Exhibit 99.1

Exhibit 99.1

TESSERA

Corporate Presentation

March 2011

Safe Harbor

This presentation and the accompanying speaker’s remarks may contain forward-looking statements made in reliance on the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties that could cause actual results to differ significantly from those projected.

Material factors that may cause results to differ from the statements made include delays, setbacks or losses relating to our intellectual property or intellectual property litigations, or any invalidation or limitation of our key patents; fluctuations in our operating results due to the timing of new license agreements and royalties or due to legal costs; changes in patent laws timing of new license agreements and royalties, or due to legal costs; changes in patent laws, regulation or enforcement, or other factors that might affect our ability to protect our intellectual property; the risk of a decline in demand for semiconductor products; failure by the industry to adopt our technologies; competing technologies; the future expiration of our patents; the future expiration of our license agreements and the cessation of related royalty income; the failure or refusal of licensees to pay royalties; failure to achieve the growth prospects and synergies refusal of licensees to pay royalties; failure to achieve the growth prospects and synergies expected from acquisition transactions; and delays and challenges associated with integrating acquired companies with our existing businesses.

You are cautioned not to place undue reliance on the forward-looking statements, which speak only as off the date off this presentation. Tessera’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2010, include more information about factors that could affect the company’s financial results.

Tessera assumes no obligation to correct or update information contained in this presentation.

Develops and monetizes innovative miniaturization technologies, which are differentiated by intellectual property content, through licensing or product sales

Tessera At A Glance

• Founded in 1990; IPO in 2003

• Headquartered in San Jose, CA

• 2010 Revenue $301.4M

• 2010 GAAP Net Income $57.3M

• 2010 Non-GAAP Net Income $91.2M

• $475 0M in cash, cash equivalents and investments at Dec. 31st

• $76. 2M in Free Cash Flow in 2010

Free Cash Flow is Operating Cash Flow minus purchase of property, equipment and patents

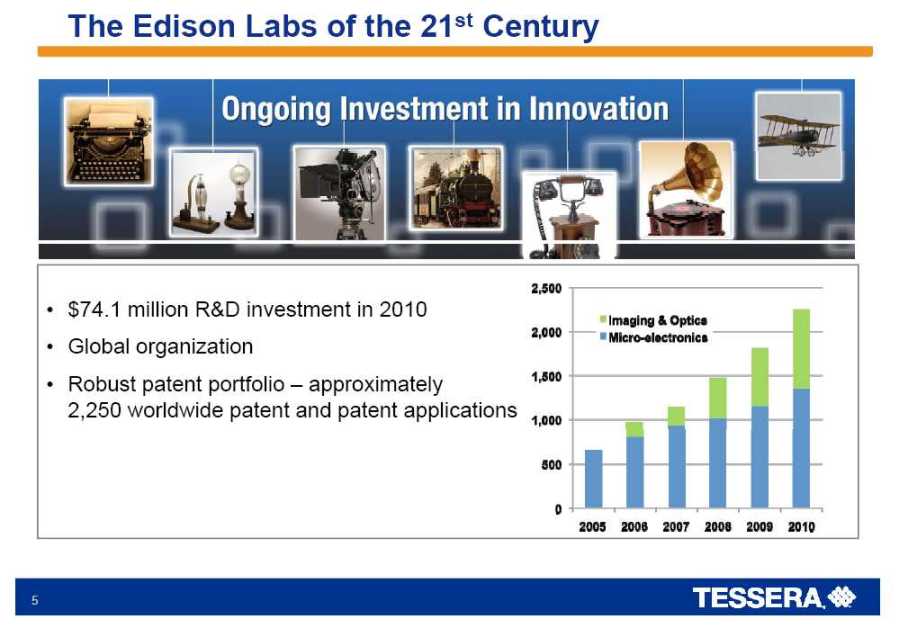

The Edison Labs of the 21st Century

Ongoing Investment in Innovation

• $74.1 million R&D investment in 2010

• Global organization

Robust patent portfolio – approximately 2,250 worldwide patent and patent applications

2,500 2,000 1,500 1,000 500 0 2005 2006 2007 2008 2009 2010

Imaging & Optics

Micro-electronics

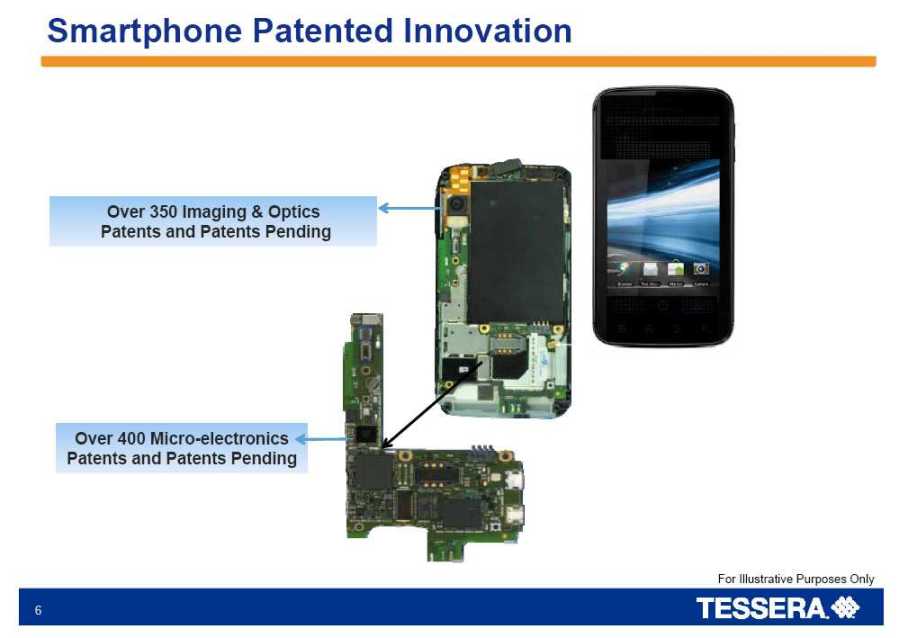

Smartphone Patented Innovation

Over 350 Imaging & Optics Patents and Patents Pending

Over 400 Micro electronics Patents and Patents Pending

For Illustrative Purposes Only

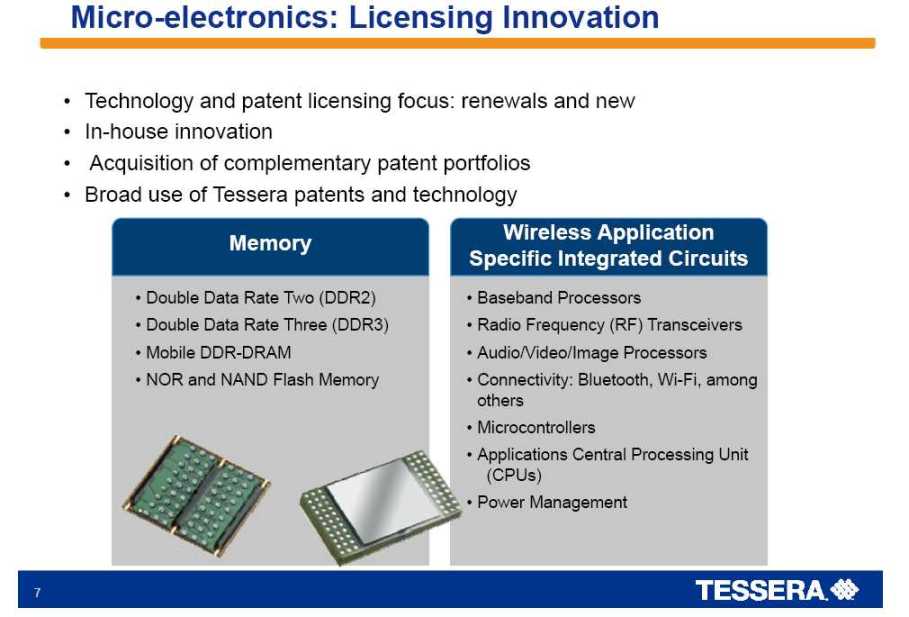

Micro-electronics: Licensing Innovation

• Technology and patent licensing focus: renewals and new

• In-house innovation

• Acquisition of complementary patent portfolios

• Broad use of Tessera patents and technology

Memory

• Double Data Rate Two (DDR2)

• Double Date Rate Three (DDR3)

• Mobile DDR-DRAM

• NOR and NAND Flash Memory

Wireless Application Specific Integrated Circuits

• Baseband Processors

• Radio Frequency (RF) Transceivers

• Audio/Video/Image Processors

• Connectivity: Bluetooth, Wi-Fi, among others

• Microcontrollers

• Applications Central processing Unit (CPUs)

• Power Management

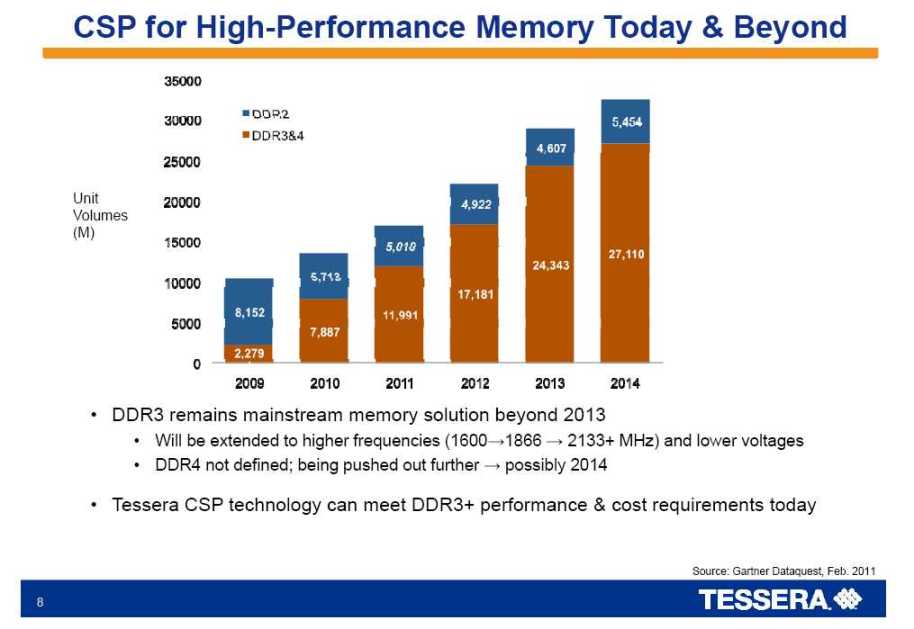

CSP for High-Performance Memory Today & Beyond

Unit Volumes (M)

35000 30000 25000 20000 15000 10000 5000 0 2009 8,152 2,279 2010 5,713 7,887 2011 5,010 11,991 2012 4,922 17,181 2013 4,607 24,343 2014 5,454 27,110

DDR2 DDR3&4

•DDR3 remains mainstream memory solution beyond 2013

• Will be extended to higher frequencies (1600 1866 2133+ MHz) and lower voltages

• DDR4 not defined; being pushed out further possibly 2014

• Tessera CSP technology can meet DDR3+ performance & cost requirements today

Source: Gartner Dataquest, Feb. 2011

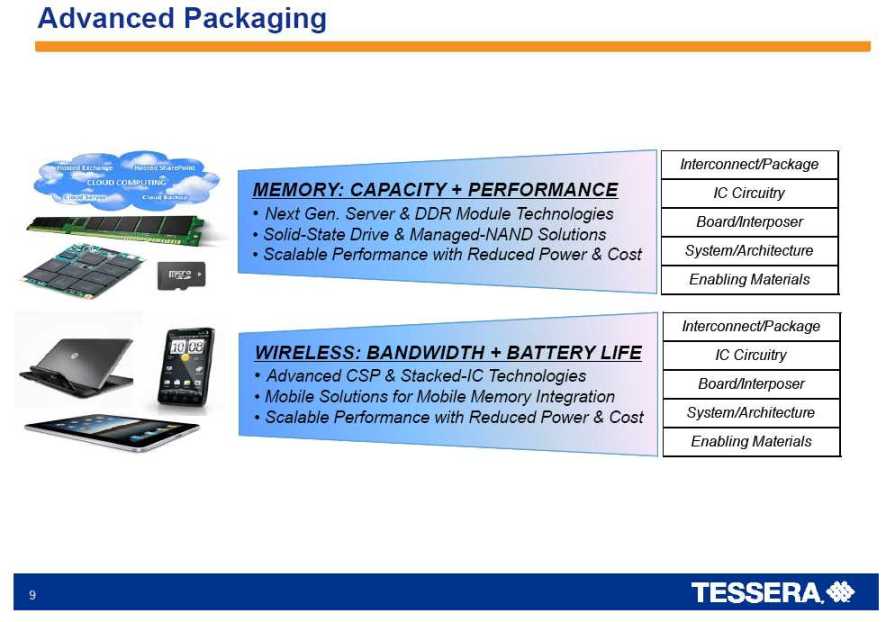

Advanced Packaging

MEMORY: CAPACITY + PERFORMANCE

• Next Gen. Server & DDR Module Technologies

• Solid-State Drive & Managed-NAND Solutions

• Scalable Performance with Reduced Power & Cost

Interconnect/Package

IC Circuitry

Board/Interposer

System/Architecture

Enabling Materials

WIRELESS: BANDWIDTH + BATTERY LIFE

• Advanced CSP & Stacked-IC Technologies

• Mobile Solutions for Mobile Memory Integration

• Scalable Performance with Reduced Power & Cost

Interconnect/Package

IC Circuitry

Board/Interposer

System/Architecture

Enabling Materials

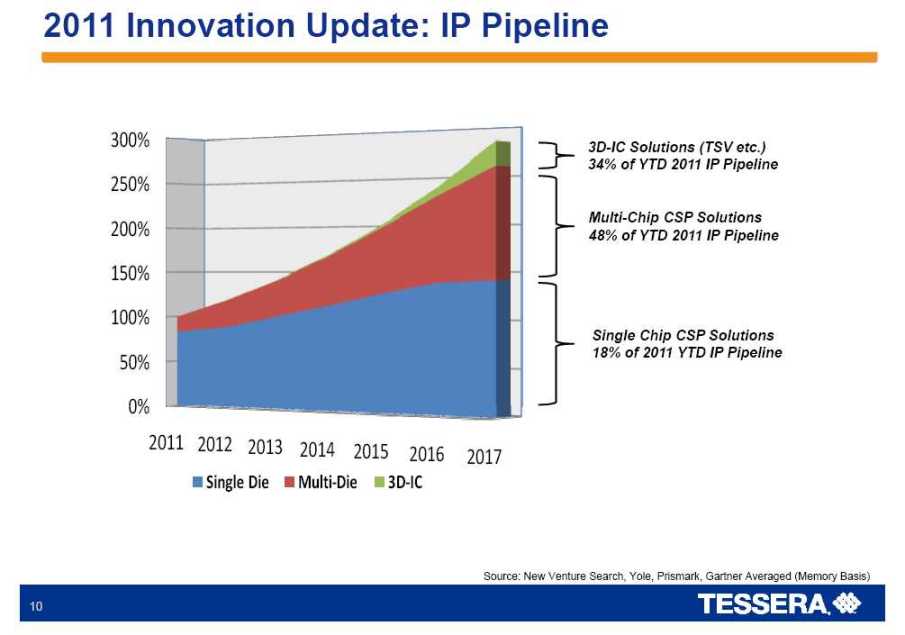

2011 Innovation Update: IP Pipeline

300% 250% 200% 150% 100% 50% 0%

2011 2012 2013 2014 2015 2016 2017

Single Die Multi-Die 3D-IC

3D-IC Solutions (TSV etc.)

34% of YTD 2011 IP Pipeline

Multi-Chip CSP Solutions

48% of YTD 2011 IP Pipeline

Single Chip CSP Solutions

18% of 2011 YTD IP Pipeline

Source: New Venture Search, Yole, Prismark, Gartner Averaged (Memory Basis)

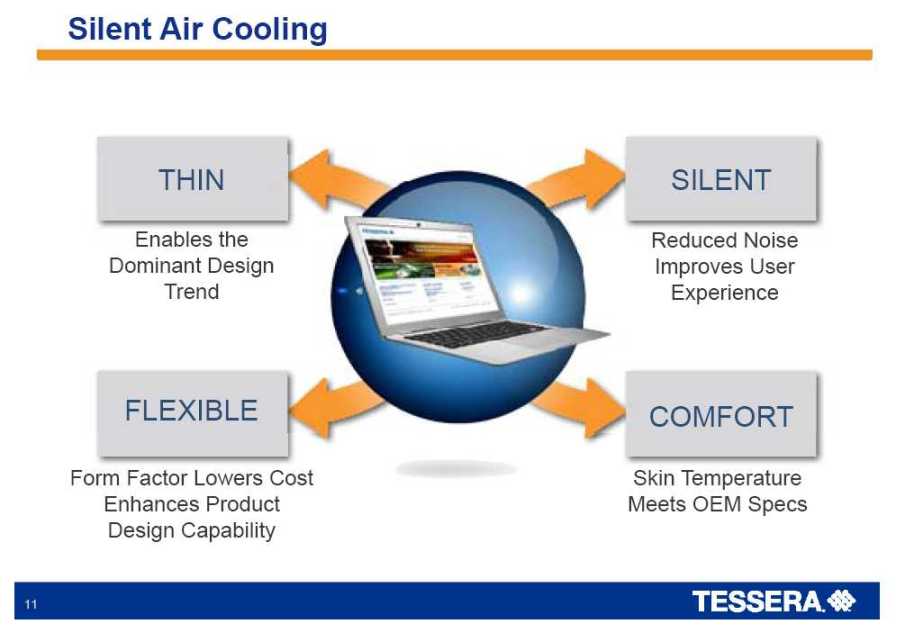

Silent Air Cooling

THIN

Enables Dominant Design Trend

SILENT

Reduced Noise Improves User Experience

FLEXIBLE

Form Factor Lowers Cost Enhances Product Design Capability

COMFORT

Skin Temperature Meets OEM Specs

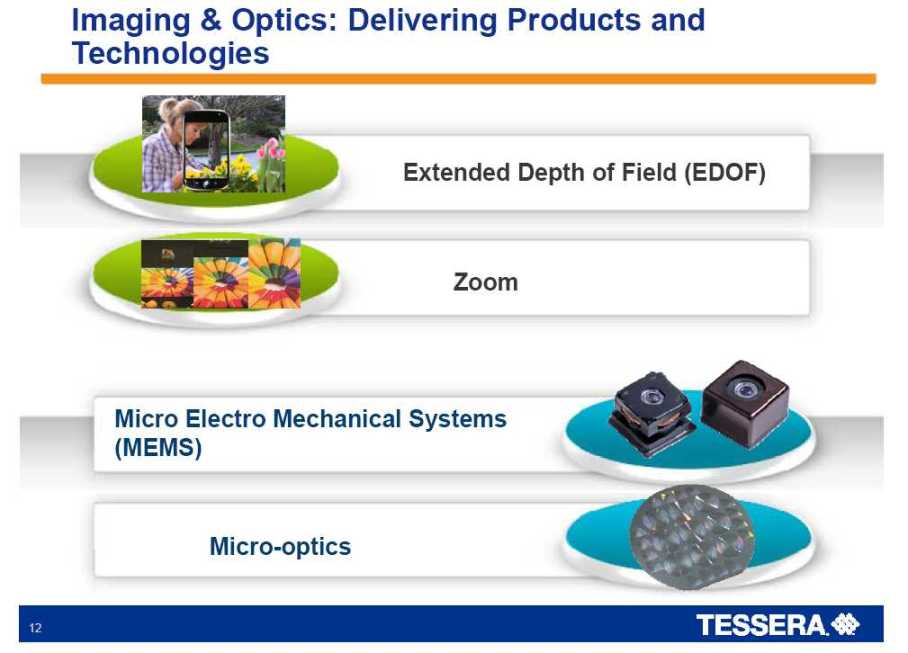

Imaging & Optics: Delivering Products and Technologies

Extended Depth of Field (EDOF)

Zoom

Micro Electro Mechanical Systems (MEMS)

Micro-optics

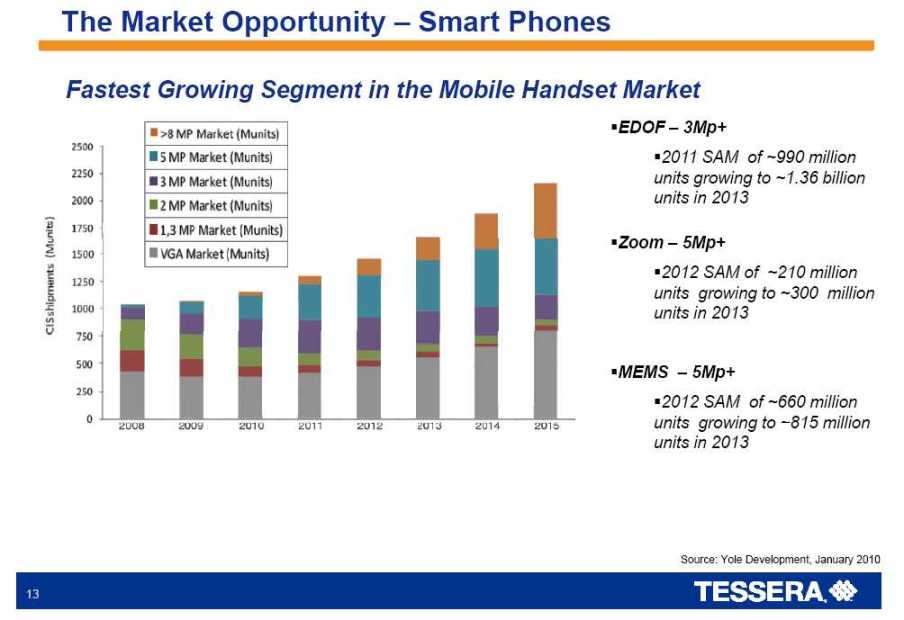

The Market Opportunity – Smart Phones

Fastest Growing Segment in the Mobile Handset Market

2500 2250 2000 1750 1500 1250 1000 750 500 250 0

2008 2009 2010 2011 2012 2013 2014 2015

>8 MP Market (Munits)

5 MP Market (Munits)

3 MP Market (Munits)

2 MP Market (Munits)

1,3 MP Market (Munits)

VGA Market (Munits)

EDOF – 3Mp+

2011 SAM of ~990 million units growing to ~1.36 billion units in 2013

Zoom – 5Mp+

2012 SAM of ~210 million units growing to ~300 million units in 2013

MEMS – 5Mp+

2012 SAM of ~660 million units growing to ~815 million units in 2013

Source: Yole Development, January 2010

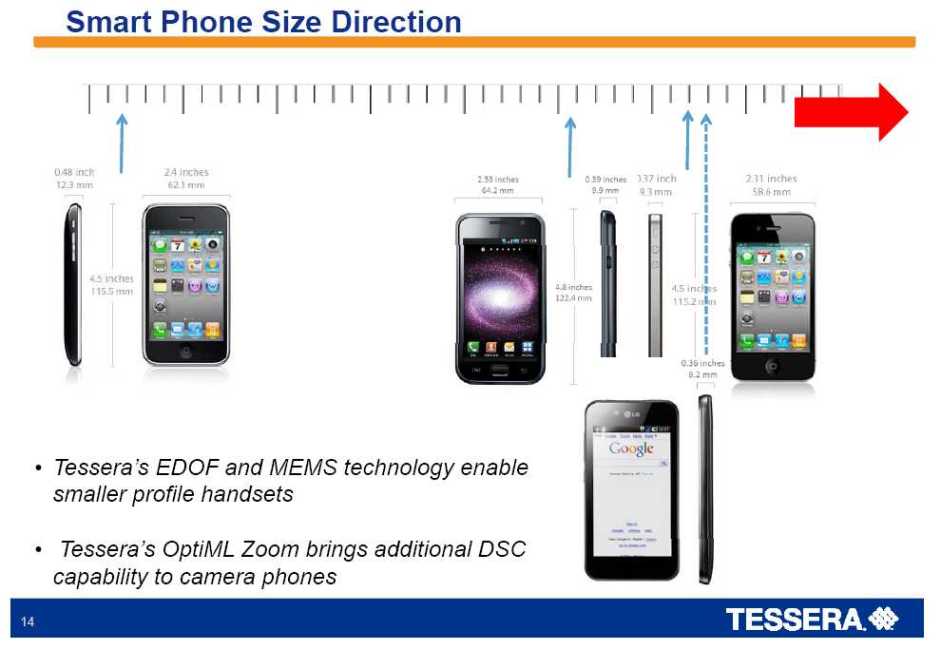

Smart Phone Size Direction

• Tessera’s EDOF and MEMS technology enable smaller profile handsets

• Tessera’s OptiML Zoom brings additional DSC capability to camera phones

Meeting Market Demand and Consumer Expectations

Delivering on the Promise of ‘DSC’ Like Functionality and High Quality Video in a Camera Phone

• Size

• Primary product requirement

• Tessera meets the size constraints of next generation handsets

• Performance

• The cell phone’s role as consumer’s primary tool driving higher performance and more full featured cameras in a mobile platform

• Tessera enables the fastest and most precise auto focus capability

• Low Power Consumption

• Growing video demand makes power consumption a critical feature

• Tessera provides the lowest power consumption

• Image Quality

• Trend towards ever better image quality and additional uses for camera phones

• Tessera delivers real time image correction and optimization

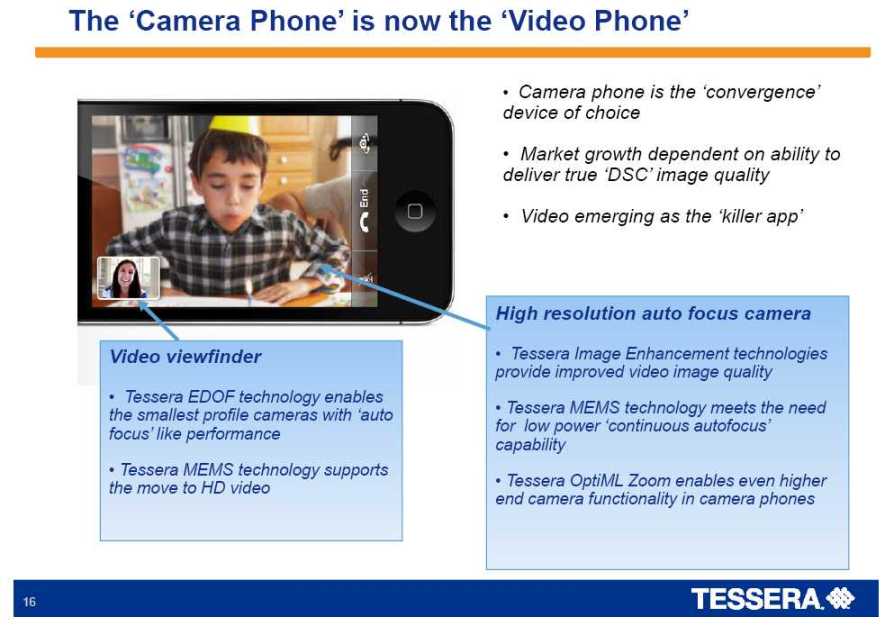

The ‘Camera Phone’ is now the ‘Video Phone

• Camera phone is the ‘convergence’ device of choice

• Market growth dependent on ability to deliver true ‘DSC’ image quality

• Video emerging as the ‘killer app’

Video viewfinder

• Tessera EDOF technology enables the smallest profile cameras with ‘auto focus’ like performance

• Tessera MEMS technology supports the move to HD video

High resolution auto focus camera

• Tessera Image Enhancement technologies provide improved video image quality

• Tessera MEMS technology meets the need for lower power ‘continuous autofocus’ capability

• Tessera OptiML Zoom enables even higher end camera functionality in camera phones

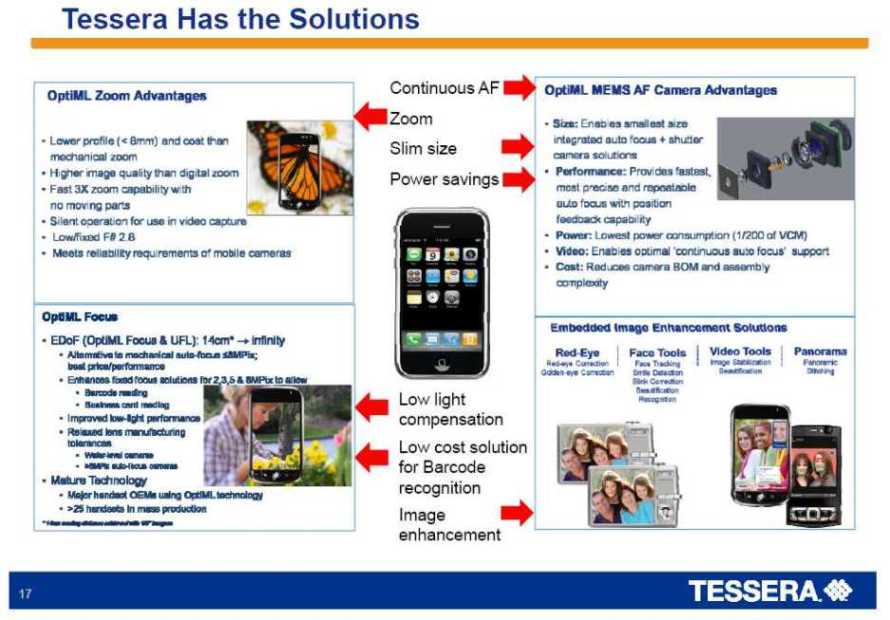

Tessera Has the Solutions

OptiML Zoom Advantages

• Lower profile (<8mm) and cost than mechanical zoom

• Higher image quality than digital zoom

• Fast 3X zoom capability with no moving parts

• Silent operation for use in video capture

• Low/fixed F# 2.8

• Meets reliability requirements of mobile cameras

OptiML Focus

EDoF (OptiML Focus & UFL): 14cm* infinity

• Alternative to mechanical auto-focus <8MPix; best price/performance

• Enhances fixed focus solutions for 2,3,5 & 8MPix to allow

• Barcode reading

• Business card reading

• Improved low-light performance

• Relaxed lens manufacturing tolerances

• Water-level cameras

• 8MPix auto-focus cameras

• Mature Technology

• Major handset OEMs using OptiML technology

• >25 handsets in mass production

Continuous AF

*14cm reading distance achieved with 1/5”

Zoom

Slim size

Power savings

Low light compensation

Low cost solution for Barcode recognition

Image enhancement

OptiML MEMS AF Camera Advantages

• Size: Enables smallest size integrated auto focus + shutter camera solutions

• Performance: Provides fastest, most precise and repeatable auto focus with position feedback capability

• Power: Lowest power consumption (1/200 of VCM)

• Video: Enables optimal ‘continuous auto focus’ support

• Cost: Reduces camera BOM and assembly complexity

Embedded Image Enhancement Solutions

Red-Eye

Red-eye Correction

Golden-eye Correction

Face Tools

Face Tracking

Smile Detection

Blink Correction Beautification

Recognition

Video Tools

Image Stabilization

Beautification

Panorama

Panoramic

Stitching

TESSERA

Transforming the Future