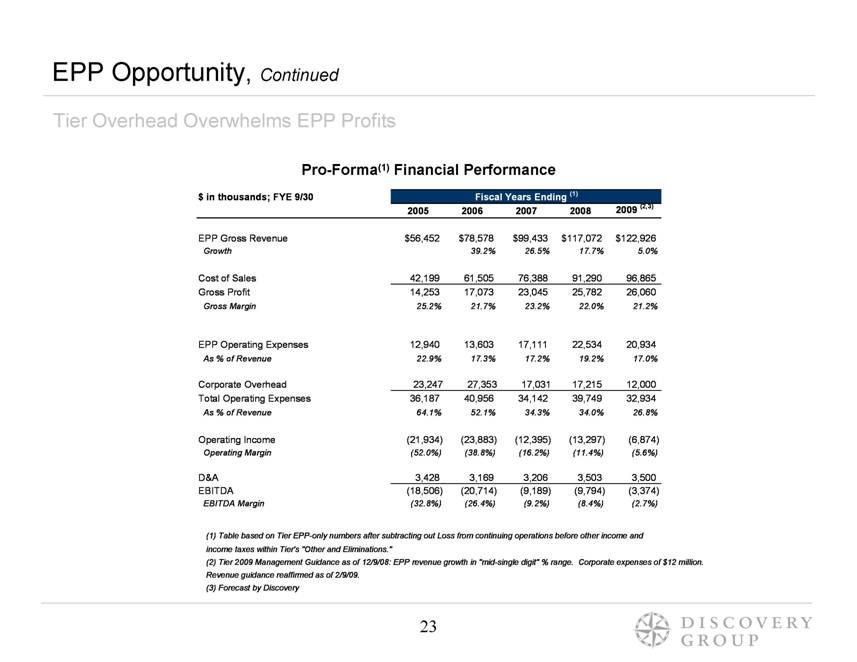

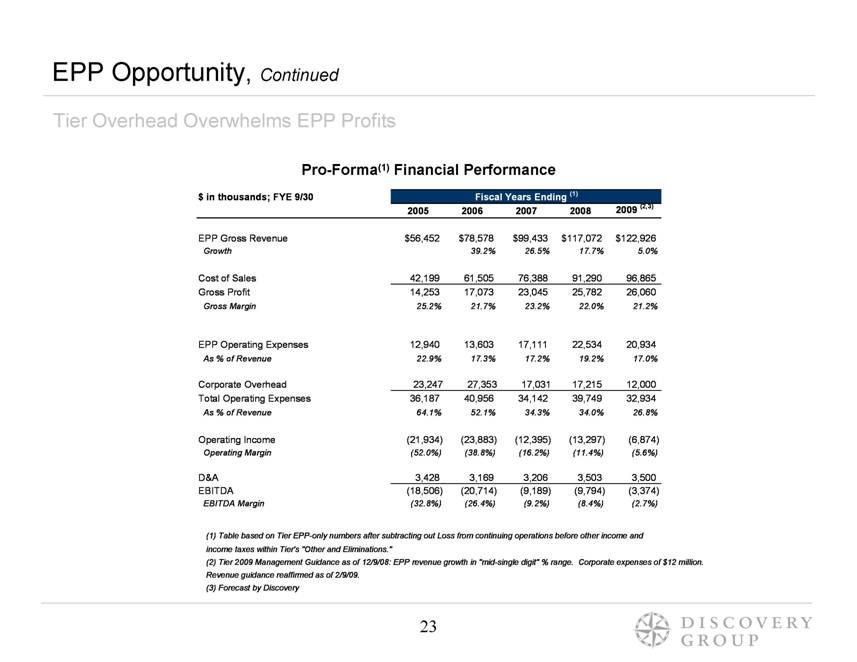

| Tier Overhead Overwhelms EPP Profits EPP Opportunity, Continued Pro-Forma(1) Financial Performance (1) Table based on Tier EPP-only numbers after subtracting out Loss from continuing operations before other income and income taxes within Tier's “Other and Eliminations.” (2) Tier 2009 Management Guidance as of 12/9/08: EPP revenue growth in “mid-single digit” % range. Corporate expenses of $12 million. Revenue guidance reaffirmed as of 2/9/09. (3) Forecast by Discovery $ in thousands; FYE 9/30 2005 2006 2007 2008 2009 (2,3) EPP Gross Revenue $56,452 $78,578 $99,433 $117,072 $122,926 Growth 39.2% 26.5% 17.7% 5.0% Cost of Sales 42,199 61,505 76,388 91,290 96,865 Gross Profit 14,253 17,073 23,045 25,782 26,060 Gross Margin 25.2% 21.7% 23.2% 22.0% 21.2% EPP Operating Expenses 12,940 13,603 17,111 22,534 20,934 As % of Revenue 22.9% 17.3% 17.2% 19.2% 17.0% Corporate Overhead 23,247 27,353 17,031 17,215 12,000 Total Operating Expenses 36,187 40,956 34,142 39,749 32,934 As % of Revenue 64.1% 52.1% 34.3% 34.0% 26.8% Operating Income (21,934) (23,883) (12,395) (13,297) (6,874) Operating Margin (52.0%) (38.8%) (16.2%) (11.4%) (5.6%) D&A 3,428 3,169 3,206 3,503 3,500 EBITDA (18,506) (20,714) (9,189) (9,794) (3,374) EBITDA Margin (32.8%) (26.4%) (9.2%) (8.4%) (2.7%) Fiscal Years Ending (1) |