UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21410

(Exact name of registrant as specified in charter)

Blackstone Plaza, 3555 Farnam Street, Suite 800 Omaha, NE 68131

(Address of principal executive offices) (Zip code)

Weitz Investment Management, Inc., Blackstone Plaza, 3555 Farnam Street, Suite 800, Omaha, NE 68131

(Name and address of agent for service)

Registrant’s telephone number, including area code: (402) 391-1980

Date of fiscal year end: March 31

Date of reporting period: September 30, 2024

Item 1. Reports to Stockholders.

Weitz Conservative Allocation Fund

Institutional Class (WBAIX)

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Conservative Allocation Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Conservative Allocation Fund - Institutional | 36 | 0.70 |

How did the Fund perform for the period?

The Fund (Ticker: WBAIX) returned 4.25% for the 6-month period ended September 30, 2024.

Equity holdings were the primary drivers, with top contributors including Oracle Corporation, Analog Devices, Inc., Veralto Corporation, S&P Global Inc., and Danaher Corporation, supported by robust performance across technology and industrial sectors. Notable equity detractors included Fortive Corporation, Microchip Technology Incorporated, and Martin Marietta Materials, Inc. The fixed income portfolio, anchored by U.S. Treasuries, provided stable contributions through income and modest price appreciation.

For additional manager insights, visit weitzinvestments.com.

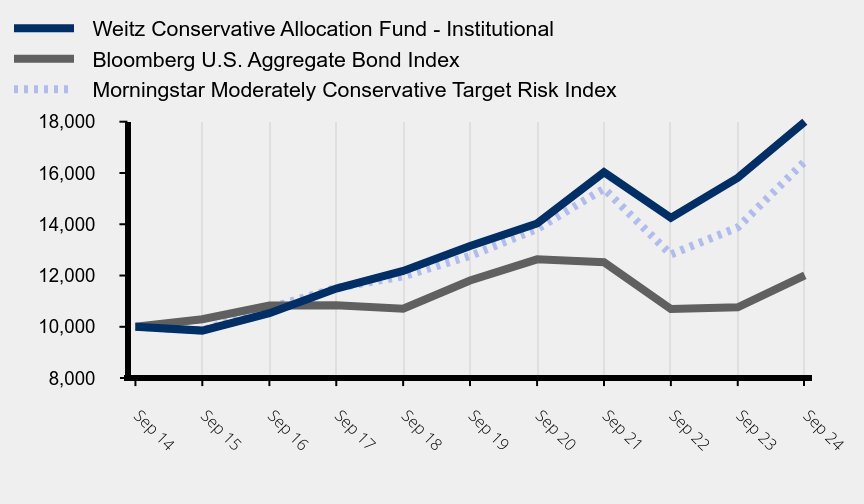

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Conservative Allocation Fund - Institutional | Bloomberg U.S. Aggregate Bond Index | Morningstar Moderately Conservative Target Risk Index |

|---|

| Sep 24 | 17,996 | 12,004 | 16,448 |

| Sep 23 | 15,811 | 10,760 | 13,877 |

| Sep 22 | 14,251 | 10,691 | 12,822 |

| Sep 21 | 16,029 | 12,518 | 15,386 |

| Sep 20 | 14,031 | 12,632 | 13,814 |

| Sep 19 | 13,149 | 11,807 | 12,764 |

| Sep 18 | 12,179 | 10,704 | 11,969 |

| Sep 17 | 11,491 | 10,838 | 11,516 |

| Sep 16 | 10,533 | 10,829 | 10,736 |

| Sep 15 | 9,852 | 10,294 | 9,857 |

| Sep 14 | 10,000 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Conservative Allocation Fund - Institutional - WBAIX | 4.25 | 13.81 | 6.48 | 6.05 |

| Bloomberg U.S. Aggregate Bond Index | 5.26 | 11.57 | 0.33 | 1.84 |

| Morningstar Moderately Conservative Target Risk Index | 6.70 | 18.53 | 5.20 | 5.10 |

The above line chart and returns table compares the fund’s results to (i) the Bloomberg U.S. Aggregate Bond Index, a broad measure of market performance and (ii) the Morningstar Moderately Conservative Target Risk Index, an additional index that the investment adviser believes more closely reflects the market segments in which the fund invests. Performance for the Institutional Class before inception (3/29/2019) is derived from historical performance of the Investor Class and has not been adjusted for expenses of the Institutional Class, had it, returns would have been different.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 239,584,665 |

| Number of Portfolio Holdings | 206 |

| Net Investment Advisory Fees Paid ($) | 707,339 |

| Portfolio Turnover Rate (%) | 12 |

| 30-Day SEC Yield (Subsidized) (%) | 2.20 |

| 30-Day SEC Yield (Unsubsidized) (%) | 2.12 |

| Average Effective Maturity (yrs) | 2.30 |

| Average Effective Duration (yrs) | 1.50 |

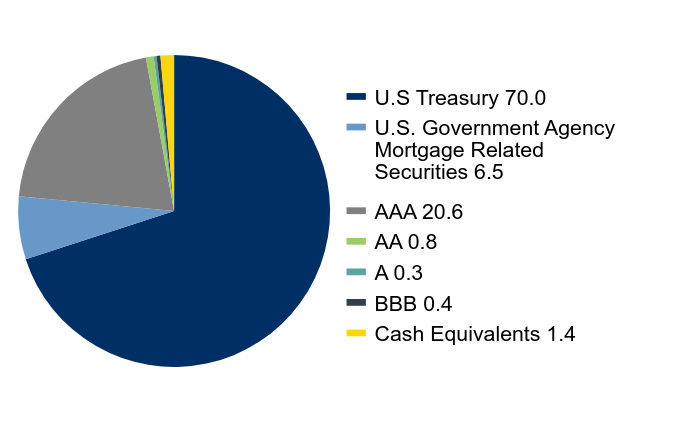

What did the Fund invest in?

(as of September 30, 2023)

| Security | % of Net Assets |

|---|

| Berkshire Hathaway, Inc. | 2.6 |

| Danaher Corp. | 2.4 |

| Aon plc | 2.4 |

| Thermo Fisher Scientific, Inc. | 2.3 |

| Mastercard, Inc. | 2.2 |

| Accenture plc | 2.1 |

| Visa, Inc. | 1.9 |

| Analog Devices, Inc. | 1.9 |

| Vulcan Materials Co. | 1.8 |

| Martin Marietta Materials, Inc. | 1.7 |

| 21.3 |

Credit Quality (% of Portfolio)

| Value | Value |

|---|

| U.S Treasury | 70.0 |

| U.S. Government Agency Mortgage Related Securities | 6.5 |

| AAA | 20.6 |

| AA | 0.8 |

| A | 0.3 |

| BBB | 0.4 |

| Cash Equivalents | 1.4 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Oracle Corp. | 36.3 | 1.5 | 0.50 |

| Analog Devices, Inc. | 17.2 | 2.0 | 0.40 |

| Veralto Corp. | 26.4 | 1.4 | 0.34 |

| S&P Global, Inc. | 21.9 | 1.4 | 0.30 |

| Danaher Corp. | 11.6 | 2.3 | 0.26 |

| % of Net Assets |

| Financials | 11.6 |

| Information Technology | 10.6 |

| Health Care | 7.4 |

| Industrials | 6.3 |

| Materials | 4.7 |

| Communication Services | 2.4 |

| Consumer Staples | 1.4 |

| U.S. Treasuries | 32.5 |

| Asset-Backed Securities | 7.0 |

| Mortgage-Backed Securities | 6.6 |

| Commercial Mortgage-Backed Securities | 2.1 |

| Corporate Bonds | 0.2 |

| Cash Equivalents/Other | 7.2 |

| 100.0 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Martin Marietta Materials, Inc. | (12.1) | 1.8 | (0.25) |

| Vulcan Materials Co. | (7.9) | 1.8 | (0.17) |

| IDEX Corp. | (11.6) | 1.2 | (0.14) |

| Fortive Corp. | (8.1) | 1.1 | (0.12) |

| Michrochip Technology, Inc. | (9.5) | 1.1 | (0.11) |

Credit quality disclosure: Credit ratings are assigned to underlying securities utilizing ratings from a Nationally Recognized Statistical Rating Organization (NRSRO) such as Moody's and Fitch, or other rating agencies and applying the following hierarchy: security is determined to be Investment Grade if it has been rated at least BBB- by one credit rating agency; once determined to be Investment Grade (BBB- and above) or Non-Investment Grade (BB+ and below) where multiple ratings are available, then the lowest rating is assigned. Mortgage-related securities issued and guaranteed by government-sponsored agencies such as Fannie Mae and Freddie Mac are generally not rated by rating agencies. Securities that are not rated do not necessarily indicate low quality. Ratings are shown in the Fitch scale (e.g., AAA). Ratings and portfolio credit quality may change over time. The Fund itself has not been rated by a credit rating agency.

Material fund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Conservative Allocation Fund

Institutional Class (WBAIX)

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Conservative Allocation Fund

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Conservative Allocation Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Conservative Allocation Fund - Investor | 44 | 0.85 |

How did the Fund perform for the period?

The Fund (Ticker: WBALX) returned 4.23% for the 6-month period ended September 30, 2024.

Equity holdings were the primary drivers, with top contributors including Oracle Corporation, Analog Devices, Inc., Veralto Corporation, S&P Global Inc., and Danaher Corporation, supported by robust performance across technology and industrial sectors. Notable equity detractors included Fortive Corporation, Microchip Technology Incorporated, and Martin Marietta Materials, Inc. The fixed income portfolio, anchored by U.S. Treasuries, provided stable contributions through income and modest price appreciation.

For additional manager insights, visit weitzinvestments.com.

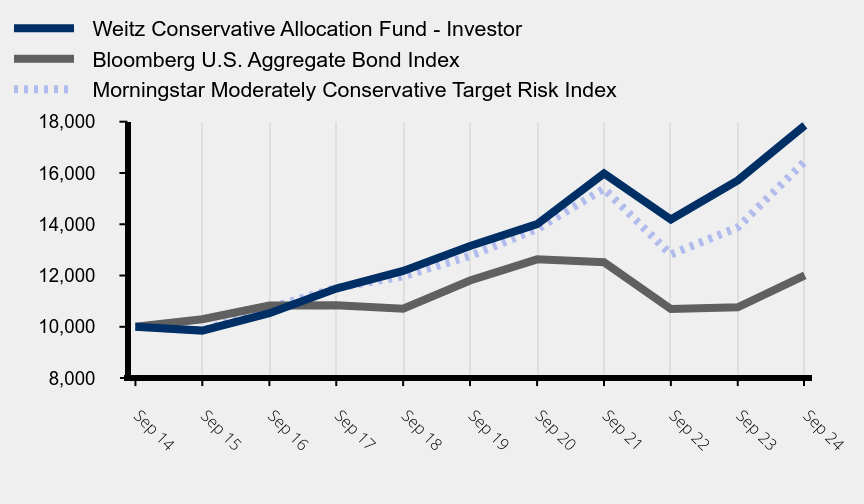

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Conservative Allocation Fund - Investor | Bloomberg U.S. Aggregate Bond Index | Morningstar Moderately Conservative Target Risk Index |

|---|

| Sep 24 | 17,859 | 12,004 | 16,448 |

| Sep 23 | 15,712 | 10,760 | 13,877 |

| Sep 22 | 14,183 | 10,691 | 12,822 |

| Sep 21 | 15,981 | 12,518 | 15,386 |

| Sep 20 | 14,004 | 12,632 | 13,814 |

| Sep 19 | 13,149 | 11,807 | 12,764 |

| Sep 18 | 12,179 | 10,704 | 11,969 |

| Sep 17 | 11,491 | 10,838 | 11,516 |

| Sep 16 | 10,533 | 10,829 | 10,736 |

| Sep 15 | 9,852 | 10,294 | 9,857 |

| Sep 14 | 10,000 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Conservative Allocation Fund - Investor - WBALX | 4.23 | 13.66 | 6.31 | 5.97 |

| Bloomberg U.S. Aggregate Bond Index | 5.26 | 11.57 | 0.33 | 1.84 |

| Morningstar Moderately Conservative Target Risk Index | 6.70 | 18.53 | 5.20 | 5.10 |

The above line chart and returns table compares the fund’s results to (i) the Bloomberg U.S. Aggregate Bond Index, a broad measure of market performance and (ii) the Morningstar Moderately Conservative Target Risk Index, an additional index that the investment adviser believes more closely reflects the market segments in which the fund invests.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 239,584,665 |

| Number of Portfolio Holdings | 206 |

| Net Investment Advisory Fees Paid ($) | 707,339 |

| Portfolio Turnover Rate (%) | 12 |

| 30-Day SEC Yield (Subsidized) (%) | 2.06 |

| 30-Day SEC Yield (Unsubsidized) (%) | 1.92 |

| Average Effective Maturity (yrs) | 2.30 |

| Average Effective Duration (yrs) | 1.50 |

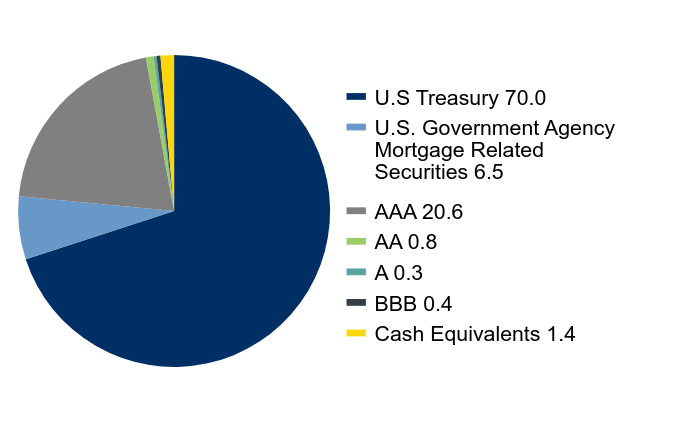

What did the Fund invest in?

(as of September 30, 2023)

| Security | % of Net Assets |

|---|

| Berkshire Hathaway, Inc. | 2.6 |

| Danaher Corp. | 2.4 |

| Aon plc | 2.4 |

| Thermo Fisher Scientific, Inc. | 2.3 |

| Mastercard, Inc. | 2.2 |

| Accenture plc | 2.1 |

| Visa, Inc. | 1.9 |

| Analog Devices, Inc. | 1.9 |

| Vulcan Materials Co. | 1.8 |

| Martin Marietta Materials, Inc. | 1.7 |

| 21.3 |

Credit Quality (% of Portfolio)

| Value | Value |

|---|

| U.S Treasury | 70.0 |

| U.S. Government Agency Mortgage Related Securities | 6.5 |

| AAA | 20.6 |

| AA | 0.8 |

| A | 0.3 |

| BBB | 0.4 |

| Cash Equivalents | 1.4 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Oracle Corp. | 36.3 | 1.5 | 0.50 |

| Analog Devices, Inc. | 17.2 | 2.0 | 0.40 |

| Veralto Corp. | 26.4 | 1.4 | 0.34 |

| S&P Global, Inc. | 21.9 | 1.4 | 0.30 |

| Danaher Corp. | 11.6 | 2.3 | 0.26 |

| % of Net Assets |

| Financials | 11.6 |

| Information Technology | 10.6 |

| Health Care | 7.4 |

| Industrials | 6.3 |

| Materials | 4.7 |

| Communication Services | 2.4 |

| Consumer Staples | 1.4 |

| U.S. Treasuries | 32.5 |

| Asset-Backed Securities | 7.0 |

| Mortgage-Backed Securities | 6.6 |

| Commercial Mortgage-Backed Securities | 2.1 |

| Corporate Bonds | 0.2 |

| Cash Equivalents/Other | 7.2 |

| 100.0 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Martin Marietta Materials, Inc. | (12.1) | 1.8 | (0.25) |

| Vulcan Materials Co. | (7.9) | 1.8 | (0.17) |

| IDEX Corp. | (11.6) | 1.2 | (0.14) |

| Fortive Corp. | (8.1) | 1.1 | (0.12) |

| Michrochip Technology, Inc. | (9.5) | 1.1 | (0.11) |

Credit quality disclosure: Credit ratings are assigned to underlying securities utilizing ratings from a Nationally Recognized Statistical Rating Organization (NRSRO) such as Moody's and Fitch, or other rating agencies and applying the following hierarchy: security is determined to be Investment Grade if it has been rated at least BBB- by one credit rating agency; once determined to be Investment Grade (BBB- and above) or Non-Investment Grade (BB+ and below) where multiple ratings are available, then the lowest rating is assigned. Mortgage-related securities issued and guaranteed by government-sponsored agencies such as Fannie Mae and Freddie Mac are generally not rated by rating agencies. Securities that are not rated do not necessarily indicate low quality. Ratings are shown in the Fitch scale (e.g., AAA). Ratings and portfolio credit quality may change over time. The Fund itself has not been rated by a credit rating agency.

Material fund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Conservative Allocation Fund

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Core Plus Income Fund

Institutional Class (WCPBX)

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Core Plus Income Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Core Plus Income Fund - Institutional | 23 | 0.45 |

How did the Fund perform for the period?

The Fund (Ticker: WCPBX) returned 5.51% for the 6-month period ended September 30, 2024.

U.S. Treasuries, Agency mortgage-backed securities (MBS), corporate bonds, asset-backed securities (ABS), and collateralized loan obligations (CLOs) were top contributors. Treasuries saw gains from longer durations as interest rates declined. MBS benefited from strong coupon income and modestly tighter spreads, while corporate bonds, led by REITs and financials, gained as credit spreads narrowed. ABS and CLOs also delivered solid returns from sector and security selections, with notable contributions from investments in data centers and fiber networks. No segments detracted materially from performance.

For additional manager insights, visit weitzinvestments.com.

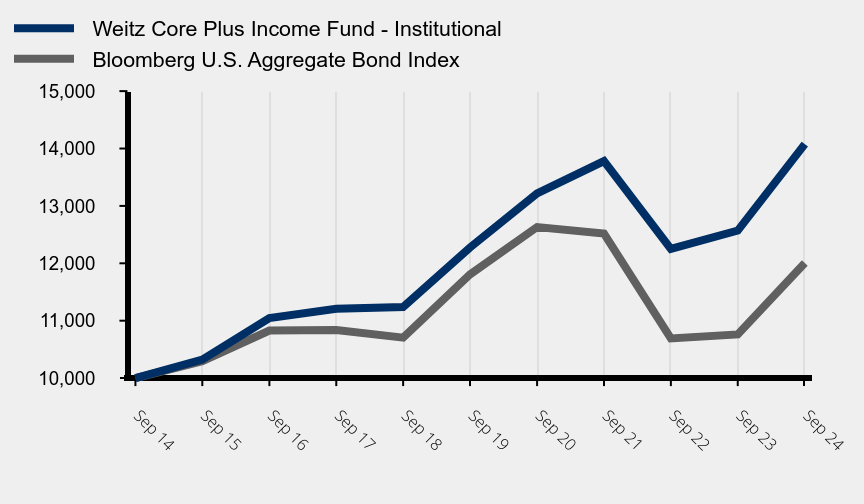

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Core Plus Income Fund - Institutional | Bloomberg U.S. Aggregate Bond Index |

|---|

| Sep 24 | 14,076 | 12,004 |

| Sep 23 | 12,570 | 10,760 |

| Sep 22 | 12,251 | 10,691 |

| Sep 21 | 13,781 | 12,518 |

| Sep 20 | 13,218 | 12,632 |

| Sep 19 | 12,276 | 11,807 |

| Sep 18 | 11,238 | 10,704 |

| Sep 17 | 11,208 | 10,838 |

| Sep 16 | 11,047 | 10,829 |

| Sep 15 | 10,321 | 10,294 |

| Sep 14 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Core Plus Income Fund - Institutional - WCPBX | 5.51 | 11.98 | 2.77 | 3.48 |

| Bloomberg U.S. Aggregate Bond Index | 5.26 | 11.57 | 0.33 | 1.84 |

The above line chart and returns table compares the fund’s results to the Bloomberg U.S. Aggregate Bond Index, a broad measure of market performance.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 2,685,443,145 |

| Number of Portfolio Holdings | 539 |

| Net Investment Advisory Fees Paid ($) | 4,290,636 |

| Portfolio Turnover Rate (%) | 5 |

| 30-Day SEC Yield (Subsidized) (%) | 5.06 |

| 30-Day SEC Yield (Unsubsidized) (%) | 4.97 |

| Average Effective Maturity (yrs) | 9.00 |

| Average Effective Duration (yrs) | 5.50 |

What did the Fund invest in?

(as of September 30, 2023)

| Maturity | % of Portfolio |

| Cash Equivalents | 0.5 |

| Less than 1 Year | 4.5 |

| 1-3 Years | 8.9 |

| 3-5 Years | 21.9 |

| 5-7 Years | 15.5 |

| 7-10 Years | 15.8 |

| 10 Years or more | 32.9 |

| 100.0 |

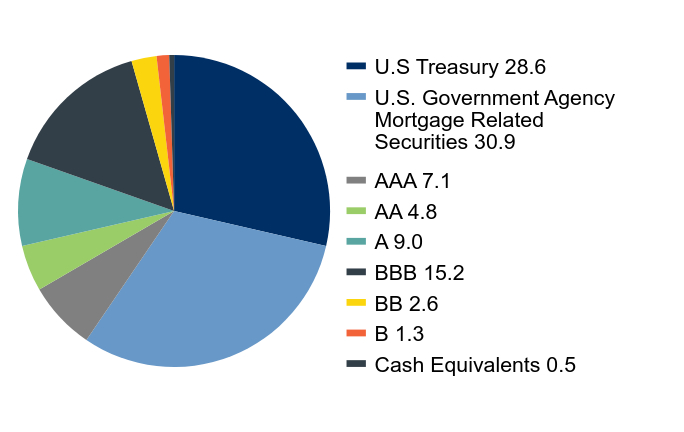

Credit Quality (% of Portfolio)

| Value | Value |

|---|

| U.S Treasury | 28.6 |

| U.S. Government Agency Mortgage Related Securities | 30.9 |

| AAA | 7.1 |

| AA | 4.8 |

| A | 9.0 |

| BBB | 15.2 |

| BB | 2.6 |

| B | 1.3 |

| Cash Equivalents | 0.5 |

| Maturity | | | % of Portfolio |

| Less than 1 Year | | | 16.6 |

| 1-3 Years | | | 20.9 |

| 3-5 Years | | | 27.1 |

| 5-7 Years | | | 9.5 |

7-10 Years | | | 2.9 |

| 10 Years or more | | | 23.0 |

| | | 100.0 |

| % of Net Assets |

| Mortgage-Backed Securities | 34.1 |

| U.S. Treasuries | 28.4 |

| Asset-Backed Securities | 18.0 |

| Corporate Bonds | 12.2 |

| Commercial Mortgage-Backed Securities | 6.3 |

| Short-Term Securities Held as Collateral for Securities on Loan | 0.2 |

| Municipal Bonds | 0.0 |

| Corporate Convertible Bonds | 0.0 |

| Cash Equivalents/Other | 0.8 |

| 100.0 |

Credit quality disclosure: Credit ratings are assigned to underlying securities utilizing ratings from a Nationally Recognized Statistical Rating Organization (NRSRO) such as Moody's and Fitch, or other rating agencies and applying the following hierarchy: security is determined to be Investment Grade if it has been rated at least BBB- by one credit rating agency; once determined to be Investment Grade (BBB- and above) or Non-Investment Grade (BB+ and below) where multiple ratings are available, then the lowest rating is assigned. Mortgage-related securities issued and guaranteed by government-sponsored agencies such as Fannie Mae and Freddie Mac are generally not rated by rating agencies. Securities that are not rated do not necessarily indicate low quality. Ratings are shown in the Fitch scale (e.g., AAA). Ratings and portfolio credit quality may change over time. The Fund itself has not been rated by a credit rating agency.

Material fund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Core Plus Income Fund

Institutional Class (WCPBX)

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Core Plus Income Fund

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Core Plus Income Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. This report describes changes to the Fund that occurred during the reporting period. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Core Plus Income Fund - Investor | 30 | 0.59 |

How did the Fund perform for the period?

The Fund (Ticker: WCPNX) returned 5.45% for the 6-month period ended September 30, 2024.

U.S. Treasuries, Agency mortgage-backed securities (MBS), corporate bonds, asset-backed securities (ABS), and collateralized loan obligations (CLOs) were top contributors. Treasuries saw gains from longer durations as interest rates declined. MBS benefited from strong coupon income and modestly tighter spreads, while corporate bonds, led by REITs and financials, gained as credit spreads narrowed. ABS and CLOs also delivered solid returns from sector and security selections, with notable contributions from investments in data centers and fiber networks. No segments detracted materially from performance.

For additional manager insights, visit weitzinvestments.com.

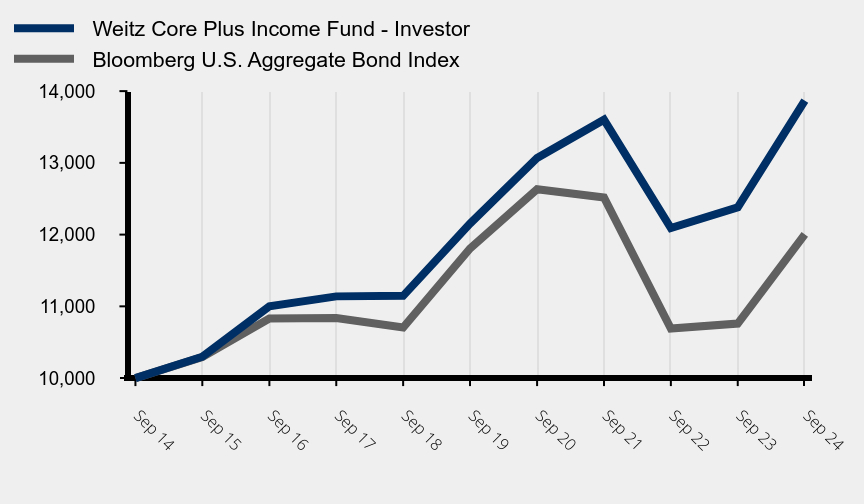

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Core Plus Income Fund - Investor | Bloomberg U.S. Aggregate Bond Index |

|---|

| Sep 24 | 13,868 | 12,004 |

| Sep 23 | 12,381 | 10,760 |

| Sep 22 | 12,091 | 10,691 |

| Sep 21 | 13,602 | 12,518 |

| Sep 20 | 13,069 | 12,632 |

| Sep 19 | 12,153 | 11,807 |

| Sep 18 | 11,146 | 10,704 |

| Sep 17 | 11,139 | 10,838 |

| Sep 16 | 11,000 | 10,829 |

| Sep 15 | 10,298 | 10,294 |

| Sep 14 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Core Plus Income Fund - Investor - WCPNX | 5.45 | 12.01 | 2.67 | 3.32 |

| Bloomberg U.S. Aggregate Bond Index | 5.26 | 11.57 | 0.33 | 1.84 |

The above line chart and returns table compares the fund’s results to the Bloomberg U.S. Aggregate Bond Index, a broad measure of market performance.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 2,685,443,145 |

| Number of Portfolio Holdings | 539 |

| Net Investment Advisory Fees Paid ($) | 4,290,636 |

| Portfolio Turnover Rate (%) | 5 |

| 30-Day SEC Yield (Subsidized) (%) | 4.86 |

| 30-Day SEC Yield (Unsubsidized) (%) | 4.79 |

| Average Effective Maturity (yrs) | 9.00 |

| Average Effective Duration (yrs) | 5.50 |

What did the Fund invest in?

(as of September 30, 2023)

| Maturity | % of Portfolio |

| Cash Equivalents | 0.5 |

| Less than 1 Year | 4.5 |

| 1-3 Years | 8.9 |

| 3-5 Years | 21.9 |

| 5-7 Years | 15.5 |

| 7-10 Years | 15.8 |

| 10 Years or more | 32.9 |

| 100.0 |

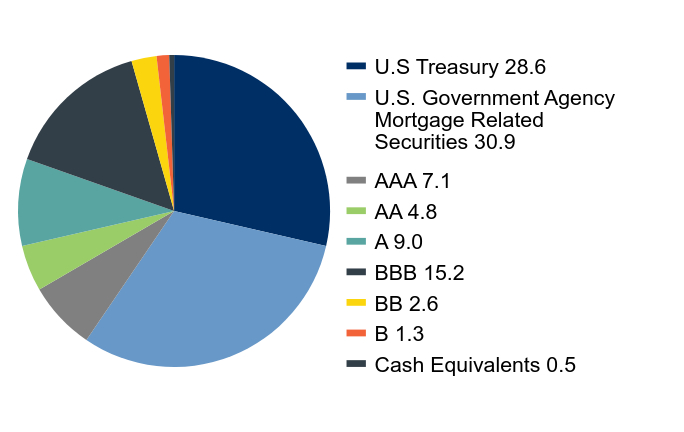

Credit Quality (% of Portfolio)

| Value | Value |

|---|

| U.S Treasury | 28.6 |

| U.S. Government Agency Mortgage Related Securities | 30.9 |

| AAA | 7.1 |

| AA | 4.8 |

| A | 9.0 |

| BBB | 15.2 |

| BB | 2.6 |

| B | 1.3 |

| Cash Equivalents | 0.5 |

| Maturity | | | % of Portfolio |

| Less than 1 Year | | | 16.6 |

| 1-3 Years | | | 20.9 |

| 3-5 Years | | | 27.1 |

| 5-7 Years | | | 9.5 |

| 7-10 Years | | | 2.9 |

| 10 Years or more | | | 23.0 |

| | | 100.0 |

| % of Net Assets |

| Mortgage-Backed Securities | 34.1 |

| U.S. Treasuries | 28.4 |

| Asset-Backed Securities | 18.0 |

| Corporate Bonds | 12.2 |

| Commercial Mortgage-Backed Securities | 6.3 |

| Short-Term Securities Held as Collateral for Securities on Loan | 0.2 |

| Municipal Bonds | 0.0 |

| Corporate Convertible Bonds | 0.0 |

| Cash Equivalents/Other | 0.8 |

| 100.0 |

Credit quality disclosure: Credit ratings are assigned to underlying securities utilizing ratings from a Nationally Recognized Statistical Rating Organization (NRSRO) such as Moody's and Fitch, or other rating agencies and applying the following hierarchy: security is determined to be Investment Grade if it has been rated at least BBB- by one credit rating agency; once determined to be Investment Grade (BBB- and above) or Non-Investment Grade (BB+ and below) where multiple ratings are available, then the lowest rating is assigned. Mortgage-related securities issued and guaranteed by government-sponsored agencies such as Fannie Mae and Freddie Mac are generally not rated by rating agencies. Securities that are not rated do not necessarily indicate low quality. Ratings are shown in the Fitch scale (e.g., AAA). Ratings and portfolio credit quality may change over time. The Fund itself has not been rated by a credit rating agency.

Material fund changes: Effective July 31, 2024, the annual operating expense ratio cap was updated to 0.65%. Prior to July 31, 2024, the annual operating expense ratio cap was 0.55%.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Core Plus Income Fund

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Large Cap Equity Fund

Institutional Class (WVAIX)

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Large Cap Equity Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Large Cap Equity Fund - Institutional | 45 | 0.87 |

How did the Fund perform for the period?

The Fund (Ticker: WVAIX) returned 5.23% for the 6-month period ended September 30, 2024.

Top contributors included Oracle Corporation, Meta Platforms, Inc., Analog Devices, Inc., S&P Global Inc., and Alphabet Inc., benefiting from diverse sector strengths. Primary detractors were CoStar Group, Inc., Global Payments Inc., Salesforce, Inc., Vulcan Materials Company, and Liberty Media Corp-Liberty SiriusXM (sold during the period). Recent additions like IDEX Corporation, Constellation Software Inc., and Old Dominion Freight Line, Inc., reflect the Fund’s focus on high-quality, long-term investments across varied industries.

For additional manager insights, visit weitzinvestments.com.

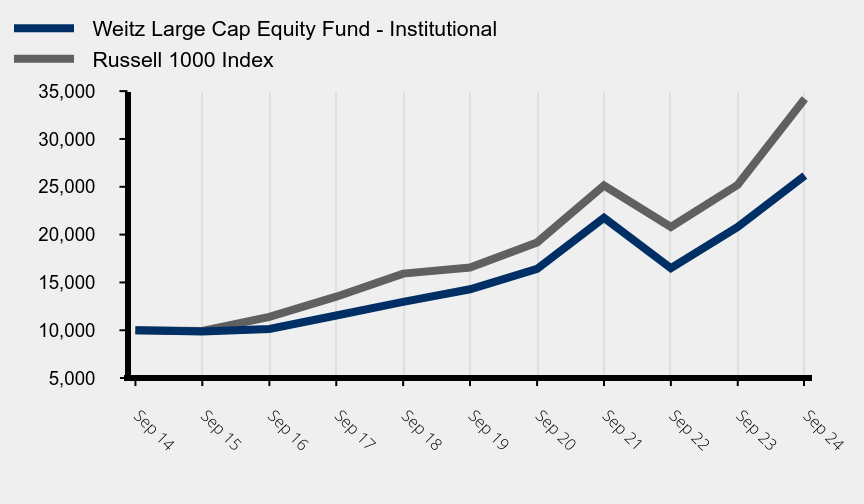

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Large Cap Equity Fund - Institutional | Russell 1000 Index |

|---|

| Sep 24 | 26,172 | 34,203 |

| Sep 23 | 20,805 | 25,209 |

| Sep 22 | 16,500 | 20,800 |

| Sep 21 | 21,756 | 25,130 |

| Sep 20 | 16,424 | 19,185 |

| Sep 19 | 14,282 | 16,554 |

| Sep 18 | 12,972 | 15,921 |

| Sep 17 | 11,543 | 13,510 |

| Sep 16 | 10,142 | 11,405 |

| Sep 15 | 9,871 | 9,923 |

| Sep 14 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Large Cap Equity Fund - Institutional - WVAIX | 5.23 | 25.80 | 12.88 | 10.10 |

| Russell 1000 Index | 9.87 | 35.68 | 15.62 | 13.09 |

The above line chart and returns table compares the fund’s results to the Russell 1000 Index, a broad measure of market performance.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 959,709,050 |

| Number of Portfolio Holdings | 31 |

| Net Investment Advisory Fees Paid ($) | 3,441,005 |

| Portfolio Turnover Rate (%) | 15 |

What did the Fund invest in?

(as of September 30, 2023)

| Security | % of Net Assets |

|---|

| Berkshire Hathaway, Inc. | 5.2 |

| Danaher Corp. | 4.9 |

| Mastercard, Inc. | 4.9 |

| Visa, Inc. | 4.9 |

| Thermo Fisher Scientific, Inc. | 4.9 |

| Global Payments, Inc. | 4.5 |

| Meta Platforms, Inc. | 4.5 |

| Aon plc | 4.4 |

| Alphabet, Inc. | 4.3 |

| Charter Communications, Inc. | 3.7 |

| 46.2 |

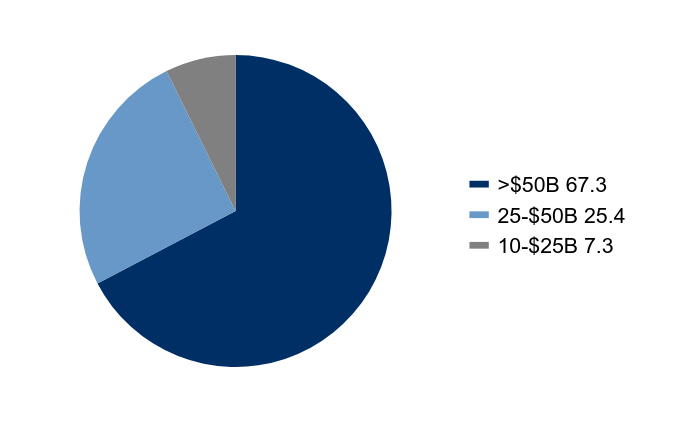

Capitalization (% of Common Stock)

| Value | Value |

|---|

| >$50B | 67.3 |

| 25-$50B | 25.4 |

| 10-$25B | 7.3 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Oracle Corp. | 36.2 | 3.0 | 0.97 |

| Meta Platforms, Inc. - Class A | 18.6 | 4.8 | 0.92 |

| Analog Devices, Inc. | 17.1 | 3.4 | 0.82 |

| Alphabet, Inc. - Class C | 10.0 | 5.0 | 0.65 |

| S&P Global, Inc. | 21.9 | 2.9 | 0.63 |

| % of Net Assets |

| Financials | 28.8 |

| Information Technology | 22.9 |

| Communication Services | 12.5 |

| Health Care | 11.5 |

| Industrials | 10.6 |

| Consumer Discretionary | 6.1 |

| Real Estate | 3.4 |

| Materials | 2.6 |

| Cash Equivalents/Other | 1.6 |

| 100.0 |

| Return (%) | Average Weight (%) | Contribution (%) |

| CoStar Group, Inc. | (21.9) | 3.8 | (1.08) |

| Global Payments, Inc. | (23.1) | 3.6 | (0.76) |

| Liberty Media Corp. - SiriusXM | (25.3) | 0.5 | (0.47) |

| Salesforce, Inc. | (9.0) | 2.8 | (0.38) |

| Vulcan Materials Co. | (8.0) | 3.0 | (0.33) |

Material fund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Large Cap Equity Fund

Institutional Class (WVAIX)

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Large Cap Equity Fund

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Large Cap Equity Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Large Cap Equity Fund - Investor | 52 | 1.02 |

How did the Fund perform for the period?

The Fund (Ticker: WVALX) returned 5.15% for the 6-month period ended September 30, 2024.

Top contributors included Oracle Corporation, Meta Platforms, Inc., Analog Devices, Inc., S&P Global Inc., and Alphabet Inc., benefiting from diverse sector strengths. Primary detractors were CoStar Group, Inc., Global Payments Inc., Salesforce, Inc., Vulcan Materials Company, and Liberty Media Corp-Liberty SiriusXM (sold during the period). Recent additions like IDEX Corporation, Constellation Software Inc., and Old Dominion Freight Line, Inc., reflect the Fund’s focus on high-quality, long-term investments across varied industries.

For additional manager insights, visit weitzinvestments.com.

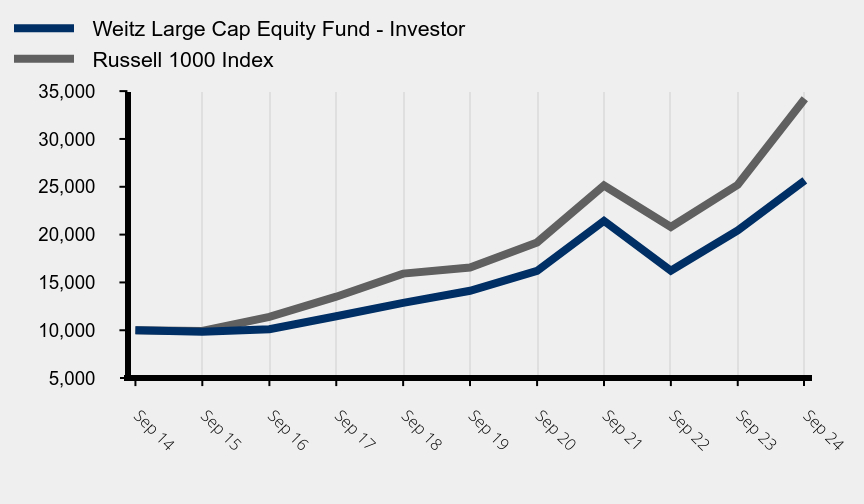

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Large Cap Equity Fund - Investor | Russell 1000 Index |

|---|

| Sep 24 | 25,666 | 34,203 |

| Sep 23 | 20,437 | 25,209 |

| Sep 22 | 16,226 | 20,800 |

| Sep 21 | 21,432 | 25,130 |

| Sep 20 | 16,210 | 19,185 |

| Sep 19 | 14,124 | 16,554 |

| Sep 18 | 12,860 | 15,921 |

| Sep 17 | 11,469 | 13,510 |

| Sep 16 | 10,101 | 11,405 |

| Sep 15 | 9,850 | 9,923 |

| Sep 14 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Large Cap Equity Fund - Investor - WVALX | 5.15 | 25.59 | 12.69 | 9.88 |

| Russell 1000 Index | 9.87 | 35.68 | 15.62 | 13.09 |

The above line chart and returns table compares the fund’s results to the Russell 1000 Index, a broad measure of market performance.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 959,709,050 |

| Number of Portfolio Holdings | 31 |

| Net Investment Advisory Fees Paid ($) | 3,441,005 |

| Portfolio Turnover Rate (%) | 15 |

What did the Fund invest in?

(as of September 30, 2023)

| Security | % of Net Assets |

|---|

| Berkshire Hathaway, Inc. | 5.2 |

| Danaher Corp. | 4.9 |

| Mastercard, Inc. | 4.9 |

| Visa, Inc. | 4.9 |

| Thermo Fisher Scientific, Inc. | 4.9 |

| Global Payments, Inc. | 4.5 |

| Meta Platforms, Inc. | 4.5 |

| Aon plc | 4.4 |

| Alphabet, Inc. | 4.3 |

| Charter Communications, Inc. | 3.7 |

| 46.2 |

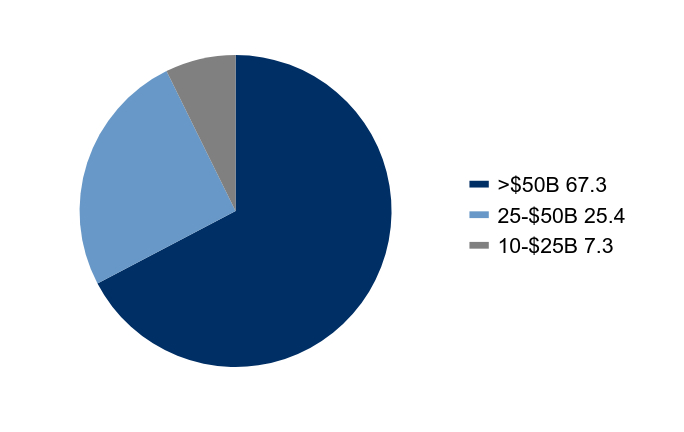

Capitalization (% of Common Stock)

| Value | Value |

|---|

| >$50B | 67.3 |

| 25-$50B | 25.4 |

| 10-$25B | 7.3 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Oracle Corp. | 36.2 | 3.0 | 0.97 |

| Meta Platforms, Inc. - Class A | 18.6 | 4.8 | 0.92 |

| Analog Devices, Inc. | 17.1 | 3.4 | 0.82 |

| Alphabet, Inc. - Class C | 10.0 | 5.0 | 0.65 |

| S&P Global, Inc. | 21.9 | 2.9 | 0.63 |

| % of Net Assets |

| Financials | 28.8 |

| Information Technology | 22.9 |

| Communication Services | 12.5 |

| Health Care | 11.5 |

| Industrials | 10.6 |

| Consumer Discretionary | 6.1 |

| Real Estate | 3.4 |

| Materials | 2.6 |

| Cash Equivalents/Other | 1.6 |

| 100.0 |

| Return (%) | Average Weight (%) | Contribution (%) |

| CoStar Group, Inc. | (21.9) | 3.8 | (1.08) |

| Global Payments, Inc. | (23.1) | 3.6 | (0.76) |

| Liberty Media Corp. - SiriusXM | (25.3) | 0.5 | (0.47) |

| Salesforce, Inc. | (9.0) | 2.8 | (0.38) |

| Vulcan Materials Co. | (8.0) | 3.0 | (0.33) |

Material fund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Large Cap Equity Fund

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Multi Cap Equity Fund

Institutional Class (WPVIX)

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Multi Cap Equity Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Multi Cap Equity Fund - Institutional | 45 | 0.87 |

How did the Fund perform for the period?

The Fund (Ticker: WPVIX) returned 6.87% for the 6-month period ended September 30, 2024.

Top contributors over the period included Perimeter Solutions SA, HEICO Corporation, Guidewire Software Inc., ACI Worldwide Inc., and Meta Platforms Inc., reflecting robust operating momentum and company-specific strategies. Detractors included CoStar Group Inc., LKQ Corporation, Liberty Media Corp-Liberty SiriusXM, Martin Marietta Materials Inc., and CarMax Inc., impacted by sector-specific challenges.

For additional manager insights, visit weitzinvestments.com.

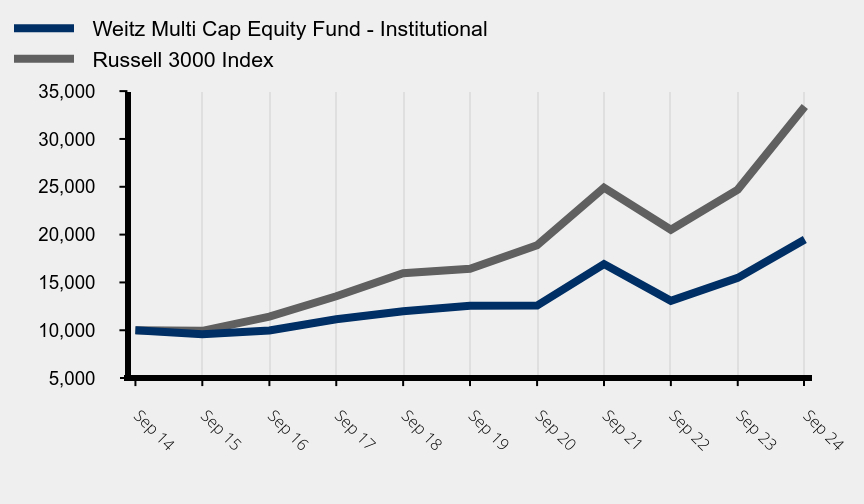

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Multi Cap Equity Fund - Institutional | Russell 3000 Index |

|---|

| Sep 24 | 19,489 | 33,401 |

| Sep 23 | 15,475 | 24,706 |

| Sep 22 | 13,074 | 20,510 |

| Sep 21 | 16,918 | 24,902 |

| Sep 20 | 12,576 | 18,880 |

| Sep 19 | 12,564 | 16,426 |

| Sep 18 | 11,977 | 15,952 |

| Sep 17 | 11,143 | 13,556 |

| Sep 16 | 9,981 | 11,429 |

| Sep 15 | 9,588 | 9,941 |

| Sep 14 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Multi Cap Equity Fund - Institutional - WPVIX | 6.87 | 25.94 | 9.18 | 6.90 |

| Russell 3000 Index | 9.65 | 35.19 | 15.25 | 12.82 |

The above line chart and returns table compares the fund’s results to the Russell 3000 Index, a broad measure of market performance.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 593,976,885 |

| Number of Portfolio Holdings | 34 |

| Net Investment Advisory Fees Paid ($) | 2,108,990 |

| Portfolio Turnover Rate (%) | 6 |

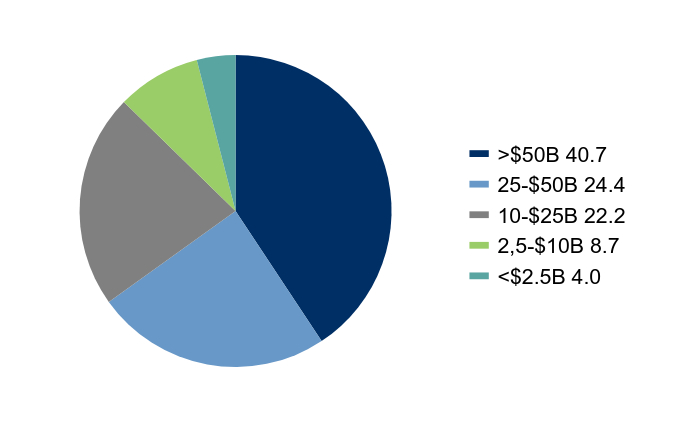

What did the Fund invest in?

(as of September 30, 2023)

| Security | % of Net Assets |

|---|

| Berkshire Hathaway, Inc. | 7.0 |

| Meta Platforms, Inc. | 6.2 |

| Alphabet, Inc. | 5.5 |

| HEICO Corp. | 5.5 |

| Visa, Inc. | 4.3 |

| Mastercard, Inc. | 4.2 |

| Aon plc | 3.9 |

| Liberty Broadband Corp. | 3.9 |

| CoStar Group, Inc. | 3.8 |

| Danaher Corp. | 3.5 |

| 47.8 |

Capitalization (% of Common Stock)

| Value | Value |

|---|

| >$50B | 40.7 |

| 25-$50B | 24.4 |

| 10-$25B | 22.2 |

| 2,5-$10B | 8.7 |

| 4.0 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Perimeter Solutions SA | 80.7 | 2.8 | 1.86 |

| HEICO Corp. - Class A | 32.4 | 5.3 | 1.66 |

| Guidewire Software, Inc. | 56.6 | 2.6 | 1.28 |

| ACI Worldwide, Inc. | 53.3 | 2.6 | 1.23 |

| Liberty Broadband Corp. - Class C | 34.9 | 3.0 | 1.07 |

| % of Net Assets |

| Communication Services | 20.3 |

| Financials | 19.4 |

| Information Technology | 15.7 |

| Industrials | 14.6 |

| Materials | 8.7 |

| Health Care | 6.6 |

| Consumer Discretionary | 6.4 |

| Real Estate | 3.8 |

| Warrants | 0.0 |

| Cash Equivalents/Other | 4.5 |

| 100.0 |

| Return (%) | Average Weight (%) | Contribution (%) |

| CoStar Group, Inc. | (21.9) | 4.3 | (1.27) |

| LKQ Corp. | (24.3) | 3.4 | (1.07) |

| Liberty Media Corp. - SiriusXM | (25.0) | 2.9 | (1.04) |

| CarMax, Inc. | (11.3) | 3.6 | (0.46) |

| Martin Marietta Materials, Inc. | (12.1) | 3.1 | (0.46) |

Material fund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Multi Cap Equity Fund

Institutional Class (WPVIX)

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Multi Cap Equity Fund

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Multi Cap Equity Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Multi Cap Equity Fund - Investor | 55 | 1.06 |

How did the Fund perform for the period?

The Fund (Ticker: WPVLX) returned 6.73% for the 6-month period ended September 30, 2024.

Top contributors over the period included Perimeter Solutions SA, HEICO Corporation, Guidewire Software Inc., ACI Worldwide Inc., and Meta Platforms Inc., reflecting robust operating momentum and company-specific strategies. Detractors included CoStar Group Inc., LKQ Corporation, Liberty Media Corp-Liberty SiriusXM, Martin Marietta Materials Inc., and CarMax Inc., impacted by sector-specific challenges.

For additional manager insights, visit weitzinvestments.com.

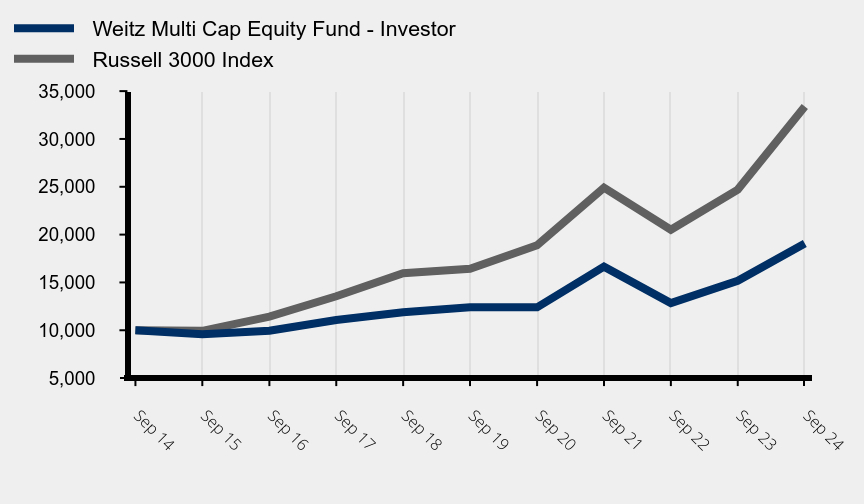

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Multi Cap Equity Fund - Investor | Russell 3000 Index |

|---|

| Sep 24 | 19,075 | 33,401 |

| Sep 23 | 15,179 | 24,706 |

| Sep 22 | 12,844 | 20,510 |

| Sep 21 | 16,652 | 24,902 |

| Sep 20 | 12,400 | 18,880 |

| Sep 19 | 12,417 | 16,426 |

| Sep 18 | 11,872 | 15,952 |

| Sep 17 | 11,073 | 13,556 |

| Sep 16 | 9,945 | 11,429 |

| Sep 15 | 9,572 | 9,941 |

| Sep 14 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Multi Cap Equity Fund - Investor - WPVLX | 6.73 | 25.67 | 8.97 | 6.67 |

| Russell 3000 Index | 9.65 | 35.19 | 15.25 | 12.82 |

The above line chart and returns table compares the fund’s results to the Russell 3000 Index, a broad measure of market performance.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 593,976,885 |

| Number of Portfolio Holdings | 34 |

| Net Investment Advisory Fees Paid ($) | 2,108,990 |

| Portfolio Turnover Rate (%) | 6 |

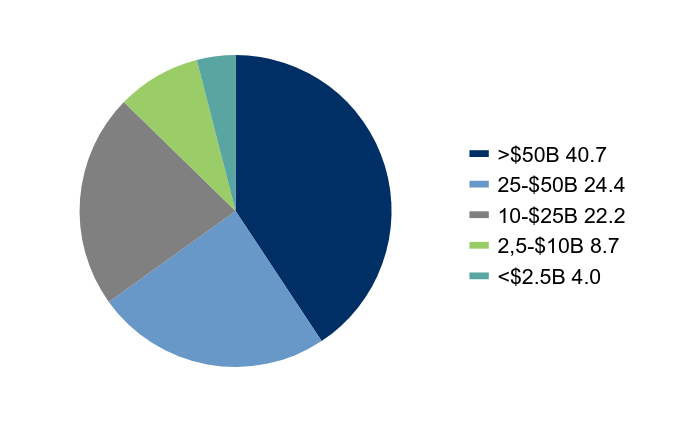

What did the Fund invest in?

(as of September 30, 2023)

| Security | % of Net Assets |

|---|

| Berkshire Hathaway, Inc. | 7.0 |

| Meta Platforms, Inc. | 6.2 |

| Alphabet, Inc. | 5.5 |

| HEICO Corp. | 5.5 |

| Visa, Inc. | 4.3 |

| Mastercard, Inc. | 4.2 |

| Aon plc | 3.9 |

| Liberty Broadband Corp. | 3.9 |

| CoStar Group, Inc. | 3.8 |

| Danaher Corp. | 3.5 |

| 47.8 |

Capitalization (% of Common Stock)

| Value | Value |

|---|

| >$50B | 40.7 |

| 25-$50B | 24.4 |

| 10-$25B | 22.2 |

| 2,5-$10B | 8.7 |

| 4.0 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Perimeter Solutions SA | 80.7 | 2.8 | 1.86 |

| HEICO Corp. - Class A | 32.4 | 5.3 | 1.66 |

| Guidewire Software, Inc. | 56.6 | 2.6 | 1.28 |

| ACI Worldwide, Inc. | 53.3 | 2.6 | 1.23 |

| Liberty Broadband Corp. - Class C | 34.9 | 3.0 | 1.07 |

| % of Net Assets |

| Communication Services | 20.3 |

| Financials | 19.4 |

| Information Technology | 15.7 |

| Industrials | 14.6 |

| Materials | 8.7 |

| Health Care | 6.6 |

| Consumer Discretionary | 6.4 |

| Real Estate | 3.8 |

| Warrants | 0.0 |

| Cash Equivalents/Other | 4.5 |

| 100.0 |

| Return (%) | Average Weight (%) | Contribution (%) |

| CoStar Group, Inc. | (21.9) | 4.3 | (1.27) |

| LKQ Corp. | (24.3) | 3.4 | (1.07) |

| Liberty Media Corp. - SiriusXM | (25.0) | 2.9 | (1.04) |

| CarMax, Inc. | (11.3) | 3.6 | (0.46) |

| Martin Marietta Materials, Inc. | (12.1) | 3.1 | (0.46) |

Material fund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Multi Cap Equity Fund

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Nebraska Tax Free Income Fund

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Nebraska Tax Free Income Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Nebraska Tax Free Income Fund | 23 | 0.45 |

How did the Fund perform for the period?

The Fund (Ticker: WNTFX) returned 2.26% for the 6-month period ended September 30, 2024.

Top contributors included school district bonds, utility bonds, appropriation-backed bonds, city general obligations, and hospital revenue bonds across Nebraska. No segments detracted from performance.

Credit conditions across most municipal bond sectors remain supportive as the U.S. economy continues to grow, unemployment remains low, and tax receipts continue to be strong. Nebraska's fiscal, educational, employment, and economic stability further support state and local bond conditions.

For additional manager insights, visit weitzinvestments.com.

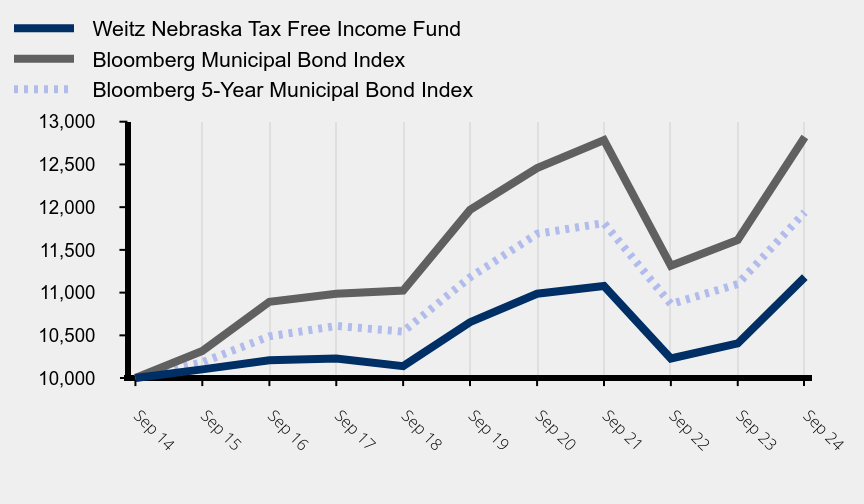

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Nebraska Tax Free Income Fund | Bloomberg Municipal Bond Index | Bloomberg 5-Year Municipal Bond Index |

|---|

| Sep 24 | 11,182 | 12,821 | 11,940 |

| Sep 23 | 10,405 | 11,616 | 11,100 |

| Sep 22 | 10,229 | 11,315 | 10,866 |

| Sep 21 | 11,077 | 12,785 | 11,814 |

| Sep 20 | 10,987 | 12,458 | 11,688 |

| Sep 19 | 10,654 | 11,968 | 11,179 |

| Sep 18 | 10,139 | 11,025 | 10,544 |

| Sep 17 | 10,228 | 10,987 | 10,610 |

| Sep 16 | 10,209 | 10,892 | 10,488 |

| Sep 15 | 10,102 | 10,316 | 10,185 |

| Sep 14 | 10,000 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Nebraska Tax Free Income Fund - WNTFX | 2.26 | 7.46 | 0.97 | 1.12 |

| Bloomberg Municipal Bond Index | 2.69 | 10.37 | 1.39 | 2.52 |

| Bloomberg 5-Year Municipal Bond Index | 2.61 | 7.56 | 1.32 | 1.79 |

The above line chart and returns table compares the fund’s results to (i) the Bloomberg Municipal Bond Index, a broad measure of market performance and (ii) the Bloomberg 5-Year Municipal Bond Index, an additional index that the investment adviser believes more closely reflects the market segments in which the fund invests.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 23,238,721 |

| Number of Portfolio Holdings | 94 |

| Net Investment Advisory Fees Paid ($) | 45,772 |

| Portfolio Turnover Rate (%) | - |

| 30-Day SEC Yield (Subsidized) (%) | 2.55 |

| 30-Day SEC Yield (Unsubsidized) (%) | 1.86 |

| Average Effective Maturity (yrs) | 2.90 |

| Average Effective Duration (yrs) | 2.70 |

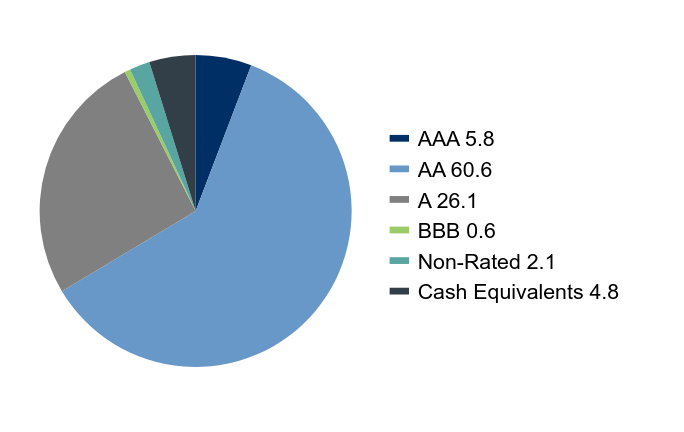

What did the Fund invest in?

(as of September 30, 2023)

| Maturity | % of Portfolio |

| Cash Equivalents | 4.8 |

| Less than 1 Year | 21.2 |

| 1-3 Years | 39.7 |

| 3-5 Years | 13.6 |

| 5-7 Years | 11.7 |

| 7-10 Years | 4.9 |

| 10 Years or more | 4.1 |

| 100.0 |

Credit Quality (% of Portfolio)

| Value | Value |

|---|

| AAA | 5.8 |

| AA | 60.6 |

| A | 26.1 |

| BBB | 0.6 |

| Non-Rated | 2.1 |

| Cash Equivalents | 4.8 |

| Maturity | | | % of Portfolio |

| Less than 1 Year | | | 26.3 |

| 1-3 Years | | | 41.3 |

| 3-5 Years | | | 14.5 |

| 5-7 Years | | | 13.0 |

| 7-10 Years | | | 4.5 |

| 10 Years or more | | | 0.4 |

| | | 100.0 |

| % of Net Assets |

| Revenue | 61.0 |

| General Obligation | 27.8 |

| Escrow/Pre-Refunded | 5.5 |

| Cash Equivalents/Other | 5.7 |

| 100.0 |

Credit quality disclosure: Credit ratings are assigned to underlying securities utilizing ratings from a Nationally Recognized Statistical Rating Organization (NRSRO) such as Moody's and Fitch, or other rating agencies and applying the following hierarchy: security is determined to be Investment Grade if it has been rated at least BBB- by one credit rating agency; once determined to be Investment Grade (BBB- and above) or Non-Investment Grade (BB+ and below) where multiple ratings are available, then the lowest rating is assigned. Mortgage-related securities issued and guaranteed by government-sponsored agencies such as Fannie Mae and Freddie Mac are generally not rated by rating agencies. Securities that are not rated do not necessarily indicate low quality. Ratings are shown in the Fitch scale (e.g., AAA). Ratings and portfolio credit quality may change over time. The Fund itself has not been rated by a credit rating agency.

Material fund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Nebraska Tax Free Income Fund

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Partners III Opportunity Fund

Institutional Class (WPOPX)

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Partners III Opportunity Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Partners III Opportunity Fund - Institutional | 61 | 1.18 |

How did the Fund perform for the period?

The Fund (Ticker: WPOPX) returned 6.15% for the 6-month period ended September 30, 2024.

Top contributors over this period included Perimeter Solutions SA, Liberty Broadband Corporation, Berkshire Hathaway Inc., Aon plc, and Alphabet Inc., driven by strong operating momentum and effective company-specific execution. Primary detractors were Liberty Media Corp-Liberty SiriusXM, Global Payments Inc., CoStar Group Inc., Sirius XM Holdings Inc., and CarMax Inc.

For additional manager insights, visit weitzinvestments.com.

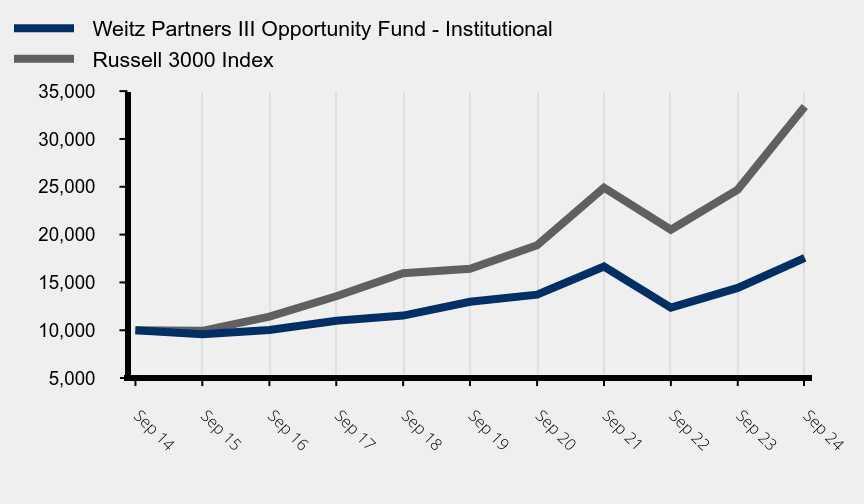

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Partners III Opportunity Fund - Institutional | Russell 3000 Index |

|---|

| Sep 24 | 17,562 | 33,401 |

| Sep 23 | 14,427 | 24,706 |

| Sep 22 | 12,359 | 20,510 |

| Sep 21 | 16,656 | 24,902 |

| Sep 20 | 13,722 | 18,880 |

| Sep 19 | 12,981 | 16,426 |

| Sep 18 | 11,535 | 15,952 |

| Sep 17 | 10,995 | 13,556 |

| Sep 16 | 10,029 | 11,429 |

| Sep 15 | 9,595 | 9,941 |

| Sep 14 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Partners III Opportunity Fund - Institutional - WPOPX | 6.15 | 21.73 | 6.23 | 5.79 |

| Russell 3000 Index | 9.65 | 35.19 | 15.25 | 12.82 |

The above line chart and returns table compares the fund’s results to the Russell 3000 Index, a broad measure of market performance.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 438,289,958 |

| Number of Portfolio Holdings | 33 |

| Net Investment Advisory Fees Paid ($) | 2,078,906 |

| Portfolio Turnover Rate (%) | 14 |

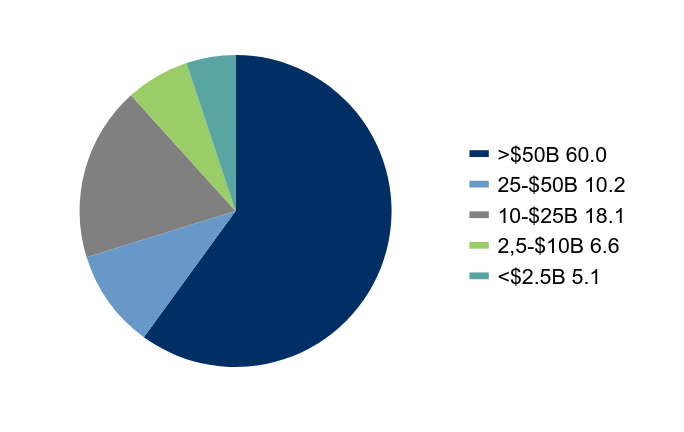

What did the Fund invest in?

(as of September 30, 2023)

| Security | % of Net Assets |

|---|

| Berkshire Hathaway, Inc. | 11.3 |

| Liberty Broadband Corp. | 6.4 |

| Danaher Corp. | 5.1 |

| Mastercard, Inc. | 5.1 |

| Thermo Fisher Scientific, Inc. | 4.9 |

| Visa, Inc. | 4.7 |

| Global Payments, Inc. | 4.2 |

| Alphabet, Inc. | 4.0 |

| Aon plc | 4.0 |

| CarMax, Inc. | 3.9 |

| 53.6 |

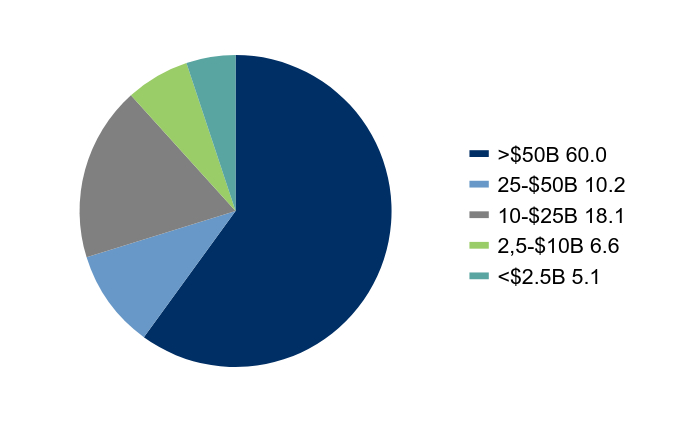

Capitalization (% of Common Stock)

| Value | Value |

|---|

| >$50B | 60.0 |

| 25-$50B | 10.2 |

| 10-$25B | 18.1 |

| 2,5-$10B | 6.6 |

| 5.1 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Perimeter Solutions SA | 80.9 | 3.1 | 2.06 |

| Liberty Broadband Corp. - Class C | 35.0 | 4.9 | 1.95 |

| Berkshire Hathaway, Inc. - Class B | 9.5 | 11.1 | 1.09 |

| Aon plc - Class A | 19.9 | 2.8 | 0.75 |

| Alphabet, Inc. - Class C | 10.0 | 5.2 | 0.73 |

| % of Net Assets |

| Financials | 31.2 |

| Communication Services | 17.1 |

| Information Technology | 14.1 |

| Health Care | 13.1 |

| Consumer Discretionary | 7.5 |

| Industrials | 4.3 |

| Materials | 3.1 |

| Real Estate | 2.4 |

| Warrants | 0.1 |

| Securities Sold Short | (4.6) |

| Short Proceeds/Other | 11.7 |

| 100.0 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Liberty Media Corp. - SiriusXM | (25.0) | 3.1 | (1.14) |

| Global Payments, Inc. | (24.5) | 4.0 | (1.04) |

| CoStar Group, Inc. | (21.9) | 2.7 | (0.80) |

| CarMax, Inc. | (12.2) | 4.2 | (0.51) |

| Sirius XM Holdings, Inc. | (13.6) | 0.3 | (0.46) |

Material fund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Partners III Opportunity Fund

Institutional Class (WPOPX)

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Partners III Opportunity Fund

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Partners III Opportunity Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Partners III Opportunity Fund - Investor | 101 | 1.96 |

How did the Fund perform for the period?

The Fund (Ticker: WPOIX) returned 5.76% for the 6-month period ended September 30, 2024.

Top contributors over this period included Perimeter Solutions SA, Liberty Broadband Corporation, Berkshire Hathaway Inc., Aon plc, and Alphabet Inc., driven by strong operating momentum and effective company-specific execution. Primary detractors were Liberty Media Corp-Liberty SiriusXM, Global Payments Inc., CoStar Group Inc., Sirius XM Holdings Inc., and CarMax Inc.

For additional manager insights, visit weitzinvestments.com.

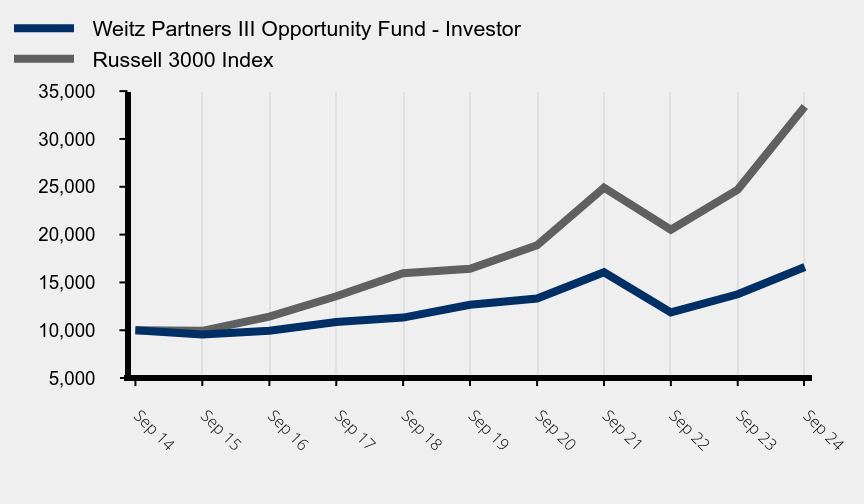

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Partners III Opportunity Fund - Investor | Russell 3000 Index |

|---|

| Sep 24 | 16,611 | 33,401 |

| Sep 23 | 13,757 | 24,706 |

| Sep 22 | 11,874 | 20,510 |

| Sep 21 | 16,060 | 24,902 |

| Sep 20 | 13,310 | 18,880 |

| Sep 19 | 12,670 | 16,426 |

| Sep 18 | 11,324 | 15,952 |

| Sep 17 | 10,853 | 13,556 |

| Sep 16 | 9,948 | 11,429 |

| Sep 15 | 9,560 | 9,941 |

| Sep 14 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Partners III Opportunity Fund - Investor - WPOIX | 5.76 | 20.75 | 5.57 | 5.21 |

| Russell 3000 Index | 9.65 | 35.19 | 15.25 | 12.82 |

The above line chart and returns table compares the fund’s results to the Russell 3000 Index, a broad measure of market performance.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 438,289,958 |

| Number of Portfolio Holdings | 33 |

| Net Investment Advisory Fees Paid ($) | 2,078,906 |

| Portfolio Turnover Rate (%) | 14 |

What did the Fund invest in?

(as of September 30, 2023)

| Security | % of Net Assets |

|---|

| Berkshire Hathaway, Inc. | 11.3 |

| Liberty Broadband Corp. | 6.4 |

| Danaher Corp. | 5.1 |

| Mastercard, Inc. | 5.1 |

| Thermo Fisher Scientific, Inc. | 4.9 |

| Visa, Inc. | 4.7 |

| Global Payments, Inc. | 4.2 |

| Alphabet, Inc. | 4.0 |

| Aon plc | 4.0 |

| CarMax, Inc. | 3.9 |

| 53.6 |

Capitalization (% of Common Stock)

| Value | Value |

|---|

| >$50B | 60.0 |

| 25-$50B | 10.2 |

| 10-$25B | 18.1 |

| 2,5-$10B | 6.6 |

| 5.1 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Perimeter Solutions SA | 80.9 | 3.1 | 2.06 |

| Liberty Broadband Corp. - Class C | 35.0 | 4.9 | 1.95 |

| Berkshire Hathaway, Inc. - Class B | 9.5 | 11.1 | 1.09 |

| Aon plc - Class A | 19.9 | 2.8 | 0.75 |

| Alphabet, Inc. - Class C | 10.0 | 5.2 | 0.73 |

| % of Net Assets |

| Financials | 31.2 |

| Communication Services | 17.1 |

| Information Technology | 14.1 |

| Health Care | 13.1 |

| Consumer Discretionary | 7.5 |

| Industrials | 4.3 |

| Materials | 3.1 |

| Real Estate | 2.4 |

| Warrants | 0.1 |

| Securities Sold Short | (4.6) |

| Short Proceeds/Other | 11.7 |

| 100.0 |

| Return (%) | Average Weight (%) | Contribution (%) |

| Liberty Media Corp. - SiriusXM | (25.0) | 3.1 | (1.14) |

| Global Payments, Inc. | (24.5) | 4.0 | (1.04) |

| CoStar Group, Inc. | (21.9) | 2.7 | (0.80) |

| CarMax, Inc. | (12.2) | 4.2 | (0.51) |

| Sirius XM Holdings, Inc. | (13.6) | 0.3 | (0.46) |

Material fund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Partners III Opportunity Fund

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

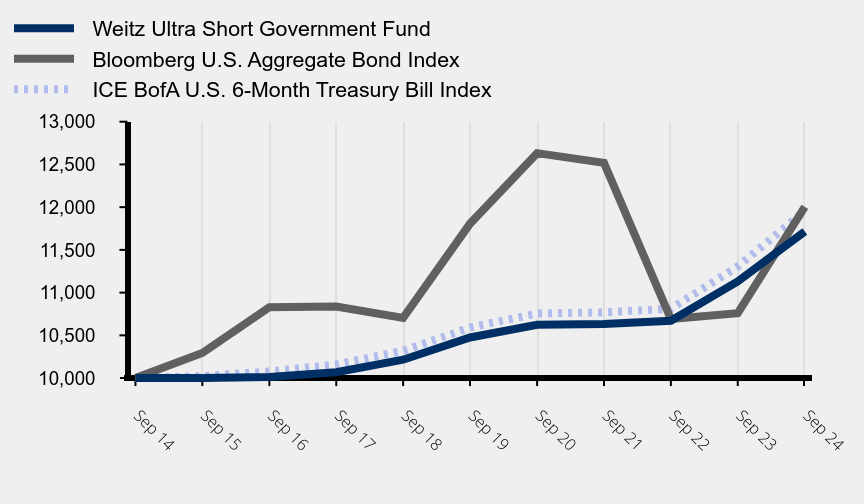

Weitz Short Duration Income Fund

Institutional Class (WEFIX)

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Short Duration Income Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Short Duration Income Fund - Institutional | 23 | 0.45 |

How did the Fund perform for the period?

The Fund (Ticker: WEFIX) returned 3.97% for the 6-month period ended September 30, 2024.

Top contributors included asset-backed securities (ABS), U.S. Treasuries, collateralized loan obligations (CLOs), non-Agency CMOs (Collateralized Mortgage Obligations), and corporate bonds. ABS performed strongly due to stable prices and robust coupon income, especially in auto, equipment, fleet, and consumer loans. U.S. Treasuries and CLOs added positive returns, benefiting from favorable rates and sector selection. No segments detracted from performance.

For additional manager insights, visit weitzinvestments.com.

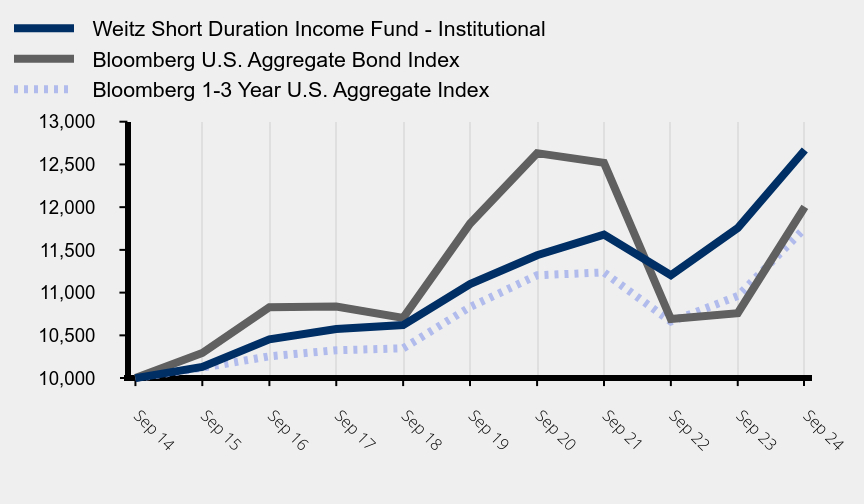

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Short Duration Income Fund - Institutional | Bloomberg U.S. Aggregate Bond Index | Bloomberg 1-3 Year U.S. Aggregate Index |

|---|

| Sep 24 | 12,669 | 12,004 | 11,753 |

| Sep 23 | 11,756 | 10,760 | 10,960 |

| Sep 22 | 11,204 | 10,691 | 10,661 |

| Sep 21 | 11,678 | 12,518 | 11,236 |

| Sep 20 | 11,437 | 12,632 | 11,203 |

| Sep 19 | 11,099 | 11,807 | 10,831 |

| Sep 18 | 10,620 | 10,704 | 10,348 |

| Sep 17 | 10,574 | 10,838 | 10,326 |

| Sep 16 | 10,454 | 10,829 | 10,255 |

| Sep 15 | 10,131 | 10,294 | 10,121 |

| Sep 14 | 10,000 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Short Duration Income Fund - Institutional - WEFIX | 3.97 | 7.77 | 2.68 | 2.39 |

| Bloomberg U.S. Aggregate Bond Index | 5.26 | 11.57 | 0.33 | 1.84 |

| Bloomberg 1-3 Year U.S. Aggregate Index | 3.93 | 7.23 | 1.65 | 1.63 |

The above line chart and returns table compares the fund’s results to (i) the Bloomberg U.S. Aggregate Bond Index, a broad measure of market performance and (ii) the Bloomberg 1-3 Year U.S. Aggregate Index, an additional index that the investment adviser believes more closely reflects the market segments in which the fund invests.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 941,993,324 |

| Number of Portfolio Holdings | 334 |

| Net Investment Advisory Fees Paid ($) | 1,788,005 |

| Portfolio Turnover Rate (%) | 22 |

| 30-Day SEC Yield (Subsidized) (%) | 4.83 |

| 30-Day SEC Yield (Unsubsidized) (%) | 4.69 |

| Average Effective Maturity (yrs) | 3.40 |

| Average Effective Duration (yrs) | 1.30 |

What did the Fund invest in?

(as of September 30, 2023)

| Maturity | % of Portfolio |

| Cash Equivalents | 3.3 |

| Less than 1 Year | 23.0 |

| 1-3 Years | 44.0 |

| 3-5 Years | 7.9 |

| 5-7 Years | 6.1 |

| 7-10 Years | 6.0 |

| 10 Years or more | 9.7 |

| 100.0 |

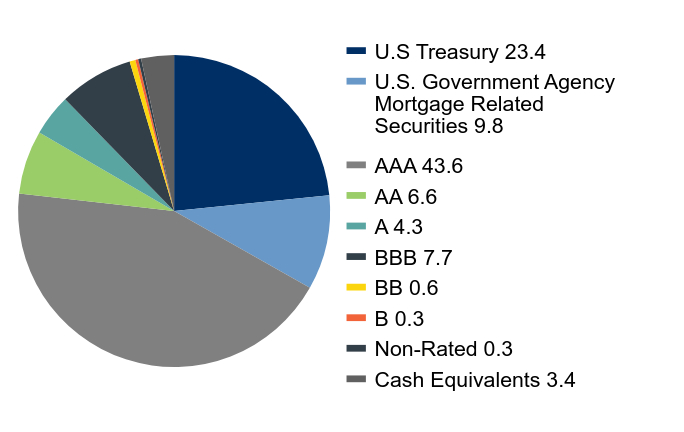

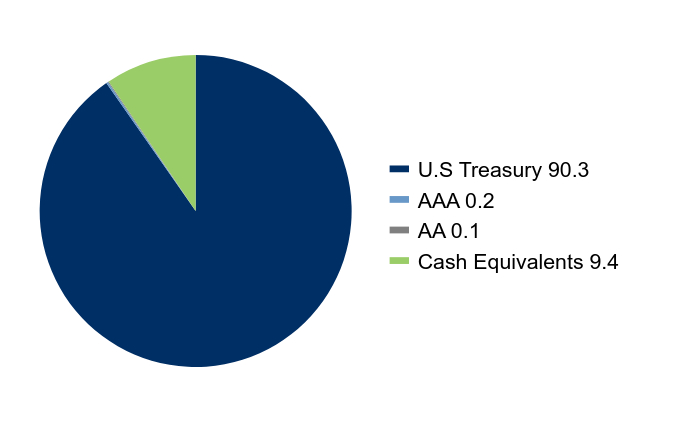

Credit Quality (% of Portfolio)

| Value | Value |

|---|

| U.S Treasury | 23.4 |

| U.S. Government Agency Mortgage Related Securities | 9.8 |

| AAA | 43.6 |

| AA | 6.6 |

| A | 4.3 |

| BBB | 7.7 |

| BB | 0.6 |

| B | 0.3 |

| Non-Rated | 0.3 |

| Cash Equivalents | 3.4 |

| Maturity | | | % of Portfolio |

| Less than 1 Year | | | 49.4 |

| 1-3 Years | | | 39.9 |

| 3-5 Years | | | 5.7 |

| 5-7 Years | | | 5.0 |

| | | 100.0 |

| % of Net Assets |

| Asset-Backed Securities | 37.2 |

| U.S. Treasuries | 22.9 |

| Mortgage-Backed Securities | 19.3 |

| Corporate Bonds | 7.7 |

| Commercial Mortgage-Backed Securities | 6.8 |

| Corporate Convertible Bonds | 0.3 |

| Cash Equivalents/Other | 5.8 |

| 100.0 |

Credit quality disclosure: Credit ratings are assigned to underlying securities utilizing ratings from a Nationally Recognized Statistical Rating Organization (NRSRO) such as Moody's and Fitch, or other rating agencies and applying the following hierarchy: security is determined to be Investment Grade if it has been rated at least BBB- by one credit rating agency; once determined to be Investment Grade (BBB- and above) or Non-Investment Grade (BB+ and below) where multiple ratings are available, then the lowest rating is assigned. Mortgage-related securities issued and guaranteed by government-sponsored agencies such as Fannie Mae and Freddie Mac are generally not rated by rating agencies. Securities that are not rated do not necessarily indicate low quality. Ratings are shown in the Fitch scale (e.g., AAA). Ratings and portfolio credit quality may change over time. The Fund itself has not been rated by a credit rating agency.

Materialfund changes: There were no material fund changes during the reporting period.

Changes in or disagreements with accountants: On September 27, 2024, The Fund replaced its existing independent registered public accounting firm, Ernst & Young LLP ("E&Y"), with Deloitte & Touche LLP. There were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

Weitz Short Duration Income Fund

Institutional Class (WEFIX)

Semi-annual shareholder report — September 30, 2024

Additional information about the Fund (e.g. Financial Statements, Prospectus and Statement of Additional Information) is available on the Fund's website at weitz.investments/reports or upon request, by calling 888-859-0698. Additional information about the Fund's Proxy Voting Record is available on the Fund's website at weitz.investments/proxy.

Weitz Short Duration Income Fund

Semi-annual shareholder report — September 30, 2024

This semi-annual shareholder report contains important information about the Weitz Short Duration Income Fund (the "Fund") for the period of April 1, 2024 to September 30, 2024. This report describes changes to the Fund that occurred during the reporting period. You can find additional information about the Fund at weitz.investments/reports. You can also request information by contacting us at 888-859-0698.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment ($) | Costs paid as a percentage of a $10,000 investment (%) |

|---|

| Weitz Short Duration Income Fund - Investor | 30 | 0.58 |

How did the Fund perform for the period?

The Fund (Ticker: WSHNX) returned 3.90% for the 6-month period ended September 30, 2024.

Top contributors included asset-backed securities (ABS), U.S. Treasuries, collateralized loan obligations (CLOs), non-Agency CMOs (Collateralized Mortgage Obligations), and corporate bonds. ABS performed strongly due to stable prices and robust coupon income, especially in auto, equipment, fleet, and consumer loans. U.S. Treasuries and CLOs added positive returns, benefiting from favorable rates and sector selection. No segments detracted from performance.

For additional manager insights, visit weitzinvestments.com.

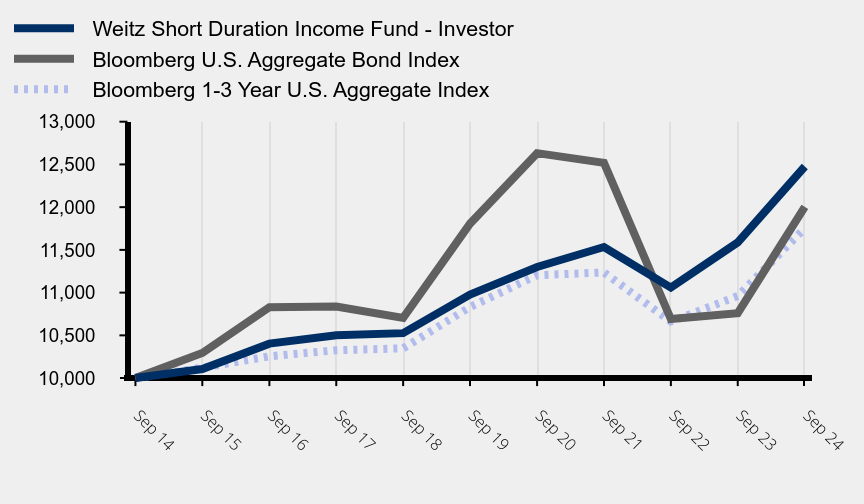

How did the Fund perform during the past 10 years?

Growth of $10,000 investment

| Weitz Short Duration Income Fund - Investor | Bloomberg U.S. Aggregate Bond Index | Bloomberg 1-3 Year U.S. Aggregate Index |

|---|

| Sep 24 | 12,476 | 12,004 | 11,753 |

| Sep 23 | 11,588 | 10,760 | 10,960 |

| Sep 22 | 11,059 | 10,691 | 10,661 |

| Sep 21 | 11,534 | 12,518 | 11,236 |

| Sep 20 | 11,300 | 12,632 | 11,203 |

| Sep 19 | 10,978 | 11,807 | 10,831 |

| Sep 18 | 10,526 | 10,704 | 10,348 |

| Sep 17 | 10,502 | 10,838 | 10,326 |

| Sep 16 | 10,403 | 10,829 | 10,255 |

| Sep 15 | 10,106 | 10,294 | 10,121 |

| Sep 14 | 10,000 | 10,000 | 10,000 |

Average Annual Total Returns

| 6 Month (%) | 1 Year (%) | 5 Year (%) | 10 Year (%) |

|---|

| Weitz Short Duration Income Fund - Investor - WSHNX | 3.90 | 7.66 | 2.59 | 2.24 |

| Bloomberg U.S. Aggregate Bond Index | 5.26 | 11.57 | 0.33 | 1.84 |

| Bloomberg 1-3 Year U.S. Aggregate Index | 3.93 | 7.23 | 1.65 | 1.63 |

The above line chart and returns table compares the fund’s results to (i) the Bloomberg U.S. Aggregate Bond Index, a broad measure of market performance and (ii) the Bloomberg 1-3 Year U.S. Aggregate Index, an additional index that the investment adviser believes more closely reflects the market segments in which the fund invests.

The fund’s past performance is not a predictor of its future performance. Investment results reflect applicable fees and expenses, assumes all distributions are reinvested, and include fee waivers and/or expense reimbursements, without which results would have been lower; however, they do not reflect the deduction of taxes an investor would pay on distributions or share redemptions.

| Net Assets ($) | 941,993,324 |

| Number of Portfolio Holdings | 334 |

| Net Investment Advisory Fees Paid ($) | 1,788,005 |

| Portfolio Turnover Rate (%) | 22 |

| 30-Day SEC Yield (Subsidized) (%) | 4.63 |

| 30-Day SEC Yield (Unsubsidized) (%) | 4.42 |

| Average Effective Maturity (yrs) | 3.40 |

| Average Effective Duration (yrs) | 1.30 |

What did the Fund invest in?

(as of September 30, 2023)

| Maturity | % of Portfolio |

| Cash Equivalents | 3.3 |

| Less than 1 Year | 23.0 |

| 1-3 Years | 44.0 |

| 3-5 Years | 7.9 |

| 5-7 Years | 6.1 |

| 7-10 Years | 6.0 |

| 10 Years or more | 9.7 |

| 100.0 |

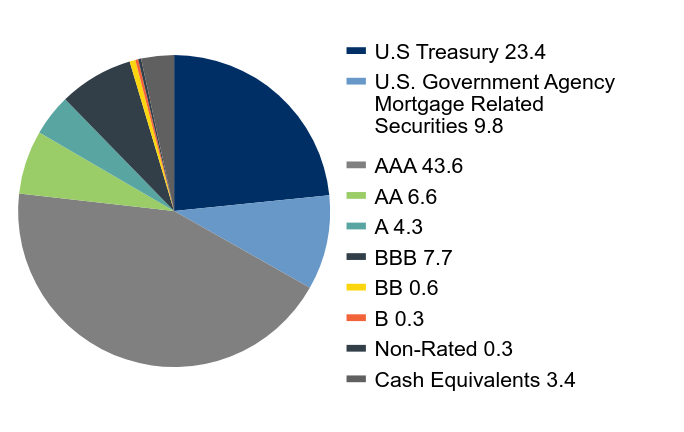

Credit Quality (% of Portfolio)

| Value | Value |

|---|

| U.S Treasury | 23.4 |

| U.S. Government Agency Mortgage Related Securities | 9.8 |

| AAA | 43.6 |

| AA | 6.6 |

| A | 4.3 |

| BBB | 7.7 |

| BB | 0.6 |

| B | 0.3 |

| Non-Rated | 0.3 |