UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-21407 |

Nuveen Diversified Dividend and Income Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Gifford R. Zimmerman

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: June 30, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

30 June 2019

Nuveen Closed-End Funds

| | |

| JDD | | Nuveen Diversified Dividend and Income Fund |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.nuveen.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting the financial intermediary (such as a broker-dealer or bank) through which you hold your Fund shares or, if you are a direct investor, by enrolling at www.nuveen.com/e-reports.

You may elect to receive all future shareholder reports in paper free of charge at any time by contacting your financial intermediary or, if you are a direct investor, (i) by calling 800-257-8787 and selecting option #2 or (ii) by logging into your Investor Center account at www.computershare.com/investor and clicking on “Communication Preferences.” Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary or, if you are a direct investor, to all your directly held Nuveen Funds and any other directly held funds within the same group of related investment companies.

Semiannual Report

Life is Complex.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund dividends and statements from your financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund dividends and statements directly from Nuveen.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

Table of Contents

3

Chairman’s Letter to Shareholders

Dear Shareholders,

The worries weighing on markets at the end of 2018 appeared to dissipate in early 2019 as positive economic and corporate earnings news, more dovish signals from central banks and trade progress boosted investor confidence. However, political noise and trade disputes continue to drive short-term market volatility and weigh on longer-term outlooks. Investors are concerned that increased tariffs and a protracted stalemate between the U.S. and its trading partners could dampen business and consumer sentiment, weakening spending and potentially impacting the global economy. Acknowledging similar concerns, the U.S. Federal Reserve recently lowered its benchmark interest rate 0.25% for the first time in a decade and will stop reducing its bond portfolio sooner than planned to help stimulate the U.S. economy. As the current U.S. economic expansion has reached the10-year mark this summer, it’s important to note that economic expansions don’t die of old age, but mature economic cycles can be more vulnerable to an exogenous shock.

Until a clearer picture on trade emerges, more bouts of market turbulence are likely in the meantime. While the downside risks warrant careful monitoring, we believe the likelihood of a near-term recession remains low. Global economic growth is moderating but still expanding, with demand driven by the historically low unemployment in the U.S., Japan and across Europe. Some central banks have begun to adjust monetary policy to help sustain growth and others continue to emphasize their readiness to act, while China’s authorities remain committed to keeping economic growth rates steady with fiscal and monetary policy.

The opportunity set may be narrower, but we believe there is still scope for gains in this environment. Patience and maintaining perspective can help you weather periodic market volatility. We encourage you to work with your financial advisor to assess short-term market movements in the context of your time horizon, risk tolerance and investment goals. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chairman of the Board

August 23, 2019

4

Portfolio Managers’ Comments

Nuveen Diversified Dividend and Income Fund (JDD)

JDD invests approximately equal proportions of its managed assets across four complementary strategies, each managed by a separate, specializedsub-adviser.

NWQ Investment Management Company, LLC (NWQ), an affiliate of Nuveen, LLC (Nuveen) is thesub-adviser for the global equity income strategy portion of the Fund consisting of a portfolio focused on income producing and dividend paying equity securities. James T. Stephenson, CFA, and Thomas J. Ray, CFA serve as the Fund’s portfolio management team.

The real estate securities strategy portion of the Fund consisting of a portfolio focused on dividend-paying common Real Estate Investment Trusts (REITs) is managed by a team at Security Capital Research & Management Incorporated, (Security Capital), a wholly-owned subsidiary of JPMorgan Chase & Co. Anthony R. Manno Jr., Kenneth D. Statz and Kevin W. Bedell lead the management team. On September 3, 2019 (subsequent to the close of the reporting period), Nathan J. Gear, CFA, will be added as a portfolio manager.

Symphony Asset Management, LLC (Symphony), an affiliate of Nuveen, is thesub-adviser for the adjustable rate senior loan strategy portion of the Fund consisting of a portfolio focused on senior loans. The Symphony management team for the Fund is led by Scott Caraher. On May 23, 2019, Jenny Rhee was added as a portfolio manager to the Nuveen Diversified Dividend and Income Fund.

Wellington Management Company LLP (Wellington Management) is thesub-adviser for the emerging market debt strategy portion of the Fund consisting of a portfolio focused on emerging market sovereign debt. James W. Valone, CFA, heads the management team. On July 1, 2019 (subsequent to the close of the reporting period), Kevin Murphy was added as a portfolio manager.

Here representatives from NWQ, Security Capital, Symphony and Wellington Management review their management strategies and the performance of the Fund for thesix-month reporting period ended June 30, 2019.

What were the key strategies used to manage the Fund during thissix-month reporting period ended June 30, 2019?

The Fund’s investment objectives are high current income and total return, while utilizing equity and debt strategies focused on providing current income, total return potential and reducing U.S. interest rate sensitivity. In its efforts to achieve these objectives, the Fund is managed by specialists in severalnon-traditional asset classes and invests primarily

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments(continued)

in 1) U.S. and foreign dividend paying common stocks, 2) dividend paying common stocks issued by real estate companies, 3) emerging markets sovereign debt, and 4) senior secured loans. The Fund expects to invest at least 40%, but no more than 70%, of its assets in equity security holdings and at least 30%, but no more than 60%, of its assets in debt security holdings. Under normal circumstances, the Fund’s target weighting is approximately 50% equity and 50% debt.

For the dividend paying equity portion of the Fund’s portfolio, NWQ continued to focus on obtaining an attractive total return with a dividend yield at least 100 bps above the MSCI World Index. NWQ employs a value based approach from their bottom up analysis. They look for attractive absolute valuation, positive risk/reward with downside risk management characteristics and catalysts that can drive a positive revaluation of companies. They believe improved capital allocation policies and the return of capital to shareholders can be a positive catalyst in two significant ways. Higher dividends add to the total return of a company and the discipline shown in rewarding shareholders can lead to a higher valuation. NWQ has seen many companies significantly increase their shareholder remuneration through share repurchases and higher dividends.

In managing the real estate portion of the Fund’s portfolio, Security Capital seeks to maintain property type and geographic diversification in selecting common equity securities, while taking into account important company-specific influences, including, cash flow generating potential, property location quality, balance sheet flexibility and the management team to name only a few. Investment decisions are based on a multi-layered analysis of the company, the real estate it owns, its management and the relative price of the security, with a focus on securities that Security Capital believes will be best positioned to generate sustainable net income and potential price appreciation over thelong-run. Throughout the latter half of 2018, the portfolio continued to consolidate a number of equity positions as a result of its focus on delivering a high conviction, diversified portfolio of securities. As of June 30, 2019, the portfolio allocations were 98.7% common stocks and 1.3% cash equivalents.

In the senior loan and other debt portion of the Fund’s portfolio, Symphony continued to manage and monitor senior loan market risks. The overall macroeconomic backdrop during the reporting period remained supportive of the leveraged loan (loan) asset class. The Fund’s capital remained invested in issuers with strong credit profiles among noninvestment grade debt while offering attractive current income and yield. Fundamentally, Symphony feels that many of these companies have stable businesses, good asset coverage for senior debt holders and could perform well in a stable to slow growth environment.

The emerging market debt portion of the Fund, which is managed by Wellington Management, invests in a diversified portfolio of emerging markets fixed income instruments through the combination of comprehensivetop-down quantitative and macroeconomic analysis and detailedbottom-up sovereign credit research.

How did the Fund perform during thissix-month reporting period ended June 30, 2019?

The table in the Performance Overview and Holding Summaries section of this report provides total returns for thesix-month,one-year, five-year andten-year periods ended June 30, 2019. The Fund’s total returns on net asset value (NAV) are compared with the performance of a corresponding market index. For thesix-month reporting period ended June 30, 2019, JDD underperformed the S&P 500®, but outperformed its comparative Blended Index.

NWQ

The dividend paying equity portion of the Fund’s portfolio, managed by NWQ, contributed to the Fund’s performance versus its blended benchmark, but underperformed it corresponding market index. Positive stock selection in the communications services, information technology and utilities sectors contributed to the Fund’s performance. This was offset by weakness in the financials, consumer staples and industrials sectors.

Geographically, performance benefited from stock selection in the United States. Investments in Europe, the Middle East and the Pacificex-Japan lagged and were a headwind for the Fund’s relative return for the reporting period.

6

Individual holdings that positively contributed to performance included financial sector holding, Citigroup Inc. The financial services sector saw a sharp rebound after thesell-off at the end of 2018. Also contributing to performance was technology sector holding, Cypress Semiconductor Corp, which saw strong price appreciation following the announcement of Infineon’s acquisition of the chipmaker in anall-cash deal. Lastly, Nintendo Co. Ltd. positively contributed to performance as optimism over Nintendo Switch hardware sales rose. Nintendo announced a partnership with Tencent to begin distributing the Nintendo Switch in China at a future date and the company forecasted hardware unit sales of 18 million in Fiscal 2020, an increase of 1 million units year-over-year.

Several individual holdings detracted from portfolio performance, particularly our financial sector holdings. Unicaja Banco SA was the leading detractor in the Fund’s portfolio. Unicaja detracted from performance following the announcement that the company had abandoned its plans to merge with Liberbank. Additionally the potential for European Central Bank (ECB) rate cuts and the effect on net interest income pushed shares lower. We continue to hold Unicaja. Challenger Ltd/Australia also detracted from performance coming off a weak fourth quarter 2018 in which the company lowered earnings expectations due to lower volume growth, lower yield on its investment portfolio and regulatory uncertainty regarding annuities. Lastly, Imperial Brands PLC underperformed due to investor concerns regarding the evolution of the tobacco industry, increased regulation and scrutiny in the U.S. and a slowdown in performance of its reduced nicotine risk product, myblu. Challenger Ltd/Australia and Imperial Brands were both eliminated from the Fund during the reporting period.

Security Capital

The real estate portion of the Fund managed by Security Capital contributed to the Fund’s performance, outperforming the blended benchmark but underperforming its corresponding market index. Within the Fund’s common equity holdings, there were distinctive differences by property type with the underlying themes and influences reflecting company-specific factors, earlier period performance differentials and, importantly, shifting investor expectations colored by macro-economic trends.

In this context, leading performance contributors by major property type were the office and industrial companies. Underperformance from the office companies was broad based but more centered on the New York-Washington corridor where owners faced significant pressure on new net lease economics due to competition from new construction and significant capital costs required to introduce amenities that will appeal to tenants who are focused on attracting and retaining millennial talent. The Fund benefited from a strong bias toward west coast office exposure versus east coast/New York City office in this segment. For the industrial segment, both the traditional warehouse companies and the data center companies generated strong performance. Traditional warehouse companies continued to see robust user demand, the result of a strong economy and the logistics demands of serving the booming online economy. While warehouse supply pipelines were active and a continued focus of wary investors, industrial markets remained generally balanced particularly with the shift to more infill locations closer to urban centers. The data center companies continued to be volatile quarter to quarter as investors responded to strong demand but also a capital intensive growth profile and active supply pipelines. The top three securities in the portfolio that had the biggest positive impact on the portfolio performance were an underweighted position in Simon Property Group, Inc. and overweight positions in Cyrus One Inc. and CoreSite Realty Corp. The Fund no longer holds its position in Cyrus One.

During the reporting period, the Fund’s relative performance versus the Wilshire U.S. Real Estate Securities Index portion of the Blended Index was constrained by common equity investments in self-storage, regional malls and hotel companies. Self-storage companies continue to exhibit steady property operations, though investors have been wary of moderating net operating income (NOI) growth rates and the corrosive impact on operations of elevated new construction levels. However, with healthy user demand, low capital expenditure requirements and limited obsolescence risk, equity pricing for the self-storage companies has been more insulated from many of the concerns weighing on other property segments. For the mall companies, investors have been highly cautious regarding the shifting retailing landscape in the context of

7

Portfolio Managers’ Comments(continued)

accelerating online sales and the associated shifts in strategy by retailers, including store closures and bankruptcies. In addition, gaining control and repurposing of department stores is a significant and unique challenge for mall companies. Finally, hotel companies have been volatilequarter-to-quarter and align well with a strong economy. However, investors appear focused on a number of corrosive factors notably elevated levels of new hotel construction, wage and property tax pressures weighing on operating margins and the inability to acquire assets on accretive economics. The bottom three performing companies in the portfolio for the reporting period were Taubman Centers Inc, Macerich Co and Senior Housing Properties Trust, all of which we continue to hold in the Fund.

Symphony

The senior loan sleeve managed by Symphony was positive on a total return basis during the reporting period, which was beneficial to Fund performance, returning 5.6% versus 5.4% for the corresponding market index but underperformed the Blended Index.

The senior loan portion of the Fund is invested predominantly in first-lien, senior secured corporate loans. Symphony prefers to focus on issuers that have strong asset coverage, defensible businesses and generally larger loan facilities. Throughout the reporting period, Symphony generally believed that these larger loan facilities offered better risk/return dynamics following a liquidity drivensell-off late in 2018.

Despite consistent outflows from retail investors throughout the reporting period, loans performed well in the first half of 2019. While outflows from retail investors have occurred amid a more benign rate environment, institutional demand for loans has remained strong. Further, while concerns have escalated regarding a slowdown in global growth, loan credit fundamentals remain largely intact and new issue supply has been quite manageable. However, it is worth noting that higher quality assets have generally outperformed while lower quality assets, such as those rated CCC, have lagged the market. This was particularly evident during June 2019. This is characteristic of a market in which risk aversion has remained somewhat elevated and where managers prefer to focus on performing assets with strong balance sheets and access to capital.

The Fund benefited from exposure to larger, more liquid positions and better quality assets which outperformed the overall market during the reporting period. Much of this was driven by deeper discounts of these assets at the beginning of the reporting period following thesell-off in the market in late 2018. Thesell-off late in 2018 can be characterized as putting acute pressure on larger positions and better quality assets within the market as mutual funds faced redemptions and were forced sellers of these loans to fund redemptions.

Sectors benefiting performance included information technology, as well as consumer durables and media/telecom. Thematically, many outperformers during the reporting period were larger, better quality assets thatsold-off in the fourth quarter of 2018 and led the market rally during the reporting period. These include the American Airlines, Inc. Term Loan, Burger King Corporation, as well as restaurant food supplier US Foods, Inc.

Detracting from performance was security selection within the financials sector. In particular, the loan of mortgage service company, Walter Investment Management Corporation detracted from performance. The distressed issuer has most recently been in the process of looking for buyers for the company. We continue to hold Walter Investment Management Corporation in the Fund.

Wellington Management

The emerging market debt portion of the Fund managed by Wellington contributed to performance.

In the emerging market debt portion, Wellington favored issuers in Eastern Europe and the Middle East over Asia and Latin America. In terms of external sovereign debt, Wellington favored Eastern European and former Soviet countries with strong fiscal performance aiding fundamentals such as Bulgaria, Azerbaijan and Croatia. We also favored select frontier markets with International Monetary Fund (IMF) and strong reform stories. Gulf Cooperation Council (GCC)

8

countries with reform momentum and attractive valuations relative to credit quality, specifically Saudi Arabia and Qatar, were also favored. In contrast, Wellington was underweight investment grade countries in Latin America where valuations are tight, including Panama, Chile and Peru. Wellington also maintained underweights to Asian countries where valuations were tight, including Malaysia and the Philippines.

Wellington kept relatively low exposure to local markets and corporate debt throughout the reporting period. Local markets debt exposure was primarily via currency where Wellington favored a moderate allocation to currency across a basket of countries including Brazil, Russia and Indonesia. Corporate exposure was more attractive as fundamentals remained healthy.Bottom-up pockets of opportunity in Brazil and China offered attractive value relative to sovereign debt with a more resilient credit profile.

The portfolio modestly underperformed the JPMorgan Emerging Markets Bond Index portion of the Blended Index over the first half of 2019. Developed markets duration positioning drove relative underperformance, with our underweight to credit spread duration also detracting. In contrast, country allocation contributed to performance, with security selection, currency positioning, and local rates positioning also having a positive impact.

During the reporting period, at the country level, overweight country allocations to the United Arab Emirate early in the reporting period, Qatar and Turkey, as well as an underweight to Costa Rica detracted from performance. Negative security selection, specifically an underweight exposure to short- and selectmid-dated external sovereign debt in Ecuador, also proved unfavorable. In contrast, at the country level, anout-of-benchmark allocation to Greece, an overweight to Egypt and an underweight to Lebanon contributed to performance. A lack of exposure to external debt in the Philippines also proved favorable. Finally, an allocation to local rates, an underweight exposure to external sovereign debt and favoring external quasi-sovereign debt as well as external corporate debt in Brazil, had a positive impact on performance.

Additionally, the Fund continued to utilize forward foreign currency contracts to reduce the currency risk of select local currency denominated emerging market bonds, as well as actively manage certain currency exposures in an attempt to benefit from potential appreciation. In aggregate, these contracts had a negligible impact on overall performance during the reporting period.

The Fund also used futures on U.S. and German interest rates as part of an overall portfolio construction strategy to reduce interest rate sensitivity and manage yield curve exposure. These positions had a negligible impact on performance during the reporting period.

9

Fund Leverage

IMPACT OF THE FUND’S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the returns of the Fund’s common shares relative to its comparative benchmark was the Fund’s use of leverage through bank borrowings. The Fund uses leverage because our research has shown that, over time, leveraging provides opportunities for additional income and total return, particularly in the recent market environment where short-term market rates are at or near historical lows, meaning that the short-term rates the Fund has been paying on its leveraging instruments in recent years have been much lower than the interest the Fund has been earning on its portfolio securities that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When the Fund uses leverage, the Fund common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in value, which will make the shares’ net asset value more volatile, and total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. Over the last few quarters, short-term interest rates have indeed increased from their extended lows after the 2007-09 financial crisis. This increase has reduced common share net income, and also reduced potential for long-term total returns. Nevertheless, the ability to effectively borrow at current short-term rates is still resulting in enhanced common share income, and management believes that the advantages of continuation of leverage outweigh the associated increase in risk and volatility described above.

The Fund’s use of leverage had a positive impact on total return performance during this reporting period.

The Fund also continued to utilize forward starting interest rate swap contracts to partially hedge its future interest cost of leverage, which as mentioned previously, is through the use of bank borrowings. The swap contracts impact on total return performance was negative during this reporting period.

As of June 30, 2019, the Fund’s percentages of leverage are as shown in the accompanying table.

| | | | |

| | | JDD | |

Effective Leverage* | | | 30.15 | % |

Regulatory Leverage* | | | 30.15 | % |

| * | Effective leverage is the Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in the Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of the Fund. Both of these are part of the Fund’s capital structure. The Fund, however, may from time to time, borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of the Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUND’S REGULATORY LEVERAGE

Bank Borrowings

As noted above, the Fund employs leverage through the use of bank borrowings. The Fund’s bank borrowing activities are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Current Reporting Period | | | | | | Subsequent to the Close

of the Reporting Period | |

| January 1, 2019 | | | Draws | | | Paydowns | | | June 30, 2019 | | | Average Balance

Outstanding | | | | | | Draws | | | Paydowns | | | August 27, 2019 | |

| | $97,900,000 | | | | $ — | | | | $ — | | | | $97,900,000 | | | | $97,900,000 | | | | | | | | $ — | | | | $ — | | | | $97,900,000 | |

Refer to Notes to Financial Statements, Note 9 – Borrowing Arrangements for further details.

Common Share Information

DISTRIBUTION INFORMATION

The following information regarding the Fund’s distributions is current as of May 31, 2019, the date of the distribution data included within the Fund’s most recent distribution notice at the time this report was prepared. The Fund’s distribution levels may vary over time based on the Fund’s investment activities and portfolio investment value changes.

The Fund has adopted a managed distribution program. The goal of the Fund’s managed distribution program is to provide shareholders relatively consistent and predictable cash flow by systematically converting its expected long-term return potential into regular distributions. As a result, regular distributions throughout the year will likely include a portion of expected long-term and/or short-term gains (both realized and unrealized), along with net investment income.

Important points to understand about Nuveen fund managed distributions are:

| • | | The Fund seeks to establish a relatively stable common share distribution rate that roughly corresponds to the projected total return from its investment strategy over an extended period of time. However, you should not draw any conclusions about the Fund’s past or future investment performance from its current distribution rate. |

| • | | Actual common share returns will differ from projected long-term returns (and therefore the Fund’s distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value. |

| • | | Each period’s distributions are expected to be paid from some or all of the following sources: |

| | • | | net investment income consisting of regular interest and dividends, |

| | • | | net realized gains from portfolio investments, and |

| | • | | unrealized gains, or, in certain cases, a return of principal (non-taxable distributions). |

| • | | A non-taxable distribution is a payment of a portion of the Fund’s capital. When the Fund’s returns exceed distributions, it may represent portfolio gains generated, but not realized as a taxable capital gain. In periods when the Fund’s returns fall short of distributions, it will represent a portion of your original principal unless the shortfall is offset during other time periods over the life of your investment (previous or subsequent) when the Fund’s total return exceeds distributions. |

| • | | Because distribution source estimates are updated throughout the current fiscal year based on the Fund’s performance, these estimates may differ from both the tax information reported to you in the Fund’s 1099 statement, as well as the ultimate economic sources of distributions over the life of your investment. |

The following table provides information regarding the Fund’s distributions and total return performance over various time periods. This information is intended to help you better understand whether the Fund’s returns for the specified time periods were sufficient to meet its distributions.

Data as of May 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Per Share

Distributions | | | | | | | | | | | | | | | Annualized Total Return

on NAV | | | | |

| Inception Date | | Quarterly | | | Monthly Equivalent | | | Monthly Net Investment Income¹ | | | YTD Net Realized Gain/Loss² | | | Inception Unrealized Gain/Loss² | | | Current Distribution Rate on NAV³ | | | 1-Year | | | 5-Year | | | YTD | | | YTD Distribution Rate on NAV4 | |

9/2003 | | | $0.2175 | | | | $0.0725 | | | | $0.0425 | | | | $(0.6856) | | | | $0.9591 | | | | 7.71% | | | | 1.69% | | | | 4.78% | | | | 11.37% | | | | 3.86% | |

| 1 | NII is net investment income, which is expressed as a monthly amount using a six-month average. Approximately 25% of JDD, net income represents net REIT cash flow which may consist of income, capital gains, and/or a return of capital. |

| 2 | These are approximations. Actual amounts may be more or less than amounts listed above. |

| 3 | Current distribution, annualized, expressed over the most recent month-end NAV. |

| 4 | Sum of year-to-date distributions expressed over the most recent month-end NAV. |

11

Common Share Information(continued)

The following table provides estimates of the Fund’s distribution sources, reflecting year-to-date cumulative experience through the latest month-end. These estimates are for informational purposes only. The Fund attributes these estimates equally to each regular distribution throughout the year. Consequently, the estimated information shown below is for the current distribution, and also represents an updated estimate for all prior months in the year.

The amounts and sources of distributions reported in this notice are only estimates and are not being provided for tax reporting purposes. The actual amounts and character of the distributions for tax reporting purposes will be reported to shareholders on Form 1099-DIV which will be sent to shareholders shortly after calendar year-end. More details about the Fund’s distributions and the basis for these estimates are available on www.nuveen.com/cef.

Data as of May 31, 20191

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Current Quarter | | | Calendar YTD | |

| | | | Estimated Source of Distribution | | | Estimated Per Share Amounts | |

Per Share Distribution | | | Net Investment Income² | | | Realized Gains | | | Return of Capital³ | | | Distributions4 | | | Net Investment Income² | | | Realized Gains | | | Return of Capital³ | |

| | $0.2175 | | | | 54.4% | | | | 0.0% | | | | 45.6% | | | | $0.4350 | | | | $0.2368 | | | | $ — | | | | $0.1982 | |

| 1 | The Fund owns REIT securities which attribute their distributions to various sources, including net investment income, realized gains and return of capital. The estimates above are based on prior year attributions percentages, which can be expected to differ, at least slightly, from the actual final attributions for the current year. |

| 2 | Net investment income is a projection through the end of the current quarter based on the most recent month-end data. |

| 3 | Return of capital may represent unrealized gains, return of shareholder’s principal, or both. In certain circumstances, all or a portion of the return of capital may be characterized as ordinary income under federal tax law. The actual tax characterization will be provided to shareholders on Form 1099-DIV shortly after calendar year-end. |

| 4 | Includes the most recent quarterly distribution declaration. |

Change in Method of Publishing Nuveen Closed-End Fund Distribution Amounts

Beginning on or about November 1, 2019, the Nuveen Closed-End Funds will be discontinuing the practice of announcing Fund distribution amounts and timing via press release. Instead, information about the NuveenClosed-End Funds’ monthly and quarterly periodic distributions to shareholders will be posted and can be found on Nuveen’s enhanced closed-end fund resource page, which is atwww.nuveen.com/closed-end-fund-distributions, along with other Nuveen closed-end fund product updates. Shareholders can expect regular distribution information to be posted on www.nuveen.com on the first business day of each month. To ensure that our shareholders have timely access to the latest information, a subscribe function can be activated at this link here, or at this web page(www.nuveen.com/en-us/people/about-nuveen/for-the-media).

COMMON SHARE REPURCHASES

During August 2019, (subsequent to the close of the reporting period), the Fund’s Board of Trustees reauthorized an open-market share repurchase program, allowing the Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of June 30, 2019, and since the inception of the Fund’s repurchase program, the Fund has cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table.

| | | | |

| | | JDD | |

Common shares cumulatively repurchased and retired | | | 475,000 | |

Common shares authorized for repurchase | | | 1,975,000 | |

During the current reporting period, the Fund did not repurchase any of its outstanding shares.

OTHER COMMON SHARE INFORMATION

As of June 30, 2019, and during the current reporting period, the Fund’s common share price was trading at a premium/(discount) to its common share NAV as shown in the accompanying table.

| | | | |

| | | JDD | |

Common share NAV | | | $11.49 | |

Common share price | | | $10.65 | |

Premium/(Discount) to NAV | | | (7.31 | )% |

6-month average premium/(discount) to NAV | | | (8.60 | )% |

12

Risk Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Diversified Dividend and Income Fund (JDD)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value.Common stock returns often have experienced significant volatility.Real estate investments may suffer due to economic downturns and changes in commercial real estate values, rents, property taxes, interest rates and tax laws.Adjustable Rate Senior Loans may not be fully secured by collateral, generally do not trade on exchanges, and are typically issued by unrated or below-investment grade companies, and therefore are subject to greater liquidity and credit risk.Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. The risks of foreign investments are magnified in emerging markets.Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. For these and other risks, includingtax risk, please see the Fund’s web page atwww.nuveen.com/JDD.

13

| | |

| JDD | | Nuveen Diversified Dividend and Income Fund Performance Overview and Holding Summaries as of June 30, 2019 |

Refer to the Glossary of Terms Used in this Report for further definition of terms used in this section.

Average Annual Total Returns as of June 30, 2019

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| JDD at Common Share NAV | | | 15.59% | | | | 5.37% | | | | 5.26% | | | | 11.57% | |

| JDD at Common Share Price | | | 20.24% | | | | (0.15)% | | | | 6.84% | | | | 13.90% | |

| Blended Index (Comparative Benchmark) | | | 12.92% | | | | 8.64% | | | | 6.26% | | | | 10.58% | |

| S&P 500® Index | | | 18.54% | | | | 10.42% | | | | 10.71% | | | | 14.70% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

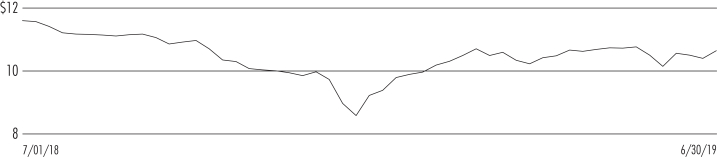

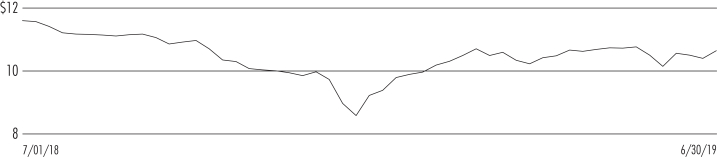

Common Share Price Performance —Weekly Closing Price

14

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 36.7% | |

REIT Common Stocks | | | 36.4% | |

Emerging Market Debt and Foreign Corporate Bonds | | | 36.1% | |

Variable Rate Senior Loan Interests | | | 31.8% | |

Structured Notes | | | 0.4% | |

Corporate Bonds | | | 0.0% | |

Common Stock Rights | | | 0.0% | |

Warrants | | | 0.0% | |

Repurchase Agreements | | | 3.1% | |

Investment Companies | | | 1.6% | |

Other Assets Less Liabilities | | | (2.9)% | |

Net Assets Plus Borrowings | | | 143.2% | |

Borrowings | | | (43.2)% | |

Net Assets | | | 100% | |

Portfolio Credit Quality

(% of total fixed-income investments)

| | | | |

| AAA | | | 0.2% | |

| AA | | | 1.8% | |

| A | | | 4.8% | |

| BBB | | | 28.2% | |

| BB or Lower | | | 64.6% | |

| N/R (not rated) | | | 0.4% | |

Total | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

REIT Common Stocks | | | 24.9% | |

Emerging Market Debt and Foreign Corporate Bonds | | | 24.7% | |

Banks | | | 3.8% | |

Oil, Gas & Consumable Fuels | | | 3.0% | |

Software | | | 2.9% | |

Pharmaceuticals | | | 2.7% | |

Hotels, Restaurants & Leisure | | | 2.5% | |

Media | | | 2.5% | |

Diversified Telecommunication Services | | | 2.0% | |

Insurance | | | 1.9% | |

Capital Markets | | | 1.6% | |

| Health Care Providers & Services | | | 1.5% | |

Airlines | | | 1.5% | |

Multi-Utilities | | | 1.5% | |

Repurchase Agreements | | | 2.1% | |

Investment Companies | | | 1.1% | |

Other | | | 19.8% | |

Total | | | 100% | |

REIT Common Stocks

Top Five Industries

(% of total investments)

| | | | |

Residential | | | 5.5% | |

Specialized | | | 5.2% | |

Office | | | 4.3% | |

Retail | | | 2.9% | |

Health Care | | | 2.4% | |

Country Allocation1

(% of total investments)

| | | | |

United States | | | 57.7% | |

Germany | | | 3.8% | |

United Kingdom | | | 2.8% | |

Japan | | | 2.7% | |

Russia | | | 1.7% | |

France | | | 1.7% | |

Croatia | | | 1.2% | |

Turkey | | | 1.1% | |

Netherlands | | | 1.1% | |

Canada | | | 1.0% | |

Egypt | | | 1.0% | |

Ireland | | | 0.9% | |

Spain | | | 0.9% | |

Saudi Arabia | | | 0.9% | |

Argentina | | | 0.9% | |

Azerbaijan | | | 0.9% | |

Other | | | 19.7% | |

Total | | | 100% | |

| 1 | Includes 24.8% (as a percentage of total investments) in emerging market countries. |

| REIT | Real Estate Investment Trust |

15

Shareholder Meeting Report

The annual meeting of shareholders was held in the offices of Nuveen on April 10, 2019 for JDD; at this meeting the shareholders were asked to elect Board Members.

| | | | |

| | | JDD | |

| | | Common

Shares | |

Approval of the Board Members was reached as follows: | | | | |

Judith M. Stockdale | | | | |

For | | | 17,439,243 | |

Withhold | | | 960,768 | |

Total | | | 18,400,011 | |

Carole E. Stone | | | | |

For | | | 17,532,242 | |

Withhold | | | 867,769 | |

Total | | | 18,400,011 | |

Margaret L. Wolff | | | | |

For | | | 17,603,326 | |

Withhold | | | 796,685 | |

Total | | | 18,400,011 | |

William C. Hunter | | | | |

For | | | 17,560,842 | |

Withhold | | | 839,169 | |

Total | | | 18,400,011 | |

16

| | |

| JDD | | Nuveen Diversified Dividend and

Income Fund Portfolio of Investments June 30, 2019 |

| | | (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares | | | | | Description (1) | | | | | | | | | | | | | | | | | Value | |

| | |

| | | | | | LONG-TERM INVESTMENTS – 141.4% (96.8% of Total Investments) | |

| | |

| | | | | | COMMON STOCKS – 36.7% (25.1% of Total Investments) | |

| | |

| | | | | | Air Freight & Logistics – 1.2% | |

| | | | | | | | |

| | 82,675 | | | | | Deutsche Post AG, (2) | | | | | | | | | | | | | | | | | | | | | | $ | 2,719,743 | |

| | |

| | | | | | Airlines – 1.2% | |

| | | | | | | | |

| | 47,750 | | | | | Delta Air Lines Inc | | | | | | | | | | | | | | | | | | | | | | | 2,709,812 | |

| | |

| | | | | | Automobiles – 0.5% | |

| | | | | | | | |

| | 21,234 | | | | | Daimler AG, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,184,259 | |

| | |

| | | | | | Banks – 5.5% | |

| | | | | | | | |

| | 646,146 | | | | | AIB Group PLC | | | | | | | | | | | | | | | | | | | | | | | 2,642,099 | |

| | 26,018 | | | | | Bank of NT Butterfield & Son Ltd | | | | | | | | | | | | | | | | | | | | | | | 883,571 | |

| | 23,958 | | | | | CIT Group Inc | | | | | | | | | | | | | | | | | | | | | | | 1,258,753 | |

| | 42,984 | | | | | Citigroup Inc | | | | | | | | | | | | | | | | | | | | | | | 3,010,170 | |

| | 224,178 | | | | | ING Groep NV | | | | | | | | | | | | | | | | | | | | | | | 2,593,739 | |

| | 11,510 | | | | | JPMorgan Chase & Co | | | | | | | | | | | | | | | | | | | | | | | 1,286,818 | |

| | 951,500 | | | | | Unicaja Banco SA, 144A, (2), (3) | | | | | | | | | | | | | | | | | | | | | | | 849,522 | |

| | | | | | Total Banks | | | | | | | | | | | | | | | | | | | | | | | 12,524,672 | |

| | |

| | | | | | Biotechnology – 0.6% | |

| | | | | | | | |

| | 18,639 | | | | | Gilead Sciences Inc | | | | | | | | | | | | | | | | | | | | | | | 1,259,251 | |

| | |

| | | | | | Capital Markets – 1.9% | |

| | | | | | | | |

| | 39,299 | | | | | AURELIUS Equity Opportunities SE & Co KGaA, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,870,051 | |

| | 266,070 | | | | | Daiwa Securities Group Inc, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,168,164 | |

| | 94,906 | | | | | Deutsche Boerse AG, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,336,277 | |

| | | | | | Total Capital Markets | | | | | | | | | | | | | | | | | | | | | | | 4,374,492 | |

| | |

| | | | | | Chemicals – 1.3% | |

| | | | | | | | |

| | 41,225 | | | | | Corteva Inc | | | | | | | | | | | | | | | | | | | | | | | 1,219,023 | |

| | 21,553 | | | | | DuPont de Nemours Inc | | | | | | | | | | | | | | | | | | | | | | | 1,617,984 | |

| | | | | | Total Chemicals | | | | | | | | | | | | | | | | | | | | | | | 2,837,007 | |

| | |

| | | | | | Diversified Telecommunication Services – 1.2% | |

| | | | | | | | |

| | 27,720 | | | | | Nippon Telegraph & Telephone Corp, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,288,841 | |

| | 112,755 | | | | | Telefonica Brasil SA | | | | | | | | | | | | | | | | | | | | | | | 1,465,541 | |

| | | | | | Total Diversified Telecommunication Services | | | | | | | | | | | | | | | | | | | | | | | 2,754,382 | |

| | |

| | | | | | Electric Utilities – 0.6% | |

| | | | | | | | |

| | 29,170 | | | | | FirstEnergy Corp | | | | | | | | | | | | | | | | | | | | | | | 1,248,768 | |

| | |

| | | | | | Electrical Equipment – 0.6% | |

| | | | | | | | |

| | 15,500 | | | | | Eaton Corp PLC | | | | | | | | | | | | | | | | | | | | | | | 1,290,840 | |

| | |

| | | | | | Energy Equipment & Services – 0.0% | |

| | | | | | | | |

| | 3,685 | | | | | Transocean Ltd | | | | | | | | | | | | | | | | | | | | | | | 23,621 | |

| | |

| | | | | | Entertainment – 1.5% | |

| | | | | | | | |

| | 6,700 | | | | | Nintendo Co Ltd, (2) | | | | | | | | | | | | | | | | | | | | | | | 2,458,221 | |

| | 28,334 | | | | | Viacom Inc | | | | | | | | | | | | | | | | | | | | | | | 846,336 | |

| | | | | | Total Entertainment | | | | | | | | | | | | | | | | | | | | | | | 3,304,557 | |

17

| | |

| |

| JDD | | Nuveen Diversified Dividend and Income Fund(continued) |

| | Portfolio of Investments June 30, 2019 |

| | (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares | | | | | Description (1) | | | | | | | | | | | | | | | | | Value | |

| | |

| | | | | | Food Products – 0.6% | |

| | | | | | | | |

| | 143,927 | | | | | Orkla ASA | | | | | | | | | | | | | | | | | | | | | | $ | 1,270,875 | |

| | |

| | | | | | Health Care Providers & Services – 0.0% | |

| | | | | | | | |

| | 6,594 | | | | | Millennium Health LLC, (2), (3) | | | | | | | | | | | | | | | | | | | | | | | 99 | |

| | 6,140 | | | | | Millennium Health LLC, (3), (4) | | | | | | | | | | | | | | | | | | | | | | | 6,723 | |

| | 5,767 | | | | | Millennium Health LLC, (3), (4) | | | | | | | | | | | | | | | | | | | | | | | 5,738 | |

| | | | | | Total Health Care Providers & Services | | | | | | | | | | | | | | | | | | | | | | | 12,560 | |

| | |

| | | | | | Household Durables – 0.7% | |

| | | | | | | | |

| | 101,424 | | | | | Sekisui House Ltd, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,671,123 | |

| | |

| | | | | | Industrial Conglomerates – 0.9% | |

| | | | | | | | |

| | 16,319 | | | | | Siemens AG, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,942,864 | |

| | |

| | | | | | Insurance – 2.7% | |

| | | | | | | | |

| | 37,666 | | | | | Ageas, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,960,150 | |

| | 5,515 | | | | | Allianz SE, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,330,086 | |

| | 25,755 | | | | | CNA Financial Corp | | | | | | | | | | | | | | | | | | | | | | | 1,212,288 | |

| | 9,340 | | | | | RenaissanceRe Holdings Ltd | | | | | | | | | | | | | | | | | | | | | | | 1,662,614 | |

| | | | | | Total Insurance | | | | | | | | | | | | | | | | | | | | | | | 6,165,138 | |

| | |

| | | | | | Marine – 0.0% | |

| | | | | | | | |

| | 262 | | | | | HGIM Corp, (2), (3) | | | | | | | | | | | | | | | | | | | | | | | 3,668 | |

| | |

| | | | | | Media – 0.3% | |

| | | | | | | | |

| | 24,320 | | | | | Clear Channel Outdoor Holdings Inc, (3) | | | | | | | | | | | | | | | | | | | | | | | 114,790 | |

| | 9,180 | | | | | Cumulus Media Inc, (3) | | | | | | | | | | | | | | | | | | | | | | | 170,289 | |

| | 655,185 | | | | | Hibu plc, (2), (3) | | | | | | | | | | | | | | | | | | | | | | | 144,141 | |

| | 10,343 | | | | | iHeartMedia Inc, (2), (3) | | | | | | | | | | | | | | | | | | | | | | | 163,678 | |

| | 2,099 | | | | | Metro-Goldwyn-Mayer Inc, (2), (3) | | | | | | | | | | | | | | | | | | | | | | | 140,282 | |

| | 3,185 | | | | | Tribune Co, (4) | | | | | | | | | | | | | | | | | | | | | | | 1,752 | |

| | | | | | Total Media | | | | | | | | | | | | | | | | | | | | | | | 734,932 | |

| | |

| | | | | | Multi-Utilities – 2.1% | |

| | | | | | | | |

| | 85,800 | | | | | Engie SA, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,301,027 | |

| | 99,900 | | | | | National Grid PLC, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,062,422 | |

| | 99,395 | | | | | Veolia Environnement SA, (2) | | | | | | | | | | | | | | | | | | | | | | | 2,420,306 | |

| | | | | | Total Multi-Utilities | | | | | | | | | | | | | | | | | | | | | | | 4,783,755 | |

| | |

| | | | | | Oil, Gas & Consumable Fuels – 4.2% | |

| | | | | | | | |

| | 15,459 | | | | | Chevron Corp | | | | | | | | | | | | | | | | | | | | | | | 1,923,718 | |

| | 98,270 | | | | | Enterprise Products Partners LP | | | | | | | | | | | | | | | | | | | | | | | 2,837,055 | |

| | 63,315 | | | | | Equitrans Midstream Corp | | | | | | | | | | | | | | | | | | | | | | | 1,247,939 | |

| | 52,725 | | | | | Suncor Energy Inc | | | | | | | | | | | | | | | | | | | | | | | 1,642,911 | |

| | 32,600 | | | | | TOTAL SA | | | | | | | | | | | | | | | | | | | | | | | 1,818,754 | |

| | | | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | | | | | | | | | 9,470,377 | |

| | |

| | | | | | Pharmaceuticals – 3.4% | |

| | | | | | | | |

| | 31,119 | | | | | AstraZeneca PLC | | | | | | | | | | | | | | | | | | | | | | | 1,284,592 | |

| | 18,120 | | | | | Bayer AG, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,256,809 | |

| | 27,910 | | | | | Bristol-Myers Squibb Co | | | | | | | | | | | | | | | | | | | | | | | 1,265,719 | |

| | 63,030 | | | | | GlaxoSmithKline PLC | | | | | | | | | | | | | | | | | | | | | | | 2,522,461 | |

| | 38,155 | | | | | Roche Holding AG, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,339,240 | |

| | | | | | Total Pharmaceuticals | | | | | | | | | | | | | | | | | | | | | | | 7,668,821 | |

| | |

| | | | | | Real Estate Management & Development – 0.4% | |

| | | | | | | | |

| | 191,200 | | | | | Great Eagle Holdings Ltd, (2) | | | | | | | | | | | | | | | | | | | | | | | 821,758 | |

| | |

| | | | | | Semiconductors & Semiconductor Equipment – 1.3% | |

| | | | | | | | |

| | 3,298 | | | | | Broadcom Inc | | | | | | | | | | | | | | | | | | | | | | | 949,362 | |

| | 55,125 | | | | | Cypress Semiconductor Corp | | | | | | | | | | | | | | | | | | | | | | | 1,225,980 | |

| | 47,249 | | | | | Infineon Technologies AG, (2) | | | | | | | | | | | | | | | | | | | | | | | 839,600 | |

| | | | | | Total Semiconductors & Semiconductor Equipment | | | | | | | | | | | | | | | | | | | | | | | 3,014,942 | |

18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares | | | | | Description (1) | | | | | | | | | | | | | | | | | Value | |

| | |

| | | | | | Software – 1.7% | |

| | | | | | | | |

| | 14,787 | | | | | Microsoft Corp, (10) | | | | | | | | | | | | | | | | | | | | | | $ | 1,980,867 | |

| | 34,820 | | | | | Oracle Corp, (10) | | | | | | | | | | | | | | | | | | | | | | | 1,983,695 | |

| | | | | | Total Software | | | | | | | | | | | | | | | | | | | | | | | 3,964,562 | |

| | |

| | | | | | Specialty Retail – 0.4% | |

| | | | | | | | |

| | 363,250 | | | | | Kingfisher PLC, (2) | | | | | | | | | | | | | | | | | | | | | | | 990,103 | |

| | |

| | | | | | Technology Hardware, Storage & Peripherals – 0.5% | |

| | | | | | | | |

| | 35,700 | | | | | Samsung Electronics Co Ltd, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,183,967 | |

| | |

| | | | | | Tobacco – 0.8% | |

| | | | | | | | |

| | 24,190 | | | | | Philip Morris International Inc | | | | | | | | | | | | | | | | | | | | | | | 1,899,641 | |

| | |

| | | | | | Trading Companies & Distributors – 0.6% | |

| | | | | | | | |

| | 80,600 | | | | | Mitsui & Co Ltd, (2) | | | | | | | | | | | | | | | | | | | | | | | 1,315,625 | |

| | | | | | Total Common Stocks (cost $74,876,048) | | | | | | | | | | | | | | | | | | | | | | | 83,146,115 | |

| | | | | | | | |

| Shares | | | | | Description (1) | | | | | | | | | | | | | | | | | Value | |

| | |

| | | | | | REAL ESTATE INVESTMENT TRUST (REIT) COMMON STOCKS – 36.4% (24.9% of Total Investments) | |

| | |

| | | | | | Diversified – 1.8% | |

| | | | | | | | |

| | 78,950 | | | | | Liberty Property Trust | | | | | | | | | | | | | | | | | | | | | | $ | 3,950,658 | |

| | |

| | | | | | Health Care – 3.5% | |

| | | | | | | | |

| | 122,425 | | | | | HCP Inc | | | | | | | | | | | | | | | | | | | | | | | 3,915,151 | |

| | 122,800 | | | | | Senior Housing Properties Trust | | | | | | | | | | | | | | | | | | | | | | | 1,015,556 | |

| | 19,825 | | | | | Ventas Inc | | | | | | | | | | | | | | | | | | | | | | | 1,355,039 | |

| | 20,900 | | | | | Welltower Inc | | | | | | | | | | | | | | | | | | | | | | | 1,703,977 | |

| | | | | | Total Health Care | | | | | | | | | | | | | | | | | | | | | | | 7,989,723 | |

| | |

| | | | | | Hotels – 2.3% | |

| | | | | | | | |

| | 191,717 | | | | | Host Hotels & Resorts Inc | | | | | | | | | | | | | | | | | | | | | | | 3,493,084 | |

| | 32,175 | | | | | Pebblebrook Hotel Trust | | | | | | | | | | | | | | | | | | | | | | | 906,691 | |

| | 64,025 | | | | | Sunstone Hotel Investors Inc | | | | | | | | | | | | | | | | | | | | | | | 877,783 | |

| | | | | | Total Hotels | | | | | | | | | | | | | | | | | | | | | | | 5,277,558 | |

| | |

| | | | | | Industrial – 2.7% | |

| | | | | | | | |

| | 77,023 | | | | | Prologis Inc | | | | | | | | | | | | | | | | | | | | | | | 6,169,543 | |

| | |

| | | | | | Office – 6.2% | |

| | | | | | | | |

| | 18,675 | | | | | Alexandria Real Estate Equities Inc | | | | | | | | | | | | | | | | | | | | | | | 2,634,856 | |

| | 7,850 | | | | | Boston Properties Inc | | | | | | | | | | | | | | | | | | | | | | | 1,012,650 | |

| | 52,400 | | | | | Brandywine Realty Trust | | | | | | | | | | | | | | | | | | | | | | | 750,368 | |

| | 45,200 | | | | | Cousins Properties Inc | | | | | | | | | | | | | | | | | | | | | | | 1,634,884 | |

| | 81,200 | | | | | Douglas Emmett Inc | | | | | | | | | | | | | | | | | | | | | | | 3,235,008 | |

| | 64,475 | | | | | Hudson Pacific Properties Inc | | | | | | | | | | | | | | | | | | | | | | | 2,145,083 | |

| | 36,425 | | | | | Kilroy Realty Corp | | | | | | | | | | | | | | | | | | | | | | | 2,688,529 | |

| | | | | | Total Office | | | | | | | | | | | | | | | | | | | | | | | 14,101,378 | |

| | |

| | | | | | Residential – 8.0% | |

| | | | | | | | |

| | 144,325 | | | | | American Homes 4 Rent, Class A | | | | | | | | | | | | | | | | | | | | | | | 3,508,540 | |

| | 78,923 | | | | | Apartment Investment & Management Co, Class A | | | | | | | | | | | | | | | | | | | | | | | 3,955,621 | |

| | 22,150 | | | | | AvalonBay Communities Inc | | | | | | | | | | | | | | | | | | | | | | | 4,500,437 | |

| | 51,325 | | | | | Equity Residential | | | | | | | | | | | | | | | | | | | | | | | 3,896,594 | |

| | 85,875 | | | | | Invitation Homes Inc | | | | | | | | | | | | | | | | | | | | | | | 2,295,439 | |

| | | | | | Total Residential | | | | | | | | | | | | | | | | | | | | | | | 18,156,631 | |

| | |

| | | | | | Retail – 4.2% | |

| | | | | | | | |

| | 116,375 | | | | | Kimco Realty Corp | | | | | | | | | | | | | | | | | | | | | | | 2,150,610 | |

| | 37,916 | | | | | Macerich Co | | | | | | | | | | | | | | | | | | | | | | | 1,269,807 | |

19

| | |

| |

| JDD | | Nuveen Diversified Dividend and Income Fund(continued) |

| | Portfolio of Investments June 30, 2019 |

| | (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares | | | | | Description (1) | | | | | | | | | | | | | | | | | Value | |

| | |

| | | | | | Retail(continued) | |

| | | | | | | | |

| | 375 | | | | | Saul Centers Inc | | | | | | | | | | | | | | | | | | | | | | $ | 21,049 | |

| | 12,610 | | | | | Simon Property Group Inc | | | | | | | | | | | | | | | | | | | | | | | 2,014,573 | |

| | 49,400 | | | | | Taubman Centers Inc | | | | | | | | | | | | | | | | | | | | | | | 2,017,002 | |

| | 74,650 | | | | | Weingarten Realty Investors | | | | | | | | | | | | | | | | | | | | | | | 2,046,903 | |

| | | | | | Total Retail | | | | | | | | | | | | | | | | | | | | | | | 9,519,944 | |

| | |

| | | | | | Specialized – 7.7% | |

| | | | | | | | |

| | 24,100 | | | | | CoreSite Realty Corp | | | | | | | | | | | | | | | | | | | | | | | 2,775,597 | |

| | 27,350 | | | | | Digital Realty Trust Inc | | | | | | | | | | | | | | | | | | | | | | | 3,221,557 | |

| | 6,575 | | | | | Equinix Inc | | | | | | | | | | | | | | | | | | | | | | | 3,315,707 | |

| | 40,025 | | | | | Life Storage Inc | | | | | | | | | | | | | | | | | | | | | | | 3,805,577 | |

| | 17,849 | | | | | Public Storage | | | | | | | | | | | | | | | | | | | | | | | 4,251,096 | |

| | | | | | Total Specialized | | | | | | | | | | | | | | | | | | | | | | | 17,369,534 | |

| | | | | | Total Real Estate Investment Trust (REIT) Common Stocks (cost $62,444,588) | | | | | | | | 82,534,969 | |

| | | | | | | | |

Principal

Amount (000) (5) | | | | | Description (1) | | | | | | | | Coupon | | | Maturity | | | Ratings (6) | | | Value | |

| | |

| | | | | | EMERGING MARKET DEBT AND FOREIGN CORPORATE BONDS – 36.1% (24.7% of Total Investments) | |

| | |

| | | | | | Angola – 0.6% | |

| | | | | | | | |

| $ | 335 | | | | | Angolan Government International Bond, 144A | | | | | | | | | | | 8.250% | | | | 5/09/28 | | | | B3 | | | $ | 358,490 | |

| | 320 | | | | | Angolan Government International Bond, 144A | | | | | | | | | | | 9.375% | | | | 5/08/48 | | | | B3 | | | | 352,416 | |

| | 640 | | | | | Angolan Government International Bond, Reg S | | | | | | | | | | | 8.250% | | | | 5/09/28 | | | | B3 | | | | 685,009 | |

| | | | | | Total Angola | | | | | | | | | | | | | | | | | | | | | | | 1,395,915 | |

| | |

| | | | | | Argentina – 1.3% | |

| | | | | | |

| | 540 | | | | | Argentine Republic Government International Bond | | | | 6.875% | | | | 1/26/27 | | | | B | | | | 433,080 | |

| | 383 | | | | | Argentine Republic Government International Bond | | | | 5.875% | | | | 1/11/28 | | | | B | | | | 291,080 | |

| | 150 | | | EUR | | Argentine Republic Government International Bond | | | | 5.250% | | | | 1/15/28 | | | | B | | | | 123,509 | |

| | 150 | | | | | Argentine Republic Government International Bond | | | | | | | | 6.625% | | | | 7/06/28 | | | | B | | | | 115,726 | |

| | 160 | | | | | Argentine Republic Government International Bond | | | | | | | | 3.750% | | | | 12/31/38 | | | | B | | | | 93,402 | |

| | 150 | | | | | Argentine Republic Government International Bond | | | | | | | | 7.625% | | | | 4/22/46 | | | | B | | | | 118,875 | |

| | 200 | | | | | Argentine Republic Government International Bond | | | | | | | | 6.875% | | | | 1/11/48 | | | | B | | | | 148,002 | |

| | 231 | | | | | Autonomous City of Buenos Aires Argentina, 144A | | | | | | | | 8.950% | | | | 2/19/21 | | | | B | | | | 232,886 | |

| | 310 | | | | | Autonomous City of Buenos Aires Argentina, 144A | | | | | | | | 7.500% | | | | 6/01/27 | | | | B | | | | 290,628 | |

| | 320 | | | | | Autonomous City of Buenos Aires Argentina, Reg S | | | | | | | | 7.500% | | | | 6/01/27 | | | | B | | | | 300,003 | |

| | 210 | | | | | Provincia de Buenos Aires/Argentina, 144A | | | | | | | | | | | 9.125% | | | | 3/16/24 | | | | B | | | | 175,352 | |

| | 220 | | | | | Provincia de Buenos Aires/Argentina, 144A | | | | | | | | | | | 7.875% | | | | 6/15/27 | | | | B | | | | 163,352 | |

| | 171 | | | | | Provincia de Cordoba, 144A | | | | | | | | | | | 7.125% | | | | 6/10/21 | | | | B | | | | 148,770 | |

| | 76 | | | | | YPF SA, 144A | | | | | | | | | | | 8.750% | | | | 4/04/24 | | | | B2 | | | | 76,927 | |

| | 139 | | | | | YPF SA, 144A | | | | | | | | | | | 6.950% | | | | 7/21/27 | | | | B | | | | 126,101 | |

| | 100 | | | | | YPF SA, 144A | | | | | | | | | | | 7.000% | | | | 12/15/47 | | | | B | | | | 85,750 | |

| | 50 | | | | | YPF SA, Reg S | | | | | | | | | | | 8.500% | | | | 7/28/25 | | | | B2 | | | | 50,017 | |

| | | | | | Total Argentina | | | | | | | | | | | | | | | | | | | | | | | 2,973,460 | |

| | |

| | | | | | Armenia – 0.3% | |

| | | | | | | | |

| | 655 | | | | | Republic of Armenia International Bond, Reg S | | | | | | | | | | | 7.150% | | | | 3/26/25 | | | | B1 | | | | 752,379 | |

| | |

| | | | | | Azerbaijan – 1.3% | |

| | | | | | | | |

| | 1,110 | | | | | Republic of Azerbaijan International Bond, Reg S | | | | | | | | | | | 4.750% | | | | 3/18/24 | | | | BB+ | | | | 1,166,765 | |

| | 150 | | | | | Republic of Azerbaijan International Bond, Reg S | | | | | | | | | | | 5.125% | | | | 9/01/29 | | | | BB+ | | | | 156,726 | |

| | 615 | | | | | Republic of Azerbaijan International Bond, Reg S | | | | | | | | | | | 3.500% | | | | 9/01/32 | | | | BB+ | | | | 579,545 | |

| | 210 | | | | | Republic of Azerbaijan International Bond, Reg S | | | | | | | | | | | 3.500% | | | | 9/01/32 | | | | BB+ | | | | 197,893 | |

| | 200 | | | | | Southern Gas Corridor CJSC, 144A | | | | | | | | | | | 6.875% | | | | 3/24/26 | | | | BB+ | | | | 231,831 | |

| | 330 | | | | | Southern Gas Corridor CJSC, Reg S | | | | | | | | | | | 6.875% | | | | 3/24/26 | | | | BB+ | | | | 382,859 | |

| | 210 | | | | | State Oil Co of the Azerbaijan Republic, Reg S | | | | | | | | | | | 6.950% | | | | 3/18/30 | | | | BB+ | | | | 248,367 | |

| | | | | | Total Azerbaijan | | | | | | | | | | | | | | | | | | | | | | | 2,963,986 | |

| | |

| | | | | | Bermuda – 0.1% | |

| | | | | | | | |

| | 200 | | | | | Bermuda Government International Bond, 144A | | | | | | | | | | | 4.750% | | | | 2/15/29 | | | | A+ | | | | 220,500 | |

20

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) (5) | | | | | Description (1) | | | | | | Coupon | | | Maturity | | | Ratings (6) | | | Value | |

| | | | | | |

| | | | | | Brazil – 1.1% | | | | | | | | | | | | |

| | | | | | |

| $ | 255 | | | | | Banco do Brasil SA/Cayman, 144A | | | 4.750% | | | | 3/20/24 | | | | Ba2 | | | $ | 266,526 | |

| | 200 | | | | | Banco do Brasil SA/Cayman, Reg S | | | 4.625% | | | | 1/15/25 | | | | Ba2 | | | | 207,400 | |

| | 200 | | | | | Braskem Netherlands Finance BV, Reg S | | | 4.500% | | | | 1/10/28 | | | | BBB– | | | | 202,300 | |

| | 1,218 | | | BRL | | Brazil Notas do Tesouro Nacional Serie F | | | 10.000% | | | | 1/01/29 | | | | BB– | | | | 369,906 | |

| | 215 | | | | | Brazilian Government International Bond | | | 4.625% | | | | 1/13/28 | | | | BB– | | | | 225,535 | |

| | 225 | | | | | Centrais Eletricas Brasileiras SA, Reg S | | | 5.750% | | | | 10/27/21 | | | | BB– | | | | 235,097 | |

| | 205 | | | | | CSN Resources SA, 144A | | | 7.625% | | | | 4/17/26 | | | | B2 | | | | 217,343 | |

| | 200 | | | | | Minerva Luxembourg SA, Reg S | | | 6.500% | | | | 9/20/26 | | | | BB– | | | | 208,280 | |

| | 200 | | | | | Minerva Luxembourg SA, Reg S | | | 5.875% | | | | 1/19/28 | | | | BB– | | | | 200,000 | |

| | 91 | | | | | Petrobras Global Finance BV | | | 5.999% | | | | 1/27/28 | | | | Ba2 | | | | 96,733 | |

| | 80 | | | | | Petrobras Global Finance BV | | | 6.900% | | | | 3/19/49 | | | | Ba2 | | | | 85,200 | |

| | 200 | | | | | Suzano Austria GmbH, 144A | | | 6.000% | | | | 1/15/29 | | | | BBB– | | | | 218,000 | |

| | | | | | Total Brazil | | | | | | | | | | | | | | | 2,532,320 | |

| | | | | | |

| | | | | | British Virgin Islands – 0.4% | | | | | | | | | | | | |

| | | | | | |

| | 430 | | | | | State Grid Overseas Investment 2016 Ltd, 144A | | | 3.500% | | | | 5/04/27 | | | | A+ | | | | 445,057 | |

| | 450 | | | | | State Grid Overseas Investment 2016 Ltd, 144A | | | 4.250% | | | | 5/02/28 | | | | A+ | | | | 493,513 | |

| | | | | | Total British Virgin Islands | | | | | | | | | | | | | | | 938,570 | |

| | | | | | |

| | | | | | Bulgaria – 0.1% | | | | | | | | | | | | |

| | | | | | |

| | 185 | | | EUR | | Bulgaria Government International Bond, Reg S | | | 3.125% | | | | 3/26/35 | | | | Baa2 | | | | 254,014 | |

| | | | | | |

| | | | | | Chile – 0.6% | | | | | | | | | | | | |

| | | | | | |

| | 200 | | | | | Celulosa Arauco y Constitucion SA | | | 4.500% | | | | 8/01/24 | | | | BBB | | | | 210,250 | |

| | 200 | | | | | Celulosa Arauco y Constitucion SA, 144A | | | 5.500% | | | | 4/30/49 | | | | BBB | | | | 210,500 | |

| | 225 | | | | | Chile Government International Bond | | | 3.500% | | | | 1/25/50 | | | | A | | | | 229,275 | |

| | 260 | | | | | Corp Nacional del Cobre de Chile, 144A | | | 3.625% | | | | 8/01/27 | | | | A+ | | | | 269,038 | |

| | 200 | | | | | Empresa Nacional del Petroleo, 144A | | | 5.250% | | | | 11/06/29 | | | | A | | | | 226,479 | |

| | 200 | | | | | Empresa Nacional del Petroleo, 144A | | | 4.500% | | | | 9/14/47 | | | | A | | | | 204,250 | |

| | | | | | Total Chile | | | | | | | | | | | | | | | 1,349,792 | |

| | | | | | |

| | | | | | China – 0.5% | | | | | | | | | | | | |

| | | | | | |

| | 210 | | | | | China Evergrande Group, Reg S | | | 8.250% | | | | 3/23/22 | | | | B2 | | | | 202,348 | |

| | 200 | | | | | Industrial & Commercial Bank of China Ltd, Reg S | | | 4.875% | | | | 9/21/25 | | | | BBB+ | | | | 215,791 | |

| | 200 | | | | | Shimao Property Holdings Ltd, Reg S | | | 4.750% | | | | 7/03/22 | | | | BBB– | | | | 201,456 | |

| | 380 | | | | | Sinopec Group Overseas Development 2012 Ltd, Reg S | | | 4.875% | | | | 5/17/42 | | | | A+ | | | | 440,517 | |

| | | | | | Total China | | | | | | | | | | | | | | | 1,060,112 | |

| | | | | | |

| | | | | | Colombia – 0.6% | | | | | | | | | | | | |

| | | | | | |

| | 280 | | | | | Colombia Government International Bond | | | 4.500% | | | | 3/15/29 | | | | Baa2 | | | | 305,760 | |

| | 220 | | | | | Colombia Government International Bond | | | 5.000% | | | | 6/15/45 | | | | Baa2 | | | | 242,770 | |

| | 260 | | | | | Ecopetrol SA | | | 5.875% | | | | 9/18/23 | | | | BBB | | | | 287,950 | |

| | 200 | | | | | Millicom International Cellular SA, 144A | | | 6.250% | | | | 3/25/29 | | | | BB+ | | | | 214,622 | |

| | 200 | | | | | Transportadora de Gas Internacional SA ESP, 144A | | | 5.550% | | | | 11/01/28 | | | | BBB | | | | 224,700 | |

| | | | | | Total Colombia | | | | | | | | | | | | | | | 1,275,802 | |

| | | | | | |

| | | | | | Costa Rica – 0.1% | | | | | | | | | | | | |

| | | | | | |

| | 250 | | | | | Costa Rica Government International Bond, Reg S | | | 7.000% | | | | 4/04/44 | | | | B+ | | | | 248,128 | |

| | | | | | |

| | | | | | Cote d“Ivoire – 0.4% | | | | | | | | | | | | |

| | | | | | |

| | 390 | | | | | Ivory Coast Government International Bond, 144A | | | 6.125% | | | | 6/15/33 | | | | Ba3 | | | | 363,184 | |

| | 595 | | | | | Ivory Coast Government International Bond, Reg S | | | 6.125% | | | | 6/15/33 | | | | Ba3 | | | | 554,088 | |

| | | | | | Total Cote d’Ivoire | | | | | | | | | | | | | | | 917,272 | |

| | | | | | |

| | | | | | Croatia – 1.7% | | | | | | | | | | | | |

| | | | | | |

| | 145 | | | | | Croatia Government International Bond, Reg S | | | 6.625% | | | | 7/14/20 | | | | BBB– | | | | 150,568 | |

| | 710 | | | | | Croatia Government International Bond, Reg S | | | 6.375% | | | | 3/24/21 | | | | BBB– | | | | 753,554 | |

| | 675 | | | | | Croatia Government International Bond, Reg S | | | 5.500% | | | | 4/04/23 | | | | BBB– | | | | 746,325 | |

| | 1,155 | | | | | Croatia Government International Bond, Reg S | | | 6.000% | | | | 1/26/24 | | | | BBB– | | | | 1,324,055 | |

| | 125 | | | EUR | | Croatia Government International Bond, Reg S | | | 3.000% | | | | 3/11/25 | | | | BBB– | | | | 162,574 | |

21

| | |

| |

| JDD | | Nuveen Diversified Dividend and Income Fund(continued) |

| | Portfolio of Investments June 30, 2019 |

| | (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) (5) | | | | | Description (1) | | | | | | Coupon | | | Maturity | | | Ratings (6) | | | Value | |

| | |

| | | | | | Croatia(continued) | |

| | | | | | |

| | 335 | | | EUR | | Croatia Government International Bond, Reg S | | | 3.000% | | | | 3/20/27 | | | | BBB– | | | $ | 443,892 | |

| | 210 | | | EUR | | Croatia Government International Bond, Reg S | | | 2.750% | | | | 1/27/30 | | | | BBB– | | | | 277,014 | |

| | | | | | Total Croatia | | | | | | | | | | | | | | | 3,857,982 | |

| | | | | | |

| | | | | | Dominican Republic – 1.1% | | | | | | | | | | | | |

| | | | | | |

| | 165 | | | | | Dominican Republic International Bond, 144A | | | 6.600% | | | | 1/28/24 | | | | BB– | | | | 182,945 | |

| | 480 | | | | | Dominican Republic International Bond, 144A | | | 6.400% | | | | 6/05/49 | | | | BB– | | | | 502,205 | |

| | 423 | | | | | Dominican Republic International Bond, Reg S | | | 7.500% | | | | 5/06/21 | | | | BB– | | | | 445,558 | |

| | 285 | | | | | Dominican Republic International Bond, Reg S | | | 6.600% | | | | 1/28/24 | | | | BB– | | | | 315,997 | |

| | 100 | | | | | Dominican Republic International Bond, Reg S | | | 6.875% | | | | 1/29/26 | | | | BB– | | | | 112,876 | |

| | 545 | | | | | Dominican Republic International Bond, Reg S | | | 7.450% | | | | 4/30/44 | | | | BB– | | | | 631,524 | |

| | 290 | | | | | Dominican Republic International Bond, Reg S | | | 6.850% | | | | 1/27/45 | | | | BB– | | | | 317,191 | |

| | | | | | Total Dominican Republic | | | | | | | | | | | | | | | 2,508,296 | |

| | | | | | |

| | | | | | Ecuador – 0.6% | | | | | | | | | | | | |

| | | | | | |

| | 561 | | | | | Ecuador Government International Bond, 144A | | | 9.650% | | | | 12/13/26 | | | | B– | | | | 607,288 | |

| | 255 | | | | | Ecuador Government International Bond, 144A | | | 7.875% | | | | 1/23/28 | | | | B– | | | | 252,134 | |

| | 355 | | | | | Ecuador Government International Bond, 144A | | | 10.750% | | | | 1/31/29 | | | | B– | | | | 400,266 | |

| | 200 | | | | | Ecuador Government International Bond, Reg S | | | 7.950% | | | | 6/20/24 | | | | B– | | | | 209,502 | |

| | | | | | Total Ecuador | | | | | | | | | | | | | | | 1,469,190 | |

| | | | | | |

| | | | | | Egypt – 1.4% | | | | | | | | | | | | |

| | | | | | |

| | 305 | | | | | Egypt Government International Bond, 144A | | | 6.588% | | | | 2/21/28 | | | | B+ | | | | 307,629 | |

| | 815 | | | | | Egypt Government International Bond, 144A | | | 7.600% | | | | 3/01/29 | | | | B+ | | | | 859,295 | |

| | 200 | | | | | Egypt Government International Bond, 144A | | | 8.700% | | | | 3/01/49 | | | | B+ | | | | 215,000 | |

| | 1,045 | | | | | Egypt Government International Bond, Reg S | | | 6.588% | | | | 2/21/28 | | | | B+ | | | | 1,054,008 | |