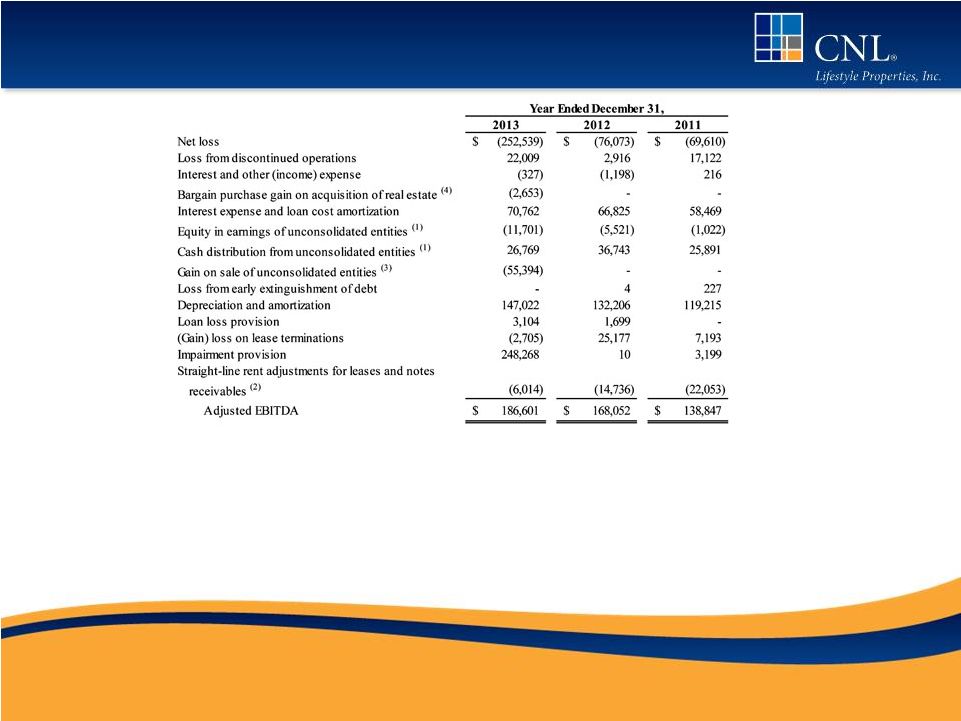

Reconciliation of FFO and MFFO to Net Loss 16 Source: CNL Lifestyle Properties 2013 Form 10-K The Company believes that its presentation of historical non-GAAP financial measures provides useful supplementary information to and facilitates additional analysis by investors. These historical non-GAAP financial measures are in addition to, not a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. Generally Accepted Accounting Principles. Past performance is not indicative of future returns. (1) Includes amounts related to the properties that are classified as assets held for sale and for which the related results are classified as income (loss) from discontinued operations in the accompanying consolidated statements of operations. (2) This amount represents our share of the FFO or MFFO adjustments allowable under the NAREIT or IPA definitions, respectively, multiplied by the percentage of income or loss recognized under the HLBV method. (3) In evaluating investments in real estate, management differentiates the costs to acquire the investment from the operations derived from the investment. By adding back acquisition fees and expense relating to business combinations, management believes MFFO provides useful supplemental information of its operat ing performance and will also allow comparability between real estate entities regardless of their level of acquisition activities. Acquisition fees and expenses include payments to our advisor or third parties. Acquisition fees and expenses relating to business combinations under GAAP are considered operating expenses and as expenses included in the determination of net income (loss) and income (loss) from continuing operations, both of which are performance measures under GAAP. All paid and accrued acquisition fees and expenses will have negative effects on returns to investors, the potential for future distributions, and cash flows generated by us, unless earnings from operations or net sales proceeds from the disposition of properties are generated to cover the purchase price of the property. (4) Under GAAP, rental receipts are allocated to periods using various methodologies. This may result in income recognition that is significantly different than underlying contract terms. By adjusting for these items (to reflect such payments from a GAAP accrual basis to a cash basis of disclosing the rent and lease payments), MFFO provides useful supplemental information on the realized economic impact of lease terms and debt investments, providing insight on the contractual cash flows of such lease terms and debt investments, and aligns results with management’s analysis of operating performance. (5) (Gain) loss of extinguishment of debt includes legal fees incurred with the transaction, prepayment penalty fees and write-off of unamortized loan costs, as applicable. (6) Management believes that adjusting for gains or write-offs of, lease related assets is appropriate because they are non-recurring non-cash adjustments that may not be reflective of our ongoing operating performance. In 2013, we recorded an impairment provisions totaling $58.1 million for deferred rent from prior GAAP straight-lining adjustments and lease incentives which resulted from a change in our expected holding periods for those properties. (7) In July 2013, we completed the sale of our interests in 42 senior housing properties held through three unconsolidated joint ventures. (8) The add back for impairment of real estate assets to arrive at FFO does not include approximately $58.1 million in impairments of deferred rent from prior GAAP straight-lining adjustments and lease incentives described in Footnote (6) above. While impairment charges are excluded from the calculation of FFO, investors are cautioned that due to the fact that impairments are based on estimated future undiscounted cash flows and the relatively limited term of our operations, it could be difficult to recover any impairment charges. |