For Release: November 7, 2019

Investor Contact: Phil Morgan, 402.458.3038

Nelnet, Inc. supplemental financial information for the third quarter 2019

(All dollars are in thousands, except per share amounts, unless otherwise noted)

The following information should be read in connection with Nelnet, Inc.'s (the “Company's”) press release for third quarter 2019 earnings, dated November 7, 2019, and the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2019.

Forward-looking and cautionary statements

This report contains forward-looking statements and information that are based on management's current expectations as of the date of this document. Statements that are not historical facts, including statements about the Company's plans and expectations for future financial condition, results of operations or economic performance, or that address management's plans and objectives for future operations, and statements that assume or are dependent upon future events, are forward-looking statements. The words “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “intend,” “may,” “plan,” “potential,” “predict,” “scheduled,” “should,” “will,” “would,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements.

The forward-looking statements are based on assumptions and analyses made by management in light of management's experience and its perception of historical trends, current conditions, expected future developments, and other factors that management believes are appropriate under the circumstances. These statements are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in the “Risk Factors” section of the 2018 Annual Report, and include such risks and uncertainties as:

•loan portfolio risks such as interest rate basis and repricing risk resulting from the fact that the interest rate characteristics of the student loan assets do not match the interest rate characteristics of the funding for those assets, the risk of loss of floor income on certain student loans originated under the Federal Family Education Loan Program (the "FFEL Program" or "FFELP"), risks related to the use of derivatives to manage exposure to interest rate fluctuations, uncertainties regarding the expected benefits from purchased securitized and unsecuritized FFELP, private education, and consumer loans and initiatives to purchase additional FFELP, private education, and consumer loans, and risks from changes in levels of loan prepayment or default rates;

•financing and liquidity risks, including risks of changes in the general interest rate environment, including the availability of any relevant money market index rate such as LIBOR or the relationship between the relevant money market index rate and the rate at which the Company's assets and liabilities are priced, and in the securitization and other financing markets for loans, including adverse changes resulting from unanticipated repayment trends on student loans in FFELP securitization trusts that could accelerate or delay repayment of the associated bonds, which may increase the costs or limit the availability of financings necessary to purchase, refinance, or continue to hold student loans;

•risks from changes in the educational credit and services markets resulting from changes in applicable laws, regulations, and government programs and budgets, such as the expected decline over time in FFELP loan interest income and fee-based revenues due to the discontinuation of new FFELP loan originations in 2010 and potential government initiatives or legislative proposals to consolidate existing FFELP loans to the Federal Direct Loan Program or otherwise allow FFELP loans to be refinanced with Federal Direct Loan Program loans;

•the uncertain nature of the expected benefits from the acquisition of Great Lakes Educational Loan Services, Inc. ("Great Lakes") on February 7, 2018 and the ability to successfully integrate technology and other activities and successfully maintain and increase allocated volumes of student loans serviced under existing and any future servicing contracts with the U.S. Department of Education (the "Department"), which current contracts accounted for 30 percent of the Company's revenue in 2018, risks to the Company related to the Department's initiatives to procure new contracts for federal student loan servicing, including the risk that the Company or Company teams may not be successful in obtaining contracts, risks related to the development by the Company of a new student loan servicing platform, including risks as to whether the expected benefits from the new platform will be realized, and risks related to the Company's ability to comply with agreements with third-party customers for the servicing of Federal Direct Loan Program, FFELP, and private education and consumer loans;

•risks related to a breach of or failure in the Company's operational or information systems or infrastructure, or those of third-party vendors, including cybersecurity risks related to the potential disclosure of confidential student loan borrower and other customer information, the potential disruption of the Company's systems or those of third-party vendors or customers, and/or the potential damage to the Company's reputation resulting from cyber-breaches;

•uncertainties inherent in forecasting future cash flows from student loan assets and related asset-backed securitizations;

•risks and uncertainties related to the ability of ALLO Communications LLC to successfully expand its fiber network and market share in existing service areas and additional communities and manage related construction risks;

•risks and uncertainties related to initiatives to pursue additional strategic investments and acquisitions, including investments and acquisitions that are intended to diversify the Company both within and outside of its historical core education-related businesses, as well as other strategic initiatives; and

•risks and uncertainties associated with litigation matters and with maintaining compliance with the extensive regulatory requirements applicable to the Company's businesses, reputational and other risks, including the risk of increased regulatory costs, resulting from the politicization of student loan servicing, and uncertainties inherent in the estimates and assumptions about future events that management is required to make in the preparation of the Company's consolidated financial statements.

All forward-looking statements contained in this report are qualified by these cautionary statements and are made only as of the date of this document. Although the Company may from time to time voluntarily update or revise its prior forward-looking statements to reflect actual results or changes in the Company's expectations, the Company disclaims any commitment to do so except as required by securities laws.

Consolidated Statements of Income

(Dollars in thousands, except share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | | | | | Nine months ended | | |

| September 30, 2019 | | | | June 30, 2019 | | September 30, 2018 | | September 30, 2019 | | September 30, 2018 |

| Interest income: | | | | | | | | | | | |

| Loan interest | $ | 229,063 | | | | | 238,222 | | | 232,320 | | | 709,618 | | | 653,414 | |

| Investment interest | 9,882 | | | | | 8,566 | | | 7,628 | | | 26,701 | | | 18,581 | |

| Total interest income | 238,945 | | | | | 246,788 | | | 239,948 | | | 736,319 | | | 671,995 | |

| Interest expense: | | | | | | | | | | | |

| Interest on bonds and notes payable | 172,488 | | | | | 186,963 | | | 180,175 | | | 551,221 | | | 487,174 | |

| Net interest income | 66,457 | | | | | 59,825 | | | 59,773 | | | 185,098 | | | 184,821 | |

| Less provision for loan losses | 10,000 | | | | | 9,000 | | | 10,500 | | | 26,000 | | | 18,000 | |

| Net interest income after provision for loan losses | 56,457 | | | | | 50,825 | | | 49,273 | | | 159,098 | | | 166,821 | |

| Other income: | | | | | | | | | | | |

| Loan servicing and systems revenue | 113,286 | | | | | 113,985 | | | 112,579 | | | 342,169 | | | 327,265 | |

| Education technology, services, and payment processing revenue | 74,251 | | | | | 60,342 | | | 58,409 | | | 213,753 | | | 167,372 | |

| Communications revenue | 16,470 | | | | | 15,758 | | | 11,818 | | | 46,770 | | | 31,327 | |

| Other income | 13,439 | | | | | 16,152 | | | 16,673 | | | 38,658 | | | 44,808 | |

| | | | | | | | | | | |

| Derivative settlements, net | 7,298 | | | | | 12,972 | | | 22,324 | | | 39,306 | | | 51,018 | |

| Derivative market value adjustments, net | (5,630) | | | | | (37,060) | | | (5,226) | | | (73,265) | | | 49,909 | |

| Total other income | 219,114 | | | | | 182,149 | | | 216,577 | | | 607,391 | | | 671,699 | |

| Cost of services: | | | | | | | | | | | |

| Cost to provide education technology, services, and payment processing services | 25,671 | | | | | 15,871 | | | 19,087 | | | 62,601 | | | 44,087 | |

| Cost to provide communications services | 5,236 | | | | | 5,101 | | | 4,310 | | | 15,096 | | | 11,892 | |

| Total cost of services | 30,907 | | | | | 20,972 | | | 23,397 | | | 77,697 | | | 55,979 | |

| Operating expenses: | | | | | | | | | | | |

| Salaries and benefits | 116,670 | | | | | 111,214 | | | 114,172 | | | 338,942 | | | 321,932 | |

| Depreciation and amortization | 27,701 | | | | | 24,484 | | | 22,992 | | | 76,398 | | | 62,943 | |

| Loan servicing fees to third parties | 3,382 | | | | | 3,156 | | | 3,087 | | | 9,431 | | | 9,428 | |

| Other expenses | 54,947 | | | | | 42,261 | | | 45,194 | | | 138,131 | | | 119,020 | |

| Total operating expenses | 202,700 | | | | | 181,115 | | | 185,445 | | | 562,902 | | | 513,323 | |

| Income before income taxes | 41,964 | | | | | 30,887 | | | 57,008 | | | 125,890 | | | 269,218 | |

| Income tax expense | (8,829) | | | | | (6,209) | | | (13,882) | | | (26,429) | | | (63,369) | |

| Net income | 33,135 | | | | | 24,678 | | | 43,126 | | | 99,461 | | | 205,849 | |

| Net loss (income) attributable to noncontrolling interests | 77 | | | | | (59) | | | (199) | | | (38) | | | 438 | |

| Net income attributable to Nelnet, Inc. | $ | 33,212 | | | | | 24,619 | | | 42,927 | | | 99,423 | | | 206,287 | |

| Earnings per common share: | | | | | | | | | | | |

| Net income attributable to Nelnet, Inc. shareholders - basic and diluted | $ | 0.83 | | | | | 0.61 | | | 1.05 | | | 2.48 | | | 5.04 | |

| Weighted average common shares outstanding - basic and diluted | 39,877,129 | | | | | 40,050,065 | | | 40,988,965 | | | 40,098,346 | | | 40,942,177 | |

Condensed Consolidated Balance Sheets

(Dollars in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | |

| As of | | As of | | As of | | |

| September 30, 2019 | | December 31, 2018 | | September 30, 2018 | | |

| | | | | | | |

| Assets: | | | | | | | |

| Loans receivable, net | $ | 21,071,441 | | | 22,377,142 | | | 22,528,362 | | | |

| Cash, cash equivalents, investments, and notes receivable | 373,395 | | | 370,717 | | | 330,352 | | | |

| Restricted cash | 977,228 | | | 1,071,044 | | | 911,929 | | | |

| Goodwill and intangible assets, net | 246,411 | | | 271,202 | | | 249,462 | | | |

| Other assets | 1,268,244 | | | 1,130,863 | | | 1,084,820 | | | |

| Total assets | $ | 23,936,719 | | | 25,220,968 | | | 25,104,925 | | | |

| Liabilities: | | | | | | | |

| Bonds and notes payable | $ | 20,910,190 | | | 22,218,740 | | | 22,251,433 | | | |

| Other liabilities | 671,864 | | | 687,449 | | | 526,364 | | | |

| Total liabilities | 21,582,054 | | | 22,906,189 | | | 22,777,797 | | | |

| Equity: | | | | | | | |

| Total Nelnet, Inc. shareholders' equity | 2,350,150 | | | 2,304,464 | | | 2,316,864 | | | |

| Noncontrolling interests | 4,515 | | | 10,315 | | | 10,264 | | | |

| Total equity | 2,354,665 | | | 2,314,779 | | | 2,327,128 | | | |

| Total liabilities and equity | $ | 23,936,719 | | | 25,220,968 | | | 25,104,925 | | | |

Overview

The Company is a diverse company with a focus on delivering education-related products and services and loan asset management. The largest operating businesses engage in student loan servicing; education technology, services, and payment processing; and communications. A significant portion of the Company's revenue is net interest income earned on a portfolio of federally insured student loans. The Company also makes investments to further diversify the Company both within and outside of its historical core education-related businesses, including, but not limited to, investments in real estate and early-stage and emerging growth companies.

GAAP Net Income and Non-GAAP Net Income, Excluding Adjustments

The Company prepares its financial statements and presents its financial results in accordance with U.S. GAAP. However, it also provides additional non-GAAP financial information related to specific items management believes to be important in the evaluation of its operating results and performance. A reconciliation of the Company's GAAP net income to net income, excluding derivative market value adjustments, and a discussion of why the Company believes providing this additional information is useful to investors, is provided below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | | | | | Nine months ended | | |

| September 30, 2019 | | | | June 30, 2019 | | September 30, 2018 | | September 30, 2019 | | September 30, 2018 |

| GAAP net income attributable to Nelnet, Inc. | $ | 33,212 | | | | | 24,619 | | | 42,927 | | | 99,423 | | | 206,287 | |

| Realized and unrealized derivative market value adjustments | 5,630 | | | | | 37,060 | | | 5,226 | | | 73,265 | | | (49,909) | |

| Tax effect (a) | (1,351) | | | | | (8,894) | | | (1,254) | | | (17,584) | | | 11,978 | |

| Net income attributable to Nelnet, Inc., excluding derivative market value adjustments (b) | $ | 37,491 | | | | | 52,785 | | | 46,899 | | | 155,104 | | | 168,356 | |

| | | | | | | | | | | |

| Earnings per share: | | | | | | | | | | | |

| GAAP net income attributable to Nelnet, Inc. | $ | 0.83 | | | | | 0.61 | | | 1.05 | | | 2.48 | | | 5.04 | |

| Realized and unrealized derivative market value adjustments | 0.14 | | | | | 0.93 | | | 0.12 | | | 1.83 | | | (1.22) | |

| Tax effect (a) | (0.03) | | | | | (0.22) | | | (0.03) | | | (0.44) | | | 0.29 | |

| Net income attributable to Nelnet, Inc., excluding derivative market value adjustments (b) | $ | 0.94 | | | | | 1.32 | | | 1.14 | | | 3.87 | | | 4.11 | |

(a) The tax effects are calculated by multiplying the realized and unrealized derivative market value adjustments by the applicable statutory income tax rate.

(b) "Derivative market value adjustments" includes both the realized portion of gains and losses (corresponding to variation margin received or paid on derivative instruments that are settled daily at a central clearinghouse) and the unrealized portion of gains and losses that are caused by changes in fair values of derivatives which do not qualify for "hedge treatment" under GAAP. "Derivative market value adjustments" does not include "derivative settlements" that represent the cash paid or received during the current period to settle with derivative instrument counterparties the economic effect of the Company's derivative instruments based on their contractual terms.

The accounting for derivatives requires that changes in the fair value of derivative instruments be recognized currently in earnings, with no fair value adjustment of the hedged item, unless specific hedge accounting criteria is met. Management has structured all of the Company’s derivative transactions with the intent that each is economically effective; however, the Company’s derivative instruments do not qualify for hedge accounting. As a result, the change in fair value of derivative instruments is reported in current period earnings with no consideration for the corresponding change in fair value of the hedged item. Under GAAP, the cumulative net realized and unrealized gain or loss caused by changes in fair values of derivatives in which the Company plans to hold to maturity will equal zero over the life of the contract. However, the net realized and unrealized gain or loss during any given reporting period fluctuates significantly from period to period.

The Company believes these point-in-time estimates of asset and liability values related to its derivative instruments that are subject to interest rate fluctuations are subject to volatility mostly due to timing and market factors beyond the control of management, and affect the period-to-period comparability of the results of operations. Accordingly, the Company’s management utilizes operating results excluding these items for comparability purposes when making decisions regarding the Company’s performance and in presentations with credit rating agencies, lenders, and investors. Consequently, the Company reports this non-GAAP information because the Company believes that it provides additional information regarding operational and performance indicators that are closely assessed by management. There is no comprehensive, authoritative guidance for the presentation of such non-GAAP information, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance.

Operating Results

The Company earns net interest income on its loan portfolio, consisting primarily of FFELP loans, in its Asset Generation and Management ("AGM") operating segment. This segment is expected to generate a stable net interest margin and significant amounts of cash as the FFELP portfolio amortizes. As of September 30, 2019, the Company had a $21.1 billion loan portfolio that management anticipates will amortize over the next approximately 20 years and has a weighted average remaining life of 8.8 years. The Company actively works to maximize the amount and timing of cash flows generated by its FFELP portfolio and seeks to acquire additional loan assets to leverage its servicing scale and expertise to generate incremental earnings and cash flow. However, due to the continued amortization of the Company’s FFELP loan portfolio, over time, the Company's net income generated by the AGM segment will continue to decrease. The Company currently believes that in the short-term it will most likely not be able to invest the excess cash generated from the FFELP loan portfolio into assets that immediately generate the rates of return historically realized from that portfolio.

In addition, the Company earns fee-based revenue through the following reportable operating segments:

���Loan Servicing and Systems ("LSS") - referred to as Nelnet Diversified Solutions ("NDS")

•Education Technology, Services, and Payment Processing ("ETS&PP") - referred to as Nelnet Business Solutions ("NBS")

•Communications - referred to as ALLO Communications ("ALLO")

Other business activities and operating segments that are not reportable are combined and included in Corporate and Other Activities ("Corporate"). Corporate and Other Activities also includes income earned on certain investments and interest expense incurred on unsecured debt transactions.

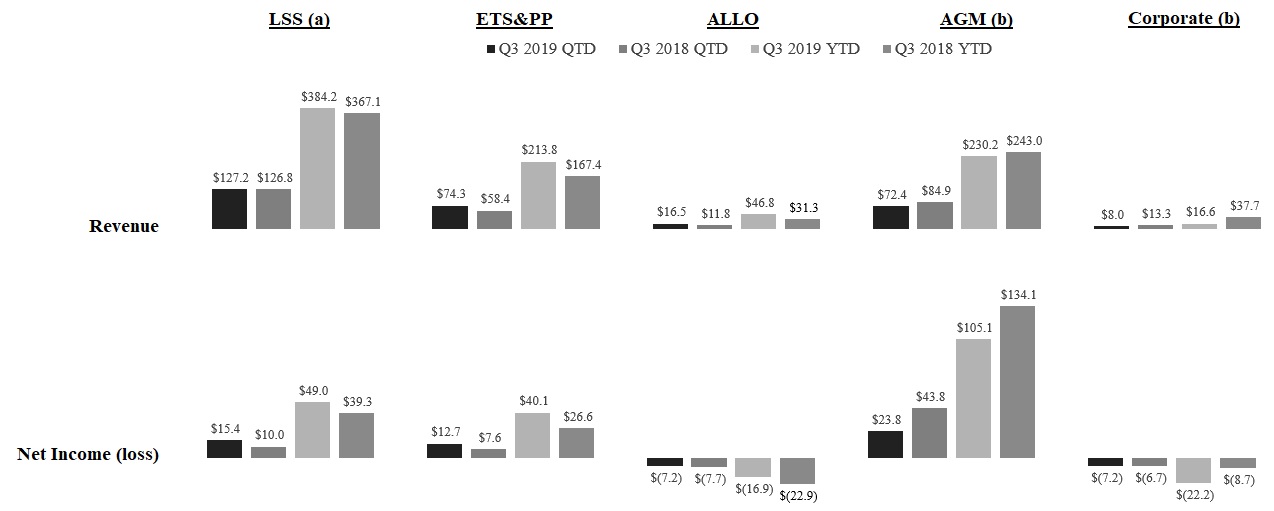

The information below provides the operating results for each reportable operating segment and Corporate and Other Activities for the three and nine months ended September 30, 2019 and 2018 (dollars in millions).

(a) Revenue includes intersegment revenue earned by LSS as a result of servicing loans for AGM.

(b) Total revenue includes "net interest income" and "total other income" from the Company's segment statements of income, excluding the impact from changes in fair values of derivatives. Net income excludes changes in fair values of derivatives, net of tax. For information regarding the exclusion of the impact from changes in fair values of derivatives, see "GAAP Net Income and Non-GAAP Net Income, Excluding Adjustments" above.

Certain events and transactions from 2018 and 2019, which have impacted or will impact the operating results of the Company and its operating segments, are discussed below.

Loan Servicing and Systems

•On February 7, 2018, the Company acquired Great Lakes. The operating results of Great Lakes are reported in the Company's consolidated financial statements from the date of acquisition. Thus, there are nine months of Great Lakes' operations included in the nine months ended September 30, 2019 as compared to approximately eight months of activity in the nine months ended September 30, 2018.

•Nelnet Servicing, LLC ("Nelnet Servicing") and Great Lakes have student loan servicing contracts awarded by the Department in June 2009 to provide servicing for loans owned by the Department. As of September 30, 2019, Nelnet Servicing was servicing $184.4 billion of student loans for 5.6 million borrowers under its contract, and Great Lakes was servicing $240.3 billion of student loans for 7.4 million borrowers under its contract. These contracts previously provided for expiration on June 16, 2019. On May 15, 2019, Nelnet Servicing and Great Lakes each received a Modification of Contract from the Department's Office of Federal Student Aid ("FSA") pursuant to which FSA extended the expiration date of the current contracts to December 15, 2019.

In addition, Nelnet Servicing's current Authority to Operate as a loan servicer for the Department expires on December 13, 2019 and is currently under review for renewal. The Company cannot predict the timing or outcome of this review.

FSA is conducting a contract procurement process entitled Next Generation Financial Services Environment (“NextGen”) for a new framework for the servicing of all student loans owned by the Department. On January 15, 2019, FSA issued solicitations for three NextGen components:

•NextGen Enhanced Processing Solution ("EPS")

•NextGen Business Process Operations ("BPO")

•NextGen Optimal Processing Solution ("OPS")

On April 1, 2019 and October 4, 2019, the Company responded to the EPS component. In addition, on August 1, 2019, the Company responded to the BPO component. The Company is also part of a team that has responded and intends to respond to various aspects of the OPS component. The Company cannot predict the timing, nature, or outcome of these solicitations.

•For the three months ended September 30, 2019 and 2018, and nine months ended September 30, 2019 and 2018, the before tax and noncontrolling interest operating margin (income before income taxes and noncontrolling interest divided by revenue) was 15.9 percent, 10.4 percent, 16.8 percent, and 14.1 percent, respectively. The third quarter of 2018 included an impairment charge of $3.9 million ($3.0 million after tax). The remaining increase in operating margin in the 2019 periods as compared to the same periods in 2018 was due primarily to efficiencies gained as a result of the completion of certain integration activities related to the Great Lakes acquisition.

Education Technology, Services, and Payment Processing

•On November 20, 2018, the Company acquired Tuition Management Systems ("TMS"), a services company that offers tuition payment plans, billing services, payment technology solutions, and refund management to educational institutions. The TMS acquisition added 380 higher education schools and 170 K-12 schools to the Company’s customer base. The results of TMS’ operations are reported in the Company’s consolidated financial statements from the date of acquisition.

•For the three months ended September 30, 2019 and 2018 and nine months ended September 30, 2019 and 2018, before tax operating margin (income before income taxes divided by net revenue) was 34.4 percent, 25.4 percent, 34.9 percent, and 28.4 percent, respectively. The increase in the before tax operating margin in the 2019 periods as compared to the same periods in 2018 was due to operating leverage and cost reductions resulting from the Company's decision in October 2018 to terminate its investment in a proprietary payment processing platform.

Communications

•ALLO recognized losses of $7.2 million and $16.9 million for the three and nine months ended September 30, 2019, respectively, as compared to losses of $7.7 million and $22.9 million for the same periods in 2018, respectively. The decrease in ALLO's net loss in 2019, as compared to 2018, was primarily due to a decrease in interest expense. ALLO recognized $4.2 million and $10.0 million of interest expense to Nelnet, Inc. (parent company) during the three and nine months ended September 30, 2018, respectively. Subsequent to October 1, 2018, ALLO will not report interest expense in its income statement related to amounts contributed to ALLO from Nelnet, Inc. due to a recapitalization of ALLO.

•ALLO's management uses earnings (loss) before interest, income taxes, depreciation, and amortization ("EBITDA") to eliminate certain non-cash and non-operating items in order to consistently measure performance from period to period. For the three months ended September 30, 2019 and 2018, ALLO had positive EBITDA of $1.5 million and $0.2 million, respectively, and for the nine months ended September 30, 2019 and 2018, ALLO has positive EBITDA of $3.7 million and negative EBITDA of $3.5 million, respectively. EBITDA is a supplemental non-GAAP performance measure which the Company believes provides useful additional information regarding a key metric used by management to assess ALLO's performance. See "Communications Financial and Operating Data" below for additional information regarding the computation and use of EBITDA for ALLO.

•ALLO has made significant investments in its communications network and currently provides fiber directly to homes and businesses in communities in Nebraska and Colorado. ALLO plans to continue to increase market share and revenue in its existing markets and is currently evaluating opportunities to expand to other communities in the Midwest. During the second quarter of 2019, ALLO announced plans to expand its network to make services available in Breckenridge, Colorado. ALLO began providing services in Lincoln, Nebraska in September 2016 as part of a multi-year project to pass substantially all commercial and residential properties in the community. As of the end of the first quarter of 2019, the build-out of the Lincoln community was substantially complete. For the nine months ended September 30, 2019, ALLO's capital expenditures were $37.2 million. The Company anticipates total ALLO network capital expenditures in the fourth quarter of 2019 will be approximately $13.0 million. However, this amount could change based on customer demand for ALLO's services.

•The Company currently anticipates ALLO's operating results will be dilutive to the Company's consolidated earnings as it continues to develop and add customers to its network in Lincoln, Nebraska and other communities, due to large upfront capital expenditures and associated depreciation and upfront customer acquisition costs.

Asset Generation and Management

•For the third quarter of 2019, the AGM segment recognized net interest income of $61.7 million, compared with $59.2 million for the same period in 2018. The Company maintains an overall risk management strategy that incorporates the use of derivative instruments to reduce the economic effect of interest rate volatility. The AGM segment recognized income from derivative settlements of $7.3 million during the third quarter of 2019, compared with income of $22.4 million for the same period in 2018. Derivative settlements for each applicable period should be evaluated with the Company's net interest income. Net interest income and derivative settlements for the AGM segment totaled $69.0 million and $81.6 million in the third quarter of 2019 and 2018, respectively.

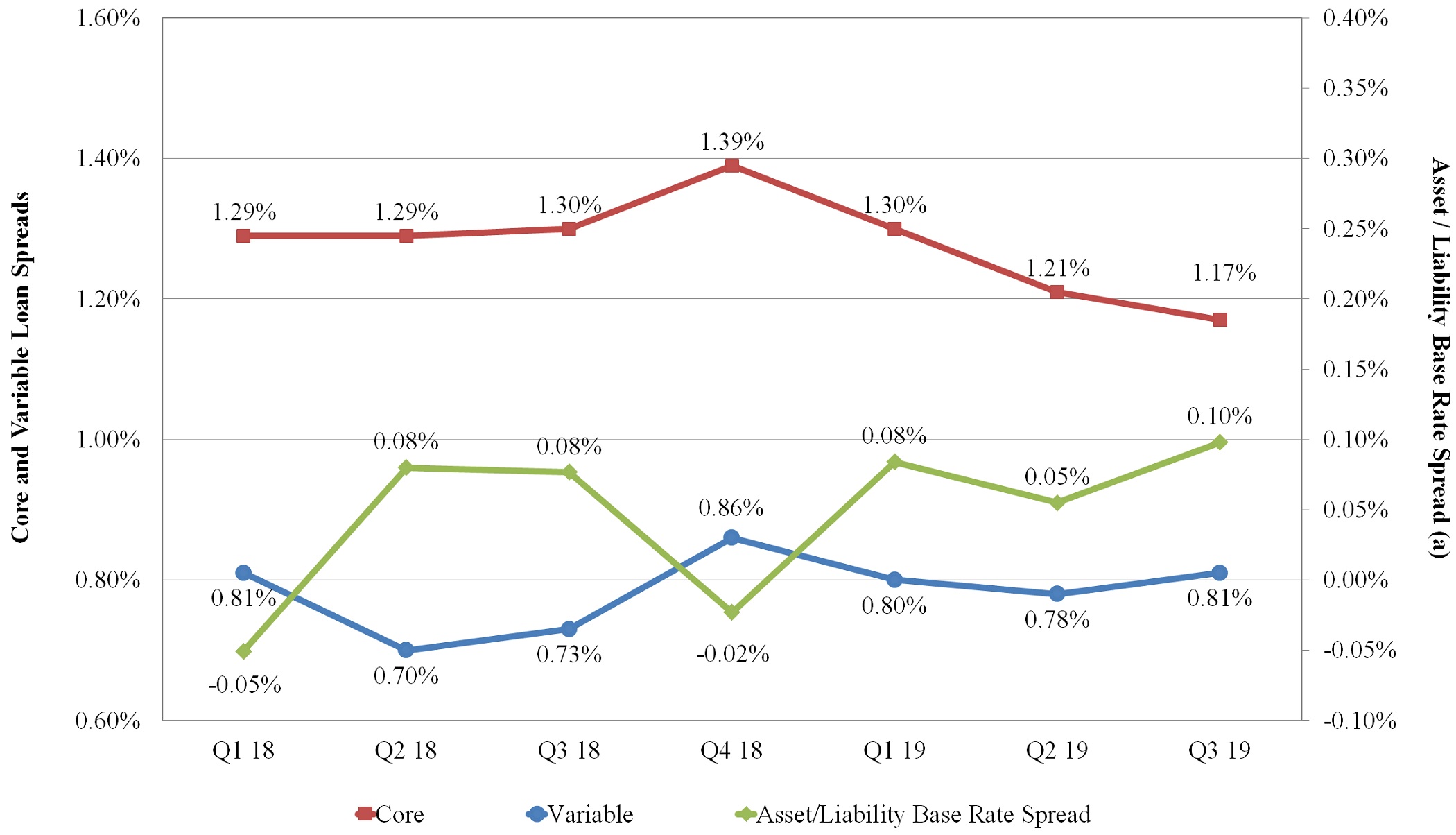

•The Company's average balance of loans decreased to $21.6 billion for the third quarter of 2019, compared with $23.0 billion for the same period in 2018. Loan spread increased to 1.04 percent for the quarter ended September 30, 2019, compared with 0.90 percent for the same period in 2018. Core loan spread, which includes the impact of derivative settlements, decreased to 1.17 percent for the quarter ended September 30, 2019, compared with 1.30 percent for the same period in 2018. Management believes core loan spread is a useful supplemental non-GAAP measure that reflects adjustments for derivative settlements related to net interest income (loan spread). However, there is no comprehensive authoritative guidance for the presentation of this measure, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance.

The Company recognized $19.7 million and $32.7 million in fixed rate floor income during the three months ended September 30, 2019 and 2018, respectively (which includes $7.1 million and $19.1 million, respectively, of settlement payments received on derivatives used to hedge student loans earning fixed rate floor income). Fixed rate floor income contributed 36 basis points and 57 basis points of core loan spread for the three months ended September 30, 2019 and 2018, respectively. The decrease in gross fixed rate floor income was due to higher interest rates in 2019 as compared to 2018, and the decrease in derivative settlement payments received on derivatives used to hedge student loans earning fixed rate floor income was due to a decrease in the notional amount of derivatives outstanding in 2019 as compared to 2018, partially offset by higher interest rates.

•Provision for loan losses was $10.0 million and $10.5 million for the three months ended September 30, 2019 and 2018, respectively, and $26.0 million and $18.0 million for the nine months ended September 30, 2019 and 2018, respectively.

Provision for loan losses for federally insured loans was $2.0 million and $8.0 million for the three months ended September 30, 2019 and 2018, respectively, and $6.0 million and $12.0 million for the nine months ended September 30, 2019 and 2018, respectively. During the third quarter of 2018, the Company determined an additional allowance was necessary related to a portfolio of federally insured loans that were purchased in 2013 and 2014, and recognized $5.0 million in provision expense related to these loans.

Provision for loan losses for consumer loans was $8.0 million and $2.5 million for the three months ended September 30, 2019 and 2018, respectively, and $20.0 million and $6.0 million for the nine months ended September 30, 2019 and 2018, respectively. The increase in provision was a result of the increased amount of consumer loan purchases during 2019. The Company purchased $298.1 million of consumer loans during the nine months ended September 30, 2019 ($113.3 million of which were purchased during the third quarter) compared to $80.4 million during the same period in 2018 ($42.8 million during the third quarter of 2018).

•The Company recognized $14.0 million of expenses during the three months ended September 30, 2019 and $15.8 million of expenses during the nine months ended September 30, 2019 related to the extinguishment of notes payable in certain asset-backed securitizations prior to the notes' contractual maturities (as further described below). These expenses consisted of premium payments made by the Company of $12.6 million and $14.0 million during the three and nine months ended September 30, 2019, respectively, and the write off of $1.4 million and $1.8 million of debt issuance costs during the three and nine months ended September 30, 2019, respectively.

Corporate and Other Activities

•The Company adopted a new lease accounting standard effective January 1, 2019. The most significant impact of the standard to the Company relates to (1) the recognition of new right-of-use ("ROU") assets and lease liabilities on its balance sheet primarily for office, data center, and dark fiber operating leases; (2) the deconsolidation of assets and liabilities for certain sale-leaseback transactions arising from build-to-suit lease arrangements for which construction was completed and the Company is leasing the constructed assets that did not qualify for sale accounting prior to the adoption of the new standard; and (3) significant new disclosures about the Company’s leasing activities.

Adoption of the new standard resulted in recognizing lease liabilities of $33.7 million based on the present value of the remaining minimum rental payments. In addition, the Company recognized ROU assets of $32.8 million, which corresponds to the lease liabilities reduced by deferred rent expense as of the effective date. The Company also deconsolidated total assets of $43.8 million and total liabilities of $34.8 million for entities that had been consolidated due to sale-leaseback transactions that failed to qualify for recognition as sales under the prior guidance. Deconsolidation of these entities reduced noncontrolling interests by $6.1 million.

Liquidity and Capital Resources

•As of September 30, 2019, the Company had cash and cash equivalents of $161.0 million. In addition, the Company had a portfolio of available-for-sale investments, consisting primarily of student loan asset-backed securities, with a fair value of $52.6 million as of September 30, 2019.

•As of September 30, 2019, the Company's $382.5 million unsecured line of credit had no amount outstanding and $382.5 million was available for future use. During the second quarter of 2019, the Company entered into a $22.0 million secured line of credit agreement, and as of September 30, 2019, this line of credit had $5.0 million outstanding and $17.0 million available for future use.

•The Company has repurchased certain of its own asset-backed securities (bonds and notes payable) in the secondary market. For accounting purposes, these notes are eliminated in consolidation and are not included in the Company's consolidated financial statements. However, these securities remain legally outstanding at the trust level and the Company could sell these notes to third parties or redeem the notes at par as cash is generated by the trust estate. Upon a sale of these notes to third parties, the Company would obtain cash proceeds equal to the market value of the notes on the date of such sale. As of September 30, 2019, the Company holds $15.0 million (par value) of its own asset-backed securities.

•During the nine months ended September 30, 2019, the Company generated $142.9 million of cash from operating activities.

•The majority of the Company’s portfolio of student loans is funded in asset-backed securitizations that will generate significant earnings and cash flow over the life of these transactions. As of September 30, 2019, the Company currently expects future undiscounted cash flows from its securitization portfolio to be approximately $1.88 billion.

Certain of the Company’s asset-backed securitizations were structured as “Turbo Transactions” which required all cash generated from the student loans (including excess spread) to be directed toward payment of interest and any outstanding principal generally until such time as all principal on the notes had been paid in full. Once the notes in such transactions were paid in full, the remaining unencumbered student loans (and other remaining assets, if any) in the securitization would be released to the Company, at which time the Company would have the option to refinance or sell these assets, or retain them on the balance sheet as unencumbered assets.

During the second and third quarters of 2019, the Company extinguished a total of $768.5 million of notes payable in certain asset-backed securitizations, including six of the Company's seven Turbo Transactions, prior to the notes' contractual maturities, resulting in the release of $1.15 billion in student loans and accrued interest receivable that were previously encumbered in the asset-backed securitizations. Upon extinguishment of the notes payable throughout the second and third quarters, the Company refinanced the student loans in its FFELP warehouse facilities and new asset-backed securitizations, resulting in net cash proceeds of $369.0 million. The Company used a portion of these proceeds to pay down the outstanding balance on its unsecured line of credit.

The cash proceeds generated by the debt extinguishments provide the Company with increased liquidity and the opportunity to invest the previously underutilized capital at higher returns.

•On January 11, 2019, the Company obtained a consumer loan warehouse facility with an aggregate maximum financing amount available of $100.0 million. On April 25, 2019, the Company amended the agreement for this warehouse facility to increase the aggregate maximum financing amount available to $200.0 million and extend the final maturity date to April 23, 2022. As of September 30, 2019, $144.0 million was outstanding under this facility and $56.0 million was available for future funding.

•During the first nine months of 2019, the Company completed five FFELP asset-backed securitizations totaling $2.2 billion (par value). The proceeds from these transactions were used primarily to refinance student loans included in the Company's FFELP warehouse facilities and unencumbered student loans from the extinguishment of certain asset-backed securitizations.

•On June 25, 2019, the Company completed a private education loan asset-backed securitization totaling $47.2 million (par value). The proceeds from this transaction were used to refinance private education loans previously funded via a private loan repurchase agreement that was terminated on June 25, 2019.

•During the nine months ended September 30, 2019, the Company repurchased a total of 723,832 shares of Class A common stock for $40.3 million ($55.62 per share), including 3,365 shares of Class A common stock repurchased during the three months ended September 30, 2019 for $0.2 million ($65.81 per share).

On May 8, 2019, the Board of Directors authorized a new stock repurchase program to repurchase up to a total of five million shares of the Company's Class A common stock during the three-year period ending May 7, 2022. The five million shares authorized under the new program include the remaining unrepurchased shares from the prior program, which the new program replaces. As of September 30, 2019, 4.8 million shares remained authorized for repurchase under the Company's stock repurchase program.

•During the nine months ended September 30, 2019, the Company paid cash dividends of $21.5 million ($0.54 per share), including $7.1 million ($0.18 per share) paid during the three months ended September 30, 2019. In addition, the Company's Board of Directors has declared a fourth quarter 2019 cash dividend on the Company's outstanding shares of Class A and Class B common stock of $0.20 per share. The fourth quarter cash dividend will be paid on December 13, 2019 to shareholders of record at the close of business on November 29, 2019.

•The Company intends to use its liquidity position to capitalize on market opportunities, including FFELP, private education, and consumer loan acquisitions; strategic acquisitions and investments; expansion of ALLO’s telecommunications network; and capital management initiatives, including stock repurchases, debt repurchases, and dividend distributions. The timing and size of these opportunities will vary and will have a direct impact on the Company’s cash and investment balances.

Subsequent Event

•Subsequent to September 30, 2019, the Company made the decision to sell $179.3 million (par value) of consumer loans to an unrelated third party who securitized such loans. As partial consideration received for the consumer loans sold, the Company received an approximate 29 percent residual interest in the consumer loan securitization. The Company will recognize a gain in the fourth quarter of 2019 of $15.5 million (pre-tax) from the sale of these loans.

Segment Reporting

The following tables include the results of each of the Company's reportable operating segments reconciled to the consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, 2019 | | | | | | | | | | | | | |

| Loan Servicing and Systems | | | Education Technology, Services, and Payment Processing | | | Communications | | | Asset

Generation and

Management | | | Corporate and Other Activities | | | Eliminations | | | Total | |

| Total interest income | $ | 532 | | | 3,499 | | | — | | | 233,225 | | | 2,859 | | | (1,171) | | | 238,945 | |

| Interest expense | 51 | | | 12 | | | — | | | 171,485 | | | 2,110 | | | (1,171) | | | 172,488 | |

| Net interest income (expense) | 481 | | | 3,487 | | | — | | | 61,740 | | | 749 | | | — | | | 66,457 | |

| Less provision for loan losses | — | | | — | | | — | | | 10,000 | | | — | | | — | | | 10,000 | |

| Net interest income (loss) after provision for loan losses | 481 | | | 3,487 | | | — | | | 51,740 | | | 749 | | | — | | | 56,457 | |

| Other income: | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 113,286 | | | — | | | — | | | — | | | — | | | — | | | 113,286 | |

| Intersegment servicing revenue | 11,611 | | | — | | | — | | | — | | | — | | | (11,611) | | | — | |

| Education technology, services, and payment processing revenue | — | | | 74,251 | | | — | | | — | | | — | | | — | | | 74,251 | |

| Communications revenue | — | | | — | | | 16,470 | | | — | | | — | | | — | | | 16,470 | |

| Other income | 2,291 | | | — | | | 532 | | | 3,384 | | | 7,231 | | | — | | | 13,439 | |

| Derivative settlements, net | — | | | — | | | — | | | 7,298 | | | — | | | — | | | 7,298 | |

| Derivative market value adjustments, net | — | | | — | | | — | | | (5,630) | | | — | | | — | | | (5,630) | |

| Total other income | 127,188 | | | 74,251 | | | 17,002 | | | 5,052 | | | 7,231 | | | (11,611) | | | 219,114 | |

| Cost of services: | | | | | | | | | | | | | |

| Cost to provide education technology, services, and payment processing services | — | | | 25,671 | | | — | | | — | | | — | | | — | | | 25,671 | |

| Cost to provide communications services | — | | | — | | | 5,236 | | | — | | | — | | | — | | | 5,236 | |

| Total cost of services | — | | | 25,671 | | | 5,236 | | | — | | | — | | | — | | | 30,907 | |

| Operating expenses: | | | | | | | | | | | | | |

| Salaries and benefits | 69,209 | | | 23,826 | | | 5,763 | | | 394 | | | 17,479 | | | — | | | 116,670 | |

| Depreciation and amortization | 8,565 | | | 2,997 | | | 10,926 | | | — | | | 5,212 | | | — | | | 27,701 | |

| Loan servicing fees to third parties | — | | | — | | | — | | | 3,382 | | | — | | | — | | | 3,382 | |

| Other expenses | 16,686 | | | 5,325 | | | 3,842 | | | 15,672 | | | 13,422 | | | — | | | 54,947 | |

| Intersegment expenses, net | 12,955 | | | 3,194 | | | 701 | | | 11,678 | | | (16,917) | | | (11,611) | | | — | |

| Total operating expenses | 107,415 | | | 35,342 | | | 21,232 | | | 31,126 | | | 19,196 | | | (11,611) | | | 202,700 | |

| Income (loss) before income taxes | 20,254 | | | 16,725 | | | (9,466) | | | 25,666 | | | (11,216) | | | — | | | 41,964 | |

| Income tax (expense) benefit | (4,861) | | | (4,014) | | | 2,272 | | | (6,160) | | | 3,935 | | | — | | | (8,829) | |

| Net income (loss) | 15,393 | | | 12,711 | | | (7,194) | | | 19,506 | | | (7,281) | | | — | | | 33,135 | |

| Net loss (income) attributable to noncontrolling interests | — | | | — | | | — | | | — | | | 77 | | | — | | | 77 | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 15,393 | | | 12,711 | | | (7,194) | | | 19,506 | | | (7,204) | | | — | | | 33,212 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2019 | | | | | | | | | | | | |

| Loan Servicing and Systems | | | Education Technology, Services, and Payment Processing | | | Communications | | | Asset

Generation and

Management | | | Corporate and Other Activities | | | Eliminations | | | Total | |

| Total interest income | $ | 550 | | | 1,659 | | | 1 | | | 243,295 | | | 2,258 | | | (974) | | | 246,788 | |

| Interest expense | 19 | | | 11 | | | — | | | 184,035 | | | 3,872 | | | (974) | | | 186,963 | |

| Net interest income (expense) | 531 | | | 1,648 | | | 1 | | | 59,260 | | | (1,614) | | | — | | | 59,825 | |

| Less provision for loan losses | — | | | — | | | — | | | 9,000 | | | — | | | — | | | 9,000 | |

| Net interest income (loss) after provision for loan losses | 531 | | | 1,648 | | | 1 | | | 50,260 | | | (1,614) | | | — | | | 50,825 | |

| Other income: | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 113,985 | | | — | | | — | | | — | | | — | | | — | | | 113,985 | |

| Intersegment servicing revenue | 11,598 | | | — | | | — | | | — | | | — | | | (11,598) | | | — | |

| Education technology, services, and payment processing revenue | — | | | 60,342 | | | — | | | — | | | — | | | — | | | 60,342 | |

| Communications revenue | — | | | — | | | 15,758 | | | — | | | — | | | — | | | 15,758 | |

| Other income | 2,277 | | | — | | | 362 | | | 4,888 | | | 8,624 | | | — | | | 16,152 | |

| | | | | | | | | | | | | |

| Derivative settlements, net | — | | | — | | | — | | | 12,972 | | | — | | | — | | | 12,972 | |

| Derivative market value adjustments, net | — | | | — | | | — | | | (37,060) | | | — | | | — | | | (37,060) | |

| Total other income | 127,860 | | | 60,342 | | | 16,120 | | | (19,200) | | | 8,624 | | | (11,598) | | | 182,149 | |

| Cost of services: | | | | | | | | | | | | | |

| Cost to provide education technology, services, and payment processing services | — | | | 15,871 | | | — | | | — | | | — | | | — | | | 15,871 | |

| Cost to provide communications services | — | | | — | | | 5,101 | | | — | | | — | | | — | | | 5,101 | |

| Total cost of services | — | | | 15,871 | | | 5,101 | | | — | | | — | | | — | | | 20,972 | |

| Operating expenses: | | | | | | | | | | | | | |

| Salaries and benefits | 66,496 | | | 22,823 | | | 5,192 | | | 382 | | | 16,321 | | | — | | | 111,214 | |

| Depreciation and amortization | 8,799 | | | 3,324 | | | 7,737 | | | — | | | 4,623 | | | — | | | 24,484 | |

| Loan servicing fees to third parties | — | | | — | | | — | | | 3,156 | | | — | | | — | | | 3,156 | |

| Other expenses | 17,118 | | | 5,805 | | | 3,865 | | | 3,051 | | | 12,423 | | | — | | | 42,261 | |

| Intersegment expenses, net | 13,604 | | | 3,148 | | | 716 | | | 11,665 | | | (17,535) | | | (11,598) | | | — | |

| Total operating expenses | 106,017 | | | 35,100 | | | 17,510 | | | 18,254 | | | 15,832 | | | (11,598) | | | 181,115 | |

| Income (loss) before income taxes | 22,374 | | | 11,019 | | | (6,490) | | | 12,806 | | | (8,822) | | | — | | | 30,887 | |

| Income tax (expense) benefit | (5,370) | | | (2,645) | | | 1,558 | | | (3,074) | | | 3,321 | | | — | | | (6,209) | |

| Net income (loss) | 17,004 | | | 8,374 | | | (4,932) | | | 9,732 | | | (5,501) | | | — | | | 24,678 | |

| Net loss (income) attributable to noncontrolling interests | — | | | — | | | — | | | — | | | (59) | | | — | | | (59) | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 17,004 | | | 8,374 | | | (4,932) | | | 9,732 | | | (5,560) | | | — | | | 24,619 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, 2018 | | | | | | | | | | | | | |

| Loan Servicing and Systems | | | Education Technology, Services, and Payment Processing | | | Communications | | | Asset

Generation and

Management | | | Corporate and Other

Activities | | | Eliminations | | | Total | |

| Total interest income | $ | 381 | | | 1,513 | | | 1 | | | 236,039 | | | 6,860 | | | (4,846) | | | 239,948 | |

| Interest expense | — | | | 3 | | | 4,174 | | | 176,874 | | | 3,968 | | | (4,846) | | | 180,175 | |

| Net interest income (expense) | 381 | | | 1,510 | | | (4,173) | | | 59,165 | | | 2,892 | | | — | | | 59,773 | |

| Less provision for loan losses | — | | | — | | | — | | | 10,500 | | | — | | | — | | | 10,500 | |

| Net interest income (loss) after provision for loan losses | 381 | | | 1,510 | | | (4,173) | | | 48,665 | | | 2,892 | | | — | | | 49,273 | |

| Other income: | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 112,579 | | | — | | | — | | | — | | | — | | | — | | | 112,579 | |

| Intersegment servicing revenue | 12,290 | | | — | | | — | | | — | | | — | | | (12,290) | | | — | |

| Education technology, services, and payment processing revenue | — | | | 58,409 | | | — | | | — | | | — | | | — | | | 58,409 | |

| Communications revenue | — | | | — | | | 11,818 | | | — | | | — | | | — | | | 11,818 | |

| Other income | 1,948 | | | — | | | 950 | | | 3,267 | | | 10,508 | | | — | | | 16,673 | |

| | | | | | | | | | | | | |

| Derivative settlements, net | — | | | — | | | — | | | 22,448 | | | (124) | | | — | | | 22,324 | |

| Derivative market value adjustments, net | — | | | — | | | — | | | (6,056) | | | 830 | | | — | | | (5,226) | |

| Total other income | 126,817 | | | 58,409 | | | 12,768 | | | 19,659 | | | 11,214 | | | (12,290) | | | 216,577 | |

| Cost of services: | | | | | | | | | | | | | |

| Cost to provide education technology, services, and payment processing services | — | | | 19,087 | | | — | | | — | | | — | | | — | | | 19,087 | |

| Cost to provide communications services | — | | | — | | | 4,310 | | | — | | | — | | | — | | | 4,310 | |

| Total cost of services | — | | | 19,087 | | | 4,310 | | | — | | | — | | | — | | | 23,397 | |

| Operating expenses: | | | | | | | | | | | | | |

| Salaries and benefits | 70,440 | | | 19,972 | | | 4,554 | | | 424 | | | 18,782 | | | — | | | 114,172 | |

| Depreciation and amortization | 8,957 | | | 3,435 | | | 6,167 | | | — | | | 4,433 | | | — | | | 22,992 | |

| Loan servicing fees to third parties | — | | | — | | | — | | | 3,087 | | | — | | | — | | | 3,087 | |

| Other expenses | 19,638 | | | 4,943 | | | 3,151 | | | 845 | | | 16,616 | | | — | | | 45,194 | |

| Intersegment expenses, net | 15,029 | | | 2,494 | | | 598 | | | 12,378 | | | (18,208) | | | (12,290) | | | — | |

| Total operating expenses | 114,064 | | | 30,844 | | | 14,470 | | | 16,734 | | | 21,623 | | | (12,290) | | | 185,445 | |

| Income (loss) before income taxes | 13,134 | | | 9,988 | | | (10,185) | | | 51,590 | | | (7,517) | | | — | | | 57,008 | |

| Income tax (expense) benefit | (3,152) | | | (2,397) | | | 2,444 | | | (12,381) | | | 1,604 | | | — | | | (13,882) | |

| Net income (loss) | 9,982 | | | 7,591 | | | (7,741) | | | 39,209 | | | (5,913) | | | — | | | 43,126 | |

| Net loss (income) attributable to noncontrolling interests | — | | | — | | | — | | | — | | | (199) | | | — | | | (199) | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 9,982 | | | 7,591 | | | (7,741) | | | 39,209 | | | (6,112) | | | — | | | 42,927 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Nine months ended September 30, 2019 | | | | | | | | | | | | | |

| Loan Servicing and Systems | | | Education Technology, Services, and Payment Processing | | | Communications | | | Asset

Generation and

Management | | | Corporate and Other

Activities | | | Eliminations | | | Total | |

| Total interest income | $ | 1,579 | | | 7,175 | | | 3 | | | 723,388 | | | 7,170 | | | (2,995) | | | 736,319 | |

| Interest expense | 70 | | | 32 | | | — | | | 544,319 | | | 9,796 | | | (2,995) | | | 551,221 | |

| Net interest income (expense) | 1,509 | | | 7,143 | | | 3 | | | 179,069 | | | (2,626) | | | — | | | 185,098 | |

| Less provision for loan losses | — | | | — | | | — | | | 26,000 | | | — | | | — | | | 26,000 | |

| Net interest income (loss) after provision for loan losses | 1,509 | | | 7,143 | | | 3 | | | 153,069 | | | (2,626) | | | — | | | 159,098 | |

| Other income: | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 342,169 | | | — | | | — | | | — | | | — | | | — | | | 342,169 | |

| Intersegment servicing revenue | 35,426 | | | — | | | — | | | — | | | — | | | (35,426) | | | — | |

Education technology, services, and payment processing

revenue | — | | | 213,753 | | | — | | | — | | | — | | | — | | | 213,753 | |

| Communications revenue | — | | | — | | | 46,770 | | | — | | | — | | | — | | | 46,770 | |

| Other income | 6,642 | | | — | | | 1,019 | | | 11,796 | | | 19,200 | | | — | | | 38,658 | |

| | | | | | | | | | | | | |

| Derivative settlements, net | — | | | — | | | — | | | 39,306 | | | — | | | — | | | 39,306 | |

| Derivative market value adjustments, net | — | | | — | | | — | | | (73,265) | | | — | | | — | | | (73,265) | |

| Total other income | 384,237 | | | 213,753 | | | 47,789 | | | (22,163) | | | 19,200 | | | (35,426) | | | 607,391 | |

| Cost of services: | | | | | | | | | | | | | |

Cost to provide education technology, services, and payment

processing services | — | | | 62,601 | | | — | | | — | | | — | | | — | | | 62,601 | |

| Cost to provide communications services | — | | | — | | | 15,096 | | | — | | | — | | | — | | | 15,096 | |

| Total cost of services | — | | | 62,601 | | | 15,096 | | | — | | | — | | | — | | | 77,697 | |

| Operating expenses: | | | | | | | | | | | | | |

| Salaries and benefits | 201,924 | | | 69,656 | | | 15,692 | | | 1,153 | | | 50,517 | | | — | | | 338,942 | |

| Depreciation and amortization | 26,236 | | | 9,832 | | | 26,025 | | | — | | | 14,305 | | | — | | | 76,398 | |

| Loan servicing fees to third parties | — | | | — | | | — | | | 9,431 | | | — | | | — | | | 9,431 | |

| Other expenses | 52,732 | | | 16,440 | | | 11,184 | | | 19,667 | | | 38,107 | | | — | | | 138,131 | |

| Intersegment expenses, net | 40,317 | | | 9,642 | | | 2,081 | | | 35,630 | | | (52,244) | | | (35,426) | | | — | |

| Total operating expenses | 321,209 | | | 105,570 | | | 54,982 | | | 65,881 | | | 50,685 | | | (35,426) | | | 562,902 | |

| Income (loss) before income taxes | 64,537 | | | 52,725 | | | (22,286) | | | 65,025 | | | (34,111) | | | — | | | 125,890 | |

| Income tax (expense) benefit | (15,489) | | | (12,654) | | | 5,349 | | | (15,606) | | | 11,971 | | | — | | | (26,429) | |

| Net income (loss) | 49,048 | | | 40,071 | | | (16,937) | | | 49,419 | | | (22,140) | | | — | | | 99,461 | |

| Net loss (income) attributable to noncontrolling interests | — | | | — | | | — | | | — | | | (38) | | | — | | | (38) | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 49,048 | | | 40,071 | | | (16,937) | | | 49,419 | | | (22,178) | | | — | | | 99,423 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, 2018 | | | | | | | | | | | | | |

| Loan Servicing and Systems | | | Education Technology, Services, and Payment Processing | | | Communications | | | Asset Generation and Management | | Corporate and Other Activities | | | Eliminations | | | Total | | |

| Total interest income | $ | 931 | | | 2,927 | | | 3 | | | 662,881 | | | 17,673 | | | (12,420) | | | 671,995 | | |

| Interest expense | — | | | 3 | | | 9,987 | | | 480,729 | | | 8,875 | | | (12,420) | | | 487,174 | | |

| Net interest income (expense) | 931 | | | 2,924 | | | (9,984) | | | 182,152 | | | 8,798 | | | — | | | 184,821 | | |

| Less provision for loan losses | — | | | — | | | — | | | 18,000 | | | — | | | — | | | 18,000 | | |

| Net interest income (loss) after provision for loan losses | 931 | | | 2,924 | | | (9,984) | | | 164,152 | | | 8,798 | | | — | | | 166,821 | | |

| Other income: | | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 327,265 | | | — | | | — | | | — | | | — | | | — | | | 327,265 | | |

| Intersegment servicing revenue | 34,670 | | | — | | | — | | | — | | | — | | | (34,670) | | | — | | |

| Education technology, services, and payment processing revenue | — | | | 167,372 | | | — | | | — | | | — | | | — | | | 167,372 | | |

| Communications revenue | — | | | — | | | 31,327 | | | — | | | — | | | — | | | 31,327 | | |

| Other income | 5,196 | | | — | | | 950 | | | 9,391 | | | 29,272 | | | — | | | 44,808 | | |

| | | | | | | | | | | | | | |

| Derivative settlements, net | — | | | — | | | — | | | 51,428 | | | (410) | | | — | | | 51,018 | | |

| Derivative market value adjustments, net | — | | | — | | | — | | | 47,070 | | | 2,839 | | | — | | | 49,909 | | |

| Total other income | 367,131 | | | 167,372 | | | 32,277 | | | 107,889 | | | 31,701 | | | (34,670) | | | 671,699 | | |

| Cost of services: | | | | | | | | | | | | | | |

| Cost to provide education technology, services, and payment processing services | — | | | 44,087 | | | — | | | — | | | — | | | — | | | 44,087 | | |

| Cost to provide communications services | — | | | — | | | 11,892 | | | — | | | — | | | — | | | 11,892 | | |

| Total cost of services | — | | | 44,087 | | | 11,892 | | | — | | | — | | | — | | | 55,979 | | |

| Operating expenses: | | | | | | | | | | | | | | |

| Salaries and benefits | 198,411 | | | 58,552 | | | 13,284 | | | 1,183 | | | 50,502 | | | — | | | 321,932 | | |

| Depreciation and amortization | 23,237 | | | 10,062 | | | 16,585 | | | — | | | 13,058 | | | — | | | 62,943 | | |

| Loan servicing fees to third parties | — | | | — | | | — | | | 9,428 | | | — | | | — | | | 9,428 | | |

| Other expenses | 51,591 | | | 14,950 | | | 8,811 | | | 2,982 | | | 40,686 | | | — | | | 119,020 | | |

| Intersegment expenses, net | 43,968 | | | 7,630 | | | 1,802 | | | 34,943 | | | (53,672) | | | (34,670) | | | — | | |

| Total operating expenses | 317,207 | | | 91,194 | | | 40,482 | | | 48,536 | | | 50,574 | | | (34,670) | | | 513,323 | | |

| Income (loss) before income taxes | 50,855 | | | 35,015 | | | (30,081) | | | 223,505 | | | (10,075) | | | — | | | 269,218 | | |

| Income tax (expense) benefit | (12,399) | | | (8,404) | | | 7,220 | | | (53,641) | | | 3,855 | | | — | | | (63,369) | | |

| Net income (loss) | 38,456 | | | 26,611 | | | (22,861) | | | 169,864 | | | (6,220) | | | — | | | 205,849 | | |

| Net loss (income) attributable to noncontrolling interests | 808 | | | — | | | — | | | — | | | (371) | | | — | | | 438 | | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 39,264 | | | 26,611 | | | (22,861) | | | 169,864 | | | (6,591) | | | — | | | 206,287 | | |

Net Interest Income, Net of Settlements on Derivatives

The following table summarizes the components of "net interest income" and "derivative settlements, net."

Derivative settlements represent the cash paid or received during the current period to settle with derivative instrument counterparties the economic effect of the Company's derivative instruments based on their contractual terms. Derivative accounting requires that net settlements with respect to derivatives that do not qualify for "hedge treatment" under GAAP be recorded in a separate income statement line item below net interest income. The Company maintains an overall risk management strategy that incorporates the use of derivative instruments to reduce the economic effect of interest rate volatility. As such, management believes derivative settlements for each applicable period should be evaluated with the Company’s net interest income as presented in the table below. Net interest income (net of settlements on derivatives) is a non-GAAP financial measure, and the Company reports this non-GAAP information because the Company believes that it provides additional information regarding operational and performance indicators that are closely assessed by management. There is no comprehensive, authoritative guidance for the presentation of such non-GAAP information, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance. See "Derivative Settlements" included in this supplement for the net settlement activity recognized by the Company for each type of derivative for the periods presented in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | | | | | Nine months ended | | |

| September 30, 2019 | | June 30, 2019 | | | | September 30, 2018 | | September 30, 2019 | | September 30, 2018 |

| Variable loan interest margin | $ | 46,051 | | | 44,310 | | | | | 42,455 | | | 134,312 | | | 129,756 | |

| Settlements on associated derivatives (a) | 234 | | | 807 | | | | | 3,361 | | | 3,375 | | | 4,676 | |

| Variable loan interest margin, net of settlements on derivatives | 46,285 | | | 45,117 | | | | | 45,816 | | | 137,687 | | | 134,432 | |

| Fixed rate floor income | 12,685 | | | 10,840 | | | | | 13,659 | | | 33,950 | | | 45,359 | |

| Settlements on associated derivatives (b) | 7,064 | | | 12,165 | | | | | 19,087 | | | 35,931 | | | 46,752 | |

| Fixed rate floor income, net of settlements on derivatives | 19,749 | | | 23,005 | | | | | 32,746 | | | 69,881 | | | 92,111 | |

| Investment interest | 9,882 | | | 8,566 | | | | | 7,628 | | | 26,701 | | | 18,581 | |

| Corporate debt interest expense | (2,161) | | | (3,891) | | | | | (3,969) | | | (9,865) | | | (8,875) | |

| Non-portfolio related derivative settlements (c) | — | | | — | | | | | (124) | | | — | | | (410) | |

| Net interest income (net of settlements on derivatives) | $ | 73,755 | | | 72,797 | | | | | 82,097 | | | 224,404 | | | 235,839 | |

(a) Includes the net settlements received related to the Company’s 1:3 basis swaps.

(b) Includes the net settlements received related to the Company’s floor income interest rate swaps.

(c) Includes the net settlements paid related to the Company’s hybrid debt hedges.

Loan Servicing and Systems Revenue

The following table provides disaggregated revenue by service offering for the Loan Servicing and Systems operating segment. The Company purchased Great Lakes on February 7, 2018. The results of Great Lakes' operations are reported in the Company's consolidated financial statements from the date of acquisition.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | | | | Nine months ended | | | | | | | |

| September 30, 2019 | | June 30, 2019 | | September 30, 2018 | | September 30, 2019 | | September 30, 2018 | | | | |

| Government servicing - Nelnet | $ | 38,645 | | | 40,459 | | | 38,907 | | | 118,744 | | | 118,015 | | | | | |

| Government servicing - Great Lakes | 46,234 | | | 45,973 | | | 45,671 | | | 139,285 | | | 122,107 | | | | | |

| Private education and consumer loan servicing | 9,561 | | | 8,985 | | | 10,007 | | | 28,026 | | | 31,990 | | | | | |

| FFELP servicing | 6,089 | | | 6,424 | | | 7,422 | | | 19,208 | | | 24,259 | | | | | |

| Software services | 10,493 | | | 10,021 | | | 8,201 | | | 30,255 | | | 24,461 | | | | | |

| Outsourced services and other | 2,264 | | | 2,123 | | | 2,371 | | | 6,651 | | | 6,433 | | | | | |

| Loan servicing and systems revenue | $ | 113,286 | | | 113,985 | | | 112,579 | | | 342,169 | | | 327,265 | | | | | |

Loan Servicing Volumes

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of | | | | | | | | | | | | | | |

| December 31,

2017 | | March 31,

2018 | | June 30,

2018 | | September 30,

2018 | | December 31,

2018 | | March 31,

2019 | | June 30,

2019 | | September 30,

2019 |

Servicing volume

(dollars in millions): | | | | | | | | | | | | | | | |

| Nelnet: | | | | | | | | | | | | | | | |

| Government | $ | 172,669 | | | 176,605 | | | 176,179 | | | 179,283 | | | 179,507 | | | 183,093 | | | 181,682 | | | 184,399 | |

| FFELP | 27,262 | | | 26,969 | | | 37,599 | | | 37,459 | | | 36,748 | | | 35,917 | | | 35,003 | | | 33,981 | |

| Private and consumer | 11,483 | | | 12,116 | | | 15,016 | | | 15,466 | | | 15,666 | | | 16,065 | | | 16,025 | | | 16,286 | |

| Great Lakes: | | | | | | | | | | | | | | | |

| Government | — | | | 242,063 | | | 241,902 | | | 232,741 | | | 232,694 | | | 237,050 | | | 236,500 | | | 240,268 | |

| FFELP (a) | — | | | 11,136 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Private and consumer (a) | — | | | 1,927 | | | 31 | | | — | | | — | | | — | | | — | | | — | |

| Total | $ | 211,414 | | | 470,816 | | | 470,727 | | | 464,949 | | | 464,615 | | | 472,125 | | | 469,210 | | | 474,934 | |

| | | | | | | | | | | | | | | |

| Number of servicing borrowers: | | | | | | | | | | | | | | | |

| Nelnet: | | | | | | | | | | | | | | | |

| Government | 5,877,414 | | | 5,819,286 | | | 5,745,181 | | | 5,805,307 | | | 5,771,923 | | | 5,708,582 | | | 5,592,989 | | | 5,635,653 | |

| FFELP | 1,420,311 | | | 1,399,280 | | | 1,787,419 | | | 1,754,247 | | | 1,709,853 | | | 1,650,785 | | | 1,588,530 | | | 1,529,392 | |

| Private and consumer | 502,114 | | | 508,750 | | | 672,520 | | | 692,763 | | | 696,933 | | | 699,768 | | | 693,410 | | | 701,299 | |

| Great Lakes: | | | | | | | | | | | | | | | |

| Government | — | | | 7,456,830 | | | 7,378,875 | | | 7,486,311 | | | 7,458,684 | | | 7,385,284 | | | 7,300,691 | | | 7,430,165 | |

| FFELP (a) | — | | | 461,553 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Private and consumer (a) | — | | | 118,609 | | | 3,987 | | | — | | | — | | | — | | | — | | | — | |

| Total | 7,799,839 | | | 15,764,308 | | | 15,587,982 | | | 15,738,628 | | | 15,637,393 | | | 15,444,419 | | | 15,175,620 | | | 15,296,509 | |

| | | | | | | | | | | | | | | |

| Number of remote hosted borrowers: | 2,812,713 | | | 6,207,747 | | | 6,145,981 | | | 6,406,923 | | | 6,393,151 | | | 6,332,261 | | | 6,211,132 | | | 6,457,296 | |

(a) During the second quarter of 2018, the Company converted Great Lakes' FFELP and private education servicing

volume to Nelnet Servicing's platform to leverage the efficiencies of supporting more volume on fewer systems.

Education Technology, Services, and Payment Processing

The following table provides disaggregated revenue by servicing offering for the Education Technology, Services, and Payment Processing operating segment.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | | | Nine months ended | | | | | | |

| September 30, 2019 | | June 30, 2019 | | September 30, 2018 | | September 30, 2019 | | September 30, 2018 | | | | |

| Tuition payment plan services | $ | 25,760 | | | 24,655 | | | 19,771 | | | 80,589 | | | 63,209 | | | | | |

| Payment processing | 35,138 | | | 21,311 | | | 26,956 | | | 85,428 | | | 62,908 | | | | | |

| Education technology and services | 13,067 | | | 14,096 | | | 11,419 | | | 46,872 | | | 40,411 | | | | | |

| Other | 286 | | | 280 | | | 263 | | | 864 | | | 844 | | | | | |

| Education technology, services, and payment processing revenue | $ | 74,251 | | | 60,342 | | | 58,409 | | | 213,753 | | | 167,372 | | | | | |

Communications Financial and Operating Data

Certain financial and operating data for ALLO is summarized in the tables below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | | | | | | | | | | | Nine months ended | | | | | | |

| September 30, 2019 | | | | | | June 30, 2019 | | | | September 30, 2018 | | | | September 30, 2019 | | | | September 30, 2018 | | |

| Residential revenue | $ | 12,397 | | | 75.3 | % | | | | $ | 11,890 | | | 75.5 | % | | $ | 8,896 | | | 75.3 | % | | $ | 35,351 | | | 75.6 | % | | $ | 23,367 | | | 74.6 | % |

| Business revenue | 4,025 | | | 24.4 | | | | | 3,816 | | | 24.2 | | | 2,861 | | | 24.2 | | | 11,256 | | | 24.1 | | | 7,779 | | | 24.8 | |

| Other | 48 | | | 0.3 | | | | | 52 | | | 0.3 | | | 61 | | | 0.5 | | | 163 | | | 0.3 | | | 181 | | | 0.6 | |

| Communications revenue | $ | 16,470 | | | 100.0 | % | | | | $ | 15,758 | | | 100.0 | % | | $ | 11,818 | | | 100.0 | % | | $ | 46,770 | | | 100.0 | % | | $ | 31,327 | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Internet | $ | 9,899 | | | 60.1 | % | | | | $ | 9,297 | | | 59.0 | % | | $ | 6,453 | | | 54.6 | % | | $ | 27,641 | | | 59.1 | % | | $ | 16,541 | | | 52.8 | % |

| Television | 4,068 | | 24.7 | | | | | 4,050 | | | 25.7 | | | 3,380 | | 28.6 | | | 12,020 | | | 25.7 | | | 9,241 | | | 29.5 | |

| Telephone | 2,487 | | 15.1 | | | | | 2,395 | | | 15.2 | | | 1,962 | | 16.6 | | | 7,062 | | | 15.1 | | | 5,482 | | | 17.5 | |

| Other | 16 | | 0.1 | | | | | 16 | | | 0.1 | | | 23 | | 0.2 | | | 47 | | | 0.1 | | | 63 | | | 0.2 | |

| Communications revenue | $ | 16,470 | | | 100.0 | % | | | | $ | 15,758 | | | 100.0 | % | | $ | 11,818 | | | 100.0 | % | | $ | 46,770 | | | 100.0 | % | | $ | 31,327 | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss | $ | (7,194) | | | | | | | (4,932) | | | | | (7,741) | | | | | (16,937) | | | | | (22,861) | | | |

| EBITDA (a) | 1,460 | | | | | | | 1,246 | | | | | 155 | | | | | 3,736 | | | | | (3,512) | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | 10,187 | | | | | | | 15,040 | | | | | 21,728 | | | | | 37,185 | | | | | 66,816 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2019 | | As of

June 30,

2019 | | As of

March 31,

2019 | | As of December 31, 2018 | | As of September 30, 2018 | | As of

June 30,

2018 | | As of

March 31,

2018 | | As of December 31, 2017 |

| Residential customer information: | | | | | | | | | | | | | | | |

| Households served | 45,228 | | | 42,760 | | | 40,338 | | | 37,351 | | | 32,529 | | | 27,643 | | | 23,541 | | | 20,428 | |

| Households passed (b) | 137,269 | | | 132,984 | | | 127,253 | | | 122,396 | | | 110,687 | | | 98,538 | | | 84,475 | | | 71,426 | |

| Households served/passed | 32.9 | % | | 32.2 | % | | 31.7 | % | | 30.5 | % | | 29.4 | % | | 28.1 | % | | 27.9 | % | | 28.6 | % |

| Total households in current markets and new markets announced (c) | 159,974 | | | 159,974 | | | 152,840 | | | 152,840 | | | 142,602 | | | 137,500 | | | 137,500 | | | 137,500 | |

(a) Earnings (loss) before interest, income taxes, depreciation, and amortization ("EBITDA") is a supplemental non-GAAP performance measure that is frequently used in capital-intensive industries such as telecommunications. ALLO's management uses EBITDA to compare ALLO's performance to that of its competitors and to eliminate certain non-cash and non-operating items in order to consistently measure performance from period to period. EBITDA excludes interest and income taxes because these items are associated with a company's particular capitalization and tax structures. EBITDA also excludes depreciation and amortization expense because these non-cash expenses primarily reflect the impact of historical capital investments, as opposed to the cash impacts of capital expenditures made in recent periods, which may be evaluated through cash flow measures. The Company reports EBITDA for ALLO because the Company believes that it provides useful additional information for investors regarding a key metric used by management to assess ALLO's performance. There are limitations to using EBITDA as a performance measure, including the difficulty associated with comparing companies that use similar performance measures whose calculations may differ from ALLO's calculations. In addition, EBITDA should not be considered a substitute for other

measures of financial performance, such as net income or any other performance measures derived in accordance with GAAP. A reconciliation of EBITDA from ALLO's net loss under GAAP is presented below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | | | | | Nine months ended | | |

| September 30, 2019 | | | | June 30, 2019 | | September 30, 2018 | | September 30, 2019 | | September 30, 2018 |

| Net loss | $ | (7,194) | | | | | (4,932) | | | (7,741) | | | (16,937) | | | (22,861) | |

| Net interest (income) expense | — | | | | | (1) | | | 4,173 | | | (3) | | | 9,984 | |

| Income tax benefit | (2,272) | | | | | (1,558) | | | (2,444) | | | (5,349) | | | (7,220) | |

| Depreciation and amortization | 10,926 | | | | | 7,737 | | | 6,167 | | | 26,025 | | | 16,585 | |

| Earnings (loss) before interest, income taxes, depreciation, and amortization (EBITDA) | $ | 1,460 | | | | | 1,246 | | | 155 | | | 3,736 | | | (3,512) | |

(b) Represents the number of single residence homes, apartments, and condominiums that ALLO already serves and those in which ALLO has the capacity to connect to its network distribution system without further material extensions to the transmission lines, but have not been connected.

(c) During the second quarter of 2019, ALLO announced plans to expand its network to make services available in Breckenridge Colorado. ALLO is now in ten communities, including eight in Nebraska and two in Colorado.

Other Income

The following table summarizes the components of "other income."

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | | | Nine months ended | | |

| | September 30, 2019 | | June 30, 2019 | | September 30, 2018 | | September 30, 2019 | | September 30, 2018 |

| Borrower late fee income | $ | 3,196 | | | 3,161 | | | 3,253 | | | 9,870 | | | 8,994 | |

| Management fee revenue | 2,084 | | | 2,051 | | | 1,756 | | | 6,007 | | | 4,673 | |

| Gain on investments and notes receivable, net of losses | 1,948 | | | 4,258 | | | 2,503 | | | 5,779 | | | 10,291 | |

| Investment advisory services | 753 | | | 731 | | | 1,183 | | | 2,194 | | | 4,169 | |

| | | | | | | | | |

| Other | 5,458 | | | 5,951 | | | 7,978 | | | 14,808 | | | 16,681 | |

| Other income | $ | 13,439 | | | 16,152 | | | 16,673 | | | 38,658 | | | 44,808 | |

Derivative Settlements

The following table summarizes the components of "derivative settlements, net" included in the attached consolidated statements of income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | | | | | Nine months ended | | |

| | September 30, 2019 | | | | June 30, 2019 | | September 30, 2018 | | September 30, 2019 | | September 30, 2018 |

| 1:3 basis swaps | $ | 234 | | | | | 807 | | | 3,361 | | | 3,375 | | | 4,676 | |

| Interest rate swaps - floor income hedges | 7,064 | | | | | 12,165 | | | 19,087 | | | 35,931 | | | 46,752 | |

| Interest rate swaps - hybrid debt hedges | — | | | | | — | | | (124) | | | — | | | (410) | |

| Total derivative settlements - income | $ | 7,298 | | | | | 12,972 | | | 22,324 | | | 39,306 | | | 51,018 | |

Loans Receivable

Loans receivable consisted of the following:

| | | | | | | | | | | | | | | | | | | | | |

| As of | | | | As of | | As of | | |

| | September 30, 2019 | | | | December 31, 2018 | | September 30, 2018 | | |

| Federally insured student loans: | | | | | | | | | |

| Stafford and other | $ | 4,720,338 | | | | | 4,969,667 | | | 4,956,324 | | | |

| Consolidation | 15,975,499 | | | | | 17,186,229 | | | 17,434,419 | | | |

| Total | 20,695,837 | | | | | 22,155,896 | | | 22,390,743 | | | |

| Private education loans | 189,912 | | | | | 225,975 | | | 169,467 | | | |

| Consumer loans | 321,199 | | | | | 138,627 | | | 112,547 | | | |

| | 21,206,948 | | | | | 22,520,498 | | | 22,672,757 | | | |

| Loan discount, net of unamortized loan premiums and deferred origination costs | (36,483) | | | | | (53,572) | | | (63,566) | | | |

| Non-accretable discount | (32,607) | | | | | (29,396) | | | (20,612) | | | |

| Allowance for loan losses: | | | | | | | | | |

| Federally insured loans | (37,676) | | | | | (42,310) | | | (43,053) | | | |

| Private education loans | (9,882) | | | | | (10,838) | | | (11,253) | | | |

| Consumer loans | (18,859) | | | | | (7,240) | | | (5,911) | | | |

| | $ | 21,071,441 | | | | | 22,377,142 | | | 22,528,362 | | | |

Loan Activity

The following table sets forth the activity of loans:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | | | Nine months ended | | |

| | September 30, 2019 | | June 30, 2019 | | September 30, 2018 | | September 30, 2019 | | September 30, 2018 |

| Beginning balance | $ | 21,590,836 | | | 22,082,643 | | | 22,856,285 | | | 22,520,498 | | | 21,995,877 | |

| Loan acquisitions: | | | | | | | | | |

| Federally insured student loans | 248,542 | | | 570,092 | | | 591,196 | | | 1,088,649 | | | 3,124,154 | |

| Private education loans | 3,804 | | | — | | | — | | | 3,804 | | | 194 | |

| Consumer loans | 113,338 | | | 114,633 | | | 42,819 | | | 298,092 | | | 80,385 | |

| Total loan acquisitions | 365,684 | | | 684,725 | | | 634,015 | | | 1,390,545 | | | 3,204,733 | |

| Repayments, claims, capitalized interest, and other | (497,762) | | | (873,466) | | | (502,474) | | | (1,875,948) | | | (1,714,820) | |