May 2017 TransDigm Non-Deal Roadshow Exhibit 99.1

Agenda 1 TransDigm Overview Nick Howley Chairman and CEO TransDigm Organic Growth & Outlook Nick Howley Chairman and CEO Consistent Operating Model & Customer Value Kevin Stein President and COO Financial Topics Terrry Paradie Executive Vice President and CFO Q&A

Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including information regarding our guidance for future periods. These forward-looking statements are based on management’s current expectations and beliefs, as well as a number of assumptions concerning future events, many of which are outside of our control. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statement. These risks and uncertainties include but are not limited to: the sensitivity of our business to the number of flight hours that our customers’ planes spend aloft and our customers’ profitability, both of which are affected by general economic conditions; future terrorist attacks; cyber-security threats and natural disasters; our reliance on certain customers; the U.S. defense budget and risks associated with being a government supplier; failure to maintain government or industry approvals; failure to complete or successfully integrate acquisitions; our substantial indebtedness; potential environmental liabilities; increases in costs that cannot be recovered in product pricing; risks associated with our international sales and operations; and other factors. Further information regarding the important factors that could cause actual results to differ materially from projected results can be found in TransDigm Group’s Annual Report on Form 10-K and other reports that TransDigm Group or its subsidiaries have filed with the Securities and Exchange Commission. You are cautioned not to place undue reliance on our forward-looking statements. TransDigm Group Incorporated assumes no obligation to, and expressly disclaims any obligation to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. 2

Special Notice Regarding Pro Forma and Non-GAAP Information This presentation sets forth certain pro forma financial information. This pro forma financial information gives effect to certain recently completed acquisitions. Such pro forma information is based on certain assumptions and adjustments and does not purport to present TransDigm's actual results of operations or financial condition had the transactions reflected in such pro forma financial information occurred at the beginning of the relevant period, in the case of income statement information, or at the end of such period, in the case of balance sheet information, nor is it necessarily indicative of the results of operations that may be achieved in the future. This presentation also sets forth certain non-GAAP financial measures. A presentation of the most directly comparable GAAP measures and a reconciliation to such measures are set forth in the appendix. 3

“Private Equity-Like Growth in Value with Liquidity of a Public Market” + 15% - 20% / Year on Average 4 Shareholder’s Value Proposition

Unique & Consistent Business Strategy Private & Public 5 Proprietary Aerospace Products with Significant Aftermarket 3-Part Value-Based Operating Strategy Decentralized, Organization / Aligned with Shareholders Focused Disciplined Acquisition Strategy “Private Equity-Like” Capital Structure & Culture TransDigm’s Consistent Goal – “Private Equity-Like” Returns to Shareholders

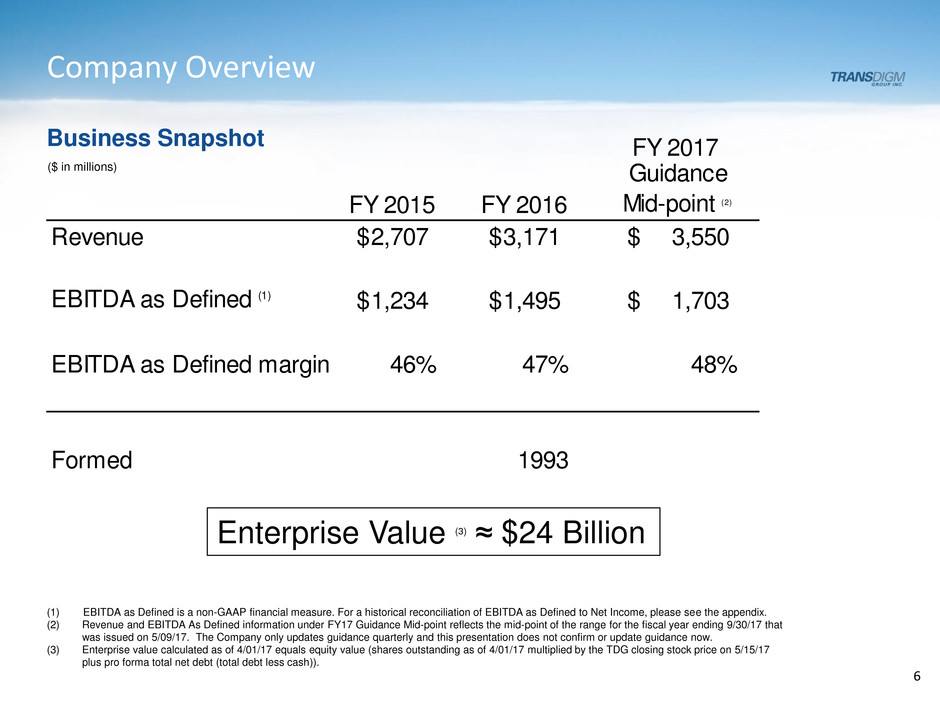

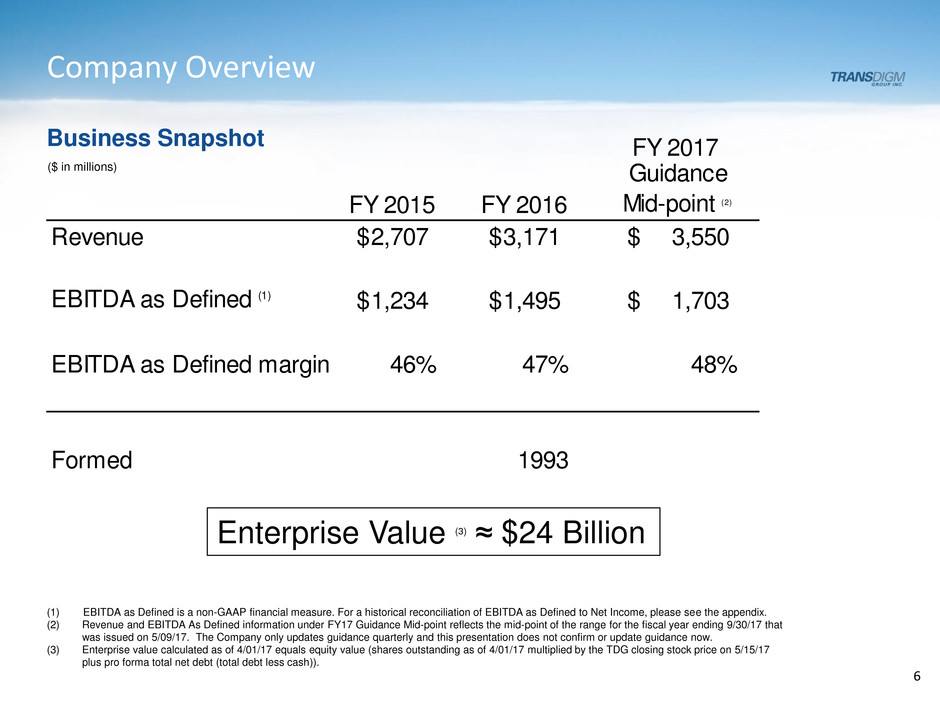

Company Overview 6 FY 2017 FY 2015 FY 2016 Guidance Mid-point (2) Revenue 2,707$ 3,171$ 3,550$ EBITDA as Defined (1) 1,234$ 1,495$ 1,703$ EBITDA as Defined margin 46% 47% 48% Formed 1993 ($ in millions) Enterprise Value (3) ≈ $24 Billion (1) EBITDA as Defined is a non-GAAP financial measure. For a historical reconciliation of EBITDA as Defined to Net Income, please see the appendix. (2) Revenue and EBITDA As Defined information under FY17 Guidance Mid-point reflects the mid-point of the range for the fiscal year ending 9/30/17 that was issued on 5/09/17. The Company only updates guidance quarterly and this presentation does not confirm or update guidance now. (3) Enterprise value calculated as of 4/01/17 equals equity value (shares outstanding as of 4/01/17 multiplied by the TDG closing stock price on 5/15/17 plus pro forma total net debt (total debt less cash)). Business Snapshot

Diverse Products, Platforms and Markets 7

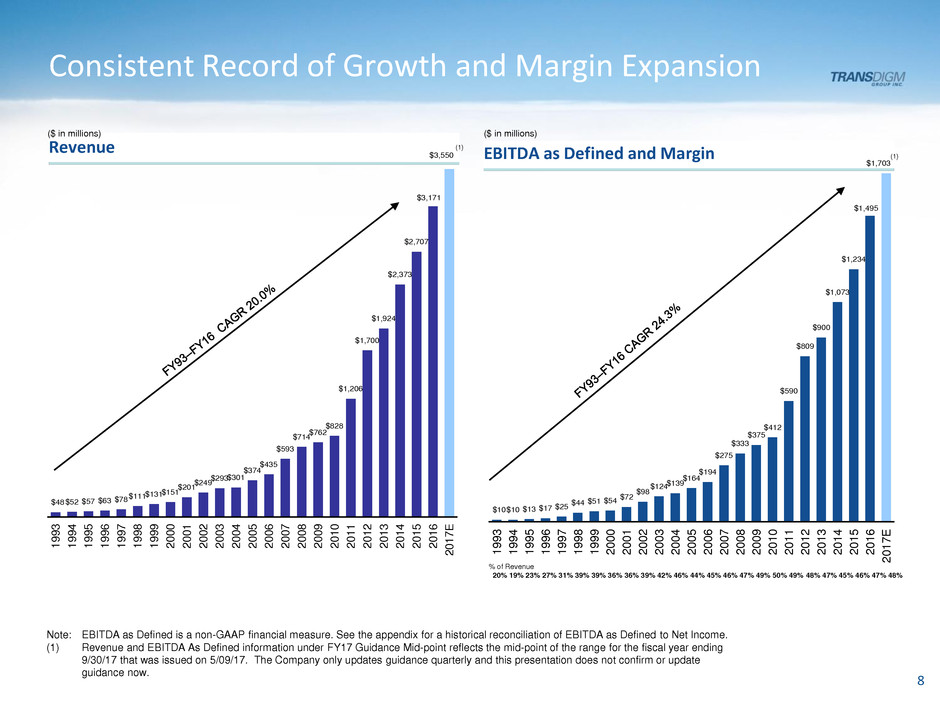

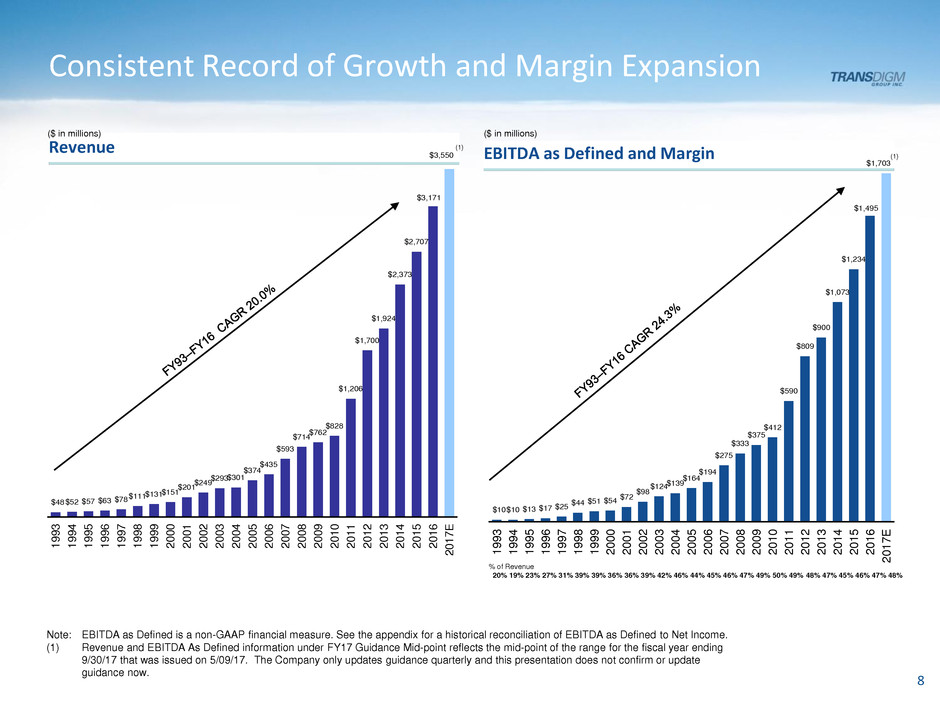

EBITDA as Defined and Margin Revenue Consistent Record of Growth and Margin Expansion Note: EBITDA as Defined is a non-GAAP financial measure. See the appendix for a historical reconciliation of EBITDA as Defined to Net Income. (1) Revenue and EBITDA As Defined information under FY17 Guidance Mid-point reflects the mid-point of the range for the fiscal year ending 9/30/17 that was issued on 5/09/17. The Company only updates guidance quarterly and this presentation does not confirm or update guidance now. ($ in millions) $48 $52 $57 $63 $78 $111 $131 $151 $201 $249 $293 $301 $374 $435 $593 $714 $762 $828 $1,206 $1,700 $1,924 $2,373 $2,707 $3,171 $3,550 1 9 9 3 1 9 9 4 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 E ($ in millions) $10 $10 $13 $17 $25 $44 $51 $54 $72 $98 $124 $139 $164 $194 $275 $333 $375 $412 $590 $809 $900 $1,073 $1,234 $1,495 $1,703 1 9 9 3 1 9 9 4 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 E 8 (1) (1) % of Revenue 20% 19% 23% 27% 31% 39% 39% 36% 36% 39% 42% 46% 44% 45% 46% 47% 49% 50% 49% 48% 47% 45% 46% 47% 48%

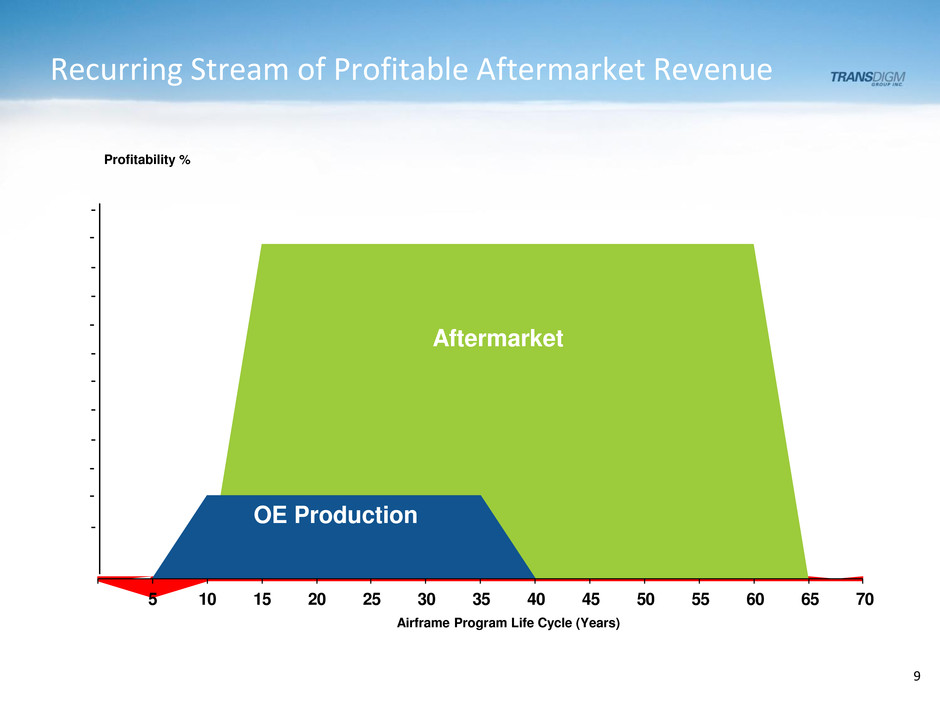

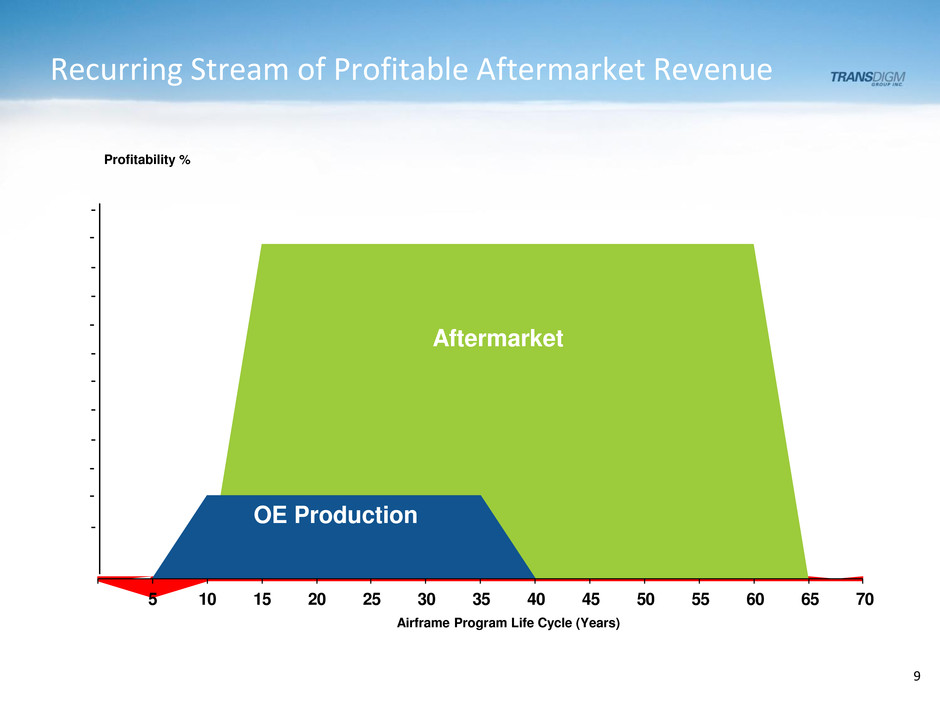

Recurring Stream of Profitable Aftermarket Revenue 9 5 10 15 20 25 30 35 40 45 50 55 60 65 70 Profitability % Airframe Program Life Cycle (Years) Aftermarket OE Production

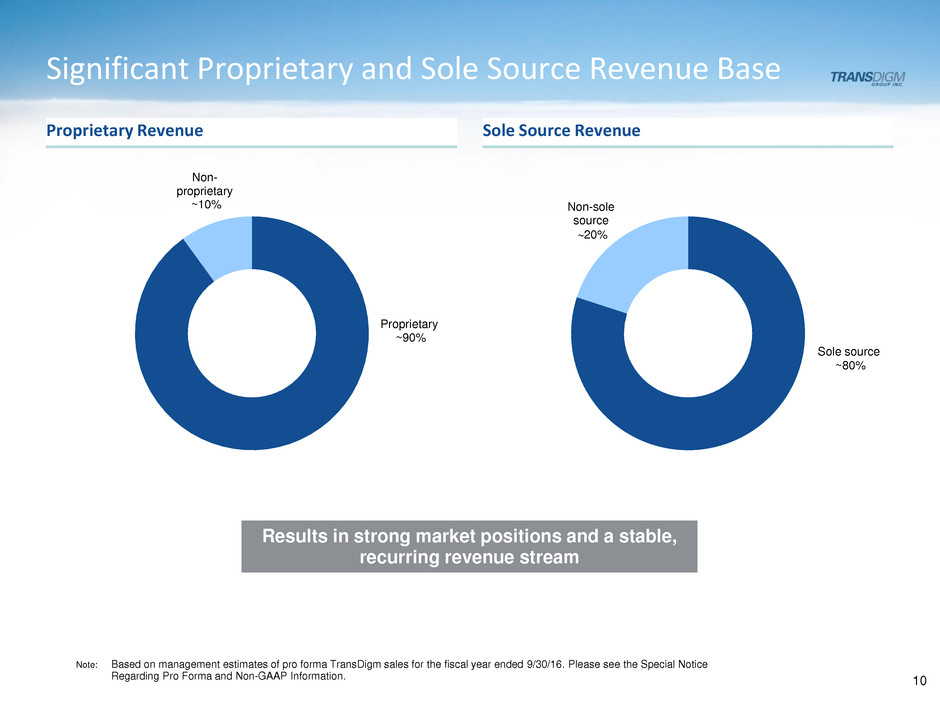

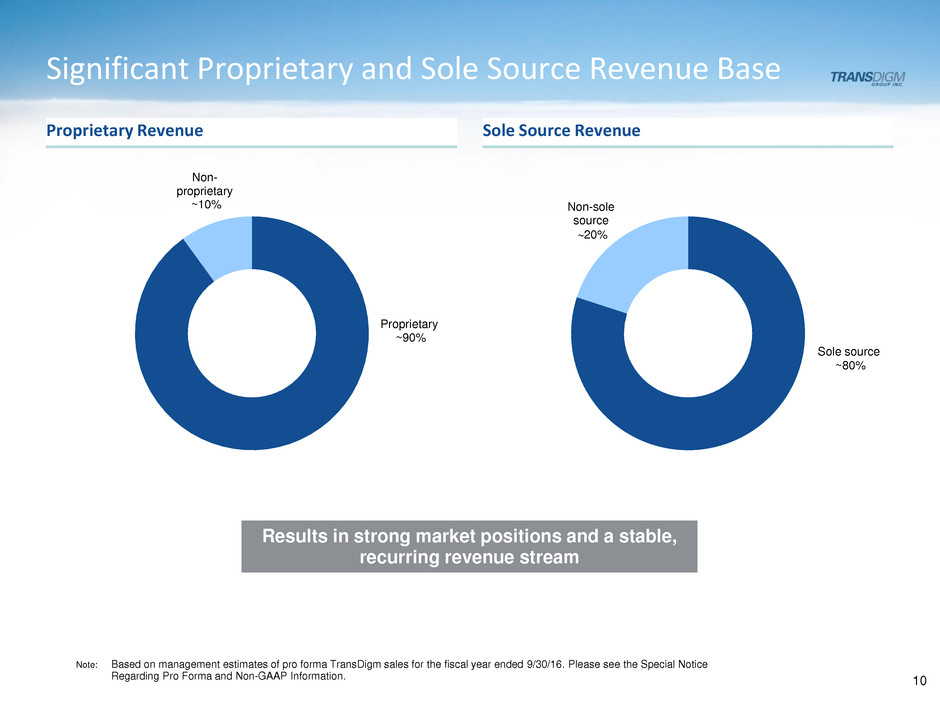

Sole Source Revenue Proprietary Revenue Significant Proprietary and Sole Source Revenue Base Proprietary ~90% Non- proprietary ~10% Note: Based on management estimates of pro forma TransDigm sales for the fiscal year ended 9/30/16. Please see the Special Notice Regarding Pro Forma and Non-GAAP Information. Sole source ~80% Non-sole source ~20% 10 Results in strong market positions and a stable, recurring revenue stream

11 Proven Operating Strategy Profitable New Business Productivity and Cost Improvements Value Based Pricing 3 Value Drivers

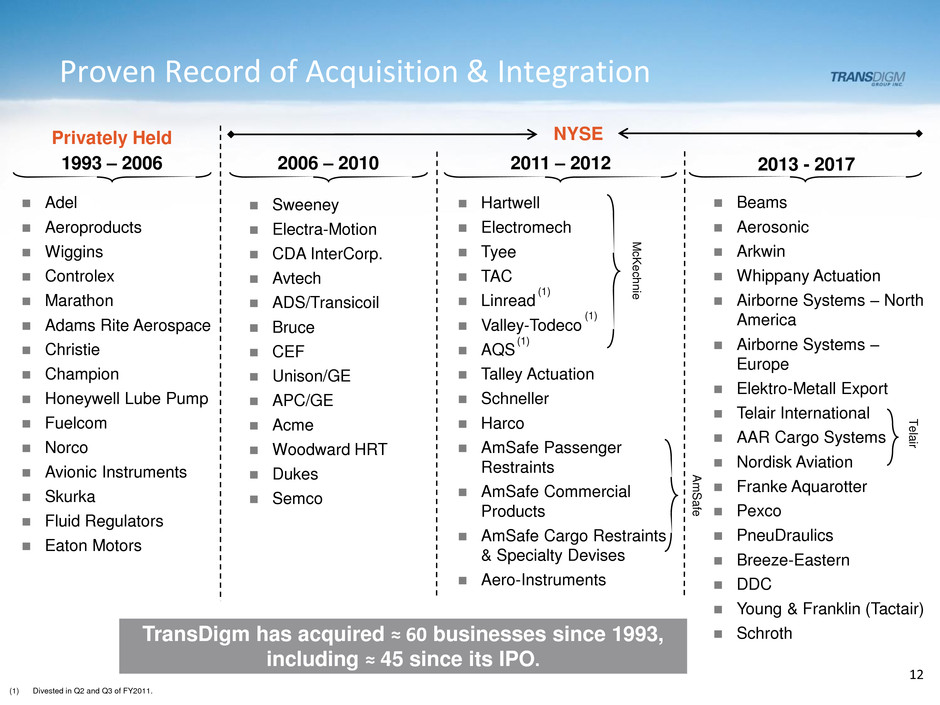

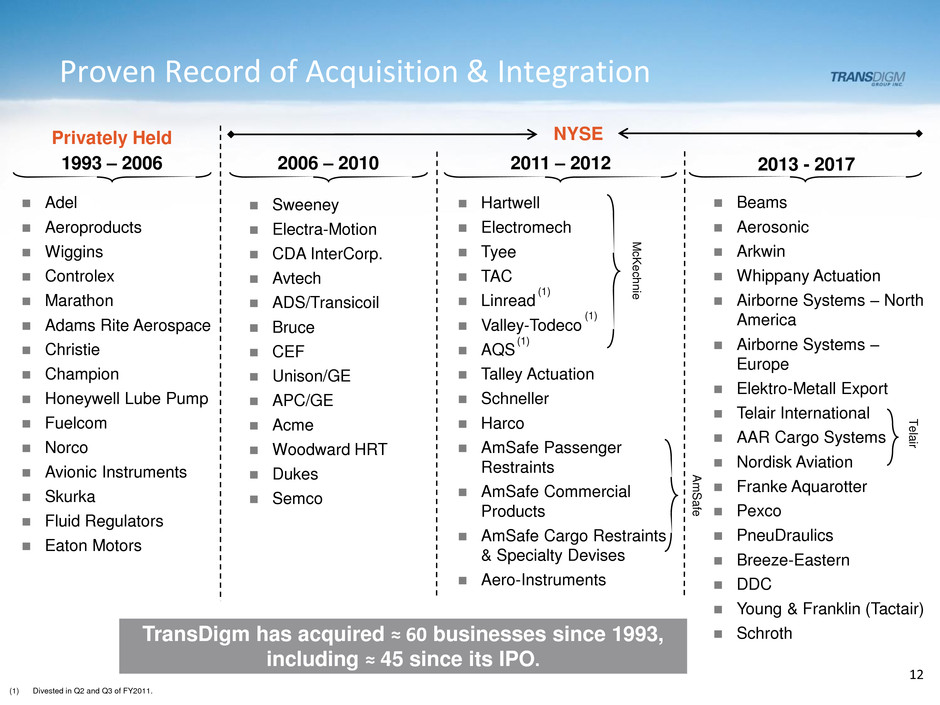

1993 – 2006 2006 – 2010 2011 – 2012 Adel Aeroproducts Wiggins Controlex Marathon Adams Rite Aerospace Christie Champion Honeywell Lube Pump Fuelcom Norco Avionic Instruments Skurka Fluid Regulators Eaton Motors Hartwell Electromech Tyee TAC Linread Valley-Todeco AQS Talley Actuation Schneller Harco AmSafe Passenger Restraints AmSafe Commercial Products AmSafe Cargo Restraints & Specialty Devises Aero-Instruments 2013 - 2017 Sweeney Electra-Motion CDA InterCorp. Avtech ADS/Transicoil Bruce CEF Unison/GE APC/GE Acme Woodward HRT Dukes Semco Privately Held NYSE TransDigm has acquired ≈ 60 businesses since 1993, including ≈ 45 since its IPO. (1) (1) Divested in Q2 and Q3 of FY2011. (1) (1) Proven Record of Acquisition & Integration Beams Aerosonic Arkwin Whippany Actuation Airborne Systems – North America Airborne Systems – Europe Elektro-Metall Export Telair International AAR Cargo Systems Nordisk Aviation Franke Aquarotter Pexco PneuDraulics Breeze-Eastern DDC Young & Franklin (Tactair) Schroth M c K e c h n ie A m S a fe T e la ir 12

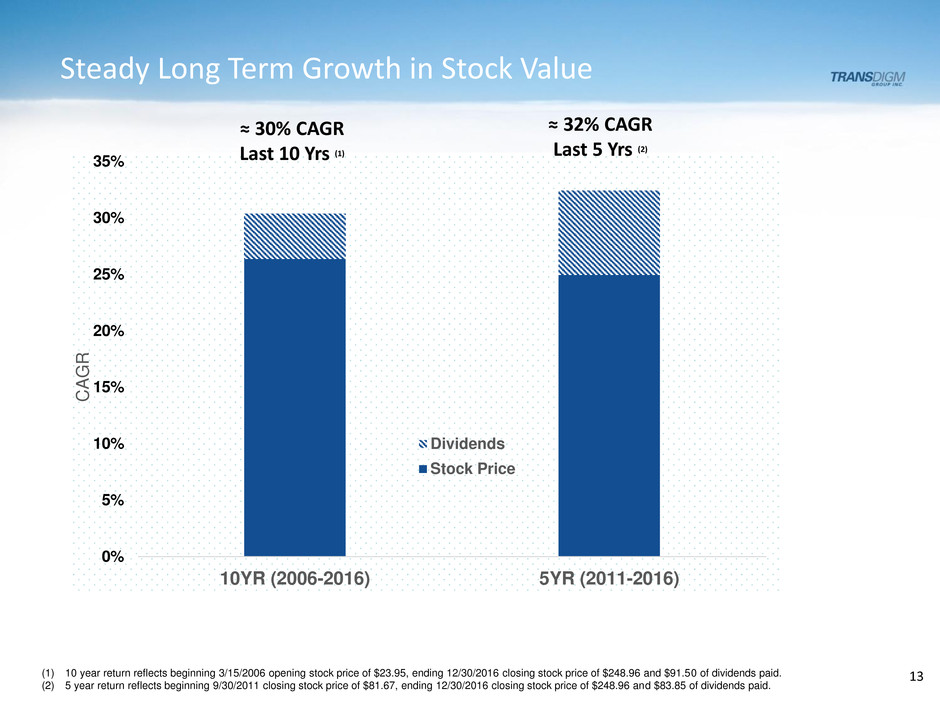

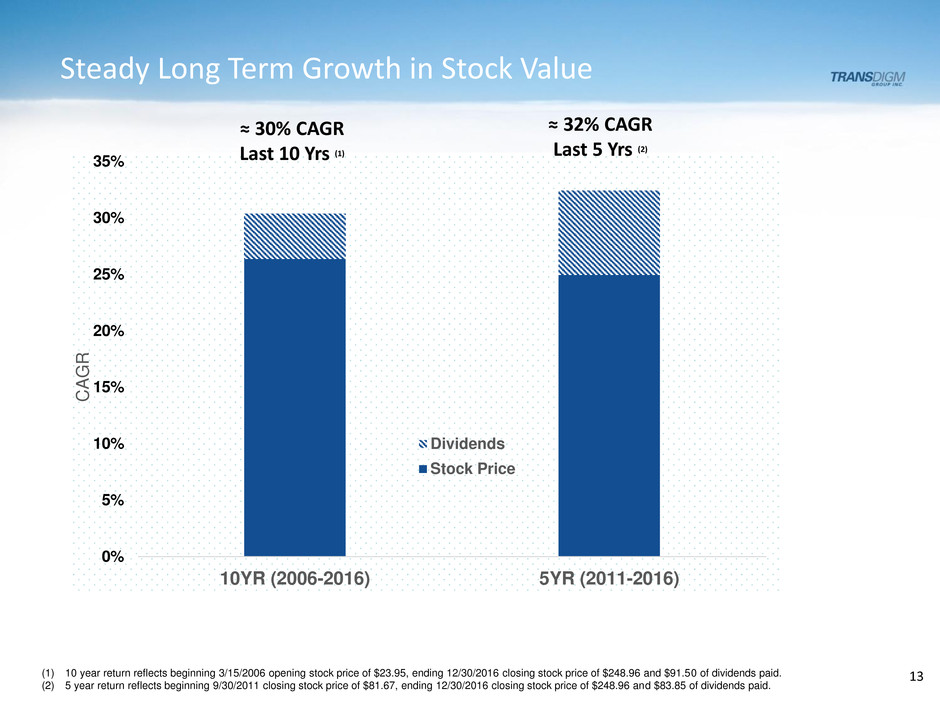

13 Steady Long Term Growth in Stock Value 0% 5% 10% 15% 20% 25% 30% 35% 10YR (2006-2016) 5YR (2011-2016) CAG R Dividends Stock Price (1) 10 year return reflects beginning 3/15/2006 opening stock price of $23.95, ending 12/30/2016 closing stock price of $248.96 and $91.50 of dividends paid. (2) 5 year return reflects beginning 9/30/2011 closing stock price of $81.67, ending 12/30/2016 closing stock price of $248.96 and $83.85 of dividends paid. ≈ 30% CAGR Last 10 Yrs (1) ≈ 32% CAGR Last 5 Yrs (2)

TDG Organic Growth & Outlook Definition of Acronyms: LSD = Low Single-Digit Percent Growth MSD = Mid Single-Digit Percent Growth HSD = High Single-Digit Percent Growth LDD = Low Double-Digit Percent Growth 14

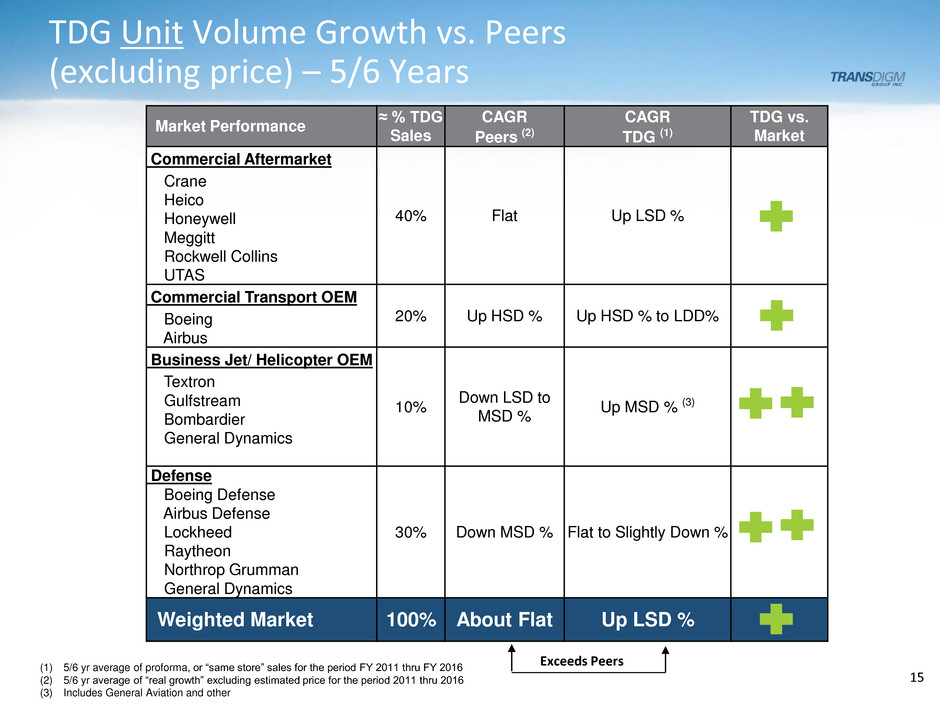

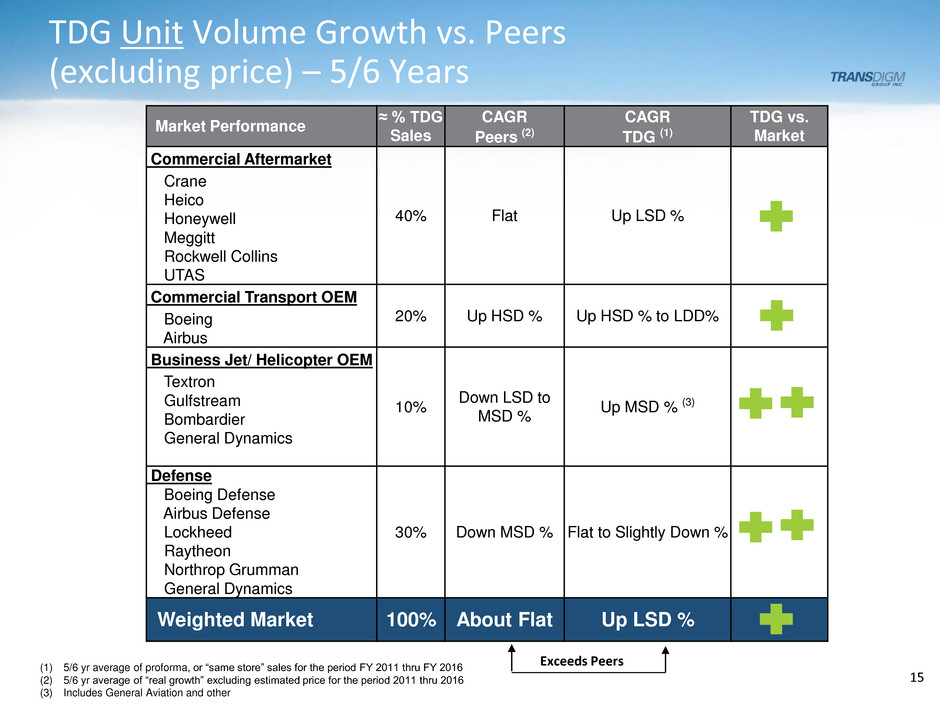

TDG Unit Volume Growth vs. Peers (excluding price) – 5/6 Years 15 (1) 5/6 yr average of proforma, or “same store” sales for the period FY 2011 thru FY 2016 (2) 5/6 yr average of “real growth” excluding estimated price for the period 2011 thru 2016 (3) Includes General Aviation and other Exceeds Peers About Flat Market Performance ≈ % TDG Sales CAGR CAGR TDG vs. Market Peers (2) TDG (1) Commercial Aftermarket 40% Flat Up LSD % Crane Heico Honeywell Meggitt Rockwell Collins UTAS Commercial Transport OEM 20% Up HSD % Up HSD % to LDD% Boeing Airbus Business Jet/ Helicopter OEM 10% Down LSD to MSD % Up MSD % (3) Textron Gulfstream Bombardier General Dynamics Defense 30% Down MSD % Flat to Slightly Down % Boeing Defense Airbus Defense Lockheed Raytheon Northrop Grumman General Dynamics Weighted Market 100% About Flat Up LSD %

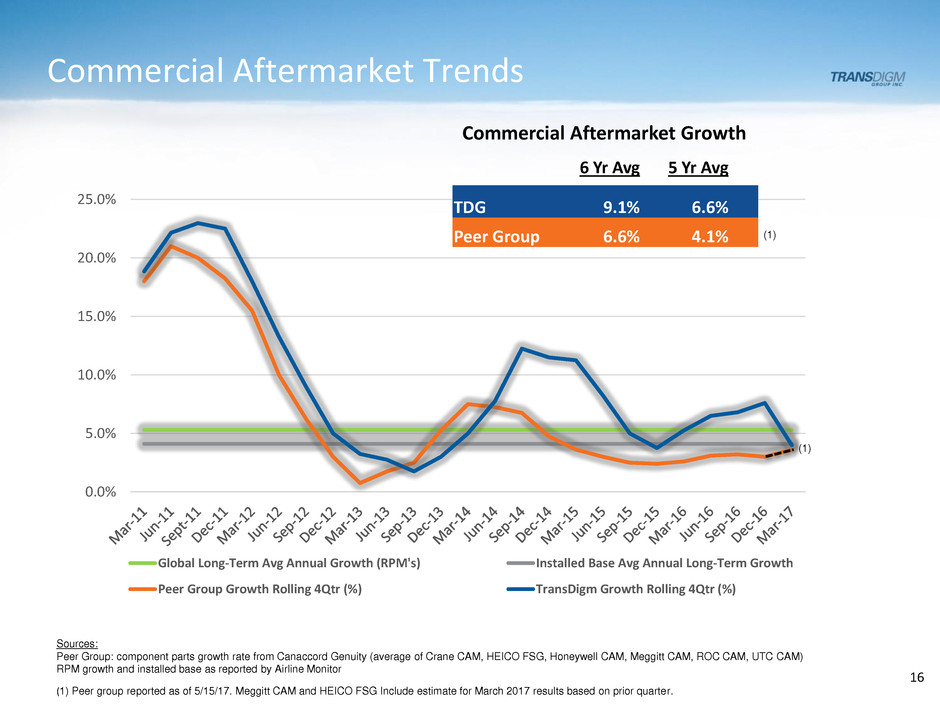

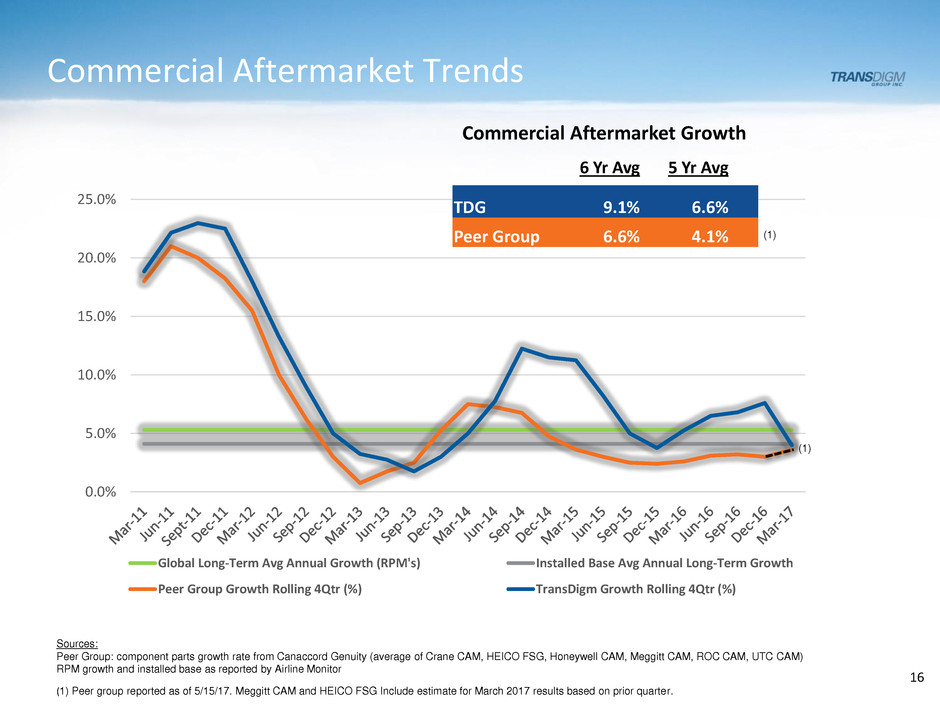

Commercial Aftermarket Trends 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% Global Long-Term Avg Annual Growth (RPM's) Installed Base Avg Annual Long-Term Growth Peer Group Growth Rolling 4Qtr (%) TransDigm Growth Rolling 4Qtr (%) (1) (1) Sources: Peer Group: component parts growth rate from Canaccord Genuity (average of Crane CAM, HEICO FSG, Honeywell CAM, Meggitt CAM, ROC CAM, UTC CAM) RPM growth and installed base as reported by Airline Monitor 6 Yr Avg 5 Yr Avg TDG 9.1% 6.6% Peer Group 6.6% 4.1% Commercial Aftermarket Growth (1) Peer group reported as of 5/15/17. Meggitt CAM and HEICO FSG Include estimate for March 2017 results based on prior quarter. 16

17 Commercial Aftermarket Theories PMA Out of Warranty Fleet Surplus Parts Parts Pooling/Inventory

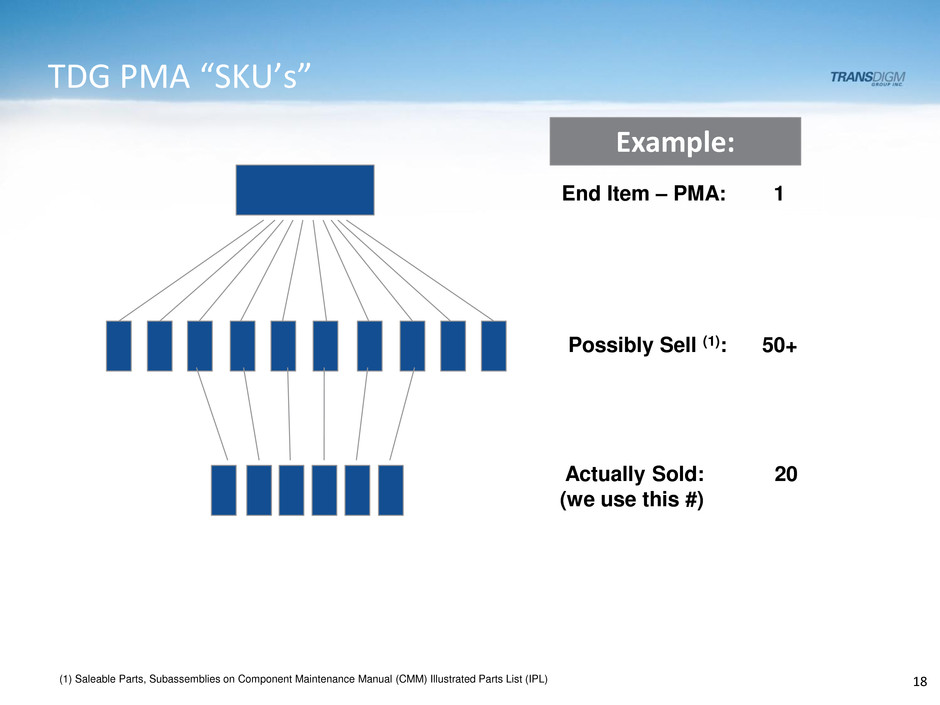

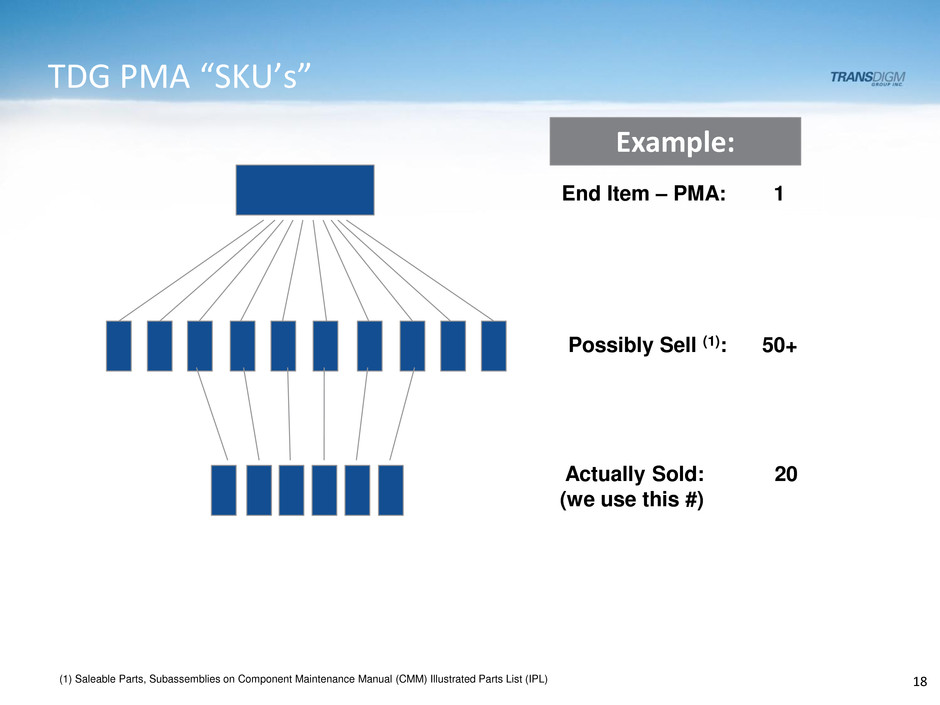

TDG PMA “SKU’s” End Item – PMA: 1 Actually Sold: 20 (we use this #) (1) Saleable Parts, Subassemblies on Component Maintenance Manual (CMM) Illustrated Parts List (IPL) Possibly Sell (1): 50+ 18 Example:

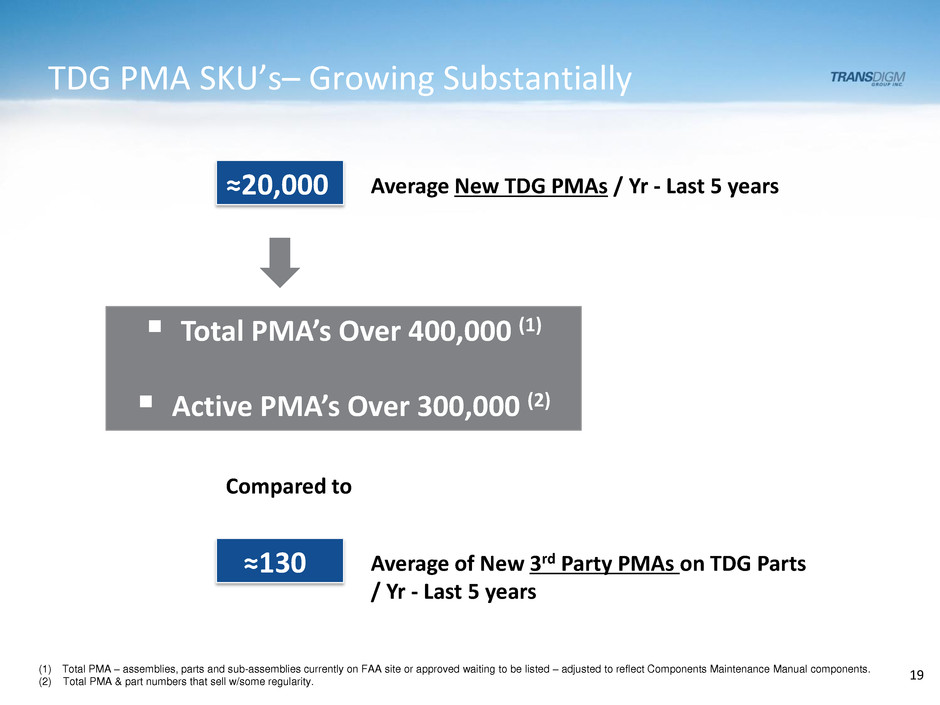

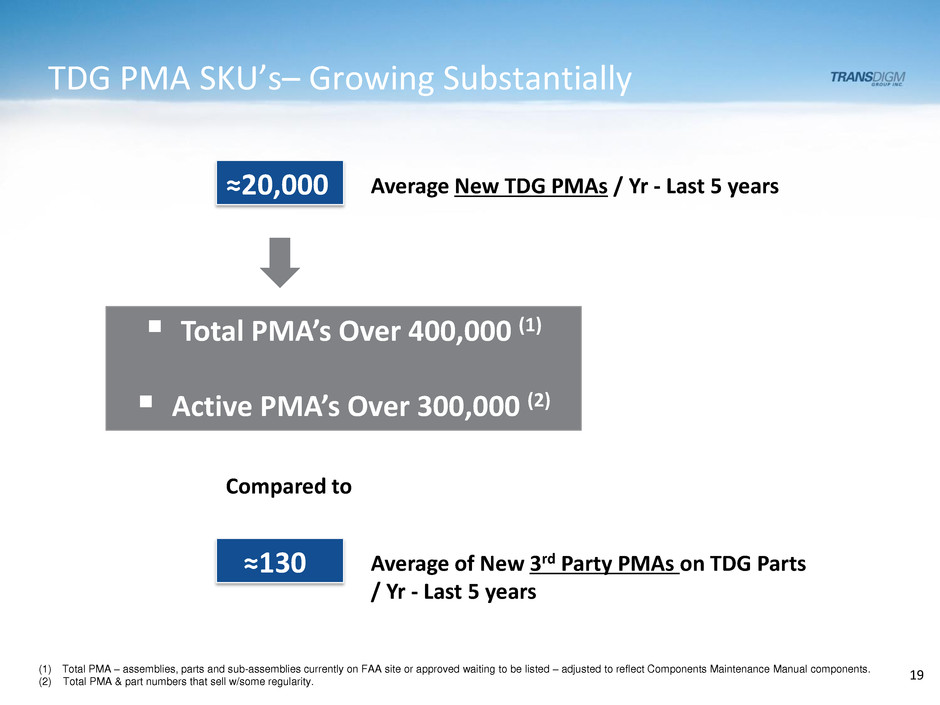

TDG PMA SKU’s– Growing Substantially ≈20,000 Total PMA’s Over 400,000 (1) Active PMA’s Over 300,000 (2) ≈130 Compared to (1) Total PMA – assemblies, parts and sub-assemblies currently on FAA site or approved waiting to be listed – adjusted to reflect Components Maintenance Manual components. (2) Total PMA & part numbers that sell w/some regularity. Average New TDG PMAs / Yr - Last 5 years Average of New 3rd Party PMAs on TDG Parts / Yr - Last 5 years 19

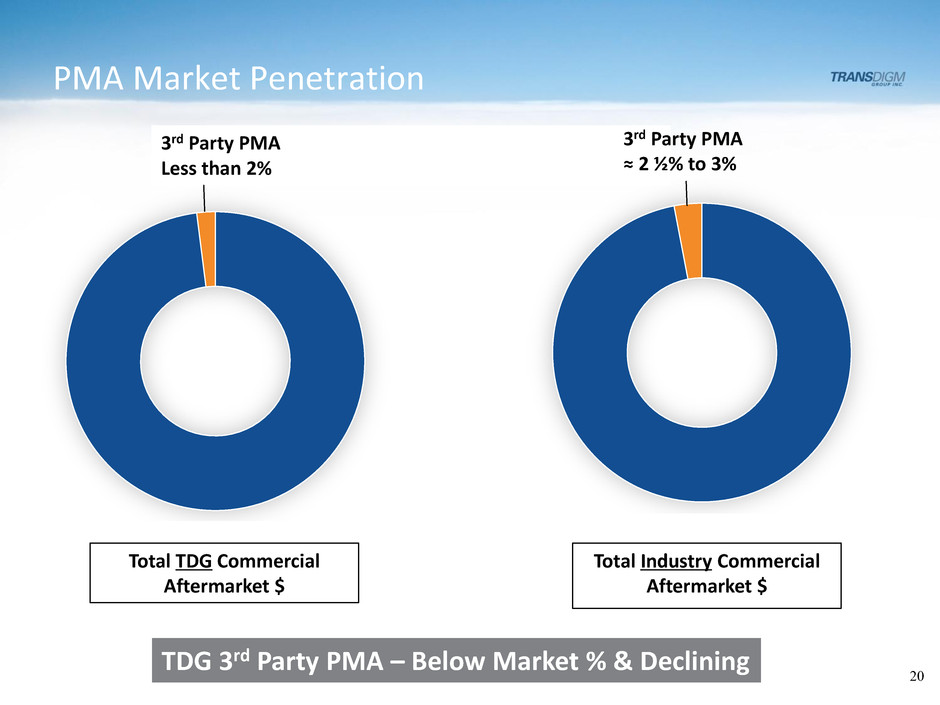

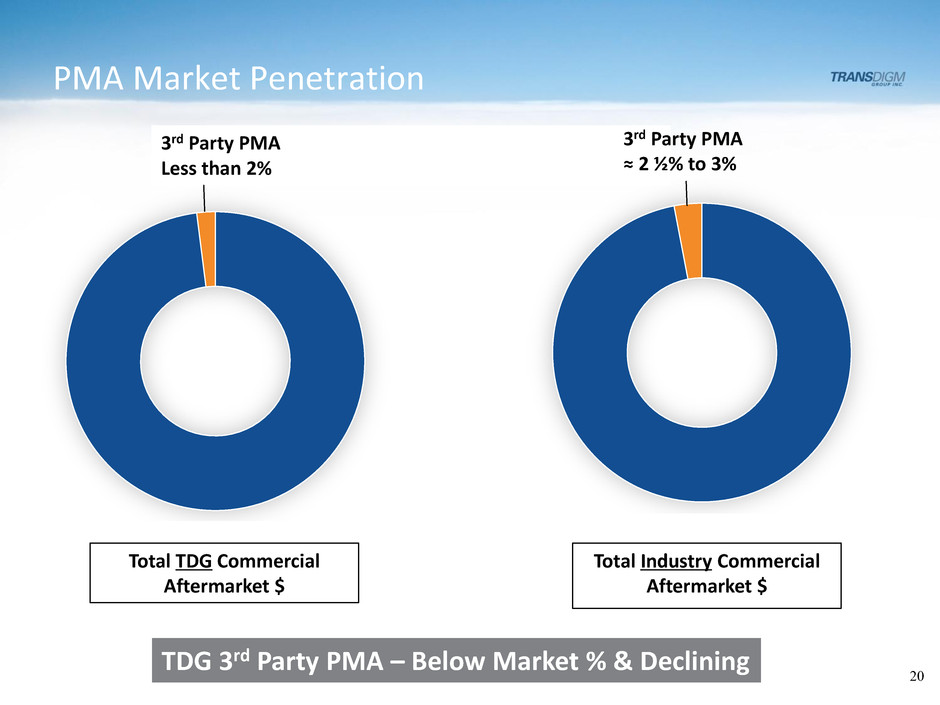

TDG 3rd Party PMA – Below Market % & Declining 20 PMA Market Penetration 3rd Party PMA Less than 2% 3rd Party PMA ≈ 2 ½% to 3% Total TDG Commercial Aftermarket $ Total Industry Commercial Aftermarket $

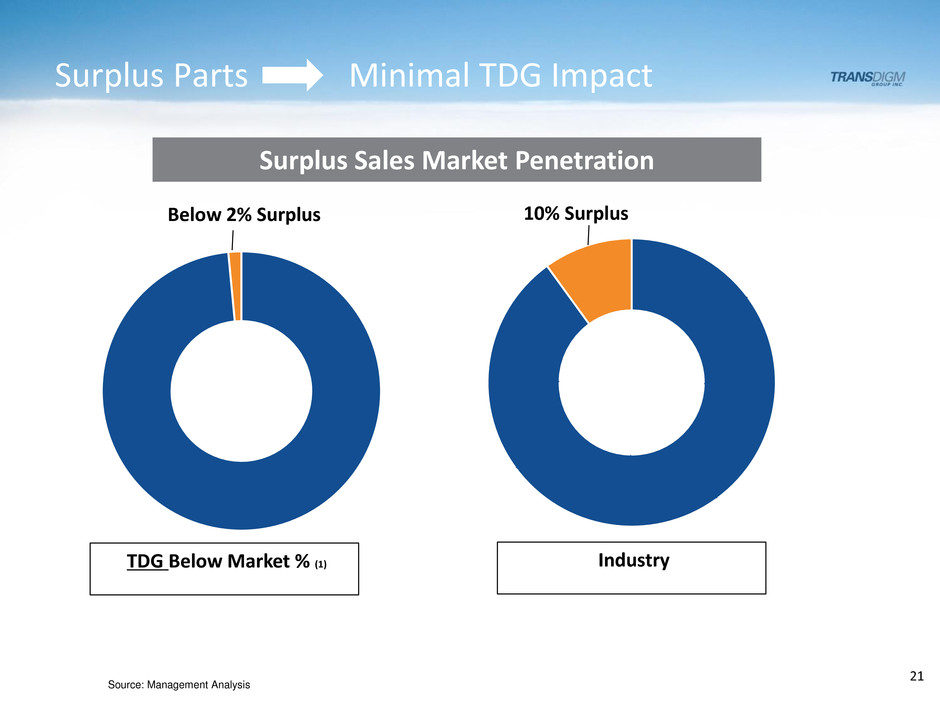

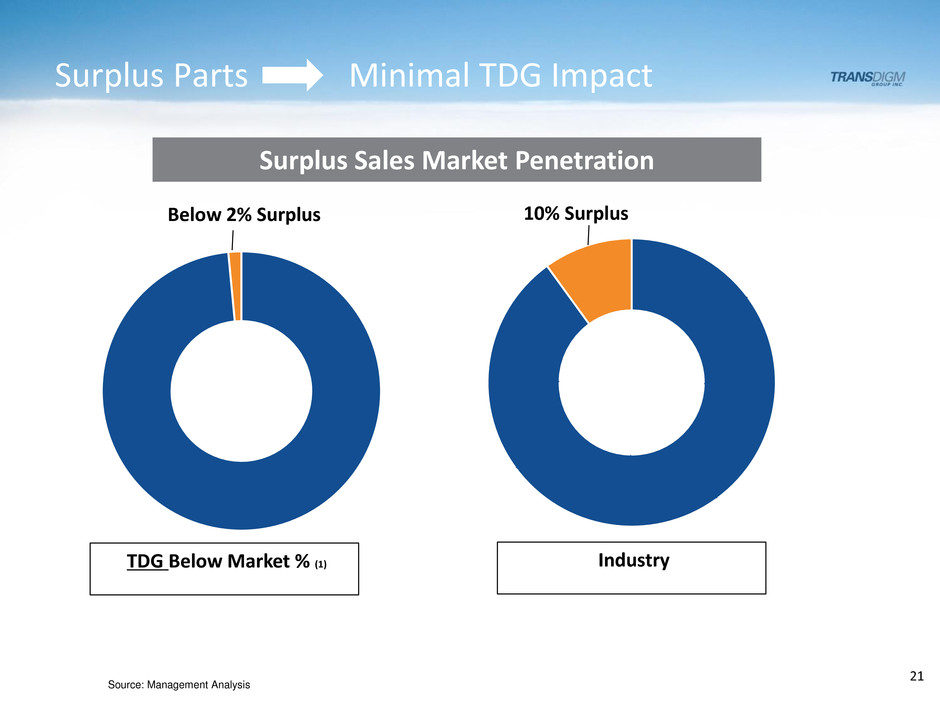

Surplus Parts Minimal TDG Impact 21 Source: Management Analysis 10% Surplus Below 2% Surplus Surplus Sales Market Penetration TDG Below Market % (1) Industry

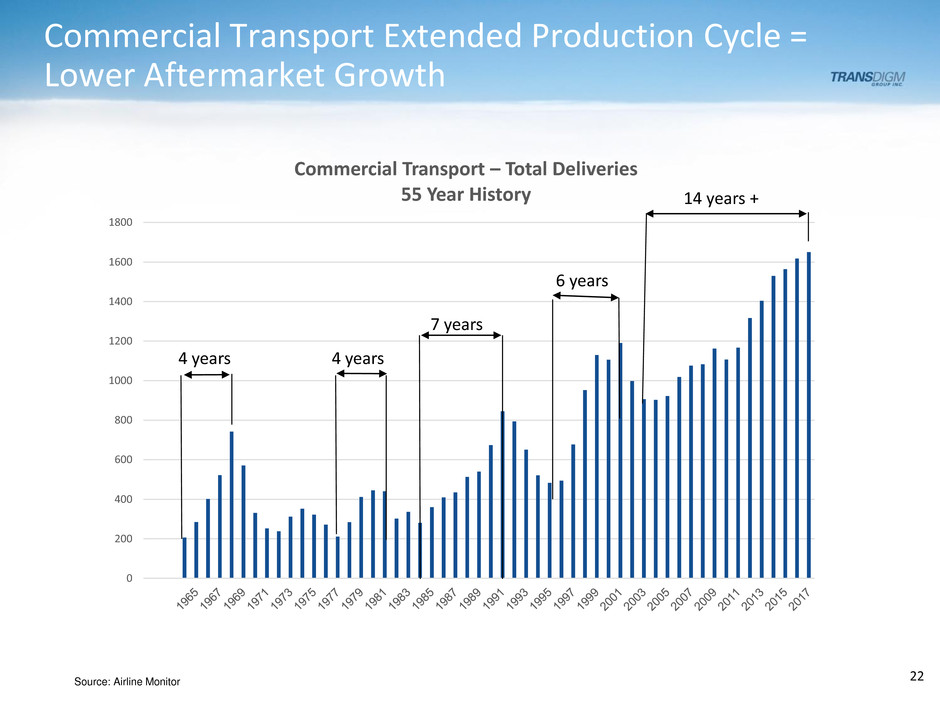

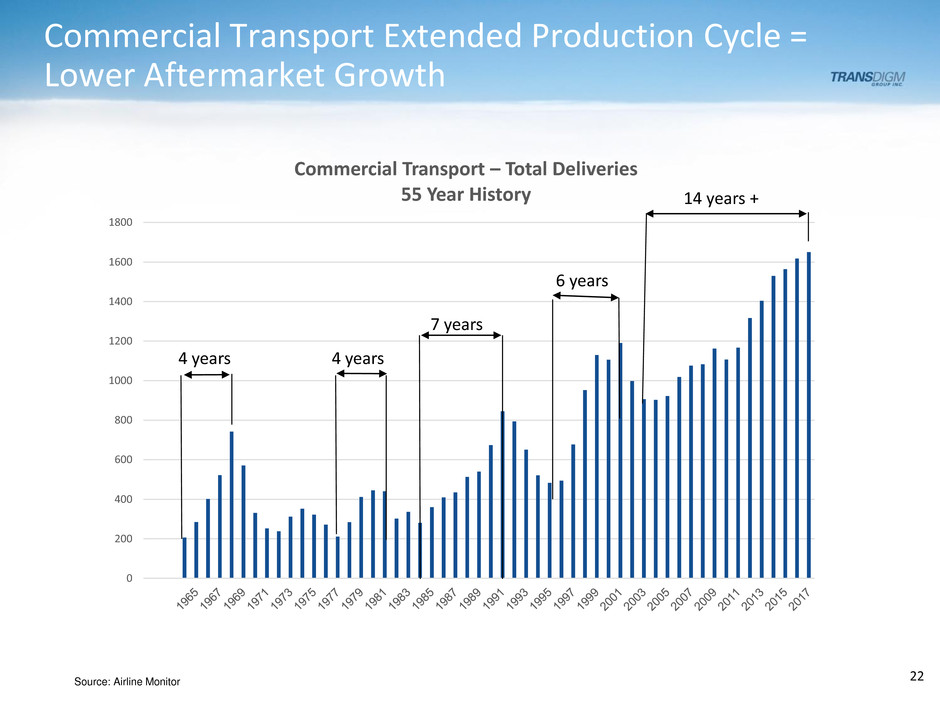

22 0 200 400 600 800 1000 1200 1400 1600 1800 Commercial Transport – Total Deliveries 55 Year History 4 years 6 years Commercial Transport Extended Production Cycle = Lower Aftermarket Growth 4 years 7 years 14 years + Source: Airline Monitor

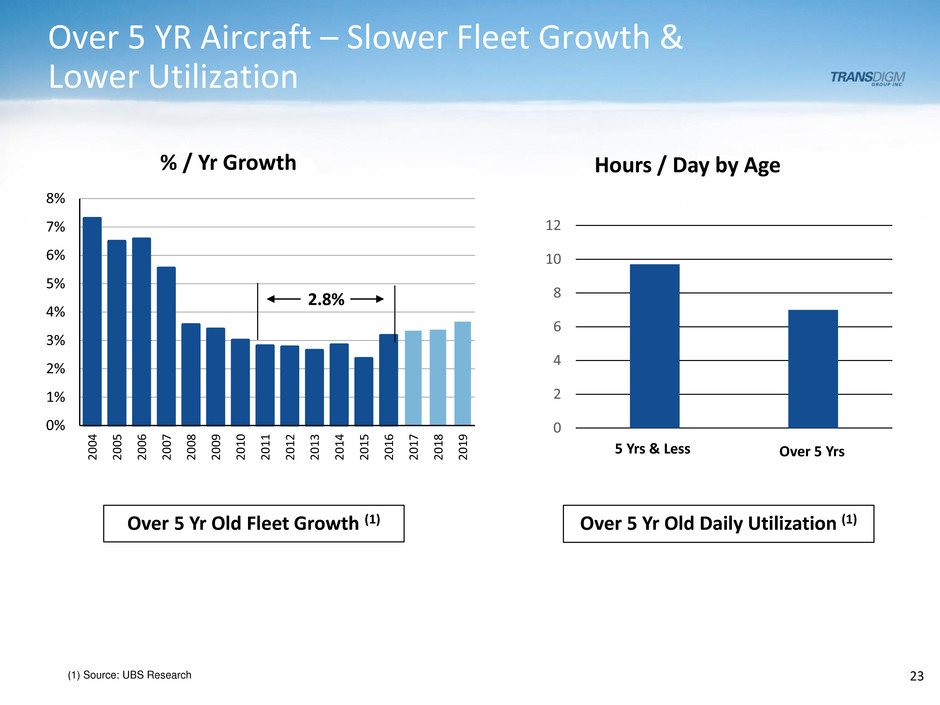

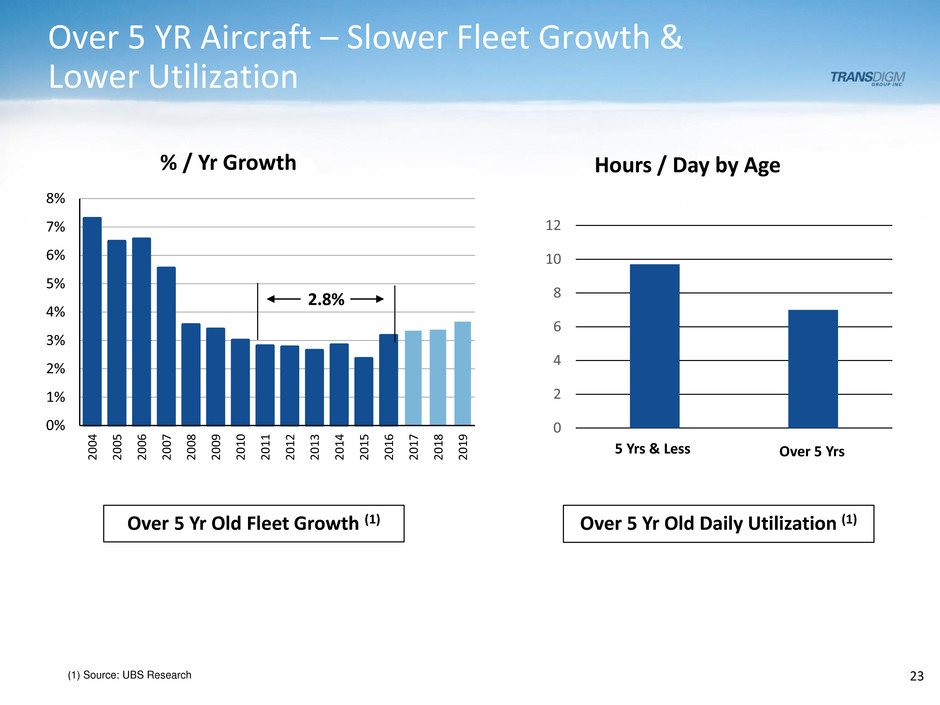

Over 5 YR Aircraft – Slower Fleet Growth & Lower Utilization 23 0 2 4 6 8 10 12 Hours / Day by Age 0% 1% 2% 3% 4% 5% 6% 7% 8% 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 % / Yr Growth 2.8% (1) Source: UBS Research Over 5 Yr Old Fleet Growth (1) Over 5 Yr Old Daily Utilization (1) 5 Yrs & Less Over 5 Yrs

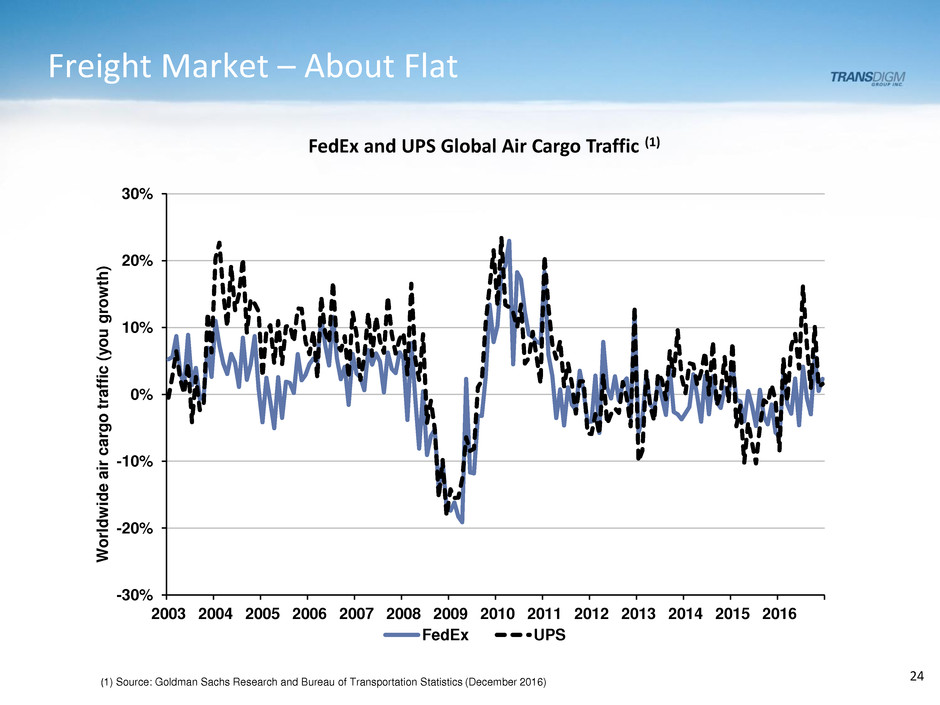

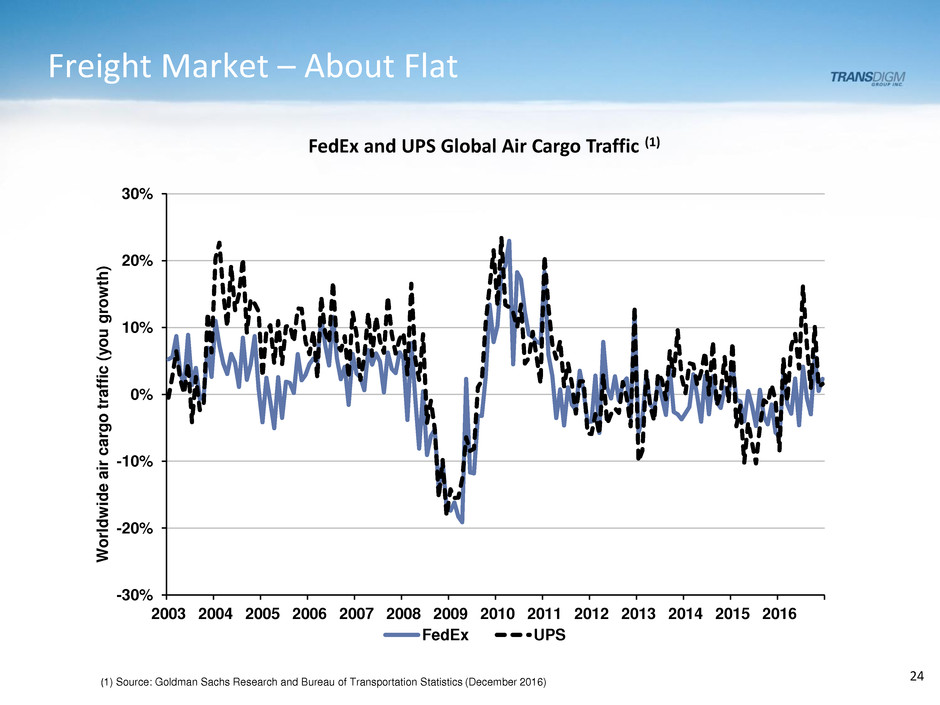

Freight Market – About Flat 24 -30% -20% -10% 0% 10% 20% 30% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 W orld w id e a ir c a rgo traf fi c ( y ou gro w th ) FedEx UPS (1) Source: Goldman Sachs Research and Bureau of Transportation Statistics (December 2016) FedEx and UPS Global Air Cargo Traffic (1)

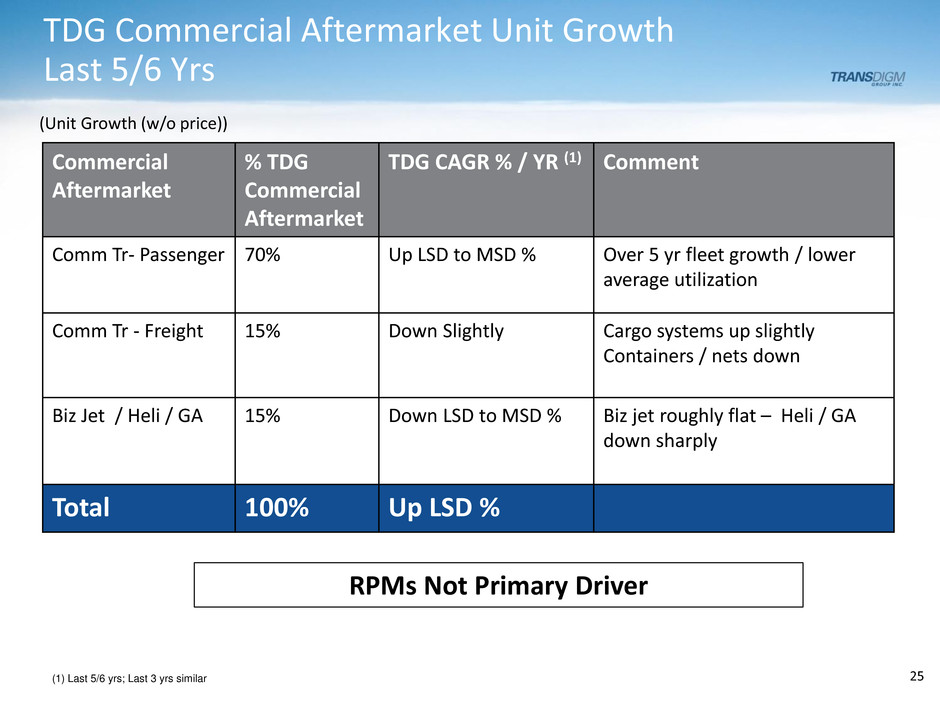

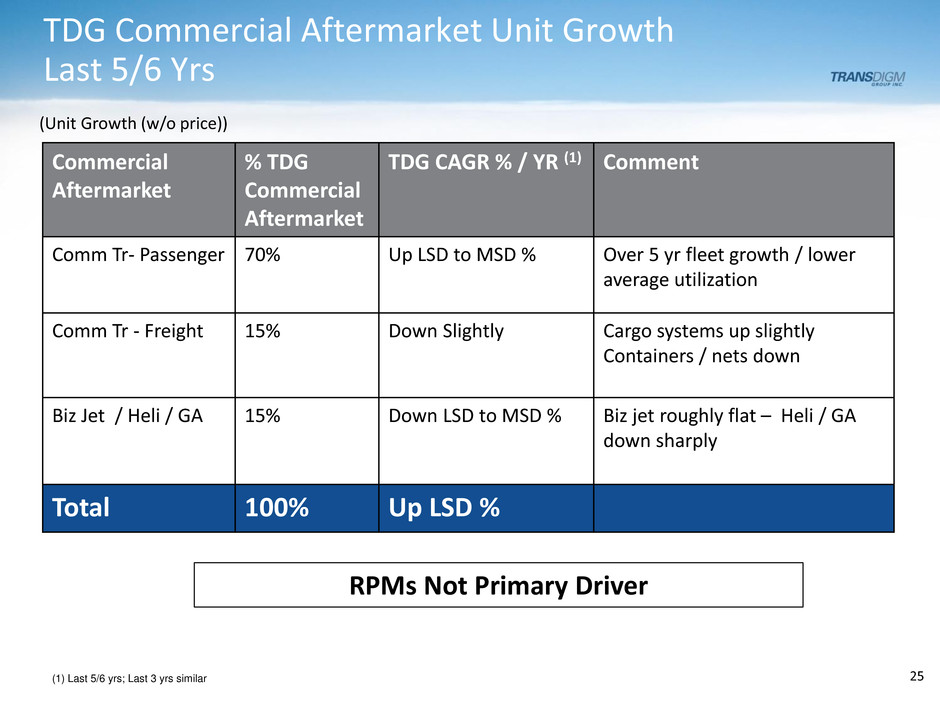

TDG Commercial Aftermarket Unit Growth Last 5/6 Yrs 25 (1) Last 5/6 yrs; Last 3 yrs similar (Unit Growth (w/o price)) RPMs Not Primary Driver Commercial Aftermarket % TDG Commercial Aftermarket TDG CAGR % / YR (1) Comment Comm Tr- Passenger 70% Up LSD to MSD % Over 5 yr fleet growth / lower average utilization Comm Tr - Freight 15% Down Slightly Cargo systems up slightly Containers / nets down Biz Jet / Heli / GA 15% Down LSD to MSD % Biz jet roughly flat – Heli / GA down sharply Total 100% Up LSD %

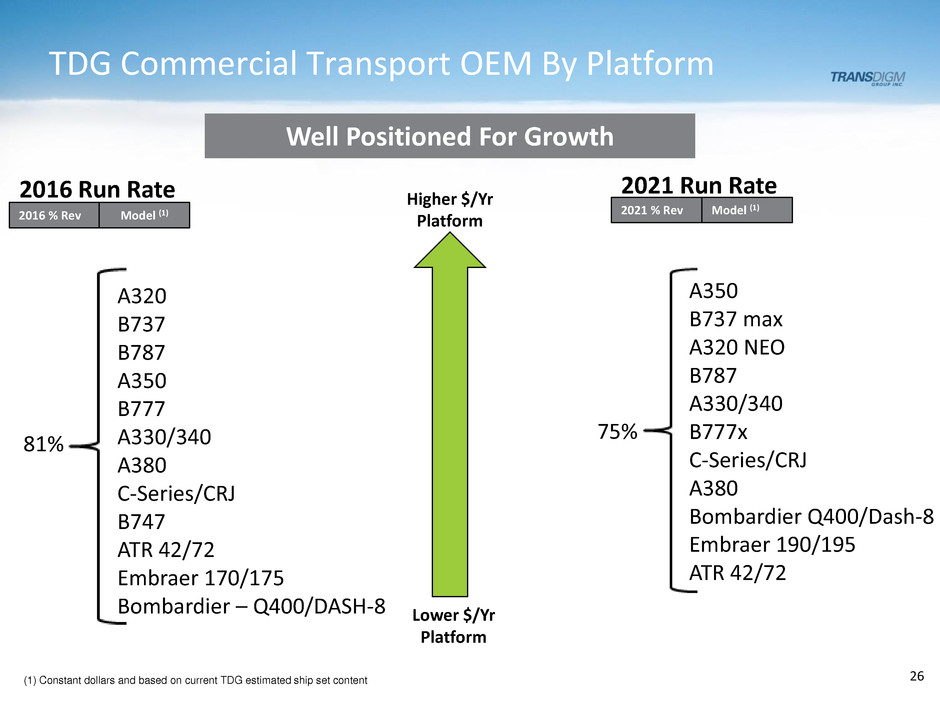

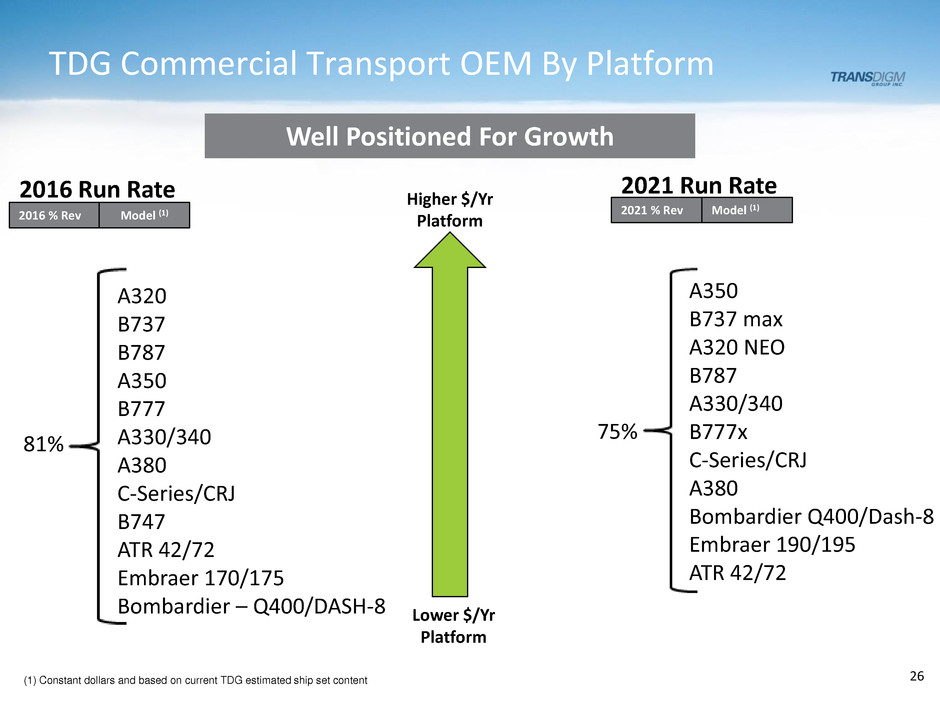

TDG Commercial Transport OEM By Platform 26 A320 B737 B787 A350 B777 A330/340 A380 C-Series/CRJ B747 ATR 42/72 Embraer 170/175 Bombardier – Q400/DASH-8 A350 B737 max A320 NEO B787 A330/340 B777x C-Series/CRJ A380 Bombardier Q400/Dash-8 Embraer 190/195 ATR 42/72 Higher $/Yr Platform Lower $/Yr Platform 81% 75% 2016 Run Rate (1) Constant dollars and based on current TDG estimated ship set content Well Positioned For Growth 2021 Run Rate 2016 % Rev Model (1) 2021 % Rev Model (1)

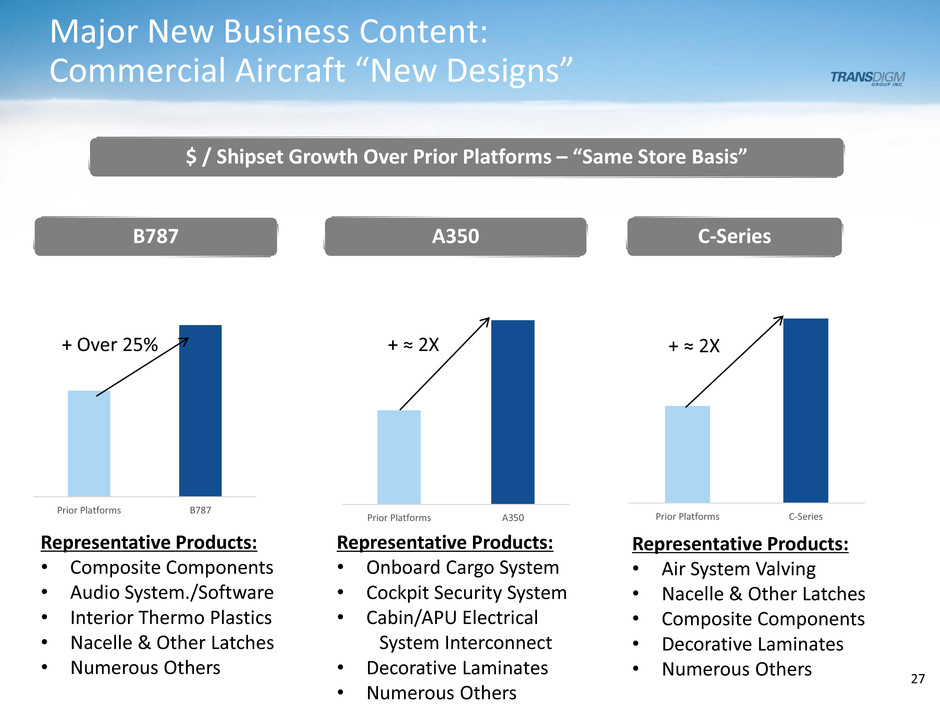

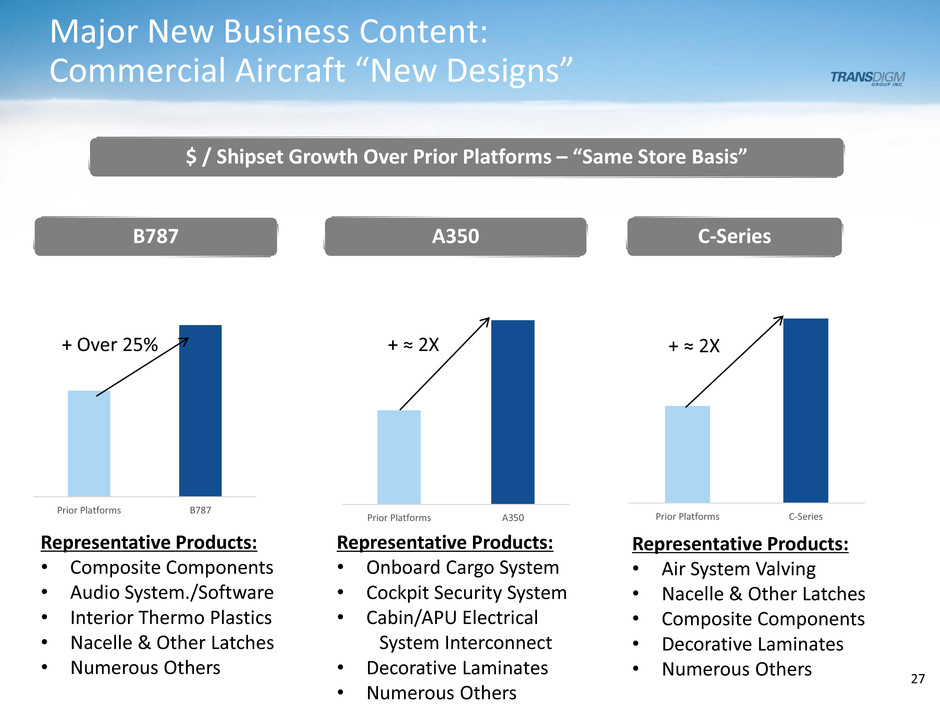

Prior Platforms C-SeriesPrior Platforms A350 Prior Platforms B787 Major New Business Content: Commercial Aircraft “New Designs” 27 B787 A350 C-Series $ / Shipset Growth Over Prior Platforms – “Same Store Basis” Representative Products: • Composite Components • Audio System./Software • Interior Thermo Plastics • Nacelle & Other Latches • Numerous Others Representative Products: • Onboard Cargo System • Cockpit Security System • Cabin/APU Electrical System Interconnect • Decorative Laminates • Numerous Others Representative Products: • Air System Valving • Nacelle & Other Latches • Composite Components • Decorative Laminates • Numerous Others + Over 25% + ≈ 2X + ≈ 2X

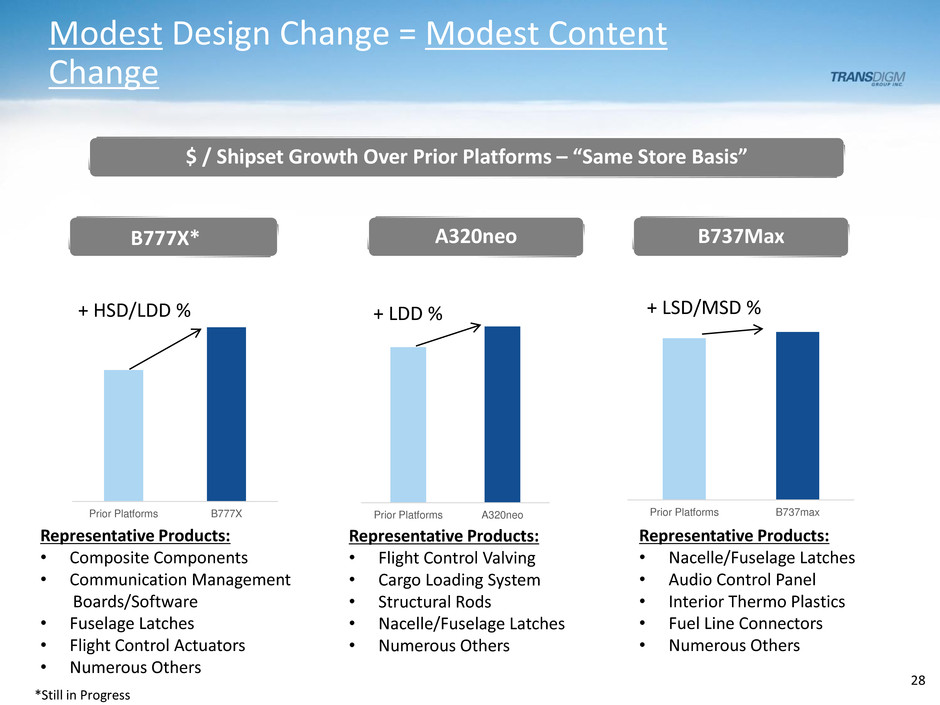

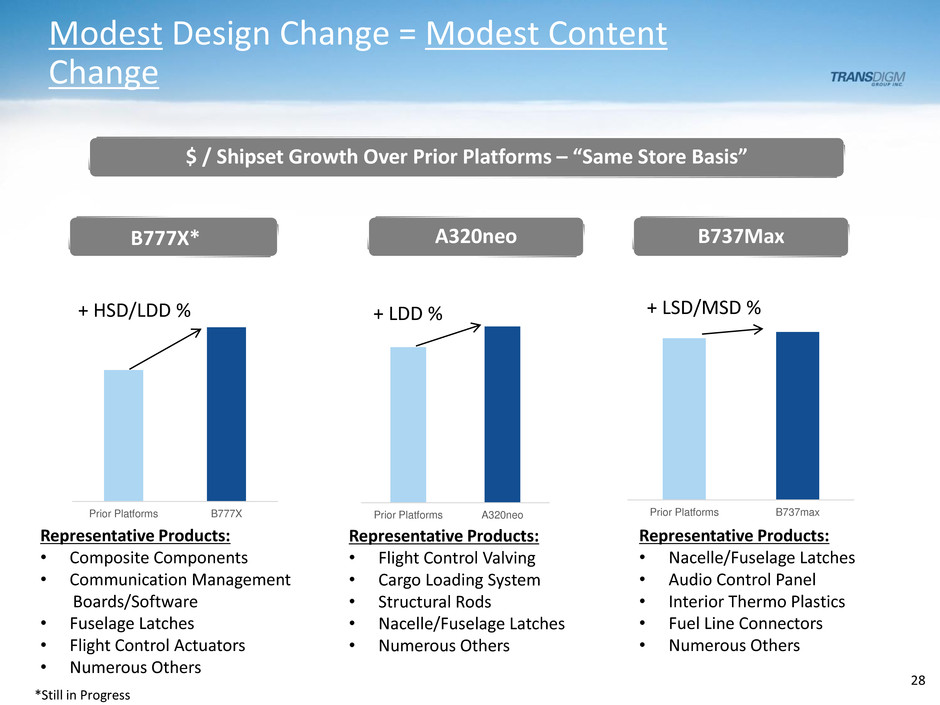

Prior Platforms A320neo + LDD % Prior Platforms B737max + LSD/MSD % Prior Platforms B777X + HSD/LDD % Modest Design Change = Modest Content Change 28 B777X* A320neo $ / Shipset Growth Over Prior Platforms – “Same Store Basis” B737Max Representative Products: • Composite Components • Communication Management Boards/Software • Fuselage Latches • Flight Control Actuators • Numerous Others Representative Products: • Flight Control Valving • Cargo Loading System • Structural Rods • Nacelle/Fuselage Latches • Numerous Others Representative Products: • Nacelle/Fuselage Latches • Audio Control Panel • Interior Thermo Plastics • Fuel Line Connectors • Numerous Others *Still in Progress

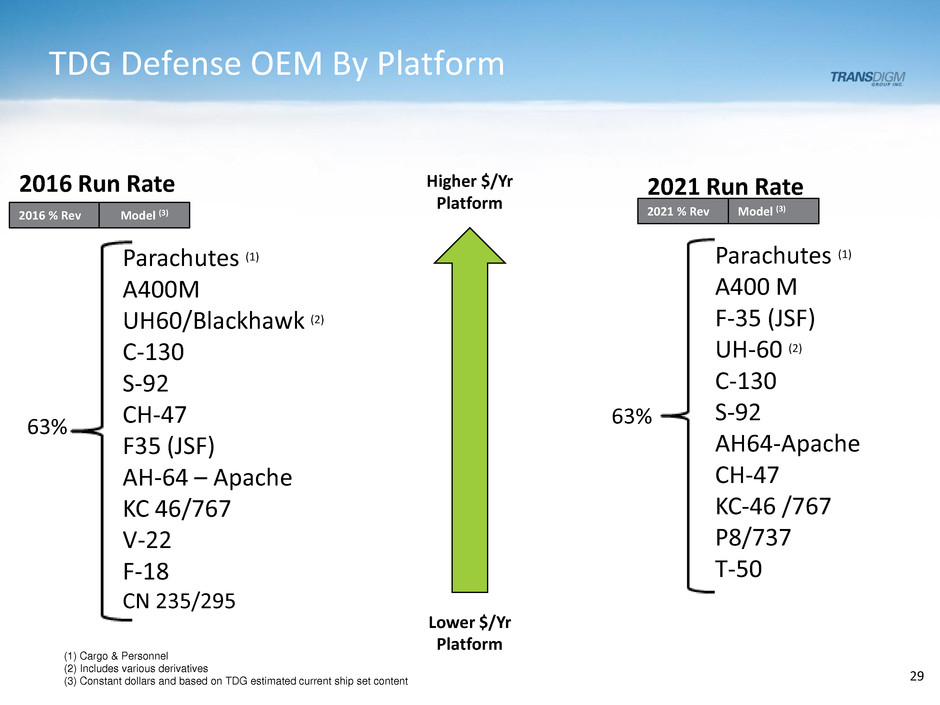

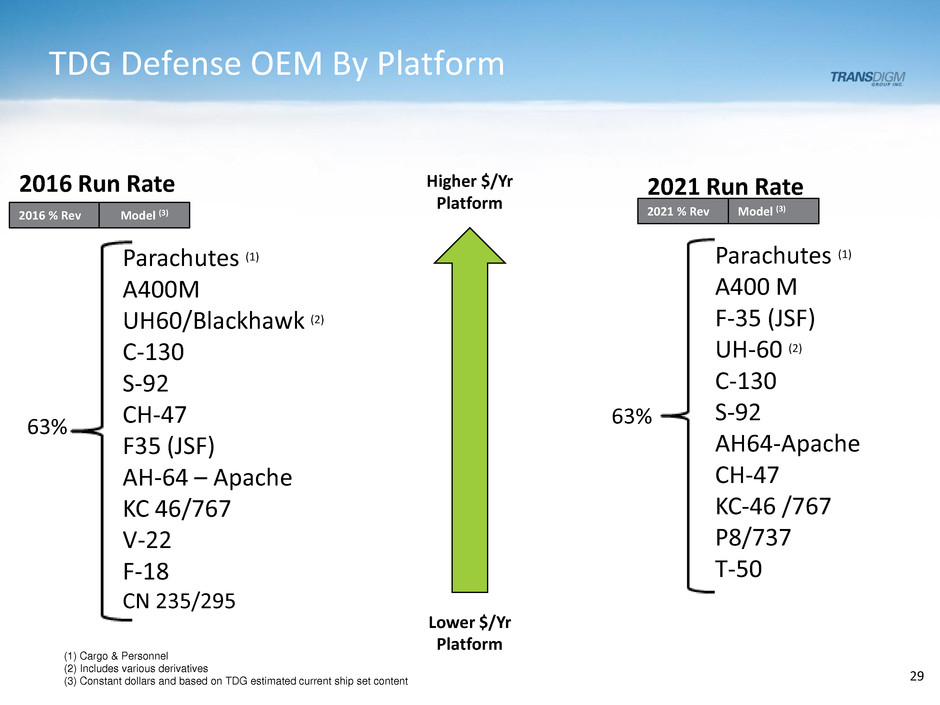

TDG Defense OEM By Platform 29 Higher $/Yr Platform Lower $/Yr Platform 63% 63% 2016 Run Rate 2021 Run Rate 2016 % Rev Model (3) 2021 % Rev Model (3) Parachutes (1) A400M UH60/Blackhawk (2) C-130 S-92 CH-47 F35 (JSF) AH-64 – Apache KC 46/767 V-22 F-18 CN 235/295 Parachutes (1) A400 M F-35 (JSF) UH-60 (2) C-130 S-92 AH64-Apache CH-47 KC-46 /767 P8/737 T-50 (1) Cargo & Personnel (2) Includes various derivatives (3) Constant dollars and based on TDG estimated current ship set content

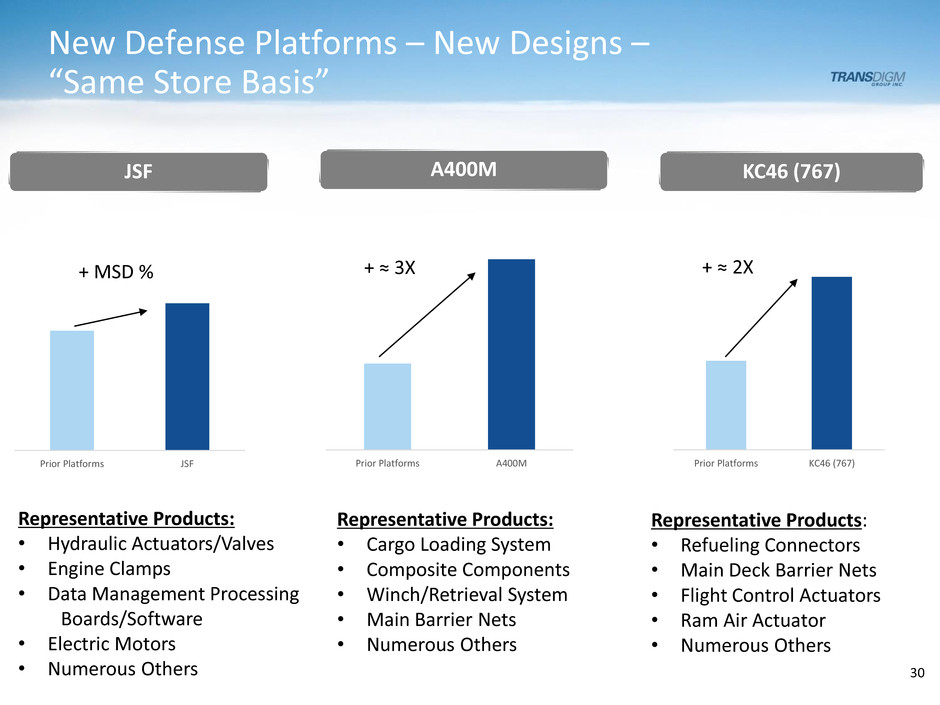

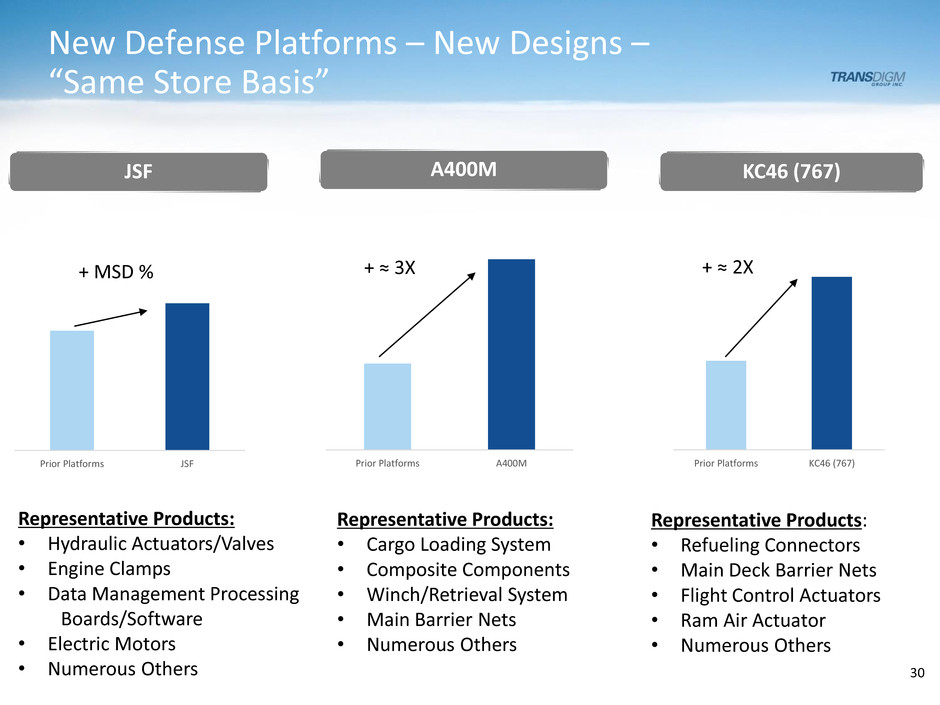

New Defense Platforms – New Designs – “Same Store Basis” 30 JSF A400M KC46 (767) Representative Products: • Hydraulic Actuators/Valves • Engine Clamps • Data Management Processing Boards/Software • Electric Motors • Numerous Others Representative Products: • Refueling Connectors • Main Deck Barrier Nets • Flight Control Actuators • Ram Air Actuator • Numerous Others Prior Platforms JSF Prior Platforms A400M Prior Platforms KC46 (767) Representative Products: • Cargo Loading System • Composite Components • Winch/Retrieval System • Main Barrier Nets • Numerous Others + ≈ 3X + MSD % + ≈ 2X

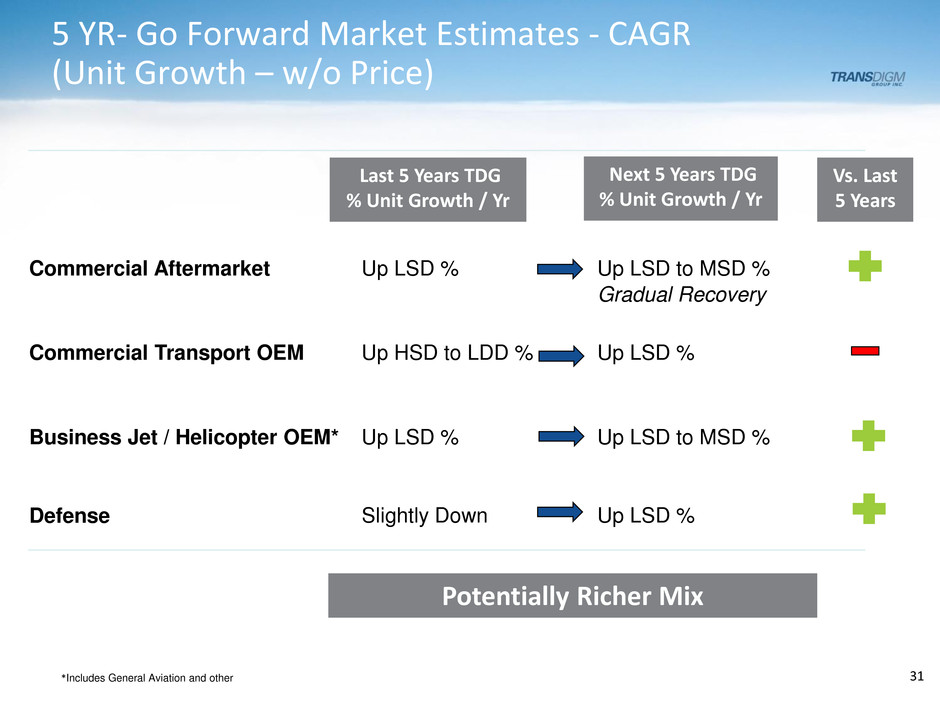

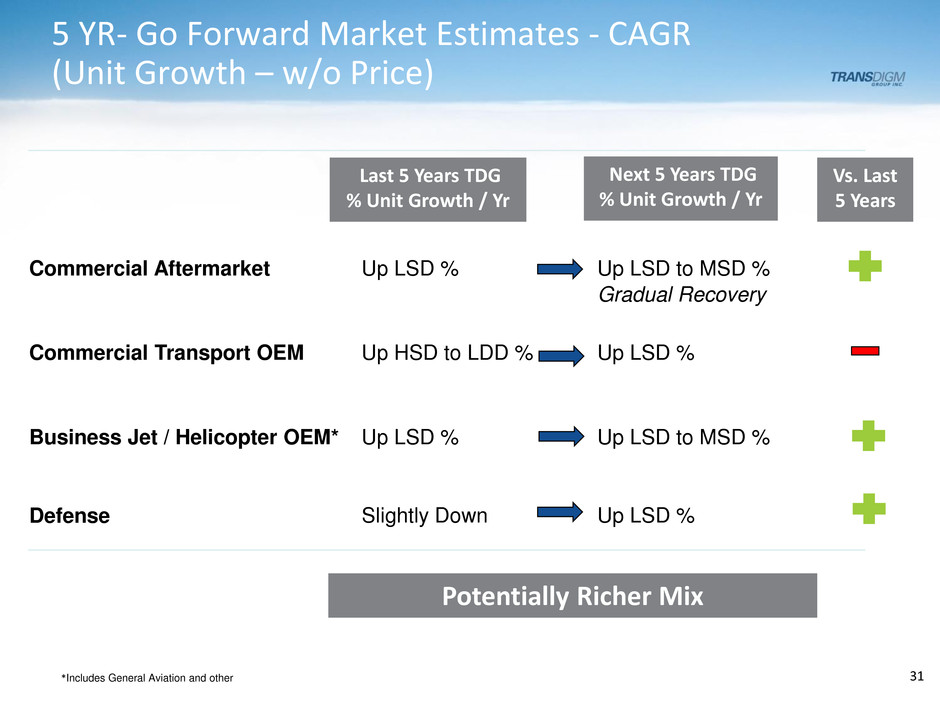

5 YR- Go Forward Market Estimates - CAGR (Unit Growth – w/o Price) 31 Commercial Aftermarket Up LSD % Up LSD to MSD % Gradual Recovery Commercial Transport OEM Up HSD to LDD % Up LSD % Business Jet / Helicopter OEM* Up LSD % Up LSD to MSD % Defense Slightly Down Up LSD % Last 5 Years TDG % Unit Growth / Yr Next 5 Years TDG % Unit Growth / Yr Vs. Last 5 Years Potentially Richer Mix *Includes General Aviation and other

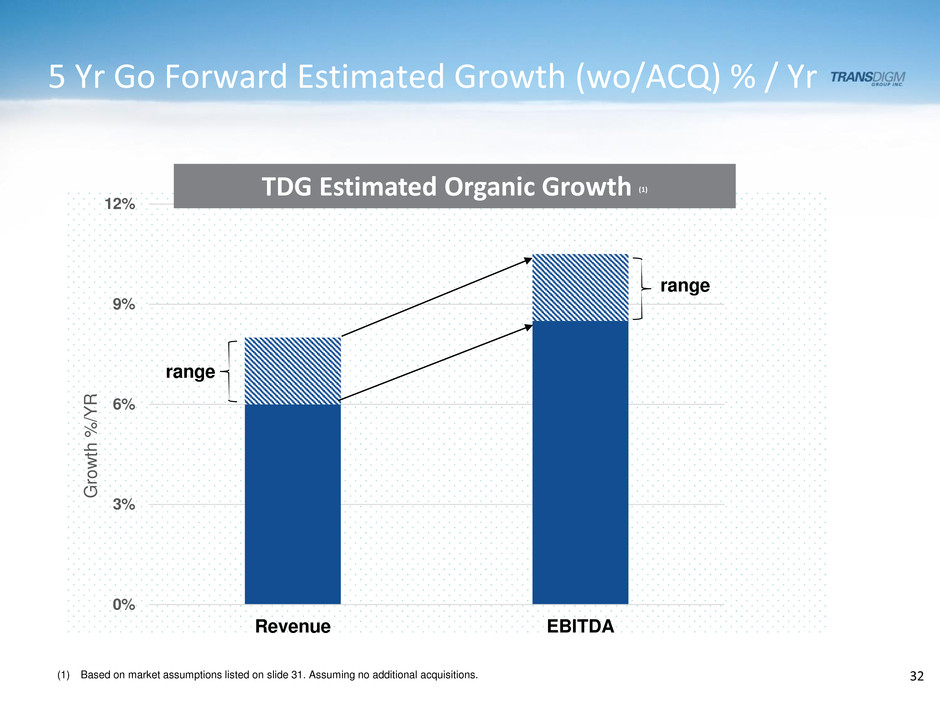

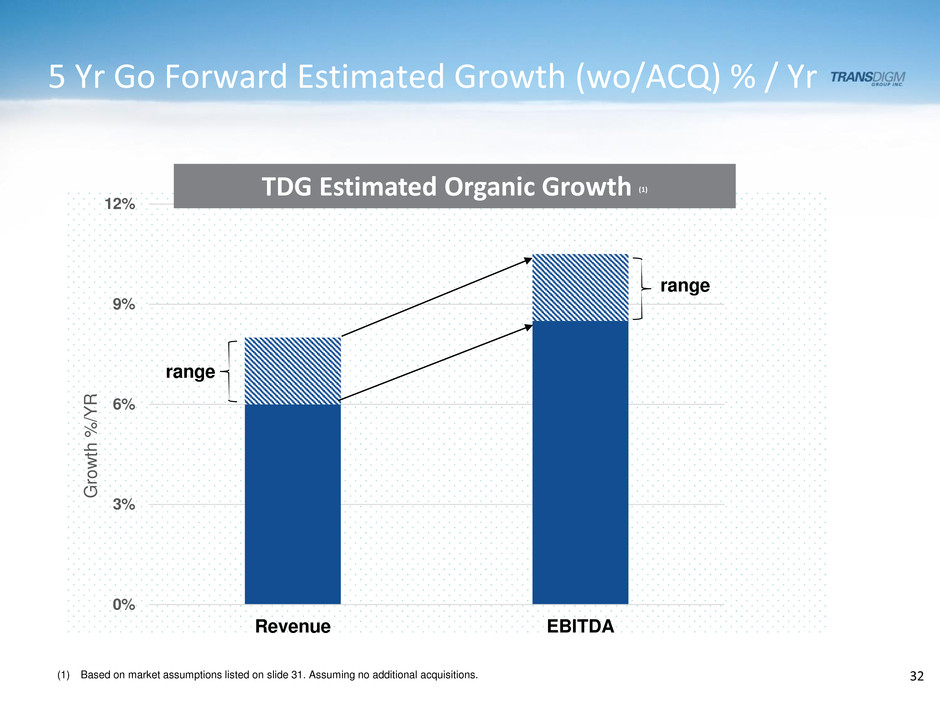

5 Yr Go Forward Estimated Growth (wo/ACQ) % / Yr 0% 3% 6% 9% 12% Revenue EBITDA G ro w th % /Y R range 32 range (1) Based on market assumptions listed on slide 31. Assuming no additional acquisitions. TDG Estimated Organic Growth (1)

Consistent Operating Model & Customer Value 33

Customer Value Proposition 34 Provide Reliable, Well Engineered Products & Deliver Them On-Time Highest Value to Customers 34

TDG Operating System: A Detailed Process Investment Highly Engineered Products Require Resourcing ~7% of total cost spent on Engineering Organization BUM Team Concept Succession Planning Execution Relentless Drive to Create Value 35

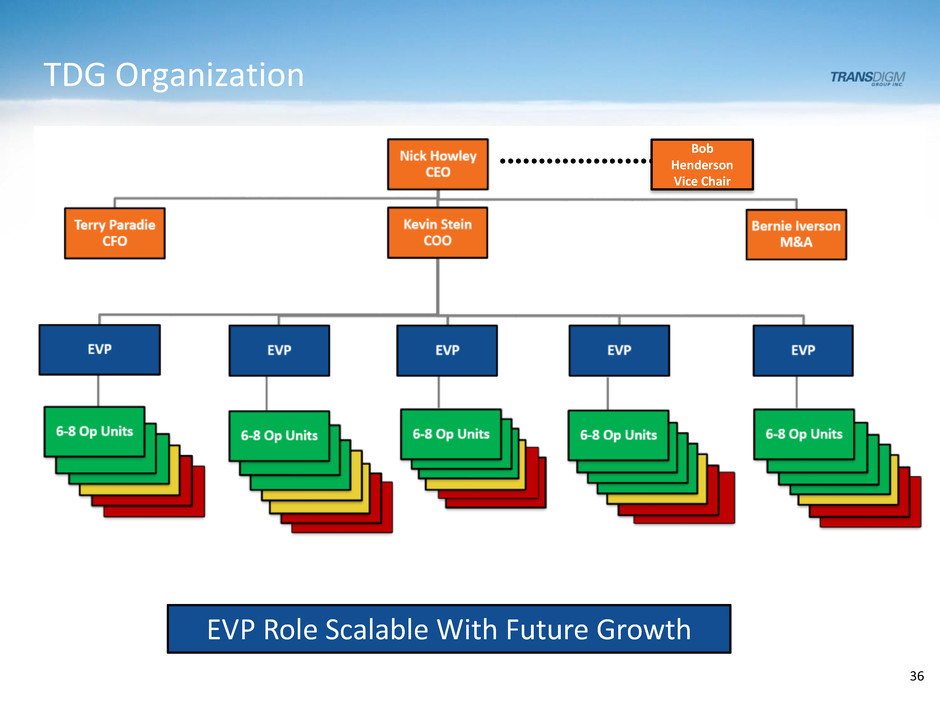

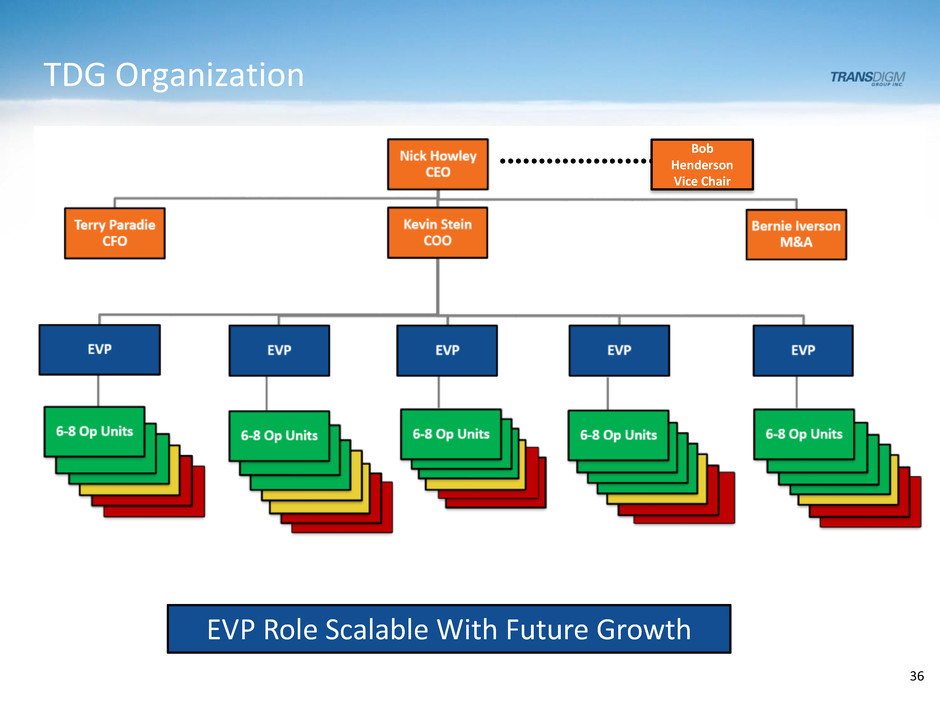

TDG Organization EVP Role Scalable With Future Growth .................... Bob Henderson Vice Chair 36

Business Unit Teams Co-Located Business Unit Manager Engineers Manufacturing Quality Purchasing/Planning Customer Service Run Your Business Like You Own It KEY TAKEAWAY: Business Unit Teams – Cross Functional, Co-Located, With a BUM Leader 37

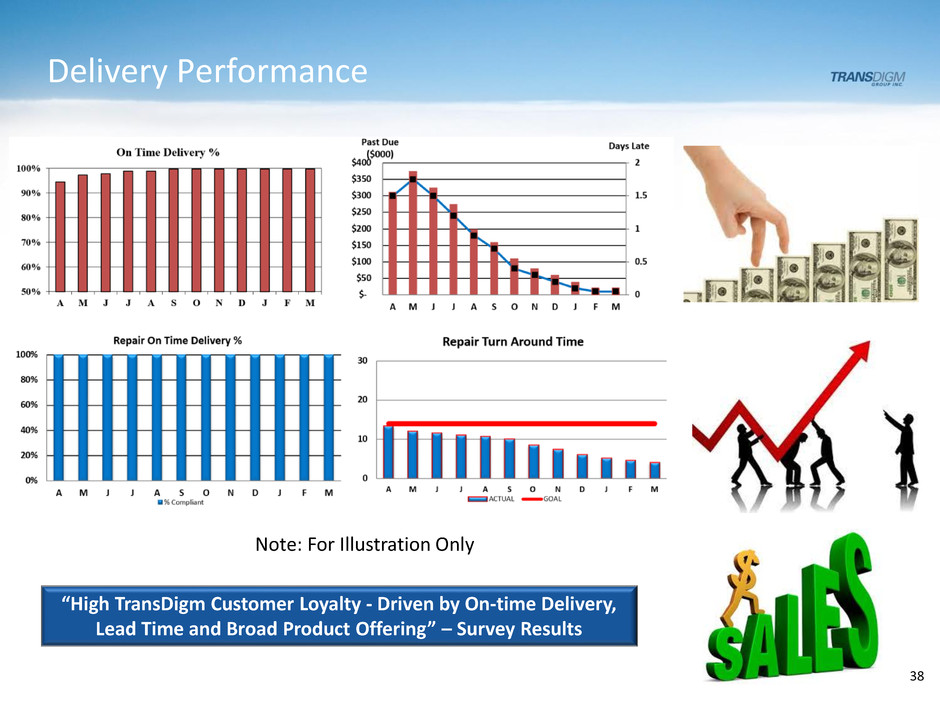

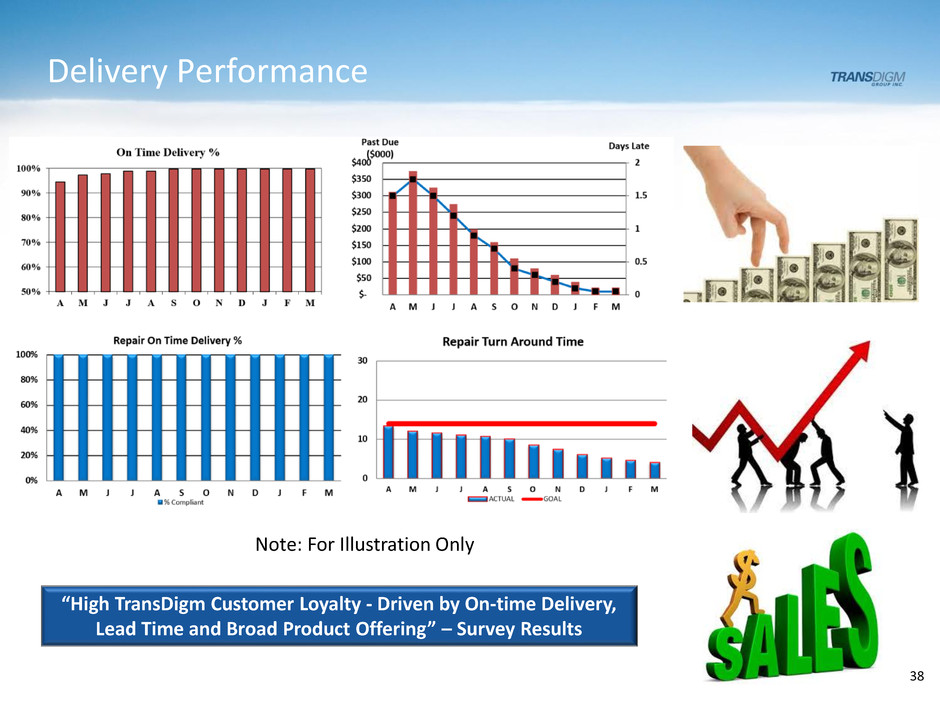

Delivery Performance 38 “High TransDigm Customer Loyalty - Driven by On-time Delivery, Lead Time and Broad Product Offering” – Survey Results Note: For Illustration Only 38

39 Proven Operating Strategy Profitable New Business Productivity and Cost Improvements Value Based Pricing 3 Value Drivers

Value Generator: Productivity TDG Cultural Elements • Simple Focus • Clear Expectations/Accountability • Visible Leadership • Bias to Action- Act Like an Owner ACTIVE LEADERSHIP 40

Clear Goal – Detailed Execution 41 Steady Trackable Productivity Improvements Across Total Cost Base 41

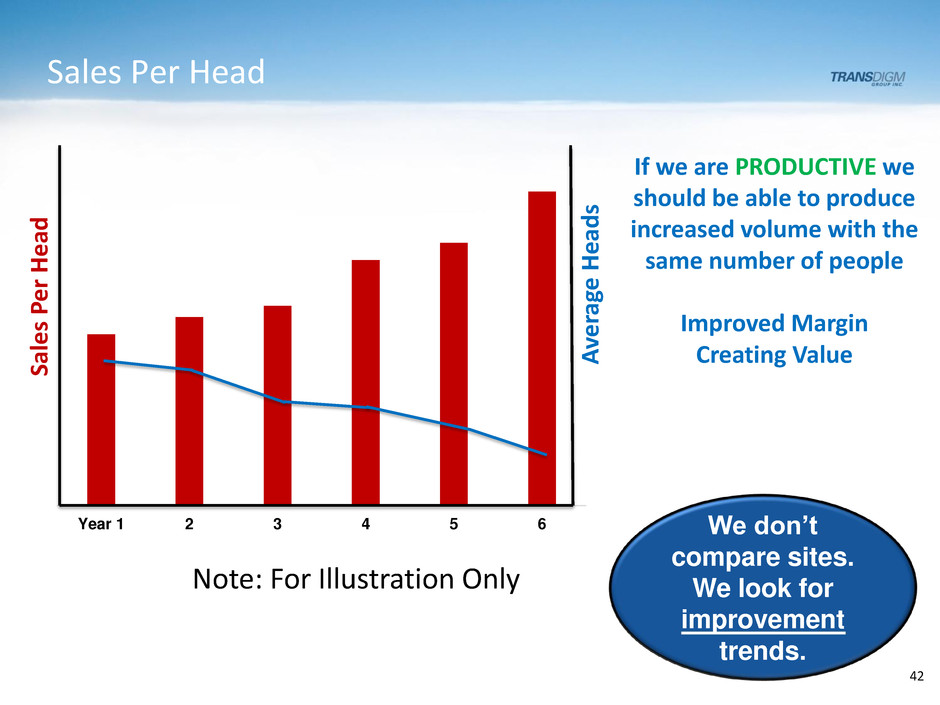

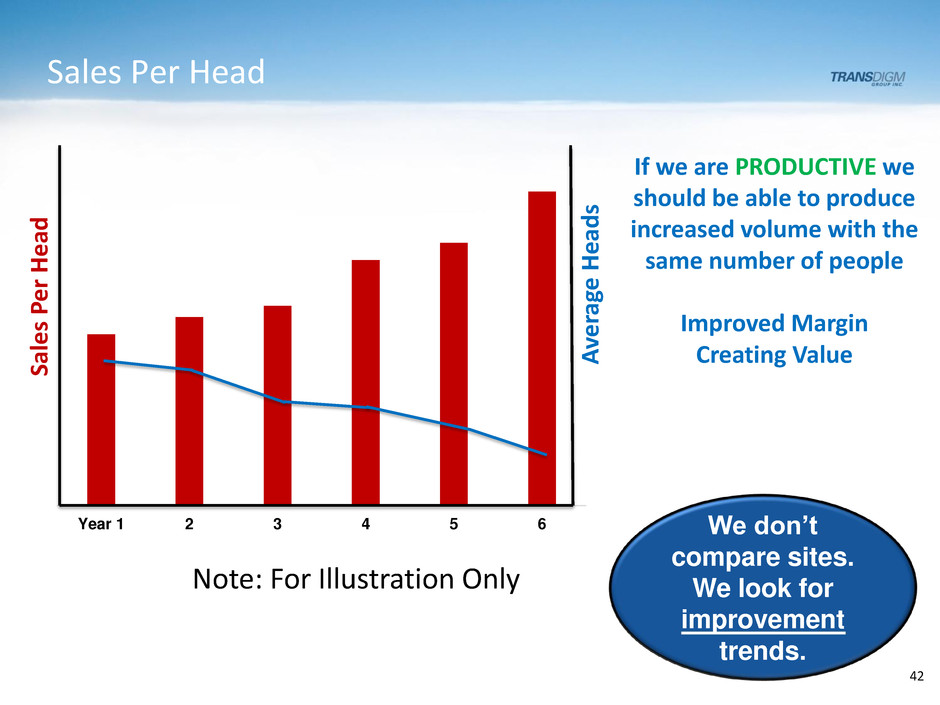

Sales Per Head 42 If we are PRODUCTIVE we should be able to produce increased volume with the same number of people Improved Margin Creating Value We don’t compare sites. We look for improvement trends. Year 1 2 3 4 5 6 Note: For Illustration Only Sa les P er H ead A ve ra ge He ad s 42

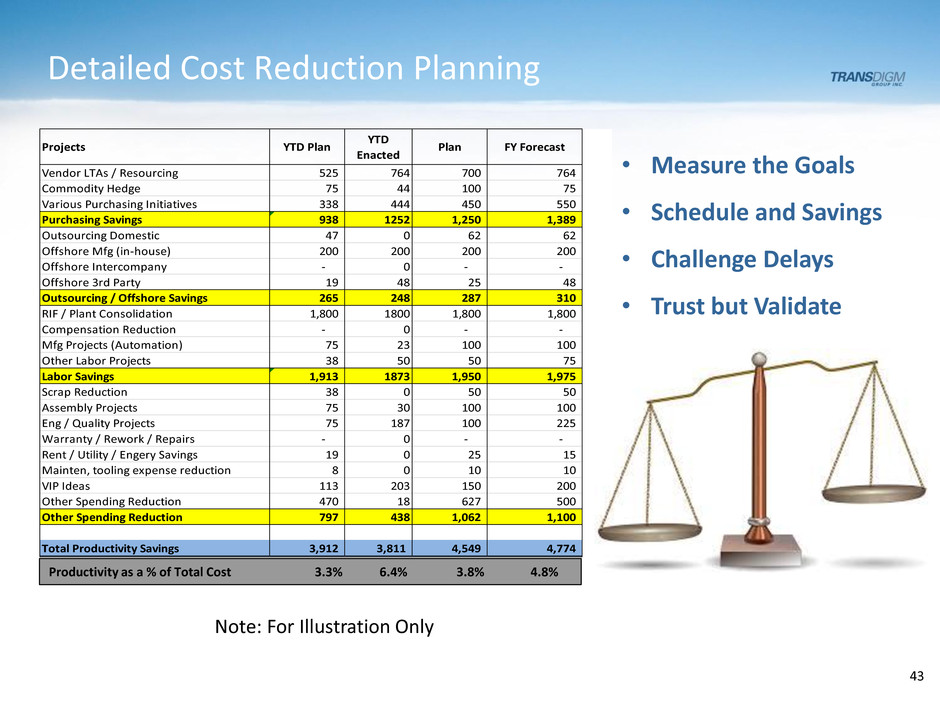

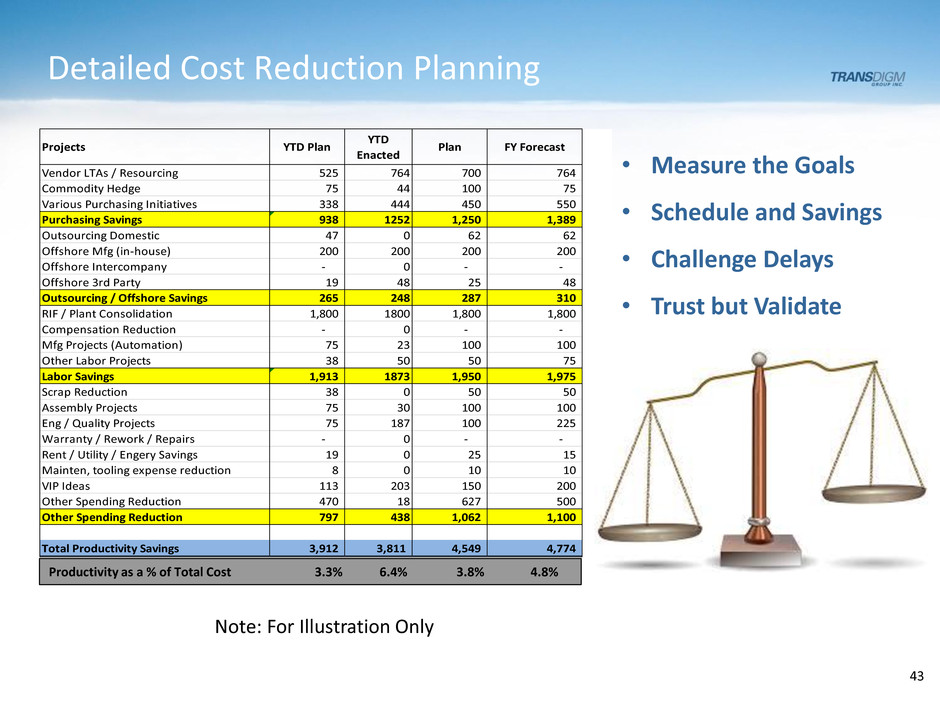

Detailed Cost Reduction Planning 43 Projects YTD Plan YTD Enacted Plan FY Forecast Vendor LTAs / Resourcing 525 764 700 764 Commodity Hedge 75 44 100 75 Various Purchasing Initiatives 338 444 450 550 Purchasing Savings 938 1252 1,250 1,389 Outsourcing Domestic 47 0 62 62 Offshore Mfg (in-house) 200 200 200 200 Offshore Intercompany - 0 - - Offshore 3rd Party 19 48 25 48 Outsourcing / Offshore Savings 265 248 287 310 RIF / Plant Consolidation 1,800 1800 1,800 1,800 Compensation Reduction - 0 - - Mfg Projects (Automation) 75 23 100 100 Other Labor Projects 38 50 50 75 Labor Savings 1,913 1873 1,950 1,975 Scrap Reduction 38 0 50 50 Assembly Projects 75 30 100 100 Eng / Quality Projects 75 187 100 225 Warranty / Rework / Repairs - 0 - - Rent / Utility / Engery Savings 19 0 25 15 Mainten, tooling expense reduction 8 0 10 10 VIP Ideas 113 203 150 200 Other Spending Reduction 470 18 627 500 Other Spending Reduction 797 438 1,062 1,100 Total Productivity Savings 3,912 3,811 4,549 4,774 • Measure the Goals • Schedule and Savings • Challenge Delays • Trust but Validate Productivity as a % of Total Cost 3.3% 6.4% 3.8% 4.8% Note: For Illustration Only 43

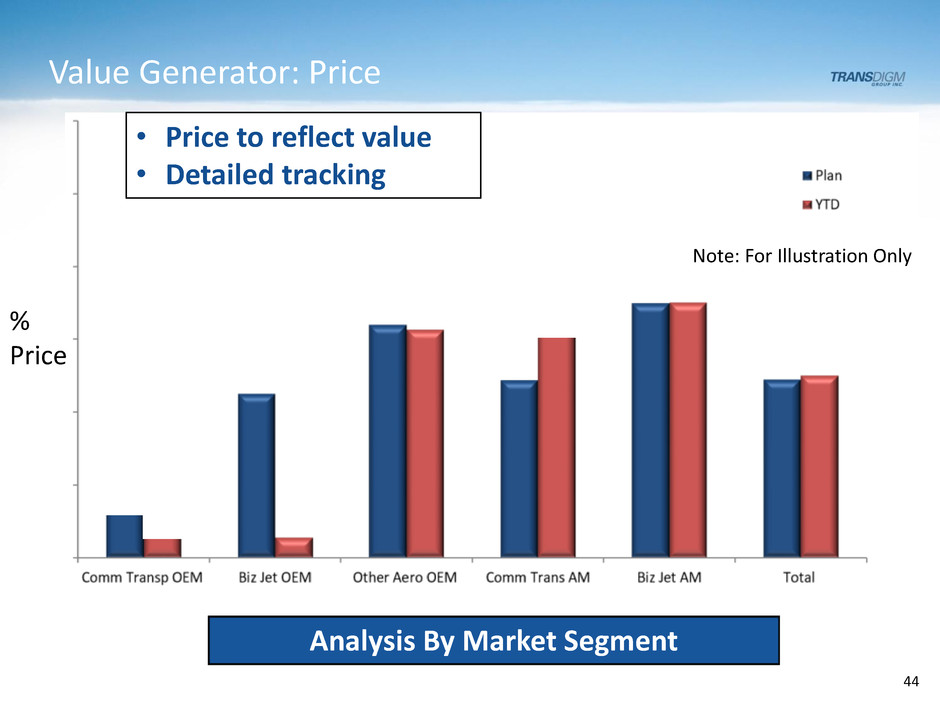

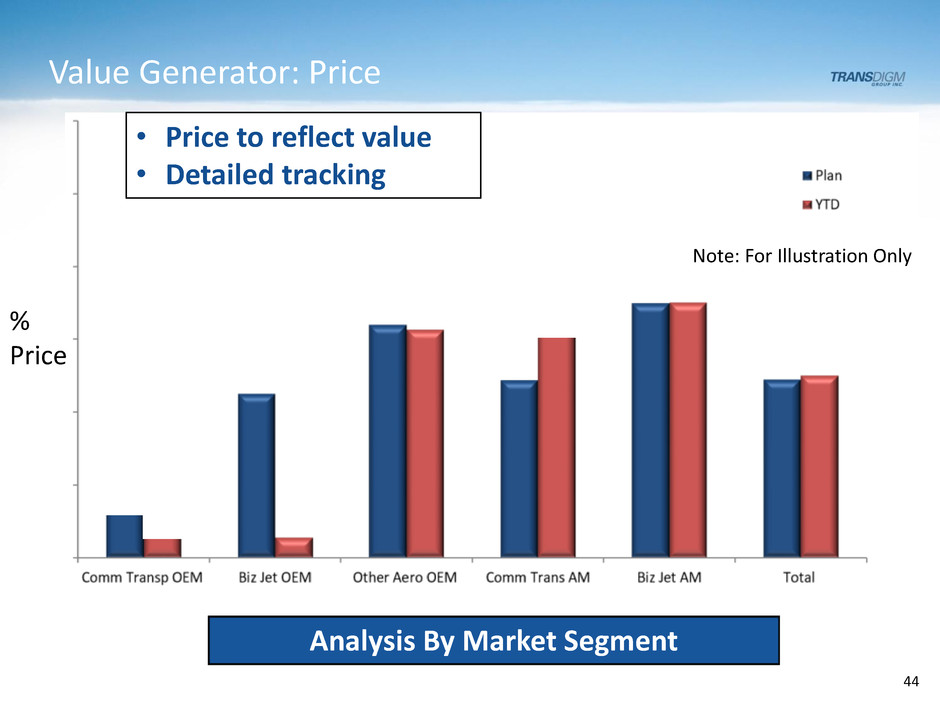

Value Generator: Price Note: For Illustration Only % Price Analysis By Market Segment • Price to reflect value • Detailed tracking 44

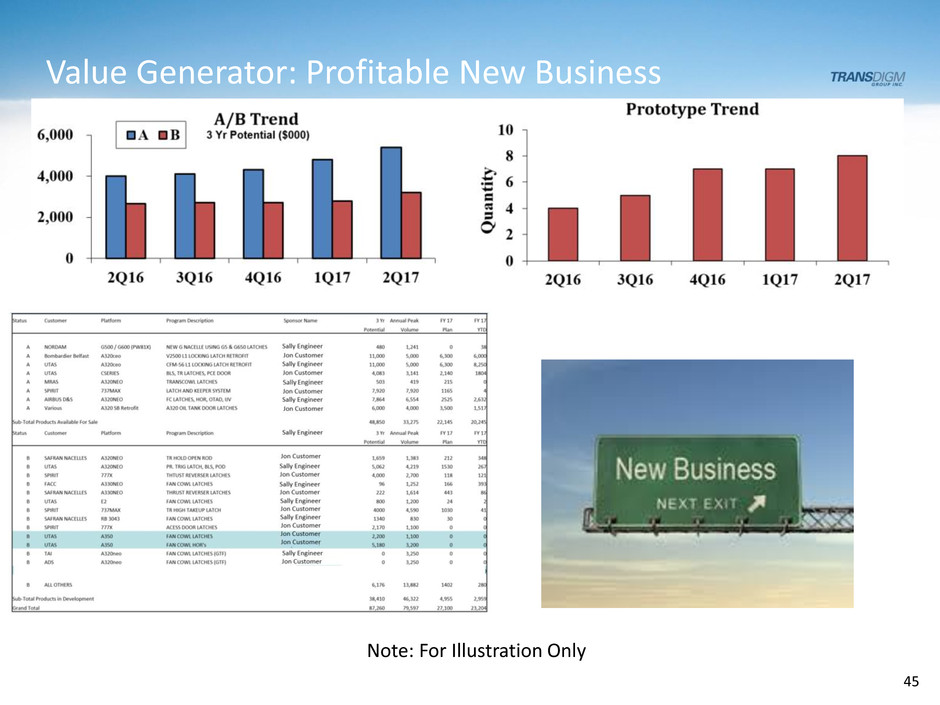

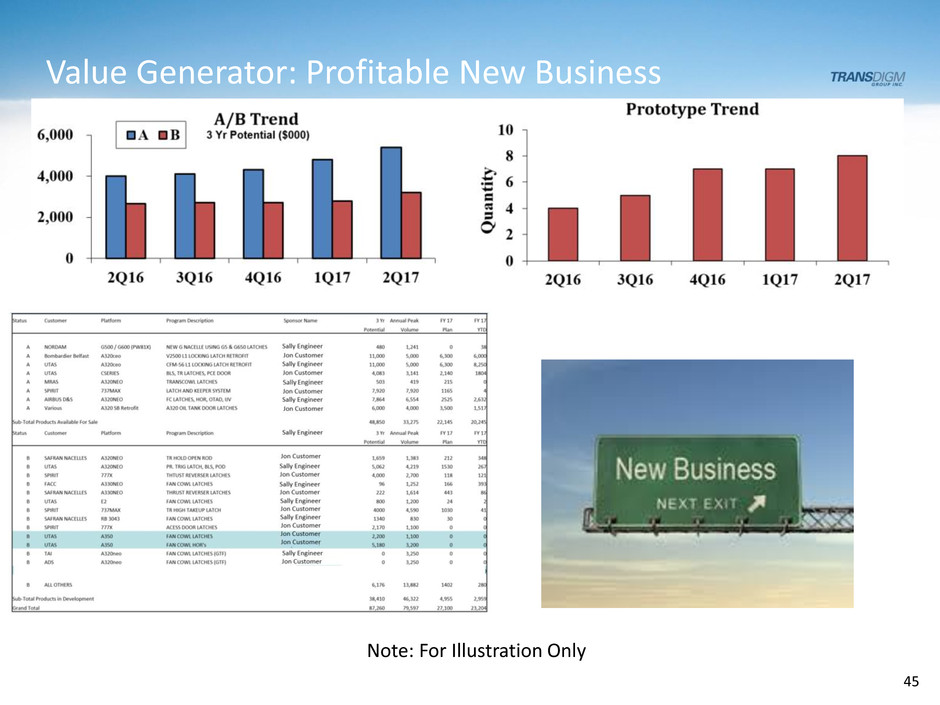

Value Generator: Profitable New Business Note: For Illustration Only 45

Sample New Business Products In Last 12 Months Product Lines Fresh & Well Positioned 46

Customer Value Proposition 47 Provide Reliable, Well Engineered Products & Deliver Them On-Time Highest Value to Customers 47

Financial Topics 48

5 Yr Go Forward Model Assumptions (w/o Acquisitions) 49 Continued Strong Free Cash Flow Generation Weighted Avg Interest Rate: 5% to 6% Cash Tax Rate: 25% to 30% Capex: ≈ 2% of Sales Leverage & Cash on Hand: No Significant Change to Current Strategy

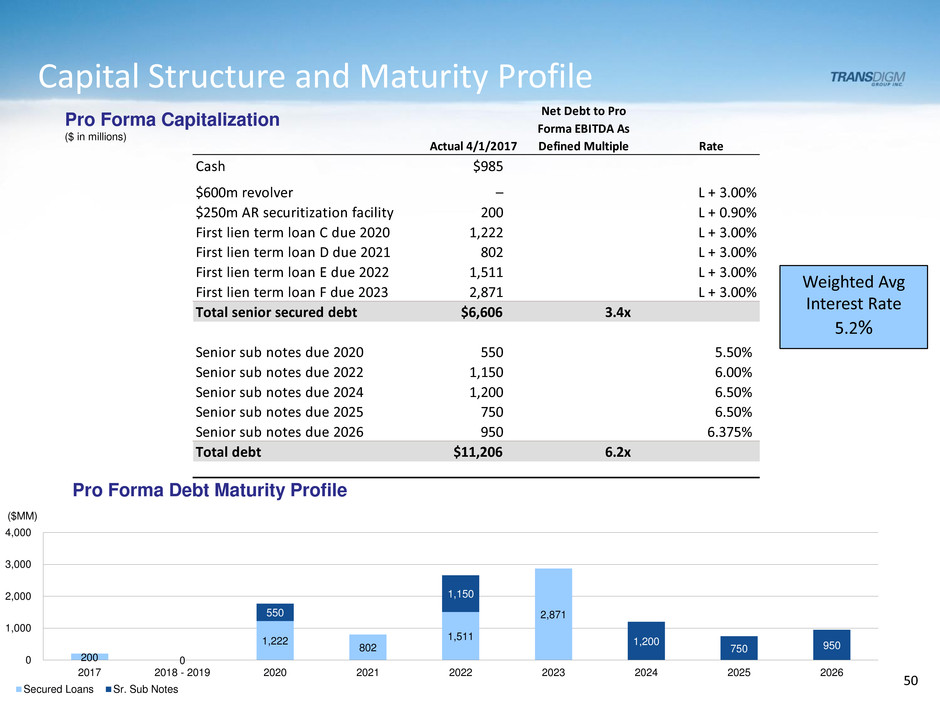

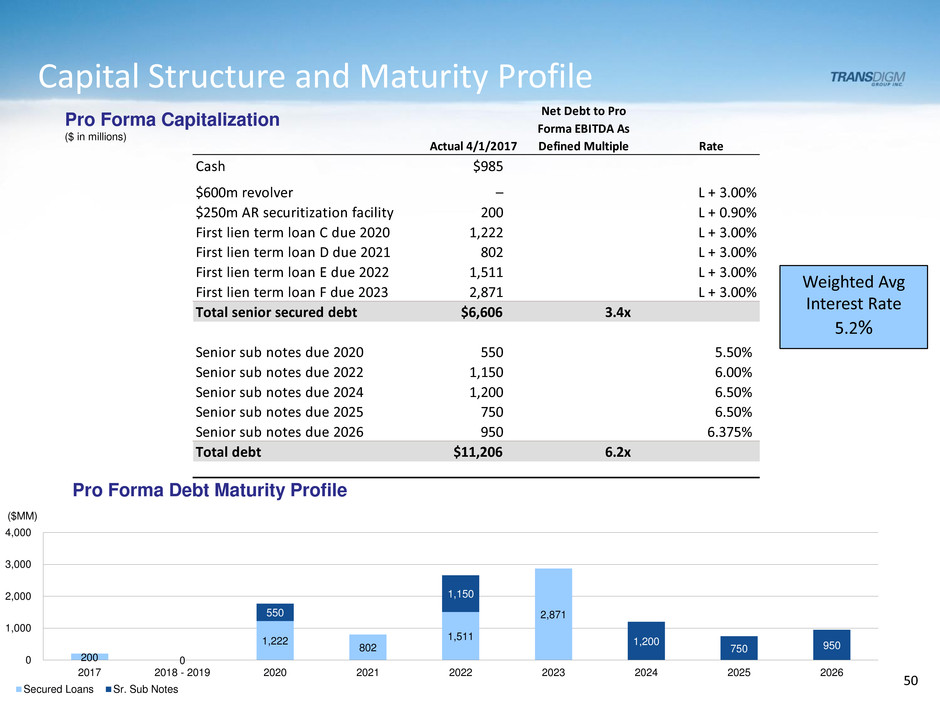

Cash $985 $600m revolver – L + 3.00% $250m AR securitization facility 200 L + 0.90% First lien term loan C due 2020 1,222 L + 3.00% First lien term loan D due 2021 802 L + 3.00% First lien term loan E due 2022 1,511 L + 3.00% First lien term loan F due 2023 2,871 L + 3.00% Total senior secured debt $6,606 3.4x Senior sub notes due 2020 550 5.50% Senior sub notes due 2022 1,150 6.00% Senior sub notes due 2024 1,200 6.50% Senior sub notes due 2025 750 6.50% Senior sub notes due 2026 950 6.375% Total debt $11,206 6.2x Actual 4/1/2017 Net Debt to Pro Forma EBITDA As Defined Multiple Rate Capital Structure and Maturity Profile Pro Forma Capitalization ($ in millions) 50 200 0 1,222 802 1,511 2,871 550 1,150 1,200 750 950 0 1,000 2,000 3,000 4,000 2017 2018 - 2019 2020 2021 2022 2023 2024 2025 2026 Secured Loans Sr. Sub Notes Pro Forma Debt Maturity Profile ($MM) 50 Weighted Avg Interest Rate 5.2%

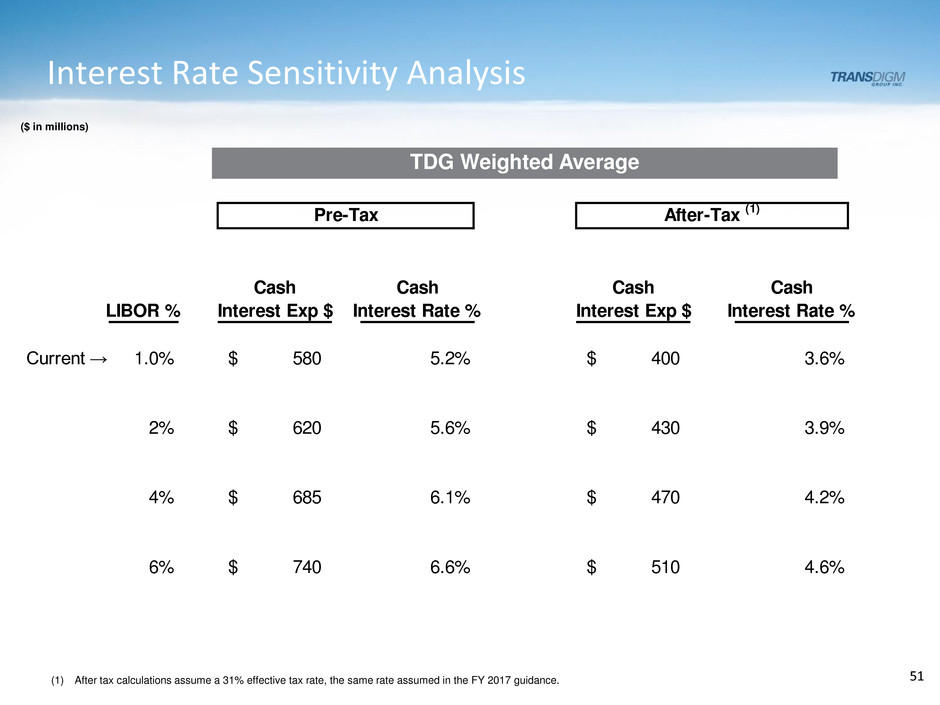

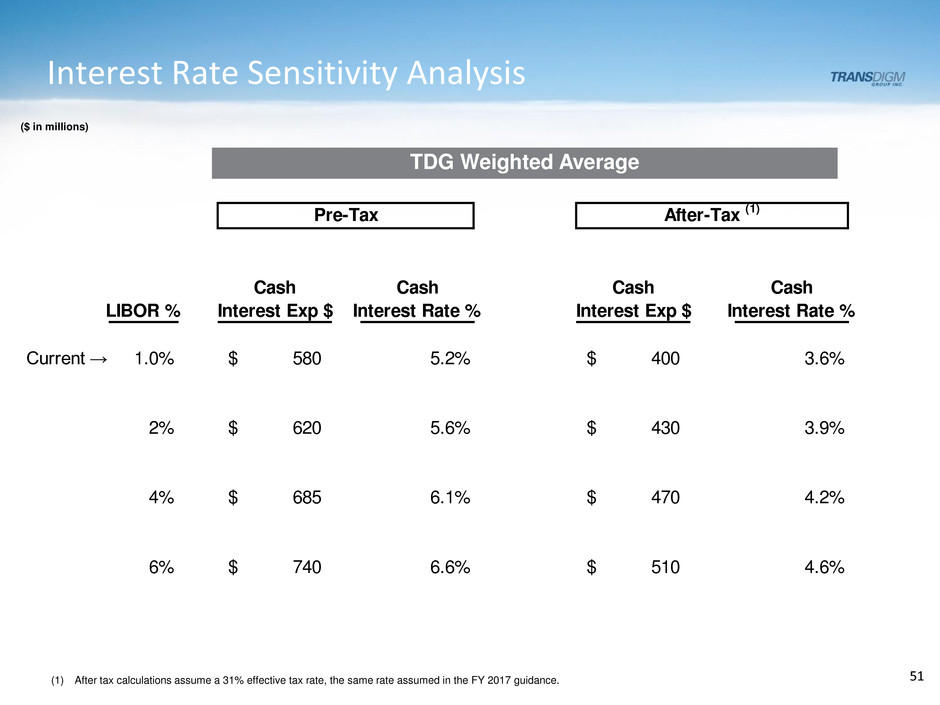

Interest Rate Sensitivity Analysis 51 ($ in millions) Cash Cash Cash Cash LIBOR % Interest Exp $ Interest Rate % Interest Exp $ Interest Rate % Current → 1.0% 580$ 5.2% 400$ 3.6% 2% 620$ 5.6% 430$ 3.9% 4% 685$ 6.1% 470$ 4.2% 6% 740$ 6.6% 510$ 4.6% Pre-Tax After-Tax (1) TDG Weighted Average (1) After tax calculations assume a 31% effective tax rate, the same rate assumed in the FY 2017 guidance.

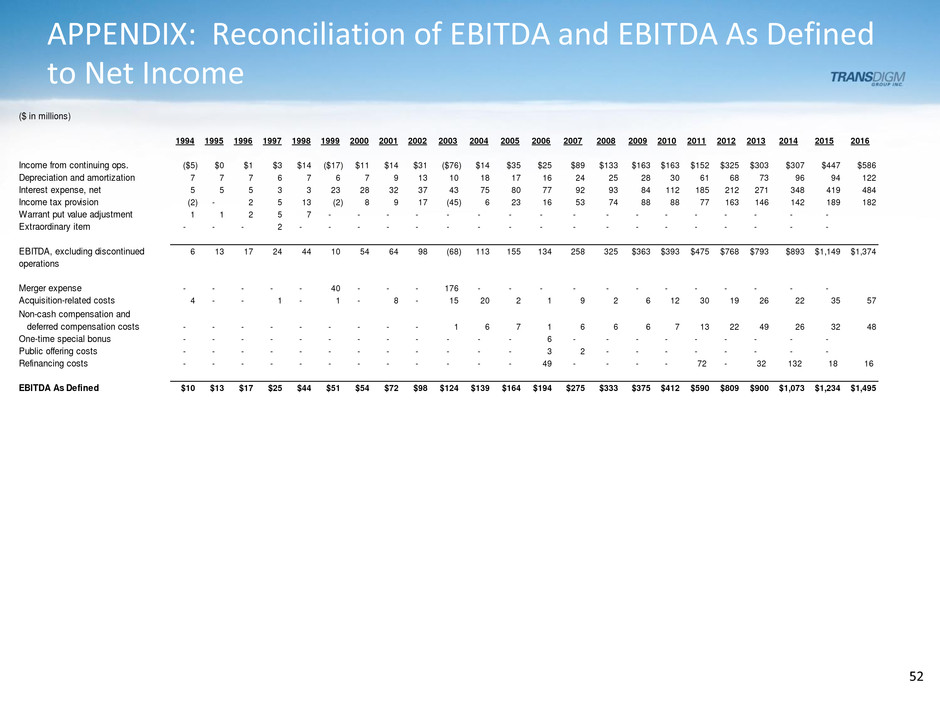

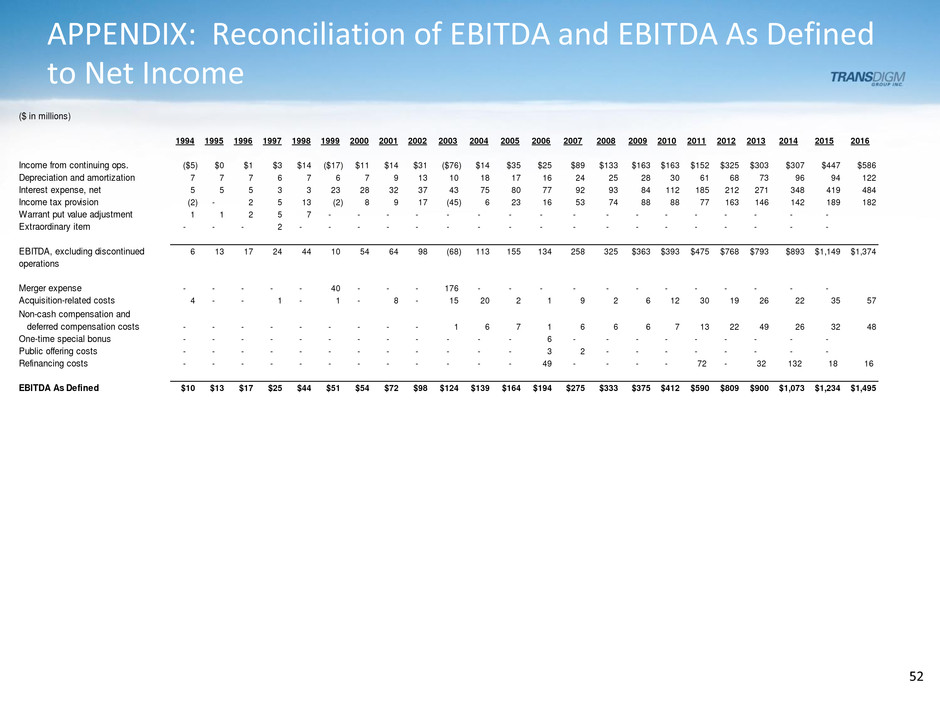

52 ($ in millions) 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Income from continuing ops. ($5) $0 $1 $3 $14 ($17) $11 $14 $31 ($76) $14 $35 $25 $89 $133 $163 $163 $152 $325 $303 $307 $447 $586 Depreciation and amortization 7 7 7 6 7 6 7 9 13 10 18 17 16 24 25 28 30 61 68 73 96 94 122 Interest expense, net 5 5 5 3 3 23 28 32 37 43 75 80 77 92 93 84 112 185 212 271 348 419 484 Income tax provision (2) - 2 5 13 (2) 8 9 17 (45) 6 23 16 53 74 88 88 77 163 146 142 189 182 Warrant put value adjustment 1 1 2 5 7 - - - - - - - - - - - - - - - - - Extraordinary item - - - 2 - - - - - - - - - - - - - - - - - - EBITDA, excluding discontinued 6 13 17 24 44 10 54 64 98 (68) 113 155 134 258 325 $363 $393 $475 $768 $793 $893 $1,149 $1,374 operations Merger expense - - - - - 40 - - - 176 - - - - - - - - - - - - Acquisition-related costs 4 - - 1 - 1 - 8 - 15 20 2 1 9 2 6 12 30 19 26 22 35 57 Non-cash compensation and deferred compensation costs - - - - - - - - - 1 6 7 1 6 6 6 7 13 22 49 26 32 48 One-time special bonus - - - - - - - - - - - - 6 - - - - - - - - - Public offering costs - - - - - - - - - - - - 3 2 - - - - - - - - Refinancing costs - - - - - - - - - - - - 49 - - - - 72 - 32 132 18 16 EBITDA As Defined $10 $13 $17 $25 $44 $51 $54 $72 $98 $124 $139 $164 $194 $275 $333 $375 $412 $590 $809 $900 $1,073 $1,234 $1,495 APPENDIX: Reconciliation of EBITDA and EBITDA As Defined to Net Income

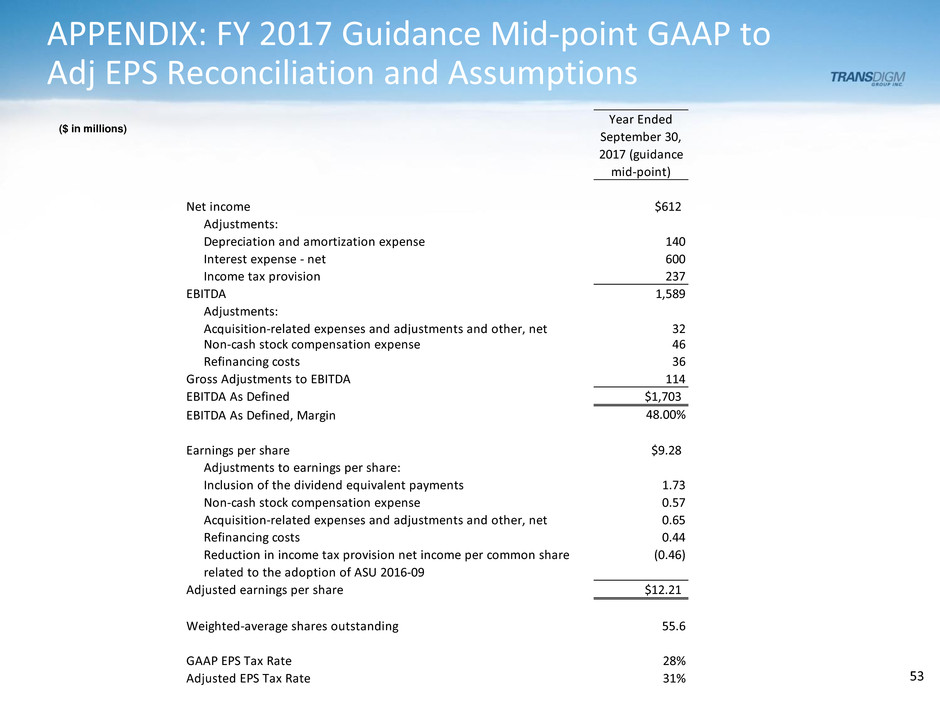

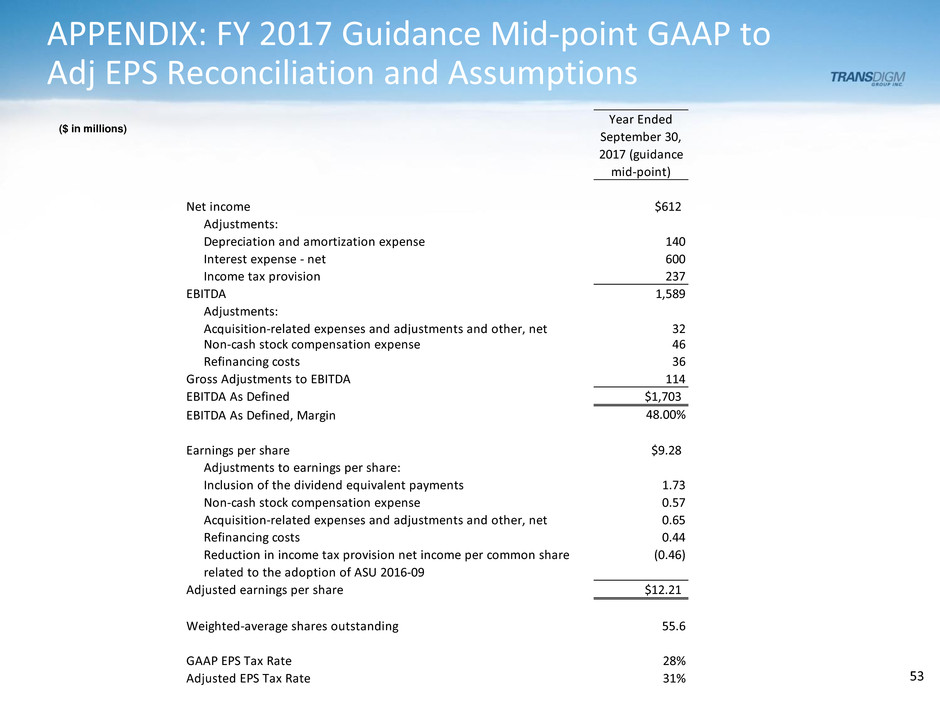

APPENDIX: FY 2017 Guidance Mid-point GAAP to Adj EPS Reconciliation and Assumptions 53 ($ in millions) Year Ended September 30, 2017 (guidance mid-point) Net income $612 Adjustments: Depreciation and amortization expense 140 Interest expense - net 600 Income tax provision 237 EBITDA 1,589 Adjustments: Acquisition-related expenses and adjustments and other, net 32 Non-cash stock compensation expense 46 Refinancing costs 36 Gross Adjustments to EBITDA 114 EBITDA As Defined $1,703 EBITDA As Defined, Margin 48.00% Earnings per share $9.28 Adjustments to earnings per share: Inclusion of the dividend equivalent payments 1.73 Non-cash stock compensation expense 0.57 Acquisition-related expenses and adjustments and other, net 0.65 Refinancing costs 0.44 Reduction in income tax provision net income per common share related to the adoption of ASU 2016-09 (0.46) Adjusted earnings per share $12.21 Weighted-average shares outstanding 55.6 GAAP EPS Tax Rate 28% Adjusted EPS Tax Rate 31%