UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2008

or

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

COMMISSION FILE NUMBER 001-31924

NELNET, INC.

(Exact name of registrant as specified in its charter)

NEBRASKA | 84-0748903 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

121 SOUTH 13TH STREET, SUITE 201 LINCOLN, NEBRASKA | 68508 |

| (Address of principal executive offices) | (Zip Code) |

(402) 458-2370

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer x | | Accelerated filer o |

Non-accelerated filer o | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of July 31, 2008, there were 37,969,493 and 11,495,377 shares of Class A Common Stock and Class B Common Stock, par value $0.01 per share, outstanding, respectively (excluding 11,058,604 shares of Class A Common Stock held by a wholly owned subsidiary).

NELNET, INC.

FORM 10-Q

June 30, 2008

| |

| | | | 2 |

| | | | 29 |

| | | | 65 |

| | | | 71 |

| | |

| |

| | | | 71 |

| | | | 73 |

| | | | 74 |

| | | | 76 |

| | | | 77 |

| | |

| 78 |

NELNET, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except share data)

| | | As of | | As of | |

| | | June 30, 2008 | | December 31, 2007 | |

| | | (unaudited) | | | |

Assets: | | | | | | | |

| Student loans receivable (net of allowance for loan losses of $47,909 and $45,592, respectively) | | $ | 25,993,307 | | | 26,736,122 | |

| Cash and cash equivalents: | | | | | | | |

| Cash and cash equivalents - not held at a related party | | | 15,629 | | | 38,305 | |

| Cash and cash equivalents - held at a related party | | | 122,825 | | | 73,441 | |

| Total cash and cash equivalents | | | 138,454 | | | 111,746 | |

| | | | | | | | |

| Restricted cash | | | 912,252 | | | 842,020 | |

| Restricted investments | | | 95,061 | | | 85,227 | |

| Restricted cash - due to customers | | | 29,543 | | | 81,845 | |

| Accrued interest receivable | | | 501,544 | | | 593,322 | |

| Accounts receivable, net | | | 45,986 | | | 49,084 | |

| Goodwill | | | 175,178 | | | 164,695 | |

| Intangible assets, net | | | 90,163 | | | 112,830 | |

| Property and equipment, net | | | 46,429 | | | 55,797 | |

| Other assets | | | 108,662 | | | 107,624 | |

| Fair value of derivative instruments | | | 295,346 | | | 222,471 | |

| Total assets | | $ | 28,431,925 | | | 29,162,783 | |

| | | | | | | |

Liabilities: | | | | | | | |

| Bonds and notes payable | | $ | 27,530,237 | | | 28,115,829 | |

| Accrued interest payable | | | 86,496 | | | 129,446 | |

| Other liabilities | | | 162,761 | | | 220,899 | |

| Due to customers | | | 29,543 | | | 81,845 | |

| Fair value of derivative instruments | | | 38,846 | | | 5,885 | |

| Total liabilities | | | 27,847,883 | | | 28,553,904 | |

| | | | | | | | |

Shareholders' equity: | | | | | | | |

| Preferred stock, $0.01 par value. Authorized 50,000,000 shares;no shares issued or outstanding | | | — | | | — | |

| Common stock: | | | | | | | |

| Class A, $0.01 par value. Authorized 600,000,000 shares; issued and outstanding 37,952,246 shares as of June 30, 2008 and 37,980,617 shares as of December 31, 2007 | | | 380 | | | 380 | |

| Class B, convertible, $0.01 par value. Authorized 60,000,000 shares; issued and outstanding 11,495,377 shares as of June 30, 2008 and December 31, 2007 | | | 115 | | | 115 | |

| Additional paid-in capital | | | 99,854 | | | 96,185 | |

| Retained earnings | | | 485,739 | | | 515,317 | |

| Employee notes receivable | | | (2,046 | ) | | (3,118 | ) |

| Total shareholders' equity | | | 584,042 | | | 608,879 | |

Commitments and contingencies | | | | | | | |

| Total liabilities and shareholders' equity | | $ | 28,431,925 | | | 29,162,783 | |

See accompanying notes to consolidated financial statements.

NELNET, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except share data)

(unaudited)

| | | Three months | | Six months | |

| | | ended June 30, | | ended June 30, | |

| | | 2008 | | 2007 | | 2008 | | 2007 | |

Interest income: | | | | | | | | | | | | | |

| Loan interest | | $ | 296,686 | | | 417,086 | | | 626,672 | | | 814,140 | |

| Investment interest | | | 9,116 | | | 18,783 | | | 20,796 | | | 40,208 | |

| Total interest income | | | 305,802 | | | 435,869 | | | 647,468 | | | 854,348 | |

Interest expense: | | | | | | | | | | | | | |

| Interest on bonds and notes payable | | | 232,464 | | | 367,893 | | | 557,605 | | | 718,388 | |

| Net interest income | | | 73,338 | | | 67,976 | | | 89,863 | | | 135,960 | |

| Less provision for loan losses | | | 6,000 | | | 2,535 | | | 11,000 | | | 5,288 | |

| Net interest income after provision for loan losses | | | 67,338 | | | 65,441 | | | 78,863 | | | 130,672 | |

| | | | | | | | | | | | | | |

Other income (expense): | | | | | | | | | | | | | |

| Loan and guaranty servicing income | | | 24,904 | | | 31,610 | | | 51,017 | | | 62,076 | |

| Other fee-based income | | | 40,817 | | | 38,262 | | | 86,730 | | | 78,291 | |

| Software services income | | | 4,896 | | | 5,848 | | | 11,648 | | | 11,596 | |

| Other income | | | 1,646 | | | 1,927 | | | 3,056 | | | 7,020 | |

| Gain (loss) on sale of loans | | | 48 | | | 1,010 | | | (47,426 | ) | | 2,796 | |

| Derivative market value, foreign currency, and put option adjustments and derivative settlements, net | | | 20,192 | | | 10,743 | | | 3,594 | | | 2,853 | |

| Total other income | | | 92,503 | | | 89,400 | | | 108,619 | | | 164,632 | |

| | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | |

| Salaries and benefits | | | 43,549 | | | 59,761 | | | 97,392 | | | 121,465 | |

| Other operating expenses: | | | | | | | | | | | | | |

| Impairment expense | | | — | | | — | | | 18,834 | | | — | |

| Advertising and marketing | | | 16,143 | | | 15,456 | | | 32,346 | | | 29,449 | |

| Depreciation and amortization | | | 10,603 | | | 10,647 | | | 21,437 | | | 21,657 | |

| Professional and other services | | | 8,478 | | | 10,514 | | | 16,585 | | | 18,883 | |

| Occupancy and communications | | | 4,914 | | | 5,032 | | | 10,755 | | | 10,251 | |

| Postage and distribution | | | 2,743 | | | 5,624 | | | 6,560 | | | 10,143 | |

| Trustee and other debt related fees | | | 2,464 | | | 2,785 | | | 4,854 | | | 5,628 | |

| Other | | | 9,028 | | | 10,827 | | | 17,996 | | | 24,399 | |

| Total other operating expenses | | | 54,373 | | | 60,885 | | | 129,367 | | | 120,410 | |

| | | | | | | | | | | | | | |

| Total operating expenses | | | 97,922 | | | 120,646 | | | 226,759 | | | 241,875 | |

| | | | | | | | | | | | | | |

| Income (loss) before income taxes | | | 61,919 | | | 34,195 | | | (39,277 | ) | | 53,429 | |

| Income tax expense (benefit) | | | 19,195 | | | 13,306 | | | (12,176 | ) | | 20,570 | |

| | | | | | | | | | | | | | |

| Income (loss) from continuing operations | | | 42,724 | | | 20,889 | | | (27,101 | ) | | 32,859 | |

| Income (loss) from discontinued operations, net of tax | | | 981 | | | (6,135 | ) | | 981 | | | (3,325 | ) |

| | | | | | | | | | | | | | |

| Net income (loss) | | $ | 43,705 | | | 14,754 | | | (26,120 | ) | | 29,534 | |

| | | | | | | | | | | | | | |

| Earnings (loss) per share, basic and diluted: | | | | | | | | | | | | | |

| Income (loss) from continuing operations | | | 0.87 | | | 0.42 | | | (0.55 | ) | | 0.66 | |

| Income (loss) from discontinued operations | | | 0.02 | | | (0.12 | ) | | 0.02 | | | (0.07 | ) |

| | | | | | | | | | | | | | |

| Net income (loss) | | $ | 0.89 | | | 0.30 | | | (0.53 | ) | | 0.59 | |

See accompanying notes to consolidated financial statements.

NELNET, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY AND COMPREHENSIVE INCOME (LOSS)

(Dollars in thousands, except share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | Accumulated | | | |

| | | Preferred | | | | | | | | Class A | | Class B | | Additional | | | | Employee | | other | | Total | |

| | | stock | | Common stock shares | | Preferred | | common | | common | | paid-in | | Retained | | notes | | comprehensive | | shareholders’ | |

| | | shares | | Class A | | Class B | | stock | | stock | | stock | | capital | | earnings | | receivable | | income | | equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2007 | | | — | | | 38,097,623 | | | 11,495,377 | | $ | — | | | 381 | | | 115 | | | 105,345 | | | 507,596 | | | (2,701 | ) | | 382 | | | 611,118 | |

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 14,754 | | | — | | | — | | | 14,754 | |

| Other comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (574 | ) | | (574 | ) |

| Non-pension postretirement benefit plan | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 192 | | | 192 | |

| Total comprehensive income | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 14,372 | |

| Cash dividend on Class A and Class B common stock - $0.07 per share | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (3,440 | ) | | — | | | — | | | (3,440 | ) |

| Issuance of common stock, net of forfeitures | | | — | | | 39,182 | | | — | | | — | | | 1 | | | — | | | 880 | | | — | | | — | | | — | | | 881 | |

| Compensation expense for stock based awards | | | — | | | — | | | — | | | — | | | — | | | — | | | 772 | | | — | | | — | | | — | | | 772 | |

| Repurchase of common stock | | | — | | | (998 | ) | | — | | | — | | | — | | | — | | | (22 | ) | | — | | | — | | | — | | | (22 | ) |

| Acquisition of enterprise under common control | | | — | | | (474,426 | ) | | — | | | — | | | (5 | ) | | — | | | (12,502 | ) | | — | | | — | | | — | | | (12,507 | ) |

| Reduction of employee stock notes receivable | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 4 | | | — | | | 4 | |

| Balance as of June 30, 2007 | | | — | | | 37,661,381 | | | 11,495,377 | | $ | — | | | 377 | | | 115 | | | 94,473 | | | 518,910 | | | (2,697 | ) | | — | | | 611,178 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2008 | | | — | | | 37,912,773 | | | 11,495,377 | | $ | — | | | 379 | | | 115 | | | 97,875 | | | 442,034 | | | (2,296 | ) | | — | | | 538,107 | |

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 43,705 | | | — | | | — | | | 43,705 | |

| Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 43,705 | |

| Issuance of common stock, net of forfeitures | | | — | | | 53,467 | | | — | | | — | | | 1 | | | — | | | 310 | | | — | | | — | | | — | | | 311 | |

| Compensation expense for stock based awards | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,848 | | | — | | | — | | | — | | | 1,848 | |

| Repurchase of common stock | | | — | | | (13,994 | ) | | — | | | — | | | — | | | — | | | (179 | ) | | — | | | — | | | — | | | (179 | ) |

| Reduction of employee stock notes receivable | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 250 | | | — | | | 250 | |

| Balance as of June 30, 2008 | | | — | | | 37,952,246 | | | 11,495,377 | | $ | — | | | 380 | | | 115 | | | 99,854 | | | 485,739 | | | (2,046 | ) | | — | | | 584,042 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2006 | | | — | | | 39,035,169 | | | 13,505,812 | | $ | — | | | 390 | | | 135 | | | 177,678 | | | 496,341 | | | (2,825 | ) | | 131 | | | 671,850 | |

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 29,534 | | | — | | | — | | | 29,534 | |

| Other comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (322 | ) | | (322 | ) |

| Non-pension postretirement benefit plan | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 191 | | | 191 | |

| Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 29,403 | |

| Cash dividend on Class A and Class B common stock - $0.14 per share | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6,904 | ) | | — | | | — | | | (6,904 | ) |

| Adjustment to adopt provisions of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FASB Interpretation No. 48 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (61 | ) | | — | | | — | | | (61 | ) |

| Issuance of common stock, net of forfeitures | | | — | | | 152,273 | | | — | | | — | | | 2 | | | — | | | 3,219 | | | — | | | — | | | — | | | 3,221 | |

| Compensation expense for stock based awards | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,530 | | | — | | | — | | | — | | | 1,530 | |

| Repurchase of common stock | | | — | | | (3,062,070 | ) | | — | | | — | | | (30 | ) | | — | | | (75,452 | ) | | — | | | — | | | — | | | (75,482 | ) |

| Conversion of common stock | | | — | | | 2,010,435 | | | (2,010,435 | ) | | — | | | 20 | | | (20 | ) | | — | | | — | | | — | | | — | | | — | |

| Acquisition of enterprise under common control | | | — | | | (474,426 | ) | | — | | | — | | | (5 | ) | | — | | | (12,502 | ) | | — | | | — | | | — | | | (12,507 | ) |

| Reduction of employee stock notes receivable | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 128 | | | — | | | 128 | |

| Balance as of June 30, 2007 | | | — | | | 37,661,381 | | | 11,495,377 | | $ | — | | | 377 | | | 115 | | | 94,473 | | | 518,910 | | | (2,697 | ) | | — | | | 611,178 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2007 | | | — | | | 37,980,617 | | | 11,495,377 | | $ | — | | | 380 | | | 115 | | | 96,185 | | | 515,317 | | | (3,118 | ) | | — | | | 608,879 | |

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (26,120 | ) | | — | | | — | | | (26,120 | ) |

| Total comprehensive income (loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (26,120 | ) |

| Cash dividend on Class A and Class B common stock - $0.07 per share | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (3,458 | ) | | — | | | — | | | (3,458 | ) |

| Issuance of common stock, net of forfeitures | | | — | | | 33,687 | | | — | | | — | | | — | | | — | | | 1,073 | | | — | | | — | | | — | | | 1,073 | |

| Compensation expense for stock based awards | | | — | | | — | | | — | | | — | | | — | | | — | | | 3,263 | | | — | | | — | | | — | | | 3,263 | |

| Repurchase of common stock | | | — | | | (62,058 | ) | | — | | | — | | | — | | | — | | | (667 | ) | | — | | | — | | | — | | | (667 | ) |

| Reduction of employee stock notes receivable | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,072 | | | — | | | 1,072 | |

| Balance as of June 30, 2008 | | | — | | | 37,952,246 | | | 11,495,377 | | $ | — | | | 380 | | | 115 | | | 99,854 | | | 485,739 | | | (2,046 | ) | | — | | | 584,042 | |

See accompanying notes to consolidated financial statements.

NELNET, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

(unaudited)

| | | Six months ended June 30, | |

| | | 2008 | | 2007 | |

| | | | | | |

| Net income (loss) | | $ | (26,120 | ) | | 29,534 | |

| Income (loss) from discontinued operations | | | 981 | | | (3,325 | ) |

| Income (loss) from continuing operations | | | (27,101 | ) | | 32,859 | |

| Adjustments to reconcile income from continuing operations to net cash provided by operating activities, net of business acquisitions: | | | | | | | |

| Depreciation and amortization, including loan premiums and deferred origination costs | | | 74,312 | | | 150,465 | |

| Derivative market value adjustment | | | (47,462 | ) | | (20,374 | ) |

| Foreign currency transaction adjustment | | | 88,530 | | | 24,974 | |

| Change in value of put options issued in business acquisitions | | | 538 | | | 1,983 | |

| Proceeds from termination of derivative instruments | | | 7,547 | | | — | |

| Payments to terminate floor contracts | | | — | | | (8,100 | ) |

| Impairment expense | | | 18,834 | | | — | |

| Loss on sale of business | | | — | | | 9,041 | |

| Loss (gain) on sale of student loans | | | 47,426 | | | (2,796 | ) |

| Non-cash compensation expense | | | 4,372 | | | 2,591 | |

| Deferred income tax benefit | | | (24,237 | ) | | (921 | ) |

| Provision for loan losses | | | 11,000 | | | 5,288 | |

| Other non-cash items | | | 344 | | | (2,906 | ) |

| Decrease (increase) in accrued interest receivable | | | 91,778 | | | (81,421 | ) |

| Decrease (increase) in accounts receivable | | | 3,098 | | | (6,698 | ) |

| Decrease in other assets | | | 9,419 | | | 6,491 | |

| Decrease in accrued interest payable | | | (42,950 | ) | | (1,545 | ) |

| (Decrease) increase in other liabilities | | | (28,351 | ) | | 5,667 | |

| Net cash flows from operating activities - continuing operations | | | 187,097 | | | 114,598 | |

| Net cash flows from operating activities - discontinued operations | | | — | | | (4,467 | ) |

| Net cash provided by operating activities | | | 187,097 | | | 110,131 | |

| | | | | | | | |

| Cash flows from investing activities, net of business acquisitions: | | | | | | | |

| Originations, purchases, and consolidations of student loans, including loan premiums and deferred origination costs | | | (1,480,305 | ) | | (3,390,016 | ) |

| Purchases of student loans, including loan premiums, from a related party | | | (212,888 | ) | | (191,003 | ) |

| Net proceeds from student loan repayments, claims, capitalized interest, participations, and other | | | 1,061,510 | | | 1,060,117 | |

| Proceeds from sale of student loans | | | 1,267,826 | | | 89,311 | |

| Purchases of property and equipment, net | | | (3,721 | ) | | (13,830 | ) |

| (Increase) decrease in restricted cash | | | (70,232 | ) | | 279,349 | |

| Purchases of restricted investments | | | (170,512 | ) | | (239,691 | ) |

| Proceeds from maturities of restricted investments | | | 160,678 | | | 261,597 | |

| Purchases of equity method investments | | | (2,988 | ) | | — | |

| Distributions from equity method investments | | | — | | | 434 | |

| Business acquisitions, net of cash acquired | | | (18,000 | ) | | 2,211 | |

| Proceeds from sale of business, net of cash sold | | | — | | | 7,551 | |

| Net cash flows from investing activities - continuing operations | | | 531,368 | | | (2,133,970 | ) |

| Net cash flows from investing activities - discontinued operations | | | — | | | (294 | ) |

| Net cash provided by (used in) investing activities | | | 531,368 | | | (2,134,264 | ) |

| | | | | | | | |

| Cash flows from financing activities: | | | | | | | |

| Payments on bonds and notes payable | | | (5,444,408 | ) | | (1,435,054 | ) |

| Proceeds from issuance of bonds and notes payable | | | 4,761,143 | | | 3,601,480 | |

| Proceeds (payments) from issuance of notes payable due to a related party, net | | | 9,269 | | | (55,715 | ) |

| Payments of debt issuance costs | | | (14,634 | ) | | (5,899 | ) |

| Dividends paid | | | (3,458 | ) | | (6,904 | ) |

| Proceeds from issuance of common stock | | | 423 | | | 951 | |

| Repurchases of common stock | | | (667 | ) | | (75,482 | ) |

| Payments received on employee stock notes receivable | | | 575 | | | 128 | |

| Net cash flows from financing activities - continuing operations | | | (691,757 | ) | | 2,023,505 | |

| Net cash flows from financing activities - discontinued operations | | | — | | | — | |

| Net cash (used in) provided by financing activities | | | (691,757 | ) | | 2,023,505 | |

| | | | | | | | |

| Effect of exchange rate fluctuations on cash | | | — | | | 548 | |

| | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | | 26,708 | | | (80 | ) |

| | | | | | | | |

| Cash and cash equivalents, beginning of period | | | 111,746 | | | 106,086 | |

| | | | | | | | |

| Cash and cash equivalents, end of period | | $ | 138,454 | | | 106,006 | |

| | | | | | | | |

| Supplemental disclosures of cash flow information: | | | | | | | |

| Interest paid | | $ | 589,578 | | | 630,175 | |

| Income taxes paid, net of refunds | | $ | 14,126 | | | 12,130 | |

See accompanying notes to consolidated financial statements.

NELNET, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Information as of June 30, 2008 and for the three months and six months ended

June 30, 2008 and 2007 is unaudited)

(Dollars in thousands, except per share amounts, unless otherwise noted)

1. Basis of Financial Reporting

The accompanying unaudited consolidated financial statements of Nelnet, Inc. and subsidiaries (the “Company”) as of June 30, 2008 and for the three and six months ended June 30, 2008 and 2007 have been prepared on the same basis as the audited consolidated financial statements for the year ended December 31, 2007 and, in the opinion of the Company’s management, the unaudited consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of results of operations for the interim periods presented. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates. Operating results for the three and six months ended June 30, 2008 are not necessarily indicative of the results for the year ending December 31, 2008. The unaudited consolidated financial statements should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended December 31, 2007. Certain amounts from 2007 have been reclassified to conform to the current period presentation.

2. Discontinued Operations

On May 25, 2007, the Company sold EDULINX Canada Corporation (“EDULINX”), a Canadian student loan service provider and a subsidiary of the Company, for initial proceeds of $19.0 million. The Company recognized an initial net loss of $9.0 million related to this transaction. During the three months ended June 30, 2008, the Company earned $2.0 million ($1.0 million net of tax) in additional consideration as a result of the sale of EDULINX. This payment represented contingent consideration earned by the Company based on EDULINX meeting certain performance measures. As a result of the sale of EDULINX, the results of operations for EDULINX, including the contingent payment earned during the current period, are reported as discontinued operations in the accompanying consolidated statements of operations.

The components of income (loss) from discontinued operations are presented below.

| | | Three months ended June 30, | | Six months ended June 30, | |

| | | 2008 | | 2007 | | 2008 | | 2007 | |

| | | | | | | | | | | | | | |

| Operating income of discontinued operations | | $ | — | | | 4,864 | | | — | | | 9,278 | |

| Income tax on operations | | | — | | | (1,958 | ) | | — | | | (3,562 | ) |

| Gain (loss) on disposal | | | 1,966 | | | (8,151 | ) | | 1,966 | | | (8,151 | ) |

| Income tax on disposal | | | (985 | ) | | (890 | ) | | (985 | ) | | (890 | ) |

| Income (loss) from discontinued operations, net of tax | | $ | 981 | | | (6,135 | ) | | 981 | | | (3,325 | ) |

The following operations of EDULINX have been segregated from continuing operations and reported as discontinued operations through the date of disposition. Interest expense was not allocated to EDULINX and, therefore, all of the Company’s interest expense is included within continuing operations.

| | | Three months ended | | Six months ended | |

| | | June 30, 2007 | | June 30, 2007 | |

| | | | | | | | |

| Net interest income | | $ | 53 | | | 124 | |

| Other income | | | 12,480 | | | 31,511 | |

| Operating expenses | | | (7,669 | ) | | (22,357 | ) |

| Income before income taxes | | | 4,864 | | | 9,278 | |

| Income tax expense | | | 1,958 | | | 3,562 | |

| | | | | | | | |

| Operating income of discontinued operations, net of tax | | $ | 2,906 | | | 5,716 | |

As a result of the contingent consideration received during the second quarter 2008, the Company earned $0.8 million of foreign tax credits available to offset future U.S. federal income taxes. Under current tax law, these tax credits expire in 2018. The Company established a valuation allowance for these tax credits due to the Company’s assessment that this deferred tax asset did not meet the more-likely-than-not recognition criteria of Statement of Financial Accounting Standards (“SFAS”) No. 109, Accounting for Income Taxes.

3. Restructuring Charges

Legislative Impact

On September 6, 2007, the Company announced a strategic initiative to create efficiencies and lower costs in advance of the enactment of the College Cost Reduction Act, which impacted the Federal Family Education Loan Program (the “FFEL Program” or “FFELP”) in which the Company participates. In anticipation of the federally driven cuts to the student loan programs, management initiated a variety of strategies to modify the Company’s student loan business model, including lowering the cost of student loan acquisition, creating efficiencies in the Company’s asset generation business, and decreasing operating expenses through a reduction in workforce and realignment of operating facilities. Implementation of the plan began immediately and was completed as of December 31, 2007. As a result of these strategic decisions, the Company recorded restructuring charges of $15.0 million and $5.3 million in the third and fourth quarters of 2007, respectively.

Information related to the remaining restructuring accrual, which is included in “other liabilities” on the consolidated balance sheet, follows:

| | | Employee | | | | | |

| | | termination | | Lease | | | |

| | | benefits | | terminations | | Total | |

| | | | | | | | | | | |

| Restructuring accrual as of December 31, 2007 | | $ | 1,193 | | | 3,682 | | | 4,875 | |

| | | | | | | | | | | |

| Adjustment from initial estimated charges | | | (191 | ) | | — | | | (191 | ) |

| | | | | | | | | | | |

| Cash payments | | | (868 | ) | | (358 | ) | | (1,226 | ) |

| | | | | | | | | | | |

| Restructuring accrual as of March 31, 2008 | | | 134 | | | 3,324 | | | 3,458 | |

| | | | | | | | | | | |

| Cash payments | | | (134 | ) | | (45 | ) | | (179 | ) |

| | | | | | | | | | | |

| Restructuring accrual as of June 30, 2008 | | $ | — | | | 3,279 | | | 3,279 | |

Capital Markets Impact

On January 23, 2008, the Company announced a plan to further reduce operating expenses related to its student loan origination and related businesses as a result of disruptions in the credit markets. Management developed a restructuring plan related to its asset generation and supporting businesses which reduced marketing, sales, service, and related support costs through a reduction in workforce of approximately 300 positions and realignment of certain operating facilities. Implementation of the plan began immediately and was completed as of June 30, 2008. As a result of these strategic decisions, the Company recorded restructuring charges of $26.5 million during the three months ended March 31, 2008 and income of $0.4 million during the three months ended June 30, 2008 to recognize adjustments from initial estimates.

Selected information relating to the restructuring charge follows:

| | | Employee | | | | | | | |

| | | termination | | Lease | | Write-down | | | |

| | | benefits | | terminations | | of assets | | Total | |

| | | | | | | | | | | | | | |

| Restructuring costs recognized during the three month period ended March 31, 2008 | | $ | 6,095 | (a) | | 1,573 | (b) | | 18,834 | (c) | | 26,502 | |

| | | | | | | | | | | | | | |

| Write-down of assets to net realizable value | | | — | | | — | | | (18,834 | ) | | (18,834 | ) |

| | | | | | | | | | | | | | |

| Cash payments | | | (4,952 | ) | | — | | | — | | | (4,952 | ) |

| | | | | | | | | | | | | | |

| Restructuring accrual as of March 31, 2008 | | | 1,143 | | | 1,573 | | | — | | | 2,716 | |

| | | | | | | | | | | | | | |

| Adjustment from initial estimated charges | | | (190) | (a) | | (175) | (b) | | — | | | (365 | ) |

| | | | | | | | | | | | | | |

| Cash payments | | | (792 | ) | | (369 | ) | | — | | | (1,161 | ) |

| | | | | | | | | | | | | | |

| Restructuring accrual as of June 30, 2008 | | $ | 161 | | | 1,029 | | | — | | | 1,190 | |

(a) Employee termination benefits are included in "salaries and benefits" in the consolidated statements of operations.

(b) Lease termination costs are included in "occupancy and communications" in the consolidated statements of operations.

(c) Costs related to the write-down of assets are included in "impairment expense" in the consolidated statements of operations.

Selected information relating to the restructuring charge by operating segment and Corporate Activity and Overhead follows:

| | | Restructuring costs | | | | | | | | | | | | | |

| | | recognized during | | | | | | | | Adjustment | | | | | |

| | | the three month | | Write-down of | | | | Restructuring | | from initial | | | | Restructuring | |

| | | period ended | | assets to net | | Cash | | accrual as of | | estimated | | Cash | | accrual as of | |

Operating segment | | March 31, 2008 | | realizable value | | payments | | March 31, 2008 | | charges | | payments | | March 31, 2008 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Student Loan and Guaranty Servicing | | $ | 6,010 | | | (5,074 | ) | | (430 | ) | | 506 | | | (104 | ) | | (352 | ) | | 50 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Tuition Payment Processing and Campus Commerce | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Enrollment Services and List Management | | | 312 | | | — | | | (291 | ) | | 21 | | | (15 | ) | | (19 | ) | | (13 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Software and Technical Services | | | 518 | | | — | | | (472 | ) | | 46 | | | (8 | ) | | — | | | 38 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Asset Generation and Management | | | 11,287 | | | (9,351 | ) | | (1,806 | ) | | 130 | | | (52 | ) | | (72 | ) | | 6 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Activity and Overhead | | | 8,375 | | | (4,409 | ) | | (1,953 | ) | | 2,013 | | | (186 | ) | | (718 | ) | | 1,109 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 26,502 | | | (18,834 | ) | | (4,952 | ) | | 2,716 | | | (365 | ) | | (1,161 | ) | | 1,190 | |

4. Legal, Industry, and Legislative Developments

Legal Proceedings

General

The Company is subject to various claims, lawsuits, and proceedings that arise in the normal course of business. These matters principally consist of claims by student loan borrowers disputing the manner in which their student loans have been processed and disputes with other business entities. On the basis of present information, anticipated insurance coverage, and advice received from counsel, it is the opinion of the Company’s management that the disposition or ultimate determination of these claims, lawsuits, and proceedings will not have a material adverse effect on the Company’s business, financial position, or results of operations.

Municipal Derivative Bid Practices Investigation

On February 8, 2008, Shockley Financial Corp. (“SFC”), an indirect wholly owned subsidiary of the Company with two associates that provides investment advisory services for the investment of proceeds from the issuance of municipal and corporate bonds, received a grand jury subpoena issued by the U.S. District Court for the Southern District of New York upon application of the Antitrust Division of the U.S. Department of Justice. The subpoena seeks certain information and documents from SFC in connection with the Department of Justice’s ongoing criminal investigation of the bond industry with respect to possible anti-competitive practices related to awards of guaranteed investment contracts (“GICs”) and other products for the investment of proceeds from bond issuances. The Company and SFC are cooperating with the investigation.

In addition, on March 5, 2008, SFC received a subpoena from the Securities and Exchange Commission (the “SEC”) related to an ongoing industry-wide investigation concerning the bidding of municipal GICs. The subpoena seeks certain information and documents from SFC relating to its GIC business. The Company and SFC are cooperating with the investigation.

On or about June 6, 2008, SFC received a subpoena from the New York Attorney General (the “NYAG”) relating to the NYAG’s investigation concerning the bidding of municipal GICs and possible violations of various state and federal laws. The subpoena seeks certain information and documents from SFC relating to its GIC business. The Company and SFC are cooperating with the investigation.

On or about June 12, 2008, SFC received a subpoena from the Florida Attorney General (the “FLAG”) relating to the FLAG’s investigation concerning the bidding of municipal GICs and possible violations of various state and federal laws. The subpoena seeks certain information and documents from SFC relating to its GIC business. The Company and SFC are cooperating with the investigation.

SFC has also been named as a defendant in a total of eight substantially identical purported class action lawsuits. In each of the lawsuits, a large number of financial institutions and financial service providers, including SFC, are named as defendants. The complaints allege that the defendants engaged in a conspiracy not to compete and to fix prices and rig bids for municipal derivatives (including GICs) sold to issuers of municipal bonds. All the complaints assert claims for violations of Section 1 of the Sherman Act and fraudulent concealment, and three complaints also assert claims for unfair competition and violation of the California Cartwright Act. On June 16, 2008, the United States Judicial Panel on Multidistrict Litigation issued an order transferring the cases then before it to the U.S. District Court for the Southern District of New York which consolidated several cases under the caption Hinds County, Mississippi v. Wachovia Bank, N.A. et al. SFC intends to vigorously contest these purported class action lawsuits.

SFC, the Company, or other subsidiaries of the Company may receive subpoenas from other regulatory agencies. Due to the preliminary nature of these matters as to SFC, the Company is unable to predict the ultimate outcome of the investigations or the class action lawsuits.

Industry Inquiries and Investigations

On January 11, 2007, the Company received a letter from the NYAG requesting certain information and documents from the Company in connection with the NYAG’s investigation into preferred lender list activities. Since January 2007, a number of state attorneys general, including the NYAG, and the U.S. Senate Committee on Health, Education, Labor, and Pensions also announced or are reportedly conducting broad inquiries or investigations of the activities of various participants in the student loan industry, including activities which may involve perceived conflicts of interest. A focus of the inquiries or investigations has been on any financial arrangements among student loan lenders and other industry participants which may facilitate increased volumes of student loans for particular lenders. Like many other student loan lenders, the Company received requests for information from certain state attorneys general and the Chairman of the U.S. Senate Committee on Health, Education, Labor, and Pensions in connection with their inquiries or investigations. In addition, the Company received subpoenas for information from the NYAG, the New Jersey Attorney General, and the Ohio Attorney General. In each case the Company is cooperating with the requests and subpoenas for information that it has received.

On July 31, 2007, the Company announced that it had agreed with the NYAG to adopt the NYAG’s Code of Conduct, which is substantially similar to the Company's previously adopted Nelnet Student Loan Code of Conduct. As part of the agreement, the Company agreed to contribute $2.0 million to a national fund for educating high school seniors and their parents regarding the financial aid process.

On October 10, 2007, the Company received a subpoena from the NYAG requesting certain information and documents from the Company in connection with the NYAG’s investigation into direct-to-consumer marketing practices of student lenders. The Company is cooperating with the subpoena.

While the Company cannot predict the ultimate outcome of any inquiry or investigation, the Company believes its activities have materially complied with applicable law, including the Higher Education Act, the rules and regulations adopted by the Department of Education thereunder, and the Department’s guidance regarding those rules and regulations.

Department of Education Review

The Department of Education periodically reviews participants in the FFEL Program for compliance with program provisions. On June 28, 2007, the Department of Education notified the Company that it would be conducting a review of the Company’s administration of the FFEL Program under the Higher Education Act. The Company understands that the Department of Education has selected several schools and lenders for review. Specifically, the Department is reviewing the Company’s practices in connection with the prohibited inducement provisions of the Higher Education Act and the provisions of the Higher Education Act and the associated regulations which allow borrowers to have a choice of lenders. The Company has responded to the Department of Education’s requests for information and documentation and is cooperating with their review.

While the Company cannot predict the ultimate outcome of the review, the Company believes its activities have materially complied with the Higher Education Act, the rules and regulations adopted by the Department of Education thereunder, and the Department’s guidance regarding those rules and regulations.

Department of Justice

In connection with the Company’s settlement with the Department of Education in January 2007 to resolve the Office of Inspector General of the Department of Education (the “OIG”) audit report with respect to the Company’s student loan portfolio receiving special allowance payments at a minimum 9.5% interest rate, the Company was informed by the Department of Education that a civil attorney with the Department of Justice had opened a file regarding the issues set forth in the OIG report, which the Company understands is common procedure following an OIG audit report. The Company has engaged in discussions with and provided information to the Department of Justice in connection with the review.

While the Company is unable to predict the ultimate outcome of the review, the Company believes its practices complied with applicable law, including the provisions of the Higher Education Act, the rules and regulations adopted by the Department of Education thereunder, and the Department’s guidance regarding those rules and regulations.

Internal Revenue Service

In October 2007, the Company received a letter from the Internal Revenue Service (“IRS”) revoking a previously issued Private Letter Ruling retroactive to September 30, 2003 concerning the Company’s arbitrage and excess interest calculations on certain of its tax-exempt bonds. The IRS letter provided procedures for the Company to follow to appeal the retroactive application of the revocation. The Company responded to the IRS in November 2007 requesting relief from retroactivity. In March 2008, the IRS responded with a final determination that the revocation of the Private Letter Ruling will apply prospectively beginning on July 1, 2008. Management believes that a July 1, 2008 prospective application of the Private Letter Ruling will not have a significant impact on the Company’s operating results.

Legislative Developments

On May 7, 2008, the President signed into law H.R. 5715, the Ensuring Continued Access to Student Loans Act of 2008 (“HR 5715”). This legislation contains provisions that expand the federal government’s support of financing the cost of higher education. Among other things, HR 5715:

| | · | Increases statutory limits on annual and aggregate borrowing for FFELP loans; and |

| | · | Allows the Department to act as a secondary market and enter into forward purchasing agreements with lenders. |

As a result of this legislation, the Departments of Education and Treasury developed a plan. Among other things, this plan:

| | · | Offers to purchase loans from lenders for the 2008-2009 academic year and offers lenders access to short-term liquidity; and |

| | · | Commits to continue working with the FFELP community to explore programs to reengage the capital markets in the long-run. |

On May 22, 2008, the Company announced that, as a result of the above plan, it will continue originating new federal student loans for the 2008-2009 academic year to all students regardless of the school they attend.

On July 1, 2008, pursuant to HR 5715, the Department of Education announced terms under which it will offer to purchase FFELP student loans and loan participations from lenders. See note 7 for information related to the Department’s programs.

On August 6, 2008, having passed in identical form in both the House of Representatives and the Senate, the Higher Education Opportunity Act was sent to the President. Upon the President’s approval, this legislation will become law. The Higher Education Opportunity Act amends the Higher Education Act of 1965 (“HEA”) to revise and reauthorize HEA programs. In addition, among other items, this legislation:

| | · | Contains lender and school code of conduct requirements applicable to FFELP and private education lenders; |

| | · | Contains additional provisions and reporting requirements for lenders and schools participating in preferred lender arrangements; and |

| | · | Contains additional disclosures that FFELP lenders must make to borrowers as well as added FFELP loan servicing requirements for lenders. |

5. Student Loans Receivable and Allowance for Loan Losses

Student loans receivable consisted of the following:

| | | As of | | As of | |

| | | June 30, 2008 | | December 31, 2007 | |

| | | | | | |

| Federally insured loans | | $ | 25,332,173 | | | 26,054,398 | |

| Non-federally insured loans | | | 279,953 | | | 274,815 | |

| | | | 25,612,126 | | | 26,329,213 | |

| Unamortized loan premiums and deferred origination costs | | | 429,090 | | | 452,501 | |

| Allowance for loan losses - federally insured loans | | | (24,084 | ) | | (24,534 | ) |

| Allowance for loan losses - non-federally insured loans | | | (23,825 | ) | | (21,058 | ) |

| | | $ | 25,993,307 | | | 26,736,122 | |

| | | | | | | | |

| Federally insured allowance as a percentage of ending balance of federally insured loans | | | 0.10 | % | | 0.09 | % |

| Non-federally insured allowance as a percentage of ending balance of non-federally insured loans | | | 8.51 | % | | 7.66 | % |

| Total allowance as a percentage of ending balance of total loans | | | 0.19 | % | | 0.17 | % |

Loan Sales

On March 31, 2008, the Company sold $857.8 million (par value) of federally insured student loans resulting in the recognition of a loss of $30.4 million. In addition, on April 8, 2008, the Company sold $428.6 million (par value) of federally insured student loans. The portfolio of student loans sold on April 8, 2008 was presented as “held for sale” on the March 31, 2008 consolidated balance sheet and was valued at the lower of cost or fair value. The Company recognized a loss of $17.1 million during the three month period ended March 31, 2008 as a result of marking these loans to fair value. Combined, the portfolios sold on March 31, 2008 and April 8, 2008 were sold for a purchase price of approximately 98% of the par value of such loans. As a result of the disruptions in the debt and secondary markets, the Company sold these loan portfolios in order to reduce the amount of student loans remaining under the Company’s multi-year committed financing facility for FFELP loans, which reduced the Company’s exposure related to certain equity support provisions included in this facility (see note 7 for additional information related to these equity support provisions).

As part of the Company’s asset management strategy, the Company periodically sells student loan portfolios to third parties. During the three and six months ended June 30, 2007, the Company sold $34.4 million (par value) and $86.0 million (par value), respectively, of federally insured student loans resulting in the recognition of gains of $1.0 million and $2.8 million, respectively.

6. Intangible Assets and Goodwill

Intangible assets consist of the following:

| | | Weighted | | | | | |

| | | average | | | | | |

| | | remaining | | | | | |

| | | useful life as of | | As of | | As of | |

| | | June 30, | | June 30, | | December 31, | |

| | | 2008 | | 2008 | | 2007 | |

| Amortizable intangible assets: | | | | | | | | | | |

| Customer relationships (net of accumulated amortization of $25,048 and $20,299, respectively) | | | 112 | | $ | 55,312 | | | 60,061 | |

| Trade names (net of accumulated amortization of $3,372 and $1,258, respectively) | | | 47 | | | 13,687 | | | 1,609 | |

| Covenants not to compete (net of accumulated amortization of $11,939 and $11,815, respectively) | | | 25 | | | 11,683 | | | 15,425 | |

| Database and content (net of accumulated amortization of $4,320 and $3,193, respectively) | | | 28 | | | 5,160 | | | 6,287 | |

| Computer software (net of accumulated amortization of $6,238 and $4,898, respectively) | | | 15 | | | 2,764 | | | 4,189 | |

| Student lists (net of accumulated amortization of $6,831 and $5,806, respectively) | | | 8 | | | 1,366 | | | 2,391 | |

| Other (net of accumulated amortization of $83 and $71, respectively) | | | 92 | | | 191 | | | 203 | |

| Loan origination rights (net of accumulated amortization of $8,180) | | | — | | | — | | | 8,473 | |

| Total - amortizable intangible assets | | | 81 months | | | 90,163 | | | 98,638 | |

| Unamortizable intangible assets - trade names | | | | | | — | | | 14,192 | |

| | | | | | $ | 90,163 | | | 112,830 | |

As disclosed in note 3, as a result of the disruption in the debt and secondary markets and the student loan business model modifications the Company implemented due to the disruption, the Company recorded an impairment charge of $18.8 million during the first quarter of 2008. This charge is included in “impairment expense” in the Company’s consolidated statements of operations. Information related to the impairment charge follows:

| | | Operating | | Impairment | |

Asset | | segment | | charge | |

| Amortizable intangible assets: | | | | | |

| Covenants not to compete | | | Student Loan and Guaranty Servicing | | $ | 4,689 | |

| Covenants not to compete | | | Asset Generation and Management | | | 336 | |

| Loan origination rights | | | Asset Generation and Management | | | 8,336 | |

| Computer software | | | Asset Generation and Management | | | 12 | |

| | | | | | | | |

| Goodwill | | | Asset Generation and Management | | | 667 | |

| | | | | | | | |

| Property and equipment | | | Student Loan and Guaranty Servicing | | | 385 | |

| Property and equipment | | | Corporate activities | | | 4,409 | |

| | | | | | | | |

| Total impairment charge | | | | | $ | 18,834 | |

The fair value of the intangible assets and reporting unit within the Asset Generation and Management operating segment were estimated using the expected present value of future cash flows.

During the first quarter of 2008, management determined that the trade names not subject to amortization have a finite useful life. As such, these assets will be amortized prospectively over their estimated remaining useful lives.

The Company recorded amortization expense on its intangible assets of $6.6 million and $6.5 million for the three months ended June 30, 2008 and 2007, respectively, and $13.1 million for the six months ended June 30, 2008 and 2007, respectively. The Company will continue to amortize intangible assets over their remaining useful lives. As of June 30, 2008, the Company estimates it will record amortization expense as follows:

| 2008 | | $ | 13,109 | |

| 2009 | | | 22,319 | |

| 2010 | | | 15,985 | |

| 2011 | | | 10,031 | |

| 2012 | | | 9,029 | |

| 2013 and thereafter | | | 19,690 | |

| | | $ | 90,163 | |

The change in the carrying amount of goodwill by operating segment was as follows:

| | | | | Tuition | | | | | | | | | |

| | | | | Payment | | Enrollment | | Software | | Asset | | | |

| | | Student Loan | | Processing | | Services | | and | | Generation | | | |

| | | and Guaranty | | and Campus | | and List | | Technical | | and | | | |

| | | Servicing | | Commerce | | Management | | Services | | Management | | Total | |

| | | | | | | | | | | | | |

| Balance as of December 31, 2007 | | $ | — | | | 58,086 | | | 55,463 | | | 8,596 | | | 42,550 | | | 164,695 | |

| Additional contingent consideration paid (a) | | | — | | | — | | | 11,150 | | | — | | | — | | | 11,150 | |

| Impairment charge | | | — | | | — | | | — | | | — | | | (667 | ) | | (667 | ) |

| Balance as of March 31, 2008 (b) | | $ | — | | | 58,086 | | | 66,613 | | | 8,596 | | | 41,883 | | | 175,178 | |

| | (a) | In January 2008, the Company paid $18.0 million (of which $6.8 million was accrued as of December 31, 2007) of additional consideration related to its 2005 acquisitions of Student Marketing Group, Inc. and National Honor Roll, L.L.C. This payment satisfies all of the Company’s obligations related to the contingencies per the terms of the purchase agreement. |

| | (b) | During the quarter ended June 30, 2008, there was no change in goodwill. |

7. Bonds and Notes Payable

The following tables summarize outstanding bonds and notes payable by type of instrument:

| | | As of June 30, 2008 | |

| | | Carrying | | Interest rate | | | |

| | | amount | | range | | Final maturity | |

| | | | | | | | |

| Variable-rate bonds and notes (a): | | | | | | | | | | |

| Bonds and notes based on indices | | $ | 21,339,035 | | | 2.65% - 4.97 | % | | 09/25/13 - 06/25/41 | |

| Bonds and notes based on auction or remarketing | | | 2,841,245 | | | 0.67% - 7.00 | % | | 11/01/09 - 07/01/43 | |

| Total variable-rate bonds and notes | | | 24,180,280 | | | | | | | |

| | | | | | | | | | | |

| Commercial paper - FFELP facility (b) | | | 1,986,212 | | | 2.08% - 2.91 | % | | 05/09/10 | |

| Commercial paper - private loan facility (b) | | | 159,800 | | | 3.08 | % | | 03/14/09 | |

| Fixed-rate bonds and notes (a) | | | 207,376 | | | 5.30% - 6.68 | % | | 11/01/09 - 05/01/29 | |

| Unsecured fixed rate debt | | | 475,000 | | | 5.13% and 7.40 | % | | 06/01/10 and 09/15/61 | |

| Unsecured line of credit | | | 450,000 | | | 2.90 | % | | 05/08/12 | |

| Other borrowings | | | 71,569 | | | 3.19% - 5.10 | % | | 05/22/09 - 11/01/15 | |

| | | $ | 27,530,237 | | | | | | | |

| | | As of December 31, 2007 | |

| | | Carrying | | Interest rate | | | |

| | | amount | | range | | Final maturity | |

| Variable-rate bonds and notes (a): | | | | | | | | | | |

| Bonds and notes based on indices | | $ | 17,508,810 | | | 4.73% - 5.78 | % | | 09/25/12 - 06/25/41 | |

| Bonds and notes based on auction or remarketing | | | 2,905,295 | | | 2.96% - 7.25 | % | | 11/01/09 - 07/01/43 | |

| Total variable-rate bonds and notes | | | 20,414,105 | | | | | | | |

| | | | | | | | | | | |

| Commercial paper - FFELP facility (b) | | | 6,629,109 | | | 5.22% - 5.98 | % | | 05/09/10 | |

| Commercial paper - private loan facility (b) | | | 226,250 | | | 5.58 | % | | 03/14/09 | |

| Fixed-rate bonds and notes (a) | | | 214,476 | | | 5.20% - 6.68 | % | | 11/01/09 - 05/01/29 | |

| Unsecured fixed rate debt | | | 475,000 | | | 5.13% and 7.40 | % | | 06/01/10 and 09/15/61 | |

| Unsecured line of credit | | | 80,000 | | | 5.40% - 5.53 | % | | 05/08/12 | |

| Other borrowings | | | 76,889 | | | 4.65% - 5.20 | % | | 09/28/08 - 11/01/15 | |

| | | $ | 28,115,829 | | | | | | | |

| (a) | Issued in asset-backed securitizations |

| (b) | Loan warehouse facilities |

Secured Financing Transactions

The Company relies upon secured financing vehicles as its most significant source of funding for student loans. The net cash flow the Company receives from the securitized student loans generally represents the excess amounts, if any, generated by the underlying student loans over the amounts required to be paid to the bondholders, after deducting servicing fees and any other expenses relating to the securitizations. The Company’s rights to cash flow from securitized student loans are subordinate to bondholder interests and may fail to generate any cash flow beyond what is due to bondholders. The Company’s secured financing vehicles are loan warehouse facilities and asset-backed securitizations.

Loan warehouse facilities

Student loan warehousing allows the Company to buy and manage student loans prior to transferring them into more permanent financing arrangements. The Company has historically relied upon three conduit warehouse loan financing vehicles to support its funding needs on a short-term basis: a multi-year committed facility for FFELP loans, a private loan warehouse for non-federally insured student loans, and a single-seller extendible commercial paper conduit for FFELP loans.

The multi-year committed facility for FFELP loans, which terminates in May 2010, was supported by 364-day liquidity which was up for renewal on May 9, 2008. The Company obtained an extension on this renewal until July 31, 2008. On July 31, 2008, the Company did not renew the liquidity provisions of this facility. Accordingly, as of July 31, 2008, the facility became a term facility with an outstanding balance of approximately $2.8 billion and a final maturity date of May 9, 2010. The FFELP warehouse facility has a provision requiring the Company to refinance or remove 75% of the pledged collateral on an annual basis. The Company must refinance or remove approximately $900 million of loans by May 2009 to satisfy this provision. Pursuant to the terms of the agreement, since liquidity was not renewed, the Company’s cost of financing under this facility increased 10 basis points. The agreement also includes provisions which allow the banks to charge a rate equal to LIBOR plus 128.5 basis points if they choose to finance their portion of the facility with sources of funds other than their commercial paper conduit.

The terms and conditions of the Company’s warehouse facility for FFELP loans provide for advance rates related to financed loans subject to a valuation formula based on current market conditions. Dislocation in the credit markets including disruptions in the current capital markets can and will cause short-term volatility in the loan valuation formulas. Severe volatility and dislocation in the credit markets, even if temporary, could cause the valuation assigned to the Company’s student loan portfolio financed by the applicable line to be significantly less than par. Should a significant change in the valuation of subject loans result in a reduction in advance rate and require equity support greater than what the Company can or is willing to provide, the facility could be subject to termination. While the Company does not believe the loan valuation formula is reflective of the fair market value of its loans, it is subject to compliance with provisions of the warehouse documents. As of August 8, 2008, the Company has $135.3 million utilized as equity funding support based on provisions of this agreement.

The private loan warehouse facility is an uncommitted facility that is offered to the Company by a banking partner, which terminates on March 14, 2009. As of June 30, 2008, $159.8 million was outstanding under this facility and $90.2 million was available for future use. As of August 8, 2008, $132.0 million was outstanding under this facility and $118.0 million was available for future use. New advances are also subject to approval by the sponsor bank and the Company believes it is unlikely such approval would be granted in the future. The Company guarantees the performance of the assets in the private loan warehouse facility. This facility provides for advance rates on subject collateral which require certain levels of equity enhancement support. As of August 8, 2008, the Company has $54.5 million utilized as equity funding support based on provisions of this agreement. There can be no assurance that the Company will be able to maintain this conduit facility, find alternative funding, or make adequate equity contributions, if necessary. While the Company’s bank supported facilities have historically been renewed for successive terms, there can be no assurance that this will continue in the future. In January 2008, the Company suspended originating private loans.

In August 2006, the Company established a $5.0 billion extendable commercial paper warehouse program for FFELP loans, under which it can issue one or more short-term extendable secured liquidity notes. As of June 30, 2008, no notes were outstanding under this warehouse program. As a result of the disruption of the credit markets, there is no market for the issuance of notes under this facility. Management believes it is currently unlikely a market will exist in the future.

The Company expects to access alternative sources of funding to originate new FFELP student loans, including the Department of Education’s Loan Participation Program (“Participation Program”), an existing facility with Union Bank and Trust Company (“Union Bank”), an entity under common control with the Company, and its $750 million unsecured operating line of credit.

On July 1, 2008, pursuant to HR 5715, the Department of Education announced terms under which it will offer to purchase FFELP student loans and loan participations from FFELP lenders. Under the Department’s Loan Purchase Commitment Program (“Purchase Program”), the Department will purchase loans at a price equal to the sum of (i) par value, (ii) accrued interest, (iii) the one percent origination fee paid to the Department, and (iv) a fixed amount of $75 per loan. Lenders will have until September 30, 2009, to sell loans to the Department. Under the Participation Program, the Department will provide interim short-term liquidity to FFELP lenders by purchasing participation interests in pools of FFELP loans. FFELP lenders will be charged a rate of commercial paper plus 50 basis points on the principal amount of participation interests outstanding. Loans funded under the Participation Program must be either refinanced by the lender or sold to the Department pursuant to the Purchase Program prior to its expiration on September 30, 2009. To be eligible for purchase or participation under the Department’s programs, loans must be FFELP Stafford or PLUS loans made for the academic year 2008-2009, first disbursed between May 1, 2008 and July 1, 2009, with eligible borrower benefits. The Company is in the process of completing and filing all relevant documents to participate in the Department of Education’s Participation Program and expects to utilize the Participation Program to fund a significant portion of its loan originations for the 2008-2009 academic year.

The Company maintains an agreement with Union Bank, as trustee for various grantor trusts, under which Union Bank has agreed to purchase from the Company participation interests in student loans (the “FFELP Participation Agreement”). The Company has the option to purchase the participation interests from the grantor trusts at the end of a 364-day term upon termination of the participation certificate. As of June 30, 2008 and August 8, 2008, approximately $228.7 million and $56.4 million, respectively, of loans were subject to outstanding participation interests held by Union Bank, as trustee, under this agreement. The agreement automatically renews annually and is terminable by either party upon five business days notice. This agreement provides beneficiaries of Union Bank’s grantor trusts with access to investments in interests in student loans, while providing liquidity to the Company on a short-term basis. The Company can participate loans to Union Bank to the extent of availability under the grantor trusts, up to $750 million. Loans participated under this agreement qualify as a sale pursuant to the provisions of SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities (“SFAS No. 140”). Accordingly, the participation interests sold are not included on the Company’s consolidated balance sheet.

Asset-backed Securitizations

On March 7, 2008, April 2, 2008, April 22, 2008, and May 19, 2008, the Company completed asset-backed securities transactions of $1.2 billion, $0.5 billion, $1.5 billion, and $1.3 billion, respectively. Notes issued in these transactions carry interest rates based on a spread to LIBOR. As part of the Company’s issuance of asset-backed securitizations in March 2008 and May 2008, due to credit market conditions when these notes were issued, the Company purchased the Class B subordinated notes of $36 million (par value) and $41 million (par value), respectively. These notes are not included on the Company’s consolidated balance sheet. If the credit market conditions improve, the Company anticipates selling these notes to third parties. Upon a sale to third parties, the Company would obtain cash proceeds equal to the market value of the notes on the date of such sale. Upon sale, these notes would be shown as “bonds and notes payable” on the Company’s consolidated balance sheet. Unless there is a significant market improvement, the Company believes the market value of such notes will be less than par value. The difference between the par value and market value would be recognized by the Company as interest expense over the life of the bonds.

Notes issued during 2006 included €773.2 million (950 million in U.S. dollars) with variable interest rates initially based on a spread to EURIBOR (the “Euro Notes”). As of June 30, 2008 and December 31, 2007, the Euro Notes were recorded on the Company’s balance sheet at $1.2 billion and $1.1 billion, respectively. The change in the principal amount of Euro Notes as a result of the fluctuation of the foreign currency exchange rate was a decrease of $4.4 million and an increase of $88.5 million for the three and six months ended June 30, 2008, respectively, and increases of $11.3 million and $25.0 million for the three and six months ended June 30, 2007, respectively, and is included in the “derivative market value, foreign currency, and put option adjustments and derivative settlements, net” in the consolidated statements of operations. Concurrently with the issuance of the Euro Notes, the Company entered into cross-currency interest rate swaps which are further discussed in note 8.

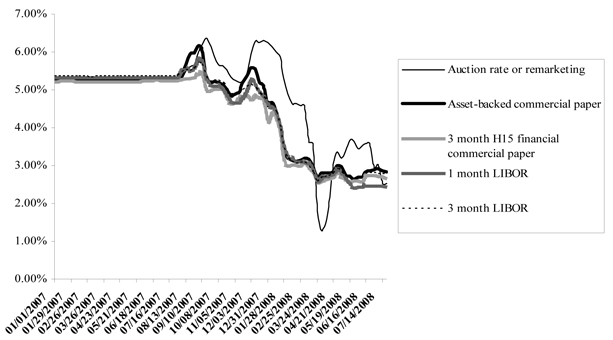

The interest rates on certain of the Company's asset-backed securities are set and periodically reset via a "dutch auction" ("Auction Rate Securities") or through a remarketing utilizing broker-dealers and remarketing agents ("Variable Rate Demand Notes"). The Company is currently sponsor on approximately $2.0 billion of Auction Rate Securities and $0.9 billion of Variable Rate Demand Notes.

For Auction Rate Securities, investors and potential investors submit orders through a broker-dealer as to the principal amount of notes they wish to buy, hold, or sell at various interest rates. The broker-dealers submit their clients' orders to the auction agent, who then determines the clearing interest rate for the upcoming period. Interest rates on these Auction Rate Securities are reset periodically, generally every 7 to 35 days, by the auction agent or agents. During the first quarter of 2008, as part of the credit market crisis, several auction rate securities from various issuers failed to receive sufficient order interest from potential investors to clear successfully, resulting in failed auction status. Since February 8, 2008, the Company’s Auction Rate Securities have failed in this manner. Under normal conditions, banks have historically stepped in when investor demand is weak. However, recently banks have been allowing these auctions to fail.

As a result of a failed auction, the Auction Rate Securities will generally pay interest to the holder at a maximum rate as defined by the commercial paper, governing documents, or indenture. While these rates will vary by the trust structure the notes were issued from as well as the class and rating of the security, they will generally be based on a spread to LIBOR, commercial paper, or Treasury Securities. Based on the relative levels of these indices as of June 30, 2008, the rates expected to be paid by the Company range from 91-day T-Bill plus 125 basis points, on the low end, to LIBOR plus 250 basis points on the high end.

During the three month period ended June 30, 2008, the Company paid favorable interest rates on the majority of its Auction Rate Securities as a result of the application of certain of these maximum rate auction provisions in the underlying documents for such financings. The Company does not expect this funding benefit on its Auction Rate Securities in future periods.

The Company cannot predict whether future auctions related to its Auction Rate Securities will be successful, but management believes it is likely auctions will continue to fail indefinitely. The Company is currently seeking alternatives for reducing its exposure to the auction rate market, but may not be able to achieve alternate financing for some or all of its Auction Rate Securities.

For Variable Rate Demand Notes, the remarketing agents set the price, which is then offered to investors. If there are insufficient potential bid orders to purchase all of the notes offered for sale, the Company could be subject to interest costs substantially above the anticipated and historical rates paid on these types of securities. The maximum rate for Variable Rate Demand Notes is based on a spread to certain indexes as defined in the underlying documents, with the highest to the Company being Prime plus 200 basis points. Certain of the Variable Rate Demand Notes are secured by financial guaranty insurance policies issued by MBIA Insurance Corporation. These Variable Rate Demand Notes are currently experiencing reduced investor demand and certain of these securities have been put to the liquidity provider, Lloyds TSB Bank, at a cost ranging from Federal Funds plus 150 basis points to LIBOR plus 175 basis points.

Unsecured Lines of Credit

The Company has a $750 million unsecured line of credit that terminates in May 2012. As of June 30, 2008, there was $450.0 million outstanding on this line and $300.0 million available for future use. The weighted average interest rate on this line of credit was 2.90% as of June 30, 2008. Upon termination in 2012, there can be no assurance that the Company will be able to maintain this line of credit, find alternative funding, or increase the amount outstanding under the line, if necessary. As discussed previously, the Company may need to fund certain loans or provide equity funding support related to advance rates on its warehouse facilities. As of August 8, 2008, the Company has contributed $189.8 million in equity funding support to these facilities. The Company has funded these contributions primarily by advances on its operating line of credit. As of August 8, 2008, the Company has $450.0 million outstanding under this line of credit and $300.0 million available for future uses.

The Company has a $725.0 million unsecured commercial paper program in which the Company may issue commercial paper for general corporate purposes. The maturities of the notes issued under this program will vary, but may not exceed 397 days from the date of issue. Notes issued under this program will bear interest at rates that will vary based on market conditions at the time of issuance. As of June 30, 2008, there were no borrowings outstanding on this line and $725.0 million of remaining authorization. The Company does not expect to be able to issue unsecured commercial paper in the near or intermediate future at a cost effective level relative to the Company’s unsecured line of credit.

Other Borrowings

As of June 30, 2008 and December 31, 2007, bonds and notes payable includes $66.6 million and $57.3 million, respectively, of notes due to Union Bank. The Company has used the proceeds from these notes to invest in student loan assets via a participation agreement. This participation agreement is in addition to the $750 million FFELP Participation Agreement, and participations under this participation agreement do not qualify as sales pursuant to SFAS No. 140.

8. Derivative Financial Instruments

The Company maintains an overall risk management strategy that incorporates the use of derivative instruments to reduce the economic effect of interest rate volatility and fluctuations in foreign currency exchange rates. Derivative instruments used as part of the Company’s risk management strategy include interest rate swaps, basis swaps, and cross-currency interest rate swaps.

Interest Rate Swaps

FFELP student loans generally earn interest at the higher of a floating rate based on the Special Allowance Payment or SAP formula set by the Department and the borrower rate, which is fixed over a period of time. The Company generally finances its student loan portfolio with variable-rate debt. In low and/or declining interest rate environments, when the fixed borrower rate is higher than the rate produced by the SAP formula, the Company’s student loans earn at a fixed rate while the interest on the variable-rate debt continues to decline. In these interest rate environments, the Company earns additional spread income that it refers to as floor income.

Depending on the type of the student loan and when it was originated, the borrower rate is either fixed to term or is reset to market rate each July 1. As a result, for loans where the borrower rate is fixed to term, the Company earns floor income for an extended period of time, which the Company refers to as fixed rate floor income, and for those loans where the borrower rate is reset annually on July 1, the Company earns floor income to the next reset date, which the Company refers to as variable-rate floor income. In accordance with new legislation enacted in 2006, lenders are required to rebate floor income and variable-rate floor income to the Department for all net FFELP loans originated on or after April 1, 2006.

Absent the use of derivative instruments, a rise in interest rates will have an adverse effect on earnings due to interest margin compression caused by increasing financing costs, until such time as the federally insured loans earn interest at a variable rate in accordance with the SAP formula. In higher interest rate environments, where the interest rate rises above the borrower rate and fixed-rate loans effectively become variable rate loans, the impact of the rate fluctuations is reduced.

As of June 30, 2008, the Company held the following interest rate derivatives to hedge fixed-rate student loan assets earning fixed rate floor income or variable-rate floor income.

| | | | | Weighted | |

| | | | | average fixed | |

| | | Notional | | rate paid by | |

Maturity | | Amount | | the Company (a) | |

| | | | | | |

| 2008 (b) | | $ | 2,000,000 | | | 4.18 | % |

| 2009 | | | 500,000 | | | 4.08 | |

| 2010 | | | 700,000 | | | 3.44 | |

| 2011 | | | 500,000 | | | 3.57 | |

| 2012 | | | 250,000 | | | 3.86 | |

| | | $ | 3,950,000 | | | 3.94 | % |

| (a) | For all interest rate derivatives for which the Company pays a fixed rate, the Company receives discrete three-month LIBOR. |

| | (b) | The maturity date on these derivatives is June 30, 2008. The Company has hedged a portion of its student loan portfolio in which the borrower interest rate resets annually on July 1. These loans can generate excess spread income compared with the rate based on the special allowance formula in declining interest rate environments. As discussed above, the Company refers to this additional income as variable-rate floor income. |

In April 2008 and May 2008, the Company entered into interest rate swaps with notional amounts of $200.0 million and $250.0 million which had forward-start dates of July 25, 2008 and June 25, 2008, respectively. The Company receives a fixed rate of 2.9805% and 3.693%, respectively, and pays discrete three-month LIBOR. These trades offset $450.0 million of fixed rate swaps previously entered into by the Company (included in the above table) and were executed in order to maintain the Company’s desired hedge ratio.

Basis Swaps

The Company has entered into basis swaps in which the Company receives three-month LIBOR set discretely in advance and pays a daily weighted average three-month LIBOR less a spread as defined in the individual agreements. The Company entered into these derivative instruments to better match the interest rate characteristics on its student loan assets and the debt funding such assets.

The following table summarizes these derivatives as of June 30, 2008:

| | | Notional Amount (a) | |

Maturity | | Effective date in second quarter 2007 | | Effective date in third quarter 2007 | | Effective date in second quarter 2008 | | Effective date in third quarter 2008 | | Total | |

| | | | | | | | | | | | |

| 2008 | | $ | 1,000,000 | | | 2,000,000 | | | — | | | — | | | 3,000,000 | |

| 2009 | | | 2,000,000 | | | 4,000,000 | | | — | | | 3,000,000 | (b)(f) | | 9,000,000 | |

| 2010 | | | 500,000 | | | 2,000,000 | (c) | | 2,000,000 | | | 1,000,000 | | | 5,500,000 | |

| 2011 | | | — | (d) | | 2,700,000 | | | — | | | — | | | 2,700,000 | |

| 2012 | | | — | (e) | | 1,000,000 | (f) | | 800,000 | | | 1,600,000 | | | 3,400,000 | |

| | | | | | | | | | | | | | | | | |

| | | $ | 3,500,000 | | | 11,700,000 | | | 2,800,000 | | | 5,600,000 | | | 23,600,000 | |

| | (a) | All basis swaps were executed by the Company during the second quarter 2007, unless otherwise noted. |

| | (b) | Executed by the Company during the second quarter 2008. |

| | (c) | In March 2008, the Company terminated a basis swap with a notional amount of $1.0 billion, which is not included in the table above. |

| | (d) | In March 2008, the Company terminated a basis swap with a notional amount of $1.35 billion, which is not included in the table above. |

| | (e) | In March 2008, the Company terminated a basis swap with a notional amount of $0.5 billion, which is not included in the table above. |

| | (f) | In July 2008, the Company terminated these basis swaps. |

During the first quarter of 2008, the Company unwound three, 10 year basis swaps with notional amounts of $500 million each in which the Company received three-month LIBOR and paid one-month LIBOR less a spread as defined in the individual agreements.

Cross-Currency Interest Rate Swaps