Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-164629

THE FRONTIER FUND

(a Delaware statutory trust)

Supplement

dated January 28, 2011 to the

Prospectus

and Disclosure Document

dated April 30, 2010

THE FRONTIER FUND

FRONTIER DIVERSIFIED SERIES; FRONTIER DYNAMIC SERIES; FRONTIER

LONG/SHORT COMMODITY SERIES; FRONTIER MASTERS SERIES

Supplement dated January 28, 2011 to the Prospectus and Disclosure Document Dated as of April 30, 2010

The following information amends the disclosure in the Prospectus and Disclosure Document dated as of April 30, 2010 (the “Prospectus”). If any statement in this supplement conflicts with a statement in the Prospectus, the statement in this supplement controls.

Risk Disclosure Statement

The disclosure included on the inside cover of the Prospectus under the heading “COMMODITY FUTURES TRADING COMMISSION RISK DISCLOSURE STATEMENT” is hereby deleted in its entirety and replaced with the following:

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT COMMODITY INTEREST TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED TO THIS POOL AT PAGES 13 TO 15 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 19.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 21-36.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

2

The Trust and Managing Owner

The fifth sentence included in the paragraph entitled “The Trust and Managing Owner” on the cover page of the Prospectus is hereby deleted in its entirety and replaced with the following:

“As of October 31, 2010, the net asset value per unit was: Frontier Diversified Series: $104.84 (Class 1), $107.43 (Class 2); Frontier Masters Series: $103.41 (Class 1), $105.94 (Class 2); Frontier Long/Short Commodity Series: $111.98 (Class 1a), $114.69 (Class 2a); and Frontier Dynamic Series: $92.27 (Class 1), $94.45 (Class 2).”

SUMMARY

The Units

The fifth paragraph under the heading “SUMMARY—The Units” is hereby deleted in its entirety and replaced with the following:

“The percent return (and associated dollar amount) that your investment must earn in the indicated series, after taking into account estimated interest income, in order to break-even after one year is as follows (please see the “Break-Even Analysis” on page 19): Frontier Diversified Series: Class 1 – 4.75% ($47.50); Class 2 – 2.59% ($25.90); Class 3 – 2.34% ($23.40); Frontier Masters Series: Class 1 – 5.65% ($56.50); Class 2 – 3.68% ($36.80); Class 3 – 3.43% ($34.30); Frontier Long/Short Commodity Series: Class 1a – 5.24% ($52.40); Class 2a – 3.49% ($34.90); Class 3a – 3.24% ($32.40); Frontier Dynamic Series: Class 1 – 5.67% ($56.70); Class 2 – 3.84% ($38.40); Class 3 – 3.59% ($35.90).”

3

BREAK-EVEN ANALYSIS

The tables included under the heading “BREAK-EVEN ANALYSIS” are hereby deleted and replaced in their entirety with the following:

FRONTIER DIVERSIFIED SERIES

| Class 1 | Class 2 | Class 3(8) | ||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||

Management Fee(1) | 7.50 | 0.75 | 7.50 | 0.75 | 7.50 | 0.75 | ||||||||||||||||||

Service Fee(2) | 20.00 | 2.00 | 2.50 | 0.25 | 0.00 | 0.00 | ||||||||||||||||||

Brokerage Commissions and Investment and Trading Fees and Expenses(3) | 32.10 | 3.21 | 32.10 | 3.21 | 32.10 | 3.21 | ||||||||||||||||||

Incentive Fee (4) | 4.10 | 0.41 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Less Interest income(5) | (17.40 | ) | (1.74 | ) | (17.40 | ) | (1.74 | ) | (17.40 | ) | (1.74 | ) | ||||||||||||

Due Diligence and Custodial Fees and Expenses(6) | 1.20 | 0.12 | 1.20 | 0.12 | 1.20 | 0.12 | ||||||||||||||||||

Redemption Fee(7) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Trading profit the series must earn for you to recoup your investment after one year | 47.50 | 4.75 | 25.90 | 2.59 | 23.40 | 2.34 | ||||||||||||||||||

FRONTIER MASTERS SERIES

| Class 1 | Class 2 | Class 3(8) | ||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||

Management Fee(1) | 20.00 | 2.00 | 20.00 | 2.00 | 20.00 | 2.00 | ||||||||||||||||||

Service Fee(2) | 20.00 | 2.00 | 2.50 | 0.25 | 0.00 | 0.00 | ||||||||||||||||||

Brokerage Commissions and Investment and Trading Fees and Expenses(3) | 30.50 | 3.05 | 30.50 | 3.05 | 30.50 | 3.05 | ||||||||||||||||||

Incentive Fee(4) | 2.20 | 0.22 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Less Interest income(5) | (17.40 | ) | (1.74 | ) | (17.40 | ) | (1.74 | ) | (17.40 | ) | (1.74 | ) | ||||||||||||

Due Diligence and Custodial Fees and Expenses(6) | 1.20 | 0.12 | 1.20 | 0.12 | 1.20 | 0.12 | ||||||||||||||||||

Redemption Fee(7) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Trading profit the series must earn for you to recoup your investment after one year | 56.50 | 5.65 | 36.80 | 3.68 | 34.30 | 3.43 | ||||||||||||||||||

FRONTIER LONG/SHORT COMMODITY SERIES

| Class 1a | Class 2a | Class 3a(8) | ||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||

Management Fee(1) | 20.00 | 2.00 | 20.00 | 2.00 | 20.00 | 2.00 | ||||||||||||||||||

Service Fee(2) | 20.00 | 2.00 | 2.50 | 0.25 | 0.00 | 0.00 | ||||||||||||||||||

Brokerage Commissions and Investment and Trading Fees and Expenses(3) | 28.60 | 2.86 | 28.60 | 2.86 | 28.60 | 2.86 | ||||||||||||||||||

Incentive Fee(4) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Less Interest income(5) | (17.40 | ) | (1.74 | ) | (17.40 | ) | (1.74 | ) | (17.40 | ) | (1.74 | ) | ||||||||||||

Due Diligence and Custodial Fees and Expenses(6) | 1.20 | 0.12 | 1.20 | 0.12 | 1.20 | 0.12 | ||||||||||||||||||

Redemption Fee(7) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Trading profit the series must earn for you to recoup your investment after one year | 52.40 | 5.24 | 34.90 | 3.49 | 32.40 | 3.24 | ||||||||||||||||||

4

FRONTIER DYNAMIC SERIES

| Class 1 | Class 2 | Class 3(8) | ||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||

Management Fee | 20.00 | 2.00 | 20.00 | 2.00 | 20.00 | 2.00 | ||||||||||||||||||

Service Fee(2) | 20.00 | 2.00 | 2.50 | 0.25 | 0.00 | 0.00 | ||||||||||||||||||

Brokerage Commissions and Investment and Trading Fees and Expenses(3, 9) | 32.10 | 3.21 | 32.10 | 3.21 | 32.10 | 3.21 | ||||||||||||||||||

Incentive Fee | 0.80 | 0.08 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Less Interest income(5, 9) | (17.40 | ) | (1.74 | ) | (17.40 | ) | (1.74 | ) | (17.40 | ) | (1.74 | ) | ||||||||||||

Due Diligence and Custodial Fees and Expenses(6, 9) | 1.20 | 0.12 | 1.20 | 0.12 | 1.20 | 0.12 | ||||||||||||||||||

Redemption Fee(7) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Trading profit the series must earn for you to recoup your investment after one year | 56.70 | 5.67 | 38.40 | 3.84 | 35.90 | 3.59 | ||||||||||||||||||

5

RISK FACTORS

The risk factor included under the heading “RISK FACTORS—OTC Transactions Are Subject to Little, if Any, Regulation and May Be Subject to the Risk of Counterparty Default” is deleted in its entirety and replaced with the following:

OTC Transactions Are Subject to Little, if Any, Regulation and May Be Subject to the Risk of Counterparty Default.

A portion of each series’ assets may be used to trade OTC commodity interest contracts, such as forward contracts, option contracts in foreign currencies and other commodities, or swaps or spot contracts. OTC contracts are typically traded on a principal-to-principal basis through dealer markets that are dominated by major money center and investment banks and other institutions and are essentially unregulated by the CFTC. You therefore do not receive the protection of CFTC regulation or the statutory scheme of the Commodity Exchange Act in connection with this trading activity. The markets for OTC contracts rely upon the integrity of market participants in lieu of the additional regulation imposed by the CFTC on participants in the futures markets. The lack of regulation in these markets could expose a series in certain circumstances to significant losses in the event of trading abuses or financial failure by participants.

Each series also faces the risk of non-performance by the counterparties to the OTC contracts. Unlike in futures contracts, the counterparty to these contracts is generally a single bank or other financial institution, rather than a clearing organization backed by a group of financial institutions. As a result, there will be greater counterparty credit risk in these transactions. The clearing member, clearing organization or other counterparty may not be able to meet its obligations, in which case the applicable series could suffer significant losses on these contracts.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) will affect the manner in which OTC swap transactions are traded and the credit risk associated with such trading. Depending upon actions taken by regulatory authorities, these changes may also affect the manner of trading of OTC foreign currency transactions. The general effective date of the derivatives portion of the Dodd-Frank Act is one year following its enactment. Transactions that have been entered into prior to implementation of the provisions of the Dodd-Frank Act will remain in effect. Accordingly, even after the new regulatory framework is fully implemented, the risks of OTC contracts will continue to be considerations with respect to transactions entered into prior to the implementation of the provisions of the Dodd-Frank Act.

An additional risk factor is hereby added under the heading “RISK FACTORS—The Frontier Fund Will Have Counterparty Risk to U.S. Bank” on page 31 of the Prospectus:

The Frontier Fund Will Have Counterparty Risk to U.S. Bank

Each of the trading companies currently holds all cash deposits not used for margin with U.S. Bank, although the managing owner may chose to hold the trading companies’ cash at other banks in its sole discretion. Because all cash deposits not used for margin are currently held at U.S. Bank, the Frontier Fund is subject to the risk that U.S. Bank may fail or that such cash deposits will not be available to the trading companies or the Frontier Fund. This could have a significant impact on you and your investment.

6

PAST PERFORMANCE OF THE SERIES

The text, table and footnotes included under the heading “PAST PERFORMANCE OF THE SERIES” are deleted in their entirety and replaced with the following:

PAST PERFORMANCE OF THE SERIES

Set forth in Capsules I-IV below is the performance record of trading of each currently offered series of the trust from its inception through October 31, 2010.

CAPSULE I | ||||

Series | Frontier Diversified Series Class 1 | Frontier Diversified Series Class 2 | ||

Type of pool | Publicly-Offered; Multi-Advisor; Not Principal-Protected | Publicly-Offered; Multi-Advisor; Not Principal-Protected | ||

Inception of trading | June 9, 2009 | June 9, 2009 | ||

Aggregate subscriptions(1) | $85,313,322.17 | $63,909,574.77 | ||

Current capitalization(1) | $88,881,322.56 | $69,476,658.40 | ||

Worst monthly % drawdown since inception(1)(2) | -3.98% (Jan 2010) | -3.85% (Jan 2010) | ||

Worst month-end peak-to-valley drawdown since inception(1)(3) | -7.45% (Nov 2009 to Jan 2010) | -7.18% (Nov 2009 to Jan 2010) | ||

Monthly performance | ||||

| Month | 2010 | 2009 | 2010 | 2009 | ||||||||||||

January | -3.98 | % | — | -3.85 | % | — | ||||||||||

February | 0.45 | % | — | 0.58 | % | — | ||||||||||

March | 2.28 | % | — | 2.44 | % | — | ||||||||||

April | 2.20 | % | — | 2.35 | % | — | ||||||||||

May | -0.05 | % | — | 0.08 | % | — | ||||||||||

June | -0.03 | % | -1.89 | % | 0.12 | % | -1.79 | % | ||||||||

July | -2.02 | % | -0.74 | % | -1.88 | % | -0.59 | % | ||||||||

August | 4.09 | % | 0.31 | % | 4.25 | % | 0.46 | % | ||||||||

September | 1.25 | % | 1.29 | % | 1.40 | % | 1.45 | % | ||||||||

October | 4.13 | % | 0.08 | % | 4.27 | % | 0.22 | % | ||||||||

November | 1.41 | % | 1.57 | % | ||||||||||||

December | -3.61 | % | -3.47 | % | ||||||||||||

Year | 8.31 | % | -3.20 | % | 9.88 | % | -2.23 | % | ||||||||

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

7

CAPSULE II | ||||

Series | Frontier Masters Series Class 1 | Frontier Masters Series Class 2 | ||

Type of pool | Publicly-Offered; Multi-Advisor; Not Principal-Protected | Publicly-Offered; Multi-Advisor; Not Principal-Protected | ||

Inception of trading | June 9, 2009 | June 9, 2009 | ||

Aggregate subscriptions(1) | $39,447,899.58 | $24,138,527.91 | ||

Current capitalization(1) | $40,540,328.76 | $25,629,324.35 | ||

Worst monthly % drawdown since | -5.74% (Dec 2009) | -5.60% (Dec 2009) | ||

Worst month-end peak-to-valley drawdown since inception(1)(3) | -9.41% (Nov 2009 to Feb 2010) | -9.03% (Nov 2009 to Feb 2010) | ||

Monthly performance | ||||

| Month | 2010 | 2009 | 2010 | 2009 | ||||||||||||

January | -3.54 | % | — | -3.40 | % | — | ||||||||||

February | -0.37 | % | — | -0.24 | % | — | ||||||||||

March | 4.32 | % | — | 4.48 | % | — | ||||||||||

April | 0.57 | % | — | 0.71 | % | — | ||||||||||

May | -1.46 | % | — | -1.33 | % | — | ||||||||||

June | -0.20 | % | -2.03 | % | -0.04 | % | -1.92 | % | ||||||||

July | -1.70 | % | -1.64 | % | -1.56 | % | -1.49 | % | ||||||||

August | 4.24 | % | -0.30 | % | 4.40 | % | -0.15 | % | ||||||||

September | 3.56 | % | 2.33 | % | 3.73 | % | 2.49 | % | ||||||||

October | 4.05 | % | -0.57 | % | 4.19 | % | -0.47 | % | ||||||||

November | 2.52 | % | 2.67 | % | ||||||||||||

December | -5.74 | % | -5.60 | % | ||||||||||||

Year | 9.47 | % | -5.54 | % | 11.08 | % | -4.63 | % | ||||||||

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

8

CAPSULE III | ||||

Series | Frontier Long/Short Commodity Series Class 1a | Frontier Long/Short Commodity Series Class 2a | ||

Type of pool | Publicly-Offered; Multi-Advisor; Not Principal-Protected | Publicly-Offered; Multi-Advisor; Not Principal-Protected | ||

Inception of trading | June 9, 2009 | June 9, 2009 | ||

Aggregate subscriptions(1) | $4,329,581.71 | $2,825,204.90 | ||

Current capitalization(1) | $4,547,105.58 | $3,030,980.41 | ||

Worst monthly % drawdown since inception(1)(2) | -5.19% (Jan 2010) | -5.09% (Jan 2010) | ||

Worst month-end peak-to-valley drawdown since inception(1)(3) | -7.13% (Nov 2009 to Jun 2010) | -6.77% (Nov 2009 to Jan 2010) | ||

Monthly performance | ||||

| Month | 2010 | 2009 | 2010 | 2009 | ||||||||||||

January | -5.19 | % | — | -5.09 | % | — | ||||||||||

February | 0.54 | % | — | 0.67 | % | — | ||||||||||

March | 2.66 | % | — | 2.82 | % | — | ||||||||||

April | 3.87 | % | — | 4.02 | % | — | ||||||||||

May | -4.15 | % | — | -4.02 | % | — | ||||||||||

June | -2.83 | % | -2.47 | % | -2.67 | % | -2.36 | % | ||||||||

July | 0.43 | % | 0.52 | % | 0.57 | % | 0.64 | % | ||||||||

August | 0.94 | % | -0.59 | % | 1.09 | % | -0.45 | % | ||||||||

September | 8.03 | % | 1.14 | % | 8.18 | % | 1.29 | % | ||||||||

October | 6.43 | % | 1.00 | % | 6.58 | % | 1.17 | % | ||||||||

November | 3.92 | % | 4.07 | % | ||||||||||||

December | -1.90 | % | -1.77 | % | ||||||||||||

Year | 10.33 | % | 1.49 | % | 11.91 | % | 2.48 | % | ||||||||

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

9

CAPSULE IV | ||||

Series | Frontier Dynamic Series Class 1 | Frontier Dynamic Series Class 2 | ||

Type of pool | Publicly-Offered; Multi-Advisor; Not Principal-Protected | Publicly-Offered; Multi-Advisor; Not Principal-Protected | ||

Inception of trading | June 9, 2009 | June 9, 2009 | ||

Aggregate subscriptions(1) | $1,431,810.21 | $410,393.90 | ||

Current capitalization(1) | $1,226,524.77 | $413,935.58 | ||

Worst monthly % drawdown since inception(1)(2) | -2.93% (Jun 2009) | -2.82% (June 2009) | ||

Worst month-end peak-to-valley drawdown since inception(1)(3) | -11.65% (May 2009 to Jul 2010) | -9.94% (May 2009 to Jul 2010) | ||

Monthly performance | ||||

| Month | 2010 | 2009 | 2010 | 2009 | ||||||||||||

January | -1.18 | % | — | -1.04 | % | — | ||||||||||

February | -0.05 | % | — | 0.09 | % | — | ||||||||||

March | 0.34 | % | — | 0.50 | % | — | ||||||||||

April | 0.01 | % | — | 0.15 | % | — | ||||||||||

May | -1.09 | % | — | -0.95 | % | — | ||||||||||

June | 0.17 | % | -2.93 | % | 0.33 | % | -2.82 | % | ||||||||

July | -1.60 | % | -0.16 | % | -1.46 | % | -0.01 | % | ||||||||

August | 1.76 | % | 0.55 | % | 1.91 | % | 0.70 | % | ||||||||

September | 1.39 | % | -0.91 | % | 1.53 | % | -0.77 | % | ||||||||

October | 1.22 | % | -0.49 | % | 1.36 | % | -0.43 | % | ||||||||

November | -2.17 | % | -2.02 | % | ||||||||||||

December | -2.74 | % | -2.59 | % | ||||||||||||

Year | 0.92 | % | -8.57 | % | 2.39 | % | -7.75 | % | ||||||||

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

| (1) | “Aggregate subscriptions,” “Current capitalization,” “Worst monthly % drawdown since inception,” “Worst month-end peak-to-valley drawdown since inception” and “Monthly Performance” are provided for each offered class of investors and include subscriptions and capitalization through October 31, 2010. |

| (2) | “Worst monthly % drawdown since inception” means losses experienced in the net asset value per unit over the specified period and is calculated by dividing the net change in the net asset value per unit by the beginning net asset value per unit for the relevant period. “Decline” is measured on the basis of monthly returns only, and does not reflect intra-month figures. |

| (3) | “Worst month-end peak-to-valley drawdown since inception” is the largest percentage decline in the net asset value per unit over the specified period. This need not be a continuous decline, but can be a series of positive and negative returns where the negative returns are larger than the positive ones. |

10

THE MANAGING OWNER

The following is hereby added under the heading “THE MANAGING OWNER—Principals of the Managing Owner—Executive Committee”:

David P. DeMuthis a member of the Executive Committee of the managing owner. Mr. DeMuth is pending as a principal of the managing owner since January 2011. In May 2006, he co-founded CFO Consulting Partners LLC, an entity which provides interim CFO services to public and private companies.

Prior to co-founding CFO Consulting Partners LLC, he was an independent consultant providing accounting and risk management services from March 2002 to April 2006, Interim Co-Chief Financial Officer and Treasurer at Kodak Polychrome Graphics (a $2 billion global manufacturer of graphic arts materials) from September 1999 to March 2002, CFO of Troy Corporation (a $150 million global specialty chemical manufacturer) from June 1996 to September 1999, Division Vice President of Continental Grain Company (a multi-billion provider of commodities and financial services) from August 1990 to June 1996, Treasurer of National Starch and Chemical Company (a $3 billion global specialty chemical manufacturer) from March 1986 to August 1990, and Director of Tax Services at PepsiCo Inc. (a multi-billion global consumer products (beverage and food) company) from May 1980 to March 1986. His industry experience includes technology, real estate development, financial services, specialty chemicals, global manufacturing/distribution, graphic arts and consumer products. His global focus is Risk Management, Internal Controls, Structured Capital Market Transactions and Regulatory Compliance. He has developed complex global strategies to manage financial reporting, financial and operations risks and compliance with regulatory authorities (SEC, tax, etc.). He was an accountant with KPMG, an accounting firm, from September 1974 to May 1980.

Mr. DeMuth holds a BS in Accounting from Loyola University, and an MBA in Finance from LaSalle University. He is a Certified Public Accountant (CPA).

11

Performance Summary for Previously Offered Commodity Pools

The table and notes included under the heading “THE MANAGING OWNER—Performance Information—Non-Offered Series” is deleted in its entirety and replaced with the following:

THE FRONTIER FUND

CAPSULE SUMMARY OF PERFORMANCE INFORMATION REGARDING

PREVIOUSLY OFFERED COMMODITY POOLS

| CAPSULE I | CAPSULE II | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series | Balanced Series Class 1 | Balanced Series Class 2 | Balanced Series Class 1A(1) | Balanced Series Class 2A(2) | Balanced Series Class 3A(3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Type of pool |

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Inception Trading | September 24, 2004 | September 24, 2004 | May 1, 2006 | May 1, 2006 | 4-Jun-09 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Close Date(5) | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Aggregate Subscri | $408,905,876.70 | $122,209,370.88 | $17,553,890.99 | $3,814,043.79 | $4,537,533.09 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Current Capita | $295,229,438.80 | $78,788,031.19 | $5,284,431.15 | $3,577,053.78 | $3,957,164.42 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worst | -7.02% (July 2007) | -6.77% (July 2007) | -7.06% (July 2007) | -6.81% (July 2007) | -5.39% (January 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worst | | -13.76% (April 2006 to August 2007) | | | -12.50% (June 2007 to August 2007) | | | -14.76% (April 2006 to August 2007) | | | -12.58% (June 2007 to August 2007) | | | -9.69% (November 2009 to | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Month | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2010 | 2009 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

January | -5.56 | % | 1.34 | % | -0.55 | % | 1.20 | % | 3.47 | % | -4.29 | % | -5.34 | % | 1.59 | % | -0.30 | % | 1.47 | % | 3.73 | % | -4.04 | % | -5.62 | % | 1.28 | % | -0.57 | % | 1.14 | % | 3.46 | % | -4.30 | % | -5.39 | % | 1.53 | % | -0.33 | % | 1.41 | % | 3.72 | % | -4.05 | % | -5.39 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

February | 1.64 | % | 0.33 | % | 7.52 | % | -4.38 | % | -2.95 | % | -1.10 | % | 1.87 | % | 0.56 | % | 7.78 | % | -4.16 | % | -2.73 | % | -0.87 | % | 1.58 | % | 0.25 | % | 7.50 | % | -4.35 | % | -2.96 | % | -1.11 | % | 1.81 | % | 0.48 | % | 7.77 | % | -4.20 | % | -2.74 | % | -0.88 | % | 1.81 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

March | 3.54 | % | -1.62 | % | -0.48 | % | -3.17 | % | 3.62 | % | -2.11 | % | 3.82 | % | -1.36 | % | -0.22 | % | -2.93 | % | 3.89 | % | -1.85 | % | 3.48 | % | -1.71 | % | -0.49 | % | -3.22 | % | 3.61 | % | -2.12 | % | 3.76 | % | -1.45 | % | -0.24 | % | -2.98 | % | 3.88 | % | -1.86 | % | 3.76 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

April | 3.48 | % | -2.35 | % | 0.26 | % | 2.77 | % | 1.26 | % | -5.45 | % | 3.74 | % | -2.11 | % | 0.50 | % | 3.03 | % | 1.51 | % | -5.22 | % | 3.42 | % | -2.36 | % | 0.23 | % | 2.72 | % | 1.25 | % | -5.46 | % | 3.68 | % | -2.12 | % | 0.48 | % | 2.98 | % | 1.50 | % | -5.23 | % | 3.68 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

May | -0.98 | % | 1.73 | % | 1.11 | % | 5.66 | % | -2.26 | % | 2.83 | % | -0.76 | % | 1.98 | % | 1.36 | % | 5.93 | % | -2.00 | % | 3.20 | % | -1.06 | % | 1.77 | % | 1.10 | % | 5.61 | % | -2.73 | % | 2.82 | % | -0.83 | % | 1.97 | % | 1.34 | % | 5.88 | % | -2.50 | % | 3.19 | % | -0.83 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

June | 0.15 | % | -2.67 | % | 5.50 | % | 0.59 | % | -1.77 | % | 4.09 | % | 0.42 | % | -2.41 | % | 5.81 | % | 0.82 | % | -1.53 | % | 4.35 | % | 0.07 | % | -2.71 | % | 5.53 | % | 0.55 | % | -1.82 | % | 4.08 | % | 0.34 | % | -2.46 | % | 5.79 | % | 0.78 | % | -1.58 | % | 4.34 | % | 0.34 | % | -2.64 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

July | -3.30 | % | -1.04 | % | -2.74 | % | -7.02 | % | -1.48 | % | -1.60 | % | -3.06 | % | -0.79 | % | -2.49 | % | -6.77 | % | -1.23 | % | -1.35 | % | -3.38 | % | -1.09 | % | -2.71 | % | -7.06 | % | -1.55 | % | -1.61 | % | -3.14 | % | -0.83 | % | -2.46 | % | -6.81 | % | -1.30 | % | -1.36 | % | -3.14 | % | -0.84 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

August | 6.28 | % | 0.22 | % | 0.15 | % | -6.37 | % | -0.85 | % | -0.17 | % | 6.56 | % | 0.48 | % | 0.39 | % | -6.15 | % | -0.59 | % | 0.09 | % | 6.17 | % | 0.16 | % | 0.15 | % | -6.42 | % | -0.88 | % | -0.18 | % | 6.45 | % | 0.42 | % | 0.38 | % | -6.19 | % | -0.63 | % | 0.08 | % | 6.45 | % | 0.43 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

September | 2.30 | % | 1.99 | % | 0.50 | % | 5.13 | % | -1.75 | % | 0.60 | % | 2.56 | % | 2.24 | % | 0.76 | % | 5.38 | % | -1.53 | % | 0.85 | % | 2.25 | % | 1.94 | % | 0.44 | % | 5.09 | % | -1.81 | % | 0.59 | % | 2.50 | % | 2.19 | % | 0.70 | % | 5.35 | % | -1.58 | % | 0.84 | % | 2.48 | % | 2.17 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

October | 4.63 | % | -0.82 | % | 4.13 | % | 3.04 | % | 0.22 | % | -0.79 | % | 4.88 | % | -0.58 | % | 4.39 | % | 3.32 | % | 0.49 | % | -0.54 | % | 4.47 | % | -0.88 | % | 4.12 | % | 3.01 | % | 0.17 | % | -0.80 | % | 4.72 | % | -0.63 | % | 4.39 | % | 3.28 | % | 0.43 | % | -0.55 | % | 4.72 | % | -0.63 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

November | 2.43 | % | 3.39 | % | -1.96 | % | 2.07 | % | 8.12 | % | 2.69 | % | 3.63 | % | -1.72 | % | 2.32 | % | 8.39 | % | 2.36 | % | 3.40 | % | -2.00 | % | 2.00 | % | 8.11 | % | 2.62 | % | 3.64 | % | -1.76 | % | 2.26 | % | 8.38 | % | 2.62 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

December | -4.71 | % | 2.85 | % | 0.54 | % | 2.71 | % | -0.79 | % | -4.46 | % | 3.13 | % | 0.80 | % | 2.95 | % | -0.53 | % | -4.78 | % | 2.90 | % | 0.51 | % | 2.67 | % | �� | -0.80 | % | -4.54 | % | 3.18 | % | 0.77 | % | 2.91 | % | -0.54 | % | -4.54 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Year | 12.20 | % | -5.30 | % | 23.37 | % | -4.88 | % | 1.99 | % | -1.37 | % | 15.02 | % | -2.41 | % | 27.18 | % | -1.98 | % | 5.08 | % | 1.76 | % | 11.33 | % | -5.88 | % | 23.32 | % | -5.29 | % | 1.08 | % | -1.50 | % | 14.12 | % | -3.04 | % | 27.06 | % | -2.47 | % | 4.11 | % | 1.64 | % | 14.10 | % | -3.58 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

12

| CAPSULE III | CAPSULE IV | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series | Campbell/Graham/Tiverton Series Class 1(10) | Campbell/Graham/Tiverton Series Class 2(11) | Currency Series Class 1(12) | Currency Series Class 2(13) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Type of pool |

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Inception | February 14, 2005 | February 14, 2005 | September 24, 2004 | September 24, 2004 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Close Date(5) | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Aggregate Subscri | $93,587,693.25 | $15,537,186.54 | $16,106,446.30 | $6,318,254.17 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Current Capita | $65,411,738.98 | $8,527,171.16 | $6,834,807.40 | $801,692.83 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worst Monthly Decline-Last 5 Years(8) | -8.59% (July 2007) | -8.34% (July 2007) | -7.24% (September 2008) | -6.99% (September 2008) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worst | -13.33% (June 2007 to August 2007) | -12.89% (June 2007 to August 2007) | -27.64% (March 2008 to January 2010) | -23.54% (March 2008 to January 2010) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Month | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

January | -5.29 | % | 0.03 | % | 0.32 | % | 0.23 | % | 1.24 | % | -5.06 | % | 0.27 | % | 0.58 | % | 0.50 | % | 1.50 | % | -1.19 | % | -3.07 | % | -0.47 | % | 0.02 | % | 0.71 | % | -0.42 | % | -0.95 | % | -2.83 | % | -0.22 | % | 0.29 | % | 0.97 | % | -0.17 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

February | 0.65 | % | 0.35 | % | 4.10 | % | -5.80 | % | -1.21 | % | -4.29 | % | 0.88 | % | 0.58 | % | 4.34 | % | -5.59 | % | -1.00 | % | -4.15 | % | 0.57 | % | -0.51 | % | 3.10 | % | -2.46 | % | 0.14 | % | 0.67 | % | 0.80 | % | -0.28 | % | 3.34 | % | -2.24 | % | 0.37 | % | 0.91 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

March | 1.50 | % | -2.99 | % | 0.69 | % | -3.99 | % | 2.75 | % | -2.69 | % | 1.77 | % | -2.74 | % | 0.94 | % | -3.76 | % | 3.01 | % | -2.44 | % | 2.57 | % | -2.30 | % | 3.11 | % | -0.55 | % | -0.27 | % | -1.12 | % | 2.85 | % | -2.04 | % | 3.37 | % | -0.31 | % | -0.01 | % | -0.87 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

April | 1.08 | % | -2.93 | % | -2.44 | % | 4.25 | % | 1.11 | % | -5.65 | % | 1.33 | % | -2.69 | % | -2.20 | % | 4.51 | % | 1.33 | % | -5.45 | % | 0.10 | % | -2.73 | % | -2.78 | % | 3.41 | % | 0.01 | % | -1.16 | % | 0.34 | % | -2.49 | % | -2.54 | % | 3.67 | % | 0.24 | % | -0.93 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

May | -0.56 | % | 1.91 | % | 1.85 | % | 9.12 | % | -2.90 | % | 2.55 | % | -0.33 | % | 2.15 | % | 2.11 | % | 9.40 | % | -2.64 | % | 2.82 | % | 1.78 | % | 0.90 | % | 0.75 | % | 2.15 | % | -2.05 | % | 0.47 | % | 2.02 | % | 1.14 | % | 1.00 | % | 2.41 | % | -1.79 | % | 0.73 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

June | -0.98 | % | -4.18 | % | 4.52 | % | 4.86 | % | -0.80 | % | 5.69 | % | -0.71 | % | -3.93 | % | 4.79 | % | 5.11 | % | -0.55 | % | 5.95 | % | -1.21 | % | -1.32 | % | -0.38 | % | 1.57 | % | 0.76 | % | 0.43 | % | -0.94 | % | -1.05 | % | -0.13 | % | 1.81 | % | 1.01 | % | 0.68 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

July | -2.02 | % | 0.32 | % | -3.44 | % | -8.59 | % | -1.83 | % | -0.80 | % | -1.77 | % | 0.58 | % | -3.18 | % | -8.34 | % | -1.57 | % | -0.54 | % | 0.74 | % | -3.40 | % | 0.82 | % | -0.58 | % | -0.59 | % | 0.30 | % | 0.99 | % | -3.15 | % | 1.08 | % | -0.32 | % | -0.34 | % | 0.55 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

August | 4.24 | % | -0.23 | % | -0.50 | % | -5.19 | % | -2.08 | % | -3.66 | % | 4.52 | % | 0.02 | % | -0.26 | % | -4.96 | % | -1.81 | % | -3.42 | % | 0.14 | % | -3.31 | % | -1.53 | % | -1.95 | % | 2.03 | % | -0.30 | % | 0.41 | % | -3.07 | % | -1.29 | % | -1.70 | % | 2.29 | % | -0.05 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

September | 2.60 | % | 3.11 | % | 1.07 | % | 3.03 | % | -1.09 | % | 4.18 | % | 2.86 | % | 3.37 | % | 1.33 | % | 3.27 | % | -0.87 | % | 4.44 | % | 0.22 | % | 2.30 | % | -7.24 | % | 0.82 | % | -1.51 | % | -0.93 | % | 0.46 | % | 2.55 | % | -6.99 | % | 1.05 | % | -1.29 | % | -0.69 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

October | 4.01 | % | -1.25 | % | 6.84 | % | 5.60 | % | 1.20 | % | 1.00 | % | 4.26 | % | -1.01 | % | 7.09 | % | 5.90 | % | 1.48 | % | 1.26 | % | 0.27 | % | -2.77 | % | 1.41 | % | 2.15 | % | -0.13 | % | -3.11 | % | 0.51 | % | -2.53 | % | 1.67 | % | 2.42 | % | 0.14 | % | -2.86 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

November | 4.10 | % | 2.82 | % | -3.91 | % | 1.06 | % | 1.86 | % | 4.37 | % | 3.05 | % | -3.69 | % | 1.31 | % | 2.11 | % | -1.24 | % | -2.26 | % | -2.45 | % | 2.49 | % | -0.61 | % | -0.99 | % | -2.03 | % | -2.20 | % | 2.75 | % | -0.36 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

December | -3.32 | % | 3.24 | % | -2.56 | % | 4.91 | % | -3.34 | % | -3.07 | % | 3.51 | % | -2.31 | % | 5.16 | % | -3.09 | % | -3.14 | % | 1.39 | % | -2.37 | % | 2.05 | % | 0.87 | % | -2.90 | % | 1.67 | % | -2.12 | % | 2.29 | % | 1.12 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Year | 4.97 | % | -5.33 | % | 20.28 | % | -4.54 | % | 2.09 | % | -5.70 | % | 7.62 | % | -2.46 | % | 23.90 | % | -1.63 | % | 5.19 | % | -3.17 | % | 4.01 | % | -18.91 | % | -4.45 | % | -0.49 | % | 3.59 | % | -4.87 | % | 6.62 | % | -16.44 | % | -1.53 | % | 2.56 | % | 6.72 | % | -1.99 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

13

THE FRONTIER FUND

CAPSULE SUMMARY OF PERFORMANCE INFORMATION REGARDING

PREVIOUSLY OFFERED COMMODITY POOLS

| CAPSULE V | CAPSULE VI | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series | Dunn Series Class 1 | Dunn Series Class 2 | Frontier Long/Short Commodity Series Class 1 | Frontier Long/Short Commodity Series Class 2 | Frontier Long/Short Commodity Series Class 3(3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Type of pool |

| Closed; Multi-Advisor; Not Principal-Protected |

|

| Closed; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

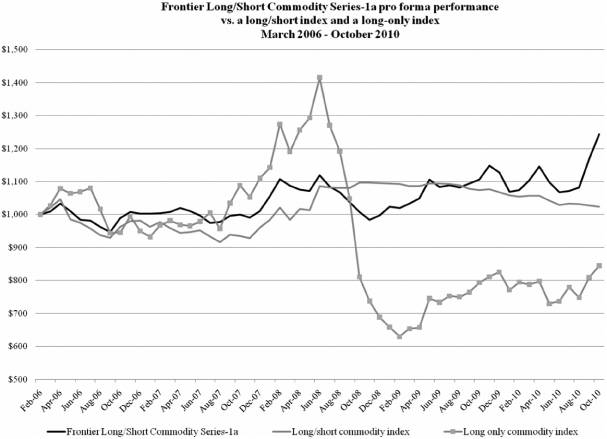

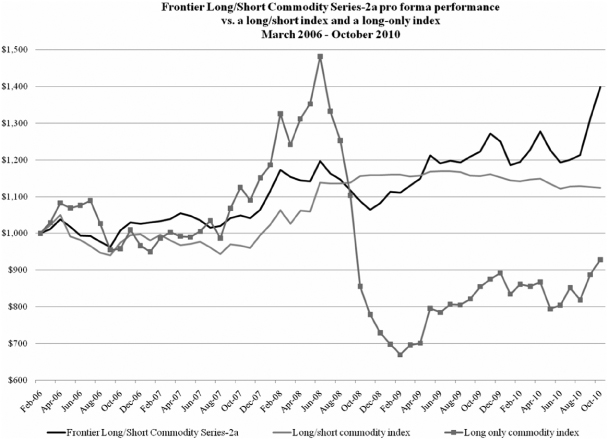

Inception | September 24, 2004 | September 24, 2004 | March 6, 2006 | March 6, 2006 | 1-Jun-09 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Close Date(5) | October 15, 2007(14) | October 15, 2007(14) | N/A | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Aggregate | $278,793.00 | $2,151,563.86 | $73,075,494.16 | $14,933,869.84 | $18,415,797.62 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Current | $0.00 | $0.00 | $ 33,403,540.35 | $15,262,751.80 | $18,025,596.87 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worst Monthly Decline-Last 5 Years(8) | -24.96% (August 2007) | -24.76% (August 2007) | -5.22% (January 2010) | -5.00% (January 2010) | -5.00% (January 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worst Peak-to-Valley Drawdown-Last 5 Years(9) | | -57.00% (November 2004 to August 2007) | | | -53.29% (November 2004 to August 2007) | | | -11.99% (June 2008 to November 2008) | | | -10.89% (June 2008 to November 2008) | | | -6.67% (November 2009 to January 2010) | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Month | 2007 | 2006 | 2005 | 2007 | 2006 | 2005 | 2010 | 2009 | 2008 | 2007 | 2006 | 2010 | 2009 | 2008 | 2007 | 2006 | 2010 | 2009 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

January | -0.72 | % | -6.61 | % | -4.09 | % | -0.45 | % | -6.37 | % | -3.84 | % | -5.22 | % | 2.66 | % | 4.57 | % | 0.07 | % | -5.00 | % | 2.91 | % | 4.84 | % | 0.33 | % | -5.00 | % | ||||||||||||||||||||||||||||||||||||||||||

February | -12.64 | % | -2.75 | % | -6.38 | % | -12.44 | % | -2.53 | % | -6.16 | % | 0.48 | % | -0.37 | % | 4.87 | % | 0.18 | % | 0.71 | % | -0.14 | % | 5.13 | % | 0.41 | % | 0.71 | % | ||||||||||||||||||||||||||||||||||||||||||

March | -6.39 | % | 9.19 | % | -4.61 | % | -6.16 | % | 9.47 | % | -4.37 | % | 2.59 | % | 1.42 | % | -1.83 | % | 0.36 | % | 0.96 | % | 2.87 | % | 1.69 | % | -1.58 | % | 0.61 | % | 1.20 | % | 2.87 | % | ||||||||||||||||||||||||||||||||||||||

April | 3.13 | % | 10.42 | % | -9.08 | % | 3.39 | % | 10.67 | % | -8.86 | % | 3.81 | % | 1.53 | % | -1.05 | % | 1.24 | % | 2.40 | % | 4.07 | % | 1.79 | % | -0.81 | % | 1.50 | % | 2.63 | % | 4.07 | % | ||||||||||||||||||||||||||||||||||||||

May | 12.16 | % | -5.59 | % | 13.53 | % | 12.45 | % | -5.33 | % | 13.83 | % | -4.22 | % | 5.40 | % | -0.39 | % | -0.89 | % | -2.22 | % | -4.00 | % | 5.55 | % | -0.15 | % | -0.64 | % | -1.95 | % | -4.00 | % | ||||||||||||||||||||||||||||||||||||||

June | 6.82 | % | -5.82 | % | 9.61 | % | 7.08 | % | -5.59 | % | 9.88 | % | -2.97 | % | -2.03 | % | 4.54 | % | -1.38 | % | -2.52 | % | -2.70 | % | -1.77 | % | 4.81 | % | -1.14 | % | -2.28 | % | -2.70 | % | -1.78 | % | ||||||||||||||||||||||||||||||||||||

July | -18.15 | % | -3.05 | % | -4.73 | % | -17.92 | % | -2.81 | % | -4.48 | % | 0.34 | % | 0.44 | % | -3.03 | % | -2.20 | % | -0.36 | % | 0.59 | % | 0.69 | % | -2.78 | % | -1.94 | % | -0.10 | % | 0.59 | % | 0.69 | % | ||||||||||||||||||||||||||||||||||||

August | -24.96 | % | -2.05 | % | -5.46 | % | -24.76 | % | -1.80 | % | -5.22 | % | 0.86 | % | -0.58 | % | -1.65 | % | 0.28 | % | -1.83 | % | 1.12 | % | -0.32 | % | -1.42 | % | 0.53 | % | -1.58 | % | 1.12 | % | -0.32 | % | ||||||||||||||||||||||||||||||||||||

September | 14.92 | % | -2.27 | % | -5.85 | % | 15.17 | % | -2.04 | % | -5.62 | % | 8.31 | % | 1.09 | % | -2.76 | % | 1.95 | % | -1.61 | % | 8.57 | % | 1.33 | % | -2.50 | % | 2.19 | % | -1.38 | % | 8.57 | % | 1.34 | % | ||||||||||||||||||||||||||||||||||||

October | -3.21 | % | -3.14 | % | 1.74 | % | -3.08 | % | -2.88 | % | 2.00 | % | 6.79 | % | 1.18 | % | -2.82 | % | 0.38 | % | 4.44 | % | 7.04 | % | 1.43 | % | -2.57 | % | 0.65 | % | 4.70 | % | 7.04 | % | 1.43 | % | ||||||||||||||||||||||||||||||||||||

November | 1.83 | % | 3.09 | % | 2.08 | % | 3.34 | % | 4.12 | % | -2.35 | % | -0.82 | % | 1.93 | % | 4.38 | % | -2.13 | % | -0.58 | % | 2.17 | % | 4.38 | % | ||||||||||||||||||||||||||||||||||||||||||||||

December | -0.61 | % | -4.02 | % | -0.37 | % | -3.79 | % | -2.01 | % | 1.34 | % | 1.95 | % | -0.52 | % | -1.76 | % | 1.62 | % | 2.21 | % | -0.28 | % | -1.76 | % | ||||||||||||||||||||||||||||||||||||||||||||||

Year | -34.47 | % | -11.42 | % | -17.28 | % | -28.81 | % | -8.74 | % | -14.77 | % | 10.34 | % | 13.33 | % | -1.06 | % | 1.04 | % | 0.44 | % | 13.11 | % | 16.67 | % | 1.95 | % | 4.13 | % | 2.93 | % | 13.10 | % | 3.90 | % | ||||||||||||||||||||||||||||||||||||

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

14

THE FRONTIER FUND

CAPSULE SUMMARY OF PERFORMANCE INFORMATION REGARDING

PREVIOUSLY OFFERED COMMODITY POOLS

| CAPSULE VII | CAPSULE VIII | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series | Long Only Commodity Series Class 1 | Long Only Commodity Series Class 2 | Managed Futures Index Series Class 1 | Managed Futures Index Series Class 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Type of pool | Closed to New Investment; Not Principal-Protected | Closed to New Investment; Not Principal-Protected | Closed to New Investment; Not Principal-Protected | Closed to New Investment; Not Principal-Protected | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Inception | March 1, 2006 | March 1, 2006 | April 25, 2006 | April 25, 2006 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Close Date(5) | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Aggregate | $8,586,279.21 | $1,612,568.43 | $3,197,156.50 | $2,283,718.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Current Capita | $3,313,089.67 | $809,499.22 | $1,498,365.15 | $4,017,990.24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worst Monthly Decline- Last 5 | -24.11% (October 2008) | -23.97% (October 2008) | -7.22% (July 2008) | -7.04% (July 2008) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worst Peak-to-Valley Draw | | -55.54% (June 2008 to February 2009) | | | -54.96% (June 2008 to February 2009) | | | -17.75% (December 2008 to April 2010) | | | -15.58% (December 2008 to April 2010) | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Month | 2010 | 2009 | 2008 | 2007 | 2006 | 2010 | 2009 | 2008 | 2007 | 2006 | 2010 | 2009 | 2008 | 2007 | 2006 | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

January | -6.38 | % | -5.86 | % | 3.19 | % | -1.79 | % | -6.24 | % | -5.70 | % | 3.36 | % | -1.61 | % | 1.24 | % | -1.55 | % | 5.61 | % | -0.07 | % | 1.40 | % | -1.38 | % | 5.79 | % | 0.12 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

February | 3.60 | % | -3.63 | % | 12.31 | % | 4.05 | % | 3.76 | % | -3.48 | % | 12.48 | % | 4.21 | % | -0.96 | % | -2.19 | % | 8.71 | % | -3.70 | % | -0.81 | % | -2.04 | % | 8.89 | % | -3.55 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

March | -1.07 | % | 3.53 | % | -4.76 | % | 1.36 | % | 3.82 | % | -0.89 | % | 3.71 | % | -4.60 | % | 1.53 | % | 4.06 | % | -1.15 | % | -2.84 | % | -3.77 | % | -3.28 | % | -0.97 | % | -2.68 | % | -3.60 | % | -3.12 | % | ||||||||||||||||||||||||||||||||||||||||||||

April | 1.22 | % | 0.70 | % | 4.39 | % | -0.92 | % | 5.72 | % | 1.39 | % | 0.87 | % | 4.56 | % | -0.75 | % | 5.88 | % | -2.53 | % | -4.23 | % | -4.11 | % | 1.56 | % | 2.48 | % | -2.37 | % | -4.11 | % | -3.95 | % | 1.73 | % | 2.63 | % | ||||||||||||||||||||||||||||||||||||||||

May | -8.28 | % | 13.48 | % | 2.31 | % | -1.12 | % | -0.60 | % | -8.13 | % | 13.66 | % | 2.48 | % | -0.95 | % | -0.42 | % | 4.79 | % | 4.15 | % | 0.17 | % | 1.61 | % | 1.51 | % | 4.95 | % | 4.32 | % | 0.34 | % | 1.79 | % | 1.69 | % | ||||||||||||||||||||||||||||||||||||||||

June | 1.00 | % | -0.44 | % | 9.85 | % | 0.43 | % | 0.33 | % | 1.19 | % | -0.27 | % | 10.04 | % | 0.59 | % | 0.49 | % | 0.95 | % | -2.06 | % | 3.16 | % | 4.79 | % | -4.47 | % | 1.13 | % | -1.89 | % | 3.33 | % | 4.95 | % | -4.32 | % | ||||||||||||||||||||||||||||||||||||||||

July | 6.32 | % | 2.14 | % | -9.60 | % | 2.83 | % | 2.87 | % | 6.50 | % | 2.31 | % | -9.43 | % | 3.01 | % | 3.04 | % | -5.08 | % | -0.45 | % | -7.22 | % | 0.83 | % | -3.29 | % | -4.92 | % | -0.28 | % | -7.04 | % | 1.01 | % | -3.13 | % | ||||||||||||||||||||||||||||||||||||||||

August | -4.09 | % | -1.12 | % | -6.00 | % | -4.87 | % | -6.65 | % | -3.92 | % | -0.96 | % | -5.85 | % | -4.71 | % | -6.49 | % | 6.66 | % | -1.19 | % | 3.12 | % | -5.82 | % | 1.99 | % | 6.84 | % | -1.02 | % | 3.25 | % | -5.66 | % | 2.16 | % | ||||||||||||||||||||||||||||||||||||||||

September | 8.02 | % | 4.25 | % | -11.13 | % | 8.21 | % | -8.82 | % | 8.20 | % | 4.42 | % | -10.98 | % | 8.37 | % | -8.68 | % | -1.61 | % | -0.93 | % | -2.46 | % | 4.73 | % | -2.96 | % | -1.45 | % | -0.76 | % | -2.36 | % | 4.89 | % | -2.81 | % | ||||||||||||||||||||||||||||||||||||||||

October | 4.02 | % | 1.08 | % | -24.11 | % | 6.55 | % | 0.11 | % | 4.19 | % | 1.24 | % | -23.97 | % | 6.75 | % | 0.29 | % | 3.78 | % | -0.86 | % | 16.07 | % | 2.12 | % | -0.83 | % | 3.95 | % | -0.70 | % | 16.36 | % | 2.31 | % | -0.66 | % | ||||||||||||||||||||||||||||||||||||||||

November | 2.19 | % | -8.51 | % | -4.37 | % | 5.15 | % | 2.37 | % | -8.38 | % | -4.21 | % | 5.33 | % | 1.41 | % | 8.46 | % | 2.52 | % | 1.66 | % | 1.58 | % | 8.35 | % | 2.69 | % | 1.83 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

December | 2.31 | % | -6.54 | % | 5.58 | % | -5.39 | % | 2.48 | % | -6.41 | % | 5.76 | % | -5.24 | % | -4.92 | % | 2.17 | % | -0.80 | % | 1.01 | % | -4.76 | % | 2.41 | % | -0.63 | % | 1.17 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Year | 3.09 | % | 18.88 | % | -36.54 | % | 16.07 | % | -4.55 | % | 4.81 | % | 21.27 | % | -35.28 | % | 18.43 | % | -2.89 | % | 5.65 | % | -14.86 | % | 31.40 | % | 3.98 | % | -3.15 | % | 7.41 | % | -13.19 | % | 33.79 | % | 6.09 | % | -1.69 | % | ||||||||||||||||||||||||||||||||||||||||

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

15

THE FRONTIER FUND

CAPSULE SUMMARY OF PERFORMANCE INFORMATION REGARDING

PREVIOUSLY OFFERED COMMODITY POOLS

| CAPSULE IX | CAPSULE X | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series | Winton Series Class 1 | Winton Series Class 2 | Winton/Graham Series Class 1(15) | Winton/Graham Series Class 2(16) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Type of pool |

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

|

| Closed to New Investment; Multi-Advisor; Not Principal-Protected |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Inception | September 24, 2004 | September 24, 2004 | November 22, 2004 | November 22, 2004 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Close Date(5) | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Aggregate Subscr | $62,991,689.86 | $9,975,096.5 | $58,357,399.70 | $18,621,556.33 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Current Capital | $49,804,708.76 | $ 11,226,208.00 | $47,115,446.29 | $11,830,863.13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worst Monthly Decline-Last 5 Years(8) | -7.75% (February 2007) | -7.53% (February 2007) | -11.12% (April 2005) | -10.90% (April 2005) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worst Peak- | | -13.31% (January 2007 to March 2007) | | | -12.89% (January 2007 to March 2007) | | | -26.89% (December 2004 to March 2007) | | | -24.02% (December 2004 to April 2005) | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Month | 2010 | 2009 | 2008 | 2007 | 2006 | 2010 | 2009 | 2008 | 2007 | 2006 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

January | -3.27 | % | 0.39 | % | 2.96 | % | 4.12 | % | -3.04 | % | 0.63 | % | 3.23 | % | 4.41 | % | -7.00 | % | -0.10 | % | 1.42 | % | -1.37 | % | 0.67 | % | -9.45 | % | -6.78 | % | 0.14 | % | 1.68 | % | -1.10 | % | 0.93 | % | -9.19 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

February | 2.83 | % | -0.77 | % | 7.22 | % | -7.75 | % | 3.06 | % | -0.54 | % | 7.48 | % | -7.53 | % | 1.67 | % | 0.10 | % | 7.20 | % | -6.18 | % | -0.72 | % | -1.69 | % | 1.90 | % | 0.33 | % | 7.46 | % | -5.97 | % | -0.49 | % | -1.46 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

March | 5.48 | % | -1.90 | % | -0.86 | % | -6.03 | % | 5.77 | % | -1.64 | % | -0.60 | % | -5.80 | % | 5.20 | % | -2.63 | % | 2.46 | % | -3.38 | % | 1.44 | % | -4.94 | % | 5.48 | % | -2.37 | % | 2.73 | % | -3.14 | % | 1.70 | % | -4.70 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

April | 1.75 | % | -3.71 | % | -2.32 | % | 5.33 | % | 2.00 | % | -3.47 | % | -2.08 | % | 5.60 | % | 2.03 | % | -3.06 | % | -0.39 | % | 5.69 | % | 7.12 | % | -11.12 | % | 2.28 | % | -2.82 | % | -0.14 | % | 5.96 | % | 7.37 | % | -10.90 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

May | -0.99 | % | -2.60 | % | 0.72 | % | 4.43 | % | -0.76 | % | -2.37 | % | 0.96 | % | 4.69 | % | -0.75 | % | 0.53 | % | 2.72 | % | 14.51 | % | -3.37 | % | 1.47 | % | -0.53 | % | 0.77 | % | 2.97 | % | 14.80 | % | -3.11 | % | 1.74 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

June | 2.10 | % | -1.74 | % | 4.16 | % | 1.41 | % | 2.37 | % | -1.48 | % | 4.43 | % | 1.65 | % | -0.14 | % | -3.43 | % | 3.28 | % | 4.14 | % | -1.29 | % | 7.47 | % | 0.13 | % | -3.10 | % | 3.54 | % | 4.39 | % | -1.05 | % | 7.74 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

July | -4.19 | % | -2.01 | % | -4.33 | % | -1.90 | % | -3.95 | % | -1.76 | % | -4.08 | % | -1.64 | % | -3.16 | % | -0.16 | % | -4.49 | % | -4.25 | % | -3.18 | % | -1.90 | % | -2.93 | % | 0.10 | % | -4.25 | % | -4.00 | % | -2.93 | % | -1.67 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

August | 6.64 | % | -0.04 | % | -2.58 | % | -1.55 | % | 2.57 | % | 6.92 | % | 0.21 | % | -2.34 | % | -1.30 | % | 2.72 | % | 5.70 | % | 0.69 | % | -2.75 | -3.45 | % | -3.73 | % | -2.63 | % | 5.98 | % | 0.95 | % | -2.52 | -3.21 | % | -3.49 | % | -2.39 | % | ||||||||||||||||||||||||||||||||||||||||||||||

September | 0.53 | % | 2.69 | % | -1.03 | % | 6.71 | % | -2.20 | % | 0.78 | % | 2.94 | % | -0.77 | % | 6.96 | % | -1.99 | % | 0.52 | % | 3.67 | % | 0.37 | % | 4.93 | % | 0.69 | % | 5.57 | % | 0.77 | % | 3.93 | % | 0.64 | % | 5.18 | % | 0.92 | % | 5.84 | % | ||||||||||||||||||||||||||||||||||||||||||||

October | 2.86 | % | -2.17 | % | 3.09 | % | 1.84 | % | 1.24 | % | 3.11 | % | -1.92 | % | 3.36 | % | 2.12 | % | 1.50 | % | 5.03 | % | -2.88 | % | 5.78 | % | 5.19 | % | 1.29 | % | -1.26 | % | 5.28 | % | -2.64 | % | 6.05 | % | 5.47 | % | 1.56 | % | -1.01 | % | ||||||||||||||||||||||||||||||||||||||||||||

November | 6.05 | % | 5.17 | % | 1.98 | % | 2.25 | % | 6.32 | % | 5.41 | % | 2.24 | % | 2.50 | % | 6.77 | % | 3.81 | % | 0.44 | % | 1.74 | % | 2.38 | % | 7.04 | % | 4.05 | % | 0.68 | % | 1.99 | % | 2.64 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

December | -4.07 | % | 2.13 | % | -0.03 | % | 1.73 | % | -3.82 | % | 2.41 | % | 0.23 | % | 1.97 | % | -4.33 | % | 1.44 | % | -2.84 | % | 1.98 | % | -4.28 | % | -4.08 | % | 1.72 | % | -2.59 | % | 2.23 | % | -4.03 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Year | 14.01 | % | -9.84 | % | 14.56 | % | 7.74 | % | 5.64 | % | 16.88 | % | -7.10 | % | 18.07 | % | 11.05 | % | 6.81 | % | 8.70 | % | -5.27 | % | 22.25 | % | 12.20 | % | 2.17 | % | -19.96 | % | 11.43 | % | -2.35 | % | 25.99 | % | 15.64 | % | 5.27 | % | -17.50 | % | ||||||||||||||||||||||||||||||||||||||||||||

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

16

Footnotes to the Frontier Fund Capsule Summary of Performance Information Regarding Previously Offered Commodity Pools

| (1) | The Balanced Series Class 1A performance table sets forth the actual performance of the Balanced Series Class 1A since May 2006 and the pro forma performance of Balanced Series Class 1, adjusted to take into account the fees associated with an investment in Balanced Series Class 1A Units, from September 2004 to April 2006. |

| (2) | The Balanced Series Class 2A performance table sets forth the actual performance of the Balanced Series Class 2A since May 2006 and the pro forma performance of Balanced Series Class 2, adjusted to take into account the fees associated with an investment in Balanced Series Class 2A Units, from September 2004 to April 2006. |

| (3) | Units that have reached the compensation limitations as determined by the managing owner will be designated as class 3 (and in the case of the Frontier Long/Short Commodity Series, class 3a) units for reporting purposes and will not be subject to additional ongoing service fees. |

| (4) | “Inception of trading” is the month and year that the pool began trading. |

| (5) | “Close Date” is the month and year that the pool liquidated its assets and stopped doing business. |

| (6) | “Aggregate Subscriptions” is the aggregate of all amounts contributed to the class, including investments that were later redeemed by investors. |

| (7) | “Current Capitalization” is the net asset value of the class as of October 31, 2010, or, in the case of liquidated pools, the net asset value of the class on the Close Date. |

| (8) | “Worst Monthly % Decline-Last 5 Years” means losses experienced in the net asset value per unit over the specified period and is calculated by dividing the net change in the net asset value per unit by the beginning net asset value per unit for the relevant period. “Decline” is measured on the basis of monthly returns only, and does not reflect intra-month figures. |

| (9) | “Worst Peak-to-Valley Drawdown-Last 5 Years” is the largest percentage decline in the net asset value per unit over the specified period, although the peak may have occurred outside of the past five years and year-to-date. This need not be a continuous decline, but can be a series of positive and negative returns where the negative returns are larger than the positive ones. |

| (10) | Prior to June 2008, the Campbell/Graham/Tiverton Series Class 1 performance table sets forth the actual performance of the Campbell/Graham/Tiverton Series Class 1, during a period when it was directed only by Campbell and Graham. The Campbell/Graham/Tiverton Series was originally designated as the “Campbell/Graham Series,” and trading for the Series was directed by Campbell and Graham. |

| (11) | Prior to June 2008, the Campbell/Graham/Tiverton Series Class 2 performance table sets forth the actual performance of the Campbell/Graham/Tiverton Series Class 2, during a period when it was directed only by Campbell and Graham. The Campbell/Graham/Tiverton Series was originally designated as the “Campbell/Graham Series,” and trading for the Series was directed by Campbell and Graham. |

| (12) | The Currency Series Class 1 performance table sets forth the actual performance of the Currency Series Class 1. The Currency Series was originally a single-advisor Series designated as the “C-View Currency Series.” The past performance information presented in the composite performance table from inception through February 1, 2006, represents the past performance of the Currency Series Class 1 under C-View as the single advisor. |

| (13) | The Currency Series Class 2 performance table sets forth the actual performance of the Currency Series Class 2. The Currency Series was originally a single-advisor Series designated as the “C-View Currency Series.” The past performance information presented in the composite performance table from inception through February 1, 2006, represents the past performance of the Currency Series Class 1 under C-View as the single advisor. |

17

| (14) | Each of the Dunn Series Class 1 and Dunn Series Class 2 ceased trading on October 15, 2007 and had no net asset value as of any subsequent month-end. |

| (15) | Prior to June 2008, the Winton/Graham Series Class 1 performance table sets forth the actual performance of the Winton/Graham Series Class 1 during a period when it was directed solely by Graham. The Winton/Graham Series was originally designated as the “Graham Series,” and trading for the Series was directed by Graham. |

| (16) | Prior to June 2008, the Winton/Graham Series Class 2 performance table sets forth the actual performance of the Winton/Graham Series Class 2 during a period when it was directed solely by Graham. The Winton/Graham Series was originally designated as the “Graham Series,” and trading for the Series was directed by Graham. |

18

THE CLEARING BROKERS

The following is added to the description of Deutsche Bank:

Reference is made to the Annual Report on Form 20-F for additional information and financial statements relating to Deutsche Bank AG.

The description of UBS is hereby deleted in its entirety and replaced with the following:

UBS Securities LLC (“UBS Securities”) principal business address is 677 Washington Blvd, Stamford, CT 06901. UBS Securities is a futures clearing broker for each trading company. UBS Securities is registered in the US with the Financial Industry Regulatory Authority (“FINRA”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant. UBS Securities is a member of various US futures and securities exchanges.

Like most securities firms, UBS is and has been a defendant in numerous legal proceedings, including actions brought by regulatory organizations and government agencies, relating to its securities and commodities business that allege various violations of federal and state securities laws. UBS AG, the ultimate parent company to UBS Securities LLC, files annual reports and quarterly reports to the SEC in which it discloses material information about UBS matters, including information about any material litigation or regulatory investigations. Actions with respect to UBS Securities’ futures commission merchant business are publicly available on the website of the National Futures Association (http://www.nfa.futures.org/).

On June 27, 2007, the Securities Division of the Secretary of the Commonwealth of Massachusetts (“Massachusetts Securities Division”) filed an administrative complaint (the “Complaint”) and notice of adjudicatory proceeding against UBS Securities LLC, captioned In The Matter of UBS Securities, LLC, Docket No. E-2007-0049, which alleged that UBS Securities violated the Massachusetts Uniform Securities Act (“the “Act”) and related regulations by providing the advisers for certain hedge funds with gifts and gratuities in the form of below market office rents, personal loans with below market interest rates, event tickets, and other perks, in order to induce those hedge fund advisers to increase or retain their level of prime brokerage fees paid to UBS Securities. The Complaint seeks a cease and desist order from conduct that violates the Act and regulations, to censure UBS Securities, to require UBS Securities to pay an administrative fine of an unspecified amount, and to find as fact the allegations of the Complaint. The matter is still pending.

In the summer of 2008, the Massachusetts Securities Division, Texas State Securities Board, and the New York Attorney General all brought actions against UBS and UBS Financial Services, Inc. (“UBS Financial”), alleging violations of various state law anti-fraud provisions in connection with the marketing and sale of auction rate securities.

On August 8, 2008, UBS Securities and UBS Financial reached agreements in principle with the SEC, the NYAG, the Massachusetts Securities Division and other state regulatory agencies represented by the North American Securities Administrators Association (“NASAA”) to restore liquidity to all remaining client’s holdings of auction rate securities by June 30, 2012. On October 2, 2008, UBS Securities and UBS Financial entered into a final consent agreement with the Massachusetts Securities Division settling all allegations in the Massachusetts Securities Division’s administrative proceeding against UBS Securities and UBS Financial with regards to the auction rate securities matter. On December 11, 2008, UBS Securities and UBS Financial executed an Assurance of Discontinuance in the auction rate securities settlement with the NYAG. On the same day, UBS Securities and UBS Financial finalized settlements with the SEC. UBS paid penalties of $75M to NYAG and an additional $75M to be apportioned among the participating NASAA states. In March 2010, UBS and NASAA agreed on final settlement terms, pursuant to which, UBS agreed to provide client liquidity up to an additional $200 million.

On August 14, 2008 the New Hampshire Bureau of Securities Regulation filed an administrative action against UBS Securities relating to a student loan issuer, the New Hampshire Higher Education Loan Corp.

19

(NHHELCO). The complaint alleges fraudulent and unethical conduct in violation of New Hampshire state statues. On April 14, 2010, UBS entered into a Consent Order resolving all of the Bureau’s claims. UBS paid $750,000 to the Bureau for all costs associated with the Bureau’s investigation. UBS entered a separate civil settlement with NHHELCO and provided a total financial benefit of $20M to NHHELCO.

On April 29, 2010, the CFTC issued an order with respect to UBS Securities LLC and levied a fine of $200,000. The Order stated that on February 6, 2009, UBS Securities’ employee broker aided and abetted UBS Securities’ customer’s concealment of material facts from the New York Mercantile Exchange (“NYMEX”) in violation of Section 9(a)(4) of the CEA, 7 U.S.C. § 13(a)(4) (2006). Pursuant to NYMEX Rules, a block trade must be reported to NYMEX “within five minutes of the time of execution” consistent with the requirements of NYMEX Rule 6.21C(A)(6). Although the block trade in question was executed earlier in the day, UBS Securities’ employee broker aided and abetted its customer’s concealment of facts when, in response to the customer’s request to delay reporting the trade until after the close of trading, UBS Securities’ employee did not report the trade until after the close. Because the employee broker undertook his actions within the scope of his employment, pursuant to Section 2(a)(1)(B) of the CEA, 7 U.S.C. § 2(a)(1)(B) (2006), and Commission Regulation 1.2, 17 C.F.R. § 1.2 (2009), UBS Securities is liable for the employee broker’s aiding and abetting of its customer’s violation of Section 9(a)(4) of the CEA. The fine has been paid and the matter is now closed.

UBS Securities will act only as clearing broker for each trading company and as such will be paid commissions for executing and clearing trades on behalf of each trading company. UBS Securities has not passed upon the adequacy or accuracy of this prospectus. UBS Securities neither will act in any supervisory capacity with respect to the managing owner or the trading advisors nor participate in the management of the trust, the managing owner or the trading companies.

20

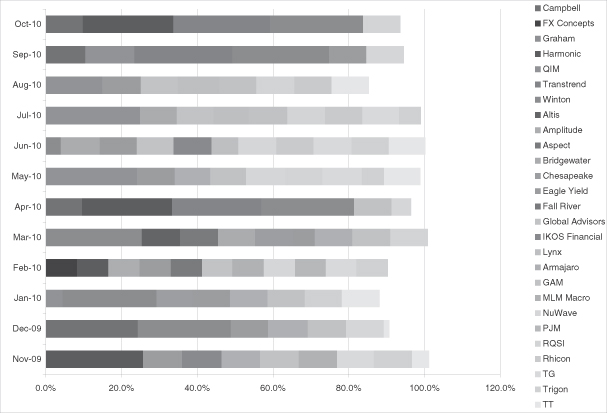

FRONTIER DIVERSIFIED SERIES APPENDIX

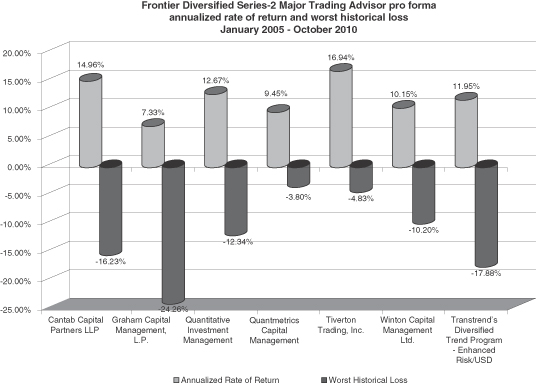

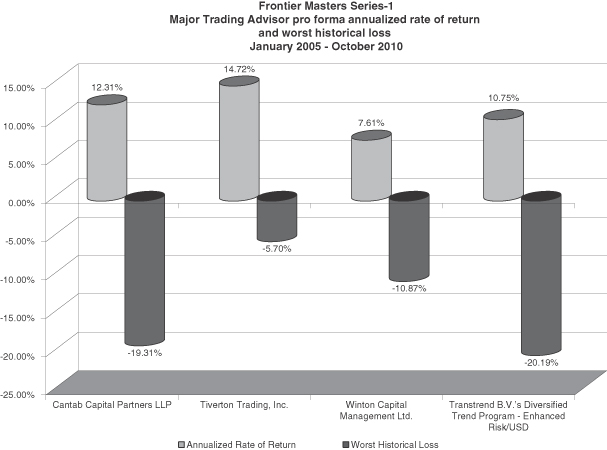

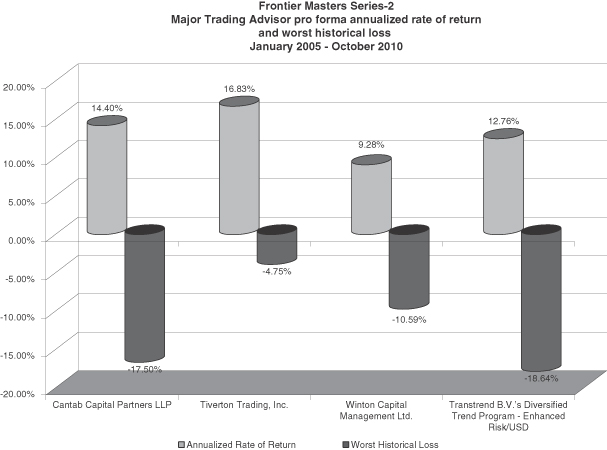

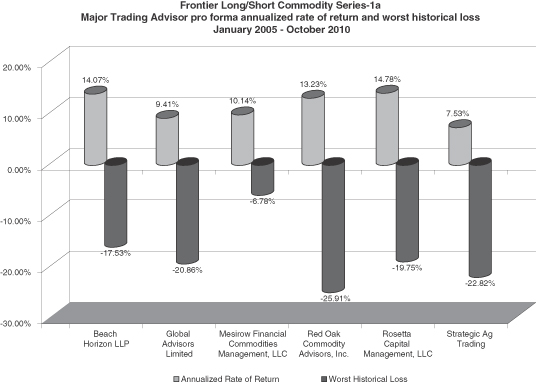

The information set forth on pages Frontier Diversified App.—5 through Frontier Diversified App.—7 is hereby deleted in its entirety and replaced with the following:

21

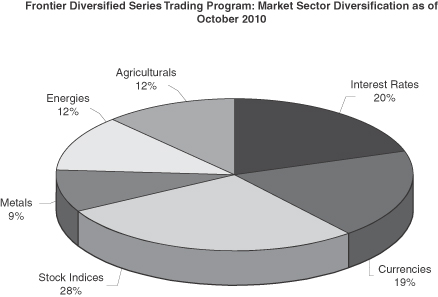

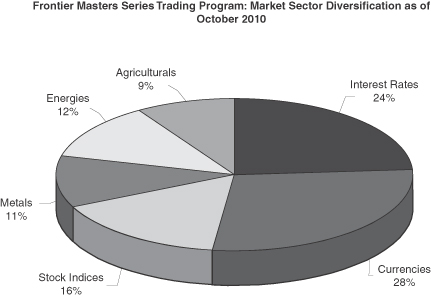

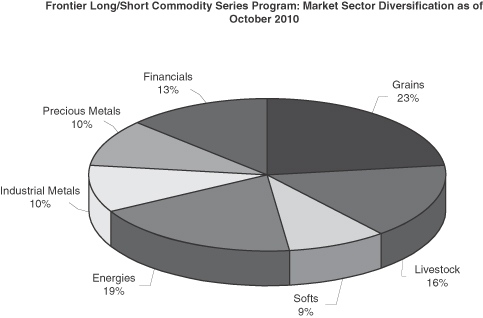

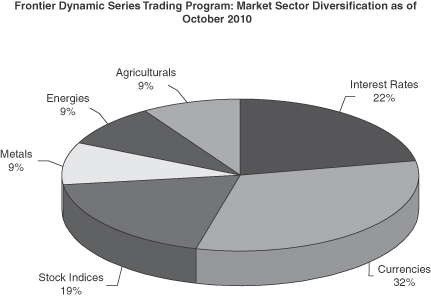

The following table sets forth certain of the markets in which the trading advisors that will receive allocations of the Frontier Diversified Series Assets may trade on behalf of client accounts. Not all markets are part of each trading advisor’s program. Each trading advisor reserves the right to vary the markets and types of instruments it trades without giving prior notice to the trust. The diversification summary below is based on long-term averages as of October 31, 2010.

Diversification Summary

The Frontier Fund—THE FRONTIER DIVERSIFIED SERIES

| Frontier Diversified Series Trading Advisors: | Program | Interest Rates | Currencies | Stock Indices | Metals | Energies | Agriculturals | Total | ||||||||||||||||||||||||

Major Advisors: | ||||||||||||||||||||||||||||||||

Cantab Capital Partners LLP | | CCP Quantitative Fund Aristarchus Program | | 28 | % | 39 | % | 13 | % | 6 | % | 8 | % | 6 | % | 100 | % | |||||||||||||||

Graham Capital Management, L.P. |

| K4D-15 Program |

| 11 | % | 55 | % | 16 | % | 3 | % | 10 | % | 5 | % | 100 | % | |||||||||||||||

Quantitative Investment Management | Global | 29 | % | 19 | % | 32 | % | 7 | % | 10 | % | 3 | % | 100 | % | |||||||||||||||||

QuantMetrics Capital Management LLP | QM Futures | 17 | % | 4 | % | 73 | % | 0 | % | 6 | % | 1 | % | 100 | % | |||||||||||||||||

Tiverton Trading, Inc. | | Discretionary Trading Methodology Program | | 17 | % | 17 | % | 16 | % | 17 | % | 17 | % | 16 | % | 100 | % | |||||||||||||||

Winton Capital Management Ltd.* | Diversified | 28 | % | 39 | % | 13 | % | 6 | % | 8 | % | 6 | % | 100 | % | |||||||||||||||||

Non-Major Advisors | N/A | 16 | % | 15 | % | 29 | % | 8 | % | 13 | % | 19 | % | 100 | % | |||||||||||||||||

Other Reference Programs | | Transtrend B.V. - Diversified Trend Program - Enhanced Risk/USD | | 25 | % | 35 | % | 15 | % | 7 | % | 12 | % | 6 | % | 100 | % | |||||||||||||||

Frontier Diversified Series | N/A | 20 | % | 19 | % | 28 | % | 9 | % | 12 | % | 12 | % | 100 | % | |||||||||||||||||

| * | These figures are based on the Winton Futures Fund projected risk of the current trading system and represents Winton’s projected long term risk breakdown and is based on historic market volatilities over the last 10 years. |

22

23

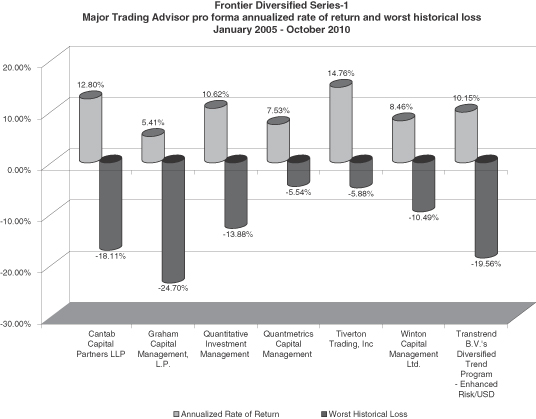

PAST PERFORMANCE OF FRONTIER DIVERSIFIED SERIES-1

The Capsule Performance Table which follows sets forth the past performance of the Frontier Diversified Series-1 during the period covered by the table.

| Month | 2010 | 2009 | ||||||

January | -3.98 | % | ||||||

February | 0.45 | % | ||||||

March | 2.28 | % | ||||||

April | 2.20 | % | ||||||

May | -0.05 | % | ||||||

June | -0.03 | % | -1.89 | % | ||||

July | -2.02 | % | -0.74 | % | ||||

August | 4.09 | % | 0.31 | % | ||||

September | 1.25 | % | 1.29 | % | ||||

October | 4.13 | % | 0.08 | % | ||||

November | 1.41 | % | ||||||

December | -3.61 | % | ||||||

Year | 8.31 | % | -3.20 | % | ||||

Name of pool: | The Frontier Fund | |

This pool is a multi-advisor advisor pool as defined in CFTC Regulation § 4.10(d)(2). | ||

Name of series and class: | Frontier Diversified Series-1 | |

Inception of Trading of Frontier Diversified Series-1: | June 9, 2009 | |

Aggregate Gross Capital Subscriptions for Frontier Diversified Series-1 as of October 31, 2010: | $85,313,322.17 | |

Net Asset Value of Frontier Diversified Series-1 as of October 31, 2010: | $88,881,322.56 | |

Worst Monthly Percentage Draw-down: | -3.98% (Jan 2010) | |

Worst peak-to-valley Draw-down: | -7.45% (Nov 2009 to Jan 2010) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

The Frontier Diversified Series-1 performance table sets forth the actual performance of the Frontier Diversified Series-1. Actual gross trading performance (gross realized and unrealized gain/loss before deduction for trading commissions and fees, management fees or any other expenses, and before addition of interest income) is adjusted for the trading expenses, management fees, incentive fees, initial service fees, on-going service fees and interest income of the Frontier Diversified Series-1. The asset-based fees, as an annualized percentage calculated monthly on the adjusted beginning of month net asset value, are as follows:

| • | Management fees: 0.75% |

| • | Initial service fees and on-going service fees: 2.00% |

24

An incentive fee of 25% of New High Net Trading Profits (as defined), earned quarterly, is deducted in the above table. Twenty percent (20%) of any interest income, based upon applying the 90-day Treasury Bill rate for each month to the adjusted beginning of month net asset value, is credited in the above table.

| * | Draw-down means losses experienced by the applicable class of the applicable series of the pool over a specified period. |

| ** | Worst peak-to-valley draw-down means the greatest cumulative percentage decline in month-end net asset value due to losses sustained by the applicable class of the applicable series of the pool during any period in which the initial month-end net asset value is not equaled or exceeded by a subsequent month-end net asset value. |

25

PAST PERFORMANCE OF FRONTIER DIVERSIFIED SERIES-2

The Capsule Performance Table which follows sets forth the past performance of the Frontier Diversified Series-2 during the period covered by the table.

| Month | 2010 | 2009 | ||||||

January | -3.85 | % | ||||||

February | 0.58 | % | ||||||

March | 2.44 | % | ||||||

April | 2.35 | % | ||||||

May | 0.08 | % | ||||||

June | 0.12 | % | -1.79 | % | ||||

July | -1.88 | % | -0.59 | % | ||||

August | 4.25 | % | 0.46 | % | ||||

September | 1.40 | % | 1.45 | % | ||||

October | 4.27 | % | 0.22 | % | ||||

November | 1.57 | % | ||||||

December | -3.47 | % | ||||||

Year | 9.88 | % | -2.23 | % | ||||

Name of pool: | The Frontier Fund | |

This pool is a multi-advisor advisor pool as defined in CFTC Regulation § 4.10(d)(2). | ||

Name of series and class: | Frontier Diversified Series-2 | |

Inception of Trading of Frontier Diversified Series-2: | June 9, 2009 | |

Aggregate Gross Capital Subscriptions for Frontier Diversified Series-2 as of October 31, 2010: | $63,909,574.77 | |

Net Asset Value of Frontier Diversified Series-2 as of October 31, 2010: | $69,476,658.40 | |

Worst Monthly Percentage Draw-down: | -3.85% (Jan 2010) | |

Worst peak-to-valley Draw-down: | -7.18% (Nov 2009 to Jan 2010) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

26

FRONTIER DIVERSIFIED SERIES APPENDIX

CANTAB

The address of Cantab has changed to: City House, 126-130 Hills Road, Cambridge, CB2 1RE, United Kingdom.

PAST PERFORMANCE OF CANTAB

The table and notes included in the section entitled “FRONTIER DIVERSIFIED SERIES APPENDIX—CANTAB—PAST PERFORMANCE OF CANTAB” are hereby deleted in their entirety and replaced with the following:

27

PAST PERFORMANCE OF CANTAB

The Capsule Performance Table which follows presents the performance results of the CCP Quantitative Fund Aristarchus Program for the period covered by the table.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

CCP Quantitative Fund Aristarchus Program

| Month | 2010 | 2009 | 2008 | 2007 | ||||||||||||

January | -6.13 | % | -1.54 | % | 7.41 | % | ||||||||||

February | -3.57 | % | 1.65 | % | 7.48 | % | ||||||||||

March | 7.25 | % | -5.86 | % | -1.76 | % | 1.82 | % | ||||||||

April | -0.22 | % | -6.15 | % | 3.90 | % | 3.71 | % | ||||||||

May | -4.82 | % | 1.03 | % | 5.88 | % | -0.25 | % | ||||||||

June | -0.83 | % | -3.36 | % | -1.84 | % | -1.61 | % | ||||||||

July | 0.21 | % | 0.16 | % | 1.66 | % | 0.40 | % | ||||||||

August | 7.09 | % | -0.65 | % | 1.14 | % | -7.48 | % | ||||||||

September | 3.43 | % | 5.16 | % | 1.11 | % | 10.10 | % | ||||||||

October | 2.81 | % | 1.22 | % | 2.95 | % | 6.83 | % | ||||||||

November | 2.79 | % | 6.58 | % | -1.23 | % | ||||||||||

December | -3.42 | % | 6.43 | % | 1.99 | % | ||||||||||

Year | 4.33 | % | -9.20 | % | 48.68 | % | 14.06 | % | ||||||||

Name of CTA: | Cantab Capital Partners LLP | |

Name of Portfolio: | CCP Quantitative Fund Aristarchus Program | |

Inception of Trading by CTA: | March 2007 | |

Inception of Trading of the Portfolio: | March 2007 | |

Number of Accounts Open: | 12 | |

Total Assets Managed by CTA: | $1,018 million | |

Total Assets Traded According to the Program: | $1,008 million | |

Worst Monthly Percentage Draw-down: | -7.48% (August 2007) | |

Worst Peak-to-Valley Draw-down: | -17.9% (February 2009 to February 2010) | |

Number of Profitable Accounts That Have Opened and Closed: | 2 | |

Range of Returns Experienced by Profitable Accounts: | 4.9% – 7.0% | |

Number of Unprofitable Accounts That Have Opened and Closed: | 1 | |

Range of Returns Experienced by Unprofitable Accounts: | -18.30% |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

Monthly Rate of Return is calculated by dividing the sum of the net performance for all accounts by the sum of the monthly beginning nominal net asset values of the accounts plus time-weighted additions and time-weighted withdrawals.

| * | Draw-down means losses experienced by the trading program over a specified period. |

| ** | Worst peak-to-valley draw-down means the greatest cumulative percentage decline in month-end net asset value due to losses sustained by the trading program during any period in which the initial month-end net asset value is not equaled or exceeded by a subsequent month-end net asset value. |

28

GRAHAM

The second paragraph of the “Background of Graham” is hereby deleted in its entirety and replaced with the following:

As of November 1, 2010 Graham has approximately 170 employees and manages assets of over $7 billion. Graham maintains its main business office at 40 Highland Avenue, Rowayton, CT 06853. Graham’s telephone number is 203-899-3400.

Pablo Calderini, Shannon Bass, Cameron Crise, Timothy Every, Ken Fahrman, Melanie Lynch, and Rita Nagle and new principals of Graham:

Pablo Calderini

Pablo Calderini is the Chief Investment Officer of Graham and is responsible for the management and oversight of the discretionary trading business at Graham. He joined Graham in August 2010 and became an Associated Person and Principal of Graham effective August 13, 2010. Prior to joining Graham, Mr. Calderini worked at Deutsche Bank from June 1997 to July 2010 where he held positions of increasing responsibility, most recently the Global Head of Equity Proprietary Trading. Mr. Calderini commenced his career at Deutsche Bank as Global Head of Emerging Markets. During his tenure at Deutsche Bank, Mr. Calderini also helped manage several groups across the fixed income and equity platforms, including the Global Credit Derivatives Team. Mr. Calderini received a B.A. in Economics from Universidad Nacional de Rosario in 1987 and a Masters in Economics from Universidad del Cema in 1988, each in Argentina.

Shannon Bass

Shannon Bass is a discretionary trader of Graham, specializing in capital structure credit trading. He became an Associated Person of Graham effective June 1, 2009 and a Principal on May 14, 2010. Prior to joining Graham in January 2009, Mr. Bass was a Senior Partner of R3 Capital Partners, an investment management firm, from June 2008 to January 2009. From November 2002 to May 2008, Mr. Bass held positions of increasing responsibility including Managing Director at the investment bank, Lehman Brothers, Inc. He was an associated person of Lehman Brothers, Inc. from January 2003 to May 2008. Mr. Bass received his M.B.A. from New York University in 1989 and his B.S. in Electrical Engineering from the University of California, San Diego in 1986.

Cameron Crise

Cameron Crise is a discretionary trader of Graham, specializing in multi-asset global macro markets. He became an Associated Person of Graham effective August 18, 2010 and a Principal on September 1, 2010. Prior to joining Graham in May 2010, Mr. Crise was employed as a portfolio manager at Nylon Capital LLP, an investment management firm, in London from April 2008 to March 2010. Mr. Crise was between employment in April 2010 and in February through March 2008. Mr. Crise was a currency portfolio manager at Fortis Investments, the global asset management arm of Fortis Group, the investment bank, from August 2004 to January 2008. Mr. Crise graduated from Duke University in 1993 where he received his B.A. in Public Policy Studies and History.

Timothy Every

Timothy Every is a discretionary trader of GCM, specializing in global foreign exchange, fixed income, and equity indices. He became an Associated Person of GCM effective August 4, 2010 and a Principal on October 1, 2010. Prior to joining GCM in April 2010, Mr. Every was a proprietary trader and Vice President in the Foreign Exchange Division of Citibank, an investment bank, from October 2007 to April 2010. From July 2000 to October 2007, Mr. Every held positions of increasing responsibility including Executive Director of U.S. Products Trading for the investment bank, Goldman Sachs. He was an associated person of Citibank from July 2008 to April 2010 and an associated person of Goldman Sachs from February 2001 to October 2007. Mr. Every received a B.A. in Economics from Stanford University in June 2000.

29

Ken Fahrman