- OXSQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Oxford Square Capital (OXSQ) DEF 14ADefinitive proxy

Filed: 13 Jul 20, 3:17pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

_____________________________________

Filed by the Registrant S

Filed by a Party other than the Registrant £

Check the appropriate box:

£ | Preliminary Proxy Statement | |

£ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

S | Definitive Proxy Statement | |

£ | Definitive Additional Materials | |

£ | Soliciting Material Pursuant to Rule 14a-12 |

Oxford Square Capital Corp.

(Name of Registrant as Specified in Its Charter)

___________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

S | No fee required. | |||

£ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| ||||

(2) | Aggregate number of securities to which transaction applies: | |||

| ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| ||||

(4) | Proposed maximum aggregate value of transaction: | |||

| ||||

(5) | Total fee paid: | |||

| ||||

£ | Fee paid previously with preliminary materials. | |||

£ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

(1) | Amount previously Paid: | |||

| ||||

(2) | Form, schedule or registration statement No.: | |||

| ||||

(3) | Filing party: | |||

| ||||

(4) | Date filed: | |||

| ||||

OXFORD SQUARE CAPITAL CORP.

8 Sound Shore Drive, Suite 255

Greenwich, Connecticut 06830

July 13, 2020

Dear Stockholder:

You are cordially invited to attend the 2020 Annual Meeting (the “Annual Meeting”) of Stockholders of Oxford Square Capital Corp. (the “Company,” “OXSQ,” “we,” “us” or “our”) to be held on August 24, 2020 at 9:00 a.m., Eastern Time, in the second floor conference room of the Company’s corporate headquarters located at 8 Sound Shore Drive, Greenwich, Connecticut 06830. Stockholders of record of OXSQ at the close of business on June 30, 2020 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Details of the business to be conducted at the Annual Meeting are provided in the accompanying Notice of Annual Meeting and 2020 Proxy Statement.

It is very important that your shares be represented at the Annual Meeting. Whether or not you plan to attend, we hope you will vote as soon as possible. If you are unable to participate at the Annual Meeting, we urge you to follow the instructions on the Notice of Internet Availability of Proxy Materials to vote your proxy on the Internet. We encourage you to vote via the Internet, as it saves us significant time and processing costs. However, on the Notice of Internet Availability of Proxy Materials, you will also find instructions on how to request a hard copy of the proxy statement and proxy card free of charge and you may vote your proxy by returning your proxy card to us after you request the hard copy materials. Returning the proxy or voting by Internet or telephone does not deprive you of your right to attend the Annual Meeting and to vote your shares in person.

As part of our precautions regarding the coronavirus, or COVID-19, we reserve the right to reconsider the date, time, and/or means of convening the Annual Meeting, including holding the Annual Meeting by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate in the meeting will be issued by press release and filed with the Securities and Exchange Commission as additional proxy material. We urge you to retain your control or proxy voting number after you vote in case changes are made to the meeting format and such information is again required.

We look forward to seeing you at the Annual Meeting. Your vote and participation, no matter how many or how few shares you own, are very important to us.

Sincerely yours, | ||

Jonathan H. Cohen | ||

Chief Executive Officer |

OXFORD SQUARE CAPITAL CORP.

8 Sound Shore Drive, Suite 255

Greenwich, Connecticut 06830

(203) 983-5275

_____________________________________

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

_____________________________________

To be held in the second floor conference room

of the Company’s corporate headquarters, located at

8 Sound Shore Drive,

Greenwich, Connecticut 06830

August 24, 2020, at 9:00 a.m., Eastern Time

To the Stockholders of Oxford Square Capital Corp.:

The 2020 Annual Meeting (the “Annual Meeting”) of Stockholders of Oxford Square Capital Corp. (the “Company,” “OXSQ,” “we,” “us” or “our”) will be held in the second floor conference room of the Company’s corporate headquarters located at 8 Sound Shore Drive, Greenwich, Connecticut 06830, on August 24, 2020, at 9:00 a.m., Eastern Time, for the following purposes:

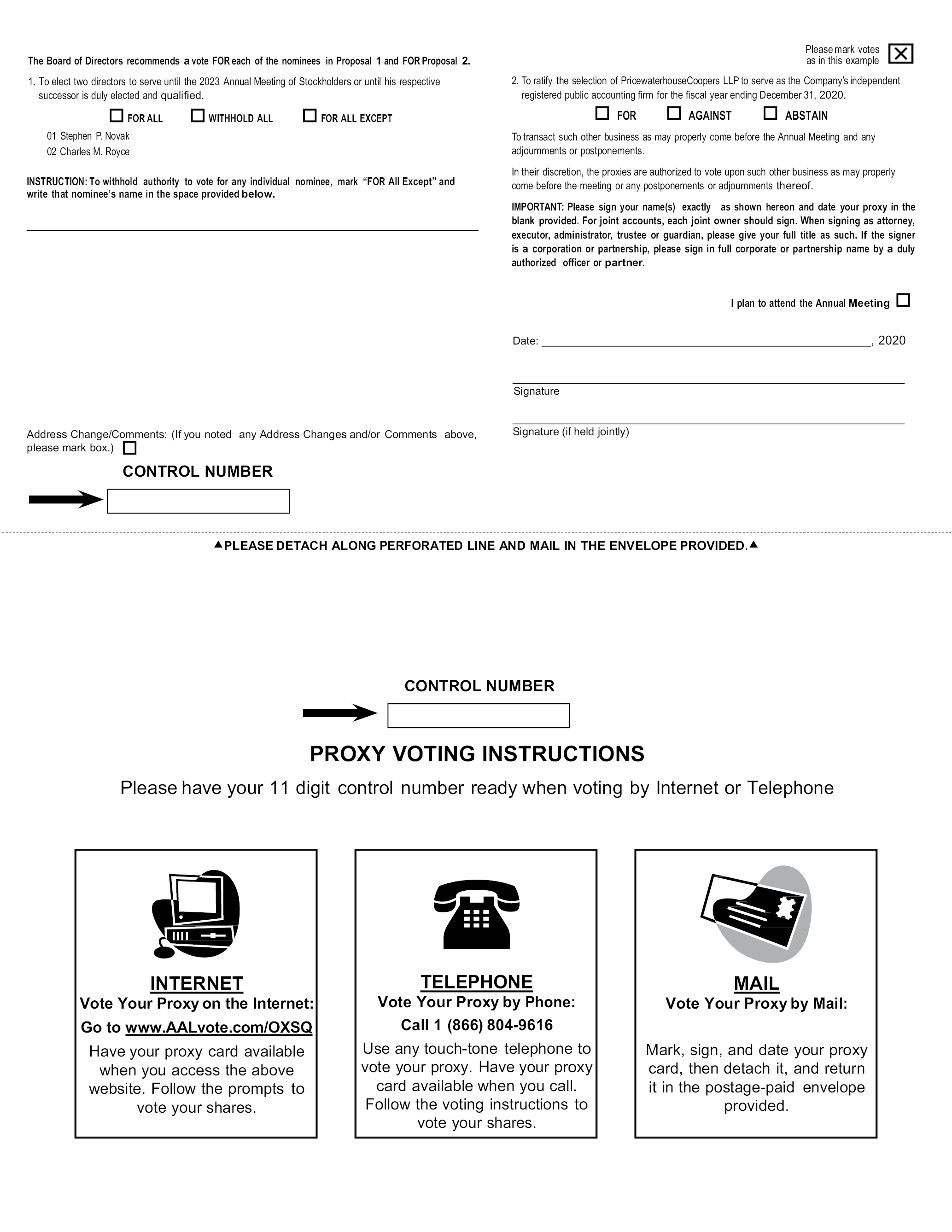

1. To vote on the election of two directors of the Company to serve for a term of three years, or until his respective successor is duly elected and qualified;

2. To vote on a proposal to ratify the selection of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for the Company for the fiscal year ending December 31, 2020; and

3. To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements.

OXSQ’S BOARD OF DIRECTORS, INCLUDING ALL THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE:

• “FOR” THE COMPANY’S DIRECTOR NOMINEES DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT, AND

• “FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2020.

Information about the nominees of the Board of Directors for election as directors of the Company is provided in the accompanying Proxy Statement.

The following information applicable to the Annual Meeting may be found in the proxy statement and accompanying proxy card:

• The date, time and location of the meeting;

• A list of the matters intended to be acted on and our recommendations regarding those matters;

• Any control/identification numbers that you need to access your proxy card; and

• Information about attending the meeting and voting in person.

You have the right to receive notice of and to vote at the Annual Meeting if you were a stockholder of record at the close of business on June 30, 2020. We are furnishing the proxy statement and proxy card to our stockholders on the Internet, available at http://www.viewproxy.com/OxfordSquare/2020, rather than mailing printed copies of those materials to each stockholder. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy statement and proxy card unless you request them. Instead, the Notice of

Internet Availability of Proxy Materials will instruct you as to how you may access and review the Proxy Statement, and vote your proxy, on the Internet. You may request hard copy proxy materials at no charge to you by following the instructions provided in the Notice of Internet Availability of Proxy Materials.

Whether or not you expect to be present in person at the Annual Meeting, and whatever the number of shares you own, you are requested to vote in accordance with the voting instructions in the Notice of Internet Availability of Proxy Materials, or by requesting hard copy proxy materials from us and returning a proxy card so that you may be represented at the Annual Meeting. Please note, however, that if you wish to vote in person at the meeting and your shares are held of record by a broker, bank, trustee, or nominee, you must obtain a “legal” proxy issued in your name from that record holder. In the event there are not sufficient votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

As part of our precautions regarding the coronavirus, or COVID-19, we reserve the right to reconsider the date, time, and/or means of convening the Annual Meeting, including holding the Annual Meeting by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate in the meeting will be issued by press release and filed with the Securities and Exchange Commission as additional proxy material. We urge you to retain your control or proxy voting number after you vote in case changes are made to the meeting format and such information is again required.

We are not aware of any other business, or any other nominees for election as directors, that may properly be brought before the Annual Meeting. Thank you for your continued support of Oxford Square Capital Corp.

By Order of the Board of Directors, | ||

Steven P. Novak | ||

Chairman |

Greenwich, Connecticut

July 13, 2020

This is a very important meeting. To ensure proper representation at the Annual Meeting, please follow the instructions on the Notice of Internet Availability of Proxy Materials to vote your proxy via the Internet or request, complete, sign, date and return a proxy card. Even if you vote your shares prior to the Annual Meeting, if you are a record holder of shares, or a beneficial holder who obtains “legal” proxy from your broker, bank, trustee, or nominee, you still may attend the Annual Meeting and vote your shares in person.

TABLE OF CONTENTS

i

OXFORD SQUARE CAPITAL CORP.

8 Sound Shore Drive, Suite 255

Greenwich, Connecticut 06830

(203) 983-5275

_____________________________________

PROXY STATEMENT

2020 Annual Meeting of Stockholders

_____________________________________

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of Oxford Square Capital Corp. (the “Company,” “OXSQ,” “we,” “us” or “our”) for use at the Company’s 2020 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on August 24, 2020, at 9:00 a.m., Eastern Time, in the second floor conference room of the Company’s corporate headquarters located at 8 Sound Shore Drive, Greenwich, Connecticut 06830, and at any postponements or adjournments thereof. This Proxy Statement, the Notice of 2020 Annual Meeting of Stockholders and the Annual Report of the Company for the year ended December 31, 2019 are being provided to the stockholders of OXSQ via the Internet at http://www.viewproxy.com/OxfordSquare/2020 on or about July 13, 2020. In addition, a Notice of Internet Availability of Proxy Materials is being sent to stockholders of record of OXSQ on or about July 13, 2020.

We encourage you to vote your shares, either by voting in person at the Annual Meeting or by granting a proxy (i.e., authorizing someone to vote your shares). If you provide voting instructions, either via the Internet, by telephone or by mail, and the Company receives them in time for the Annual Meeting, the persons named as proxies will vote your shares in the manner that you specified.

We will hold the Annual Meeting in the second floor conference room of the Company’s corporate headquarters located at 8 Sound Shore Drive, Greenwich, Connecticut 06830, on August 24, 2020 at 9:00 a.m., Eastern Time.

As part of our precautions regarding the coronavirus, or COVID-19, we reserve the right to reconsider the date, time, and/or means of convening the Annual Meeting, including holding the Annual Meeting by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate in the meeting will be issued by press release and filed with the Securities and Exchange Commission as additional proxy material. We urge you to retain your control or proxy voting number after you vote in case changes are made to the meeting format and such information is again required.

You are entitled to attend the Annual Meeting only if you were a stockholder of OXSQ as of the close of business on the record date for the Annual Meeting, which is June 30, 2020 (the “Record Date”), or you hold a valid proxy for the Annual Meeting. You must present valid photo identification, such as a driver’s license or passport, for admittance. If you are not a stockholder of record of the Company but hold shares as a beneficial owner in street name, in order to attend the Annual Meeting you must also provide proof of beneficial ownership, such as your most recent account statement prior to the Record Date, a copy of the voting instruction form provided by your broker, bank, trustee, or nominee, or other similar evidence of ownership of shares of the Company.

Since seating is limited, admission to the Annual Meeting will be on a first-come, first-served basis. If you do not comply with the procedures outlined above, you will not be admitted to the Annual Meeting. For security reasons, you and your bags will be subject to search prior to your admittance to the Annual Meeting.

1

Availability of Proxy and Annual Meeting Materials

This Proxy Statement, the Notice of 2020 Annual Meeting of Stockholders and the accompanying Annual Report of the Company for the fiscal year ended December 31, 2019 are available at http://www.viewproxy.com/OxfordSquare/2020.

At the Annual Meeting, you will be asked to vote on the following proposals:

Proposal 1 — To elect two directors to serve until the 2023 Annual Meeting of Stockholders or until his successor is duly elected and qualified;

Proposal 2 — To ratify the selection of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020; and

To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements.

OXSQ’S BOARD OF DIRECTORS, INCLUDING ALL THE INDEPENDENT DIRECTORS (AS DEFINED BELOW), UNANIMOUSLY RECOMMENDS THAT YOU VOTE:

• “FOR” OXSQ’s DIRECTOR NOMINEES DESCRIBED IN THIS PROXY STATEMENT (PROPOSAL 1), AND

• “FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR OXSQ FOR THE FISCAL YEAR ENDING DECEMBER 31, 2020 (PROPOSAL 2).

Record Date and Voting Securities

You may vote your shares of the Company’s common stock, in person or by proxy, at the Annual Meeting only if you were a stockholder of record at the close of business on the Record Date. All shares of the Company’s common stock have equal voting rights and are the only class of voting securities outstanding. On the Record Date, there were 49,589,607 shares of the Company’s common stock outstanding. Each share of common stock is entitled to one vote.

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the Record Date, or 24,794,804 shares of the Company’s common stock, will constitute a quorum. Abstentions will be treated as shares present for quorum purposes. Shares for which brokers have not received voting instructions from the beneficial owner of the shares and do not have discretionary authority to vote on a proposal at the Annual Meeting (which are considered “Broker Non-Votes” with respect to such proposal) will be treated as shares present for quorum purposes. However, abstentions and Broker Non-Votes are not counted as votes cast. If a quorum is not present, the Annual Meeting may be adjourned pursuant to the provisions of the Company’s Bylaws until a quorum is present. The persons named as proxies will vote those proxies for such adjournment, unless marked to be voted against any proposal for which an adjournment is sought, to permit the further solicitation of proxies.

Voting Your Shares

If you are the record holder of your shares, you may vote by submitting your proxy by telephone, over the Internet, by mail, or in person at the Annual Meeting.

• You may vote your shares by telephone or over the internet by following the instructions set forth on the Notice of Internet Availability of Proxy Materials. We encourage you to vote via the Internet, as it saves us significant time and processing costs.

2

• If you request hard copies of the proxy statement and proxy card, you may vote by mail by completing, dating and signing the proxy card and promptly mailing it in the enclosed postage-paid envelope. You do not need to put a stamp on the enclosed envelope if you mail it in the United States. The shares you own will be voted according to the instructions on the proxy card you mail. If you return the proxy card, but do not give any instructions on a particular matter described in this proxy statement, the shares you own will be voted in accordance with the recommendations of our Board of Directors. Our Board of Directors recommends that you vote FOR the director nominees and FOR the ratification of the selection of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for the Company for the fiscal year ending December 31, 2020.

• If you attend the Annual Meeting and are a registered stockholder, you may vote by completing a ballot available at the Annual Meeting, or, if you requested a hard copy of the proxy card, by delivering your completed proxy card in person at the Annual Meeting.

Submitting Voting Instructions for Shares Held Through a Broker, Bank, Trustee, or Nominee

If you hold shares of the Company’s common stock through a broker, bank, trustee, or nominee (“Broker Securities”), you must follow the voting instructions you receive from your broker, bank, trustee, or nominee. If you hold Broker Securities and you want to vote in person at the Annual Meeting, you must obtain a legal proxy from the record holder of your shares and present it at the Annual Meeting. Please instruct your broker, bank, trustee, or nominee so your vote can be counted.

Pursuant to New York Stock Exchange (the “NYSE”) Rule 452 and the corresponding Listed Company Manual Section 402.08, discretionary voting by banks or brokers of Broker Securities is generally prohibited, subject to the exceptions as discussed in this paragraph. If you do not give instructions to your bank or broker within ten days of the Annual Meeting, the bank or broker may vote Broker Securities with respect to matters that the NYSE determines to be “routine,” but will not be permitted to vote your Broker Securities with respect to “non-routine” items. Typically, “non-routine” matters would include the election of directors (Proposal 1), while “routine” matters would include the ratification of the appointment of our independent registered public accounting firm (Proposal 2). However, when a matter to be voted on at a stockholder’s meeting is the subject of a contested solicitation, brokers do not have discretion to vote Broker Securities on any matters at the Annual Meeting, to the extent they have provided you with the opposition party’s proxy materials. When a bank or broker has not received instructions from the beneficial owners of Broker Securities or persons entitled to vote any Broker Securities, and the bank or broker cannot vote on a particular matter because it is not “routine,” then there is a “broker non-vote” on that matter. Broker non-votes will be counted in determining whether there is a quorum for the Annual Meeting and will have the same effect as votes against a “non-routine” matter.

Please note that to be sure your vote is counted on all of the proposals to be considered at the Annual Meeting, including the election of directors, you should instruct your broker, bank, trustee, or nominee how to vote any Broker Securities. If you do not provide voting instructions, votes may not be cast on your behalf with respect to those “non-routine” matters.

Authorizing a Proxy for Shares Held in Your Name

If you are a record holder of shares of the Company’s common stock, you may authorize a proxy to vote on your behalf by following the instructions provided on the enclosed proxy card. Authorizing your proxy will not limit your right to vote in person at the Annual Meeting. A properly completed and submitted proxy will be voted in accordance with your instructions, unless you subsequently revoke your instructions. If you authorize a proxy without indicating your voting instructions, the proxyholder will vote your shares according to the Board’s recommendations. Internet and telephone voting procedures are designed to authenticate the stockholder’s identity and to allow stockholders to vote their shares and confirm that their instructions have been properly recorded. Your telephone or Internet vote authorizes the named proxies to vote your shares in the same manner as if you had marked, signed and returned a proxy card.

Receipt of Multiple Proxy Cards

Many of our stockholders hold their shares in more than one account and may receive separate proxy cards or voting instruction forms for each of those accounts. To ensure that all of your shares are represented at the Annual Meeting, we recommend that you vote every proxy card you receive.

3

If you are a “stockholder of record” (i.e., you hold shares directly in your name), you may revoke a proxy at any time before it is exercised by: (i) submitting a later-dated proxy that we receive no later than the conclusion of voting at the Annual Meeting; or (ii) voting in person at the Annual Meeting. If you hold Broker Securities, you must follow the instructions you receive from them in order to revoke your voting instructions. Attending the Annual Meeting does not revoke your proxy unless you also vote in person at the Annual Meeting. Stockholders have no dissenters’ or appraisal rights in connection with any of the proposals described herein.

Proposal 1 — Election of Directors. In an uncontested election, a majority of the votes cast at a meeting of stockholders duly called and at which a quorum is present shall be sufficient to elect a director. In a contested election, a plurality of all votes cast at a meeting of stockholders duly called and at which a quorum is present shall be sufficient to elect a director. Stockholders may not cumulate their votes. If you vote “Withhold” with respect to OXSQ’s Board nominees, your shares will not be voted with respect to the person indicated. Abstentions and Broker Non-Votes, if any, will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal. This proposal is considered a “non-routine matter”; accordingly, brokers cannot vote on this proposal unless they have received voting instructions from the beneficial owner of Broker Securities.

Proposal 2 — Ratification of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the votes cast at the Annual Meeting in person or by proxy is required to ratify the appointment of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020 (i.e., the number of shares voted “for” the ratification of the appointment of PricewaterhouseCoopers LLP exceeds the number of votes “against” the ratification of the appointment of PricewaterhouseCoopers LLP). Abstentions, if any, will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal. This proposal is considered a “routine matter”; accordingly, brokers have discretionary authority to vote on this proposal without receiving voting instructions from the beneficial owner of Broker Securities.

Additional Solicitation. If there are not enough votes to approve any proposals at the Annual Meeting, stockholders who are represented may adjourn the Annual Meeting to permit the further solicitation of proxies. The persons named as proxies will vote those proxies for such adjournment, unless marked to be voted against any proposal for which an adjournment is sought, to permit the further solicitation of proxies. Also, a stockholder vote may be taken on one or more of the proposals in this Proxy Statement prior to any such adjournment if there are sufficient votes for approval of such proposal(s).

Participants in the Solicitation of Proxies

Under applicable Securities and Exchange Commission (the “SEC”) regulations, the Company, its directors and certain of its executive officers, the officers and employees of Oxford Square Management, LLC (“Oxford Square Management”), the Company’s investment adviser, and the officers and employees of Oxford Funds, LLC (“Oxford Funds”), the Company’s administrator, may be deemed to be participants in the solicitation of proxies from OXSQ’s stockholders in connection with the Annual Meeting. Oxford Square Management and Oxford Funds are both located at 8 Sound Shore Drive, Suite 255, Greenwich, CT 06830. No additional compensation will be paid to directors, officers or regular employees of the Company, Oxford Square Management or Oxford Funds for soliciting proxies in connection with the Annual Meeting.

Information Regarding This Solicitation

The Board is making this proxy solicitation and the Company will bear the expense of the solicitation of proxies for the Annual Meeting, including the cost of preparing, printing and mailing this Proxy Statement, the accompanying Notice of Annual Meeting of Stockholders, and proxy card. If brokers, trustees, or fiduciaries and other institutions or nominees holding shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners, the Company will reimburse such persons for their reasonable expenses in so doing.

4

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of the Record Date, the beneficial ownership of each current director, the director nominees, the Company’s executive officers, each person known to us to beneficially own more than 5% of the outstanding shares of our common stock, and the executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Ownership information for those persons who beneficially own more than 5% of our shares of common stock is based upon Schedule 13D and Schedule 13G filings by such persons with the SEC and other information obtained from such persons, if available.

Unless otherwise indicated, the Company believes that each beneficial owner set forth in the table has sole voting and investment power and has the same address as the Company. The Company’s current address is 8 Sound Shore Drive, Suite 255, Greenwich, Connecticut 06830.

Name of Beneficial Owner | Number | Percentage of | ||||

Interested Directors |

|

| ||||

Jonathan H. Cohen(3) | 1,412,909 |

| 2.8 | % | ||

Charles M. Royce(4) | 1,342,180 |

| 2.7 | % | ||

Independent Directors |

|

| ||||

Steven P. Novak(5) | 17,410 |

| * |

| ||

Richard W. Neu | 70,000 |

| * |

| ||

George Stelljes III | 34,000 |

| * |

| ||

Executive Officers |

|

| ||||

Saul B. Rosenthal(3) | 1,251,125 |

| 2.5 | % | ||

Bruce L. Rubin(6) | 9,030 |

| * |

| ||

Gerald Cummins | — |

| — |

| ||

Executive Officers and Directors as a Group | 4,135,961 | (7) | 8.3 | % | ||

____________

* Represents less than one percent

(1) Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act, as amended (the “Exchange Act”). Assumes no other purchases or sales of our common stock since the information most recently available to us as of the Record Date. This assumption has been made under the rules and regulations of the SEC and does not reflect any knowledge that we have with regard to the present intent of the beneficial owners of our common stock listed in this table. Any fractional shares owned directly or beneficially have been rounded down for purposes of this table.

(2) Based on a total of 49,589,607 shares of the Company’s common stock issued and outstanding on the Record Date.

(3) Includes 693 shares held by Oxford Funds, which may be deemed to be beneficially owned by Messrs. Cohen and Rosenthal by virtue of their ownership interests therein.

(4) Mr. Royce may be deemed to beneficially own 1,047,966 shares held by Royce Family Investments, LLC and 294,214 shares held by Royce Family Fund, Inc. Mr. Royce disclaims beneficial ownership of any shares directly held by Royce Family Fund, Inc. The address for both of these entities is 745 Fifth Avenue, New York, New York 10151.

(5) These shares are held by Mr. Novak’s spouse, which Mr. Novak may be deemed to beneficially own.

(6) Mr. Rubin may be deemed to beneficially own 818 shares held by his children. Mr. Rubin disclaims beneficial ownership of any shares directly held by his children.

(7) The 693 shares held by Oxford Funds, described in footnote 3 above, are included in the number of shares held by each of Mr. Cohen and Mr. Rosenthal, but are only counted once in the total held by the executive officers and directors as a group.

5

Set forth below is the dollar range of equity securities beneficially owned by each of our directors as of the Record Date.

Name of Director | Dollar Range of Equity | |

Interested Directors | ||

Jonathan H. Cohen | Over $100,000 | |

Charles M. Royce | Over $100,000 | |

Independent Directors | ||

Steven P. Novak | $10,001 – $50,000 | |

Richard W. Neu | Over $100,000 | |

George Stelljes III | $50,001 – $100,000 |

____________

(1) The dollar ranges are: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, or Over $100,000.

(2) The dollar range of equity securities beneficially owned is based on the closing price for our common stock of $2.80 on the Record Date on the NASDAQ Global Select Market. Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) of the Exchange Act.

6

PROPOSAL 1: ELECTION OF DIRECTORS

Pursuant to the Company’s bylaws, the number of directors is set at five unless otherwise designated by the Board of Directors. Directors are elected for a staggered term of three years each, with a term of office of one of the three classes of directors expiring each year. Each director will hold office for the term to which he or she is elected or until his or her respective successor is duly elected and qualified.

Mr. Steven P. Novak and Mr. Charles M. Royce have each been unanimously nominated by OXSQ’s Board of Directors, including the Nominating and Corporate Governance Committee, for election for a three-year term expiring in 2023. Messrs. Novak and Royce are not being proposed for election pursuant to any agreement or understanding between Messrs. Novak and Royce and the Company or any other person or entity.

A stockholder can vote for or withhold his, her or its vote from OXSQ’s Board nominees. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy “FOR” the election of the OXSQ’s nominees named above. If either of OXSQ’s Board nominees should decline or be unable to serve as a director, it is intended that the proxy will vote for the election of such person as is nominated by the Board of Directors as a replacement. OXSQ’s Board of Directors has no reason to believe that the person named above will be unable or unwilling to serve.

This proposal is considered a “non-routine matter” per the NYSE rules and instructions; accordingly, brokers cannot vote on this proposal unless they have received voting instructions from the beneficial owner of Broker Securities.

In an uncontested election, a majority of the votes cast at a meeting of stockholders duly called and at which a quorum is present shall be sufficient to elect a director. In a contested election, a plurality of all votes cast at a meeting of stockholders duly called and at which a quorum is present shall be sufficient to elect a director. Stockholders may not cumulate their votes. If you vote “Withhold” with respect to either director nominee, your shares will not be voted with respect to the person indicated. Abstentions and Broker Non-Votes, if any, will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal. This proposal is considered a “non-routine matter”; accordingly, brokers cannot vote on this proposal unless they have received voting instructions from the beneficial owner of Broker Securities.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF MR. STEVEN P. NOVAK AND MR. CHARLES M. ROYCE, OXSQ’S NOMINEES NAMED IN THIS PROXY STATEMENT.

Information About the Nominees and Directors

As described below under “Committees of the Board of Directors — Nominating and Corporate Governance Committee,” the Board of Directors has identified certain desired talents and experience for director nominees. Each of our directors and the director nominees has demonstrated high character and integrity; the knowledge, skills and experience necessary to be able to offer advice and guidance to our management in light of prevailing business conditions; familiarity with business matters; experience with accounting rules and practices; appreciation of the relationship of our business to the changing needs of society; and the desire to complement the considerable benefit of continuity with the benefit of diverse view points and perspectives. Each of our directors and the director nominees also has sufficient time available to devote to the affairs of the Company, is able to work with the other members of the Board of Directors and contribute to the success of the Company and can represent the long-term interests of the Company’s stockholders as a whole. Our directors and the director nominees have been selected such that the Board of Directors represents a diverse range of backgrounds and experience. All of our directors are encouraged to attend the Annual Meeting.

Certain information, as of the Record Date, with respect to the Company’s director nominees for election at the Annual Meeting, as well as each of the current directors, is set forth below, including their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships that each person holds, the year in which each person became a director of the Company, and a discussion of their particular experience, qualifications, attributes or skills that lead us to conclude, as of the Record Date, that such individual should serve as a director of the Company, in light of the Company’s business and structure.

The business address of the nominees and the directors listed below is 8 Sound Shore Drive, Suite 255, Greenwich, Connecticut 06830.

7

Nominees for Director — Term Expiring 2023

Interested Director

Mr.Royce is an interested person as defined in the 1940 Act due to his ownership of a minority, non-controlling interest in the Company’s investment adviser, Oxford Square Management.

Name and Year First Elected Director | Age | Background Information | ||

Charles M. Royce (2003) | 80 | Mr. Royce currently serves as Chairman of the Board of Managers of Royce & Associates, LP. Prior to 2017, Mr. Royce served as Chief Executive Officer of Royce & Associates, LP since 1972. He also manages or co-manages eight of Royce & Associates, LP’s open- and closed-end registered funds. Mr. Royce serves on the Board of Trustees of The Royce Funds. Mr. Royce’s history with us, familiarity with our investment platform, and extensive knowledge of the financial services industry and the investment valuation process in particular qualify him to serve as a member of our Board of Directors. |

Independent Director

Mr.Novak is not an interested person as defined in the 1940 Act.

Name and Year First Elected Director | Age | Background Information | ||

Steven P. Novak (2003) | 72 | Mr. Novak currently serves as the Chairman of the Board of Directors of Quisk, Inc. an early stage mobile payments company, in the process of liquidating its assets. Mr. Novak also served on the Board of Directors of CyberSource Corporation, a payment processing and fraud management company, until its July 2010 acquisition by Visa, Inc. In the course of his tenure at CyberSource Corporation, he served as Chairman of the Audit and Nominating Committees and as Lead Independent Director. Mr. Novak previously served as President of Palladio Capital Management, LLC and as the Principal and Managing Member of the General Partner of Palladio Partners, LP, an equities hedge fund, from July 2002 until July 2009. Mr. Novak received a Bachelor of Science degree from Purdue University and an M.B.A. from Harvard University. A Chartered Financial Analyst, Mr. Novak’s financial expertise from his experience as a financial manager and varied roles on the boards of both publicly-traded and privately-held companies qualifies him to serve as chairman of our Board of Directors and provides our Board of Directors with particular technology-related knowledge and the perspective of a knowledgeable corporate leader. |

8

Current Directors — Term Expiring 2021

Interested Director

Mr. Cohen is an interested person of the Company as defined in the 1940 Act due to his position as Chief Executive Officer of the Company and Oxford Square Management, the Company’s investment adviser, and as the managing member of Oxford Funds, the managing member of Oxford Square Management.

Name and Year First Elected Director | Age | Background Information | ||

Jonathan H. Cohen (2003) | 55 | Mr. Cohen has served as Chief Executive Officer of both OXSQ and Oxford Square Management, and as the managing member of Oxford Funds, since 2003. Mr. Cohen has also served as Chief Executive Officer and Director of Oxford Lane Capital Corp. (NasdaqGS:OXLC), a registered closed-end fund, and as Chief Executive Officer of Oxford Lane Management, since 2010. Since 2015 and 2018, respectively, Mr. Cohen has also served as the Chief Executive Officer of each of Oxford Bridge Management, LLC, or “Oxford Bridge Management,” the investment adviser to Oxford Bridge, LLC and Oxford Bridge II, LLC (collectively, the “Oxford Bridge Funds”), and, Oxford Gate Management, LLC, or “Oxford Gate Management,” the investment adviser to Oxford Gate Master Fund, LLC, Oxford Gate, LLC, and Oxford Gate (Bermuda) LLC, (collectively the “Oxford Gate Funds”). The Oxford Bridge Funds and the Oxford Gate Funds are private investment funds. Previously, Mr. Cohen managed technology equity research groups at Wit Capital, Merrill Lynch, UBS and Smith Barney. Mr. Cohen is member of the Board of Trustees of Connecticut College. Mr. Cohen received a B.A. in Economics from Connecticut College and an M.B.A. from Columbia University. Mr. Cohen’s depth of experience in managerial positions in investment management, securities research and financial services, as well as his intimate knowledge of our business and operations, gives our Board of Directors valuable industry-specific knowledge and expertise on these and other matters. |

Independent Director

Mr. Stelljes is not an interested person as defined in the 1940 Act.

Name and Year First Elected Director | Age | Background Information | ||

George Stelljes III (2016) | 58 | Mr. Stelljes is currently the managing partner of St. John’s Capital, LLC, a vehicle used to make private equity investments. From 2001 to 2013, Mr. Stelljes held various senior positions with the Gladstone Companies, including serving as the chief investment officer, president and a director of Gladstone Capital Corporation and Gladstone Investment Corporation, both of which are business development companies, of Gladstone Commercial Corporation, a real estate investment trust, and of their registered investment adviser, Gladstone Management Corporation. From 1999 to 2001, Mr. Stelljes was a managing member of Camden Partners, a private equity firm which finances high growth companies in communications, education, healthcare and business services sectors. From 1997 to 1999, Mr. Stelljes was a managing director and partner of Columbia Capital, a venture capital firm focused on investments in communications and information technology. From 1989 to 1997, Mr. Stelljes held various positions, including executive vice president and principal, with the Allied Capital companies. From 2001 through 2012, Mr. Stelljes served as a general partner and investment committee member of Patriot Capital and Patriot Capital II, which are private equity funds. Mr. Stelljes currently serves on the board of directors of Intrepid Capital Corporation, an asset management firm. Mr. Stelljes is also currently the chairman |

9

Name and Year First Elected Director | Age | Background Information | ||

of the board of directors of Bluestone Community Development Fund, a closed-end investment company that operates as an interval fund. He is also a former board member and regional president of the National Association of Small Business Investment Companies. Mr. Stelljes holds an MBA from the University of Virginia and a BA in Economics from Vanderbilt University. Mr. Stelljes was selected to serve as a director on our board of directors due to his more than twenty-five years of experience in the investment analysis, management, and advisory industries. |

Current Director — Term Expiring 2022

Independent Director

Mr. Neu is not an interested person as defined in the Investment Company Act of 1940, as amended (the “1940 Act”).

Name and Year First Elected Director | Age | Background Information | ||

Richard W. Neu (2016) | 64 | Mr. Neu currently serves on the board of directors, including on the audit committee, the compensation committee and as a lead director, of Tempur Sealy International, Inc., a manufacturer of mattresses and bedding products. Mr. Neu also currently serves on the board of directors, as chair of the audit committee and as a member of the executive committee and nominating and corporate governance committee of Huntington Bancshares Incorporated, a bank holding company. Until the sale of the company in 2012, he was the lead director and a member of the audit committee and governance committee of Dollar Thrifty Automotive Group, Inc., a car rental business, having served as the chairman of the Dollar Thrifty board of directors from 2010 through 2011. Mr. Neu also served as a director of MCG Capital Corporation, a business development company, from 2007 until its sale in 2015, and during this period served as chairman of the board from 2009 to 2015 and as Chief Executive Officer from November 2011 to November 2012. Mr. Neu served from 1985 to 2004 as Chief Financial Officer of Charter One Financial, Inc., a major regional bank holding company, and a predecessor firm, and as a director of Charter One Financial, Inc. from 1992 to August 2004. Mr. Neu previously worked for KPMG as a senior audit manager. Mr. Neu received a B.B.A. from Eastern Michigan University with a major in accounting. Mr. Neu was selected to serve as a director on our board of directors due to his extensive knowledge and experience handling complex financial and operational issues through his service as both a director and executive officer of a variety of public companies. |

10

Information About Executive Officers Who Are Not Directors

The following information, as of the Record Date, pertains to our executive officers who are not directors of the Company.

Name | Age | Background Information | ||

Saul B. Rosenthal | 51 | Mr. Rosenthal has served as President since 2004 of OXSQ and Oxford Square Management, and is a member of Oxford Funds. In addition, Mr. Rosenthal has served as President and a Director of Oxford Lane Capital Corp. (NasdaqGS:OXLC), a registered closed-end fund, and as President of Oxford Lane Management, since 2010. Mr. Rosenthal has also served as President of Oxford Bridge Management, the investment adviser to the Oxford Bridge, Funds and Oxford Gate Management, the investment advisor to Oxford Gate Funds, since 2015 and 2018, respectively. Mr. Rosenthal was previously an attorney at the law firm of Shearman & Sterling LLP. Mr. Rosenthal serves on the board of the National Museum of Mathematics. Mr. Rosenthal received a B.S., magna cum laude, from the Wharton School of the University of Pennsylvania, a J.D. from Columbia University Law School, where he was a Harlan Fiske Stone Scholar, and a LL.M. (Taxation) from New York University School of Law. | ||

Bruce L. Rubin | 60 | Mr. Rubin has served as the Company’s Controller since 2005, the Company’s Senior Vice President and Treasurer since 2009, the Company’s Chief Accounting Officer since August 2015 and the Company’s Chief Financial Officer and Secretary since August 2015. Mr. Rubin has also served as Oxford Lane Capital Corp.’s Chief Financial Officer and Secretary since August 2015, and as its Treasurer and Controller since its initial public offering in 2011. Mr. Rubin also currently serves as the Chief Financial Officer and Secretary of Oxford Lane Management, LLC, Oxford Square Management, Oxford Funds, Oxford Bridge Management, LLC and Oxford Gate Management, LLC. From 1995 to 2003, Mr. Rubin was the Assistant Treasurer & Director of Financial Planning of the New York Mercantile Exchange, Inc., the largest physical commodities futures exchange in the world and has extensive experience with Sarbanes-Oxley, treasury operations and SEC reporting requirements. From 1989 to 1995, Mr. Rubin was a manager in financial operations for the American Stock Exchange, where he was primarily responsible for budgeting matters. Mr. Rubin began his career in commercial banking as an auditor primarily of the commercial lending and municipal bond dealer areas. Mr. Rubin received his BBA in Accounting from Hofstra University where he also obtained his M.B.A. in Finance. |

11

Name | Age | Background Information | ||

Gerald Cummins | 64 | Mr. Cummins has served as the Company’s Chief Compliance Officer since June 2015 pursuant to an agreement between the Company and Alaric Compliance Services, LLC, a compliance consulting firm. Mr. Cummins also currently serves as the Chief Compliance Officer of Oxford Square Management, Oxford Lane Capital Corp., Oxford Lane Management, LLC, Oxford Funds LLC, Oxford Bridge Management, LLC, and since 2018 Oxford Gate Management, LLC. Mr. Cummins has been a Director of Alaric Compliance Services, LLC since June 2014 and in that capacity he also serves as the Chief Compliance Officer to a private equity firm. Prior to joining Alaric Compliance Services, LLC, Mr. Cummins was a consultant for Barclays Capital Inc. from 2012 to 2013, where he participated in numerous compliance projects on pricing and valuation, compliance assessments, and compliance policy and procedure development. Prior to his consulting work at Barclays, Mr. Cummins was from 2010 to 2011 the Chief Operating Officer and the Chief Compliance Officer for BroadArch Capital and from 2009 to 2011 the Chief Financial Officer and Chief Compliance Officer to its predecessor New Castle Funds, a long-short equity asset manager. Prior to that, Mr. Cummins spent 25 years at Bear Stearns Asset Management, where he was a Managing Director and held senior compliance, controllers and operations risk positions. Mr. Cummins graduated with a B.A. in Mathematics from Fordham University. |

Our Board of Directors monitors and performs an oversight role with respect to the business and affairs of OXSQ, including with respect to investment practices and performance, compliance with regulatory requirements and the services, expenses and performance of service providers to OXSQ. Among other things, our Board of Directors approves the appointment of our investment adviser and officers, reviews and monitors the services and activities performed by our investment adviser and executive officers, and approves the engagement, and reviews the performance, of our independent registered public accounting firm.

Under our bylaws, our Board of Directors may designate a Chairman to preside over the meetings of our Board of Directors and meetings of the stockholders and to perform such other duties as may be assigned to him by our Board of Directors. Mr. Novak serves as the Chairman of our Board of Directors. Mr. Novak is not an “interested person” of OXSQ as defined in Section 2(a)(19) of the 1940 Act. We believe that Mr. Novak’s financial expertise from his experience as a financial manager and varied roles on the boards of both publicly-traded and privately-held companies qualifies him to serve as the Chairman of our Board of Directors and provides our Board with particular technology-related knowledge and the perspective of a knowledgeable corporate leader. We believe that we are best served through this existing leadership structure, as Mr. Novak encourages an open dialogue between management and our Board of Directors, ensuring that these groups act with a common purpose with respect to the Company.

Our corporate governance policies include regular meetings of the directors who are not “interested persons” of the Company, as defined in the 1940 Act (the “Independent Directors”), in executive session without the presence of interested directors and management, the establishment of an Audit Committee, Valuation Committee, Nominating and Corporate Governance Committee, and Compensation Committee, all of which are comprised solely of Independent Directors, and the appointment of a Chief Compliance Officer, with whom the Independent Directors meet regularly without the presence of interested directors and other members of management, for administering our compliance policies and procedures.

Board’s Role In Risk Oversight

Our Board of Directors performs its risk oversight function primarily through (i) its four standing committees, which report to the entire Board of Directors and are comprised solely of Independent Directors, and (ii) active monitoring of our Chief Compliance Officer and our compliance policies and procedures.

12

As described below in more detail under “Committees of the Board of Directors,” the Audit Committee, the Valuation Committee, the Nominating and Corporate Governance Committee and the Compensation Committee assist the Board of Directors in fulfilling its risk oversight responsibilities. The Audit Committee’s risk oversight responsibilities include overseeing our accounting and financial reporting processes, our systems of internal controls regarding finance and accounting, and audits of our financial statements. The Valuation Committee’s risk oversight responsibilities include establishing guidelines and making recommendations to our Board of Directors regarding the valuation of our loans and investments. The Nominating and Corporate Governance Committee’s risk oversight responsibilities include selecting, researching and nominating directors for election by our stockholders, developing and recommending to the Board of Directors a set of corporate governance principles and overseeing the evaluation of our Board of Directors and our management. The Compensation Committee’s risk oversight responsibilities include reviewing and recommending to our Board of Directors for approval the Investment Advisory Agreement and the Administration Agreement, and, to the extent that we may compensate our executive officers directly in the future, reviewing and evaluating the compensation of our executive officers and making recommendations to the Board of Directors regarding such compensation.

Our Board of Directors also performs its risk oversight responsibilities with the assistance of our Chief Compliance Officer. Our Board of Directors annually reviews a written report from the Chief Compliance Officer discussing the adequacy and effectiveness of the compliance policies and procedures of OXSQ and its service providers. The Chief Compliance Officer’s annual report addresses at a minimum (i) the operation of the compliance policies and procedures of OXSQ and its service providers since the last report; (ii) any material changes to such policies and procedures since the last report; (iii) any recommendations for material changes to such policies and procedures as a result of the Chief Compliance Officer’s annual review; and (iv) any compliance matter that has occurred since the date of the last report about which our Board of Directors would reasonably need to know to oversee our compliance activities and risks. In addition, the Chief Compliance Officer meets separately in executive session with the Independent Directors at least quarterly.

We believe that our Board of Directors’ role in risk oversight is effective, and appropriate given the extensive regulation to which we are already subject to as a BDC. As a BDC, we are required to comply with certain regulatory requirements that control the levels of risk in our business and operations. For example, our ability to incur indebtedness is limited such that our asset coverage must equal at least 150% immediately after each time we incur indebtedness, we generally cannot invest in assets that are not “qualifying assets” unless at least 70% of our gross assets consist of “qualifying assets” immediately prior to such investment, and we are not generally permitted to invest, subject to certain exceptions, in any portfolio company in which one of our affiliates currently has an investment.

We recognize that different board roles in risk oversight are appropriate for companies in different situations. We re-examine the manner in which our Board of Directors administers its oversight function on an ongoing basis to ensure that they continue to meet our needs.

Transactions with Related Persons

We have entered into the Investment Advisory Agreement with Oxford Square Management. Oxford Square Management is controlled by Oxford Funds, its managing member. In addition to Oxford Funds, Oxford Square Management is owned by Charles M. Royce, a member of our Board of Directors, who holds a minority, non-controlling interest in Oxford Square Management as the non-managing member. Oxford Funds, as the managing member of Oxford Square Management, manages the business and internal affairs of Oxford Square Management. In addition, Oxford Funds provides us with office facilities and administrative services pursuant to the Administration Agreement.

Messrs. Cohen and Rosenthal also currently serve as Chief Executive Officer and President, respectively, at Oxford Bridge Management, LLC, the investment adviser to the Oxford Bridge Funds, and Oxford Gate Management, LLC, the investment adviser to the Oxford Gate Funds. Oxford Funds is the managing member of each of Oxford Bridge Management, LLC and Oxford Gate Management, LLC. In addition, Bruce L. Rubin serves as the Chief Financial Officer, and Gerald Cummins serves as the Chief Compliance Officer, of each of Oxford Bridge Management, LLC and Oxford Gate Management, LLC.

Messrs. Cohen and Rosenthal currently serve as Chief Executive Officer and President, respectively, of Oxford Lane Capital Corp., a non-diversified closed-end management investment company that invests primarily in equity and junior debt tranches of collateralized loan obligation vehicles, and its investment adviser, Oxford Lane Management, LLC. Oxford Funds provides Oxford Lane Capital Corp. with office facilities and administrative services pursuant to

13

an administration agreement and also serves as the managing member of Oxford Lane Management, LLC. In addition, Bruce L. Rubin serves as the Chief Financial Officer, Treasurer and Corporate Secretary of Oxford Lane Capital Corp. and Chief Financial Officer and Treasurer of Oxford Lane Management, LLC, and Mr. Cummins serves as the Chief Compliance Officer of Oxford Lane Capital Corp. and Oxford Lane Management, LLC.

As a result, certain conflicts of interest may arise with respect to the management of our portfolio by Messrs. Cohen and Rosenthal on the one hand, and the obligations of Messrs. Cohen and Rosenthal to manage Oxford Lane Capital Corp., the Oxford Bridge Funds and the Oxford Gate Funds, respectively, on the other hand.

Oxford Square Management, Oxford Lane Management, LLC, Oxford Bridge Management, LLC and Oxford Gate Management, LLC are subject to a written policy with respect to the allocation of investment opportunities among the Company, Oxford Lane Capital Corp., the Oxford Bridge Funds and the Oxford Gate Funds. Where investments are suitable for more than one entity, the allocation policy generally provides that, depending on size and subject to current and anticipated cash availability, the absolute size of the investment as well as its relative size compared to the total assets of each entity, current and anticipated weighted average costs of capital, among other factors, an investment amount will be determined by the adviser to each entity. If the investment opportunity is sufficient for each entity to receive its investment amount, then each entity receives the investment amount; otherwise, the investment amount is reduced pro rata. On June 14, 2017, the Securities and Exchange Commission issued an order permitting the Company and certain of its affiliates to complete negotiated co-investment transactions in portfolio companies, subject to certain conditions (the “Order”). Subject to satisfaction of certain conditions to the Order, the Company and certain of its affiliates are now permitted, together with any future BDCs, registered closed-end funds and certain private funds, each of whose investment adviser is the Company’s investment adviser or an investment adviser controlling, controlled by, or under common control with the Company’s investment adviser, to co-invest in negotiated investment opportunities where doing so would otherwise be prohibited under the 1940 Act, providing the Company’s stockholders with access to a broader array of investment opportunities. Pursuant to the Order, we are permitted to co-invest in such investment opportunities with our affiliates if a “required majority” (as defined in Section 57(o) of the 1940 Act) of our independent directors make certain conclusions in connection with a co-investment transaction, including, but not limited to, that (1) the terms of the potential co-investment transaction, including the consideration to be paid, are reasonable and fair to us and our stockholders and do not involve overreaching in respect of us or our stockholders on the part of any person concerned, and (2) the potential co-investment transaction is consistent with the interests of our stockholders and is consistent with our then-current investment objective and strategies.

In the ordinary course of business, we may enter into transactions with portfolio companies that may be considered related party transactions. In order to ensure that we do not engage in any prohibited transactions with any persons affiliated with us, we have implemented certain policies and procedures whereby our executive officers screen each of our transactions for any possible affiliations between the proposed portfolio investment, us, companies controlled by us and our employees and directors. We will not enter into any agreements unless and until we are satisfied that doing so will not raise concerns under the 1940 Act or, if such concerns exist, we have taken appropriate actions to seek board review and approval or exemptive relief for such transaction. Our Board of Directors reviews these procedures on an annual basis.

Investment Advisory Agreement Subject to Annual Approval by the Independent Directors

OXSQ’s stockholders benefit from a robust annual review of the Investment Advisory Agreement with Oxford Square Management under the 1940 Act. In accordance with the requirements of the 1940 Act, the Board of Directors, including its Independent Directors, review on an annual basis whether the terms of the Investment Advisory Agreement between OXSQ and its investment adviser are fair in light of the services provided by the investment adviser. In other words, the Board considers whether the terms are fair and reasonable in relation to the services rendered.

Our Board of Directors determined at a meeting held on April 23, 2020, to re-approve the Investment Advisory Agreement, as modified by the fee waiver letter, dated March 9, 2016. In its consideration of the re-approval of the Investment Advisory Agreement, the Board of Directors focused on information it had received relating to, among other things:

• The nature, extent and quality of advisory and other services provided by Oxford Square Management, including information about the investment performance of the Company relative to its stated objectives and in comparison to the performance of the Company’s peer group and relevant market indices, and concluded that such advisory and other services are satisfactory and the Company’s investment performance is reasonable;

14

• The experience and qualifications of the personnel providing such advisory and other services, including information about the backgrounds of the investment personnel, the allocation of responsibilities among such personnel and the process by which investment decisions are made, and concluded that the investment personnel of Oxford Square Management have extensive experience and are well qualified to provide advisory and other services to the Company;

• The current fee structure, the existence of any fee waivers, and the Company’s anticipated expense ratios in relation to those of other investment companies having comparable investment policies and limitations, and concluded that the current fee structure is reasonable;

• The advisory fees charged by Oxford Square Management to the Company and comparative data regarding the advisory fees charged by other investment advisers to business development companies with similar investment objectives, and concluded that the advisory fees charged by Oxford Square Management to the Company are reasonable;

• The direct and indirect costs, including for personnel and office facilities, that are incurred by Oxford Square Management and its affiliates in performing services for the Company and the basis of determining and allocating these costs, and concluded that the direct and indirect costs, including the allocation of such costs, are reasonable;

• Possible economies of scale arising from the Company’s size and/or anticipated growth, and the extent to which such economies of scale are reflected in the advisory fees charged by Oxford Square Management to the Company, and concluded that some economies of scale may be possible in the future;

• Other possible benefits to Oxford Square Management and its affiliates arising from their relationships with the Company, and concluded that any such other benefits were not material to Oxford Square Management and its affiliates; and

• Possible alternative fee structures or bases for determining fees, and concluded that the Company’s current fee structure and bases for determining fees are satisfactory.

Based on the information reviewed and the discussions detailed above, the Board of Directors, including all of the Independent Directors, concluded that fees payable to Oxford Square Management pursuant to the Investment Advisory Agreement were reasonable, and comparable to the fees paid by other management investment companies with similar investment objectives, in relation to the services to be provided, and the Board of Directors unanimously approved the re-approval of the Investment Advisory Agreement. The Board of Directors did not assign relative weights to the above factors or the other factors considered by it. Individual members of the Board of Directors may have given different weights to different factors.

Review, Approval or Ratification of Transactions with Related Persons

We have also adopted a Code of Business Conduct and Ethics which applies to, among others, our senior officers, including our Chief Executive Officer and Chief Financial Officer, as well as all of our officers, directors and employees. Our Code of Business Conduct and Ethics requires that all employees and directors avoid any conflict, or the appearance of a conflict, between an individual’s personal interests and our interests. Pursuant to our Code of Business Conduct and Ethics, each employee and director must disclose any conflicts of interest, or actions or relationships that might give rise to a conflict, to our Chief Compliance Officer. Our Audit Committee is charged with approving any waivers under our Code of Business Conduct and Ethics. As required by the NASDAQ Global Select Market corporate governance listing standards, the Audit Committee of our Board of Directors is also required to review and approve any transactions with related parties (as such term is defined in Item 404 of Regulation S-K).

15

Corporate Governance Documents

Our Code of Business Conduct and Ethics and the Board Committee charters are available on our website at www.oxfordsquarecapital.com and are also available to any stockholder who requests them by writing to Oxford Square Capital Corp., c/o Bruce L. Rubin, Corporate Secretary, 8 Sound Shore Drive, Suite 255, Greenwich, Connecticut 06830.

In accordance with rules of the NASDAQ Stock Market, our Board of Directors annually determines each director’s independence. We do not consider a director independent unless our Board of Directors has determined that he or she has no material relationship with us. We monitor the relationships of our directors and officers through a questionnaire each director completes no less frequently than annually and updates periodically as information provided in the most recent questionnaire changes.

In order to evaluate the materiality of any such relationship, our Board of Directors uses the definition of director independence set forth in the rules promulgated by the NASDAQ Stock Market. Rule 5605(a)(2) provides that a director of a BDC, shall be considered to be independent if he or she is not an “interested person” of OXSQ, as defined in Section 2(a)(19) of the 1940 Act.

The Board of Directors has determined that each of the directors is independent and has no relationship with us, except as a director and stockholder, with the exception of Jonathan H. Cohen, as a result of his position as our Chief Executive Officer, and Charles M. Royce, as a result of his ownership of a minority, non-controlling interest in our investment adviser, Oxford Square Management.

The Company’s directors perform an evaluation and assessment, no less frequently than annually, of the effectiveness of the Board of Directors and its committees.

Communication with the Board of Directors

Stockholders with questions about OXSQ are encouraged to contact our Investor Relations Department. However, if stockholders believe that their questions have not been addressed, they may communicate with our Board of Directors by sending their communications to Oxford Square Capital Corp., c/o Bruce L. Rubin, Corporate Secretary, 8 Sound Shore Drive, Suite 255, Greenwich, Connecticut 06830. All stockholder communications received in this manner will be delivered to one or more members of our Board of Directors, as appropriate.

Our Code of Ethics and Insider Trading Policy does not expressly prohibit any Covered Persons from engaging in hedging transactions with respect to our securities. However, our Code of Ethics and Insider Trading Policy requires any person wishing to enter into any hedging transactions with respect to our securities to first pre-clear the proposed transaction with our Chief Compliance Officer. Such request for pre-clearance of a hedging or similar arrangement must be received at least two weeks before the Covered Person intends to execute the documents in connection with the proposed transaction and must set forth the reason for the proposed transaction. A “Covered Person” means any our directors, officers or employees (including a temporary employee), or of any of our affiliates or subsidiaries, including our investment adviser, our administrator and any other persons designated by our Chief Compliance Officer.

Committees of the Board of Directors

Our Board of Directors has established a standing Audit Committee, Valuation Committee, Nominating and Corporate Governance Committee, and Compensation Committee. During 2019, our Board of Directors held four Board meetings, four Audit Committee meetings, four Valuation Committee meetings, one Nominating and Corporate Governance meeting, and one Compensation Committee meeting. All directors attended at least 75% of the aggregate number of meetings of our Board of Directors and of the respective committees on which they served. We require each director to make a diligent effort to attend all Board and committee meetings, as well as each annual meeting of stockholders.

16

The Audit Committee operates pursuant to a charter approved by our Board of Directors, copy of which is available on our website at www.oxfordsquarecapital.com. The charter sets forth the responsibilities of the Audit Committee. The Audit Committee’s responsibilities include recommending the selection of our independent registered public accounting firm, reviewing with such independent registered public accounting firm the planning, scope and results of their audit of our financial statements, pre-approving the fees for services performed, reviewing with the independent registered public accounting firm the adequacy of internal control systems, reviewing our annual financial statements and periodic filings, and receiving the audit reports covering our financial statements. The Audit Committee is presently composed of three persons: Messrs. Novak, Neu and Stelljes, all of whom are considered independent under the rules promulgated by the NASDAQ Global Stock Market. Our Board of Directors has determined that Messrs. Novak, Neu and Stelljes are each an “audit committee financial expert” as that term is defined under Item 407 of Regulation S-K of the Exchange Act. Messrs. Novak, Neu and Stelljes each meet the current independence and experience requirements of Rule 10A-3 of the Exchange Act and, in addition, are each not an “interested person” of OXSQ as defined in Section 2(a)(19) of the 1940 Act. Mr. Neu currently serves as Chairman of the Audit Committee. The Audit Committee met on four occasions during 2019.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee operates pursuant to a charter approved by our Board of Directors, a copy of which is available on our website at www.oxfordsquarecapital.com. The charter sets forth the responsibilities of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee’s responsibilities include selecting, researching and nominating directors for election by our stockholders, selecting nominees to fill vacancies on the Board of Directors or a committee thereof, monitoring and making recommendations to the Board of Directors on matters of Company policies and practices relating to corporate governance and overseeing the evaluation of the Board of Directors and our management. The Nominating and Corporate Governance Committee is presently composed of three persons: Messrs. Novak, Neu and Stelljes, all of whom are considered independent under the rules promulgated by the NASDAQ Global Stock Market. Mr. Neu currently serves as Chairman of the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee does not currently have a written policy with regard to nominees recommended by our stockholders. The absence of such a policy does not mean, however, that a stockholder recommendation would not have been considered had one been received.

The Nominating and Corporate Governance Committee will consider qualified director nominees recommended by stockholders when such recommendations are submitted in accordance with our Bylaws and any applicable law, rule or regulation regarding director nominations. When submitting a nomination for consideration, a stockholder must provide certain information that would be required under applicable SEC rules, including the following minimum information for each director nominee: full name, age and address; principal occupation during the past five years; current directorships on publicly held companies and investment companies; number of shares of Company common stock owned, if any; and, a written consent of the individual to stand for election if nominated by our Board of Directors and to serve if elected by our stockholders.

In evaluating director nominees, the members of the Nominating and Corporate Governance Committee consider the following factors:

• the appropriate size and composition of our Board of Directors;

• whether or not the person is an “interested person” of OXSQ as defined in Section 2(a)(19) of the 1940 Act;

• the knowledge, skills and experience of nominees in light of the Company’s business and strategic direction and the knowledge, skills and experience already possessed by other members of the Board of Directors;

• familiarity with business matters;

• experience with accounting rules and practices;

17

• the desire to complement the considerable benefit of continuity with the benefit of diverse view points and perspectives (such as gender, race, national origin and education); and

• all applicable laws, rules, regulations, and listing standards.

The Nominating and Corporate Governance Committee’s goal is to assemble a Board of Directors that brings to OXSQ a variety of perspectives and skills derived from high quality business and professional experience.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the members of the Nominating and Corporate Governance Committee may also consider such other factors as they may deem are in the best interests of OXSQ and its stockholders. The Nominating and Corporate Governance Committee also believes it appropriate for certain key members of our management to participate as members of the Board of Directors.

The members of the Nominating and Corporate Governance Committee identify nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the Board of Directors with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board of Directors with that of the benefits of diverse perspectives. If any member of the Board of Directors does not wish to continue in service or if the Board of Directors decides not to re-nominate a member for re-election, the independent members of the Board of Directors identify the desired skills and experience of a new nominee in light of the criteria above. The entire Board of Directors is polled for suggestions as to individuals meeting the aforementioned criteria. Research may also be performed to identify qualified individuals. To date, neither the Board of Directors nor the Nominating and Corporate Governance Committee has engaged third parties to identify or evaluate or assist in identifying potential nominees although each reserves the right in the future to retain a third party search firm, if necessary.

The Nominating and Corporate Governance Committee has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees. However, in determining whether to recommend a director nominee, the Nominating and Corporate Governance Committee considers and discusses diversity, among other factors, with a view toward the needs of our Board of Directors as a whole. The Nominating and Corporate Governance Committee generally conceptualizes diversity expansively to include, without limitation, concepts such as gender, race, national origin, differences of viewpoint, professional experience, education, skill and other qualities that contribute to our Board of Directors, when identifying and recommending director nominees. The Nominating and Corporate Governance Committee believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Nominating and Corporate Governance Committee’s goal of creating a Board of Directors that best serves the needs of OXSQ and the interest of its stockholders.

The Board, including the Nominating and Corporate Governance Committee, unanimously recommended that each of Steven P. Novak and Charles M. Royce be nominated for election to the Board.