Universal Technical Institute, Inc. Q1 2025 Financial Supplement

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended). Forward-looking statements may contain words such as "goal," "target," "future," "estimate," "expect," "anticipate," "intend," "plan," "believe," "seek," "project," "may," "should," "will," the negative form of these expressions or similar expressions. These statements are based on our management’s current beliefs, expectations and assumptions about future events, conditions and results and on information currently available to us. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, achievements or events and circumstances reflected in the forward-looking statements will occur. Discussions containing these forward-looking statements may be found, among other places, in the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference from our most recent Annual Report on Form 10-K, in our subsequent Quarterly Reports on Form 10-Q and certain of our Current Reports on Form 8-K, as well as any amendments thereto, filed with the Securities and Exchange Commission (the “SEC”). In addition, statements that refer to projections of earnings, revenue, costs or other financial items in future periods; anticipated growth and trends in our business or key markets; cost synergies, growth opportunities and other potential financial and operating benefits; future growth and revenues; future economic conditions and performance; anticipated performance of curriculum; plans, objectives and strategies for future operations; and other characterizations of future events or circumstances, and all other statements that are not statements of historical fact are forward-looking statements. Such statements are based on currently available operating, financial and competitive information and are subject to various risks, uncertainties and assumptions that could cause actual results to differ materially from those anticipated or implied in our forward-looking statements due to a number of factors, including, but not limited to, those set forth under the section entitled “Risk Factors” in our filings with the SEC. Important factors that could affect our actual results include, among other things, failure of our schools to comply with the extensive regulatory requirements for school operations; our failure to maintain eligibility for federal student financial assistance funds; the effect of current and future Title IV Program regulations arising out of negotiated rulemakings, including any potential reductions in funding or restrictions on the use of funds received through Title IV Programs; the effect of future legislative or regulatory initiatives related to veterans’ benefit programs; continued Congressional examination of the for-profit education sector; our failure to maintain eligibility for or the ability to process federal student financial assistance; regulatory investigations of, or actions commenced against, us or other companies in our industry; changes in the state regulatory environment or budgetary constraints; failure to comply with private education loan requirements; the effect of "borrower defense to repayment" regulation; the effect of postsecondary education regulatory environment as a results of U.S. federal elections; our failure to execute on our growth and diversification strategy, including effectively identifying, establishing and operating additional schools, programs or campuses; our failure to realize the expected benefits of our acquisitions, or our failure to successfully integrate our acquisitions; our failure to improve underutilized capacity at certain of our campuses; enrollment declines or challenges in our students’ ability to find employment as a result of macroeconomic conditions; our failure to maintain and expand existing industry relationships and develop new industry relationships; our ability to update and expand the content of existing programs and develop and integrate new programs in a timely and cost-effective manner while maintaining positive student outcomes; a loss of our senior management or other key employees; failure to comply with the restrictive covenants and our ability to pay the amounts when due under the Credit Agreement; increased scrutiny and changing expectations regarding our environmental, social and governance practices; the effect of public health pandemics, epidemics or outbreak, including COVID-19, and other risks that are described from time to time in our public filings. Given these risks, uncertainties and other factors, many of which are beyond our control, you should not place undue reliance on these forward-looking statements. Neither we nor any other person makes any representation as to the accuracy or completeness of these forward-looking statements and, except as required by law, we assume no obligation to update these forward-looking statements publicly, or to revise any forward-looking statements, even if new information becomes available in the future. This presentation also contains estimates and other statistical data made by independent parties, and by us, relating to market size and growth and other data about our industry and our business. This data involves several assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. PAGE 2

Consolidated Q1 2025 Highlights Q1 2025 Revenue $201.4 million Net Income $22.2 million Adjusted EBITDA $35.5 million Diluted Earnings Per Share $0.40 PAGE 3 ■ Delivered Q1 results that exceeded expectations for all key metrics. ■ New student starts of 5,313 representing 22.3% growth versus the prior year period, with UTI driving improvements, including the impact of timing shifts between Q4’24 and Q1’25 due to FAFSA delays, which resulted in a 19.0% increase year-over-year, and Concorde benefiting from continued marketing investments, resulting in an increase of 26.0% year-over-year. ■ Revenue of $201.4 million representing 15.3% growth versus the prior year period, with UTI and Concorde achieving 14.0% and 17.9% growth, respectively. ■ Significant increases in key profitability measures year-over-year, with a Net Income improvement of 113.2% versus the prior year period and Adjusted EBITDA(1) increasing by 44.8%. ■ $246 million of total liquidity (including $74 million of revolver capacity) provides ample available funds for any potential business needs or new opportunities that may arise. ■ Increased fiscal 2025 guidance ranges across all metrics, driven by Q1 outperformance and improved visibility for the remainder of the year. ■ Reiterated confidence in previously announced(2) 5-year strategic targets with a Revenue CAGR of ~10% and Adjusted EBITDA margin approaching 20% by FY2029. 1. For a detailed reconciliation of Non-GAAP measures, see slides 14-17. 2. See Company press release dated 2/5/2025

Consolidated Q1 2025 Summary Results ($ in millions) ($ in millions, except for student data) 3 Mos. 12/31/24 3 Mos. 12/31/23 YoY Change Revenues $201.4 $174.7 15.3% Operating expenses $174.0 $160.5 8.4% Educational services and facilities $100.2 $92.4 8.4% Selling, general and administrative $73.8 $68.1 8.5% Income from operations $27.5 $14.2 93.1% Total other income (expense), net $0.1 $(0.7) (107.5)% Income tax expense $(5.4) $(3.2) 70.1% Net income $22.2 $10.4 113.2% Adjusted EBITDA(1) $35.5 $24.5 44.8% Operating cash flow $23.0 $10.8 111.9% Adjusted free cash flow(1) $18.9 $10.2 85.1% Capital expenditures $3.3 $3.8 (13.1)% PAGE 4 1. For a detailed reconciliation of Non-GAAP measures, see slides 14-17.

Consolidated Statements of Operations Trend ($ in thousands, except EPS) 3 Mos. 12/31/24 12 Mos. 9/30/24 3 Mos. 9/30/24 3 Mos. 6/30/24 3 Mos. 3/31/24 3 Mos. 12/31/23 12 Mos. 9/30/23(1) Revenues $ 201,429 $ 732,687 $ 196,358 $ 177,458 $ 184,176 $ 174,695 $ 607,408 Operating expenses: Educational services and facilities 100,141 384,529 99,355 95,277 97,488 92,409 329,870 Selling, general and administrative 73,810 289,267 70,981 74,735 75,496 68,055 256,139 Total operating expenses $ 173,951 $ 673,796 $ 170,336 $ 170,012 $ 172,984 $ 160,464 $ 586,009 Income from operations 27,478 58,891 26,022 7,446 11,192 14,231 21,399 Total other income (expense), net 51 (2,661) (652) (689) (638) (682) (3,312) Income tax expense (5,376) (14,229) (6,530) (1,772) (2,767) (3,160) (5,765) Net Income $ 22,153 $ 42,001 $ 18,840 $ 4,985 $ 7,787 $ 10,389 $ 12,322 Preferred stock dividends — (1,097) — — — (1,097) (5,069) Income available for distribution $ 22,153 $ 40,904 $ 18,840 $ 4,985 $ 7,787 $ 9,292 $ 7,253 Income allocated to participating securities $ — $ (2,855) $ — $ — $ — $ (2,855) $ (2,712) Net income available to common shareholders $ 22,153 $ 38,049 $ 18,840 $ 4,985 $ 7,787 $ 6,437 $ 4,541 Net income per share, diluted $ 0.40 $ 0.75 $ 0.34 $ 0.09 $ 0.14 $ 0.17 $ 0.13 EBITDA(2) $ 35,442 $ 88,711 $ 33,927 $ 14,842 $ 18,513 $ 21,429 $ 47,097 Total Shares Outstanding (Period End) 54,366 53,817 53,817 53,812 53,801 53,732 34,075 Weighted Average Diluted Shares Outstanding 55,406 50,851 55,404 54,951 54,770 37,439 34,479 PAGE 5 1. The acquisition of Concorde closed on December 1, 2022 impacting comparability for the twelve months ended September 30, 2023 against all future periods. 2. For a detailed reconciliation of Non-GAAP measures, see slides 14-17.

Consolidated Results of Operations Trend Percent of Revenue 3 Mos. 12 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 12 Mos. 12/31/24 9/30/24 9/30/24 6/30/24 3/31/24 12/31/23 9/30/23(1) Revenues 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Operating Expenses: Educational services and facilities 49.8% 52.5% 50.6% 53.7% 52.9% 52.9% 54.3% Selling, general and administrative 36.6% 39.5% 36.1% 42.1% 41.0% 39.0% 42.2% Total operating expenses 86.4% 92.0% 86.7% 95.8% 93.9% 91.9% 96.5% Income from operations 13.6% 8.0% 13.3% 4.2% 6.1% 8.1% 3.5% Total other income (expense), net 0.1% (0.4)% (0.3)% (0.4)% (0.3)% (0.4)% (0.5)% Income tax expense (2.7)% (1.9)% (3.3)% (1.0)% (1.5)% (1.8)% (0.9)% Net Income 11.0% 5.7% 9.6% 2.8% 4.2% 5.9% 2.0% Preferred stock dividends —% (0.1)% —% —% —% (0.6)% (0.8)% Income available for distribution 11.0% 5.6% 9.6% 2.8% 4.2% 5.3% 1.2% Income allocated to participating securities —% (0.4)% —% —% —% (1.6)% (0.4)% Net income available to common shareholders 11.0% 5.2% 9.6% 2.8% 4.2% 3.7% 0.7% EBITDA(2) 17.6% 12.1% 17.3% 8.4% 10.1% 12.3% 7.8% PAGE 6 1. The acquisition of Concorde closed on December 1, 2022 impacting comparability for the twelve months ended September 30, 2023 against all future periods. 2. For a detailed reconciliation of Non-GAAP measures, see slides 14-17.

Quarterly Trend – Segment Key Metrics ($ in millions, except revenue per student amounts) ($ in millions, except for student data) 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 12/31/24 9/30/24 6/30/24 3/31/24 12/31/23 12/31/24 9/30/24 6/30/24 3/31/24 12/31/23 UTI UTI UTI UTI UTI Concorde Concorde Concorde Concorde Concorde New student starts 2,753 7,068 2,916 2,840 2,314 2,560 4,424 2,651 2,640 2,032 Y/Y growth/(decline)(1) 19.0% 8.7% (12.5)% 19.6% 17.2% 26.0% 13.7% 34.8% 17.2% 533.0% Average full-time active students 15,464 14,067 13,041 13,810 14,321 9,598 9,113 8,038 8,506 8,244 Average student Y/Y growth/(decline)(1) 8.0% 9.2% 13.0% 10.3% 6.0% 16.4% 13.8% 14.0% 8.9% 6.6% Revenue per student $8,500 $9,300 $9,000 $8,900 $8,100 $7,300 $7,200 $7,500 $7,200 $7,200 Y/Y growth/(decline)(1) 4.9% 4.5% 3.4% 3.5% 3.8% 1.4% 4.3% 1.4% —% 28.6% Revenues $131.5 $130.5 $117.1 $123.3 $115.4 $70.0 $65.8 $60.3 $60.9 $59.3 Y/Y growth/(decline)(1) 14.0% 13.2% 16.1% 14.7% 9.3% 18.0% 19.6% 15.0% 8.2% 311.8% Income from operations $25.5 $30.4 $14.1 $18.1 $15.1 $11.2 $6.7 $3.7 $3.2 $7.1 Margin(1) 19.4% 23.3% 12.0% 14.7% 13.1% 16.0% 10.2% 6.1% 5.3% 12.0% Adjusted EBITDA(2) $31.9 $37.5 $20.7 $24.4 $21.6 $13.0 $8.3 $5.9 $5.4 $8.8 Adjusted EBITDA margin(1) 24.2% 28.7% 17.7% 19.8% 18.7% 18.6% 12.6% 9.8% 8.9% 14.8% PAGE 7 1. Year-over-year comparisons are shown on an "as-reported basis." First quarter fiscal 2023 reflects UTI results for the full quarter and Concorde results beginning December 1, 2022. 2. For a detailed reconciliation of Non-GAAP measures, see slides 14-17. Note: Corporate results are not included within these metrics as they do not have any student data.

3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 12/31/24 12/31/24 12/31/24 12/31/24 12/31/23 12/31/23 12/31/23 12/31/23 UTI Concorde Corporate Consolidated UTI Concorde Corporate Consolidated Revenues $ 131,478 $ 69,951 $ — $ 201,429 $ 115,373 $ 59,322 $ — $ 174,695 Educational services and facilities 59,722 40,419 — 100,141 57,368 35,041 — 92,409 Selling, general and administrative 46,303 18,337 9,170 73,810 42,915 17,153 7,987 68,055 Total operating expenses 106,025 58,756 9,170 173,951 100,283 52,194 7,987 160,464 Income (loss) from operations 25,453 11,195 (9,170) 27,478 15,090 7,128 (7,987) 14,231 Net income (loss) 24,328 11,165 (13,340) 22,153 13,597 7,173 (10,381) 10,389 EBITDA(1) 31,431 12,904 (8,893) 35,442 20,597 8,282 (7,450) 21,429 Adjusted EBITDA(1) 31,856 12,983 (9,334) 35,505 21,611 8,752 (5,835) 24,528 Adjusted EBITDA margin 24.2% 18.6% —% 17.6% 18.7% 14.8% —% 14.0% Segment Results of Operations: First Quarter ($ in thousands) PAGE 8 1. For a detailed reconciliation of Non-GAAP measures, see slides 14-17.

Segment Expense Details: First Quarter ($ in thousands) 3 Mos. % of 3 Mos. % of 3 Mos. % of 3 Mos. % of 12/31/2024 Segment 12/31/2024 Segment 12/31/2024 Consolidated 12/31/2024 Consolidated UTI Revenue Concorde Revenue Corporate Revenue Consolidated Revenue EDUCATIONAL SERVICES AND FACILITIES EXPENSES: Compensation and related costs $ 31,646 24.1 % $ 26,384 37.7 % $ — — % $ 58,030 28.8 % Occupancy Costs 7,611 5.8 % 5,406 7.7 % — — % 13,017 6.5 % Depreciation and amortization expense 5,939 4.5 % 1,453 2.1 % — — % 7,392 3.7 % Supplies, maintenance and student expense 7,693 5.9 % 4,093 5.9 % — — % 11,786 5.9 % Contract service expense 951 0.7 % 593 0.8 % — — % 1,544 0.8 % Other educational services and facilities expense 5,882 4.5 % 2,490 3.6 % — — % 8,372 4.2 % Total $ 59,722 45.4 % $ 40,419 57.8 % $ — — % $ 100,141 49.7 % SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES: Compensation and related costs $ 23,419 17.8 % $ 6,627 9.5 % $ 6,692 3.3 % $ 36,738 18.2 % Advertising and marketing costs 13,677 10.4 % 7,362 10.5 % 189 0.1 % 21,228 10.5 % Professional and contract service expense 1,747 1.3 % 746 1.1 % 3,727 1.9 % 6,220 3.1 % Other selling general and administrative expense 7,460 5.7 % 3,602 5.1 % (1,438) (0.7) % 9,624 4.8 % Total $ 46,303 35.2 % $ 18,337 26.2 % $ 9,170 4.6 % $ 73,810 36.6 % COMPENSATION AND RELATED COST SUMMARY: Salaries, employee benefit and tax expense $ 51,116 38.9 % $ 31,974 45.7 % $ 5,096 2.5 % $ 88,186 43.8 % Bonus expense 3,567 2.7 % 958 1.4 % 1,337 0.7 % 5,862 2.9 % Stock based compensation 382 0.3 % 79 0.1 % 259 0.1 % 720 0.4 % Total compensation and related costs $ 55,065 41.9 % $ 33,011 47.2 % $ 6,692 3.3 % $ 94,768 47.0 % PAGE 9

New Student Starts Details 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 9/30/2023 Total Consolidated Total New Student Starts 5,313 11,492 5,567 5,480 4,346 10,392 Y/Y growth/(decline)(1) 22.3% 10.6% 5.0% 18.5% 89.4% 74.2% UTI Segment Total New Student Starts 2,753 7,068 2,916 2,840 2,314 6,500 Y/Y growth/(decline) 19.0% 8.7% (12.5)% 19.6% 17.2% 9.0% High School New Student Starts 737 4,436 708 631 640 4,044 Y/Y growth/(decline) 15.2% 9.7% (40.8)% 17.1% 14.3% 6.8% Adult New Student Starts 1,383 1,974 1,586 1,579 1,154 1,919 Y/Y growth/(decline) 19.8% 2.9% (1.7)% 19.6% 13.9% 11.0% Military New Student Starts 633 658 622 630 520 537 Y/Y growth/(decline) 21.7% 22.5% 18.5% 22.3% 29.7% 19.3% Concorde Segment Total New Student Starts 2,560 4,424 2,651 2,640 2,032 3,892 Y/Y growth/(decline)(1) 26.0% 13.7% 34.8% 17.2% 533.0% —% Core New Student Starts 1,474 2,183 1,434 1,433 1,254 1,912 Y/Y growth/(decline)(1)(2) 17.5% 14.2% 10.4% 4.8% 307.1% —% Clinical New Student Starts 988 2,033 1,053 1,084 657 1,906 Y/Y growth/(decline)(1) 50.4% 6.7% 64.0% 24.9% —% —% Short-Course New Student Starts 98 208 164 123 121 74 Y/Y growth/(decline)(1)(2) (19.0)% 181.1% 530.8% 623.5% 830.8% —% PAGE 10 1. Total company year-over-year comparisons are shown on an "as-reported basis." There is no year-over-year comparability for periods prior to Q1 2024 for Concorde. First quarter fiscal 2023 reflects UTI results for the full quarter and Concorde results beginning December 1, 2022. 2. Short-Course New Student Starts, previously presented within Core New Student Starts, are now presented separately and all prior periods have been restated to the new presentation.

Consolidated Balance Sheet and Cash Flow Summary ($ in thousands) At: 12/31/24 9/30/24 Cash & cash equivalents $ 171,999 $ 161,900 Restricted cash 5,755 5,572 Total current assets 230,873 221,951 PP&E (net) 262,261 264,797 Right-of-use assets for operating leases 155,666 158,778 Goodwill and intangible assets 46,466 46,688 Notes receivable, less current portion 39,558 36,267 Total assets 753,756 744,575 Operating lease liability – current 21,688 22,210 Long term debt, current portion 2,738 2,697 Total current liabilities 202,356 204,963 Operating lease liability – LT 144,409 146,831 Long-term debt 117,327 123,007 Total liabilities 473,780 484,344 Stockholders’ equity 279,976 260,231 Total liabilities & equity $ 753,756 $ 744,575 3 Mos. 12/31/24 3 Mos. 12/31/23 Net cash provided by operating activities $ 22,962 $ 10,836 Purchase of property and equipment (3,345) (3,848) Net cash used in investing activities (3,345) (3,848) Payments on revolving credit facility (5,000) — Payment of preferred stock cash dividend — (1,097) Preferred share repurchase — (11,320) Proceeds from stock option exercises 659 — Payments on term loans and finance leases (662) (618) Payment of payroll taxes on stock-based compensation through shares withheld (4,332) (2,054) Net cash used in financing activities (9,335) (15,089) Change in cash and restricted cash 10,282 (8,101) Ending balance of cash and restricted cash 177,754 148,823 PAGE 11 Note: On December 18, 2023, the Company exercised in full its right of conversion of the Company’s Series A Preferred Stock which resulted in the conversion of all outstanding Series A Preferred shares into 19,296,843 shares of Common Stock.

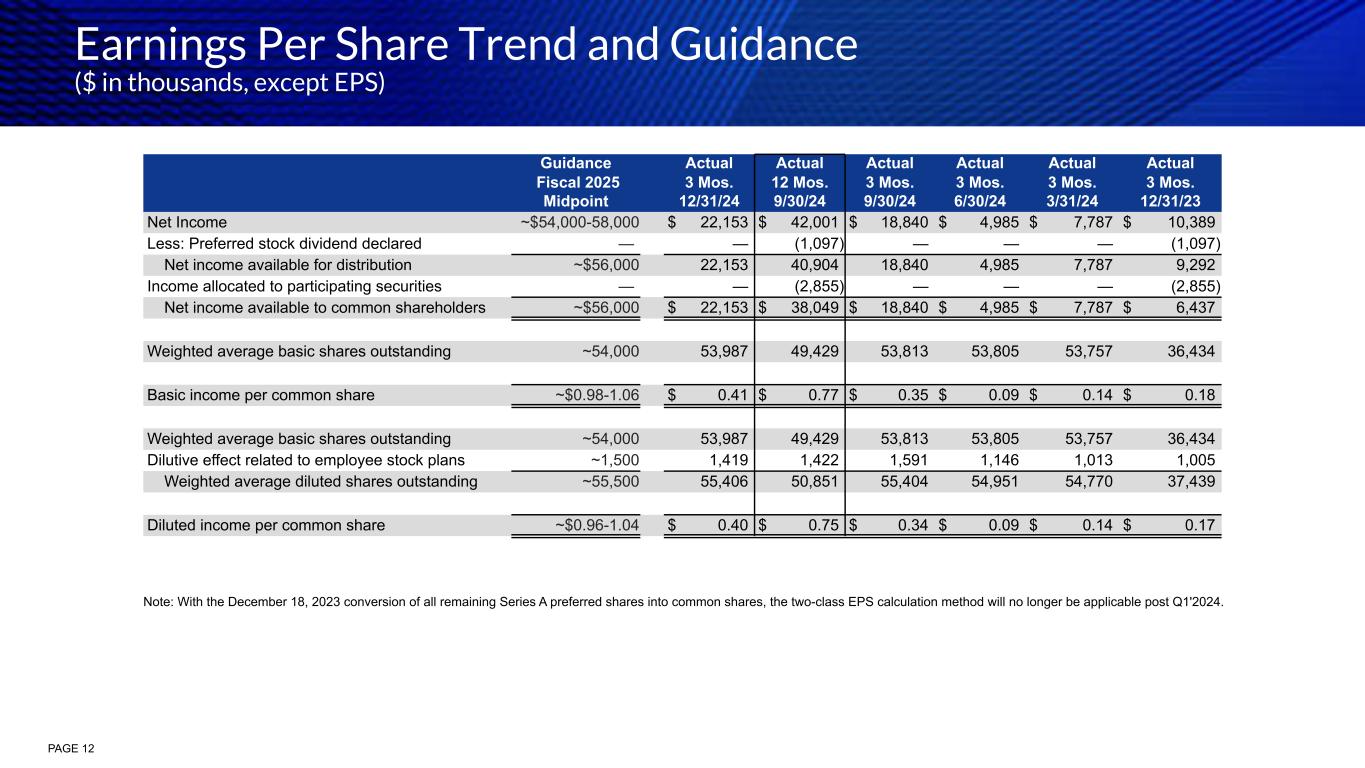

Earnings Per Share Trend and Guidance ($ in thousands, except EPS) Guidance Actual Actual Actual Actual Actual Actual Fiscal 2025 Midpoint 3 Mos. 12/31/24 12 Mos. 9/30/24 3 Mos. 9/30/24 3 Mos. 6/30/24 3 Mos. 3/31/24 3 Mos. 12/31/23 Net Income ~$54,000-58,000 $ 22,153 $ 42,001 $ 18,840 $ 4,985 $ 7,787 $ 10,389 Less: Preferred stock dividend declared — — (1,097) — — — (1,097) Net income available for distribution ~$56,000 22,153 40,904 18,840 4,985 7,787 9,292 Income allocated to participating securities — — (2,855) — — — (2,855) Net income available to common shareholders ~$56,000 $ 22,153 $ 38,049 $ 18,840 $ 4,985 $ 7,787 $ 6,437 Weighted average basic shares outstanding ~54,000 53,987 49,429 53,813 53,805 53,757 36,434 Basic income per common share ~$0.98-1.06 $ 0.41 $ 0.77 $ 0.35 $ 0.09 $ 0.14 $ 0.18 Weighted average basic shares outstanding ~54,000 53,987 49,429 53,813 53,805 53,757 36,434 Dilutive effect related to employee stock plans ~1,500 1,419 1,422 1,591 1,146 1,013 1,005 Weighted average diluted shares outstanding ~55,500 55,406 50,851 55,404 54,951 54,770 37,439 Diluted income per common share ~$0.96-1.04 $ 0.40 $ 0.75 $ 0.34 $ 0.09 $ 0.14 $ 0.17 PAGE 12 Note: With the December 18, 2023 conversion of all remaining Series A preferred shares into common shares, the two-class EPS calculation method will no longer be applicable post Q1'2024.

Leverage as of 12/31/2024 Current Loan Balances $120.1M LTM EBITDA $113.8M Cash & Cash Equivalents $172.0M Gross Leverage Ratio 1.06x Net Leverage Ratio (0.46)x Debt as of 12/31/2024 Term Loan: Avondale Campus (Fifth Third Bank) Original Note Amount $31.2M Inception Date 5/12/2021 Rate* Fixed/Floating Maturity 7 years Current Note Balance $28.2M Term Loan: Lisle Campus (Valley National Bank) Original Note Amount $38.0M Inception Date 4/14/2022 Rate** Fixed/Floating Maturity 7 years Current Note Balance $36.7M Revolver (Fifth Third Bank) Total Capacity $125.0M Inception Date 11/21/2022 Rate*** Floating Maturity 5 years Current Loan Balance $51.0M 9/30/2025 proforma leverage calculation is based upon midpoint of the adjusted EBITDA guidance range and projected year-end cash balance, both of which will depend on actual company performance. For a detailed reconciliation of Non-GAAP measures, see slides 14-17. Note: Actual use of revolver in fiscal 2025 will continue to be evaluated throughout the year. Any further reduction to the outstanding revolver balance would benefit gross leverage but have no impact on net leverage. Leverage Ratios PAGE 13 *Avondale rate is 50% fixed at 1.45% + 50% Floating @ SOFR plus 2% Margin **Lisle rate is 50% fixed at 4.69% + 50% Floating @ SOFR plus 2% Margin ***Revolver rate is SOFR plus 1.75% to 2.25% Margin based on UTI's Total Leverage Proforma Leverage 9/30/2025 Projected Note Balances ~$118.1M LTM EBITDA - FY 2025 Guidance midpoint ~$124.0M Cash & Cash Equivalents (projected) ~$200.0M Gross Leverage Ratio ~0.95x Net Leverage Ratio ~(0.66)x

Use of Non-GAAP Financial Information PAGE 14 In addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles ("GAAP"), the Company also discloses certain non-GAAP financial information. These financial measures are not recognized measures under GAAP and are not intended to be and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The Company discloses these non-GAAP financial measures because it believes that they provide investors an additional analytical tool to clarify its results of operations and identify underlying trends. Additionally, the Company believes that these measures may also help investors compare its performance on a consistent basis across time periods. The Company defines adjusted EBITDA as net income (loss) before interest expense, interest income, income taxes, depreciation and amortization, adjusted for stock-based compensation expense and items not considered normal recurring operations. The Company defines adjusted free cash flow as net cash provided by (used in) operating activities less capital expenditures, adjusted for items not considered normal recurring operations. Management utilizes adjusted figures as performance measures internally for operating decisions, strategic planning, annual budgeting and forecasting. For the periods presented, our adjustments for items that management does not consider to be normal recurring operations include: • Acquisition-related costs: We have excluded costs associated with both potential and announced acquisitions to allow for comparable financial results to historical operations and forward-looking guidance. • Integration-related costs for completed acquisitions: We have excluded integration costs related to business structure realignment and new programs for recent acquisitions to allow for comparable financial results to historical operations and forward-looking guidance. In addition, the nature and amount of such charges vary significantly based on the size and timing of the programs. By excluding the referenced expenses from our non-GAAP financial measures, our management is able to further evaluate our ability to utilize existing assets and estimate their long-term value. Furthermore, our management believes that the adjustment of these items supplements the GAAP information with a measure that can be used to assess the sustainability of our operating performance. • One-time costs associated with new campus openings: During fiscal 2022, we opened new campus locations in Austin, Texas and Miramar, Florida. We continued to incur one-time costs during fiscal 2023 for the campus opening as we completed the build-out of the remaining programs in the new facilities. We disclose any campus adjustments as direct costs (net of any corporate allocations). Outfitting a new campus requires significant facility improvements and modifications, and the purchase of technical equipment and training aids necessary for teaching our programs, the combination of which requires a significant investment by the Company which would not be considered part of normal recurring operations. • Restructuring charges: In December 2023, we announced plans to consolidate the two Houston, Texas campus locations to align the curriculum, student facing systems, and support services to better serve students seeking careers in in-demand fields. As part of the transition, the MIAT-Houston campus, acquired in November 2021, began a phased teach-out in May 2024, and such campus began operating under the UTI brand. MIAT-Houston students who have not completed their programs before their program’s teach-out date may enroll at UTI-Houston to complete their program. Both facilities will remain in use, operated by UTI-Houston post-consolidation. • Facility lease accounting adjustments: During 2024, we recorded a lease accounting adjustment for a lease termination payment for the previous Concorde corporate offices. These adjustments are not considered part of normal recurring operations. To obtain a complete understanding of our performance, these measures should be examined in connection with net income (loss) and net cash provided by (used in) operating activities, determined in accordance with GAAP, as presented in the financial statements and notes thereto included in the annual and quarterly filings with the SEC. Because the items excluded from these non-GAAP measures are significant components in understanding and assessing our financial performance under GAAP, these measures should not be considered to be an alternative to net income (loss) or net cash provided by (used in) operating activities as a measure of our operating performance or liquidity. Exclusion of items in the non-GAAP presentation should not be construed as an inference that these items are unusual, infrequent or non-recurring. Other companies, including other companies in the education industry, may define and calculate non-GAAP financial measures differently than we do, limiting their usefulness as a comparative measure across similarly titled performance measures presented by other companies. A reconciliation of the historical non-GAAP financial measures to the most directly comparable GAAP measures is included in the following slides and investors are encouraged to review the reconciliations. Information reconciling forward-looking adjusted EBITDA and adjusted free cash flow to the most directly comparable GAAP financial measure is unavailable to the company without unreasonable effort. The company is not able to provide a quantitative reconciliation of forward-looking adjusted EBITDA or adjusted free cash flow to the most directly comparable GAAP financial measure because certain items required for such reconciliation are uncertain, outside of the company’s control and/or cannot be reasonably predicted, including but not limited to the provision for (benefit from) income taxes. Preparation of such reconciliation would require a forward-looking statement of income and statement of cash flows prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to the company without unreasonable effort.

Consolidated Adjusted EBITDA Reconciliation Trend ($ in thousands) QUARTER-TO-DATE 3 Mos. 12/31/24 12 Mos. 9/30/24 3 Mos. 9/30/24 3 Mos. 6/30/24 3 Mos. 3/31/24 3 Mos. 12/31/23 12 Mos. 9/30/23(7) Net income, as reported $ 22,153 $ 42,001 $ 18,840 $ 4,985 $ 7,787 $ 10,389 $ 12,322 Interest (income) expense, net (86) 3,157 795 709 757 896 3,795 Income tax expense 5,376 14,229 6,530 1,772 2,767 3,160 5,765 Depreciation and amortization 7,999 29,324 7,762 7,376 7,202 6,984 25,215 EBITDA $ 35,442 $ 88,711 $ 33,927 $ 14,842 $ 18,513 $ 21,429 $ 47,097 Acquisition related costs(1) — — — — — — 2,374 Integration related costs for completed acquisitions(2)(3) (700) 6,049 1,126 1,653 1,696 1,574 8,585 Start-up costs for new campuses and program expansion(4) — — — — — — 2,341 Stock-based compensation expense 720 8,560 2,862 1,863 2,353 1,482 3,848 Facility lease accounting adjustments(5) — (650) (650) — — — — Restructuring Costs(6) 43 185 44 53 45 43 — Adjusted EBITDA, non-GAAP $ 35,505 $ 102,855 $ 37,309 $ 18,411 $ 22,607 $ 24,528 $ 64,245 PAGE 15 1. Costs related to both announced and potential acquisition targets. 2. During the three months ended December 31, 2024, the Company received $0.7 million in funds in final settlement of the outstanding escrow accounts affiliated with the purchase of Concorde on December 1, 2022. 3. Costs related to integrating the MIAT programs at the UTI campuses and launching Concorde programs that were previously approved by regulatory bodies prior to the acquisition are presented in “Integration related costs for completed acquisitions.” In prior quarters, these costs were presented in a line labeled “Start-up costs for new campuses and program expansion.” As the nature of the spend and activity are more aligned to integration, we have updated our presentation and recast the prior year for comparability. 4. The Austin, TX and Miramar, FL campuses opened during FY2022. The adjustment reflects one-time opening costs incurred for both campuses. 5. During 2024, we recorded a lease accounting adjustment for a lease termination payment for the previous Concorde corporate offices. 6. On December 5, 2023, UTI announced plans to consolidate the two Houston, Texas campus locations to better align with our business strategy. 7. The acquisition of Concorde closed on December 1, 2022 impacting comparability for the twelve months ended September 30, 2023 against all future periods.

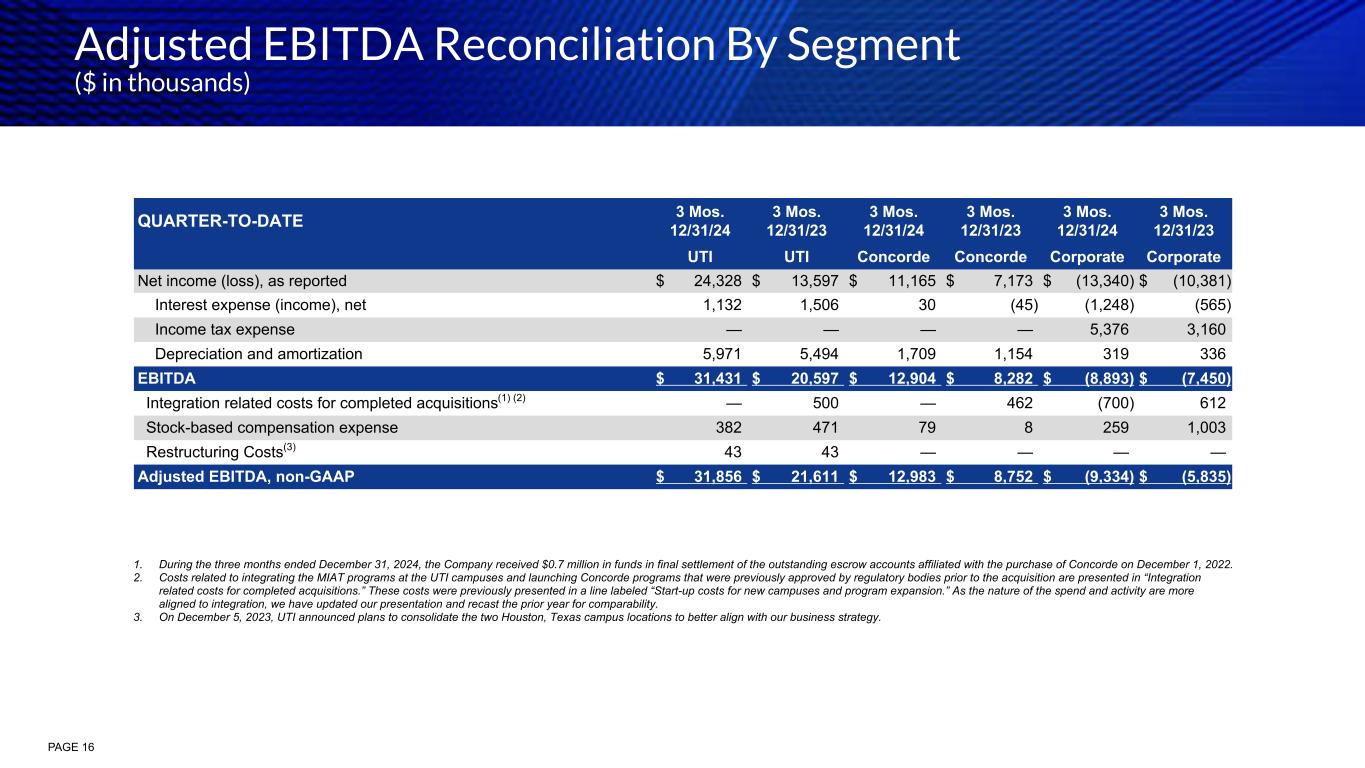

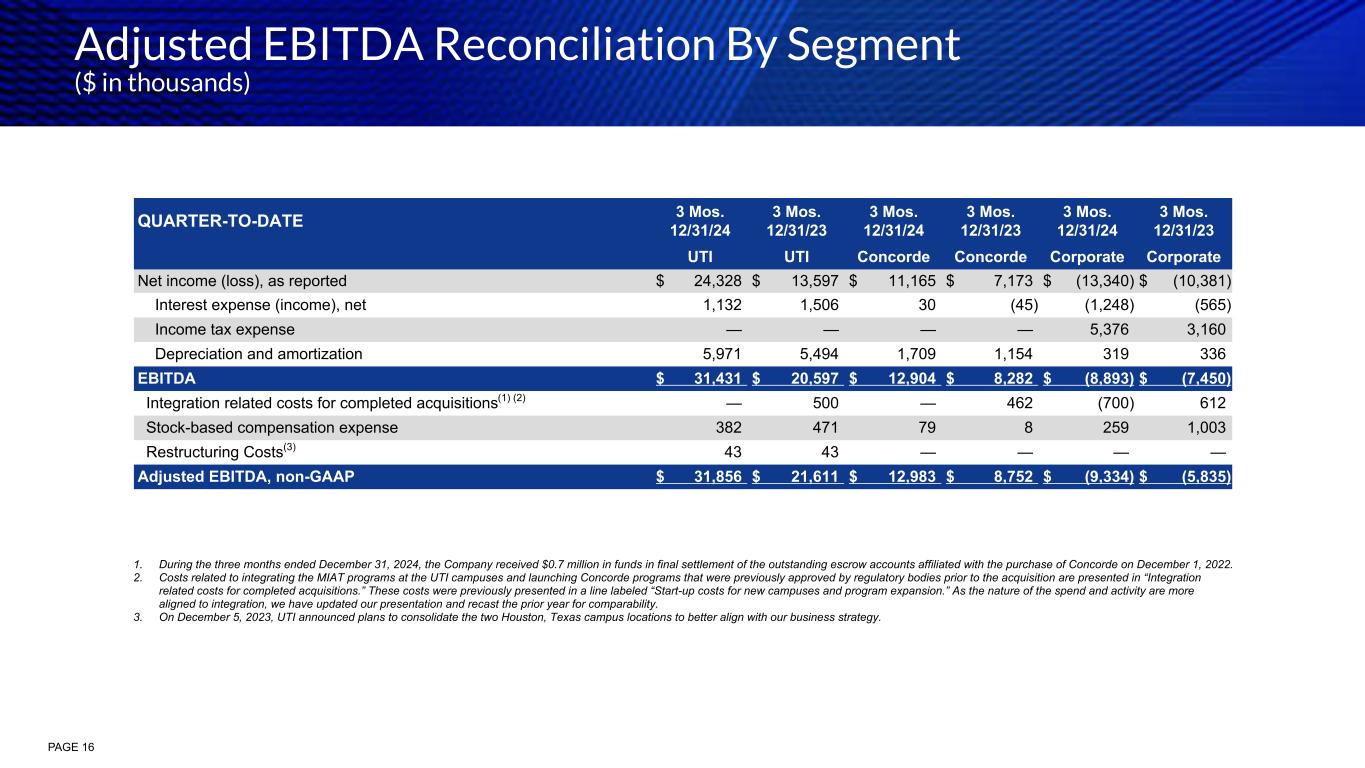

Adjusted EBITDA Reconciliation By Segment ($ in thousands) QUARTER-TO-DATE 3 Mos. 12/31/24 3 Mos. 12/31/23 3 Mos. 12/31/24 3 Mos. 12/31/23 3 Mos. 12/31/24 3 Mos. 12/31/23 UTI UTI Concorde Concorde Corporate Corporate Net income (loss), as reported $ 24,328 $ 13,597 $ 11,165 $ 7,173 $ (13,340) $ (10,381) Interest expense (income), net 1,132 1,506 30 (45) (1,248) (565) Income tax expense — — — — 5,376 3,160 Depreciation and amortization 5,971 5,494 1,709 1,154 319 336 EBITDA $ 31,431 $ 20,597 $ 12,904 $ 8,282 $ (8,893) $ (7,450) Integration related costs for completed acquisitions(1) (2) — 500 — 462 (700) 612 Stock-based compensation expense 382 471 79 8 259 1,003 Restructuring Costs(3) 43 43 — — — — Adjusted EBITDA, non-GAAP $ 31,856 $ 21,611 $ 12,983 $ 8,752 $ (9,334) $ (5,835) PAGE 16 1. During the three months ended December 31, 2024, the Company received $0.7 million in funds in final settlement of the outstanding escrow accounts affiliated with the purchase of Concorde on December 1, 2022. 2. Costs related to integrating the MIAT programs at the UTI campuses and launching Concorde programs that were previously approved by regulatory bodies prior to the acquisition are presented in “Integration related costs for completed acquisitions.” These costs were previously presented in a line labeled “Start-up costs for new campuses and program expansion.” As the nature of the spend and activity are more aligned to integration, we have updated our presentation and recast the prior year for comparability. 3. On December 5, 2023, UTI announced plans to consolidate the two Houston, Texas campus locations to better align with our business strategy.

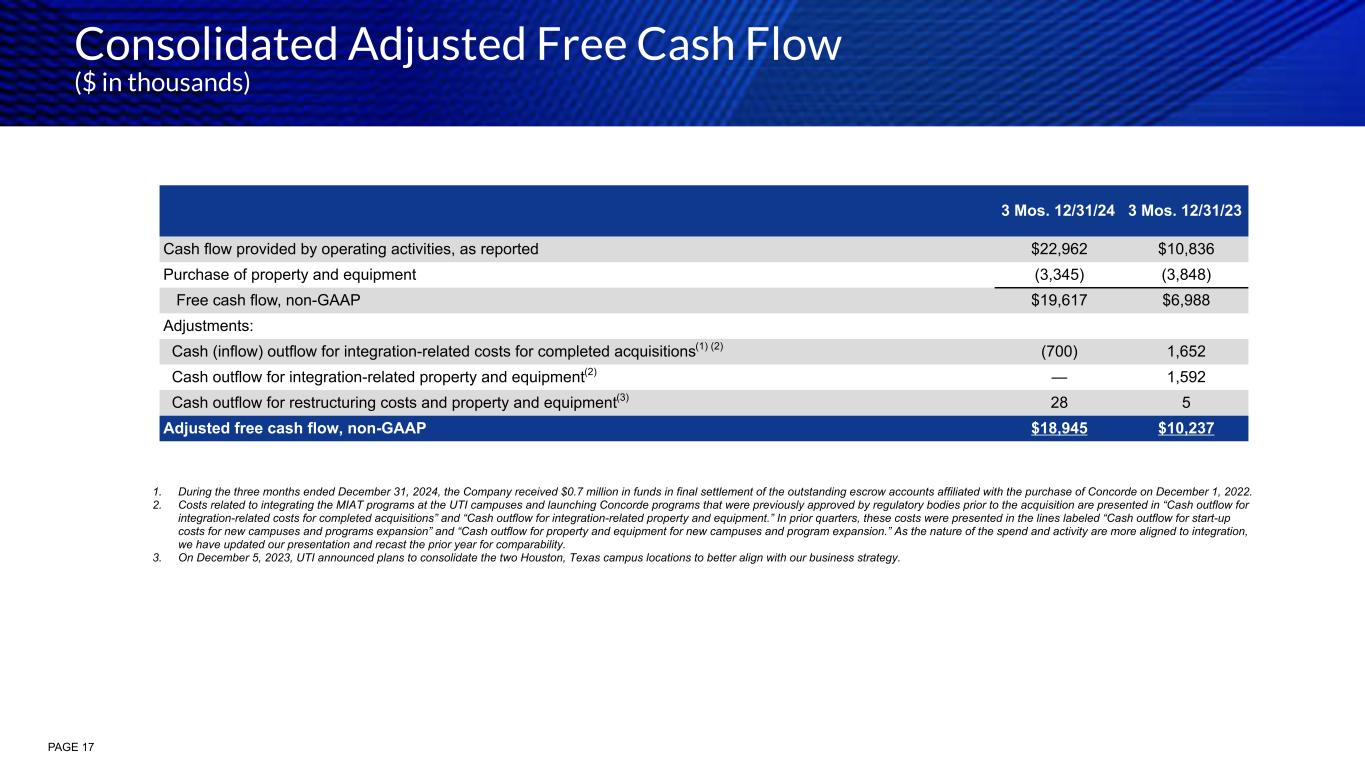

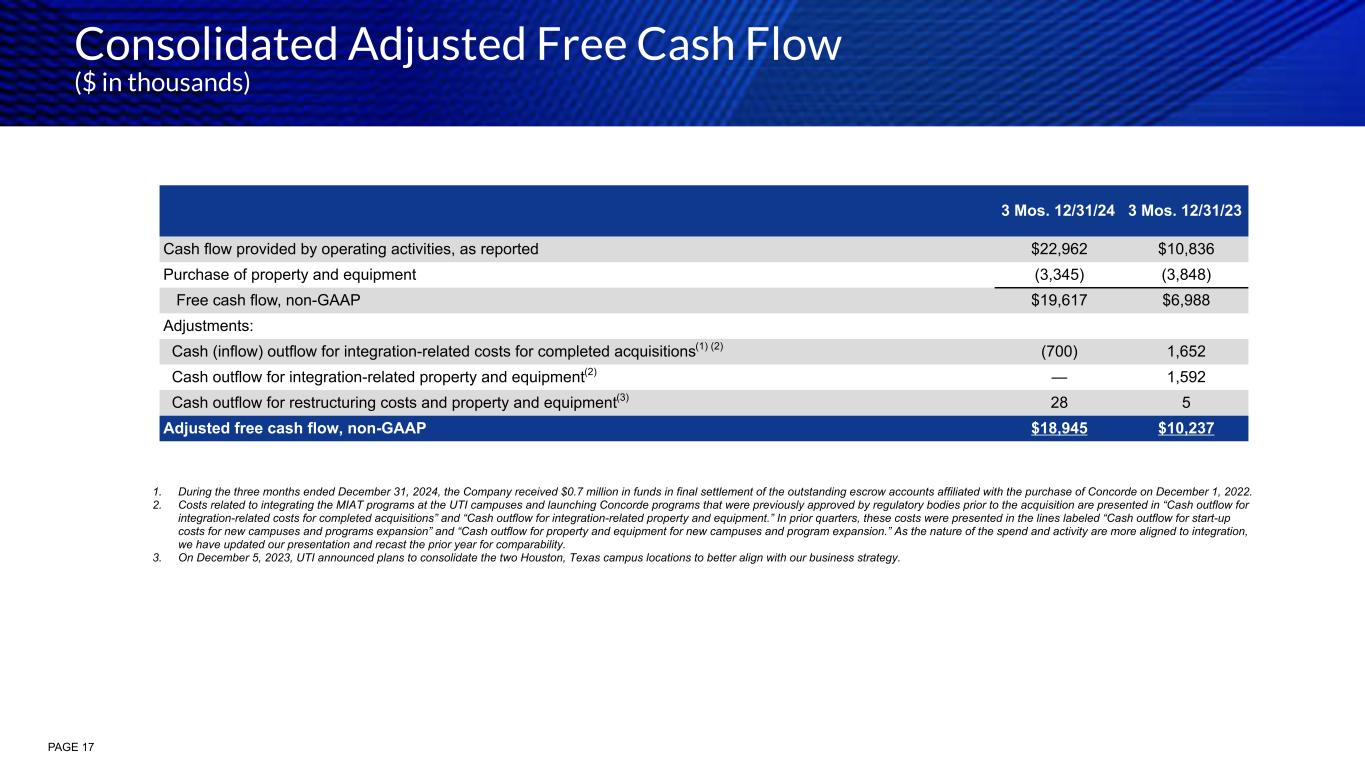

Consolidated Adjusted Free Cash Flow ($ in thousands) 3 Mos. 12/31/24 3 Mos. 12/31/23 Cash flow provided by operating activities, as reported $22,962 $10,836 Purchase of property and equipment (3,345) (3,848) Free cash flow, non-GAAP $19,617 $6,988 Adjustments: Cash (inflow) outflow for integration-related costs for completed acquisitions(1) (2) (700) 1,652 Cash outflow for integration-related property and equipment(2) — 1,592 Cash outflow for restructuring costs and property and equipment(3) 28 5 Adjusted free cash flow, non-GAAP $18,945 $10,237 1. During the three months ended December 31, 2024, the Company received $0.7 million in funds in final settlement of the outstanding escrow accounts affiliated with the purchase of Concorde on December 1, 2022. 2. Costs related to integrating the MIAT programs at the UTI campuses and launching Concorde programs that were previously approved by regulatory bodies prior to the acquisition are presented in “Cash outflow for integration-related costs for completed acquisitions” and “Cash outflow for integration-related property and equipment.” In prior quarters, these costs were presented in the lines labeled “Cash outflow for start-up costs for new campuses and programs expansion” and “Cash outflow for property and equipment for new campuses and program expansion.” As the nature of the spend and activity are more aligned to integration, we have updated our presentation and recast the prior year for comparability. 3. On December 5, 2023, UTI announced plans to consolidate the two Houston, Texas campus locations to better align with our business strategy. PAGE 17