UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

ELDERWATCH, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and O-11.

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

ELDERWATCH, INC.

c/o David Lubin & Associates, PLLC

26 East Hawthorne Avenue

Valley Stream, New York 11580

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

A special meeting of the stockholders of Elderwatch, Inc. (“Elderwatch”) will be held on August 22, 2006, at 10:00 a.m., at the offices of David Lubin & Associates, PLLC, located at 26 East Hawthorne Avenue, Valley Stream, New York 11580, for the following purposes:

| 1. | To act on a proposal to change Elderwatch’s state of incorporation from Florida to Nevada by the merger of Elderwatch with and into its wholly-owned subsidiary, Energtek Inc., a Nevada corporation (“Energtek”). |

| 2. | To authorize a change in the name of Elderwatch to “Energtek Inc.” |

| 3. | To authorize an increase in authorized common stock from 50,000,000 shares, par value $0.001 per share, to 250,000,000 shares, par value $0.0001 per share. |

| 4. | To authorize a decrease in authorized preferred stock from 10,000,000 shares, par value $0.001 per share, to 5,000,000 shares, par value $0.0001 per share. |

| 5. | To elect one director of the Company to serve until the election and qualification of his successor; |

| 6. | To grant discretionary authority to our board of directors to implement a forward stock split of our common stock on the basis of up to five post-split shares for each one pre-split share to occur at some time within 12 months of the date of the special meeting, with the exact time of the forward split to be determined by the Board of Directors; |

| 7. | To transact such other business as may properly be brought before a special meeting of the stockholders of Elderwatch or any adjournment thereof. |

You may vote at the meeting if you were a shareholder at the close of business on July 28, 2006, the record date. Only shareholders of record at the record date are entitled to notice of and to vote at the meeting or any adjournments thereof. Shareholders are entitled to appraisal rights as to the proposal to change Elderwatch’s state of incorporation from Florida to Nevada. For more information on such appraisal rights, please see the section entitled “Appraisal Rights” in the Proxy Statement enclosed herein.

Your attention is called to the Proxy Statement on the following pages. Please review it carefully. We hope you will attend the meeting. If you do not plan to attend, please sign, date and mail the enclosed proxy in the enclosed envelope, which requires no postage if mailed in the United States, so that your shares can be voted at the Special Meeting in accordance with your instructions. For more instructions, please see the Questions and Answers beginning on page 1 of this proxy statement and the instructions on the proxy card.

By Order of the Board of Directors,

| | | | |

| /s/ Doron Uziel | | | |

| | | |

Doron Uziel President, Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer | | | |

July 28, 2006

STOCKHOLDERS WHO DO NOT EXPECT TO ATTEND THE SPECIAL MEETING IN PERSON ARE URGED TO DATE, SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENVELOPE PROVIDED WHICH REQUIRES NO POSTAGE.

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT

THIS PROXY MATERIAL AND THE SPECIAL MEETING

These questions do not, and are not intended to, address all the questions that may be important to you. You should carefully read the entire Proxy Statement, as well as the documents incorporated by reference in this Proxy Statement.

GENERAL

Solicitation of Proxies. This Proxy Statement and the accompanying proxy card are being mailed to holders of shares of common stock, $0.001 par value (the "Common Stock"), of Elderwatch, Inc., a Florida corporation ("Elderwatch"), commencing on or about July 28, 2006, in connection with the solicitation of proxies by the Board of Directors of Elderwatch (the "Board") for use at the special meeting of the stockholders of Elderwatch (the "Meeting") to be held at the offices of David Lubin & Associates, PLLC, located at 26 East Hawthorne Avenue, Valley Stream, New York 11580on August 22, 2006 at 10:00 A.M.

Vote Required for Approval. The holders of a majority of the shares of Common Stock issued and outstanding and entitled to vote at the Meeting, present in person or represented by proxy, will constitute a quorum at the Meeting. A majority of the shares of Common Stock outstanding and entitled to vote at the Meeting is required to approve each proposal.

Voting Your Proxy. Proxies in the form enclosed are solicited by the Board for use at the Meeting. Each such share is entitled to one vote on each matter submitted to a vote at the Meeting. All properly executed proxies received prior to or at the Meeting will be voted. If a proxy specifies how it is to be voted, it will be so voted. If no specification is made, it will be voted (1) for the change of Elderwatch’s state of incorporation from Florida to Nevada, (2) to authorize a change in the name of Elderwatch to “Energtek Inc.”, (3) to authorize an increase in authorized common stock from 50,000,000 shares, par value $0.001 per share, to 250,000,000 shares, par value $0.0001 per share, (4) to authorize a decrease in authorized preferred stock from 10,000,000 shares, par value $0.001 per share, to 5,000,000 shares, par value $0.0001 per share, (5) to elect one director of the Company to serve until the election and qualification of his successor, and (6) to grant discretionary authority to our board of directors to implement a forward stock split of our common stock on the basis of up to five post-split shares for each one pre-split share to occur at some time within 12 months of the date of the special meeting, with the exact time of the forward split to be determined by the Board of Directors. The proxy may be revoked by a properly executed writing of the stockholder delivered to Elderwatch’s President before the Meeting or by the stockholders at the Meeting before it is voted, by submitting a later-dated proxy or by attending the special meeting and voting your shares in person.

Record Date. The Board fixed the close of business on July 28, 2006 as the record date for determining the stockholders of Elderwatch entitled to notice of and to vote at the Meeting (the “Record Date”).

Outstanding Shares. On the record date, there were 7,837,500 shares of Common Stock outstanding and entitled to vote.

Cost of Solicitation. We will bear the costs of soliciting proxies. In addition to the use of the mails, certain directors or officers of our company may solicit proxies by telephone, facsimile or personal contact. Upon request, we will reimburse brokers, dealers, banks and trustees, or their nominees, for reasonable expenses incurred by them in forwarding proxy material to beneficial owners of shares of Common Stock.

Appraisal Rights. Stockholders are entitled to appraisal rights as to the proposal to change Elderwatch’s state of incorporation from Florida to Nevada.

PROPOSAL NO. 1

APPROVAL OF REINCORPORATION OF THE COMPANY

IN NEVADA

QUESTIONS AND ANSWERS

The following questions and answers are intended to respond to frequently asked questions concerning the reincorporation of Elderwatch in Nevada (“Reincorporation”). These questions do not, and are not intended to, address all the questions that may be important to you. You should carefully read the entire Proxy Statement, as well as its appendices and the documents incorporated by reference in this Proxy Statement.

Q: Why is Elderwatch reincorporating in Nevada?

A: We believe that the Reincorporation in Nevada will give us more flexibility and simplicity in various corporate transactions. Nevada has adopted a General Corporation Law that includes by statute many concepts created by judicial rulings in other jurisdictions and provides additional rights in connection with the issuance and redemption of stock. Nevada has developed a flexible body of corporate law that is responsive to the needs of modern business. Nevada has taken affirmative steps to encourage corporations to establish themselves in the state of Nevada, including reduced filing fees and corporate taxes, expedited filing procedures and flexible policies. The Board believes that the advantages offered by the corporate laws of Nevada will make Elderwatch a more manageable corporation for accomplishing its business activities.

Q: What are the principal features of the Reincorporation?

A: The Reincorporation will be accomplished by a merger of Elderwatch with and into our wholly owned subsidiary, Energtek Inc. (“Energtek”). One new share of Energtek common stock will be issued for each share of our Common Stock held by our stockholders on the record date for the Reincorporation. The shares of Elderwatch will cease to trade on the Over-The-Counter Bulletin Board market. The shares of Energtek will begin trading in their place beginning on or about the effective date of the Reincorporation under a new CUSIP number and a new trading symbol which has not yet been assigned.

Q: How will the Reincorporation affect my ownership of Elderwatch?

A: After the effective date of the Reincorporation and the exchange of your stock certificates, you will own the same number of shares and the same class as you held immediately before the Reincorporation.

Q: How will the Reincorporation affect the owners, officers, directors and employees of Elderwatch?

A: Our Board currently consists of one director, Doron Uziel. The Board of Energtek currently consists of two directors, Doron Uziel and Joseph Shefet. If the Reincorporation is approved by the shareholders, the members of the Board of Energtek will become the members of the Board of Elderwatch. Since the election of Mr. Shefet is a separate action distinct from the vote on the Reincorporation, the election of Mr. Shefet is presented as a separate proposal to be voted on at the Meeting. The vote for the Reincorporation is separate from the vote for the election of Mr. Shefet. If the Reincorporation is approved but the shareholders do not elect Mr. Shefet as director, then the Board of Elderwatch will not continue with the Reincorporation and Elderwatch will remain a Florida corporation.

Q: How will the Reincorporation affect the business of Elderwatch?

A: If the Reincorporation is approved by the shareholders, Elderwatch (Florida) will cease to exist on the effective date of the Reincorporation; following the merger, the assets and liabilities of Energtek will consist solely of the assets and liabilities of Elderwatch, and Energtek will be engaged in the business activities in which Elderwatch is currently engaged. Energtek has no assets or liabilities and no previous operating history - it has been formed for the sole purpose of changing the domicile of Elderwatch. If the Reincorporation is not approved, Elderwatch will continue its business as it is currently being conducted.

Q: How do I exchange certificates of Elderwatch for certificates of Energtek?

A: If the Reincorporation is approved by the stockholders, promptly after the effective date of the Reincorporation, you should receive a letter of transmittal and instructions for use in surrendering certificates representing your shares. Upon the surrender of each certificate formerly representing Common Stock, together with a properly completed letter of transmittal, such stock certificate shall be cancelled; upon such cancellation, each shareholder participating in the exchange will receive shares of Energtek common stock in exchange for their shares of common stock of Elderwatch. We will issue new share certificates representing the shares in Energtek. Until so surrendered and exchanged, each Elderwatch stock certificate shall represent solely the right to receive shares in Energtek. Energtek has no prior operating history, and, therefore, no prior trading market; however, we expect that the Energtek common shares will be able to trade on the OTCBB at or about the effective date of the Reincorporation.

Q: What happens if I do not surrender my certificates of Elderwatch?

A: You are not required to surrender certificates representing shares of Elderwatch to receive shares of Energtek. All shares of Elderwatch outstanding after the effective date of the Reincorporation continue to be valid. Until you receive shares of Energtek you are entitled to receive notice of or vote at stockholder meetings or receive dividends or other distributions on the shares of Elderwatch. However, if the Reincorporation is approved by the shareholders, the merger certificate will be filed and Elderwatch, the Florida corporation, will cease to exist. In such event, Elderwatch will cease to trade on the OTCBB and there will be no trading market for the Elderwatch stock certificates.

Even if you do not surrender your Elderwatch certificates, you still have appraisal rights if you do not vote for the Reincorporation provided you follow properly your appraisal rights as described below under “Appraisal Rights”.

Q: What if I have lost Elderwatch certificates?

A: If you have lost your Elderwatch certificates, you should contact our transfer agent as soon as possible to have a new certificate issued. You may be required to post a bond or other security to reimburse us for any damages or costs if the certificate is later delivered for conversion. Our transfer agent may be reached at:

Holladay Stock Transfer

2939 North 67th Place, Suite C

Scottsdale, AZ 85251

Attention: Tom Laucks

Telephone: (480) 481-3940

Facsimile: (480) 481-4941

Q: Can I require Elderwatch to purchase my stock?

A: Yes. Under the Florida Business Corporation Act, you are entitled to appraisal and purchase of your stock as a result of the Reincorporation if you dissent to the Reincorporation. For more information, please see below the section entitled “Appraisal Rights.”

Q: Who will pay the costs of Reincorporation?

A: Elderwatch will pay all of the costs of Reincorporation in Nevada, including distributing this Proxy Statement. We may also pay brokerage firms and other custodians for their reasonable expenses for forwarding information materials to the beneficial owners of our Common Stock. We do not anticipate contracting for other services in connection with the Reincorporation. Each stockholder must pay the costs of exchanging their certificates for new certificates.

Q: Will I have to pay taxes on the new certificates?

A: We believe that the Reincorporation is not a taxable event and that you will be entitled to the same basis in the shares of Energtek that you had in our Common Stock. No gain or loss will be recognized to the holders of capital stock of Elderwatch upon receipt of Energtek stock pursuant to the reincorporation, and no gain or loss will be recognized by the company. Elderwatch has not obtained a ruling from the Internal Revenue Service or an opinion of legal or tax counsel with respect to the consequences of the reincorporation.

EVERYONE'S TAX SITUATION IS DIFFERENT AND YOU SHOULD CONSULT WITH YOUR PERSONAL TAX ADVISOR REGARDING THE TAX EFFECT OF THE REINCORPORATION.

Q: What effect does the Reincorporation have on the price volatility and liquidity of the shares of Elderwatch?

A: We cannot predict what effect the Reincorporation will have on our market price prevailing from time to time or the liquidity of our shares.

Q: What happens if the shareholders vote for the Reincorporation but do not vote to approve the proposed changes to the Articles and Bylaws of Elderwatch?

A: If the shareholders vote for the merger but do not vote to approve the change in the name of the company, the increase in the authorized share capital, the decrease in the authorization of the preferred shares or any of the other proposed changes to the Articles, then Elderwatch will not continue with the merger and will remain a Florida corporation.

Q: What happens if the shareholders do not vote for the Reincorporation but approve the proposed changes to the Articles and Bylaws of Elderwatch?

A: If the shareholders do not vote to reincorporate the company in Nevada but desire to maintain the existence of the company in Florida, the Board will file the applicable amendments to the Articles of Elderwatch in Florida to approve the specific change(s) approved by the shareholders. For example, if the shareholders vote to change the name of Elderwatch to “Energtek Inc.”, then an amendment will be filed to the Articles of Elderwatch in Florida to change the name of the company to such name.

BACKGROUND

Elderwatch is a corporation formed under the laws of the state of Florida on November 18, 1998. Elderwatch is in the development stage and has no revenues or business operations.

As further discussed below, until May 24, 2006, we sought to establish a monitoring and visitation service for elderly citizens, and we concentrated our efforts on market research and development of business strategy. On May 24, 2006, we underwent a change in control. Allan Weiss, who was our principal shareholder and our President and Chief Executive Officer, entered into a Purchase and Sale Agreement which provided, among other things, for the sale of 4,537,500 shares of common stock of Elderwatch to twenty three buyers listed in such Purchase and Sale Agreement. The shares sold by Mr. Weiss represented an aggregate of 58% of the issued and outstanding share capital of our Company on a fully-diluted basis.

History of our Business

From our inception on November 18, 1998 and until May 24, 2006, our business objectives were to establish a regular monitoring and visitation service for elderly citizens whether they are living alone, in assisted living facilities or complete-care nursing homes. This service would have been obtained by the elderly themselves or by members of the family that are geographically removed from their family members. Our purpose was to observe and report on the general conditions of the facility and the resident or patient.

We intended to offer regular visits to the elderly in whatever facility in which the elderly are housed, ensuring that they are receiving proper care and attention. These visits could have been had weekly, bi-weekly or monthly with a full report (with a dated photograph available on demand) submitted after each visit to the concerned family. We believed that the implementation of our services will have resulted in the better treatment for our elderly clients, peace of mind for the family of our clients and financial savings for the clients as a result of our oversight.

We intended to provide the elderly regular visits, assist in problem solving and endeavor to protect our clients from being victimized. For elderly in assisted living facilities, we intended to provide a monitoring service that attempts to make certain that the patient/client gets properly dressed, takes medication(s) properly and as scheduled and meals properly provided. For elderly in nursing homes, we intended to provide a relatively inexpensive service that will check on the patient in the nursing home, making sure that they are kept clean, that their bedding is clean and changed regularly, that their hair is clean and presentable and that they have no complaints of mistreatment. Enhancing our mandate to observe and report, our visits are randomly scheduled, adding further chances to find sub-standard treatment, if present. The cost of the service was intended to make the service affordable for our clients. We intended to provide the elderly regular visits, primarily to “observe and report” and by reporting we will draw attention to any observed deficiencies, report on the patient’s general attitude and frame of mind For elderly in assisted living facilities, we intended to report on the accommodation and basic assistance, commenting on dress, whether or not they take their medication(s) and satisfaction on their meals. For elderly in nursing homes, we intended to provide an inexpensive service that will check on the patient in the nursing home, reporting patient cleanliness, condition of their bedding, that their hair is clean and presentable and that they have no complaints of mistreatment.

Our Current Business Activities

Since May 24, 2006, when we underwent a change in control, management decided to change the focus of the company to enter the field of clean energy technologies. We are currently looking at various alternatives in this field, but have no definitive agreements or arrangements in connection with this new strategy. As we begin to pursue such alternatives, we expect that significant developments and changes in our business will take place. We will disclose such developments and changes in our business from time to time, as they occur, by filing with the Securities and Exchange Commission a Current Report on Form 8-K. Such reports on Form 8-K will be made available on the website of the Securities and Exchange Commission, http://www.sec.gov. We advise our shareholders to review our filings with the Securities and Exchange Commission on its website from time to time in order to keep abreast of any significant developments or changes in our business.

Employees

Our sole director and officer is currently providing services to us on an as-needed basis.

Properties

We currently have no office or space, but are maintaining the current address of the company until we are in position to obtain our own office space.

Legal Proceedings

There are no pending legal proceedings to which Elderwatch is a party or in which any director, officer or affiliate of Elderwatch, any owner of record or beneficially of more than 5% of any class of voting securities of Elderwatch, or security holder is a party adverse to Elderwatch or has a material interest adverse to Elderwatch. Elderwatch’s property is not the subject of any pending legal proceedings.

Management’s Discussion and Analysis of Financial Condition and Results of Operation

Forward-Looking Statements

This Proxy Statement contains forward-looking information. Forward-looking information includes statements relating to future actions, future performance, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management, and other such matters of Elderwatch. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking information to encourage companies to provide prospective information about themselves without fear of litigation so long as that information is identified as forward-looking and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in the information. Forward-looking information may be included in Proxy Statement or may be incorporated by reference from other documents filed with the Securities and Exchange Commission by Elderwatch. You can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Proxy Statement or in documents incorporated by reference in this Proxy Statement. Except as may be otherwise required under applicable federal sercurities laws, Elderwatch undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

Elderwatch has based the forward-looking statements relating to Elderwatch’s operations on management’s current expectations, estimates and projections about Elderwatch and the industry in which it intends to operate. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, Elderwatch’s actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to general economic and business conditions, the inability to raise sufficient funding, commence research and development, inadequate results of the research and development project, lack of marketability, operating costs, advertising and promotional efforts, the existence or absence of adverse publicity, changes in business strategy or development plans, the ability to retain management, availability, terms and deployment of capital; business abilities and judgment of personnel, availability of qualified personnel, changes in, or failure to comply with various government regulations and slower than anticipated completion of research and development project. Actual results may also differ as a result of factors over which we have no control, including general economic and business conditions; effects of war or terrorists acts on the capital markets or Elderwatch's activities.

Plan of Operation

As of July 17, 2006, Elderwatch had no business operations, revenues, or assets. Over the next twelve months, Elderwatch intends to engage in the field of clean energy technologies. To such end, Elderwatch intends to analyze a series of projects and investments proposed to it in areas related to clean energy technologies. Elderwatch anticipates entering into agreements with experts and consultants in the relevant areas, in order to perform evaluations of the proposals. Elderwatch anticipates that the said evaluation process may include in some cases the performance of evaluation experiments which may require entering into subcontracting agreements with laboratories and companies capable of performing the same. Elderwatch expects that once a proposal/project is identified as being of interest to Elderwatch, Elderwatch will enter into development activities and/or will purchase a stake in such activities and/or will invest in such activities.

Though at the present there are no specific plans, Elderwatch expects that the process will involve increased expenses, including material investments in equipment, shares of other entities, development, and so on. Elderwatch also expects a significant change in the size of its team, which is expected to increase significantly, whether as employees of Elderwatch or under agreements for provision of services.

Elderwatch intends to raise additional funds during the next twelve months in order to support its plans, primarily in the form of investment. Without the additional fundraising, Elderwatch will neither be able to carry on these plans nor will it be able to satisfy its immediate cash requirements. Elderwatch expects to need to raise at least $400,000 during the following six months in order to be able to start with the implementations of the plans, while further fund raisings will be required for the performance of the plans as expected. In order to raise such funds, we may have to issue debt or equity or enter into a strategic arrangement with a third party. There can be no assurance that additional capital will be available to us. We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources.

Off Balance Sheet Arrangements

Elderwatch does not have any off balance sheet arrangements.

REASONS FOR THE REINCORPORATION

We believe that Reincorporation in Nevada will give Elderwatch a greater measure of flexibility and simplicity in corporate governance than is available under Florida law. The State of Nevada is recognized for adopting comprehensive modern and flexible corporate laws which are periodically revised to respond to the changing legal and business needs of corporations. For this reason, many major corporations have initially incorporated in Nevada or have changed their corporate domiciles to Nevada in a manner similar to that proposed by Elderwatch. Consequently, the Nevada judiciary has become particularly familiar with corporate law matters and a substantial body of court decisions has developed construing Nevada Law. Nevada corporate law, accordingly, has been and is likely to continue to be, interpreted in many significant judicial decisions, a fact which may provide greater clarity and predictability with respect to Elderwatch’s corporate legal affairs. For these reasons, the Board believes that Elderwatch’s business and affairs can be conducted more advantageously if Elderwatch is able to operate under Nevada Law.

PRINCIPAL FEATURES OF THE REINCORPORATION

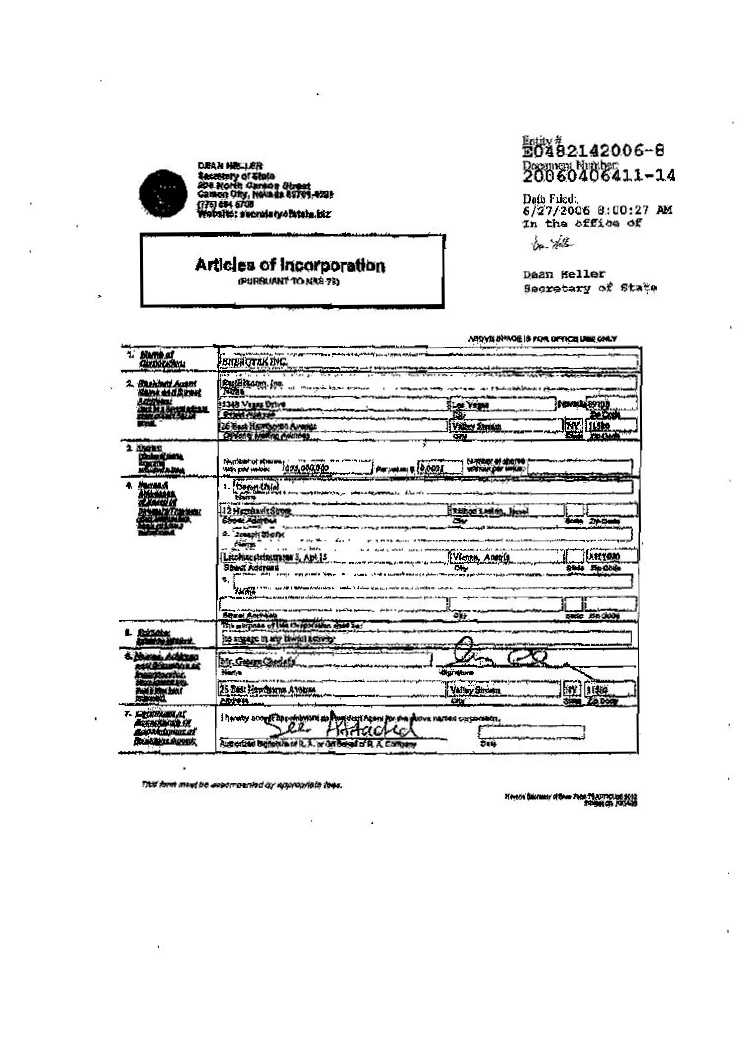

The Reincorporation will be effected by the merger of Elderwatch with and into Energtek pursuant to a Plan and Agreement of Merger (the “Plan of Merger”). Energtek is a wholly-owned subsidiary of Elderwatch, incorporated under the Nevada Revised Statutes (the "Nevada Law") for the sole purpose of effectuating the Reincorporation. Energtek has no operations and no assets or liabilities. If the Plan of Merger is approved, all the assets and liabilities of Elderwatch will become the assets and liabilities of Energtek. The Reincorporation will become effective upon the filing of the requisite merger documents in Nevada and Florida, which filings will occur upon approval of Elderwatch’s stockholders to the Reincorporation, or as soon as practicable thereafter (the “Effective Date”). This summary does not include all of the provisions of the Plan of Merger, a copy of which is attached hereto as Appendix A.

On the Effective Date of the Reincorporation, (i) any fractional shares of Energtek common stock that a holder of shares of Elderwatch Common Stock would otherwise be entitled to receive upon exchange of his Elderwatch Common Stock will be canceled with the holder thereof being entitled to receive one whole share of Energtek common stock, and (ii) each outstanding share of Elderwatch Common Stock held by Elderwatch shall be retired and canceled and shall resume the status of authorized and unissued Energtek common stock.

The Articles of Incorporation of Energtek are different from the Articles of Incorporation of Elderwatch. Accordingly, an affirmative vote for the Plan of Merger does not necessarily represent a vote for the adoption by the shareholders of the Articles of Energtek. Since the adoption of the Articles of Energtek are separate actions distinct from the vote on the Plan of Merger, each of these material differences between the Articles of Elderwatch from the Articles of Energtek are presented as separate proposals to be voted on at the Special Meeting. The vote for the Reincorporation is separate from the vote for the amendments to the Articles of Incorporation. Because of the material differences between the Articles of Incorporation of Elderwatch and the laws of the State of Florida which govern Elderwatch, and the Articles of Incorporation of Energtek and the laws of the State of Nevada which govern Energtek, your rights as stockholders will be affected by the Reincorporation. See the information under "Significant Changes in Elderwatch’s Charter" and “Comparative Rights of Stockholders under Florida and Nevada Law” for a summary of the differences between the Articles of Incorporation of Elderwatch and the laws of the State of Florida and the Articles of Incorporation of Energtek and the laws of the State of Nevada.

The new board of directors will consist of the persons presently serving on the board of directors of Energtek, which consist of Doron Uziel, who is currently the sole director of Elderwatch, and Joseph Shefet. The individual who will serve as executive officer of Energtek is Doron Uziel, who currently serves as executive officer of Elderwatch. Such persons and their terms of office are set forth below under the caption "Directors and Nominees for Election to Our Board of Directors.” Since the election of Mr. Shefet as a director of Elderwatch is a separate action distinct from the vote on the Reincorporation, the election of Mr. Shefet is presented as a separate proposal to be voted on at the Meeting. The vote for the Reincorporation is separate from the vote for the election of Mr. Shefet. If the Reincorporation is approved but the shareholders do not elect Mr. Shefet as director, then the Board of Elderwatch will not continue with the Reincorporation and Elderwatch will remain a Florida corporation.

Until further notice, Elderwatch’s mailing address will be at located c/o David Lubin & Associates, PLLC, 26 East Hawthorne Avenue, Valley Stream, New York 11580.

ABANDONMENT

Pursuant to the terms of the Plan of Merger, the merger may be abandoned by the boards of directors of Elderwatch and Energtek at any time prior to the Effective Date. In addition, the Board of Elderwatch may amend the Plan of Merger at any time prior to the Effective Date provided that any amendment made may not, without approval by the stockholders of Elderwatch, alter or change the amount or kind of Energtek common stock to be received in exchange for or on conversion of all or any of Elderwatch Common Stock, alter or change any term of the Articles of Incorporation of Energtek (the “Energtek Articles”) or alter or change any of the terms and conditions of the Plan of Merger if such alteration or change would adversely affect the holders of Elderwatch Common Stock. The Board has made no determination as to any circumstances which may prompt a decision to abandon the Reincorporation. Approval by stockholders of the Reincorporation will constitute approval of the Plan of Merger, but not necessarily the adoption of the Articles of Incorporation and the Bylaws of Energtek. Each of the differences between the Articles and Bylaws of Elderwatch and those of Energtek must be affirmatively adopted by the shareholders at the Special Meeting.

CORPORATE NAME

Immediately following the merger, Energtek will be the surviving corporation and its name will remain unchanged.

MATERIAL TAX CONSEQUENCES FOR STOCKHOLDERS

The following description of federal income tax consequences is based on the Internal Revenue Code of 1986, as amended (the "Code"), and applicable Treasury regulations promulgated thereunder. This summary does not address the tax treatment of special classes of stockholders, such as banks, insurance companies, tax-exempt entities and foreign persons. Stockholders desiring to know their individual federal, state, local and foreign tax consequences should consult their own tax advisors.

The Reincorporation is intended to qualify as a tax-free reorganization under Section 368(a)(1)(F) or 368(a)(1)(A) of the Code. Assuming such tax treatment, no taxable income, gain, or loss will be recognized by Elderwatch or the stockholders as a result of the exchange of shares of Elderwatch Common Stock for shares of Energtek common stock upon consummation of the transaction. The Reincorporation and change of each share of Elderwatch's Common Stock into one share of Energtek common stock will be a tax-free transaction, and the holding period and tax basis of Common Stock will be carried over to the Energtek common stock received in exchange therefor.

Because of the complexity of the capital gains and loss provisions of the Code and because of the uniqueness of each individual’s capital gain or loss situation, stockholders contemplating exercising statutory appraisal rights should consult their own tax advisor regarding the federal income tax consequences of exercising such rights. State, local or foreign income tax consequences to stockholders may vary from the federal income tax consequences described above. STOCKHOLDERS ARE URGED TO CONSULT THEIR OWN TAX ADVISOR AS TO THE CONSEQUENCES TO THEM OF THE REINCORPORATION UNDER ALL APPLICABLE TAX LAWS.

ACCOUNTING TREATMENT OF THE REINCORPORATION

For U.S. accounting purposes, the Reincorporation of our company from a Florida corporation to a Nevada corporation represents a transaction between entities under common control. Assets and liabilities transferred between entities under common control are accounted for at historical cost, in accordance with the guidance for transactions between entities under common control in Statement of Financial Accounting Standards No. 141, Business Combinations. The historical comparative figures of Elderwatch will be those of Energtek.

PRICE VOLATILITY

We cannot predict what effect the Reincorporation will have on our market price prevailing from time to time or the liquidity of our shares.

SIGNIFICANT CHANGES IN ELDERWATCH’S CHARTER TO BE IMPLEMENTED IF THE SHAREHOLDERS APPROVE THE CHANGES TO THE ARTICLES

Elderwatch was incorporated under the laws of the State of Florida and Energtek was incorporated under the laws of the State of Nevada. Upon the Reincorporation, the stockholders of Elderwatch will become stockholders of Energtek. Their rights as stockholders will be governed by Title 7, Chapter 78 of the Nevada Law.

If the shareholders approve the changes described in this proxy regarding the Articles of Incorporation of Energtek, the Articles of Incorporation of Elderwatch will no longer be applicable. There are significant differences between some of the provisions of the Articles of Elderwatch as compared to some of the provisions of the Articles of Energtek. The other proposals to be voted upon at the Special Meeting relate to these differences and are further explained in the other proposals contained in this Proxy.

COMPARATIVE RIGHTS OF STOCKHOLDERS UNDER FLORIDA AND NEVADA LAW

The Nevada General Corporation Law (the "Nevada Code") differs from the Florida Business Corporation Act (the "FBCA") in certain respects. It is impractical to describe all such differences, but the following is a summary description of the more significant differences. This summary description is qualified in its entirety by reference to the Nevada Code and the Utah Code.

FLORIDA | | NEVADA |

TRANSACTIONS WITH OFFICERS AND DIRECTORS |

Under the FBCA, no contract or other transaction between a corporation and one or more of its directors or any other corporation, firm, association, or entity in which one or more of its directors are directors or officers or are financially interested shall be either void or voidable if: (a) The fact of such relationship or interest is disclosed or known to the board of directors or committee which authorizes, approves, or ratifies the contract or transaction by a vote or consent sufficient for the purpose without counting the votes or consents of such interested directors; (b) The fact of such relationship or interest is disclosed or known to the shareholders entitled to vote and they authorize, approve, or ratify such contract or transaction by vote or written consent; or (c) The contract or transaction is fair and reasonable as to the corporation at the time it is authorized by the board, a committee, or the shareholders. | | Under Nevada law, such transactions are not automatically void or voidable if (i) the fact of the common directorship, office or financial interest is known to the board of directors or committee, and the board or committee authorizes, approves or ratifies the contract or transactions in good faith by a vote sufficient for the purpose, without counting the vote or votes of the common or interested director or directors, or (ii) the contract or transaction, in good faith, is ratified or approved by the holders of a majority of the voting power, or (iii) the fact of common directorship, office or financial interest known to the director or officer at the time of the transactions is brought before the board of directors for actions, or (iv) the contract or transaction is fair to the corporation at the time it is authorized or approved. Common or interested directors may be counted to determine presence of a quorum and if the votes of the common or interested directors are not counted at the meeting, then a majority of directors may authorize, approve or ratify a contract or transactions. |

ELECTION AND REMOVAL OF DIRECTORS |

The FBCA provides that directors are to be elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present, unless the articles provide otherwise. Under the FBCA, shareholders may remove a director with or without cause, unless the articles provide otherwise. The FBCA also provides that if a director is elected by a voting group of shareholders, only the shareholders of that group may participate in the vote to remove the director. A director may be removed only if the number of votes cast to remove the director exceeds the number of votes cast not to remove him or her. Shareholders may remove a director of a Florida corporation only at a meeting called for the purpose of such removal. A majority of directors may also remove a director for cause. Under the FBCA, unless the articles provide otherwise, a vacancy on the board may be filled the affirmative vote of a majority of directors remaining in office or by the shareholders, unless the articles of incorporation provide otherwise. | | In Nevada, a director will hold office until the next annual meeting of stockholders and until his or her successor is elected and qualified, and a director may be removed during his or her term with or without cause. Such removal must be approved by the vote of not less than two thirds of the voting power of the corporation at a meeting called for that purpose. Vacancies on the board of directors may be filled under the Nevada Code by the directors. |

INSPECTION OF BOOKS AND RECORDS |

| Under the FBCA, Florida corporations are required to maintain the following records, which any shareholder of record may, after at least five business days’ prior written notice, inspect and copy: (1) the articles and bylaws, (2) certain board and shareholder resolutions, (3) certain written communications to shareholders, (4) names and addresses of current directors and officers and (6) the most recent annual report. In addition, shareholders of a Florida corporation are entitled to inspect and copy other books and records of the corporation during regular business hours if the shareholder gives at least five business days’ prior written notice to the corporation and (a) the shareholder’s demand is made in good faith and for a proper purpose, (b) the demand describes with particularity its purpose and the records to be inspected or copied and (c) the requested records are directly connected with such purpose. | | In Nevada certain stockholders have the right to inspect certain books and records of the Corporation. In Nevada, such a right is available to any stockholder of record of a corporation for at least six months immediately preceding the demand, or any person holding at least 5% of all of its outstanding shares. Under the Nevada Code, the books and records that may be inspected are the company's stock ledger, a list of its stockholders, and its other books and records. Under the Nevada Code, the inspection is to take place during normal business hours and copies of the inspected documents may be made by the stockholder. |

| |

LIMITATION ON LIABILITY OF DIRECTORS; INDEMNIFICATION OF OFFICERS AND DIRECTORS |

Under the FBCA, a director is not personally liable for monetary damages to the corporation or any other person for any statement, vote, decision or failure to act, regarding corporate management or policy, by a director unless the director breached or failed to perform his duties as a director under certain circumstances, including a violation of criminal law, a transaction from which the director derived an improper personal benefit, conscious disregard for the best interests of the corporation, willful misconduct, bad faith or disregard of human rights, safety, or property. Under the FBCA, a Florida corporation may generally indemnify its officers, directors, employees and agents against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement of any proceedings (other than derivative actions), if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was unlawful. A similar standard is applicable in derivative actions, except that indemnification may be made only for (a) expenses (including attorneys’ fees) and certain amounts paid in settlement and (b) in the event the person seeking indemnification has been adjudicated liable, amounts deemed proper, fair and reasonable by the appropriate court upon application thereto. The FBCA provides that to the extent that such persons have been successful in defense of any proceeding, they must be indemnified by the corporation against expenses actually and reasonably incurred in connection therewith. The FBCA also provides that, unless a corporation’s articles of incorporation provide otherwise, if a corporation does not so indemnify such persons, they may seek, and a court may order, indemnification under certain circumstances even if the board of directors or shareholders of the corporation have determined that the persons are not entitled to indemnification. | | Nevada law provides for discretionary indemnification made by the corporation only as authorized in the specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances. The determination must be made either: (i) by the stockholders; (ii) by the board of directors by majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding; (iii) if a majority vote of a quorum consisting of directors who were not parties to the actions, suit or proceeding so orders, by independent legal counsel in a written opinion; or (iv) If a quorum consisting of directors who were not parties to the action, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion. The Articles of Incorporation, the bylaws or an agreement made by the corporation may provide that the expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding must be paid by the corporation as they are incurred and in advance of the final disposition of the actions, suit or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he is not entitled to be indemnified by the corporation. The provisions do not affect any right to advancement of expenses to which corporate personnel other than directors or officers may be entitled under any contract or otherwise by law. The indemnification and advancement of expenses authorized in or ordered by a court pursuant to Nevada law does not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under the Articles of Incorporation or any bylaw, agreement, vote of stockholders or disinterested directors or otherwise, for either an action in his or her official capacity or an action in another capacity while holding office, except that indemnification, unless ordered by a court or for the advancement of expenses, may not be made to or on behalf of any director or officer if his or her acts or omissions involved intentional misconduct, fraud or a knowing violation of the law and were material to the cause of action. In addition, indemnification continues for a person who has ceased to be a director, officer, employee or agent and inures to the benefit of the heirs, executors and administrators of such a person. |

| |

VOTING RIGHTS WITH RESPECT TO EXTRAORDINARY CORPORATE TRANSACTIONS |

Under the FBCA, a merger, consolidation or sale of all or substantially all of the assets of a corporation requires (a) approval by the board of directors and (b) the affirmative vote of a majority of the outstanding stock of the corporation entitled to vote thereon. The FBCA allows the board of directors or the articles of incorporation to establish a higher vote requirement. The FBCA does not require shareholder approval from the shareholder of a surviving corporation if: • the articles of the surviving corporation will not differ, with certain exceptions, from its articles before the merger; and • each shareholder of the surviving corporation whose shares were outstanding immediately prior to the merger will hold the same number of shares, with identical designations, preferences, limitations and relative rights, immediately after; Under the FBCA, a parent corporation owning at least 80 percent of the outstanding shares of each class of a subsidiary corporation may merge the subsidiary into itself, may merge itself into the subsidiary, or may merge the subsidiary into and with another subsidiary in which the parent corporation owns at least 80 percent of the outstanding shares of each class of the subsidiary without the approval of the shareholders of the parent or subsidiary. In a merger of a parent corporation into its subsidiary corporation, the approval of the shareholders of the parent corporation shall be required if the articles of incorporation of the surviving corporation will differ, except for amendments enumerated therein, from the articles of incorporation of the parent corporation before the merger, and the required vote shall be the greater of the vote required to approve the merger and the vote required to adopt each change to the articles of incorporation as if each change had been presented as an amendment to the articles of incorporation of the parent corporation. | | Approval of mergers and consolidations and sales, leases or exchanges of all or substantially all of the property or assets of a corporation, whether or not in the ordinary course of business, requires the affirmative vote or consent of the holders of a majority of the outstanding shares entitled to vote, except that, unless required by the articles of incorporation, no vote of stockholders of the corporation surviving a merger is necessary if: (i) the merger does not amend the articles of incorporation of the corporation; (ii) each outstanding share immediately prior to the merger is to be an identical share after the merger, and (iii) either no common stock of the corporation and no securities or obligations convertible into common stock are to be issued in the merger, or the common stock to be issued in the merger, plus that initially issuable on conversion of other securities issued in the merger does not exceed 20% of the common stock of the corporation outstanding immediately before the merger. |

DIVIDENDS |

| Under the FBCA, no distribution may be made if, after giving it effect: (a) The corporation would not be able to pay its debts as they become due in the usual course of business; or (b) The corporation's total assets would be less than the sum of its total liabilities plus (unless the articles of incorporation permit otherwise) the amount that would be needed, if the corporation were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of shareholders whose preferential rights are superior to those receiving the distribution. | | A corporation is prohibited from making a distribution to its stockholders if, after giving effect to the distribution, the corporation would not be able to pay its debts as they become due in the usual course of business or the corporation's total assets would be less than its total liabilities (plus any amounts necessary to satisfy any preferential rights). |

APPRAISAL RIGHTS; DISSENTERS' RIGHTS |

| Under the FBCA, dissenting holders of common stock who follow prescribed statutory procedures are entitled to appraisal rights in certain circumstances, including in the case of a merger or consolidation, a sale or exchange of all of substantially all the assets of a corporation or amendments to the articles of incorporation that adversely affect the rights or preferences of shareholder. These rights are not provided when the dissenting stockholders are shareholders of a corporation surviving a merger or consolidation where no vote of the shareholders is required for the merger or consolidation, or if the shares of the corporation are listed on a national securities exchange, designated as a national market security by the National Association of Securities Dealers, Inc. or held of record by more than 2,000 shareholders. | | Unlike the FBCA, the Nevada Code does not provide for dissenters' rights in the case of a sale of assets. Like the FBCA, the Nevada Code similarly limits dissenters rights, when the shares of the corporation are listed on a national securities exchange included in the National Market System established by the National Association of Securities Dealers, Inc. or are held by at least 2,000 stockholders of record, unless the stockholders are required to accept in exchange for their shares anything other than cash or (i) shares in the surviving corporation, (ii) shares in another entity that is publicly listed or held by more than 2,000 stockholders, or (iii) any combination of cash or shares in an entity described in (i) or (ii). |

| |

SPECIAL MEETINGS OF STOCKHOLDERS |

| Under the FBCA, a special meeting of shareholders may be called by the board of directors or by the holders of at least 10 percent of the shares entitled to vote at the meeting, unless a greater percentage (not to exceed 50 percent) is required by the articles of incorporation, or by such other persons or groups as may be authorized in the articles of incorporation or the bylaws of the Florida corporation. | | The Nevada Code provides that a special meeting of stockholders may be called by: (i) a corporation's board of directors; (ii) the persons authorized by the articles of incorporation or bylaws; or (iii) the holders of not less than 10% of all votes entitled to be cast on any issue to be considered at the proposed special meeting. A corporation's articles of incorporation may require a higher percentage of votes, up to a maximum of 50% to call a special meeting of stockholders. |

STOCKHOLDERS' CONSENT WITHOUT A MEETING |

| Under the FBCA, any action required or permitted to be taken at a meeting of shareholders may be taken without a meeting if the action is taken by holders of at least the minimum number of votes necessary to authorize the action at a meeting and these shareholders execute a written consent setting forth the action. | | The Nevada Code permits corporate action without a meeting of stockholders upon the written consent of the holders of that number of shares necessary to authorize the proposed corporate action being taken, unless the certificate of incorporation or articles of incorporation expressly provide otherwise. |

This proxy statement merely summarizes certain differences between the corporation laws of Florida and Nevada. Many provisions of the FBCA and the Nevada Code may be subject to differing interpretations, and the discussion offered herein may be incomplete in certain respects. The discussion contained in this proxy statement is not a substitute for direct reference to the FBCA and the Nevada Code, or for professional interpretation of them.

APPRAISAL RIGHTS

Stockholders of Elderwatch will have appraisal rights under Florida law as a result of the proposed Reincorporation. Stockholders who oppose the Reincorporation (“Dissenting Stockholders”) will have the right to receive payment for the value of their shares as set forth in Sections 607.1301 et seq. of the Florida Business Corporations Act (the “Florida Dissent Provisions”). A copy of these sections is attached hereto as Appendix B to this Proxy Statement. The material requirements for a stockholder to properly exercise his or her rights are summarized below. However, these provisions are very technical in nature, and the following summary is qualified in its entirety by the actual statutory provisions that should be carefully reviewed by any stockholder wishing to assert such rights.

Under the Florida Business Corporations Act, such appraisal rights will be available only to those stockholders who comply with the following procedures: (i) the Dissenting Stockholder must file with Elderwatch prior to the Special Meeting, written notice of the intent to demand payment for the shares of Elderwatch capital stock (the "Shares"); (ii) the Dissenting Stockholder must refrain from voting in favor of the Reincorporation; (iii) within 10 days after the date of the Meeting, Elderwatch shall give written notice of approval of the Reincorporation by the holders of the majority of the shares of Elderwatch Common Stock to such Dissenting Stockholder; and (iv) within 20 days after the Dissenting Stockholder receives such notice of authorization, the Dissenting Stockholder shall file with a notice of election and a demand for payment of the fair value of the Shares. Any Dissenting Stockholder filing an election to dissent shall deposit the certificates for certified Shares with Elderwatch simultaneously with the filing of the election to dissent. A shareholder of Elderwatch may dissent as to less than all of the Shares held and in such event, will be treated as two separate holders of Elderwatch shares. Once Elderwatch offers to pay the Dissenting Stockholder, the notice of election cannot be withdrawn except with the consent of Elderwatch. However, the right of a Dissenting Stockholder to be paid the fair value of the Shares shall cease if (i) the demand is withdrawn, (ii) the Reincorporation is abandoned, (iii) no demand or petition for determination of fair value is filed with the appropriate court within the time provided by law, or (iv) a court of competent jurisdiction determines that such stockholder is not entitled to the relief provided by the Florida Dissent Provisions.

Submission of a proxy or vote against the Reincorporation does not constitute a notice of intent to demand payment under the Florida Dissent Provisions.

Within 10 days after the later of the expiration of the period in which the Dissenting Stockholder may file a notice of election to dissent or the Reincorporation, Elderwatch is required to make a written offer to each Dissenting Stockholder to purchase the Shares at a price deemed by Elderwatch to be the fair value of such shares. If, within 30 days after the making of such offer, any holder accepts the same, payment therefor shall be made within 90 days after the later of the date such offer was made or the consummation of the Transaction. However, if, within such 30-day period, Elderwatch and the Dissenting Stockholder are unable to agree with respect to a price, then Elderwatch, within 30 days after receipt of written demand from such Dissenting Stockholder given within 60 days after the Closing, shall, or at its election within such period may, file an action in a court of competent jurisdiction in, Florida requesting that the fair value of the Shares be found and determined. If Elderwatch fails to institute such proceedings, any Dissenting Stockholder may do so in the name of Elderwatch. In such proceeding, the court may, if it so elects, appoint one or more persons as appraisers to receive evidence and recommend a decision on the question of fair value. Elderwatch shall pay each Dissenting Stockholder the amount found to be due within 10 days after final determination of the proceedings. Upon payment of such judgment, the Dissenting Stockholder will cease to have any interest in the shares.

Any judgment rendered in any dissent proceeding may, at the discretion of the court, include any allowance for interest at such rate as the court may deem fair and equitable. The cost and expenses of any such dissent proceeding shall be determined by the court and shall be assessed against Elderwatch, but all or any part of such costs and expenses may be apportioned and assessed against the Dissenting Stockholders, in such amount as the court deems equitable, if the court determines that Elderwatch made an offer to the Dissenting Stockholders and the failure to accept such offer was arbitrary, vexatious or not in good faith. The expenses awarded by the court shall include compensation for reasonable expenses of any appraiser but shall not include the fees and expenses of counsel or experts employed by any party. If the fair value of the Shares as determined by the proceeding, material exceeds the amount which Elderwatch initially offered to pay, or if no offer was made, the court, in its discretion, may award to any Dissenting Stockholder who is a party to the proceeding such sum as the court may determine to be reasonable compensation for any attorney or expert employed by the Dissenting Stockholder in the proceeding.

The foregoing discussion only summarizes certain provisions of the Florida Dissent Provisions. Elderwatch shareholders are urged to review such provisions in their entirety, which are included as Appendix B to this Proxy Statement. Any of Elderwatch shareholders who intends to dissent from the Reincorporation should review the text of the Florida Dissent Provisions carefully and also should consult with his or her attorney. Any Company shareholders who fail to strictly follow the procedures set forth in such statutes will forfeit dissenters' rights.

IF YOU FAIL TO COMPLY STRICTLY WITH THE PROCEDURES DESCRIBED ABOVE, YOU WILL LOSE YOUR APPRAISAL RIGHTS. CONSEQUENTLY, IF YOU WISH TO EXERCISE YOUR APPRAISAL RIGHTS, WE STRONGLY URGE YOU TO CONSULT A LEGAL ADVISOR BEFORE ATTEMPTING TO EXERCISE YOUR APPRAISAL RIGHTS.

OUR RECOMMENDATION TO SHARHOLDERS REGARDING

PROPOSAL NO. 1

APPROVAL OF REINCORPORATION OF THE COMPANY IN NEVADA

Taking into consideration all of the factors and reasons for the Reincorporation set forth above and elsewhere in this Proxy Statement, the Board has approved the Reincorporation and recommends that stockholders of Elderwatch vote FOR approval of the Reincorporation. IN THE EVENT THAT THIS PROPOSAL NO. 1 REGARDING THE REINCORPORATION IS APPROVED BUT PROPOSALS NUMBERED 2 THROUGH 5 REGARDING THE CHANGES IN THE COMPANY’S ARTICLES AND THE ELECTION OF A DIRECTOR ARE NOT APPROVED, THE BOARD OF ELDERWATCH WILL NOT CONTINUE WITH THE REINCORPORATION AND ELDERWATCH WILL REMAIN A FLORIDA CORPORATION.

PROPOSAL NO. 2

CHANGE IN THE COMPANY’S NAME FROM “ELDERWATCH, INC.” TO

“ENERGTEK INC.”

Our Board seeks the approval of the shareholders to change our company name from Elderwatch, Inc. to Energtek Inc. Our Board has determined that it is in the best interests of Elderwatch and its shareholders to change the name of the company to reflect its proposed business activities and to seek shareholder approval of such name change.

OUR RECOMMENDATION TO SHAREHOLDERS

REGARDING PROPOSAL NO. 2

The Board has approved the change in the name of Elderwatch to “Energtek Inc.” and recommends that stockholders of Elderwatch vote FOR approval of the change in the name of Elderwatch. IN THE EVENT THAT THIS PROPOSAL NO. 2 IS APPROVED BUT PROPOSAL NUMBER 1 REGARDING THE REINCORPORATION OF ELDERWATCH FROM FLORIDA TO NEVADA IS NOT APPROVED, THE BOARD OF ELDERWATCH WILL FILE AN AMENDMENT TO THE ARTICLES OF ELDERWATCH IN FLORIDA SIMILAR TO THE ATTACHED APPENDIX C TO CHANGE THE NAME OF THE COMPANY.

PROPOSAL NO. 3

INCREASE IN THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

As of the record date, the authorized capital of Elderwatch, on the record date, consisted of 50,000,000 shares of Common Stock, $0.001 par value, and 10,000,000 shares of preferred stock, $0.001 par value. Approximately 7,837,500 shares of Elderwatch Common Stock were outstanding. No shares of preferred stock were outstanding. The authorized capital of Energtek, which will be the authorized capital of Elderwatch if so approved by the shareholders, consists of 250,000,000 shares of common stock, $0.0001 par value, and 5,000,000 shares of preferred stock, $0.0001 par value. The approval of this proposal will not affect total stockholder equity but will change the authorized capitalization of Elderwatch.

The Board believes that it is in Elderwatch's best interests to increase the number of authorized shares of Common Stock in order to provide Elderwatch with the flexibility to issue Common Stock without further action by Elderwatch's stockholders (unless required by law or regulation) for such other corporate purposes as the Board may deem advisable. These purposes may include, among other things, the sale of shares to obtain additional capital funds, the purchase of property, the use of additional shares for various equity compensation and other employee benefit plans of Elderwatch or of acquired companies, the acquisition of other companies, and other bona fide purposes.

Promptly after the distribution of this proxy statement, Elderwatch anticipates closing on a private placement of 2,500,000 units, resulting in gross proceeds to the company of $250,000. Each unit shall consist of one share of common stock, one Class A warrant, entitling the holder to purchase one share of common stock until December 31, 2007 for 20 cents and one Class B warrant, entitling the holder to purchase share of common stock until June 30, 2009 for 30 cents. The warrants are redeemable by Elderwatch. The units are being offered and sold pursuant to Regulation S promulgated by the Securities and Exchange Commission; there are no offers or selling efforts in the United States. There are also no underwriters or broker-dealers involved in this private placement.

|

The additional shares of Common Stock for which authorization is sought would be a part of the existing class of Energtek common stock and, if and when issued, would have the same rights and privileges as the currently outstanding shares of Common Stock. Current stockholders do not have preemptive rights under Elderwatch's Certificate of Incorporation, and will not have such rights with respect to these additional authorized shares of Common Stock. When the Board elects to issue additional shares of Common Stock, such issuance will have a dilutive effect on the voting power and percentage ownership of Elderwatch, and an adverse effect on the market price of the common stock and the continuation of the current management of Elderwatch. The Board believes that the issuance of additional shares to raise capital outweighs any of the disadvantages associated with the increase in the authorized shares of Common Stock.

OUR RECOMMENDATION TO SHAREHOLDERS

REGARDING PROPOSAL NO. 3

The Board has approved the change in the Articles of Elderwatch from having 50,000,000 shares of common stock authorized to the change in the Articles of Energtek providing for 250,000,000 shares of common stock authorized and recommends that shareholders of Elderwatch vote FOR approval of the increase in the number of authorized shares of common stock. IN THE EVENT THAT THIS PROPOSAL NO. 3 IS APPROVED BUT PROPOSAL NUMBER 1 REGARDING THE REINCORPORATION OF ELDERWATCH FROM FLORIDA TO NEVADA IS NOT APPROVED, THE BOARD OF ELDERWATCH WILL FILE AN AMENDMENT TO THE ARTICLES OF ELDERWATCH IN FLORIDA SIMILAR TO THE ATTACHED APPENDIX C TO INCREASE THE AUTHORIZED NUMBER OF SHARES OF COMMON STOCK OF THE COMPANY.

PROPOSAL NO. 4

DECREASE IN AUTHORIZED PREFERRED STOCK

The current Articles of Elderwatch authorize the issuance of 10,000,000 shares of preferred stock, $0.001 par value, none of which were issued and outstanding as of the Record Date. The authorized preferred stock of Energtek, which will be the authorized preferred stock of Elderwatch, if so approved by the shareholders, consists of 5,000,000 shares of common stock, $0.0001 par value (the “Energtek Preferred Stock”).

The Board believes the Energtek Preferred Stock is sufficient to facilitate corporate financing and other plans of Elderwatch, which are intended to foster its growth and flexibility. Under the terms of the Energtek Preferred Stock, the Board would be empowered, with no need for further stockholder approval, to issue Energtek Preferred Stock in one or more series, and with such dividend rates and rights, liquidation preferences, voting rights, conversion rights, rights and terms of redemption and other rights, preferences, and privileges as determined by the Board. The Board will be permitted to issue Energtek Preferred Stock from time to time for any proper corporate purpose including acquisitions of other businesses or properties and the raising of additional capital. Shares of Energtek Preferred Stock could be issued publicly or privately, in one or more series, and each series of Energtek Preferred Stock could rank senior to the Common Stock of Elderwatch with respect to dividends and liquidation rights. There are no present plans, understandings or agreements for, and Elderwatch is not engaged in any negotiations that will involve, the issuance of Energtek Preferred Stock.

OUR RECOMMENDATION TO SHAREHOLDERS

REGARDING PROPOSAL NO. 4

The Board recommends that shareholders of Elderwatch vote FOR approval of the decrease in the authorization of preferred stock from 10,000,000 shares, par value $0.001, to 5,000,000 shares, par value $0.0001. IN THE EVENT THAT THIS PROPOSAL NO. 4 IS APPROVED BUT PROPOSAL NUMBER 1 REGARDING THE REINCORPORATION OF ELDERWATCH FROM FLORIDA TO NEVADA IS NOT APPROVED, THE BOARD OF ELDERWATCH WILL FILE AN AMENDMENT TO THE ARTICLES OF ELDERWATCH IN FLORIDA SIMILAR TO THE ATTACHED APPENDIX C TO AUTHORIZE THE COMPANY TO ISSUE PREFERRED STOCK.

PROPOSAL NO. 5

ELECTION OF DIRECTOR

Our Board currently consists of one director, Doron Uziel. The Board of Energtek currently consists of two directors, Doron Uziel and Joseph Shefet. If the Reincorporation is approved by the shareholders, the members of the Board of Energtek will become the members of the Board of Elderwatch. Accordingly, at the Meeting, shareholders will be asked to elect Joseph Shefet as a director of Elderwatch. The term of office for Mr. Shefet will expire when his successor is elected and qualified. See the section entitled “Director and Nominee for Election to our Board of Directors” below for biographical information on Mr. Shefet. If Mr. Shefet is elected as a director of Elderwatch at the Meeting, he will serve as a director of Elderwatch until his successor is elected and qualified, regardless of whether the Reincorporation is approved.

OUR RECOMMENDATION TO SHAREHOLDERS

REGARDING PROPOSAL NO. 5

Our Board of Directors unanimously recommends a vote “FOR” the election of Joseph Shefet as a director of Elderwatch. IN THE EVENT THAT THIS PROPOSAL NO. 5 IS APPROVED, JOSEPH SHEFET WILL BE ELECTED AS A DIRECTOR OF ELDERWATCH, REGARDLESS OF WHETHER OR NOT PROPOSAL NUMBER 1 REGARDING THE REINCORPORATION OF ELDERWATCH FROM FLORIDA TO NEVADA IS APPROVED.

PROPOSAL NO. 6

GRANT OF DISCRETIONARY AUTHORITY TO THE BOARD OF DIRECTORS

TO IMPLEMENT AN UP TO FIVE FOR ONE FORWARD STOCK SPLIT

Our Board seeks shareholder approval for discretionary authority to our Board to implement a forward split for the purpose of increasing the liquidity of our common stock. The forward split exchange ratio that the directors approved and deemed advisable is up to five post-split shares for each one pre-split share, with the forward split to occur within twelve months of the date of the Meeting, the exact time of the forward split to be determined by the Board in its discretion. Approval of this proposal would give the Board authority to implement the forward split on the basis of up to five post-split shares for each one pre-split share at any time it determined within twelve months of the date of the Meeting. In addition, approval of this proposal would also give the Board authority to decline to implement a forward split.

Our directors believe that shareholder approval of a range for the exchange ratio of the forward split (as contrasted with approval of a specified ratio of the split) provides the Board of directors with maximum flexibility to achieve the purposes of a stock split, and, therefore, is in the best interests of our shareholders. The actual ratio for implementation of the forward split would be determined by our Board based upon its evaluation as to what ratio of post-split shares to pre-split shares would be most advantageous to us and our shareholders.

Our directors also believe that shareholder approval of a twelve-months range for the effectuation of the forward split (as contrasted with approval of a specified time of the split) provides the Board with maximum flexibility to achieve the purposes of a stock split, and, therefore, is in the best interests of our shareholders. The actual timing for implementation of the forward split would be determined by our Board based upon its evaluation as to when and whether such action would be most advantageous to us and our shareholders.

If you approve the grant of discretionary authority to our Board to implement a forward split and the Board decides to implement the forward split, we will effect a forward split of our then issued and outstanding common stock on the basis of up to five post-split shares for each one pre-split share. The directors believe that the forward stock split could increase the liquidity of our common stock and could help generate interest in the Company among investors and thereby assist us in raising future capital to fund our operations or make acquisitions.

A lower share price might initially result from the forward stock split. Shareholders should note that the effect of the forward split upon the market price for our common stock cannot be accurately predicted. In particular, if we elect to implement a forward stock split, there is no assurance that prices for shares of our common stock after a forward split will be up to five times lower than the price for shares of our common stock immediately prior to the forward split, depending on the ratio of the split. Furthermore, there can be no assurance that the market price of our common stock immediately after a forward split will be maintained for any period of time. Moreover, because some investors may view the forward split negatively, there can be no assurance that the forward split will not adversely impact the market price of our common stock.

Effect of the Forward Split

The number of shares of our common stock issued and outstanding would be increased following the effective time of the forward split in accordance with the following formula: if our directors decide to implement a five for one forward split, every one share of our common stock owned by a shareholder will automatically be changed into and become five new shares of our common stock, with five being equal to the exchange ratio of the forward split, as determined by the directors in their discretion. Shareholders should recognize that if a forward split is effected, they will own a greater number of shares than they presently own (a number equal to the number of shares owned immediately prior to the effective time multiplied by the five for one exchange ratio, or such lesser exchange ratio as may be determined by our directors). The authorized number of shares of our common stock and the par value of our common stock under our articles of incorporation would remain the same following the effective time of the forward split.

The number of shareholders of record would not be affected by the forward split.

Federal Income Tax Consequences

We will not recognize any gain or loss as a result of the forward split.

The following description of the material federal income tax consequences of the forward split to our shareholders is based on the Code, applicable Treasury Regulations promulgated thereunder, judicial authority and current administrative rulings and practices in effect on the date of this Proxy Statement. Changes to the laws could alter the tax consequences described below, possibly with retroactive effect. We have not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of the forward split. This discussion is for general information only and does not discuss the tax consequences that may apply to special classes of taxpayers (e.g., non-residents of the United States, broker/dealers or insurance companies). The state and local tax consequences of the forward split may vary significantly as to each shareholder, depending upon the jurisdiction in which such shareholder resides. You are urged to consult your own tax advisors to determine the particular consequences to you.

In general, we believe that the likely federal income tax effects of the forward split will be that a shareholder who receives solely an increased number of shares of our common stock will not recognize gain or loss. With respect to a forward split, such shareholder's basis in the reduced number of shares of our common stock will equal the shareholder's basis in his old shares of our common stock.

Effective Date