| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-207132-08 | ||

October 31, 2016

Free Writing Prospectus

Structural and Collateral Term Sheet

$756,492,189

(Approximate Initial Mortgage Pool Balance)

$663,821,000

(Offered Certificates)

Citigroup Commercial Mortgage Trust 2016-C3

As Issuing Entity

Citigroup Commercial Mortgage Securities Inc.

As Depositor

Commercial Mortgage Pass-Through Certificates

Series 2016-C3

Citigroup Global Markets Realty Corp.

Barclays Bank PLC

Cantor Commercial Real Estate Lending, L.P.

Rialto Mortgage Finance, LLC

As Sponsors and Mortgage Loan Sellers

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Citigroup | Barclays | Cantor Fitzgerald & Co. | |

| Co-Lead Managers and Joint Bookrunners | |||

| Academy Securities | |||

| Co-Manager | |||

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus, dated on or about October 31, 2016, included as part of our registration statement (SEC File No. 333-207132) (the “Preliminary Prospectus”). The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including, without limitation, a detailed discussion of risks associated with an investment in the offered securities under the heading“Risk Factors” in the Preliminary Prospectus). The Preliminary Prospectus is available upon request from Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co. or Academy Securities, Inc. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus. This Term Sheet is subject to change.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity of, the aggregate amount and timing of distributions on and the market value of the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

The securities offered by these materials are being offered when, as and if issued. This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co. or Academy Securities, Inc. provides accounting, tax or legal advice.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

2

The issuing entity will be relying on an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

3

| CERTIFICATE SUMMARY |

| OFFERED CERTIFICATES | |||||||||||||||

Offered Classes | Expected Ratings | Initial Certificate | Approximate | Initial Pass- | Pass- | Expected | Expected | ||||||||

| Class A-1 | Aaa(sf) / AAAsf / AAA(sf) | $31,197,000 | 30.000%(5) | [ ]% | (6) | 2.65 | 12/16 - 9/21 | ||||||||

| Class A-2 | Aaa(sf) / AAAsf / AAA(sf) | $75,370,000 | 30.000%(5) | [ ]% | (6) | 4.90 | 9/21 – 10/21 | ||||||||

| Class A-3 | Aaa(sf) / AAAsf / AAA(sf) | $180,000,000 | 30.000%(5) | [ ]% | (6) | 9.79 | 12/25 – 10/26 | ||||||||

| Class A-4 | Aaa(sf) / AAAsf / AAA(sf) | $209,266,000 | 30.000%(5) | [ ]% | (6) | 9.91 | 10/26 – 10/26 | ||||||||

| Class A-AB | Aaa(sf) / AAAsf / AAA(sf) | $33,711,000 | 30.000%(5) | [ ]% | (6) | 7.06 | 10/21 – 12/25 | ||||||||

| Class X-A | Aa1(sf) / AAAsf / AAA(sf) | $592,900,000 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A | |||||||

| Class X-B | NR / AA-sf / AAA(sf) | $40,662,000 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A | |||||||

| Class A-S | Aa3(sf) / AAAsf / AAA(sf) | $63,356,000 | 21.625% | [ ]% | (6) | 9.91 | 10/26 – 10/26 | ||||||||

| Class B | NR / AA-sf / AA(sf) | $40,662,000 | 16.250% | [ ]% | (6) | 9.92 | 10/26 – 11/26 | ||||||||

| Class C | NR / A-sf / A(sf) | $30,259,000 | 12.250% | [ ]% | (6) | 9.99 | 11/26 – 11/26 | ||||||||

| NON-OFFERED CERTIFICATES | |||||||||||||||

Non-Offered Classes | Expected Ratings | Initial Certificate | Approximate | Initial Pass- | Pass- | Expected | Expected | ||||||||

| Class X-D | NR / BBB-sf / AAA(sf) | $39,716,000 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A | |||||||

| Class X-E | NR / BB-sf / AAA(sf) | $17,021,000 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A | |||||||

| Class X-F | NR / B-sf / AAA(sf) | $7,565,000 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A | |||||||

| Class X-G | NR / NR / AAA(sf) | $28,369,189 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A | |||||||

| Class D | NR / BBB-sf / BBB(low)(sf) | $39,716,000 | 7.000% | [ ]% | (6) | 9.99 | 11/26 - 11/26 | ||||||||

| Class E | NR / BB-sf / BB(sf) | $17,021,000 | 4.750% | [ ]% | (6) | 9.99 | 11/26 - 11/26 | ||||||||

| Class F | NR / B-sf / B(high)(sf) | $7,565,000 | 3.750% | [ ]% | (6) | 9.99 | 11/26 - 11/26 | ||||||||

| Class G | NR / NR / NR | $28,369,189 | 0.000% | [ ]% | (6) | 9.99 | 11/26 - 11/26 | ||||||||

| Class S(9) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||

| Class R(9) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||

| (1) | It is a condition of issuance that the offered certificates receive the ratings set forth above. The anticipated ratings shown are those of Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and DBRS, Inc. (“DBRS”). Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. Moody’s, Fitch and DBRS have informed us that the “sf” designation in the ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related rating agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the rating agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5%. |

| (3) | Approximateper annum rate as of the Closing Date. |

| (4) | Determined assuming no prepayments prior to the maturity date or any anticipated repayment date, as applicable, for each mortgage loan and based on the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in the Preliminary Prospectus. |

| (5) | The approximate initial credit support percentages set forth for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates are represented in the aggregate. |

| (6) | The pass-through rate on each class of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F and Class G certificates will generally be equal to one of (i) a fixedper annum rate, (ii) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as in effect from time to time, (iii) a rate equal to the lesser of a specifiedper annum rate and the weighted average rate described in clause (ii), or (iv) the weighted average rate described in clause (ii) less a specified percentage, but no less than 0.000%, as described under “Description of the Certificates—Distributions—Pass Through Rates” in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

4

| CERTIFICATE SUMMARY (continued) |

| (7) | The Class X-A, Class X-B, Class X-D, Class X-E, Class X-F and Class X-G certificates (collectively, the “Class X certificates”) will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A, Class X-B, Class X-D, Class X-E, Class X-F and Class X-G certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A certificates will be equal to the aggregate of the certificate balances of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB and Class A-S certificates from time to time. The notional amount of the Class X-B certificates will be equal to the certificate balance of the Class B certificates from time to time. The notional amount of the Class X-D certificates will be equal to the certificate balance of the Class D certificates from time to time. The notional amount of the Class X-E certificates will be equal to the certificate balance of the Class E certificates from time to time. The notional amount of the Class X-F certificates will be equal to the certificate balance of the Class F certificates from time to time. The notional amount of the Class X-G certificates will be equal to the certificate balance of the Class G certificates from time to time. |

| (8) | The pass-through rate on each class of Class X certificates will generally be equal to aper annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as in effect from time to time, over (ii) the pass-through rate (or the weighted average of the pass-through rates, as applicable) on the class (or classes, as applicable) of certificates with the certificate balance(s) upon which the notional amount of such class of Class X certificates is based, as described in the Preliminary Prospectus. |

| (9) | Neither the Class S certificates nor the Class R certificates will have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interests in each of two separate REMICs, as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. The Class S certificates will be entitled to receive certain excess interest accruing after the related anticipated repayment date on any mortgage loan with an anticipated repayment date. See “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—ARD Loans” in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

5

| MORTGAGE POOL CHARACTERISTICS |

| Mortgage Pool Characteristics(1) | |

| Initial Pool Balance(2) | $756,492,189 |

| Number of Mortgage Loans | 44 |

| Number of Mortgaged Properties | 72 |

| Average Cut-off Date Balance | $17,193,004 |

| Weighted Average Mortgage Rate | 4.159865% |

| Weighted Average Remaining Term to Maturity/ARD (months)(3) | 113 |

| Weighted Average Remaining Amortization Term (months)(4) | 353 |

| Weighted Average Cut-off Date LTV Ratio(5) | 60.4% |

| Weighted Average Maturity Date/ARD LTV Ratio(3)(5) | 54.0% |

| Weighted Average UW NCF DSCR(6) | 2.23x |

| Weighted Average Debt Yield on Underwritten NOI(7) | 11.3% |

| % of Initial Pool Balance of Mortgage Loans that are Amortizing Balloon | 42.5% |

| % of Initial Pool Balance of Mortgage Loans that are Interest Only then Amortizing Balloon | 16.4% |

| % of Initial Pool Balance of Mortgage Loans that are Interest Only | 41.1% |

| % of Initial Pool Balance of Mortgaged Properties with Single Tenants | 11.4% |

| % of Initial Pool Balance of Mortgage Loans with Mezzanine or Subordinate Debt | 5.0% |

| (1) | With respect to each mortgage loan that is part of a loan combination (as identified under “Collateral Overview—Loan Combination Summary” below), the Cut-off Date LTV Ratio, Maturity Date/ARD LTV Ratio, UW NCF DSCR and Debt Yield on Underwritten NOI are calculated based on both that mortgage loan and any related pari passu companion loan(s), but without regard to any related subordinate companion loan(s), unless otherwise indicated. Other than as specifically noted, the Cut-off Date LTV Ratio, Maturity Date/ARD LTV Ratio, UW NCF DSCR and Debt Yield on Underwritten NOI information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future. |

| (2) | Subject to a permitted variance of plus or minus 5%. |

| (3) | Unless otherwise indicated, mortgage loans with anticipated repayment dates are presented as if they were to mature on the anticipated repayment date. |

| (4) | Excludes mortgage loans that are interest-only for the entire term. |

| (5) | The Cut-off Date LTV Ratios and Maturity Date/ARD LTV Ratios presented in this Term Sheet are generally based on the “as-is” appraised values of the related mortgaged properties (as set forth on Annex A to the Preliminary Prospectus), provided that such LTV ratios may be based on “as-stabilized” or similar values in certain cases in which reserves have been established at origination for the applicable condition or circumstance that is expected to result in stabilization. In addition, in the case of a portfolio of mortgaged properties, the appraisals may reflect a “portfolio premium” or an “as-is bulk” appraised value based on the assumption that such portfolio of mortgaged properties will be sold as a collective whole. See the definitions of “Appraised Value”, “Cut-off Date LTV Ratio” and “Maturity Date/ARD LTV Ratio” under “Certain Definitions” in this Term Sheet and under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

| (6) | The UW NCF DSCR for each mortgage loan is generally calculated by dividing the UW NCF for the related mortgaged property or mortgaged properties by the annual debt service for such mortgage loan, as adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment due. See the definition of “UW NCF DSCR” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

| (7) | The Debt Yield on Underwritten NOI for each mortgage loan is generally calculated as the related mortgaged property’s Underwritten NOI divided by the Cut-off Date Balance of such mortgage loan, and the Debt Yield on Underwritten NCF for each mortgage loan is generally calculated as the related mortgaged property’s Underwritten NCF divided by the Cut-off Date Balance of such mortgage loan. See the definitions of “Debt Yield on Underwritten NOI” and “Debt Yield on Underwritten NCF” under“Description of the Mortgage Pool—Certain Calculations and Definitions”in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

6

| KEY FEATURES OF THE CERTIFICATES |

| Co-Lead Managers and Joint Bookrunners: | Citigroup Global Markets Inc. Barclays Capital Inc. Cantor Fitzgerald & Co. |

| Co-Manager: | Academy Securities, Inc. |

| Depositor: | Citigroup Commercial Mortgage Securities Inc. |

| Initial Pool Balance: | $756,492,189 |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Special Servicer: | Rialto Capital Advisors, LLC |

| Certificate Administrator: | Citibank, N.A. |

| Trustee: | Deutsche Bank Trust Company Americas |

| Operating Advisor: | Trimont Real Estate Advisors, LLC |

| Asset Representations Reviewer: | Trimont Real Estate Advisors, LLC |

| Closing Date: | On or about November 17, 2016 |

| Cut-off Date: | With respect to each mortgage loan, the due date in November 2016 for that mortgage loan (or, in the case of any mortgage loan that has its first due date subsequent to November 2016, the date that would have been its due date in November 2016 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month) |

| Determination Date: | The 11th day of each month or next business day, commencing in December 2016 |

| Distribution Date: | The 4th business day after the Determination Date, commencing in December 2016 |

| Interest Accrual: | Preceding calendar month |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible, subject to the exemption conditions described in the Preliminary Prospectus |

| SMMEA Eligible: | No |

| Payment Structure: | Sequential Pay |

| Day Count: | 30/360 |

| Tax Structure: | REMIC |

| Rated Final Distribution Date: | November 2049 |

| Cleanup Call: | 1.0% |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to the Class X-A and Class X-B certificates: $1,000,000 minimum); integral multiples of $1 thereafter for all the offered certificates |

| Delivery: | Book-entry through DTC |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

7

| TRANSACTION HIGHLIGHTS |

| ■ | $756,492,189 (Approximate) New-Issue Multi-Borrower CMBS: |

| — | Overview: The mortgage pool consists of 44 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $756,492,189 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $17,193,004 and are secured by 72 mortgaged properties located throughout 23 states |

| — | LTV: 60.4% weighted average Cut-off Date LTV Ratio |

| — | DSCR: 2.23x weighted average Underwritten Debt Service Coverage Ratio |

| — | Debt Yield: 11.3% weighted average Debt Yield on Underwritten NOI |

| — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 / A-4 / A-AB |

| ■ | Loan Structural Features: |

| — | Amortization: 58.9% of the mortgage loans by Initial Pool Balance have scheduled amortization: |

| - | 42.5% of the mortgage loans by Initial Pool Balance have amortization for the entire term with a balloon payment due at maturity |

| - | 16.4% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| — | Hard Lockboxes: 57.9% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| — | Cash Traps: 96.0% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.10x coverage, that fund an excess cash flow reserve |

| — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| - | Real Estate Taxes: 38 mortgage loans representing 74.6% of the Initial Pool Balance |

| - | Insurance: 24 mortgage loans representing 40.3% of the Initial Pool Balance |

| - | Replacement Reserves (Including FF&E Reserves): 38 mortgage loans representing 69.8% of the Initial Pool Balance |

| - | Tenant Improvements / Leasing Commissions: 14 mortgage loans representing 43.9% of the portion of the Initial Pool Balance that is secured by office, retail and mixed use properties |

| — | Defeasance Mortgage Loans: 83.8% of the mortgage loans by Initial Pool Balance permit defeasance after an initial lockout period |

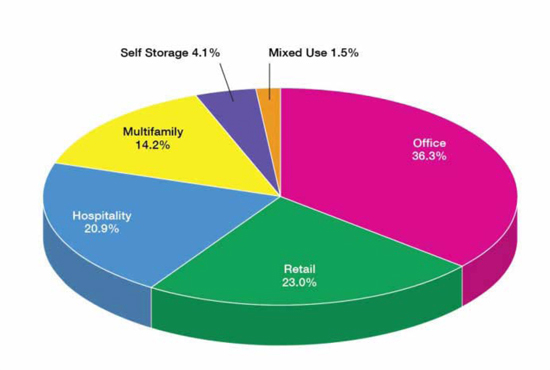

| ■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| — | Office: 36.3% of the mortgaged properties by allocated Initial Pool Balance are office properties |

| — | Retail: 23.0% of the mortgaged properties by allocated Initial Pool Balance are retail properties (19.1% are anchored retail properties) |

| — | Hospitality: 20.9% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

| — | Multifamily: 14.2% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

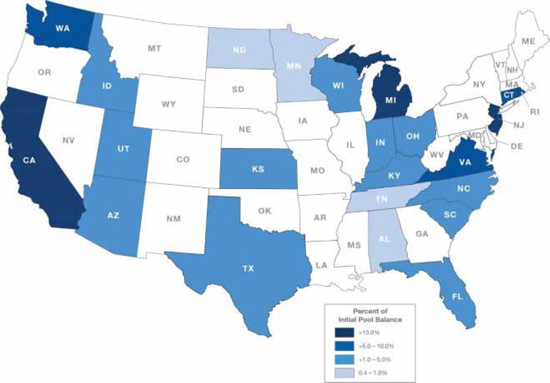

| ■ | Geographic Diversity: The 72 mortgaged properties are located throughout 23 states with only three states having greater than 10.0% of the allocated Initial Pool Balance: New Jersey (15.0%), California (12.6%) and Michigan (11.6%) |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

8

| COLLATERAL OVERVIEW |

Mortgage Loans by Loan Seller

Mortgage Loan Seller | Mortgage Loans | Mortgaged Properties | Aggregate Cut-off | % of Initial | ||||

| Citigroup Global Markets Realty Corp. | 15 | 39 | $270,379,720 | 35.7% | ||||

| Barclays Bank PLC | 12 | 12 | 222,282,500 | 29.4 | ||||

| Cantor Commercial Real Estate Lending, L.P. | 9 | 13 | 124,171,388 | 16.4 | ||||

| Rialto Mortgage Finance, LLC | 7 | 7 | 109,705,463 | 14.5 | ||||

| Citigroup Global Markets Realty Corp. and Rialto Mortgage Finance, LLC(1) | 1 | 1 | 29,953,118 | 4.0 | ||||

| Total | 44 | 72 | $756,492,189 | 100.0% |

| (1) | The Marriott Hilton Head Resort & Spa mortgage loan was co-originated by Citigroup Global Markets Realty Corp. and Rialto Mortgage Finance, LLC and is evidenced by two promissory notes: (i) note A-2B, with an outstanding principal balance of $14,976,559 as of the Cut-off Date, as to which Citigroup Global Markets Realty Corp. is acting as mortgage loan seller and (ii) note A-4, with an outstanding principal balance of $14,976,559 as of the Cut-off Date, as to which Rialto Mortgage Finance, LLC is acting as mortgage loan seller. |

Ten Largest Mortgage Loans(1)

# | Mortgage Loan Name | Cut-off Date | % of Initial | Property | Property | Cut-off Date | UW | UW | Cut-off | |||||||||

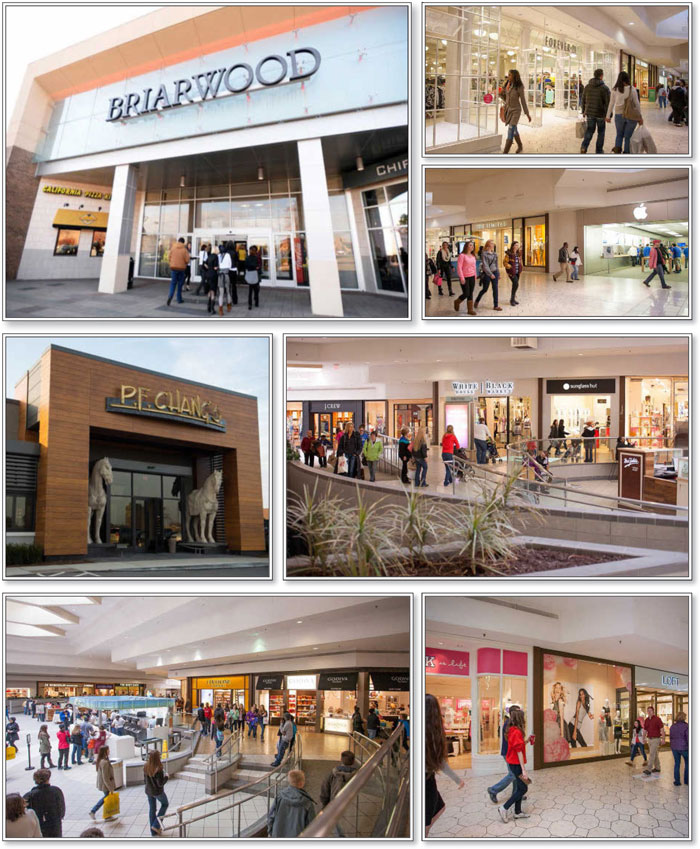

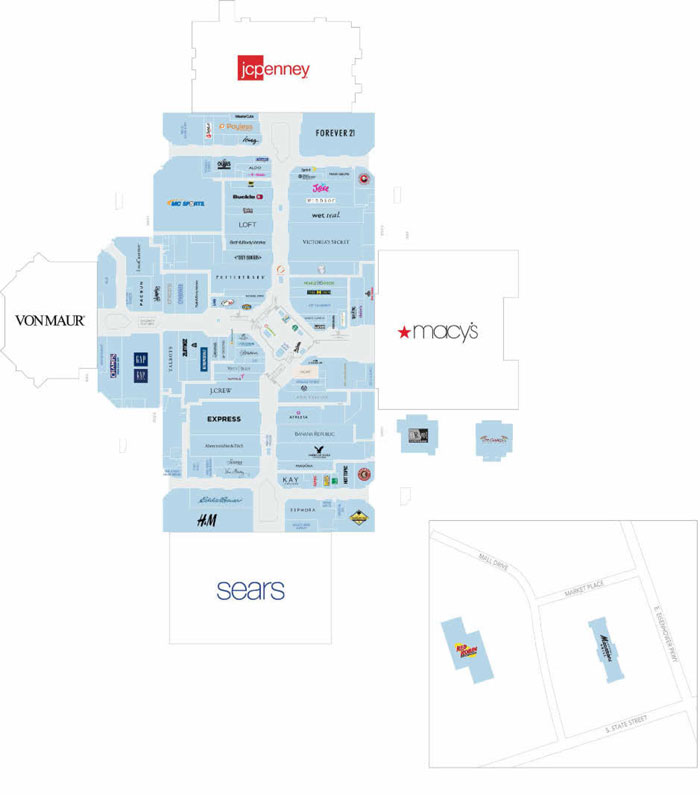

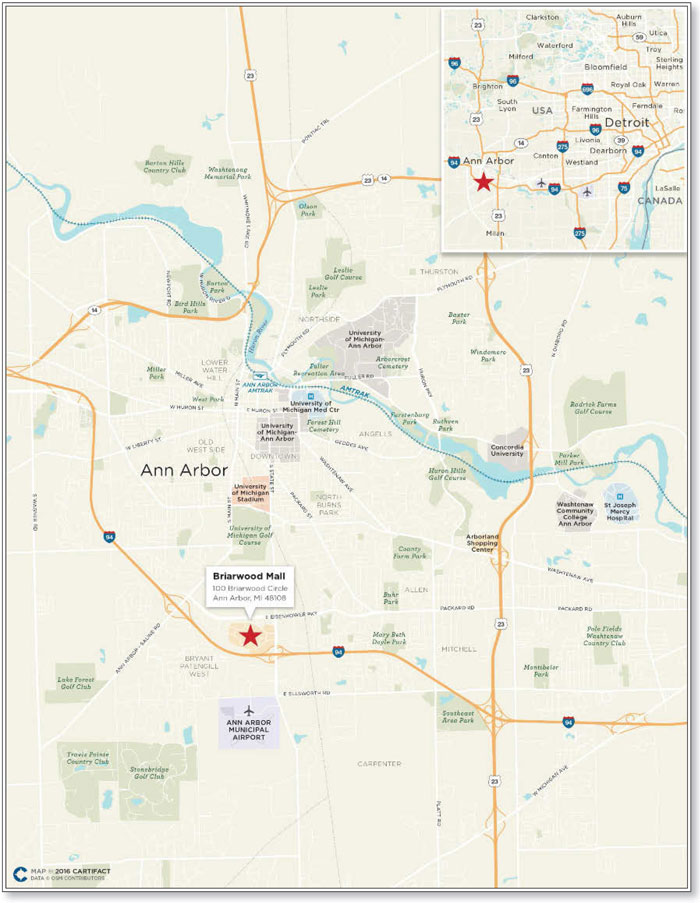

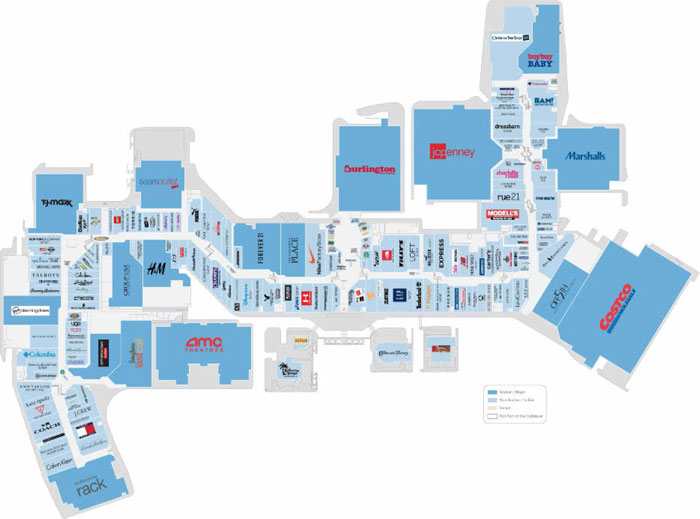

| 1 | Briarwood Mall | $65,000,000 | 8.6% | Retail | 369,916 | $446 | 3.34x | 11.7% | 49.1% | |||||||||

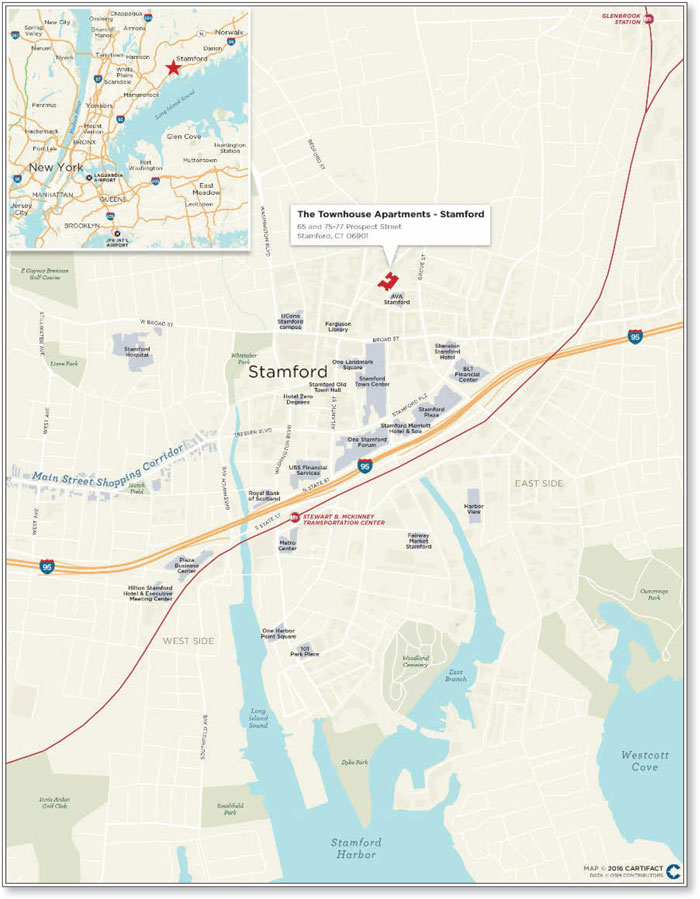

| 2 | The Townhouse Apartments - Stamford | 58,000,000 | 7.7 | Multifamily | 270 | $214,815 | 1.72x | 7.6% | 63.0% | |||||||||

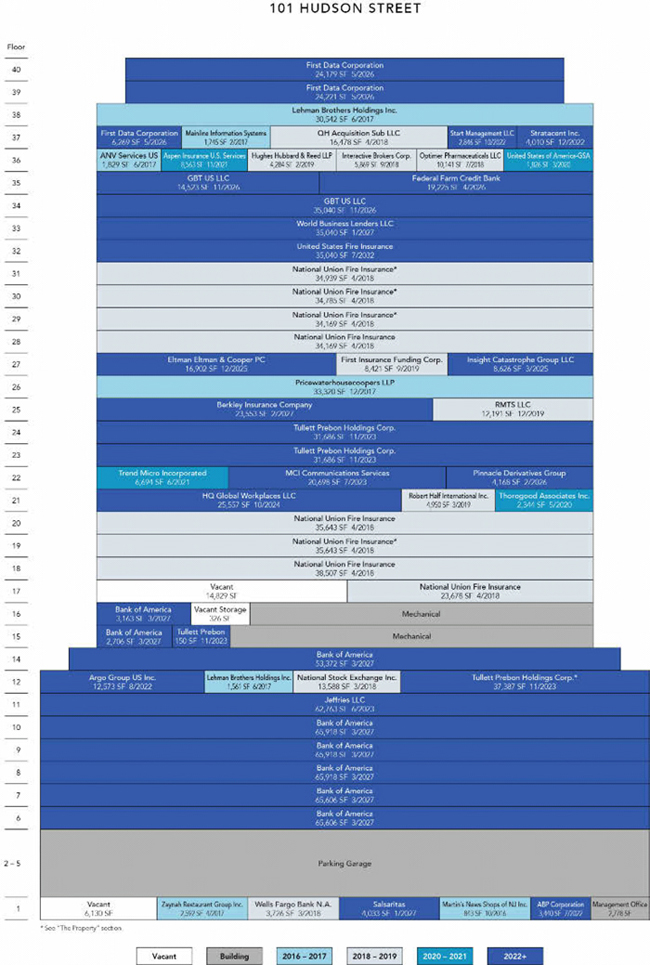

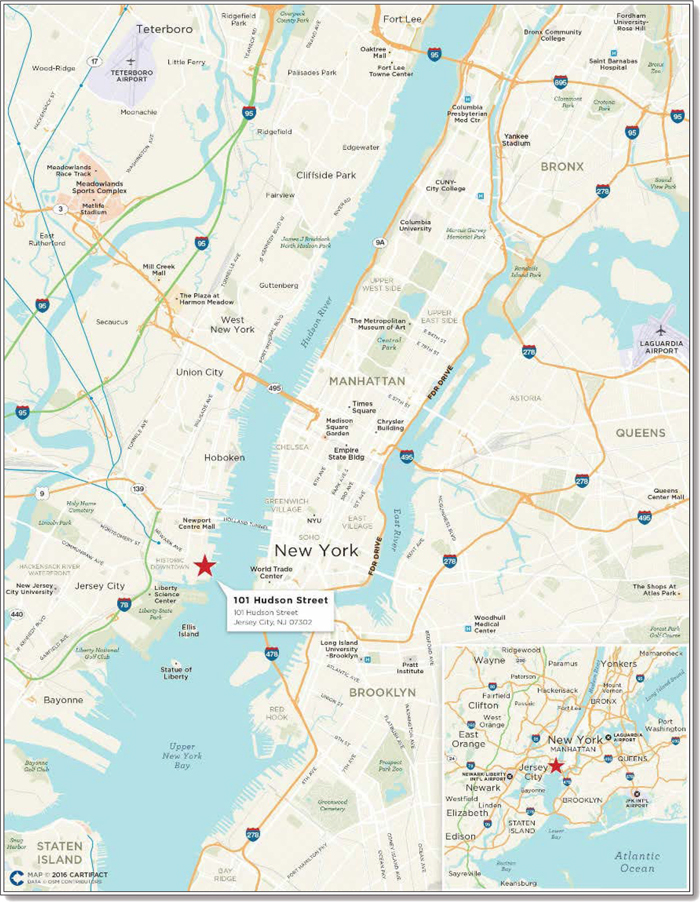

| 3 | 101 Hudson Street | 56,250,000 | 7.4 | Office | 1,341,649 | $186 | 3.68x | 12.9% | 51.8% | |||||||||

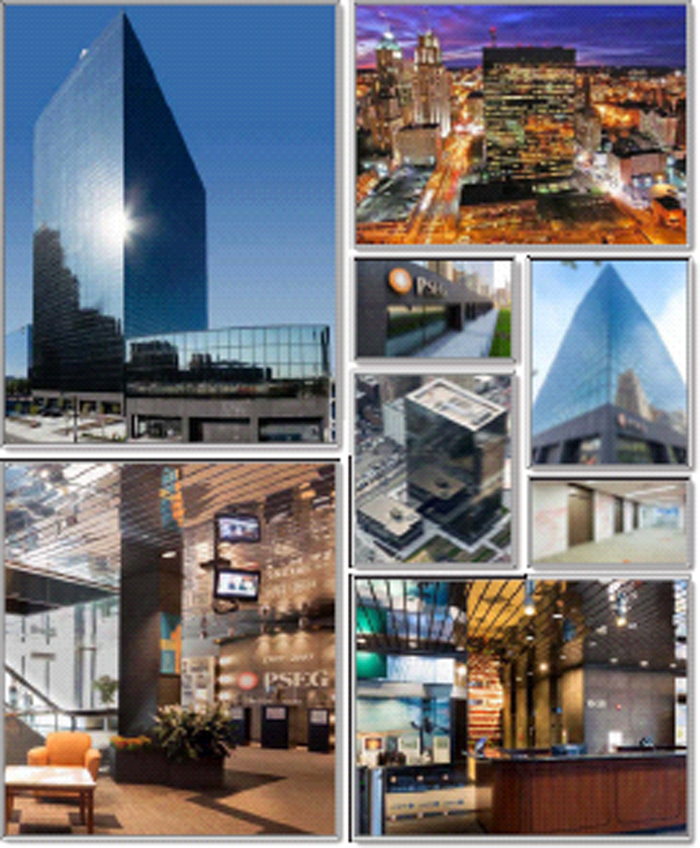

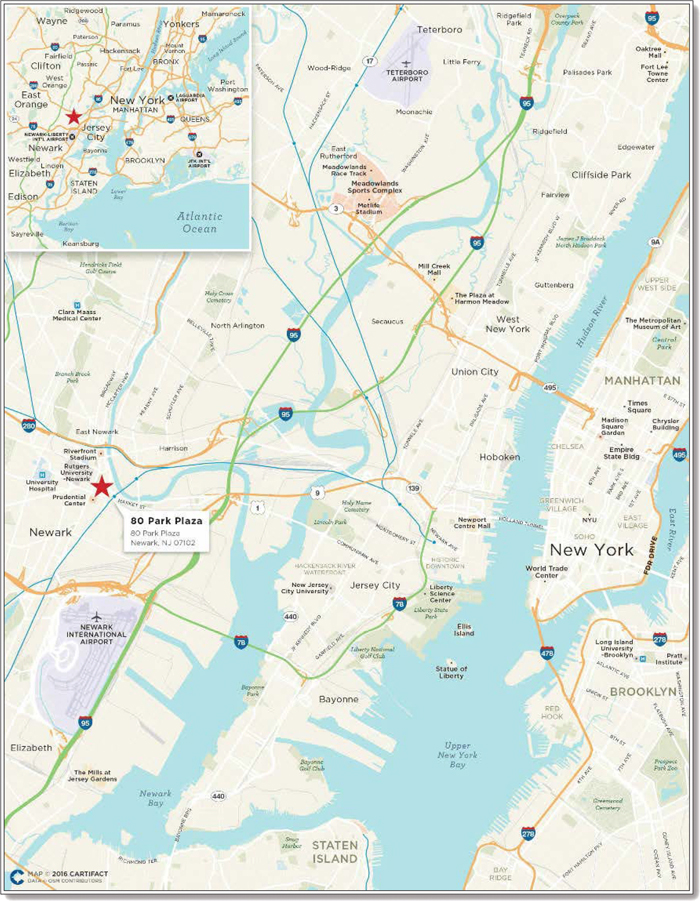

| 4 | 80 Park Plaza | 50,000,000 | 6.6 | Office | 960,689 | $138 | 1.52x | 9.4% | 75.0% | |||||||||

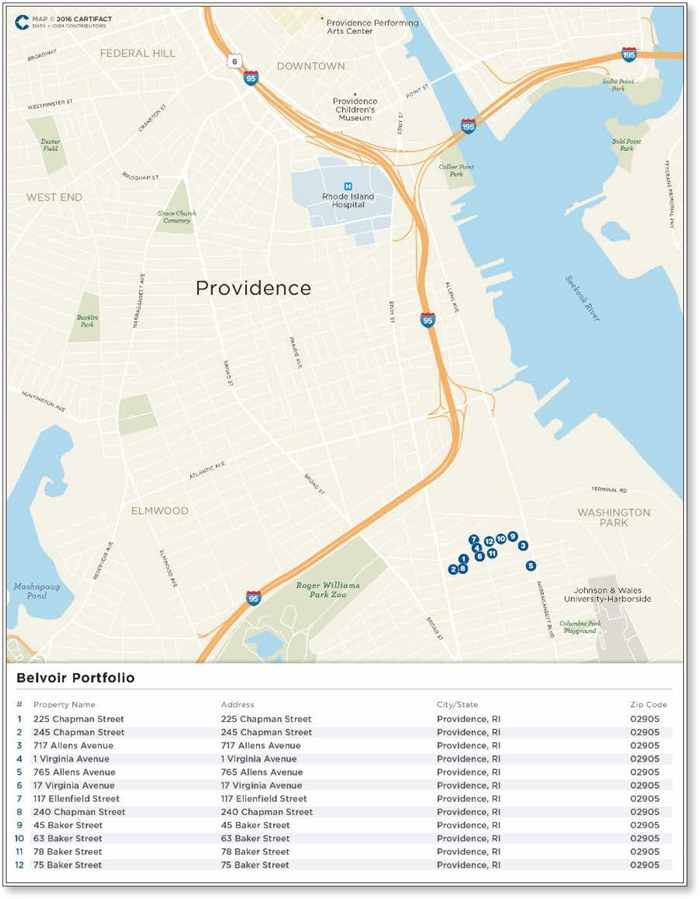

| 5 | Belvoir Portfolio | 42,000,000 | 5.6 | Office | 347,214 | $121 | 1.88x | 12.2% | 69.4% | |||||||||

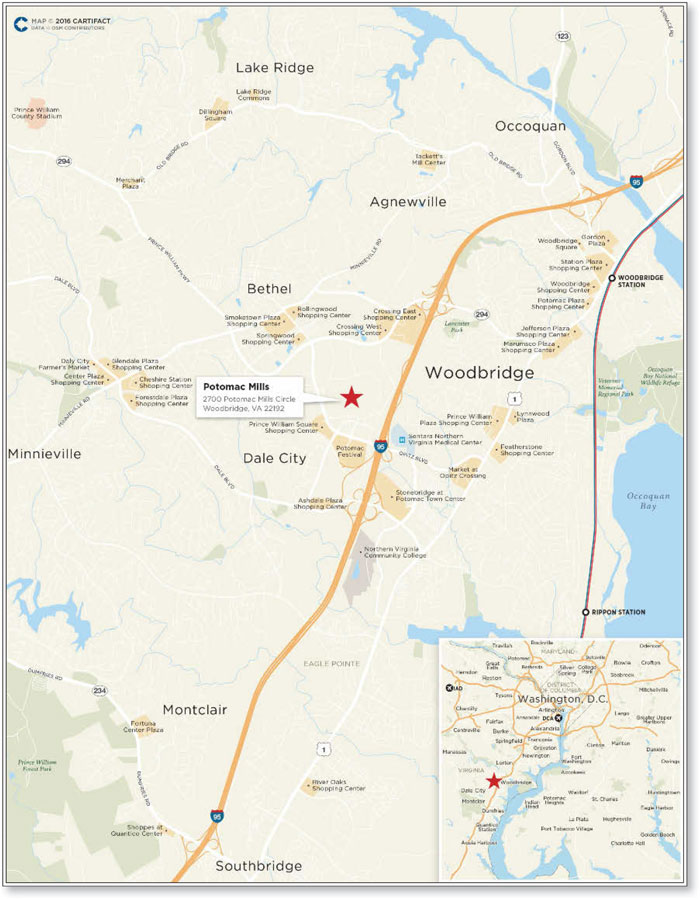

| 6 | Potomac Mills | 35,000,000 | 4.6 | Retail | 1,459,997 | $199 | 4.39x | 13.9% | 38.0% | |||||||||

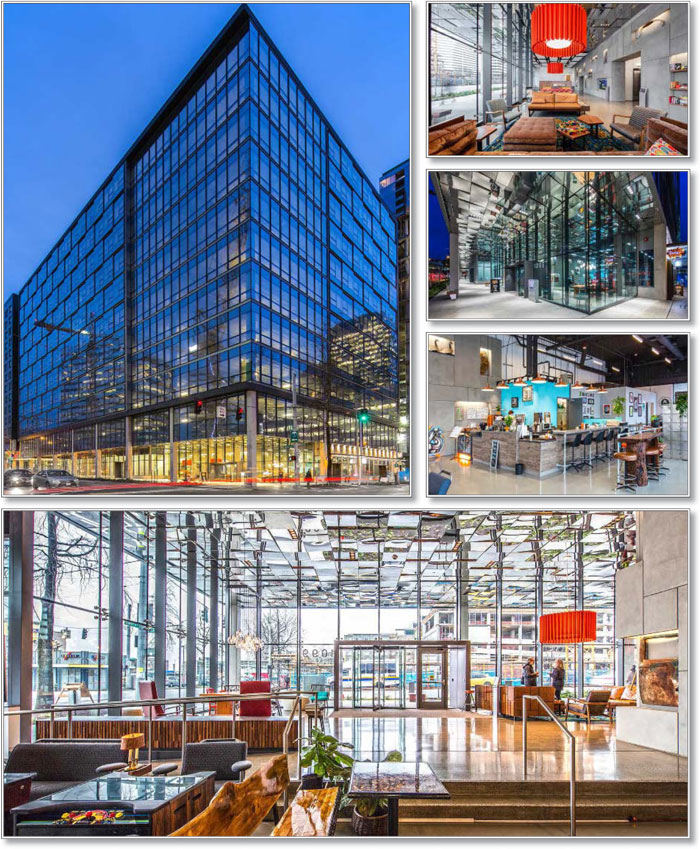

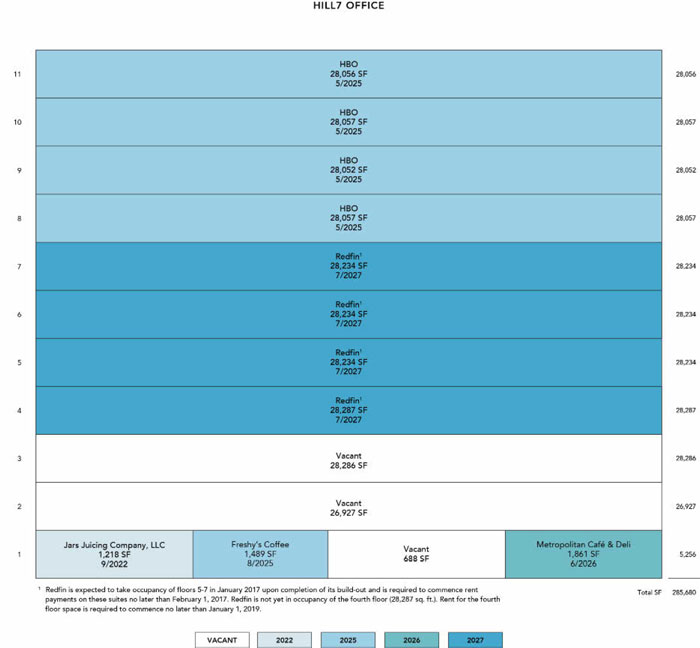

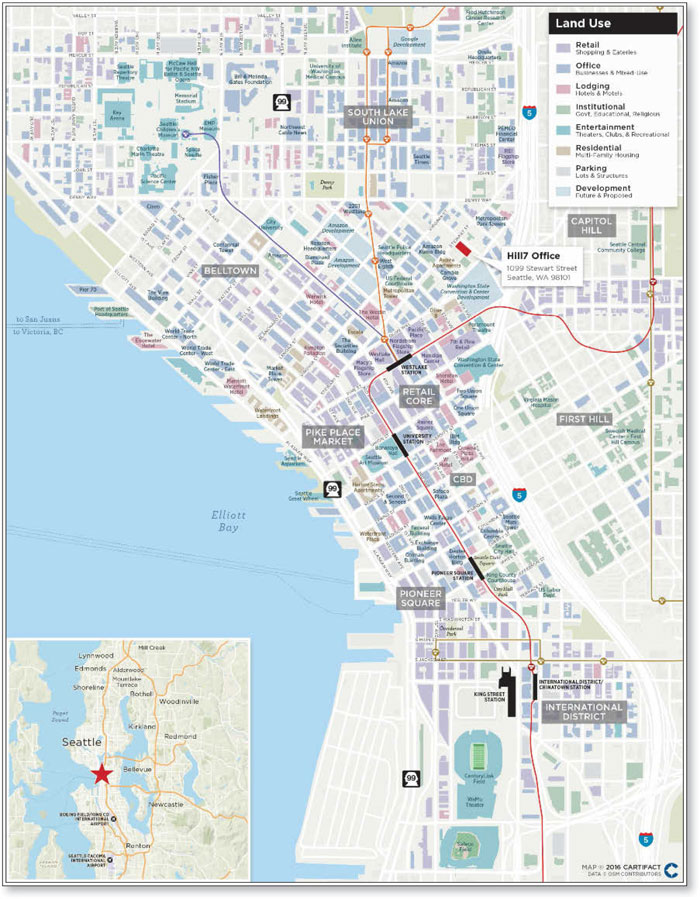

| 7 | Hill7 Office | 30,000,000 | 4.0 | Office | 285,680 | $354 | 2.68x | 9.2% | 48.5% | |||||||||

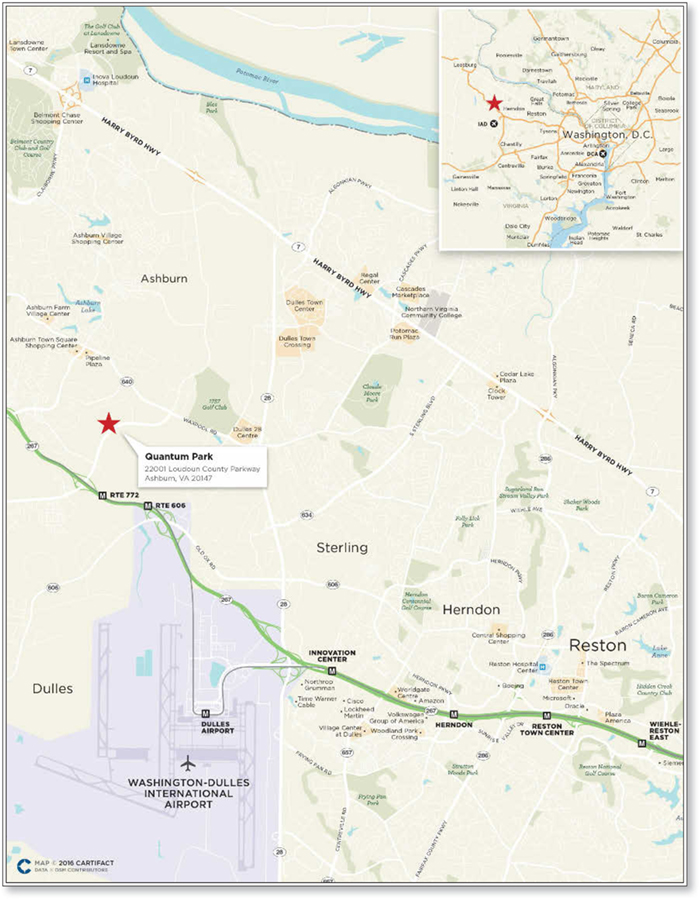

| 8 | Quantum Park | 30,000,000 | 4.0 | Office | 942,843 | $140 | 3.00x | 11.4% | 66.0% | |||||||||

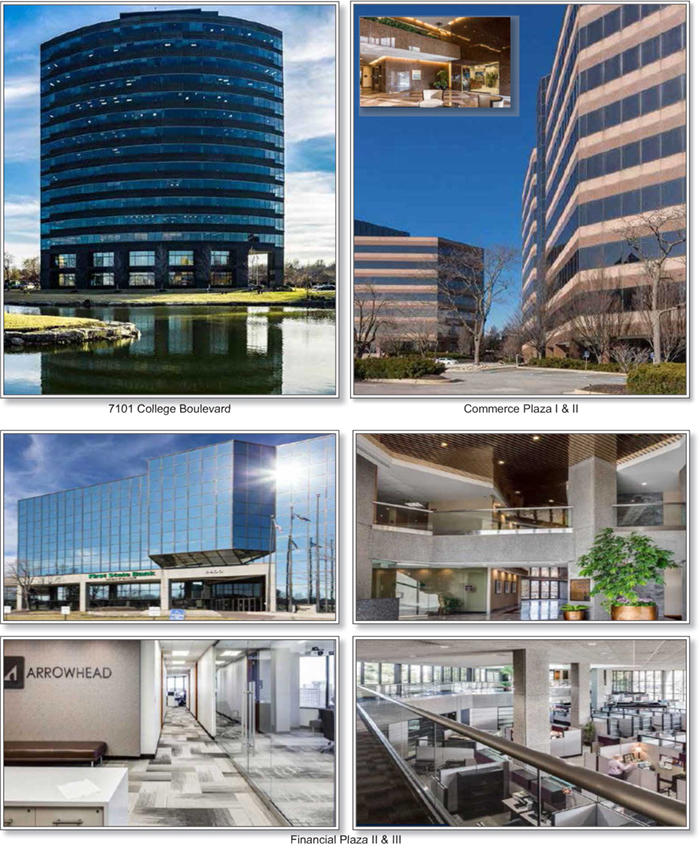

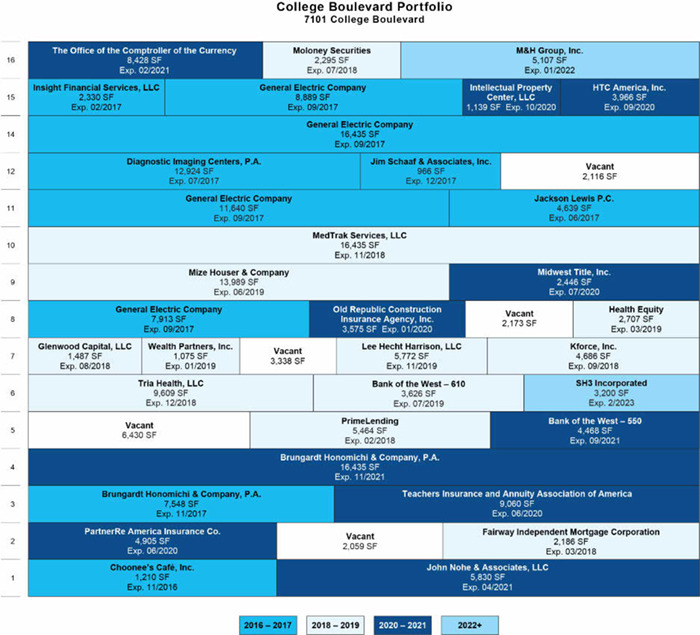

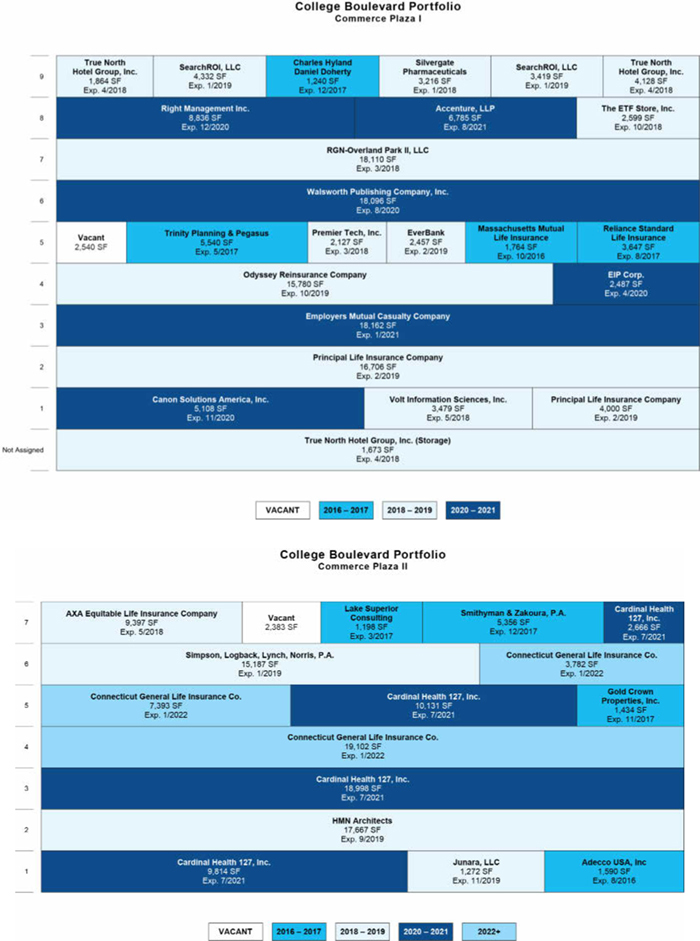

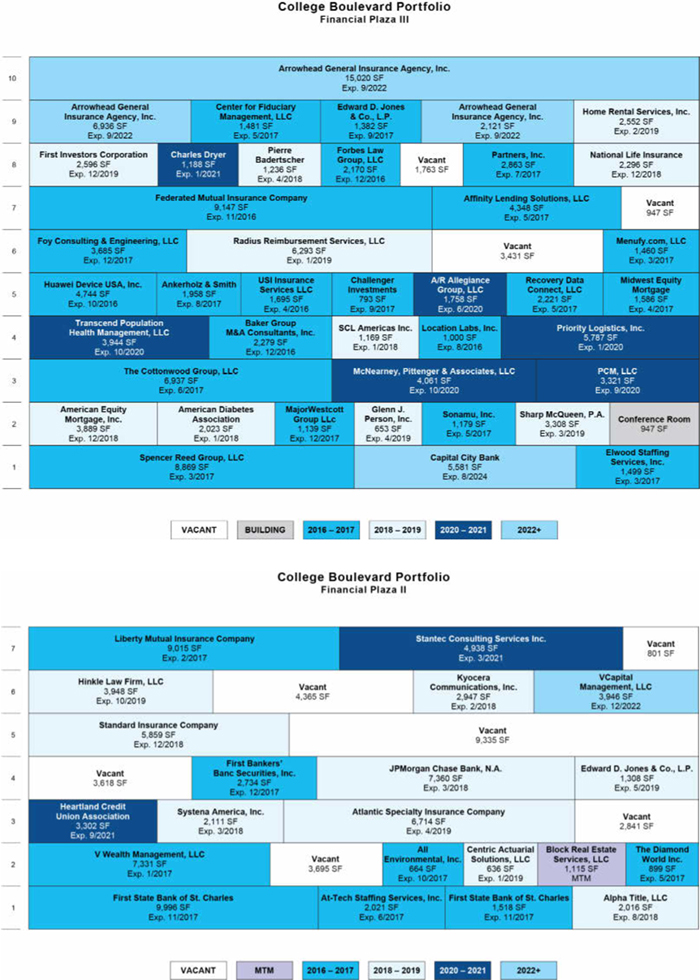

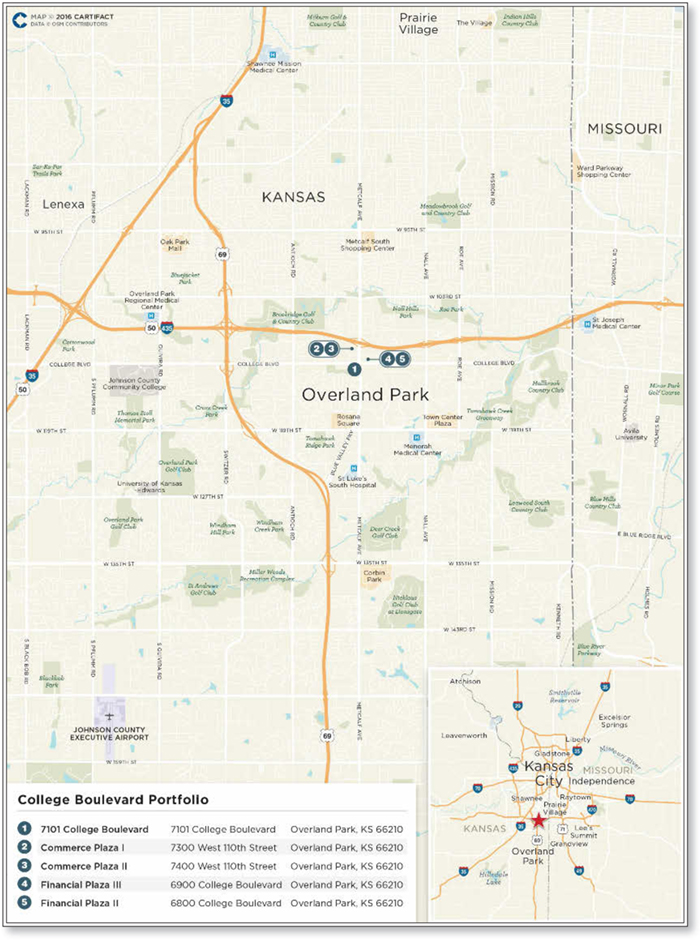

| 9 | College Boulevard Portfolio | 29,961,377 | 4.0 | Office | 768,461 | $92 | 1.74x | 11.6% | 72.4% | |||||||||

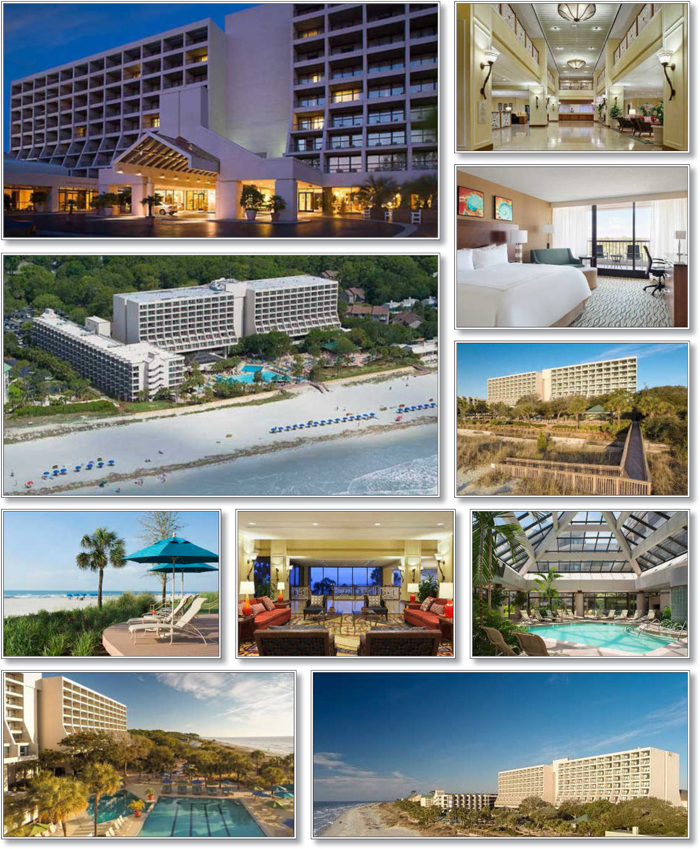

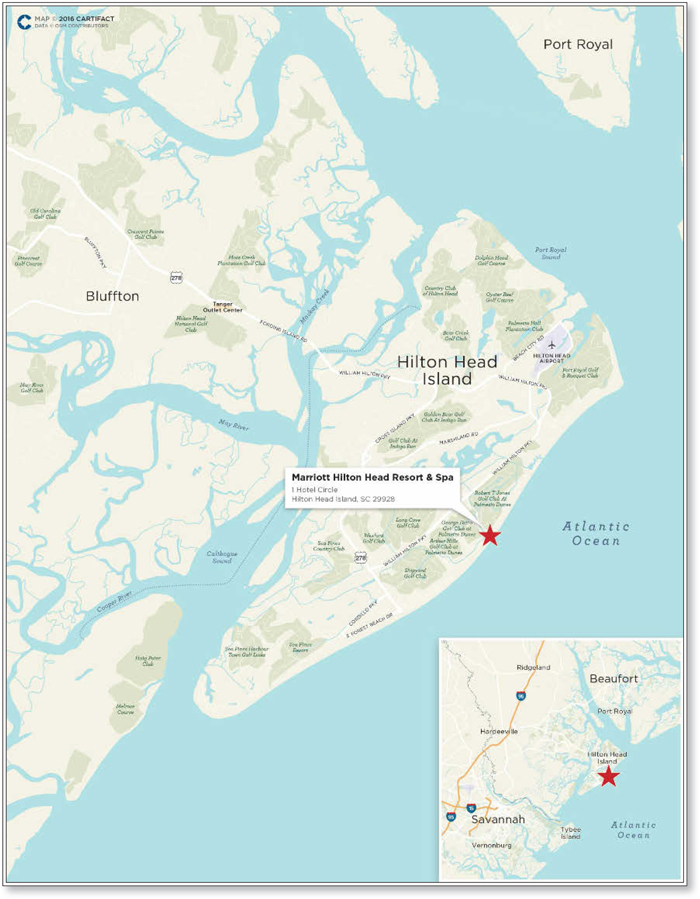

| 10 | Marriott Hilton Head Resort & Spa | 29,953,118 | 4.0 | Hospitality | 513 | $190,735 | 1.47x | 11.9% | 59.8% | |||||||||

| Top 10 Total / Wtd. Avg. | $426,164,496 | 56.3% | 2.58x | 11.1% | 59.0% | |||||||||||||

| Remaining Total / Wtd. Avg. | 330,327,694 | 43.7 | 1.78x | 11.5% | 62.3% | |||||||||||||

| Total / Wtd. Avg. | $756,492,189 | 100.0% | 2.23x | 11.3% | 60.4% |

| (1) | See footnotes to table entitled“Mortgage Pool Characteristics” above. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

9

| COLLATERAL OVERVIEW (continued) |

Loan Combination Summary

Mortgaged Property Name(1) | Mortgage | Mortgage Loan as Approx. % | Aggregate Pari Passu Companion Loan Cut-off Date Balance | Aggregate Subordinate Companion | Loan Combination Cut-off Date Balance | Controlling Pooling | Master Outside | Special | ||||||||

| Briarwood Mall | $65,000,000 | 8.6% | $100,000,000 | — | $165,000,000 | MSBAM 2016-C30 | Wells Fargo | LNR | ||||||||

| 101 Hudson Street | $56,250,000 | 7.4% | $193,750,000 | — | $250,000,000 | WFCM 2016-C36(3) | Wells Fargo(3) | C-III(3) | ||||||||

| 80 Park Plaza | $50,000,000 | 6.6% | $83,000,000 | — | $133,000,000 | CGCMT 2016-C3 | Midland | Rialto | ||||||||

| Potomac Mills | $35,000,000 | 4.6% | $256,000,000 | $125,000,000 | $416,000,000 | CFCRE 2016-C6(4)(5) | Wells Fargo(4) | AEGON USA Realty Advisors(4) | ||||||||

| Hill7 Office | $30,000,000 | 4.0% | $71,000,000 | — | $101,000,000 | CFCRE 2016-C6(4)(5) | Wells Fargo(4) | Rialto(4) | ||||||||

| Quantum Park | $30,000,000 | 4.0% | $102,000,000 | — | $132,000,000 | CGCMT 2016-C3(5)(6) | Midland(6) | Rialto(6) | ||||||||

| College Boulevard Portfolio | $29,961,377 | 4.0% | $40,447,859 | — | $70,409,237 | CGCMT 2016-P5 | Midland | LNR | ||||||||

| Marriott Hilton Head Resort & Spa | $29,953,118 | 4.0% | $67,893,735 | — | $97,846,854 | CGCMT 2016-C3(5)(6) | Midland(6) | Rialto(6) | ||||||||

| Mills Fleet Farm | $27,869,389 | 3.7% | $36,827,407 | — | $64,696,796 | CGCMT 2016-C3 | Midland | Rialto | ||||||||

| Marriott Saddle Brook | $6,909,786 | 0.9% | $20,235,804 | — | $27,145,590 | SGCMS 2016-C5 | Wells Fargo | Rialto |

| (1) | Each of the mortgage loans secured by a mortgaged property or portfolio of mortgaged properties identified in the table above, together with the related companion loan(s), is referred to in this Term Sheet as a “loan combination”. |

| (2) | Each loan combination will be serviced under the related Controlling PSA, and the controlling class representative (or an equivalent entity) under the related Controlling PSA (or such other party as is designated under the related Controlling PSA) will be entitled to exercise the rights of controlling note holder for the subject loan combination, except as otherwise discussed in footnotes (4) and (6) below. |

| (3) | The 101 Hudson Street loan combination is expected to initially be serviced pursuant to the WFCM 2016-C36 pooling and servicing agreement (which will be the initial Controlling PSA for such loan combination), by the outside servicer and outside special servicer set forth in the table above. The information in preceding sentence and the foregoing table for the 101 Hudson Street loan combination is, in part, based on a publicly available preliminary prospectus for the WFCM 2016-C36 securitization transaction. Notwithstanding the foregoing, upon the inclusion of the related controlling pari passu companion loan in a future securitization transaction, such loan combination will be serviced under the pooling and servicing agreement entered into in connection with that future securitization, which will then be the applicable Controlling PSA for such loan combination. Although the WFCM 2016-C36 pooling and servicing agreement will initially be the Controlling PSA for the 101 Hudson Street loan combination, the holder of the related controlling pari passu companion loan for such loan combination will be the directing holder for such loan combination while it is serviced under the WFCM 2016-C36 pooling and servicing agreement and, solely as to such loan combination, will exercise all rights normally exercised by the WFCM 2016-C36 directing certificateholder with respect to most other mortgage loans serviced under the WFCM 2016-C36 pooling and servicing agreement. |

| (4) | Each of the Potomac Mills loan combination and the Hill7 Office loan combination will initially be serviced by the master servicer and the special servicer pursuant to the CGCMT 2016-C3 pooling and servicing agreement, which will be the initial Controlling PSA for each such loan combination. However, in the case of each such loan combination, upon the inclusion of the related controlling pari passu companion loan in a future securitization transaction (which in each case is expected to be the CFCRE 2016-C6 securitization transaction), the subject loan combination will be serviced under the pooling and servicing agreement entered into in connection with that future securitization (which in each case is expected to be the CFCRE 2016-C6 pooling and servicing agreement), which will then be the applicable Controlling PSA for such loan combination. The outside servicer and outside special servicer set forth in the table above for each such loan combination are the anticipated master servicer and applicable special servicer, respectively, under the CFCRE 2016-C6 pooling and servicing agreement. The information in this footnote and the foregoing table for each such loan combination is, in part, based on a publicly available preliminary prospectus for the CFCRE 2016-C6 securitization transaction. |

| (5) | Although the CGCMT 2016-C3 pooling and servicing agreement will initially be the Controlling PSA for each of the Potomac Mills, Hill7 Office, Quantum Park and Marriott Hilton Head Resort & Spa loan combinations, the holder of the related controlling pari passu companion loan for each such loan combination (or, solely in the case of the Potomac Mills loan combination, unless and until an AB control appraisal period is in effect, the holder of the related controlling subordinate companion loan for such loan combination) will be the Directing Holder of each of the Potomac Mills loan combination, the Hill7 Office loan combination, the Quantum Park loan combination and the Marriott Hilton Head Resort & Spa loan combination while it is serviced under the CGCMT 2016-C3 pooling and servicing agreement and, solely as to each such loan combination, will exercise all rights normally exercised by the CGCMT 2016-C3 controlling class representative with respect to other loan combinations for which the CGCMT 2016-C3 pooling and servicing agreement is the Controlling PSA. |

| (6) | Each of the Quantum Park loan combination and the Marriott Hilton Head Resort & Spa loan combination will initially be serviced by the master servicer and the special servicer pursuant to the CGCMT 2016-C3 pooling and servicing agreement. In the case of each such loan combination, upon the inclusion of the related controlling pari passu companion loan in a future securitization transaction, the subject loan combination will be serviced under the pooling and servicing agreement entered into in connection with that future securitization, which will then be the applicable Controlling PSA for such loan combination. |

Mortgage Loans with Existing Mezzanine Debt

Mortgaged Property Name | Mortgage | Pari Passu Companion | Mezzanine | Cut-off Date | Wtd. Avg Cut-off Date Total Debt Interest Rate | Cut-off | Cut-off Date Total Debt LTV | Cut-off Date Mortgage Loan UW NCF DSCR | Cut-off | |||||||||

| Fresenius Birmingham | $2,800,000 | — | $214,435 | $3,014,435 | 5.52265% | 63.6% | 68.5% | 1.49x | 1.28x |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

10

| COLLATERAL OVERVIEW (continued) |

Previously Securitized Mortgaged Properties(1)

Mortgaged Property Name | Mortgage | City | State | Property | Cut-off Date Balance / Allocated Cut-off Date Balance(2) | % of | Previous Securitization | |||||||

| The Townhouse Apartments - Stamford | RMF | Stamford | Connecticut | Multifamily | $58,000,000 | 7.7% | MSC 2006-IQ12 | |||||||

| Potomac Mills | CCRE | Woodbridge | Virginia | Retail | $35,000,000 | 4.6% | LBUBS 2007-C6, WBCMT 2007-C33 | |||||||

| Commerce Plaza I | CGMRC | Overland Park | Kansas | Office | $6,724,454 | 0.9% | ACR 2013-FL1 | |||||||

| Commerce Plaza II | CGMRC | Overland Park | Kansas | Office | $5,482,033 | 0.7% | ACR 2013-FL1 | |||||||

| Financial Plaza III | CGMRC | Overland Park | Kansas | Office | $5,093,818 | 0.7% | JPMCC 2007-CB20 | |||||||

| Financial Plaza II | CGMRC | Overland Park | Kansas | Office | $2,735,596 | 0.4% | JPMCC 2007-CB20 | |||||||

| Marriott Hilton Head Resort & Spa | CGMRC, RMF | Hilton Head Island | South Carolina | Hospitality | $29,953,118 | 4.0% | JPMCC 2007-CB18 | |||||||

| Hampton Inn Muskegon | CGMRC | Muskegon | Michigan | Hospitality | $5,393,992 | 0.7% | CSMC 2006-C5 | |||||||

| Residence Inn Boise | CGMRC | Boise | Idaho | Hospitality | $10,298,530 | 1.4% | CSMC 2006-C4 | |||||||

| Residence Inn Spokane | CGMRC | Spokane Valley | Washington | Hospitality | $8,640,376 | 1.1% | CSMC 2006-C4 | |||||||

| Las Palmas I, II, III | Barclays Bank PLC | Rialto | California | Multifamily | $16,750,000 | 2.2% | WBCMT 2006-C28 | |||||||

| North Pointe - Riverside | Barclays Bank PLC | Riverside | California | Multifamily | $13,500,000 | 1.8% | JPMCC 2007-LDPX | |||||||

| Southland Office Center | CCRE | Hayward | California | Office | $12,074,328 | 1.6% | JPMCC 2006-CB17 | |||||||

| The Bristol Hotel | RMF | San Diego | California | Hospitality | $11,987,098 | 1.6% | BSCMS 2007-PW15 | |||||||

| 444 Connecticut Avenue | RMF | Norwalk | Connecticut | Retail | $11,400,000 | 1.5% | CSMC 2007-A1A2 C3 | |||||||

| Hampton Inn & Suites Tempe ASU Area | CGMRC | Tempe | Arizona | Hospitality | $9,887,088 | 1.3% | BSCMS 2006-PW13 | |||||||

| Storage Etc. - Torrance, CA | Barclays Bank PLC | Torrance | California | Self Storage | $9,112,500 | 1.2% | LBUBS 2007-C6 | |||||||

| Marriott Saddle Brook | CCRE | Saddle Brook | New Jersey | Hospitality | $6,909,786 | 0.9% | WBCMT 2006-C23 | |||||||

| Brookdale Shopping Center | CGMRC | South Lyon | Michigan | Retail | $6,892,283 | 0.9% | CD 2006-CD3 | |||||||

| Parkview Apartments | RMF | Sherman | Texas | Multifamily | $6,642,681 | 0.9% | LBUBS 2006-C7 | |||||||

| Town House Apartments - Memphis | RMF | Memphis | Tennessee | Multifamily | $6,200,000 | 0.8% | MLCFC 2007-5 | |||||||

| Preston Racquet Club Condominiums | RMF | Dallas | Texas | Multifamily | $6,000,000 | 0.8% | LBUBS 2006-C7 | |||||||

| Oakdale Shopping Center | CCRE | Oakdale | California | Retail | $4,883,665 | 0.6% | CGCMT 2006-C5 | |||||||

| Congress Pointe Shopping Center | Barclays Bank PLC | Lake Worth | Florida | Retail | $4,000,000 | 0.5% | CSMC 2007-C1 | |||||||

| Grand Avenue Business Plaza | CCRE | San Marcos | California | Retail | $2,838,092 | 0.4% | MSC 2006-T23 | |||||||

| Overland Corporate B Building | CCRE | Temecula | California | Office | $1,796,130 | 0.2% | MLMT 2006-C2 |

| (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of such mortgaged property was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the mortgage loan sellers. |

| (2) | Reflects the allocated loan amount in cases where the applicable mortgaged property is one of a portfolio of mortgaged properties securing a particular mortgage loan. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

11

| COLLATERAL OVERVIEW (continued) |

Property Types

Property Type / Detail | Number of Mortgaged Properties | Aggregate | % of Initial | Wtd. Avg. Underwritten NCF DSCR(2) | Wtd. Avg. Cut- | Wtd. Avg.Debt Yield on Underwritten NOI(2) | ||||||

| Office | 28 | $274,831,834 | 36.3% | 2.38x | 63.7% | 11.2% | ||||||

| CBD | 3 | 136,250,000 | 18.0 | 2.67x | 59.6% | 10.8% | ||||||

| Suburban | 12 | 93,781,834 | 12.4 | 2.23x | 67.2% | 11.3% | ||||||

| Medical | 13 | 44,800,000 | 5.9 | 1.86x | 69.0% | 12.1% | ||||||

| Retail | 15 | $173,683,428 | 23.0% | 2.79x | 52.8% | 11.6% | ||||||

| Super Regional Mall | 2 | 100,000,000 | 13.2 | 3.71x | 45.2% | 12.5% | ||||||

| Single Tenant Retail | 8 | 44,569,389 | 5.9 | 1.54x | 63.2% | 10.5% | ||||||

| Unanchored | 2 | 14,500,000 | 1.9 | 1.49x | 64.2% | 9.6% | ||||||

| Shadow Anchored | 2 | 9,730,375 | 1.3 | 1.58x | 66.1% | 11.1% | ||||||

| Anchored | 1 | 4,883,665 | 0.6 | 1.52x | 51.8% | 12.5% | ||||||

| Hospitality | 16 | $157,834,844 | 20.9% | 1.80x | 60.3% | 13.2% | ||||||

| Extended Stay | 7 | 76,657,747 | 10.1 | 1.87x | 61.1% | 13.4% | ||||||

| Limited Service | 7 | 44,314,192 | 5.9 | 1.95x | 58.8% | 13.8% | ||||||

| Full Service | 2 | 36,862,904 | 4.9 | 1.49x | 60.4% | 12.0% | ||||||

| Multifamily | 6 | $107,092,681 | 14.2% | 1.60x | 65.5% | 8.4% | ||||||

| High Rise | 2 | 64,200,000 | 8.5 | 1.71x | 62.5% | 7.9% | ||||||

| Garden | 4 | 42,892,681 | 5.7 | 1.44x | 69.9% | 9.1% | ||||||

| Self Storage | 5 | $31,332,500 | 4.1% | 2.29x | 56.6% | 10.4% | ||||||

| Mixed Use | 2 | $11,716,901 | 1.5% | 1.68x | 62.5% | 10.4% | ||||||

| Self Storage/Warehouse | 1 | 6,491,901 | 0.9 | 1.90x | 56.0% | 11.6% | ||||||

| Multifamily/Retail | 1 | 5,225,000 | 0.7 | 1.40x | 70.6% | 8.9% | ||||||

| Total | 72 | $756,492,189 | 100.0% | 2.23x | 60.4% | 11.3% |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

12

| COLLATERAL OVERVIEW (continued) |

Geographic Distribution

Property | Number of Mortgaged Properties | Aggregate Cut-off Date Balance(1) | % of Initial Pool Balance(1) | Aggregate | % of Total Appraised Value | Underwritten NOI(2) | % of Total Underwritten | |||||||

| New Jersey | 3 | $113,159,786 | 15.0% | $702,900,000 | 22.0% | $48,027,796 | 23.7% | |||||||

| California | 12 | 95,161,811 | 12.6 | 155,980,000 | 4.9 | 9,538,166 | 4.7 | |||||||

| Michigan | 5 | 87,420,807 | 11.6 | 372,150,000 | 11.6 | 22,464,521 | 11.1 | |||||||

| Connecticut | 2 | 69,400,000 | 9.2 | 109,660,000 | 3.4 | 5,389,092 | 2.7 | |||||||

| Virginia | 2 | 65,000,000 | 8.6 | 965,000,000 | 30.2 | 55,347,917 | 27.3 | |||||||

| Washington | 3 | 55,901,226 | 7.4 | 243,500,000 | 7.6 | 12,503,630 | 6.2 | |||||||

| Rhode Island | 12 | 42,000,000 | 5.6 | 60,500,000 | 1.9 | 5,136,769 | 2.5 | |||||||

| Kansas | 6 | 37,450,462 | 5.0 | 109,700,000 | 3.4 | 9,155,299 | 4.5 | |||||||

| South Carolina | 1 | 29,953,118 | 4.0 | 163,500,000 | 5.1 | 11,692,374 | 5.8 | |||||||

| Florida | 5 | 29,000,000 | 3.8 | 48,000,000 | 1.5 | 3,141,543 | 1.5 | |||||||

| North Carolina | 2 | 18,878,106 | 2.5 | 32,600,000 | 1.0 | 2,197,067 | 1.1 | |||||||

| Wisconsin(3) | 3 | 15,527,036 | 2.1 | 56,800,000 | 1.8 | 4,097,678 | 2.0 | |||||||

| Kentucky | 4 | 13,191,211 | 1.7 | 20,500,000 | 0.6 | 1,666,655 | 0.8 | |||||||

| Texas | 2 | 12,642,681 | 1.7 | 18,540,000 | 0.6 | 1,235,837 | 0.6 | |||||||

| Utah | 1 | 11,107,020 | 1.5 | 18,900,000 | 0.6 | 1,718,546 | 0.8 | |||||||

| Idaho | 1 | 10,298,530 | 1.4 | 15,300,000 | 0.5 | 1,384,287 | 0.7 | |||||||

| Arizona | 1 | 9,887,088 | 1.3 | 17,300,000 | 0.5 | 1,469,914 | 0.7 | |||||||

| Ohio | 2 | 9,695,272 | 1.3 | 13,900,000 | 0.4 | 1,199,986 | 0.6 | |||||||

| Indiana | 1 | 9,475,684 | 1.3 | 14,000,000 | 0.4 | 1,182,548 | 0.6 | |||||||

| North Dakota(3) | 1 | 6,697,401 | 0.9 | 24,500,000 | 0.8 | 1,767,485 | 0.9 | |||||||

| Tennessee | 1 | 6,200,000 | 0.8 | 10,650,000 | 0.3 | 651,289 | 0.3 | |||||||

| Minnesota(3) | 1 | 5,644,952 | 0.7 | 20,650,000 | 0.6 | 1,489,737 | 0.7 | |||||||

| Alabama | 1 | 2,800,000 | 0.4 | 4,400,000 | 0.1 | 275,547 | 0.1 | |||||||

| Total | 72 | $756,492,189 | 100.0% | $3,198,930,000 | 100.0% | $202,733,683 | 100.0% |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Aggregate Appraised Values and Underwritten NOI reflect the aggregate values without any reduction for thepari passucompanion loan(s). |

| (3) | With respect to the Mills Fleet Farm mortgage loan, the mortgage loan was underwritten on the loan level and not underwritten on an individual property basis. For purposes of the above chart, underwritten NOI was allocated to each of the states containing properties secured by the Mills Fleet Farm mortgage loan (Wisconsin, North Dakota and Minnesota) based upon the percentage of allocated Cut-off Date balance for each state. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

13

| COLLATERAL OVERVIEW (continued) |

| Distribution of Cut-off Date Balances | ||||||||||||

| Number | % of | |||||||||||

| of | Initial | |||||||||||

| Range of Cut-off Date | Mortgage | Cut-off Date | Pool | |||||||||

| Balances ($) | Loans | Balance | Balance | |||||||||

| 1,796,130 - 4,999,999 | 7 | $25,762,886 | 3.4 | % | ||||||||

| 5,000,000 - 9,999,999 | 15 | 103,851,007 | 13.7 | |||||||||

| 10,000,000 - 14,999,999 | 7 | 86,097,908 | 11.4 | |||||||||

| 15,000,000 - 19,999,999 | 2 | 35,688,906 | 4.7 | |||||||||

| 20,000,000 - 24,999,999 | 1 | 22,689,728 | 3.0 | |||||||||

| 25,000,000 - 29,999,999 | 4 | 116,151,754 | 15.4 | |||||||||

| 30,000,000 - 44,999,999 | 4 | 137,000,000 | 18.1 | |||||||||

| 45,000,000 - 65,000,000 | 4 | 229,250,000 | 30.3 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| Distribution of UW NCF DSCRs(1) | ||||||||||||

| % of | ||||||||||||

| Number of | Initial | |||||||||||

| Mortgage | Cut-off Date | Pool | ||||||||||

| Range of UW DSCR (x) | Loans | Balance | Balance | |||||||||

| 1.28 - 1.35 | 5 | $34,108,549 | 4.5 | % | ||||||||

| 1.36 - 1.50 | 7 | 82,728,118 | 10.9 | |||||||||

| 1.51 - 1.65 | 10 | 132,731,703 | 17.5 | |||||||||

| 1.66 - 1.80 | 3 | 94,853,660 | 12.5 | |||||||||

| 1.81 - 2.00 | 6 | 117,410,843 | 15.5 | |||||||||

| 2.01 - 4.39 | 13 | 294,659,316 | 39.0 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| (1) | See footnotes (1) and (6) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Amortization Types(1) | ||||||||||||

| % of | ||||||||||||

| Number of | Initial | |||||||||||

| Mortgage | Cut-off Date | Pool | ||||||||||

| Amortization Type | Loans | Balance | Balance | |||||||||

| Amortizing (30 Years) | 23 | $279,496,322 | 36.9 | % | ||||||||

| Interest Only | 9 | 250,970,000 | 33.2 | |||||||||

| Interest Only, Then Amortizing(2) | 7 | 123,700,000 | 16.4 | |||||||||

| Interest Only - ARD | 2 | 60,000,000 | 7.9 | |||||||||

| Amortizing (25 Years) | 3 | 42,325,867 | 5.6 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| (1) | All of the mortgage loans will have balloon payments at maturity date or anticipated repayment date. | |||||||||||

| (2) | Original partial interest only periods range from 12 to 60 months. | |||||||||||

| Distribution of Lockboxes | ||||||||||||

| Number | % of | |||||||||||

| of | Initial | |||||||||||

| Mortgage | Cut-off Date | Pool | ||||||||||

| Lockbox Type | Loans | Balance | Balance | |||||||||

| Hard | 17 | $438,076,372 | 57.9 | % | ||||||||

| Springing | 22 | 250,269,333 | 33.1 | |||||||||

| Soft Springing | 5 | 68,146,484 | 9.0 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| Distribution of Cut-off Date LTV Ratios(1) | ||||||||||||

| % of | ||||||||||||

| Number of | Initial | |||||||||||

| Range of Cut-off Date | Mortgage | Pool | ||||||||||

| LTV (%) | Loans | Cut-off Date Balance | Balance | |||||||||

| 38.0 - 54.9 | 8 | $219,722,346 | 29.0 | % | ||||||||

| 55.0 - 59.9 | 11 | 138,259,705 | 18.3 | |||||||||

| 60.0 - 64.9 | 9 | 138,364,139 | 18.3 | |||||||||

| 65.0 - 69.9 | 8 | 143,171,529 | 18.9 | |||||||||

| 70.0 - 75.0 | 8 | 116,974,469 | 15.5 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| (1) | See footnotes (1) and (5) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Maturity Date/ARD LTV Ratios(1) | ||||||||||||

| % of | ||||||||||||

| Number of | Initial | |||||||||||

| Range of Maturity | Mortgage | Pool | ||||||||||

| Date/ARD LTV (%) | Loans | Cut-off Date Balance | Balance | |||||||||

| 38.0 - 49.9 | 12 | $242,994,183 | 32.1 | % | ||||||||

| 50.0 - 54.9 | 9 | 153,907,691 | 20.3 | |||||||||

| 55.0 - 59.9 | 17 | 196,165,987 | 25.9 | |||||||||

| 60.0 - 64.9 | 4 | 83,424,328 | 11.0 | |||||||||

| 65.0 - 66.0 | 2 | 80,000,000 | 10.6 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| (1) | See footnotes (1), (3) and (5) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Loan Purpose | ||||||||||||

| % of | ||||||||||||

| Numberof | Initial | |||||||||||

| Mortgage | Pool | |||||||||||

| Loan Purpose | Loans | Cut-off Date Balance | Balance | |||||||||

| Refinance | 30 | $380,478,437 | 50.3 | % | ||||||||

| Acquisition | 6 | 184,761,377 | 24.4 | |||||||||

| Recapitalization | 7 | 163,382,986 | 21.6 | |||||||||

| Recapitalization/Acquisition | 1 | 27,869,389 | 3.7 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| Distribution of Mortgage Rates | ||||||||||||

| % of | ||||||||||||

| Number of | Initial | |||||||||||

| Range of Mortgage | Mortgage | Pool | ||||||||||

| Rates (%) | Loans | Cut-off Date Balance | Balance | |||||||||

| 2.988 - 4.000 | 9 | $245,620,000 | 32.5 | % | ||||||||

| 4.001 - 4.500 | 13 | 268,253,550 | 35.5 | |||||||||

| 4.501 - 5.000 | 17 | 211,511,220 | 28.0 | |||||||||

| 5.001 - 5.320 | 5 | 31,107,419 | 4.1 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

14

| COLLATERAL OVERVIEW (continued) |

| Distribution of Debt Yield on Underwritten NOI(1) | ||||||||||||

| Range of | Number of | % of Initial | ||||||||||

| Debt Yields on | Mortgage | Cut-off Date | Pool | |||||||||

| Underwritten NOI (%) | Loans | Balance | Balance | |||||||||

| 7.6 - 7.9 | 1 | $58,000,000 | 7.7 | % | ||||||||

| 8.0 - 8.9 | 4 | 39,375,000 | 5.2 | |||||||||

| 9.0 - 9.9 | 12 | 145,728,549 | 19.3 | |||||||||

| 10.0 - 10.9 | 4 | 22,142,681 | 2.9 | |||||||||

| 11.0 - 11.9 | 9 | 213,605,166 | 28.2 | |||||||||

| 12.0 - 12.9 | 8 | 150,620,718 | 19.9 | |||||||||

| 13.0 - 14.9 | 6 | 127,020,074 | 16.8 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| (1) | See footnotes (1) and (7) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Debt Yield on Underwritten NCF(1) | ||||||||||||

| Range of | Number of | % of Initial | ||||||||||

| Debt Yields on | Mortgage | Cut-off Date | Pool | |||||||||

| Underwritten NCF (%) | Loans | Balance | Balance | |||||||||

| 7.5 - 7.9 | 1 | $58,000,000 | 7.7 | % | ||||||||

| 8.0 - 8.9 | 8 | 69,583,549 | 9.2 | |||||||||

| 9.0 - 9.9 | 13 | 143,112,681 | 18.9 | |||||||||

| 10.0 - 10.9 | 8 | 132,956,715 | 17.6 | |||||||||

| 11.0 - 11.9 | 8 | 245,074,538 | 32.4 | |||||||||

| 12.0 - 12.9 | 4 | 62,877,617 | 8.3 | |||||||||

| 13.0 - 13.3 | 2 | 44,887,088 | 5.9 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| (1) | See footnotes (1) and (7) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Mortgage Loans with Original Partial Interest Only Periods | ||||||||||||

| Original Partial | Number of | % of Initial | ||||||||||

| Interest Only Period | Mortgage | Cut-off Date | Pool | |||||||||

| (months) | Loans | Balance | Balance | |||||||||

| 12 | 1 | $6,000,000 | 0.8 | % | ||||||||

| 24 | 2 | $47,300,000 | 6.3 | % | ||||||||

| 36 | 3 | $67,600,000 | 8.9 | % | ||||||||

| 60 | 1 | $2,800,000 | 0.4 | % | ||||||||

| Distribution of Original Terms to Maturity/ARD(1) | ||||||||||||

| Number of | % of Initial | |||||||||||

| Original Term to | Mortgage | Cut-off Date | Pool | |||||||||

| Maturity/ARD (months) | Loans | Balance | Balance | |||||||||

| 60 | 4 | $77,931,281 | 10.3 | % | ||||||||

| 120 | 40 | 678,560,908 | 89.7 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| (1) | See footnote (3) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Remaining Terms to Maturity/ARD(1) | ||||||||||||

| Range of Remaining | Number of | % of Initial | ||||||||||

| Terms to Maturity/ARD | Mortgage | Cut-off Date | Pool | |||||||||

| (months) | Loans | Balance | Balance | |||||||||

| 58 - 59 | 4 | $77,931,281 | 10.3 | % | ||||||||

| 109 | 1 | 6,909,786 | 0.9 | |||||||||

| 116 - 120 | 39 | 671,651,123 | 88.8 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| (1) | See footnote (3) to the table entitled “Mortgage Pool Characteristics“ above. | |||||||||||

| Distribution of Original Amortization Terms(1) | ||||||||||||

| % of | ||||||||||||

| Number of | Initial | |||||||||||

| Original Amortization | Mortgage | Pool | ||||||||||

| Term (months) | Loans | Cut-off Date Balance | Balance | |||||||||

| Interest Only | 11 | $310,970,000 | 41.1 | % | ||||||||

| 300 | 3 | 42,325,867 | 5.6 | |||||||||

| 360 | 30 | 403,196,322 | 53.3 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| (1) | All of the mortgage loans will have balloon payments at maturity or have an anticipated repayment date. | |||||||||||

| Distribution of Remaining Amortization Terms(1) | ||||||||||||

| % of | ||||||||||||

| Range of Remaining | Number of | Initial | ||||||||||

| Amortization Terms | Mortgage | Pool | ||||||||||

| (months) | Loans | Cut-off Date Balance | Balance | |||||||||

| Interest Only | 11 | $310,970,000 | 41.1 | % | ||||||||

| 298 - 299 | 3 | 42,325,867 | 5.6 | |||||||||

| 349 | 1 | 6,909,786 | 0.9 | |||||||||

| 356 - 360 | 29 | 396,286,536 | 52.4 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| (1) | All of the mortgage loans will have balloon payments at maturity or have an anticipated repayment date. | |||||||||||

| Distribution of Prepayment Provisions | ||||||||||||

| % of | ||||||||||||

| Number of | Initial | |||||||||||

| Mortgage | Cut-off Date | Pool | ||||||||||

| Prepayment Provision | Loans | Balance | Balance | |||||||||

| Defeasance | 37 | $580,277,072 | 76.7 | % | ||||||||

| Yield Maintenance | 4 | 122,450,000 | 16.2 | |||||||||

| Defeasance or Yield Maintenance | 3 | 53,765,117 | 7.1 | |||||||||

| Total | 44 | $756,492,189 | 100.0 | % | ||||||||

| Distribution of Escrow Types | ||||||||||||

| % of | ||||||||||||

| Number of | Initial | |||||||||||

| Mortgage | Cut-off Date | Pool | ||||||||||

| Escrow Type | Loans | Balance | Balance | |||||||||

| Real Estate Tax | 38 | $564,272,800 | 74.6 | % | ||||||||

| Replacement Reserves(1) | 38 | $527,872,800 | 69.8 | % | ||||||||

| TI/LC(2) | 14 | $201,937,209 | 43.9 | % | ||||||||

| Insurance | 24 | $304,670,217 | 40.3 | % | ||||||||

| (1) | Includes mortgage loans with FF&E reserves. | |||||||||||

| (2) | Percentage of the portion of the Initial Pool Balance secured by office, retail and mixed use properties. | |||||||||||

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

15

| SHORT TERM CERTIFICATE PRINCIPAL PAY DOWN SCHEDULE |

Class A-2 Principal Pay Down(1)

Mortgage Loan Name | Property Type | Cut-off Date Balance | % of Initial | Remaining Loan Term | Underwritten NCF DSCR | Debt Yield on Underwritten NOI | Cut-off Date LTV Ratio | |||||||

| Quantum Park | Office | $30,000,000 | 4.0% | 59 | 3.00x | 11.4% | 66.0% | |||||||

| Lightstone Hotel Portfolio | Hospitality | $28,367,869 | 3.7% | 59 | 1.82x | 13.0% | 59.6% | |||||||

| Southland Office Center | Office | $12,074,328 | 1.6% | 58 | 1.28x | 9.6% | 66.3% | |||||||

| Homewood Suites Overland Park | Hospitality | $7,489,084 | 1.0% | 59 | 1.52x | 12.8% | 46.8% |

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the certificate balance of the Class A-2 certificates assuming a 0% CPR and applying the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in the Preliminary Prospectus, including the assumptions that (i) no mortgage loan in the pool experiences prepayments prior to its stated maturity date or anticipated repayment date, as applicable, or defaults or losses; (ii) there are no extensions of the maturity date of any mortgage loan in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date or, if applicable, anticipated repayment date. Each class of certificates, including the Class A-2 certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A to the Preliminary Prospectus. See the footnotes to the table entitled “Mortgage Pool Characteristics” above. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

16

| STRUCTURAL OVERVIEW |

| Distributions | On each Distribution Date, funds available for distribution from the mortgage loans, net of (i) specified expenses of the issuing entity, including fees payable to, and costs and expenses reimbursable to, the master servicer, the special servicer, the certificate administrator, the trustee, the operating advisor and the asset representations reviewer, (ii) any yield maintenance charges and prepayment premiums and (iii) any excess interest distributable on the Class S certificates, will be distributed in the following amounts and order of priority (in each case to the extent of remaining available funds): |

| 1. | Class A-1, A-2, A-3, A-4, A-AB, X-A, X-B, X-D, X-E, X-F and X-G certificates: to interest on the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class X-A, Class X-B, Class X-D, Class X-E, Class X-F and Class X-G certificates, up to, andpro rata in accordance with, their respective interest entitlements. |

| 2. | Class A-1, A-2, A-3, A-4 and A-AB certificates: to the extent of funds allocable to principal received or advanced on the mortgage loans, (i) to principal on the Class A-AB certificates until their certificate balance is reduced to the Class A-AB scheduled principal balance set forth in Annex F to the Preliminary Prospectus for the relevant Distribution Date, then (ii) to principal on the Class A-1 certificates until their certificate balance is reduced to zero, all funds available for distribution of principal remaining after the distributions to the Class A-AB certificates in clause (i) above, then (iii) to principal on the Class A-2 certificates until their certificate balance is reduced to zero, all funds available for distribution of principal remaining after the distributions to the Class A-1 certificates in clause (ii) above, then (iv) to principal on the Class A-3 certificates until their certificate balance is reduced to zero, all funds available for distribution of principal remaining after the distributions to the Class A-2 certificates in clause (iii) above, then (v) to principal on the Class A-4 certificates until their certificate balance is reduced to zero, all funds available for distribution of principal remaining after the distributions to the Class A-3 certificates in clause (iv) above and then (vi) to principal on the Class A-AB certificates until their certificate balance is reduced to zero, all funds available for distribution of principal remaining after the distributions to the Class A-4 certificates in clause (v) above. However, if the certificate balances of each and every class of certificates other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates have been reduced to zero as a result of the allocation of mortgage loan losses and other unanticipated expenses to those certificates, then funds available for distributions of principal will be distributed to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates,pro rata, based on their respective certificate balances (and the schedule for the Class A-AB principal distributions will be disregarded). |

| 3. | Class A-1, A-2, A-3, A-4 and A-AB certificates: to reimburse the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates,pro rata, for any unreimbursed losses on the mortgage loans that were previously allocated to reduce the certificate balances of those classes, together with interest at their respective pass-through rates. |

| 4. | Class A-S certificates: (i) first, to interest on the Class A-S certificates in the amount of their interest entitlement; (ii) next, to the extent of funds allocated to principal remaining after distributions in respect of principal to each class of principal balance certificates with a higher principal payment priority (in this case, the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates), to principal on the Class A-S certificates until their certificate balance is reduced to zero; and (iii) next, to reimburse the Class A-S certificates for any unreimbursed losses on the mortgage loans that were previously allocated to reduce the certificate balance of that class, together with interest at its pass-through rate. |

| 5. | Class B certificates: (i) first, to interest on the Class B certificates in the amount of their interest entitlement; (ii) next, to the extent of funds allocated to principal remaining after distributions in respect of principal to each class of principal balance certificates with a higher principal payment priority (in this case, the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB and Class A-S certificates), to principal on the Class B certificates until their certificate balance is reduced to zero; and (iii) next, to reimburse Class B certificates for any unreimbursed losses on the mortgage loans that were previously allocated to reduce the certificate balance of that class, together with interest at its pass-through rate. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., Cantor Fitzgerald & Co., Academy Securities, Inc., or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

17

| STRUCTURAL OVERVIEW (continued) |

| Distributions |

| (continued) | 6. | Class C certificates: (i) first, to interest on the Class C certificates in the amount of their interest entitlement; (ii) next, to the extent of funds allocated to principal remaining after distributions in respect of principal to each class of principal balance certificates with a higher principal payment priority (in this case, the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S and Class B certificates), to principal on the Class C certificates until their certificate balance is reduced to zero; and (iii) next, to reimburse the Class C certificates for any unreimbursed losses on the mortgage loans that were previously allocated to reduce the certificate balance of that class, together with interest at its pass-through rate. |

| 7. | After the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class X-A, Class X-B, Class X-D, Class X-E, Class X-F, Class X-G, Class A-S, Class B and Class C certificates are paid all amounts to which they are entitled on such Distribution Date, the remaining funds available for distribution will be used to pay interest and principal and to reimburse any unreimbursed losses to the Class D, Class E, Class F and Class G certificates, sequentially in that order and in a manner analogous to the Class C certificates pursuant to clause 6 above. |