For Release: August 7, 2014

Media Contact: Ben Kiser, 402.458.3024

Investor Contact: Phil Morgan, 402.458.3038

Nelnet, Inc. supplemental financial information for the second quarter 2014

(All dollars are in thousands, except per share amounts, unless otherwise noted)

The following information should be read in connection with Nelnet, Inc.'s (the “Company's”) press release for second quarter 2014 earnings, dated August 7, 2014, and the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2014.

This report contains forward-looking statements and information that are based on management's current expectations as of the date of this document. Statements that are not historical facts, including statements about the Company's plans and expectations for future financial condition, results of operations or economic performance, or that address management's plans and objectives for future operations, and statements that assume or are dependent upon future events, are forward-looking statements. The words “may,” “should,” “could,” “would,” “predict,” “potential,” “continue,” “expect,” “anticipate,” “future,” “intend,” “plan,” “believe,” “estimate,” “assume,” “forecast,” “will,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements.

The forward-looking statements are based on assumptions and analyses made by management in light of management's experience and its perception of historical trends, current conditions, expected future developments, and other factors that management believes are appropriate under the circumstances. These statements are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in the "Risk Factors" section of the Company's Annual Report on Form 10-K for the year ended December 31, 2013 (the "2013 Annual Report"), in particular such risks and uncertainties as:

| |

| • | student loan portfolio risks such as interest rate basis and repricing risk resulting from the fact that the interest rate characteristics of the student loan assets do not match the interest rate characteristics of the funding for those assets, the risk of loss of floor income on certain student loans originated under the Federal Family Education Loan Program (the "FFEL Program" or "FFELP"), risks related to the use of derivatives to manage exposure to interest rate fluctuations, uncertainties regarding the expected benefits from recently purchased securitized and unsecuritized FFELP student loans, and risks from changes in levels of student loan prepayment or default rates; |

| |

| • | financing and liquidity risks, including risks of changes in the general interest rate environment and in the securitization and other financing markets for student loans, which may increase the costs or limit the availability of financings necessary to purchase, refinance, or continue to hold student loans; |

| |

| • | risks from changes in the educational credit and services markets resulting from changes in applicable laws, regulations, and government programs and budgets, such as the expected decline over time in FFELP loan interest income and fee-based revenues due to the discontinuation of new FFELP loan originations in 2010 and potential government initiatives or legislative proposals to consolidate existing FFELP loans to the Federal Direct Loan Program or otherwise allow FFELP loans to be refinanced with Federal Direct Loan Program loans, risks related to reduced government payments to guaranty agencies to rehabilitate defaulted FFELP loans and services in support of those activities, risks related to the Company's ability to maintain or increase volumes under the Company's loan servicing contract with the Department, which accounted for 23 percent of the Company's fee-based revenue in 2013, and risks related to the Company's ability to comply with agreements with third-party customers for the servicing of FFELP and Federal Direct Loan Program loans; |

| |

| • | risks related to a breach of or failure in the Company's operational or information systems or infrastructure, or those of third-party vendors; |

| |

| • | uncertainties inherent in forecasting future cash flows from student loan assets and related asset-backed securitizations; and |

| |

| • | risks and uncertainties associated with litigation matters and with maintaining compliance with the extensive regulatory requirements applicable to the Company's businesses, and uncertainties inherent in the estimates and assumptions about future events that management is required to make in the preparation of the Company's consolidated financial statements. |

All forward-looking statements contained in this report are qualified by these cautionary statements and are made only as of the date of this document. Although the Company may from time to time voluntarily update or revise its prior forward-looking statements to reflect actual results or changes in the Company's expectations, the Company disclaims any commitment to do so except as required by securities laws.

Consolidated Statements of Income

(unaudited)

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, 2014 | | March 31, 2014 | | June 30, 2013 | | June 30, 2014 | | June 30, 2013 |

| Interest income: | | | | | | | | | |

| Loan interest | $ | 175,466 |

| | 156,896 |

| | 158,063 |

| | 332,362 |

| | 313,602 |

|

| Investment interest | 1,482 |

| | 1,979 |

| | 1,483 |

| | 3,461 |

| | 3,100 |

|

| Total interest income | 176,948 |

| | 158,875 |

| | 159,546 |

| | 335,823 |

| | 316,702 |

|

| Interest expense: | | | | | | | | | |

| Interest on bonds and notes payable | 69,235 |

| | 60,004 |

| | 58,127 |

| | 129,239 |

| | 116,485 |

|

| Net interest income | 107,713 |

| | 98,871 |

| | 101,419 |

| | 206,584 |

| | 200,217 |

|

| Less provision for loan losses | 1,500 |

| | 2,500 |

| | 5,000 |

| | 4,000 |

| | 10,000 |

|

| Net interest income after provision for loan losses | 106,213 |

| | 96,371 |

| | 96,419 |

| | 202,584 |

| | 190,217 |

|

| Other income (expense): | | | | | | | | | |

| Loan and guaranty servicing revenue | 66,460 |

| | 64,757 |

| | 60,078 |

| | 131,217 |

| | 115,679 |

|

| Tuition payment processing and campus commerce revenue | 21,834 |

| | 25,235 |

| | 18,356 |

| | 47,069 |

| | 41,767 |

|

| Enrollment services revenue | 20,145 |

| | 22,011 |

| | 24,823 |

| | 42,156 |

| | 53,780 |

|

| Other income | 15,315 |

| | 18,131 |

| | 12,288 |

| | 33,446 |

| | 21,704 |

|

| Gain on sale of loans and debt repurchases | 18 |

| | 39 |

| | 7,355 |

| | 57 |

| | 8,762 |

|

| Derivative settlements, net | (6,214 | ) | | (6,229 | ) | | (8,357 | ) | | (12,443 | ) | | (16,541 | ) |

| Derivative market value and foreign currency adjustments, net | 7,784 |

| | 1,964 |

| | 48,545 |

| | 9,748 |

| | 57,801 |

|

| Total other income | 125,342 |

| | 125,908 |

| | 163,088 |

| | 251,250 |

| | 282,952 |

|

| Operating expenses: | | | | | | | | | |

| Salaries and benefits | 53,888 |

| | 52,484 |

| | 47,432 |

| | 106,372 |

| | 95,337 |

|

| Cost to provide enrollment services | 13,311 |

| | 14,475 |

| | 16,787 |

| | 27,786 |

| | 36,429 |

|

| Depreciation and amortization | 5,214 |

| | 4,783 |

| | 4,320 |

| | 9,997 |

| | 8,697 |

|

| Other | 40,377 |

| | 35,627 |

| | 34,365 |

| | 76,004 |

| | 69,306 |

|

| Total operating expenses | 112,790 |

| | 107,369 |

| | 102,904 |

| | 220,159 |

| | 209,769 |

|

| Income before income taxes | 118,765 |

| | 114,910 |

| | 156,603 |

| | 233,675 |

| | 263,400 |

|

| Income tax expense | 43,078 |

| | 40,611 |

| | 54,746 |

| | 83,689 |

| | 93,193 |

|

| Net income | 75,687 |

| | 74,299 |

| | 101,857 |

| | 149,986 |

| | 170,207 |

|

| Net income attributable to noncontrolling interest | 693 |

| | 513 |

| | 614 |

| | 1,206 |

| | 885 |

|

| Net income attributable to Nelnet, Inc. | $ | 74,994 |

| | 73,786 |

| | 101,243 |

| | 148,780 |

| | 169,322 |

|

| Earnings per common share: | | | | | | | | | |

| Net income attributable to Nelnet, Inc. shareholders - basic and diluted | $ | 1.61 |

| | 1.59 |

| | 2.17 |

| | 3.20 |

| | 3.63 |

|

| Weighted average common shares outstanding - basic and diluted | 46,529,377 |

| | 46,527,917 |

| | 46,626,853 |

| | 46,528,651 |

| | 46,642,356 |

|

Condensed Consolidated Balance Sheets

(unaudited)

|

| | | | | | | | | |

| | As of | | As of | | As of |

| | June 30, 2014 | | December 31, 2013 | | June 30, 2013 |

| Assets: | | | | | |

| Student loans receivable, net | $ | 29,342,430 |

| | 25,907,589 |

| | 24,575,636 |

|

| Cash, cash equivalents, and investments | 233,588 |

| | 255,307 |

| | 245,825 |

|

| Restricted cash and investments | 960,039 |

| | 902,699 |

| | 763,909 |

|

| Goodwill and intangible assets, net | 171,049 |

| | 123,250 |

| | 124,849 |

|

| Other assets | 663,916 |

| | 582,004 |

| | 592,958 |

|

| Total assets | $ | 31,371,022 |

| | 27,770,849 |

| | 26,303,177 |

|

| Liabilities: | | | | | |

| Bonds and notes payable | $ | 29,492,560 |

| | 25,955,289 |

| | 24,690,952 |

|

| Other liabilities | 298,334 |

| | 371,570 |

| | 292,630 |

|

| Total liabilities | 29,790,894 |

| | 26,326,859 |

| | 24,983,582 |

|

| Equity: | | | | | |

| Total Nelnet, Inc. shareholders' equity | 1,579,742 |

| | 1,443,662 |

| | 1,319,482 |

|

| Noncontrolling interest | 386 |

| | 328 |

| | 113 |

|

| Total equity | 1,580,128 |

| | 1,443,990 |

| | 1,319,595 |

|

| Total liabilities and equity | $ | 31,371,022 |

| | 27,770,849 |

| | 26,303,177 |

|

Overview

The Company is an education services company focused primarily on providing fee-based processing services and quality education-related products and services in four core areas: asset management and finance, loan servicing, payment processing, and enrollment services (education planning). These products and services help students and families plan, prepare, and pay for their education and make the administrative and financial processes more efficient for schools and financial organizations. In addition, the Company earns interest income on a portfolio of federally insured student loans.

A reconciliation of the Company's GAAP net income to net income, excluding derivative market value and foreign currency adjustments, is provided below.

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, 2014 | | March 31, 2014 | | June 30, 2013 | | June 30, 2014 | | June 30, 2013 |

| GAAP net income attributable to Nelnet, Inc. | $ | 74,994 |

| | 73,786 |

| | 101,243 |

| | 148,780 |

| | 169,322 |

|

| Derivative market value and foreign currency adjustments, net of tax | (4,826 | ) | | (1,218 | ) | | (30,098 | ) | | (6,044 | ) | | (35,837 | ) |

| Net income, excluding derivative market value and foreign currency adjustments (a) | $ | 70,168 |

| | 72,568 |

| | 71,145 |

| | 142,736 |

| | 133,485 |

|

| | | | | | | | | | |

| Earnings per share: | | | | | | | | | |

| GAAP net income attributable to Nelnet, Inc. | $ | 1.61 |

| | 1.59 |

| | 2.17 |

| | 3.20 |

| | 3.63 |

|

| Derivative market value and foreign currency adjustments, net of tax | (0.10 | ) | | (0.03 | ) | | (0.64 | ) | | (0.13 | ) | | (0.77 | ) |

| Net income, excluding derivative market value and foreign currency adjustments (a) | $ | 1.51 |

| | 1.56 |

| | 1.53 |

| | 3.07 |

| | 2.86 |

|

| |

(a) | The Company provides non-GAAP information that reflects specific items management believes to be important in the evaluation of its financial position and performance. "Derivative market value and foreign currency adjustments" include (i) the unrealized gains and losses that are caused by changes in fair values of derivatives which do not qualify for "hedge treatment" under GAAP; and (ii) the foreign currency transaction gains or losses caused by the re-measurement of the Company's Euro-denominated bonds to U.S. dollars. The Company believes these point-in-time estimates of asset and liability values related to these financial instruments that are subject to interest and currency rate fluctuations affect the period-to-period comparability of the results of operations. Accordingly, the Company provides operating results excluding these items for comparability purposes. |

Included in net income for the three and six month periods ended June 30, 2013 were gains on the repurchase of the Company's own asset-backed debt securities of $7.4 million ($0.10 per share after tax) and $8.7 million ($0.12 per share after tax), respectively. Excluding these gains, the increase in net income, excluding derivative market value and foreign currency adjustments, in the 2014 periods compared with the same periods in 2013 was primarily due to an increase in income from the Company's student loan portfolio, an increase in income from providing investment advisory services through a SEC registered investment advisor subsidiary, and an increase in gains from investment activities. The increase in income from the Company's student loan portfolio in 2014 compared to 2013 was due to an increase in the portfolio from recent acquisitions and a lower provision for loan losses expense recorded in 2014 compared to 2013.

The Company earns net interest income on its FFELP student loan portfolio in its Asset Generation and Management ("AGM") operating segment. This segment is expected to generate a stable net interest margin and significant amounts of cash as the FFELP portfolio amortizes. As of June 30, 2014, the Company had a $29.3 billion student loan portfolio that will amortize over the next approximately 25 years. The Company actively seeks to acquire additional FFELP loan portfolios to leverage its servicing scale and expertise to generate incremental earnings and cash flow.

In addition, the Company earns fee-based revenue through the following reportable operating segments:

| |

| • | Student Loan and Guaranty Servicing ("LGS") - referred to as Nelnet Diversified Solutions ("NDS") |

| |

| • | Tuition Payment Processing and Campus Commerce ("TPP&CC") - referred to as Nelnet Business Solutions ("NBS") |

| |

| • | Enrollment Services - commonly called Nelnet Enrollment Solutions ("NES") |

The information below provides the operating results for each reportable operating segment for the three and six months ended June 30, 2014 and 2013 (dollars in millions).

| |

| (a) | Revenue includes intersegment revenue of $13.8 million and $13.9 million for the three months ended June 30, 2014 and 2013, respectively, and $28.0 million and $28.9 million for the six months ended June 30, 2014 and 2013, respectively, earned by LGS as a result of servicing loans for AGM. |

| |

| (b) | Total revenue includes "net interest income after provision for loan losses" and "total other income" from the Company's segment statements of income, excluding the impact from changes in fair values of derivatives and foreign currency transaction adjustments, which was income of $8.8 million and $43.1 million for the three months ended June 30, 2014 and 2013, respectively, and income of $12.3 million and $48.4 million for the six months ended June 30, 2014 and 2013, respectively. Net income excludes changes in fair values of derivatives and foreign currency transaction adjustments, net of tax, which was income of $5.5 million and $26.7 million for the three months ended June 30, 2014 and 2013, respectively, and income of $7.6 million and $30.0 million for the six months ended June 30, 2014 and 2013, respectively. |

| |

| (c) | Computed as income before income taxes divided by total revenue. |

Student Loan and Guaranty Servicing

| |

| • | As of June 30, 2014, the Company was servicing $150.0 billion in FFELP, private, and government owned student loans, as compared with $116.8 billion of loans as of June 30, 2013. |

| |

| • | Revenue increased in the three and six months ended June 30, 2014 compared to the same periods in 2013 due to growth in servicing volume under the Company's contract with the Department, offset partially by a decrease in traditional FFELP servicing revenue. Revenue from the Department servicing contract increased to $31.0 million and $60.9 million for the three and six months ended June 30, 2014, respectively, compared to $22.1 million and $42.5 million, respectively, for the same periods in 2013. As of June 30, 2014, the Company was servicing $123.2 billion of loans for 5.5 million borrowers under this contract. |

| |

| • | The servicing contract with the Department was originally scheduled to expire in June 2014, with a five-year extension at the option of the Department. Effective as of June 17, 2014, the Department exercised its optional ordering period to extend the servicing contract for an additional five years through June 16, 2019. The Company expects the performance metrics to determine loan servicing volume allocation each servicer will receive and the amount servicers may be paid per borrower will change during the extended period of the contract. |

| |

| • | Before tax operating margin was 26.6% and 30.8% for the three months ended June 30, 2014 and 2013, respectively, and 27.5% and 28.9% for the six months ended June 30, 2014 and 2013, respectively. Operating margin in this segment will continue to decrease as the volume of loans serviced under the Department servicing contract increases as a percentage of overall volume serviced. |

| |

| • | Recent federal budget provisions that became effective July 1, 2014 reduced payments by the Department to guaranty agencies for assisting student loan borrowers with the rehabilitation of defaulted loans under FFELP. Rehabilitation collection revenue recognized by the Company was $17.3 million and $13.6 million for the three months ended June 30, 2014 and 2013, respectively, and $30.7 million and $25.7 million for the six months ended June 30, 2014 and 2013, respectively. The Company anticipates this revenue will be negatively impacted as a result of these federal budget provisions. |

Tuition Payment Processing and Campus Commerce

| |

| • | On June 3, 2014, the Company purchased 100 percent of the ownership interests of RenWeb for total consideration of $46.3 million (of which $2.3 million represents the estimated fair value of contingent consideration). RenWeb provides school information systems for private and faith-based schools that currently help over 3,000 schools automate administrative processes such as admissions, scheduling, student billing, attendance, and grade book management. The Company currently offers tuition management and financial needs assessment services to over 6,500 schools. The combination of RenWeb’s school administration software and the Company’s tuition management and financial needs assessment services are expected to significantly increase the value of the Company’s offerings, allowing the Company to deliver a comprehensive suite of solutions to over 8,500 school customers in this area. The results of operations of RenWeb are reported in the Company's consolidated financial statements from the date of acquisition. RenWeb's revenue for the twelve months ended December 31, 2013 was $14 million. |

| |

| • | In addition to the acquisition of RenWeb, revenue increased in the three and six months ended June 30, 2014 compared to the same periods in 2013 due to increases in the number of managed tuition payment plans, campus commerce customer transaction volume, and new school customers. |

| |

| • | Excluding the amortization of intangibles, before tax operating margin was 24.1% for both the three months ended June 30, 2014 and 2013 and 32.7% and 33.9% for the six months ended June 30, 2014 and 2013, respectively. |

| |

| • | This segment is subject to seasonal fluctuations. Based on the timing of when revenue is recognized and when expenses are incurred, revenue and operating margin are higher in the first quarter as compared to the remainder of the year. |

Enrollment Services

| |

| • | Revenue decreased in the three and six months ended June 30, 2014 compared to the same periods in 2013 due to a decrease in inquiry management and generation revenue as a result of the regulatory uncertainty regarding recruiting and marketing to potential students in the for-profit college industry, which has caused schools to decrease spending on marketing efforts. |

| |

| • | The Company continues to focus on improving the profitability of this segment by reducing operating expenses in reaction to the ongoing decline in revenue and gross margin. |

| |

| • | Due to the on-going decrease in school spending on marketing efforts, effective August 29, 2014, the Company will stop providing inquiry generation services. The initial and on-going impact to net income as a result of shutting down the inquiry generation services portion of this segment is expected to be immaterial. |

Asset Generation and Management

| |

| • | The Company acquired $5.2 billion of student loans during the first six months of 2014, of which $4.8 billion were purchased in the second quarter. The average loan portfolio balance for the three months ended June 30, 2014 and 2013 was $28.2 billion and $24.8 billion, respectively. |

| |

| • | Forecasted future cash flows from the Company's FFELP student loan portfolio financed in asset-backed securitization transactions are estimated to be approximately $2.39 billion as of June 30, 2014. |

| |

| • | Core student loan spread was 1.46% for the three months ended June 30, 2014, compared to 1.44% for the three months ended March 31, 2014 and 1.52% for the three months ended June 30, 2013. The year over year decrease in student loan spread was the result of recent consolidation loan acquisitions, which have lower margins but longer terms. The increase in student loan spread for the three months ended June 30, 2014 compared to the three months ended March 31, 2014, was due to an increase in fixed rate floor income. Due to recent loan acquisitions, the Company is earning fixed rate floor income on a larger portfolio. |

| |

| • | Due to historically low interest rates, the Company continues to earn significant fixed rate floor income. During the three months ended June 30, 2014 and 2013, the Company earned $43.6 million and $36.1 million, respectively, of fixed rate floor income (net of $7.0 million and $8.5 million of derivative settlements, respectively, used to hedge such loans). As of June 30, 2014, the Company was earning fixed rate floor income on $13.0 billion of student loans. |

| |

| • | The provision for loan losses on the Company’s federally insured loans was $2.0 million and $5.0 million for the three months ended June 30, 2014 and 2013, respectively, and $5.0 million and $11.0 million for the six months ended June 30, 2014 and 2013, respectively. As the Company’s overall student loan portfolio continues to season with the length of time that loans are in active repayment, credit performance continues to improve. |

Corporate Activities

| |

| • | Whitetail Rock Capital Management, LLC ("WRCM"), the Company's SEC-registered investment advisory subsidiary, recognized investment advisory revenue of $7.0 million and $6.3 million for the three months ended June 30, 2014 and 2013, respectively, and $12.2 million and $9.2 million for the six months ended June 30, 2014 and 2013, respectively. WRCM earns annual fees of up to 25 basis points on the outstanding balance of investments and up to 50 percent of the gains from the sale of securities for which it provides advisory services. Due to improvements in the capital markets, the opportunities to earn performance fees on the sale of securities are becoming more limited. As of June 30, 2014, WRCM was managing an investment portfolio of $814.4 million for third-party entities. |

| |

| • | The Company had $2.1 million in gains on investments during the three months ended June 30, 2014, compared to a net loss of $0.2 million for the same period in 2013. The Company had gains on investments of $9.3 million and $1.0 million during the six months ended June 30, 2014 and 2013, respectively. |

| |

| • | The Company’s effective tax rate was 36.5% and 35.1% in the three months ended June 30, 2014 and 2013, respectively, and 36.0% and 35.5% in the six months ended June 30, 2014 and 2013, respectively. The lower effective tax rates in 2013 were due to the resolution of certain tax positions which lowered income tax expense. |

Liquidity and Capital Resources

| |

| • | As of June 30, 2014, the Company had cash and investments of $233.6 million. |

| |

| • | For the six months ended June 30, 2014, the Company generated $156.5 million in net cash provided by operating activities. |

| |

| • | On June 30, 2014, the Company’s unsecured line of credit was amended to increase the line of credit from $275.0 million to $350.0 million and extend the maturity date from March 28, 2018 to June 30, 2019. As of June 30, 2014, $65.0 million was outstanding on the line of credit and $285.0 million was available for future use. |

| |

| • | During the three months ended June 30, 2014, the Company repurchased a total of 209,940 shares of Class A common stock for $8.4 million ($40.18 per share). |

| |

| • | The Company intends to use its liquidity position to capitalize on market opportunities, including FFELP student loan acquisitions; strategic acquisitions and investments in its core business areas of loan financing, loan servicing, payment processing, and enrollment services; and capital management initiatives, including stock repurchases, debt repurchases, and dividend distributions. |

Operating Segments

The Company earns fee-based revenue through its Student Loan and Guaranty Servicing, Tuition Payment Processing and Campus Commerce, and Enrollment Services operating segments. In addition, the Company earns interest income on its student loan portfolio in its Asset Generation and Management operating segment. The Company’s operating segments are defined by the products and services they offer and the types of customers they serve, and they reflect the manner in which financial information is currently evaluated by management. See note 1 of the notes to consolidated financial statements included in the 2013 Annual Report for a description of each operating segment, including the primary products and services offered.

The management reporting process measures the performance of the Company’s operating segments based on the management structure of the Company, as well as the methodology used by management to evaluate performance and allocate resources. Executive management (the "chief operating decision maker") evaluates the performance of the Company’s operating segments based on their financial results prepared in conformity with U.S. generally accepted accounting principles.

Intersegment revenues are charged by a segment that provides a product or service to another segment. Intersegment revenues and expenses are included within each segment consistent with the income statement presentation provided to management. Income taxes are allocated based on 38% of income (loss) before taxes for each individual operating segment. The difference between the consolidated income tax expense and the sum of taxes calculated for each operating segment is included in income taxes in Corporate Activity and Overhead.

Corporate Activity and Overhead

Corporate Activity and Overhead includes the following items:

| |

| • | The operating results of WRCM, the Company's SEC-registered investment advisory subsidiary |

| |

| • | Income earned on certain investment activities |

| |

| • | Interest expense incurred on unsecured debt transactions |

| |

| • | Other product and service offerings that are not considered operating segments |

Corporate Activities and Overhead also includes certain corporate activities and overhead functions related to executive management, human resources, accounting, legal, occupancy, and marketing. These costs are allocated to each operating segment based on estimated use of such activities and services.

Segment Results of Operations

The following tables include the results of each of the Company's operating segments reconciled to the consolidated financial statements.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended June 30, 2014 |

| | Fee-Based | | | | | | | | | | |

| | Student Loan and Guaranty Servicing | | Tuition Payment Processing and Campus Commerce | | Enrollment Services | | Total Fee- Based | | Asset Generation and Management | | Corporate Activity and Overhead | | Eliminations | | Total |

| Total interest income | $ | 9 |

| | 3 |

| | — |

| | 12 |

| | 175,562 |

| | 2,036 |

| | (662 | ) | | 176,948 |

|

| Interest expense | — |

| | — |

| | — |

| | — |

| | 67,936 |

| | 1,961 |

| | (662 | ) | | 69,235 |

|

| Net interest income | 9 |

| | 3 |

| | — |

| | 12 |

| | 107,626 |

| | 75 |

| | — |

| | 107,713 |

|

| Less provision for loan losses | — |

| | — |

| | — |

| | — |

| | 1,500 |

| | — |

| | — |

| | 1,500 |

|

| Net interest income after provision for loan losses | 9 |

| | 3 |

| | — |

| | 12 |

| | 106,126 |

| | 75 |

| | — |

| | 106,213 |

|

| Other income (expense): | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Loan and guaranty servicing revenue | 66,460 |

| | — |

| | — |

| | 66,460 |

| | — |

| | — |

| | — |

| | 66,460 |

|

| Intersegment servicing revenue | 13,800 |

| | — |

| | — |

| | 13,800 |

| | — |

| | — |

| | (13,800 | ) | | — |

|

| Tuition payment processing and campus commerce revenue | — |

| | 21,834 |

| | — |

| | 21,834 |

| | — |

| | — |

| | — |

| | 21,834 |

|

| Enrollment services revenue | — |

| | — |

| | 20,145 |

| | 20,145 |

| | — |

| | — |

| | — |

| | 20,145 |

|

| Other income | — |

| | — |

| | — |

| | — |

| | 4,496 |

| | 10,819 |

| | — |

| | 15,315 |

|

| Gain on sale of loans and debt repurchases | — |

| | — |

| | — |

| | — |

| | 18 |

| | — |

| | — |

| | 18 |

|

| Derivative market value and foreign currency adjustments, net | — |

| | — |

| | — |

| | — |

| | 8,848 |

| | (1,064 | ) | | — |

| | 7,784 |

|

| Derivative settlements, net | — |

| | — |

| | — |

| | — |

| | (5,958 | ) | | (256 | ) | | — |

| | (6,214 | ) |

| Total other income (expense) | 80,260 |

| | 21,834 |

| | 20,145 |

| | 122,239 |

| | 7,404 |

| | 9,499 |

| | (13,800 | ) | | 125,342 |

|

| Operating expenses: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Salaries and benefits | 33,093 |

| | 11,112 |

| | 4,132 |

| | 48,337 |

| | 570 |

| | 4,981 |

| | — |

| | 53,888 |

|

| Cost to provide enrollment services | — |

| | — |

| | 13,311 |

| | 13,311 |

| | — |

| | — |

| | — |

| | 13,311 |

|

| Depreciation and amortization | 2,819 |

| | 1,845 |

| | 41 |

| | 4,705 |

| | — |

| | 509 |

| | — |

| | 5,214 |

|

| Other | 19,815 |

| | 2,956 |

| | 1,844 |

| | 24,615 |

| | 8,845 |

| | 6,917 |

| | — |

| | 40,377 |

|

| Intersegment expenses, net | 1,124 |

| | 1,404 |

| | 944 |

| | 3,472 |

| | 13,968 |

| | (3,640 | ) | | (13,800 | ) | | — |

|

| Total operating expenses | 56,851 |

| | 17,317 |

| | 20,272 |

| | 94,440 |

| | 23,383 |

| | 8,767 |

| | (13,800 | ) | | 112,790 |

|

| Income before income taxes and corporate overhead allocation | 23,418 |

| | 4,520 |

| | (127 | ) | | 27,811 |

| | 90,147 |

| | 807 |

| | — |

| | 118,765 |

|

| Corporate overhead allocation | (2,060 | ) | | (687 | ) | | (687 | ) | | (3,434 | ) | | (1,249 | ) | | 4,683 |

| | — |

| | — |

|

| Income before income taxes | 21,358 |

| | 3,833 |

| | (814 | ) | | 24,377 |

| | 88,898 |

| | 5,490 |

| | — |

| �� | 118,765 |

|

| Income tax expense | (8,116 | ) | | (1,456 | ) | | 309 |

| | (9,263 | ) | | (33,781 | ) | | (34 | ) | | — |

| | (43,078 | ) |

| Net income | 13,242 |

| | 2,377 |

| | (505 | ) | | 15,114 |

| | 55,117 |

| | 5,456 |

| | — |

| | 75,687 |

|

| Net income attributable to noncontrolling interest | — |

| | — |

| | — |

| | — |

| | — |

| | 693 |

| | — |

| | 693 |

|

| Net income attributable to Nelnet, Inc. | $ | 13,242 |

| | 2,377 |

| | (505 | ) | | 15,114 |

| | 55,117 |

| | 4,763 |

| | — |

| | 74,994 |

|

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, 2014 |

| | Fee-Based | | | | | | | | | | |

| | Student Loan and Guaranty Servicing | | Tuition Payment Processing and Campus Commerce | | Enrollment Services | | Total Fee- Based | | Asset Generation and Management | | Corporate Activity and Overhead | | Eliminations | | Total |

| Total interest income | $ | 11 |

| | — |

| | — |

| | 11 |

| | 157,003 |

| | 2,658 |

| | (797 | ) | | 158,875 |

|

| Interest expense | — |

| | — |

| | — |

| | — |

| | 59,476 |

| | 1,325 |

| | (797 | ) | | 60,004 |

|

| Net interest income | 11 |

| | — |

| | — |

| | 11 |

| | 97,527 |

| | 1,333 |

| | — |

| | 98,871 |

|

| Less provision for loan losses | — |

| | — |

| | — |

| | — |

| | 2,500 |

| | — |

| | — |

| | 2,500 |

|

| Net interest income after provision for loan losses | 11 |

| | — |

| | — |

| | 11 |

| | 95,027 |

| | 1,333 |

| | — |

| | 96,371 |

|

| Other income (expense): | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Loan and guaranty servicing revenue | 64,757 |

| | — |

| | — |

| | 64,757 |

| | — |

| | — |

| | — |

| | 64,757 |

|

| Intersegment servicing revenue | 14,221 |

| | — |

| | — |

| | 14,221 |

| | — |

| | — |

| | (14,221 | ) | | — |

|

| Tuition payment processing and campus commerce revenue | — |

| | 25,235 |

| | — |

| | 25,235 |

| | — |

| | — |

| | — |

| | 25,235 |

|

| Enrollment services revenue | — |

| | — |

| | 22,011 |

| | 22,011 |

| | — |

| | — |

| | — |

| | 22,011 |

|

| Other income | — |

| | — |

| | — |

| | — |

| | 4,164 |

| | 13,967 |

| | — |

| | 18,131 |

|

| Gain on sale of loans and debt repurchases | — |

| | — |

| | — |

| | — |

| | 39 |

| | — |

| | — |

| | 39 |

|

| Derivative market value and foreign currency adjustments | — |

| | — |

| | — |

| | — |

| | 3,477 |

| | (1,513 | ) | | — |

| | 1,964 |

|

| Derivative settlements, net | — |

| | — |

| | — |

| | — |

| | (5,977 | ) | | (252 | ) | | — |

| | (6,229 | ) |

| Total other income (expense) | 78,978 |

| | 25,235 |

| | 22,011 |

| | 126,224 |

| | 1,703 |

| | 12,202 |

| | (14,221 | ) | | 125,908 |

|

| Operating expenses: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Salaries and benefits | 32,307 |

| | 10,027 |

| | 4,380 |

| | 46,714 |

| | 609 |

| | 5,161 |

| | — |

| | 52,484 |

|

| Cost to provide enrollment services | — |

| | — |

| | 14,475 |

| | 14,475 |

| | — |

| | — |

| | — |

| | 14,475 |

|

| Depreciation and amortization | 2,789 |

| | 1,428 |

| | 47 |

| | 4,264 |

| | — |

| | 519 |

| | — |

| | 4,783 |

|

| Other | 18,452 |

| | 2,647 |

| | 1,449 |

| | 22,548 |

| | 7,146 |

| | 5,933 |

| | — |

| | 35,627 |

|

| Intersegment expenses, net | 1,083 |

| | 1,420 |

| | 1,006 |

| | 3,509 |

| | 14,371 |

| | (3,659 | ) | | (14,221 | ) | | — |

|

| Total operating expenses | 54,631 |

| | 15,522 |

| | 21,357 |

| | 91,510 |

| | 22,126 |

| | 7,954 |

| | (14,221 | ) | | 107,369 |

|

| Income before income taxes and corporate overhead allocation | 24,358 |

| | 9,713 |

| | 654 |

| | 34,725 |

| | 74,604 |

| | 5,581 |

| | — |

| | 114,910 |

|

| Corporate overhead allocation | (1,860 | ) | | (620 | ) | | (620 | ) | | (3,100 | ) | | (1,329 | ) | | 4,429 |

| | — |

| | — |

|

| Income before income taxes | 22,498 |

| | 9,093 |

| | 34 |

| | 31,625 |

| | 73,275 |

| | 10,010 |

| | — |

| | 114,910 |

|

| Income tax expense | (8,549 | ) | | (3,455 | ) | | (13 | ) | | (12,017 | ) | | (27,844 | ) | | (750 | ) | | — |

| | (40,611 | ) |

| Net income | 13,949 |

| | 5,638 |

| | 21 |

| | 19,608 |

| | 45,431 |

| | 9,260 |

| | — |

| | 74,299 |

|

| Net income attributable to noncontrolling interest | — |

| | — |

| | — |

| | — |

| | — |

| | 513 |

| | — |

| | 513 |

|

| Net income attributable to Nelnet, Inc. | $ | 13,949 |

| | 5,638 |

| | 21 |

| | 19,608 |

| | 45,431 |

| | 8,747 |

| | — |

| | 73,786 |

|

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended June 30, 2013 |

| | Fee-Based | | | | | | | | | | |

| | Student Loan and Guaranty Servicing | | Tuition Payment Processing and Campus Commerce | | Enrollment Services | | Total Fee- Based | | Asset Generation and Management | | Corporate Activity and Overhead | | Eliminations | | Total |

| Total interest income | $ | 9 |

| | — |

| | — |

| | 9 |

| | 158,175 |

| | 2,196 |

| | (834 | ) | | 159,546 |

|

| Interest expense | — |

| | — |

| | — |

| | — |

| | 56,920 |

| | 2,041 |

| | (834 | ) | | 58,127 |

|

| Net interest income | 9 |

| | — |

| | — |

| | 9 |

| | 101,255 |

| | 155 |

| | — |

| | 101,419 |

|

| Less provision for loan losses | — |

| | — |

| | — |

| | — |

| | 5,000 |

| | — |

| | — |

| | 5,000 |

|

| Net interest income after provision for loan losses | 9 |

| | — |

| | — |

| | 9 |

| | 96,255 |

| | 155 |

| | — |

| | 96,419 |

|

| Other income (expense): | |

| | |

| | |

| | | | |

| | |

| | |

| | |

|

| Loan and guaranty servicing revenue | 60,078 |

| | — |

| | — |

| | 60,078 |

| | — |

| | — |

| | — |

| | 60,078 |

|

| Intersegment servicing revenue | 13,903 |

| | — |

| | — |

| | 13,903 |

| | — |

| | — |

| | (13,903 | ) | | — |

|

| Tuition payment processing and campus commerce revenue | — |

| | 18,356 |

| | — |

| | 18,356 |

| | — |

| | — |

| | — |

| | 18,356 |

|

| Enrollment services revenue | — |

| | — |

| | 24,823 |

| | 24,823 |

| | — |

| | — |

| | — |

| | 24,823 |

|

| Other income | — |

| | — |

| | — |

| | — |

| | 3,030 |

| | 9,258 |

| | — |

| | 12,288 |

|

| Gain on sale of loans and debt repurchases | — |

| | — |

| | — |

| | — |

| | 7,355 |

| | — |

| | — |

| | 7,355 |

|

| Derivative market value and foreign currency adjustments, net | — |

| | — |

| | — |

| | — |

| | 43,096 |

| | 5,449 |

| | — |

| | 48,545 |

|

| Derivative settlements, net | — |

| | — |

| | — |

| | — |

| | (7,845 | ) | | (512 | ) | | — |

| | (8,357 | ) |

| Total other income (expense) | 73,981 |

| | 18,356 |

| | 24,823 |

| | 117,160 |

| | 45,636 |

| | 14,195 |

| | (13,903 | ) | | 163,088 |

|

| Operating expenses: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Salaries and benefits | 28,091 |

| | 9,427 |

| | 4,809 |

| | 42,327 |

| | 592 |

| | 4,513 |

| | — |

| | 47,432 |

|

| Cost to provide enrollment services | — |

| | — |

| | 16,787 |

| | 16,787 |

| | — |

| | — |

| | — |

| | 16,787 |

|

| Depreciation and amortization | 2,731 |

| | 1,132 |

| | 61 |

| | 3,924 |

| | — |

| | 396 |

| | — |

| | 4,320 |

|

| Other | 18,031 |

| | 2,192 |

| | 1,243 |

| | 21,466 |

| | 7,923 |

| | 4,976 |

| | — |

| | 34,365 |

|

| Intersegment expenses, net | 851 |

| | 1,494 |

| | 1,130 |

| | 3,475 |

| | 14,108 |

| | (3,680 | ) | | (13,903 | ) | | — |

|

| Total operating expenses | 49,704 |

| | 14,245 |

| | 24,030 |

| | 87,979 |

| | 22,623 |

| | 6,205 |

| | (13,903 | ) | | 102,904 |

|

| Income before income taxes and corporate overhead allocation | 24,286 |

| | 4,111 |

| | 793 |

| | 29,190 |

| | 119,268 |

| | 8,145 |

| | — |

| | 156,603 |

|

| Corporate overhead allocation | (1,513 | ) | | (504 | ) | | (504 | ) | | (2,521 | ) | | (1,081 | ) | | 3,602 |

| | — |

| | — |

|

| Income before income taxes | 22,773 |

| | 3,607 |

| | 289 |

| | 26,669 |

| | 118,187 |

| | 11,747 |

| | — |

| | 156,603 |

|

| Income tax expense | (8,655 | ) | | (1,370 | ) | | (109 | ) | | (10,134 | ) | | (44,911 | ) | | 299 |

| | — |

| | (54,746 | ) |

| Net income | 14,118 |

| | 2,237 |

| | 180 |

| | 16,535 |

| | 73,276 |

| | 12,046 |

| | — |

| | 101,857 |

|

| Net income attributable to noncontrolling interest | — |

| | — |

| | — |

| | — |

| | — |

| | 614 |

| | — |

| | 614 |

|

| Net income attributable to Nelnet, Inc. | $ | 14,118 |

| | 2,237 |

| | 180 |

| | 16,535 |

| | 73,276 |

| | 11,432 |

| | — |

| | 101,243 |

|

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, 2014 |

| | Fee-Based | | | | | | | | | | |

| | Student Loan and Guaranty Servicing | | Tuition Payment Processing and Campus Commerce | | Enrollment Services | | Total Fee- Based | | Asset Generation and Management | | Corporate Activity and Overhead | | Eliminations | | Total |

| Total interest income | $ | 20 |

| | 3 |

| | — |

| | 23 |

| | 332,565 |

| | 4,694 |

| | (1,459 | ) | | 335,823 |

|

| Interest expense | — |

| | — |

| | — |

| | — |

| | 127,412 |

| | 3,286 |

| | (1,459 | ) | | 129,239 |

|

| Net interest income | 20 |

| | 3 |

| | — |

| | 23 |

| | 205,153 |

| | 1,408 |

| | — |

| | 206,584 |

|

| Less provision for loan losses | — |

| | — |

| | — |

| | — |

| | 4,000 |

| | — |

| | — |

| | 4,000 |

|

| Net interest income after provision for loan losses | 20 |

| | 3 |

| | — |

| | 23 |

| | 201,153 |

| | 1,408 |

| | — |

| | 202,584 |

|

| Other income: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Loan and guaranty servicing revenue | 131,217 |

| | — |

| | — |

| | 131,217 |

| | — |

| | — |

| | — |

| | 131,217 |

|

| Intersegment servicing revenue | 28,021 |

| | — |

| | — |

| | 28,021 |

| | — |

| | — |

| | (28,021 | ) | | — |

|

| Tuition payment processing and campus commerce revenue | — |

| | 47,069 |

| | — |

| | 47,069 |

| | — |

| | — |

| | — |

| | 47,069 |

|

| Enrollment services revenue | — |

| | — |

| | 42,156 |

| | 42,156 |

| | — |

| | — |

| | — |

| | 42,156 |

|

| Other income | — |

| | — |

| | — |

| | — |

| | 8,660 |

| | 24,786 |

| | — |

| | 33,446 |

|

| Gain on sale of loans and debt repurchases | — |

| | — |

| | — |

| | — |

| | 57 |

| | — |

| | — |

| | 57 |

|

| Derivative market value and foreign currency adjustments, net | — |

| | — |

| | — |

| | — |

| | 12,325 |

| | (2,577 | ) | | — |

| | 9,748 |

|

| Derivative settlements, net | — |

| | — |

| | — |

| | — |

| | (11,935 | ) | | (508 | ) | | — |

| | (12,443 | ) |

| Total other income | 159,238 |

| | 47,069 |

| | 42,156 |

| | 248,463 |

| | 9,107 |

| | 21,701 |

| | (28,021 | ) | | 251,250 |

|

| Operating expenses: | |

| | |

| | |

| | | | |

| | |

| | |

| | |

|

| Salaries and benefits | 65,400 |

| | 21,139 |

| | 8,512 |

| | 95,051 |

| | 1,179 |

| | 10,142 |

| | — |

| | 106,372 |

|

| Cost to provide enrollment services | — |

| | — |

| | 27,786 |

| | 27,786 |

| | — |

| | — |

| | — |

| | 27,786 |

|

| Depreciation and amortization | 5,608 |

| | 3,273 |

| | 88 |

| | 8,969 |

| | — |

| | 1,028 |

| | — |

| | 9,997 |

|

| Other | 38,267 |

| | 5,603 |

| | 3,293 |

| | 47,163 |

| | 15,991 |

| | 12,850 |

| | — |

| | 76,004 |

|

| Intersegment expenses, net | 2,207 |

| | 2,824 |

| | 1,950 |

| | 6,981 |

| | 28,339 |

| | (7,299 | ) | | (28,021 | ) | | — |

|

| Total operating expenses | 111,482 |

| | 32,839 |

| | 41,629 |

| | 185,950 |

| | 45,509 |

| | 16,721 |

| | (28,021 | ) | | 220,159 |

|

| Income before income taxes and corporate overhead allocation | 47,776 |

| | 14,233 |

| | 527 |

| | 62,536 |

| | 164,751 |

| | 6,388 |

| | — |

| | 233,675 |

|

| Corporate overhead allocation | (3,920 | ) | | (1,307 | ) | | (1,307 | ) | | (6,534 | ) | | (2,578 | ) | | 9,112 |

| | — |

| | — |

|

| Income before income taxes | 43,856 |

| | 12,926 |

| | (780 | ) | | 56,002 |

| | 162,173 |

| | 15,500 |

| | — |

| | 233,675 |

|

| Income tax (expense) benefit | (16,665 | ) | | (4,911 | ) | | 296 |

| | (21,280 | ) | | (61,625 | ) | | (784 | ) | | — |

| | (83,689 | ) |

| Net income | 27,191 |

| | 8,015 |

| | (484 | ) | | 34,722 |

| | 100,548 |

| | 14,716 |

| | — |

| | 149,986 |

|

| Net income attributable to noncontrolling interest | — |

| | — |

| | — |

| | — |

| | — |

| | 1,206 |

| | — |

| | 1,206 |

|

| Net income attributable to Nelnet, Inc. | $ | 27,191 |

| | 8,015 |

| | (484 | ) | | 34,722 |

| | 100,548 |

| | 13,510 |

| | — |

| | 148,780 |

|

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, 2013 |

| | Fee-Based | | | | | | | | | | |

| | Student Loan and Guaranty Servicing | | Tuition Payment Processing and Campus Commerce | | Enrollment Services | | Total Fee- Based | | Asset Generation and Management | | Corporate Activity and Overhead | | Eliminations | | Total |

| Total interest income | $ | 19 |

| | — |

| | — |

| | 19 |

| | 313,829 |

| | 4,507 |

| | (1,653 | ) | | 316,702 |

|

| Interest expense | — |

| | — |

| | — |

| | — |

| | 114,402 |

| | 3,736 |

| | (1,653 | ) | | 116,485 |

|

| Net interest income | 19 |

| | — |

| | — |

| | 19 |

| | 199,427 |

| | 771 |

| | — |

| | 200,217 |

|

| Less provision for loan losses | — |

| | — |

| | — |

| | — |

| | 10,000 |

| | — |

| | — |

| | 10,000 |

|

| Net interest income after provision for loan losses | 19 |

| | — |

| | — |

| | 19 |

| | 189,427 |

| | 771 |

| | — |

| | 190,217 |

|

| Other income: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Loan and guaranty servicing revenue | 115,679 |

| | — |

| | — |

| | 115,679 |

| | — |

| | — |

| | — |

| | 115,679 |

|

| Intersegment servicing revenue | 28,856 |

| | — |

| | — |

| | 28,856 |

| | — |

| | — |

| | (28,856 | ) | | — |

|

| Tuition payment processing and campus commerce revenue | — |

| | 41,767 |

| | — |

| | 41,767 |

| | — |

| | — |

| | — |

| | 41,767 |

|

| Enrollment services revenue | — |

| | — |

| | 53,780 |

| | 53,780 |

| | — |

| | — |

| | — |

| | 53,780 |

|

| Other income | — |

| | — |

| | — |

| | — |

| | 7,226 |

| | 14,478 |

| | — |

| | 21,704 |

|

| Gain on sale of loans and debt repurchases | — |

| | — |

| | — |

| | — |

| | 8,762 |

| | — |

| | — |

| | 8,762 |

|

| Derivative market value and foreign currency adjustments, net | — |

| | — |

| | — |

| | — |

| | 48,371 |

| | 9,430 |

| | — |

| | 57,801 |

|

| Derivative settlements, net | — |

| | — |

| | — |

| | — |

| | (15,384 | ) | | (1,157 | ) | | — |

| | (16,541 | ) |

| Total other income | 144,535 |

| | 41,767 |

| | 53,780 |

| | 240,082 |

| | 48,975 |

| | 22,751 |

| | (28,856 | ) | | 282,952 |

|

| Operating expenses: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Salaries and benefits | 56,535 |

| | 18,786 |

| | 10,576 |

| | 85,897 |

| | 1,154 |

| | 8,286 |

| | — |

| | 95,337 |

|

| Cost to provide enrollment services | — |

| | — |

| | 36,429 |

| | 36,429 |

| | — |

| | — |

| | — |

| | 36,429 |

|

| Depreciation and amortization | 5,520 |

| | 2,270 |

| | 122 |

| | 7,912 |

| | — |

| | 785 |

| | — |

| | 8,697 |

|

| Other | 36,421 |

| | 4,479 |

| | 2,894 |

| | 43,794 |

| | 15,436 |

| | 10,076 |

| | — |

| | 69,306 |

|

| Intersegment expenses, net | 1,786 |

| | 2,919 |

| | 2,279 |

| | 6,984 |

| | 29,250 |

| | (7,378 | ) | | (28,856 | ) | | — |

|

| Total operating expenses | 100,262 |

| | 28,454 |

| | 52,300 |

| | 181,016 |

| | 45,840 |

| | 11,769 |

| | (28,856 | ) | | 209,769 |

|

| Income before income taxes and corporate overhead allocation | 44,292 |

| | 13,313 |

| | 1,480 |

| | 59,085 |

| | 192,562 |

| | 11,753 |

| | — |

| | 263,400 |

|

| Corporate overhead allocation | (2,510 | ) | | (836 | ) | | (836 | ) | | (4,182 | ) | | (1,793 | ) | | 5,975 |

| | — |

| | — |

|

| Income before income taxes | 41,782 |

| | 12,477 |

| | 644 |

| | 54,903 |

| | 190,769 |

| | 17,728 |

| | — |

| | 263,400 |

|

| Income tax (expense) benefit | (15,878 | ) | | (4,741 | ) | | (244 | ) | | (20,863 | ) | | (72,492 | ) | | 162 |

| | — |

| | (93,193 | ) |

| Net income | 25,904 |

| | 7,736 |

| | 400 |

| | 34,040 |

| | 118,277 |

| | 17,890 |

| | — |

| | 170,207 |

|

| Net income attributable to noncontrolling interest | — |

| | — |

| | — |

| | — |

| | — |

| | 885 |

| | — |

| | 885 |

|

| Net income attributable to Nelnet, Inc. | $ | 25,904 |

| | 7,736 |

| | 400 |

| | 34,040 |

| | 118,277 |

| | 17,005 |

| | — |

| | 169,322 |

|

| | | | | | | | | | | | | | | | |

Net Interest Income, Net of Settlements on Derivatives

The Company maintains an overall risk management strategy that incorporates the use of derivative instruments to reduce the economic effect of interest rate volatility. Derivative settlements for each applicable period should be evaluated with the Company's net interest income.

The following table summarizes the components of “net interest income” and “derivative settlements, net” included in the attached consolidated statements of income.

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, 2014 | | March 31,

2014 | | June 30, 2013 | | June 30, 2014 | | June 30, 2013 |

| Variable student loan interest margin, net of settlements on derivatives | $ | 58,627 |

| | 54,396 |

| | 58,076 |

| | 113,023 |

| | 113,697 |

|

| Fixed rate floor income, net of settlements on derivatives | 43,607 |

| | 37,844 |

| | 36,056 |

| | 81,451 |

| | 71,772 |

|

| Investment interest | 1,482 |

| | 1,979 |

| | 1,483 |

| | 3,461 |

| | 3,100 |

|

| Non-portfolio related derivative settlements | (256 | ) | | (252 | ) | | (512 | ) | | (508 | ) | | (1,157 | ) |

| Corporate debt interest expense | (1,961 | ) | | (1,325 | ) | | (2,041 | ) | | (3,286 | ) | | (3,736 | ) |

| Net interest income (net of settlements on derivatives) | $ | 101,499 |

| | 92,642 |

| | 93,062 |

| | 194,141 |

| | 183,676 |

|

Student Loan Servicing Volumes (dollars in millions)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Company owned | | $23,727 | | $22,650 | | $21,237 | | $20,820 | | $20,629 | | $20,715 | | $21,397 | | $21,192 | | $21,110 |

| % of total | | 38.6% | | 29.8% | | 21.8% | | 18.5% | | 17.7% | | 15.3% | | 15.5% | | 14.3% | | 14.1% |

| Number of servicing borrowers: | | | | | | | | | | | | | | | |

| Government servicing: | | 2,804,502 |

| | 3,036,534 |

| | 3,892,929 |

| | 4,261,637 |

| | 4,396,341 |

| | 5,145,901 |

| | 5,305,498 |

| | 5,438,933 |

| | 5,465,395 |

|

| FFELP servicing: | | 1,912,748 |

| | 1,799,484 |

| | 1,626,146 |

| | 1,586,312 |

| | 1,529,203 |

| | 1,507,452 |

| | 1,462,122 |

| | 1,426,435 |

| | 1,390,541 |

|

| Private servicing: | | 155,947 |

| | 164,554 |

| | 173,948 |

| | 170,224 |

| | 173,588 |

| | 178,935 |

| | 195,580 |

| | 191,606 |

| | 186,863 |

|

| Total: | | 4,873,197 |

| | 5,000,572 |

| | 5,693,023 |

| | 6,018,173 |

| | 6,099,132 |

| | 6,832,288 |

| | 6,963,200 |

| | 7,056,974 |

| | 7,042,799 |

|

| | | | | | | | | | | | | | | | | | | |

| Number of remote hosted borrowers: | | 545,456 |

| | 9,566,296 |

| | 6,912,204 |

| | 5,001,695 |

| | 3,218,896 |

| | 1,986,866 |

| | 1,915,203 |

| | 1,796,287 |

| | 1,735,594 |

|

Other Income

The following table summarizes the components of "other income" included in the attached consolidated statements of income.

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30,

2014 | | March 31,

2014 | | June 30,

2013 | | June 30,

2014 | | June 30,

2013 |

| Borrower late fee income | $ | 3,557 |

| | 3,673 |

| | 3,233 |

| | 7,244 |

| | 6,738 |

|

| Investment advisory fees | 7,008 |

| | 5,220 |

| | 6,334 |

| | 12,228 |

| | 9,164 |

|

| Realized and unrealized gains/(losses) on investments, net | 2,081 |

| | 7,210 |

| | (158 | ) | | 9,291 |

| | 996 |

|

| Other | 2,669 |

| | 2,028 |

| | 2,879 |

| | 4,683 |

| | 4,806 |

|

| Other income | $ | 15,315 |

| | 18,131 |

| | 12,288 |

| | 33,446 |

| | 21,704 |

|

Derivative Settlements

The following table summarizes the components of "derivative settlements, net" included in the attached consolidated statements of income.

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30,

2014 | | March 31,

2014 | | June 30,

2013 | | June 30,

2014 | | June 30,

2013 |

| 1:3 basis swaps | $ | 858 |

| | 881 |

| | 782 |

| | 1,739 |

| | 1,692 |

|

| Interest rate swaps - floor income hedges | (6,974 | ) | | (6,950 | ) | | (8,534 | ) | | (13,924 | ) | | (16,839 | ) |

| Interest rate swaps - hybrid debt hedges | (256 | ) | | (252 | ) | | (512 | ) | | (508 | ) | | (1,157 | ) |

| Cross-currency interest rate swaps | 158 |

| | 92 |

| | (93 | ) | | 250 |

| | (237 | ) |

| Total settlements - expense | $ | (6,214 | ) | | (6,229 | ) | | (8,357 | ) | | (12,443 | ) | | (16,541 | ) |

Derivative Market Value and Foreign Currency Adjustments

"Derivative market value and foreign currency adjustments" include (i) the unrealized gains and losses that are caused by changes in fair values of derivatives which do not qualify for "hedge treatment" under GAAP; and (ii) the foreign currency transaction gains or losses caused by the re-measurement of the Company's Euro-denominated bonds to U.S. dollars.

The following table summarizes the components of “derivative market value and foreign currency adjustments” included in the attached consolidated statements of income.

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30,

2014 | | March 31,

2014 | | June 30,

2013 | | June 30,

2014 | | June 30,

2013 |

| Change in fair value of derivatives - income (expense) | $ | 5,033 |

| | 2,916 |

| | 63,236 |

| | 7,950 |

| | 43,729 |

|

| Foreign currency transaction adjustment - income (expense) | 2,751 |

| | (952 | ) | | (14,691 | ) | | 1,798 |

| | 14,072 |

|

| Derivative market value and foreign currency adjustments - income (expense) | $ | 7,784 |

| | 1,964 |

| | 48,545 |

| | 9,748 |

| | 57,801 |

|

Student Loans Receivable

The table below outlines the components of the Company’s student loan portfolio:

|

| | | | | | | | | |

| | As of | | As of | | As of |

| | June 30,

2014 | | December 31,

2013 | | June 30,

2013 |

| Federally insured loans | | | | | |

| Stafford and other | $ | 6,479,493 |

| | 6,686,626 |

| | 7,010,404 |

|

| Consolidation | 23,032,622 |

| | 19,363,577 |

| | 17,678,330 |

|

| Total | 29,512,115 |

| | 26,050,203 |

| | 24,688,734 |

|

| Non-federally insured loans | 67,670 |

| | 71,103 |

| | 29,634 |

|

| | 29,579,785 |

| | 26,121,306 |

| | 24,718,368 |

|

| Loan discount, net of unamortized loan premiums and deferred origination costs | (184,888 | ) | | (158,595 | ) | | (91,121 | ) |

| Allowance for loan losses – federally insured loans | (40,921 | ) | | (43,440 | ) | | (39,848 | ) |

| Allowance for loan losses – non-federally insured loans | (11,546 | ) | | (11,682 | ) | | (11,763 | ) |

| | $ | 29,342,430 |

| | 25,907,589 |

| | 24,575,636 |

|

| | | |

|

| |

|

|

Loan Activity

The following table sets forth the activity of loans:

|

| | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2014 | | 2013 | | 2014 | | 2013 |

| Beginning balance | $ | 25,814,195 |

| | 25,030,597 |

| | 26,121,306 |

| | 24,995,880 |

|

| Loan acquisitions | 4,800,640 |

| | 403,018 |

| | 5,187,898 |

| | 1,146,784 |

|

| Repayments, claims, capitalized interest, participations, and other | (825,365 | ) | | (592,099 | ) | | (1,374,070 | ) | | (1,146,349 | ) |

| Consolidation loans lost to external parties | (209,679 | ) | | (123,145 | ) | | (355,343 | ) | | (266,296 | ) |

| Loans sold | (6 | ) | | (3 | ) | | (6 | ) | | (11,651 | ) |

| Ending balance | $ | 29,579,785 |

| | 24,718,368 |

| | 29,579,785 |

| | 24,718,368 |

|

Student Loan Spread

The following table analyzes the student loan spread on the Company’s portfolio of student loans, which represents the spread between the yield earned on student loan assets and the costs of the liabilities and derivative instruments used to fund those assets.

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30,

2014 | | March 31,

2014 | | June 30,

2013 | | June 30,

2014 | | June 30,

2013 |

| Variable student loan yield, gross | 2.54 | % | | 2.50 | % | | 2.58 | % | | 2.52 | % | | 2.57 | % |

| Consolidation rebate fees | (0.82 | ) | | (0.80 | ) | | (0.77 | ) | | (0.81 | ) | | (0.77 | ) |

| Discount accretion, net of premium and deferred origination costs amortization | 0.06 |

| | 0.05 |

| | 0.03 |

| | 0.06 |

| | 0.03 |

|

| Variable student loan yield, net | 1.78 |

| | 1.75 |

| | 1.84 |

| | 1.77 |

| | 1.83 |

|

| Student loan cost of funds - interest expense | (0.95 | ) | | (0.92 | ) | | (0.91 | ) | | (0.94 | ) | | (0.91 | ) |

| Student loan cost of funds - derivative settlements | 0.01 |

| | 0.02 |

| | 0.01 |

| | 0.01 |

| | 0.01 |

|

| Variable student loan spread | 0.84 |

| | 0.85 |

| | 0.94 |

| | 0.84 |

| | 0.93 |

|

| Fixed rate floor income, net of settlements on derivatives | 0.62 |

| | 0.59 |

| | 0.58 |

| | 0.61 |

| | 0.58 |

|

| Core student loan spread | 1.46 | % | | 1.44 | % | | 1.52 | % | | 1.45 | % | | 1.51 | % |

| | | | | | | | | | |

| Average balance of student loans | $ | 28,163,626 |

| | 25,915,053 |

| | 24,798,537 |

| | 27,039,339 |

| | 24,789,981 |

|

| Average balance of debt outstanding | 28,229,140 |

| | 25,826,656 |

| | 24,832,555 |

| | 27,034,535 |

| | 24,828,001 |

|

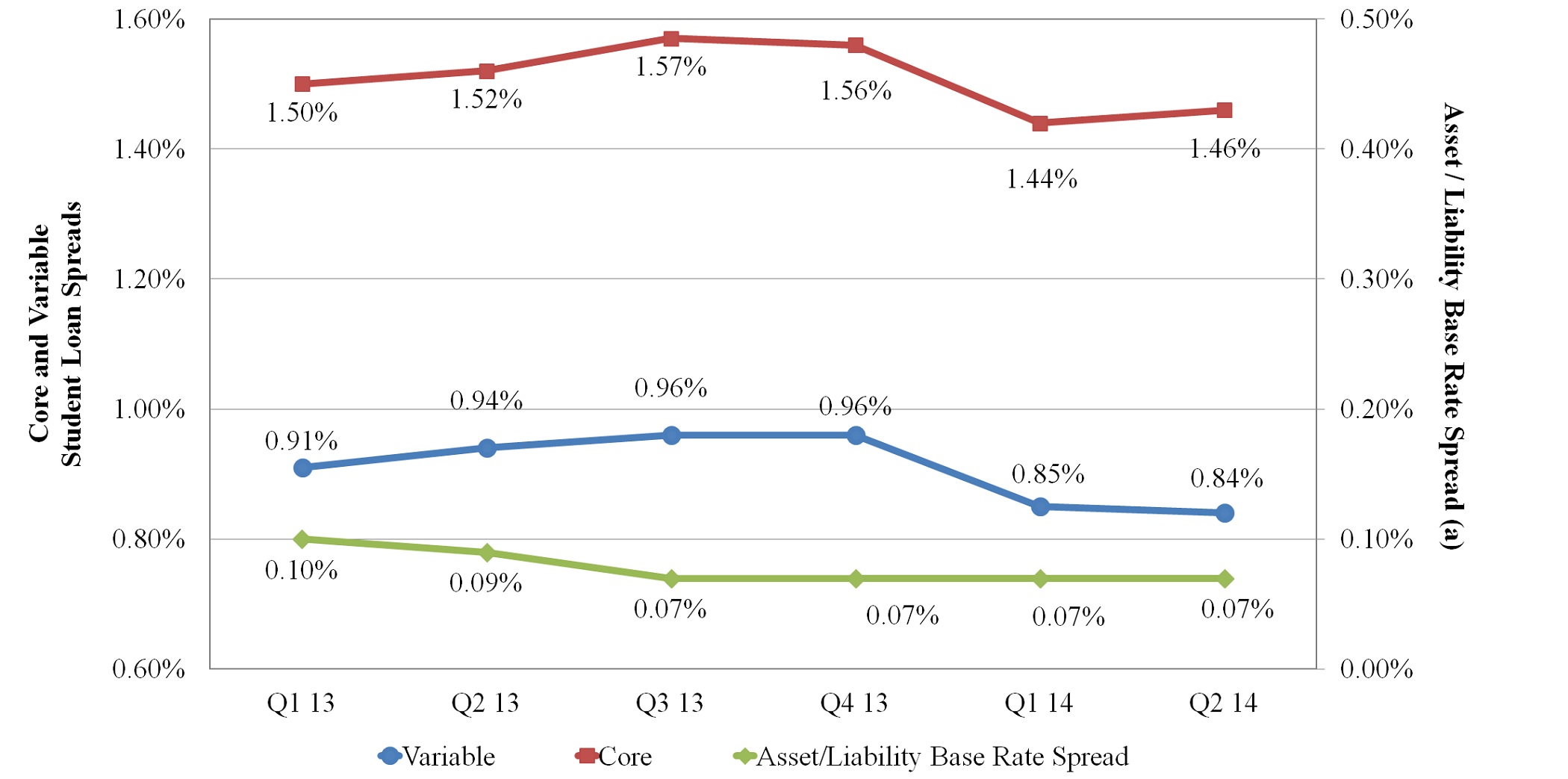

A trend analysis of the Company's core and variable student loan spreads is summarized below.

| |

| (a) | The interest earned on a large portion of the Company's FFELP student loan assets is indexed to the one-month LIBOR rate. The Company funds the majority of its assets with three-month LIBOR indexed floating rate securities. The relationship between the indices in which the Company earns interest on its loans and funds such loans has a significant impact on student loan spread. This table (the right axis) shows the difference between the Company's liability base rate and the one-month LIBOR rate by quarter. |

Variable student loan spread decreased during the three and six months ended June 30, 2014 as a result of recent acquisitions of consolidation loans, which have lower margins but longer terms.

The primary difference between variable student loan spread and core student loan spread is fixed rate floor income. A summary of fixed rate floor income and its contribution to core student loan spread follows:

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, 2014 | | March 31,

2014 | | June 30, 2013 | | June 30, 2014 | | June 30, 2013 |

| Fixed rate floor income, gross | $ | 50,581 |

| | 44,794 |

| | 44,590 |

| | 95,375 |

| | 88,611 |

|

| Derivative settlements (a) | (6,974 | ) | | (6,950 | ) | | (8,534 | ) | | (13,924 | ) | | (16,839 | ) |

| Fixed rate floor income, net | $ | 43,607 |

| | 37,844 |

| | 36,056 |

| | 81,451 |

| | 71,772 |

|

| Fixed rate floor income contribution to spread, net | 0.62 | % | | 0.59 | % | | 0.58 | % | | 0.61 | % | | 0.58 | % |

| |

| (a) | Includes settlement payments on derivatives used to hedge student loans earning fixed rate floor income. |

Fixed Rate Floor Income

The following table shows the Company’s student loan assets that are earning fixed rate floor income as of June 30, 2014:

|

| | | | | | | | |

| Fixed interest rate range | | Borrower/lender weighted average yield | | Estimated variable conversion rate (a) | | Loan balance |

| | | |

| < 3.0% | | 2.87% | | 0.23% | | $ | 1,867,914 |

|

| 3.0 - 3.49% | | 3.20% | | 0.56% | | 2,424,505 |

|

| 3.5 - 3.99% | | 3.65% | | 1.01% | | 2,303,132 |

|

| 4.0 - 4.49% | | 4.20% | | 1.56% | | 1,755,038 |

|

| 4.5 - 4.99% | | 4.72% | | 2.08% | | 1,083,052 |

|

| 5.0 - 5.49% | | 5.22% | | 2.58% | | 691,949 |

|

| 5.5 - 5.99% | | 5.67% | | 3.03% | | 410,536 |

|

| 6.0 - 6.49% | | 6.18% | | 3.54% | | 463,625 |

|

| 6.5 - 6.99% | | 6.71% | | 4.07% | | 448,223 |

|

| 7.0 - 7.49% | | 7.17% | | 4.53% | | 197,403 |

|

| 7.5 - 7.99% | | 7.71% | | 5.07% | | 322,499 |

|

| 8.0 - 8.99% | | 8.17% | | 5.53% | | 726,538 |

|

| > 9.0% | | 9.04% | | 6.40% | | 295,305 |

|

| | | | | | | $ | 12,989,719 |

|

| |

| (a) | The estimated variable conversion rate is the estimated short-term interest rate at which loans would convert to a variable rate. As of June 30, 2014, the weighted average estimated variable conversion rate was 1.85% and the short-term interest rate was 15 basis points. |

The following table summarizes the outstanding derivative instruments as of June 30, 2014 used by the Company to economically hedge loans earning fixed rate floor income.

|

| | | | | | | |

| Maturity | | Notional amount | | Weighted average fixed rate paid by the Company (a) |

| | |

| 2014 | | $ | 1,250,000 |

| | 0.67 | % |

| 2015 | | 1,100,000 |

| | 0.89 |

|

| 2016 | | 750,000 |

| | 0.85 |

|

| 2017 | | 1,250,000 |

| | 0.86 |

|

| | | $ | 4,350,000 |

| | 0.81 | % |

| |

| (a) | For all interest rate derivatives, the Company receives discrete three-month LIBOR. |