Table of Contents

As filed with the Securities and Exchange Commission on November 19, 2003

Registration No. 333-108664

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

To

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

NPTEST HOLDING CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 3825 | 37-1469466 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification No.) | (I.R.S. Employer Identification Number) |

150 Baytech Drive

San Jose, CA 95134

(Address, Including Zip Code of Registrant’s Principal Executive Offices)

Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, DE 19808

(800) 927-9800

(Name, Address and Telephone Number, Including Area Code of Agent For Service)

Copies to:

Alan F. Denenberg, Esq. Davis Polk & Wardwell 1600 El Camino Real Menlo Park, CA 94025 (650) 752-2000 | William H. Hinman, Jr., Esq. Simpson Thacher & Bartlett LLP 3330 Hillview Avenue Palo Alto, CA 94304 (650) 251-5000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ ____________

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ ____________

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ ____________

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box.¨

CALCULATION OF REGISTRATION FEE CHART

Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||||

Common Stock, par value $0.001 per share | 16,790,000 | $13.00 | 218,270,000 | 17,658(3) | ||||

| (1) | Includes shares which the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457 under the Securities Act of 1933. |

| (3) | Includes $16,281 previously paid in connection with the initial filing of this Registration Statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 19, 2003

PROSPECTUS

14,600,000 Shares

NPTest Holding Corporation

Common Stock

$ per share

We are selling 14,600,000 shares of our common stock. The selling stockholder has granted the underwriters an option to purchase up to 2,190,000 additional shares of common stock to cover over-allotments. We will not receive proceeds from the sale of any shares of common stock by the selling stockholder.

This is the initial public offering of our common stock. We currently expect the initial public offering price to be between $11.00 and $13.00 per share. We have applied to have the common stock included for quotation on the Nasdaq National Market under the symbol “NPTT.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||

Public Offering Price | $ | $ | ||||

Underwriting Discount | $ | $ | ||||

Proceeds to NPTest Holding Corporation (before expenses) | $ | $ | ||||

The underwriters expect to deliver the shares to purchasers on or about , 2003.

| Citigroup | Credit Suisse First Boston |

| Lehman Brothers | Banc of America Securities LLC |

, 2003

Table of Contents

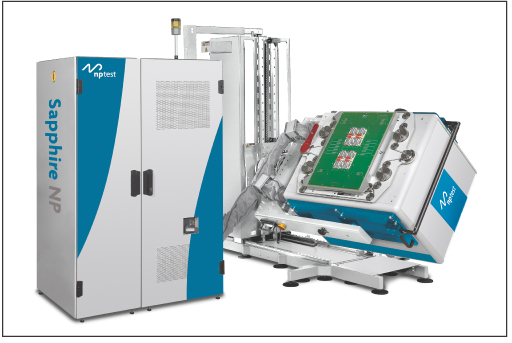

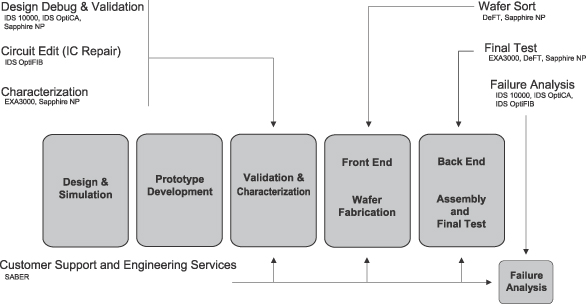

Sapphire NP – A highly flexible test platform which can be used in design debug, validation, characterization, wafer sort and final test for a wide range of integrated circuits. The Sapphire NP tester is designed to be scalable and capable of both functional and structural test, resulting in a significant reduction in integrated circuit test costs. It is scheduled to be first shipped in late 2003 or early 2004.

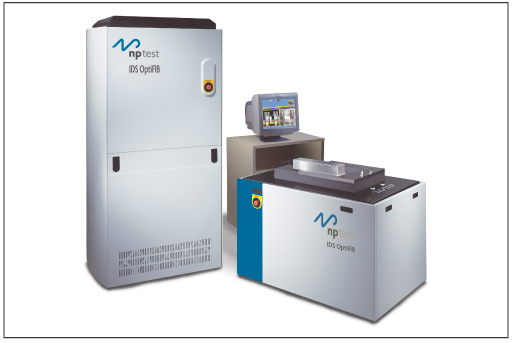

IDS OptiFIB – A focused ion beam system used for circuit edit and repair of integrated circuits, in design and failure analysis. It combines ion and photon optics in a single coaxial column, with a computer aided design navigation interface, resulting in more accurate circuit modifications.

Table of Contents

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

| Page | ||

| 1 | ||

| 8 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 22 | ||

| 23 | ||

Unaudited Pro Forma Combined Condensed Financial Information | 25 | |

| 30 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 33 | |

| 54 | ||

| 64 | ||

| 72 | ||

| 76 | ||

| 77 | ||

| 78 | ||

| 80 | ||

| 83 | ||

| 83 | ||

| 83 | ||

| F-1 |

Until , 2004 (25 days after the date of this prospectus), all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

In this prospectus, statistical information about the semiconductor market is based on data published by the Semiconductor Industry Association and VLSI Research.

NPTest, the NPTest logo, DeFT, Sapphire NP, IDS, IDS OptiFIB, IDS OptiCA and SABER are our trademarks in the United States and other countries. All other trademarks, trade names or service marks appearing in this prospectus are the property of their respective owners.

i

Table of Contents

You should read the following summary together with the more detailed information regarding our company and the securities being sold in this offering and the financial statements and the related notes and the pro forma financial data appearing elsewhere in this prospectus.

NPTest Holding Corporation

We design, develop and manufacture advanced semiconductor test and diagnostic systems and provide related services for the semiconductor industry. Our customers include integrated device manufacturers, fabless design companies, foundries and assembly and test subcontractors worldwide. Our products and services enable our customers to bring their increasingly complex integrated circuits to market faster, at lower cost and without compromising integrated circuit quality. We offer products that enable our customers to debug, characterize and test a wide range of integrated circuits, including the fastest multi-Gigahertz microprocessors and the most highly integrated, high-speed system-on-a-chip devices. In addition, we provide test engineering services, including debug, repair and characterization. As of September 30, 2003, we had 886 employees worldwide.

Our Solution

Our test and diagnostic systems and our test engineering services enable our customers to increase their engineering and manufacturing efficiency and lower their cost of test. Our solution offers:

| • | Leading technology. We are recognized as a technology leader in functional and structural test with our EXA and DeFT platforms. Our products test the most complex system-on-a-chip devices and the highest performance microprocessors at high levels of accuracy. In addition to our test platforms, our diagnostic tools detect circuit defects and design faults down to 90nm. |

| • | Accelerated time-to-market for our customers. Our products and services enable our customers to reduce the number of prototype iterations, reduce engineering and mask costs and accelerate time-to-market for their integrated circuits. Our systems perform signal measurement, failure analysis, circuit edit and characterization to identify design defects and functional failures early in the design cycle. |

| • | Multiple test capabilities on a single platform. We have designed our latest platform, Sapphire NP, for use throughout the semiconductor design and manufacturing process. With lower infrastructure costs, the same system can be configured for the engineering stages, including device debug, validation and characterization, and the high volume manufacturing stages, including wafer sort and final test. |

| • | A reconfigurable, scalable test platform. We have designed our Sapphire NP platform to be reconfigurable as the performance requirements, functionality needs and test methodologies of our customers change. Sapphire NP is designed to perform both functional and structural test. This platform is designed to test a wide range of integrated circuits, including complex system-on-a-chip devices, at varying operating speeds, without sacrificing accuracy and at a significantly lower cost of test. |

Our Business Strategy

Our objective is to lead the semiconductor test industry by introducing technologies that enhance the efficiency of test, validation and characterization in the semiconductor design and manufacturing process. Key elements of our strategy include:

| • | Extending our technology leadership. We are committed to maintaining our leadership at the high end of the market, and therefore, work closely with our customers and share product roadmaps to anticipate technology progression. |

1

Table of Contents

| • | Innovating for cost efficiency. We strive to offer leading-edge products and services that drive cost efficiency in the test and diagnostic industry. We expect the recently introduced Sapphire NP platform to improve cost efficiency by bringing a new level of integration to the test market and providing a scalable cost structure for our customers. |

| • | Enabling the transition to low cost test strategies. As semiconductor manufacturers transition from functional to structural test, we intend to provide systems that facilitate the transition to lower cost test strategies. Our DeFT platform was the first structural test product commercially available and our Sapphire NP platform supports both functional and structural test. |

| • | Expanding our addressable market. Our products have traditionally focused on the high end of the market. We are expanding our addressable market to test integrated circuits operating at frequencies of 200 MHz and less, and further penetrate the fabless semiconductor and assembly and test subcontractor markets. |

| • | Collaborating with strategic customers to improve our market position. We have and will continue to develop strategic relationships with the leading companies in the semiconductor industry to develop new products and services. By collaborating with existing and potential customers, we attempt to minimize our development risk and to better understand the product roadmaps and development needs of our customers. |

| • | Facilitating collaboration between design and manufacturing test engineers. We offer systems and software which allow design and manufacturing test engineers to collaborate and to operate on a common hardware and software platform, thereby facilitating communication between design and manufacturing test engineers, improving manufacturing yields and easing the transition to structural test. |

Our History

Our business dates back to 1965 when Fairchild Semiconductor established an automated test equipment division. Schlumberger Limited, a global oilfield and information services company with major activity in the energy industry, acquired Fairchild Semiconductor in 1979. The business we now operate, which we refer to as NPTest, Inc., was a part of the business Schlumberger acquired. On July 29, 2003, NPTest Holding, LLC, which is principally owned by Francisco Partners (95.7%) and Shah Management (3.6%), acquired NPTest, Inc. from Schlumberger. NPTest Holding, LLC acquired the business, in part, on the belief that Francisco Partners could add value to the business through its experience in the semiconductor industry. After completion of this offering, NPTest Holding, LLC will beneficially own approximately 63% of our outstanding common stock, assuming no exercise of the underwriters’ over-allotment option.

We and certain of our subsidiaries have entered into agreements with NPTest Holding, LLC and various Schlumberger subsidiaries. In particular, we may be required to make certain additional payments to Schlumberger in connection with the acquisition of NPTest, Inc. These agreements are described more fully in the section entitled “Certain Relationships and Related Transactions” included elsewhere in this prospectus.

We were incorporated in June 2003 in Delaware. Our principal executive offices are located at 150 Baytech Drive, San Jose, CA 95134 and our telephone number is (408) 586-8200. We maintain a web site at www.nptest.com. The information on our web site is not part of this prospectus.

Corporate Structure

We indirectly own 100% of the capital stock of NPTest, Inc., the subsidiary through which we conduct substantially all of our operations. NPTest, Inc. conducts its operations, in part, through direct and indirect wholly-owned subsidiaries in the United States, Europe and Asia.

2

Table of Contents

The Offering

Common stock offered | 14,600,000 shares | |

| Common stock to be outstanding after the offering | 39,900,957 shares | |

| Use of proceeds | We estimate that our net proceeds from this offering will be approximately $160.7 million. We expect to use approximately $75.0 million of the net proceeds from the sale of the shares by us in this offering to repay our senior term loan from an affiliate of Citigroup. We intend to use the remainder of our net proceeds to redeem preferred stock of our subsidiary, to pay an advisory termination fee and for working capital and general corporate purposes, including investments in sales and marketing, general and administrative activities and product development. In addition, we may use a portion of the net proceeds to acquire complementary products, technologies or businesses. We will not receive any proceeds from the exercise of the underwriters’ over-allotment option. See “Use of Proceeds.” | |

| Proposed Nasdaq National Market symbol | “NPTT” | |

| Dividend policy | We intend to retain all future earnings to fund the development and growth of our business. We do not anticipate paying cash dividends on our common stock in the foreseeable future. | |

The common stock to be outstanding immediately after the offering is based on 39,900,957 shares to be outstanding as of November 30, 2003, and excludes:

| • | 2,743,894 shares subject to options at a weighted average exercise price of $7.54 per share; |

| • | approximately 560,000 shares subject to options expected to be granted to our employees upon completion of this offering at an exercise price equal to the initial public offering price; and |

| • | 500,000 additional shares to be reserved for issuance under our stock option plan upon completion of this offering. |

Except as otherwise indicated, all information in this prospectus assumes:

| • | an initial public offering price of $12.00 per share, the mid-point of the filing range set forth on the cover of this prospectus; |

| • | a one for four reverse stock split effected on November 18, 2003; |

| • | the repayment of our existing senior term loan upon completion of this offering; |

| • | the redemption of $20.75 million of outstanding shares of mandatory redeemable Series A Preferred Stock of NPTest Capital Corporation, our subsidiary, held by NPTest Holding, LLC and the exchange immediately prior to completion of this offering, at the initial public offering price, of all remaining shares of mandatory redeemable Series A Preferred Stock of NPTest Capital Corporation (including the additional amounts accreted from July 29, 2003 through November 30, 2003) for shares of our common stock. As of November 30, 2003 and assuming an initial public offering price of $12.00 per share, NPTest Holding, LLC would receive 2,550,742 shares of our common stock; |

3

Table of Contents

| • | the exchange immediately prior to completion of this offering of all of our outstanding shares of convertible mandatory redeemable Series A Preferred Stock (including the additional amounts accreted from July 29, 2003 through November 30, 2003) held by NPTest Holding, LLC for 17,125,215 shares of our common stock at $4.09216 per share, the conversion price of the preferred stock; |

| • | the filing of our amended and restated certificate of incorporation immediately prior to completion of this offering; and |

| • | no exercise of the underwriters’ over-allotment option. |

4

Table of Contents

SUMMARY HISTORICAL AND PRO FORMA COMBINED FINANCIAL DATA

NPTest Holding Corporation was incorporated on June 20, 2003 for the purpose of acquiring NPTest, Inc. from Schlumberger and did not have any operations prior to July 29, 2003. Selected financial data for the periods prior to July 29, 2003 are referred to as the “Predecessor Company” and are derived from the combined financial statements of NPTest, Inc. NPTest, Inc.’s combined financial statements for all periods presented have been derived from the consolidated financial statements of Schlumberger and are presented as if NPTest, Inc. had existed as an entity separate from Schlumberger and its subsidiaries.

On July 29, 2003, NPTest Holding Corporation acquired NPTest, Inc. in a transaction that was accounted for using the purchase method. The statement of operations data for the period from inception to September 30, 2003 and the balance sheet data as of September 30, 2003 are derived from the consolidated financial statements of NPTest Holding Corporation included herein and include the financial statement impact of purchase accounting adjustments arising from the acquisition of NPTest, Inc.

The pro forma as adjusted statement of operations data assume that the acquisition of NPTest, Inc. and this offering were completed as of January 1, 2002. The pro forma as adjusted financial information reflects: (i) our application of the estimated net proceeds from the sale of the shares of common stock by us in the offering, based on an assumed initial public offering price of $12.00 per share after deducting underwriting discounts and estimated expenses payable by us, to repay our existing $75.0 million senior term loan, redeem $20.75 million of the outstanding mandatory redeemable Series A Preferred Stock of our subsidiary, NPTest Capital Corporation, all of which is held by NPTest Holding, LLC, and make a one-time payment of $5.0 million to Francisco Partners payable in consideration for the termination of certain obligations to Francisco Partners; (ii) the exchange immediately prior to completion of this offering, at the initial public offering price, of all remaining shares of mandatory redeemable Series A Preferred Stock of NPTest Capital Corporation (including the additional amounts accreted from July 29, 2003 through November 30, 2003) held by NPTest Holding, LLC for 2,550,742 shares of our common stock, based upon an assumed initial public offering price of $12.00 per share, and (iii) the exchange immediately prior to completion of this offering of all of our outstanding shares of convertible mandatory redeemable Series A Preferred Stock (including the additional amounts accreted from July 29, 2003 through November 30, 2003) held by NPTest Holding, LLC for 17,125,215 shares of our common stock at $4.09216 per share, the conversion price of the preferred stock.

The NPTest, Inc. and NPTest Holding Corporation financial information should be read together with the “Pro Forma Combined Condensed Financial Information,” the “Selected Financial Data” and the historical financial statements and the related notes that are included elsewhere in this prospectus as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The following financial information may not be indicative of our future performance and does not reflect what our financial position and results of operations would have been if we had operated as a separate, stand-alone entity during the periods presented. Results for the nine months ended September 30, 2003 are not necessarily indicative of results to be expected for the full year.

5

Table of Contents

| Predecessor Company | NPTest Holding Corporation | |||||||||||||||||||||||||||||||

| Actual | Pro Forma As Adjusted | Actual | Actual | Pro Forma As Adjusted | ||||||||||||||||||||||||||||

| Year Ended December 31, | Nine Months Ended Sept. 30, 2002 | Jan. 1, to July 29, 2003 | Inception to Sept. 30, 2003 | Nine Months Ended Sept. 30, 2003 | ||||||||||||||||||||||||||||

| 2000 | 2001 | 2002 | 2002 | |||||||||||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||||||||||||||

Statement of Operations Data | ||||||||||||||||||||||||||||||||

Net revenue: | ||||||||||||||||||||||||||||||||

Product | $ | 216,445 | $ | 149,543 | $ | 180,035 | $ | 180,035 | $ | 146,939 | $ | 90,935 | $ | 34,289 | $ | 125,224 | ||||||||||||||||

Services | 69,889 | 71,389 | 63,456 | 63,456 | 47,009 | 38,935 | 11,893 | 50,828 | ||||||||||||||||||||||||

Total net revenue | 286,334 | 220,932 | 243,491 | 243,491 | 193,948 | 129,870 | 46,182 | 176,052 | ||||||||||||||||||||||||

Cost of net revenue: | ||||||||||||||||||||||||||||||||

Product | ||||||||||||||||||||||||||||||||

Cost of product revenue excluding amortization of identifiable intangible assets | 140,255 | 130,627 | (a) | 110,056 | 110,102 | 88,395 | 54,834 | (b) | 21,805 | (c) | 73,793 | |||||||||||||||||||||

Amortization of identifiable intangible assets | 11,929 | 2,792 | 1,684 | |||||||||||||||||||||||||||||

Total cost of product revenue | 140,255 | 130,627 | (a) | 110,056 | 122,031 | 88,395 | 54,834 | (b) | 24,597 | 75,477 | ||||||||||||||||||||||

Services | 44,127 | 49,549 | 38,137 | 38,137 | 29,158 | 25,795 | (b) | 7,331 | 33,126 | |||||||||||||||||||||||

Total cost of net revenue | 184,382 | 180,176 | 148,193 | 160,168 | 117,553 | 25,795 | (b) | 31,928 | 108,603 | |||||||||||||||||||||||

Operating expenses: | ||||||||||||||||||||||||||||||||

Research and development | 32,718 | 34,748 | 36,573 | 36,573 | 26,250 | 29,017 | (b) | 13,274 | (d) | 37,291 | ||||||||||||||||||||||

Selling, general and administrative | 66,571 | 51,971 | 49,652 | 48,962 | 39,149 | 27,877 | (b) | 8,293 | (e) | 35,767 | ||||||||||||||||||||||

Gain on curtailment of pensions and | (8,667 | ) | (8,667 | ) | ||||||||||||||||||||||||||||

Total operating expenses | 99,289 | 86,719 | 77,558 | 76,868 | 65,399 | 56,894 | 21,567 | 73,058 | ||||||||||||||||||||||||

Operating income (loss) | 2,663 | (45,963 | ) | 17,740 | 6,455 | 10,996 | (7,653 | ) | (7,313 | ) | (5,609 | ) | ||||||||||||||||||||

Interest income (expense), net | (625 | ) | 8 | |||||||||||||||||||||||||||||

Dividend and accretion on mandatory redeemable preferred stock | (713 | ) | ||||||||||||||||||||||||||||||

Foreign currency transactions loss, net | (34 | ) | (139 | ) | (1,147 | ) | (1,147 | ) | (1,050 | ) | (473 | ) | (241 | ) | (714 | ) | ||||||||||||||||

Income (loss) before income taxes | 2,629 | (46,102 | ) | 16,593 | 5,308 | 9,946 | (8,126 | ) | (8,892 | ) | (6,315 | ) | ||||||||||||||||||||

Income tax provision (benefit) | (3,328 | ) | (22,366 | ) | 2,117 | (1,281 | ) | 1,127 | (4,355 | ) | (1,491 | ) | (3,656 | ) | ||||||||||||||||||

Net income (loss) | $ | 5,957 | $ | (23,736 | ) | $ | 14,476 | $ | 6,589 | $ | 8,819 | $ | (3,771 | ) | $ | (7,401 | ) | $ | (2,659 | ) | ||||||||||||

Dividend and accretion on convertible mandatory redeemable preferred stock | (1,456 | ) | ||||||||||||||||||||||||||||||

Net income (loss) attributable to common shareholders | $ | 5,957 | $ | (23,736 | ) | $ | 14,476 | $ | 6,589 | $ | 8,819 | $ | (3,771 | ) | $ | (8,857 | ) | $ | (2,659 | ) | ||||||||||||

Unaudited net income (loss) attributable to common shareholders per share: | ||||||||||||||||||||||||||||||||

Basic | $ | 0.17 | $ | (2.50 | ) | $ | (0.07 | ) | ||||||||||||||||||||||||

Diluted | $ | 0.17 | $ | (2.50 | ) | $ | (0.07 | ) | ||||||||||||||||||||||||

Shares used in computing unaudited basic | 39,595 | 3,544 | 39,595 | |||||||||||||||||||||||||||||

(Footnotes on next page)

6

Table of Contents

| Sept. 30, 2003 | ||||||

| Actual | Pro Forma As Adjusted | |||||

| (in thousands) | ||||||

Balance Sheet Data | ||||||

Cash and cash equivalents | $ | 24,854 | $ | 84,153 | ||

Working capital | 171,186 | 230,834 | ||||

Total assets | 282,119 | 336,138 | ||||

Senior term loan | 75,338 | — | ||||

Mandatory redeemable preferred stock | 49,354 | — | ||||

Convertible mandatory redeemable preferred stock | 17,294 | — | ||||

Stockholders’ equity | 80,651 | 277,006 | ||||

| (a) | Cost of product revenue for the year ended December 31, 2001 included a charge of approximately $35,400 related to excess inventory. |

| (b) | NPTest, Inc. recorded a charge of approximately $7,673 in divestiture bonuses in the July 1, 2003 to July 29, 2003 period in connection with the acquisition of NPTest, Inc. from Schlumberger. Of this amount, $667 was charged to cost of net product revenue, $1,095 was charged to cost of net service revenue, $2,230 was charged to research and development, and $3,681 was charged to selling, general and administrative expense. |

| (c) | Includes $2,873 of increase in cost of product revenue resulting from the write-up to fair value of our inventory and $8 of increase in depreciation of property plant and equipment as a result of the acquisition of NPTest, Inc. on July 29, 2003. |

| (d) | Includes a one-time $5,000 charge related to the write-off of in-process research and development in connection with the acquisition of NPTest, Inc. from Schlumberger. |

| (e) | Includes approximately $345 in advisory fees payable to Francisco Partners under an Advisory Agreement and approximately $44 of increase in depreciation of property plant and equipment as a result of the acquisition of NPTest, Inc. on July 29, 2003. |

7

Table of Contents

Risks Related to Our Business

Our operating results could be harmed by the highly cyclical nature of the semiconductor industry and general economic slowdowns.

Our business and operating results depend in significant part upon capital expenditures of manufacturers of semiconductors, which in turn depend upon the current and anticipated market demand for these products. Historically, the semiconductor industry has been highly cyclical with recurring periods of over-supply, which often have had a severe negative effect on demand for test equipment, including systems manufactured and marketed by us. During these periods, we experienced significant reductions in customer orders. In the most recent downward cycle, our net product revenue decreased from approximately $216.4 million in 2000 to approximately $149.5 million in 2001 and increased to approximately $180.0 million in 2002. During industry downturns when our products are used less frequently, our services may also be adversely affected. The current industry slowdown has had, and future slowdowns may have, a material adverse effect on our operating results.

The downturn in the semiconductor industry has affected the test equipment market more significantly than the overall capital equipment sector. The impact of this slowdown is magnified due to the high proportion of fixed costs in our industry, including significant research and development, manufacturing and sales costs. The uncertainty regarding the growth rate of economies throughout the world has caused companies to reduce capital investment and may cause further reduction of such investments. These reductions have been particularly severe in the semiconductor equipment industry. If the worldwide economies rebound in the near future, we do not know if our business will experience similar effects. If the worldwide economies do not rebound in the near future, we expect that the growth we have recently experienced may not be sustainable and that our business may be harmed.

Our quarterly operating results fluctuate significantly from period to period and this may cause our stock price to decline.

In the past we have experienced, and in the future we expect to continue to experience, fluctuations in revenue and operating results from quarter to quarter for a variety of reasons, including:

| • | demand for and market acceptance of our products as a result of the cyclical nature of the semiconductor equipment industry or otherwise, often resulting in reduced equipment sales during industry downturns and increased equipment sales during periods of industry recovery; |

| • | changes in the timing and terms of product orders by our customers as a result of our customer concentration or otherwise, as the loss of a significant customer or reduced orders by that customer would likely adversely affect revenues in one or more quarters; |

| • | changes in the mix of products that we offer, as well as the relative mix of our product and service offerings, thereby affecting our margins in a particular quarter; |

| • | timeliness of our new product introductions and market acceptance of our new products, including our new Sapphire NP tester; |

| • | delays or problems in the planned introduction of new products, including new versions of our Sapphire NP tester, which could result in the loss of anticipated revenue for a particular quarter and limited ability to contemporaneously reduce our costs; |

| • | competitive pressures resulting in lower selling prices arising from the current economic downturn in our industry or otherwise; |

| • | adverse changes in the semiconductor and electronics industries, on which we are particularly dependent, which would likely reduce overall demand for semiconductor equipment, including our products; |

8

Table of Contents

| • | our competitors’ announcements of new products, services or technological innovations, which can, among other things, render our products less competitive due to the rapid technological change in our industry; |

| • | our inability to quickly reduce our costs in response to decreased demand for our products and services as many of our costs are fixed in nature; |

| • | disruptions in our manufacturing or in the supply of components to us causing us to delay shipment of products; and |

| • | write-offs of excess or obsolete inventory. |

Each of the risks indicated in the foregoing list applies to us without regard to geographic or other boundaries as a result of the global nature of the semiconductor industry. As a result of these risks, we believe that quarter-to-quarter comparisons of our revenue and operating results may not be meaningful, and that these comparisons may not be an accurate indicator of our future performance. Also, sales of a relatively limited number of our systems account for a substantial portion of our net revenue in any particular quarter. Thus, changes in the timing or terms of a small number of transactions could disproportionately affect our operating results in any particular quarter. Moreover, our operating results in one or more future quarters may fail to meet the expectations of securities analysts or investors. If this occurs, we would expect to experience an immediate and significant decline in the trading price of our stock.

Variations in the amount of time it takes for us to sell our systems may cause fluctuations in our operating results.

Variations in the length of our sales cycles could cause our net sales, and therefore our business, financial condition, operating results and cash flows, to fluctuate widely from period to period. These variations often are based upon factors partially or completely outside our control. The factors that affect the length of time it takes for us to complete a sale depend upon many elements including:

| • | the complexity of the customer’s fabrication processes; |

| • | the willingness of customers to adopt new product platforms or products; |

| • | the availability of components from our suppliers; |

| • | the internal technical capabilities and sophistication of the customer; |

| • | our actual or perceived ability to scale our manufacturing processes to meet the customer’s requirements; and |

| • | the capital expenditures of our customers. |

As a result of these and a number of other factors influencing our sales cycles with particular customers, the period between our initial contact with a potential customer and the time when we recognize revenue from that customer, if ever, varies widely. Our product sales cycle typically can range from six to 24 months. Sometimes our sales cycle can be much longer, particularly when the sales cycle involves developing new applications for our systems and technology or the introduction of new products. During these cycles, we commit substantial resources to our sales efforts before receiving any revenue, and we may never receive any revenue from a customer despite these sales efforts.

We rely on a small number of customers for a significant portion of our revenues, and the termination of any of these relationships would adversely affect our business.

Intel Corporation accounted for 30% in 2000, 37% in 2001, 52% in 2002, and 46% in the combined nine months ended September 30, 2003, of our net revenue, and STMicroelectronics accounted for 30% in 2000, 18% in 2001, 10% in 2002, and 12% in the combined nine months ended September 30, 2003 of our net revenue. The combined nine months ended September 30, 2003 information represents the sum of the financial data for the

9

Table of Contents

January 1, 2003 to July 29, 2003 period for NPTest, Inc. and the financial data for the period from inception to September 30, 2003 for NPTest Holding Corporation. Our customers are generally not obligated by long-term contracts to purchase our systems, and frequently evaluate competitive products prior to placing new orders. Furthermore, one of our competitors is working with our largest customer in the development and promotion of their open architecture initiative. If that initiative is successful, it could lead to that competitor gaining a larger percentage of that customer’s business for test equipment. The semiconductor industry is highly concentrated, and a small number of integrated circuit device manufacturers and assembly and test subcontractors account for a substantial portion of the purchases of integrated circuit test equipment generally, including our diagnostic and test equipment. Consequently, our business and operating results would be materially adversely affected by the loss of, or any reduction in orders by, any of our significant customers, particularly if we were not able to replace that lost revenue with additional orders from new or existing customers.

If we do not develop and maintain new customer relationships, our ability to generate revenue growth will be adversely affected.

Our ability to increase our sales will depend in part upon our ability to obtain orders from new customers. Obtaining orders from new customers is difficult because integrated circuit device manufacturers typically select one vendor’s systems for testing an entire generation of integrated circuits and make substantial investments to develop related test program software and interfaces. Once a manufacturer has selected a test system vendor for a generation of integrated circuits, that manufacturer is more likely to continue to purchase test systems from that vendor for that generation of integrated circuits, as well as subsequent generations of integrated circuits. If we are unable to obtain new customers that adopt and implement our products and technology, our business will be harmed.

New customer acquisition can be a costly process. The development of new customer relationships can require substantial investment in components and processes without any assurance from prospective customers that they will place significant orders. In addition, the length of time required to complete a sale varies widely, with some sales taking up to two years.

If we do not continue to introduce new products and services that reflect advances in integrated circuit technology in a timely manner, our products and services will become obsolete, we will not achieve broad market penetration and our operating results will suffer.

The integrated circuit design and manufacturing industry into which we sell our products is characterized by rapid technological changes, frequent new product and service introductions and evolving industry standards. The success of our new product and service offerings will depend on several factors, including our ability to:

| • | properly identify customer needs and anticipate technological advances and industry trends; |

| • | innovate, develop and commercialize new technologies and applications in a timely manner; |

| • | introduce and promote market acceptance of new products, such as our new Sapphire NP tester; |

| • | adjust to changing market conditions; |

| • | manufacture and deliver our products in sufficient volumes on time; |

| • | price our products competitively and maintain effective marketing strategies; and |

| • | differentiate our offerings from our competitors’ offerings. |

Many of our products are used by our customers to develop, test and manufacture their new products. We therefore must anticipate industry trends and develop products in advance of the commercialization of our customers’ products. Development of new products generally requires a substantial investment before we can determine the commercial viability of these innovations. The future success of our new technologies, products and services depends on broad acceptance among our customers. In addition, new methods of testing integrated circuits such as self-testing integrated circuits, may be developed which render our products uncompetitive or

10

Table of Contents

obsolete. If we fail to adequately predict our customers’ needs and technological advances, we may invest heavily in research and development of products and services that do not lead to significant revenue, or we may fail to invest in technology necessary to meet changing customer demands. Without the timely introduction of new products, services and enhancements that reflect these changes, our products and services will likely become technologically obsolete and our revenue and operating results would suffer.

If we are not able to successfully market and sell our new Sapphire NP platform, our revenue and financial condition will be adversely affected.

Our success will depend in large part upon broad adoption of our new Sapphire NP platform. We are currently devoting and intend to continue to devote significant resources to the development, production and commercialization of the Sapphire NP products. As of September 30, 2003, we had received purchase orders for over fifteen Sapphire NP testers, the first of which is expected to ship in late 2003 or early 2004. As this is a new product, it will be subject to acceptance criteria which could delay the recognition of revenue from these sales until 2004. Typically, these acceptance criteria will consist of testing to ensure the tester conforms to published specifications and will not include any customer-specific acceptance criteria. We have not marketed the product broadly to date. Only a small number of products in the integrated circuit test equipment market have achieved broad market acceptance. Accordingly, we cannot be sure that the Sapphire NP platform will achieve market acceptance or generate substantial revenue. Furthermore, existing and prospective customers may not order any of our current products as they assess the Sapphire NP platform and the degree to which it is accepted in the market. The success of Sapphire NP depends upon a number of factors, including:

| • | willingness of our customers to invest in a new testing platform; |

| • | our ability to timely and efficiently manufacture the product; |

| • | the product’s performance and reliability at customer locations; |

| • | our ability to effectively install and support the product; |

| • | our ability to continually offer enhancements to the platform; and |

| • | our ability to effectively market and sell the platform worldwide. |

Delays in introducing Sapphire NP or in our ability to obtain customer acceptance would delay the recognition of revenue by us. If the Sapphire NP platform has actual or perceived reliability, quality or other problems, we may suffer reduced orders, higher manufacturing costs, delays in collecting accounts receivable and higher service, support and warranty expenses, and/or inventory write-offs, among other effects. In addition, Sapphire NP runs on software that we developed internally, as well as Microsoft Windows-based operating software. If viruses or other problems develop in this software the operation of our Sapphire NP tester could be adversely affected. We believe that the acceptance, volume production, timely delivery and customer satisfaction of our Sapphire NP platform is of critical importance to our future financial results. As a result, our inability to correct any technical, reliability, parts shortages or other difficulties or to manufacture and ship the Sapphire NP testers on a timely basis to meet customer requirements could damage our relationships with current and prospective customers and would materially adversely affect our business, financial condition and results of operations.

If we discover problems in the design or development of our new Sapphire NP platform, our business would be harmed.

Our new Sapphire NP platform is continuing to undergo further development, modification and enhancement. Successful development of Sapphire NP is dependent on a number of factors, including:

| • | further development and improvement of the product design; |

| • | timely and efficient achievement of product hardware and software engineering milestones; and |

| • | successful achievement of functionality and reliability standards. |

11

Table of Contents

We expect to begin to ship our Sapphire NP tester in late 2003 or early 2004. As this is a new product, these shipments are likely to be subject to acceptance criteria that could delay the recognition of revenue from these sales. Typically, these acceptance criteria will consist of testing to ensure the tester conforms to published specifications and will not include any customer-specific acceptance criteria. At introduction, Sapphire NP will be available in less complex configurations targeted at markets that require cost effective test solutions. Our future operating results will depend in large part upon our ability to successfully introduce and commercialize a range of Sapphire NP products, many of which are not yet available and are under development. We experienced delays from time to time in the development of the Sapphire NP platform. More complex configurations of the Sapphire NP, which we plan to introduce in the future, will require additional software development and the development of a new integrated circuit. Unanticipated difficulties or delays in further design and development of the Sapphire NP platform could lead to increased production costs and could adversely impact our ability to take customer orders, ship products and fulfill contractual obligations in a timely manner. As a result, our relationship with our customers could be harmed and our business, financial condition and results of operations could be materially adversely affected.

Existing customers may be unwilling to bear expenses associated with transitioning to a new product.

The expense to our customers of transitioning to a new product can be significant. Certain customers may be unwilling, or unable, to bear the increased costs of migrating to a new testing platform, particularly during the current industry downturn. This may make it difficult to market and sell new products, such as the Sapphire NP tester, to customers, including our existing customers, at least in the short-term. In addition, as we introduce new products, such as Sapphire NP testers, we cannot predict with certainty if and when our customers will transition to those products.

If we fail to plan the production of products accurately, we could incur inventory losses.

Given the nature of the markets in which we participate, we cannot reliably predict future revenue or profitability. Accordingly, we must order components and build some inventory in advance of the receipt of actual purchase orders. Furthermore, purchase orders may be cancelled or postponed, generally without penalty to the customer. If we do not obtain orders as we anticipate, we could have excess inventory for a specific product that we would not be able to sell to any other customer, likely resulting in inventory write-offs, which could have a material adverse effect on our business, financial condition and results of operations.

Failure in our ability to effectively design custom integrated circuits or to develop the software used for our products would harm our business.

We customize integrated circuits and develop software as part of the production of many of our products. Design defects in the custom integrated circuits or in the software used for our products could cause delays in the manufacturing and shipment of our products. Such delays may adversely affect customer relationships, as well as our business, financial condition and results of operations.

Products that do not meet customer specifications or contain defects that harm our customers could damage our reputation and cause us to lose customers and revenue.

The complexity and ongoing development of our products could lead to design or manufacturing problems. Our test equipment may fail to meet our customers’ technical requirements and may harm our customers’ business. If any of our products fail to meet specifications or have reliability or quality problems, our reputation could be damaged significantly and customers might be reluctant to buy our products, which could result in a decline in revenues, an increase in product returns and the loss of existing customers or the failure to attract new customers.

12

Table of Contents

We may not be able to fund our future capital requirements from our operations, and financing from other sources may not be available on favorable terms or at all.

We made capital expenditures of $27.0 million in 2000, $4.0 million in 2001, $5.3 million in 2002, and $3.6 million in the combined nine months ended September 30, 2003. The combined nine months ended September 30, 2003 information represents the sum of the financial data for the January 1, 2003 to July 29, 2003 period for NPTest, Inc. and the financial data for the period from inception to September 30, 2003 for NPTest Holding Corporation. During the periods in which we were owned by Schlumberger, it provided funds to finance our working capital or other cash requirements. However, since our acquisition by Francisco Partners, Schlumberger no longer provides these funds. Our future capital requirements will depend on many factors, including the timing and extent of spending to support product development efforts, the expansion of sales and marketing activities, the timing of introductions of new products and enhancement to existing products, the cost to ensure access to adequate manufacturing capacity, and the market acceptance of our products. To the extent that existing cash and cash equivalents, together with any cash from operations, are insufficient to fund our future activities, we may need to raise additional funds through public or private equity or debt financing. Future equity financings could be dilutive to the existing holders of our common stock. Future debt financings could involve restrictive covenants. We will likely not be able to obtain financing with interest rates as favorable as those that we have enjoyed in the past. If we cannot raise funds on acceptable terms, if and when needed, we may not be able to develop or enhance our products and services, take advantage of future opportunities, grow our business or respond to competitive pressures or unanticipated requirements, which could materially adversely affect our business, financial condition and results of operations.

We face substantial competition which, among other things, may lead to price pressure and adversely affect our sales.

We face substantial competition throughout the world in each of our product areas. Our competitors include Advantest, Agilent Technologies, Credence Systems, FEI Company, Hamamatsu, LTX Corporation and Teradyne. Some of these competitors have substantially greater financial resources and more extensive engineering, manufacturing, marketing and customer support capabilities than we do. We expect our competitors to continue to improve the performance of their current products and to introduce new products, new technologies or services that could adversely affect sales of our current and future products and services. We may not be able to compete effectively with these competitors.

Our competitors may also elect to reduce the price of their products leading to a reduction in average selling prices throughout our industry. The overall demand for test equipment is not likely to increase as prices are reduced. Accordingly, price reductions may limit our opportunities for growth as the overall size of the test equipment market may be reduced and could result in reduced sales.

Economic, political and other risks associated with international sales and operations, particularly in Asia, could adversely affect our sales.

Since we sell our products and services worldwide, our business is subject to risks associated with doing business internationally. Our revenue originating outside the United States, including export sales from our United States manufacturing facilities to foreign customers and sales by our foreign subsidiaries and branches, as a percentage of our total net revenue, was 65.0% in 2000, 60.7% in 2001, 47.6% in 2002, and 47.9% in the combined nine months ended September 30, 2003. The combined nine months ended September 30, 2003 information represents the sum of the financial data for the January 1, 2003 to July 29, 2003 period for NPTest, Inc. and the financial data for the period from inception to September 30, 2003 for NPTest Holding Corporation. In particular, the economies of Asia have been highly volatile and recessionary in the past, resulting in significant fluctuations in local currencies and other instabilities. Many countries in Asia have recently been affected by the occurrence of severe acute respiratory syndrome, or SARS. These instabilities continue and may occur again in the future. Our exposure to the business risks presented by the economies of Asia will increase to the extent that

13

Table of Contents

we continue to expand our operations in that region. An outbreak of SARS could result in delay in customer acceptance of our products or prevent us from installing or servicing our products sold in the affected region.

International turmoil, exacerbated by the war in Iraq, and the escalating tensions in North Korea have contributed to an uncertain political and economic climate, both in the United States and globally, which may affect our ability to generate revenue on a predictable basis. In addition, terrorist attacks and the threat of future terrorist attacks both domestically and internationally have negatively impacted an already weakened worldwide economy. As we sell products both in the United States and internationally, the threat of future terrorist attacks may adversely affect our business. These conditions make it difficult for us and for our customers to accurately forecast and plan future business activities and could have a material adverse effect on our business, financial condition and results of operations.

We are subject to risks associated with currency fluctuations.

We sell our products and services and incur a variety of costs outside of the United States. Therefore we are exposed to foreign currency exchange movements, particularly in the Euro, the Japanese Yen and, to a lesser extent, the British Pound. With respect to revenue, our primary exposure exists during the period between execution of a purchase order denominated in a foreign currency and collection of the related receivable. During this period, changes in the exchange rates of the foreign currency to the U.S. Dollar will affect our revenue, cost of revenue and operating margins and could result in exchange losses. While a significant portion of our purchase orders to date have been denominated in U.S. Dollars, competitive conditions may require us to enter into an increasing number of purchase orders denominated in foreign currencies. We incur a variety of costs in foreign currencies, including some of our manufacturing costs, components and sales costs. While we have not entered into foreign currency hedging arrangements in the past, we may do so in the future. We cannot assure you that any hedging transactions we may enter into will be effective or will not result in foreign exchange hedging losses.

The technology labor market is very competitive, and our business will suffer if we are not able to hire and retain key personnel.

Our future success depends in part on the continued service of our key executive officers, as well as our research, engineering, sales, marketing, manufacturing and administrative personnel, most of whom are not subject to employment or non-competition agreements. In addition, competition for qualified personnel in the technology area is intense, and we operate in several geographic locations where labor markets are particularly competitive, including the Silicon Valley region of Northern California where our headquarters and central research and development laboratories are located. Our business is particularly dependent on expertise which only a very limited number of engineers possess. The loss of any of our key employees, or a broader loss of any of our employees who are highly-skilled in our specialized sector of integrated circuit technology, would materially adversely affect our business, financial condition and results of operations.

Our dependence on subcontractors and sole source suppliers may prevent us from delivering an acceptable product on a timely basis.

We rely on subcontractors to manufacture certain subassemblies for our products, and we rely on both single source and sole source suppliers, some of whom are relatively small in size, for many of the components we use in our products. As custom integrated circuits are found in virtually every product that we sell, virtually all of our products contain some components from sole source suppliers. Our reliance on subcontractors gives us less control over the manufacturing process and exposes us to significant risks, especially inadequate capacity, late delivery, substandard quality and high costs. Additionally, our subcontractors and suppliers are generally under no obligation to provide us with material for as long as our requirements may exist. As a result, the loss or failure to perform by any of these providers could adversely affect our business and operating results.

In addition, the manufacturing of certain components and subassemblies is an extremely complex process. Therefore, if a supplier became unable to provide the volume of parts required on a timely basis, or at an

14

Table of Contents

acceptable price, we would have to identify and qualify acceptable replacements from alternative sources of supply, or manufacture such components internally. The process of qualifying new subcontractors and new suppliers, or initiating manufacturing internally for these complex components is a lengthy process and could also materially adversely affect our business, financial condition and results of operations.

Third parties may claim we are infringing their intellectual property, and we could suffer significant litigation or licensing expenses or be prevented from selling our products or services.

Third parties may claim that we are infringing their intellectual property rights and we may be unaware of intellectual property rights of others that may cover some of our technology, products and services. Any litigation regarding patents or other intellectual property could be costly and time-consuming, and divert our management and key personnel from our business operations. The complexity of the technology involved and the uncertainty of intellectual property litigation increase these risks. Claims of intellectual property infringement might also require us to enter into costly royalty or license agreements. However, we may not be able to obtain royalty or license agreements on terms acceptable to us, or at all. We also may be subject to significant damages or injunctions against development and sale of certain of our products and services.

We often rely on licenses of intellectual property useful for our business. These licenses may not be available in the future on favorable terms, or at all. In addition, our position with respect to the negotiation of licenses may change as a result of our acquisition from Schlumberger. The loss of any of these licenses could harm our business, financial condition and results of operations.

Third parties may infringe our intellectual property, and we may expend significant resources enforcing our rights or suffer competitive injury.

Our success depends in large part on our proprietary technology. We rely on a combination of patents, copyrights, trademarks, trade secrets, confidentiality provisions and licensing arrangements to establish and protect our proprietary rights. If we fail to successfully enforce our intellectual property rights, our competitive position could suffer, which could harm our operating results.

Our pending patent and trademark registration applications may not be allowed or competitors may challenge the validity or scope of these patent applications or trademark registrations. In addition, our patents may not provide us with a significant competitive advantage.

We may be required to spend significant resources to monitor and protect our intellectual property rights. We may not be able to detect infringement and may lose competitive position in the market before we do so. In addition, competitors may design around our technology or develop competing technologies. Intellectual property rights may also be unavailable or limited in some foreign countries, which could make it easier for competitors to capture market share in those countries.

In the event that environmental contamination were to occur as a result of our ongoing operations, we could be subject to substantial liabilities in the future.

Our manufacturing processes involve the use of substances regulated under various international, federal, state and local laws governing the environment. The failure or inability to comply with existing or future laws could result in significant remediation liabilities, the imposition of fines or the suspension or termination of production. Schlumberger has agreed to indemnify us for up to three years from the acquisition date for environmental liabilities resulting from operations conducted prior to our acquisition of the NPTest business. However, we are responsible for any liabilities resulting from our operation of the business after the acquisition and also for future costs of compliance with these laws. In addition, we may not be aware of all conditions that could subject us to liability.

15

Table of Contents

If our facilities were to experience catastrophic loss due to natural disasters, our operations would be seriously harmed.

Several of our facilities could be subject to a catastrophic loss caused by natural disasters, including fires and earthquakes. We have significant facilities in areas with above average seismic activity, such as our production facilities and headquarters in California. If any of these facilities were to experience a catastrophic loss, it could disrupt our operations, delay production and shipments, reduce revenue and result in large expenses to repair or replace the facility. We do not carry catastrophic insurance policies which cover potential losses caused by earthquakes.

We may incur a variety of costs to engage in future acquisitions of companies, products or technologies, and the anticipated benefits of those acquisitions may never be realized.

We may make acquisitions of, or significant investments in, complementary companies, products or technologies, although no acquisition or investments are currently pending. Any future acquisitions would be accompanied by risks such as:

| • | difficulties in assimilating the operations and personnel of acquired companies; |

| • | diversion of our management’s attention from ongoing business concerns; |

| • | our potential inability to maximize our financial and strategic position through the successful incorporation of acquired technology and rights into our products and services; |

| • | additional expense associated with amortization of acquired assets; |

| • | maintenance of uniform standards, controls, procedures and policies; |

| • | impairment of existing relationships with employees, suppliers and customers as a result of the integration of new management personnel; |

| • | dilution to our stockholders in the event we issue stock as consideration to finance an acquisition; and |

| • | increased leverage if we incur debt to finance an acquisition. |

We cannot guarantee that we will be able to successfully integrate any business, products, technologies or personnel that we might acquire in the future, and our failure to do so could harm our business.

Risks Related to Our Ownership by Francisco Partners and our Previous Ownership by Schlumberger

Our historical financial information may not be representative of our results as a separate company.

Our combined financial statements have been derived in part from the combined financial statements of Schlumberger. Accordingly, the historical financial information we have included in this prospectus does not necessarily reflect what our financial position, operating results and cash flows would have been had we been a separate, stand-alone entity during the periods presented. Schlumberger did not account for us, and we were not operated, as a separate, stand-alone entity during the periods in which we were owned by Schlumberger.

During the periods in which we were owned by Schlumberger, certain amounts of Schlumberger’s corporate expenses, including legal, accounting, employee benefits, real estate, insurance services, information technology services, treasury and other corporate and infrastructure costs, although not directly attributable to our operations, were allocated to us until the third quarter of 2002 on a basis that Schlumberger and we considered to be a reasonable reflection of the utilization of services provided or the benefit received by us. However, the financial information included in this prospectus may not reflect our combined financial position, operating results, changes in equity and cash flows in the future or what they would have been had we been a separate, stand-alone entity during the periods in which we were owned by Schlumberger.

16

Table of Contents

Our overall tax rate will increase as a result of our acquisition from Schlumberger.

When we were owned by Schlumberger, our tax rate was based on our earnings before taxes in the various tax jurisdictions in which we operate throughout the world. Part of the income that was previously recognized from Schlumberger’s foreign operations and that was not subject to U.S. taxation due to Schlumberger’s foreign incorporation became subject to U.S. taxation following our acquisition from Schlumberger due to our incorporation in Delaware. As a result, we expect that our overall tax rate will increase. For example, excluding for each period adjustments for purchase accounting and divestiture bonuses, we would have had a tax benefit for the January 1, 2003 to July 29, 2003 period, when we were part of Schlumberger, and an effective tax rate of 27% for the period from our inception to September 30, 2003. This may not be indicative of our overall tax rate for future periods.

We must create our own systems to operate as a stand-alone company and continue to enhance our financial reporting capabilities.

During the period in which we were owned by Schlumberger we used Schlumberger’s systems and processes to support our operations, including to manage inventory, financial reporting, order processing and accounting. Many of these systems are critical to our business and very complex. We have created, and are continuing to upgrade, our systems and processes to perform these functions which we need in order to operate as a stand-alone public company. In addition, we will need to continue to enhance our financial reporting capabilities and systems as we become a public company. We have very recently hired a chief financial officer to help us satisfy our new responsibilities, but he is new to our company. To the extent that we are not successful in creating our own systems or in enhancing our financial reporting capabilities, our business, financial condition and results of operations may suffer.

We will be controlled by NPTest Holding, LLC as long as it owns a significant percentage of our common stock, and our other stockholders will be unable to affect the outcome of stockholder voting during such time.

After the completion of this offering, Francisco Partners will beneficially own approximately 63% of our outstanding common stock, or approximately 58% if the underwriters exercise in full their over-allotment option to purchase additional shares. Because we are a controlled company in accordance with the rules of the Nasdaq National Market, we are not required to comply with regulations that would otherwise require a majority of our board to be comprised of independent directors under rule 4350(c)(5) of the Nasdaq National Market. As long as NPTest Holding, LLC owns at least 25% of our outstanding common stock, it will continue to be able to nominate a majority of our board of directors in accordance with the terms of our stockholders’ agreement with NPTest Holding, LLC. To our knowledge, NPTest Holding, LLC has no immediate plans to nominate additional directors to our board. Furthermore, investors in this offering will not be able to affect the outcome of any stockholder vote prior to the time that NPTest Holding, LLC owns less than a majority of our outstanding common stock. As a result, NPTest Holding, LLC will control all matters affecting us, including:

| • | the composition of our board of directors and, through it, any determination with respect to our business direction and policies, including the appointment and removal of officers; |

| • | any determinations with respect to mergers or other business combinations; |

| • | our acquisition or disposition of assets; and |

| • | our financing. |

In addition, to the extent that NPTest Holding, LLC continues to beneficially own a significant portion of our outstanding common stock, although less than a majority, it will continue to have a significant influence over all matters submitted to our stockholders and to exercise significant control over our business policies and affairs. In particular, for so long as NPTest Holding, LLC holds at least 25% of our common stock the board of directors

17

Table of Contents

is prohibited from taking many significant corporate actions without the consent of NPTest Holding, LLC, including mergers, acquisitions or sales of assets outside of the ordinary course of business, the issuance of securities and the incurrence or refinancing of indebtedness in excess of $10 million. Such power could have the effect of delaying, deterring or preventing a change of control or other business combination that might otherwise be beneficial to our stockholders. NPTest Holding, LLC also is not prohibited from selling a controlling interest in us to a third party or a participant in our industry. For additional information regarding our relationship with NPTest Holding, LLC, you should read the section of this prospectus entitled “Certain Relationships and Related Transactions.”

NPTest Holding, LLC and its designees on our board of directors may have interests that conflict with our interests.

NPTest Holding, LLC and its designees on our board of directors may have interests that conflict with, or are different from, our own. Francisco Partners, which will be the beneficial holder of 63% of our stock after completion of this offering through its membership interest in NPTest Holding, LLC, has invested in or acquired other businesses that are involved in the semiconductor industry. Conflicts of interest between NPTest Holding, LLC and us may arise, and such conflicts of interest may not be resolved in a manner favorable to us, including potential competitive business activities, corporate opportunities, indemnity arrangements, registration rights, sales or distributions by NPTest Holding, LLC of our common stock and the exercise by NPTest Holding, LLC of its ability to control our management and affairs. Our certificate of incorporation does not contain any provisions designed to facilitate resolution of actual or potential conflicts of interest, or to ensure that potential business opportunities that may become available to both NPTest Holding, LLC and us will be reserved for or made available to us. Pertinent provisions of law will govern any such matters if they arise. In addition, NPTest Holding, LLC and its director designees could delay or prevent an acquisition or merger even if the transaction would benefit other stockholders. In addition, NPTest Holding, LLC’s significant concentration of share ownership may adversely affect the trading price for our common stock because investors often perceive disadvantages in owning stock in companies with controlling stockholders. Please see “Principal and Selling Stockholders” for a more detailed description of our share ownership.

As part of our acquisition from Schlumberger, we may be required to make additional payments to Schlumberger under certain circumstances.

As part of the consideration for the acquisition of the NPTest business from Schlumberger, we may be required to make additional payments to Schlumberger. We will be required to make a payment if NPTest Holding, LLC, our parent company, distributes to its members our stock, or other consideration in respect of our stock, with an aggregate value in excess of $330 million. The payment would be an amount equal to 15% of the excess of the aggregate value of the distribution by NPTest Holding, LLC to its members over $330 million. Once the first payment to Schlumberger occurs, future distributions from NPTest Holding, LLC will only require payment of an amount equal to 15% of that future distribution. Alternatively, upon the first anniversary of the completion of this offering or upon the first anniversary of an acquisition of our business, and in certain other circumstances, Schlumberger has the option to receive from us an amount equal to 15% of any excess over $330 million of the sum of the value of NPTest Holding, LLC’s then current holdings of our stock plus any proceeds previously received by NPTest Holding, LLC from our stock, including proceeds resulting from the transaction which triggered the payment obligation. We may generally settle this obligation in cash or shares of our common stock.

Furthermore, in the event of a merger, acquisition or sale of all or substantially all of our assets involving a specified party that occurs by January 26, 2004, and that results in NPTest Holding, LLC receiving at least $227 million in consideration, Schlumberger will have the right to receive from us an amount equal to 50% of the excess over $227 million of the value of the consideration received by NPTest Holding, LLC in such sale. The payment may be made in a combination of cash or stock, depending on the type of consideration received by NPTest Holding, LLC.

18

Table of Contents

As a result of the foregoing, we could be required to make a substantial payment when we have not actually received any additional funds or issue additional shares of our common stock without receiving further consideration. In the event we issue additional shares of our common stock, our stockholders would suffer dilution. After completion of this offering, NPTest Holding, LLC will beneficially own 63% of our outstanding common stock and, as of the date of this offering, NPTest Holding, LLC has not received any distributions. This obligation is described more fully under “Certain Relationships and Related Party Transactions—Transactions with Schlumberger.”

Risks Related to the Securities Markets and Ownership of Our Common Stock

Future sales of our common stock could depress our stock price.

Sales of substantial amounts of our common stock by Francisco Partners, or the perception that these sales might occur, may depress prevailing market prices of our common stock. All of our outstanding shares are subject to lock-up agreements with our underwriters that prohibit the resale of these shares for 180 days from the date of this prospectus. The shares beneficially owned by Francisco Partners and Shah Management have the benefit of an agreement with us that provides for customary demand and piggyback registration rights. We will also be required to provide registration rights for any shares that may be issued to Schlumberger as part of the contingent consideration we may become obligated to pay them. Upon expiration of the 180-day lock-up, in addition to the shares beneficially owned by Francisco Partners and Shah Management that may be sold under a registration statement, shares underlying exercisable options to purchase our common stock will be available for resale without restriction or further registration under the Securities Act.

Our underwriters may release all or a portion of the shares subject to lock-up agreements at any time without notice.

Our securities have no prior trading history, and we cannot assure you that our stock price will not decline after the offering.

Before this offering, there has not been a public market for our common stock, and an active public market for our common stock may not develop or be sustained after this offering. The market price of our common stock could be subject to significant fluctuations after this offering. Among the factors that could affect our stock price are:

| • | quarterly variations in our operating results; |

| • | our ability to successfully introduce new products and manage new product transitions; |

| • | changes in revenue or earnings estimates or publication of research reports by analysts; |

| • | speculation in the press or investment community; |

| • | strategic actions by us or our competitors, such as acquisitions or restructurings; |

| • | announcements relating to any of our key customers, significant suppliers or the semiconductor manufacturing and capital equipment industry generally; |

| • | general market conditions; and |

| • | domestic and international economic factors unrelated to our performance. |