2023 Letter to Shareholders | Page 1 Dear Shareholder, Last year (2023) was a pivotal year for our company, for the country, and for the world. An increase of over 500 basis points in interest rates in the United States (U.S.) in a 14-month period. A run on and subsequent collapse of a major banking institution. Unprecedented volatility and changes to the federal student loan programs. Two ongoing wars. Not to mention Taylor Swift dating Travis Kelce. Who could have planned for or predicted such a situation even 12 months ago? We live in a rapidly changing world that requires constant vigilance and innovation. In the midst of all these events, we honor the passing of one of the legends we have always admired. One of the greatest investors of all time and, of course, a hero to us Nebraskans: Charlie Munger. He had many legendary quotes, and one of our favorites has always been: “A great business at a fair price is superior to a fair business at a great price.” -Charlie Munger For Nelnet, 2023 represented a critical turning point. We would describe it as a significant transitional year for our company. It was transitional in the context that it was the first time in our corporate history that the majority of our net income came from our fee-based businesses and not the net interest income on our loan portfolio. It may finally be a good time for the market to stop thinking of Nelnet strictly as a “student loan company.” Our multi-decade strategy to diversify into a technology, servicing, payments, and financial services company with a core strength in education is clearly evident in our 2023 performance. Even though the world is constantly changing, the five core values we have as a company remain the same and carry over to each of our businesses: 1. Provide superior customer experiences. 2. Create an awesome work environment. 3. Pursue opportunities for diversification and growth. 4. Communicate openly and honestly. 5. Give back to the communities in which we live and work. February 27, 2024 Our goal is for each Nelnet shareholder to record a gain or loss in market value proportional to the gain or loss in per-share fundamental (intrinsic) value recorded by the company. To achieve this goal, we strive to maintain a one-to-one relationship between the company's fundamental value and market. As that implies, we would rather see Nelnet's stock price at a fair level than at an artificial level. Our fair value approach may not be preferred by all investors, but we believe it aligns with Nelnet's long-term approach to both our business model and market value. However, from time to time Ms./Mr. Market can be irrational and will materially overvalue or undervalue the investments they currently love or hate. Short term Ms./Mr. Market is a voting machine, long term the market is a weighing machine." - Mike Dunlap "

2023 Letter to Shareholders | Page 2 Our focus on diversification over many years is what has allowed us to reach this point, where our fee-based businesses are now contributing the majority of the bottom line. Our GAAP earnings for 2023 were $92 million, or $2.45 per share, and our non-GAAP net income, excluding derivative market value adjustments1, was $123 million, or $3.29 per share. Even though our total earnings were down due to the amortization of our loan portfolio and our solar business (as mentioned further below), we had many bright spots including record earnings in our education technology services and payments division, processing almost $46 billion in payment volume in 2023. We weathered an unexpected storm in the finance and hedging of our loan portfolio in March, when the markets became highly volatile due to the Silicon Valley Bank (SVB) failure. At that time, we felt it was prudent to unwind our derivatives and take the cash onto our balance sheet to shore it up due to the market’s volatility. In addition, we had a heck of a year-long roller coaster ride in our loan servicing business in conjunction with the volatile political environment surrounding student loans. The leaders in this business, Nelnet Diversified Services (NDS), did a great job adjusting quickly to the ups and downs and also benefited from their ongoing diversification to have a solid year. ALLO executed its first-ever securitization of fiber-optic subscriptions. We officially launched our Nelnet Financial Services division. You will see this presented in our financial statements. This new division combines our asset generation and management business (our loan acquisition and on-balance sheet loan portfolio) with Nelnet Bank, Nelnet Insurance Services, Nelnet real- estate management, Whitetail Rock Capital Management, and the management of a portfolio of investment securities into one division. Think of it as all our traditional financial services operating businesses now under one umbrella and one management team. We believe this simplifies the management of the business and consolidates the reporting of our story into three distinct divisions and separates and aggregates the reporting of our other investment activity into a corporate treasury function. Inside the Corporate and Other Activities section of our financial statements, we now have included shared services, Nelnet Renewable Energy, our current minority investment in ALLO, and our venture capital investments, which are dominated by our large investment in Hudl. We will cover these in more detail as well. We sincerely did not believe the Federal Reserve could increase interest rates by 500 basis points in approximately one year’s time and not crater the U.S. economy. We did not believe a “soft landing” was possible. Yet here we are, and that is what has happened so far. The rise in interest rates increased our cost of capital on anything we were financing with debt including residuals in loan portfolios, slowed down our investments in real estate and solar development, and increased the cost of capital for ALLO. The good news for us is that we have a somewhat natural hedge embedded in our business against rising rates with the additional earnings they provide us on the float in our Nelnet Business Services (NBS) division. We have always been focused on creating long-term free cash flow. Sometimes this is not captured well by (GAAP) earnings. Other companies use other measures to judge their performance; our feelings are more in line with Munger’s. “I think that every time you see the word EBITDA, you should substitute the words bull$#!t earnings.” -Charlie Munger Our overall earnings for the year are down because of the expected runoff of the Federal Family Education Loan Program (FFELP) portfolio and losses in our solar business. In addition, we are down from what we expected as a result of the impact of the unwinding of our derivatives in March, which we did to create liquidity when we saw the run on SVB. Even though our earnings were down, we created a significant amount of cash flow generated by operations to the tune of $433 million, which gives us a lot of arrows in the quiver to deploy cash for opportunistic acquisitions, investments into our products and services, stock buybacks, and dividends to our shareholders. 1We prepare our financial statements and present our financial results in accordance with GAAP. However, we also provide additional non-GAAP financial information related to specific items management believes to be important in the evaluation of our operating results and performance. A reconciliation of our GAAP net income to net income, excluding derivative market value adjustments, and a discussion of why we believe providing this additional information is useful to investors can be found in our Annual Report on Form 10-K for the year ended Dec. 31, 2023, filed with the Securities and Exchange Commission on February 27, 2024.

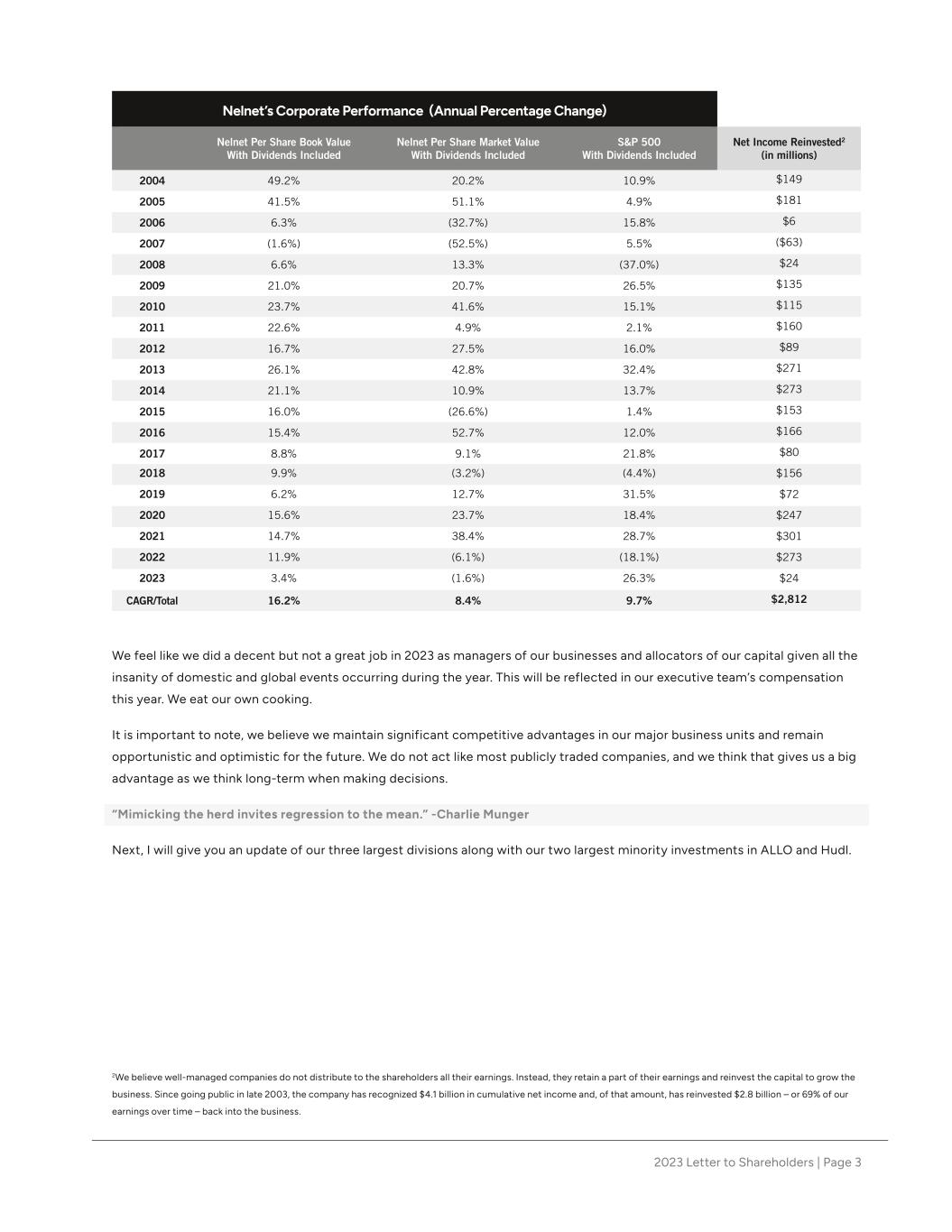

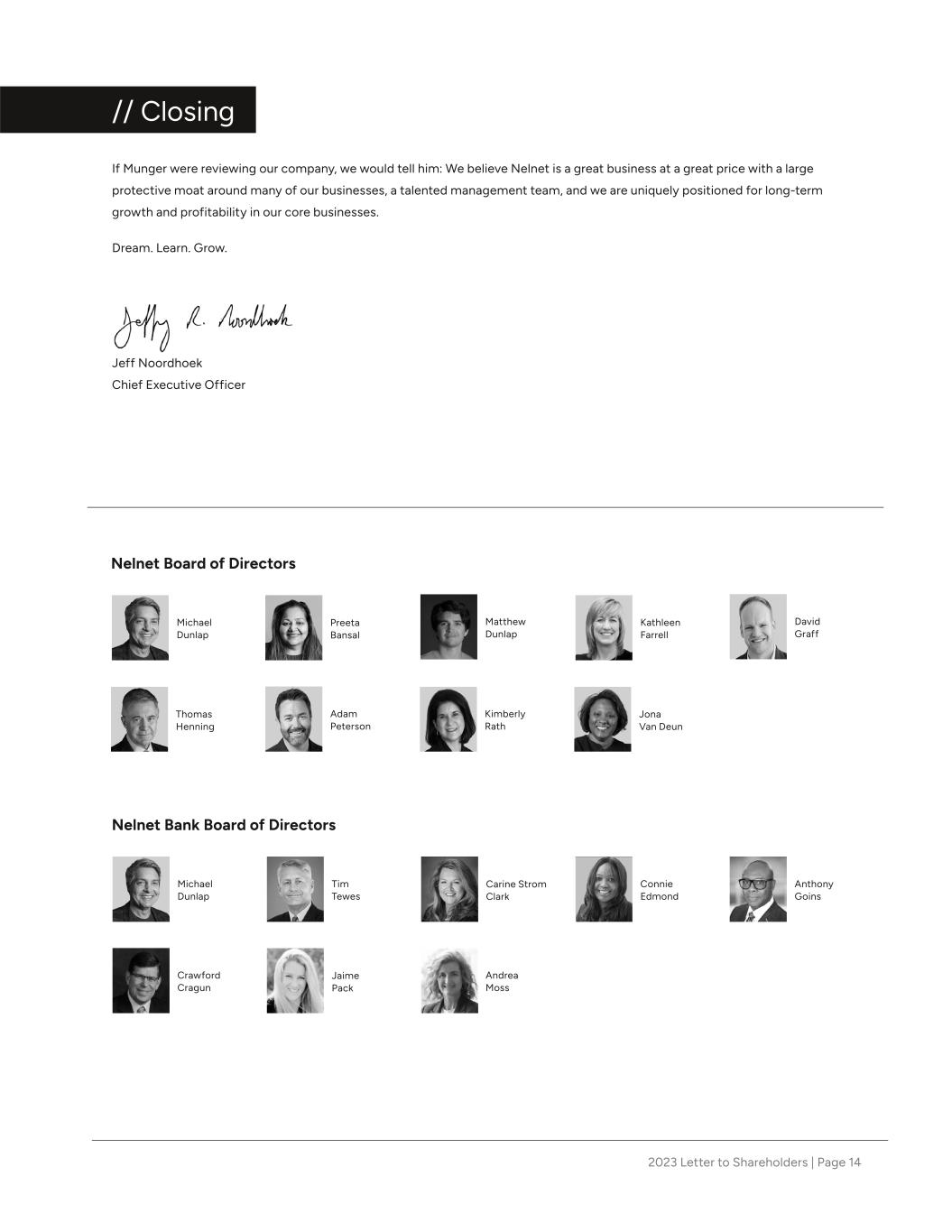

2023 Letter to Shareholders | Page 3 [Chart here on our cash sources and uses] We feel like we did a decent but not a great job in 2023 as managers of our businesses and allocators of our capital given all the insanity of domestic and global events occurring during the year. This will be reflected in our executive team’s compensation this year. We eat our own cooking. It is important to note, we believe we maintain significant competitive advantages in our major business units and remain opportunistic and optimistic for the future. We do not act like most publicly traded companies, and we think that gives us a big advantage as we think long-term when making decisions. “Mimicking the herd invites regression to the mean.” -Charlie Munger Next, I will give you an update of our three largest divisions along with our two largest minority investments in ALLO and Hudl. Nelnet’s Corporate Performance (Annual Percentage Change) Nelnet Per Share Book Value With Dividends Included Nelnet Per Share Market Value With Dividends Included S&P 500 With Dividends Included Net Income Reinvested2 (in millions) 2004 49.2% 20.2% 10.9% $149 2005 41.5% 51.1% 4.9% $181 2006 6.3% (32.7%) 15.8% $6 2007 (1.6%) (52.5%) 5.5% ($63) 2008 6.6% 13.3% (37.0%) $24 2009 21.0% 20.7% 26.5% $135 2010 23.7% 41.6% 15.1% $115 2011 22.6% 4.9% 2.1% $160 2012 16.7% 27.5% 16.0% $89 2013 26.1% 42.8% 32.4% $271 2014 21.1% 10.9% 13.7% $273 2015 16.0% (26.6%) 1.4% $153 2016 15.4% 52.7% 12.0% $166 2017 8.8% 9.1% 21.8% $80 2018 9.9% (3.2%) (4.4%) $156 2019 6.2% 12.7% 31.5% $72 2020 15.6% 23.7% 18.4% $247 2021 14.7% 38.4% 28.7% $301 2022 11.9% (6.1%) (18.1%) $273 2023 3.4% (1.6%) 26.3% $24 CAGR/Total 16.2% 8.4% 9.7% $2,812 2We believe well-managed companies do not distribute to the shareholders all their earnings. Instead, they retain a part of their earnings and reinvest the capital to grow the business. Since going public in late 2003, the company has recognized $4.1 billion in cumulative net income and, of that amount, has reinvested $2.8 billion – or 69% of our earnings over time – back into the business.

2023 Letter to Shareholders | Page 4 // Nelnet Diversified Services Over the last year, NDS may have had the wildest roller coaster ride of its 45-year existence. We could not have imagined it could have been wilder than the previous few years, but decisions impacting the Federal Student Loan Program continue to be driven by a volatile political climate in this country. As an entity trying to serve borrowers the best we can, we are not blaming either side of the political divide, just highlighting the politically challenging and unpredictable nature of the current federal servicing environment. At our core in loan servicing, we are a business-to-business-to-consumer company. Lenders hire us to service their borrower customers’ accounts. They pay us an amount based upon the level of service they require. We have many clients within the division: banks, finance companies, fintechs, state agencies, and of course the largest consumer lender: the Federal Government. We have had some amazing growth in the business including large transactions associated with the Wells Fargo portfolio and the recently announced Discover Financial Services portfolio. The approximately $10 billion Discover portfolio with approximately 500,000 borrowers will be a significant addition to our consumer loan servicing business when it is converted to our system. In addition to consumer loan servicing, we service $495 billion in Direct Loans for 14.5 million borrowers on behalf of the Federal Government. When the pandemic hit, every federally held loan was put into a non-interest-bearing non-payment status, first using executive authority and then under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act forbearance was extended by President Trump through the 2020 election and then extended multiple times by President Biden. The Biden administration also announced the President’s forgiveness plan utilizing executive authority based upon a unique interpretation of the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act passed back in 2003, which they argued gave the President emergency authority to forgive loans in the absence of Congressional student loan forgiveness legislation. Predictably, certain state attorneys general believed this was outside the executive branch’s authority under the HEROES Act and challenged the Biden forgiveness program in court. As we all know, the Supreme Court ultimately ruled in favor of the states and kept broad loan forgiveness from moving forward, holding that the Biden administration exceeded its statutory authority in promulgating the program. This background is very important for what happened in the loan servicing contract in 2023. Throughout the 3.5-year CARES Act forbearance period—which included multiple promises of return to repayment (R2R), followed instead by extension after extension of the forbearance—we were instructed by the U.S. Department of Education (the Department) to maintain appropriate staffing levels in preparation for the inevitable and seemingly imminent R2R. We were frequently asked by Congress for our plans for R2R practically each time a repayment date was announced. We were repeatedly promised, “This time is it, we are definitely going back into repayment,” and asked for staffing plans. We ramped up hiring and stayed ready to provide high-quality service in an unprecedented time period, only to be told forbearance would be extended for all 40 million U.S. student loan borrowers. At the same time, due to a significant underfunding of the Office of Federal Student Aid (FSA) in the Fiscal Year 2023 Omnibus Appropriations Act, the Department announced cuts to the fees paid to the student loan servicers in March of 2023. Following terse contract negotiations, we begrudgingly accepted the cut to compensation in exchange for relief on required service levels to the Government’s borrowers. We argued vehemently against this strategy as there are two major cost drivers in servicing: systems and people. We made clear to FSA that the cut to servicer compensation would negatively impact federal borrowers if they returned to repayment in the fall.

2023 Letter to Shareholders | Page 5 The systems for borrowers to access their accounts are required to run 24/7/365, so there was no ability to reduce costs there. This meant the only possible outcome was a reduction in staff. This was extremely bad timing and right before staff would be needed, given the agreed upon October R2R if the forgiveness plan were to be stopped by the Supreme Court. It takes many months to hire and train as well as obtain security clearance for thousands of people to support borrowers. The cuts to our fees saved millions of dollars for the Federal Government temporarily but most likely cost the taxpayers tens of billions over the years to come by reducing servicing activity necessary to support the Federal Government as a lender to collect on its loans. “The iron rule of nature is: you get what you reward for. If you want ants to come, you put sugar on the floor.” -Charlie Munger Finally, as expected, in 2023, Congress ended up striking a deal to keep the Federal Government from defaulting on its debt, within which was included a provision mandating an end to the CARES Act forbearance, with repayment set to begin on October 1, 2023. Starting October 1, 2023, 40 million people were required to start paying back their loans. The Biden administration then announced, in rapid succession, multiple new repayment plans including the Saving on Valuable Education (SAVE) Plan, on-ramp programs (all delinquent loans past 90 days brought current), and a litany of new forgiveness initiatives based upon new calculators of time in repayment to various categories of borrowers. All these constant program changes, little lead time or communication about program requirements, and new announcements have created borrower confusion, leading to unprecedented activity in our call centers and processing areas. This bluntly means that for months we experienced the predicable long hold times and delayed processing times. It is not where anyone would like to be, but it is the hand that was dealt us. Going into calendar year 2024, FSA’s budget issues persist, and the Department continues to look for ways to reduce fees and costs in servicing. Almost all these reductions come at the expense of what anyone would deem as acceptable service. The Department also continues its quest toward broad student loan forgiveness, having begun Negotiated Rulemaking on a provision of the Higher Education Act in the wake of the Supreme Court’s ruling on the President’s first forgiveness attempt. The good news is we are confident this situation will pass, as is always the case. The roller coaster will eventually reach the flat part of the track. We are hopeful that smart, caring, practical people on both sides of the aisle will come to the right conclusion and set things back on a more reasonable track so that student borrowers receive adequate levels of service. In the meantime, rest assured we are doing everything in our power to support Direct Loan borrowers and the Department. We are very grateful for the strong fortitude and caring servant leadership of our team and teammates, who are on the front lines of this business every day, helping borrowers navigate this extremely complex and shifting program. // Nelnet Business Services As we stated in the introduction, NBS had a record year in 2023, earning $91 million in pre-tax net income and processing almost $46 billion in payments. It is our belief that on a stand-alone basis this business could arguably be valued nearly equal to the whole of Nelnet at its current market value. Munger would definitely be excited by this business as it creates a lot of cash flow, has dominant market share, a large moat, is not too difficult to understand, and has an industry leading management team. NBS concentrates on education technology, services, and payment processing for the K–12 and higher education markets in the U.S. and globally. This segment is divided into four distinct areas: FACTS, Nelnet Campus Commerce, Nelnet Payment Services, and Nelnet International.

2023 Letter to Shareholders | Page 6 FACTS is a partner to private and faith-based K-12 schools providing payment solutions to create an efficient customer experience for administrators, teachers, and families. We continue to add new products to the comprehensive suite of product solutions, ranging from financial management tools to make the costs of education more affordable, a robust school information system, and coaching and professional development opportunities for the teachers we serve. In support of our expanded product offering and similar client needs, we consolidated the brands under Nelnet Community Engagement into the FACTS family in 2023. This allows our value to extend beyond education to the for-profit and faith markets as a trusted partner focusing on the needs of educators and learners. We continue to bring value to the students in the classrooms through Title I and Title II federal funding programs across the U.S. and Puerto Rico. The majority of pandemic-related funding for education will expire in 2024, and we continue to work with many schools to put those funds to work in closing any learning gaps resulting from the pandemic. Our overall commitment to providing technology with superior customer experiences contributes to our consistent retention rate in excess of 98%. We are honored to support the nearly 12,000 schools we serve and the over 4.5 million students and their families. // FACTS Nelnet Campus Commerce has offered payment solutions designed to meet the unique mission and needs of higher education for over 25 years. We currently serve over 1,000 institutions in the U.S and over 8 million students with an integrated payment experience across the campus. We focus on providing intuitive and secure payment technologies ranging from tuition payment plans, refunds, online storefronts, in-person transactions, and a broad range of electronic payment products. In 2023, we continued to add new colleges and universities to our client base while maintaining strong retention rates of 98% with our existing institutions. New revenue opportunities are also achieved through adding additional product solutions to our current relationships. We serve a diverse base of clients ranging from a small community college to a large university system with multiple campuses. Our priorities include the security of our systems and modern, simple-to-use technologies. // Nelnet Campus Commerce Nelnet Payment Services is an independent sales organization (ISO), providing end-to-end payment processing technology for our education segment, other Nelnet entities, and other non-education businesses. In 2023, we processed almost $46 billion in total payments while adding new payment options such as a two-transaction model with Apple Pay for our higher education market. We prioritize the security of our information throughout the processing cycle and focus on complying with the regulatory requirements in the payments industry. // Nelnet Payment Services

2023 Letter to Shareholders | Page 7 // Nelnet Financial Services As we stated earlier, we have officially combined our loan asset generation and management business (FFELP, private education, and consumer loans) and Nelnet Bank along with our real estate management, insurance services business, and investment management business (Whitetail Rock) into the Nelnet Financial Services (NFS) division. Our primary goal in NFS is to leverage our unique long-term time investment horizon along with our experience and expertise in credit and capital markets to originate assets that achieve acceptable risk-adjusted returns while managing liquidity and duration to support Nelnet’s other investment opportunities. We focus on investments that have predictable recurring cash flows. Additionally, we are continually evaluating asset classes that could be originated and funded at Nelnet Bank and serviced by NDS. We believe our investment philosophy, bank platform, servicing operation, and corporate structure allow us to see and create unique asset investment opportunities. FFELP truly was a unique asset class that allowed us to achieve strong returns on equity with little credit risk. As we look beyond FFELP, we must take a view toward building on our core competencies (risks we understand well) and be opportunistic. When reviewing any asset opportunity, we consider whether the best funding source is the bank, our balance sheet, or the capital markets. We employ structured investments across the capital stack with a goal of optimizing risk-adjusted returns. We look to balance the size of our investments with diversification, conviction, expertise, and the synergies (bank, servicing) that may exist. An example of this is how we invested in the Wells Fargo private loan portfolio. Nelnet Bank is an industrial loan company (ILC) fully owned by Nelnet, Inc. Nelnet Bank, which exited the de novo period in November 2023, is an incredibly valuable asset and a key component of Nelnet Financial Services’ strategies. Our highly experienced capital markets team provides valuable insight and recommendations for product development, partnership opportunities, and expertise for Nelnet Bank. Today the bank has just over $1 billion in assets and is focused on originating high-quality student and consumer loans while building out a strong deposit strategy. Nelnet International is based in Melbourne, Australia, and focuses on serving the technology needs of the education market from primary school through the university experience. We focus on payment solutions through a variety of applications across the campuses in the Australian higher education industry, where we have 80% market share working with 32 of the 40 universities. In recent years, we have expanded our footprint to include several countries in the Asia Pacific region. We also provide payment plans, incidental payment processing, and a student management system in Australia and New Zealand in addition to serving students in 64 other countries through our school information system. // Nelnet International

2023 Letter to Shareholders | Page 8 As we have been emphasizing for the last decade, FFELP continues to be in a state of runoff and appears to be in the final stages of its life. As one of the largest and one of the few remaining purchasers in the space, we are still in position to act opportunistically; however, we expect these opportunities for FFELP portfolio purchases to be few and far between. FFELP remains susceptible to government policy that can have a dramatic impact on prepayment rates. At the end of 2003, we had a portfolio of nearly $12 billion supported by roughly $1 billion of equity. We have financing facilities, supporting about $1.5 billion of unsecuritized FFELP loans. Credit spreads widened out in 2022 and 2023 and have made financing through securitization less valuable during 2023. We will look to securitize once spreads tighten closer to our warehouse cost of funds, and it is trending that way at the time of this letter. // FFELP As will be touched on in more detail at the end of the letter, our non-FFELP finance business began in earnest with the initial acquisition of consumer loans in 2017 and has gained significantly more scale over the last five years as we have developed key origination partnerships and completed diligence on new opportunities and sectors. We invest when and where we believe there are compelling long-term, resilient, risk-adjusted returns and are cognizant of credit and capital markets for new investments and portfolio management. The impact of rising rates, inflation, and erosion of stimulus funds in 2023, resulted in market pressures impacting financing costs, credit, and loan origination economics for many companies in the sector, while also contributing to rationalized partnership opportunities. We expect to continue to diversify and be conscious around asset classes, funding strategies, and third-party exposures. // Specialty Finance Nelnet’s real estate ventures began in 2013 as a diversification and capital redeployment avenue as traditional student loan opportunities began to wane. We have taken a majority limited partner position in our investments, which means we have influence and protective rights over major items such as annual budget and buy/sell/refinance decisions. We partner with groups that have either an asset or geographical expertise and allow them to run day-to-day operations. We target properties with a total capitalization of $10 to $40 million, which frequently allows us to buy assets from local sellers, improve them, and sell them to larger national groups. We are targeting net returns in the mid-high teens on an annual percentage basis and typically hold the investments for three to seven years. However, we have no requirement to sell should the market or projected gain from a longer-term hold be more prudent. The current portfolio has approximately 40 separate investments with a total equity at risk of approximately $120 million. Given current interest rates and other dynamics in the market today, there is a noticeable gap between what buyers and sellers think a property is worth. Sellers saw a noticeable increase in comparable properties early during COVID and have anchored themselves to sales information from one to two years ago. Buyers today are more concerned with the future profitability of the property, which typically causes values to be below where they were a couple years ago. We believe commercial real estate is in for further correction, which could create buying opportunities for us at the right price. // Real Estate

2023 Letter to Shareholders | Page 9 Nelnet Insurance Services focuses on property and casualty reinsurance and also includes First National Life (FNL), a Nebraska- chartered life and health company, which reinsures a decreasing term life insurance product distributed by FACTS. Property and casualty reinsurance activities comprise of five treaties that reinsure risk on roughly 70 different insurance programs issued by four carriers. We have diversified into reinsurance based on a few key factors: 1) it is a “hard” property insurance market that benefits reinsurers; 2) this provides an uncorrelated return opportunity to Nelnet; 3) we have the necessary infrastructure due to our micro- captive that has built up a surplus of roughly $20 million over the last decade; and, 4) we believe we can effectively invest the float in assets that we understand well (asset-backed securities [ABS]). For the 2023 calendar year, we recognized $20 million in reinsurance premiums (net of $21 million retroceded to a third party). Claims incurred during the year were modest and less than expected. Our reinsurance risk is relatively evenly spread between general liability, commercial auto, and property coverages. During 2024, we expect general liability risk will decline, and property risk will increase as a percentage of our reinsurance portfolio. Catastrophic losses from property exposure are mitigated by per property and per event caps as well as exposed geography exclusions. // Insurance Whitetail had $3.3 billion in assets under management for third-party customers, consisting of student loan asset-backed securities ($2.6 billion) and Nelnet stock ($0.7 billion)—primarily shares of Class B common stock. Whitetail earns annual management fees of 10 to 25 basis points for asset-backed securities under management and a share of the gains from the sale of securities or securities being called prior to the full contractual maturity for which it provides advisory services. Whitetail earns annual management fees of five basis points for Nelnet stock under management. During 2023, Whitetail earned $6.2 million in management fees and $0.5 million in performance fees. Whitetail is beginning the transition away from FFELP ABS to additional ABS asset classes (consumer ABS/collateralized loan obligations) that it can manage on behalf of its clients. // Whitetail Rock Capital Management // ALLO It’s been eight years since our initial investment in ALLO, and each year, including 2023, has seen significant growth in fiber footprint, customers, and importance to the communities served. By year’s end, ALLO was operational in 34 communities and in construction in another 11 communities across Tier II and III communities in Nebraska, Arizona, and Colorado. Our line count grew from 131,000 to 158,000 in 2023. Higher interest rates have reduced the number of markets we can build that hit our return targets, but at the same time the Federal Government is investing a lot of money through the Broadband Equity, Access, and Deployment (BEAD) program to incentivize the industry to build underserved communities.

2023 Letter to Shareholders | Page 10 We are currently carrying our voting equity investment in ALLO on our balance sheet at $10 million and our preferred equity at $155 million, and we expect the $10 million voting equity investment to be written down to zero in the first quarter of 2024. We have structured the transaction to maximize tax benefits, which has resulted in us writing down the voting equity investment for accounting purposes using the Hypothetical Liquidation of Book Value methodology. Needless to say, we believe the unrealized market value of ALLO is significantly higher than the value reflected on our balance sheet. Reflecting on eight years since we first made this investment draws our attention to Lincoln, Nebraska, ALLO’s largest community, Nelnet’s home, and the initial expansion of our investment. The journey to serve the nation’s 70th largest city has been rapid and successful. Originally, the plan was to build fiber over a 5-year period that was shortened to a little over three years due to the demand from the residents, businesses, and governmental entities. The primary construction was completed in spring 2019. ALLO now has nearly 500 of its approximately 1,500 teammates based in Lincoln, serving the city as well as other communities. In 2023, ALLO’s Lincoln residential market share crossed 50% of census households with an annual increase of over 4% with even faster business and governmental growth. The market shares and market cash flows exceed our original expectations, and we expect both to continue to increase. Additionally, in the second quarter 2023, Lincoln was ranked by Speedtest by Ookla as the second-fastest download, second-fastest upload, and third-best latency of the 100 largest cities in the United States, making Lincoln the most connected city on a blended basis. Before the ALLO overbuild, Lincoln ranked 28th in internet speeds just in Nebraska. ALLO’s operating model ensures that all communities it serves receive the same customer service and quality as Lincoln. The brand is very strong across Nebraska communities and is developing in the Arizona and Colorado locations. In Arizona, the first customers activated in 2023 and early interest from all customer segments is very strong. ALLO selected Arizona for expansion due to significant deficiencies in internet and other communications services. Several small communities in Colorado have been operating for years. ALLO’s expansion in northeast Colorado is accelerating, and we expect another strong region that is contiguous with the Nebraska fiber footprint. Common geography, agriculture, and demographics make the region very attractive for ALLO’s fiber products. While there are many tailwinds in the fiber industry related to ever-increasing demands for bandwidth, efficient connections, and exceptional customer service, the industry also has challenges from construction permitting pace and inflationary costs. ALLO expects to meet the challenges, continue to maximize opportunities, and serve customers in their regions. During 2023, ALLO completed an inaugural securitization of more than $600 million. Future securitizations and a construction debt facility combine to significantly mature the capital structure and reduce (but not eliminate) the need for future equity. Opportunities related to new regions, acquisitions, and government-funded projects will be evaluated in the next few years as the nation substantially completes its fiber coverage. We expect ALLO to continue to take advantage of these opportunities given consistent product depth, customer demand, and competitive advantages. // Hudl Hudl continues to innovate in expanding its base and reaching new consumers. A particular focus over the last year was engaging a new customer—the fan. Long a household name for athletes and coaches, Hudl is now bringing parents, grandparents, classmates, community members, and others onto the platform more directly. Since April 2023, more than 41 million fans have visited the Hudl Fan Experience to buy tickets, watch highlights, find rosters, and view livestreams. Two new products spurred the growth in this area: Hudl Tickets and Hudl TV.

2023 Letter to Shareholders | Page 11 Hudl Tickets is the company’s newest offering for this market and was officially launched in September 2023. Fans can search for events, purchase a ticket, and get a quick-response (QR) code to scan and enter the game—no more checking multiple apps, texting family to find game times, or keeping track of paper tickets. For the athletic director, it removes juggling cash boxes, emails to parents with game information, and updating game information across multiple platforms—all at no additional cost to the organization. Hudl expanded into livestreaming by combining the power of Blueframe (acquired in 2022) and Focus cameras. Teams can now connect with fans through high-quality broadcasts streamed from Focus cameras through Hudl TV. This feeds Hudl’s content engine by getting more games into their content library—more than 6,000 schools and clubs have streamed more than 227,000 broadcasts to fans on Hudl this season. These have been viewed by more than 2.4 million people, watching more than 11.5 million hours of their favorite teams and athletes. Teams can earn revenue through pay-per-view streams and season passes, and Hudl can sell advertisements on the streams. Combining this with revenue from Hudl Tickets, schools and clubs have incredible opportunities to support their teams. The content on the Hudl platform includes most of the top athletes in the nation. In 2023, more than 80% of players drafted into the NBA, 75% of athletes drafted into the WNBA, and 100% of athletes drafted to the NFL had video and highlights on Hudl. Broadening that out to the wider athlete base, Hudl has seen more than 4 million active athletes this season. These athletes created more than 7.3 million highlight reels with more than 220 million views. Overall, Hudl has taken a big swing at a new market with exciting results so far. The team has its eye on bringing together Hudl’s suite of software, hardware, and content to change the sports ecosystem and continue to help solve their customers’ biggest challenges. We remain extremely optimistic about our investment in Hudl. We are currently carrying the value of this investment on our books of $165 million, and we believe the actual market value of this investment is significantly higher than our carrying value. // A message from Executive Chairman of the Board, Mike Dunlap This month we lost another one of our dear friends and 17-year board member from our initial public offering date until 2020, Mike Reardon. Mike was genuinely one of the nicest, most kindhearted people you could ever meet. At his celebration of life, a seemingly endless line of people spoke about his contribution to their lives and to making the world a better place. Mike was a steady guiding voice in our lives and for our company in all times, good and bad. He is already sorely missed, and we are a significantly better company for his contribution to Nelnet’s success. Jeff covered a lot of things already and included summaries of what happened in most of our divisions, but I wanted to highlight a couple things specifically. 2023 was a year during which your chairman ate a lot of humble pie served cold with a return on equity (ROE) of 3.4%—not close to our long-term goals. The primary ingredients to my humble pie included a less-than-stellar acquisition and the impact of interest rates and banking industry disruption on our liquidity and investment positions. As a reminder, in 2022 we acquired a solar construction business to leverage our tax credit and syndication business and expand our development capabilities. We had another good year in the tax credit and syndication business with expected strong returns. We will show an accounting loss because of GAAP accounting rules, but we are confident we have created significant value, which will be recognized in future years.

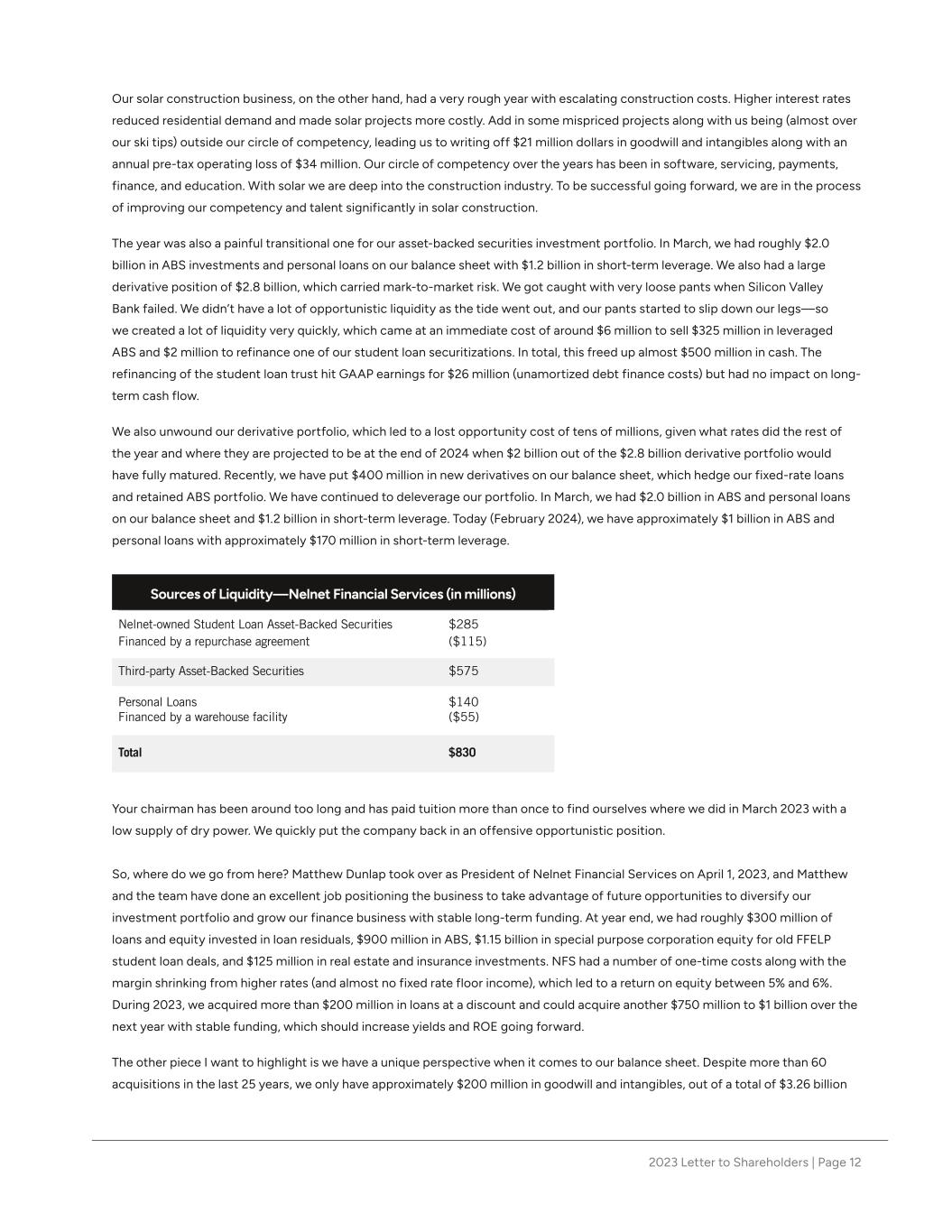

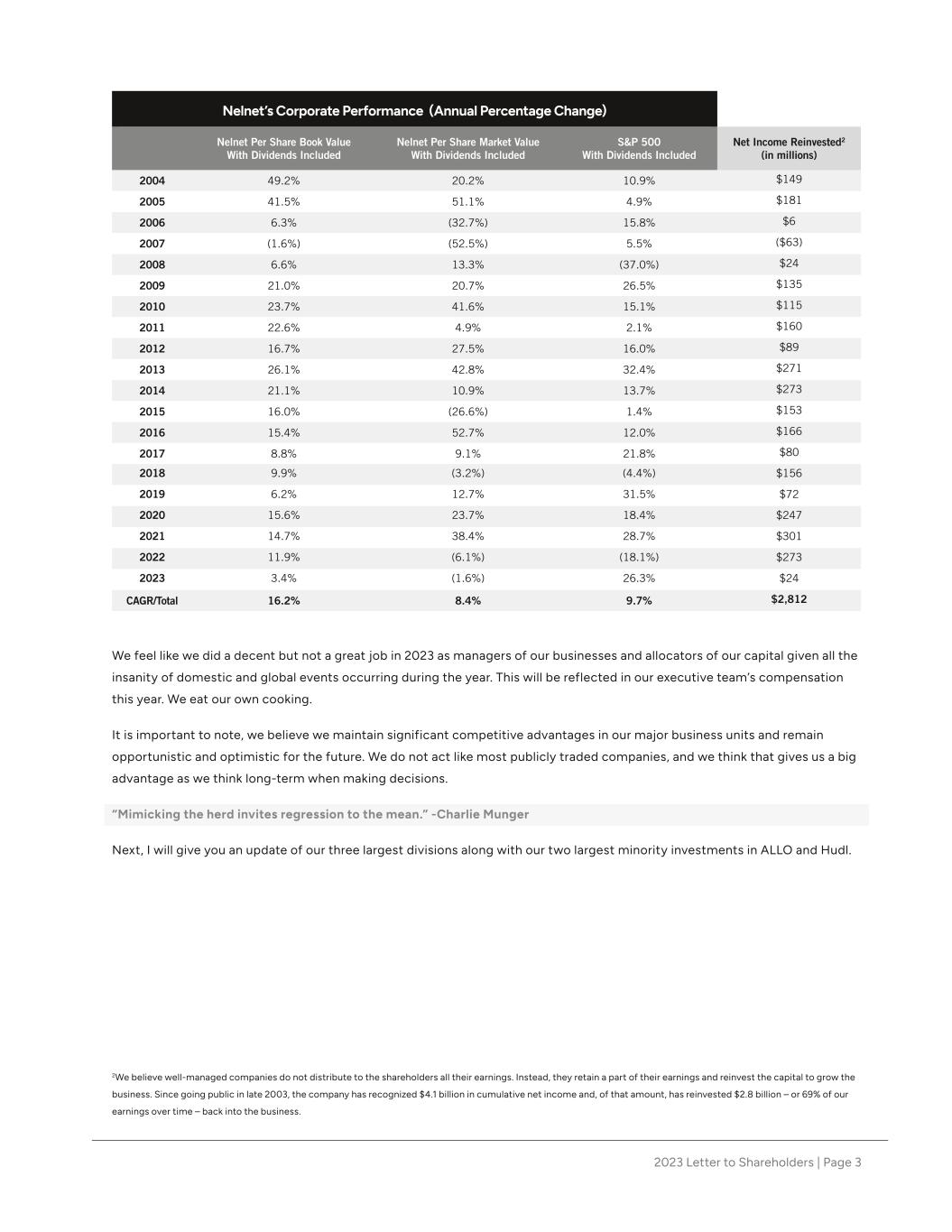

2023 Letter to Shareholders | Page 12 Sources of Liquidity—Nelnet Financial Services (in millions) Nelnet-owned Student Loan Asset-Backed Securities Financed by a repurchase agreement $285 ($115) Third-party Asset-Backed Securities $575 Personal Loans Financed by a warehouse facility $140 ($55) Total $830 Our solar construction business, on the other hand, had a very rough year with escalating construction costs. Higher interest rates reduced residential demand and made solar projects more costly. Add in some mispriced projects along with us being (almost over our ski tips) outside our circle of competency, leading us to writing off $21 million dollars in goodwill and intangibles along with an annual pre-tax operating loss of $34 million. Our circle of competency over the years has been in software, servicing, payments, finance, and education. With solar we are deep into the construction industry. To be successful going forward, we are in the process of improving our competency and talent significantly in solar construction. The year was also a painful transitional one for our asset-backed securities investment portfolio. In March, we had roughly $2.0 billion in ABS investments and personal loans on our balance sheet with $1.2 billion in short-term leverage. We also had a large derivative position of $2.8 billion, which carried mark-to-market risk. We got caught with very loose pants when Silicon Valley Bank failed. We didn’t have a lot of opportunistic liquidity as the tide went out, and our pants started to slip down our legs—so we created a lot of liquidity very quickly, which came at an immediate cost of around $6 million to sell $325 million in leveraged ABS and $2 million to refinance one of our student loan securitizations. In total, this freed up almost $500 million in cash. The refinancing of the student loan trust hit GAAP earnings for $26 million (unamortized debt finance costs) but had no impact on long- term cash flow. We also unwound our derivative portfolio, which led to a lost opportunity cost of tens of millions, given what rates did the rest of the year and where they are projected to be at the end of 2024 when $2 billion out of the $2.8 billion derivative portfolio would have fully matured. Recently, we have put $400 million in new derivatives on our balance sheet, which hedge our fixed-rate loans and retained ABS portfolio. We have continued to deleverage our portfolio. In March, we had $2.0 billion in ABS and personal loans on our balance sheet and $1.2 billion in short-term leverage. Today (February 2024), we have approximately $1 billion in ABS and personal loans with approximately $170 million in short-term leverage. Your chairman has been around too long and has paid tuition more than once to find ourselves where we did in March 2023 with a low supply of dry power. We quickly put the company back in an offensive opportunistic position. So, where do we go from here? Matthew Dunlap took over as President of Nelnet Financial Services on April 1, 2023, and Matthew and the team have done an excellent job positioning the business to take advantage of future opportunities to diversify our investment portfolio and grow our finance business with stable long-term funding. At year end, we had roughly $300 million of loans and equity invested in loan residuals, $900 million in ABS, $1.15 billion in special purpose corporation equity for old FFELP student loan deals, and $125 million in real estate and insurance investments. NFS had a number of one-time costs along with the margin shrinking from higher rates (and almost no fixed rate floor income), which led to a return on equity between 5% and 6%. During 2023, we acquired more than $200 million in loans at a discount and could acquire another $750 million to $1 billion over the next year with stable funding, which should increase yields and ROE going forward. The other piece I want to highlight is we have a unique perspective when it comes to our balance sheet. Despite more than 60 acquisitions in the last 25 years, we only have approximately $200 million in goodwill and intangibles, out of a total of $3.26 billion

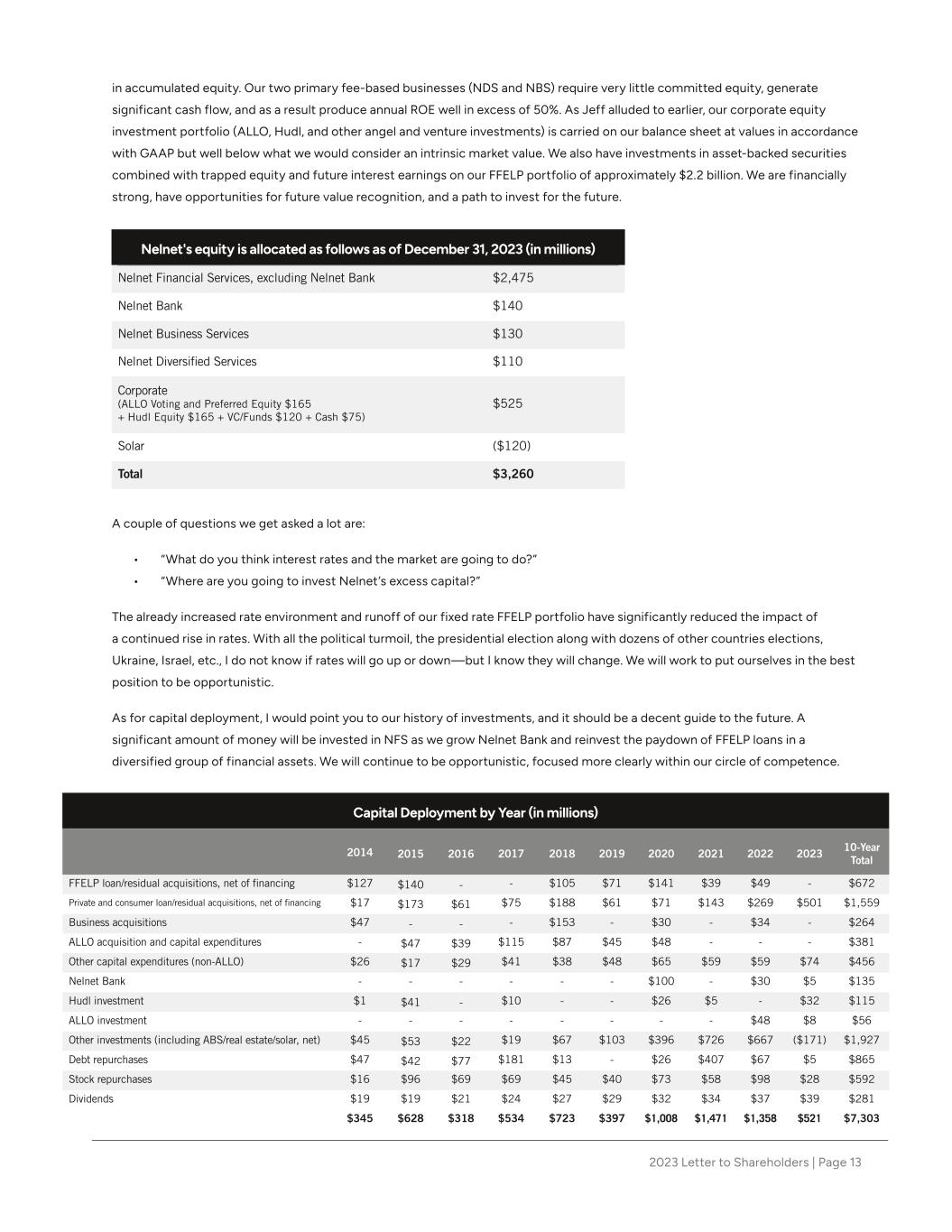

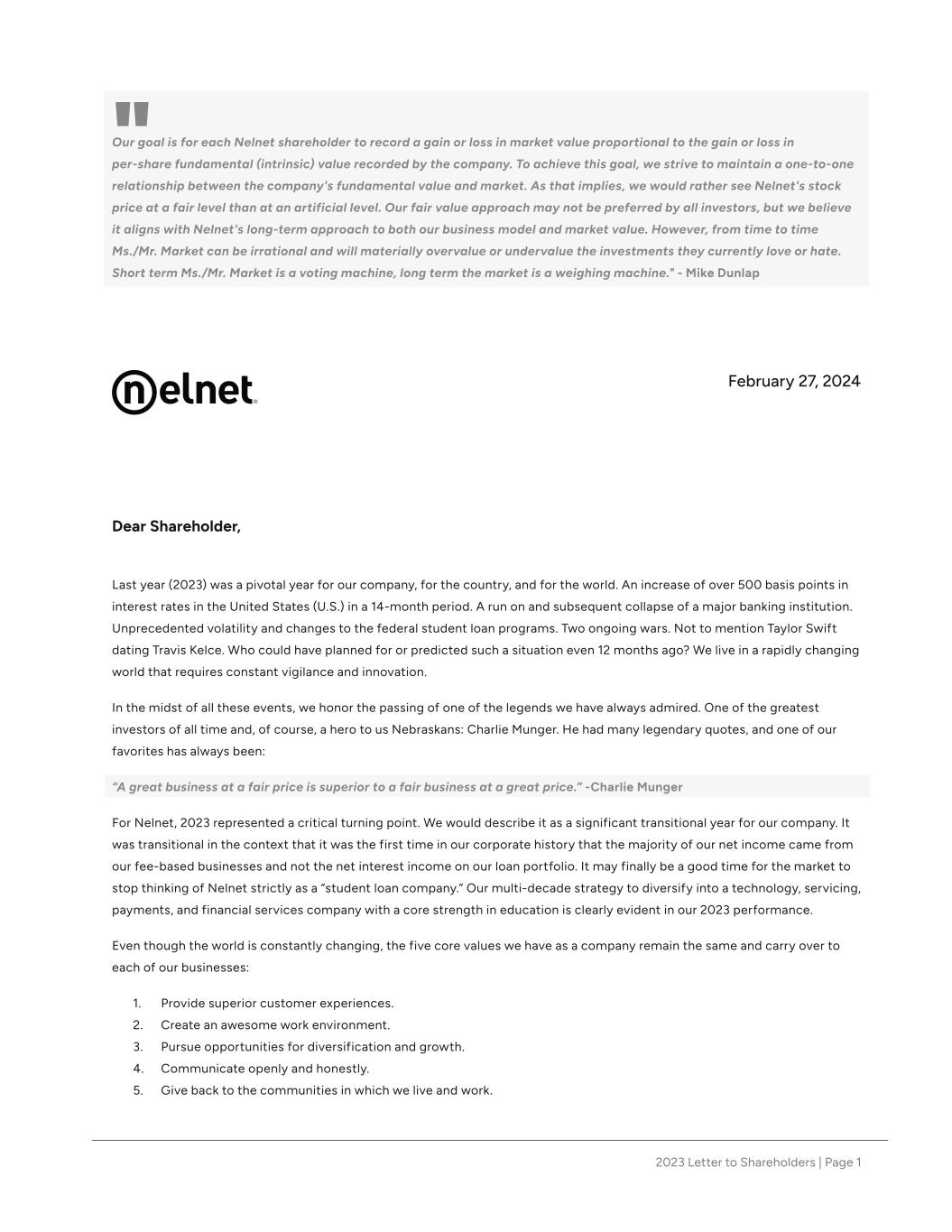

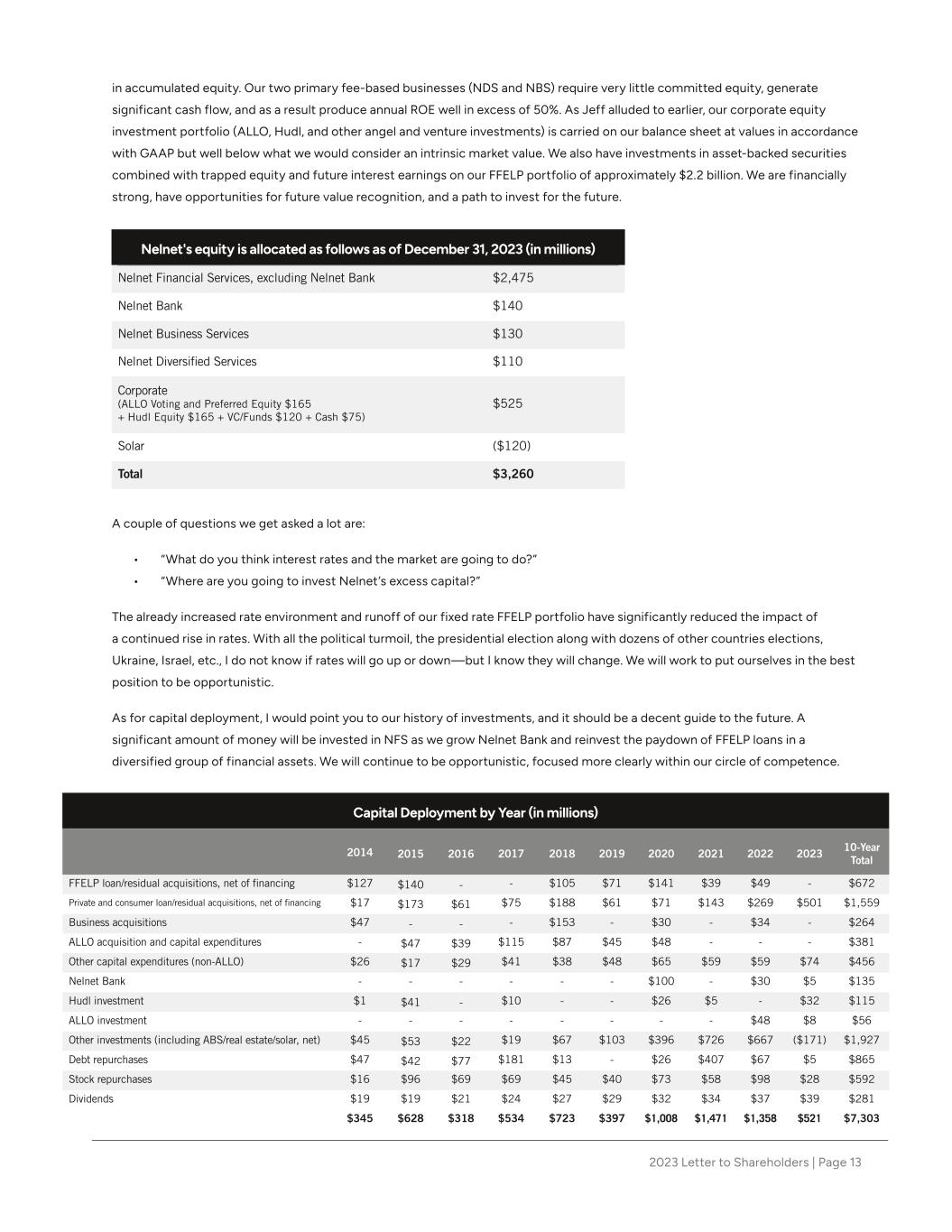

2023 Letter to Shareholders | Page 13 Nelnet's equity is allocated as follows as of December 31, 2023 (in millions) Nelnet Financial Services, excluding Nelnet Bank $2,475 Nelnet Bank $140 Nelnet Business Services $130 Nelnet Diversified Services $110 Corporate (ALLO Voting and Preferred Equity $165 + Hudl Equity $165 + VC/Funds $120 + Cash $75) $525 Solar ($120) Total $3,260 in accumulated equity. Our two primary fee-based businesses (NDS and NBS) require very little committed equity, generate significant cash flow, and as a result produce annual ROE well in excess of 50%. As Jeff alluded to earlier, our corporate equity investment portfolio (ALLO, Hudl, and other angel and venture investments) is carried on our balance sheet at values in accordance with GAAP but well below what we would consider an intrinsic market value. We also have investments in asset-backed securities combined with trapped equity and future interest earnings on our FFELP portfolio of approximately $2.2 billion. We are financially strong, have opportunities for future value recognition, and a path to invest for the future. A couple of questions we get asked a lot are: • “What do you think interest rates and the market are going to do?” • “Where are you going to invest Nelnet’s excess capital?” The already increased rate environment and runoff of our fixed rate FFELP portfolio have significantly reduced the impact of a continued rise in rates. With all the political turmoil, the presidential election along with dozens of other countries elections, Ukraine, Israel, etc., I do not know if rates will go up or down—but I know they will change. We will work to put ourselves in the best position to be opportunistic. As for capital deployment, I would point you to our history of investments, and it should be a decent guide to the future. A significant amount of money will be invested in NFS as we grow Nelnet Bank and reinvest the paydown of FFELP loans in a diversified group of financial assets. We will continue to be opportunistic, focused more clearly within our circle of competence. Capital Deployment by Year (in millions) 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 10-Year Total FFELP loan/residual acquisitions, net of financing $127 $140 - - $105 $71 $141 $39 $49 - $672 Private and consumer loan/residual acquisitions, net of financing $17 $173 $61 $75 $188 $61 $71 $143 $269 $501 $1,559 Business acquisitions $47 - - - $153 - $30 - $34 - $264 ALLO acquisition and capital expenditures - $47 $39 $115 $87 $45 $48 - - - $381 Other capital expenditures (non-ALLO) $26 $17 $29 $41 $38 $48 $65 $59 $59 $74 $456 Nelnet Bank - - - - - - $100 - $30 $5 $135 Hudl investment $1 $41 - $10 - - $26 $5 - $32 $115 ALLO investment - - - - - - - - $48 $8 $56 Other investments (including ABS/real estate/solar, net) $45 $53 $22 $19 $67 $103 $396 $726 $667 ($171) $1,927 Debt repurchases $47 $42 $77 $181 $13 - $26 $407 $67 $5 $865 Stock repurchases $16 $96 $69 $69 $45 $40 $73 $58 $98 $28 $592 Dividends $19 $19 $21 $24 $27 $29 $32 $34 $37 $39 $281 $345 $628 $318 $534 $723 $397 $1,008 $1,471 $1,358 $521 $7,303

2023 Letter to Shareholders | Page 14 If Munger were reviewing our company, we would tell him: We believe Nelnet is a great business at a great price with a large protective moat around many of our businesses, a talented management team, and we are uniquely positioned for long-term growth and profitability in our core businesses. Dream. Learn. Grow. Jeff Noordhoek Chief Executive Officer // Closing Matthew Dunlap Nelnet Board of Directors Michael Dunlap Preeta Bansal Kathleen Farrell David Graff Thomas Henning Kimberly Rath Nelnet Bank Board of Directors Michael Dunlap Tim Tewes Carine Strom Clark Connie Edmond Anthony Goins Crawford Cragun Jaime Pack Andrea Moss Adam Peterson Jona Van Deun

2023 Letter to Shareholders | Page 15 Forward-Looking and Cautionary Statements This letter to shareholders contains forward-looking statements within the meaning of federal securities laws. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “would,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements. These statements are based on management's current expectations as of the date of this letter and are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: risks related to the ability to successfully maintain and increase allocated volumes of student loans serviced by the company under existing and future servicing contracts with the Department, including the company’s level of service as the result of the unprecedented event of all borrowers returning to repayment in October 2023, which has generated extraordinary call volume and web traffic, and risks related to the company's ability to comply with agreements with third-party customers for the servicing of Federal Direct Loan Program, FFEL Program, private education, and consumer loans; loan portfolio risks, such as credit risk, interest rate basis and repricing risk, risks related to the use of derivatives to manage exposure to interest rate fluctuations, uncertainties regarding the expected benefits from purchased securitized and unsecuritized FFEL Program, private education, consumer, and other loans, or investment interests therein, and initiatives to purchase additional FFEL Program, private education, consumer, and other loans, and risks from changes in levels of loan prepayment or default rates; financing and liquidity risks, including risks of changes in the interest rate environment; risks from changes in the terms of education loans and in the educational credit and services markets resulting from changes in applicable laws, regulations, and government programs and budgets; risks related to a breach of or failure in the company's operational or information systems or infrastructure, or those of third-party vendors, including disclosure of confidential or personal information and/or damage to reputation resulting from cyber- breaches; uncertainties inherent in forecasting future cash flows from student loan assets and related asset-backed securitizations; risks and uncertainties related to the operations of Nelnet Bank, including the ability to successfully conduct banking operations and achieve expected market penetration; risks related to the expected benefits to the company from its continuing investment in ALLO and Hudl, and risks related to investments in solar projects, including risks of not being able to realize tax credits which remain subject to recapture by taxing authorities and rising construction costs; risks and uncertainties related to other initiatives to pursue additional strategic investments (and anticipated income therefrom), acquisitions, and other activities, including activities that are intended to diversify the company both within and outside of its historical core education-related businesses; risks and uncertainties associated with climate change; risks from changes in economic conditions and consumer behavior; risks related to the company's ability to adapt to technological change, including artificial intelligence; risks related to the company's reinsurance business; risks related to the exclusive forum provisions in the company's articles of incorporation; risks related to the company's executive chairman's ability to control matters related to the company through voting rights; risks related to related party transactions; risks related to natural disasters, terrorist activities, or international hostilities; and risks and uncertainties associated with litigation matters and with maintaining compliance with the extensive regulatory requirements applicable to the company's businesses. For more information, see the "Risk Factors" sections and other cautionary discussions of risks and uncertainties included in documents filed or furnished by the company with the SEC, including the most recent Form 10-K filed by the company with the SEC. All forward-looking statements in this letter are as of the date of this letter. Although the company may voluntarily update or revise its forward-looking statements from time to time to reflect actual results or changes in the company's expectations, the company disclaims any commitment to do so except as required by law.