For Release: May 8, 2023

Investor Contact: Phil Morgan, 402.458.3038

Nelnet, Inc. supplemental financial information for the first quarter 2023

(All dollars are in thousands, except per share amounts, unless otherwise noted)

The following information should be read in connection with Nelnet, Inc.'s (the “Company's”) press release for first quarter 2023 earnings, dated May 8, 2023, and the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 (the "Q1 2023 10-Q Quarterly Report").

Forward-looking and cautionary statements

This report contains forward-looking statements and information that are based on management's current expectations as of the date of this document. Statements that are not historical facts, including statements about the Company's plans and expectations for future financial condition, results of operations or economic performance, or that address management's plans and objectives for future operations, and statements that assume or are dependent upon future events, are forward-looking statements. The words “anticipate,” “assume,” “believe,” “continue,” “could,” “ensure,” “estimate,” “expect,” “forecast,” “future,” “intend,” “may,” “plan,” “potential,” “predict,” “scheduled,” “should,” “will,” “would,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements.

The forward-looking statements are based on assumptions and analyses made by management in light of management's experience and its perception of historical trends, current conditions, expected future developments, and other factors that management believes are appropriate under the circumstances. These statements are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in the “Risk Factors” section of the Company's Annual Report on Form 10-K for the year ended December 31, 2022 (the "2022 Annual Report"), and include such risks and uncertainties as:

•risks related to the ability to successfully maintain and increase allocated volumes of student loans serviced by the Company under existing and future servicing contracts with the U.S. Department of Education (the "Department") and risks related to the Company's ability to comply with agreements with third-party customers for the servicing of Federal Direct Loan Program, Federal Family Education Loan Program (the "FFEL Program" or FFELP), private education, and consumer loans;

•loan portfolio risks such as interest rate basis and repricing risk, the risk of loss of floor income on certain student loans originated under the FFEL Program, risks related to the use of derivatives to manage exposure to interest rate fluctuations, uncertainties regarding the expected benefits from purchased securitized and unsecuritized FFELP, private education, consumer, and other loans, or investment interests therein, and initiatives to purchase additional FFELP, private education, consumer, and other loans, and risks from changes in levels of loan prepayment or default rates;

•financing and liquidity risks, including risks of changes in the interest rate environment;

•risks from changes in the terms of education loans and in the educational credit and services markets resulting from changes in applicable laws, regulations, and government programs and budgets;

•risks related to a breach of or failure in the Company's operational or information systems or infrastructure, or those of third-party vendors;

•uncertainties inherent in forecasting future cash flows from student loan assets and related asset-backed securitizations;

•risks and uncertainties of the expected benefits from the November 2020 launch of Nelnet Bank operations, including the ability to successfully conduct banking operations and achieve expected market penetration;

•risks related to the expected benefits to the Company from its continuing investment in ALLO Holdings, LLC (referred to collectively with its subsidiary ALLO Communications LLC as "ALLO"), and risks related to investments in solar projects, including risks of not being able to realize tax credits which remain subject to recapture by taxing authorities;

•risks and uncertainties related to other initiatives to pursue additional strategic investments (and anticipated income therefrom), acquisitions, and other activities, including activities that are intended to diversify the Company both within and outside of its historical core education-related businesses;

•risks and uncertainties associated with climate change; and

•risks and uncertainties associated with litigation matters and with maintaining compliance with the extensive regulatory requirements applicable to the Company's businesses.

All forward-looking statements contained in this supplement are qualified by these cautionary statements and are made only as of the date of this document. Although the Company may from time to time voluntarily update or revise its prior forward-looking statements to reflect actual results or changes in the Company's expectations, the Company disclaims any commitment to do so except as required by law.

Consolidated Statements of Income

(Dollars in thousands, except share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | |

| March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | | | |

| Interest income: | | | | | | | | | |

| Loan interest | $ | 225,243 | | | 228,878 | | | 111,377 | | | | | |

| Investment interest | 40,725 | | | 34,012 | | | 13,819 | | | | | |

| Total interest income | 265,968 | | | 262,890 | | | 125,196 | | | | | |

| Interest expense on bonds and notes payable and bank deposits | 199,449 | | | 181,790 | | | 48,079 | | | | | |

| Net interest income | 66,519 | | | 81,100 | | | 77,117 | | | | | |

| Less provision (negative provision) for loan losses | 34,275 | | | 27,801 | | | (435) | | | | | |

| Net interest income after provision for loan losses | 32,244 | | | 53,299 | | | 77,552 | | | | | |

| Other income (expense): | | | | | | | | | |

| Loan servicing and systems revenue | 139,227 | | | 140,021 | | | 136,368 | | | | | |

| Education technology, services, and payment processing revenue | 133,603 | | | 98,332 | | | 112,286 | | | | | |

| Solar construction revenue | 8,651 | | | 15,186 | | | — | | | | | |

| Other, net | (14,071) | | | 735 | | | 9,877 | | | | | |

| Gain (loss) on sale of loans, net | 11,812 | | | (2,713) | | | 2,989 | | | | | |

| Impairment expense | — | | | (9,361) | | | — | | | | | |

| Derivative settlements, net | 23,337 | | | 20,858 | | | (2,809) | | | | | |

| Derivative market value adjustments, net | (37,411) | | | (7,434) | | | 145,734 | | | | | |

| Total other income (expense) | 265,148 | | | 255,624 | | | 404,445 | | | | | |

| Cost of services: | | | | | | | | | |

| Cost to provide education technology, services, and payment processing services | 47,704 | | | 39,330 | | | 35,545 | | | | | |

| Cost to provide solar construction services | 8,299 | | | 14,004 | | | — | | | | | |

| Total cost of services | 56,003 | | | 53,334 | | | 35,545 | | | | | |

| Operating expenses: | | | | | | | | | |

| Salaries and benefits | 152,710 | | | 151,568 | | | 149,414 | | | | | |

| Depreciation and amortization | 16,627 | | | 20,099 | | | 16,956 | | | | | |

| Other expenses | 40,785 | | | 50,481 | | | 39,499 | | | | | |

| Total operating expenses | 210,122 | | | 222,148 | | | 205,869 | | | | | |

| Income before income taxes | 31,267 | | | 33,441 | | | 240,583 | | | | | |

| Income tax expense | (8,250) | | | (5,459) | | | (55,697) | | | | | |

| Net income | 23,017 | | | 27,982 | | | 184,886 | | | | | |

| Net loss attributable to noncontrolling interests | 3,470 | | | 2,791 | | | 1,761 | | | | | |

| Net income attributable to Nelnet, Inc. | $ | 26,487 | | | 30,773 | | | 186,647 | | | | | |

| Earnings per common share: | | | | | | | | | |

| Net income attributable to Nelnet, Inc. shareholders - basic and diluted | $ | 0.71 | | | 0.83 | | | 4.91 | | | | | |

| Weighted average common shares outstanding - basic and diluted | 37,344,604 | | | 37,290,293 | | | 38,041,834 | | | | | |

Condensed Consolidated Balance Sheets

(Dollars in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | |

| As of | | As of | | As of |

| March 31, 2023 | | December 31, 2022 | | March 31, 2022 |

| Assets: | | | | | |

| Loans and accrued interest receivable, net | $ | 14,561,108 | | | 15,243,889 | | | 17,621,576 | |

| Cash, cash equivalents, and investments | 2,175,144 | | | 2,230,063 | | | 1,812,363 | |

| Restricted cash | 710,469 | | | 1,239,470 | | | 1,014,881 | |

| Goodwill and intangible assets, net | 237,690 | | | 240,403 | | | 191,636 | |

| Other assets | 398,198 | | | 420,219 | | | 349,285 | |

| Total assets | $ | 18,082,609 | | | 19,374,044 | | | 20,989,741 | |

| Liabilities: | | | | | |

| Bonds and notes payable | $ | 13,438,416 | | | 14,637,195 | | | 16,736,701 | |

| Bank deposits | 675,767 | | | 691,322 | | | 484,047 | |

| Other liabilities | 745,097 | | | 845,625 | | | 683,930 | |

| Total liabilities | 14,859,280 | | | 16,174,142 | | | 17,904,678 | |

| Equity: | | | | | |

| Total Nelnet, Inc. shareholders' equity | 3,229,683 | | | 3,198,959 | | | 3,088,313 | |

| Noncontrolling interests | (6,354) | | | 943 | | | (3,250) | |

| Total equity | 3,223,329 | | | 3,199,902 | | | 3,085,063 | |

| Total liabilities and equity | $ | 18,082,609 | | | 19,374,044 | | | 20,989,741 | |

Overview

The Company is a diverse, innovative company with a purpose to serve others and a vision to make dreams possible. The largest operating businesses engage in loan servicing and education technology, services, and payment processing, and the Company also has a significant investment in communications. A significant portion of the Company's revenue is net interest income earned on a portfolio of federally insured student loans. The Company also makes investments to further diversify both within and outside of its historical core education-related businesses including, but not limited to, investments in early-stage and emerging growth companies, real estate, and renewable energy (solar). The Company is also actively expanding its private education, consumer, and other loan portfolios, and in November 2020 launched Nelnet Bank.

GAAP Net Income and Non-GAAP Net Income, Excluding Adjustments

The Company prepares its financial statements and presents its financial results in accordance with GAAP. However, it also provides additional non-GAAP financial information related to specific items management believes to be important in the evaluation of its operating results and performance. A reconciliation of the Company's GAAP net income to Non-GAAP net income, excluding derivative market value adjustments, and a discussion of why the Company believes providing this additional information is useful to investors, is provided below.

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | |

| March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | | | |

| GAAP net income attributable to Nelnet, Inc. | $ | 26,487 | | | 30,773 | | | 186,647 | | | | | |

| Realized and unrealized derivative market value adjustments | 37,411 | | | 7,434 | | | (145,734) | | | | | |

| Tax effect (a) | (8,979) | | | (1,784) | | | 34,976 | | | | | |

| Non-GAAP net income attributable to Nelnet, Inc., excluding derivative market value adjustments (b) | $ | 54,919 | | | 36,423 | | | 75,889 | | | | | |

| | | | | | | | | |

| Earnings per share: | | | | | | | | | |

| GAAP net income attributable to Nelnet, Inc. | $ | 0.71 | | | 0.83 | | | 4.91 | | | | | |

| Realized and unrealized derivative market value adjustments | 1.00 | | | 0.20 | | | (3.83) | | | | | |

| Tax effect (a) | (0.24) | | | (0.05) | | | 0.91 | | | | | |

| Non-GAAP net income attributable to Nelnet, Inc., excluding derivative market value adjustments (b) | $ | 1.47 | | | 0.98 | | | 1.99 | | | | | |

(a) The tax effects are calculated by multiplying the realized and unrealized derivative market value adjustments by the applicable statutory income tax rate.

(b) "Derivative market value adjustments" includes both the realized portion of gains and losses (corresponding to variation margin received or paid on derivative instruments that are settled daily at a central clearinghouse) and the unrealized portion of gains and losses that are caused by changes in fair values of derivatives which do not qualify for "hedge treatment" under GAAP. "Derivative market value adjustments" does not include "derivative settlements" that represent the cash paid or received during the current period to settle with derivative instrument counterparties the economic effect of the Company's derivative instruments based on their contractual terms.

The accounting for derivatives requires that changes in the fair value of derivative instruments be recognized currently in earnings, with no fair value adjustment of the hedged item, unless specific hedge accounting criteria is met. Management has structured all of the Company’s derivative transactions with the intent that each is economically effective; however, the Company’s derivative instruments do not qualify for hedge accounting. As a result, the change in fair value of derivative instruments is reported in current period earnings with no consideration for the corresponding change in fair value of the hedged item. Under GAAP, the cumulative net realized and unrealized gain or loss caused by changes in fair values of derivatives in which the Company plans to hold to maturity will equal zero over the life of the contract. However, the net realized and unrealized gain or loss during any given reporting period fluctuates significantly from period to period.

The Company believes these point-in-time estimates of asset and liability values related to its derivative instruments that are subject to interest rate fluctuations are subject to volatility mostly due to timing and market factors beyond the control of management, and affect the period-to-period comparability of the results of operations. Accordingly, the Company’s management utilizes operating results excluding these items for comparability purposes when making decisions regarding the Company’s performance and in presentations with credit rating agencies, lenders, and investors. Consequently, the Company reports this non-GAAP information because the Company believes that it provides additional information regarding operational and performance indicators that are closely assessed by management. There is no comprehensive, authoritative guidance for the presentation of such non-GAAP information, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance.

Operating Segments

The Company's reportable operating segments are described in note 1 of the notes to consolidated financial statements included in the 2022 Annual Report. They include:

•Loan Servicing and Systems (LSS) - referred to as Nelnet Diversified Services (NDS)

•Education Technology, Services, and Payment Processing (ETS&PP) - referred to as Nelnet Business Services (NBS)

•Asset Generation and Management (AGM)

•Nelnet Bank

The Company earns fee-based revenue through its NDS and NBS reportable operating segments. The Company earns net interest income on its loan portfolio, consisting primarily of FFELP loans, in its AGM reportable operating segment. This segment is expected to generate significant amounts of cash as the FFELP portfolio amortizes. The Company actively works to maximize the amount and timing of cash flows generated from its FFELP portfolio and seeks to acquire additional loan assets to leverage its servicing scale and expertise to generate incremental earnings and cash flow.

On November 2, 2020, the Company obtained final approval for federal deposit insurance from the Federal Deposit Insurance Corporation (FDIC) and for a bank charter from the Utah Department of Financial Institutions (UDFI) in connection with the establishment of Nelnet Bank, and Nelnet Bank launched operations. Nelnet Bank operates as an internet industrial bank franchise focused on the private education and unsecured consumer loan markets, with a home office in Salt Lake City, Utah.

Other business activities and operating segments that are not reportable are combined and included in Corporate and Other Activities ("Corporate"). Corporate also includes income earned on the majority of the Company’s investments, interest expense incurred on unsecured and other corporate related debt transactions, and certain shared service activities related to internal audit, human resources, accounting, legal, enterprise risk management, information technology, occupancy, and marketing. These shared services are allocated to each operating segment based on estimated use of such activities and services. In addition, Corporate includes corporate costs and overhead functions not allocated to operating segments, including executive management, investments in innovation, and other holding company organizational costs.

The information below provides the operating results (net income (loss) before taxes) for each reportable operating segment and Corporate and Other Activities for the three months ended March 31, 2023 and 2022.

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | Certain Items Impacting Comparability

(All dollar amounts below are pre-tax) |

| 2023 | | 2022 | |

| NDS | $ | 25,219 | | | 12,094 | | | •An increase in before tax operating margin in 2023 compared with 2022 due to a decrease in operating expenses, primarily salaries and benefits. In 2022, the Company was fully staffed in preparation for the resumption of federal student loan payments once the CARES Act suspension was to expire. The expiration of the CARES Act was extended multiple times throughout 2022. The Company reduced staff in January 2023 to manage excess staff due to the delays in the government's student debt relief and return to repayment programs. |

| NBS | 37,637 | | | 33,113 | | | •The recognition of $6.0 million of interest income in 2023 compared with $0.3 million in 2022 due to higher interest rates. •A decrease in before tax operating margin, excluding net interest income, in 2023 compared with 2022 due to additional investments in the development of new services and technologies and superior customer experiences to align with the Company's strategies to grow, retain, and diversify revenue. |

| AGM | (221) | | | 213,429 | | | •A net loss of $37.4 million related to changes in the fair values of derivative instruments that do not qualify for hedge accounting in 2023 compared with a net gain of $145.7 million in 2022. •The recognition of $31.9 million in provision for loan losses in 2023 compared with a negative provision of $0.9 million in 2022. •A decrease of $12.6 million in net interest income due to the decrease in the average balance of loans in 2023 compared with 2022. •An increase of $4.2 million in net interest income due to an increase in core loan spread in 2023 compared with 2022. •The recognition of $11.8 million in gains from the sale of loans in 2023 compared with $3.0 million in 2022. |

| Nelnet Bank | (93) | | | 961 | | | |

| Corporate | (31,275) | | | (19,013) | | | •The recognition of a net loss of $20.2 million in 2023 related to the Company’s investment in ALLO, compared with a net loss of $13.1 million in 2022. •The recognition of net investment losses of $3.3 million in 2023 compared with net investment income and gains of $8.5 million in 2022. |

| Income before income taxes | 31,267 | | | 240,583 | | | |

| Income tax expense | (8,250) | | | (55,697) | | | |

| Net loss attributable to noncontrolling interests | 3,470 | | | 1,761 | | | |

| Net income | $ | 26,487 | | | 186,647 | | | |

Segment Reporting

The following tables present the results of each of the Company's reportable operating segments reconciled to the consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, 2023 |

| Loan Servicing and Systems | | Education Technology, Services, and Payment Processing | | Asset

Generation and

Management | | Nelnet Bank | | Corporate and Other Activities | | Eliminations | | Total |

| Total interest income | $ | 1,037 | | | 6,036 | | | 234,719 | | | 12,259 | | | 21,199 | | | (9,282) | | | 265,968 | |

| Interest expense | — | | | — | | | 189,198 | | | 7,214 | | | 12,318 | | | (9,282) | | | 199,449 | |

| Net interest income | 1,037 | | | 6,036 | | | 45,521 | | | 5,045 | | | 8,881 | | | — | | | 66,519 | |

| Less provision (negative provision) for loan losses | — | | | — | | | 31,858 | | | 2,417 | | | — | | | — | | | 34,275 | |

| Net interest income after provision for loan losses | 1,037 | | | 6,036 | | | 13,663 | | | 2,628 | | | 8,881 | | | — | | | 32,244 | |

| Other income (expense): | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 139,227 | | | — | | | — | | | — | | | — | | | — | | | 139,227 | |

| Intersegment revenue | 7,790 | | | 56 | | | — | | | — | | | — | | | (7,846) | | | — | |

| Education technology, services, and payment processing revenue | — | | | 133,603 | | | — | | | — | | | — | | | — | | | 133,603 | |

| Solar construction revenue | — | | | — | | | — | | | — | | | 8,651 | | | — | | | 8,651 | |

| Other, net | 608 | | | — | | | 2,845 | | | 210 | | | (17,734) | | | — | | | (14,071) | |

| Gain (loss) on sale of loans, net | — | | | — | | | 11,812 | | | — | | | — | | | — | | | 11,812 | |

| Impairment expense | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Derivative settlements, net | — | | | — | | | 23,337 | | | — | | | — | | | — | | | 23,337 | |

| Derivative market value adjustments, net | — | | | — | | | (37,411) | | | — | | | — | | | — | | | (37,411) | |

| Total other income (expense) | 147,625 | | | 133,659 | | | 583 | | | 210 | | | (9,083) | | | (7,846) | | | 265,148 | |

| Cost of services: | | | | | | | | | | | | | |

| Cost to provide education technology, services, and payment processing services | — | | | 47,704 | | | — | | | — | | | — | | | — | | | 47,704 | |

| Cost to provide solar construction services | — | | | — | | | — | | | — | | | 8,299 | | | — | | | 8,299 | |

| Total cost of services | — | | | 47,704 | | | — | | | — | | | 8,299 | | | — | | | 56,003 | |

| Operating expenses: | | | | | | | | | | | | | |

| Salaries and benefits | 84,560 | | | 37,913 | | | 755 | | | 2,064 | | | 27,419 | | | — | | | 152,710 | |

| Depreciation and amortization | 4,513 | | | 2,578 | | | — | | | 5 | | | 9,531 | | | — | | | 16,627 | |

| Other expenses | 13,313 | | | 8,063 | | | 5,016 | | | 782 | | | 13,611 | | | — | | | 40,785 | |

| Intersegment expenses, net | 21,057 | | | 5,800 | | | 8,696 | | | 80 | | | (27,787) | | | (7,846) | | | — | |

| Total operating expenses | 123,443 | | | 54,354 | | | 14,467 | | | 2,931 | | | 22,774 | | | (7,846) | | | 210,122 | |

| Income (loss) before income taxes | 25,219 | | | 37,637 | | | (221) | | | (93) | | | (31,275) | | | — | | | 31,267 | |

| Income tax (expense) benefit | (6,053) | | | (9,066) | | | 53 | | | 35 | | | 6,781 | | | — | | | (8,250) | |

| Net income (loss) | 19,166 | | | 28,571 | | | (168) | | | (58) | | | (24,494) | | | — | | | 23,017 | |

| Net loss attributable to noncontrolling interests | — | | | 138 | | | — | | | — | | | 3,332 | | | — | | | 3,470 | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 19,166 | | | 28,709 | | | (168) | | | (58) | | | (21,162) | | | — | | | 26,487 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, 2022 |

| Loan Servicing and Systems | | Education Technology, Services, and Payment Processing | | Asset

Generation and

Management | | Nelnet Bank | | Corporate and Other Activities | | Eliminations | | Total |

| Total interest income | $ | 1,578 | | | 4,457 | | | 234,631 | | | 10,181 | | | 21,489 | | | (9,446) | | | 262,890 | |

| Interest expense | — | | | — | | | 176,180 | | | 5,263 | | | 9,793 | | | (9,446) | | | 181,790 | |

| Net interest income | 1,578 | | | 4,457 | | | 58,451 | | | 4,918 | | | 11,696 | | | — | | | 81,100 | |

| Less provision (negative provision) for loan losses | — | | | — | | | 27,423 | | | 378 | | | — | | | — | | | 27,801 | |

| Net interest income after provision for loan losses | 1,578 | | | 4,457 | | | 31,028 | | | 4,540 | | | 11,696 | | | — | | | 53,299 | |

| Other income (expense): | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 140,021 | | | — | | | — | | | — | | | — | | | — | | | 140,021 | |

| Intersegment revenue | 8,028 | | | 64 | | | — | | | — | | | — | | | (8,092) | | | — | |

| Education technology, services, and payment processing revenue | — | | | 98,332 | | | — | | | — | | | — | | | — | | | 98,332 | |

| Solar construction revenue | — | | | — | | | — | | | — | | | 15,186 | | | — | | | 15,186 | |

| Other, net | 597 | | | — | | | 4,898 | | | 402 | | | (5,161) | | | — | | | 735 | |

| Gain (loss) on sale of loans, net | — | | | — | | | (2,712) | | | — | | | — | | | — | | | (2,713) | |

| Impairment expense | (5,511) | | | (2,239) | | | — | | | (214) | | | (1,397) | | | — | | | (9,361) | |

| Derivative settlements, net | — | | | — | | | 20,858 | | | — | | | — | | | — | | | 20,858 | |

| Derivative market value adjustments, net | — | | | — | | | (7,434) | | | — | | | — | | | — | | | (7,434) | |

| Total other income (expense) | 143,135 | | | 96,157 | | | 15,610 | | | 188 | | | 8,628 | | | (8,092) | | | 255,624 | |

| Cost of services: | | | | | | | | | | | | | |

| Cost to provide education technology, services, and payment processing services | — | | | 39,330 | | | — | | | — | | | — | | | — | | | 39,330 | |

| Cost to provide solar construction services | — | | | — | | | — | | | — | | | 14,003 | | | — | | | 14,004 | |

| Total cost of services | — | | | 39,330 | | | — | | | — | | | 14,003 | | | — | | | 53,334 | |

| Operating expenses: | | | | | | | | | | | | | |

| Salaries and benefits | 87,550 | | | 35,072 | | | 666 | | | 1,866 | | | 26,415 | | | — | | | 151,568 | |

| Depreciation and amortization | 8,199 | | | 2,639 | | | — | | | 4 | | | 9,258 | | | — | | | 20,099 | |

| Other expenses | 13,299 | | | 10,555 | | | 6,910 | | | 916 | | | 18,802 | | | — | | | 50,481 | |

| Intersegment expenses, net | 18,703 | | | 5,367 | | | 8,985 | | | 73 | | | (25,036) | | | (8,092) | | | — | |

| Total operating expenses | 127,751 | | | 53,633 | | | 16,561 | | | 2,859 | | | 29,439 | | | (8,092) | | | 222,148 | |

| Income (loss) before income taxes | 16,962 | | | 7,651 | | | 30,077 | | | 1,869 | | | (23,118) | | | — | | | 33,441 | |

| Income tax (expense) benefit | (4,071) | | | (1,838) | | | (7,219) | | | (439) | | | 8,108 | | | — | | | (5,459) | |

| Net income (loss) | 12,891 | | | 5,813 | | | 22,858 | | | 1,430 | | | (15,010) | | | — | | | 27,982 | |

| Net loss attributable to noncontrolling interests | — | | | 5 | | | — | | | — | | | 2,786 | | | — | | | 2,791 | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 12,891 | | | 5,818 | | | 22,858 | | | 1,430 | | | (12,224) | | | — | | | 30,773 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, 2022 |

| Loan Servicing and Systems | | Education Technology, Services, and Payment Processing | | Asset

Generation and

Management | | Nelnet Bank | | Corporate and Other Activities | | Eliminations | | Total |

| Total interest income | $ | 67 | | | 339 | | | 118,598 | | | 3,030 | | | 3,992 | | | (828) | | | 125,196 | |

| Interest expense | 24 | | | — | | | 46,003 | | | 856 | | | 2,026 | | | (828) | | | 48,079 | |

| Net interest income | 43 | | | 339 | | | 72,595 | | | 2,174 | | | 1,966 | | | — | | | 77,117 | |

| Less provision (negative provision) for loan losses | — | | | — | | | (864) | | | 429 | | | — | | | — | | | (435) | |

| Net interest income after provision for loan losses | 43 | | | 339 | | | 73,459 | | | 1,745 | | | 1,966 | | | — | | | 77,552 | |

| Other income (expense): | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 136,368 | | | — | | | — | | | — | | | — | | | — | | | 136,368 | |

| Intersegment revenue | 8,480 | | | 3 | | | — | | | — | | | — | | | (8,483) | | | — | |

| Education technology, services, and payment processing revenue | — | | | 112,286 | | | — | | | — | | | — | | | — | | | 112,286 | |

| Solar construction revenue | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Other, net | 740 | | | — | | | 6,511 | | | 1,500 | | | 1,125 | | | — | | | 9,877 | |

| Gain (loss) on sale of loans, net | — | | | — | | | 2,989 | | | — | | | — | | | — | | | 2,989 | |

| Impairment expense | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Derivative settlements, net | — | | | — | | | (2,809) | | | — | | | — | | | — | | | (2,809) | |

| Derivative market value adjustments, net | — | | | — | | | 145,734 | | | — | | | — | | | — | | | 145,734 | |

| Total other income (expense) | 145,588 | | | 112,289 | | | 152,425 | | | 1,500 | | | 1,125 | | | (8,483) | | | 404,445 | |

| Cost of services: | | | | | | | | | | | | | |

| Cost to provide education technology, services, and payment processing services | — | | | 35,545 | | | — | | | — | | | — | | | — | | | 35,545 | |

| Cost to provide solar construction services | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Total cost of services | — | | | 35,545 | | | — | | | — | | | — | | | — | | | 35,545 | |

| Operating expenses: | | | | | | | | | | | | | |

| Salaries and benefits | 91,972 | | | 31,286 | | | 591 | | | 1,554 | | | 24,012 | | | — | | | 149,414 | |

| Depreciation and amortization | 4,954 | | | 2,315 | | | — | | | 3 | | | 9,684 | | | — | | | 16,956 | |

| Other expenses | 16,213 | | | 5,764 | | | 3,033 | | | 682 | | | 13,804 | | | — | | | 39,499 | |

| Intersegment expenses, net | 20,398 | | | 4,605 | | | 8,831 | | | 45 | | | (25,396) | | | (8,483) | | | — | |

| Total operating expenses | 133,537 | | | 43,970 | | | 12,455 | | | 2,284 | | | 22,104 | | | (8,483) | | | 205,869 | |

| Income (loss) before income taxes | 12,094 | | | 33,113 | | | 213,429 | | | 961 | | | (19,013) | | | — | | | 240,583 | |

| Income tax (expense) benefit | (2,903) | | | (7,947) | | | (51,223) | | | (223) | | | 6,598 | | | — | | | (55,697) | |

| Net income (loss) | 9,191 | | | 25,166 | | | 162,206 | | | 738 | | | (12,415) | | | — | | | 184,886 | |

| Net loss attributable to noncontrolling interests | — | | | — | | | — | | | — | | | 1,761 | | | — | | | 1,761 | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 9,191 | | | 25,166 | | | 162,206 | | | 738 | | | (10,654) | | | — | | | 186,647 | |

Loan Servicing and Systems Revenue

The following table presents disaggregated revenue by service offering for the Loan Servicing and Systems operating segment.

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | |

| March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | | | |

| Government loan servicing | $ | 108,880 | | | 110,698 | | | 109,125 | | | | | |

| Private education and consumer loan servicing | 12,164 | | | 12,016 | | | 12,873 | | | | | |

| FFELP loan servicing | 3,368 | | | 3,630 | | | 4,248 | | | | | |

| Software services | 9,697 | | | 9,873 | | | 7,400 | | | | | |

| Outsourced services | 5,118 | | | 3,804 | | | 2,722 | | | | | |

| Loan servicing and systems revenue | $ | 139,227 | | | 140,021 | | | 136,368 | | | | | |

Loan Servicing Volumes

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| December 31,

2021 | | March 31,

2022 | | June 30,

2022 | | September 30,

2022 | | December 31,

2022 | | March 31,

2023 | | | | |

| Servicing volume (dollars in millions): | | | | | | | | | | | | | | | |

| Government | $ | 478,402 | | | 507,653 | | | 542,398 | | | 545,546 | | | 545,373 | | | 537,291 | | | | | |

| FFELP | 26,916 | | | 25,646 | | | 24,224 | | | 22,412 | | | 20,226 | | | 19,815 | | | | | |

| Private and consumer | 23,702 | | | 23,433 | | | 22,838 | | | 22,461 | | | 21,866 | | | 21,484 | | | | | |

| Total | $ | 529,020 | | | 556,732 | | | 589,460 | | | 590,419 | | | 587,465 | | | 578,590 | | | | | |

| | | | | | | | | | | | | | | |

| Number of servicing borrowers: | | | | | | | | | | | | | | | |

| Government | 14,196,520 | | | 14,727,860 | | | 15,426,607 | | | 15,657,942 | | | 15,777,328 | | | 15,518,751 | | | | | |

| FFELP | 1,092,066 | | | 1,034,913 | | | 977,785 | | | 910,188 | | | 829,939 | | | 819,791 | | | | | |

| Private and consumer | 1,065,439 | | | 1,030,863 | | | 998,454 | | | 979,816 | | | 951,866 | | | 925,861 | | | | | |

| Total | 16,354,025 | | | 16,793,636 | | | 17,402,846 | | | 17,547,946 | | | 17,559,133 | | | 17,264,403 | | | | | |

| | | | | | | | | | | | | | | |

| Number of remote hosted borrowers: | 4,799,368 | | | 5,487,943 | | | 5,738,381 | | | 6,025,377 | | | 6,135,760 | | | 5,048,324 | | | | | |

Education Technology, Services, and Payment Processing

The following table presents disaggregated revenue by servicing offering for the Education Technology, Services, and Payment Processing operating segment.

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | |

| March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | | | |

| Tuition payment plan services | $ | 34,187 | | | 26,671 | | | 30,716 | | | | | |

| Payment processing | 44,041 | | | 34,216 | | | 38,071 | | | | | |

| Education technology and services | 54,787 | | | 35,924 | | | 43,251 | | | | | |

| Other | 588 | | | 1,521 | | | 248 | | | | | |

| Education technology, services, and payment processing revenue | $ | 133,603 | | | 98,332 | | | 112,286 | | | | | |

As discussed further in the Company's 2022 Annual Report, this segment of the Company’s business is subject to seasonal fluctuations which correspond, or are related to, the traditional school year. Based on the timing of revenue recognition and when expenses are incurred, revenue and before tax operating margin are higher in the first quarter compared with the remainder of the year.

Other Income (Expense)

The following table presents the components of "other, net" in "other income (expense)" on the consolidated statements of income:

| | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | |

| | March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | | | |

| ALLO preferred return | $ | 2,249 | | | 2,164 | | | 2,117 | | | | | |

| Borrower late fee income | 2,247 | | | 3,116 | | | 2,431 | | | | | |

| Administration/sponsor fee income | 1,772 | | | 1,844 | | | 2,123 | | | | | |

| Investment advisory services | 1,612 | | | 1,651 | | | 1,282 | | | | | |

| Loss from ALLO voting membership interest investment | (20,213) | | | (20,332) | | | (13,130) | | | | | |

| Investment activity, net | (3,577) | | | 10,866 | | | 11,856 | | | | | |

| Loss from solar investments | (1,947) | | | (2,379) | | | (1,030) | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other | 3,786 | | | 3,805 | | | 4,228 | | | | | |

| Other, net | $ | (14,071) | | | 735 | | | 9,877 | | | | | |

Derivative Settlements

The following table summarizes the components of "derivative settlements, net" included in the consolidated statements of income.

| | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | |

| | March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | | | |

| 1:3 basis swaps | $ | 859 | | | (448) | | | 396 | | | | | |

| Interest rate swaps - floor income hedges (a) | 22,478 | | | 21,306 | | | (3,205) | | | | | |

| | | | | | | | | |

| Total derivative settlements - income (expense) | $ | 23,337 | | | 20,858 | | | (2,809) | | | | | |

(a) All over-the-counter derivative contracts executed by the Company are cleared post-execution at a regulated clearinghouse. Clearing is a process by which a third party, the clearinghouse, steps in between the original counterparties and guarantees the performance of both, by requiring that each post liquid collateral on an initial (initial margin) and mark-to-market (variation margin) basis to cover the clearinghouse’s potential future exposure in the event of default. Through March 15, 2023, the Company had received cash or had a receivable from the clearinghouse related to variation margin equal to the fair value of the derivatives used to hedge loans earning fixed rate floor income as of March 15, 2023 of $183.2 million, which included $19.1 million related to current period settlements. To minimize the Company's exposure to market volatility, the Company terminated its entire derivative portfolio hedging loans earning fixed rate floor income. As a result of the Company terminating these derivatives, there will be no derivative settlements on these derivatives in future periods.

Loans and Accrued Interest Receivable and Allowance for Loan Losses

Loans and accrued interest receivable and allowance for loan losses consisted of the following:

| | | | | | | | | | | | | | | | | |

| As of | | As of | | As of |

| | March 31, 2023 | | December 31, 2022 | | March 31, 2022 |

| Non-Nelnet Bank: | | | | | |

| Federally insured loans: | | | | | |

| Stafford and other | $ | 3,229,778 | | | 3,389,178 | | | 3,741,495 | |

| Consolidation | 9,701,781 | | | 10,177,295 | | | 12,553,882 | |

| Total | 12,931,559 | | | 13,566,473 | | | 16,295,377 | |

| Private education loans | 241,515 | | | 252,383 | | | 278,537 | |

| Consumer and other loans | 309,546 | | | 350,915 | | | 44,713 | |

| Non-Nelnet Bank loans | 13,482,620 | | | 14,169,771 | | | 16,618,627 | |

| Nelnet Bank: | | | | | |

| Federally insured loans | 63,399 | | | 65,913 | | | 82,789 | |

| | | | | |

| | | | | |

| | | | | |

| Private education loans | 355,705 | | | 353,882 | | | 285,468 | |

| Consumer and other loans | 19,903 | | | — | | | — | |

| Nelnet Bank loans | 439,007 | | | 419,795 | | | 368,257 | |

| | | | | |

| Accrued interest receivable | 800,400 | | | 816,864 | | | 774,774 | |

| Loan discount, net of unamortized loan premiums and deferred origination costs | (26,215) | | | (30,714) | | | (22,257) | |

| Allowance for loan losses: | | | | | |

| Non-Nelnet Bank: | | | | | |

| Federally insured loans | (79,331) | | | (83,593) | | | (95,995) | |

| Private education loans | (15,175) | | | (15,411) | | | (14,622) | |

| Consumer and other loans | (35,317) | | | (30,263) | | | (5,710) | |

| Non-Nelnet Bank allowance for loan losses | (129,823) | | | (129,267) | | | (116,327) | |

| Nelnet Bank: | | | | | |

| Federally insured loans | (160) | | | (170) | | | (247) | |

| Private education loans | (2,894) | | | (2,390) | | | (1,251) | |

| Consumer and other loans | (1,827) | | | — | | | — | |

| Nelnet Bank allowance for loan losses | (4,881) | | | (2,560) | | | (1,498) | |

| | $ | 14,561,108 | | | 15,243,889 | | | 17,621,576 | |

The following table summarizes the allowance for loan losses as a percentage of the ending loan balance for each of the Company's loan portfolios.

| | | | | | | | | | | | | | | | | |

| As of | | As of | | As of |

| March 31, 2023 | | December 31, 2022 | | March 31, 2022 |

| Non-Nelnet Bank: | | | | | |

| Federally insured loans (a) | 0.61 | % | | 0.62 | % | | 0.59 | % |

| Private education loans | 6.28 | % | | 6.11 | % | | 5.25 | % |

| Consumer and other loans | 11.41 | % | | 8.62 | % | | 12.77 | % |

| Nelnet Bank: | | | | | |

| Federally insured loans (a) | 0.25 | % | | 0.26 | % | | 0.30 | % |

| Private education loans | 0.81 | % | | 0.68 | % | | 0.44 | % |

| Consumer and other loans | 9.18 | % | | — | | | — | |

(a) As of March 31, 2023, December 31, 2022, and March 31, 2022, the allowance for loan losses as a percent of the risk sharing component of federally insured student loans not covered by the federal guaranty for non-Nelnet Bank was 22.3%, 22.4%, and 21.6%, respectively, and for Nelnet Bank was 10.1%, 10.3%, and 11.8%, respectively.

Loan Activity

The following table sets forth the activity of the Company's loan portfolios:

| | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | |

| | March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | | | |

| Non-Nelnet Bank: | | | | | | | | | |

| Beginning balance | $ | 14,169,771 | | | 14,794,015 | | | 17,441,790 | | | | | |

| Loan acquisitions: | | | | | | | | | |

| Federally insured student loans | 2,980 | | | 667,008 | | | 10,202 | | | | | |

| Private education loans | — | | | 67 | | | 1,026 | | | | | |

| Consumer and other loans | 250,706 | | | 259,217 | | | 18,522 | | | | | |

| Total loan acquisitions | 253,686 | | | 926,292 | | | 29,750 | | | | | |

| Repayments, claims, capitalized interest, participations, and other, net | (410,239) | | | (383,829) | | | (447,140) | | | | | |

| Loans lost to external parties | (268,696) | | | (1,046,911) | | | (387,648) | | | | | |

| Loans sold | (261,902) | | | (119,796) | | | (18,125) | | | | | |

| | | | | | | | | |

| Ending balance | $ | 13,482,620 | | | 14,169,771 | | | 16,618,627 | | | | | |

| | | | | | | | | |

| Nelnet Bank: | | | | | | | | | |

| Beginning balance | $ | 419,795 | | | 429,476 | | | 257,901 | | | | | |

| Loan originations: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Private education loans | 14,226 | | | 8,426 | | | 130,342 | | | | | |

| Consumer and other loans | 19,632 | | | — | | | — | | | | | |

| Total loan originations | 33,858 | | | 8,426 | | | 130,342 | | | | | |

| Repayments | (14,529) | | | (18,011) | | | (18,394) | | | | | |

| | | | | | | | | |

| Sales to AGM | (117) | | | (96) | | | (1,592) | | | | | |

| | | | | | | | | |

| Ending balance | $ | 439,007 | | | 419,795 | | | 368,257 | | | | | |

The Company has also purchased partial ownership in certain consumer, private education, and federally insured student loan securitizations that are accounted for as held-to-maturity beneficial interest investments and included in "investments and notes receivable" in the Company's consolidated financial statements. As of the latest remittance reports filed by the various trusts prior to or as of March 31, 2023, the Company’s ownership correlates to approximately $585 million, $590 million, and $370 million of consumer, private education, and federally insured student loans, respectively, included in these securitizations. The loans held in these securitizations are not included in the above table.

Since late 2021, the Company has experienced accelerated run-off of its FFELP portfolio due to FFELP borrowers consolidating their loans into Federal Direct Loan Program loans as a result of the continued extension of the CARES Act payment pause on Department held loans and the initiatives offered by the Department for FFELP borrowers to consolidate their loans to qualify for loan forgiveness under the Public Service Loan Forgiveness and other programs.

Loan Spread Analysis

The following table analyzes the loan spread on AGM’s portfolio of loans, which represents the spread between the yield earned on loan assets and the costs of the liabilities and derivative instruments used to fund the assets.

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | |

| | March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | | | |

| Variable loan yield, gross | 7.12 | % | | 6.52 | % | | 2.75 | % | | | | |

| Consolidation rebate fees | (0.81) | | | (0.82) | | | (0.85) | | | | | |

| Discount accretion, net of premium and deferred origination costs amortization (a) | 0.05 | | | 0.06 | | | 0.03 | | | | | |

| Variable loan yield, net | 6.36 | | | 5.76 | | | 1.93 | | | | | |

| Loan cost of funds - interest expense | (5.53) | | | (4.64) | | | (1.09) | | | | | |

| Loan cost of funds - derivative settlements (b) (c) | 0.03 | | | (0.01) | | | 0.01 | | | | | |

| Variable loan spread | 0.86 | | | 1.11 | | | 0.85 | | | | | |

| Fixed rate floor income, gross | 0.03 | | | 0.07 | | | 0.68 | | | | | |

| Fixed rate floor income - derivative settlements (b) (d) | 0.68 | | | 0.59 | | | (0.08) | | | | | |

| Fixed rate floor income, net of settlements on derivatives | 0.71 | | | 0.66 | | | 0.60 | | | | | |

| Core loan spread | 1.57 | % | | 1.77 | % | | 1.45 | % | | | | |

| | | | | | | | | |

| Average balance of AGM's loans | $ | 13,991,241 | | | 14,764,466 | | | 17,208,909 | | | | | |

| Average balance of AGM's debt outstanding | 13,364,876 | | | 14,352,548 | | | 16,773,698 | | | | | |

(a) During the fourth quarter of 2022, the Company changed its estimate of the constant prepayment rate used to amortize/accrete federally insured loan premium/discounts for its loans which resulted in a $8.4 million increase to interest income. The impact of this adjustment was excluded from the table above.

(b) Derivative settlements represent the cash paid or received during the current period to settle with derivative instrument counterparties the economic effect of the Company's derivative instruments based on their contractual terms. Derivative accounting requires that net settlements with respect to derivatives that do not qualify for "hedge treatment" under GAAP be recorded in a separate income statement line item below net interest income. The Company maintains an overall risk management strategy that incorporates the use of derivative instruments to reduce the economic effect of interest rate volatility. As such, management believes derivative settlements for each applicable period should be evaluated with the Company’s net interest income (loan spread) as presented in this table. The Company reports this non-GAAP information because the Company believes that it provides additional information regarding operational and performance indicators that are closely assessed by management. There is no comprehensive, authoritative guidance for the presentation of such non-GAAP information, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance. See "Derivative Settlements" included in this supplement for the net settlement activity recognized by the Company for each type of derivative for the periods presented in the table.

A reconciliation of core loan spread, which includes the impact of derivative settlements on loan spread, to loan spread without derivative settlements follows.

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | |

| March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | | | |

| Core loan spread | 1.57 | % | | 1.77 | % | | 1.45 | % | | | | |

| Derivative settlements (1:3 basis swaps) | (0.03) | | | 0.01 | | | (0.01) | | | | | |

| Derivative settlements (fixed rate floor income) | (0.68) | | | (0.59) | | | 0.08 | | | | | |

| Loan spread | 0.86 | % | | 1.19 | % | | 1.52 | % | | | | |

(c) Derivative settlements consist of net settlements received (paid) related to the Company’s 1:3 basis swaps.

(d) Derivative settlements consist of net settlements received (paid) related to the Company’s floor income interest rate swaps.

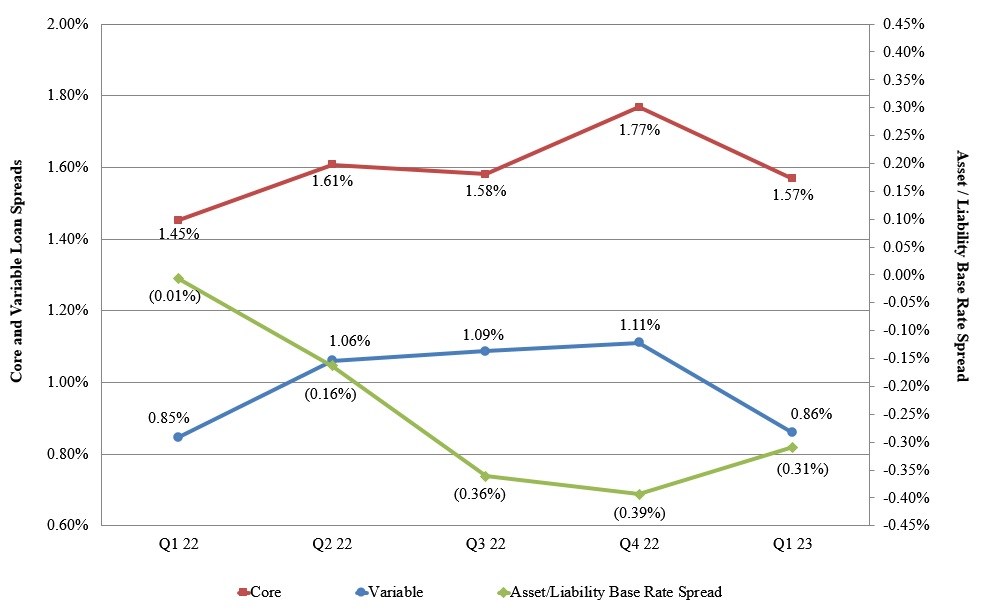

A trend analysis of AGM's core and variable loan spreads is summarized below.

The interest earned on a large portion of AGM's FFELP student loan assets is indexed to the one-month LIBOR rate. AGM funds a portion of its assets with three-month LIBOR indexed floating rate securities. The relationship between the indices in which AGM earns interest on its loans and funds such loans has a significant impact on loan spread. The table above (the right axis) shows the difference between AGM's liability base rate and the one-month LIBOR rate by quarter.

Variable loan spread increased during the three months ended March 31, 2023 compared with the same period in 2022 due to a narrowing of the basis between the asset and debt indices in which the Company earns interest on its loans and funds such loans (as reflected in the table above). In an increasing interest rate environment, student loan spread on FFELP loans increases due to the timing of interest rate resets on the Company's assets occurring daily in contrast to the timing of the interest resets on the Company's debt that occurs either monthly or quarterly.

The difference between variable loan spread and core loan spread is fixed rate floor income earned on a portion of AGM's federally insured student loan portfolio. A summary of fixed rate floor income and its contribution to core loan spread follows:

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | |

| | March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | | | |

| Fixed rate floor income, gross | $ | 1,110 | | | 2,510 | | | 28,993 | | | | | |

| Derivative settlements (a) | 22,478 | | | 21,306 | | | (3,205) | | | | | |

| Fixed rate floor income, net | $ | 23,588 | | | 23,816 | | | 25,788 | | | | | |

| Fixed rate floor income contribution to spread, net | 0.71 | % | | 0.66 | % | | 0.60 | % | | | | |

(a) Derivative settlements consist of net settlements received (paid) related to the Company's derivatives used to hedge student loans earning fixed rate floor income. As a result of the Company terminating all its interest rate swaps hedging loans earning fixed rate floor income on March 15, 2023 (as discussed under "Derivative Settlements" included in this supplement), there will be no derivative settlements on these derivatives in future periods.

Fixed Rate Floor Income

The following table shows AGM’s federally insured student loan assets that were earning fixed rate floor income as of March 31, 2023.

| | | | | | | | | | | | | | | | | | | | |

| Fixed interest rate range | | Borrower/lender weighted average yield | | Estimated variable conversion rate (a) | | Loan balance |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| 7.0 - 7.49% | | 7.38% | | 4.74% | | $ | 14,294 | |

| 7.5 - 7.99% | | 7.73% | | 5.09% | | 124,236 | |

| 8.0 - 8.99% | | 8.18% | | 5.54% | | 339,275 | |

> 9.0% | | 9.05% | | 6.41% | | 131,116 | |

| | | | | | | $ | 608,921 | |

(a) The estimated variable conversion rate is the estimated short-term interest rate at which loans would convert to a variable rate. As of March 31, 2023, the weighted average estimated variable conversion rate was 5.62% and the short-term interest rate was 470 basis points.