2022 Letter to Shareholders | Page 1 Dear Shareholder, Nelnet produced significant long-term value for all our constituents in 2022 including our customers, our associates, our community, and our shareholders. The year ended up being quite a ride, as we predicted it would be in last year’s letter to our shareholders. The uncertainty caused by an election year, economic turbulence, continued supply chain disruptions, and a major world power launching an invasion of a sovereign nation—resulting in an increase in global energy costs—made a lot of business decisions very fluid. Some decisions were strategic, some were opportunistic, and some were reactive to ever-changing circumstances. In last year’s letter, Executive Chairman Mike Dunlap made some strong predictions about the economy and how certain aspects would play out including: the effect of unprecedented government stimulus and the impact of the substantial excess cash infused into the economy on the valuation of growth stocks, meme stocks, special purpose acquisition companies (SPACs), cryptocurrencies, and real estate prices. He also was concerned with overall hyper- inflated equity valuations, especially “growth-at-all-costs-focused” fintechs and their sustainability in a rising-rate environment. His skepticism was due to some nascent companies’ reliance upon credit loss models that had not been tested in a rising-rate environment or a period of unstable capital markets—not to mention the inevitable equity and credit markets’ reaction to the Federal Reserve increasing interest rates to tame rapid inflation and to slow down overblown asset valuations across the board. These predictions were based upon a lifetime of battle scars we acquired the hard way by learning ourselves. As the year progressed and the markets experienced increased volatility, we listened to business news pundits and finance company executives start to talk about how the market was no longer valuing growth for growth’s sake and how investors were now valuing positive net income and positive cash flow. It was great to hear market participants start to validate what we have always valued as a leadership team and have attempted to achieve in all our businesses, which is growing after-tax cash flow over a long-time horizon. In 2022, our corporate objectives were to enhance customer experiences across all our divisions, grow our core business segments, diversify our products and services, energize our associates, exceed our financial targets, and continue to reposition the company for the long-term considering our shrinking Federal Family Education Loan Program (FFELP) portfolio. We made significant progress toward all those objectives. All our core businesses including servicing, payments and education technology, and financial services performed very well in 2022, especially amid the external storms that were brewing. February 28, 2023

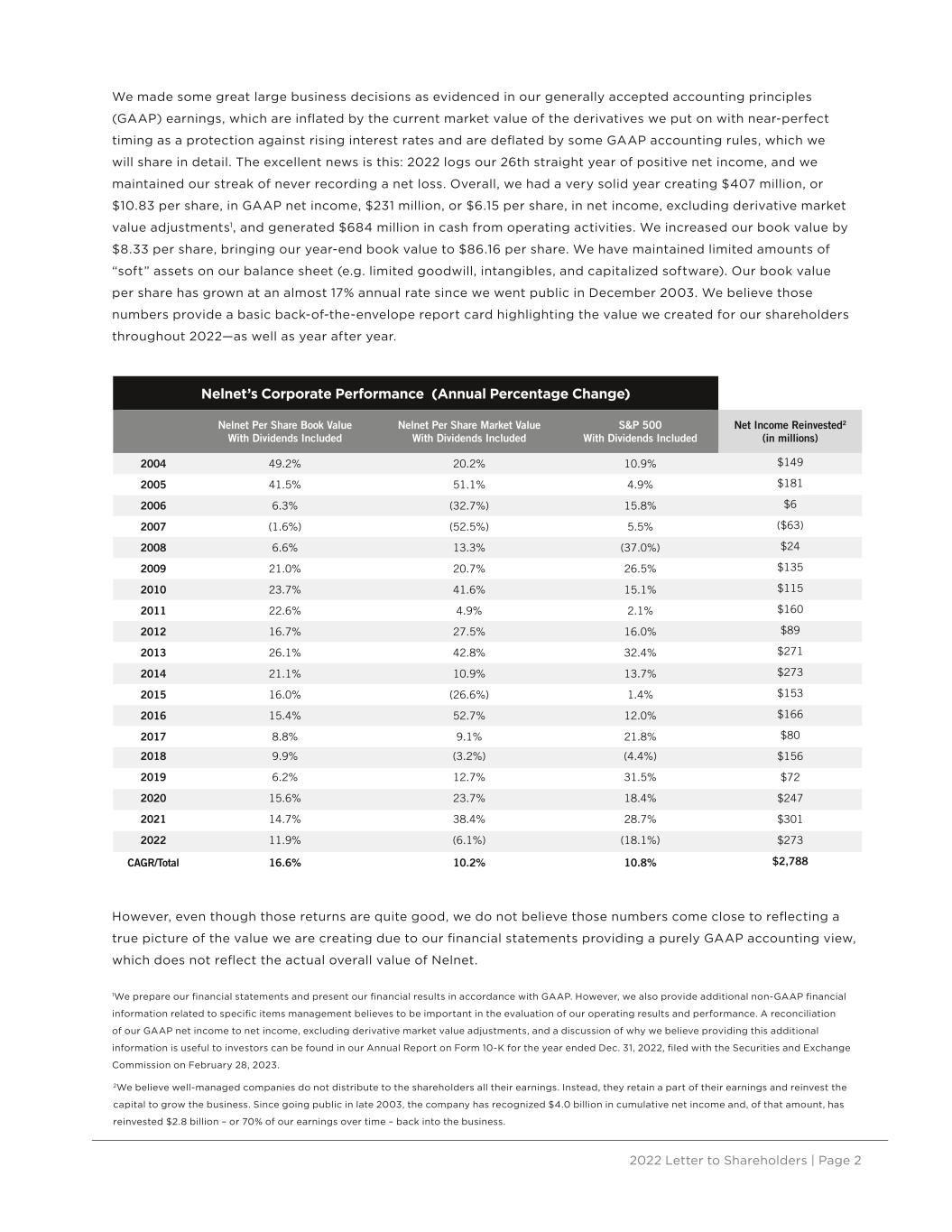

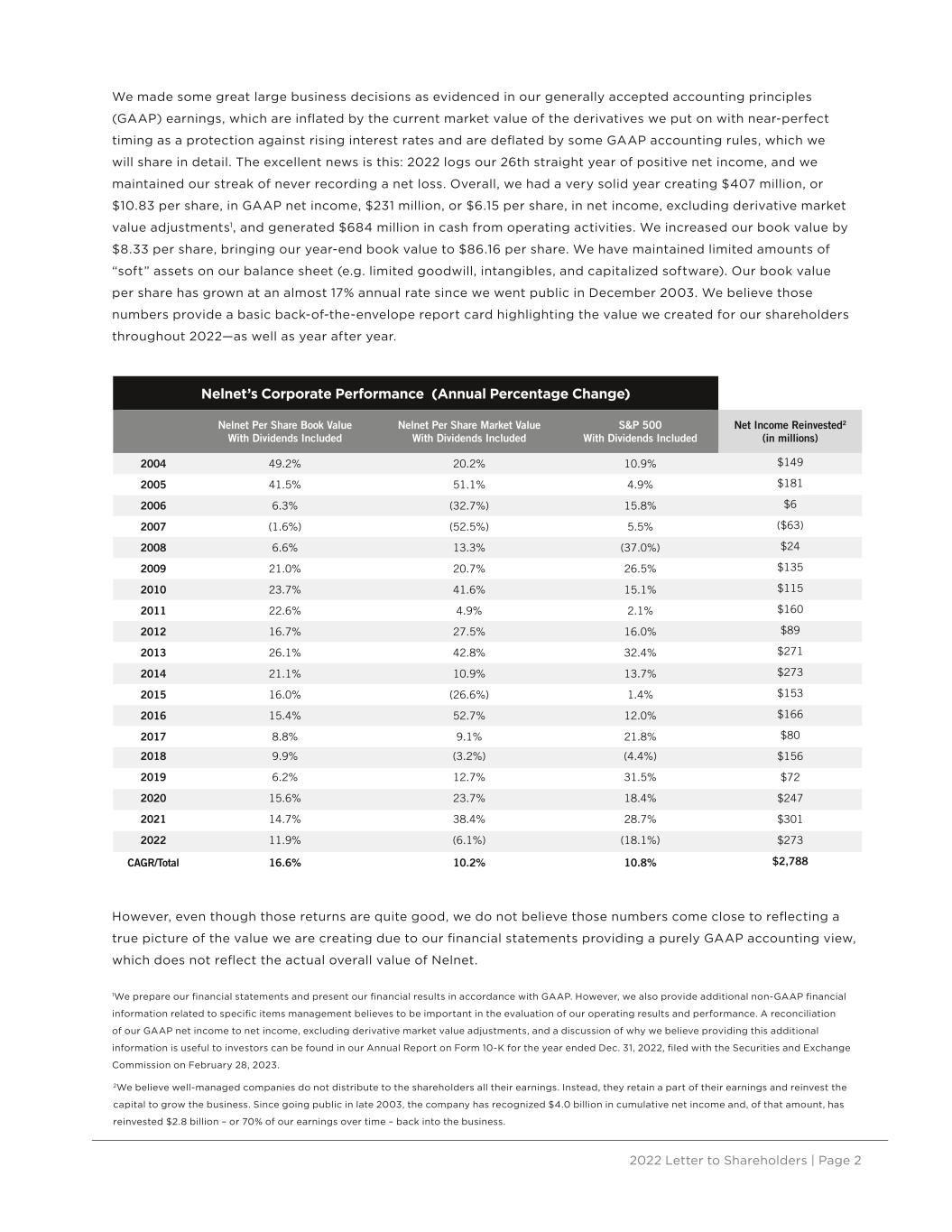

2022 Letter to Shareholders | Page 2 We made some great large business decisions as evidenced in our generally accepted accounting principles (GAAP) earnings, which are inflated by the current market value of the derivatives we put on with near-perfect timing as a protection against rising interest rates and are deflated by some GAAP accounting rules, which we will share in detail. The excellent news is this: 2022 logs our 26th straight year of positive net income, and we maintained our streak of never recording a net loss. Overall, we had a very solid year creating $407 million, or $10.83 per share, in GAAP net income, $231 million, or $6.15 per share, in net income, excluding derivative market value adjustments1, and generated $684 million in cash from operating activities. We increased our book value by $8.33 per share, bringing our year-end book value to $86.16 per share. We have maintained limited amounts of “soft” assets on our balance sheet (e.g. limited goodwill, intangibles, and capitalized software). Our book value per share has grown at an almost 17% annual rate since we went public in December 2003. We believe those numbers provide a basic back-of-the-envelope report card highlighting the value we created for our shareholders throughout 2022—as well as year after year. However, even though those returns are quite good, we do not believe those numbers come close to reflecting a true picture of the value we are creating due to our financial statements providing a purely GAAP accounting view, which does not reflect the actual overall value of Nelnet. 1We prepare our financial statements and present our financial results in accordance with GAAP. However, we also provide additional non-GAAP financial information related to specific items management believes to be important in the evaluation of our operating results and performance. A reconciliation of our GAAP net income to net income, excluding derivative market value adjustments, and a discussion of why we believe providing this additional information is useful to investors can be found in our Annual Report on Form 10-K for the year ended Dec. 31, 2022, filed with the Securities and Exchange Commission on February 28, 2023. Nelnet’s Corporate Performance (Annual Percentage Change) Nelnet Per Share Book Value With Dividends Included Nelnet Per Share Market Value With Dividends Included S&P 500 With Dividends Included Net Income Reinvested2 (in millions) 2004 49.2% 20.2% 10.9% $149 2005 41.5% 51.1% 4.9% $181 2006 6.3% (32.7%) 15.8% $6 2007 (1.6%) (52.5%) 5.5% ($63) 2008 6.6% 13.3% (37.0%) $24 2009 21.0% 20.7% 26.5% $135 2010 23.7% 41.6% 15.1% $115 2011 22.6% 4.9% 2.1% $160 2012 16.7% 27.5% 16.0% $89 2013 26.1% 42.8% 32.4% $271 2014 21.1% 10.9% 13.7% $273 2015 16.0% (26.6%) 1.4% $153 2016 15.4% 52.7% 12.0% $166 2017 8.8% 9.1% 21.8% $80 2018 9.9% (3.2%) (4.4%) $156 2019 6.2% 12.7% 31.5% $72 2020 15.6% 23.7% 18.4% $247 2021 14.7% 38.4% 28.7% $301 2022 11.9% (6.1%) (18.1%) $273 CAGR/Total 16.6% 10.2% 10.8% $2,788 2We believe well-managed companies do not distribute to the shareholders all their earnings. Instead, they retain a part of their earnings and reinvest the capital to grow the business. Since going public in late 2003, the company has recognized $4.0 billion in cumulative net income and, of that amount, has reinvested $2.8 billion – or 70% of our earnings over time – back into the business.

2022 Letter to Shareholders | Page 3 The purpose of this letter is to provide you with an overview of the various ways we are creating value throughout the organization, which may not be apparent as they are not yet fully reflected in our balance sheet or income statement. It’s no secret that Nelnet is complex as we continue to diversify. Our financials reflect short-term “book” gains and losses, and we think and operate using a long-term horizon. Because of this strategy, many areas of value do not appear in today’s financials—but we are confident they will down the road as we continue to play the long game. Examples include our continued investment in ALLO, Hudl, Nelnet Renewable Energy, and the growing consumer loan portfolio and real estate acquisitions we have made in our Nelnet Financial Services division. Although, in certain circumstances, the accounting rules require that we book upfront losses on these investments, we know we’re creating real long-term value. This can adversely impact near-term GAAP earnings and create choppiness in our year-to-year earnings, but we are bullish and excited about the prospects of all these businesses. Here’s a great example. When we raised capital at ALLO in December 2020, we structured the transaction to maximize overall cash flow to Nelnet—primarily by making the structure tax efficient. That resulted in our recognizing the remaining equity investment under the Hypothetical Liquidation at Book Value (HLBV) method of accounting. Applying the HLBV method of accounting, through December 31, 2022, Nelnet has recognized $114 million of losses from ALLO since December 2020, and Nelnet’s carrying value of its 45% investment in ALLO as of December 31, 2022, is $68 million. Although we are recognizing book losses on our ALLO investment, we believe the market value of ALLO continues to grow. Applying a value to each of ALLO’s 131,000 lines (and growing) is an interesting exercise. If ALLO would do a transaction to monetize its value, we expect Nelnet would recognize a significant gain on our 45% ownership investment. It is a simple math exercise along with a couple assumptions. Let’s review our current investment in Hudl, which was $134 million as of December 31, 2022. Hudl’s most recent equity raise in May 2020 was considered an observable market transaction for accounting purposes; and as such, we increased our carrying value in Hudl resulting in a $51 million gain. We purchased additional shares of Hudl from existing shareholders for total consideration of $32 million in February 2023. The purchase of these shares was not an observable market transaction. However, since the transaction in May 2020, we are confident the fair value of Hudl has increased and we believe our carrying value is substantially less than its market value. If Hudl were to complete an observable market transaction, we believe Nelnet would recognize a significant gain on this investment. Another example of hidden value within Nelnet is our investment in renewable energy tax equity credits and solar generation. We began making investments in community solar projects in 2018 and as of December 31, 2022, Nelnet manages $278 million of tax equity, with $103 million being syndicated to co-investors and the remainder being held on Nelnet’s balance sheet. We generate returns through federal income tax credits, operating cash flows, and tax deductions from operating losses of the investments over five to six years. Through December 31, 2022, we have recognized cumulative losses of $35 million on these investments, and our carrying value as of December 31, 2022, is negative $55 million. The tax laws require us to reduce carrying value by tax credits earned when the solar project is placed into service, and like ALLO, these investments also use the HLBV method of accounting. This in turn creates accelerated losses in the initial years of investment. We expect our current investments to generate $38 million in excess of our initial investment and approximately $73 million in GAAP income over the remaining years of the investment. It should be noted, we think this is a great use of capital; thus, we currently plan to make additional investments in solar in 2023 and beyond.

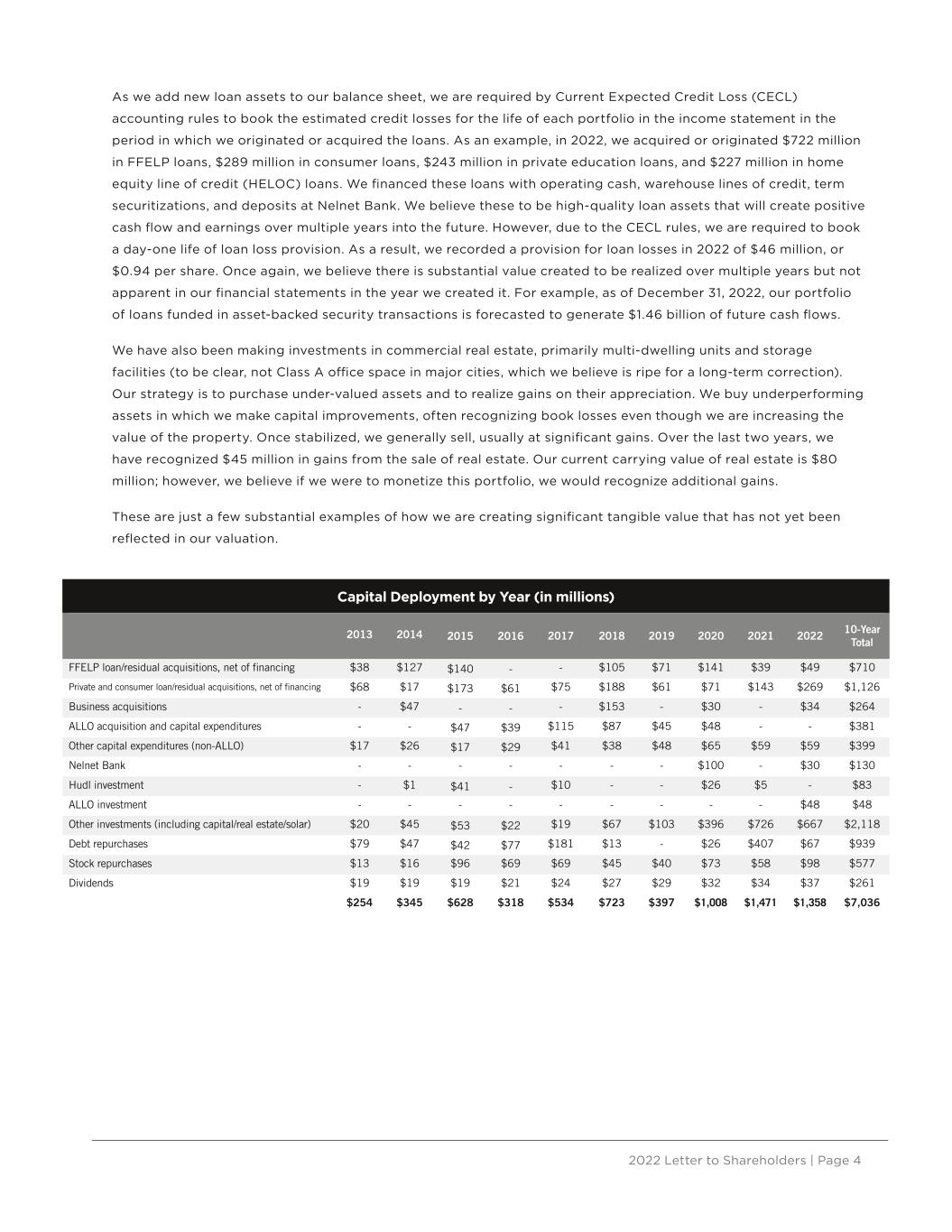

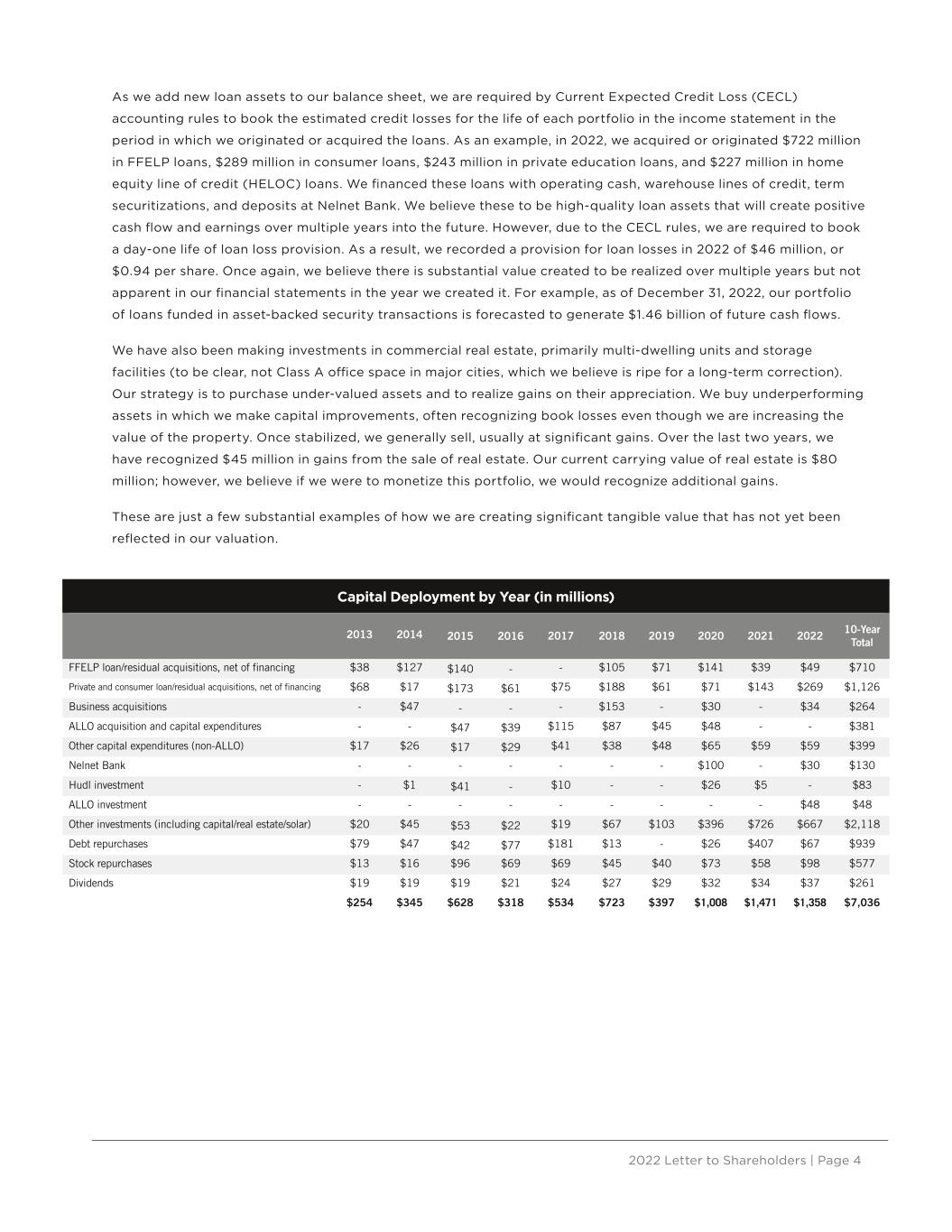

2022 Letter to Shareholders | Page 4 As we add new loan assets to our balance sheet, we are required by Current Expected Credit Loss (CECL) accounting rules to book the estimated credit losses for the life of each portfolio in the income statement in the period in which we originated or acquired the loans. As an example, in 2022, we acquired or originated $722 million in FFELP loans, $289 million in consumer loans, $243 million in private education loans, and $227 million in home equity line of credit (HELOC) loans. We financed these loans with operating cash, warehouse lines of credit, term securitizations, and deposits at Nelnet Bank. We believe these to be high-quality loan assets that will create positive cash flow and earnings over multiple years into the future. However, due to the CECL rules, we are required to book a day-one life of loan loss provision. As a result, we recorded a provision for loan losses in 2022 of $46 million, or $0.94 per share. Once again, we believe there is substantial value created to be realized over multiple years but not apparent in our financial statements in the year we created it. For example, as of December 31, 2022, our portfolio of loans funded in asset-backed security transactions is forecasted to generate $1.46 billion of future cash flows. We have also been making investments in commercial real estate, primarily multi-dwelling units and storage facilities (to be clear, not Class A office space in major cities, which we believe is ripe for a long-term correction). Our strategy is to purchase under-valued assets and to realize gains on their appreciation. We buy underperforming assets in which we make capital improvements, often recognizing book losses even though we are increasing the value of the property. Once stabilized, we generally sell, usually at significant gains. Over the last two years, we have recognized $45 million in gains from the sale of real estate. Our current carrying value of real estate is $80 million; however, we believe if we were to monetize this portfolio, we would recognize additional gains. These are just a few substantial examples of how we are creating significant tangible value that has not yet been reflected in our valuation. Capital Deployment by Year (in millions) 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 10-Year Total FFELP loan/residual acquisitions, net of financing $38 $127 $140 - - $105 $71 $141 $39 $49 $710 Private and consumer loan/residual acquisitions, net of financing $68 $17 $173 $61 $75 $188 $61 $71 $143 $269 $1,126 Business acquisitions - $47 - - - $153 - $30 - $34 $264 ALLO acquisition and capital expenditures - - $47 $39 $115 $87 $45 $48 - - $381 Other capital expenditures (non-ALLO) $17 $26 $17 $29 $41 $38 $48 $65 $59 $59 $399 Nelnet Bank - - - - - - - $100 - $30 $130 Hudl investment - $1 $41 - $10 - - $26 $5 - $83 ALLO investment - - - - - - - - - $48 $48 Other investments (including capital/real estate/solar) $20 $45 $53 $22 $19 $67 $103 $396 $726 $667 $2,118 Debt repurchases $79 $47 $42 $77 $181 $13 - $26 $407 $67 $939 Stock repurchases $13 $16 $96 $69 $69 $45 $40 $73 $58 $98 $577 Dividends $19 $19 $19 $21 $24 $27 $29 $32 $34 $37 $261 $254 $345 $628 $318 $534 $723 $397 $1,008 $1,471 $1,358 $7,036

2022 Letter to Shareholders | Page 5 // Nelnet Business Services The Nelnet Business Services (NBS) division provides technology, services, and payment processing primarily to our clients in the K–12 and higher education industries within the United States (U.S.) and globally. In addition, we provide learning and engagement Software as a Service (SaaS) products to community-minded organizations and corporations. The unique value to our customers is based on our superior customer service models and reliable and secure technology products. This division operates under five different businesses: FACTS, Nelnet Campus Commerce, Nelnet Payment Services, Nelnet International, and Nelnet Community Engagement. Below is a brief overview of the performance of each business. // FACTS The FACTS brand holds a strong reputation of service, support, and client satisfaction since its launch in 1986. Today, our business serves over 4 million students for almost 11,000 schools. We continue to diversify and offer more products and services to meet the needs of our customers. Our success can be attributed to providing a suite of solutions that supports the school and their families from the time of application and enrollment through the student’s graduation by processing payments and supporting the school and student information along the way. Ease of use for families and schools is imperative as well as ensuring the security of family and school data. We also provide direct resources to students in the classroom through Title I federal funding and professional development opportunities to teachers through Title II federal funding. Due to the increases in federal pandemic-related funds supporting K–12 education, we have witnessed a spike in schools asking for services in these areas. Our business now employs over 2,000 teachers and supports enhanced learning opportunities for tens of thousands of students through these programs. We continue to grow this service offering organically as well as through acquisition. We added market share in New York City and Puerto Rico through recent acquisitions. FACTS continues to create consistent cash flow for the division while investing in new products and associates to further enhance the value we provide to our school customers. We strive to elevate the education experience for our schools, teachers, students, and families. Our customer retention rate has consistently been over 98%, illustrating our service commitment to our customers. // Nelnet Campus Commerce The higher education industry has been under stress with many colleges and universities experiencing declining enrollment and high school students questioning the value of traditional degree programs. Despite the declining enrollment trend, Nelnet Campus Commerce serves more than 1,100 higher education institutions and over 8 million students and families across the U.S. with an integrated e-commerce solution suite for student payments across all areas of campus. These products include tuition payment plans, electronic billing and payments, refunds, shopping cart experiences, and mobile payments. We have introduced new products to the market while prioritizing the modernization and security of our overall user experience. Nelnet Campus Commerce continues to grow revenue through adding new products to existing customer relationships and acquiring new customers. Meeting the needs of our customers through superior service and technology has resulted in retention rates over 98%.

2022 Letter to Shareholders | Page 6 // Nelnet Payment Services Nelnet Payment Services is an Independent Sales Organization (ISO), providing end-to-end payment processing technology for our education and community-based customers and processing payments for Nelnet and other non- education businesses. In 2022, we processed almost $44 billion in total payments. One of the highest priorities of this business is the security of our payment information and ensuring compliance with all regulatory requirements. // Nelnet International Our international business, based in Melbourne, Australia, has been negatively impacted the most in our NBS division due to the pandemic restrictions over the past few years. This business focuses on both K–12 and higher education markets in Australia and a number of other countries, while also serving local governments and healthcare markets. Nelnet International’s suite of products includes an e-commerce payment platform, student management system, payment plans, and other incidental payment processing. We currently have a strong market share in the higher education industry in Australia with a focus on expansion into the Asia-Pacific region. We also provide products and services to private K–12 schools in Australia and New Zealand, and our student information system is used in more than 55 countries around the globe through our network of education-minded resellers. // Nelnet Community Engagement Nelnet Community Engagement is our newest business and provides engagement and learning management platforms to faith-based and community-minded organizations. We offer website development and a customizable mobile app that enables leaders and members to virtually communicate and interact with each other within one platform. Our business also focuses on providing content management with a robust learning management platform used by more than 3,500 parishes and churches in the U.S. We also offer this platform for the training needs of our for- profit customers in a variety of industries. Nelnet Community Engagement is closely aligned with FACTS to create an expanded value proposition for our shared customer-base. // Nelnet Communication Services/ALLO In 2022, ALLO’s fiber business continued its expansion in Nebraska, Colorado, and Arizona. Several tailwinds existed throughout the year—high demand for broadband primarily from work/learn from home and maintaining a high Net Promoter Score from the customer experience team. The headwinds were mostly temporary with permitting and local bureaucracy hurdles being the most significant. At the beginning of 2022, the “great resignation” and open positions were the key concern. By August, ALLO’s recruiting department had mitigated our concerns, and hiring rates improved for the balance of the year. Additionally, technological improvements were successfully implemented across the network, construction capabilities were expanded, and supply chain issues were successfully alleviated.

2022 Letter to Shareholders | Page 7 // Nelnet Diversified Services Nelnet Diversified Services (NDS) provides outsourced business services, licensed technology solutions, back-up servicing, and life of loan payment servicing for private student loans, consumer loans, FFELP loans, and direct loans for banks, finance companies, and state and federal government entities. Within the Nelnet business lines, the NDS division felt the most volatility last year as it is home to our Direct Loan Servicing contract. As most everyone knows, all Direct Loan student loan payments were paused under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, starting in March 2020. The pause was extended multiple times under the Trump and then Biden administrations including extensions throughout 2022 and was set to finally expire with borrowers to “return to repayment” in January 2023. We were told in late 2022 by the Federal Government that we needed to be fully staffed and ready for the January 1, 2023, return to repayment of all borrowers whose payments were initially paused under the CARES Act. This was a massive undertaking that took significant lead time and capital investment to provide a great customer experience for borrowers. It requires months of additional hiring, obtaining federal security clearances for the new hires, detailed training and supervision, and planning for the forecasted call volume, payment volume, auto debits, statements, electronic and print mail services, and more for the 15.8 million Direct Loan borrowers we service. After we invested significant time, resources, capital, and people, on November 22, 2022, the Department announced repayment would be delayed yet again. Repayment won’t start until October 2023 or 60 days following the resolution of the Supreme Court case on the President’s Loan Forgiveness Program. Ultimately, this led to NDS being significantly overstaffed by nearly 1,000 people, with little to no work for people servicing loans that won’t have payments due until October 2023. This required us to announce layoffs in January 2023. These are hard decisions to make, but we found ourselves between a rock and a hard place given the demands of the business and the fluidity of the government decisions around the payment pause and proposed loan forgiveness plan. Mature market shares and cash flow continue to exceed our initial underwriting expectations. The demand is accelerating for communication and entertainment solutions across business, governmental, and consumer channels. As such, new market investments to increase regional density remain an on-going focus. ALLO’s construction teams are actively developing markets and working around permitting delays. Unmet customer demand for high-quality fiber service bodes well for ALLO’s future customer growth. Additionally, new work, gaming, and other entertainment needs are driving existing customers to increase bandwidth and services. Low latency and fast upload speeds are vital to the customer experience now more than ever. Customer growth is expected to accelerate in upcoming years with revenue per customer also on an upward trajectory as ALLO realizes the benefits from the construction efforts. Meanwhile, the benefits of scale are keeping the cost to connect and support ALLO’s customer base efficient. 2023 marks ALLO’s 20th year of serving customers and the opportunities continue to be vast. With 131,000 lines in place and growing, we continue to be bullish on fiber optic telecommunications.

2022 Letter to Shareholders | Page 8 During this fluidity, our NDS team did an amazing job finding outsourcing work for a lot of our associates, modernizing and combining system platforms, being very open and honest in communications with our associates, managing the bottom line, and treating our impacted associates with dignity and respect. People have sometimes asked us why we want to remain in this business. Our response is that regardless of what happens with the payment pause, there is nearly $1.6 trillion in student debt owed by 44 million Americans. Over its nearly 30-year life, the Direct Loan program has become the most complex consumer lending program on the planet. Nothing compares to it. The variability of payment options, loan types, forgiveness initiatives for public service, military service, deferments, forbearances, income-contingent payment options, disability benefits, and interest rates and terms require trained experts like our teams, with state-of-the-art systems and infrastructure like ours to administer them. The public’s need for our services is immense. And even if the Supreme Court approves the White House’s loan forgiveness program, it does nothing to solve the underlying need for student loan debt. By most projections, $160 billion in new student debt will be borrowed in each 2023 and 2024—and presumably every year we can see into the future. As long as there are colleges and universities and students who need to borrow money to attend them, the need to help people navigate the myriad of options and pay off their debt is tremendous, and we are here to make sure people have the best resources and help available to improve their lives and make their dreams possible. // Nelnet Financial Services (NFS) NFS is our division in which we fund all our student and consumer loan asset acquisitions, hedging, and capital markets activity that occur outside of Nelnet Bank. We fund loan assets through warehouse lines of credit until the portfolios are large enough to be securitized in term- funded Asset Backed Securities, which requires us to be closely aligned with the credit markets. 2022 was a volatile year for the fixed-income market in general and for our FFELP loan portfolio in particular. Specifically, as mentioned in the NDS overview, student lending seemed to be in the headlines nearly every day with loan forgiveness, payment pauses, program changes, and loan originators and servicing companies exiting the business. Through all the volatility, we’re pleased to share our FFELP portfolio continues to perform well, generating a significant amount of cash but it is shrinking rapidly. While in 2022 we were able to purchase one of the largest remaining FFELP loan portfolios at a significant discount, our overall portfolio paid down at the fastest rate we can recall. It was less than $14 billion at year-end, compared to over $17 billion one year earlier. We were largely protected from the rise in interest rates thanks to our portfolio of interest rate derivatives, which provided a full hedge against the dramatic increase in rates as the Federal Reserve acted to fight inflation. Without that protection, our student loan spread would have compressed with rising rates. As we look to 2023, our focus will continue to be on diversifying our loan portfolio away from student lending and into diverse types of loan assets. We expect our FFELP loan portfolio to continue to amortize and that elevated interest rates will render private loan refinance opportunities unattractive to most borrowers. We expect to expand our participation in the unsecured consumer loan market and to grow our portfolio of HELOCs and other loans. While these assets certainly have more credit risk than FFELP loans, we do like their risk-adjusted returns and liquidity as well as our ability to get leverage on them through the asset-backed markets and through Nelnet Bank.

2022 Letter to Shareholders | Page 9 // Nelnet Bank Nelnet Bank had a remarkable second year of its de novo in 2022, reaching profitability, launching its private in-school student loan product, expanding deposit capabilities, reaching early and significant refinance volume prior to interest rates rising, maintaining low credit losses, and controlling operating expenses. The bank grew significantly in 2022 and had over $900 million in assets at year-end while continuing to maintain adequate levels of capital and liquidity. We believe the bank’s risk management and compliance programs are commensurate with the size and complexity of the bank. The private student loan product launched in time for peak school season. It was a good first year with learnings that will help us continue to grow the product by enhancing our customer experience and improving our marketing efforts. We were able to increase our presence on school lender lists by 36% and now support 569 institutions that serve over 4.6 million students. The private student loan product is important to Nelnet Bank and will continue to be a focus in future years. The year was also a foundational one in our efforts to prepare for consumer loan products. We have selected strategic partners and prepared systems and operational processes that will allow us to enter the consumer loan market early in 2023. The bank is also happy to share that it received an outstanding rating from the Federal Deposit Insurance Corporation (FDIC) for its Community Reinvestment Act program in the first two years of operation. // Nelnet Real Estate Services For Nelnet’s real estate investment portfolio, 2022 was another productive year. The team was able to selectively deploy capital in a rising rate environment while also selectively selling assets into a strong market. We approved 15 separate acquisitions and committed $63 million in capital to new projects including office, storage, and industrial space. All projects were conservatively underwritten, and our exit cap rates ranged from 5.5% to 6%. We also sold seven projects and generated gains of nearly $23 million. We opportunistically sold a couple projects earlier in their lifecycle than we had originally forecast but do not see as much short-term upside in the 2023 sales market. The first half of the year was strong; however, capital markets began to shift, causing a noticeable decrease in commercial real estate investment activity toward the end of the year. We expect this slowdown to continue into early 2023 followed by an uptick in transactions in the back half of the year. The market is forecasting lower interest rate volatility, which would provide a more stable environment for project financing. While our focus will remain on traditional limited partnership (LP) equity placement, we expect structured deal flow to be more active due to market dislocations that are beginning to appear. Our investment targets are a 15% internal rate of return and a 2.0x multiple on LP equity and 12%+ on any structured investment.

2022 Letter to Shareholders | Page 10 // Nelnet Renewable Energy Nelnet Renewable Energy continues to drive value within our company by providing a diversified cash flow stream. Nelnet continued to support the global transition to clean energy throughout the year as we committed to or funded a total of $634 million of tax equity to support the construction and operation of solar projects worth approximately $2.45 billion. We estimate these investments power nearly 118,000 homes and will replace more than 24 million tons of carbon emissions during their lifecycle. In addition to the environmental attributes, these investments create jobs, generate cost savings for energy consumers, strengthen energy resilience, and provide expected financial returns that fit well within our capital deployment strategy. Though these investments do create volatility within our earnings due to the unique accounting treatment, we continue to prefer the early-phase and life-to-term cash flows. In addition to utilizing Nelnet’s balance sheet to make these investments, we continued to provide significant future cash flow and value to our co-investors during the year as we now have more than 22 investors on our platform with committed dollars exceeding $194 million. Though the industry experienced some challenges during the year that delayed project completion and generation of tax credits, we are bullish on the industry and our ability to execute within it. The enactment of the Inflation Reduction Act and global ambitions to create cleaner and more resilient energy sources allows us to create a positive impact for our customers, associates, communities, and shareholders. During the year, we continued to diversify the business by investing in cleantech-related start-up companies and started a new business to assist K–12 and postsecondary educational institutions achieve their carbon-neutral goals. This service provides the consultation, design, management, and capital funding associated with these activities. Lastly, we are excited about our mid-year acquisition of 80% of GRNE Solar, a full service, engineering, procurement, and construction company providing solar services to residential homes and commercial entities. The acquisition and integration of this company allows us to be vertically integrated and positions us uniquely in the distributed power generation market. We can now efficiently originate, finance, own, and manage all aspects of these renewable assets for the long-term. We believe the business model will allow us to grow and diversify cash flows as we continue to construct assets to sell to customers, develop solar photovoltaic systems that we own and sell the electricity, and syndicate the associated tax equity fundings. This acquisition provided technical know-how, customer relationships, a talented workforce, and revenue streams. When coupled with our financial acumen, access to capital, and asset management experience, we are extremely optimistic about the continued growth and performance of our renewable energy business. We believe this vertical integration, continued commitment to high-quality customer service, and lower transaction costs, will be a differentiator in this market. It may not be so hidden to many of you with children or grandchildren playing high school sports, but Hudl works with more than 95% of all U.S. high schools that play sports competitively and more than 200,000 teams globally. These are incredibly valuable relationships when you focus solely on Hudl’s historical lines of business, but it’s even more exciting when you look at Hudl’s latest acquisitions and new product offerings. Hudl completed three acquisitions in 2022: Blueframe Technology (based in Lexington, KY), Realtrack Systems (based in Almeria, Spain), and Instat (based in Limerick, Ireland). Each acquisition brought impressive talent to the Hudl team as well as impressive product extensions and expansion opportunities. // Hudl

2022 Letter to Shareholders | Page 11 Hudl’s focus on listening to its customers and adapting to their needs drove each of these acquisitions: • For the past couple years, we’ve talked about Hudl’s smart camera solution—Hudl Focus. Hudl now has more than 14,000 Hudl Focus units deployed in the market, with many customers taking advantage of the ability to easily livestream their games and matches to family, friends, and fans. Teams loved this offering, but a growing number were looking for the option to monetize those streams. Enter Blueframe—founded in in 2015, the company built an incredible set of production tools enabling teams to enhance their livestreams with broadcast-level graphics. Teams could also choose to charge on a subscription or pay-per-view basis. • Professional and college sports are increasingly emphasizing human performance, specifically load management and injury prevention. For years, teams have been equipping their athletes with global positioning system (GPS) sensors to track information around speed, acceleration, and distance run. More recently, teams have focused on marrying this performance data with video to add important context and get more value out of the data. Enter Realtrack’s solution, WIMU, developed in association with FC Barcelona’s Barça Innovation Hub. The product tracks up to 20,000 data points per second and monitors more than 250 variables for each individual athlete, with applications for real-time monitoring, post-session in-depth analysis, and cloud-based customizable dashboards. • A couple years ago, we discussed Hudl’s acquisition of Wyscout, the scouting platform that powers global football (or soccer) recruitment all around the world. In December, Hudl added Instat, expanding its video and data coverage to more countries and more levels in global football as well as adding a powerful scouting platform for basketball and ice hockey. As with any acquisition, the real work (and value) comes in the integration. We’re excited to see Hudl continue to strengthen its acquisition muscle and playbook as Instat marked the twelfth acquisition in Hudl’s 16-year history. In December, we lost one of our dearest friends and long-time board member Bill Cintani. Bill was a driving factor in our success and gave us sage advice over many years of service to Nelnet. He is sorely missed already, and we want to thank his family for sharing their time with Bill, our friend and adviser. We enter 2023 with a cautious view given all the macro-global events occurring including wars, spy balloons, budget crises, U.S. debt limit showdowns, and rising interest rates. Even in light of all the unknowns in the greater global economy, we remain bullish on the prospects of every core division within Nelnet and all the major investments we hold on our balance sheet. We believe we have created substantial value for our shareholders that will be unlocked and realized in the coming years. We are maniacally focused on customer experience and customer service, bettering our communities, and making Nelnet an awesome place to work for our associates. Dream. Learn. Grow. Jeff Noordhoek Chief Executive Officer // Closing

2022 Letter to Shareholders | Page 12 Matthew Dunlap Nelnet Board of Directors Michael S. Dunlap Preeta Bansal Kathleen A. Farrell Ph.D. David Graff Thomas E. Henning Kimberly Rath Nelnet Bank Board of Directors Michael S. Dunlap Tim Tewes Carine Strom Clark Connie Edmond Anthony Goins Crawford Cragun Jaime Pack Andrea Moss Adam Peterson Jona Van Deun

2022 Letter to Shareholders | Page 13 Our goal is for each Nelnet shareholder to record a gain or loss in market value proportional to the gain or loss in per-share fundamental (intrinsic) value recorded by the company. To achieve this goal, we strive to maintain a one-to-one relationship between the company’s fundamental value and market value. As that implies, we would rather see Nelnet’s stock price at a fair level than at an artificial level. Our fair value approach may not be preferred by all investors, but we believe it aligns with Nelnet’s long-term approach to both our business model and market value. However, from time-to-time Mrs./Mr. Market can be irrational and will materially overvalue or undervalue the investment style they currently love. Short-term, Mrs./Mr. market is a voting machine; long-term, the market is a weighing machine. Over the last few years, Mr. Market created something from nothing (stock price bubbles, crypto, non-fungible tokens (NFTs), meme stocks, real estate prices that do not work in historically average interest rate environments) to fill the demand from bad government policy, speculation, short-term thinking, greed, over stimulus, leverage, and low interest rates. Many of these speculative investments are now down over 60%. Many real estate investments are going to be underwater when variable interest rate loans reset, potentially creating opportunities. If you live in a hyper-inflationary environment (Argentina, Zimbabwe), Bitcoin may act as a store of value over short periods of time. There is enough friction in the Bitcoin/crypto protocols, which leads most people to buy, hold, and sell their crypto on an exchange versus holding their own crypto wallets with block-long passwords that cannot be recovered if lost. Over longer periods of time, it is a speculation on the capability of an algorithm to create mathematical scarcity and become stable enough in a decentralized, quasi non-regulatable environment to avoid the mess FTX, all of their clients, and Sam Bankman-Fried are experiencing. Where is the next potential fraud? One of the largest cryptocurrency trading exchanges, with millions of monthly users and billions in daily trading volume, regularly moves its operations from country to country and claims to be decentralized with no official headquarters. Auditors have halted all work for many crypto clients including at least one of the largest exchanges. There is no third- party review of their books, and they have insanely small numbers of staff for a business moving hundreds of billions of dollars and shifting headquarters, locations, and mailboxes. Let’s add leverage (gas) and 1,000 other crypto coins (infinitely copied) to the fire and see what happens. What could go wrong in crypto? Do you want to speculate in crypto/NFTs and meme stocks or make solid, long-term investments in great companies with real assets? I just finished reading the Benjamin Franklin autobiography by Walter Isaacson. Franklin believed in the common person and their collective ability to drive people toward the best possible outcomes versus one supremely smart, elite group of people. Today this concept has been referenced as the "wisdom of the crowd." The future of social media is here with ChatGPT-3; artificial intelligence has been all the rage these last few months. I am confident these tools will enhance our abilities and lead to many new ways to learn and do business. At the same time these new and older (Facebook, Tik Tok, Snapchat, Instagram, Twitter) algorithms are similar and prone to making things up to fill in the blanks. If we abdicate our responsibility to educate and inform ourselves and end up with a handful of elite algorithms informing us on everything under the sun, we are going to lose the wide diversity of thought, backgrounds, and perspectives that lead to optimal outcomes. There are also some great quotes from Franklin that are timeless reminders of what made and make our country great. For example: “Ordaining of laws in favor of one part of the nation to the prejudice and oppression of another is certainly the most erroneous and mistaken policy…An equal dispensation of protection, rights, privileges, and advantages, is what every part is entitled to, and ought to enjoy.” // Mike Dunlap’s Thoughts about Investments

2022 Letter to Shareholders | Page 14 Summarized from the end of the 2021 annual report, we live in the best country in the world. Let’s hope as we wake up from our hangover, we don’t make the same economic mistakes and create a nation where we have perfect equality because we are all broke. On the bright side, as these future disruptions occur in the economy, we will continue to try to position Nelnet to be opportunistic as we have been in the past. Recently, I talked to our senior team about what makes Nelnet different from many other publicly traded companies. None of the characteristics are overly complicated or special, unique insights. A lot of our philosophy comes from our banking background and focus on the customer, associate, diversification, and community. In addition, when I was in graduate/law school in the 80s at University of Nebraska–Lincoln, I had the opportunity to read the Warren Buffet Partnership Letters and Berkshire Hathaway annual reports, which had a major impact on our business philosophies— many of which you will see below. What is Nelnet’s DNA? • Long-Term Perspective: Focus on long-term potential versus short-term market fluctuations. Short term, the market is a voting machine; long term, a “weighing” machine. We are not focused on short-term moves in our stock price. We want to create value for decades to come. We do not give earnings guidance, and we do not do earnings calls. We think focusing our intellectual capital on our customers and associates will create real long-term value versus hyping our stock. • Moat: Strong, sustainable competitive advantages, recurring revenue, profit margin, and cash flow. These are the attributes we look for in businesses we want to invest in, manage, and grow. • Discounted Cash Flow: The value of bonds and stocks comes from “free” cash flow. Will our decisions create long-term cash flow? We don’t want to make our short-term financials look better to the detriment of long-term cash flow—think capitalized software. Some companies play games by capitalizing everything they can possibly get their accountants to agree with; we do not play those games. • Opportunistic / Contrarian: Look for businesses out of favor with the market versus current market “darlings.” We’re not looking for the “greater fool” to buy at a high price and then sell at a higher price to an even greater fool. We buy businesses to hold and grow over time. • Diversification: Stability of a unicycle versus a bicycle versus a car versus an 18-wheeler (or a stool with one leg versus four legs). Inside of that diversification, we try to focus on our core competencies: servicing, software, payments, finance, and with a large focus on education. • Debt: Debt is a double-edged sword. Leverage magnifies your gains, but it will also magnify your losses. When the tide goes out, you quickly learn who’s been swimming naked. Use debt prudently. How do our businesses hold up to our strategy? • NDS: Large moat—we do not see many new competitors jumping into this government-run student loan program. We are on a constant pendulum ride, being swung from one extreme to the other. • NBS: Significant momentum as we continue to grow our recuring revenue and net income over time at double-digit rates. The K–12 team has diversified its products from payment plans, to grant and aid, a student information system, and now FACTS Education Solutions, which provides professional development and instructional services. Campus Commerce now has over 1,100 higher ed institutions as customers and growing with diversified tuition management and integrated commerce solutions.

2022 Letter to Shareholders | Page 15 • ALLO: The four values of being local, honest, exceptional, and hassle-free have led to over 50% market share in ALLO's largest markets as they mature. The first-mover advantage, great customer service, and large infrastructure investment are widening our moat further each year, leading to long-term, growing recurring cash flow into the future with relatively low turnover. • Nelnet Financial Services / Nelnet Bank: Opportunistic originations, acquisitions, and prudent leverage continue to create significant free cash flow. The Fed’s transitory nonsense gave us the opportunistic ability to aggressively hedge our portfolio with pay-fixed swaps, which created over $5 in earnings in 2022 as the Feds played catch-up fighting inflation by raising rates significantly. • Nelnet Renewable Energy: Opportunistically, we started with tax equity and then syndicated tax equity; we have purchased an engineering and construction firm GRNE Solar and started to develop our own projects. We believe this diversified group with the stimulus from the Inflation Reduction Act is set up to be a significant long-term cash flow generator for Nelnet. Like ALLO, the accounting treatment of this business doesn’t provide an accurate picture of the value we are creating. GAAP accounting on many of these projects show losses in the early years and all the gains in the later years. As I stated earlier, we do not care if our short-term earnings don’t look great if we know long term, we are creating value and true free cash flow. » Environmental, Social, and Governance (ESG) has been at Nelnet for a long time under different terminology / syntax. I do not want to waste significant company resources rewording what we have always strived to do to appease a few investors who want to put us into an investment flavor-of-the-day box. • Priorities: (1) Customers (2) Associates (3) Diversification (4) Open Communication (5) Give Back • Horizontal Flywheel: Think of a horizontal wheel with four quadrants: Customer, Associate, Community, and Shareholder. All these constituencies need to be in balance. If they get out of alignment, the flywheel will fall off balance. Great, lasting companies balance their investment in these constituencies.

2022 Letter to Shareholders | Page 16 Forward-Looking and Cautionary Statements This letter to shareholders contains forward-looking statements within the meaning of federal securities laws. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “would,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements. These statements are based on management's current expectations as of the date of this letter and are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: risks and uncertainties related to the severity, magnitude, and duration of the COVID-19 pandemic, including changes in the macroeconomic environment, consumer behavior, and government policy; risks related to the ability to successfully maintain and increase allocated volumes of student loans serviced by the company under existing and any future servicing contracts with the Department, which contracts accounted for 32% of the company's revenue in 2022; risks to the company related to the Department's initiatives to procure new contracts for federal student loan servicing, including the pending and uncertain nature of the Department's procurement process, risks that the company may not be successful in obtaining any of such potential new contracts, and risks related to the company's ability to comply with agreements with third-party customers for the servicing of loans; risks related to the company's loan portfolio, such as interest rate basis and repricing risk, changes in levels of loan repayment, default rates, and prepayment rates; the use of derivatives to manage exposure to interest rate fluctuations; the uncertain nature of expected benefits from FFEL Program, private education, and consumer loan purchases and initiatives to purchase additional FFEL Program, private education, and consumer loans or investment interests therein; financing and liquidity risks, including risks of changes in the securitization and other financing markets for loans; risks and uncertainties from changes in terms of education loans and in the educational credit and services marketplace resulting from changes in applicable laws, regulations, and government programs and budgets, such as changes resulting from the CARES Act and the expected decline over time in FFEL Program loan interest income due to the discontinuation of new FFEL Program loan originations in 2010 and the resulting initiatives by the company to adjust to a post-FFEL Program environment, as well as the possibility of new student loan forgiveness or broad debt cancellation programs by the government or other incentives to consolidate away from existing FFEL Program loans; our ability to maintain federal guarantees for certain government loans; risks and uncertainties of the expected benefits from Nelnet Bank’s operations, including the ability to successfully conduct banking operations and achieve expected market penetration; risks related our renewable energy business, including availability of federal incentives, regulatory uncertainty, climate change risk, supply change risk, and rising debt and construction costs; risks and uncertainties related to other initiatives to pursue additional strategic investments (and anticipated income therefrom), acquisitions, and other activities, including activities that are intended to diversify the company both within and outside of its historical core education-related businesses; our reliance on third parties to provide certain services; risks from changes in economic conditions and consumer behavior; cybersecurity risks, including disruptions to systems, disclosure of confidential or personal information, and/or damage to reputation resulting from cyber-breaches; our ability to adapt to technological change; changes in the general interest rate environment, including the transition away from LIBOR; risks related to the exclusive forum provisions in our articles of incorporation; risks related to our Executive Chairman’s ability to control matters related to the company through voting rights; risk related to related party transactions; risks related to climate change; concerns about the downgrade of the U.S. credit rating; and risks related to natural disasters, terrorist activities, or international hostilities. For more information, see the "Risk Factors" sections and other cautionary discussions of risks and uncertainties included in documents filed or furnished by the company with the SEC, including the most recent Form 10-K filed by the company with the SEC. All forward- looking statements in this letter are as of the date of this letter. Although the company may voluntarily update or revise its forward-looking statements from time to time to reflect actual results or changes in the company's expectations, the company disclaims any commitment to do so except as required by law.