Use these links to rapidly review the document

Table of Contents

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

| (Mark One) | | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

|

Commission file number 001-36017

Control4 Corporation

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 42-1583209

(I.R.S. Employer

Identification No.) |

11734 S. Election Road

Salt Lake City, Utah

(Address of principal executive offices) |

|

84020

(Zip Code) |

(801) 523-3100

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange on which registered |

|---|

| Common Stock, $0.0001 par value per share | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "accelerated filer", "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý

(do not check if a

smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

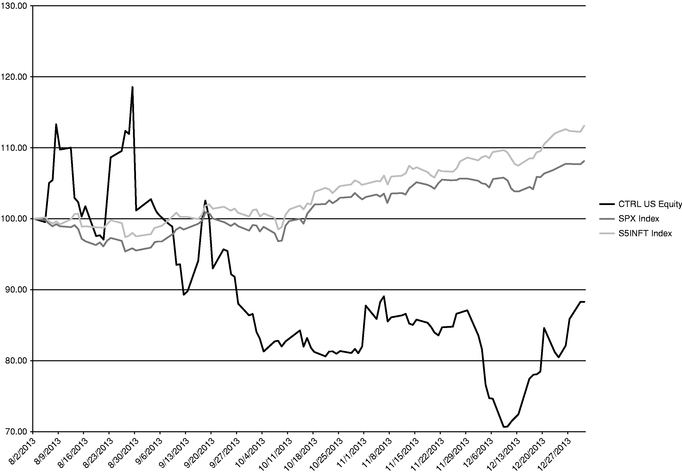

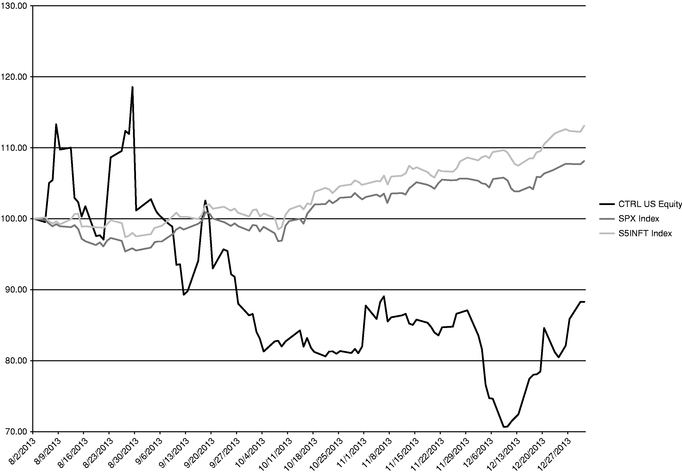

As of June 30, 2013, the last business day of the registrant's most recently completed second quarter, there was no established public market for the registrant's common stock. The registrant's common stock began trading on the NASDAQ Global Select Market on August 2, 2013. The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of August 2, 2013 was approximately $199.7 million (based on a closing sale price of $20.05 per share as reported for the NASDAQ Global Select Market on August 2, 2013). For purposes of this calculation, shares of common stock held by officers, directors and their affiliated holders and shares of common stock held by persons who hold more than 10% of the outstanding common stock of the registrant have been excluded from this calculation because such persons may be deemed to be affiliates. This determination of executive officer or affiliate status is not necessarily a conclusive determination for other purposes.

As of February 14, 2014, 22,901,986 shares of the registrant's Common Stock, $0.0001 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement relating to its 2014 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such Proxy Statement will be filed with the U.S. Securities and Exchange Commission ("SEC") within 120 days after the end of the fiscal year to which this report relates.

Table of Contents

Control4 Corporation

Form 10-K

For Fiscal Year Ended December 31, 2013

Table of Contents

| | | | | | |

Part I. | | | | | | |

Item 1. | | Business | | | 4 | |

Item 1A. | | Risk Factors | | | 16 | |

Item 1B. | | Unresolved Staff Comments | | | 38 | |

Item 2. | | Properties | | | 38 | |

Item 3. | | Legal Proceedings | | | 38 | |

Item 4. | | Mine Safety Disclosures | | | 38 | |

Part II. | | | | |

| |

Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | 39 | |

Item 6. | | Selected Financial Data | | | 41 | |

Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | | 44 | |

Item 7A. | | Qualitative and Quantitative Disclosures about Market Risk | | | 63 | |

Item 8. | | Financial Statements and Supplementary Data | | | 63 | |

Item 9. | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | | | 63 | |

Item 9A. | | Controls and Procedures | | | 63 | |

Item 9B. | | Other Information | | | 64 | |

Part III. | | | | |

| |

Item 10. | | Directors, Executive Officers and Corporate Governance | | | 65 | |

Item 11. | | Executive Compensation | | | 65 | |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | 65 | |

Item 13. | | Certain Relationships and Related Transactions and Director Independence | | | 65 | |

Item 14. | | Principal Accountant Fees and Services | | | 65 | |

Part IV. | | | | |

| |

Item 15. | | Exhibits, Consolidated Financial Statements and Financial Statement Schedules | | | 66 | |

Signatures | | | 69 | |

2

Table of Contents

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K ("Form 10-K") contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding Control4's financial outlook. All statements other than statements of historical fact contained in this Form 10-K are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these terms or other comparable terminology. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Control4's control. Control4's actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, those discussed in the section titled "Risk Factors" included in this Form 10-K, as well as other documents that may be filed by the Company from time to time with the SEC. The forward-looking statements included in this Form 10-K represent Control4's views as of the date of this Form 10-K. The Company anticipates that subsequent events and developments will cause its views to change. Control4 undertakes no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. References in this Form 10-K to the "Company," "Control4," "we," "us," and "our" refer to Control4 Corporation and, where appropriate, its subsidiaries, unless otherwise stated.

3

Table of Contents

PART I.

ITEM 1. Business

Overview

We are a leading provider of automation and control solutions for the connected home. We unlock the potential of connected devices, making entertainment systems easier to use, homes more comfortable and energy efficient, and families more secure. We provide our consumers with the ability to integrate music, video, lighting, temperature, security, communications and other functionalities into a unified home automation solution that enhances our consumers' daily lives. More than 78% of our consumers have integrated two or more of these functionalities with our solution. At the center of our solution is our advanced software platform, which we provide through our products that interface with a wide variety of connected devices that are developed both by us and by third parties.

Our solution functions as the operating system of the home, making connected devices work together to control, automate and personalize the homes of our consumers.

Consumer need for simplicity and a personalized experience, combined with advances in technology, are driving rapid growth in the connected home market. As a result of the significant growth in smart devices, mobile data networks, home broadband access and in-home wireless networking, consumers are more comfortable with ubiquitous connectivity and device interoperability. Accustomed to network connectivity and control of their digital lives, consumers are now looking for affordable ways to extend this functionality into their homes, driving growth in the mainstream home automation market.

We were founded in 2003 to deliver a mainstream home automation solution by enabling consumers to unify their connected devices into a personalized system at an accessible and affordable entry point. Sold through our worldwide network of over 3,000 active direct dealers, our solution sits at the center of the mainstream home automation market by providing integrated and extensible control of over 7,700 third-party devices and services. These devices and services span a broad variety of product categories including music, video, lighting, temperature, security, communications and other devices. Our platform capabilities provide consumers with solutions that are easy to use, comprehensive, personalized, flexible and affordable.

Based on our analysis, we estimate that we have automated more than 150,000 homes representing cumulative sales of more than 340,000 of our controller appliances, the brain of the connected home. We sell and deliver our solutions through an extensive worldwide dealer and distributor network and have solutions installed in 87 countries. Our top 100 dealers represented 22% of our total revenue in 2013.

We generated revenue of $93.4 million, $109.5 million, and $128.5 million in 2011, 2012 and 2013, respectively. We had a net loss of $3.9 million and $3.7 million, and a net income of $3.5 million in 2011, 2012 and 2013, respectively.

Our Industry

Within the last decade, the pace of innovation in the electronics industry has accelerated rapidly. Network-aware devices—such as televisions, smartphones, tablets, thermostats, appliances and security systems—that separately connect to a home network create the "connected home." Home automation technology integrates devices in the connected home, unlocking the collective potential of these devices working together to improve consumers' lives. The home automation market has reached a major inflection point and is becoming a mainstream offering accessible by a broad base of consumers.

Home automation solutions unify the control of music, video, lighting, temperature, security, communications and other devices in the connected home to provide consumers with improved

4

Table of Contents

convenience, comfort, energy efficiency and security. The key functional elements of home automation include:

- •

- Control. Controlling devices is the most basic capability of home automation solutions. From a single interface, consumers can operate a wide array of devices using wired or wireless connections. With the recent growth in smartphones and tablets, control functionality is increasingly being extended to these mobile devices;

- •

- Automation. After initial programming, automation enables devices to function without additional human intervention. Automation also enables various devices to work in concert to perform more complex tasks and to take actions based on external conditions; and

- •

- Personalization. Personalization enables home automation solutions to be tailored to the unique lifestyle requirements of individual consumers and their families. Personalization unlocks the full potential of home automation to enhance, enrich and simplify the lives of consumers.

Our Solution

The Control4 solution, built around our advanced software platform, sits at the center of the fast growing mainstream segment of the home automation market. We unlock the potential of connected devices, making entertainment systems easier to use, homes more comfortable and energy efficient, and families more secure. Our solution functions as the operating system of the home, integrating music, video, lighting, temperature, security, communications and other devices into a unified automation solution that enhances our consumers' lives.

The Control4 solution integrates more than 7,700 third-party devices and systems into a unified, easy-to-use solution for mainstream consumers. As a result, our solution provides the consumer with the following benefits:

- •

- Easy to Use. Our solution is designed to be simple and intuitive. Through our unified software platform, consumers can easily interact with their entire automated home without learning multiple interfaces or numerous remote controls. We have designed our solution so that anyone, from a young child to a grandparent, can pick up a Control4 device, push a button and watch a movie without any prior instruction;

- •

- Broad Device Interoperability. Our open and flexible platform provides consumers with access to a broad universe of third-party devices that become connected and interoperable through our solution. The Control4 software platform currently operates with over 7,700 discrete third-party devices;

- •

- Advanced Personalization. Our adaptable solution enables our consumers to personalize the features and functionality of their Control4 system. Our modular design also enables the smooth integration of new third-party products to meet the evolving needs of our consumers as their lifestyles change;

- •

- Attractive Entry Point. Consumers can start with a single room multi-media automation experience for about $1,000 and scale to an integrated solution with an average cost of $26,000. Based on our research, more than half of our consumers have Control4 system configurations with one controller, with an average cost of $4,000 and a median cost of $2,500 (including estimated installation costs);

- •

- Professional Installation and Support through Our Global Dealer Network. As the number and types of connected devices continues to grow, the need for local professional consultation, installation and support is currently essential for a successful home automation experience. We have built a global network of over 3,000 active direct dealers and distributors. Our certified dealers receive in-depth training, on-going education and support, enabling them to help consumers develop and

5

Table of Contents

Our Growth Strategy

Our goal is to be the leading provider of mainstream home automation solutions and the operating system of choice for the home. The following are key elements of our growth strategy:

- •

- Enhance Our Software Platform and Products. We believe that our success to-date has been largely driven by the capabilities of our software platform. We will continue to invest in our software platform to develop and support new products, features and capabilities that deliver exceptional performance and value to our consumers;

- •

- Strengthen and Expand Our Global Dealer Network. We have developed a global network of over 3,000 active direct dealers and 29 distributors to sell, install and support our solutions. We will continue to expand and optimize our dealer network to ensure that we have sufficient geographic coverage across both existing and new markets. We will also continue to devote significant resources to increase the productivity and competency of our dealers and distributors by providing them with ongoing training, tools and support;

- •

- Increase Penetration of Our North America Core Market. We intend to continue to focus on the residential market in North America, which represented approximately 76% of our revenue for the year ended December 31, 2013. We believe the residential market offers us an opportunity for significant long-term growth, and we will continue to devote sales and marketing resources to increase penetration of that core market;

- •

- Expand Our Focus on Adjacent Markets. We are also making investments to capitalize on opportunities outside the residential market and internationally. Internationally, our user interfaces are now available in 28 languages and our products are distributed in 87 countries. In addition, we have had initial success in the light commercial, multi-dwelling unit and hospitality markets, and we plan to continue our focus on these and other adjacent opportunities to expand our addressable market;

- •

- Enhance Our Solution with Services and Apps. In addition to automating devices within the home, our solution also enables a wide variety of service and application opportunities. We plan to continue to enhance our 4Sight subscription services to provide consumers with enhanced home monitoring and control capabilities from any Internet-connected mobile device or computer;

- •

- Pursue Technology Licensing Opportunities. We plan to make our technology increasingly available to third parties through licensing agreements. We have also begun making our device auto-discovery technology, Simple Device Discovery Protocol ("SDDP"), available on a royalty-free basis to third parties to streamline and automate the setup, identification and configuration of their devices into our system. As of December 31, 2013, 59 third parties had agreed to license SDDP from us, and 22 of them had begun shipping SDDP-enabled devices. We also plan to expand our licensing activities to leverage third-party distribution channels, grow our partner relationships, simplify the home automation experience for dealers and consumers, and increase interoperability; and

6

Table of Contents

- •

- Pursue Strategic Acquisitions. We believe that our software platform has a strategic position as the operating system of the connected home. As a result, we believe we are ideally positioned to identify, acquire and integrate strategic acquisitions that are complementary to our current offerings, strengthen and expand our technology foundation, enhance our market positioning, distribution channels and sales, and are consistent with our overall growth strategy.

Our Products and Services

The primary benefits we provide consumers and dealers lie in the value and competitive differentiation of our software platform. We deliver value and differentiation to consumers and generate revenues by embedding our software into a range of physical products.

Software Platform

At the center of the Control4 product line is the Control4 Home Operating System, which we refer to as the C4 OS, and the associated application software and software development kits, or SDKs. The high-level software components include:

- •

- Director. Director is a real-time, extensible home operating system kernel that is responsible for monitoring and receiving events from numerous devices and services, processing those events according to consumer personalized settings, and then dispatching commands to the appropriate devices to perform predefined actions. Director runs on our controller appliances and certain authorized partner products such as Sony ES receivers;

- •

- Navigator. Navigator displays intuitive and rich graphical user interfaces on televisions, in-wall and table-top touch panels, smartphones and tablets, as well as list-based devices such as remote controls with LCD text-displays;

- •

- Composer Professional Edition. Composer Professional Edition is a software application that enables trained and certified Control4 dealers and installers to design, configure and personalize a Control4 home automation system for consumers;

- •

- Composer Home Edition and Composer Media Edition. Composer Home Edition and Media Edition enable consumers to view and configure their Control4 managed devices. These drag-and-drop programs provide the ability to manage digital media and create and modify simple programs and policies (such as changing lighting scenes, modifying custom buttons and controlling behaviors among devices based on schedules or times of the day);

- •

- DriverWorks SDK. DriverWorks SDK is a software development kit that enables dealers, programmers and device manufacturers to independently develop and test custom two-way interface drivers to support the integration of a new device or device model into our system, or to customize and enhance an existing driver. DriverWorks SDK has enabled 7,700 different products and services to be incorporated into the Control4 ecosystem; and

- •

- Navigator SDK and Application SDK. Navigator SDK and Application SDK are software development kits that enable third-party dealers and programmers to customize and deliver new application functionality within Navigator user interfaces on Control4 interface devices through the development of apps.

Products with Embedded Software and Services

Our products leverage our software platform to provide consumers with a comprehensive and easy-to-use connected home experience. We designed our software platform to be extensible, which has allowed us to improve and augment the functionality of hardware products (both those designed by us

7

Table of Contents

and by others) over time. We also design and manufacture our products via contract manufacturers as well as certify partner products for sale through our dealers. Our products and services include:

- •

- Controller Appliances. Our controller appliances run our Director software to monitor, process and automate events, statuses and actions for numerous devices and services, creating a comprehensive connected home experience. Currently we offer the HC-800, a whole home controller appliance, and the HC-250, a single-room controller appliance;

- •

- Interface Devices. We offer touch panels, handheld remote controls and keypads as interface devices. We also develop and deliver software applications for Apple iOS and Android smartphones and tablets that enable these personal devices to become control interfaces to Control4 connected homes, both on-premise and remotely;

- •

- Audio/Video Equipment. The Wireless Music Bridge is a simple, elegant way to allow consumers to enjoy the music available on their smartphone, tablet or computer—their own music collection as well as streaming services like Pandora, Rhapsody, Spotify or TuneIn—by wirelessly streaming their selection to their home audio system using AirPlay, DLNA or Bluetooth technologies. We also offer 4x4 and 8x8 zone power amplifiers, network-enabled 4x4 and 8x8 zone matrix amplifiers, and a 16x16 audio matrix switch for versatile multi-room and whole-home audio distribution. In addition, we offer an 8x8 HDMI matrix switch and an HDBaseT receiver that distribute eight HDMI sources to eight video display locations with full HD, an integrated digital media player for integration of local digital audio and video, as well as Wi-Fi and Ethernet amplified speaker points for streaming digital audio to speakers in areas without an audio receiver;

- •

- Lighting Products. We offer a suite of lighting products that provide personalized control and energy management. Our suite of wireless light switches and dimmers can easily replace devices in an existing home or be installed in new homes. We offer innovative in-wall wireless switches and dimmers for 120V, 240V and 277V electrical loads, which meet the requirements of North America and many international markets. We also offer panelized systems, where all of the lighting control will be done on a remote panel. In addition to providing lighting control, our switches can be programmed to operate other systems in the home, such as allowing consumers to access their favorite music playlist with the touch of a button.

- •

- Thermostats. Our wireless multi-stage thermostat is completely programmable with up to six set points per day and, using our 4Sight subscription service, is remotely accessible and controllable. Through the Control4 operating system, we also integrate with third-party products (such as automated shades and pool controls) that provide additional energy savings, convenience and efficiency;

- •

- Security Products. We provide a set of products and software services created by us as well as distribute certified third-party products, including deadbolts, door and window sensors, motion sensors, garage access systems and water leak detection systems, from our security partners such as Baldwin, Card Access, Kwikset and Yale. Through our SDDP technology, we also integrate with over 1,500 network video recorders and surveillance cameras sold by five of the top security monitoring manufacturers;

- •

- Communication Products. We offer full motion video and high quality audio intercom capability through our in-wall and tabletop touchscreens, as well as our exterior weather-resistant door stations; and

8

Table of Contents

- •

- Subscription Services. 4Sight is a subscription service that enables 24x7 home monitoring and control from virtually anywhere, remote home programming and support, and instant email alerts based on home events so that homeowners are always in-the-know. For example, 4Sight allows consumers to remotely unlock the front door to let in a repairman, to turn on the air conditioning on the way home, and to monitor their home security cameras from a smartphone.

Sales of our controller appliances, including software, represented 37% of our total revenue in 2013.

Our installed solutions include functionalities in the following percentages:

| | | | |

Video | | | 100 | % |

Music | | | 57 | |

Lighting | | | 51 | |

Communications | | | 32 | |

Security | | | 31 | |

Temperature | | | 23 | |

More than 78% of our consumers have integrated two or more of these functionalities with our solution.

Our Distribution Network

In 2005, we started selling our solutions through a network of over 450 independent dealers. Since that time, our distribution network has grown to over 3,000 active direct dealers and distributors in 87 countries. Dealers range in size from small family businesses to very large organizations.

Our dealers are home automation specialists that have significant experience in designing, installing and servicing both low- and high-voltage systems including music, video, security, communications and temperature control. Every Control4 dealer has gone through extensive training and has passed the necessary certification tests—either in one of our training facilities located in the United States, the United Kingdom, China, or India or in a training facility of one of our 29 distributors. Every installer for each dealer must complete course work and pass pre-training examinations, as well as pass rigorous testing at the conclusion of the multi-day formal training in order to become certified to sell and install our solutions.

We sell directly through dealers in the United States, Canada, the United Kingdom and 43 other countries. We partner with 29 distributors to serve 41 additional countries where currently we do not have dealer training and support facilities. Our distributors recruit, train and manage dealers within their region and also help dealers find country specific solutions for unique needs based on the special home automation market characteristics within each country. In recent years, we have moved more toward a dealer-direct model in specific international regions as we have added and continue to add sales and support staff, namely in the United Kingdom, China and India.

During the years ended December 31, 2011, 2012 and 2013, none of our dealers or distributors accounted for more than 5% of our revenue. None of our dealers or distributors have minimum or long-term purchase obligations. Dealer orders are typically placed on a project-by-project basis. As such, our dealers do not typically carry significant levels of inventory. The resulting just-in-time model helps reduce dealer inventory investment and also reduces dealer returns. Our dealers around the world are each responsible for local marketing, selling, installing and servicing our solution for the consumer.

9

Table of Contents

Our Partners

The home automation market is made up of a collection of thousands of electronically controllable products made by hundreds of key manufacturers. We believe that our success has come, in part, due to our success in forming relationships with many of these manufacturers. As of December 31, 2013, we had agreements with over 150 manufacturers, of which 49 have formally submitted their devices to us for Control4 certification so that our worldwide dealer network can be assured that these third-party devices work well with our platform.

In addition to standard interoperability with Control4, more and more manufacturers are realizing the value our technology can bring when it is embedded inside their products. For example, we recently launched our device auto-discovery technology, SDDP, which enables seamless installation of devices by embedding code at the manufacturer, making it easier for dealers and consumers to add new products to existing systems. As of December 31, 2013, 59 third parties had agreed to license SDDP from us, and 22 of them had begun shipping SDDP-enabled devices.

Third-party manufacturers are currently selling over 800 different products representing 43 brands (including brands such as Sony, Baldwin, Kwikset, Leaf, Yale and TruAudio) through our online store. Our online store provides manufacturers valuable reach into our trained dealer network, and it helps our dealers gain easy access to products that they know are certified by Control4. We also partner with other companies for purposes of strategic initiatives.

Our Technology

Core Automation Enabling Technology

At the core of the Control4 platform is the C4 OS. The C4 OS consists of two main components, our Director and Navigator software that work in concert with different modules within the system to provide consumers with a unified and comprehensive connected home experience. These modules help our software platform manage media, update connected devices and interoperate using a variety of communication protocols including Ethernet, Wi-Fi, Bluetooth, ZigBee, Infrared, or IR, serial interfaces and more.

- •

- Director Software. Director is the brain of the C4 OS and interfaces with a Linux kernel. Director architecture includes a proprietary "driver pairing" technology that creates a hardware abstraction layer and exposes a single common software Applications Programming Interface ("API") for all devices of the same type. This enables an application developer to write an application to manage a lighting system that will work with any brand of lighting control equipment. Director also includes an advanced scheduling engine and astronomical clock that allows for time-based control of anything in a Control4 system. Director has a component called "Connection Manager" that is responsible for discovering new devices and maintaining connections with all of the diverse devices in an automation system.

- •

- Navigator Software. Navigator is the C4 OS user interface application. Navigator connects to Director through the Director API and based on what is in the system, automatically provides a customized user interface for control of the system. All Control4 controller appliances and touch panels run Navigator. When running on a controller appliance, Navigator produces an "On-Screen" interface for use on TVs and projection systems with a remote control. Navigator can also produce an interface that is touch-based. Navigator is also available for Macs, PCs, Apple iOS and Android devices.

- •

- Media Manager. Media Manager discovers, scrubs and indexes media audio and video content across various sources—from local content spread across Macs, PCs, NAS drives, tablets, smartphones, cable boxes and satellite receivers to streaming content scattered across online services such as Rhapsody, TuneIn, Netflix, Vudu, Hulu and Amazon Prime. Using the C4 OS, a

10

Table of Contents

Simple Device Discovery Protocol (SDDP)

We have a patented device auto-discovery technology called Simple Device Discovery Protocol, or SDDP, that we developed to enable seamless installation of devices in our system. When a new SDDP-enabled device is installed in a home, the device sends out a signal that is immediately discovered by the system, thereby allowing the new device to easily be added.

4Sight Subscription Service

We offer a subscription service called 4Sight that enables secure remote access to the connected home without exposing the installer or consumer to the complexities of communicating around firewalls and private Internet Protocol addresses. This service facilitates connections between remote client devices and our systems through a cloud-based service. Using 4Sight, consumers can remotely monitor and control their Control4 systems as if they were at their homes.

Our Research and Development

Our flexible research and development model relies upon a combination of in-house staff and offshore design and manufacturing partners to improve and enhance our existing products and services, as well as develop new products, features and functionality in a cost-effective manner. We believe that our software platform is critical to expanding our leadership position within the mainstream home automation market. As a result, we devote the majority of our research and development resources to software development. We work closely with our consumers to understand their current and future needs and have designed a product development process that captures and integrates feedback from our consumers.

As of December 31, 2013, we had 164 employees in our research and development organization, substantially all of whom were located at our headquarters in Salt Lake City, Utah. Our research and development expenses were $19.2 million in 2011, $20.3 million in 2012 and $25.0 million in 2013. We intend to continue to significantly invest in research and development to expand our solutions and capabilities in the future.

11

Table of Contents

Our Manufacturing

We outsource the manufacturing of our hardware products to contract manufacturers. The majority of our hardware products are manufactured by Sanmina and LiteOn at their respective facilities located in southern China, with additional manufacturing performed by six contract manufacturers located throughout Asia. Our agreement with Sanmina expires in June 2017, after which it automatically renews for successive one-year terms unless either party terminates the agreement with 90 days' notice. Our agreement with LiteOn expires in December 2014, after which it automatically renews for successive one-year terms unless either party terminates the agreement with 180 days' notice. Our manufacturing partners assemble our products using our design specifications, quality assurance programs and standards, and procure components and assemble our products based on our demand forecasts. These forecasts represent our estimates of future demand for our products based upon historical trends and analysis from our sales and product management functions. We maintain fulfillment centers in Salt Lake City, Utah and York, England. Our manufacturing partners currently ship all hardware products to our fulfillment centers and then we ship them directly to our dealers and distributors around the world.

We have multiple sources for most of our components. However, we do depend on single source manufacturers for certain critical components, including processors, memory modules and touch panels. We can choose to change processor and memory modules for any of our products but because of high implementation costs, we generally choose to make these changes only upon development of new products. We also rely on certain custom connectors, cables and mechanical enclosures for our hardware products that are single sourced because of the high tooling costs of sourcing the components from multiple suppliers. In each of these cases, we own the drawings and design of these custom components.

Our Marketing

Our marketing team supports our sales channel with dealer-directed advertising and promotions, lead-generation, social media engagements and training events, as well as the design and production of consumer-facing collateral, showroom signage and market-specific advertising. Our website is the anchor to our online and social media strategy, from which we direct leads to our dealers. Control4's bi-annual magazine, Home Smart Home, features lifestyle stories of Control4 installations from around the world and is available on iTunes and on our website. The publication is also reproduced and distributed to customers and prospects on our behalf by our dealers and partners.

We are active participants at global industry conferences and maintain a significant presence at CEDIA trade shows. Beyond CEDIA in the United States, we sponsored the 2013 CEDIA Conference in London and an exhibit at Integrated Systems Europe ("ISE") in February 2014, the annual industry trade show held in Amsterdam. Additionally, beginning in the second quarter of 2014, we will be participating in CEDIA-specific events and tradeshows throughout China. We are frequently featured in the trade press and maintain strong relationships with the industry's key analysts and associations.

In 2013 and early 2014, we invested in an automated marketing platform to deliver leads and creative assets to our dealers that can be customized at a local level. Dealers can leverage the automated marketing platform to run online advertising campaigns, download and customize video and ad creative, showroom collateral, direct mail templates and newsletters.

We believe that partnering with device manufacturers, leveraging co-marketing partnerships, expanding our sales channels and increasing our brand recognition among consumers are key components of our growth strategy.

12

Table of Contents

Our Competition

The market for home automation systems is fragmented, highly competitive and continually evolving. Our current competitors fall into several categories:

- •

- Providers that focus primarily on the luxury segment of the home automation market, including AMX, Crestron and Savant;

- •

- Providers of point products that address a narrow set of control and automation capabilities, including Logitech, Lutron, Nest Labs (recently acquired by Google), Roku, Sonos and Universal Remote Control; and

- •

- Providers of managed home automation and security services, including ADT, Comcast, Verizon and Vivint (which in turn may utilize third-party software from companies including Alarm.com and iControl).

Companies that provide popular point solutions have eliminated or restricted, and may again eliminate or restrict, our ability to control and be compatible with their products.

In addition, large technology companies such as Apple, Google (which recently acquired Nest Labs), Microsoft and Samsung offer control capabilities among their own products, applications and services, and have ongoing development efforts to address the broader home automation market. Given the growth dynamics of this market, there are many new and existing companies targeting portions of the mainstream home automation market. To the extent that consumers adopt products, applications and services from a single large technology company or any of these companies broaden their home automation capabilities, we will face increased competition.

The principal competitive factors in our market include the:

- •

- Breadth of home automation capabilities provided;

- •

- Simplicity of use and installation;

- •

- Interoperability with third-party devices;

- •

- Price and total cost of ownership;

- •

- Sales reach and local installation and support capabilities; and

- •

- Brand awareness and reputation.

We believe that our home automation solution competes favorably with respect to these factors. Nevertheless, many of our competitors have substantially greater financial, technical and other resources, greater name recognition, larger sales and marketing budgets, broader distribution channels, and larger and more mature intellectual property portfolios than we do.

Our Intellectual Property

Our success and ability to compete effectively depend in part on our ability to protect our proprietary technology and to establish and adequately protect our intellectual property rights. To accomplish these objectives, we rely on a combination of patent, trademark, copyright and trade secret laws in the United States and other jurisdictions, as well as license agreements, confidentiality agreements and other contractual protections.

As of December 31, 2013, we owned 41 issued United States patents (16 of which are design patents) that are scheduled to expire between 2025 and 2031, with respect to utility patents, and between 2020 and 2022, with respect to design patents. We continue to file patent applications in multiple jurisdictions and as of December 31, 2013, we had one patent application allowed, 8 patent applications published and 11 patent applications pending in the United States. We also had two issued

13

Table of Contents

patents and 10 pending patent applications under foreign jurisdictions and treaties such as Canada, Australia, New Zealand, the United Kingdom and the European Patent Convention. The claims for which we have sought patent protection apply to both our hardware and software products. Our patent and patent applications generally apply to the features and functions of our C4 OS and the applications associated with our platform.

We also rely on several registered and unregistered trademarks to protect our brand. We have registered the trademarks Control4, Control4 MyHome, the Control4 logo, the Control4 design, 4Store and Everyday Easy in the United States, and Control4 in the European Union and Mexico. We have a trademark application pending in the United States, and 10 trademark applications, for various marks, pending in Brazil, Canada, China, the European Union, and India.

We have filed for United States copyright protection for our source code for all major releases of our software. We also license software from third parties for integration into or use with our products, including open-source software and other commercially available software.

In addition, we seek to protect our intellectual property rights by requiring our employees and independent contractors involved in development to enter into agreements acknowledging that all inventions, trade secrets, works of authorship, developments, concepts, processes, improvements and other works generated by them on our behalf are our intellectual property, and assigning to us any rights, including intellectual property rights, that they may claim in those works.

Employees

As of December 31, 2013, we had 386 employees, including 353 employees in the United States and 33 employees internationally. None of our employees are represented by a labor union with respect to his or her employment with us. We have not experienced any work stoppages and we consider our relations with our employees to be good.

Available Information

We were incorporated in Delaware in 2003. Our principal executive offices are located at 11734 South Election Road, Salt Lake City, Utah 84020, and our telephone number is (801) 523-3100. Our principal website address iswww.control4.com. Information contained on our website does not constitute a part of, and is not incorporated by reference into, this Form 10-K or in any other report or document we file with the Securities and Exchange Commission ("SEC").

Control4, the Control4 logo, 4Sight, 4Store and Control4 MyHome are registered trademarks or trademarks of Control4 Corporation in the United States and, in certain cases, in other countries. This Form 10-K contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of these companies' trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"). We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.0 billion in annual revenue; the date we qualify as a "large accelerated filer," with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; or the last day of the fiscal year ending after the fifth anniversary of our initial public offering.

We file reports with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any other filings required by the SEC. Through our website, we make available free of charge our Annual Reports on Form 10-K, Quarterly Reports on

14

Table of Contents

Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

The public may read and copy any materials we file with, or furnish to, the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

15

Table of Contents

ITEM 1A. Risk Factors

A description of the risks and uncertainties associated with our business is set forth below. You should carefully consider such risks and uncertainties, together with the other information contained in this report, and in our other public filings. If any of such risks and uncertainties actually occurs, our business, financial condition or operating results could differ materially from the plans, projections and other forward-looking statements included in the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in this report and in our other public filings. In addition, if any of the following risks and uncertainties, or if any other risks and uncertainties, actually occurs, our business, financial condition or operating results could be harmed substantially, which could cause the market price of our stock to decline, perhaps significantly.

Risks Related to Our Business and Industry

We have incurred operating losses in the past, may incur operating losses in the future, and may not achieve or maintain profitability.

We began our operations in 2003. For substantially all of our history, we have experienced net losses and negative cash flows from operations. As of December 31, 2013, we had an accumulated deficit of $102.1 million. We expect our operating expenses to increase in the future as we expand our operations. Furthermore, as a public company, we incur additional legal, accounting and other expenses that we did not incur as a private company. If our revenue does not grow to offset these increased expenses, we will not become profitable. We may incur significant losses in the future for a number of reasons, including without limitation the other risks and uncertainties described herein. Additionally, we may encounter unforeseen operating or legal expenses, difficulties, complications, delays and other unknown factors that may result in losses in future periods. If these losses exceed our expectations or our revenue growth expectations are not met in future periods, our financial performance will be harmed.

The markets in which we participate are highly competitive and many companies, including large technology companies, broadband and security service providers and other managed service providers, are actively targeting the home automation market. Our failure to differentiate ourselves and compete successfully with these companies would make it difficult for us to add and retain consumers, and would reduce or impede the growth of our business.

The market for automation and control solutions for the connected home is increasingly competitive and global. Many large technology companies have expanded into the connected home market by developing their own solutions, or by acquiring other companies with home automation solution offerings. For example, Microsoft Corporation recently acquired id8 Group R2 Studios Inc., a home entertainment technology company, and Google recently acquired Nest Labs, which manufactures thermostats and smoke detectors. These large technology companies already have broad consumer awareness and sell a variety of devices for the home, and consumers may choose their offerings instead of ours, even if we offer superior products and services. Similarly, many managed service providers, such as cable TV, telephone and security companies, are beginning to offer services that provide device control and automation capability within the home for an additional monthly service fee. For example, Comcast is expanding its Xfinity service to provide residential security, energy and automation services. These managed service providers have the advantage of leveraging their existing consumer base, network of installation and support technicians and name recognition to gain traction in the home automation market. In addition, consumers may prefer the monthly service fee with little to no upfront cost offered by some of these managed service providers over a larger upfront cost with little to no monthly service fees.

16

Table of Contents

We expect competition from these large technology companies and managed service providers to increase in the future. This increased competition could result in pricing pressure, reduced sales, lower margins or the failure of our solutions to achieve or maintain broad market acceptance. To remain competitive and to maintain our position as a leading provider of automation and control solutions for the connected home, we will need to invest continuously in product development, marketing, dealer and distributor service and support, and product delivery infrastructure. We may not have sufficient resources to continue to make the investments in all of the areas needed to maintain our competitive position. In addition, most of our competitors have longer operating histories, greater name recognition, larger consumer bases and significantly greater financial, technical, sales, marketing and other resources than us, which may provide them with an advantage in developing, marketing or servicing new solutions. Increased competition could reduce our market share, revenue and operating margins, increase our operating costs, harm our competitive position and otherwise harm our business and results of operations.

Consumers may choose to adopt point products that provide control of discrete home functionality rather than adopting our unified home automation solution. If we are unable to increase market awareness of the benefits of our unified solution, our revenue may not continue to grow, or it may decline.

Many vendors have emerged, and may continue to emerge, to provide point products with advanced functionality for use in the home, such as a thermostat that can be controlled by an application on a smartphone. We expect more and more consumer electronic and consumer appliance products to be network-aware and connected—each very likely to have its own smart device (phone or tablet) application. Consumers may be attracted to the relatively low costs of these point products and the ability to expand their home control solution over time with minimal upfront costs, despite some of the disadvantages of this approach. While we have built our solution to be flexible and support third-party point products, these products may reduce the revenue we receive for each installation. It is therefore important that we have technical expertise and provide attractive top quality products in many areas, such as lighting and video, and establish broad market awareness of these solutions. If a significant number of consumers in our target market choose to adopt point products rather than our unified automation solution, then our business, financial condition and results of operations will be harmed, and we may not be able to achieve sustained growth or our business may decline.

Many of the competitors in our market, including providers of luxury integrated installations with long operating histories, established markets, broad user bases and proven consumer acceptance, may be successful in expanding into the mainstream home automation market, which may harm our growth and future prospects.

Many companies with which we directly compete have been operating in this industry for many years and, as a result, have established significant name recognition in the home automation industry. For example, Crestron, a provider of luxury integrated installations, has been in business for over 40 years and has become an established presence in the home automation industry. Another provider of luxury integrated installations is Savant Systems, which provides home automation based on the Apple iOS operating platform. To the extent these providers are able to develop more affordable products that compete more directly with our solution, our growth may be constrained and our business could suffer. In addition, given the strong growth potential of the market, we expect there to be many new entrants in the future.

17

Table of Contents

Since we rely on third-party dealers and distributors to sell and install our solutions, we do not have a direct sales pipeline, which makes it difficult for us to accurately forecast future sales and correctly predict manufacturing requirements.

We depend on our dealer and distributor network to sell and install our solution. As a result, we do not develop or control our sales pipeline, making it difficult for us to predict future sales. In addition, because the production of certain of our products requires long lead times, we enter into agreements for the manufacture and purchase of certain of our products well in advance of the time in which those products will be sold. These contracts are based on our best estimates of our near-term product needs. If we underestimate consumer demand, we may forego revenue opportunities, lose market share and damage our relationships. Conversely, if we overestimate consumer demand, we may purchase more inventory than we are able to sell at any given time, or at all. If we fail to accurately estimate demand for our products, we could have excess or obsolete inventory, resulting in a decline in the value of our inventory, which would increase our costs of revenues and reduce our liquidity. Our failure to accurately manage inventory relative to demand would adversely affect our results of operations.

We have relatively limited visibility regarding the consumers that ultimately purchase our products, and we often rely on information from third-party dealers and distributors to help us manage our business. If these dealers and distributors fail to provide timely or accurate information, our ability to quickly react to market changes and effectively manage our business may be harmed.

We sell our solutions through dealers and distributors. These dealers and distributors work with consumers to design, install, update and maintain their home automation installations. While we are able to track orders from dealers and distributors and have access to certain information about the configurations of their Control4 systems that we receive through our controller appliances, we also rely on dealers and distributors to provide us with information about consumer behavior, product and system feedback, consumer demographics, buying patterns and information on our competitors. We use this channel sell-through data, along with other metrics, to assess consumer demand for our solutions, develop new products, adjust pricing and make other strategic business decisions. Channel sell-through data is subject to limitations due to collection methods and the third-party nature of the data and thus may not be complete or accurate. In addition, to the extent we collect information directly from consumers, for example through surveys that we conduct, the consumers who supply this sell-through data self select and vary by geographic region and from period to period, which may impact the usefulness of the results. If we do not receive consumer information on a timely or accurate basis, or if we do not properly interpret this information, our ability to quickly react to market changes and effectively manage our business may be harmed.

Our quarterly results of operations have fluctuated and may continue to fluctuate. As a result, we may fail to meet or exceed the expectations of investors or securities analysts, which could cause our stock price to decline.

Our quarterly revenue and results of operations may fluctuate as a result of a variety of factors, many of which are outside of our control. If our quarterly revenue or results of operations fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially. Fluctuations in our results of operations may be due to a number of factors, including:

- •

- Demand for and market acceptance of our solutions;

- •

- Our ability to increase, retain and incentivize the certified dealers and distributors that market, sell, install and support our solutions;

- •

- The ability of our contract manufacturers to continue to manufacture high-quality products, and to supply sufficient products to meet our demands;

18

Table of Contents

- •

- The timing and success of introductions of new products, solutions or upgrades by us or our competitors and the entrance of new competitors;

- •

- The strength of regional, national and global economies;

- •

- The impact of natural disasters or manmade problems such as terrorism;

- •

- Changes in our business and pricing policies, or those of our competitors;

- •

- Competition, including entry into the industry by new competitors and new offerings by existing competitors;

- •

- The impact of seasonality on our business;

- •

- The amount and timing of expenditures, including those related to expanding our operations, increasing research and development, introducing new solutions or paying litigation expenses; and

- •

- Changes in the payment terms for our solutions.

Due to the foregoing factors and the other risks discussed herein, you should not rely on quarter-to-quarter comparisons of our results of operations as an indication of our future performance. You should not consider our recent revenue growth as indicative of our future performance.

If we are unable to develop new solutions, sell our solutions into new markets or further penetrate our existing markets, our revenue may not grow as expected.

Our ability to increase sales will depend in large part on our ability to enhance and improve our solutions, to introduce new solutions in a timely manner, to sell into new markets and to further penetrate our existing markets. The success of any enhancement or new product or solution depends on several factors, including the timely completion, introduction and market acceptance of enhanced or new solutions, the ability to attract, retain and effectively train sales and marketing personnel, the ability to develop relationships with dealers and distributors and the effectiveness of our marketing programs. Any new product or solution we develop or acquire may not be introduced in a timely or cost-effective manner, and may not achieve the broad market acceptance necessary to generate significant revenue. Any new markets into which we attempt to sell our solutions, including new vertical markets and new countries or regions, may not be receptive. Our ability to further penetrate our existing markets depends on the quality of our solutions and our ability to design our solutions to meet consumer demand. Moreover, we are frequently required to enhance and update our solutions as a result of changing standards and technological developments, which makes it difficult to recover the cost of development and forces us to continually qualify new solutions with our consumers. If we are unable to successfully develop or acquire new solutions, enhance our existing solutions to meet consumer requirements, sell solutions into new markets or sell our solutions to additional consumers in our existing markets, our revenue may not grow as expected.

Our success depends, in part, on our ability to develop and expand our global network of dealers and distributors.

As of December 31, 2013, we have developed a global network of over 3,000 active direct dealers and 29 distributors to sell, install and support our solutions. We rely on our dealers and distributors to provide consumers with a successful Control4 home automation experience. In some cases, dealers may choose not to offer our solution and instead offer a product from one of our competitors or, in other cases, the dealer may simply discontinue its operations. In order to continue our growth and expand our business, it is important that we continue to add new dealers and distributors and maintain most of our existing relationships. We must also work to expand our network of dealers and distributors to ensure that we have sufficient geographic coverage and technical expertise to address new markets and

19

Table of Contents

technologies. While it is difficult to estimate the total number of available dealers in our markets, there are a finite number of dealers that are able to perform the types of technical installations required for home automation systems. In the event that we saturate the available dealer pool, or if market or other forces cause the available pool of dealers to decline, it may be increasingly difficult to grow our business. As consumers' home automation options grow, it is important that we enhance our dealer footprint by broadening the expertise of our dealers, working with larger and more sophisticated dealers and expanding the mainstream consumer products our dealers offer. If we are unable to expand our network of dealers and distributors, our business could be harmed.

We rely on our dealers and distributors to sell our solution, and if our dealers and distributors fail to perform, our ability to sell and distribute our products and services will be limited, and our results of operations may be harmed.

Substantially all of our revenue is generated through the sales of our solution by our dealers and distributors. Our dealers and distributors are independent businesses that voluntarily sell our products as well as the products of other companies to consumers. We provide our dealers and distributors with specific training and programs to assist them in selling our products, but we cannot assure that these steps will be effective. We have observed, and expect to continue to observe, high volatility in the monthly, quarterly and annual sales performance of individual dealers and distributors. Although we can make estimated forecasts of cumulative sales of large numbers of dealers and distributors, we cannot assure their accuracy collectively or individually. Accordingly, we may not be able to reduce or slow our spending quickly enough if our actual sales fall short of our expectations. As a result, we expect that our revenues, results of operations and cash flows may fluctuate significantly on a quarterly basis. We believe that period-to-period comparisons of our revenues, results of operations and cash flows may not be meaningful and should not be relied upon as an indication of future performance.

Our dealers and distributors may be unsuccessful in marketing, selling, and supporting our products and services. If we are unable to develop and maintain effective sales incentive programs for our third-party dealers and distributors, we may not be able to incentivize them to sell our products to consumers and, in particular, to larger businesses and organizations. Our dealers and distributors may also market, sell and support products and services that are competitive with ours, and may devote more resources to the marketing, sales, and support of such competitive products. Our dealers and distributors may have incentives to promote our competitors' products to the detriment of our own, or may cease selling our products altogether. Our agreements with our dealers and distributors may generally be terminated for any reason by either party with advance notice. We cannot assure you that we will retain these dealers and distributors, or that we will be able to secure additional or replacement dealers and distributors. Further, if we alter our sales process in a region by switching from a distributor to a direct dealer model, our sales may be impacted leading up to or in connection with such change in sales process. In addition, while we take certain steps to protect ourselves from liability for the actions of our dealers and distributors, consumers may seek to recover amounts from us for any damages caused by dealers in connection with system installations, or the failure of a system to perform properly due to an incorrect installation by a dealer. In addition, our dealers and distributors may use our name and our brand in ways we do not authorize, and any such improper use may harm our reputation or expose us to liability for their actions.

If we fail to effectively manage our existing sales channels, if our dealers or distributors are unsuccessful in fulfilling the orders for our products, or if we are unable to enter into arrangements with, and retain a sufficient number of, high quality dealers and distributors in each of the regions in which we sell products, and keep them motivated to sell our products, our results of operations may be harmed. The termination of our relationship with any significant dealer or distributor may also adversely impact our sales and results of operations.

20

Table of Contents

We have entered into several strategic arrangements and intend to pursue additional strategic opportunities in the future. If the intended benefits from our strategic relationships are not realized, our results of operations may be harmed.

We are in the process of growing our relationships with strategic partners in order to attempt to reach markets that we cannot currently address cost-effectively and to increase awareness of our solution. If these relationships do not develop in the manner we intend, our future growth could be impacted. Furthermore, the termination of our relationship with a partner may cause us to incur expenses without corresponding revenue, incur a termination penalty and harm our sales and results of operations. For example, in 2012, we discontinued energy products for utility customers and, in connection with that decision, we incurred an expense related to an inventory purchase commitment and paid a fee to our counterparty to terminate the arrangement. Any loss of a major partner or distribution channel or other channel disruption could harm our results of operations and make us more dependent on alternate channels, damage our reputation, increase pricing and promotional pressures from other partners and distribution channels, increase our marketing costs, or harm buying and inventory patterns, payment terms or other contractual terms.

If we do not maintain the compatibility of our solutions with third-party products and applications that our consumers use, demand for our solutions could decline.

Our solutions are designed to interoperate with a wide range of other third-party products, including products in the areas of music, video, lighting, temperature and security. If we do not support the continued integration of our solutions with third-party products and applications, including through the provision of application programming interfaces that enable data to be transferred readily between our solutions and third-party products and applications, demand for our solutions could decline and we could lose sales. We will also be required to make our solutions compatible with new or additional third-party products and applications that are introduced into the markets that we serve. To help us meet this challenge, we have developed our Simple Device Discovery Protocol ("SDDP"), designed to enable our devices to recognize and control third-party products by embedding software in such products at the manufacturer, making it easier for dealers and consumers to add them to their Control4 systems. Although we are making SDDP available on a royalty-free basis to product manufacturers, its adoption is not yet substantial, and may not achieve greater or broad market acceptance. In addition, companies that provide popular point solutions have and may continue to eliminate or restrict our ability to control and be compatible with these products. As a result, we may not be successful in making our solutions compatible with these third-party products and applications, which could reduce demand for our solutions. In addition, if prospective consumers require customized features or functions that we do not offer, then the market for our solutions may be harmed.

Our inability to adapt to technological change could impair our ability to remain competitive.

The market for home automation and control solutions is characterized by rapid technological change, frequent introductions of new products and evolving industry standards. Our ability to attract new consumers and increase revenue from existing consumers will depend in significant part on our ability to anticipate changes in industry standards and to continue to enhance or introduce existing solutions on a timely basis to keep pace with technological developments. We are currently changing several aspects of our operating system, and may utilize Android open source technology in the future, which may cause difficulties including compatibility, stability and time to market. The success of this or any enhanced or new product or solution will depend on several factors, including the timely completion and market acceptance of the enhanced or new product or solution. Similarly, if any of our competitors implement new technologies before we are able to implement them, those competitors may be able to provide more effective products than ours, possibly at lower prices. Any delay or failure in

21

Table of Contents

the introduction of new or enhanced solutions could harm our business, results of operations and financial condition.

We currently rely on contract manufacturers to manufacture our products and component vendors to supply parts used in our products. The majority of our components are supplied by a single source. Any disruption in our supply chain, or our failure to successfully manage our relationships with our contract manufacturers or component vendors could harm our business.

Our reliance on contract manufacturers reduces our control over the assembly process, exposing us to risks, including reduced control over quality assurance, production costs and product supply. We rely on a limited number of contract manufacturers to manufacture substantially all of our products. We also do business with a number of component vendors, and the parts they supply may not perform as expected. For certain of our products and components, we rely on a sole-source manufacturer or supplier. For the year ended December 31, 2013, two contract manufacturers, Sanmina and LiteOn, manufactured 72% of our inventory purchases. Certain of our contract manufacturers and component vendors are located outside of the United States and may be subject to political, economic, social and legal uncertainties that may harm our relationships with these parties. If we fail to manage our relationships with our contract manufacturers or component vendors effectively, or if our contract manufacturers or component vendors experience delays, disruptions, capacity constraints or quality control problems in their operations, our ability to ship products may be impaired and our competitive position and reputation could be harmed. In addition, any adverse change in our contract manufacturers' or component vendors' financial or business condition could disrupt our ability to supply quality products to our dealers and distributors. If we are required to change contract manufacturers or component vendors, we may lose revenue, incur increased costs or damage our relationships, or we might be unable to find a new contract manufacturer or component vendor on acceptable terms, or at all. In addition, qualifying a new contract manufacturer or component vendor can be an expensive and lengthy process. If we experience increased demand that our contract manufacturers or component vendors are unable to fulfill, or if they are unable to provide us with adequate supplies of high-quality products for any reason, we could experience a delay in our order fulfillment, and our business, results of operations and financial condition would be harmed.

Growth of our business will depend on market awareness and a strong brand, and any failure to develop, maintain, protect and enhance our brand would hurt our ability to retain or attract consumers.

Because of the early stage of development of the mainstream home automation market, we believe that building and maintaining market awareness, brand recognition and goodwill is critical to our success. This will depend largely on our ability to continue to provide high-quality solutions, and we may not be able to do so effectively. While we may choose to engage in a broader marketing campaign to further promote our brand, this effort may not be successful. Our efforts in developing our brand may be affected by the marketing efforts of our competitors and our reliance on our dealers, distributors and strategic partners to promote our brand. If we are unable to cost-effectively maintain and increase awareness of our brand, our business, results of operations and financial condition could be harmed.

We operate in the emerging and evolving home automation market, which may develop more slowly or differently than we expect. If the mainstream home automation market does not grow as we expect, or if we cannot expand our solutions to meet the demands of this market, our revenue may decline, fail to grow or fail to grow at an accelerated rate, and we may incur additional operating losses.

The market for home automation and control solutions is in an early stage of development, and it is uncertain whether, how rapidly or how consistently this market will develop, and even if it does develop, whether our solutions will achieve and sustain high levels of demand and market acceptance.

22

Table of Contents

Some consumers may be reluctant or unwilling to use our solutions for a number of reasons, including satisfaction with traditional solutions, concerns for additional costs and lack of awareness of our solutions. Unified home automation solutions such as ours have traditionally been luxury purchases for the high end of the residential market. Our ability to expand the sales of our solutions to a broader consumer base depends on several factors, including the awareness of our solutions, the timely completion, introduction and market acceptance of our solutions, the ability to attract, retain and effectively train sales and marketing personnel, the ability to develop relationships with dealers and distributors, the effectiveness of our marketing programs, the costs of our solutions and the success of our competitors. If we are unsuccessful in developing and marketing our home automation solutions to mainstream consumers, or if these consumers do not perceive or value the benefits of our solutions, the market for our solutions might not continue to develop or might develop more slowly than we expect, either of which would harm our revenue and growth prospects.