SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended: December 31, 2006

| o | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to ____________

Commission File Number: 000-50917

CHINA SECURITY & SURVEILLANCE TECHNOLOGY, INC.

(Exact Name Of Registrant As Specified In Its Charter)

Delaware | 98-0509431 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| |

| |

13/F, Shenzhen Special Zone Press Tower, Shennan Road, Futian District, Shenzhen, Peoples Republic of China, 518034 |

| (86) 755-8351-0888 |

| (Registrant’s telephone number, including area code) |

| |

| |

Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.0001 par value |

| |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

At June 30, 2006, the last business day of the registrant’s most recently completed second fiscal quarter, there were 24,524,667 shares of the registrant’s common stock outstanding, and the aggregate market value of such shares held by non-affiliates of the registrant (based upon the closing price of such shares as reported on the Over-the-Counter Bulletin Board) was approximately $54 million. Shares of the registrant’s common stock held by the registrant’s executive officers and directors have been excluded because such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were 34,734,127 shares of common stock outstanding as of March 16, 2007.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant’s Proxy Statement for its Annual Meeting of Shareholders to be filed with the Commission within 120 days after the close of the registrant’s fiscal year are incorporated by reference into Part III of this Annual Report on Form 10-K.

CHINA SECURITY & SURVEILLANCE TECHNOLOGY, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2006

Number | | Page |

| | |

| |

| | 3 |

| | 10 |

| | 18 |

| | 19 |

| | 19 |

| | 19 |

| | | |

| |

| | 20 |

| | 21 |

| | 23 |

| | 34 |

| | 35 |

| | 36 |

| | 36 |

| | 36 |

| | | |

| |

| | 37 |

| | 37 |

| | 37 |

| | 37 |

| | 37 |

| | | |

| |

| | 37 |

INTRODUCTORY NOTE

Except as otherwise indicated by the context, references to “CSST,” “we,” “us,” “our,” “our Company,” or “the Company” are to China Security & Surveillance Technology, Inc., a Delaware corporation and its direct and indirect subsidiaries. Unless the context otherwise requires, all references to (i) “Safetech” are to China Safetech Holdings Limited, a British Virgin Islands corporation; (ii) “CSST HK” are to China Security & Surveillance Technology (HK) Ltd., a Hong Kong corporation; (iii) “CSST China” are to China Security & Surveillance Technology (PRC) Ltd., a corporation incorporated in the People’s Republic of China; (iv)“Golden” are to Golden Group Corporation (Shenzhen) Limited, a corporation incorporated in the People’s Republic of China; (v) “Cheng Feng” are to Shanghai Cheng Feng Digital Technology Co. Ltd.; (vi) “BVI” are to British Virgin Islands; (vii) “PRC” and “China” are to People’s Republic of China; (viii) “U.S. dollar,” “$” and “US$” are to United States dollars; (ix) “RMB” are to Yuan Renminbi of China; (x) “Securities Act” are to Securities Act of 1933, as amended; and (xi) “Exchange Act” are to the Securities Exchange Act of 1934, as amended.

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions are intended to identify forward-looking statements. Such statements include, among others, those concerning our expected financial performance, liquidity and capital resources and strategic and operational plans, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions, that, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties, among others, include:

| | · | General economic and business conditions in China and in the local economies in which we regularly conduct business, which can affect demand for the Company’s products and services; |

| | · | Changes in laws, rules and regulations governing the business community in China in general and the security and surveillance industry in particular; |

| | · | Competition and competitive factors in the markets in which we compete; |

| | · | Our ability to attract new customers; |

| | · | Our ability to keep pace with technological developments in the security and surveillance industry, and to develop and commercialize new products; |

| | · | Our ability to employ and retain qualified employees; |

| | · | Our ability to successfully integrate companies that we have acquired and to avoid or mitigate potential damages arising from risks associated with acquired companies and the legal structures utilized to effectuate acquisitions of these companies; and |

| | · | The risks identified in Item 1A. “Risk Factors,” included herein. |

All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including statements regarding new and existing products, technologies and opportunities; statements regarding market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China; any statements of belief or intention; and any statements of assumptions underlying any of the foregoing. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Overview

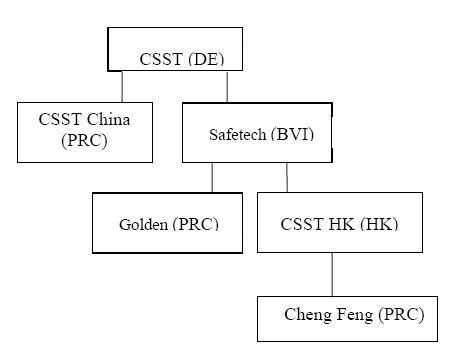

We are a holding company that owns two direct subsidiaries, Safetech and CSST China. Safetech is a holding company that owns both Golden and CSST HK. CSST HK in turn owns Cheng Feng. Our primary business operations are conducted through our indirect subsidiaries Golden and Cheng Feng. Golden’s business is focused on manufacturing, distributing, installing and maintaining security and surveillance systems in China. Cheng Feng’s business is focused on the manufacturing, marketing and sales of security and surveillance related hardware as well as the development and integration of software. Until our acquisition of Safetech in September 2005, our business strategy and ownership changed over the years as a result of several acquisitions of our stock that are discussed in the section below entitled “Our Background and History.”

The chart below demonstrates our corporate structure:

Our Background and History

We were incorporated in the BVI on April 8, 2002 under the name “Apex Wealth Enterprises Limited” as a corporation under the International Business Companies Ordinance of 1984. In February 2006, we changed our name to China Security and Surveillance Technology Inc. In November 2006, we changed our domicile from the BVI to Delaware by merging the BVI corporation into a newly incorporated Delaware corporation China Security & Surveillance Technology, Inc. The main reasons for the change of domicile were to comply with the covenants of a stock purchase agreement that we entered into on April 4, 2006 in connection with a financing transaction, as well as to take advantage of the benefits of being a Delaware corporation, including the enhanced credibility, greater flexibility in corporate law and attractiveness for directors and officers.

Prior to our reverse acquisition of Safetech, which was consummated on September 12, 2005 and is discussed in more detail below, we were a development stage enterprise and had not yet generated any revenues. Prior to the reverse acquisition, we provided business advisory and management consulting services in greater China, initially concentrating on the Hong Kong market. The focus of these services was on small to medium size enterprises.

From and after the reverse acquisition, our business became the business of our indirect, wholly-owned subsidiary, Golden. Golden is a corporation incorporated in the PRC which is engaged in the business of manufacturing, distributing, installing and maintaining security and surveillance systems. Golden was organized in the PRC in January 1995. In 2006, we acquired Cheng Feng, a corporation incorporated in the PRC which is engaged in the business of manufacturing, marketing and sales of security and surveillance related hardware as well as the development and integration of software. We are headquartered in Shenzhen, China.

Reverse Acquisition with Safetech

On September 12, 2005, we acquired 50,000 shares of the issued and outstanding capital stock of Safetech, constituting all of the issued and outstanding capital stock of Safetech. The 50,000 shares of Safetech were acquired from the individual shareholders of Safetech in a share exchange transaction in return for the issuance of 8,138,000 shares of our common stock. As a result of this transaction, Safetech became our wholly-owned subsidiary, and Golden became our indirect wholly-owned subsidiary. Completion of the transaction resulted in a change in control of our Company. After the transaction, we were no longer a shell company. The contracts relating to this transaction have been filed as exhibits to our current report on Form 6-K that was filed with the SEC on July 22, 2005 and is incorporated herein by reference.

For accounting purposes, this transaction was treated as a reverse acquisition, with Safetech as the acquirer and our Company as the acquired party. When we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Golden and Cheng Feng on a consolidated basis unless otherwise specified.

Subsequent Acquisitions

On October 25, 2005, we entered into an agreement with the equity owners of Shenzhen Yuan Da Wei Shi Technology Limited, or “Yuan Da,” which was subsequently amended in April and May 2006. Pursuant to the agreement, as amended, we acquired all of the assets of Yuan Da for RMB 1,000,000 (approximately $125,000) and 200,000 shares of our common stock. Yuan Da is a limited liability company established in Shenzhen, China and was principally engaged in the sale and development of security and surveillance systems.

In July 2006, we entered into an agreement with shareholders of Cheng Feng to acquire 100% ownership of Cheng Feng for a consideration of RMB 120 million (approximately $15 million), consisting of RMB 60 million (approximately $7.5 million) in cash and 1,361,748 shares of our common stock. We received the relevant Chinese government approval for such acquisition in December 2006. Cheng Feng is a company that is engaged in the business of manufacturing, marketing and sales of security and surveillance related hardware as well as the development and integration of software.

In November 2006, we acquired the security and surveillance business of Jian Golden An Ke Technology Co. Ltd., or “Jian An Ke,” Shenzhen Golden Guangdian Technology Co. Ltd., or “Shenzhen Guangdian,” Shenyang Golden Digital Technology Co. Ltd., or “Shenyang Golden,” and Jiangxi Golden Digital Technology Co. Ltd., or “Jiangxi Golden,” of which our CEO and director Guoshen Tu owned 80%, 60%, 42% and 90%, respectively. We refer to these companies in this report as the Four-Related Companies. Mr. Tu did not receive any consideration for the acquisition of his interest in the Four-Related Companies. The minority shareholders of these four companies and their designees received in aggregate 850,000 shares of our common stock. Shenzhen

Guangdian is engaged in the business of manufacturing and distributing security and surveillance products. The other three companies are engaged in the business of distributing security and surveillance products.

Industry Background and Our Principal Market

The Chinese surveillance and security industry was established at the beginning of the 1980s and the surveillance and security products were used primarily by government agencies, financial institutions, transportation and mega-size companies. Since then, the industry has experienced significant growth and is growing at an annual rate of approximately 40%, according to the China Public Security Guide published by the Chinese Security and Protection Association, which also predicts that the industry will grow by over 20% annually in the near future and the Chinese market for security and surveillance products and services will reach approximately $160 billion by 2010.

In 2006, the Chinese government promulgated Ordinance 458 which requires all entertainment locations to install surveillance systems. In addition, the booming Chinese real estate market and the increasing focus on the security of the Chinese mining industry provide great opportunities for the surveillance and security industry. The Chinese security and surveillance industry is also expected to benefit from the expected spending of an estimated $6 billion to $12 billion for security infrastructure by the Chinese government in preparation for the 2008 Beijing Olympics, along with the planned investment by the city of Shanghai for the 2010 World’s Fair.

At present, video surveillance is estimated to have a market of about RMB 60 billion (approximately $7.5 billion) and accounts for about 40% market share of the surveillance and security market. It is expected that the video surveillance market share will increase to approximately 60% of the whole industry, according to the China Public Security Guide published by the China Security and Protection Association.

There are many companies in China that engage in the business of manufacturing, selling, installing and maintaining of security and surveillance products. Due to the high growth of the industry and the fact that it is still in the early stage of development, the Chinese security and surveillance market is highly fragmented and there is no apparent market leader.

Principal Products and Services

Through our subsidiaries Golden and Cheng Feng, we engage in the business of manufacturing, distributing, installing and maintaining surveillance and security products, as well as the development and integration of related software in China. We generate revenues primarily through the installation of security and surveillance systems and sales of security and surveillance products.

Installation Services

In 2006, we derived approximately 88% of our revenues from the supply and installation of security and surveillance systems for various projects involving railways, schools, banks, highways, commercial buildings, and public security and government entities, among others. Generally, our installation projects involve the following steps:

We receive most of our installation projects through a bidding process. In a typical bidding process, our potential client will send us and our competitors a request for proposal that outlines the work to be performed and the specifications of the equipment to be installed. We then prepare and submit our bid and the potential client chooses the winning contractor from among all the bids submitted. On some projects, we also act as a subcontractor where a third party has submitted a winning bid.

Upon winning a project, we provide the final project design for approval. System design is generally conducted through the joint efforts of our research and development personnel, sales department, project service department and quality control department.

| | · | Manufacture and Purchase of Security and Surveillance Products |

The major products used in our installation projects include computer accessories, decoders, video capture cards, recorders and computer cases. We use equipment manufactured by us in most of the installation projects, but also use products from other manufacturers. Generally, approximately 60% of the equipment used in any given project is equipment we have manufactured.

We have a project service department that performs installations. We use subcontractors for non-technical, labor intensive work. We usually assign a project group with 5-10 members who are in charge of the technical components of the project and manage the progress of each project.

| | · | System Software Design and Integration |

System software design and integration services are usually conducted by our technical department. We design software for our customers’ security and surveillance systems in accordance with our customers’ specifications. We generally test the software on our own computer system before integrating it into our customers’ computer system. We then assign our technicians to the site of each project to assist in the integration of the security and surveillance system with our customers’ computer system.

Upon integration, our technical department will test and examine the system to ensure the proper functioning of the installed security and surveillance system.

Our Products

In 2006, we derived approximately 12% of our revenues from sales of our products, excluding products sold in connection with the installation projects described above. The recent acquisition of Cheng Feng and the security and surveillance businesses of Shenzhen Guangdian improved and will continue to enhance our manufacturing capacity of our products. Cheng Feng’s Security Resources Integrated Management (“SRIM”) software platform will enhance the functionality and management control of our key products. SRIM software platform is essential to and facilitates coordination among systems such as DVRs, building automation systems, access control systems, intruder alarm systems and air-conditioning systems.

We manufacture the key components of the security and surveillance products and rely on third party electronic assembling companies to assemble the final products utilizing our technology. The final products are sold under our brand names. Our main products include standalone digital video recorders, embedded digital video recorders, mobile digital video recorders, digital cameras and auxiliary apparatus.

| | · | Standalone digital video recorders (Standalone DVR) |

The Standalone DVR stores digital images captured via the security cameras. It also controls the recording functions of the cameras and manages the storage of the data. This product has a pre-installed surveillance software system developed by us, which enables it to perform access control and recording functions. It also has an upgradable hard drive which allows clients to customize the digital storage capacity, network server functions which allow the clients to access the digital images via Internet, MPEG-4 video compression which allows a more efficient compression of the images and higher image quality, and 4-16 signal input channels which allows 4 to 16 cameras to be connected to the Standalone DVR. This product has the competitive features of small size, low cost and high reliability. The primary markets for this product are small to medium size businesses, non-profit organizations and home use. It is generally used for small sized security and surveillance needs.

| | · | Embedded digital video recorders (Embedded DVR) |

Similar to the Standalone DVR, the Embedded DVR provides recording and compression functions. It has a pre-installed surveillance software system developed by us, upgradable hard drive, network server function, MPEG-4 Video compression and 4-36 signal input channels, and uses the Windows operating system. The main difference is that the Embedded DVR has expanded capacity to accommodate recording functions for a greater number of cameras compared to the Standalone DVR. In addition, it is operated via Microsoft’s Windows Operating System. The primary markets for these products are large projects and community security projects.

| | · | Mobile digital video recorders (Mobile DVR) |

Similar to the Standalone DVR, the Mobile DVR is smaller in size and has a maximum of 4 ports. The Mobile DVR, which can be installed in a vehicle, enables recording of digital video images within the cabin. This product is easily installed, supports GPS/GPRS and has 1 to 4 signal input channels and MPEG-4 video compression. The primary markets for this product are the transportation industry and governmental agencies.

Digital cameras can be easily installed in most locations on a customer’s site. The range of cameras that we produce and sell includes high speed dome cameras, color Charge Coupled Device (“CCD”) cameras, indoor color CCD dome cameras, color/black and white CCD flying saucer cameras, Infra Red CCD multi-function cameras, mini digital signal processing cameras, indoor stand alone sphere CCD cameras and network high speed sphere CCD cameras.

Auxiliary apparatus includes DVR compression cards, video capture cards, digital light processing monitors, decoders, alarm notification switches, digital video fiber optics systems and matrix switch/control systems.

Raw Materials and Our Principal Suppliers

We use manufactured electronic components in our products. The main components of our products include camcorders, monitors, frames, decoders, lenses and outdoor hoods.

Shenzhen is one of the biggest and most concentrated bases for electronic products in China. As a result, there are numerous suppliers and vendors of the components that are needed for our products. Because of the high level of competition among the suppliers, the prices of our principal components are relatively stable and we are able to purchase these raw materials at reasonable prices. We have entered into written contracts with several major suppliers and vendors. The main suppliers to Golden are Shenzhen Ronghen Co. Ltd., Shenzhen Dongxun Shidai Technology Co. Ltd., Shenzhen Kerui Electronic Co. Ltd., Shenzhen Huichuang Computer Technology Co. Ltd. and Shenzhen Jingfeiya Electronic Co. Ltd. The main suppliers to Cheng Feng are Hangzhou Hengsheng Shiji Co., Ltd., Wuhan Hengyi Electronics Technology Development Co., Ltd., Shanghai Dongyang Electronics System Co., Ltd., Jiaenbi Electronics (Shenzhen) Co., Ltd. and Fushan Yongxinlong Electronics Parts Co., Ltd. We believe we are not dependent on any of these suppliers and will be able to replace them, if necessary, without material difficulties.

Our Distribution, Marketing, Customers and Customer Programs

Our customers are mainly government entities, non-profit organizations and commercial entities throughout China, such as airports, customs agencies, hotels, real estate developments, banks, mines, railways, supermarkets, and entertainment enterprises. Because a large percentage of our revenues derive from the installation of security and surveillance systems which are generally non-recurring, we do not rely on one single or a small group of customers. Not one single customer accounted for more than 10% of our total revenue in 2006. We generally do not generate significant revenues from any existing client after the installation project is completed unless that client has additional installation sites for which our services might be required.

We have developed a multi-tiered marketing plan, allowing us to effectively market products and services to our clients. We sell most of our products and services through our own distribution network. Our distribution network covers all of China.

We have approximately 400 engineers and sales personnel. We divide our market into 9 geographic regions. Each region is managed by a regional manager who is responsible for technical support and management within the region as well as client relations. Golden has 37 branch offices in provincial capital cities and Cheng Feng has 22 distribution points throughout China.

In addition to our own branch offices and employees, we cooperate with independent sales agents and have established close relationships with these sales agents in order to take advantage of their regional resources and provide products and services that are tailored to the needs of our customers in those regions.

Through this distribution and marketing network, we believe we can continue to promote our brand recognition, strengthen the management of our distribution network and improve our sales revenue and market share.

We have also been marketing and promoting our products through the following means:

| | · | participating in various industrial shows to display our products; |

| | · | advertising in industrial magazines and periodicals to introduce and promote our products; |

| | · | publishing our own magazine which is distributed to our suppliers and sales agents so that they can better understand our Company and strengthen their confidence in us; and |

| | · | utilizing the internet to promote our products, such as the public safety network, Chinese Security Association network and HuiChong Network. |

Competition

There are many companies in China engaged in the business of manufacturing surveillance and security products and designing and installing security and surveillance systems. The surveillance and security industry in China is still nascent and no company has monopolized it. In addition, it is difficult in the surveillance and security industry for very large companies to reap benefits from their size, because most of the projects require the product to be specially tailored to meet customers’ individual requirements.

In the security and surveillance industry, competition is based on price, product quality, ability to distribute products, and ability to provide after sales service.

Our major competitor in China is Hangzhou Haikang Weishi Digital Technology Co. Ltd. which focuses on the development of video and audio decoding technology and the development and manufacture of digital video compression cards. Its most successful product is a digital video compression card which we believe has a significant market share of such products in China.

Additional competition comes from international companies, such as General Electric and Honeywell. Some of our international competitors are larger than we are and possess greater name recognition, assets, personnel, sales and financial resources. However, these competitors generally have higher prices for their products, and most of them do not have distribution networks in China that are as developed as ours.

We believe that the range of our product and service offerings, our brand recognition by the market, our capital resource, our relatively low labor cost and our extensive distribution channels enable us to compete favorably in the market for the security and surveillance products and services that we offer in China.

Intellectual Property

We have registered with the Trademark office of the State Administration for Industry and Commerce of China the following trademarks:

| | | Name | | Trademark No./ Application No. | | Type | | Expiration Date | | Status |

| 1 | | Golden Group | | 4108508 | | Word (Chinese) | | July 2014 | | Approved |

| | | | | | | | | | | |

| 2 | | DVR | | 4108509 | | Word | | July 2014 | | Approved |

| | | | | | | | | | | |

| 3 | | | | 4108511 | | Word and Logo | | July 2014 | | Approved |

| | | | | | | | | | | |

| 4 | | | | 4108510 | | Logo | | July 2014 | | Approved |

| | | | | | | | | | | |

| 5 | |  威勒 威勒 | | 3814725 | | Word and logo | | December 2013 | | Approved |

| | | | | | | | | | | |

| 6 | | JDR | | N/A | | Word | | N/A | | Pending |

| | | | | | | | | | | |

| 7 | | 小保安 | | 4142706 | | | | September 2016 | | Approved |

| | | | | | | | | | | |

| 8 | | chenova | | 4207147 | | Word | | December 2016 | | Approved |

| | | | | | | | | | | |

| 9 | |  | | 4207148 | | Logo | | December 2016 | | Approved |

| | | | | | | | | | | |

| 10 | | ITDVR | | | | Word | | N/A | | Pending |

| | | | | | | | | | | |

| 11 | | AUNIQUE | | | | Word and Logo | | N/A | | Pending |

| | | | | | | | | | | |

| 12 | | AVK | | | | Word and Logo | | N/A | | Pending |

| | | | | | | | | | | |

| 13 | | chenovation | | | | Word | | N/A | | Pending |

| | | Name | | Trademark No./ Application No. | | Type | | Expiration Date | | Status |

| 14 | | | | | | Logo | | N/A | | Pending |

| | | | | | | | | | | |

| 15 | | ITVS | | | | Word and Logo | | N/A | | Pending |

| | | | | | | | | | | |

| 16 | | | | | | | | N/A | | Pending |

| | | | | | | | | | | |

We have registered the domain name www.csstf.com. In addition, our subsidiaries, Golden and Cheng Feng, have registered the domain names www.goldengroup.cn and www.cf1688.com, respectively.

We hold no patents under our own name. We protect our trade secrets through confidentiality provisions of the employment contracts we enter into with our employees. In addition, our engineers are generally divided into different project groups, each of which generally handles only a portion of the project. As a result, no one engineer generally has access to the entire design process and documentation for a particular product.

Employees

We have approximately 580 full-time employees. Approximately 100 of them are administrative and accounting staff, approximately 80 of them are research and development staff and approximately 400 of them are engineers and sales staff.

Approximately 162 employees are located in Shenzhen, and the rest of the employees are located in various branches throughout China.

Approximately 80% of our employees have bachelor degrees, and most of those majored in computer sciences.

Our employees are members in trade unions which protect employees’ rights, aim to assist in the fulfillment of our economic objectives, encourage employee participation in management decisions and assist in mediating disputes between us and union members. We believe that we maintain a satisfactory working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations.

As required by applicable Chinese law, we have entered into employment contracts with all of our officers, managers and employees. Our employees in China participate in a state pension plan organized by Chinese municipal and provincial governments. We are required to contribute monthly to the plan at the rate of 23% of the average monthly salary. As of the date of this report, we have complied with the regulation and have paid the state pension plan as required by law.

In addition, we are required by Chinese law to cover employees in China with various types of social insurance. We have purchased social insurance for some of our employees. For those whom we have not purchased social insurance, the premium has been added into their salary so that they can purchase social insurance in their individual capacity at the location of their recorded residences.

With the expansion of our business operations and several anticipated acquisitions, we expect that the number of our employees will increase in the next 12 months.

Research and Development

Currently, we have approximately 80 employees devoted to our research and development efforts, which are aimed at finding new varieties of products, improving existing products, improving overall product quality and reducing production costs. We have established a strategic partnership with Beijing University through which we will provide funds to Beijing University for the research and development of video surveillance and security products. Our research and development efforts are led by Dr. Yong Zhao, who worked for the research and development department of a large international surveillance and security company and has extensive research experience. Under the partnership agreement with Beijing University, we have agreed to provide Beijing University up to RMB 2 million (approximately $250,000) for their research and development efforts. We paid RMB500,000 (approximately $62,500) under the agreement in 2006.

Government Regulation

All security and surveillance products produced in China must satisfy testing by the China Public Security Bureau, and manufacturers of such products must receive the Security Technology Protection Product Manufacturing Permit from the provincial agency. We satisfactorily completed this testing in 2002 and also received a permit from Guangdong province in May 2003. In addition, we have a license from the Guangdong province for the design, installation and repair of security protection systems.

Because our operating subsidiaries Golden and Cheng Feng are located in PRC, we are regulated by the national and local laws of PRC.

There is no private ownership of land in China and all land ownership is held by the government of the PRC, its agencies and collectives. Land use rights can be obtained from the government for a period up to 70 years, and are typically renewable. Land use rights can be transferred upon approval by the land administrative authorities of the PRC (State Land Administration Bureau) upon payment of the required land transfer fee. We have received the necessary land use right certificate for the properties described under “Item 2 - Description of Property.” See “Item 2 - Description of Property” for more details.

In addition, we are also subject to PRC’s foreign currency regulations. The PRC government has control over RMB reserves through, among other things, direct regulation of the conversion or RMB into other foreign currencies. Although foreign currencies which are required for “current account” transactions can be bought freely at authorized Chinese banks, the proper procedural requirements prescribed by Chinese law must be met. At the same time, Chinese companies are also required to sell their foreign exchange earnings to authorized Chinese banks and the purchase of foreign currencies for capital account transactions still requires prior approval of the Chinese government.

We believe that we are in material compliance with all registrations and requirements for the issuance and maintenance of all licenses required by the governing bodies, and that all license fees and filings are current.

RISK RELATED TO OUR BUSINESS

DUE TO THE NATURE OF OUR BUSINESS, WE DO NOT HAVE SIGNIFICANT AMOUNTS OF RECURRING REVENUES FROM OUR EXISTING CUSTOMERS AND WE ARE HIGHLY DEPENDENT ON NEW BUSINESS DEVELOPMENT.

Most of our revenues derive from the installation of security and surveillance systems which are generally non-recurring. Our customers are mainly governmental entities, non-profit organizations and commercial entities, such as airports, customs agencies, hotels, real estate developments, banks, mines, railways, supermarkets, and entertainment enterprises. We manufacture and install security systems for these customers and generate revenues from the sale of these systems to our customers and, to a lesser extent, from maintenance of these systems for our customers. After we have manufactured and installed a system at any particular customer site, we have generated the majority of revenues from that particular client. We would not expect to generate significant revenues from any existing client in future years unless that client has additional installation sites for which our services might be required. Therefore, in order to maintain a level of revenues each year that is at or in excess of the level of revenues we generated in prior years, we must identify and be retained by new clients. If our business development, marketing and sales techniques do not result in an equal or greater number of projects of at least comparable size and value for us in a given year compared to the prior year, then we may be unable to increase our revenues and earnings or even sustain current levels in the future.

IN ORDER TO GROW AT THE PACE EXPECTED BY MANAGEMENT, WE WILL REQUIRE ADDITIONAL CAPITAL TO SUPPORT OUR LONG-TERM BUSINESS PLAN. IF WE ARE UNABLE TO OBTAIN ADDITIONAL CAPITAL IN FUTURE YEARS, WE MAY BE UNABLE TO PROCEED WITH OUR LONG-TERM BUSINESS PLAN AND WE MAY BE FORCED TO CURTAIL OR CEASE OUR OPERATIONS.

We will require additional working capital to support our long-term business plan, which includes identifying suitable targets for horizontal or vertical mergers or acquisitions, so as to enhance the overall productivity and benefit from economies of scale. Our working capital requirements and the cash flow provided by future operating activities, if any, will vary greatly from quarter to quarter, depending on the volume of business during the period and payment terms with our customers. We may not be able to obtain adequate levels of additional financing, whether through equity financing, debt financing or other sources. Additional financings could result in significant dilution to our earnings per share or the issuance of securities with rights superior to our current outstanding securities. In addition, we may grant registration rights to investors purchasing our equity or debt securities in the future. If we are unable to raise additional financing, we may be unable to implement our long-term business plan, develop or enhance our products and services, take advantage of future opportunities or respond to competitive pressures on a timely basis, if at all. In addition, a lack of additional financing could force us to substantially curtail or cease operations.

OUR FUTURE SUCCESS DEPENDS IN PART ON ATTRACTING AND RETAINING KEY SENIOR MANAGEMENT AND QUALIFIED TECHNICAL AND SALES PERSONNEL.

Our future success depends in part on the contributions of our management team and key technical and sales personnel and our ability to attract and retain qualified new personnel. In particular, our success depends on the continuing employment of our CEO, Mr. Guoshen Tu; our CFO, Terence Yap; our Chief Technical Officer, Dr. Yong Zhao; our Chief Operating Officer, Shufang Yang; our Vice President, Jianguo Jiang; and our Vice President, Lingfeng Xiong. There is significant competition in our industry for qualified managerial, technical and sales personnel and we cannot assure you that we will be able to retain our key senior managerial, technical and sales personnel or that we will be able to attract, integrate and retain other such personnel that we may require in the future. We also cannot assure that our employees will not leave and subsequently compete against us. If we are unable to attract and retain key personnel in the future, our business, financial condition and results of operations could be adversely affected.

OUR GROWTH STRATEGY INCLUDES MAKING ACQUISITIONS IN THE FUTURE, WHICH COULD SUBJECT US TO SIGNIFICANT RISKS, ANY OF WHICH COULD HARM OUR BUSINESS.

Our growth strategy includes identifying and acquiring or investing in suitable candidates on acceptable terms. We recently acquired the security and surveillance business of the Four-Related Companies and acquired a 100% ownership interest in Cheng Feng. We also expect to close the acquisitions of Shenzhen Hongtianzhi Electronics Co., Ltd., or “Hongtianzhi,” and HiEasy Electronic Technology Development Co., Ltd., or “HiEasy,” and establish an exclusive cooperation relationship with Shenzhen Chuang Guan Intelligence Network Technology Co., Ltd., or “Chuang Guan,” in 2007. In addition, over time, we may acquire or make investments in other providers of products that complement our business and other companies in the security industry.

Acquisitions involve a number of risks and present financial, managerial and operational challenges, including:

| | · | diversion of management’s attention from running our existing business; |

| | · | increased expenses, including travel, legal, administrative and compensation expenses resulting from newly hired employees; |

| | · | increased costs to integrate personnel, customer base and business practices of the acquired company with our own; |

| | · | adverse effects on our reported operating results due to possible write-down of goodwill associated with acquisitions; |

| | · | potential disputes with sellers of acquired businesses, technologies, services, products and potential liabilities; and |

| | · | dilution to our earnings per share if we issue common stock in any acquisition. |

Moreover, performance problems with an acquired business, technology, product or service could also have a material adverse impact on our reputation as a whole. In addition, any acquired business, technology, product or service could significantly under-perform relative to our expectations, and we may not achieve the benefits we expect from our acquisitions. For all of these reasons, our pursuit of an acquisition and investment strategy or any individual acquisition or investment could have a material adverse effect on our business, financial condition and results of operations.

OUR LIMITED ABILITY TO PROTECT OUR INTELLECTUAL PROPERTY MAY ADVERSELY AFFECT OUR ABILITY TO COMPETE.

We rely on a combination of trademarks, copyrights, trade secret laws, confidentiality procedures and licensing arrangements to protect our intellectual property rights. A successful challenge to the ownership of our technology could materially damage our business prospects. Our competitors may assert that our technologies or products infringe on their patents or proprietary rights. We may be required to obtain from others licenses that may not be available on commercially reasonable terms, if at all. Problems with intellectual property rights could increase the cost of our products or delay or preclude our new product development and commercialization. If infringement claims against us are deemed valid, we may not be able to obtain appropriate licenses on acceptable terms or at all. Litigation could be costly and time-consuming but may be necessary to protect our technology license positions or to defend against infringement claims.

WE SOMETIMES EXTEND CREDIT TO OUR CUSTOMERS. FAILURE TO COLLECT THE TRADE RECEIVABLES OR UNTIMELY COLLECTION COULD AFFECT OUR LIQUIDITY.

We extend credit to a large number of our customers while generally requiring no collateral. Generally, our customers pay in installments, with a portion of the payment upfront, a portion of the payment upon receipt of our products by our customers and before the installation, and a portion of the payment after the installation of our products and upon satisfaction of our customer. Sometimes, a small portion of the payment will not be paid until after a certain period following the installation. We perform ongoing credit evaluations of our customers’ financial condition and generally have no difficulties in collecting our payments. However, if we encounter future problems collecting amounts due from our clients or if we experience delays in the collection of amounts due from our clients, our liquidity could be negatively affected.

IF OUR SUBCONTRACTORS FAIL TO PERFORM THEIR CONTRACTUAL OBLIGATIONS, OUR ABILITY TO PROVIDE SERVICES AND PRODUCTS TO OUR CUSTOMERS, AS WELL AS OUR ABILITY TO OBTAIN FUTURE BUSINESS, MAY BE HARMED.

Many of our contracts involve subcontracts with other companies upon which we rely to perform a portion of the services that we must provide to our customers. There is a risk that we may have disputes with our subcontractors, including disputes regarding the quality and timeliness of work performed by those subcontractors. A failure by one or more of our subcontractors to satisfactorily perform the agreed-upon services may materially and adversely impact our ability to perform our obligations to our customers, could expose us to liability and could have a material adverse effect on our ability to compete for future contracts and orders.

SAFETECH IS A BVI COMPANY, WHILE GOLDEN AND CHENG FENG ARE PRC COMPANIES, AND ALL OF OUR OFFICERS AND DIRECTORS RESIDE OUTSIDE THE UNITED STATES. THEREFORE, CERTAIN JUDGMENTS OBTAINED AGAINST OUR COMPANY BY OUR SHAREHOLDERS MAY NOT BE ENFORCEABLE IN THE BVI OR CHINA.

Safetech is a BVI company and our operating subsidiaries Golden and Cheng Feng are PRC companies. All of our officers and directors reside outside of the United States. All or substantially all of our assets and the assets of these persons are located outside of the United States. As a result, it may not be possible for investors to effect service of process within the United States upon our Company or such persons or to enforce against it or these persons the United States federal securities laws, or to enforce judgments obtained in United States courts predicated upon the civil liability provisions of the federal securities laws of the United States, including the Securities Act and the Exchange Act.

RISKS RELATED TO OUR INDUSTRY

SEASONALITY AFFECTS OUR OPERATING RESULTS.

Our sales are affected by seasonality. Our revenues are usually higher in the second half of the year than in the first half of the year because fewer projects are undertaken during and around the Chinese spring festival.

OUR SUCCESS RELIES ON OUR MANAGEMENT’S ABILITY TO UNDERSTAND THE HIGHLY EVOLVING SURVEILLANCE AND SECURITY INDUSTRY.

The Chinese surveillance and security industry is nascent and rapidly evolving. Therefore, it is critical that our management is able to understand industry trends and make good strategic business decisions. If our management is unable to identify industry trends and act in response to such trends in a way that is beneficial to us, our business will suffer.

IF WE ARE UNABLE TO RESPOND TO THE RAPID CHANGES IN OUR INDUSTRY AND CHANGES IN OUR CUSTOMERS’ REQUIREMENTS AND PREFERENCES, OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS COULD BE ADVERSELY AFFECTED.

If we are unable, for technological, legal, financial or other reasons, to adapt in a timely manner to changing market conditions or customer requirements, we could lose customers and market share. The electronic security systems industry is characterized by rapid technological change. Sudden changes in customer requirements and preferences, the frequent introduction of new products and services embodying new technologies and the emergence of new industry standards and practices could render our existing products, services and systems obsolete. The emerging nature of products and services in the electronic security systems industry and their rapid evolution will require that we continually improve the performance, features and reliability of our products and services. Our success will depend, in part, on our ability to:

| | · | enhance our existing products and services; |

| | · | anticipate changing customer requirements by designing, developing, and launching new products and services that address the increasingly sophisticated and varied needs of our current and prospective customers; and |

| | · | respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis. |

The development of additional products and services involves significant technological and business risks and requires substantial expenditures and lead time. If we fail to introduce products with new technologies in a timely manner, or adapt our products to these new technologies, our business, financial condition and results of operations could be adversely affected. We cannot assure you that even if we are able to introduce new products or adapt our products to new technologies that our products will gain acceptance among our customers. In addition, from time to time, we or our competitors may announce new products, product enhancements or technological innovations that have the potential to replace or shorten the life cycles of our existing products and that may cause customers to refrain from purchasing our existing products, resulting in inventory obsolescence.

WE MAY NOT BE ABLE TO MAINTAIN OR IMPROVE OUR COMPETITIVE POSITION BECAUSE OF STRONG COMPETITION IN THE SECURITY AND SURVEILLANCE INDUSTRY, AND WE EXPECT THIS COMPETITION TO CONTINUE TO INTENSIFY.

The Chinese security and surveillance industry is highly competitive. There are about 15,000 companies in China that engage in the business of manufacturing, designing and building surveillance and security products. In addition, since China joined the World Trade Organization (“WTO”), we also face competition from international competitors. Some of our international competitors are larger than us and possess greater name recognition, assets, personnel, sales and financial resources. These entities may be able to respond more quickly to changing market conditions by developing new products and services that meet customer requirements or are otherwise superior to our products and services and may be able to more effectively market their products than we can because they have significantly greater financial, technical and marketing resources than we do. They may also be able to devote greater resources than we can to the development, promotion and sale of their products. Increased competition could require us to reduce our prices, result in our receiving fewer customer orders, and result in our loss of market share. We cannot assure you that we will be able to distinguish ourselves in a competitive market. To the extent that we are unable to successfully compete against existing and future competitors, our business, operating results and financial condition could be materially adversely affected.

OUR BUSINESS AND REPUTATION AS A MANUFACTURER OF HIGH QUALITY SECURITY AND SURVEILLANCE PRODUCTS MAY BE ADVERSELY AFFECTED BY PRODUCT DEFECTS OR SUBSTANDARD PERFORMANCE.

We believe that we offer high quality products that are reliable and competitively priced. If our products do not perform to specifications, we might be required to redesign or recall those products or pay substantial damages. Such an event could result in significant expenses, disrupt sales and affect our reputation and that of our products. In addition, product defects could result in substantial product liability. We do not have product liability insurance. If we face significant liability claims, our business, financial condition, and results of operations would be adversely affected.

OUR PRODUCT OFFERINGS INVOLVE A LENGTHY SALES CYCLE AND WE MAY NOT ANTICIPATE SALES LEVELS APPROPRIATELY, WHICH COULD IMPAIR OUR PROFITABILITY.

Some of our products and services are designed for medium to large commercial, industrial and government facilities desiring to protect valuable assets and/or prevent intrusion into high security facilities in China. Given the nature of our products and the customers that purchase them, sales cycles can be lengthy as customers conduct intensive investigations and deliberate between competing technologies and providers. For these and other reasons, the sales cycle associated with some of our products and services is typically lengthy and subject to a number of significant risks over which we have little or no control. If sales in any period fall significantly below anticipated levels, our financial condition and results of operations could suffer.

RISKS RELATED TO DOING BUSINESS IN CHINA

ECONOMIC, POLITICAL, LEGAL AND SOCIAL UNCERTAINTIES IN CHINA COULD HARM OUR FUTURE INTERESTS IN CHINA.

All of our future business projects and plans are expected to be located in China. As a consequence, the economic, political, legal and social conditions in China could have an adverse effect on our business, results of operations and financial condition. The legislative trend in China over the past decade has been to enhance the protection afforded to foreign investment and to allow for more active control by foreign parties of foreign invested enterprises. There can be no assurance, however, that legislation directed towards promoting foreign investment will continue. More restrictive rules on foreign investment could adversely affect our ability to expand our operations in China or repatriate any profits earned there. Some of the changes that could adversely affect us include:

| · | level of government involvement in the economy; |

| · | control of foreign exchange; |

| · | methods of allocating resources; |

| · | balance of payments position; |

| · | international trade restrictions; and |

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development (“OECD”), in many ways. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy were similar to those of the OECD member countries.

THE LEGAL ENVIRONMENT IN CHINA IS UNCERTAIN AND YOUR ABILITY TO LEGALLY PROTECT YOUR INVESTMENT COULD BE LIMITED.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 20 years has been to enhance the protections afforded to foreign-owned enterprises in China. However, these laws, regulations and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. For example, on March 16, 2007, PRC adopted new property and corporate income tax laws, and the implications of these new laws are uncertain as of the date of this report. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign-invested enterprises to hold licenses and permits such as requisite business licenses. In addition, all of our executive officers and our directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to effect service of process in the United States, or to enforce a judgment obtained in the United States against us or any of these persons.

THE CHINESE GOVERNMENT EXERTS SUBSTANTIAL INFLUENCE OVER THE MANNER IN WHICH WE MUST CONDUCT OUR BUSINESS ACTIVITIES.

China only recently has permitted provincial and local economic autonomy and private economic activities. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy, or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

FUTURE INFLATION IN CHINA MAY INHIBIT OUR ACTIVITY TO CONDUCT BUSINESS IN CHINA.

In recent years, the Chinese economy has experienced periods of rapid expansion and widely fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as -2.2%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

WE MAY BE UNABLE TO COMPLETE A BUSINESS COMBINATION TRANSACTION EFFECTIVELY OR ON FAVORABLE TERMS DUE TO COMPLICATED MERGER AND ACQUISITION REGULATIONS IMPLEMENTED ON SEPTEMBER 8, 2006.

On September 8, 2006, the PRC Ministry of Commerce, or “MOFCOM,” together with several other government agencies, promulgated a comprehensive set of regulations governing the approval process by which a Chinese company may participate in an acquisition of its assets or its equity interests and by which a Chinese company may obtain public trading of its securities on a securities exchange outside of the PRC. Depending on the structure of the transaction, these regulations will require the Chinese parties to make a series of applications and supplemental applications to the governmental agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer, which are designed to allow the government to assess the transaction. Governmental approvals will have expiration dates by which a transaction must be completed and reported to the governmental agencies. Compliance with the new regulations is likely to be more time consuming and expensive than in the past and the government now can exert more control over the combination of two businesses. Accordingly, due to these new regulations, our ability to engage in business combination transactions has become significantly more complicated, time consuming and expensive and we may not be able to negotiate a transaction that is acceptable to our stockholders or sufficiently protect their interests in a transaction.

The new regulations allow PRC government agencies to assess the economic terms of a business combination transaction. Parties to a business combination transaction may have to submit to MOFCOM and the other government agencies an appraisal report, an evaluation report and the acquisition agreement, all of which form part of the application for approval, depending on the structure of the transaction. The regulations also prohibit a transaction at an acquisition price obviously lower than the appraised value of the Chinese business or assets and in certain transaction structures, require that consideration must be paid within defined periods, generally not in excess of a year. The regulations also limit our ability to negotiate various terms of the acquisition, including aspects of the initial consideration, contingent consideration, holdback provisions, indemnification provisions and provisions relating to the assumption and allocation of assets and liabilities. Transaction structures involving trusts, nominees and similar entities are prohibited. Therefore, such regulations may impede our ability to negotiate and complete a business combination transaction on financial terms which satisfy our investors and protect our stockholders’ economic interests and we may not be able to negotiate a business combination transaction on terms favorable to our stockholders.

In addition to the above risks, in many instances, we will seek to structure transactions in a manner that avoids the need to make applications or a series of applications with Chinese regulatory authorities under these M&A regulations. If we fail to effectively structure an acquisition in a manner that avoids the need for such applications or if the Chinese government interprets the requirements of the M&A regulations in a manner different from our understanding of such regulations, then acquisitions that we have effected may be unwound or subject to rescission. Also, if the Chinese government determines that our structure of any of our acquisitions does not comply with these new regulations, then we may also be subject to fines and penalties.

RESTRICTIONS ON CURRENCY EXCHANGE MAY LIMIT OUR ABILITY TO RECEIVE AND USE OUR REVENUES EFFECTIVELY.

The majority of our revenues will be settled in RMB, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, and only at those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

THE VALUE OF OUR SECURITIES WILL BE AFFECTED BY THE FOREIGN EXCHANGE RATE BETWEEN THE U.S. DOLLARS AND RENMINBI.

The value of our common stock will be affected by the foreign exchange rate between U.S. dollars and RMB, and between those currencies and other currencies in which our sales may be denominated. For example, to the extent that we need to convert U.S. dollars into RMB for our operational needs, should the RMB appreciate against the U.S. dollar at that time, our financial position, the business of our Company, and the price of our common stock may be harmed. Conversely, if we decide to convert our RMB into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes, should the U.S. dollar appreciate against the RMB, the U.S. dollar equivalent of our earnings from our subsidiaries in China would be reduced.

ACCOUNTING LAWS IN CHINA MANDATE ACCOUNTING PRACTICES WHICH MAY NOT BE CONSISTENT WITH U.S. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES AND THEREFORE OUR FINANCIALS AND THEIR INTERPRETATION INVOLVE UNCERTAINTIES.

The PRC accounting laws require an annual “statutory audit” to be performed in accordance with PRC accounting standards and the books of foreign invested enterprises to be maintained in accordance with Chinese accounting laws. These Chinese accounting practices which may not be consistent with U.S. generally accepted accounting principles. Article 14 of the PRC Wholly Foreign-Owned Enterprise Law requires a wholly foreign-owned enterprise to submit certain periodic fiscal reports and statements to designated financial and tax authorities. Noncompliance with such requirements may cause revocation of our business license. The translation of the financial statements from the requirements of the PRC to US GAAP, requires interpretation and exercise of judgment.

RISKS RELATED TO OUR COMMON STOCK

OUR COMMON STOCK IS CURRENTLY QUOTED ONLY ON THE OTC BULLETIN BOARD, WHICH MAY HAVE AN UNFAVORABLE IMPACT ON STOCK PRICE AND LIQUIDITY.

Our common stock is quoted only on the OTCBB. The OTCBB is a significantly more limited market than the New York Stock Exchange or NASDAQ system. The quotation of our shares on the OTCBB may result in a less liquid market available for existing and potential stockholders to trade shares of the common stock, could depress the trading price of the common stock and could have a long-term adverse impact on our ability to raise capital in the future.

PROVISIONS IN OUR CERTIFICATE OF INCORPORATION AND BYLAWS OR DELAWARE LAW MIGHT DISCOURAGE, DELAY OR PREVENT A CHANGE OF CONTROL OF OUR COMPANY OR CHANGES IN ITS MANAGEMENT AND, THEREFORE DEPRESS THE TRADING PRICE OF THE COMMON STOCK.

Delaware corporate law and our certificate of incorporation and bylaws contain provisions that could discourage, delay or prevent a change in control of our Company or changes in its management that our stockholders may deem advantageous. These provisions:

| | – | deny holders of our common stock cumulative voting rights in the election of directors, meaning that stockholders owning a majority of our outstanding shares of common stock will be able to elect all of our directors; |

| | – | any stockholder wishing to properly bring a matter before a meeting of stockholders must comply with specified procedural and advance notice requirements; and |

| – | any vacancy on the board of directors, however the vacancy occurs, may only be filled by the directors. |

In addition, Section 203 of the Delaware General Corporation Law generally limits our ability to engage in any business combination with certain persons who own 15% or more of our outstanding voting stock or any of our associates or affiliates who at any time in the past three years have owned 15% or more of our outstanding voting stock. These provisions may have the effect of entrenching our management team and may deprive you of the opportunity to sell your shares to potential acquirors at a premium over prevailing prices. This potential inability to obtain a control premium could reduce the price of our common stock.

None.

All land in China is owned by the State. Individuals and companies are permitted to acquire rights to use land or land use rights for specific purposes. In the case of land used for industrial purposes, the land use rights are granted for a period of 50 years. This period may be renewed at the expiration of the initial and any subsequent terms. Granted land use rights are transferable and may be used as security for borrowings and other obligations.

We currently have land use rights to approximately 119,245 square meters consisting of manufacturing facilities and office buildings in various parts of China, including Shenzhen and Jiangxi province. We have fully paid the land use fees. The chart below lists all facilities owned by us.

Location | | Type of Facility | | Size of the Land (Square Meters) | | Size of the Building (Square Meters) | |

| Shangtian, Taihe County, Jiangxi Province | | | Manufacturing | | | 64,533 | | | 45,878 | |

| | | | | | | | | | | |

| No. 45 Jifu Road, Jiangxi Province | | | Manufacturing | | | 28,593 | | | 5,224 | |

| | | | | | | | | | | |

| Jishui County, Jiangxi Province | | | Manufacturing | | | 24,867 | | | 10,405 | |

| | | | | | | | | | | |

4th Floor, Building 3, Shaige Technology Park, Futian District, Shenzhen | | | Office and Manufacturing | | | 1,252 | | | 1,252 | |

| | | | | | | | | | | |

| 13/F, Shenzhen Special Zone Press Tower, Shennan Road, Futian District, Shenzhen * | | | Office | | | | | | 2,069 | |

| | | | | | | | | | | |

| 3/F, Block 89, No. 1122, Qin Zhou North Road, Shanghai | | | Office and Manufacturing | | | | | | 1,139 | |

| | | | | | | | | | | |

| Total | | | | | | 119,245 | | | 65,967 | |

| | | | | | | | | | | |

| * | Pursuant to a trust agreement, dated August 21, 2006, by and between Golden and Zhiqun Li, Ms. Li holds this property in trust for Golden. Golden has the right to request Ms. Li to transfer the property to Golden without consideration upon its request. In addition, without prior approval from Golden, Ms. Li has no right to dispose the property. |

In order to facilitate our business expansion, we plan to acquire an industrial park in Shenzhen in 2007. We believe our property is sufficient to meet our current needs.

On March 16, 2007, the National People’s Congress of the PRC adopted a new property law in its fifth plenary session. The new property law will become effective on October 1, 2007. As of the date of this report, we cannot be sure of the potential impact of such new property law on our financial position and operating results.

From time to time, we have disputes that arise in the ordinary course of its business. Currently, there are no material legal proceedings to which we are a party, or to which any of our property is subject, that we expect to have a material adverse effect on our financial condition.

None.

Our common stock has been quoted on the OTCBB since June 2005 and currently trades under the symbol “CSCT.OB.” The CUSIP number is 16942J105.

The following table sets forth the quarterly high and low bid prices of a share of our common stock as reported by the OTCBB for the periods indicated. The quotations listed below reflect inter-dealer prices, without retail mark-ups, mark-downs or commissions and may not necessarily represent actual transactions.

| | | Closing Bid Prices(1) | |

| | | High | | Low | |

Year Ended December 31, 2006 | | | | | |

| 1st Quarter | | $ | 4.40 | | $ | 3.50 | |

| 2nd Quarter | | | 8.10 | | | 3.60 | |

| 3rd Quarter | | | 6.70 | | | 4.00 | |

| 4th Quarter | | | 12.10 | | | 7.05 | |

| | | | | | | | |

Year Ended December 31, 2005 | | | | | | | |

| 1st Quarter | | | N/A | | | N/A | |

| 2nd Quarter | | | 0.25 | | | 0.05 | |

| 3rd Quarter | | | 4.50 | | | 0.05 | |

| 4th Quarter | | | 3.00 | | | 1.85 | |

| | | | | | | | |

| (1) | The above tables set forth the range of high and low closing bid prices per share of our common stock as reported by www.quotemedia.com for the periods indicated. |

Approximate Number of Holders of Our Common Stock

On March 16, 2007, there were approximately 438 stockholders of record of our common stock. This number excludes the 12,397,119 shares of our common stock owned by stockholders holding stock under nominee security position listings.

Dividend Policy

We have never declared or paid cash dividends. Any future decisions regarding dividends will be made by our board of directors. We currently intend to retain and use any future earnings for the development and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

Recent Sales of Unregistered Securities

In March 2006, we issued 100,000 shares of common stock to Terence Yap as payment for his services which are being rendered through February 2009. The value attributed to these shares was $350,000 ($3.50 per share). These stock issuances were exempt from registration pursuant to Section 4(2) of the Securities Act.

On April 4, 2006, we completed a private placement in which we sold 2,666,667 shares of our common stock at a price of $3.00 per share for aggregate gross proceeds of $800,000 to certain accredited investors. We also issued warrants to purchase 416,667 shares of our common stock to certain entities as compensation for their services in connection with the private placement, 150,000 of which have an exercise price of $3.80 per share, while the remaining 266,667 are exercisable at a price of $3.00 per share. The issuance was made in reliance on the exemption provided by Section 4(2) of the Securities Act for the offer and sale of securities not involving a public offering and Regulation D promulgated thereunder.

On July 31, 2006, we issued 4,634,592 units to 26 accredited investors for an aggregate gross cash purchase price of $16,221,093 at a price of $3.50 per share. Each unit consists of one share of our common stock and a warrant to purchase one-fifth of one share of our common stock. We also issued warrants to purchase 324,421 shares of our common stock with an exercise price of $4.20 to two placement agents as compensation for their services in connection with the private placement. The issuance was made in reliance on the exemption provided by Section 4(2) of the Securities Act for the offer and sale of securities not involving a public offering and regulation D promulgated thereunder.

In October 2006, we issued 50,000 shares of our common stock to Hayden Communications, Inc. as payment for their investor relationship services rendered pursuant to a consulting agreement dated February 9, 2006. These stock issuances were exempt from registration pursuant to Section 4(2) of the Securities Act.

On November 27, 2006, we issued 1,538,462 shares of our common stock to 3 accredited investors for a consideration of $10 million at a price of $6.50 per share. The issuance was made in reliance on the exemption provided by Section 4(2) of the Securities Act for the offer and sale of securities not involving a public offering and Regulation D promulgated thereunder.

In instances described above where we issued securities in reliance upon Regulation D, we relied upon Rule 506 of Regulation D under the Securities Act. These stockholders who received the securities in such instances made representations that (a) the stockholder is acquiring the securities for his, her or its own account for investment and not for the account of any other person and not with a view to or for distribution, assignment or resale in connection with any distribution within the meaning of the Securities Act, (b) the stockholder agrees not to sell or otherwise transfer the purchased shares unless they are registered under the Securities Act and any applicable state securities laws, or an exemption or exemptions from such registration are available, (c) the stockholder has knowledge and experience in financial and business matters such that he, she or it is capable of evaluating the merits and risks of an investment in us, (d) the stockholder had access to all of our documents, records, and books pertaining to the investment and was provided the opportunity to ask questions and receive answers regarding the terms and conditions of the offering and to obtain any additional information which we possessed or were able to acquire without unreasonable effort and expense, and (e) the stockholder has no need for the liquidity in its investment in us and could afford the complete loss of such investment. Management made the determination that the investors in instances where we relied on Regulation D are Accredited Investors (as defined in Regulation D) based upon management’s inquiry into their sophistication and net worth. In addition, there was no general solicitation or advertising for securities issued in reliance upon Regulation D.

In instances described above where we indicate that we relied upon Section 4(2) of the Securities Act in issuing securities, our reliance was based upon the following factors: (a) the issuance of the securities was an isolated private transaction by us which did not involve a public offering; (b) there were only a limited number of offerees; (c) there were no subsequent or contemporaneous public offerings of the securities by us; (d) the securities were not broken down into smaller denominations; and (e) the negotiations for the sale of the stock took place directly between the offeree and us.

The selected consolidated statement of income and comprehensive income data for the years ended December 31, 2004, 2005 and 2006 and the selected balance sheet data as of December 31, 2005 and 2006 are derived from our audited consolidated financial statements included elsewhere in this report. The selected consolidated financial data for the year ended December 31, 2003 and the selected balance sheet data as of December 31, 2004 are derived from our audited consolidated financial statements not included in this report. The selected consolidated financial data for the year ended December 31, 2002 is derived from our unaudited consolidated financial statements that are not included in this report.

The following selected historical financial information should be read in conjunction with our consolidated financial statements and related notes and the information contained in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

All amounts, other than percentages, in U.S. dollars.

| | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

| | | | | | | | | | | | | | | | | |

| Revenues | | $ | 106,989,359 | | $ | 32,688,582 | | $ | 16,055,704 | | $ | 11,794,869 | | $ | 10,330,847 | |