UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under Rule 14a-12 |

Tessera Technologies, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials: |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed |

TESSERA TECHNOLOGIES, INC.

3025 Orchard Parkway

San Jose, CA 95134

May 29, 2013

Dear Stockholder,

On May 22, 2013, Tessera Technologies, Inc. (the “Company”) and Starboard Value and Opportunity Master Fund Ltd and its affiliates and director nominees (together, “Starboard”) entered into a settlement agreement (the “Settlement Agreement”) for the purpose of, among other things, resolving the pending proxy contest. Pursuant to the Settlement Agreement, (i) Robert J. Boehlke and Anthony J. Tether resigned from the Board of Directors (the “Board”) of the Company, (ii) the size of the Board was increased to twelve (12) members up to the date of the Annual Meeting of Stockholders (the “Annual Meeting”) and the Company appointed each of Tudor Brown, George Cwynar, Peter A. Feld, Thomas Lacey, George A. Riedel and Donald E. Stout (the “Starboard Nominees”) to the Board, (iii) the Annual Meeting was adjourned to June 7, 2013, (iv) the Board determined to expand the number of Board seats that will be open for election at the Annual Meeting by two (2) seats such that effective as of the Annual Meeting the Board will consist of ten (10) members, (v) John H.F. Miner and David C. Nagel are not standing for re-election to the Board at the Annual Meeting, and (vi) the Board nominated for election as directors at the Annual Meeting the following individuals (collectively, the “Revised Slate of Nominees”): Tudor Brown, John Chenault, George Cwynar, Peter A. Feld, Richard S. Hill, Thomas Lacey, George A. Riedel, Christopher A. Seams, Donald E. Stout and Timothy J. Stultz.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF ALL TEN (10) OF THE REVISED SLATE OF NOMINEES.

The Company previously furnished to stockholders a GOLD proxy card which identified six (6) persons, John Chenault, Richard S. Hill, John H.F. Miner, David C. Nagel, Christopher A. Seams and Timothy J. Stultz, as nominees for election to the Board at the Annual Meeting. Pursuant to the Settlement Agreement, John H.F. Miner and David C. Nagel are no longer standing for election to the Board at the Annual Meeting. TheBLUE card enclosed with this proxy statement supplement differs from the GOLD proxy card previously furnished by the Company in that it includes all of the Starboard Nominees and it excludes Mr. Miner and Dr. Nagel. If you submitted or submit the GOLD proxy card previously furnished to you which does not include all of the Revised Slate of Nominees, the persons identified as proxies on the GOLD proxy card are not permitted to exercise their discretionary authority to vote for the election of the Starboard Nominees. Thus, if you wish to vote with respect to all ten (10) nominees, including the Starboard Nominees, please submit the enclosedBLUE proxy card. In addition, if you have already voted on any proxy card sent to you by Starboard, such proxy card will NOT be voted at the Annual Meeting and you can vote by executing and delivering the accompanyingBLUE proxy card or by voting in person at the Annual Meeting, through the Internet or by telephone.

We hope that you will vote as soon as possible to ensure that your shares will be represented at the Annual Meeting.

The Board and management look forward to your participation.

|

| Sincerely yours, |

|

| /s/ Richard S. Hill |

|

| Richard S. Hill |

|

Chairman of the Board |

San Jose, California

May 29, 2013

TESSERA TECHNOLOGIES, INC.

3025 Orchard Parkway

San Jose, CA 95134

AMENDED NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 7, 2013

The Annual Meeting of Stockholders (the “Annual Meeting”) of Tessera Technologies, Inc. (the “Company”) has been adjourned to Friday, June 7, 2013 at 10:00 a.m. Pacific Daylight Time, at Tessera Technologies, Inc., 3025 Orchard Parkway, San Jose, CA 95134, for the following purposes:

| | 1. | To elect ten members of the Board of Directors to hold office until the next annual meeting or until their successors are duly elected and qualified; |

| | 2. | To hold an advisory vote on executive compensation; |

| | 3. | To ratify the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm of the Company for its fiscal year ending December 31, 2013; |

| | 4. | To approve the amendment and restatement of the Employee Stock Purchase Plan; |

| | 5. | To approve the International Employee Stock Purchase Plan; and |

| | 6. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the proxy statement filed by the Company on April 16, 2013 and the fourth proxy statement supplement accompanying this Notice. The Board of Directors has fixed the close of business on April 12, 2013 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting, or at any adjournments thereof.

All stockholders are cordially invited to attend the Annual Meeting. However, whether or not you plan to attend the Annual Meeting in person, you are urged to mark, date, sign and return the enclosedBLUE proxy card as promptly as possible in the postage-prepaid envelope provided, or vote electronically through the Internet or by telephone, to ensure your representation and the presence of a quorum at the Annual Meeting. If you attend the Annual Meeting and file with the Secretary of the Company an instrument revoking your proxy or a duly executed proxy bearing a later date, your proxy will not be used.

Our Board intends to nominate for election as directors the ten (10) persons named in the fourth proxy statement supplement. We believe that our revised slate of nominees have the independence, experience, knowledge and commitment to deliver value for the Company and its stockholders.THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF ALL OF THE REVISED SLATE OF NOMINEES ON THE ENCLOSED BLUE PROXY CARD.

TheBLUE card enclosed with this proxy statement supplement differs from the GOLD proxy card previously furnished by the Company in that it includes all of the Starboard Nominees and it excludes Mr. Miner and Dr. Nagel. If you submitted or submit the GOLD proxy card previously furnished to you which does not include all of the Revised Slate of Nominees, the persons identified as proxies on the GOLD proxy card are not permitted to exercise their discretionary authority to vote for the election of the Starboard Nominees. Thus, if you wish to vote with respect to all ten (10) nominees, including the Starboard Nominees, please submit the enclosedBLUE proxy card. If you have already voted using a proxy card sent to you by Starboard, the Board urges you to please vote by executing and delivering theBLUE proxy card or by voting in person at the Annual Meeting, through the Internet or by telephone.

|

| By Order of the Board of Directors |

|

| TESSERA TECHNOLOGIES, INC. |

|

| /s/ BERNARD J. CASSIDY |

|

BERNARD J. CASSIDY Secretary |

San Jose, California

May 29, 2013

TESSERA TECHNOLOGIES, INC.

3025 Orchard Parkway

San Jose, CA 95134

SUPPLEMENT TO PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

June 7, 2013

This supplement to the proxy statement dated May 29, 2013, which we refer to as the fourth proxy statement supplement, is being sent to you in connection with the solicitation of proxies for use prior to or at the Annual Meeting of Stockholders (the “Annual Meeting”) of Tessera Technologies, Inc. (together with its subsidiaries, herein referred to as the “Company”), a Delaware corporation, to be held at 10:00 a.m. Pacific Daylight Time on Friday, June 7, 2013 and at any adjournments or postponements thereof. The Annual Meeting will be held at Tessera Technologies, Inc., 3025 Orchard Parkway, San Jose, CA 95134. This fourth proxy statement supplement updates the definitive proxy statement dated April 16, 2013 and previously mailed to you on or about April 17, 2013, which we refer to in this fourth proxy statement supplement as the proxy statement. This fourth proxy statement supplement also updates the supplement filed as definitive additional material on Schedule 14A dated May 3, 2013 and previously mailed to you on or about May 7, 2013, which we refer to in this fourth proxy statement supplement as the first proxy statement supplement, as well as the supplement filed as definitive additional material on Schedule 14A dated May 15, 2013 and previously mailed to you on or about May 16, 2013, which we refer to in this fourth proxy statement supplement as the second proxy statement supplement, as well as the supplement filed as definitive additional material on Schedule 14A dated May 17, 2013, which we refer to in this fourth proxy statement supplement as the third proxy statement supplement. We have made this fourth proxy statement supplement, which should be read in conjunction with the proxy statement, the first proxy statement supplement, the second proxy statement supplement, the third proxy statement supplement and accompanying form of proxy available to stockholders beginning on May 29, 2013. The Board of Directors (the “Board”) of the Company has fixed the close of business on April 12, 2013 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting, or at any adjournments of the Annual Meeting, which is the same record date specified in the proxy statement.

On May 22, 2013, the Company and Starboard Value and Opportunity Master Fund Ltd and its affiliates and director nominees (together, “Starboard”) entered into a settlement agreement (the “Settlement Agreement”) for the purpose of, among other things, resolving the pending proxy contest. Pursuant to the Settlement Agreement, (i) Robert J. Boehlke and Anthony J. Tether resigned from the Board, (ii) the size of the Board was increased to twelve (12) members up to the date of the Annual Meeting and the Company appointed each of Tudor Brown, George Cwynar, Peter A. Feld, Thomas Lacey, George A. Riedel and Donald E. Stout to the Board (the “Starboard Nominees”), (iii) the Annual Meeting was adjourned to June 7, 2013, (iv) the Board determined to expand the number of Board seats that will be open for election at the Annual Meeting by two (2) seats such that effective as of the Annual Meeting the Board will consist of ten (10) members, (v) John H.F. Miner and David C. Nagel are not standing for re-election to the Board at the Annual Meeting, and (vi) the Board nominated for election as directors at the Annual Meeting the following individuals (collectively, the “Revised Slate of Nominees”): Tudor Brown, John Chenault, George Cwynar, Peter A. Feld, Richard S. Hill, Thomas Lacey, George A. Riedel, Christopher A. Seams, Donald E. Stout and Timothy J. Stultz.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF ALL TEN (10) OF THE REVISED SLATE OF NOMINEES.

For additional information regarding the Settlement Agreement, please refer to the section below captioned “Certain Background Information.”

The Company previously furnished to stockholders a GOLD proxy card which identified six (6) persons, John Chenault, Richard S. Hill, John H.F. Miner, David C. Nagel, Christopher A. Seams and Timothy J. Stultz as nominees for election to the Board at the Annual Meeting. Pursuant to the Settlement Agreement, John H.F. Miner and David C. Nagel are no longer standing for election to the Board at the Annual Meeting. TheBLUE card enclosed with this fourth proxy statement supplement differs from the GOLD proxy card previously furnished by the Company in that it includes all of the Starboard Nominees and it excludes Mr. Miner and Dr. Nagel. If you submitted or submit the GOLD proxy card previously furnished to you which does not include all of the Revised Slate of Nominees, the persons identified as proxies on the GOLD proxy card are not permitted to exercise their discretionary authority to vote for the election of the Starboard Nominees. Thus, if you wish to vote with respect to all ten (10) nominees, including the Starboard Nominees, please submit the enclosedBLUE proxy card. In addition, if you have already voted on any proxy card sent to you by Starboard, such proxy card will NOT be voted at the Annual Meeting and you can vote by executing and delivering the accompanyingBLUE proxy card or by voting in person at the Annual Meeting, through the Internet or by telephone. Only your last-dated proxy will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in this fourth proxy statement supplement.

We urge you to mark, date, sign and return the enclosedBLUE proxy card as promptly as possible in the postage-prepaid envelope provided, or vote electronically through the Internet or by telephone. If you choose to vote by mail, your shares will be voted in accordance with your voting instructions if the proxy card is received prior to or at the Annual Meeting. If you sign and return your proxy card but do not give voting instructions, your shares will be voted (1) FOR ALL of the ten (10) Revised Slate of Nominees; (2) FOR the approval of compensation of our named executive officers as disclosed in the proxy statement; (3) FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm for the Company for the fiscal year ending December 31, 2013; (4) FOR the approval of the amendment and restatement of the Employee Stock Purchase Plan; (5) FOR the approval of the International Employee Stock Purchase Plan; and (6) as the proxy holders deem advisable, in their discretion, on other matters that may properly come before the Annual Meeting.

For additional information regarding voting of your shares, refer to the section below captioned “Voting Rights and Outstanding Shares.”

The information provided in the proxy statement, the first proxy statement supplement, the second proxy statement supplement and the third proxy statement supplement continues to apply, except as described in this fourth proxy statement supplement. To the extent information in this fourth proxy statement supplement differs from, updates or conflicts with information contained in the proxy statement, the first proxy statement supplement, the second proxy statement supplement or the third proxy statement supplement, the information in this fourth proxy statement supplement is the more current information. If you need another copy of the proxy statement, the first proxy statement supplement, the second proxy statement supplement, the third proxy statement supplement or a copy of this fourth proxy statement supplement, you may obtain it free of charge from us by directing such request to Investor Relations at (408) 321-6000, send an e-mail request to ir@tessera.com, or write to c/o Investor Relations, Tessera Technologies, Inc., 3025 Orchard Parkway, San Jose, CA 95134.

Certain Background Information

On May 22, 2013, the Company and Starboard entered into the Settlement Agreement for the purpose of, among other things, resolving the pending proxy contest and effecting an orderly change in the composition of the Board.

According to the Settlement Agreement, the Company modified the Company’s slate of nominees standing for election as directors at the Annual Meeting to consist of the following individuals: Peter A. Feld, Tudor Brown, George Cwynar, Thomas Lacey, George A. Riedel and Donald E. Stout (collectively, referred to herein as the Starboard Nominees), in addition to John Chenault, Richard S. Hill, Christopher A. Seams and Timothy J. Stultz (collectively, referred to herein as the Company Nominees, and together with the Starboard Nominees, the Revised Slate of Nominees).

The Settlement Agreement also provides for the following:

| | • | | Robert J. Boehlke and Anthony J. Tether resigned from the Board. |

| | • | | The Company increased the size of the Board to twelve (12) members up to the date of the Annual Meeting and appointed each of the Starboard Nominees to the Board. |

| | • | | John H.F. Miner and David C. Nagel are not standing for re-election to the Board at the Annual Meeting, such that the size of the Board will decrease to ten (10) members following the Annual Meeting. |

| | • | | Starboard withdrew its nomination letter to the Company and agreed to cause all shares of the Company’s common stock beneficially owned by it and its affiliates in favor of (i) the election of each of the nominees of the Board included in the Revised Slate of Nominees and (ii) each other proposal to come before the Annual Meeting in accordance with the Board’s recommendation. |

| | • | | The Board agreed to promptly appoint an interim chief executive officer from among the Starboard Nominees, with Richard S. Hill returning to his previous position of non-executive chairman of the Board. |

| | • | | Upon the Board’s eventual appointment of a successor to the interim chief executive officer, one of the Company Nominees as selected by the Board, other than Mr. Hill, will step down from the Board. |

| | • | | Company Nominees John Chenault and Timothy J. Stultz will remain in their roles as chair of the Audit Committee and Compensation Committee, respectively. The Board agreed to promptly appoint Starboard Nominees to the Audit Committee and the Compensation Committee, such that Starboard Nominees will compose a majority of those committees. Company Nominee Christopher A. Seams will remain a member of the Audit Committee. The Board has appointed Mr. Cwynar to the Audit Committee, effective May 23, 2013, and has appointed Messrs. Feld, Hill and Riedel to the Compensation Committee, effective June 7, 2013. |

| | • | | The Board agreed to promptly appoint Starboard Nominees to the Nominating Committee, including a Starboard Nominee as the chair, such that Starboard Nominees will compose a majority of the Nominating Committee. The Nominating Committee will be responsible for evaluating and identifying potential candidates for appointment as the Company’s permanent chief executive officer. The Board has appointed Mr. Feld as chair of the Nominating Committee, effective May 23, 2013, and has appointed Messrs. Cwynar, Hill, Seams and Stout to the Nominating Committee, effective June 7, 2013. |

| | • | | Each of the Company and Starboard waives, discharges and releases, and covenants not to sue, the other party or its respective controlling persons, officers, directors, stockholders, agents, affiliates, employees, attorneys, advisors and assigns, past and present, in their capacity as such for any and all claims, causes of action, actions, judgments, liens, debts, contracts, indebtedness, damages, losses, liabilities, rights, interests and demands (other than fraud) based on any event, fact, act, omission, or failure to act, whether known or unknown, occurring or existing prior to the execution of the Settlement Agreement. |

| | • | | Each of the Company and Starboard have agreed not to disparage, call into disrepute, or otherwise defame the other, or the other’s subsidiaries, affiliates, successors, assigns, officers or directors (including officers or directors that no longer serve in such capacity following the execution of the Settlement Agreement), employees, stockholders, agents, attorneys or representatives, or any of their products or services, in any manner that would damage their respective businesses or reputations. |

The Company has also agreed to reimburse Starboard for its documented, reasonable out-of-pocket expenses incurred in connection with the matters related to the Annual Meeting and negotiation of the Settlement Agreement, up to a maximum of $650,000.

On May 29, 2013, the Board appointed Mr. Lacey as Interim Chief Executive Officer. Effective upon Mr. Lacey’s appointment as Interim Chief Executive Officer, Mr. Hill returned to his role as non-executive chairman of the Board. Mr. Lacey will not be considered an “independent director” under NASDAQ listing standards while serving in such interim capacity. The Board has determined that each of the nominees, other than Mr. Lacey, on the Revised Slate of Nominees is an “independent director” as such term is defined in NASDAQ Marketplace Rule 5605(a)(2). Mr. Lacey will not be disqualified from being considered an “independent director” following the end of his service as interim chief executive officer if his interim employment does not last longer than one year.

Revised Slate of Nominees for Election

Pursuant to the Settlement Agreement, the Board nominates the following individuals for election to the Board at the Annual Meeting:

Tudor Brown,age 54, was appointed to the Board on May 22, 2013 in accordance with the Settlement Agreement. Mr. Brown was one of the founding members and until May 2012, President of ARM Holdings plc (“ARM”), a publicly-traded, semiconductor IP and software design company based in Cambridge, UK. Mr. Brown began his career at ARM over twenty years ago as a principal engineer and later assumed other roles, including Chief Technical Officer from 1997

through 2000, Chief Operating Officer from 2001 through 2008, and a member of the board of directors from 2001 through his retirement in May 2012. Mr. Brown became President of ARM in July 2008 with responsibility for developing high-level relationships with industry partners and governmental agencies and for regional development, and served as a director on ARM’s board of directors. Mr. Brown was also a non-executive director of ANT Software Limited, a UK company, from April 2005 until February 2013. He became an independent director of Lenovo Group, listed on HKSE, in January 2013 and is a member of the advisory board of Annapurna Labs, an Israeli company. Mr. Brown received an MA degree in Electrical Sciences from Cambridge University, and holds one patent in low-power logic. He is a Fellow of the Institution of Engineering and Technology and a Fellow of the Royal Academy of Engineering.

The Board believes Mr. Brown’s experience as a founder and senior executive of one of the world’s most successful semiconductor technology and licensing companies along with his strong operational experience and deep industry knowledge will enable him to provide invaluable oversight to the Board.

John Chenault,age 65, has served on the Board since March 2013. Mr. Chenault served as Chief Financial Officer of Novellus Systems, a semiconductor company, from April 2005 to September 2005, at which point he retired. Prior to that, he served as Vice President of Corporate Development from February 2005 to April 2005, Vice President of Operation and Administration from September 2003 to February 2005, Executive Vice President of Worldwide Sales and Service from February 2002 to September 2003 and Executive Vice President of Business Operations from July 1997 to January 2002. Mr. Chenault also serves on the board of directors of Ultra Clean Technology and Synos Technology, Inc. Mr. Chenault received a Bachelor of Business degree in Economics and an M.B.A. from Western Illinois University.

The Board believes Mr. Chenault brings his extensive management and operations experience in the semiconductor industry to his role as a member of the Board.

George Cwynar, age 64, was appointed to the Board on May 22, 2013 in accordance with the Settlement Agreement. Mr. Cwynar is a consultant offering strategic and operational guidance, mentoring and executive coaching to small and mid-sized companies. Mr. Cwynar was the President of COM DEV Canada, a division of COM DEV International, a global designer and manufacturer of space hardware, from May 2008 until November 2009. From November 1994 until April 2007, Mr. Cwynar served as the President and Chief Executive Officer of MOSAID Technologies Incorporated (“MSD”), a Canadian-based leading designer and licensor of memory technology, and supplier of memory test systems to major semiconductor companies worldwide that was traded on the Toronto Stock Exchange. Prior to his work at MSD, Mr. Cwynar served in several capacities, including senior vice-president and general manager of operations at Macdonald Dettwiler & Associates, a systems engineering company specializing in remote sensing and air traffic control systems, from March 1980 until January 1994. Mr. Cwynar served on the board of directors of MetroPhotonics Inc. from February 2001 until March 2007 and Accelerix Incorporated until it was acquired by MSD in 1999. Mr. Cwynar also currently serves on the Advisory Board of OCM Manufacturing. Mr. Cwynar earned a B.A.Sc in electrical engineering from the University of Toronto.

The Board believes Mr. Cwynar’s experience as the former chief executive officer of a semiconductor product and licensing company, as well as his technology and engineering background, will enable him to provide invaluable oversight to the Board.

Peter A. Feld, age 34, was appointed to the Board on May 22, 2013 in accordance with the Settlement Agreement. Mr. Feld is a Managing Member and Head of Research of Starboard Value LP. Previously, Mr. Feld served as a Managing Director of Ramius LLC and a portfolio manager of Ramius Value and Opportunity Master Fund Ltd, a position he held between November 2008 and April 2011. Prior to becoming a Managing Director, Mr. Feld served as a Director at Ramius LLC from February 2007 to November 2008. Mr. Feld joined Ramius LLC as an Associate in February 2005. From June 2001 to July 2004, Mr. Feld was an investment banking analyst at Banc of America Securities, LLC, the investment banking arm of Bank of America Company, a bank and financial holding company. Mr. Feld has served on the board of directors of Unwired Planet, Inc. (f/k/a Openwave Systems Inc.), an intellectual property licensing company, since July 2011, and currently serves as its Chairman of the Board. Mr. Feld also has served on the board of directors of Integrated Device Technology, Inc., a mixed-signal semiconductor solutions company, since June 2012. Mr. Feld served on the board of directors of SeaChange International, Inc., a company engaged in the delivery of multi-screen video, from December 2010 to January 2013. Mr. Feld previously served on the board of directors of CPI Corp. from July 2008 to July 2009.

The Board believes that Mr. Feld’s experience as an active stockholder, board member, and expert in capital markets and corporate governance practices, as well as his knowledge of intellectual property licensing, will enable him to provide invaluable oversight to the Board.

Richard S. Hill,age 61, has served as a member of the Board since August 2012 and as Chairman of the Board since March 2013. Mr. Hill previously served as the Company’s Interim Chief Executive Officer from April 15, 2013 until May 29, 2013. Mr. Hill previously served as the Chief Executive Officer and member of the board of directors of Novellus Systems Inc., until its acquisition for more than $3 billion by Lam Research Corporation in June 2012. During his nearly 20 years leading Novellus Systems, a designer, manufacturer, and marketer of semiconductor equipment used in fabricating integrated circuits, Mr. Hill grew annual revenues from approximately $100 million to over $1 billion. Before joining Novellus in 1993, Mr. Hill spent 12 years with Tektronix Corporation, a leading designer and manufacturer of test and measurement devices such as oscilloscopes and logic analyzers. Mr. Hill rose through the ranks of the corporation starting as a General Manager of the Integrated Circuits division, and finishing his time as the President of the Tektronix Development Company and Tektronix Components Corporation. Before joining Tektronix, Mr. Hill worked in a variety of engineering and management positions with General Electric, Motorola and Hughes Aircraft Company. Presently, Mr. Hill is a member of the Boards of Directors of Arrow Electronics, Inc., a global provider of products and services to industrial and commercial users of electronic components and enterprise computing, Cabot Microelectronics Corporation, the leading global supplier of chemical mechanical planarization (CMP) slurries and a growing CMP pad supplier to the semiconductor industry, and LSI Corporation, a provider of semiconductors and software to accelerate storage and networking in datacenters and mobile networks. Mr. Hill received a B.S. in Bioengineering from the University of Illinois in Chicago and an M.B.A. from Syracuse University.

The Board believes that Mr. Hill brings extensive expertise in executive management and engineering for technology and defense-related companies to his role as Chairman of the Board.

Thomas Lacey, age 55, was appointed to the Board on May 22, 2013 and as the Company’s Interim Chief Executive Officer on May 29, 2013 in accordance with the Settlement Agreement. Mr. Lacey is the former Chairman and Chief Executive Officer of Components Direct, a provider of cloud-based product life cycle solutions, and served in those capacities from May 2011 to April 2013. Mr. Lacey also currently serves on the board of directors and the audit committee of publicly-traded International Rectifier Corporation, a leader in power management technology, and DSP Group, Inc. (“DSP”), a publicly-traded leading global provider of wireless chipset solutions for converged communications, and has served in those capacities since March 2008 and May 2012, respectively. In May 2013, Mr. Lacey was also appointed to the audit committee of DSP’s board of directors. Previously, Mr. Lacey served as the President, Chief Executive Officer and a director of Phoenix Technologies Ltd., a publicly-traded, global provider of basic input-output software for personal computers, from February 2010 to February 2011. Prior to joining Phoenix Technologies Ltd., Mr. Lacey was the Corporate Vice President and General Manager of the SunFabTM Thin Film Solar Products group of Applied Materials, Inc., which trades on NASDAQ, from September 2009. Mr. Lacey previously served as President of Flextronics International’s Components Division, now Vista Point Technologies, from 2006 to 2007. Mr. Lacey joined Flextronics in connection with the sale to Flextronics of publicly-traded International Display Works, where Mr. Lacey had been Chairman, President and Chief Executive Officer from 2004 to 2006. Prior to International Display Works, Mr. Lacey held various management and executive positions at publicly-traded Intel Corporation for 13 years, including Vice President Sales and Marketing, President of Intel Americas, and Vice President and General Manager, Flash Products. Mr. Lacey holds a Bachelor of Arts degree in computer science from the University of California, Berkeley, and masters of business administration degree from the Leavy School of Business at Santa Clara University.

The Board believes that Mr. Lacey’s experience in the senior management of public companies, including service as chairman, president, chief executive officer and corporate vice president, his experience on the boards of directors of public companies, his financial expertise and his direct knowledge of the component manufacturing and camera module business, will enable him to provide invaluable oversight to the Board.

George A. Riedel, age 55, was appointed to the Board on May 22, 2013 in accordance with the Settlement Agreement. Mr. Riedel is currently the Chairman of the Board of Montreal-based Accedian Networks, where he has served as a director since 2010. Mr. Riedel has also served on the board of directors of PeerApp since 2011. Mr. Riedel served on the board of directors of Blade Network Technologies from 2009 until its sale to IBM in 2010. In March 2006, Mr. Riedel joined Nortel Networks Corporation, a publicly-traded, multinational, telecommunications equipment manufacturer (“Nortel”), as part of the turnaround team as the Chief Strategy Officer. His role changed after Nortel initiated creditor protection under the respective restructuring regimes of Canada under the Companies’ Creditors

Arrangement Act, in the U.S. under the Bankruptcy Code, the United Kingdom under the Insolvency Act 1986, on January 14, 2009, and subsequently, Israel, to lead the sale/restructuring of various carrier and enterprise business units through a series of transactions to leading industry players such as Ericsson, Avaya and Ciena. Mr. Riedel led the efforts to create stand-alone business units, carve out the relevant P&L and balance sheet elements and assign predominately used patents to enable sales of the assets. In 2010, Mr. Riedel’s role changed to President of Business Units and CSO as he took leadership of the effort to monetize the remaining 6,500 patents and applications patents as well as manage the P&L for several business units that were held for sale. The 2011 patent sale led to an unprecedented transaction of $4.5 billion to a consortium of Apple, Ericsson, RIM, Microsoft and EMC. Prior to Nortel, Mr. Riedel was the Vice President of Strategy and Corporate Development of Juniper Networks, Inc., a publicly-traded designer, developer and manufacturer of networking products, from 2003 until 2006. Previously, Mr. Riedel was also a Director at McKinsey & Company, a global management consulting firm, where he spent 15 years serving clients in the telecom and technology sectors in Asia and North America on a range of strategy and growth issues. Mr. Riedel earned a BS with Distinction in Mechanical Engineering from the University of Virginia and his MBA from Harvard Business School.

The Board believes Mr. Riedel’s direct involvement in the restructuring of Nortel, including the sale of the Nortel’s patent portfolio for $4.5 billion, as well as his knowledge of the technology industry and leadership experience, will enable him to provide invaluable oversight to the Board.

Christopher A. Seams,age 50, has served on the Board since March 2013. Mr. Seams has been an Executive Vice President of Sales & Marketing at Cypress Semiconductor Corporation, a global semiconductor company, since July 2005. He previously served as an Executive Vice President of Worldwide Manufacturing & Research and Development of Cypress Semiconductor Corporation. Mr. Seams joined Cypress in 1990 and held a variety of positions in process and assembly technology research and development and manufacturing operations. Prior to joining Cypress in 1990, he worked as a process development Engineer or Manager for Advanced Micro Devices and Philips Research Laboratories. Mr. Seams previously served as a member of the board of directors of Sunpower Corporation. Mr. Seams is a senior member of IEEE, serves on the Engineering Advisory Council for Texas A&M University and was a board member of Joint Venture Silicon Valley. Mr. Seams received a B.S. in Electrical Engineering from Texas A&M University and a M.S. in Electrical and Computer Engineering from the University of Texas at Austin.

The Board believes that Mr. Seams brings extensive management, sales and marketing, and engineering experience in the semiconductor industry to his role as a member of the Board.

Donald E. Stout(Don), age 66, was appointed to the Board on May 22, 2013 in accordance with the Settlement Agreement. Mr. Stout is a senior partner at the law firm of Antonelli, Terry, Stout & Kraus, LLP of Arlington, Virginia. In 1992, Mr. Stout co-founded NTP Inc. (“NTP”), a patent holding company for which he prepared the original NTP patents and managed its patent litigation strategy, and currently serves as its Chief Strategist. Mr. Stout was employed by the United States Patent and Trademark Office (“USPTO”) from 1968 to 1972 as an assistant examiner involved with patent applications covering radio and television technologies. In 1972, Mr. Stout worked as a law clerk for two former board members of the USPTO Board of Appeals, where he assisted in deciding issues of patentability for applicants who appealed previous decisions. Mr. Stout has been a director of Vringo, Inc., a company engaged in the innovation, development and monetization of mobile technologies and intellectual property, since July 2012, and has been a director of Augme Technologies, Inc., a mobile marketing and advertising technology company, since January 4, 2011. Mr. Stout’s legal practice has involved all facets of intellectual property, including litigation, the provision of expert witness opinions, and the licensing and representation of clients before the USPTO in diverse technological areas, including telecommunications. In such capacity, Mr. Stout has testified as an expert witness regarding obtaining and prosecuting patents. Mr. Stout has written and prosecuted hundreds of patent applications in diverse technologies and has also rendered opinions on patent infringement and/or validity. Mr. Stout is a member of the bars of the District of Columbia and Virginia, and he is admitted to practice before the Supreme Court of the United States, the Court of Appeals for the Federal Circuit, the Fifth Circuit of Appeals, and the USPTO. He earned his J.D. degree (with honors) from George Washington University in 1972.

The Board believes Mr. Stout’s deep knowledge of the intellectual property industry, his role in the success of NTP, and his extensive legal experience will enable him to provide invaluable oversight to the Board.

Timothy J. Stultz, Ph.D.,age 65, has served as a member of the Board since August 2012. Since 2007, Dr. Stultz has served as President, Chief Executive Officer and member of the board of directors of Nanometrics Incorporated, a leading provider of advanced, high-performance process control metrology and inspection systems used primarily in the

fabrication of semiconductors, high brightness LEDs, data storage devices and solar photovoltaics. Before joining Nanometrics in 2007, Dr. Stultz served as President and Chief Executive Officer at Imago Scientific Instruments Corporation, a manufacturer and distributer of metrology and analysis equipment for the microelectronic and general research markets. Dr. Stultz was integral in Imago’s development from its university origins to an international entity by creating strategic partnerships with larger venture capital groups and corporations with greater market reach. Prior to Imago, one of Dr. Stultz’s most notable roles was as Vice President and General Manager of the Metrology Group at Veeco Instruments. Under his leadership, the Metrology Group brought to market the first fully automated Atomic Force Microscope for use by leading chip makers. By the end of his tenure at Veeco, Veeco’s global market share in high-end metrology systems had grown to nearly 75%, from less than 10% when he assumed leadership of the Metrology Group. Dr. Stultz received a B.S., a M.S., and a Ph.D. in Materials Science and Engineering from Stanford University.

The Board believes that Dr. Stultz brings 20 years of executive management and operational and strategic development experience in technology and capital equipment manufacturing to his role as a member of the Board.

We believe that the individuals comprising the Revised Slate of Nominees have the independence, experience, knowledge and commitment to deliver value for the Company and its stockholders. Our recommendation is based on our carefully considered judgment that the experience, knowledge and qualifications of the Revised Slate of Nominees make them the best candidates to serve on the Board.

The Board recommends that the stockholders vote FOR the election of each of Tudor Brown, John Chenault, George Cwynar, Peter A. Feld, Richard S. Hill, Thomas Lacey, George Riedel, Christopher A. Seams, Donald E. Stout and Timothy J. Stultz.

Voting Rights and Outstanding Shares

Only holders of record of our common stock as of the close of business on April 12, 2013, are entitled to receive notice of, and to vote at, the Annual Meeting. The outstanding common stock constitutes the only class of our securities entitled to vote at the Annual Meeting, and each holder of common stock shall be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting. At the close of business on April 12, 2013, there were 52,761,636 shares of common stock issued and outstanding, which were held by approximately 25 holders of record.

A quorum of stockholders is necessary to take action at the Annual Meeting. Stockholders representing a majority of the outstanding shares of our common stock present in person or represented by proxy will constitute a quorum. We appointed IVS Associates, Inc. as independent election inspectors for the Annual Meeting to determine whether or not a quorum is present and to tabulate votes cast by proxy or in person at the Annual Meeting.

Under our Bylaws, because the Board determined the number of nominees timely nominated for election at the Annual Meeting exceeded the number of directors to be elected at the Annual Meeting, the election of directors at the Annual Meeting is deemed a contested election. As a result, directors will be elected by a plurality of the votes cast at the Annual Meeting, meaning that the ten (10) individuals receiving the most votes will be elected. If you return theBLUE proxy card, unless indicated otherwise thereon, your shares will be voted FOR ALL of the ten (10) Revised Slate of Nominees listed in this fourth proxy statement supplement. Instructions on the accompanyingBLUE proxy card to withhold authority to vote for one or more of the nominees will result in those nominees receiving fewer votes but will not count as a vote “AGAINST” the nominees. Abstentions, withheld votes and broker non-votes (which occur when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular matter because such broker, bank or other nominee does not have discretionary authority to vote on that matter and has not received voting instructions from the beneficial owner) are counted as present for purposes of determining the presence of a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will also result in those nominees receiving fewer votes but will not count as a vote “AGAINST” the nominees.

All other proposals require the affirmative vote of holders of a majority of outstanding shares present in person or by proxy and entitled to vote at the Annual Meeting. Abstentions have the same effect as negative votes on such proposals. Broker non-votes are not counted for any purpose in determining whether proposals have been approved

We urge you to mark, date, sign and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope provided, or vote electronically through the Internet or by telephone. If you choose to vote by mail, your shares will be voted in accordance with your voting instructions if the proxy card is received prior to or at the

Annual Meeting. If you sign and return your proxy card but do not give voting instructions, your shares will be voted (1) FOR ALL of the Revised Slate of Nominees; (2) FOR the approval of compensation of our named executive officers as disclosed in the proxy statement; (3) FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm for the Company for the fiscal year ending December 31, 2013; (4) FOR the approval of the amendment and restatement of the Employee Stock Purchase Plan; (5) FOR the approval of the International Employee Stock Purchase Plan; and (6) as the proxy holders deem advisable, in their discretion, on other matters that may properly come before the Annual Meeting.

|

| By Order of the Board of Directors |

|

| TESSERA TECHNOLOGIES, INC. |

|

| Sincerely, |

|

| /s/ BERNARD J. CASSIDY |

|

BERNARD J. CASSIDY Secretary |

San Jose, California

May 29, 2013

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 7, 2013: This Fourth Proxy Statement Supplement, the Third Proxy Statement Supplement, the Second Proxy Statement Supplement, the First Proxy Statement Supplement, the Proxy Statement and the Annual Report on Form 10-K for the fiscal year ended December 31, 2012 are available for viewing, printing and downloading at www.ViewOurMaterial.com/TSRA and www.proxyvote.com.

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN

If you have questions about how to vote your shares, or need additional assistance, please contact MacKenzie Partners, Inc., who is assisting the Company in the solicitation of proxies:

105 Madison Avenue New York, New York 10016

Stockholders may call toll-free at (800) 322-2885 or call collect at (212) 929-5500 with any questions

IMPORTANT

If you have already signed any Starboard proxy card, the Board urges you to vote by executing and dating theBLUE proxy card, and returning it in the postage-paid envelope provided, or by voting through the Internet or by telephone by following the instructions provided on the enclosedBLUE proxy card.

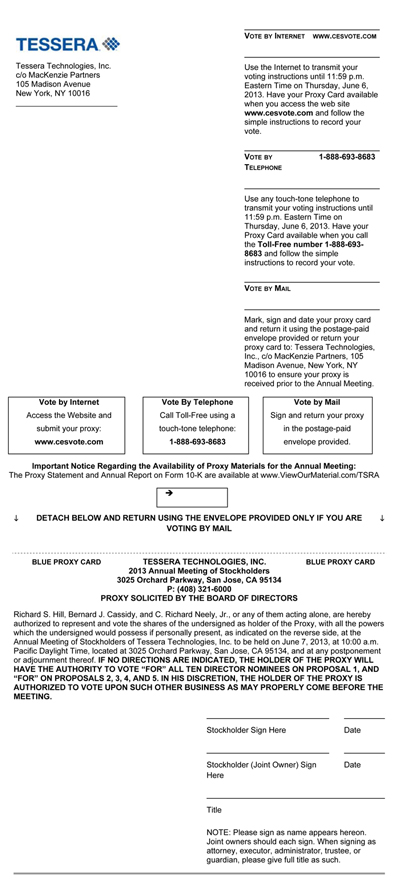

TESSERA

Tessera Technologies, Inc.

c/o MacKenzie Partners

105 Madison Avenue

New York, NY 10016

Vote by Internet

www.cesvote.com

Use the Internet to transmit your voting instructions until 11:59 p.m. Eastern Time on Thursday, June 6, 2013. Have your Proxy Card available when you access the web site www.cesvote.com and follow the simple instructions to record your vote.

Vote by Telephone

1-888-693-8683

Use any touch-tone telephone to transmit your voting instructions until 11:59 p.m. Eastern Time on Thursday, June 6, 2013. Have your Proxy Card available when you call the Toll-Free number 1-888-693-8683 and follow the simple instructions to record your vote.

Vote by Mail

Mark, sign and date your proxy card and return it using the postage-paid envelope provided or return your proxy card to: Tessera Technologies, Inc., c/o MacKenzie Partners, 105 Madison Avenue, New York, NY 10016 to ensure your proxy is received prior to the Annual Meeting.

Vote by Internet

Access the Website and

submit your proxy:

www.cesvote.com

Vote By Telephone

Call Toll-Free using a

touch-tone telephone:

1-888-693-8683

Vote by Mail

Sign and return your proxy

in the postage-paid

envelope provided.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

The Proxy Statement and Annual Report on Form 10-K are available at www.ViewOurMaterial.com/TSRA

DETACH BELOW AND RETURN USING THE ENVELOPE PROVIDED ONLY IF YOU ARE VOTING BY MAIL

BLUE PROXY CARD TESSERA TECHNOLOGIES, INC. BLUE PROXY CARD

2013 Annual Meeting of Stockholders

3025 Orchard Parkway, San Jose, CA 95134

P: (408) 321-6000

PROXY SOLICITED BY THE BOARD OF DIRECTORS

Richard S. Hill, Bernard J. Cassidy, and C. Richard Neely, Jr., or any of them acting alone, are hereby authorized to represent and vote the shares of the undersigned as holder of the Proxy, with all the powers which the undersigned would possess if personally present, as indicated on the reverse side, at the Annual Meeting of Stockholders of Tessera Technologies, Inc. to be held on June 7, 2013, at 10:00 a.m. Pacific Daylight Time, located at 3025 Orchard Parkway, San Jose, CA 95134, and at any postponement or adjournment thereof. IF NO DIRECTIONS ARE INDICATED, THE HOLDER OF THE PROXY WILL HAVE THE AUTHORITY TO VOTE “FOR” ALL TEN DIRECTOR NOMINEES ON PROPOSAL 1, AND “FOR” ON PROPOSALS 2, 3, 4, AND 5. IN HIS DISCRETION, THE HOLDER OF THE PROXY IS AUTHORIZED TO VOTE UPON SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING.

Stockholder Sign Here

Date

Stockholder (Joint Owner) Sign Here

Date

Title

NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee, or guardian, please give full title as such.

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, DETACH ALONG THE PERFORATION,

MARK, SIGN, DATE AND RETURN THE BOTTOM PORTION USING THE ENCLOSED ENVELOPE.

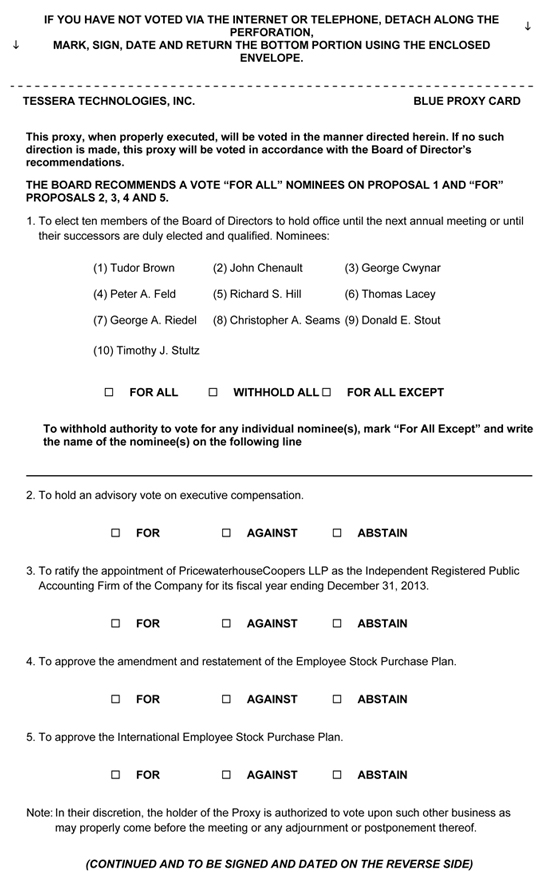

TESSERA TECHNOLOGIES, INC.

BLUE PROXY CARD

This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Director’s recommendations.

THE BOARD RECOMMENDS A VOTE “FOR ALL” NOMINEES ON PROPOSAL 1 AND “FOR” PROPOSALS 2, 3, 4 AND 5.

1. To elect ten members of the Board of Directors to hold office until the next annual meeting or until their successors are duly elected and qualified. Nominees:

(1) Tudor Brown

(2) John Chenault

(3) George Cwynar

(4) Peter A. Feld

(5) Richard S. Hill

(6) Thomas Lacey

(7) George A. Riedel

(8) Christopher A. Seams

(9) Donald E. Stout

(10) Timothy J. Stultz

¨ FOR ALL

¨ WITHHOLD ALL

¨ FOR ALL EXCEPT

To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the name of the nominee(s) on the following line

2. To hold an advisory vote on executive compensation.

¨ FOR

¨ AGAINST

¨ ABSTAIN

3. To ratify the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm of the Company for its fiscal year ending December 31, 2013.

¨ FOR

¨ AGAINST

¨ ABSTAIN

4. To approve the amendment and restatement of the Employee Stock Purchase Plan.

¨ FOR

¨ AGAINST

¨ ABSTAIN

5. To approve the International Employee Stock Purchase Plan.

¨ FOR

¨ AGAINST

¨ ABSTAIN

Note: In their discretion, the holder of the Proxy is authorized to vote upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

(CONTINUED AND TO BE SIGNED AND DATED ON THE REVERSE SIDE)