QuickLinks -- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on April 29, 2005

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Worldspan, L.P.

WS Financing Corp.

(Exact name of Registrant as specified in its charter)

| Delaware Delaware (State or Other Jurisdiction of Incorporation or Organization) | 7374 7374 (Primary Standard Industrial Classification Code Number) | 43-1537250 75-3125720 (I.R.S. Employer Identification No.) |

300 Galleria Parkway, N.W.

Atlanta, Georgia 30339

(770) 563-7400

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

See Table of Additional Registrants Below

Jeffrey C. Smith, Esq.

General Counsel

Worldspan, L.P.

300 Galleria Parkway, N.W.

Atlanta, Georgia 30339

(770) 563-7400

(Name, address including zip code, and telephone number, including area code, of agent for service)

Copies to:

G. Daniel O'Donnell, Esq.

R. Craig Smith, Esq.

Dechert LLP

4000 Bell Atlantic Tower

1717 Arch Street

Philadelphia, Pennsylvania 19103

(215) 994-4000

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

| Title of each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Unit | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2) | ||||

|---|---|---|---|---|---|---|---|---|

| Senior Second Lien Secured Floating Rate Notes due 2011 | $300,000,000 | 100% | $300,000,000 | $35,310.00 | ||||

| Guarantees(2) | $300,000,000 | — | — | (3) | ||||

- (1)

- Estimated pursuant to Rule 457(f) under the Securities Act of 1933, as amended, solely for purposes of calculating the registration fee.

- (2)

- The other companies listed in the Table of Additional Registrants below have guaranteed, jointly and severally, the Senior Second Lien Secured Floating Rate Notes Due 2011 being registered hereby. The Guarantors are registering the Guarantees. Pursuant to Rule 457(n) under the Securities Act of 1933, no registration fee is required with respect to the Guarantees.

- (3)

- Not applicable.

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Additional Registrants

| Name | State of Incorporation or Organization | Primary Standard Industrial Classification Code Number | IRS Employer Identification No. | |||

|---|---|---|---|---|---|---|

| Worldspan iJet Holdings, LLC | Delaware | 7374 | 58-2645324 | |||

| Worldspan XOL LLC | Georgia | 7374 | 58-2530483 | |||

| Worldspan BBN Holdings, LLC | California | 7374 | 58-2607622 | |||

| Worldspan Digital Holdings, LLC | Delaware | 7374 | 58-2611355 | |||

| Worldspan StoreMaker Holdings, LLC | Delaware | 7374 | 58-2611361 | |||

| Worldspan Viator Holdings, LLC | Delaware | 7374 | 58-2611356 | |||

| Worldspan OpenTable Holdings, LLC | Georgia | 7374 | 58-2611353 | |||

| Worldspan South American Holdings LLC | Georgia | 7374 | 58-2529667 | |||

| Worldspan S.A. Holdings II, LLC | Georgia | 7374 | 58-2607619 |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 29, 2005

PROSPECTUS

Worldspan, L.P.

WS Financing Corp.

OFFER TO EXCHANGE

$300,000,000 Principal Amount of

Senior Second Lien Secured Floating Rate Notes Due 2011

for

$300,000,000 Principal Amount of Outstanding

Senior Second Lien Secured Floating Rate Notes Due 2011

The exchange offer will expire at 5:00 p.m.,

New York City time on , 2005, unless extended.

We are offering, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, to exchange up to $300,000,000 aggregate principal amount of our new Senior Second Lien Secured Floating Rate Notes Due 2011 that we have registered under the Securities Act of 1933 for an equal principal amount of our outstanding Senior Second Lien Secured Floating Rate Notes Due 2011. We refer to the new notes you will receive on this exchange offer collectively as the "new notes," and we refer to the old notes you will tender on this exchange offer collectively as the "old notes." The new notes will represent the same debt as the corresponding old notes, will be secured by the same collateral, and we will issue the new notes under the same applicable indenture.

Terms of the exchange offer:

- —

- We will exchange all old notes that are validly tendered and not withdrawn prior to the expiration of the exchange offer.

- —

- You may withdraw tenders of old notes at any time prior to the expiration of the exchange offer.

- —

- We believe that the exchange of old notes will not be a taxable event for U.S. federal income tax purposes, but you should see "Certain Federal Income Tax Considerations" on page 184 for more information.

- —

- We will not receive any proceeds from the exchange offer.

- —

- The terms of the new notes are substantially identical to the old notes, except that the new notes are registered under the Securities Act of 1933 and the transfer restrictions and registration rights applicable to the old notes do not apply to the new notes.

See "Risk Factors" beginning on page 16 for a discussion of risks that should be considered by holders prior to tendering their old notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2005.

| | Page | |

|---|---|---|

| SUMMARY | 1 | |

| RISK FACTORS | 16 | |

| USE OF PROCEEDS | 36 | |

| CAPITALIZATION | 37 | |

| UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | 38 | |

| SELECTED HISTORICAL FINANCIAL DATA | 43 | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 46 | |

| BUSINESS | 70 | |

| MANAGEMENT | 87 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 103 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 107 | |

| DESCRIPTION OF OTHER INDEBTEDNESS | 111 | |

| THE EXCHANGE OFFER | 115 | |

| DESCRIPTION OF THE NEW NOTES | 123 | |

| CERTAIN FEDERAL INCOME TAX CONSIDERATIONS | 184 | |

| PLAN OF DISTRIBUTION | 188 | |

| LEGAL MATTERS | 188 | |

| EXPERTS | 188 | |

| WHERE YOU CAN FIND MORE INFORMATION | 188 | |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | F-1 |

You should rely only on the information contained in this document and any supplement or to which we have referred you. See "Where You Can Find Other Information." We have not authorized anyone to provide you with information that is different. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted, where the person making the offer is not qualified to do so, or to any person who cannot legally be offered the securities. You should assume that the information appearing in this prospectus or incorporated by reference is accurate only as of the date on the front cover of this prospectus or any supplement or the date of the documents incorporated by reference, as the case may be.

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of new notes. The Letter of Transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act of 1933, as amended, which we refer to as the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where the old notes were acquired by the broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

We have obtained some industry data from third party sources that we believe to be reliable. In particular, we obtained raw airline bookings data compiled by DOB Systems, Inc. and sold as marketing industry data tapes, which we refer to as MIDT, and our determinations of market size and share within our industry are based on our processing of this data. As of April 1, 2004, we no longer use DOB Systems, Inc. to compile MIDT and instead compile the data internally. In many cases,

i

however, we have made statements in this prospectus regarding our industry and our position in the industry based on our experience in the industry and our own investigation of market conditions. In particular, we designate each travel agency as traditional or online based on our belief as to whether a travel agency is traditional or online. Our designation of travel agencies as online or traditional is based on an agency's aggregate booking activity for all its locations and our knowledge of the agency. These designations may be revised as an agency's business changes.

This prospectus includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, including without limitation the statements under "Summary," "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business." The words "believes," "anticipates," "plans," "expects," "intends," "estimates" and similar expressions are intended to identify forward-looking statements. These forward looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance and achievements, industry results, to be materially different from any future results, performance and achievements expressed or implied by such forward-looking statements.

All forward-looking statements included in this prospectus are based on information available to us on the date of this prospectus. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this prospectus.

ii

SUMMARY

This summary highlights certain significant aspects of our business and this exchange offer contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our combined financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision. In addition, certain statements include forward-looking information that involves risks and uncertainties. See "Forward-Looking Statements."

In this prospectus, unless the context otherwise requires, the "issuers" refers to Worldspan L.P., exclusive of its subsidiaries, and WS Financing Corp.; "WTI" refers to Worldspan Technologies Inc. (formerly named Travel Transaction Processing Corporation); "we," "us," "our" and "our company" refer to the consolidated business of Worldspan, L.P. and all of its subsidiaries unless otherwise specified; the "Acquisition" refers to the acquisition by WTI of the general partnership interests and, indirectly through its wholly-owned subsidiaries, the limited partnership interests of Worldspan, L.P.

On February 11, 2005, Worldspan, L.P. and WS Financing Corp. issued and sold $300.0 million aggregate principal amount of Senior Second Lien Secured Floating Rate Notes Due 2011, referred to herein as the old notes. In connection with that sale, we entered into a registration rights agreement with the initial purchasers of the old notes in which we agreed to deliver this prospectus to you and to complete an exchange offer for the old notes. As required by the registration rights agreement, we are offering to exchange $300.0 million aggregate principal amount of our new Senior Second Lien Secured Floating Rate Notes Due 2011, referred to herein as the new notes, the issuance of which will be registered under the Securities Act, for a like aggregate principal amount of our old notes. We refer to this offer to exchange new notes for old notes in accordance with the terms set forth in this prospectus and the accompanying letter of transmittal as the exchange offer. You are entitled to exchange your old notes for new notes. We urge you to read the discussions under the headings "The Exchange Offer" and "Description of the New Notes" in this prospectus for further information regarding the exchange offer and the new notes. We refer to the old notes and the new notes collectively as the "notes."

We are a provider of mission-critical transaction processing and information technology services to the global travel industry. Globally, we are the largest transaction processor for online travel agencies, having processed 64% of all global distribution system, or GDS, online air transactions during the twelve months ended December 31, 2004. In the United States (the world's largest travel market), we are the second largest transaction processor for travel agencies, accounting for 32% of GDS air transactions and over 67% of online GDS air transactions processed during the twelve months ended December 31, 2004. We provide subscribers (including traditional travel agencies, online travel agencies and corporate travel departments) with real-time access to schedule, price, availability and other travel information and the ability to process reservations and issue tickets for the products and services of approximately 800 travel suppliers (such as airlines, hotels, car rental companies, tour companies and cruise lines) throughout the world. During the year ended December 31, 2004, we processed approximately 202 million transactions. We also provide information technology services to the travel industry, primarily airline internal reservation systems, flight operations technology and software development.

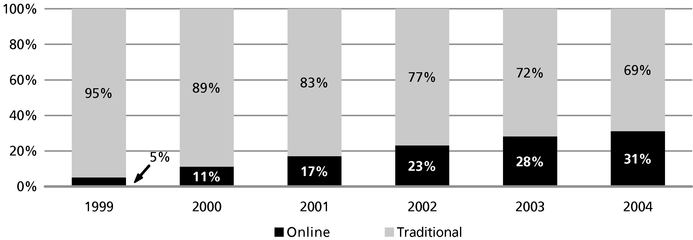

In recent years, the travel industry has been marked by the emergence and growth of the Internet as a travel distribution channel. The growth in use of the Internet has led to the establishment of online travel agencies that provide a link between the consumer and the travel supplier, typically

1

through a GDS. In 2004, airline transactions generated through online travel agencies accounted for approximately 31% of all airline transactions in the United States processed by a GDS, up from approximately 28% in 2003, approximately 23% in 2002 and approximately 17% in 2001. Between 2000 and 2004, the number of airline transactions in the United States generated through online travel agencies and processed by a GDS increased at a compound annual growth rate of 22.3% and an annual growth rate of 13.8% from 2003 to 2004.

We have executed an alternative strategy with regard to the online travel agency channel. Unlike our primary competitors, we do not own an online travel agency that competes with travel suppliers or travel agencies. Instead, we have developed strategic relationships with online travel agencies to provide them with transaction processing, mission-critical technology and services, and access to our aggregated travel information, which enable online travel agencies to operate effectively and efficiently. As a result of this strategy, we have entered into long-term contracts with Expedia, Orbitz and Priceline, which are three of the five largest online travel agencies in the world. In addition, we have an agreement with Hotwire, another online travel agency, to process its airline transactions and have converted all of its airline transactions from Sabre, its previous provider, to us since March 2003.

Business Segments

We operate in two business segments: electronic travel distribution and information technology services, which represented approximately 93% and 7%, respectively, of our revenues in the year ended December 31, 2004.

Electronic Travel Distribution We are the second largest transaction processor for travel agencies in the United States (the world's largest travel market), with a 32% market share of all travel agency air transactions processed through a GDS, and the largest processor globally for online travel agencies, with a 64% market share of all GDS online air transactions processed during the twelve months ended December 31, 2004. The $5.0 billion-plus global GDS industry is a core component of the worldwide travel industry and is organized around two major sets of customers: travel suppliers and travel agencies. Suppliers of travel and travel-related products and services (such as airlines, car rental companies and hotels) utilize GDSs as a means of selling tickets and generating sales. Travel agencies (including traditional travel agencies, online travel agencies and corporate travel departments) utilize GDSs to search schedule, price, availability and other travel information and to process transactions on behalf of consumers. GDSs provide travel agencies with a single, expansive source of travel information, allowing travel agencies to search and process tens of thousands of itinerary and pricing options across multiple travel suppliers within seconds.

Through our GDS, we provide approximately 16,000 traditional travel agency locations in over 70 countries and approximately 50 online travel agencies, including four of the largest online travel agencies, with access to the inventory, reservations and ticketing of travel suppliers, including approximately 463 airlines, 225 hotel chains and 30 car rental companies throughout the world. As compensation for performing these services, we generally charge the travel supplier a fee for every transaction we process. For example, for a roundtrip ticket with one connection each way, a three night hotel stay and a three day car rental, we charge the respective travel suppliers one transaction fee for each segment of the airline ticket, one transaction fee for the hotel stay and one transaction fee for the car rental for a total of six transaction fees. The value of the travel purchase or the length of stay has no impact on our transaction fee.

2

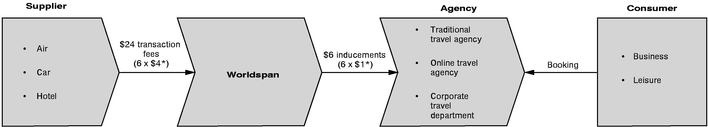

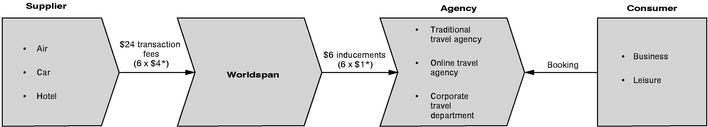

Set forth below is a chart illustrating the flow of payments in a typical consumer travel booking processed by us.

| 1 roundtrip airline ticket (one connection each way) | 4 transactions | ||

| 1 car rental (3 days) | 1 transaction | ||

| 1 hotel reservation (3 days) | 1 transaction | ||

| 6 transactions |

- *

- Transaction and inducement fees are for illustrative purposes only.

Information Technology Services We provide a comprehensive suite of information technology, or IT, services to airlines, including: (i) internal reservation system services; (ii) flight operations technology services; and (iii) software development and licensing services, which include custom development and integration. We provide some of these services to several airlines, including Delta Airlines, which we refer to as Delta, and Northwest Airlines, which we refer to as Northwest. We have also developed other products and services to meet the needs of airlines, which we sell on a subscription basis. These products and services include Worldspan Rapid RepriceSM, Electronic Ticketing, e-Pricing® and Fares and Pricing.

Competitive Strengths

Market leading transaction processor for online travel agencies. During 2004, we processed over 67% of online airline transactions made in the United States and processed by a GDS. Our leadership in the online travel agency channel began in 1995 when Microsoft chose us as its transaction processing partner when it was developing Expedia as an online travel agency. In addition, we have executed a strategy of developing contractual relationships with online travel agencies, rather than owning an online travel agency like our primary competitors. As a result, we process online transactions for Expedia, Hotwire, Orbitz and Priceline, four of the six largest online travel agencies in the world. While these relationships have allowed us to develop a market leading position, we are highly dependent on these four online travel agencies, and the success of our business depends on continuing these relationships. In May 2004, Expedia announced that it intends to move a portion of its transactions to another GDS provider. To date, the anticipated movement of Expedia's transactions has not occurred and, at this time, we cannot forecast the timing or magnitude of any such movement on our financial position or results of operations. If Expedia were to move a material portion of its transactions to another GDS provider, our business would be negatively and materially impacted. Further, Cendant Corporation recently acquired Orbitz. Cendant's Travel Distribution Services Division includes Galileo, which is a competitor of ours. Orbitz is one of our largest online travel agency customers. Our contract with Orbitz extends into 2011 subject to standard termination rights held by Orbitz including for-cause termination rights.

Well Positioned to Take Advantage of the Shift to the Online Travel Agency Channel. An increasing number of travel transactions are being made online. During 2004, airline transactions generated through online travel agencies accounted for approximately 31% of all airline transactions in the

3

United States processed by a GDS, up from approximately 28% in 2003 and approximately 23% in 2002. Our relationships with four of the six largest online travel agencies in the world have positioned us well to take advantage of this shift. However, despite the substantial shift to online transactions in the past few years, we cannot assure you that this shift will continue at the rate that it has in the past or at all.

Barriers to Entry. A GDS is a computerized system based on state-of-the-art technology and is highly customized and difficult to replicate. In order to become a successful participant in the GDS industry, a new market entrant would face several barriers to entry, including:

- •

- the cost and length of time required to assemble the hardware systems and develop the sophisticated intellectual property of a GDS necessary to compile, process and manage the large and complex database of travel information;

- •

- the costs and length of time required to establish relationships and negotiate distribution agreements with a wide range of travel suppliers; and

- •

- the costs and length of time required to establish relationships and negotiate agreements with travel agencies, which are generally operating under multi-year contracts with existing GDSs and which incur costs in converting to a new GDS.

Neutrality. Unlike our competitors, we have intentionally not pursued a strategy of vertical integration and instead have forged strategic partnerships with leading online travel agencies. As the shift towards the online travel agency channel continues, we believe the traditional travel agencies will increasingly view the GDS-owned online travel agencies as competitive to their core business. As a result, our neutrality gives us an opportunity to capture additional business from both online and traditional travel agencies. On the other hand, because we do not own an online travel agency, we do not have a captive customer like the other GDSs.

Robust Technology Capabilities. Our use of Internet and server-based technologies has allowed us to provide travel suppliers and online and traditional travel agencies with products and services that enable custom applications, reduce operating costs, increase productivity and enhance the customer experience. In addition, as a result of our agreement with IBM, we believe that we will be able to increase our processing and computer capabilities without a significant increase in associated software and hardware costs. While we believe we have strong technological capabilities, we are substantially dependent on IBM, our most significant and material vendor, for much of this technological capability. An adverse development in our relationship with IBM would have a material impact on our technological capabilities.

Proven Business Model with Strong Cash Flow Generation. Our ability to leverage our cost structure, grow transaction volumes, enlarge our customer base, and incur moderate ongoing capital expenditure and working capital requirements, enables us to generate significant net cash from operations. From January 1, 1999 through December 31, 2004, we generated $950.7 million of net cash from operations, which primarily enabled us to distribute $715.0 million to our founding airlines from January 1, 1999 through the closing of the Acquisition. Our free cash flow generation in the approximately 18 months between the close of the acquisition of Worldspan, L.P. on June 30, 2003 and December 31, 2004 has enabled us to reduce our total debt plus capital leases (less cash and cash equivalents) from approximately $459.9 million to $310.5 million, respectively. However, given the uncertainty in the airline industry, from which we derive most of our revenues, we cannot be certain that we can generate cash at the rates we were able to in the past. In addition, we have significantly more indebtedness than we did prior to the Acquisition, and a significant portion of our generated cash will be used to service our indebtedness.

4

Business strategy

Continue to Increase Our Share and the Number of Online Travel Agency Transactions. While we processed over 67% of online airline transactions made in the United States and processed by a GDS during 2004, we believe there are still opportunities to increase our number of transactions and our market share in the online travel agency channel. Our primary competitors own online travel agencies. As the shift towards the online travel agency channel continues, we believe the traditional travel agencies will increasingly view the GDS-owned online travel agencies as competitive to their core business. As a result, our neutrality gives us an opportunity to capture additional business from both online and traditional travel agencies. However, to the extent that such agencies are acquired by or become affiliated with one of our competitors, the likelihood of our capturing additional business from those agencies may be reduced and our existing business with those agencies may be at risk. Further, given our currently strong position in the online market, we cannot be certain how much more of the market we can capture or whether we can maintain our current position.

Increase our Global Penetration of the Traditional Travel Agency Channel. We have historically focused on selected geographic markets where our founding airlines had significant operations. We believe we have the opportunity to obtain new traditional travel agencies both in and outside the United States, particularly in Europe, Asia, Australia and South America, where we have not previously concentrated and where travel reservations are not generally made using current Internet technologies. However, because we have not historically focused on these geographic markets, we cannot be sure how successful we will be in attracting new business in these markets or at what cost. In addition, we intend to expand the number of transactions we process for traditional travel agencies in the United States.

Capitalize on the Shift By Corporate Travel Departments to Online Travel Services. We believe there will be a substantial opportunity to capitalize on the trend of corporate travel departments toward making bookings for business travel through online services. We are well positioned to benefit from this trend, as Expedia and Orbitz, two of our largest online travel agency customers, have entered the corporate travel market. Nevertheless, because we are relying on our online travel agencies to develop and service the corporate travel market, our ability to compete in this market will depend on the success of our online travel agencies in attracting and maintaining corporate travel departments as customers.

Increase Hospitality and Destination Services Transactions. We intend to increase our transaction revenues from hospitality and destination services, which include car, hotel, tour, cruise and rail transactions. We derived approximately 9% of our transaction fee revenues during the year ended December 31, 2004 from hospitality and destination services transactions. We expect these future transactions to increase in number, largely as a result of the emergence of the Internet and online travel agencies as a means of facilitating travel commerce. Nevertheless, we cannot be certain that the hospitality and destination services market will embrace the use of online travel agencies quickly or to the extent experienced by the airline services market.

Expand Information Technology Services Business. We intend to expand our existing information technology services business. We believe airlines and other travel suppliers have been and will be increasingly outsourcing non-core technology functionalities due to the desire to focus on their core travel business. However, despite our belief that we can provide important IT services to airlines and other travel suppliers, we have historically provided most of our IT services to only two airlines. We cannot be certain that other airlines and travel services providers will be receptive to our services.

Continue to Reduce Costs. Since the Acquisition, we have executed several strategic cost reduction initiatives. We believe additional opportunities exist to reduce costs and improve profitability. We plan to improve our cost structure by streamlining our programming and processing systems and reducing

5

our network and data center costs, among other initiatives. Nevertheless, we face the challenge of continuing to reduce costs without adversely impacting our productivity and operational performance.

Our Corporate Structure and History

WTI was formed in March 2003 by Citigroup Venture Capital Equity Partners, L.P., which we refer to as CVC, and Ontario Teachers' Pension Plan Board, which we refer to as OTPP, for the purpose of acquiring all of our general partnership interests and indirectly acquiring all of our limited partnership interests. On June 30, 2003, WTI acquired 100% of our outstanding general partnership interests and limited partnership interests from affiliates of our founding airlines for an aggregate consideration of $901.5 million and agreed to provide credits to Delta and Northwest totaling up to $250.0 million structured over nine years in exchange for the agreement of those airlines to continue using us for information technology services.

Worldspan, L.P. is a Delaware limited partnership. WS Financing Corp. is a Delaware corporation and a subsidiary of Worldspan, L.P. and was formed in 2003 for the purposes of serving as a co-issuer of our 95/8% Senior Notes Due 2011, referred to herein as the 95/8% notes, and in order to facilitate that offering. WS Financing does not and will not have any substantial operations or assets and does not and will not have any revenues. Our principal executive offices are located at 300 Galleria Parkway, N.W., Atlanta, Georgia 30339, and our telephone number at that address is (770) 563-7400. Our website address is htpp://www.worldspan.com. The website and the information included therein are not part of this prospectus.

CVC is a private equity fund managed by Citigroup Venture Capital Ltd., one of the industry's oldest private equity firms. Citigroup Venture Capital Ltd. was established in 1968, and manages funds in excess of $6.0 billion. Citigroup Venture Capital is a leading technology and travel investor, sponsoring such industry leading names as Fairchild Semiconductor, Intersil, ChipPAC, AMI Semiconductor, Federal Express and People Express.

OTPP, with approximately C$84 billion in net assets at December 31, 2004, is one of the largest pension plans in Canada. OTPP's private equity arm was established in 1991. The private equity arm has completed more than 130 transactions in a wide range of industries having participated in many management buy-outs in Canada, the United States and Europe, including The Yellow Pages Group, Samsonite Corp. and Shoppers Drug Mart Corporation. With a portfolio valued at C$6.8 billion as of December 31, 2004, OTPP's private equity arm is one of Canada's largest private equity investors.

In November 2004, we terminated the employment agreement of Michael Wood, our former Chief Financial Officer. In March 2005, we appointed Kevin W. Mooney to the position of Chief Financial Officer. Mr. Mooney began his service as an officer of the Company on March 21, 2005. During the transition, Dale Messick, our Chief Financial Officer between 1997 and February 2004, is overseeing finance activities and functions.

On January 25, 2005, we made a tender offer and commenced a related consent solicitation for all of our outstanding 95/8% notes, of which $280.0 million in aggregate principal amount were outstanding as of that date. The proceeds of the offering of the old notes were used, in part, to repurchase the 95/8% notes from holders that agreed to tender their 95/8% notes prior to the closing of the offering of the old notes (provided that over 50% of the aggregate principal amount of the 95/8% notes which were not held by us or our affiliates were tendered prior to the closing) and to prepay our sponsor advisory

6

fees and the special dividends on WTI's Class B Common Stock, referred to herein as WTI Class B dividends. The tender offer remained open until February 22, 2005. In connection with the tender offer, we repurchased $279.5 million principal amount of 95/8% notes validly tendered pursuant to the tender offer. On February 7, 2005, we announced that approximately 99% of the aggregate principal amount of the 95/8% notes were tendered prior to the expiration of the consent solicitation period on February 4, 2005. We received the requisite consents from the holders of the 95/8% notes with respect to the consent solicitation and executed a supplemental indenture that eliminated substantially all of the restrictive covenants and certain default provisions in the indenture governing the 95/8% notes. The supplemental indenture became operative upon our acceptance for payment of a majority in principal amount of the outstanding 95/8% notes tendered. An affiliate of CVC owned approximately $30.0 million of those notes and received the tender offer purchase price for those notes.

In addition, in connection with the refinancings, we redeemed our outstanding subordinated seller notes which were originally issued to American Airlines in connection with the Acquisition and were held by affiliates of CVC at the time of the closing of the offering of the old notes. On February 16, 2005, we redeemed the subordinated seller notes (as defined hereafter) in exchange for new holding company notes (as defined hereafter) issued by WTI in an aggregate principal amount equal to approximately $43.6 million (approximately the then current face amount of the subordinated seller notes plus accrued and unpaid interest thereon) and a consent fee of approximately $8.6 million. See "Certain Relationships and Related Transactions" for a more detailed description of the redemption of our subordinated seller notes.

In connection with the offering of the old notes, we also entered into a senior credit facility, which we refer to as the "senior credit facility," "new senior credit facility" or "new senior credit facilities," and which has a first priority lien on the collateral securing the notes. The new senior credit facility consists of a revolving credit facility in the amount of $40.0 million and a term loan facility in the amount of $450.0 million. See "Description of Other Indebtedness—New Senior Credit Facility." The proceeds of the new senior credit facility have been used to redeem the WTI preferred stock and to repay our term loan under our old senior credit facility, which we refer to as the "old senior credit facility."

We refer to the tender offer and consent solicitation, the offering of the notes, the refinancing of our old senior credit facility with a new senior credit facility, the redemption of the WTI preferred stock, the redemption of our subordinated seller notes and the prepayment of our sponsor advisory fees and the WTI Class B dividends as the "Refinancing Transactions."

7

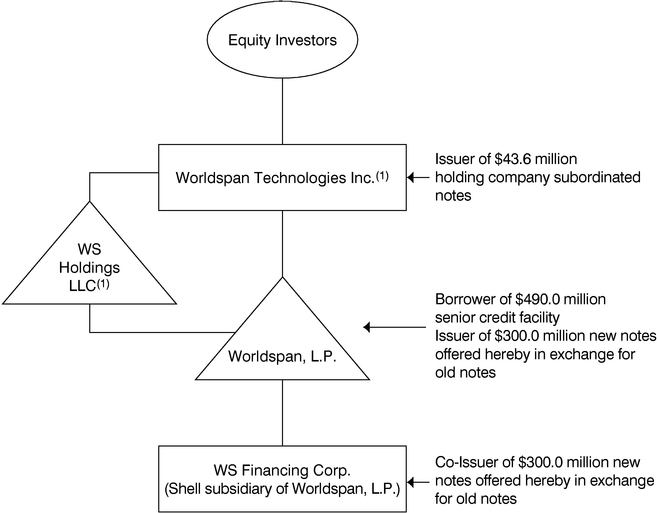

The following chart illustrates our corporate structure.

- (1)

- Guarantors of senior credit facility

8

| Notes Offered | $300,000,000 aggregate principal amount of Senior Second Lien Secured Floating Rate Notes Due 2011. The terms of the new notes and the old notes are identical in all material respects, except for transfer restrictions and registration rights relating to the old notes. | |

The Exchange Offer | We are offering the new notes to you in exchange for a like principal amount of old notes. Old notes may be exchanged only in integral multiples of $1,000. We intend by the issuance of the new notes to satisfy our obligations contained in the registration rights agreement. | |

Expiration Date; Withdrawal of Tender | The exchange offer will expire at 5:00 p.m., New York City time, on , 2005, or such later date and time to which it may be extended by us. The tender of old notes pursuant to the exchange offer may be withdrawn at any time prior to the expiration date of the exchange offer. Any old notes not accepted for exchange for any reason will be returned without expense to the tendering holder thereof as promptly as practicable after the expiration or termination of the exchange offer. | |

Conditions to the Exchange Offer | Our obligation to accept for exchange, or to issue new notes in exchange for, any old notes is subject to customary conditions relating to compliance with any applicable law or any applicable interpretation by the staff of the Securities and Exchange Commission, the receipt of any applicable governmental approvals and the absence of any actions or proceedings of any governmental agency or court which could materially impair our ability to consummate the exchange offer. We currently expect that each of the conditions will be satisfied and that no waivers will be necessary. See "The Exchange Offer—Conditions to the Exchange Offer." | |

Procedures for Tendering Old Notes | If you wish to accept the exchange offer and tender your old notes, you must complete, sign and date the Letter of Transmittal, or a facsimile of the Letter of Transmittal, in accordance with its instructions and the instructions in this prospectus, and mail or otherwise deliver such Letter of Transmittal, or the facsimile, together with the old notes and any other required documentation, to the exchange agent at the address set forth herein. See "The Exchange Offer—Procedures for Tendering Old Notes." | |

Use of Proceeds | We will not receive any proceeds from the exchange offer. | |

Exchange Agent | The Bank of New York Trust Company, N.A. is serving as the exchange agent in connection with the exchange offer. | |

Federal Income Tax Considerations | The exchange of notes pursuant to the exchange offer should not be a taxable event for federal income tax purposes. See "Certain Federal Income Tax Considerations." |

9

Consequences of Exchanging Old Notes Pursuant to the Exchange Offer

Based on certain interpretive letters issued by the staff of the Securities and Exchange Commission to third parties in unrelated transactions, we are of the view that holders of old notes (other than any holder who is an "affiliate" of our company within the meaning of Rule 405 under the Securities Act) who exchange their old notes for new notes pursuant to the exchange offer generally may offer the new notes for resale, resell such new notes and otherwise transfer the new notes without compliance with the registration and prospectus delivery provisions of the Securities Act, provided:

- •

- the new notes are acquired in the ordinary course of the holders' business;

- •

- the holders have no arrangement with any person to participate in a distribution of the new notes; and

- •

- neither the holder nor any other person is engaging in or intends to engage in a distribution of the new notes.

Each broker-dealer that receives new notes for its own account in exchange for old notes must acknowledge that it will deliver a prospectus in connection with any resale of the new notes. See "Plan of Distribution." In addition, to comply with the securities laws of applicable jurisdictions, the new notes may not be offered or sold unless they have been registered or qualified for sale in the applicable jurisdiction or in compliance with an available exemption from registration or qualification. We have agreed, under the registration rights agreement and subject to limitations specified in the registration rights agreement, to register or qualify the new notes for offer or sale under the securities or blue sky laws of the applicable jurisdictions as any holder of the notes reasonably requests in writing. If a holder of old notes does not exchange the old notes for new notes according to the terms of the exchange offer, the old notes will continue to be subject to the restrictions on transfer contained in the legend printed on the old notes. In general, the old notes may not be offered or sold, unless registered under the Securities Act, except under an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Holders of old notes do not have any appraisal or dissenters' rights under the Delaware General Corporation Law in connection with the exchange offer. See "The Exchange Offer—Consequences of Failure to Exchange; Resales of New Notes."

The old notes are currently eligible for trading in the Private Offerings, Resales and Trading through Automated Linkages (PORTAL) market. Following commencement of the exchange offer but prior to its completion, the old notes may continue to be traded in the PORTAL market. Following completion of the exchange offer, the new notes will not be eligible for PORTAL trading.

10

| Issuers | Worldspan, L.P. and WS Financing Corp. | |||

Maturity | February 15, 2011. | |||

Interest | Interest on the new notes will be payable at a rate equal to three-month LIBOR, which will be reset quarterly, plus 6.25%. | |||

Interest will be payable on February 15, May 15, August 15 and November 15 of each year, commencing on May 15, 2005. | ||||

Optional redemption | We may redeem some or all of the new notes at any time on or after August 15, 2006 at the redemption prices listed under "Description of the New Notes—Optional Redemption." We may also redeem up to 100% of the new notes with the net cash proceeds of certain equity offerings completed before August 15, 2006 at the prices listed under "Description of the New Notes—Optional Redemption." | |||

In addition, upon the occurrence of a change of control prior to August 15, 2006 we may redeem some or all of the new notes at the price set forth in this prospectus under the heading "Description of the New Notes—Optional Redemption" after the consummation of the change of control offer with respect thereto. | ||||

Guarantees | The new notes will be guaranteed on a second priority senior secured basis by each of our current and future domestic subsidiaries that guarantee the new senior credit facility. | |||

Collateral and intercreditor agreement | The new notes will be secured by second-priority liens on the collateral securing our new senior credit facility, other than certain assets of our parent companies (which we refer to collectively as the "collateral"). Our new senior credit facility is secured by a first-priority lien on the collateral. The indenture and the security documents relating to the new notes permit us to incur a significant amount of debt, including obligations secured (including on a first priority basis) by the collateral, subject to compliance with certain conditions. No appraisals of any collateral have been prepared by us or on our behalf in connection with the offering of the notes. The value of the collateral at any time will depend on market and other economic conditions, including the availability of suitable buyers for the collateral. | |||

We and the administrative agent under the security documents governing the first-priority liens may release the first-priority liens on the collateral, whereupon the second-priority lien that secures the new notes on such released collateral shall automatically be released without the consent of the holders of the new notes. In addition, the holders of first-priority liens, including lenders under our new senior credit facility will have the sole ability to control remedies (including any sale or liquidation after acceleration of the debt under our new senior credit facility) with respect to the collateral. See "Risk Factors—Risks Relating to the New Notes—The holders of first-priority liens, including lenders under the new senior credit facility, will have the sole right to exercise remedies against the collateral for so long as the debt securing such liens are outstanding and, unless a default or event of default has occurred and is continuing, release the collateral securing the new notes." | ||||

11

You should read "Description of the New Notes—Collateral" for a more complete description of the security granted to the holders of the notes. | ||||

Pursuant to the terms of an intercreditor agreement among the trustee under the indenture, the administrative agent under the new senior credit facility, Worldspan, L.P. and the other parties thereto, the rights of the holders of the notes as secured creditors will be significantly limited. See "Risk Factors—Risks Relating to the New Notes." | ||||

Rankings | The new notes and the guarantees will be our and our guarantors' senior obligations and will: | |||

• | rank equally in right of payment with all of our and our guarantors' existing and future senior indebtedness; | |||

• | rank senior in right of payment to all of our and our guarantors' existing and future subordinated indebtedness; and | |||

• | rank effectively junior to any of our and our guarantors' indebtedness which is either: (i) secured by a lien on the collateral that is senior or prior to the second priority liens securing the new notes, including the new senior credit facility, or (ii) secured by assets that are not part of the collateral securing the new notes, in each case, to the extent of the value of the assets securing such indebtedness. | |||

Covenants | The new notes are issued under an indenture with The Bank of New York Trust Company, N.A., as trustee. The indenture, among other things, limits our ability and the ability of the restricted subsidiaries (as defined in "Description of the New Notes") to: | |||

• | incur or guarantee additional indebtedness; | |||

• | pay dividends or make other distributions in respect of our capital stock or make certain other restricted payments or investments; | |||

• | purchase, redeem or otherwise acquire for value any of our equity interests or the equity interests of our parent entities; | |||

• | sell assets; | |||

• | create liens; | |||

• | enter into agreements that restrict the ability of the restricted subsidiaries to pay dividends or other payments to Worldspan, L.P.; | |||

• | enter into mergers and consolidation; or | |||

• | enter into transactions with our affiliates. | |||

These covenants are subject to important exceptions and qualifications, which are described under "Description of the New Notes." | ||||

For a discussion of certain risks that should be considered in connection with an investment in the new notes, we urge you to consider carefully the factors set forth under "Risk Factors" beginning immediately after this "Summary."

12

Summary Historical and Pro Forma Financial Information

The following table sets forth our summary historical and unaudited pro forma consolidated financial data for the periods ended and the dates indicated. We have derived the summary historical consolidated financial data as of December 31, 2002, 2003 and 2004 and for the fiscal years ended December 31, 2002 and 2004, and for the six months ended June 30, 2003 and December 31, 2003 from our audited financial statements and related notes included elsewhere in this prospectus. We have derived the summary historical consolidated financial data as of June 30, 2003 from our unaudited financial statements and related notes, which are not included in this prospectus. The unaudited pro forma consolidated financial data give effect to the Refinancing Transactions and assumptions described in "Unaudited Pro Forma Condensed Consolidated Financial Statements" and the accompanying notes as if each had occurred at the beginning of the period indicated below. The summary historical and unaudited pro forma consolidated financial data set forth below are not necessarily indicative of the results of future operations and should be read in conjunction with the discussion under the headings "Management's Discussion and Analysis of Financial Condition and Results of Operations," and "Unaudited Pro Forma Condensed Consolidated Financial Statements" and the historical consolidated financial statements and accompanying notes included elsewhere in this prospectus.

We were acquired on June 30, 2003 in a business combination accounted for under the purchase method of accounting. Accordingly, the financial data set forth below includes a predecessor basis and a successor basis. As a result of the Acquisition, our assets and liabilities were adjusted to their estimated fair values. In addition, our statements of operations for the successor basis include interest expense resulting from indebtedness incurred to finance the Acquisition and amortization of intangible assets related to the Acquisition. Therefore, our successor basis financial data generally is not comparable to our predecessor basis financial data.

13

| | Predecessor Basis | | | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Successor Basis | Pro Forma | |||||||||||||||

| | Year Ended December 31, | | |||||||||||||||

| | Six Months Ended June 30, 2003 | Six Months Ended December 31, 2003 | | Twelve Months Ended December 31, 2004 | |||||||||||||

| | Year Ended December 31, 2004 | ||||||||||||||||

| | 2002 | ||||||||||||||||

| | (Dollars and transactions in thousands) | Unaudited | |||||||||||||||

| Statement of Operations Data: | |||||||||||||||||

| Revenues: | |||||||||||||||||

Electronic travel distribution | $ | 807,095 | $ | 414,933 | $ | 396,488 | $ | 876,552 | $ | 876,552 | |||||||

Information technology services | 107,774 | 52,539 | 32,974 | 67,666 | 67,666 | ||||||||||||

| Total revenues | 914,869 | 467,472 | 429,462 | 944,218 | 944,218 | ||||||||||||

| Total operating expenses | 802,902 | 417,969 | 421,612 | 855,761 | 855,072 | ||||||||||||

| Operating income | 111,967 | 49,503 | 7,850 | 88,457 | 89,146 | ||||||||||||

| Interest income (expense), net | (3,396 | ) | (2,355 | ) | (20,596 | ) | (40,113 | ) | (48,269 | ) | |||||||

| Loss on extinguishment of debt | — | — | — | — | (55,879 | ) | |||||||||||

| Net income (loss) | $ | 104,819 | $ | 28,414 | $ | (14,700 | ) | $ | 41,863 | $ | (21,483 | ) | |||||

| Balance Sheet Data (at End of Period): | |||||||||||||||||

| Cash and cash equivalents | $ | 132,101 | $ | 43,931 | $ | 43,746 | $ | 100,474 | $ | 61,537 | |||||||

| Working capital (deficit)(1) | 62,831 | (20,542 | ) | (17,729 | ) | 21,401 | (7,731 | ) | |||||||||

| Property and equipment | 115,610 | 110,711 | 120,510 | 118,218 | 118,218 | ||||||||||||

| Total assets | 454,866 | 385,801 | 1,119,495 | 1,112,286 | 1,088,172 | ||||||||||||

| Total debt(2) | 93,556 | 96,807 | 464,138 | 410,935 | 823,948 | ||||||||||||

| Partners' capital | 135,602 | 54,226 | 416,552 | 451,399 | 16,080 | ||||||||||||

| Other Data: | |||||||||||||||||

| Total transactions using the Worldspan system:(3) | |||||||||||||||||

| Online | 75,896 | 45,058 | 45,201 | 101,451 | 101,451 | ||||||||||||

| Traditional | 116,370 | 54,064 | 48,397 | 101,000 | 101,000 | ||||||||||||

| Total transactions | 192,266 | 99,122 | 93,598 | 202,451 | 202,451 | ||||||||||||

Depreciation and amortization | $ | 79,215 | $ | 32,322 | $ | 52,955 | $ | 101,878 | $ | 101,878 | |||||||

| Capital expenditures(4) | 56,484 | 22,840 | 29,490 | 38,617 | 38,617 | ||||||||||||

| Distributions | 100,000 | 110,000 | — | — | |||||||||||||

| Ratio of earnings to fixed charges(5) | 12.6x | 7.4x | 0.4x | 2.0x | 0.6x | ||||||||||||

- (1)

- Working capital is calculated as current assets (including cash and cash equivalents) minus current liabilities.

- (2)

- Includes 95/8% notes, old notes, term loan and assets acquired under capital leases.

- (3)

- We designate each travel agency for which we process transactions as traditional or online based on management's belief as to whether a travel agency is traditional or online. The historical transaction data set forth above reflects the designations which were in effect for each period presented. We evaluate the classification of our travel agencies on a monthly basis and reclassify them as appropriate. Upon a reclassification of a travel agency, all transactions for such travel agency are correspondingly reclassified for all historical and subsequent periods. Accordingly, to the extent we change a designation for a travel agency, the transactions for such travel agency may be reflected in different categories at different times. Based on a recent evaluation of the classifications, we generated total online transactions of 74,939 for the year ended December 31, 2002, 44,248 and 44,601 for the six months ended June 30, 2003 and December 31, 2003, respectively, and 101,451 for the year ended December 31, 2004.

14

- (4)

- The following table summarizes capital expenditures for the periods indicated:

| | Predecessor Basis | | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Successor Basis | |||||||||||

| | Year Ended December 31, | | ||||||||||

| | Six Months Ended June 30, 2003 | Six Months Ended December 31, 2003 | | |||||||||

| | Year Ended December 31, 2004 | |||||||||||

| | 2002 | |||||||||||

| | (Dollars in thousands) | |||||||||||

| Purchase of property and equipment | $ | 12,375 | $ | 4,236 | $ | 15,961 | $ | 13,758 | ||||

| Assets acquired under capital leases | 41,053 | 17,237 | 12,134 | 23,994 | ||||||||

| Capitalized software for internal use | 3,056 | 1,367 | 1,395 | 865 | ||||||||

| Total capital expenditures | $ | 56,484 | $ | 22,840 | $ | 29,490 | $ | 38,617 | ||||

- (5)

- The ratio of earnings to fixed charges is computed by dividing earnings to fixed charges. For this, purpose, "earnings" include income before taxes, income or loss from equity investees and fixed charges. "Fixed charges" include interest costs and such portion of rental expense as can be demonstrated to be representative of the interest factor. For the six months ended December 31, 2003 and the pro forma twelve months ended December 31, 2004, there was a deficiency of $13,989 and $18,436, respectively.

15

You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before deciding whether to exchange your old notes in the exchange offer. If any of the following risks actually occur, our business, financial condition or results of operations could suffer. In such case, you may lose all or part of your original investment.

Substantial Leverage—Our substantial indebtedness could adversely affect our financial health and prevent us from fulfilling our obligations under the notes.

We have a significant amount of indebtedness. As of December 31, 2004, after giving pro forma effect to the Refinancing Transactions detailed in "Management's Discussion and Analysis of Financial Condition and Operations—Liquidity and Capital Resources", we had total indebtedness of $823.9 million (of which $300.00 million consisted of our old notes, $0.5 million consisted of our remaining 95/8% notes, $450.0 million consisted of senior debt under our new senior credit facility, and the balance consisted of obligations under capital leases). On December 31, 2004, we had total indebtedness of $410.9 million (of which $280.0 million consisted of the 95/8% notes and the balance consisted of senior debt under our old senior credit facility and obligations under capital leases and long-term software arrangements). Our ratio of earnings to fixed charges was 0.4x and 2.0x for the six months ended December 31, 2003 and the year ended December 31, 2004, respectively.

Our substantial indebtedness could have important consequences to you. For example, it could:

- •

- make it more difficult for us to satisfy our obligations with respect to the notes;

- •

- increase our vulnerability to general adverse economic and industry conditions;

- •

- require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts and other general corporate purposes;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

- •

- place us at a competitive disadvantage compared to our competitors that have less debt; and

- •

- limit our ability to borrow additional funds.

In addition, the indenture governing the notes, and our new senior credit facility contain financial and other restrictive covenants that limit our ability to engage in activities that may be in our long-term best interests. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all of our debts.

Additional Borrowings Available—Despite current indebtedness levels, we and our subsidiaries may still be able to incur substantially more debt. This could further exacerbate the risks associated with our substantial leverage.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. The terms of the indenture governing the notes do not fully prohibit us or our subsidiaries from doing so. Our new senior credit facility permits additional borrowings of up to $40.0 million. If new debt is added to our and our subsidiaries' current debt levels, the related risks that we and they now face could intensify. See "Description of Other Indebtedness—New Senior Credit Facility."

16

Restrictions on Indebtedness—Restrictions on our debt instruments may limit our ability to make payments on the notes or operate our business.

Our new senior credit facility and the indenture governing the notes contain covenants that limit the discretion of our management with respect to certain business matters. These covenants significantly restrict our ability to (among other things):

- •

- incur additional indebtedness;

- •

- create liens or other encumbrances;

- •

- pay dividends or make certain other payments, investments, loans and guarantees; and

- •

- sell or otherwise dispose of assets and merge or consolidate with another entity.

In addition, our new senior credit facility requires us to meet certain financial ratios and financial condition tests. You should read the discussions under the headings "Description of Other Indebtedness—New Senior Credit Facility" and "Description of the New Notes—Certain Covenants" for further information about these covenants. Events beyond our control can affect our ability to meet these financial ratios and financial condition tests. Our failure to comply with these obligations could cause an event of default under our new senior credit facility. If an event of default occurs under our new senior credit facility, our lenders could elect to declare all amounts outstanding and accrued and unpaid interest under our new senior credit facility to be immediately due, and the lenders thereafter could foreclose upon the assets securing our new senior credit facility. In that event, we cannot assure you that we would have sufficient assets to repay all of our obligations, including the notes and the related guarantees. We may incur other indebtedness in the future that may contain financial or other covenants more restrictive than those applicable to our new senior credit facility or the indenture governing the notes.

Ability to Service Debt—To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control.

Our ability to make payments on and to refinance our indebtedness, including the notes, and to fund planned capital expenditures and research and development efforts will depend on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

Based on our current level of operations and anticipated cost savings and operating improvements, we believe our cash flow from operations, available cash, and borrowings available under our new senior credit facility will be adequate to meet our future liquidity needs for the foreseeable future.

We cannot assure you, however, that our business will generate sufficient cash flow from operations, that currently anticipated cost savings and operating improvements will be realized on schedule or that future borrowings will be available to us under our new senior credit facility in an amount sufficient to enable us to pay our indebtedness, including the notes, or to fund our other liquidity needs. We may need to refinance all or a portion of our indebtedness, including the notes, on or before maturity. We cannot assure you that we will be able to refinance any of our indebtedness, including our new senior credit facility, any outstanding 95/8% notes and the notes, on commercially reasonable terms or at all.

Not All Subsidiaries are Guarantors—Your right to receive payments on the new notes could be adversely affected if any of our non-guarantor subsidiaries declare bankruptcy, liquidate or reorganize.

None of our foreign subsidiaries have guaranteed the notes. In the event of a bankruptcy, liquidation or reorganization of any of our non-guarantor subsidiaries, holders of their indebtedness

17

and their trade creditors will generally be entitled to payment of their claims from the assets of those subsidiaries before any assets are made available for distribution to us.

As of December 31, 2004, our non-guarantor subsidiaries had approximately $43.7 million of trade accounts payable and other accrued expenses. Our non-guarantor subsidiaries generated approximately 15.1% of our consolidated revenues in the year ended December 31, 2004 and held approximately 4.1% of our consolidated assets as of December 31, 2004. See footnote 16 to our consolidated financial statements included at the back of this prospectus.

Financing Change of Control Offer—We may not have the ability to raise the funds necessary to finance the change of control offer required by the indenture.

Upon the occurrence of certain specific kinds of change of control events, we will be required to offer to repurchase all outstanding notes at 101% of the principal amount thereof plus accrued and unpaid interest and liquidated damages, if any, to the date of repurchase. However, it is possible that we will not have sufficient funds at the time of the change of control to make the required repurchase of the notes or that restrictions in our senior credit facility or the indenture governing the notes will not allow such repurchases. In addition, certain important corporate events, such as leveraged recapitalizations that would increase the level of our indebtedness, would not constitute a "Change of control" under the indenture. See "Description of the New Notes—Repurchase at the Option of Holders."

Second Priority Lien on Collateral—If there is a default, proceeds from sales of the collateral will be applied first to satisfy amounts owed under our first-priority debt, including our new senior credit facility, and the value of the collateral may not be sufficient to repay the holders of the notes.

We have secured our obligations under the notes and related guarantees by a second-priority lien on certain assets that are also pledged on a first-priority basis to the lenders under our senior credit facility. As a result, upon any foreclosure on the collateral, proceeds will be applied first to repay amounts owed under our first-priority debt, including our new senior credit facility, and only then to satisfy amounts owed to holders of the notes. The value of the notes in the event of a liquidation will depend on market and economic conditions, the availability of buyers and similar factors. You should not rely upon the book value of the assets underlying the collateral as a measure of realizable value for such assets. By its nature, some or all the collateral may be illiquid and may have not readily ascertainable market value. Likewise, there is no assurance that the assets underlying the collateral will be saleable or, if saleable, that there will not be substantial delays in its liquidation. Accordingly, there can be no assurance that the proceeds of any sale of the collateral following any acceleration of the maturity of the notes would be sufficient to satisfy, or would not be substantially less than, amounts due on the notes after satisfying the obligations secured by the first-priority liens.

If the proceeds of any sale of the assets underlying the collateral are insufficient to repay all amounts due on the notes, the holders of the notes (to the extent the notes are not repaid from the proceeds of the sale of the collateral) would have only an unsecured claim against our remaining assets, which claim will rank equal in priority to the unsecured claims of any unsatisfied portion of the obligations secured by the first-priority liens and our other unsecured senior indebtedness.

Notes Effectively Subordinated to Other Debt—The second priority notes and the related guarantees are effectively subordinated to other debt.

The notes effectively rank junior to all amounts owed under our new senior credit facility, to the extent of the value of the collateral, as the new senior credit facility lenders have a first-priority lien on the collateral pledged for the benefit of the notes. In addition, the new senior credit facility is secured by liens on certain other collateral not pledged for the benefit of the holders of the notes, including a

18

pledge of the stock of our subsidiaries. As a result, the lenders under the new senior credit facility will be paid in full from the proceeds of the collateral pledged to them before holders of notes are paid from any remaining proceeds from the second lien collateral. In addition, subject to the restrictions contained in the indenture governing the notes, we may incur additional debt that is secured by first-priority liens on the collateral or by liens on assets that are not pledged to the holders of notes, all or which would effectively rank senior to the notes to the extent of the value of the assets securing such debt. Following the consummation of the Refinancing Transactions, the old notes and the related guarantees ranked, and the new notes will rank, junior to $450.0 million of secured indebtedness secured on a first-priority basis by the collateral, with an additional $40.0 million available to be borrowed which would be secured indebtedness.

Additional Indebtedness—We may incur additional indebtedness ranking equally with the notes or the related guarantees.

The indenture governing the notes permits us to issue additional debt secured on an equal and ratable basis with the notes. If we incur any additional debt that is secured on an equal and ratable basis with the notes, the holders of that debt will be entitled to share ratably with the holders of the notes in any proceeds distributed in connection with any foreclosure upon the collateral or an insolvency, liquidation, reorganization, dissolution or other winding-up of Worldspan. This may have the effect of reducing the amount of proceeds paid to you.

Intercreditor Agreement—The holders of first-priority liens, including lenders under the new senior credit facilities, will have the sole right to exercise remedies against the collateral for so long as the debt secured by such liens is outstanding and, unless a default or event of default has occurred and is continuing, release the collateral securing the notes.

The intercreditor agreement provides that holders of first-priority liens, including the lenders under the new senior credit facilities, have the exclusive right to manage, perform and enforce the terms of the security documents relating to the collateral, and to exercise and enforce all privileges, rights and remedies thereunder, including to take or retake control or possession of the collateral and to hold or dispose of the collateral. Under the terms of the intercreditor agreement, if those lenders release all or any portion of the collateral securing the new senior credit facilities for any reason whatsoever, including, without limitation, in connection with any repayment of those facilities or any sale of assets, the collateral so released will no longer secure our and the guarantors' obligations under the notes if at the time of such release no default or event of default has occurred and is continuing with respect to the notes. If an event of default has occurred, the lenders under the new senior credit facilities and other future first lien credit facilities may release collateral in connection with the foreclosure, sale or other disposition of such collateral to satisfy obligations under such credit facilities. Any collateral released would cease to act as security for the notes and the guarantees of the notes, as well as our and the guarantors' obligations under the new senior credit facilities and any other indebtedness which is secured by such collateral. The liens on securities of our subsidiaries will be released if the liens thereon would trigger reporting obligations under Rule 3-16 of Regulation S-X as described under "—Pledge of Capital Stock—The capital stock securing the notes will automatically be released from the second-priority lien and no longer be deemed to be collateral to the extent the pledge of the capital stock would require the filing of separate financial statements for any of our subsidiaries with the SEC." In addition, because the lenders under the new senior credit facilities control the disposition of the collateral securing the new senior credit facilities and the notes, the lenders could decide not to proceed against the collateral, regardless of whether or not there is a default under the new senior credit facilities. In such event, the only remedy available to the holders of the notes would be to sue for payment on the notes and the note guarantees. By virtue of the direction of the administration of the pledges and security interests and the release of collateral, actions may be taken under the collateral documents that may be adverse to you.

19

Pledge of Capital Stock—The capital stock securing the notes will automatically be released from the second-priority lien and no longer be deemed to be collateral to the extent the pledge of the capital stock would require the filing of separate financial statements for any of our subsidiaries with the SEC.

The indenture governing the notes and the security documents provides that, to the extent that any rule is adopted, amended or interpreted which would require the filing with the SEC (or any other governmental agency) of separate financial statements of any of our subsidiaries due to the fact that the subsidiary's capital stock or other securities secure the notes, then such capital stock or other securities will automatically be deemed not to be part of the collateral securing the notes to the extent necessary to render such subsidiary not subject to such requirement. In such event, the security documents will be amended without the consent of any holder of notes, to the extent necessary to release the second-priority liens on such capital stock or securities. As a result, holders of the notes could lose all or a portion of their security interest in the capital stock or other securities if any such rule comes into effect.

Difficulty of Realizing Value of the Collateral—It may be difficult to realize the value of the collateral securing the notes.

The collateral agent's ability to foreclose on the collateral on your behalf may be subject to perfection and the consent of third parties. The collateral agent's ability to foreclose may also be subject to priority issues and practical problems associated with the realization of the collateral agent's security interest in the collateral. We cannot assure you that the consents of any third parties will be given when required to facilitate a foreclosure on such assets. Accordingly, the collateral agent may not have the ability to foreclose upon those assets and the value of the collateral may significantly decrease.

No appraisals of any collateral have been prepared in connection with the offering of the notes. The value of the collateral at any time will depend on market and other economic conditions, including the availability of suitable buyers for the collateral. By their nature some or all of the pledged assets may be illiquid and may have no readily ascertainable market value. We cannot assure you that the fair market value of the collateral as of the date of this prospectus exceeds the principal amount of the debt secured therby. Furthermore, there is a possibility that the security interests with respect to certain collateral may not be timely perfected by the closure of this exchange offer. This could impair the collateral trustee's ability to foreclose on certain collateral on your behalf. The value of the assets pledged as collateral for the notes could be impaired in the future as a result of changing economic conditions, our failure to implement our business strategy, competition and other future trends.

Restrictive Provisions in the Indenture and the Intercreditor Agreement—The priority and voting provisions set forth in the indenture and the intercreditor agreement substantially limit the rights of the holders of the notes with respect to the collateral securing the notes.