|

Exhibit 99.1

|

Net Asset Valuation Presentation

March 2014

Owning America’s Lifestyle

CNL

Lifestyle Properties, Inc.

Exhibit 99.2

General Notices

This is not an offer to sell nor a solicitation of an offer to buy shares of the REIT. The information herein does not supplement or revise any information in the REIT’s public filings. To the extent information herein conflicts with the prospectus, as supplemented, the information in the prospectus shall govern.

This piece is for general information purposes only and does not constitute legal, tax, investment or other professional advice on any subject matter. Information provided is not all-inclusive and should not be relied upon as being all-inclusive.

This presentation may include forward-looking statements. Forward-looking statements are based on current expectations and may be identified by words such as “believes,” “expects,” “may,” “could,” “consider” and terms of similar substance, and speak only as of the date made. Actual results could differ materially from those expressed or implied in the REIT’s forward-looking statements. Important factors, among others, that could cause the REIT’s actual results to differ materially from those in its forward-looking statements include those identified in the Risk Factors described below. Investors should not place undue reliance on forward-looking statements. The REIT is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise.

An investment in the REIT is subject to significant risks, some of which are summarized below in the “Risk Factors” section of this piece. See also, “Risk Factors” in the REIT’s prospectus for a more detailed description. Investors should read and understand all of the risks and the entire prospectus, as supplemented, before making a decision to invest.

Risk Factors

Investing in a non-traded REIT is a higher-risk, longer term investment and is not suitable for all investors. Due to the risks involved in the ownership of real estate, there is no guarantee of any return on investment. The shares may lose value or investors could lose their entire investment. The shares are not FDIC-insured, nor bank guaranteed.

The REIT and its advisor were recently organized and have limited operating histories on which investors may evaluate the REIT’s operations and prospects for the future.

Non-traded REITs are illiquid. There is no public trading market for the shares. The REIT has no obligation to list on any public securities market and does not expect to list the shares in the near future. If investors are able to sell their shares, it would likely be at a substantial discount.

There are significant limitations on the redemption of investors’ shares under the REIT’s Redemption Plan. Funds available for redemption, if any, are within the REIT’s sole discretion. The REIT can determine not to redeem any shares, or only a portion of the shares for which redemption is requested. In no event will more than five percent of the outstanding shares be redeemed in any 12-month period. The REIT may suspend, terminate or reduce the Redemption Plan at any time. For more specific information, please refer to the prospectus. No shares will be redeemed on any date that distributions are paid. Holding period may be waived and redemptions paid at the purchase price in the event of death, qualifying disability, confinement to a long-term care facility or bankruptcy.

The REIT is obligated to pay substantial fees to its advisor, managing dealer, property manager and their respective affiliates based upon agreements which have not been negotiated at arm’s length, and some of which are payable based upon factors other than the quality of services. These fees could influence their advice and judgment in performing services. In addition, certain officers and directors of the advisor also serve as the REIT’s officers and directors, as well as officers and directors of competing programs, resulting in conflicts of interest. Those persons could take actions more favorable to other entities.

Risk Factors

The REIT may make distributions to investors from sources other than from its cash flows or funds from operations, such as from borrowings and/or the proceeds of its public offering. To the extent the REIT pays cash distributions from such sources, it will reduce the cash available for investment in properties and other real estate-related assets, and lower investors’ overall return on investment. The REIT has not established a limit on the extent to which it may use borrowings, the proceeds of this offering, or shares of common stock to pay distributions. There is no assurance that the REIT’s current distribution rate will not change, or that it can be sustained at any level. The amount or basis of distributions will be determined by and at the discretion of the REIT’s board of directors and is dependent upon a number of factors, including but not limited, to expected and actual net cash flow from operations, funds from operations, the REIT’s financial condition, capital requirements, and avoidance of volatility of distributions. The distribution of solely new common stock to stockholders is not currently included as a component of the recipient’s gross income under the IRS Code and is therefore tax deferred and not taxable when received. Investors should consult with their financial professional, accountant and/or attorney for tax advice specific to their particular needs and objectives.

If the REIT fails to maintain its qualification as a REIT for any taxable year, it will be subject to federal income tax on taxable income at regular corporate rates. In such event, net earnings available for investment or distributions would be reduced.

The use of leverage to acquire assets may hinder the REIT’s ability to pay distributions and/or decrease the value of stockholders’ investment in the event income from or the value of the property securing the debt declines.

The REIT has invested primarily in lifestyle-related properties in the United States & Canada. An investment in the REIT’s shares may be subject to greater risk to the extent that the REIT has limited diversification in its portfolio of investments.

Valuation Disclosures

The offering price of our shares is based on our estimated net asset value per share as of Dec. 31,2013, plus selling commissions and marketing support fees, and may not be indicative of the price at which our shares would trade if they were actively traded.

Our share price is primarily based on the estimated net asset value per share value of our shares, but is also based upon subjective judgments, assumptions and opinions which may or may not turn out to be correct. Therefore, our share price may not reflect the amount that might be paid to you for your shares in a market transaction.

In determining our estimated net asset value per share, we primarily relied upon a valuation of our portfolio of properties as of Dec. 31, 2013. Valuations and appraisals of our properties are estimates of fair value and may not necessarily correspond to realizable value upon the sale of such properties, therefore our estimated net asset value per share may not reflect the amount that would be realized upon a sale of each of our properties.

We may not perform a subsequent calculation of our net asset value per share for our shares prior to the end of our DRP offering, therefore, you may not be able to determine the net asset value of your shares on an ongoing basis during our DRP offering.

This valuation represents the estimated net asset value per share at a snapshot in time and will likely change over the company’s lifecycle. The estimated net asset value per share does not necessarily represent the amount an investor could expect to receive if the company were to list its shares or liquidate its assets, now or in the future. The estimated net asset value per share is only an estimate and is based on a number of assumptions and estimates which may not be complete. CBRE Cap, the independent valuation firm, made numerous assumptions with respect to industry, business, economic and regulatory conditions, all of which are subject to changes beyond the control of CBRE Cap or the company. CBRE Cap is not responsible for our estimated net asset value per share as of Dec. 31, 2013, and did not participate in the determination of the offering price of our shares. Throughout the valuation process, the valuation committee, our advisor and senior members of management reviewed, confirmed and approved the processes and methodologies and their consistency with real estate industry standards and best practices.

|

|

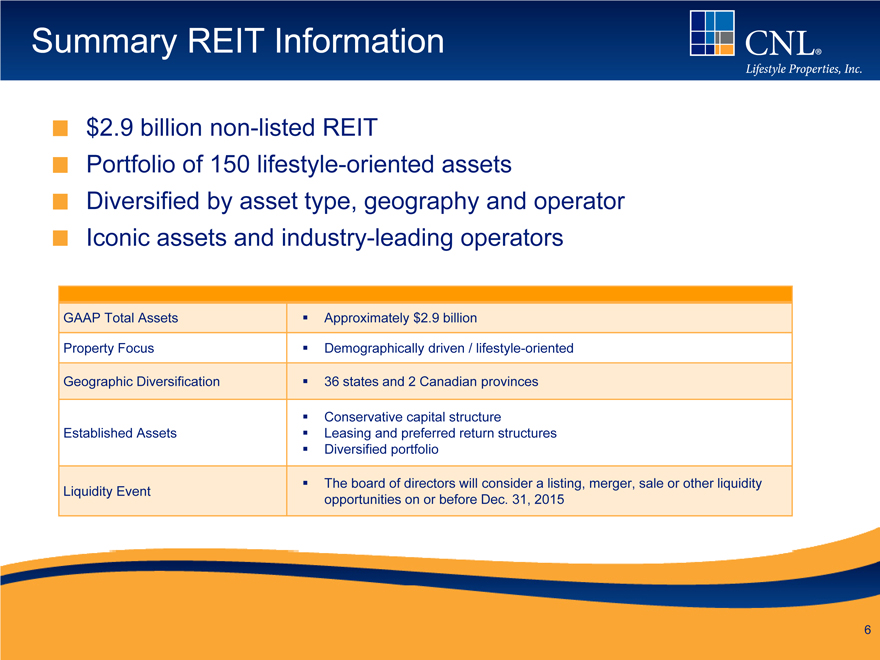

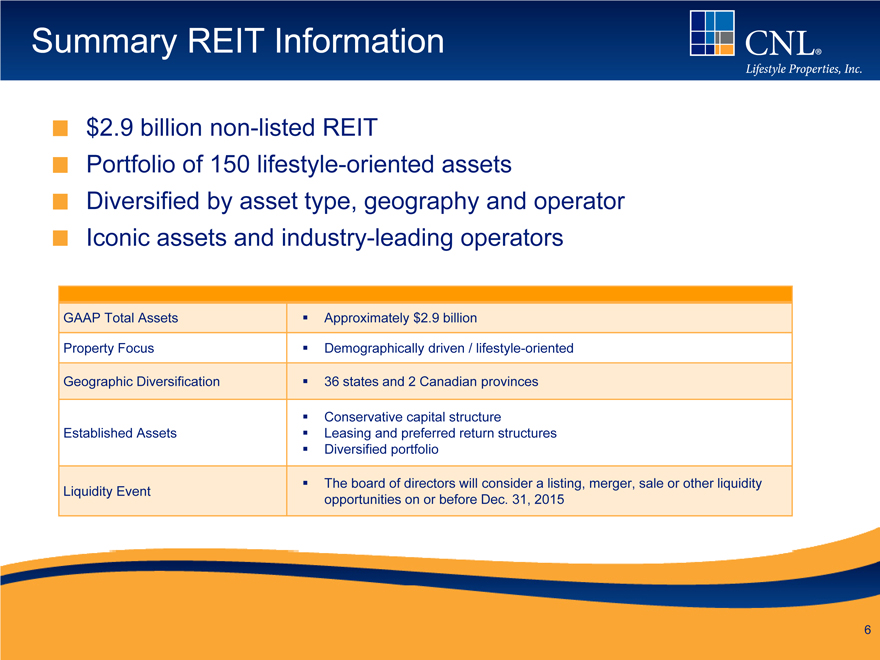

Summary REIT Information

$2.9 billion non-listed REIT

Portfolio of 150 lifestyle-oriented assets

Diversified by asset type, geography and operator Iconic assets and industry-leading operators

GAAP Total Assets Approximately $2.9 billion

Property Focus Demographically driven / lifestyle-oriented

Geographic Diversification 36 states and 2 Canadian provinces

Conservative capital structure

Established Assets Leasing and preferred return structures

Diversified portfolio

Liquidity Event The board of directors will consider a listing, merger, sale or other liquidity

opportunities on or before Dec. 31, 2015

6

Portfolio Snapshot*

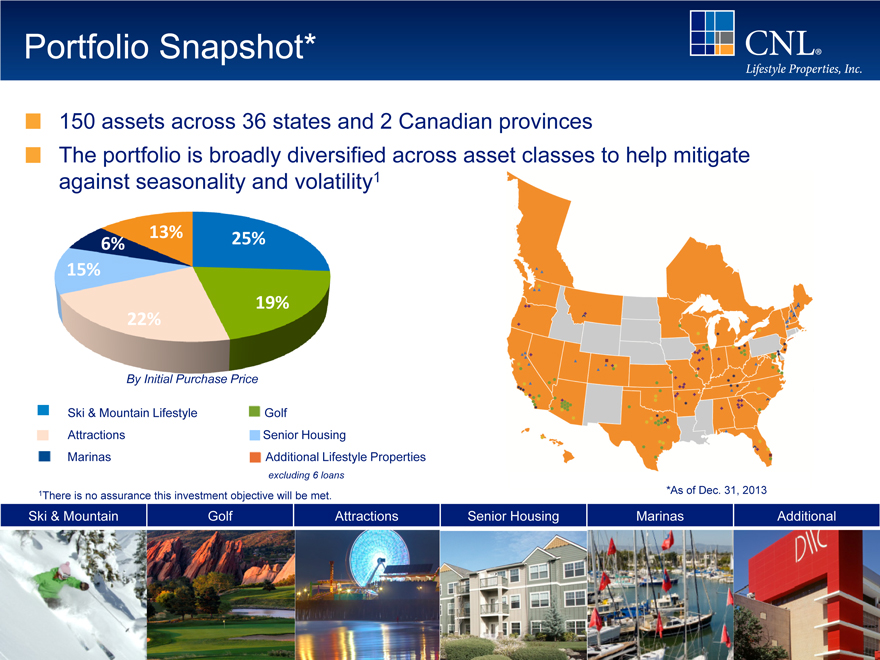

150 assets across 36 states and 2 Canadian provinces

The portfolio is broadly diversified across asset classes to help mitigate against seasonality and volatility1

13%

6% 25%

15%

19%

22%

By Initial Purchase Price

Ski & Mountain Lifestyle Golf

Attractions Senior Housing

Marinas Additional Lifestyle Properties

excluding 6 loans

1 There is no assurance this investment objective will be met.

Ski & Mountain Golf Attractions Senior Housing Marinas Additional

*As of Dec. 31, 2013

Overview

Board approved an estimated net asset value (NAV) per share of the company’s common stock of $6.85 as of Dec. 31, 2013 Board approved amendments to the company’s advisory agreement to eliminate all acquisition, debt, disposition and performance fees and reduce asset management fees Company engaged Jefferies LLC, a leading global investment banking and advisory firm, to formally begin the process of evaluating strategic alternatives to provide liquidity to shareholders

8

Overview

Board approved an estimated net asset value (NAV) per share of the company’s common stock of $6.85 as of Dec. 31, 2013 Board approved amendments to the company’s advisory agreement to eliminate all acquisition, debt, disposition and performance fees and reduce asset management fees Company engaged Jefferies LLC, a leading global investment banking and advisory firm, to formally begin the process of evaluating strategic alternatives to provide liquidity to shareholders

8

Since Prior Estimated NAV

Actively restructured challenged situations and non-performing tenants –

Golf and most-recently Marinas

Continued disposition of select “non-core” assets

Closed sale of Sunrise JV interests in 42 properties to Healthcare REIT

However, our senior housing portfolio continues to perform exceptionally well, with same

store values increasing

Purchased 13 new senior housing communities and two water parks, plus

acquired the North American rights to Wet ‘n’ Wild brand

Made significant strategic investments to grow existing properties

Expansion of the SplashTown Waterpark in Houston and re-branding to Wet ‘n’ Wild

SplashTown as an example

Positive growth and strengthening of tenants and property operations

through active asset management efforts

9

Estimated Net Asset Value (NAV)

Based on IPA Valuation Methodology1

Use of independent investment banking firm

Engaged CBRE Capital Advisors, Inc. (“CBRE Cap”), an independent investment banking firm, as valuation expert

Utilized discounted cash flow method

Tested for reasonableness using direct capitalization approach

Range provided by stressing key assumptions

Discount rates, terminal capitalization rates

Disclosure of methodology Individual MAI property appraisals

Does not include any potential additional value relating to the size or scale of components of the company’s portfolio of assets and is not necessarily indicative of the value the company would expect to realize from the portfolio as it pursues strategies to provide liquidity

Provided estimate of value as of Dec. 31, 2013

1There is no assurance that all of the IPA guidelines were met or that the IPA Valuation Methodology is acceptable to the SEC, FINRA or under ERISA for compliance with reporting requirements.

10

Methodology – Wholly Owned Assets

136 properties

CBRE’s appraisals utilized an unlevered 10-year discounted cash flow analysis from for each operating asset

For properties with third-party leases, valuation represents leased fee value A valuation range was calculated by varying the discount rate and terminal cap

Lease-up discount and costs-to-complete, where applicable, applied to value for non-stabilized properties One-time capital expenditures, where applicable, applied to property values Certain golf course assets valued based on market knowledge of recent activity for similar properties as well as qualified inquiries for the acquisition of various properties owned by the company Vacant land value derived from MAI appraisal, which is based on market sales comps

Cap rates and discount rates sourced from MAI appraisals and vary by location, asset quality and supply/demand metrics

11

Methodology – Partially Owned Assets

Eight properties

Valuation assumed a sale of the partially owned portfolios and net proceeds derived after debt repayment to capture specific joint venture promote structures

For sale values, CBRE relied on the MAI appraisal discounted cash flow value indications by property A valuation range was calculated by varying the discount rate and terminal cap rate

Cap rates and discount rates sourced from MAI appraisals and vary by location, asset quality and supply/demand metrics

12

Key Factors Impacting Change in NAV

Slow sector recoveries and financial impacts of actively addressing challenged tenant situations

Golf Marinas

Effect of weather extremes on property level performance

Golf and Attractions particularly impacted by rain and extreme weather

Fair market value of fixed debt

Unsecured notes have traded at a premium, which had negative impact

Unanticipated early repurchase of senior housing assets

Sale of 42 properties held in JV’s with HCN (SRZ) occurred approximately two years earlier than originally anticipated

13

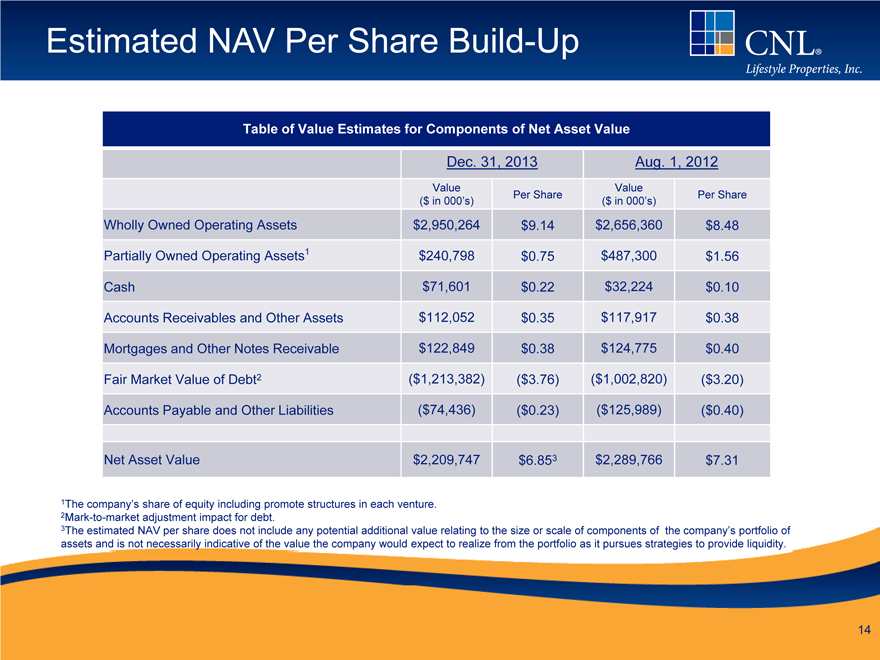

Estimated NAV Per Share Build-Up

Table of Value Estimates for Components of Net Asset Value

Dec. 31, 2013 Aug. 1, 2012

Value Value

Per Share Per Share

($ in 000’s) ($ in 000’s)

Wholly Owned Operating Assets $2,950,264 $9.14 $2,656,360 $ 8.48

Partially Owned Operating Assets1 $240,798 $0.75 $487,300 $ 1.56

Cash $71,601 $0.22 $32,224 $ 0.10

Accounts Receivables and Other Assets $112,052 $0.35 $117,917 $ 0.38

Mortgages and Other Notes Receivable $122,849 $0.38 $124,775 $ 0.40

Fair Market Value of Debt2 ($1,213,382) ($3.76) ($1,002,820) ($ 3.20)

Accounts Payable and Other Liabilities ($74,436) ($0.23) ($125,989) ($ 0.40)

Net Asset Value $2,209,747 $6.853 $2,289,766 $ 7.31

1The company’s share of equity including promote structures in each venture. 2Mark-to-market adjustment impact for debt.

3The estimated NAV per share does not include any potential additional value relating to the size or scale of components of the company’s portfolio of assets and is not necessarily indicative of the value the company would expect to realize from the portfolio as it pursues strategies to provide liquidity.

14

Re-pricing of Shares

Estimated NAV per share of $6.85 as of Dec. 31, 2013 Distribution Policy1

No anticipated change to the distribution policy at this time

Quarterly distribution remains at $.10625 per share, which represents an annual distribution rate of 6.2 percent on the estimated NAV per share of $6.85

Distribution Reinvestment Plan2

Available for purchase at the estimated NAV per share of $6.85, rather than a discount to NAV, effective March 6, 2014 New price effective for the Q1 2014 distribution Notice of participation change will be accepted so long as notice is received by the transfer agent, DST Systems, Inc. between March 6, 2014 and March 25, 2014

1The board of directors continues to evaluate the distribution rate on an ongoing basis. The amount of distributions declared is determined by the company’s board of directors and is dependent upon a number of factors, including projected level of MFFO, income and cash flows, REIT requirements, the desire to retain cash for growth, and avoiding distribution volatility, etc. The company’s Distribution Reinvestment Plan and Redemption Plan are subject to suspension, modification or termination at any time. To date, the company has experienced cumulative net losses. When the company has not generated sufficient operating cash flow or funds from operations sufficient to make distributions, it has and may continue to make cash distributions to shareholders from other sources, such as borrowings, which reduce cash available for investment in properties and other real estate-related assets and will lower overall return. The company has not established a limit on the extent to which it may use borrowings to pay cash distributions. For the years ended December 31, 2013, 2012, 2011 and 2010, distributions net of distributions reinvested were funded primarily from borrowings and also from cash from operating activities. Approximately 70.7%, 99.7%, 100.0%, and 100.0% respectively, were considered a return of capital to stockholders for federal income tax purposes. Our cash flows from operating activities will fluctuate due to the seasonality of certain properties.

2The company’s Distribution Reinvestment Plan and Redemption Plan are subject to suspension, modification or termination at any time.

15

Re-pricing of Shares

Redemption Plan1

Redemption price based on the estimated NAV as set forth in the amended redemption plan. Redemptions are limited and there is currently a wait list to redeem

1The company’s Distribution Reinvestment Plan and Redemption Plan are subject to suspension, modification or termination at any time.

16

Strategies for Looking Ahead1

Engaged leading global investment banking and advisory firm, Jefferies LLC, as advisor and initiated the active evaluation of strategic alternatives to provide liquidity Continue to dispose of assets that are not central to ongoing strategy Maximize growth in rental income and property operating income through continued:

Active asset management

Strategic investment into existing properties

Effective April 1, 2014, the Advisor will:

Eliminate all Acquisition, Debt, Disposition and Performance Fees Reduce Asset Management Fee from 100bps to 90bps

Consider further reductions to Asset Management Fee if the company has not materially begun to execute liquidity event or events before April 1, 2015

1 There is no assurance these objectives will be met. Forward-looking statements are based on current expectations and may be identified by words such as “believes,” “consider”, “continue”, “expects,” “may,” “could” and terms of similar substance, and speak only as of the date made. Actual results could differ materially due to risks and uncertainties that are beyond the REIT’s ability to control or accurately predict. Investors should not place undue reliance on forward-looking statements.

17

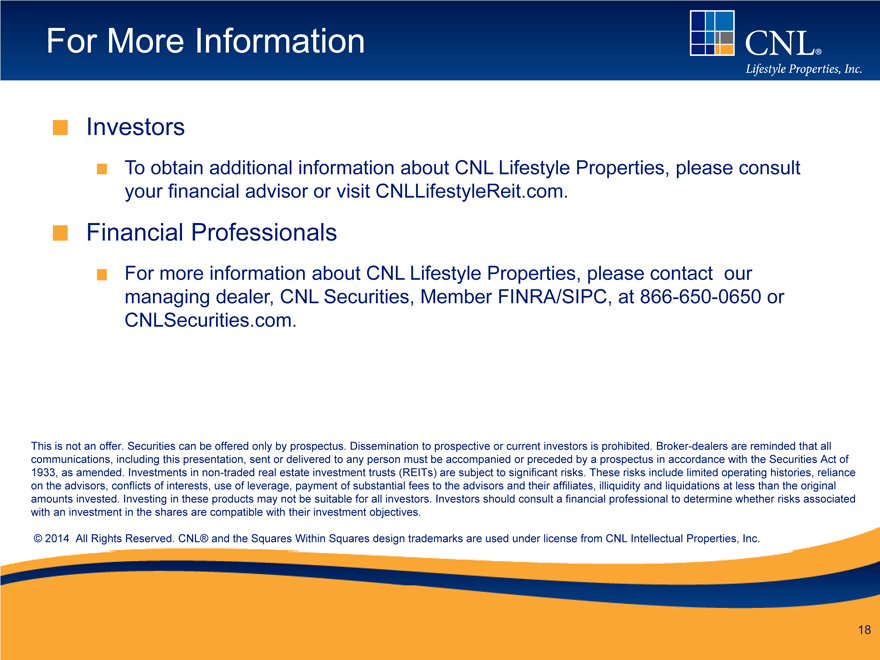

For More Information

Investors

To obtain additional information about CNL Lifestyle Properties, please consult your financial advisor or visit CNLLifestyleReit.com.

Financial Professionals

For more information about CNL Lifestyle Properties, please contact our managing dealer, CNL Securities, Member FINRA/SIPC, at 866-650-0650 or CNLSecurities.com.

This is not an offer. Securities can be offered only by prospectus. Dissemination to prospective or current investors is prohibited. Broker-dealers are reminded that all communications, including this presentation, sent or delivered to any person must be accompanied or preceded by a prospectus in accordance with the Securities Act of

1933, as amended. Investments in non-traded real estate investment trusts (REITs) are subject to significant risks. These risks include limited operating histories, reliance on the advisors, conflicts of interests, use of leverage, payment of substantial fees to the advisors and their affiliates, illiquidity and liquidations at less than the original amounts invested. Investing in these products may not be suitable for all investors. Investors should consult a financial professional to determine whether risks associated with an investment in the shares are compatible with their investment objectives.

© 2014 All Rights Reserved. CNL® and the Squares Within Squares design trademarks are used under license from CNL Intellectual Properties, Inc.

18