Exhibit 99.1

Investor Presentation NASDAQ/TSX - BLU September 16 th , 2022

Forward Looking Statements 2 Certain statements contained in this presentation, other than statements of fact that are independently verifiable at the dat e h ereof, may constitute "forward - looking statements" within the meaning of Canadian securities legislation and regulations, the U.S. Private Securities Litigation Reform Act of 1995, as ame nde d, and other applicable securities laws. Forward - looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “esti mat es,” “potential,” “possible,” “projects,” “plans,” and similar expressions. Such statements, based as they are on the current expectations of management, inherently involve numerous import ant risks, uncertainties and assumptions, known and unknown, many of which are beyond BELLUS Health Inc.'s (“BELLUS Health”) control. Such statements include, but are not limite d t o, the potential of BLU - 5937 to successfully treat refractory chronic cough (“RCC”) and other hypersensitization - related disorders and benefit such patients, BELLUS Health's expec tations related to its preclinical studies and clinical trials, including the timing of initiation of and the design of the Phase 3 clinical trials of BLU - 5937 in RCC, the timing and o utcome of interactions with regulatory agencies, the potential activity and tolerability profile, selectivity, potency and other characteristics of BLU - 5937, including as compared to other co mpetitor candidates, especially where head - to - head studies have not been conducted and cross - trial comparisons may not be directly comparable due to differences in study protocols, condit ions and patient populations, the commercial potential of BLU - 5937, including with respect to patient population, pricing and labeling, BELLUS Health's financial position and sufficie ncy of cash resources to bring BELLUS Health through topline results of CALM - 1 and CALM - 2 clinical trials, and the potential applicability of BLU - 5937 and BELLUS Health's P2X3 platform to treat other disorders. Risk factors that may af fect BELLUS Health's future results include but are not limited to: the benefits and impact on label of its enrichment strategy, e sti mates and projections regarding the size and opportunity of the addressable RCC market for BLU - 5937, the ability to expand and develop its project pipeline, the ability to obtain adequate financing, the ability of BELLUS Health to maintain its rights to intellectual property and obtain adequate protection of future products through such intellectual property, the imp act of general economic conditions, general conditions in the pharmaceutical industry, the impact of the ongoing COVID - 19 pandemic on BELLUS Health's operations, plans and prospects, includi ng to the initiation and completion of clinical trials in a timely manner or at all, changes in the regulatory environment in the jurisdictions in which BELLUS Health does business, s upp ly chain impacts, stock market volatility, fluctuations in costs, changes to the competitive environment due to consolidation, achievement of forecasted burn rate, achievement of forec ast ed preclinical study and clinical trial milestones, reliance on third parties to conduct preclinical studies and clinical trials for BLU - 5937 and that actual results may differ from topline results once the final and quality - controlled verification of data and analyses has been completed. In addition, the length of BELLUS Health's product candidate's development process and its m ark et size and commercial value are dependent upon a number of factors. Moreover, BELLUS Health's growth and future prospects are mainly dependent on the successful development, pat ient tolerability, regulatory approval, commercialization and market acceptance of its product candidate BLU - 5937 and other products. Consequently, actual future result s and events may differ materially from the anticipated results and events expressed in the forward - looking statements. BELLUS Health believes that expectations represented by forward - looking statements are reasonable, yet there can be no assurance that such expectations will prove to be correct. The reader should not place undue reliance, if any, on any forw ard - looking statements included in this presentation. These forward - looking statements speak only as of the date made, and BELLUS Health is under no obligation and disavows any intention t o update publicly or revise such statements as a result of any new information, future event, circumstances or otherwise, unless required by applicable legislation or regulat ion . Please see BELLUS Health's public filings with the Canadian securities regulatory authorities, including, but not limited to, its Annual Information Form, and the United States Se curities and Exchange Commission, including, but not limited to, its Annual Report on Form 40 - F, for further risk factors that might affect BELLUS Health and its business.

Company Overview

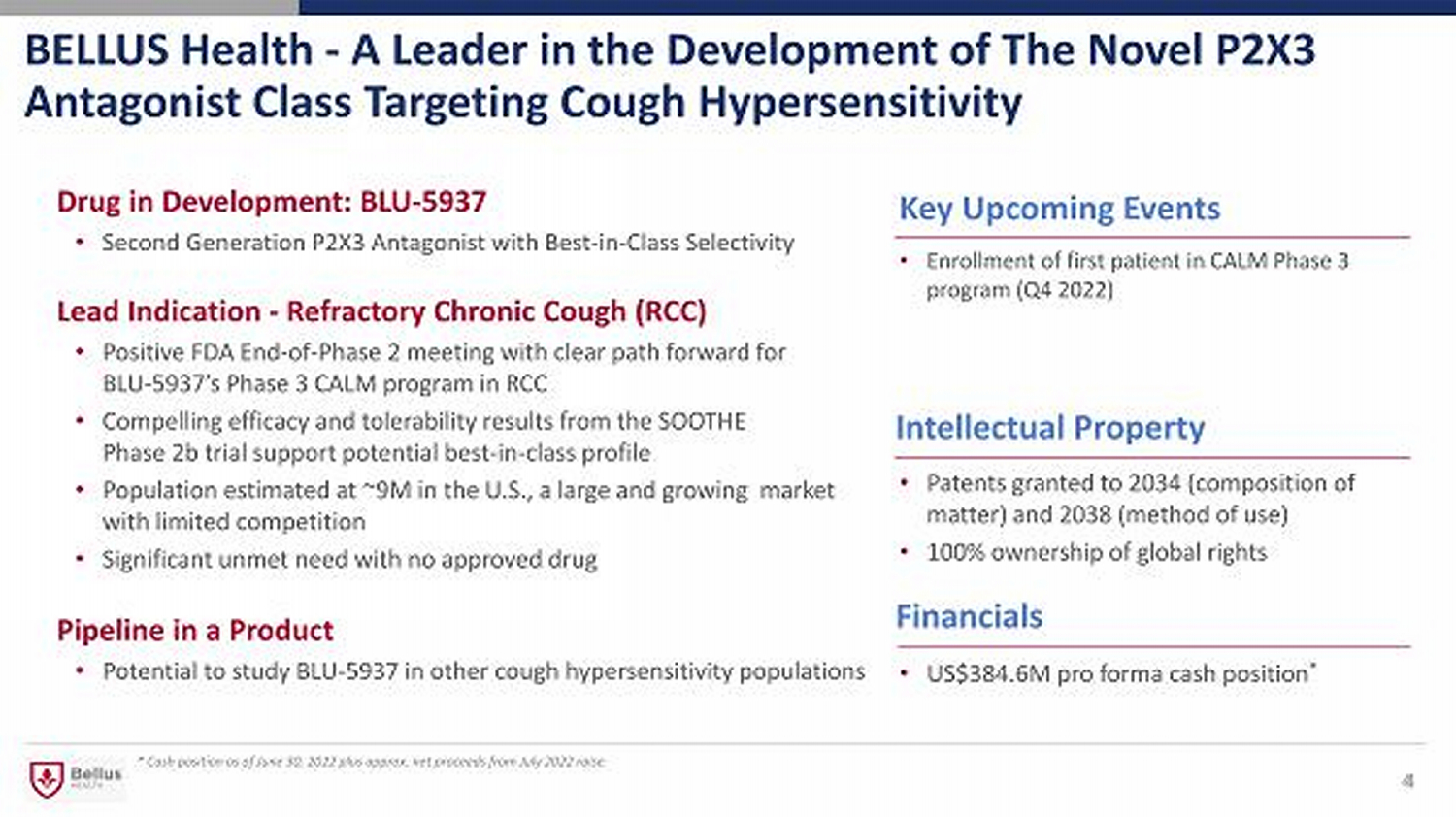

BELLUS Health - A Leader in the Development of The Novel P2X3 Antagonist Class Targeting Cough Hypersensitivity Financials Key Upcoming Events Lead Indication - Refractory Chronic Cough (RCC) • Positive FDA End - of - Phase 2 meeting with clear path forward for BLU - 5937’s Phase 3 CALM program in RCC • Compelling efficacy and tolerability results from the SOOTHE Phase 2b trial support potential best - in - class profile • Population estimated at ~9M in the U.S., a large and growing market with limited competition • Significant unmet need with no approved drug * Cash position as of June 30, 2022 plus approx. net proceeds from July 2022 raise • Enrollment of first patient in CALM Phase 3 program (Q4 2022) Pipeline in a Product • Potential to study BLU - 5937 in other cough hypersensitivity populations 4 Intellectual Property • Patents granted to 2034 (composition of matter) and 2038 (method of use) • 100% ownership of global rights 4 Drug in Development: BLU - 5937 • Second Generation P2X3 Antagonist with Best - in - Class Selectivity • US$384.6M pro forma cash position *

Strong Leadership and Advisory Group Management Board of Directors Clinical Advisory Board Dr. Surinder Birring, MB ChB (Hons), MD King’s College London Dr. Michael S. Blaiss, MD Medical College of Georgia Dr. Peter Dicpinigaitis, MD Albert Einstein Medical College Dr. Jacky Smith (Chair) , MB, ChB, FRCP, PhD Manchester University Dr. Denis Garceau, PhD Chief Scientific Officer Tony Matzouranis Senior Vice President, Business Development Roberto Bellini President & Chief Executive Officer Dr. Catherine Bonuccelli, MD Chief Medical Officer Ramzi Benamar, MBA Chief Financial Officer Franklin Berger Roberto Bellini Joseph Rus Pierre Larochelle Dr. Clarissa Desjardins, PhD Dr. Youssef Bennani, PhD Dr. Francesco Bellini, PhD Chair Dr. Bill Mezzanotte, MD, PhD CHRONIC COUGH 5 Dr. Andreas Orfanos, MBBCh, MBA, FFPM Chief Operations Officer

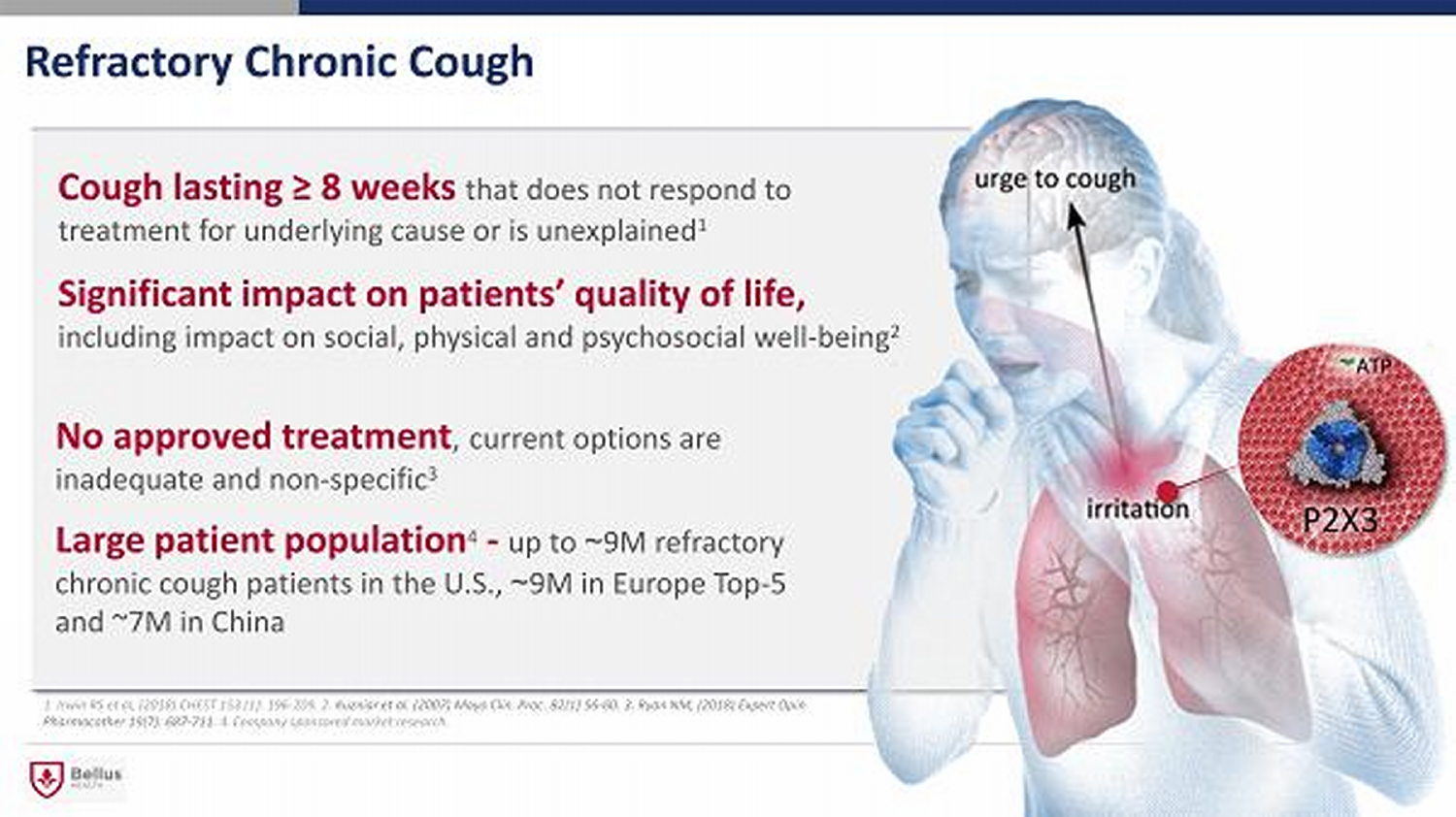

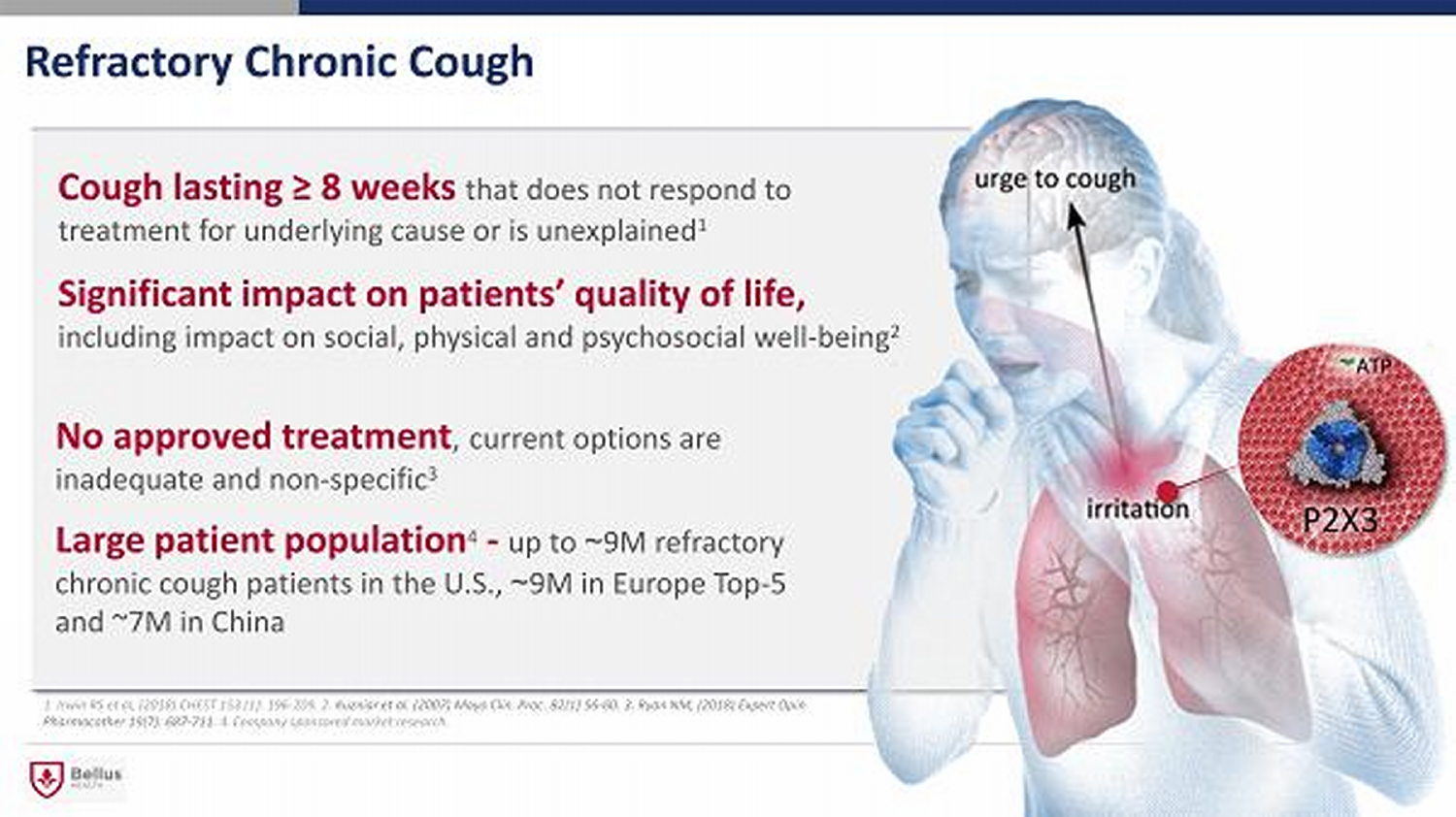

Refractory Chronic Cough Cough lasting ≥ 8 weeks that does not respond to treatment for underlying cause or is unexplained 1 No approved treatment , current options are inadequate and non - specific 3 Significant impact on patients ’ quality of life, including impact on social, physical and psychosocial well - being 2 Large patient population 4 - up to ~ 9 M refractory chronic cough patients in the U . S ., ~ 9 M in Europe Top - 5 and ~7M in China 1. Irwin RS et al, (2018) CHEST 153 (1): 196 - 209. 2. Kuzniar et al. (2007) Mayo Clin. Proc. 82(1) 56 - 60. 3. Ryan NM, (2018) Expert Opin Pharmacother 19(7): 687 - 711. 4. Company sponsored market research.

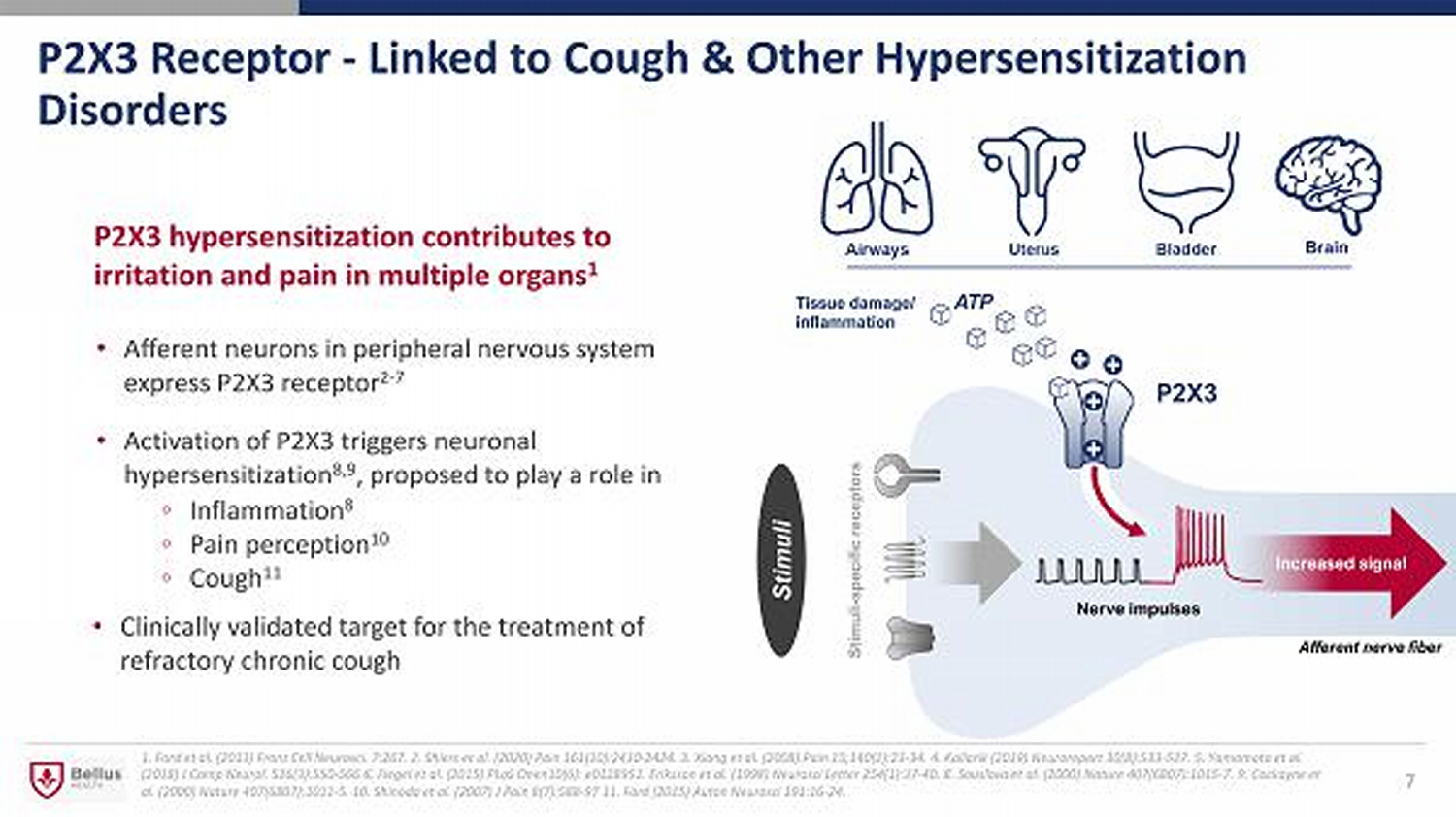

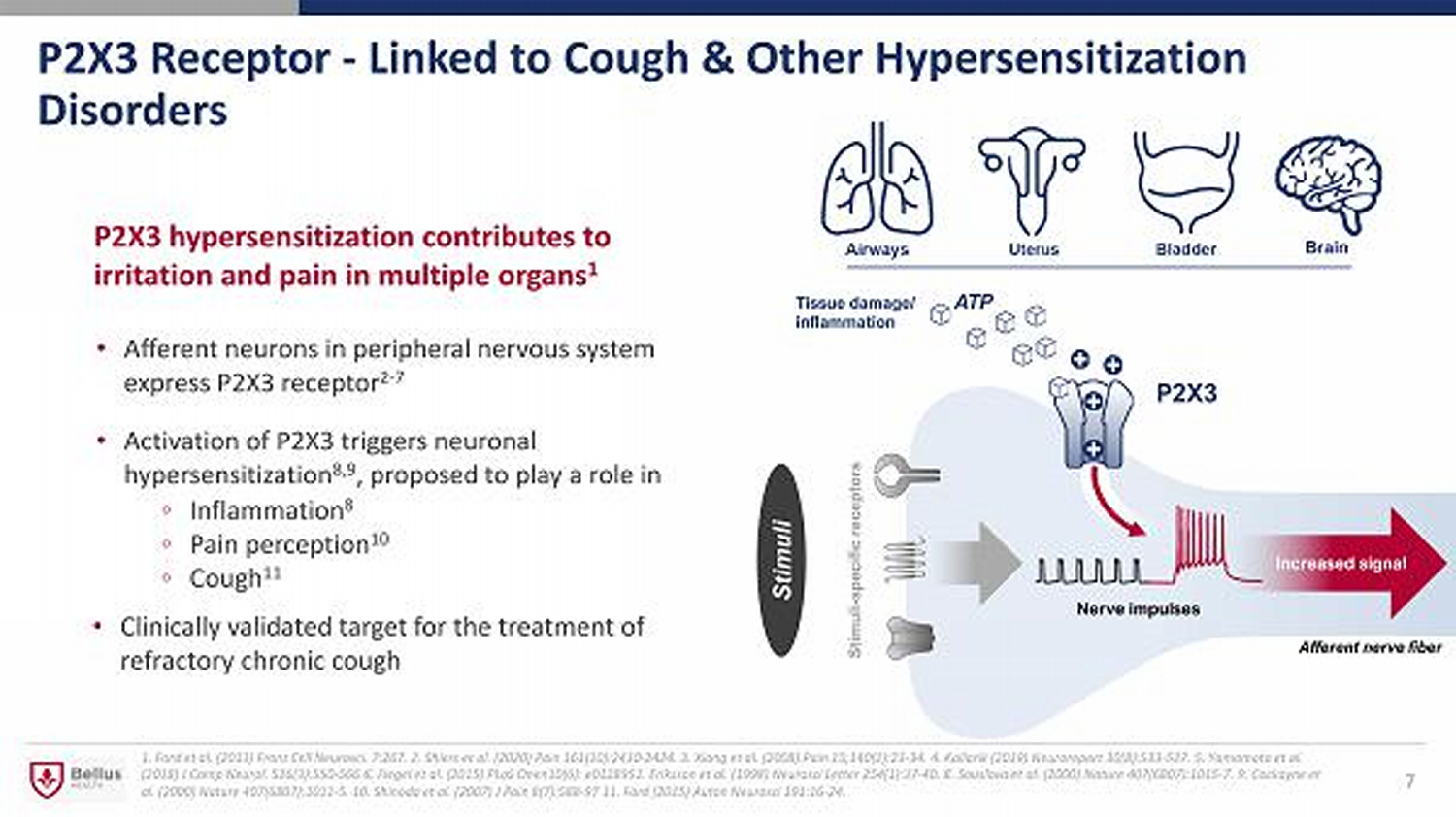

P2X3 Receptor - Linked to Cough & Other Hypersensitization Disorders • Afferent neurons in peripheral nervous system express P2X3 receptor 2 - 7 • Activation of P2X3 triggers neuronal hypersensitization 8,9 , proposed to play a role in 1. Ford et al. (2013) Front Cell Neurosci. 7:267 . 2. Shiers et al. (2020) Pain 161(10):2410 - 2424. 3. Xiang et al. (2008) Pain 15;140(1):23 - 34. 4. Kollarik (2019) Neuroreport 30(8): 533 - 537. 5. Yamamoto et al. (2018) J Comp Neurol. 526(3):550 - 566 6. Flegel et al. (2015) PLoS Onen10(6): e0128951. Eriksson et al. (1998) Neurosci Letter 254(1):37 - 40. 8. Souslova et al. (2000) Nature 407(6807):1015 - 7. 9. Cockayne et al. (2000) Nature 407(6807):1011 - 5. 10. Shinoda et al. (2007) J Pain 8(7):588 - 97 11. Ford (2015) Auton Neurosci 191:16 - 24. P2X3 hypersensitization contributes to irritation and pain in multiple organs 1 ◦ Inflammation 8 ◦ Pain perception 10 ◦ Cough 11 7 Tissue damage/ inflammation Brain ATP Stimuli - specific receptors Stimuli • Clinically validated target for the treatment of refractory chronic cough

BLU - 5937 - Best - In - Class Potential 8 Compelling efficacy from SOOTHE Phase 2b trial completed in December 2021 Well - tolerated with a low rate of class - related taste side effects Twice daily dosing with once - daily dosing in development BLU - 5937 Highly potent P2X3 antagonist with best - in - class selectivity being developed to treat refractory chronic cough

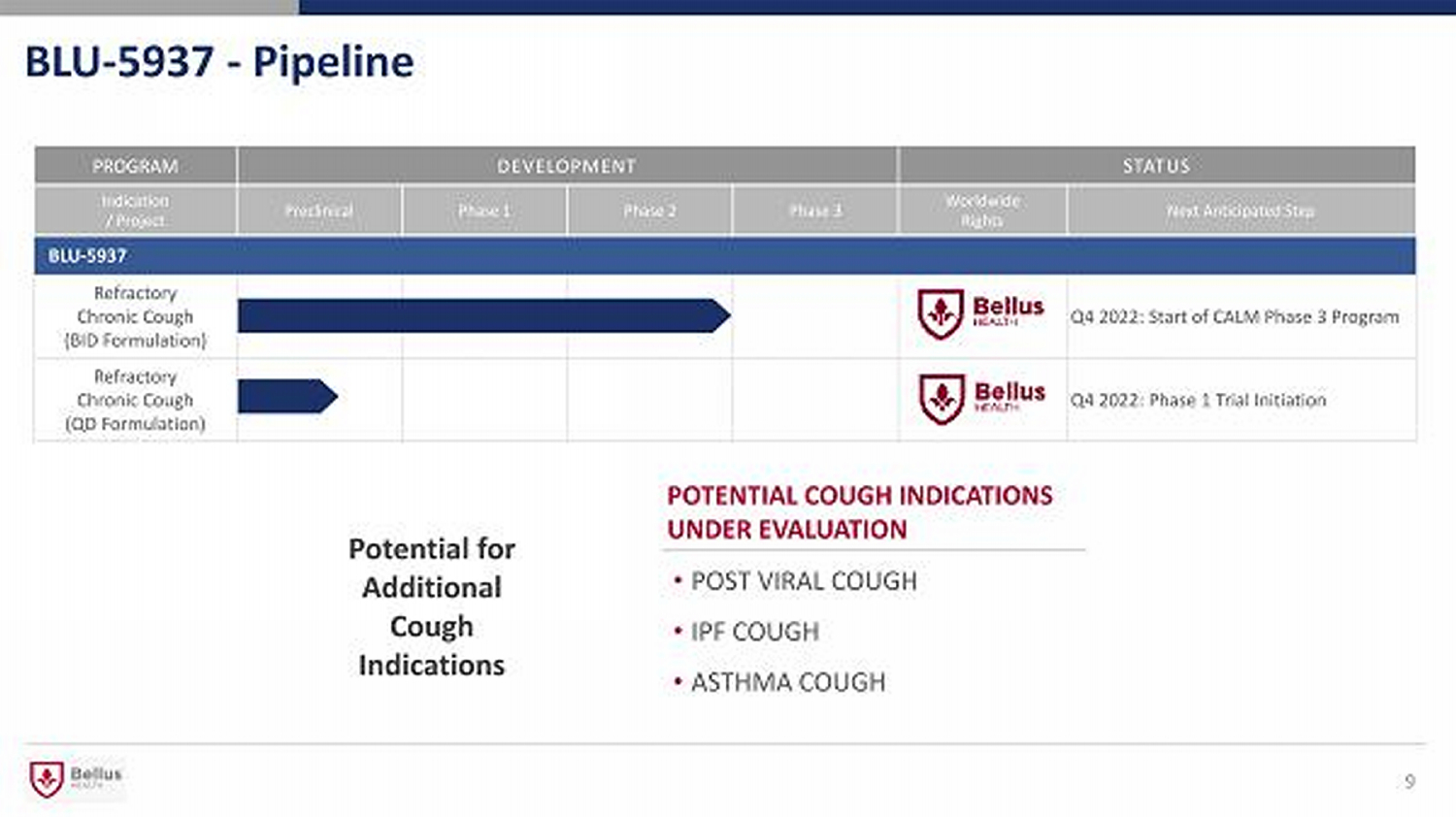

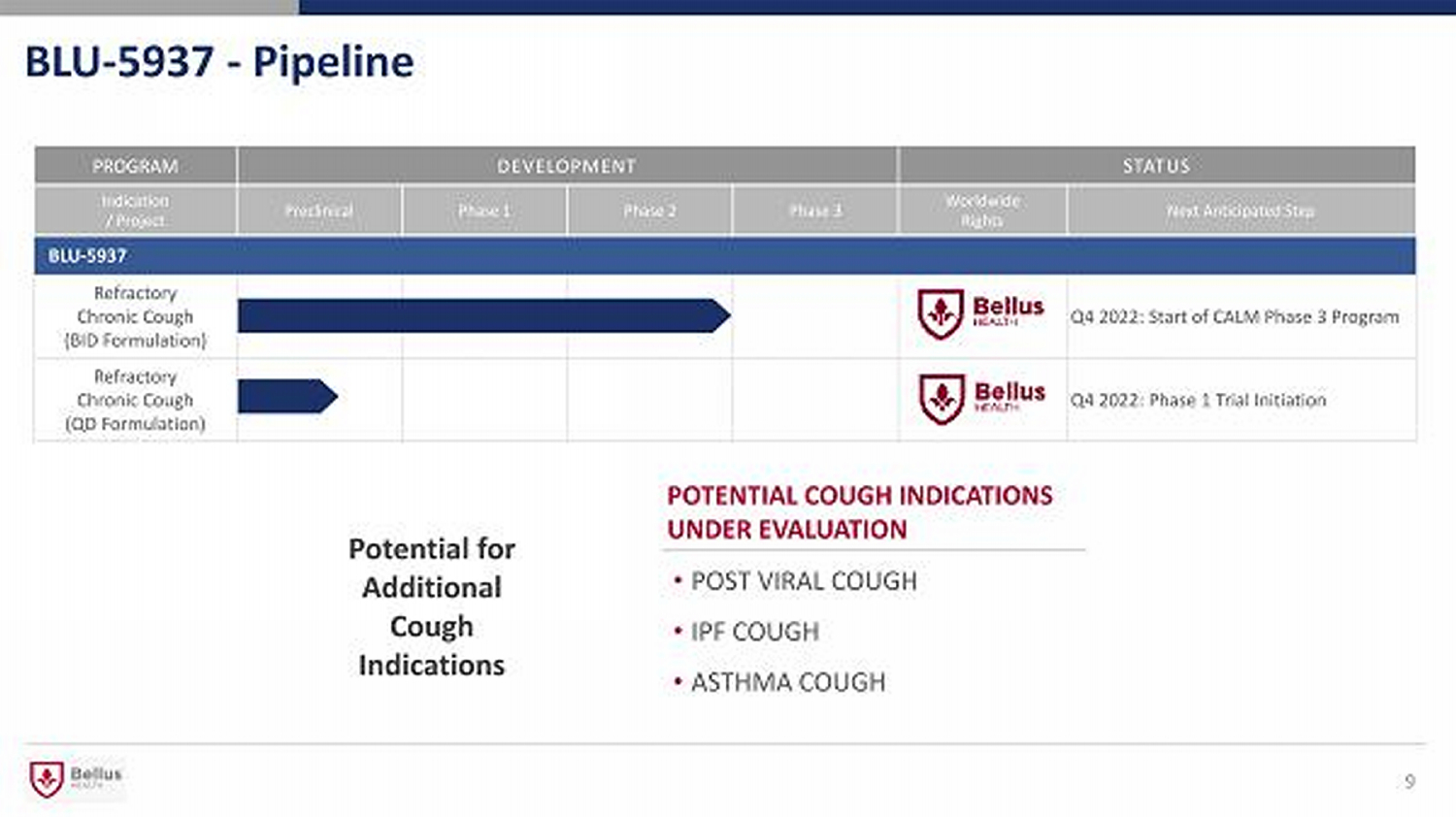

BLU - 5937 - Pipeline 9 PROGRAM DEVELOPMENT STATUS Indication / Project Preclinical Phase 1 Phase 2 Phase 3 Worldwide Rights Next Anticipated Step BLU - 5937 Refractory Chronic Cough (BID Formulation) Q4 2022: Start of CALM Phase 3 Program Refractory Chronic Cough (QD Formulation) Q4 2022: Phase 1 Trial Initiation Potential for Additional Cough Indications POTENTIAL COUGH INDICATIONS UNDER EVALUATION • POST VIRAL COUGH • IPF COUGH • ASTHMA COUGH

SOOTHE Phase 2b Results

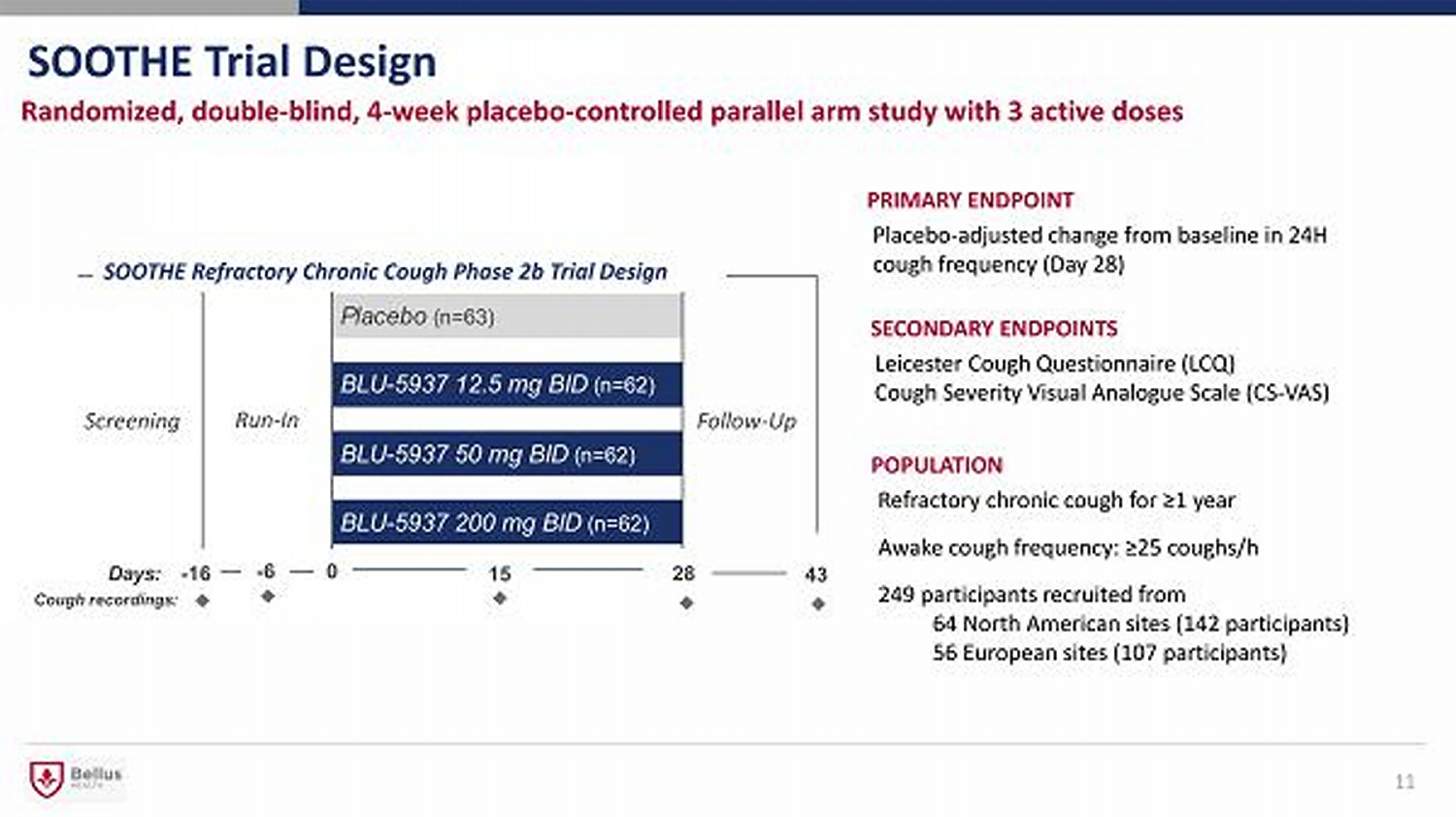

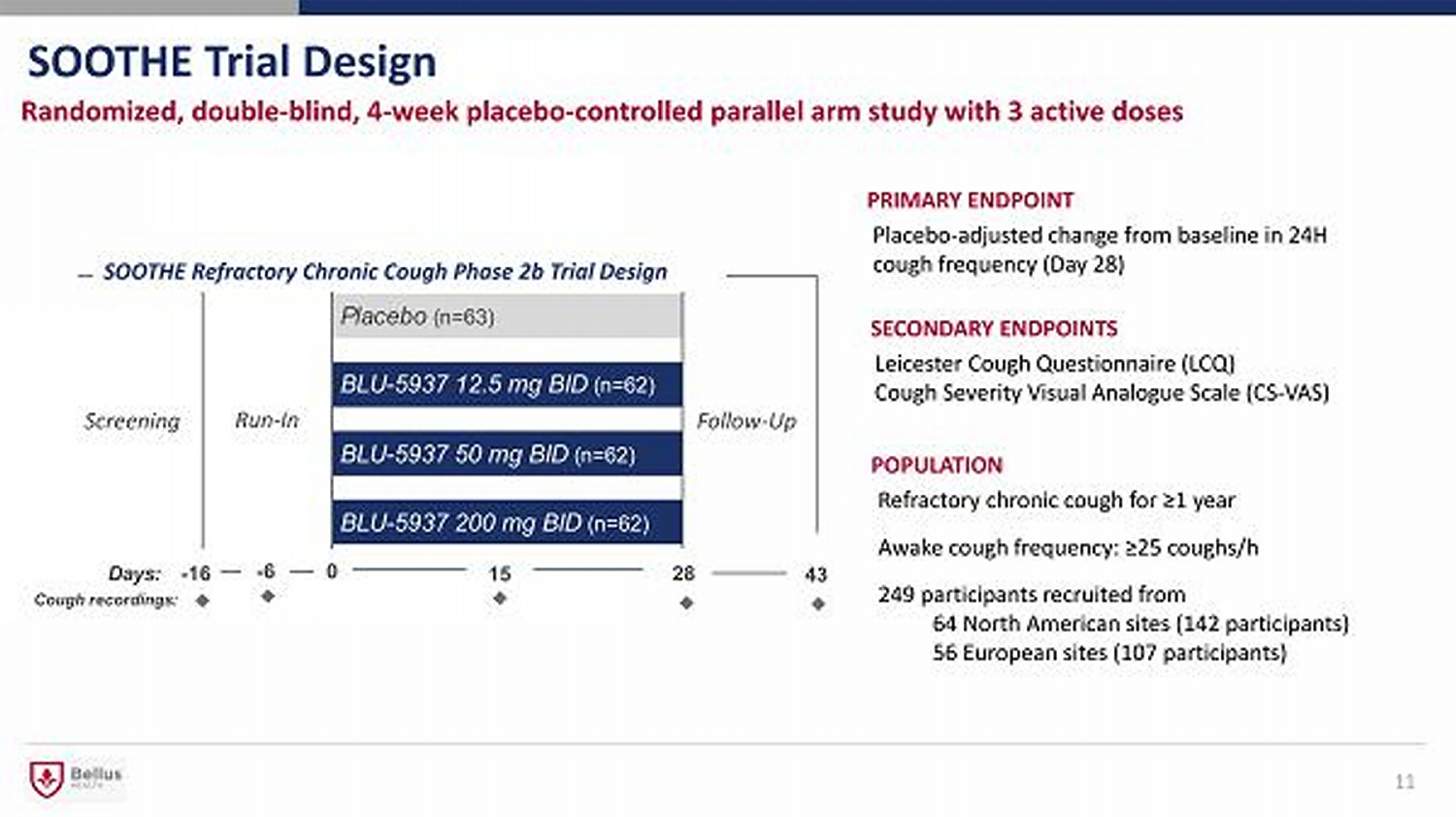

SOOTHE Trial Design 11 Randomized, double - blind, 4 - week placebo - controlled parallel arm study with 3 active doses PRIMARY ENDPOINT Placebo - adjusted change from baseline in 24H cough frequency (Day 28) POPULATION Refractory chronic cough for ≥1 year Awake cough frequency: ≥25 coughs/h 249 participants recruited from 64 North American sites ( 142 participants) 56 European sites (107 participants) Run - In Placebo (n= 63) BLU - 5937 12.5 mg BID (n= 62) BLU - 5937 50 mg BID (n= 62) BLU - 5937 200 mg BID (n= 62) Follow - Up SOOTHE Refractory Chronic Cough Phase 2b Trial Design Screening 43 Days: - 16 0 28 Cough recordings: - 6 15 SECONDARY ENDPOINTS Leicester Cough Questionnaire (LCQ) Cough Severity Visual Analogue Scale (CS - VAS)

SOOTHE: Primary Efficacy Endpoint Placebo - Adjusted Change in 24H Cough Frequency 12 34% placebo - adjusted reduction in 24 - hour cough frequency at 50 mg and 200 mg BID doses (p ≤ 0.005) Dose response observed between 12.5 mg and 50 mg BID doses -60 -40 -20 0 20 40 60 Dose Δ p - value 12.5 mg - 21.1% 0.098 50 mg - 34.4% 0.003 200 mg - 34.2% 0.005 Mean and 95% CI Intent - to - treat analysis Placebo - adjusted 24H cough frequency change from baseline at Day 28 1 * * * p ≤ 0.005, two - sided BLU - 5937 better Placebo better % 1. Geometric mean ratio of difference from baseline between BLU - 5937 doses and placebo is estimated by back transformation of the LS mean difference. Percent treatment benefit over placebo in mean cough frequency is defined as 100x((geom. LS mean Ratio) - 1).

-60.0% -50.0% -40.0% -30.0% -20.0% -10.0% 0.0% Placebo 12.5 mg BID 50 mg BID 200 mg BID Relative change from baseline in 24H cough frequency (ITT) Baseline Day 15 Day 28 SOOTHE: Change from Baseline in 24H Cough Frequency 13 Percentage change in 24H cough frequency 53% reduction from baseline in 24 - hour cough frequency at day 28 with 50 mg and 200 mg BID doses * p ≤ 0.005, two - sided * * * *

36% 14% 7% 52% 35% 19% 61% 44% 25% 62% 48% 19% 0% 10% 20% 30% 40% 50% 60% 70% 80% ≥ 30% ≥ 50% ≥ 70% Placebo BLU-5937 12.5 mg BID BLU-5937 50 mg BID BLU-5937 200 mg BID Day 28 12.5 mg BID 50 mg BID 200 mg BID -1 1 3 5 7 9 11 13 15 p=0.0865 p=0.0077 p=0.0080 ≥ 30% -1 1 3 5 7 9 11 13 15 p=0.0147 p=0.0007 p=0.0003 ≥ 50% -1 1 3 5 7 9 11 13 15 p=0.0716 p=0.0157 p=0.0715 ≥ 70% Odds ratio (95% CI) 2.9 4.2 5.6 4.8 3.1 2.8 1.9 3.0 3.2 >60% of patients achieved ≥30% reduction in cough frequency at therapeutic doses Robust odds ratios favored treatment at every dose; almost all data points at therapeutic doses are statistically significant SOOTHE: Responder Rates In 24H Cough Frequency

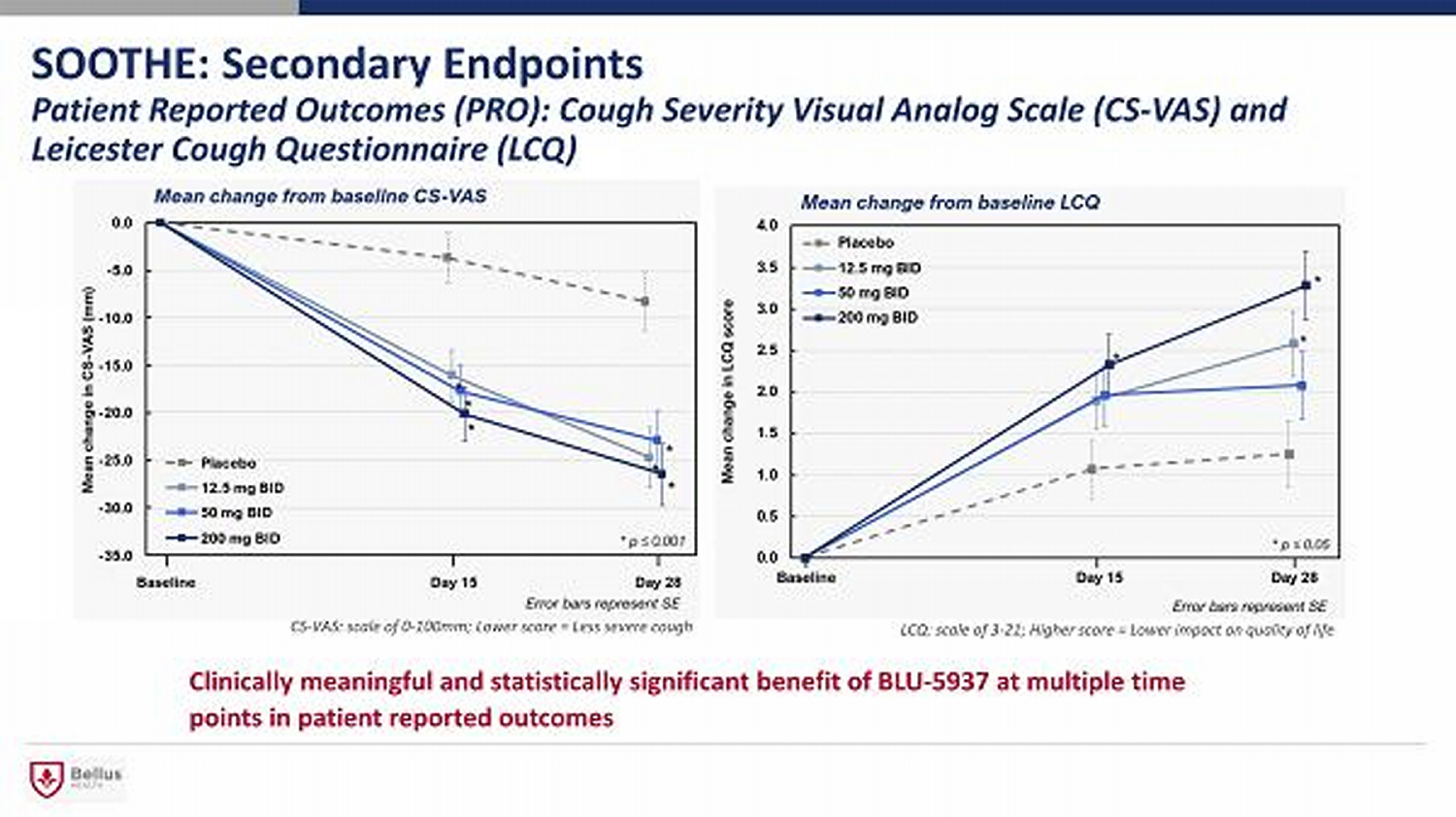

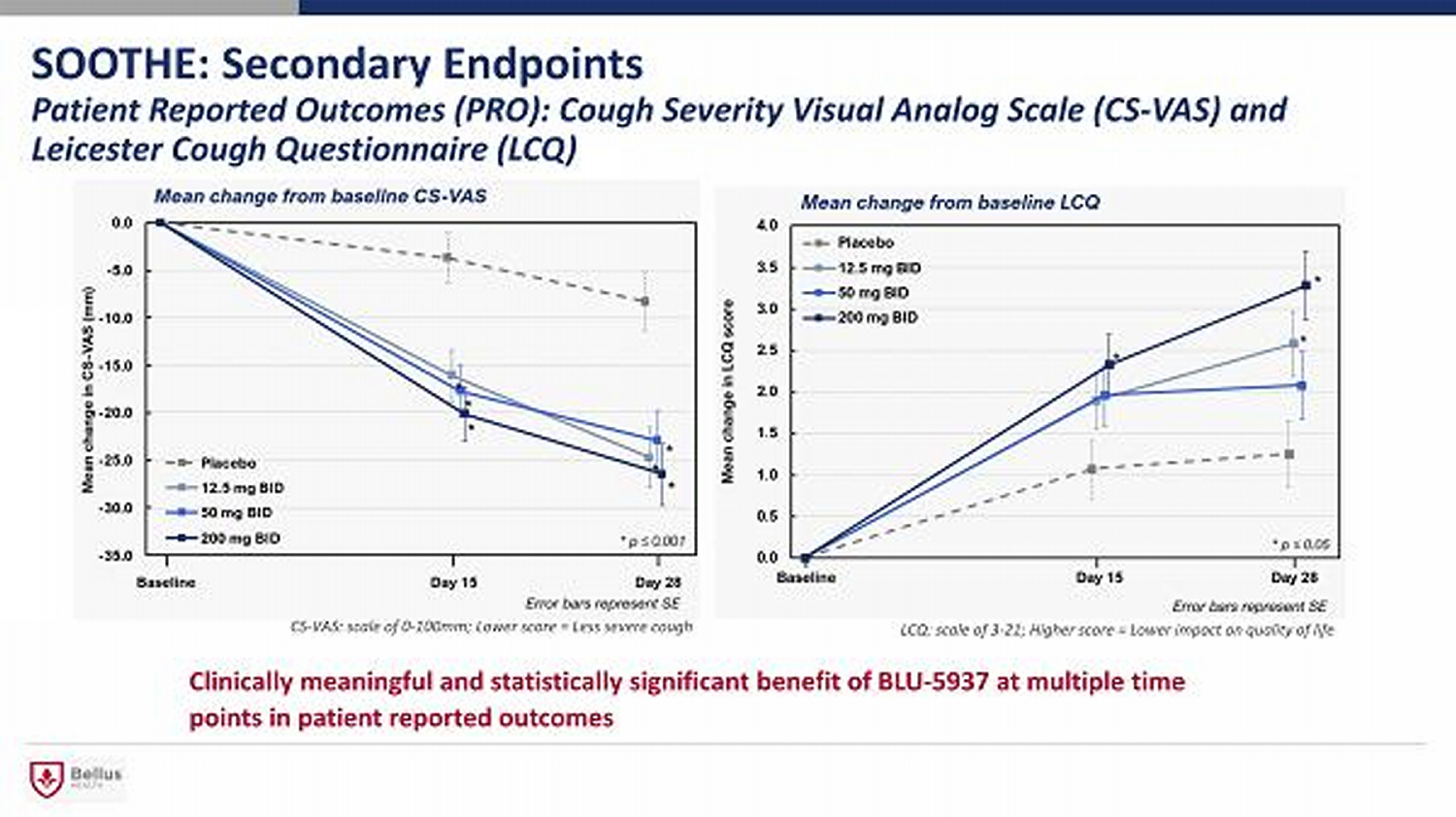

SOOTHE: Secondary Endpoints Patient Reported Outcomes (PRO): Cough Severity Visual Analog Scale (CS - VAS) and Leicester Cough Questionnaire (LCQ) Clinically meaningful and statistically significant benefit of BLU - 5937 at multiple time points in patient reported outcomes LCQ: scale of 3 - 21; Higher score = Lower impact on quality of life CS - VAS: scale of 0 - 100mm; Lower score = Less severe cough

SOOTHE: Safety and Tolerability 16 Generally well - tolerated S imilar rate of treatment emergent adverse events (TEAEs) reported for placebo and BLU - 5937 n (%) Placebo (n= 63) BLU - 5937 12.5 mg BID (n= 62) BLU - 5937 50 mg BID (n= 62) BLU - 5937 200 mg BID (n= 62) Subjects with ≥1 TEAE 22 (34.9%) 23 (37.1%) 13 (21.0%) 19 (30.6%) Subjects with ≥1 TE SAE 0 0 0 0 Subjects with TEAE leading to discontinuation, n (%) * 1 (1.6%) 0 0 2 (3.2%) Most Common TEAEs (≥5% at any dose) † Nausea 0 0 5 (8.1%) 2 (3.2%) Dysgeusia 0 3 (4.8%) 4 (6.5%) 3 (4.8%) UTI 0 3 (4.8%) 0 0 † No TEAE reported with an incidence ≥5% in the exploratory population * Placebo: worsening of cough; BLU - 5937 200 mg BID: worsening of cough, dry mouth

SOOTHE: Low Taste - Related Adverse Events Associated to P2X3 Class 17 Low rate of taste disturbance adverse events at all doses (≤ 6.5%) with: • No loss of taste • No discontinuations due to taste disturbance INCIDENCE OF TASTE DISTURBANCE ADVERSE EVENTS Placebo (n= 63 ) BLU - 5937 12.5 mg BID (n= 62) BLU - 5937 50 mg BID (n= 62) BLU - 5937 200 mg BID (n= 62) Taste alteration (dysgeusia) 0 3 (4.8%) 4 (6.5%) 3 (4.8%) Partial taste loss (hypogeusia) 0 0 0 0 Complete taste loss (ageusia) 0 0 0 0 Total taste disturbances 0 3 (4.8%) 4 (6.5%) 3 (4.8%)

CALM Phase 3 Program Plans

CALM Program: Study Design Two randomized, double - blind, placebo - controlled parallel arm trials with 2 active doses 12 weeks CALM - 1 Run In Screening Randomization Primary Randomized Treatment Period 50 mg BID –– n≈225 25 mg BID –– n≈225 Placebo BID –– n≈225 40 weeks Randomized Blinded Extension 50 mg BID 25 mg BID Placebo BID 24 weeks Open Label Extension 50 mg BID Primary Endpoint CALM - 2 Run In Screening Randomization 24 weeks Primary Randomization Treatment Period 50 mg BID –– n≈225 25 mg BID –– n≈225 Placebo BID –– n≈225 28 weeks Open Label Extension 50 mg BID Primary Endpoint POPULATION • Refractory/unexplained chronic cough • Cough ≥1 year • Enriched for baseline cough frequency • CALM - 1 and CALM - 2: ∼ 675 participants each PRIMARY EFFICACY ENDPOINT • 24H cough frequency (CF) in enriched population 19

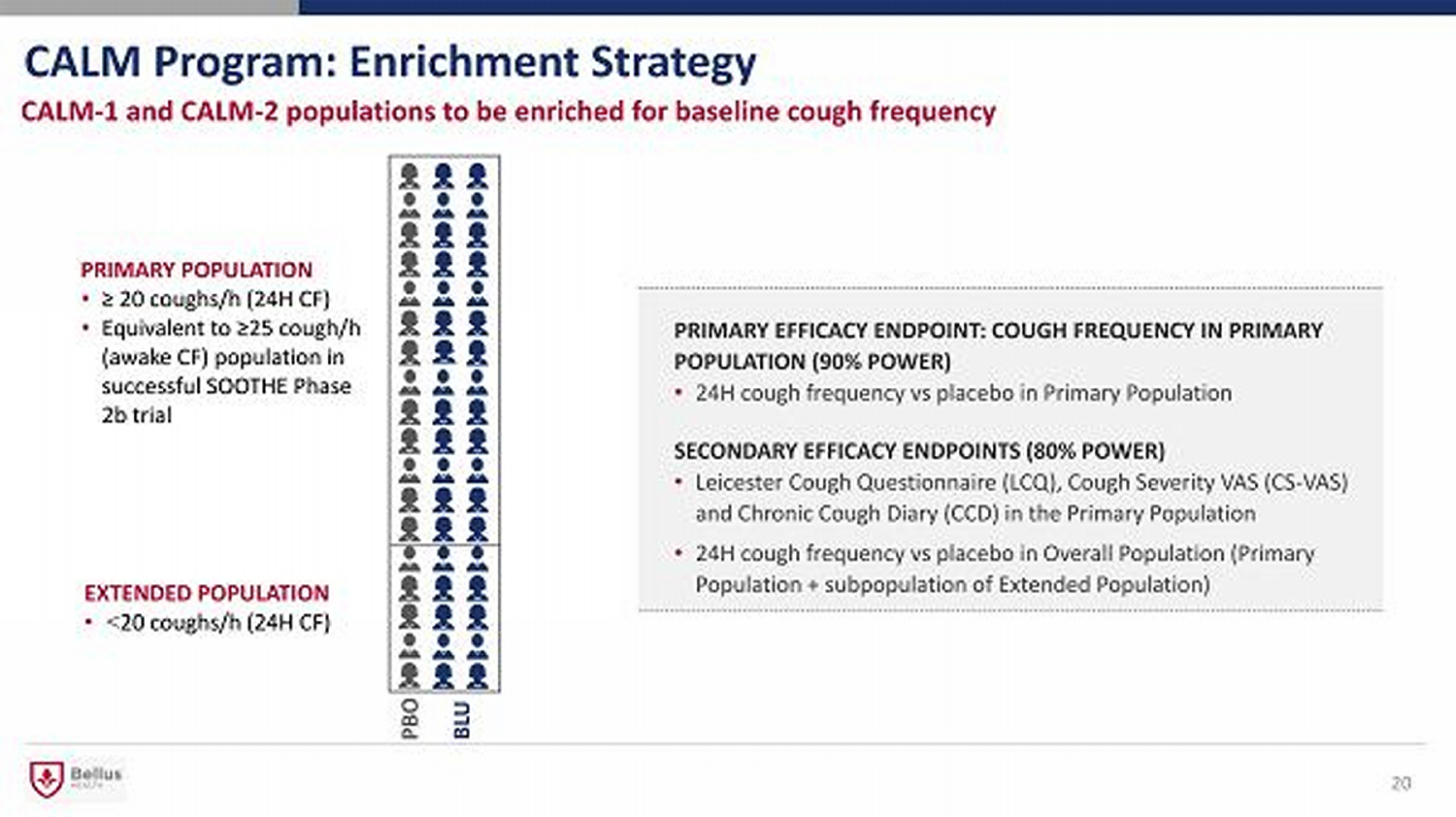

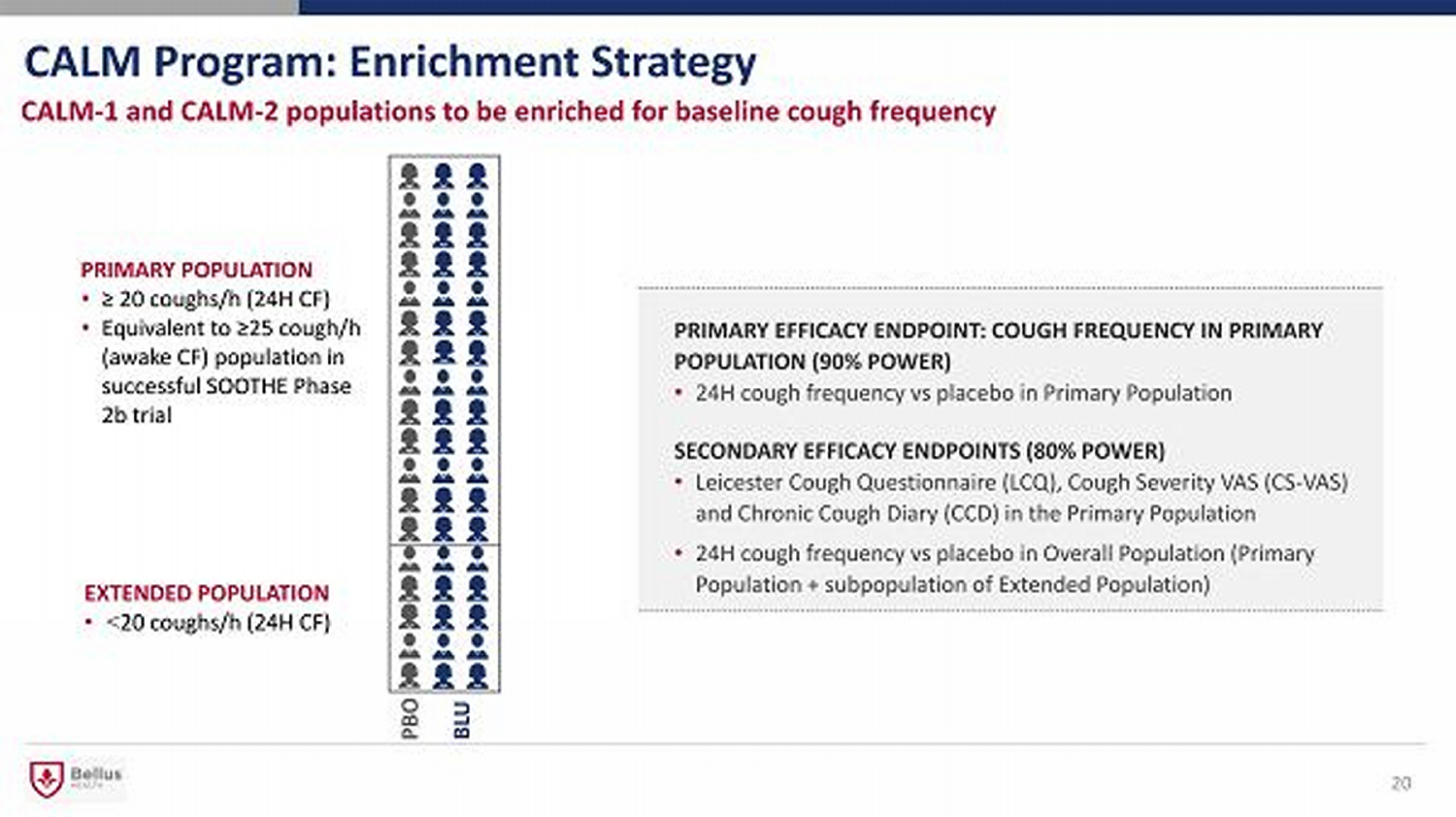

CALM Program: Enrichment Strategy 20 CALM - 1 and CALM - 2 populations to be enriched for baseline cough frequency PRIMARY EFFICACY ENDPOINT: COUGH FREQUENCY IN PRIMARY POPULATION (90% POWER) • 24H cough frequency vs placebo in Primary Population SECONDARY EFFICACY ENDPOINTS (80% POWER ) • Leicester Cough Questionnaire (LCQ), Cough Severity VAS (CS - VAS) and Chronic Cough Diary (CCD) in the Primary Population • 24H cough frequency vs placebo in Overall Population (Primary Population + subpopulation of Extended Population) PRIMARY POPULATION • ≥ 20 coughs/h (24H CF) • Equivalent to ≥25 cough/h (awake CF) population in successful SOOTHE Phase 2b trial EXTENDED POPULATION • < 20 coughs/h (24H CF) PBO BLU

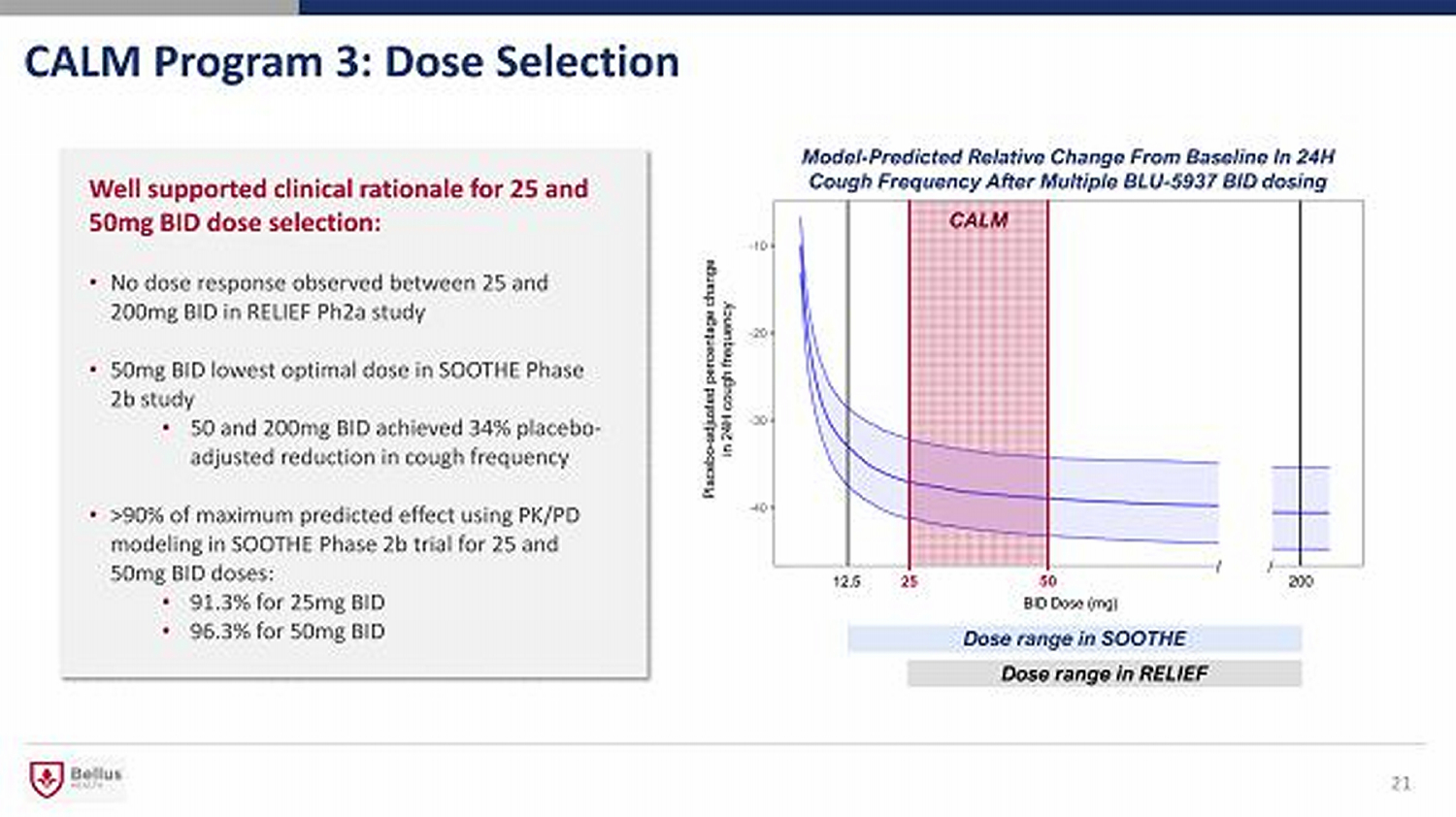

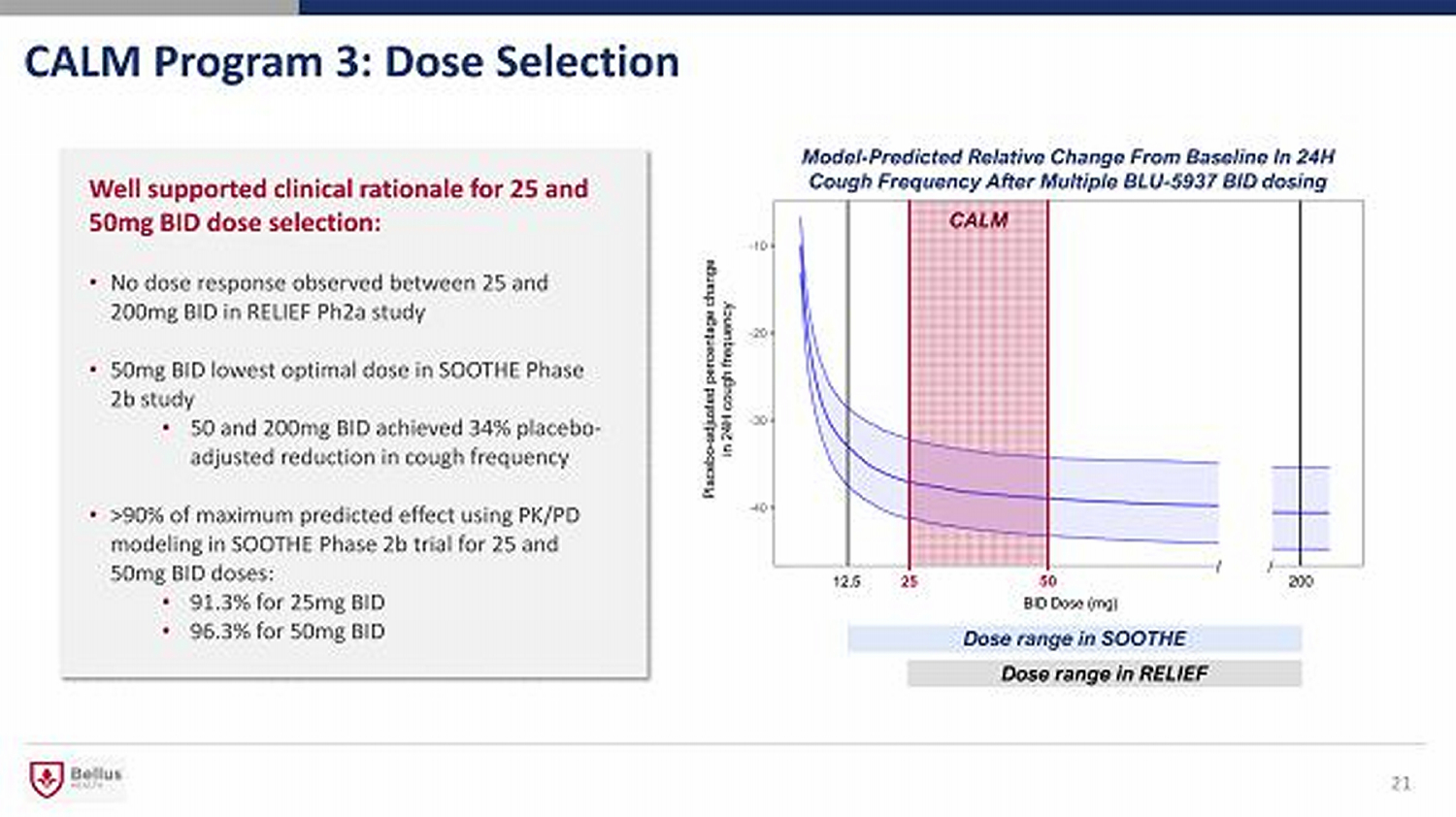

CALM Program 3: Dose Selection Well supported clinical rationale for 25 and 50mg BID dose selection: • No dose response observed between 25 and 200mg BID in RELIEF Ph2a study • 50mg BID lowest optimal dose in SOOTHE Phase 2b study • 50 and 200mg BID achieved 34% placebo - adjusted reduction in cough frequency • >90% of maximum predicted effect using PK/PD modeling in SOOTHE Phase 2b trial for 25 and 50mg BID doses: • 91.3% for 25mg BID • 96.3% for 50mg BID 21

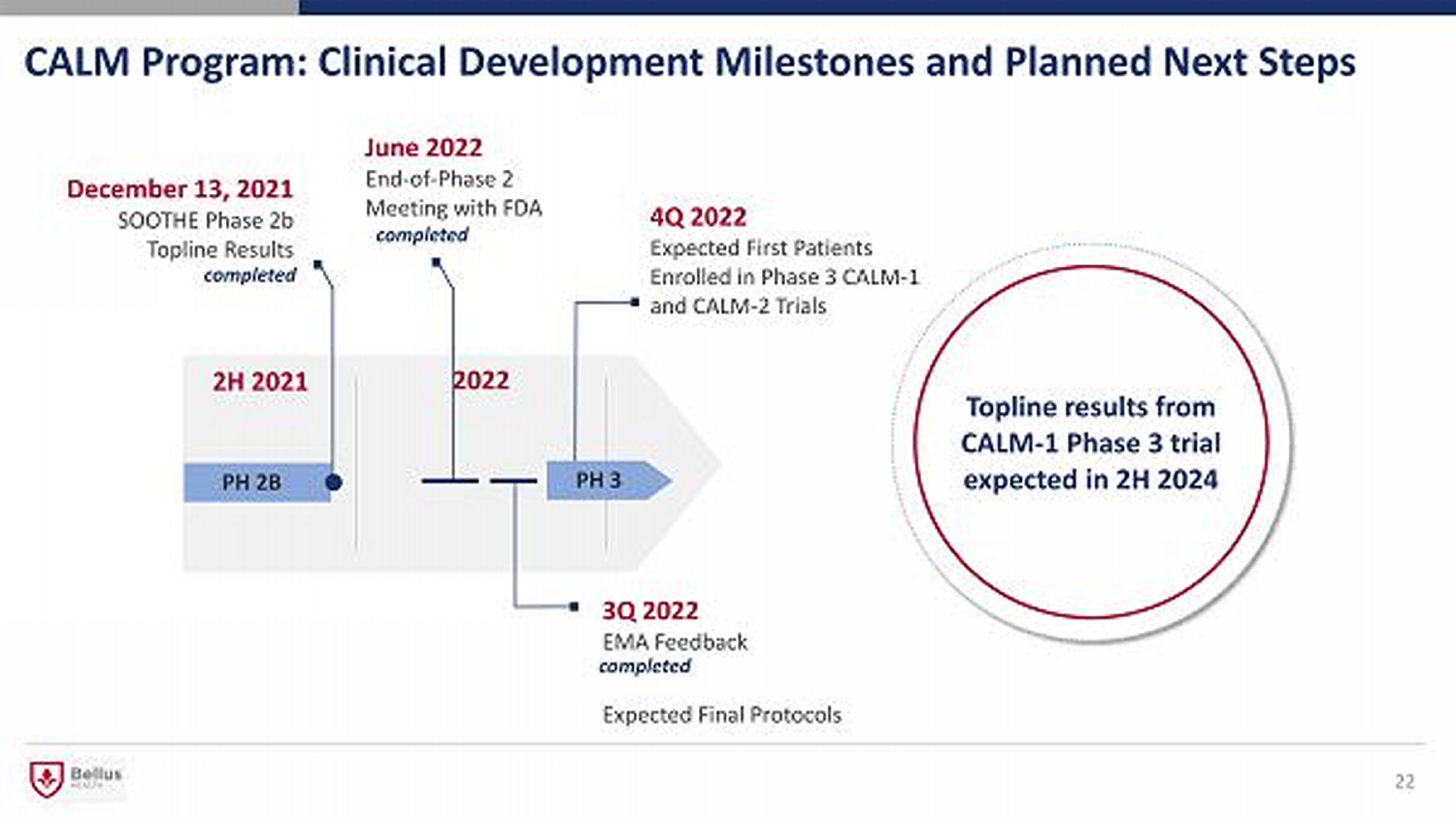

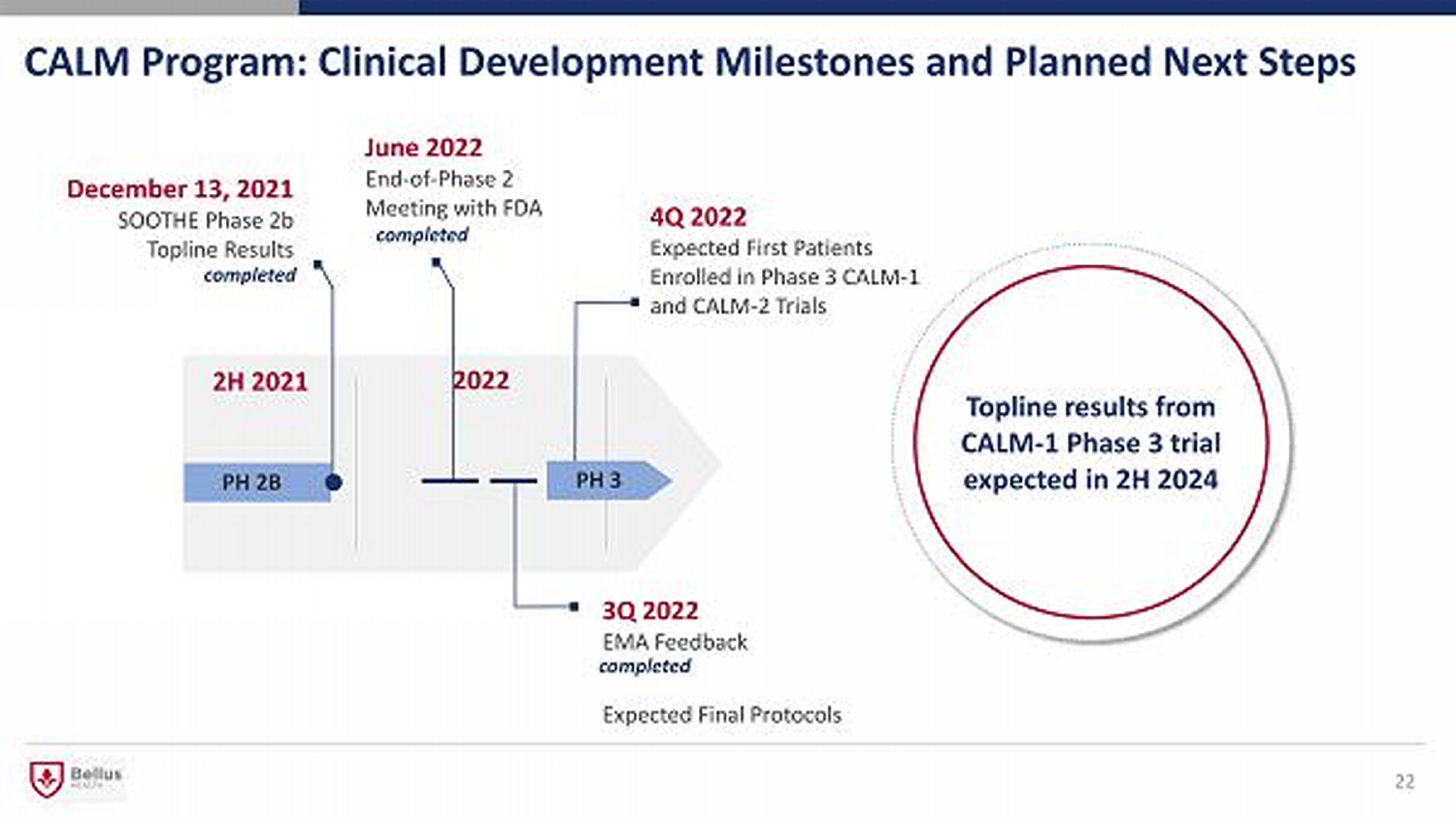

CALM Program: Clinical Development Milestones and Planned Next Steps 22 Topline results from CALM - 1 Phase 3 trial expected in 2H 2024 December 13 , 2021 SOOTHE Phase 2b Topline Results 2H 2021 2022 PH 2B June 2022 End - of - Phase 2 Meeting with FDA 4Q 2022 Expected First Patients Enrolled in Phase 3 CALM - 1 and CALM - 2 Trials 3Q 2022 EMA Feedback Expected Final Protocols PH 3 completed completed completed

Market and Competitive Landscape

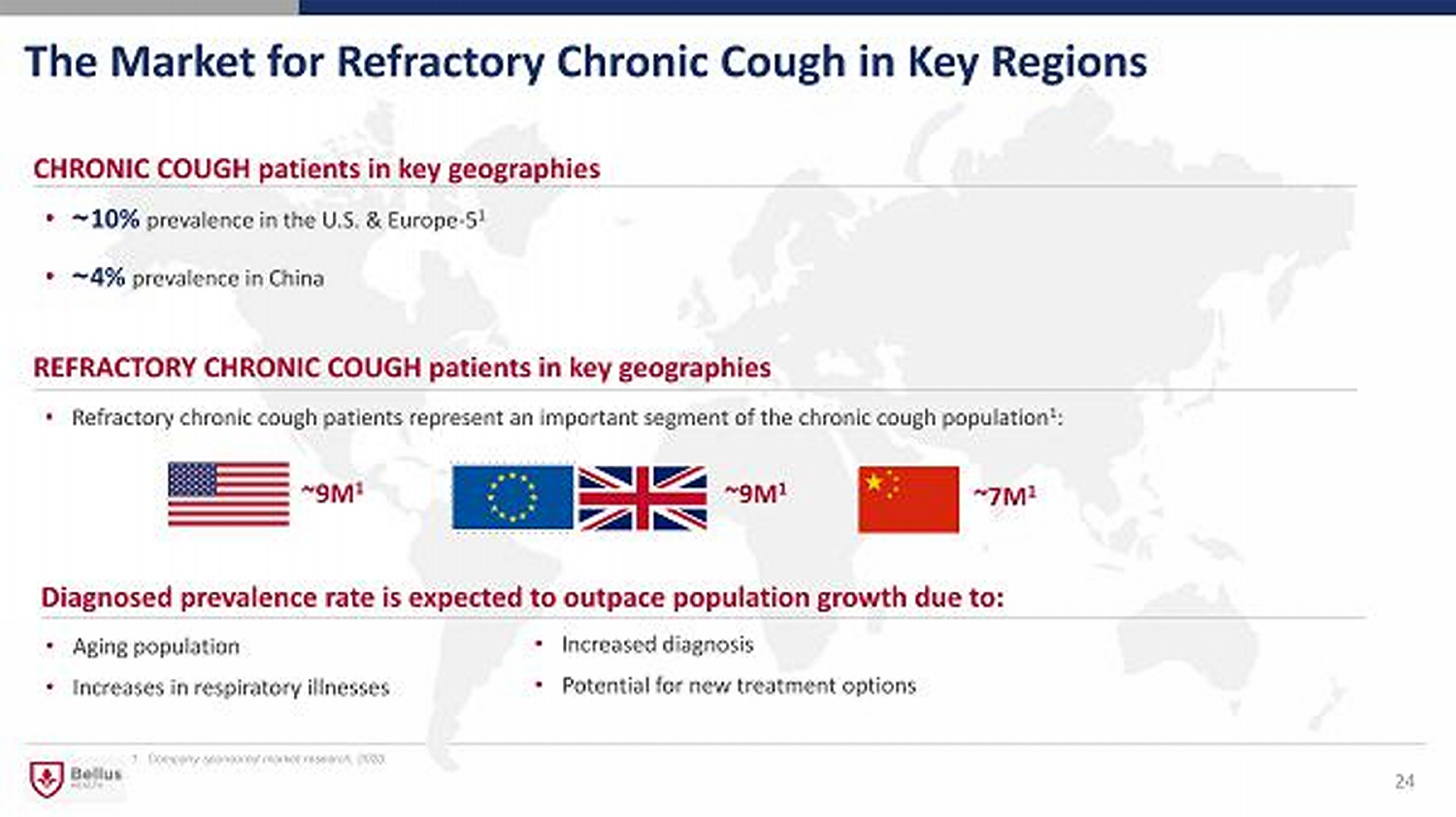

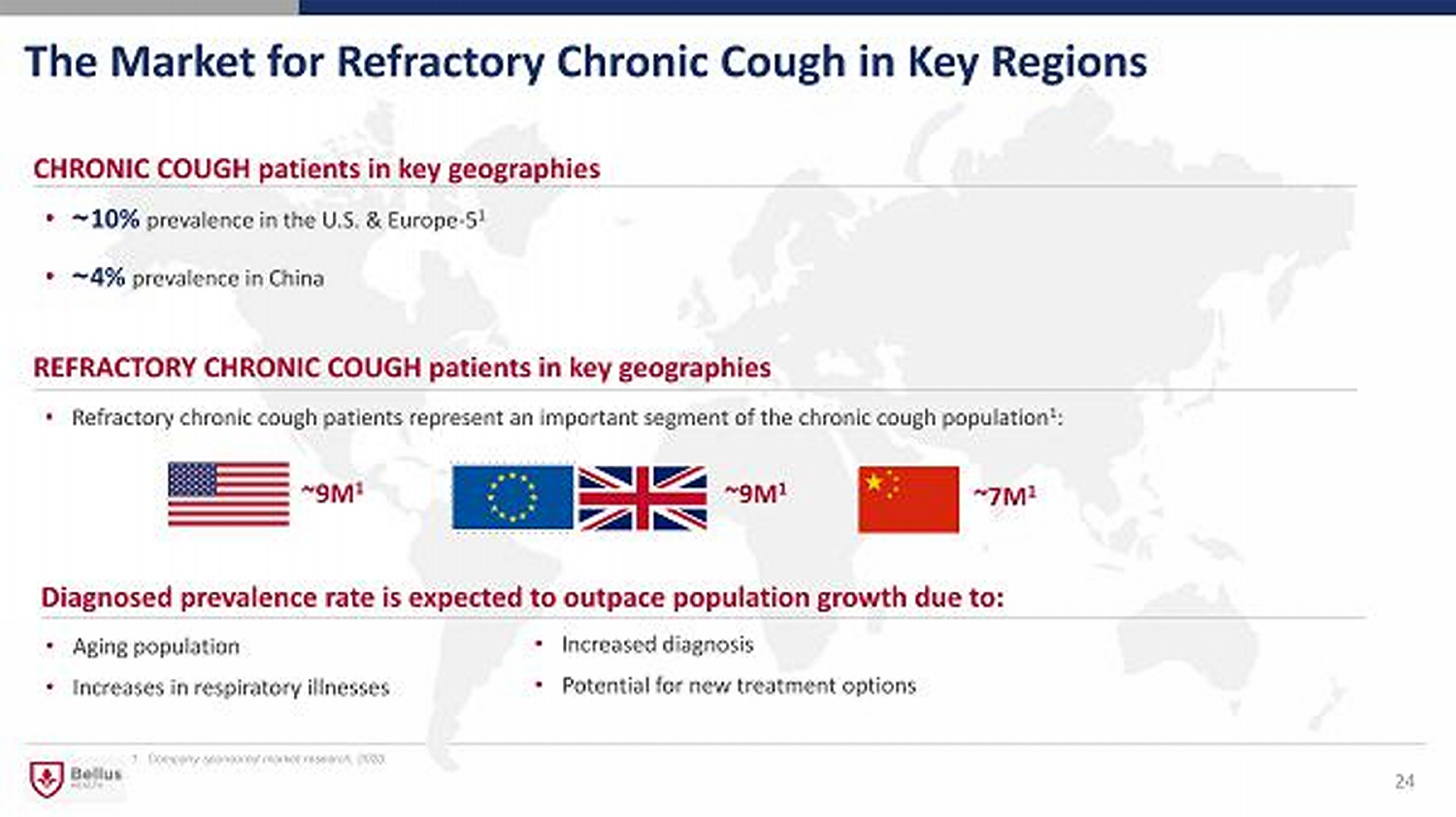

The Market for Refractory Chronic Cough in Key Regions 24 CHRONIC COUGH patients in key geographies • ~ 10% prevalence in the U.S. & Europe - 5 1 • ~ 4% prevalence in China • Refractory chronic cough patients represent an important segment of the chronic cough population 1 : REFRACTORY CHRONIC COUGH patients in key geographies ~9M 1 ~9M 1 • Aging population • Increases in respiratory illnesses Diagnosed prevalence rate is expected to outpace population growth due to: • Increased diagnosis • Potential for new treatment options 1. Company sponsored market research, 2020 ~7M 1

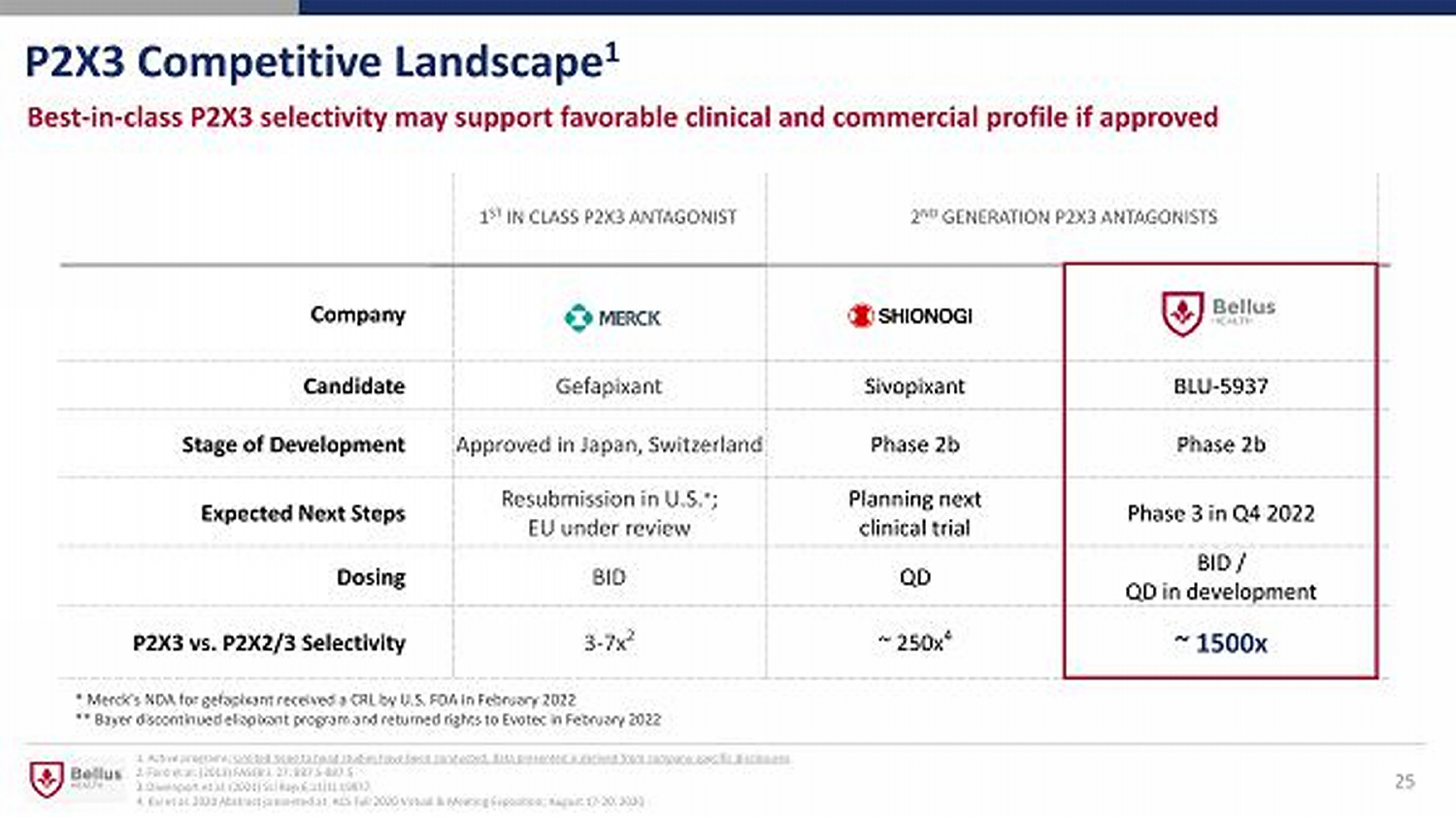

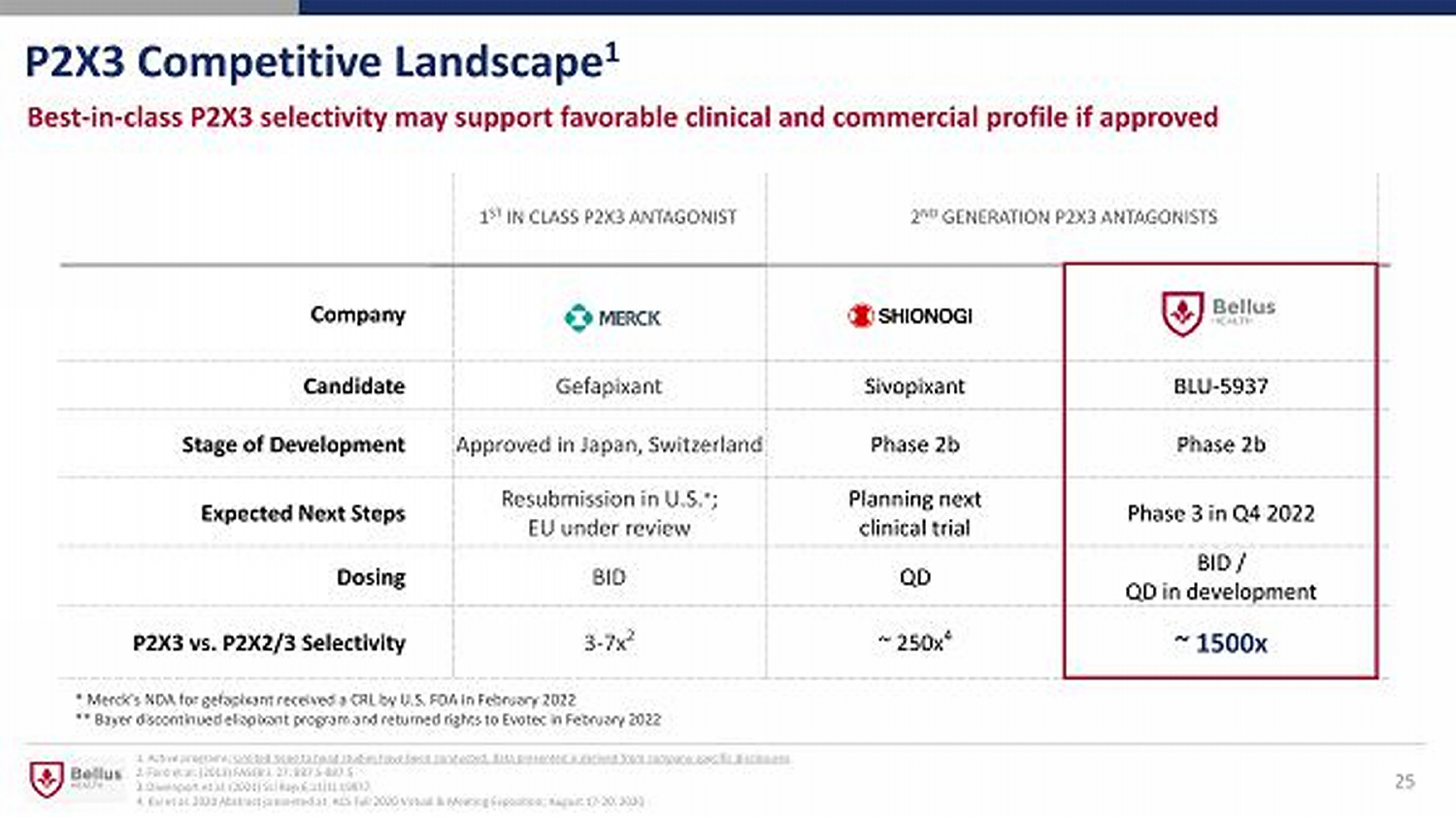

25 P2X3 Competitive Landscape 1 Company Candidate Gefapixant Sivopixant BLU - 5937 Stage of Development Approved in Japan, Switzerland Phase 2b Phase 2b Expected Next Steps Resubmission in U.S. * ; EU under review Planning next clinical trial Phase 3 in Q4 2022 Dosing BID QD BID / QD in development P2X3 vs. P2X2/3 Selectivity 3 - 7x 2 ~ 250x 4 ~ 1500x 1 ST IN CLASS P2X3 ANTAGONIST 2 ND GENERATION P2X3 ANTAGONISTS Best - in - class P2X3 selectivity may support favorable clinical and commercial profile if approved 1. Active programs; Limited head to head studies have been conducted; data presented is derived from company specific disclosures . 2. Ford et al. (2013) FASEB J. 27: 887.5 - 887.5 3. Davenport et al. (2021) Sci Rep 6;11(1):19877. 4. Kai et al. 2020 Abstract presented at: ACS Fall 2020 Virtual & Meeting Exposition; August 17 - 20, 2020 * Merck’s NDA for gefapixant received a CRL by U.S. FDA in February 2022 ** Bayer discontinued eliapixant program and returned rights to Evotec in February 2022

First - in - Class P2X3 Antagonist, Merck’s MK - 7264 ( gefapixant ) 26 18% & 15 % Cough 1 MK - 7264 58% & 69% Taste AEs 1 Placebo - adjusted reduction in 24H cough frequency (primary endpoint) of patients have taste alteration and/or taste loss Two Phase 3 Trials of gefapixant: COUGH - 1 (12 week duration) and COUGH - 2 (24 week duration) First generation P2X3 antagonist with low selectivity vs P2X2/3 Reduces cough but with Taste Side Effects Approved in Japan, Switzerland FDA requested additional efficacy information (CRL issued) in January 2022 1. McGarvey L. et al. (2020) Eur. Respir. J. 2020 56: 3800

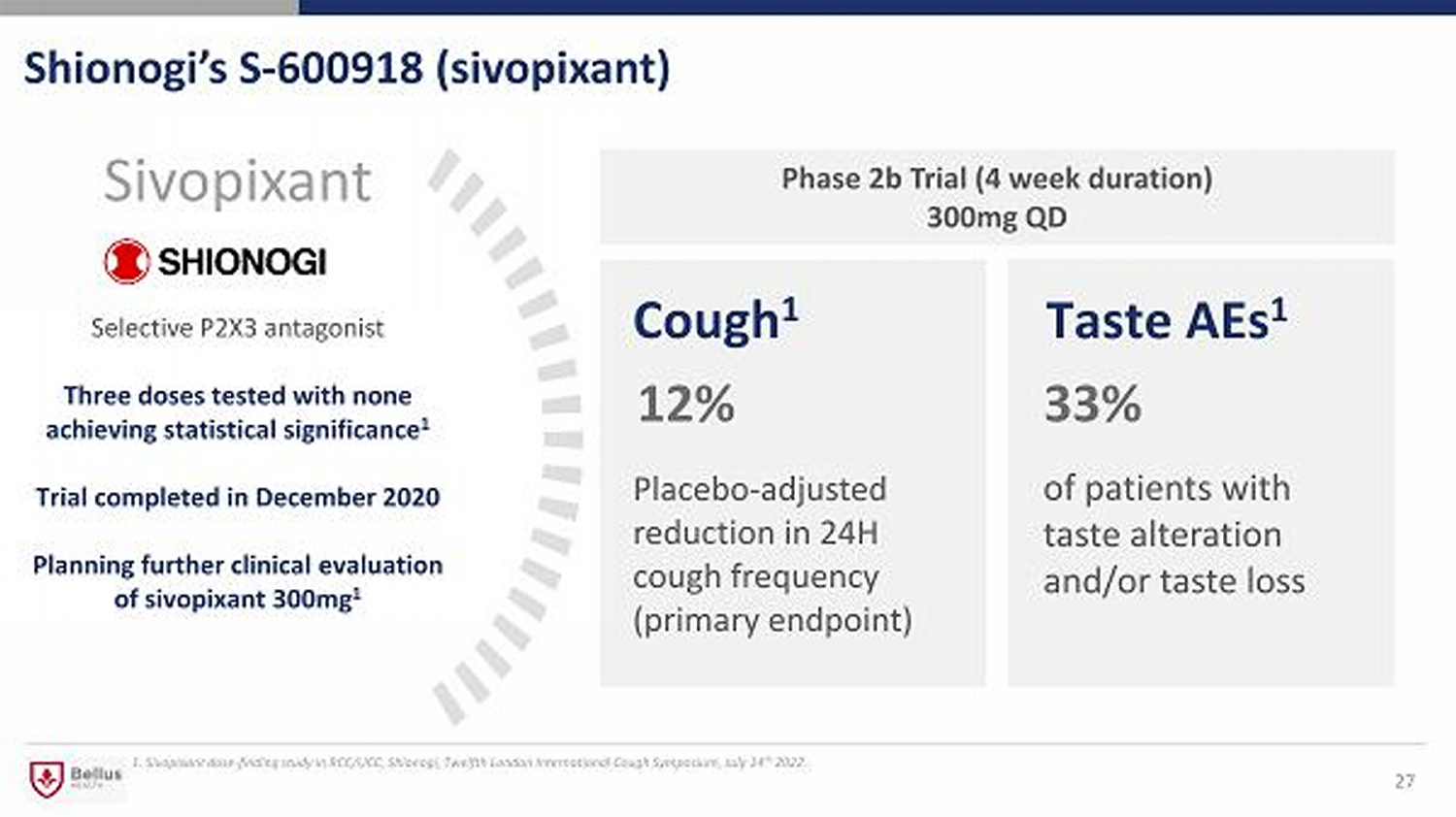

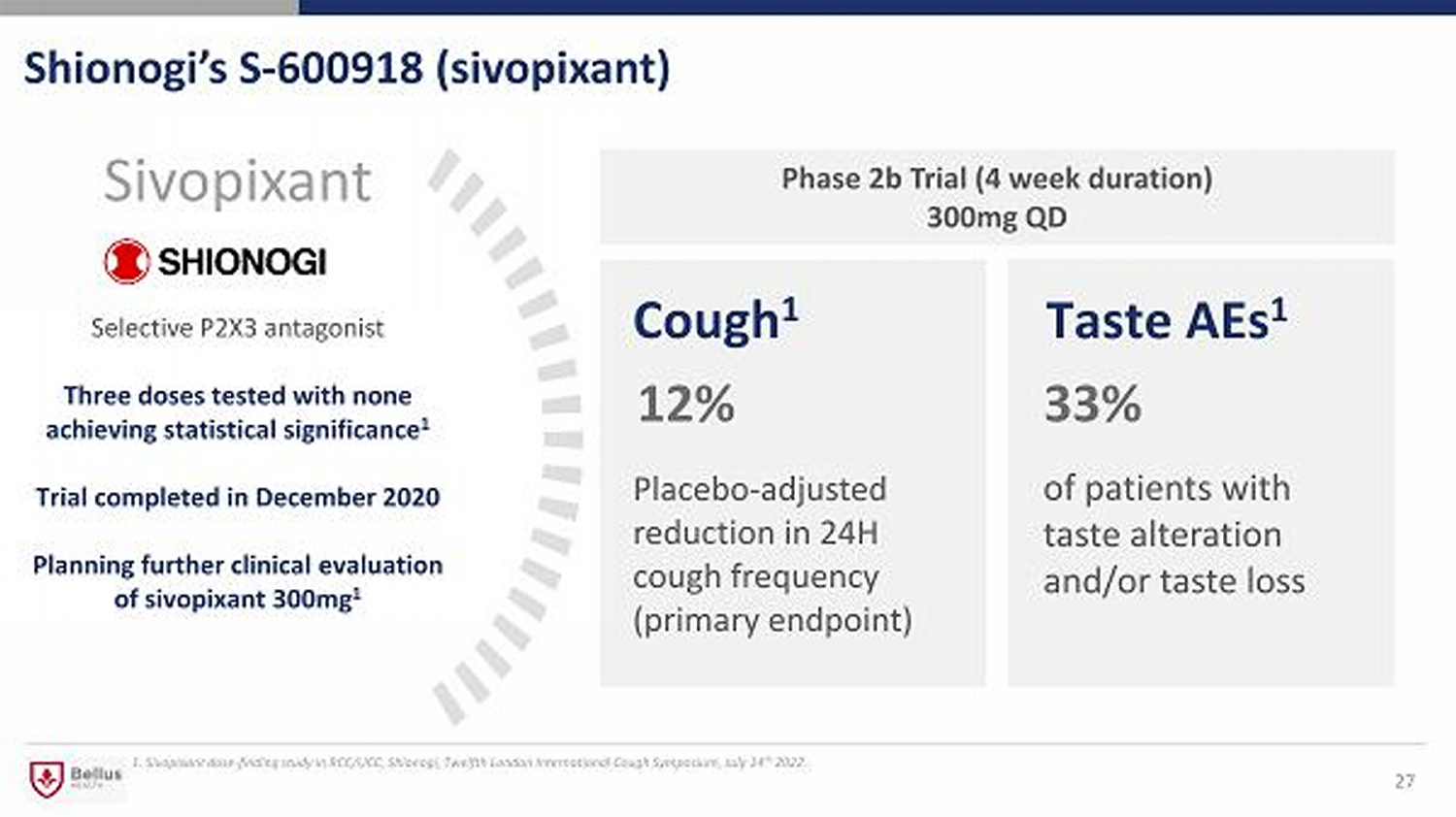

Shionogi’s S - 600918 (sivopixant) 27 12 % Cough 1 Sivopixant 33% Taste AEs 1 Placebo - adjusted reduction in 24H cough frequency (primary endpoint) of patients with taste alteration and/or taste loss Phase 2b Trial (4 week duration) 300mg QD Selective P2X3 antagonist Three doses tested with none achieving statistical significance 1 Trial completed in December 2020 Planning further clinical evaluation of sivopixant 300mg 1 1. Sivopixant dose - finding study in RCC/UCC, Shionogi, Twelfth London International Cough Symposium, July 14 th 2022.

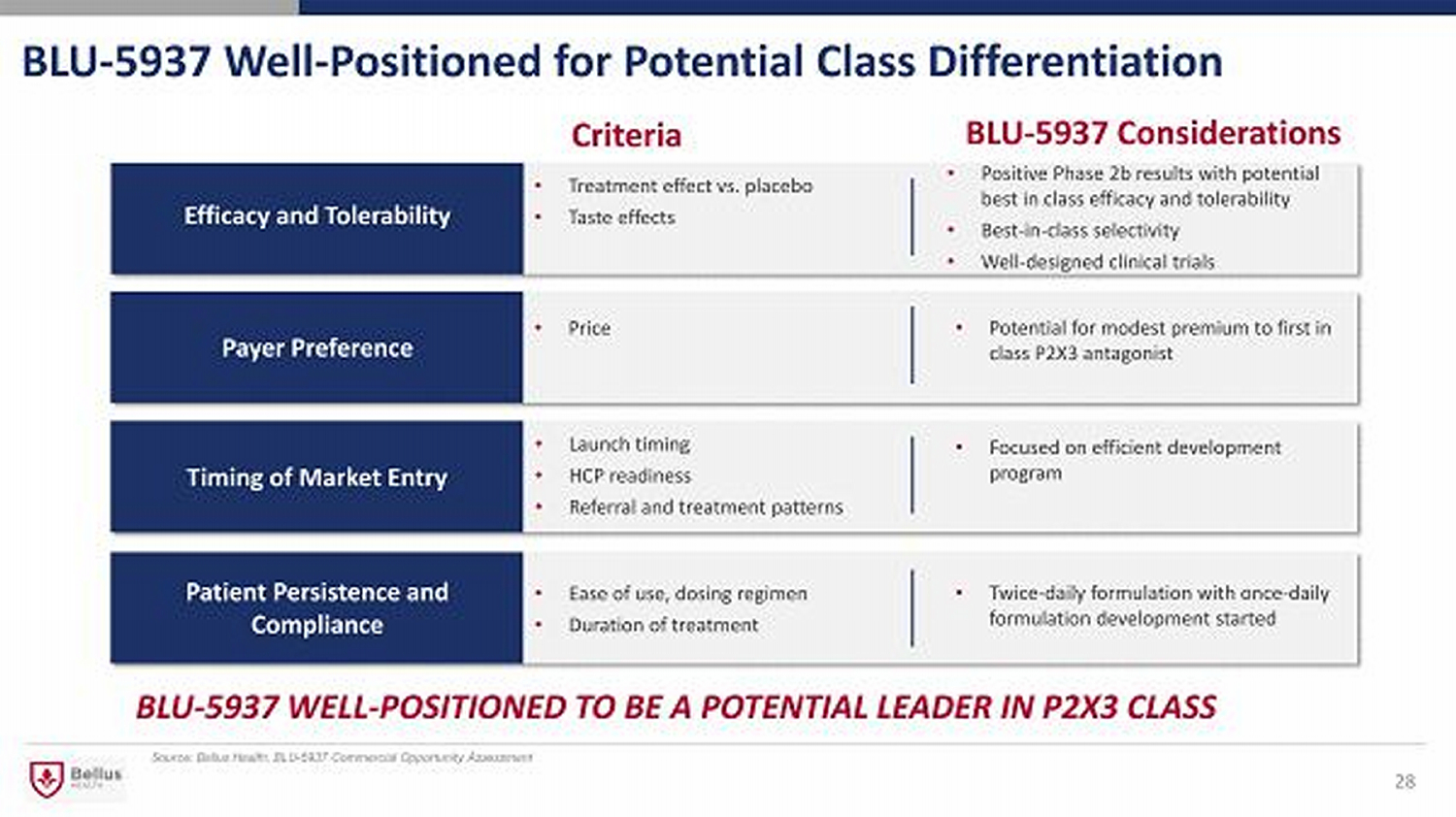

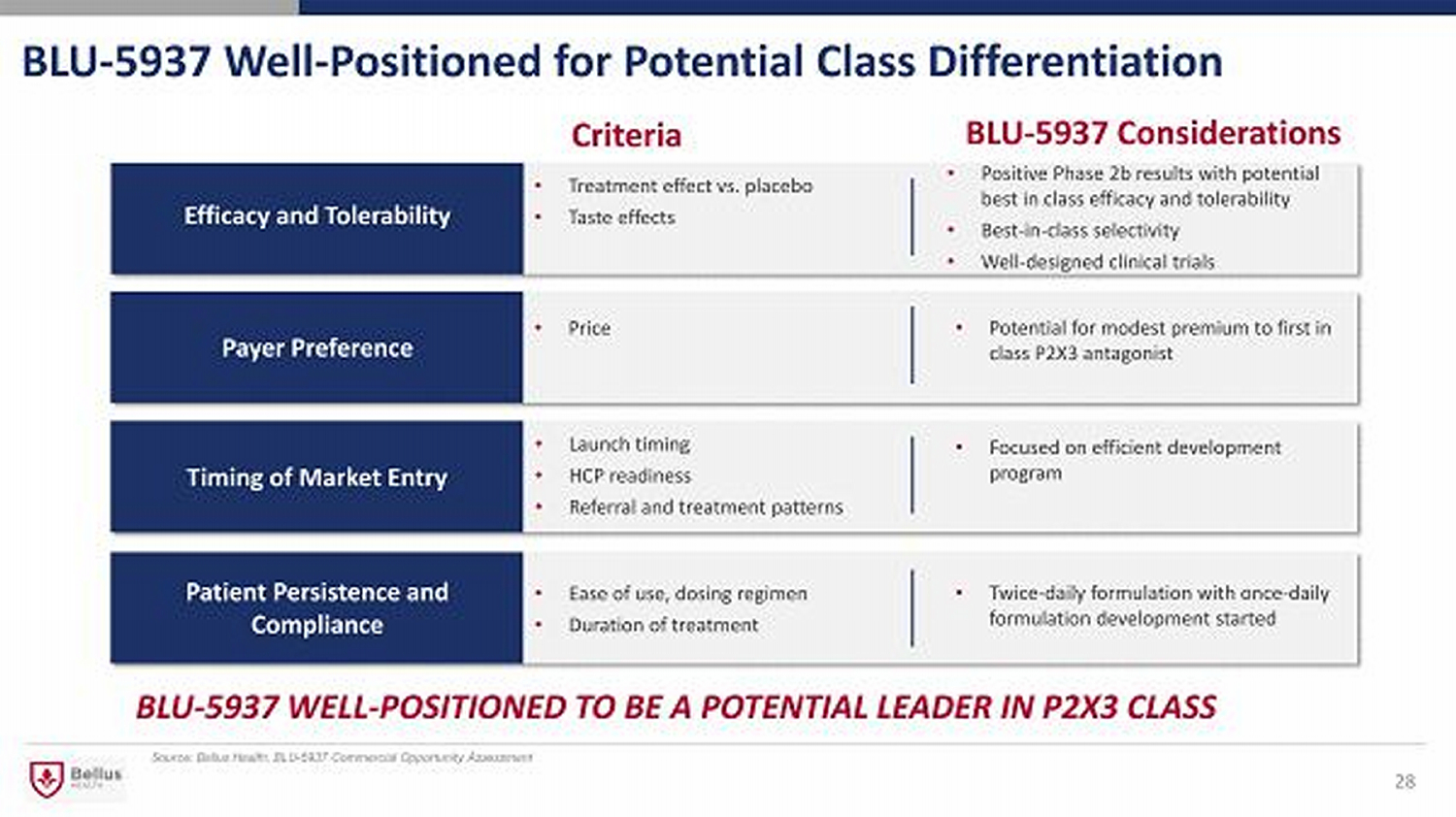

BLU - 5937 Well - Positioned for Potential Class Differentiation Source: Bellus Health, BLU - 5937 Commercial Opportunity Assessment Criteria • Treatment effect vs. placebo • Taste effects • Positive Phase 2b results with potential best in class efficacy and tolerability • Best - in - class selectivity • Well - designed clinical trials BLU - 5937 Considerations BLU - 5937 WELL - POSITIONED TO BE A POTENTIAL LEADER IN P2X3 CLASS Efficacy and Tolerability Patient Persistence and Compliance Payer Preference Timing of Market Entry • Launch timing • HCP readiness • Referral and treatment patterns • Focused on efficient development program • Ease of use, dosing regimen • Duration of treatment • Twice - daily formulation with once - daily formulation development started • Price • Potential for modest premium to first in class P2X3 antagonist 28

U.S. Commercialization Strategy

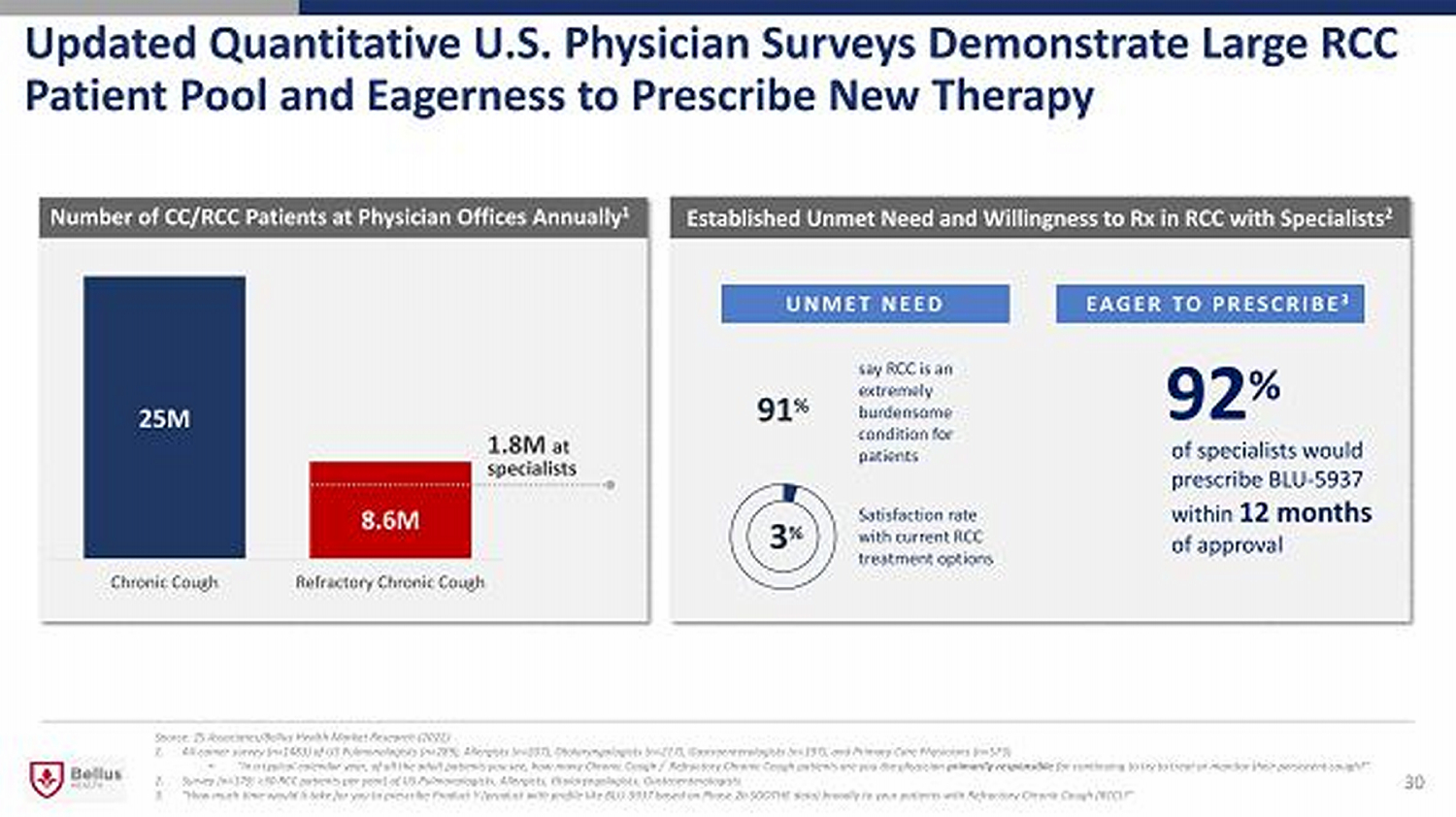

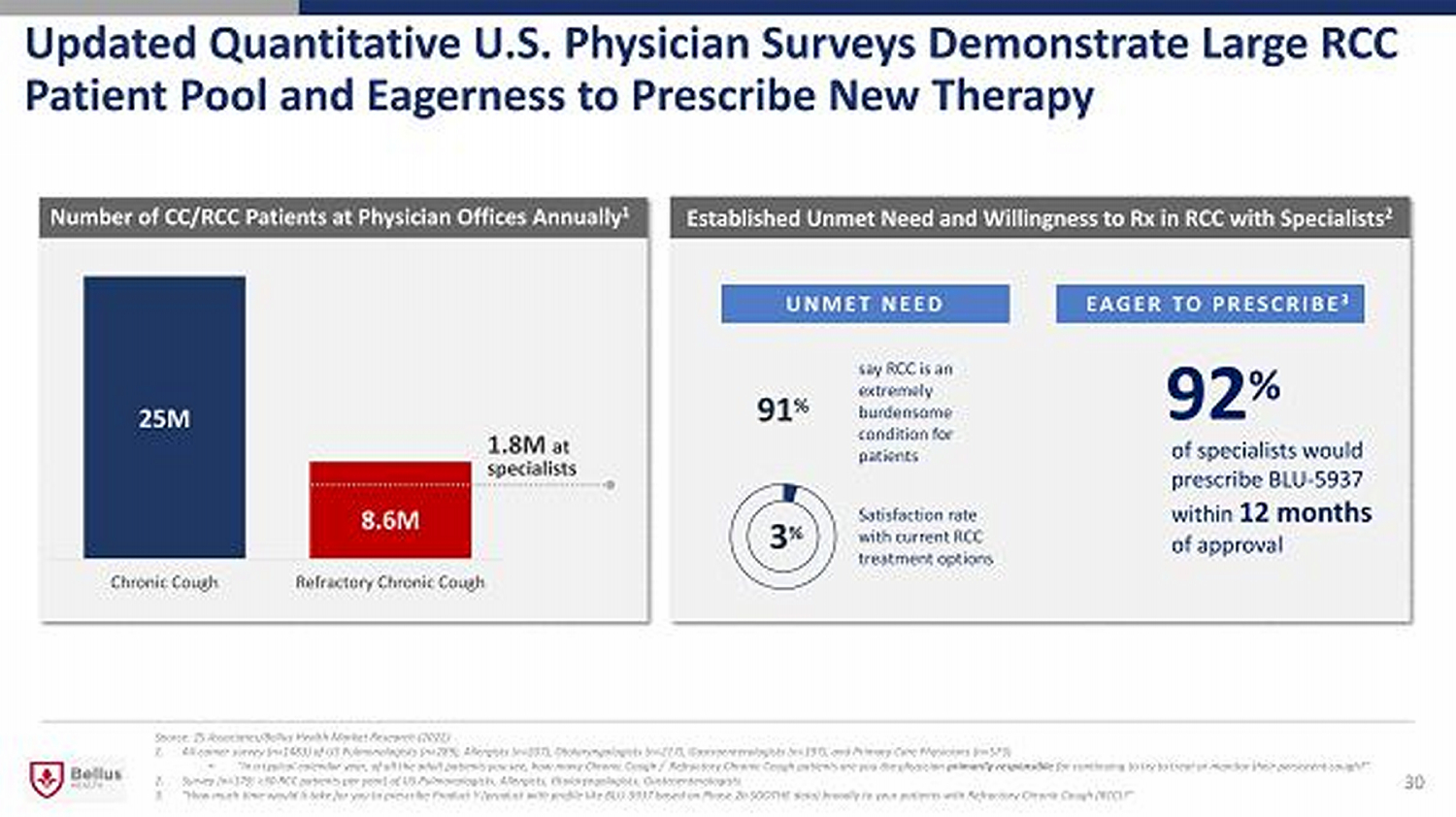

91 % 30 25 M 8.6 M Chronic Cough Refractory Chronic Cough Established Unmet Need and Willingness to Rx in RCC with Specialists 2 Source: ZS Associates/Bellus Health Market Research (2022) 1. All - comer survey (n=1483) of US Pulmonologists (n= 289) , Allergists (n= 207) , Otolaryngologists (n= 217) , Gastroenterologists (n= 197) , and Primary Care Physicians (n= 573) • “In a typical calendar year, of all the adult patients you see, how many Chronic Cough / Refractory Chronic Cough patients are you the physician primarily responsible for continuing to try to treat or monitor their persistent cough?” 2. Survey (n=179; >30 RCC patients per year) of US Pulmonologists, Allergists, Otolaryngologists, Gastroenterologists 3. “How much time would it take for you to prescribe Product Y (product with profile like BLU - 5937 based on Phase 2b SOOTHE data) b roadly to your patients with Refractory Chronic Cough (RCC)?” Number of CC/RCC Patients at Physician Offices Annually 1 EAGER TO PRESCRIBE 3 of specialists would prescribe BLU - 5937 within 12 months of approval say RCC is an extremely burdensome condition for patients 3 % Satisfaction rate with current RCC treatment options 1.8M at specialists 92 % UNMET NEED Updated Quantitative U.S. Physician Surveys Demonstrate Large RCC Patient Pool and Eagerness to Prescribe New Therapy

31 EXPECTED BY LAUNCH OF BLU - 5937 EXISTS NOW High Treatment Rate Medical Education Awareness & Guidelines Payer Track Record of Reimbursing Poor Quality - of - Life Conditions Prescription Patterns and Physician Experience with P2X3 Intent to Use P2X3 P2X3 Pricing and Access Established with Payers Payer Evidence New P2X3 Treatment High Dissatisfaction with Standard of Care Solid Foundation for U.S. P2X3 Market Success

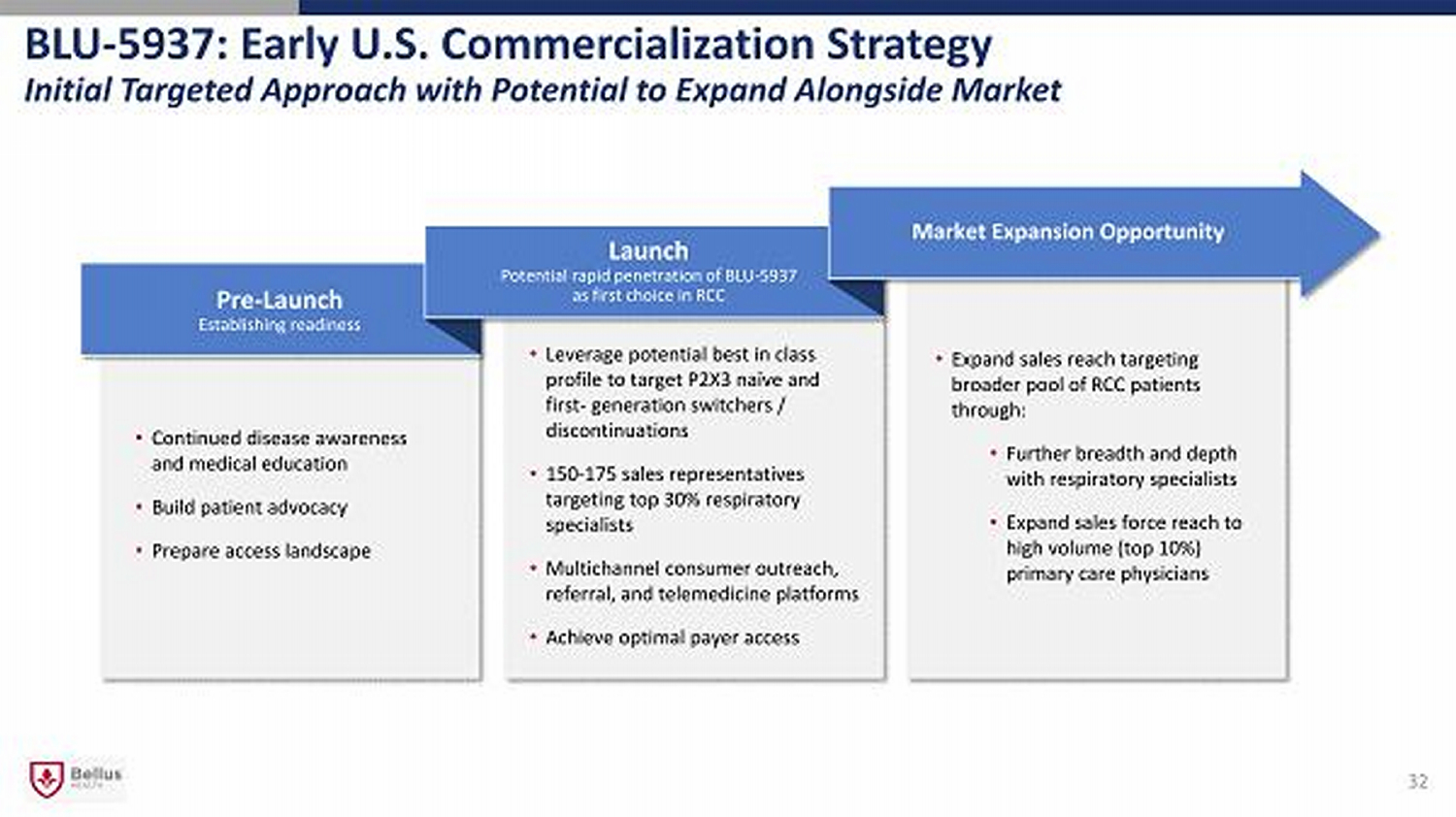

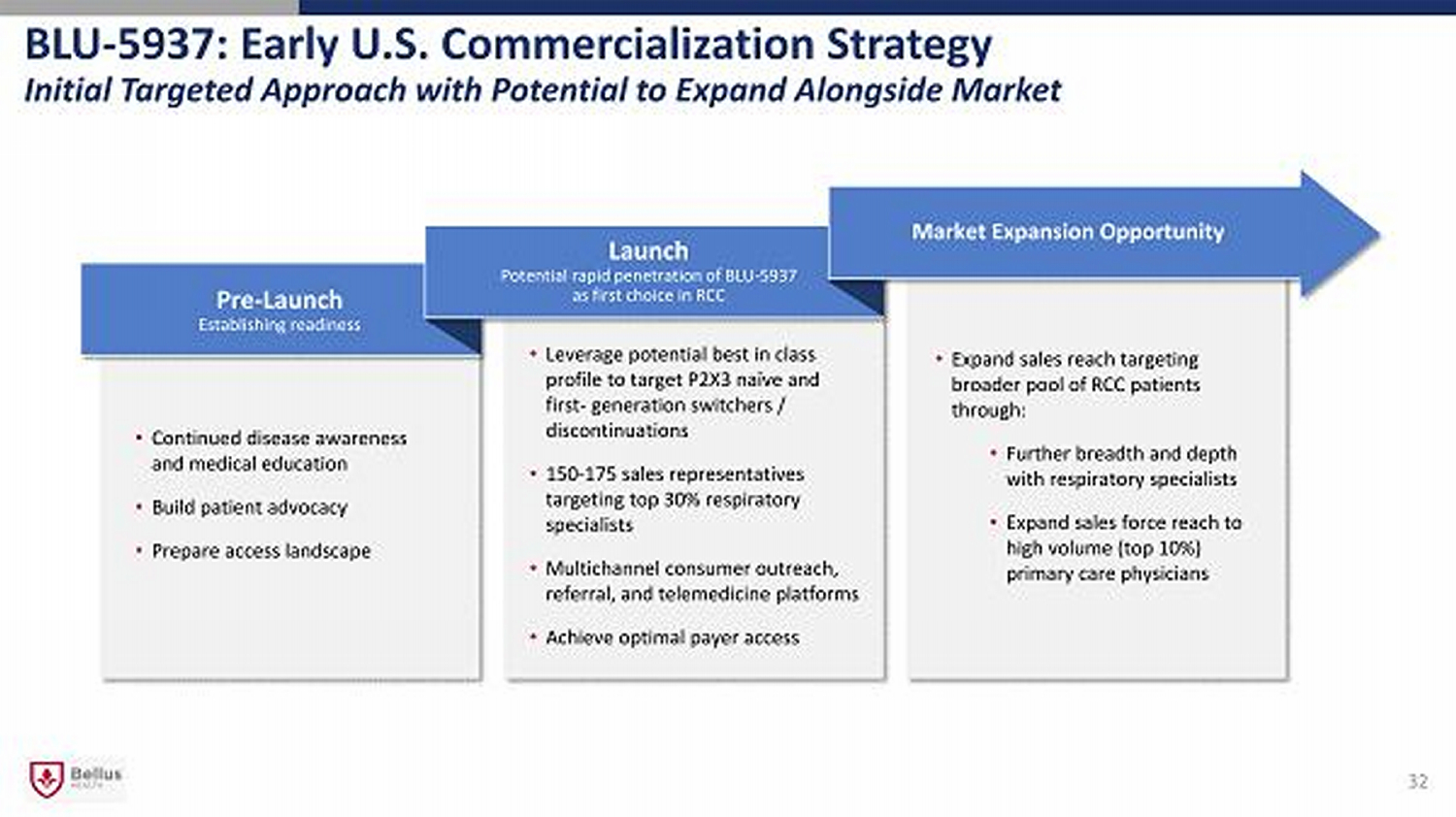

32 • Leverage potential best in class profile to target P2X3 naïve and first - generation switchers / discontinuations • 150 - 175 sales representatives targeting top 30% respiratory specialists • Multichannel consumer outreach, referral, and telemedicine platforms • Achieve optimal payer access • Continued disease awareness and medical education • Build patient advocacy • Prepare access landscape Pre - Launch Establishing r eadiness • Expand sales reach targeting broader pool of RCC patients through: • Further breadth and depth with respiratory specialists • Expand sales force reach to high volume (top 10%) primary care physicians Launch Potential rapid penetration of BLU - 5937 as first choice in RCC Market Expansion Opportunity BLU - 5937: Early U.S. Commercialization Strategy Initial Targeted Approach with Potential to Expand Alongside Market

BLU - 5937 Potential Additional Indications

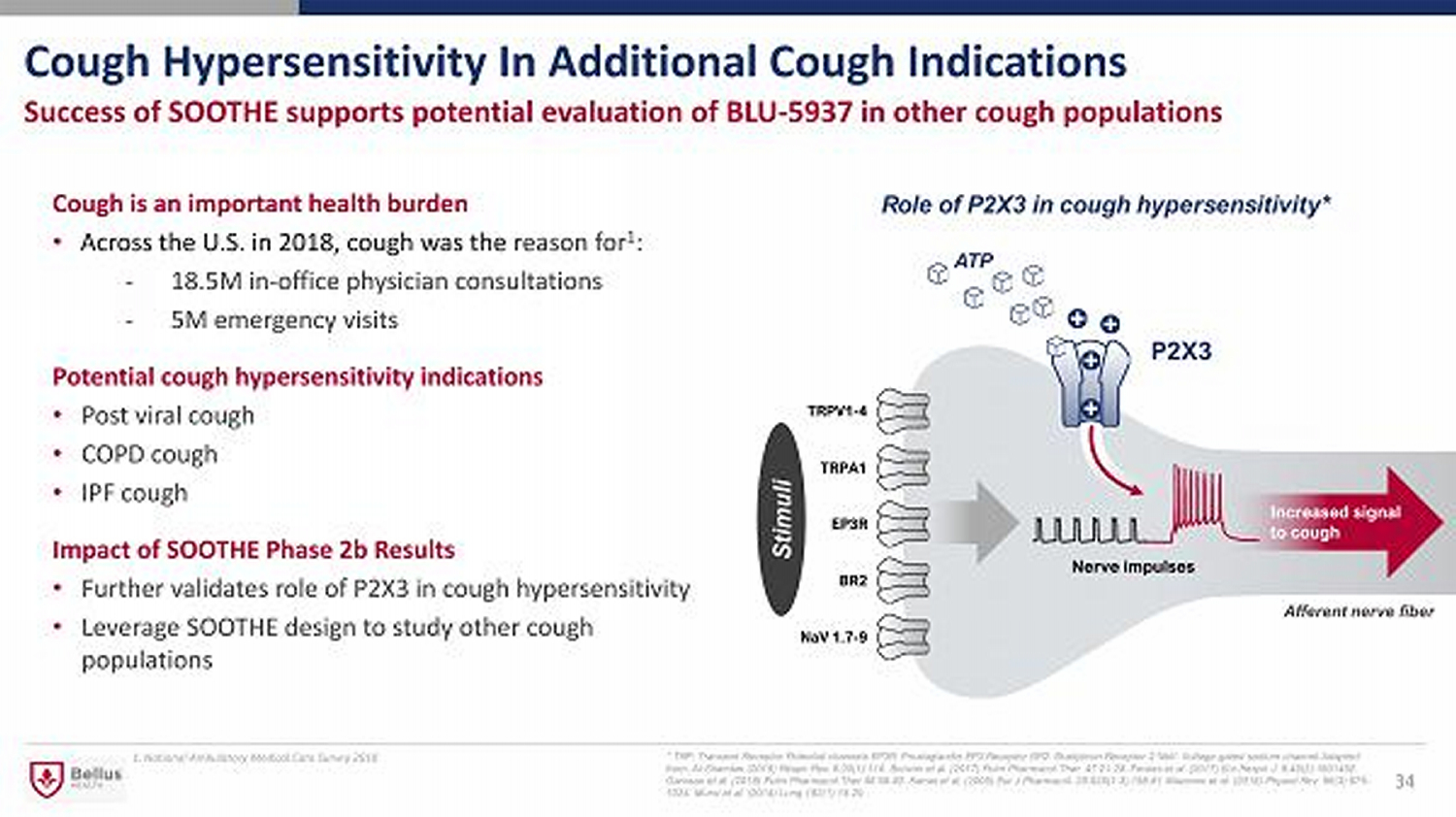

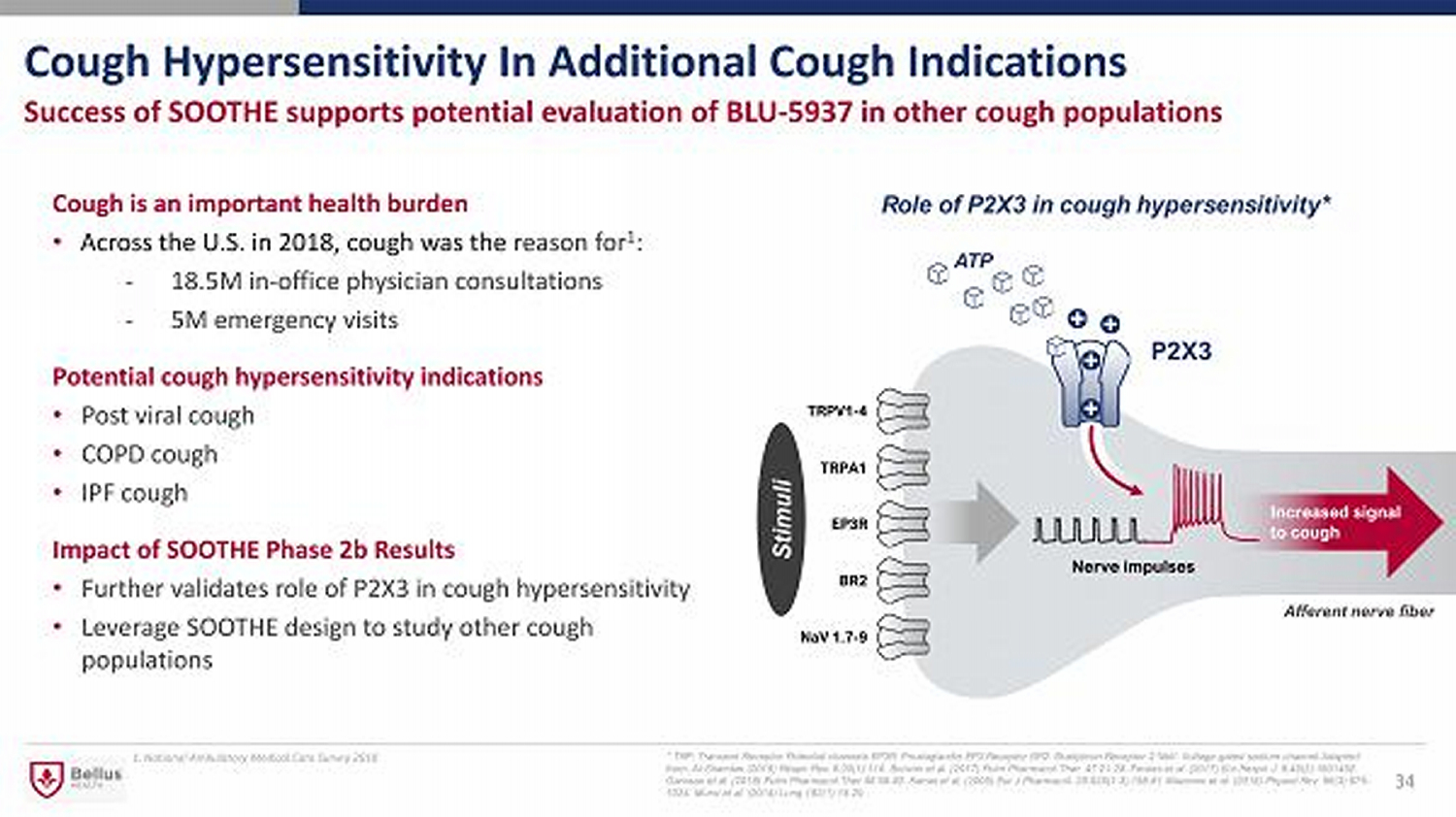

Cough Hypersensitivity In Additional Cough Indications 34 Success of SOOTHE supports potential evaluation of BLU - 5937 in other cough populations Cough is an important health burden • Across the U.S. in 2018, cough was the reason for 1 : - 18.5M in - office physician consultations - 5M emergency visits Potential cough hypersensitivity indications • Post viral cough • COPD cough • IPF cough Impact of SOOTHE Phase 2b Results • Further validates role of P2X3 in cough hypersensitivity • Leverage SOOTHE design to study other cough populations * TRP: Transient Receptor Potential channels EP3R: Prostaglandin EP3 Receptor BR2: Bradykinin Receptor 2 NaV: Voltage - gated sodi um channel Adapted from: Al - Shamlan (2019) Respir Res. 6;20(1):110. Bonvini et al. (2017) Pulm Pharmacol Ther. 47:21 - 28. Fowles et al. (2017) Eur Respir J. 8;49(2):1601452. Garceau et al. (2019) Pulm Pharmacol Ther 56:56 - 62 . Kamei et al. (2005) Eur J Pharmacol. 28;528(1 - 3):158 - 61 Mazzone et al. (2016) Physiol Rev. 96(3):975 - 1024 . Muroi et al. (2014) Lung 192(1):15 - 20. ATP Stimuli Afferent nerve fiber Role of P2X3 in cough hypersensitivity* 1. National Ambulatory Medical Care Survey 2018

IP and Corporate Summary

100% Owned Intellectual Property Portfolio 36 N N X N R 1 R 3 O N O R 9 R 2 R 4 R 6 R 5 R 8 R 7 • All intellectual property 100% owned by BELLUS with no future obligations owed • U.S. and international patent estate covering BLU - 5937 and related compounds • Composition of matter patent for BLU - 5937 and related P2X3 antagonists granted in the U.S., Europe, Japan, and China (expires in 2034 not including potential patent term extension) • Methods of Use patent for the treatment of cough granted in the U.S. (expires 2038) BLU - 5937 composition of matter patent expires in 2034

Stock and Financial Information 37 125.8M basic shares 136.8M fully diluted shares Capital Structure Cash, cash equivalent and short - term investments position of US$384.6M* Pro Forma Cash Position * Cash position as of June 30, 2022 plus approx. net proceeds from July 2022 raise

Expected Milestones Potential Catalysts & Upcoming Events 38 BLU - 5937 in Refractory C hronic C ough BLU - 5937 Platform FDA End - of - Phase 2 Meeting (June 2022) EMA Feedback (Q3 2022) Final Protocols (Q3 2022) CALM - 1 & CALM - 2 trial initiations (Q4 2022) Once - daily extended release formulation Phase 1 trial initiation (Q4 2022) x x Third Party P2X3 Programs Merck’s gefapixant approved in Japan & Switzerland (2022) Merck’s gefapixant FDA resubmission (1H 2023) Conferences ATS (May 15 - 18) ERS (Sept 4 - 6) x x ICS (July 13 - 14) CHEST (Oct 16 - 19) x x Expected Events

Investor Contact: Ramzi Benamar CFO investors@bellushealth.com