Republic of Brazil | | | 8.250 | % | | 1/20/34 | | BBB | | | 228,820 | | |

| | 710 | | | | | | | Federative Republic of Brazil | | | 7.125 | % | | 1/20/37 | | BBB | | | 1,086,300 | | |