SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

CNL Income Properties, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

CNL INCOME PROPERTIES, INC.

CNL Center at City Commons

450 South Orange Avenue

Orlando, Florida 32801

April 29, 2005

To Our Stockholders:

You are cordially invited to attend the annual meeting of stockholders of CNL Income Properties, Inc. (the “Company”) on June 14, 2005, at 10:00 a.m. Eastern time, at CNL Center at City Commons, 450 South Orange Avenue, Orlando, Florida 32801 (such meeting, and any adjournment or postponement thereof, the “Annual Meeting”). The directors and executive officers of the Company look forward to greeting you personally. Enclosed for your review are the proxy card, proxy statement, notice setting forth the business to come before the Annual Meeting and our 2004 annual report.

During 2004, the Company raised approximately $86,678,044 in gross proceeds through its public offering of common stock and invested in commercial and retail properties at seven resort villages in the U.S. and Canada. We believe the Company is well positioned to participate in the expected continued growth in the recreation and lifestyle real estate market.

In the accompanying proxy statement, the Company’s board of directors (the “Board”) is requesting that you consider the re-election of five directors. The Board unanimously recommends that you vote“FOR ALL” to re-elect each of the nominated directors.

Your vote is very important. Regardless of the number of shares you own in the Company, it is very important that your shares be represented. This year you may vote by Internet, by telephone or by mailing your proxy card. Please complete and return the enclosed proxy card today. Voting will ensure your representation at the annual meeting if you choose not to attend in person. Thank you for your attention to this matter.

| | | | |

Sincerely, | | | | |

| | |

| | | |  |

James M. Seneff, Jr. Chairman of the Board | | | | Thomas J. Hutchinson III Chief Executive Officer |

CNL INCOME PROPERTIES, INC.

CNL Center at City Commons

450 South Orange Avenue

Orlando, Florida 32801

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

Annual Meeting to be held June 14, 2005

To Our Stockholders:

Notice is hereby given that the 2005 annual meeting of stockholders of CNL Income Properties, Inc. (the “Company”) will be held at CNL Center at City Commons, 450 South Orange Avenue, Orlando, Florida 32801 on June 14, 2005, at 10:00 a.m., Eastern time (such meeting, and any adjournment or postponement thereof, the “Annual Meeting”), for the following purposes:

| 1. | To elect five directors of the Company for terms expiring at the 2006 annual meeting of stockholders; |

| 2. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on April 1, 2005, are entitled to vote at the Annual Meeting.

Stockholders are cordially invited to attend the Annual Meeting in person. All stockholders, whether or not they plan to attend the Annual Meeting, are requested to complete, date and sign the enclosed proxy card and return it promptly in the envelope provided. You may also grant your proxy by telephone or Internet by following the instructions on the proxy card. It is important that your shares be voted. By returning your proxy card promptly, you can help the Company avoid additional expenses to ensure that a quorum is met so the Annual Meeting can be held. If you decide to attend the Annual Meeting, you may revoke your proxy and vote your shares in person.

|

By Order of the Board of Directors, |

|

|

Tammie A. Quinlan Corporate Secretary |

April 29, 2005

Orlando, Florida

PROXY STATEMENT

Table of Contents

CNL INCOME PROPERTIES, INC.

CNL Center at City Commons

450 South Orange Avenue

Orlando, Florida 32801

(800) 522-3863

PROXY STATEMENT

GENERAL INFORMATION

This proxy statement is furnished by the board of directors of CNL Income Properties, Inc. (the “Company”) in connection with the solicitation by the board of directors (the “Board”) of proxies to be voted at the annual meeting of stockholders to be held at 10:00 a.m., Eastern time, on June 14, 2005, at the Company’s offices located at CNL Center at City Commons, 450 South Orange Avenue, Orlando, Florida 32801 (such meeting, and any adjournment or postponement thereof, the “Annual Meeting”), for the purposes set forth in the accompanying notice of such meeting. Only stockholders of record at the close of business on April 1, 2005 (the “Record Date”) will be entitled to vote at the Annual Meeting. This proxy statement, proxy card, notice setting for matters upon which stockholders are entitled to vote, and the enclosed 2004 Annual Report are first being mailed on or about April 29, 2005, to stockholders of record at the Record Date.

As of April 1, 2005, 13,346,722 shares of common stock of the Company were outstanding and entitled to vote. Each share of common stock entitles the holder thereof to one vote on each of the matters to be voted upon at the Annual Meeting. As of the Record Date, officers and directors of the Company had the power to vote, as determined by the rules of the Securities and Exchange Commission (the “Commission”), less than 1% of the outstanding shares of common stock.

Proxy and Voting Procedures

Any proxy, if received in time, properly signed and not revoked, will be voted at such meeting in accordance with the directions of the stockholder. If no directions are specified, the proxy will be voted“FOR” the proposals set forth in this proxy statement. Any stockholder giving a proxy has the power to revoke it at any time before it is exercised. A proxy may be revoked (1) by delivery of a written statement to the corporate secretary of the Company stating that the proxy is being revoked, (2) by presentation at the Annual Meeting of a subsequent proxy executed by the person executing the prior proxy, or (3) by attendance at the Annual Meeting and voting in person.

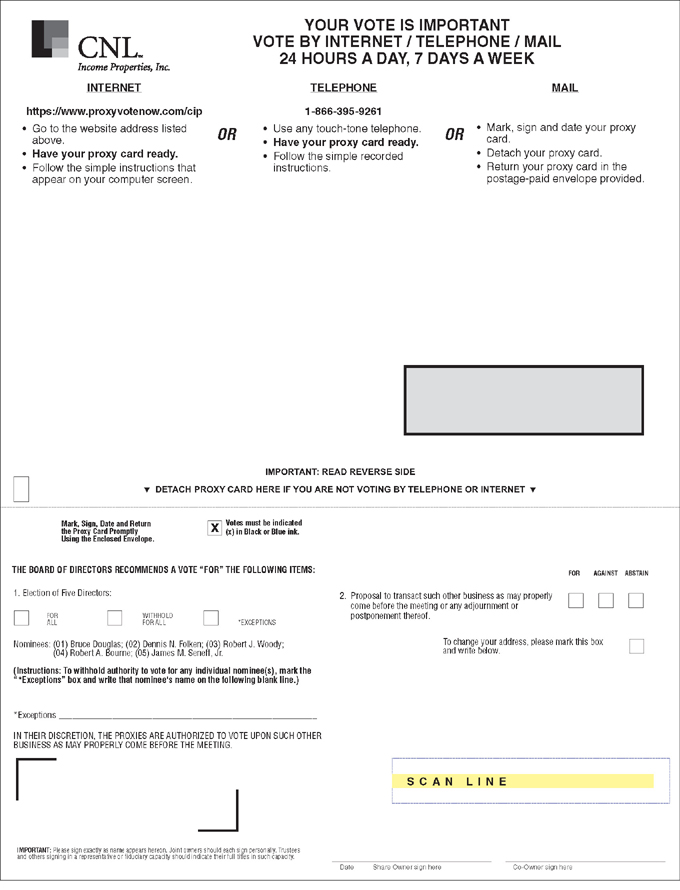

A proxy card is enclosed for your use. The proxy card contains instructions for responding either by telephone, Internet or by mail. Votes cast in person or by proxy at the Annual Meeting will be tabulated and a determination will be made as to whether or not a quorum is present. The Company will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence or absence of a quorum, but as unvoted for purposes of determining the approval of any matter submitted to the stockholders. If a broker submits a proxy indicating that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to such matter. The presence, in person or by proxy, of stockholders entitled to cast at least 50% of the votes entitled to be cast by all stockholders will constitute a quorum for the transaction of business at the Annual Meeting.

Solicitation Expenses

Solicitation of proxies will be primarily by mail. However, directors and officers of the Company and certain employees of CNL Investment Company and CNL Securities Corp., affiliates of the Company, also may solicit proxies by telephone, Internet, telegram or in person. All of the expenses of preparing, assembling, printing and mailing the materials used in the solicitation of proxies will be paid by the Company. Arrangements may be made with brokerage houses and other custodians, nominees and fiduciaries to forward soliciting materials, at the expense of the Company, to the beneficial owners of shares held of record by such persons.

Electronic Delivery of Proxy Materials and Annual Report

If you are a stockholder of record, you can elect to receive next year’s proxy statement and Annual Report electronically by registering on-line at www.giveconsent.com/cip. If you choose to register online, then next year when the proxy materials are available, you will receive an e-mail with instructions which will enable you to review these materials via the Internet rather than by mail. By opting to receive your proxy materials on-line, you will save the Company the cost of producing and mailing documents to you, reduce the amount of mail you receive and help preserve environmental resources. You may incur certain charges by viewing these materials via the Internet, such as telephone charges.

Where to Obtain More Information

The mailing address of the principal executive offices of the Company is CNL Center at City Commons, 450 South Orange Avenue, Orlando, Florida 32801. Notices of revocation of proxy should be sent to the attention of the Company’s Corporate Secretary at this address.

The Company makes available free of charge on or through its Internet web site (www.cnlonline.com/ir/investcnl_ip.asp) the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the Commission.

A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004, that was filed with the Commission will be furnished without the accompanying exhibits to stockholders without charge upon written request sent to the Corporate Secretary, Tammie A. Quinlan, at the Company’s offices. Each such request must set forth a good faith representation that as of April 1, 2005, the person making the request was the beneficial owner of common stock entitled to vote at the 2004 Annual Meeting of stockholders.

Annual Report

A copy of the Company’s Annual Report to stockholders for the year ended December 31, 2004, accompanies this proxy statement.

PROPOSAL I

ELECTION OF DIRECTORS

Nominees for Election to the Board of Directors

The persons named below have been nominated by the Board for election as directors to serve until the 2006 annual meeting of stockholders or until their successors have been elected and qualified. Messrs. Bourne and Seneff have been directors since the Company’s inception in August 2003. The remaining independent directors have served since March 4, 2004. The table sets forth each nominee’s name, age, principal occupation or employment during at least the last five years, and directorships in other public corporations.

2

The Company’s officers and directors that own shares of common stock have advised the Company that they intend to vote their shares of common stock for the election of each of the nominees. The Board of the Company unanimously recommends a vote“FOR ALL” to elect each of the following nominees to the Board. Proxies will be voted“FOR ALL” to elect the following nominees unless authority is withheld.

In the event that any nominee(s) should be unable to accept the office of director, which is not anticipated, it is intended that the persons named in the proxy will vote“FOR” the election of such other person in the place of such nominee(s) for the office of director as the Board may recommend. The affirmative votes of a majority of the shares of common stock present in person or represented by proxy and entitled to vote is required for the election of directors.

A majority of the Company’s directors are required to be independent, as that term is defined in the Company’s Amended and Restated Articles of Incorporation. Messrs. Douglas, Folken and Woody are independent directors.

Directors and Executive Officers

The Company’s directors are listed below:

James M. Seneff, Jr. Director and Chairman of the Board. Mr. Seneff has served as a director and Chairman of the Board of CNL Income Properties since inception. Mr. Seneff also serves as a director and Chairman of the Board of the advisor. Mr. Seneff is a principal stockholder of CNL Holdings, Inc., the parent company of CNL Financial Group, Inc., a diversified real estate company, and has served as a director, Chairman of the Board and Chief Executive Officer of CNL Financial Group, Inc. and its subsidiaries since CNL Holdings, Inc.’s formation in 2000. CNL Financial Group, Inc. is the parent company, either directly or indirectly through subsidiaries, of CNL Real Estate Group, Inc., the advisor, CNL Capital Markets, Inc., CNL Investment Company and CNL Securities Corp., the managing dealer in this offering. CNL Financial Group, Inc., a corporation organized and controlled by Mr. Seneff, is CNL Income Properties’ founder. As of September 30, 2004, CNL Holdings, Inc. and the entities it has formed or acquired have more than $15 billion in assets, and manage an additional $2.5 billion for third party investors and have interests in approximately 5,100 properties across North America. Mr. Seneff also serves as a director and Chairman of the Board of CNL Retirement Properties, Inc., a public, unlisted real estate investment trust, as well as CNL Retirement Corp., its advisor. From inception until August 2003, Mr. Seneff was Chief Executive Officer of CNL Retirement Properties, Inc. Mr. Seneff also serves as a director and Chairman of the Board of CNL Hotels & Resorts, Inc., a public, unlisted real estate investment trust, and served as its Chief Executive Officer from inception through February 14, 2003, and as co-Chief Executive Officer from February 14, 2003 through May 1, 2003. Mr. Seneff is also a director, Chairman of the Board and Co-Chief Executive Officer of CNL Hospitality Corp., the advisor to CNL Hotels & Resorts, Inc. Mr. Seneff has served as a director since 1994 and Chairman of the Board since 1969 of Commercial Net Lease Realty, Inc., a public real estate investment trust that is listed on the New York Stock Exchange, and served as its Chief Executive Officer from 1994 through February 16, 2004. On March 9, 2005, Mr. Seneff informed Commercial Net Lease Realty, Inc. that he would retire from its Board of directors, effective as of Commercial Net Lease Realty, Inc.’s annual meeting of stockholders, scheduled for June 1, 2005. In addition, Mr. Seneff served as a director and Chairman of the Board from inception in 1994 through February 25, 2005, served as Chief Executive Officer from 1994 through August 1999 and co-Chief Executive Officer from December 2000 through September 2003 of CNL Restaurant Properties, Inc. (formerly CNL American Properties Fund, Inc.). CNL Restaurant Properties Inc., was a public, unlisted real estate investment trust until February 25, 2005, when it merged with U.S. Restaurant Properties, Inc. Since February 25, 2005, Mr. Seneff has served as Chairman of the Board of Trustreet Properties, Inc., the successor of the merger between CNL Restaurant Properties, Inc. and U.S. Restaurant Properties, Inc. Trustreet Properties, Inc. is a REIT listed on the New York Stock Exchange. Mr. Seneff has also served as a director and Chairman of the Board since 1979 and Chief Executive Officer since 1992 of CNL Securities Corp. Mr. Seneff has served as a director, Chairman of the Board and Chief Executive Officer of CNL Investment Company, since 1990; CNL Fund Advisors, Inc., a registered investment adviser for pension plans, since 1990; and CNL Institutional Advisors, Inc., a registered investment advisor for pension plans, since inception. Mr. Seneff formerly served as a director of First Union National Bank of Florida, N.A., and currently serves as the Chairman of the Board of CNLBank. Mr. Seneff served on the Florida State Commission on Ethics and is a former member and past chairman of the State of Florida Investment Advisory Council, which recommends to the Florida Board of Administration investments for various Florida employee retirement funds. The Florida Board of Administration is Florida’s principal investment advisory and money management agency and oversees the investment of more than $60 billion of

3

retirement funds. Mr. Seneff received his degree in Business Administration from Florida State University in 1968.

Robert A. Bourne. Director, Vice Chairman of the Board and Treasurer. Mr. Bourne has served as a director, Vice Chairman of the Board and Treasurer of CNL Income Properties since inception. Mr. Bourne also serves as a director, Vice Chairman of the Board and Treasurer of the advisor. Mr. Bourne also serves as a director and Vice Chairman of the Board of CNL Hotels & Resorts, Inc., a public, unlisted real estate investment trust, as well as a director, Vice Chairman of the Board and Treasurer of CNL Hospitality Corp., its advisor. Mr. Bourne served as the President of CNL Hotels & Resorts, Inc. and CNL Hospitality Corp., its advisor, from 1997 to June 2002. Mr. Bourne is also the President and Treasurer of CNL Financial Group, Inc.; a director, Vice Chairman of the Board and Treasurer of CNL Retirement Properties, Inc., a public, unlisted real estate investment trust; as well as a director, Vice Chairman of the Board and Treasurer of CNL Retirement Corp., its advisor. Mr. Bourne served as President of CNL Retirement Properties, Inc. and CNL Retirement Corp. from 1998 and 1997, respectively, to June 2002. Mr. Bourne also serves as a director of CNLBank. He serves as a director and Vice Chairman of the Board of Commercial Net Lease Realty, Inc., a public real estate investment trust listed on the New York Stock Exchange. On March 9, 2005, Mr. Bourne informed Commercial Net Lease Realty, Inc. that he would retire from its Board of directors, effective as of Commercial Net Lease Realty, Inc.’s annual meeting of stockholders, scheduled for June 1, 2005. Mr. Bourne served as a director from inception in 1994 until February 25, 2005, President from 1994 through February 1999, Treasurer from February 1999 through August 1999, and Vice Chairman of the Board from February 1999 until February 25, 2005, of CNL Restaurant Properties, Inc. CNL Restaurant Properties, Inc. was a public, unlisted real estate investment trust until February 25, 2005, when it merged with U.S. Restaurant Properties, Inc., forming Trustreet Properties, Inc. Since February 25, 2005, Mr. Bourne has served as a director of Trustreet Properties, Inc. Trustreet Properties, Inc. is a REIT listed on the New York Stock Exchange. Mr. Bourne also serves as a director and officer for various Affiliates of CNL Financial Group, Inc., including CNL Investment Company, CNL Securities Corp., the managing dealer for this offering, CNL Fund Advisors, Inc., a registered investment advisor for pension plans, and CNL Institutional Advisors, Inc., an investment advisor for pension plans, since inception. As President of CNL Financial Group, Inc., Mr. Bourne has overseen CNL Holdings, Inc.’s real estate and capital markets activities including the investment of over $4 billion in equity and the financing, acquisition, construction and leasing of restaurants, office buildings, apartment complexes, hotels, retirement properties and other real estate. Mr. Bourne began his career as a certified public accountant employed by Coopers & Lybrand, Certified Public Accountants, from 1971 through 1978, where he attained the position of tax manager in 1975. Mr. Bourne graduated from Florida State University in 1970 where he received a B.A. in Accounting, with honors.

Bruce Douglas. Independent Director. On March 1, 2001, Mr. Douglas founded and has been the chief executive officer of Harvard Development Company, a real estate development organization specializing in urban revitalization and rejuvenation through the development of civic-minded projects in underprivileged communities. From 1975 to February 28, 2001, Mr. Douglas founded and was the chairman and chief executive officer of The Douglas Company and Design Services Company, a construction firm and an engineering firm, respectively, that specialize in health care, elderly housing, multi-family and retail construction. Mr. Douglas serves on the boards of numerous educational and cultural organizations, including the Toledo Symphony, the Northwest Ohio Venture Fund, the Toledo Repertoire Theater, Taubman Center Advisory Board of Harvard University, Regional Advisory Committee of the Center for Policy Analysis and Public Service of Bowling Green State University, Wilberforce University and the Roy E. Crummer Graduate School of Business of Rollins College. Mr. Douglas is also the founder of the New Ohio Institute, a non-profit policy center focused on finding and carrying out solutions to urban problems. Mr. Douglas received his B.A. in Physics from Kalamazoo College in 1954, B.S. in Civil Engineering from the University of Michigan in 1955, MPA from Harvard University in 1995 and his Ph.D. in History at the University of Toledo in 2004.

Dennis N. Folken. Independent Director. Mr. Folken is a retired Certified Public Accountant, having received his certified public accountant designation in 1957. He was with Coopers & Lybrand, Certified Public Accountants from 1969 to 1988, and prior to that was with several local accounting firms. Over his 30-year career, Mr. Folken practiced as an office managing partner and group managing partner. Mr. Folken’s areas of expertise included tax and financial planning for real estate investments, partnerships and Subchapter-S corporations. Mr. Folken’s subsequent experience included managing Devex Realty, Inc. & Comreal, Inc., a real estate brokerage firm, from 1989 to 1992; advising Fiduciary Associates, Inc., a trust administration company, from 1991 to 1993; and serving as a director of BankFIRST, a commercial bank, from 1989 to 1995, and as a director of Osceola Financial Corp., a real estate mortgage/investment corporation, from 1989 to 1997. Mr. Folken received a B.A. from Rollins College in 1956 and attended the University of Florida Graduate School of Business. He has been active in professional and civic affairs including as trustee of Florida Tax-Watch in Tallahassee, vice-chairman of the Economic Development

4

Commission of Mid-Florida, board member of the Committee of 100 of Orange County, Florida., trustee of Arts United, Inc. and president of Rollins College Alumni Association.

Robert J. Woody. Independent Director. Mr. Woody has served as the chief executive officer of Northstar Consulting Group, Inc. since July 1, 2004. Prior to that, Mr. Woody was the executive vice president for Northstar Companies, Inc., an international wealth management firm utilizing specialized insurance and reinsurance products and strategies to enhance the stewardship of financial resources, since January 2002. From 1997 to January 2002, Mr. Woody was a partner with the law firm of Shook, Hardy & Bacon, L.L.P. in the business and finance division, and chairman of the firm’s energy section. From 1975 to 1997, Mr. Woody was an associate, a partner and then the managing partner in Washington, D.C. for the law firm of Lane & Mittendorf, responsible for building the Washington practice into a twenty-lawyer office engaged in all phases of commercial law, prior to the firm’s merger into Shook, Hardy & Bacon, L.L.P. in 1997. Mr. Woody served as vice president and a director, from 1990-1991, of One To One/The National Mentoring Partnership, Inc., taking a one-year leave of absence from the firm to help launch a new national effort to address the problems of “at risk” youth. From July to December 1978, Mr. Woody served as special counsel to the U.S. Delegation to the 33rd General Assembly to the United Nations. In addition, Mr. Woody served as counsel to the Committee on Commerce of the United States Senate, from 1971 to 1973, and served as legislative assistant to U.S. Senator James B. Pearson of Kansas, from 1969 to 1971. Mr. Woody also served to the rank of Captain, Judge Advocate General’s Corp., U.S. Army Reserve, from 1969 to 1975. Mr. Woody currently serves as the chairman of the International Leadership Group, as co-chairman of the Buxton Initiative, Inc. (a charitable organization focused on inter-faith dialogue), and as counsel in Washington, D.C. for the University of Kansas. In addition, Mr. Woody has served as a director for Bethlehem Rebar Industries, Inc.; Sessel’s Inc.; U.S. National Commission on UNESCO; Counsel to the Permanent Organization Committee of the Republican National Convention; Counsel to the U.S. Delegation to the 24th International Conference of the Red Cross; on the Advisory Council, Center for the Study of Values in Public Life, Harvard Divinity School; and as the National Recruiting Chairman, Lawyers for Dole, in 1988 and 1996. Mr. Woody received a Bachelor of Arts in 1966, and Juris Doctor degree in 1969, from the University of Kansas, as well as having undertaken graduate legal study in international law at the University of Exeter, England, in 1972.

The executive officers of the Company are as follows:

| | | | |

Name

| | Age

| | Position

|

James M. Seneff, Jr. | | 58 | | Director and Chairman of the Board |

Robert A. Bourne | | 58 | | Director, Vice Chairman of the Board and Treasurer |

Thomas J. Hutchison | | 63 | | Chief Executive Officer |

R. Byron Carlock, Jr. | | 42 | | President |

Charles A. Muller | | 46 | | Chief Operating Officer and Executive Vice President |

Tammie A. Quinlan | | 42 | | Chief Financial Officer, Senior Vice President and Secretary |

Thomas G. Huffsmith | | 49 | | Chief Investment Officer and Senior Vice President |

Thomas J. Hutchison III. Chief Executive Officer. Mr. Hutchison has served as Chief Executive Officer of CNL Income Properties since inception and served as President from inception through April 2004. Mr. Hutchison also serves as a director and Chief Executive Officer of the Company’s advisor. Mr. Hutchison served as President of the advisor from inception through April 2004. Mr. Hutchison serves as a director and Chief Executive Officer of CNL Hotels & Resorts, Inc., a public, unlisted real estate investment trust, as well as the co-Chief Executive Officer and a director of CNL Hospitality Corp., its advisor. From June 2002 through February 2003, Mr. Hutchison served as President of CNL Hotels & Resorts, Inc. and CNL Hospitality Corp., its advisor. From 2000 to June 2002, Mr. Hutchison served as Executive Vice President of CNL Hotels & Resorts, Inc. and CNL Hospitality Properties Corp., its advisor. In addition, Mr. Hutchison serves as President and Chief Operating Officer of CNL Real Estate Services, Inc., which is the parent company of CNL Hospitality Corp. and CNL Retirement Corp. He also serves as the President and Chief Operating Officer of CNL Realty & Development Corp.

5

In addition, Mr. Hutchison serves as President and Chief Executive Officer of CNL Retirement Properties, Inc. and as President, Chief Executive Officer and a director of CNL Retirement Corp., its advisor. Mr. Hutchison also serves as a director, Chairman and Chief Executive Officer of EMTG, LLC. EMTG, LLC publishes the Mobil Travel Guide, a publication which features information about domestic hotels, resorts, restaurants, sites and attractions. From 2000 to June 2002, Mr. Hutchison served as Executive Vice President of CNL Retirement Properties, Inc. and CNL Retirement Corp. Mr. Hutchison joined CNL Real Estate Group, Inc. in January 2000 with more than 30 years of senior management and consulting experience in the real estate development and services industries. He currently serves on the board of directors of Restore Orlando, a nonprofit community volunteer organization. Prior to joining CNL, Mr. Hutchison was president and owner of numerous real estate services and development companies. From 1995 to 2000, he was chairman and chief executive officer of Atlantic Realty Services, Inc. and TJH Development Corporation. Since 1990, he has fulfilled a number of long-term consulting assignments for large corporations, including managing a number of large international joint ventures. From 1990 to 1991, Mr. Hutchison was the court-appointed president and chief executive officer of General Development Corporation, a real estate community development company, where he assumed the day-to-day management of the $2.6 billion NYSE-listed company entering reorganization. From 1986 to 1990, he was the chairman and chief executive officer of a number of real estate-related companies engaged in the master planning and land acquisition of forty residential, industrial and office development projects. From 1978 to 1986, Mr. Hutchison was the president and chief executive officer of Murdock Development Corporation and Murdock Investment Corporation, as well as Murdock’s nine service divisions. In this capacity, he managed an average of $350 million of new development per year for over nine years. Additionally, he expanded the commercial real estate activities to a national basis, and established both a new extended care division and a hotel division that grew to 14 properties. Mr. Hutchison was educated at Purdue University and the University of Maryland Business School.

R. Byron Carlock, Jr. President. Mr. Carlock has served as President of CNL Income Properties and CNL Income Corp. since April 19, 2004. From March 1998 through June 1998 and since October 2000, Mr. Carlock has served as chairman of The Carlock Companies, LLC, a Dallas-based advisory firm specializing in mergers, acquisitions and recapitalizations. Mr. Carlock, through The Carlock Companies, LLC, provides consulting services to a number of our advisor’s affiliates. From June 1998 to October 2000, Mr. Carlock served as chief investment officer and executive vice president of Post Corporate Services, where he managed the luxury apartment company’s capital markets activities and investment committee. From March 1997 through February 1998, Mr. Carlock also served as president and chief operating officer of W.B. Johnson Properties, LLC. W.B. Johnson Properties, LLC founded The Ritz-Carlton Hotel Company and as of June 2004 operated the largest Waffle House franchise in the United States. From June 1987 to March 1997, Mr. Carlock served the Trammell Crow Company and then Crow Holdings International in various capacities, ultimately acting as Managing director of Capital Markets for the last two years of that term. Mr. Carlock previously served as alumni vice president of the Harvard Business School Board of directors. He has also served on multiple civic boards including Zoo Atlanta, the Atlanta Boy Choir, Big Brothers of Dallas, Charis Community Housing and Christian Services of Dallas. He currently serves on the board of Hope Network Ministries based in San Antonio. Mr. Carlock received a M.B.A. from the Harvard Business School in 1988 and a B.A. in Accounting from Harding University in Arkansas in 1984. Mr. Carlock completed additional studies as a Rotary Scholar at the Chinese University of Hong Kong in 1985. Mr. Carlock is an inactive certified public accountant.

Charles A. Muller. Chief Operating Officer and Executive Vice President. Mr. Muller joined CNL Income Properties as Chief Operating Officer in April 2004 and as Executive Vice President in April 2005. Mr. Muller also serves CNL Income Corp., the Company’s advisor, as Chief Operating Officer beginning April 2004 and Executive Vice President beginning February 2005, and is responsible for the Company’s acquisition, asset management and investor relations efforts. Prior to that, he served as Executive Vice President since October 1996 and Chief Operating Officer from October 1996 to November 2003 of CNL Hotels & Resorts, Inc., formerly known as CNL Hospitality Properties, Inc. a public, unlisted real estate investment trust, and its advisor, CNL Hospitality Corp. As a part of CNL Hotels & Resorts, Inc.’s senior management team, Mr. Muller participated in planning and implementing hotel industry investments, including acquisitions, development, project analysis and due diligence. Prior to joining CNL Hospitality Corp., Mr. Muller spent 15 years in hotel and resort sector investment, development and operations working for companies such as AIRCOA Hospitality Services, Inc., PKF Consulting, Wyndham Hotels & Resorts and Tishman Hotel Corporation. Mr. Muller currently serves on the Urban Land Institute, Recreational Development Council. He received a B.A. in Hotel Administration from Cornell University in 1981.

6

Tammie A. Quinlan. Chief Financial Officer, Senior Vice President and Secretary. Since April 2004, Ms. Quinlan has served as Chief Financial Officer and Senior Vice President of CNL Income Properties and the Company’s advisor, CNL Income Corp. Ms. Quinlan also began serving as Secretary of CNL Income Properties in June 2004. In these roles, Ms. Quinlan supervises CNL Income Properties’ financial reporting, financial controls, legal and regulatory compliance and accounting functions as well as forecasting, budgeting and cash management activities. She is also responsible for equity and debt financing activities. Ms. Quinlan’s previous position was with CNL Hospitality Corp. from 1999 to April 2004, where she served as Senior Vice President of Corporate Finance and Treasury. She was responsible for all accounting and financial reporting requirements, corporate finance and treasury functions for CNL Hospitality Corp. Prior to joining CNL Hospitality Corp., Ms. Quinlan was employed by KPMG LLP from 1987 to 1999, most recently as a senior manager, performing services for a variety of clients in the real estate, hospitality and financial services industries. She assisted several clients through their initial public offerings, secondary offerings, securitizations and complex business and accounting issues. Ms. Quinlan is a certified public accountant. She graduated from the University of Central Florida in 1986 where she received a B.S. in Accounting and Finance.

Thomas G. Huffsmith. Chief Investment Officer and Senior Vice President. Mr. Huffsmith has served as Chief Investment Officer and Senior Vice President since August 2004. Mr. Huffsmith has also served as Chief Investment Officer since June 2004 and as Senior Vice President since August 2004 of CNL Income Corp. Prior to that, he served as president of Huffsmith Development, LLC, a real estate principal and advisory business in Paris and as President of Regent International Hotels. Prior to joining Regent in 2001, Mr. Huffsmith was senior vice president of development and investments, EMEA (Europe, Middle East and Africa), for Six Continents Hotels in London. In this position he served as head of all development and acquisition activities for the company’s brands throughout EMEA. He also served as senior vice president of development, The Americas for Crowne Plaza Hotels. Both Six Continents and Crowne Plaza are in the Intercontinental Hotels Group, PLC’s family of hotels. Prior to joining the Intercontinental Hotels companies in October 1997, Mr. Huffsmith was employed by LaSalle Partners in New York where he held the position of senior vice president of hotel investments on such projects as the leasing of 42nd Street between 7th and 8th Avenue in New York as well as participating as senior management in the start-up of several LaSalle-sponsored REITs. Mr. Huffsmith was also vice president of hotel investments for Prudential Realty Group in Newark, New Jersey where he was in charge of strategic planning for the office, retail and hotel portfolios. He also managed Prudential Real Estate Investor’s separate account hotel investment portfolio. Mr. Huffsmith received his M.B.A. degree from the Wharton School of the University of Pennsylvania in Philadelphia, Pennsylvania. He graduated from Cornell University in Ithaca, New York, with a B.S. degree in Hotel Administration.

The backgrounds of Mr. Bourne and Mr. Seneff are described above at “Nominees for Election to the Board of Directors.”

Board Independence

For the year ended December 31, 2004, each of Messrs. Douglas, Folken and Woody served as “independent directors” of the Company, as that term is defined in the Company’s Articles of Incorporation. Although the Company’s shares are not listed on the New York Stock Exchange, the Company applied the exchange’s standards of independence to its own outside directors and for the year ended December 31, 2004, each of Messrs. Douglas, Folken and Woody met the definition of “independent” under Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange listing standards.

Compensation of Directors and Executive Officers

During the year ended December 31, 2004, each director earned $12,000 for serving on the Board. Each director also received $1,000 per Board meeting attended ($500 for each telephonic meeting of the Board in which the independent director participated), $1,000 (or $1,500 in the case of the Chairman of the Audit Committee) per Audit Committee meeting attended or telephonic Audit Committee meeting in which the independent director participated. During the year ended December 31, 2004, the Company held five Board meetings, two of which were telephonic meetings, and four Audit Committee meetings, none of which were telephonic meetings although two

7

directors each called into one meeting each. The Company has not, and in the future will not, pay any compensation to the officers and directors of the Company who also serve as officers and directors of CNL Income Corp. (the “Advisor”).

Commencing January 1, 2005, each director receives a $30,000 annual fee for services as well as $1,500 per Board meeting attended whether they participate by telephonic or in person. Each director receives $1,500 per Audit Committee meeting attended whether they participate by telephonic or in person. The Audit Committee Chair receives an annual retainer of $5,000 in addition to Audit Committee meeting fees and fees for meeting with the independent accountants as a representative of the Audit Committee. No additional compensation will be paid for attending the annual stockholders meeting.

No annual or long-term compensation was paid by the Company to the executive officers for services rendered in all capacities to the Company during the period ended December 31, 2004. In addition, no executive officer of the Company received an annual salary or bonus from the Company during the period ended December 31, 2004. The Company’s executive officers also are employees and executive officers of the Advisor or its affiliates and receive compensation from the Advisor or its affiliates in part for services in such capacities. See “Certain Relationships and Related Transactions” for a description of the fees payable and expenses reimbursed to the Advisor and its affiliates.

Board Meetings During Fiscal Year 2004

The Board met eleven times (including seven telephonic meetings) during the year ended December 31, 2004, and the average attendance by directors at Board meetings was 96%. Each member of the Board as it was constituted during 2004, attended at least 75% of the total meetings of the Board and each member of the Audit Committee attended 100% of the total Audit Committee meetings during 2004.

Committees of the Board of Directors

The Company has a standing Audit Committee, the members of which are selected by the Board each year. During 2004, the Audit Committee was composed of Bruce Douglas, Dennis N. Folken and Robert J. Woody, each of whom has been determined to be “independent” under the listing standards of the New York Stock Exchange referenced above. The Committee operates under a written charter adopted by the Board, which is required to be provided to stockholders every three years, unless amended earlier. A copy of the Audit Committee Charter, is included as Appendix A hereto and posted on the Company’s website at www.cnlonline.com/ir/investcnl_ip.asp. The Audit Committee assists the Board by providing oversight responsibilities relating to:

(1) The integrity of financial reporting;

(2) The independence, qualifications and performance of the Company’s independent auditors;

(3) The systems of internal controls;

(4) The performance of the Company’s internal audit function; and

(5) Compliance with management’s audit, accounting and financial reporting policies and procedures.

In addition, the Audit Committee recommends the independent auditors for appointment by the Board and is responsible for the compensation and oversight of the Company’s independent auditor and internal auditors. In performing these functions, the Audit Committee meets periodically with the independent auditors, management and internal auditors (including private sessions) to review the results of their work. During the year ended December 31, 2004, the Audit Committee met two times with the Company’s independent auditors, internal auditors and management, and held two telephonic meetings with the Company’s independent auditors and management to discuss the annual and quarterly financial reports prior to filing them with the Commission. The Audit Committee has determined that Mr. Folken, the Chairman of the Audit Committee and an independent director, is an “audit committee financial expert” under the rules and regulations of the Commission for purposes of Section 407 of the Sarbanes-Oxley Act of 2002.

8

Currently, the Company does not have a nominating committee, and therefore, does not have a nominating committee charter. The Board is of the view that it is not necessary to have a nominating committee at this time because the Board is compromised of only five members, including three “independent directors” (as defined under the New York Stock Exchange listing standards), and each director is responsible for identifying and recommending qualified Board candidates. The Board does not have any minimum qualifications with respect to Board nominees, however, the Board considers many factors with regard to each candidate, including judgment, integrity, diversity, prior experience, the interplay of the candidate’s experience with the experience of other Board members, the extent to which the candidate would be desirable as a member of the Audit Committee, and the candidate’s willingness to devote substantial time and effort to Board responsibilities. The persons nominated for election to the Board under Proposal I of this proxy statement were recommended by the entire Board, including the independent directors.

Company stockholders may recommend individuals to the Board for consideration as potential director candidates by submitting their names and appropriate background and biographical information to the Company’s Corporate Secretary at the Company’s office at CNL Center at City Commons, 450 South Orange Avenue, Orlando, Florida, 32801. Assuming that the appropriate information has been timely provided, the Board will consider these candidates substantially in the same manner as it considers other Board candidates it identifies.

At such time, if any, as the Company’s shares of common stock are listed on a national securities exchange included for quotation on the National Market System of the Nasdaq Stock Market, the Company will form a compensation committee, the members of which will be selected by the full Board each year. Currently, the Company does not have a compensation committee.

Audit Committee Report

The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the Commission, nor shall such information be incorporated by reference into any previous or future filings under the Securities Act of 1933, as amended, or the Exchange Act except to the extent that the Company incorporates it by specific reference.

Review and Discussions with Management. The Audit Committee has reviewed and discussed the Company’s audited financial statements for the year ended December 31, 2004, with the management of the Company. The Audit Committee also discussed with the Company’s senior management the process for certifications by the Company’s Chief Executive Officer and Chief Financial Officer which is required by the Commission and the Sarbanes-Oxley Act of 2002 for certain of the Company’s filings with the Commission.

Review and Discussions with Independent Auditors. The Audit Committee has discussed with PricewaterhouseCoopers LLP, the Company’s independent auditors, the matters required to be disclosed by Statement on Auditing Standards No. 61, “Communication with Audit Committees,” which includes, among other items, matters related to the conduct of the audit of the Company’s financial statements. In addition, the Audit Committee has reviewed the selection, application and disclosure of the Company’s critical accounting policies. The Audit Committee has also received written disclosures and a letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1 (which relates to the accountant’s independence from the Company and its related entities) and has discussed with PricewaterhouseCoopers LLP their independence from the Company.

Conclusion. Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the Company’s audited financial statements be included in the Annual Report of the Company on Form 10-K for the year ended December 31, 2004, for filing with the Commission.

|

The Audit Committee: |

|

| Bruce Douglas |

|

| Dennis N. Folken |

|

| Robert J. Woody |

9

Corporate Governance

The Board has adopted policies and procedures that the Board believes are in the best interest of the Company and its stockholders as well as compliant with the Sarbanes-Oxley Act of 2002 and the Commission’s rules and regulations. In particular:

| | • | | The majority of the Board is independent of the Company and management, and all of the members of the Audit Committee are independent. |

| | • | | The Board has adopted a charter for the Audit Committee. One member of the Audit Committee is an “audit committee financial expert” under Commission rules. |

| | • | | The Audit Committee hires, determines compensation of, and decides the scope of services performed by the Company’s independent auditors. |

| | • | | The Company has adopted a Code of Business Conduct that applies to all directors and officers of the Company as well as all directors, officers and employees of the Company’s Advisor. The Code of Business Conduct sets forth the basic principles to guide their day-to-day activities. |

| | • | | The Company has adopted a “Whistleblower” Policy that applies to the Company and all employees of the Company’s Advisor, and establishes procedures for the anonymous submission of employee complaints or concerns regarding financial statement disclosures, accounting, internal accounting controls or auditing matters. |

The Company’s Audit Committee Charter, Code of Business Conduct and Whistleblower Policy are available on the Company’s website at www.cnlonline.com/ir/investcnl_ip.asp.

Stockholder Communications

Stockholders who wish to communicate with a member or members of the Board may do so by addressing their correspondence to the Board member or members, c/o the Corporate Secretary, CNL Income Properties, Inc., 450 South Orange Avenue, Orlando, Florida, 32801. The Corporate Secretary will review and forward correspondence to the appropriate person or persons for response.

[Remainder of page left intentionally blank]

10

SECURITY OWNERSHIP

The following table sets forth, as of April 1, 2004, the number and percentage of outstanding shares beneficially owned by all persons known by the Company to own beneficially more than 5% of the Company’s common stock, by each director and nominee, by each executive officer and by all executive officers and directors as a group, based upon information furnished to the Company by such stockholders, officers and directors. The address of the named officers and directors is CNL Center at City Commons, 450 South Orange Avenue, Orlando, Florida 32801.

| | | | | | |

Name and Address of Beneficial Owner

| | Number of Shares Beneficially Owned

| | | Percent of Shares

| |

James M. Seneff, Jr. | | 137,706 | (1) | | | (2) |

Robert A. Bourne | | — | | | — | |

Thomas J. Hutchison, III | | — | | | — | |

Bruce Douglas | | — | | | — | |

Dennis N. Folken | | 2,823 | | | | (2) |

Robert J. Woody | | — | | | — | |

R. Byron Carlock, Jr. | | — | | | — | |

Tammie A. Quinlan | | — | | | — | |

Charles A. Muller | | — | | | — | |

Thomas G. Huffsmith | | — | | | — | |

| | |

|

| |

|

|

All directors and executive officers as a group (10 persons) | | 140,529 | | | | (2) |

| | |

|

| |

|

|

| (1) | Represents shares held by the Advisor and CNL Financial Group (“CFG”) of which Mr. Seneff is a director. Mr. Seneff and his wife share beneficial ownership of the Advisor through their ownership of CFG. The Advisor is a wholly owned subsidiary of CFG. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of a registered class of the Company’s equity securities (collectively, the “Reporting Persons”), to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the Commission. Reporting Persons are required by the Commission’s regulations to furnish the Company with copies of all Forms 3, 4 and 5 that they file. The Company’s Reporting Persons were not subject to Section 16(a) during 2004. Commencing in April 30, 2005, the Reporting Persons for the Company will begin filing Forms 3, 4 and 5.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

All of the executive officers of the Company are executive officers of the Advisor, a wholly owned subsidiary of CFG, in which Messrs. Seneff and Bourne serve as executive officers and/or directors and whose shares are beneficially owned by Mr. Seneff and his wife. In addition, Messrs. Seneff and Bourne are executive officers of CNL

11

Securities Corp., the managing dealer of the Company’s offering of shares of common stock, and a wholly owned subsidiary of CFG. Messrs. Seneff and Bourne are directors of the Company, the Advisor and CNL Securities Corp., and Mr. Hutchison is a director and an executive officer of the Advisor. Administration of the day-to-day operations of the Company is provided by the Advisor, pursuant to the terms of an advisory agreement. The Advisor also serves as the Company’s consultant in connection with policy decisions to be made by the Company’s Board, manages the Company’s properties and renders such other services as the Board deems appropriate. The Advisor also bears the expense of providing the executive personnel and office space to the Company. The Advisor is at all times subject to the supervision of the Board of the Company and has only such functions and authority as the Company may delegate to it as the Company’s agent. The Advisor and its affiliates receive fees and compensation in connection with the offerings, permanent financing that the Company obtains, and the acquisition, management and sale of the Company’s assets.

For services in connection with the sale of the Company’s shares, CNL Securities Corp. receives fees based on the amounts raised from the Company’s offerings, including: (i) commissions of 6.5%, and (ii) a marketing support fee up to 2.5%. The majority of such fees have been re-allowed to other broker dealers. For the year ended December 31, 2004, the Company incurred the following costs related to such fees (in thousands):

| | | |

Selling commissions | | $ | 5,396,516 |

Marketing support fees and due diligence costs | | | 2,075,972 |

| | |

|

|

| | | $ | 7,472,488 |

| | |

|

|

The Advisor receives acquisition fees for services in identifying properties and structuring the terms of their leases and loans equal to 3.0% of the gross proceeds of the offering and loan proceeds from permanent financing, excluding that portion of the permanent financing used to finance secured equipment leases. In addition, if there is a listing of the Company’s common stock on a national securities exchange or it is included for quotation on the National Market System of the Nasdaq Stock Market, the Advisor will receive an acquisition fee of 3.0% of amounts outstanding on a line of credit, if any, at the time of listing. During the year ended December 31, 2004, the Company incurred $3,144,876 million of such fees. These fees are recorded as other assets in the consolidated financial statements of the Company prior to being allocated to individual properties or investments upon closing of an acquisition.

The Company and the Advisor have entered into an advisory agreement pursuant to which the Advisor receives a monthly asset management fee of 0.08334% of the Company’s real estate asset value and the outstanding principal balance of any mortgage loan as of the end of the preceding month. During the year ended December 31, 2004, the Company incurred no such fees.

The Advisor and its affiliates provide various administrative services to the Company, including services related to accounting; financial, tax and regulatory compliance reporting; stockholder distributions and reporting; due diligence and marketing; and investor relations (including administrative services in connection with the offerings). The expenses incurred for these services for the year ended December 31, 2004 are as follows:

| | | |

Offering expenses (1) | | $ | 7,845,258 |

General and administrative expenses | | | 581,348 |

| | |

|

|

| | | $ | 8,426,606 |

| | |

|

|

| (1) | Approximately $5.38 million has been capitalized and included in deferred offering costs as of December 31, 2004. |

Offering expenses paid by the Company, together with selling commissions, the marketing support fee and due diligence expense reimbursements incurred by the Company will not exceed 13% of the proceeds raised in connection with the offering. In addition, during the year ended December 31, 2004, affiliates incurred on behalf of the Company $ 1,509,808 for certain acquisition expenses and $21,351 for certain organization costs.

Pursuant to the advisory agreement, the Advisor is required to reimburse the Company the amount by

12

which the total operating expenses incurred by the Company in any four consecutive fiscal quarters (the “Expense Year”) exceed the greater of 2% of average invested assets or 25% of net income (the “Expense Cap”). The Company’s operating expenses did not exceed the Expense Cap in any Expense Year that ended during the year ended December 31, 2004. The Expense Cap test is applicable to the Company for the 12 months ended June 30, 2005, which is considered to be the end of our first Expense Year.

Amounts due to related parties at December 31, 2004 are as follows:

| | | | | | | |

| | | Years ended December 31,

|

| | | 2004

| | | 2003

|

Due to the Advisor and its affiliates: | | | | | | | |

Expenditures incurred for offering expenses | | $ | 6,960,292 | | | $ | 939,716 |

Accounting and administrative services | | | 1,207,252 | | | | — |

Acquisition fees and expenses | | | 1,893,200 | | | | 100,081 |

| | |

|

|

| |

|

|

| | | $ | 10,060,744 | | | $ | 1,039,797 |

| | |

|

|

| |

|

|

Due to CNL Securities Corp.: | | | | | | | |

Selling commissions | | $ | 320,767 | | | $ | — |

Marketing support fees and due diligence costs | | | 123,373 | | | | — |

Offering costs | | | (90,050 | ) | | | — |

| | |

|

|

| |

|

|

| | | $ | 354,090 | | | $ | — |

| | |

|

|

| |

|

|

In addition to the transactions with related parties listed above, the Company’s President, individually and in conjunction with a consulting company owned by him, contracts with various affiliates of the Advisor to provide consulting services.

On September 30, 2004, the Company borrowed funds in order to fund a portion of its distributions in the approximate principal amount of $470,512 from CFG the affiliate and parent company of the Advisor. CFG is wholly-owned by the Company’s chairman of the board and his wife. On December 16, 2004, the Board authorized the issuance of approximately 48,534 restricted shares of common stock at a share price of $10.00 per share to CFG in exchange for the cancellation of the loan due to CFG of approximately $485,340, including accrued interest.

On December 16, 2004, the Board also authorized the issuance of approximately 69,174 restricted shares of common stock at a share price of $10.00 per share to CFG in exchange for a capital contribution of approximately $691,740. The proceeds of the stock issuance were used to fund the distributions declared for stockholders of record on September 20, which was paid September 30, 2004 and the distributions declared on October 1, November 1, and December 1, 2004, which were paid by December 31, 2004.

Both of the above securities transactions were made pursuant to the exemption from registration provided under Section 4(2) of the Securities Act of 1933.

INDEPENDENT AUDITORS

Upon recommendation of and approval by the Board, including the independent directors, PricewaterhouseCoopers LLP (“PWC”) has been selected to act as independent auditors for the Company for 2005. PWC has served as the independent auditors since the Company’s inception in 2003.

A representative of PWC will be present at the annual meeting and will be provided with the opportunity to make a statement if desired. Such representative will also be available to respond to appropriate questions.

Independent Auditor Fees

The following table sets forth the aggregate fees billed by PWC for the years ended December 31, 2004 and 2003 for audit and non-audit services (as well as all “out-of-pocket” costs incurred in connection with these services)

13

and are categorized as Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees. The nature of the services provided in each such category is described following the table.

| | | | | | |

| | | 2004

| | 2003

|

Audit Fees | | $ | 21,344 | | $ | 13,500 |

Audit-Related Fees | | | — | | | — |

Tax Fees | | | 15,000 | | | — |

All Other Fees | | | — | | | — |

| | |

|

| |

|

|

Total Fees | | $ | 36,344 | | $ | 13,500 |

| | |

|

| |

|

|

Audit Fees – Consists of professional services rendered in connection with the annual audit of the Company’s consolidated financial statements on Form 10-K and quarterly reviews of the Company’s interim financial statements on Form 10-Q. Audit fees also include fees for services performed by PWC that are closely related to the audit and in many cases could only be provided by the Company’s independent auditors. Such services include the issuance of comfort letters and consents related to the Company’s registration statements and capital raising activities, assistance with and review of other documents filed with the Commission and accounting advice on completed transactions.

Audit Related Fees –Consists of services related to audits of properties acquired, due diligence services related to contemplated property acquisitions and accounting consultations.

Tax Fees –Consists of services related to corporate tax compliance, including review of corporate tax returns, review of the tax treatments for certain expenses and tax due diligence relating to acquisitions.

All Other Fees –There were no professional services rendered by PWC that would be classified as other fees during the years ended December 31, 2004 and 2003.

Pre-Approval of Audit and Non-Audit Services

Under the Company’s Audit Committee Charter, as adopted by the Audit Committee in May 2004, the Audit Committee must pre-approve all audit and non-audit services provided by the independent auditors in order to assure that the provisions of such services do not impair the auditor’s independence. The policy, as described below and set forth in the Audit Committee Charter provided herewith as Appendix A, sets forth conditions and procedures for such pre-approval of services to be performed by the independent auditor and utilizes both a framework of general pre-approval for certain specified services and specific pre-approval for all other services.

The annual audit services, as well as all audit-related services (assurance and related services that are reasonably related to the performance of the auditor’s review of the financial statements or that are traditionally performed by the independent auditor), requires the specific pre-approval of the Audit Committee. The Audit Committee may, however, grant general pre-approval for other audit services, which are those services that only the independent auditor reasonably can provide (such as comfort letters or consents). The Audit Committee has pre-approved all tax services and may grant general pre-approval for those permissible non-audit services that it has classified as “all other services” because it believes such services are routine and recurring services, and would not impair the independence of the auditor.

The fee amounts for all services to be provided by the independent auditor are established annually by the Audit Committee, and any proposed service fees exceeding approved levels will require specific pre-approval by the Audit Committee. Requests to provide services that require specific approval by the Audit Committee are submitted to the Audit Committee by the independent auditor, the chief financial officer and the chief executive officer, and must include a joint statement as to whether, in their view, the request is consistent with the Commission’s rules on auditor independence.

14

OTHER MATTERS

The Board of directors does not know of any matters to be presented at the Annual Meeting other than those stated above. If any other business should come before the Annual Meeting, the person(s) named in the enclosed proxy will vote thereon as he or they determine to be in the best interests of the Company.

15

PROPOSALS FOR THE 2006 ANNUAL MEETING OF STOCKHOLDERS

Any stockholder proposal to be considered for inclusion in the Company’s proxy statement and form of proxy for the annual meeting of stockholders to be held in 2006 must be received at the Company’s office at 450 South Orange Avenue, Orlando, Florida 32801, no later than December 28, 2005.

Notwithstanding the aforementioned deadline, under the Company’s Bylaws, a stockholder must follow certain other procedures to nominate persons for election as directors or to propose other business to be considered at an annual meeting of stockholders. These procedures provide that stockholders desiring to make nominations for directors and/or to bring a proper subject before a meeting must do so by notice timely received by the Corporate Secretary of the Company. With respect to proposals for the 2005 annual meeting, the Corporate Secretary of the Company must receive notice of any such proposal no earlier than March 1, 2006, and no later than April 29, 2006.

|

By Order of the Board of directors, |

|

|

Tammie A. Quinlan Corporate Secretary |

April 29, 2005

Orlando, Florida

16

APPENDIX A

CNL INCOME PROPERTIES, INC.

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

CHARTER

A-1

Audit Committee of

the Board of Directors Charter

CNL INCOME PROPERTIES, INC

PURPOSE

The primary purpose of the Audit Committee (the “Committee”) is to assist the Board of Directors (the “Board”) in fulfilling its oversight responsibilities relating to: (a) the integrity of the financial reports and other financial information provided by CNL Income Properties, Inc. (the “Company”) to the public; (b) the Company’s compliance with legal and regulatory requirements, (c) the systems of internal controls which management has established; (d) the performance of the Company’s internal audit function; (e) the independence, qualifications and performance of the Company’s independent auditor; (f) the Company’s auditing, accounting and financial reporting processes generally; and (g) the duties set forth below and such other responsibilities as may be delegated to the Committee by the Board from time to time. The Committee is responsible for appointment, compensation and oversight of the Company’s independent auditors and internal auditors who shall report directly to the Committee and are ultimately accountable to the Board and the Committee. Consistent with this function, the Committee should encourage continuous improvement of, and should foster adherence to, the Company’ s policies, procedures and practices at all levels.

COMPOSITION

The Committee shall be composed of three or more directors as determined by the Board, each of whom shall be “independent,” as such term is defined or construed from time to time in the Securities Exchange Act of 1934 and the rules and regulations promulgated thereunder (the “Exchange Act”) and other laws and regulations applicable to the Company and the Committee. In addition, all members of the Committee must possess the requisite financial knowledge and accounting or related financial management experience to fulfill their duties, and the Committee shall endeavor to include in its membership at least one member that qualifies as an “audit committee financial expert” as that term is defined or construed from time to time in the Exchange Act and other laws and regulations applicable to the Company and the Committee. Committee members may enhance their familiarity with finance and accounting by participating in educational programs conducted by the Company or an outside consultant.

Prior to approving a director’s appointment to the Committee, the Board shall have determined; (a) that such director satisfies the foregoing independence requirements; (b) in the exercise of its business judgment, that such director has the requisite financial and accounting knowledge to serve on the Committee; and (c) whether such director qualifies as an “audit committee financial expert.”

No member of the Committee shall simultaneously serve on the audit committee of more than two public companies (excluding service on the Audit Committee of the Company) unless the Board has made a determination that such simultaneous service would not impair the ability of such member to effectively serve on the Committee.

The Board, after consultation with the Chief Executive Officer of the Company (“CEO”), shall determine which directors should serve on the Committee and who shall serve as chairman of the Committee. In

A-2

addition, from time to time as it sees fit, the Board, after consultation with the CEO, shall remove directors from the Committee or appoint additional directors to the Committee. If a chairman is not elected by the Board, the members of the Committee may designate a chairman by majority vote of the full Committee.

COMPENSATION

The chairman of the Committee and each member of the Committee shall be entitled to compensation for being the chairman and/or member of the Committee, as applicable, and for meeting attendance as such fees are established from time to time by the Board. Each member of the Committee shall be entitled to reimbursement for reasonable out-of-pocket expenses incurred by such member in attending meetings of the Committee and in performing his/her duties as a member of the Committee. No member of the Committee shall receive from the Company any compensation other than his/her fees for serving as a director and a member of the Committee or any other committee of the Board.

MEETINGS

The Committee shall meet at least quarterly, or more frequently as circumstances dictate. As part of its job to foster open communication, the Committee should meet at least annually with management and the independent accountants in separate sessions to discuss any matters that the Committee or either of these groups believe should be discussed privately.

Meetings of the Committee may be called by the Secretary of the Company upon the request of the chairman of the Committee, the CEO, the Company’s principal financial officer or a majority of the members of the Committee. Except for the regular quarterly meetings of the Committee, notice of any meeting of the Committee shall be given in the manner provided for in the Bylaws of the Company for meetings of the Board and its committees.

The provisions set forth in the Company’s Bylaws for meetings of the Board and its committees shall govern the quorum and voting requirements for all meetings of the Committee.

The Committee shall be required to keep a record of its actions and proceedings and from time to time shall report to the Board such record and include recommendations for Board actions when appropriate.

As necessary or desirable, the chairman of the Committee may request that members of management, independent consultants, and representatives of the independent auditors be present at meetings of the Committee.

RESPONSIBILITIES AND DUTIES

The Committee’s specific powers and responsibilities in carrying out its oversight role are delineated in the Audit Committee Powers and Responsibilities Checklist. The checklist will be updated annually to reflect changes in regulatory requirements, authoritative guidance, and evolving oversight practices. As the compendium of Committee powers and responsibilities, the most recently updated checklist will be considered to be an addendum to this charter and is attached hereto.

Additionally, this charter, including the most recently updated Audit Committee Powers and Responsibilities Checklist, is available on the Company’s website at www.cnlonline.com/ir/investcnl_ip.asp.

Last Revised: April 20, 2005

A-3

Audit Committee Powers &

Responsibilities Checklist

CNL INCOME PROPERTIES, INC

| | | | | | | | | | | | |

| | | WHEN PERFORMED Meetings

|

| | | First

Quarter

| | Second

Quarter

| | Third

Quarter

| | Fourth

Quarter

| | A/N

|

| A. Independent Auditors | | | | | | | | | | |

| | | | | | |

| 1. | | In the sole discretion of the Committee, retain or terminate the Company’s independent auditor and pre-approve all fees and terms of the audit engagement | | | | | | | | X | | |

| | | | | | |

| 2. | | Approve in advance all tax and non-audit services which may legally be provided to the Company by its independent auditor, including the fees and terms for such services in accordance with Section 10A(i) of the Securities Exchange Act of 1934 (the “Exchange Act”) and the rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”) thereunder The chairman of the Committee shall have the right to pre-approve all such tax and non-audit services on behalf of the Committee and shall promptly advise the remaining members of the Committee of such approval at the next regularly scheduled meeting | | X | | X | | X | | X | | X |

| | | | | | |

| 3. | | Meet with the independent auditor to review the scope of the annual audit and the audit procedures to be utilized. | | | | | | | | X | | |

| | | | | | |

| 4. | | At the conclusion of the audit, review such audit, including any comments or recommendations of the independent auditor. The review will cover any audit problems or difficulties encountered by the independent auditors and management’s response to those items. Items to be reviewed would include: any restrictions on the scope of the independent auditor’s activities or on access to requested information, any significant disagreements between the independent auditor and management, any accounting adjustments that were noted or proposed by the independent auditor, but were passed (as immaterial or otherwise); any “management” or “internal control” letter issued, or proposed to be issued, by the independent auditor to the Company, and management’s responses to such letters; and relevant current accounting rules and developments. | | X | | | | | | | | |

| | | | | | |

| 5. | | Review with the independent auditor and the Company’s financial management the adequacy and effectiveness of the Company’s internal accounting and financial controls, and management’s report on any significant deficiencies in internal controls which could adversely affect the Company’s ability to record, process, summarize and report financial data and report on any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal controls | | X | | X | | X | | X | | X |

A-4

| | | | | | | | | | | | |

| | | WHEN PERFORMED Meetings

|

| | | First

Quarter

| | Second

Quarter

| | Third

Quarter

| | Fourth

Quarter

| | A/N

|

| | | | | | |

| 6. | | Review the independent auditor’s ability to attest to and report on management’s assertion on its assessment of the effectiveness of the Company’s internal control structure and its financial reporting procedures in its Annual Report on Form 10-K | | X | | | | | | | | |

| | | | | | |

| 7. | | Obtain and review, at least annually, a report by the independent auditor describing the auditor’s internal quality-control procedures, and any material issues raised by the most recent internal quality-control review or peer review of the auditor, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the auditor and any steps taken to deal with any such issues | | | | | | X | | | | |

| | | | | | |

| 8. | | Review with the Company’s financial management and the independent auditor at least annually the Company’s critical accounting policies and practices and significant accounting judgments and estimates to be used | | | | | | | | X | | X |

| | | | | | |

| 9. | | Confirm quarterly that the Company’s independent auditor has no conflict of interest with the Company under Section 10A(l) of the Exchange Act and the rules and regulations of the SEC promulgated thereunder | | X | | X | | X | | X | | |

| | | | | | |

| 10. | | Review the annual written statement from the independent auditor delineating all relationships between the independent auditor and the Company, and discussing any relationships which may impact the continued objectivity and independence of the independent auditors | | | | | | | | X | | |

| | | | | | |

| 11. | | Evaluating the independent auditor and the lead audit partner on an annual basis, taking into account the opinions of the Company’s management and internal auditors or others performing similar functions | | X | | | | | | | | |

| | | | | | |

| 12. | | Consider whether, in order to assure continuing auditor independence, there should be regular rotation of the lead audit partner or the independent auditor | | X | | | | | | | | |

| | | | | | |

| 13. | | Report the Committee’s conclusions to the full Board with respect to the independent auditor’s qualifications, performance and independence | �� | X | | | | | | X | | X |

A-5

| | | | | | | | | | | | |

| | | WHEN PERFORMED Meetings

|

| | | First

Quarter

| | Second

Quarter

| | Third

Quarter

| | Fourth

Quarter

| | A/N

|

B. Annual and Quarterly Financial Results and Statements and Public Announcements

of Financial Information | | | | | | | | | | |

| | | | | | |