UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 7, 2017 (August 1, 2017)

FRONTIER FUNDS

FRONTIER SELECT FUND

FRONTIER HERITAGE FUND

(Exact Name of Registrant as Specified in Charter)

| | | | |

| Delaware | | 000-51274 | | 36-6815533 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

c/o Frontier Fund Management, LLC

25568 Genesee Trail Road

Golden, Colorado 80401

(Address of Principal Executive Offices)

(303)454-5500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act. |

| | ☐ | Soliciting material pursuant to Rule14a-12 under the Exchange Act. |

| | ☐ | Pre-commencement communications pursuant to Rule14d-2b under the Exchange Act. |

| | ☐ | Pre-commencement communications pursuant to Rule13e-4(c) under the Exchange Act. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | 1. | Effective August 1, 2017, the Frontier Select Fund added Welton Investment Partners,LLC as a major commodity trading advisor. |

The current major commodity trading advisors, including those advising commodity pools on the Galaxy Plus Platform and/or reference programs for the Frontier Select Fund are:

| | • | | BH-DG Systematic Trading LLP |

| | • | | Welton Investment Partners, LLC |

The managing owner anticipates that between 10% and 50% of the assets of the Frontier Select Fund may be allocated to each of the major commodity trading advisors, commodity pools on the Galaxy Plus Platform and/or reference programs at any time.

| | 2. | Effective August 1, 2017, the Frontier Heritage Fund added Welton Investment Partners, LLC as a major commodity trading advisor. |

The current major commodity trading advisors, including those advising commodity pools on the Galaxy Plus Platform and/or reference programs for the Frontier Heritage Fund are:

| | • | | BH-DG Systematic Trading LLP |

| | • | | Welton Investment Partners, LLC |

| | • | | Winton Capital Management, Ltd. |

The managing owner anticipates that between 10% and 50% of the assets of the Frontier Heritage Fund may be allocated to each of the major commodity trading advisors, commodity pools on the Galaxy Plus Platform and/or reference programs at any given time.

| | 3. | SUMMARY – Frontier Select Fund Allocation of Assets among Trading Advisors and Commodity Pools |

As of August 1, 2017, the allocation of the assets of the Frontier Select Fund between the trading advisors was as follows (however, the actual allocation among trading advisors for the Frontier Select Fund will vary based on the relative trading performance of the trading advisors and/or reference programs, and the managing owner may otherwise vary such percentages from time to time in its sole discretion):

| | | | |

Advisor | | Allocation as of August 1, 2017 (expressed as a percentage of aggregate notional exposure to commodity trading programs) | |

BH-DG Systematic Trading LLP | | | 13.9 | % |

Transtrend B.V. (accessed via Galaxy Plus Fund – Transtrend B.V. Feeder Fund (531) | | | 50.2 | % |

Welton Investment Partners, LLC (accessed via Galaxy Plus Fund – Welton GDP Feeder Fund (538) LLC) | | | 35.9 | % |

4. SUMMARY – Frontier Heritage Fund Allocation of Assets among Trading Advisors and Commodity Pools

As of August 1, 2017, the allocation of the assets of the Frontier Heritage Fund between the trading advisors was as follows (however, the actual allocation among trading advisors for the Frontier Heritage Fund will vary based on the relative trading performance of the trading advisors and/or reference programs, and the managing owner may otherwise vary such percentages from time to time in its sole discretion):

| | | | |

Advisor | | Allocation as of August 1, 2017 (expressed as a percentage of aggregate notional exposure to commodity trading programs) | |

BH-DG Systematic Trading LLP | | | 15.4 | % |

Welton Investment Partners, LLC (accessed via Galaxy Plus Fund – Welton GDP Feeder Fund (538) | | | 33.6 | % |

Winton Capital Management Ltd. | | | 51.0 | % |

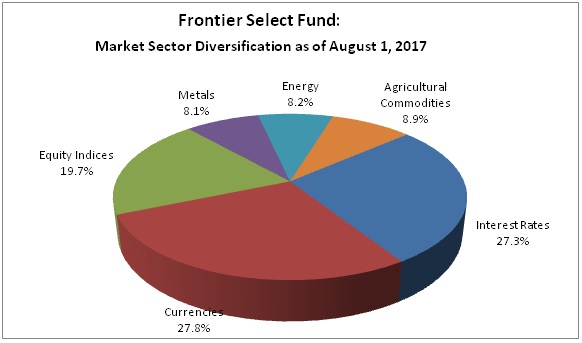

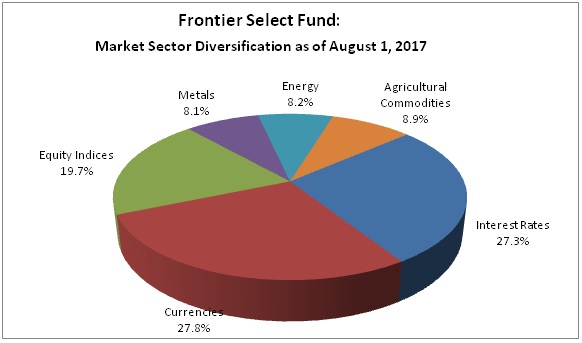

| | 5. | FRONTIER SELECT FUND APPENDIX – DIVERSIFICATION SUMMARY |

DIVERSIFICATION SUMMARY

FRONTIER FUNDS – FRONTIER SELECT FUND

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Frontier Select Fund Trading Advisors and/or Reference Programs: | | Program | | Interest

Rates | | | Currencies | | | Equity

Indices | | | Metals | | | Energy | | | Agricultural

Commodities | | | Total | |

BH-DG Systematic Trading LLP | | Systematic Trading Program | | | 28.7 | % | | | 16.3 | % | | | 23.7 | % | | | 14.4 | % | | | 7.9 | % | | | 9.1 | % | | | 100 | % |

Transtrend B.V. | | Diversified Trend Program – Enhanced Risk/USD | | | 25.0 | % | | | 33.0 | % | | | 22.0 | % | | | 5.0 | % | | | 7.0 | % | | | 8.0 | % | | | 100 | % |

Welton Investment Partners LLC | | GDP Program | | | 30.0 | % | | | 25.0 | % | | | 15.0 | % | | | 10.0 | % | | | 10.0 | % | | | 10.0 | % | | | 100 | % |

Frontier Select Fund | | N/A | | | 27.3 | % | | | 27.8 | % | | | 19.7 | % | | | 8.1 | % | | | 8.2 | % | | | 8.9 | % | | | 100 | % |

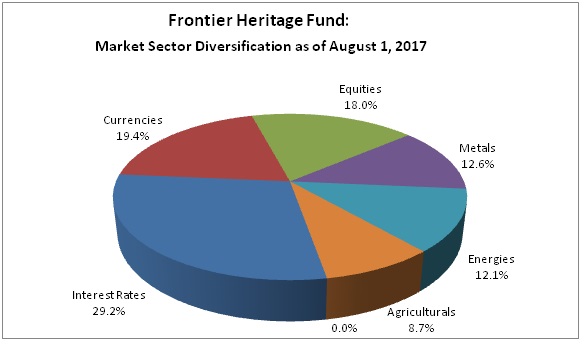

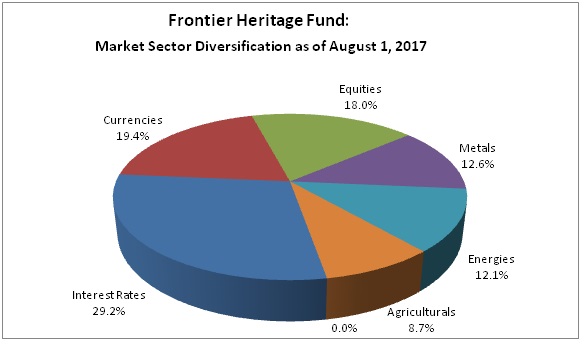

| | 6. | FRONTIER HERITAGE FUND APPENDIX – DIVERSIFICATION SUMMARY |

DIVERSIFICATION SUMMARY

FRONTIER FUNDS – FRONTIER HERITAGE FUND

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Frontier Select Fund Trading Advisors and/or Reference Programs: | | Program | | Interest

Rates | | | Currencies | | | Equity

Indices | | | Metals | | | Energy | | | Agricultural

Commodities | | | Total | |

BH-DG Systematic Trading LLP | | Systematic Trading Program | | | 28.7 | % | | | 16.3 | % | | | 23.7 | % | | | 14.4 | % | | | 7.9 | % | | | 9.1 | % | | | 100 | % |

Welton Investment Partners LLC | | GDP Program | | | 30.0 | % | | | 25.0 | % | | | 15.0 | % | | | 10.0 | % | | | 10.0 | % | | | 10.0 | % | | | 100 | % |

Winton Capital Management Ltd.** | | Diversified Futures Fund | | | 28.8 | % | | | 16.7 | % | | | 18.2 | % | | | 13.8 | % | | | 14.8 | % | | | 7.7 | % | | | 100 | % |

Frontier Select Fund | | N/A | | | 29.2 | % | | | 19.4 | % | | | 18.0 | % | | | 12.6 | % | | | 12.1 | % | | | 8.7 | % | | | 100 | % |

| | 7. | The following section is added before the section entitled “APPENDICES TO PART ONE – FRONTIER SELECT FUND APPENDIX AND FRONTIER HERITAGE FUND APPENDIX – WELTON INVESTMENT PARTNERS, LLC: |

WELTON INVESTMENT PARTNERS LLC

Background

Welton Investment Partners LLC (the “Company”) is a Delaware Limited Liability Company created in June 2014. Welton Investment Partners LLC was formed to provide all of the investment advisory andday-to-day operational services previously assumed by its sole managing member, Welton Investment Corporation (the “Managing Member”, and together with the Company, “Welton”), a Delaware corporation that merged in May 1997 from a California corporation originally formed in 1988.

Welton provides discretionary investment management services regarding the trading of commodity futures contracts and over the counter (“OTC”) foreign exchange products utilizing quantitative research combined with experienced portfolio management. The Company or its Managing Member has been registered as a commodity trading advisor (CTA) and commodity pool operator (CPO) with the Commodity Futures Trading Commission (CFTC) since January 1989 and has been a member of the National Futures Association (NFA), the futures industry self-regulatory organization, since January 1989. The Company has been registered as an investment advisor (RIA) with the Security Exchange Commission (SEC) since July 2014. The Company is also a member of the Managed Funds Association (MFA). The primary place of business is:

The Eastwood Building

San Carlos between 5th and 6th

P.O. Box 6147

Carmel, California 93921-6147

Tel: (831)626-5190

Fax: (831)626-5199

E-Mail:inquiries@welton.com

www.welton.com

Principals

THE PRINCIPALS OF WELTON ARE PATRICK L. WELTON, ANNETTE L. WELTON, DONALD H. PUTNAM, DAVID S. NOWLIN, TODD W. MERRELL, HUNTER L. LEIGHTON, CHRISTOPHER S. KEENAN, CORNELIUS J. HOWE, JUSTIN B. DEW, GUILLAUME DETRAIT, ARTHUR BELL, JUSTIN BALAS AND WELTON INVESTMENT CORPORATION

| | |

| Dr. Patrick L. Welton | | Chief Executive Officer, Chief Investment Officer andCo-Founder |

Dr. Welton chairs the Investment Committee and participates in ongoing research. He has been an active investor for more than three decades andco-founded the Managing Member in 1988. Dr. Welton has served on committees for the Managed Funds Association (MFA) and as a member of the Board of Directors of the National Futures Association (NFA) from 1997-2000. He has spoken at numerous conferences globally, participated in panel presentations, and has authored articles about alternative investments. Dr. Welton currently chairs the investment committee of a foundation and a California pension plan. He holds undergraduate, doctoral and postdoctoral degrees from the University of Wisconsin, University of California, Los Angeles (UCLA), and Stanford University respectively.

Dr. Welton has been registered as an Associated Person and listed as a Principal with Welton Investment Partners LLC since July 2014. He has also been registered as an Associated Person and listed as a Principal with an affiliated entity Welton Global Funds Management Corporation since February 1996. Dr. Welton serves as the President and Chief Executive Officer of Welton Global Funds Management Corporation. The main business of Welton Global Funds Management Corporation is to function as a commodity pool operator for a private fund. Dr. Welton has also been listed as a Principal with an affiliated entity Welton Fund Advisors LLC since March 2014. The main business of Welton Fund Advisors LLC is to function as a commodity pool operator for a registered investment company.

| | |

| Annette L. Welton | | Chair, Board of Directors andCo-Founder |

Ms. Welton is Chair of the Board of Directors. She oversees firm management, develops independent feedback to the Board and engages in high-level industry relations. Ms. Weltonco-founded the Managing Member and served as its Chief Operating Officer for two decades. She has served on the Managed Futures Association (now Managed Funds Association) Public Relations and Trading and Markets Committees, as well as on the National Futures Association (NFA) Nominating Committee. Ms. Welton serves on the UCLA Foundation Board of Directors and also serves as the Chair of the Finance Committee. She holds a BS from the University of California, Los Angeles (UCLA).

Ms. Welton has been registered as an Associated Person and listed as a Principal with Welton Investment Partners LLC since July 2014. She has also been registered as an Associated Person and listed as a Principal with an affiliated entity Welton Global Funds Management Corporation since February 1996. Ms. Welton serves as the Secretary and Chief Financial Officer of Welton Global Funds Management Corporation. The main business of Welton Global Funds Management Corporation is to function as a commodity pool operator for a private fund. Ms. Welton has also been listed as a Principal with an affiliated entity Welton Fund Advisors LLC since March 2014. The main business of Welton Fund Advisors LLC is to function as a commodity pool operator for a registered investment company.

| | |

| Guillaume Detrait | | Chief Operating Officer and Chief Enterprise Risk Officer |

Mr. Detrait chairs the Operating Committee. He is responsible for overseeing the overall operations of the firm, helping each department adopt sound business practices and mitigating all major risks. Mr. Detrait holds an MBA from Columbia Business School and a BS in Economics from ESC Reims in France. Mr. Detrait joined Welton in July 2008 and has been registered as an Associated Person and listed as a Principal with Welton Investment Partners LLC since July 2014. Mr. Detrait has also been registered as an Associated Person and Principal with an affiliated entity Welton Fund Advisors LLC since March 2014. Mr. Detrait serves as the Chief Operating Officer of Welton Fund Advisors LLC. The main business of Welton Fund Advisors LLC is to function as a commodity pool operator for a registered investment company.

| | |

| Justin P. Balas, CAIA | | Head of Quantitative Macro Group |

Mr. Balas oversees the firm’s proprietary research and product development for the Quantitative Macro group. He holds the CAIA designation, earned a BA from the University of California, Santa Cruz and is a graduate of the Stanford Executive Program. Mr. Balas joined Welton in September 2004 and has been registered as an Associated Person and listed as a Principal with Welton Investment Partners LLC since July 2014.

| | |

| David S. Nowlin, CRCP | | Chief Compliance Officer |

Mr. Nowlin oversees compliance, legal and internal departmental reviews. He earned an MBA from Santa Clara University and a BA from Westmont College. Mr. Nowlin has successfully completed the FINRA® Institute at Wharton Certified Regulatory and Compliance Professional (CRCP) program. Mr. Nowlin joined Welton in June 1993 and has been registered as an Associated Person and listed as a Principal with Welton Investment Partners LLC since July 2014. Mr. Nowlin has also been registered as an Associated Person and Principal with an affiliated entity Welton Fund Advisors LLC since March 2014. Mr. Nowlin serves as the Chief Compliance Officer of Welton Fund Advisors LLC. The main business of Welton Fund Advisors LLC is to function as a commodity pool operator for a registered investment company.

| | |

| Christopher S. Keenan | | Director of Marketing |

Mr. Keenan manages marketing initiatives. He holds an MBA from Northwestern’s Kellogg School of Business and a BA from UCLA. Mr. Keenan joined Welton in September 2002 and has been registered as an Associated Person and listed as a Principal with Welton Investment Partners LLC since July 2014.

| | |

| Justin B. Dew | | Director of Strategic Development |

Mr. Dew is responsible for business development, expanding the firm’s East Coast presence and identifying, evaluating and executing strategic growth opportunities. Mr. Dew holds an MBA from Cornell University and a BS from Ithaca College. Mr. Dew joined Welton in December 2008 and has been registered as an Associated Person and listed as a Principal with Welton Investment Partners LLC since July 2014. He is listed as the branch office manager of the New York office. Mr. Dew has also been registered as an Associated Person and Principal with an affiliated entity Welton Fund Advisors LLC since March 2014. Mr. Dew serves as the Chief Executive Officer of Welton Fund Advisors LLC. The main business of Welton Fund Advisors LLC is to function as a commodity pool operator for a registered investment company.

| | |

| Arthur F. Bell, Jr., CPA | | Independent Director |

Mr. Bell is an independent Director of Welton Investment Partners LLC’s board of directors. In his role, he provides independent feedback to the board and oversight of management. Mr. Bell has been the Founder and Managing Member of Arthur F. Bell, Jr. & Associates, L.L.C., Certified Public Accountants, since October 1974. Mr. Bell has over 37 years of experience in the alternative investment world and has been an active member of the MFA Executive Committee and Board of Directors since September 1994. Mr. Bell was also a member of the CFTC’s Global Markets Advisory Committee. He is currently a member of the Futures Industry Association Editorial Advisory Board, the American Institute of Certified Public Accountants (AICPA), the Pension Research Accounting Group (PRAG) based in London, the Alternative Investment Management Association (AIMA) also based in London, and is on numerous industry committees and working groups. Mr. Bell previously served as anon-executive Director of Tewksbury Capital Management Ltd. from June 2002 to May 2009. Mr. Bell is a graduate of Johns Hopkins University and a licensed CPA in Maryland and New York. He has been listed as a Principal with Welton Investment Partners LLC since July 2014.

| | |

| Donald H. Putnam | | Director |

Mr. Putnam serves on Welton Investment Partners’ Board of Directors. In his role, he provides feedback to the board and oversight of management. Mr. Putnam is the Managing Partner of Grail Partners LLC, a firm he founded in early 2005. Prior to Grail he led Putnam Lovell Securities which he founded in 1987. At Putnam Lovell he served as Chief Executive Officer, Chairman of the Board, and Managing Director in the firm’s investment banking group. Putnam Lovell was sold to National Bank Financial in 2002; until 2005 Mr. Putnam served as CEO and Vice Chairman of Putnam Lovell NBF. Prior to founding Putnam Lovell in 1987, Mr. Putnam was affiliated with and held senior positions at SEI Investments, SEI Financial Services Company and its various mutual funds, Catallactics Corporation (a subsidiary of SunGard), and Bankers Trust Company. Mr. Putnam serves on the investment committee of Ripon College and the boards of EMG and Manifold Partners. He also serves on the advisory board of Syntel Inc. Mr. Putnam studied at NYU. He has been listed as a Principal with Welton Investment Partners LLC since July 2014.

| | |

| Hunter L. Leighton | | Head of Infrastructure, Systems and Cybersecurity |

Mr. Leighton oversees Welton Investment Partners information technology infrastructure, systems administration and cybersecurity. He formerly worked as a Senior Trader with John W. Henry & Company Inc., bringing thirteen years of experience in the global futures and foreign exchange markets. Mr. Leighton holds a BS from the University of Florida. Mr. Leighton joined Welton Investment Partners in 2008.

| | |

| Cornelius ‘Neal’ J. Howe | | Director of Investor Solutions |

Mr. Howe leads the Investor Solutions team overseeing the new business development effort for all of Welton’s strategies, and working closely with investors to develop the most optimal solutions designed to meet their return objectives. Previously he was Managing Director and Head of Distribution for Barclays Funds and Advisory. Mr. Howe has also worked with Merrill Lynch, Schroders and Lazard in senior Distribution roles. He holds a BS from Indiana University. Mr. Howe joined Welton Investment Partners in 2015.

| | |

| Todd W. Merrell, CPA, CA | | Director of Finance |

Mr. Merrell is responsible for all aspects of finance, middle- and back-office operations for Welton. This includes: corporate finance, fund accounting, fund administration, trade oversight, and investor relations. Prior to joining Welton, Mr. Merrell was an Assistant Vice-President with JPMorgan Chase Hedge Fund Services in Bermuda. Before JPMorgan, he worked for Deloitte in Canada where he qualified as a Chartered Accountant (CA). Mr. Merrell holds memberships with the Chartered Professional Accountants of Canada (CPA Canada) in both Bermuda and Saskatchewan. He earned a Master of Professional Accounting degree and a Bachelor of Commerce degree in Finance from the University of Saskatchewan. Mr. Merrell joined Welton Investment Partners in 2009.

Welton Investment Corporation

As the sole Managing Member, Welton Investment Corporation has been listed as a Principal with Welton Investment Partners LLC since July 2014.

Chalice Welton LLC

As a Member, Chalice Welton LLC has been listed as a Principal with Welton Investment Partners LLC since July 2014.

Legal Actions

There have never been any administrative, civil, or criminal proceedings (whether pending, on appeal or concluded) against Welton Investment Partners LLC or its Principals.

Trading Approach

The Welton Global Directional Portfolio (“GDP”) is proprietary and highly confidential to Welton. Accordingly, the description set out below is general only and is not intended to be exhaustive or absolute.

The GDP is a comprehensive managed futures program designed to reliably deliver the style class returns of directional managed futures accompanied by a sustainable performance advantage. The Global Directional Portfolio commenced trading client assets in June 2004.

The program employs exchange-traded futures contracts and foreign exchange instruments within global interest rate, currency, equity index and commodity markets. The inclusion or exclusion of certain markets in investment products and the instruments selected to trade those markets at various times is affected by many factors including, but not limited to, contract liquidity, Futures Commission Merchant constraints, regulatory requirements, market conditions and investment opportunity as determined by Welton. In addition, U.S. clients may be restricted from participating in certain markets not yet approved for use by U.S. regulatory authorities. In its sole discretion, Welton may adjust the systems, methodology, weighting, capacity and market composition (including the addition of markets not listed and/or the deletion of listed markets) in each investment product at any time. Unless otherwise directed by the client or the client’s clearing broker, positions will be offset on afirst-in,first-out basis.

GDP was conceived to provide investors with a source ofnon-correlated returns and long-term capital appreciation by capitalizing on the full range of investment opportunities available in the global futures and FX markets. GDP does this by employing a broadly diversified portfolio architecture that spans multiple asset classes, strategy types, holding periods and directionality (i.e., taking either long or short positions).

To accomplish its goals GDP today trades 26 unique and diverse strategies, each attempting to capture a specific recurrent market phenomena generated by behavioural inefficiencies amongst capital market participants. These inefficiencies include, but are not limited to, under-anticipated price shifts from a variety of recurrent global macro-economic themes, carry differentials, structural financing premiums within and across markets, and the exploitation of a variety of short- and long-term statistical probabilities, among others.

Strategies are then systematically combined through atop-down Multi-Asset Class Correlation and Risk Optimization (MACRO) allocation framework to achieve GDP’s clear objectives over the long-term. This system was specifically designed to target maximum diversification to complement GDP’s momentum / trend following core, and embeds risk management at multiple layers within the portfolio for a stable portfolio risk profile over time.

By maintaining these core design principles, an unwavering focus, and a process of continuous improvement, Welton hopes to ensure that GDP will continue to deliver the dual traits of alpha plus portfolio-enhancing diversification that investors value.

Past Performance of Global Directional Portfolio Program

Welton Investment Partners LLC – Global Directional Portfolio Program

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| Monthly Rates of Return | | (%) | | | (%) | | | (%) | | | (%) | | | (%) | | | (%) | |

January | | | -0.76 | | | | 4.36 | | | | 7.56 | | | | -2.01 | | | | 2.86 | | | | -1.15 | |

February | | | 2.71 | | | | 7.83 | | | | -0.59 | | | | 5.68 | | | | -1.32 | | | | 1.31 | |

March | | | -1.43 | | | | -5.34 | | | | 3.68 | | | | -1.43 | | | | 1.03 | | | | -1.41 | |

April | | | 1.03 | | | | -0.44 | | | | -5.24 | | | | 6.13 | | | | 1.56 | | | | 0.85 | |

May | | | 0.09 | | | | -2.94 | | | | -0.79 | | | | 5.17 | | | | -5.70 | | | | 1.33 | |

June | | | -5.04 | | | | 11.26 | | | | -6.22 | | | | 3.04 | | | | -2.73 | | | | -4.71 | |

July | | | | | | | 2.38 | | | | 4.39 | | | | -3.59 | | | | -3.08 | | | | 5.27 | |

August | | | | | | | -3.90 | | | | -7.19 | | | | 5.31 | | | | -1.10 | | | | -1.26 | |

September | | | | | | | 1.10 | | | | 3.18 | | | | -1.14 | | | | -2.67 | | | | -2.86 | |

October | | | | | | | -4.98 | | | | -1.31 | | | | 0.45 | | | | 5.29 | | | | -3.95 | |

November | | | | | | | 0.82 | | | | 3.58 | | | | 8.92 | | | | 4.71 | | | | -0.85 | |

December | | | | | | | 1.78 | | | | -1.79 | | | | 3.95 | | | | -4.06 | | | | -0.62 | |

Compound Rate of Return | | | -3.52 | | | | 11.08 | | | | -1.91 | | | | 34.01 | | | | -5.73 | | | | -8.12 | |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

| | |

| Name of CTA: | | Welton Investment Partners LLC |

| Name of program: | | Global Directional Portfolio Program |

| Inception of trading by CTA: | | February 1989 |

| Inception of trading program: | | June 2004 |

| Worst monthly drawdown*: | | -9.15% |

| Worst peak-to-valley drawdown**: | | -33.18% |

| Totals Assets in the Program: | | $492,000,000 (as of June 30, 2017) |

| Total Assets Under Management of the CTA: | | $845,000,000 (as of June 30, 2017) |

| * | Draw-down means losses experienced by the trading program over a specified period. |

| ** | Worst peak-to-valley draw-down means the greatest cumulative percentage decline in month-end net asset value due to losses sustained by the trading program during any period in which the initial month-end net asset value is not equaled or exceeded by a subsequent month-end net asset value. |

Frontier Select Fund, Correlation matrix of CTA programs

| | | | | | | | | | |

| Correlation CoefficientJul-2012 toJun-2017 | | BH-DG | | Transtrend | | | Welton | |

BH-DG | | 1.00 | | | 0.85 | | | | 0.79 | |

Transtrend | | 0.85 | | | 1.00 | | | | 0.81 | |

Welton | | 0.79 | | | 0.81 | | | | 1.00 | |

Frontier Heritage Fund, Correlation matrix of CTA programs

| | | | | | | | | | | | |

| Correlation CoefficientJul-2012 toJun-2017 | | BH-DG | | | Welton | | | Winton | |

BH-DG | | | 1.00 | | | | 0.79 | | | | 0.82 | |

Welton | | | 0.79 | | | | 1.00 | | | | 0.84 | |

Winton | | | 0.82 | | | | 0.84 | | | | 1.00 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | |

| | Frontier Funds |

| | (Registrant) |

| | |

| Date: August 7, 2107 | | By: | | /s/ Patrick F. Hart III |

| | | | Patrick F. Hart III |

| | | | President and Chief Executive Officer of Frontier Fund Management, LLC, the Managing Owner |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | |

| | Frontier Select Fund, |

| | a Series of Frontier Funds |

| | (Registrant) |

| | |

| Date: August 7, 2017 | | By: | | /s/ Patrick F. Hart III |

| | | | Patrick F. Hart III |

| | | | President and Chief Executive Officer of Frontier Fund Management, LLC, the Managing Owner of Frontier Select Fund, a Series of Frontier Funds |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | |

| | Frontier Heritage Fund, |

| | a Series of Frontier Funds |

| | (Registrant) |

| | |

| Date: August 7, 2017 | | By: | | /s/ Patrick F. Hart III |

| | | | Patrick F. Hart III |

| | | | President and Chief Executive Officer of Frontier Fund Management, LLC, the Managing Owner of Frontier Heritage Fund, a Series of Frontier Funds |