UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

TESSERA TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

��

TESSERA TECHNOLOGIES, INC.

3025 Orchard Parkway

San Jose, CA 95134

Dear Stockholder,

We certainly appreciate your support of the Company. We are proud of our accomplishments and excited about our future. You are cordially invited to attend the Annual Meeting of the Stockholders of Tessera Technologies, Inc. which will be held on Thursday, April 30, 2015 at 11:00 a.m. Pacific Daylight Time, at the Company’s principal executive offices at 3025 Orchard Parkway, San Jose, CA 95134.

We hope that you will vote as soon as possible to ensure that your shares will be represented.

The Board of Directors and management look forward to your participation.

|

Sincerely yours, |

|

/S/ THOMAS LACEY |

THOMAS LACEY Chief Executive Officer |

San Jose, California

March 18, 2015

TESSERA TECHNOLOGIES, INC.

3025 Orchard Parkway

San Jose, CA 95134

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 30, 2015

The Annual Meeting of the Stockholders of Tessera Technologies, Inc. (the “Company”) will be held on Thursday, April 30, 2015 at 11:00 a.m. Pacific Daylight Time, at Tessera Technologies, Inc., 3025 Orchard Parkway, San Jose, CA 95134, for the following purposes:

| | 1. | To elect seven (7) members of the Board of Directors to hold office until the next annual meeting or until their successors are duly elected and qualified; |

| | 2. | To hold an advisory vote on executive compensation; |

| | 3. | To ratify the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm of the Company for its fiscal year ending December 31, 2015; |

| | 4. | To approve the Company’s Sixth Amended and Restated 2003 Equity Incentive Plan; and |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the proxy statement accompanying this notice. The Board of Directors has fixed the close of business on March 6, 2015 as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the Annual Meeting of Stockholders, or at any adjournments of the Annual Meeting of Stockholders.

We are pleased to be furnishing proxy materials to stockholders primarily over the Internet. We believe that this process expedites stockholders’ receipt of proxy materials and lowers the costs of printing and distributing our annual meeting materials. On or about March 20, 2015, a Notice of Internet Availability of Proxy Materials was mailed to our stockholders containing instructions on how to access our 2015 Proxy Statement and 2014 Annual Report on Form 10-K, and how to vote online. The Notice also included instructions on how you can receive a copy of your annual meeting materials, including the notice of annual meeting, proxy statement, and proxy card by mail, via e-mail or by downloading them online. If you choose to receive your annual meeting materials by mail, the notice of annual meeting, proxy statement from the Board of Directors, proxy card and annual report will be enclosed. If you choose to receive your annual meeting materials via e-mail, the e-mail will contain voting instructions and links to the annual report and the proxy statement on the Internet, both of which are available at http://www.proxyvote.com and on our website at http://ir.tessera.com/. If you accesshttp://www.proxyvote.com using the instructions on the Notice, you will also be given the option to elect to receive future proxy materials by e-mail or in printed form by mail. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to the annual meeting materials and a link to the proxy voting site. Your election to receive future proxy materials by e-mail or in printed form by mail will remain in effect until you terminate such election.

In order to ensure your representation at the Annual Meeting of Stockholders, you are requested to submit your proxy over the Internet, by telephone or by mail. If you attend the Annual Meeting of Stockholders and file with the Secretary of the Company an instrument revoking your proxy or a duly executed proxy bearing a later date, your proxy will not be used.

All stockholders are cordially invited to attend the Annual Meeting of Stockholders.

|

By Order of the Board of Directors |

TESSERA TECHNOLOGIES, INC. |

|

/S/ PAUL E. DAVIS |

|

PAUL E. DAVIS Secretary |

San Jose, California

March 18, 2015

TESSERA TECHNOLOGIES, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

April 30, 2015

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This proxy statement is furnished in connection with the solicitation of proxies for use prior to or at the Annual Meeting of Stockholders (the “Annual Meeting”) of Tessera Technologies, Inc. (together with its subsidiaries, herein referred to as the “Company”), a Delaware corporation, to be held at 11:00 a.m. Pacific Daylight Time on Thursday, April 30, 2015 and at any adjournments or postponements thereof for the following purposes:

| | • | | To elect seven (7) members of the Board of Directors to hold office until the next annual meeting or until their successors are duly elected and qualified; |

| | • | | To hold an advisory vote on executive compensation; |

| | • | | To ratify the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm of the Company for its fiscal year ending December 31, 2015; |

| | • | | To approve the Company’s Sixth Amended and Restated 2003 Equity Incentive Plan; and |

| | • | | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

We made this proxy statement and accompanying form of proxy available to stockholders beginning on March 20, 2015.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on April 30, 2015:

This proxy statement, form of proxy and the Company’s 2014 Annual Report on Form 10-K are available electronically at http://www.proxyvote.com and on our website at http://ir.tessera.com.

Solicitation

This solicitation is made on behalf of our Board of Directors. The Company will bear the costs of preparing, mailing, online processing and other costs of the proxy solicitation made by our Board of Directors. Certain of our officers and employees may solicit the submission of proxies authorizing the voting of shares in accordance with the Board of Directors’ recommendations. Such solicitations may be made by telephone, facsimile transmission or personal solicitation. No additional compensation will be paid to such officers, directors or regular employees for such services. We will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in sending proxy material to stockholders.

Voting Rights and Outstanding Shares

Only holders of record of our common stock as of the close of business on March 6, 2015 are entitled to receive notice of, and to vote at, the Annual Meeting. The outstanding common stock constitutes the only class of our securities entitled to vote at the Annual Meeting, and each holder of common stock shall be entitled to one

1

vote for each share held on all matters to be voted upon at the Annual Meeting. At the close of business on March 6, 2015, there were 52,769,028 shares of common stock issued and outstanding, which were held by approximately 24 holders of record.

A quorum of stockholders is necessary to take action at the Annual Meeting. Stockholders representing a majority of the outstanding shares of our common stock present in person or represented by proxy will constitute a quorum. We will appoint an election inspector for the meeting to determine whether or not a quorum is present and to tabulate votes cast by proxy or in person at the Annual Meeting.

The Company has adopted a majority vote standard for non-contested director elections and a plurality vote standard for contested director elections. The voting standard is discussed further under the section entitled “Proposal No. 1—Election of Directors—Voting Standard.”

All other proposals require the affirmative vote of holders of a majority of outstanding shares present in person or by proxy and entitled to vote at the Annual Meeting. Abstentions have the same effect as negative votes on such proposals. Broker non-votes are not counted for any purpose in determining whether proposals have been approved.

Voting by Proxy Over the Internet, by Telephone or by Mail

Stockholders whose shares are registered in their own names may vote by proxy by mail, over the Internet or by telephone. Instructions for voting by proxy over the Internet or by mail are set forth on the Notice of Internet Availability of Proxy Materials mailed to you, or on the proxy card mailed to you if you chose to receive materials by mail. Instructions for voting by proxy by telephone are available on the Internet site identified on the Notice of Internet Availability of Proxy Materials or on the proxy card mailed to you if you chose to receive materials by mail. The Internet and telephone voting facilities will close at 11:59 pm Eastern Daylight Time on Wednesday, April 29, 2015. If you accesshttp://www.proxyvote.com using the instructions on the Notice, you will also be given the option to elect to receive future proxy materials by e-mail or in printed form by mail. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to the proxy materials and a link to the proxy voting site. Your election to receive future proxy materials by e-mail or in printed form by mail will remain in effect until you terminate such election.

If you sign and return a proxy card by mail but do not give voting instructions, your shares will be voted (1) FOR ALL of the seven (7) nominees named in Proposal No. 1 in this proxy statement; (2) FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm for the Company for the fiscal year ending December 31, 2015; (3) FOR the approval of compensation of our named executive officers (NEOs) as disclosed in this proxy statement; (4) FOR the approval of the Company’s Sixth Amended and Restated 2003 Equity Incentive Plan and (5) as the proxy holders deem advisable, in their discretion, on other matters that may properly come before the Annual Meeting.

If your shares are held in street name, the voting instruction form sent to you by your broker, bank or other nominee should indicate whether the institution has a process for beneficial holders to provide voting instructions over the Internet or by telephone. A number of banks and brokerage firms participate in a program that permits stockholders whose shares are held in street name to direct their vote over the Internet or by telephone. If your bank or brokerage firm gives you this opportunity, the voting instructions from the bank or brokerage firm that accompany this proxy statement will tell you how to use the Internet or telephone to direct the vote of shares held in your account. If your voting instruction form does not include Internet or telephone information, please complete and return the voting instruction form in the self-addressed, postage-paid envelope provided by your broker. Stockholders who vote by proxy over the Internet or by telephone need not return a proxy card or voting instruction form by mail, but may incur costs, such as usage charges, from telephone companies or Internet service providers.

2

Voting in Person at the Annual Meeting

If you plan to attend the Annual Meeting and wish to vote in person, you will be given a ballot at the Annual Meeting. Please note, however, that if your shares are held in “street name,” which means your shares are held of record by a broker, bank or other nominee, and you wish to vote at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the broker, bank or other nominee who is the record holder of the shares, authorizing you to vote at the Annual Meeting.

Revocability of Proxies

Any proxy may be revoked at any time before it is exercised by filing with the Company’s Secretary an instrument revoking it or by submitting prior to the time of the Annual Meeting a duly executed proxy bearing a later date. Stockholders who have voted by proxy over the Internet or by telephone or have executed and returned a proxy and who then attend the Annual Meeting and desire to vote in person are requested to so notify the Secretary in writing prior to the time of the Annual Meeting. We request that all such written notices of revocation to the Company be addressed to Paul E. Davis, Secretary, Tessera Technologies, Inc., at the address of our principal executive offices at 3025 Orchard Parkway, San Jose, California 95134. Our telephone number is (408) 321-6000. Stockholders may also revoke their proxy by entering a new vote over the Internet or by telephone.

Stockholder Proposals to be Presented at the Next Annual Meeting

Any stockholder who meets the requirements of the proxy rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), may submit to the Board of Directors proposals to be presented at the 2016 annual meeting. Such proposals must comply with the requirements of Rule 14a-8 under the Exchange Act and be submitted in writing by notice delivered or mailed by first-class United States mail, postage prepaid, to our Secretary at our principal executive offices at the address set forth above no later than November 13, 2015 in order to be considered for inclusion in the proxy materials to be disseminated by the Board of Directors for such annual meeting.

Our Amended and Restated Bylaws, as amended to date, also provide for separate notice procedures to recommend a person for nomination as a director or to propose business to be considered by stockholders at a meeting. To be considered timely under these provisions, the stockholder’s notice must be received by our Secretary at our principal executive offices at the address set forth above no earlier than December 31, 2015 and no later than January 30, 2016. Our Amended and Restated Bylaws also specify requirements as to the form and content of a stockholder’s notice.

The chairman of the meeting may refuse to acknowledge the introduction of any stockholder proposal if it is not made in compliance with the applicable notice provisions.

3

PROPOSAL 1

ELECTION OF DIRECTORS

General

The Board of Directors has nominated the seven (7) individuals identified under “Director Nominees” below for election as directors, all of whom are currently directors of the Company. Each of the nominees has agreed to be named in this proxy statement and to serve as a director if elected. Our Board of Directors is currently comprised of ten (10) members. Messrs. Cwynar and Feld and Dr. Stultz are not standing for re-election. Directors are elected at each annual meeting and hold office until their successors are duly elected and qualified at the next annual meeting. In the absence of instructions to the contrary, the persons named as proxy holders in the accompanying proxy intend to vote in favor of the election of the seven (7) nominees designated below to serve until the 2016 Annual Meeting of Stockholders and until their respective successors shall have been duly elected and qualified.

Director Nominees

The following table sets forth certain information concerning the nominees for directors of the Company as of March 10, 2015.

| | | | | | |

Name | | Age | | Director

Since | | Position with the Company |

Tudor Brown | | 56 | | 2013 | | Director |

John Chenault | | 67 | | 2013 | | Director |

Richard S. Hill | | 63 | | 2012 | | Chairman of the Board |

Thomas Lacey | | 56 | | 2013 | | Chief Executive Officer and Director |

George A. Riedel | | 57 | | 2013 | | Director |

Christopher A. Seams | | 52 | | 2013 | | Director |

Donald E. Stout | | 68 | | 2013 | | Director |

Tudor Brown has served on the Board since May 2013. Mr. Brown was one of the founding members and until May 2012, President of ARM Holdings plc (“ARM”), a publicly-traded, semiconductor IP and software design company based in Cambridge, UK. Mr. Brown began his career at ARM over twenty years ago as a principal engineer and later assumed other roles, including Chief Technical Officer from 1997 through 2000, Chief Operating Officer from 2001 through 2008, and a member of the board of directors from 2001 through his retirement in May 2012. Mr. Brown became President of ARM in July 2008 with responsibility for developing high-level relationships with industry partners and governmental agencies and for regional development, and served as a director on ARM’s board of directors. Mr. Brown was also a non-executive director of ANT Software Limited, a UK company, from April 2005 until February 2013. He became an independent director of Lenovo Group, listed on HKSE, in January 2013 and Semiconductor Manufacturing International Corporation in August 2013 and was a member of the advisory board of Annapurna Labs up until January 2015. Mr. Brown received an MA degree in Electrical Sciences from Cambridge University, and holds one patent in low-power logic. He is a Fellow of the Institution of Engineering and Technology and a Fellow of the Royal Academy of Engineering.

The Board believes that Mr. Brown brings his experience as a founder and senior executive of one of the world’s most successful semiconductor technology and licensing companies, along with his strong operational experience and deep industry knowledge, to his role as a member of the Board.

John Chenault has served on the Board since March 2013. Mr. Chenault served as Chief Financial Officer of Novellus Systems, a semiconductor company, from April 2005 to September 2005, at which point he retired. Prior to that, he served as Vice President of Corporate Development from February 2005 to April 2005, Vice President of Operation and Administration from September 2003 to February 2005, Executive Vice President of Worldwide Sales and Service from February 2002 to September 2003 and Executive Vice President of Business

4

Operations from July 1997 to January 2002. Mr. Chenault also serves on the board of directors of Ultra Clean Technology. Mr. Chenault received a Bachelor of Business degree in Economics and an M.B.A. from Western Illinois University.

The Board believes Mr. Chenault brings his extensive management, financial expertise and operations experience in the semiconductor industry to his role as a member of the Board.

Richard S. Hill has served as a member of the Board since August 2012 and as Chairman of the Board since March 2013. Mr. Hill also served as the Company’s Interim Chief Executive Officer from April 15, 2013 until May 29, 2013. Mr. Hill previously served as the Chief Executive Officer and member of the board of directors of Novellus Systems Inc., until its acquisition for more than $3 billion by Lam Research Corporation in June 2012. During his nearly 20 years leading Novellus Systems, a designer, manufacturer, and marketer of semiconductor equipment used in fabricating integrated circuits, Mr. Hill grew annual revenues from approximately $100 million to over $1 billion. Before joining Novellus in 1993, Mr. Hill spent 12 years with Tektronix Corporation, a leading designer and manufacturer of test and measurement devices such as oscilloscopes and logic analyzers. Mr. Hill rose through the ranks of the corporation starting as a General Manager of the Integrated Circuits division, and finishing his time as the President of the Tektronix Development Company and Tektronix Components Corporation. Before joining Tektronix, Mr. Hill worked in a variety of engineering and management positions with General Electric, Motorola and Hughes Aircraft Company. Presently, Mr. Hill is a member of the Boards of Directors of Arrow Electronics, Inc., a global provider of products and services to industrial and commercial users of electronic components and enterprise computing, Cabot Microelectronics Corporation, the leading global supplier of chemical mechanical planarization (CMP) slurries and a growing CMP pad supplier to the semiconductor industry, and Planar Systems, Inc., a display and digital signage technology company. Mr. Hill previously served on the Board of Directors of LSI Corporation. Mr. Hill received a B.S. in Bioengineering from the University of Illinois in Chicago and an M.B.A. from Syracuse University.

The Board believes that Mr. Hill brings extensive expertise in executive management and engineering for technology and defense-related companies to his role as Chairman of the Board.

Thomas Lacey has served on the Board since May 2013 and as its Chief Executive Officer since December 9, 2013. From May 2013 until his appointment as Chief Executive Officer, Mr. Lacey served as the Company’s Interim Chief Executive Officer. Mr. Lacey is the former Chairman and Chief Executive Officer of Components Direct, a provider of cloud-based product life cycle solutions, and served in those capacities from May 2011 to April 2013. Mr. Lacey has also served on the board of directors of DSP Group, Inc. (“DSP”), a publicly-traded leading global provider of wireless chipset solutions for converged communications, since May 2012 and joined its audit committee and became chairman of its nominating and governance committee in May 2013. Mr. Lacey also previously served on the board of directors and the audit committee of publicly-traded International Rectifier Corporation, a leader in power management technology from March 2008 until January 2015. Previously, Mr. Lacey served as the President, Chief Executive Officer and a director of Phoenix Technologies Ltd., a publicly-traded, global provider of basic input-output software for personal computers, from February 2010 to February 2011. Prior to joining Phoenix Technologies Ltd., Mr. Lacey was the Corporate Vice President and General Manager of the SunFab™ Thin Film Solar Products group of Applied Materials, Inc., which trades on NASDAQ, from September 2009. Mr. Lacey previously served as President of Flextronics International’s Components Division, now Vista Point Technologies, from 2006 to 2007. Mr. Lacey joined Flextronics in connection with the sale to Flextronics of publicly-traded International Display Works, where Mr. Lacey had been Chairman, President and Chief Executive Officer from 2004 to 2006. Prior to International Display Works, Mr. Lacey held various management and executive positions at publicly-traded Intel Corporation for 13 years, including Vice President Sales and Marketing, President of Intel Americas, and Vice President and General Manager, Flash Products. Mr. Lacey holds a Bachelor of Arts degree in computer science from the University of California, Berkeley, and masters of business administration degree from the Leavy School of Business at Santa Clara University.

5

The Board believes that Mr. Lacey brings his experience in the senior management of public companies, including service as chairman, president, chief executive officer and corporate vice president, his experience on the boards of directors of public companies, his financial expertise and his direct knowledge of the component manufacturing and camera module business, as well as his knowledge of the Company as its Chief Executive Officer, to his role as a member of the Board.

George A. Riedel has served on the Board since May 2013. Mr. Riedel is currently the Chairman and CEO of Cloudmark, a private SF based network security company. Mr. Riedel joined the board at Cloudmark in June 2013, became Chairman in January 2014 and CEO in December 2014. Mr. Riedel is currently the Chairman of the Board of Montreal-based Accedian Networks, where he has served as a director since 2010. Mr. Riedel has also served on the board of directors of PeerApp since 2011. Mr. Riedel served on the board of directors of Blade Network Technologies from 2009 until its sale to IBM in 2010. In March 2006, Mr. Riedel joined Nortel Networks Corporation, a publicly-traded, multinational, telecommunications equipment manufacturer (“Nortel”), as part of the turnaround team as the Chief Strategy Officer. His role changed after Nortel initiated creditor protection under the respective restructuring regimes of Canada under the Companies’ Creditors Arrangement Act, in the U.S. under the Bankruptcy Code, the United Kingdom under the Insolvency Act 1986, on January 14, 2009, and subsequently, Israel, to lead the sale/restructuring of various carrier and enterprise business units through a series of transactions to leading industry players such as Ericsson, Avaya and Ciena. Mr. Riedel led the efforts to create stand-alone business units, carve out the relevant P&L and balance sheet elements and assign predominately used patents to enable sales of the assets. In 2010, Mr. Riedel’s role changed to President of Business Units and CSO as he took leadership of the effort to monetize the remaining 6,500 patents and applications patents as well as manage the P&L for several business units that were held for sale. The 2011 patent sale led to an unprecedented transaction of $4.5 billion to a consortium of Apple, Ericsson, RIM, Microsoft and EMC. Prior to Nortel, Mr. Riedel was the Vice President of Strategy and Corporate Development of Juniper Networks, Inc., a publicly-traded designer, developer and manufacturer of networking products, from 2003 until 2006. Previously, Mr. Riedel was also a Director at McKinsey & Company, a global management consulting firm, where he spent 15 years serving clients in the telecom and technology sectors in Asia and North America on a range of strategy and growth issues. Mr. Riedel earned a BS with Distinction in Mechanical Engineering from the University of Virginia and his MBA from Harvard Business School.

The Board believes that Mr. Riedel brings his experience from his direct involvement in the restructuring of Nortel, including the sale of Nortel’s patent portfolio for $4.5 billion, as well as his knowledge of the technology industry and leadership experience, to his role as a member of the Board.

Christopher A. Seamshas served on the Board since March 2013. Mr. Seams has been the Chief Executive Officer and a member of the Board of Directors of Deca Technologies, a subsidiary of Cypress Semiconductor Corporation, a global semiconductor company, since June 2013. Mr. Seams previously was an Executive Vice President of Sales & Marketing at Cypress Semiconductor Corporation, from July 2005 until June 2013. He previously served as an Executive Vice President of Worldwide Manufacturing & Research and Development of Cypress Semiconductor Corporation. Mr. Seams joined Cypress in 1990 and held a variety of positions in process and assembly technology research and development and manufacturing operations. Prior to joining Cypress in 1990, he worked as a process development Engineer or Manager for Advanced Micro Devices and Philips Research Laboratories. Mr. Seams previously served as a member of the board of directors of Sunpower Corporation. Mr. Seams is a senior member of IEEE, serves on the Engineering Advisory Council for Texas A&M University and was a board member of Joint Venture Silicon Valley. Mr. Seams received a B.S. in Electrical Engineering from Texas A&M University and a M.S. in Electrical and Computer Engineering from the University of Texas at Austin.

The Board believes that Mr. Seams brings extensive management, sales and marketing, and engineering experience in the semiconductor industry to his role as a member of the Board.

Donald E. Stouthas served on the Board since May 2013. Mr. Stout is a senior partner at the law firm of Antonelli, Terry, Stout & Kraus, LLP of Arlington, Virginia. In 1992, Mr. Stout co-founded NTP Inc. (“NTP”), a

6

patent holding company for which he prepared the original NTP patents and managed its patent litigation strategy, and currently serves as its Chief Strategist. Mr. Stout was employed by the United States Patent and Trademark Office (“USPTO”) from 1968 to 1972 as an assistant examiner involved with patent applications covering radio and television technologies. In 1972, Mr. Stout worked as a law clerk for two former board members of the USPTO Board of Appeals, where he assisted in deciding issues of patentability for applicants who appealed previous decisions. Mr. Stout has been a director of Vringo, Inc., a company engaged in the innovation, development and monetization of mobile technologies and intellectual property, since July 2012, and has been a director of Hipcricket, Inc. (formerly Augme Technologies, Inc.), a mobile marketing and advertising technology company, since January 4, 2011. Mr. Stout’s legal practice has involved all facets of intellectual property, including litigation, the provision of expert witness opinions, and the licensing and representation of clients before the USPTO in diverse technological areas, including telecommunications. In such capacity, Mr. Stout has testified as an expert witness regarding obtaining and prosecuting patents. Mr. Stout has written and prosecuted hundreds of patent applications in diverse technologies and has also rendered opinions on patent infringement and/or validity. Mr. Stout is a member of the bars of the District of Columbia and Virginia, and he is admitted to practice before the Supreme Court of the United States, the Court of Appeals for the Federal Circuit, the Fifth Circuit of Appeals, and the USPTO. He earned his J.D. degree (with honors) from George Washington University in 1972.

The Board believes Mr. Stout’s deep knowledge of the intellectual property industry, his role in the success of NTP, and his extensive legal experience enables him to provide invaluable oversight to the Board.

We believe that the nominees for election to the Board have the independence, experience, knowledge and commitment to deliver value for the Company and its stockholders. Our recommendation is based on our carefully considered judgment that the experience, knowledge and qualifications of the nominees make them the best candidates to serve on the Board.

The Board recommends that the stockholders vote FOR the election of each of Tudor Brown, John Chenault, Richard S. Hill, Thomas Lacey, George Riedel, Christopher A. Seams, and Donald E. Stout.

Corporate Governance Overview

Our business, assets and operations are managed under the direction of our Board of Directors. Members of our Board of Directors are kept informed of our business through discussions with our chief executive officer, our chief financial officer, our executive officers, our general counsel, members of management and other Company employees as well as our independent auditors, and by reviewing materials provided to them and participating in meetings of the Board of Directors and its committees.

In addition to its management function, our Board of Directors remains committed to strong and effective corporate governance, and, as a result, it regularly monitors our corporate governance policies and practices to ensure we meet or exceed the requirements of applicable laws, regulations and rules, the NASDAQ listing standards, as well as the best practices of other public companies.

The Company’s corporate governance program features the following:

| | • | | a strong independent chairman of the Board; |

| | • | | a Board that is up for election annually and has been since the Company’s initial public offering in 2003; |

| | • | | all of our directors, other than our CEO, are independent; |

| | • | | we have no stockholder rights plan in place; |

| | • | | regularly updated charters for each of the Board’s committees, which clearly establish the roles and responsibilities of each such committee; |

7

| | • | | regular executive sessions among our non-employee and independent directors; |

| | • | | a Board that enjoys unrestricted access to the Company’s management, employees and professional advisers; |

| | • | | each director attended at least 75% of the aggregate of the total number of Board meetings and total number of meetings of Board committees on which such director served during the time he served on the Board or committees.; |

| | • | | a continuing education program; |

| | • | | a clear Code of Business Conduct and Ethics that is reviewed regularly for best practices; |

| | • | | a clear set of Corporate Governance Guidelines that is reviewed regularly for best practices; |

| | • | | a clawback policy that provides that our Compensation Committee or Board of Directors may require the forfeiture, recovery or reimbursement of incentive compensation from an executive officer in the event of restatement of the company’s financial results due to its material noncompliance with any financial reporting requirement under United States securities laws; |

| | • | | policy prohibiting hedging, pledging or shorting of company stock by all employees and directors; |

| | • | | longest tenure of any director is less than three years; |

| | • | | no board member is serving on an excessive number of public company boards; |

| | • | | majority voting for directors in non-contested elections; |

| | • | | the Compensation Committee’s engagement of an independent compensation consultant; and |

| | • | | stock ownership requirement to ensure that our directors and executives remain aligned with the interests of the Company and its stockholders. |

Board of Directors’ Role in Risk Management

The Board of Directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. Risk management includes not only understanding company specific risks and the steps management implements to manage those risks, but also what level of risk is acceptable and appropriate for the Company. Management is responsible for establishing our business strategy, identifying and assessing the related risks and implementing appropriate risk management practices. Our Board of Directors reviews our business strategy and management’s assessment of the related risk, and discusses with management the appropriate level of risk for the Company. For example, the Board of Directors meets with management at least quarterly to review, advise and direct management with respect to strategic business risks, litigation risks and risks related to the Company’s acquisition strategy, among others. The Board also delegates oversight to Board committees to oversee selected elements of risk.

The Audit Committee oversees financial risk exposures, including monitoring the integrity of the Company’s financial statements, internal controls over financial reporting, and the independence of the Company’s Independent Registered Public Accounting Firm. The Audit Committee receives periodic internal controls and related assessments from the Company’s finance department and an annual attestation report on internal control over financial reporting from the Company’s Independent Registered Public Accounting Firm. The Audit Committee also assists the Board of Directors in fulfilling its oversight responsibility with respect to compliance matters and meets at least quarterly with our finance department, Independent Registered Public Accounting Firm and internal or external legal counsel to discuss risks related to our financial reporting function. In addition, the Audit Committee ensures that the Company’s business is conducted with the highest standards of ethical conduct in compliance with applicable laws and regulations by monitoring our Code of Business Conduct and Ethics Policy and our Corporate Compliance Hotline, and the Audit Committee discusses other risk assessment and risk management policies of the Company periodically with management.

8

The Compensation Committee participates in the design of compensation structures that create incentives that encourage a level of risk-taking behavior consistent with the Company’s business strategy as is further described in the Compensation Discussion and Analysis section below.

The Nominating & Governance Committee oversees governance-related risks by working with management to establish corporate governance guidelines applicable to the Company, and making recommendations regarding director nominees, the determination of director independence, Board leadership structure and membership on Board committees.

Board of Directors and Committees of the Board

During 2014, the Board of Directors held a total of eleven meetings. Each director attended at least 75% of the aggregate of the total number of Board meetings and total number of meetings of Board committees on which such director served during the time he served on the Board or committees.

The Board of Directors has determined that all of the Company’s directors nominated for election, other than Mr. Lacey, are each “independent directors” as such term is defined in NASDAQ Marketplace Rule 5605(a)(2).

The Board of Directors has a standing Audit Committee, Compensation Committee and Nominating & Governance Committee. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Exchange Act. Each of our Audit Committee, Compensation Committee and Nominating & Governance Committee is composed entirely of independent directors in accordance with current NASDAQ listing standards. Furthermore, each member of our Audit Committee meets the enhanced independence standards established by the Sarbanes-Oxley Act of 2002 and related rulemaking of the Securities and Exchange Commission (the “SEC”). The Board of Directors has further determined that Mr. John Chenault, a member of the Audit Committee of the Board of Directors, is an “Audit Committee Financial Expert,” as such term is defined in Item 407(d)(5) of Regulation S-K promulgated by the SEC, by virtue of his relevant experience listed in his biographical summary provided above in the section entitled “Proposal 1—Election of Directors.” Copies of our Audit Committee, Nominating & Governance Committee and Compensation Committee charters and our corporate governance guidelines are available, free of charge, on our website at http://www.tessera.com. The Board of Directors from time to time constitutes such other committees as it deems appropriate to further the purposes of the Board.

Audit Committee. The Audit Committee reviews the work of our internal accounting and audit processes and the Independent Registered Public Accounting Firm. The Audit Committee has sole authority for the appointment, compensation and oversight of our Independent Registered Public Accounting Firm and to approve any significant non-audit relationship with the Independent Registered Public Accounting Firm. The Audit Committee is also responsible for preparing the report required by the rules of the SEC to be included in our annual proxy statement. The Audit Committee is currently comprised of Mr. Chenault as the Chair, Mr. Cwynar and Mr. Seams. Messrs. Chenault and Seams joined the Audit Committee in April 2013 and Mr. Cwynar joined the Audit Committee in May 2013. During 2014, the Audit Committee held eight meetings.

Compensation Committee. The Compensation Committee approves our goals and objectives relevant to compensation, stays informed as to market levels of compensation and, based on evaluations submitted by management, recommends to our Board of Directors compensation levels and systems for the Board of Directors and our officers that correspond to our goals and objectives. The Compensation Committee also produces an annual report on executive compensation for inclusion in our proxy statement. The Compensation Committee is currently comprised of Dr. Stultz as the Chair, Mr. Feld and Mr. Riedel. Mr. Feld and Mr. Riedel joined the Compensation Committee in June 2013 and Dr. Stultz became the Chair of the Compensation Committee in March 2013. During 2014, the Compensation Committee held eight meetings.

9

Nominating & Governance Committee. The Nominating & Governance Committee is responsible for recommending to our Board of Directors individuals to be nominated as directors and committee members. This includes evaluation of new candidates as well as evaluation of current directors. In evaluating the current directors the committee conducted a thorough self-evaluation process, which included the use of questionnaires and a third-party expert that interviewed each of the directors and provided an analysis of the results of the interviews to the committee. This committee is also responsible for developing and recommending to the Board of Directors our corporate governance guidelines, as well as reviewing and recommending revisions to the guidelines on a regular basis. The Nominating & Governance Committee is currently comprised of Mr. Feld as the Chair, Mr. Cwynar and Mr. Stout. Mr. Feld joined the Nominating & Governance Committee as chair in May 2013 and Mr. Cwynar and Mr. Stout joined the Nominating & Governance Committee in June 2013. During 2014, the Nominating & Governance Committee held five meetings.

Non-Executive Chairman and Board Leadership

Mr. Hill has served as non-executive Chairman of the Board since March 21, 2013, except for a period from April 15, 2013 through May 29, 2013 when he served as Interim Chief Executive Officer and Executive Chairman while a search for a new Chief Executive Officer was being conducted. We believe that separating the roles of Chief Executive Officer and Chairman of the Board is in the best interests of the Company and its stockholders because it provides the appropriate balance between strategy development and oversight and accountability of management. Our Corporate Governance Guidelines require that the Chairman of the Board not be the same person as the Chief Executive Officer.

Director Nominations

The director qualifications developed to date focus on what the Board believes to be essential competencies to effectively serve on the Board. The Nominating & Governance Committee may consider the following criteria in recommending candidates for election to the board:

| | • | | experience in corporate governance, such as an officer or former officer of a publicly held company; |

| | • | | experience in the Company’s industry; |

| | • | | experience as a board member of other publicly held companies; and |

| | • | | technical expertise in an area of the Company’s operations. |

The Nominating & Governance Committee evaluates each individual in the context of the Board as a whole, with the objective of assembling a Board that can best perpetuate the success of the Company and represent shareholder interests through the exercise of sound judgment using its diversity of experience.

Prior to each annual meeting of stockholders at which directors are to be elected, and whenever there is otherwise a vacancy on the Board of Directors, the Nominating & Governance Committee will consider incumbent Board members and other well-qualified individuals as potential director nominees. The Nominating & Governance Committee will determine whether to retain an executive search firm to identify Board candidates, and if so, will identify the search firm and approve the search firm’s fees and other retention terms and will specify for the search firm the criteria to use in identifying potential candidates, consistent with the director qualification criteria described above. The Nominating & Governance Committee will review each potential candidate. Management may assist the Nominating & Governance Committee in the review process at the Nominating & Governance Committee’s direction. The Nominating & Governance Committee will select the candidate or candidates it believes are the most qualified to recommend to the Board for selection as a director nominee. Our Nominating & Governance Committee will consider candidates recommended by our stockholders in accordance with the procedures set forth in the Nominating & Governance Committee Charter. Such recommendations must be submitted in writing to the Chairman of the Nominating & Governance Committee, c/o the Corporate Secretary, Tessera Technologies, Inc., 3025 Orchard Parkway, San Jose, CA 95134, no later than 120 days prior to the anniversary of the date on which the Company’s proxy statement was mailed or made

10

available to stockholders in connection with the previous year’s annual meeting of stockholders. The recommendations must be accompanied by the following information: the name and address of the nominating stockholder, a representation that the nominating stockholder is a record holder, a representation that the nominating stockholder intends to appear in person or by proxy at the annual meeting to nominate the person or persons specified, information regarding each nominee that would be required to be included in a proxy statement, a description of any arrangements or understandings between the nominating stockholder and the nominee, and the consent of each nominee to serve as a director, if elected. Candidates recommended by the stockholders are evaluated in the same manner as candidates identified by a Nominating & Governance Committee member.

Each of the nominees for election as director at the 2015 Annual Meeting is recommended by the Nominating & Governance Committee and each nominee is presently a director and stands for re-election by the stockholders.

Pursuant to our bylaws, stockholders who wish to nominate persons for election to the Board of Directors at an annual meeting must be a stockholder of record both at the time of giving the notice and at the meeting, must be entitled to vote at the meeting and must comply with the notice provisions in our bylaws. A stockholder’s notice of nomination to be made at an annual meeting must be delivered to our principal executive offices not less than 90 days nor more than 120 days before the anniversary date of the immediately preceding annual meeting. However, if an annual meeting is more than 30 days before or more than 60 days after such anniversary date, the notice must be delivered no later than the 90th day prior to such annual meeting or, if later, the 10th day following the day on which the first public announcement of the date of such annual meeting was made. A stockholder’s notice of nomination to be made at a special meeting at which the election of directors is a matter specified in the notice of meeting must be delivered to our principal executive offices not earlier than the 120th day prior to and not later than the 90th day prior to such special meeting or, if later, the 10th day following the day on which first public announcement of the date of such special meeting was made. The stockholder’s notice must include the following information for the person making the nomination:

| | • | | the class and number of shares of the Company owned beneficially or of record; |

| | • | | disclosure regarding any derivative, swap or other transactions which give the nominating person economic risk similar to ownership of shares of the Company or provide the opportunity to profit from an increase in the price or value of shares of the Company; |

| | • | | any proxy, agreement, arrangement, understanding or relationship that confers a right to vote any shares of the Company; |

| | • | | any agreement, arrangement, understanding or relationship, engaged in to mitigate economic risk related to, or the voting power with respect to, shares of the Company; |

| | • | | any rights to dividends on the shares that are separate from the underlying shares; |

| | • | | any performance related fees that the nominating person is entitled to based on any increase or decrease in the value of any shares of the Company; and |

| | • | | any other information relating to the nominating person that would be required to be disclosed in a proxy statement filed with the SEC. |

The stockholder’s notice must also include the following information for each proposed director nominee:

| | • | | description of all direct and indirect financial or other relationships between the nominating person and the nominee during the past three years; |

| | • | | the same information as for the nominating person (see above); and |

| | • | | all information required to be disclosed in a proxy statement in connection with a contested election of directors. |

11

The stockholder’s notice must be updated and supplemented, if necessary, so that the information required to be provided in the notice is true and correct as of the record date for the meeting and as of the date that is ten business days prior to the meeting.

The chairman of the meeting will determine if the procedures in the bylaws have been followed, and if not, declare that the nomination be disregarded. The nominee must be willing to provide any other information reasonably requested by the Nominating & Governance Committee in connection with its evaluation of the nominee’s independence.

Stockholder Communications with the Board of Directors

Stockholders may send correspondence to the Board of Directors or any member of the Board of Directors, c/o the Secretary at our principal executive offices at the address set forth above. The Secretary will review all correspondence addressed to the Board, or any individual Board member, for any inappropriate correspondence and correspondence more suitably directed to management. However, the Secretary will summarize all correspondence not forwarded to the Board and make the correspondence available to the Board for its review at the Board’s request. The Secretary will forward stockholder communications to the Board prior to the next regularly scheduled meeting of the Board of Directors following the receipt of the communication.

Director Attendance at Annual Meetings

Directors are encouraged to attend in person the Annual Meeting of Stockholders. All members of the Board of Directors attended our last Annual Meeting in May 2014.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2014, Dr. Stultz, Mr. Riedel and Mr. Feld served as members of the Compensation Committee for the entire year. None of such Compensation Committee members has ever been an officer or employee of the Company or any of its subsidiaries during their appointment on the Compensation Committee. In addition, during the fiscal year ended December 31, 2014, none of our executive officers served as a member of the Board of Directors or Compensation Committee of an entity that has one or more executive officers serving as members of our Board of Directors or our Compensation Committee.

Director Compensation

Director Compensation Program.The Board of Directors has adopted a non-employee director compensation policy that provides annual retainer fees (each paid quarterly) to Board members of $35,000 and for committee membership, other than the chairman of such committee, as follows: $8,000 for Audit Committee members, $6,000 for Compensation Committee members and $4,000 for Nominating & Governance Committee members. Under the policy, the retainer fee paid to our non-executive Chairman is $20,000 and the retainer fees paid to our committee chairmen are as follows: $20,000 for the Chairman of our Audit Committee, $12,000 for the Chairman of our Compensation Committee, and $8,000 for the Chairman of our Nominating & Governance Committee. We also reimburse our non-employee directors for their travel expenses. Members of the Board who are also our employees do not receive any compensation as directors. Our directors do not receive Board meeting fees.

Each of our non-employee directors receives restricted stock and options to purchase shares of our common stock on the terms and conditions set forth in our Fifth Amended and Restated 2003 Equity Incentive Plan. Any non-employee director who is initially elected or appointed to the Board of Directors receives a restricted stock award of 10,000 shares on the date of his or her initial election or appointment to the Board of Directors. In

12

addition, a non-employee director receives a combination of options and/or restricted stock awards on the date of each annual meeting of our stockholders following the director’s initial election or appointment to the Board of Directors, as follows:

| | • | | The number of shares of common stock in the restricted stock award is determined by dividing (1) a dollar value to be paid in the form of restricted stock grants (“Restricted Stock Amount”) by (2) the fair market value per share of our common stock on the date of grant. |

| | • | | The number of shares that may be purchased pursuant to the option award is determined by dividing (1) a dollar amount to be paid in the form of option grants (“Option Amount”) by (2) the quotient of (A) the fair market value per share of our common stock on the date of grant divided by (B) two (2). |

| | • | | The total of the Restricted Stock Amount plus the Option Amount received by each non-employee director at each annual meeting of stockholders is equal to $100,000. The Compensation Committee will determine the allocation between restricted stock and option amounts annually. |

Initial restricted stock awards vest over a period of four years, with 25% of the shares subject to the award vesting on each of the first four anniversaries of the date of grant. Annual option grants and restricted stock awards currently vest on the first anniversary of the date of grant, but on or after this Annual Meeting, annual grants vest on the earlier to occur of the first anniversary of the date of grant or the next annual meeting of stockholders. No portion of an option automatically granted to a director is exercisable after the tenth anniversary after the date of option grant. Additionally, an option automatically granted to a director may be exercisable after the termination of the director’s services as described in the option agreement, generally ending three months after such termination.

Director Ownership Policy.Pursuant to the Corporate Governance Guidelines adopted by the Board of Directors on July 17, 2003 (and amended on October 14, 2013), the Company encourages directors to purchase shares of the Company’s stock. Because the Board believes that equity ownership is important in order to help align the interests of Board members with those of the Company’s stockholders, the Board requires that each of its members (collectively with members of the director’s immediate family or with family trusts) personally own, within three years following his or her first election or appointment to the Board, an amount of Company stock with either a purchase price or a fair market value (measured annually) equal to at least three times the total annual cash compensation paid by the Company for Board service (excluding for this purpose compensation that is not paid to all independent directors, such as compensation for committee or chair service). For purposes of this ownership policy, unvested restricted stock or restricted stock units and unvested stock options will not be considered when determining an individual’s stock ownership. Until such time as a Board member reaches his or her share ownership minimum, such Board member will be required to hold at least 50% of the shares of Company stock received upon lapse of the restrictions upon restricted stock and upon exercise of stock options (net of any shares utilized to pay for the exercise price of the option and tax withholding).

2014 Director Compensation. The table below sets forth the compensation paid to each current non-employee member of our Board of Directors during the fiscal year ended December 31, 2014:

| | | | | | | | | | | | | | | | |

Name | | Fees Earned

or Paid

in Cash ($) | | | Stock

Awards

($) (1) | | | Option

Awards

($) | | | Total ($) | |

Richard S. Hill | | $ | 55,000 | | | $ | 99,989 | | | | — | | | $ | 154,989 | |

John Chenault | | $ | 55,000 | | | $ | 99,989 | | | | — | | | $ | 154,989 | |

Christopher A. Seams | | $ | 43,000 | | | $ | 99,989 | | | | — | | | $ | 142,989 | |

Donald Stout | | $ | 39,000 | | | $ | 99,989 | | | | — | | | $ | 138,989 | |

George Cwynar | | $ | 47,000 | | | $ | 99,989 | | | | — | | | $ | 146,989 | |

George A. Riedel | | $ | 41,000 | | | $ | 99,989 | | | | — | | | $ | 140,989 | |

Peter A. Feld | | $ | 49,000 | | | $ | 99,989 | | | | — | | | $ | 148,989 | |

Timothy J. Stultz. Ph.D. | | $ | 47,000 | | | $ | 99,989 | | | | — | | | $ | 146,989 | |

Tudor Brown | | $ | 35,000 | | | $ | 99,989 | | | | — | | | $ | 134,989 | |

13

| (1) | The amounts reflected in this column represent the aggregate grant date fair value for stock awards granted to our non-employee directors in 2014, measured in accordance with ASC 718, excluding the effect of estimated forfeitures, and do not reflect whether the recipient has actually realized a financial benefit from these awards. For the methodology of how the aggregate grant date fair value amount is calculated, please see Note 11 of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on February 25, 2015. The aggregate number of shares subject to unvested stock awards outstanding for each non-employee director at December 31, 2014 was: Mr. Hill: 9,222; Mr. Chenault: 10,472; Mr. Seams: 10,472; Mr. Stout: 11,097; Mr. Cwynar: 11,097; Mr. Riedel: 11,097; Mr. Feld: 11,097; Dr. Stultz: 9,222; and Mr. Brown: 11,097. None of the non-employee directors held any outstanding stock options as of December 31, 2014. |

Voting Standard and Required Vote

Our bylaws provide that, in an uncontested election, each director will be elected by a majority of votes cast. A “majority of votes cast” means the number of shares voted “for” a director exceeds the number of votes cast “against” that director. Abstentions and broker non-votes will not be counted when determining the outcome of the election of directors under this standard. In addition, our Corporate Governance Guidelines (the “Guidelines”) include a director resignation policy that provides that, in uncontested elections, an incumbent director nominee who does not receive the required votes for re-election is expected to tender his or her resignation to the Board. The Nominating & Governance Committee, or another duly authorized committee of the Board, will determine whether to accept or reject the tendered resignation generally within 90 days after certification of the election results. No director who failed to receive the required votes for re-election may participate in the consideration of the matter. The Company will publicly disclose the Nominating & Governance Committee’s (or other responsible committee’s) decision.

Recommendation of the Board of Directors

The Board recommends that the stockholders vote FOR the election of each of Tudor Brown, John Chenault, Richard S. Hill, Thomas Lacey, George Riedel, Christopher A. Seams, and Donald E. Stout.

14

PROPOSAL 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

This proxy statement includes extensive disclosure regarding the compensation of our named executive officers under the headings “Compensation Discussion and Analysis” and “Compensation of Executive Officers” on pages 30 to 49 below. Section 14A of the Exchange Act, as enacted as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act in July 2010, requires us to submit to our stockholders a nonbinding advisory resolution to approve the compensation of the named executive officers disclosed in this proxy statement, commonly referred to as a say-on-pay vote. When determining how often to hold a stockholder advisory vote on executive compensation, the Board of Directors took into account the strong preference for an annual vote expressed by our stockholders at our 2011 Annual Meeting. Accordingly, the Board of Directors determined that we will hold an annual advisory stockholder vote on the compensation of our named executive officers until the next say-on-pay frequency vote.

The Board of Directors has approved the submission of the following resolution to the Company’s stockholders for approval at the 2015 Annual Meeting:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed in the 2015 Proxy Statement pursuant to Item 402 of Regulation S-K, including the disclosure under the headings ‘Compensation Discussion and Analysis’ and ‘Compensation of Executive Officers,’ is hereby approved.”

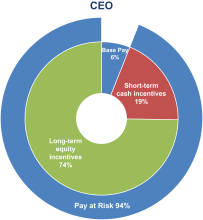

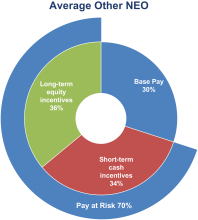

As described more fully in the “Compensation Discussion and Analysis” section of this proxy statement, the Company’s executive compensation program is designed to attract, motivate and retain talented executives that will drive the Company’s financial, operational and strategic objectives while creating long-term stockholder value. The compensation program is designed to achieve these objectives through a combination of the following types of compensation: base salary, annual cash incentive bonus awards, long-term equity incentive awards and time-based equity awards. Base salary is intended to provide a baseline level of compensation for our named executive officers. The remaining types of compensation, which in the aggregate represent the majority of our named executive officers’ target total compensation opportunities, tie compensation directly to the achievement of corporate and individual objectives, increases in our stock price, or both.

Required Vote

The affirmative vote of the holders of a majority of the outstanding shares of common stock present or represented by proxy and entitled to vote at the Annual Meeting will be required to approve the compensation of the named executive officers as disclosed in this proxy statement.

The stockholder vote on executive compensation is an advisory vote only, and it is not binding on the Company, the Board of Directors, or the Compensation Committee. Although the vote is non-binding, the Compensation Committee and the Board of Directors value the opinions of the stockholders and will consider the outcome of the vote when making future compensation decisions.

Recommendation of the Board of Directors

The Board of Directors recommends a vote FOR the approval of the compensation of the named executive officers as disclosed in this proxy statement.

15

PROPOSAL 3

RATIFICATION OF AUDITORS

The Audit Committee has appointed PricewaterhouseCoopers LLP as the Company’s Independent Registered Public Accounting Firm for 2015. Representatives of PricewaterhouseCoopers LLP will attend the Annual Meeting of Stockholders and will have the opportunity to make a statement if they desire to do so. They will also be available to respond to appropriate questions.

The following is a summary of fees billed by PricewaterhouseCoopers LLP for fiscal years ended December 31, 2014 and 2013:

| | | | | | | | |

| | | 2014 | | | 2013 | |

Audit fees (1) | | $ | 1,113,300 | | | $ | 1,459,900 | |

Audit-related fees (2) | | | — | | | | — | |

Tax fees (3) | | | — | | | | — | |

All other fees (4) | | | 2,700 | | | | — | |

| | | | | | | | |

Total | | $ | 1,116,000 | | | $ | 1,459,900 | |

| (1) | Represents the aggregate fees billed for the audit of the Company’s financial statements, review of the financial statements included in the Company’s quarterly reports and services in connection with the statutory and regulatory filings or engagements for those fiscal years. |

| (2) | Represents the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under “audit fees.” |

| (3) | Represents the aggregate fees billed for tax compliance, advice and planning. |

| (4) | Represents the aggregate fees billed for all products and services provided that are not included under “audit fees,” “audit-related fees” or “tax fees.” |

Audit Committee Pre-Approval Policies

Before an Independent Registered Public Accounting Firm is engaged by the Company or its subsidiaries to render audit or non-audit services, the Audit Committee shall pre-approve the engagement. Audit Committee pre-approval of audit and non-audit services will not be required if the engagement for the services is entered into pursuant to pre-approval policies and procedures established by the Audit Committee regarding the Company’s engagement of the Independent Registered Public Accounting Firm, provided the policies and procedures are detailed as to the particular service, the Audit Committee is informed of each service provided and such policies and procedures do not include delegation of the Audit Committee’s responsibilities under the Exchange Act to the Company’s management. The Audit Committee may delegate to one or more designated members of the Audit Committee the authority to grant pre-approvals, provided such approvals are presented to the Audit Committee at a subsequent meeting. If the Audit Committee elects to establish pre-approval policies and procedures regarding non-audit services, the Audit Committee must be informed of each non-audit service provided by the Independent Registered Public Accounting Firm. Audit Committee pre-approval of non-audit services (other than review and attest services) also will not be required if such services fall within available exceptions established by the SEC. All non-audit services provided by PricewaterhouseCoopers LLP during fiscal years 2014 and 2013 were pre-approved by the Audit Committee in accordance with the pre-approval policy described above.

Required Vote

The affirmative vote of the holders of a majority of the outstanding shares of common stock present or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the appointment of PricewaterhouseCoopers LLP.

16

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm of the Company for its fiscal year ending December 31, 2015.

17

PROPOSAL 4

APPROVAL OF THE COMPANY’S SIXTH AMENDED AND RESTATED 2003

EQUITY INCENTIVE PLAN

Introduction

Our stockholders are being asked to approve our Sixth Amended and Restated 2003 Equity Incentive Plan (the “Restated Plan”). Our Board of Directors approved the Restated Plan on March 13, 2015, subject to stockholder approval. The Restated Plan will become effective immediately upon stockholder approval at the Annual Meeting. If the Restated Plan is not approved by our stockholders, the Restated Plan will not become effective, the Fifth Amended and Restated 2003 Equity Incentive Plan (the “Existing Plan”) will continue in full force and effect, and we may continue to grant awards under the Existing Plan, subject to its terms, conditions and limitations, using the shares available for issuance thereunder.

The principal features of the Restated Plan are summarized below, but the summary is qualified in its entirety by reference to the Restated Plan itself, which is attached to this proxy statement as Appendix A.

Description of Proposed Amendments

No Increase in Share Reserve.The share reserve under the Restated Plan will be the same as the existing share reserve under the Existing Plan, which was most recently approved by our stockholders in 2010.

No Extension of Term.The Restated Plan will expire in March 2020, which is the same as the current expiration date of the Existing Plan.

Stockholder Reapproval Under Section 162(m) of the Code. Our stockholders are being asked to approve the Restated Plan to satisfy the stockholder approval requirements of Section 162(m) (“Section 162(m)”) of the Internal Revenue Code of 1986, as amended (the “Code”) and to approve the material terms of the performance goals for awards that may be granted under the Restated Plan as required under Section 162(m). In general, Section 162(m) places a limit on the deductibility for federal income tax purposes of the compensation paid to our Chief Executive Officer or any of our three other most highly compensated executive officers (other than our Chief Financial Officer). Under Section 162(m), compensation paid to such persons in excess of $1 million in a taxable year generally is not deductible. However, compensation that qualifies as “performance-based” under Section 162(m) does not count against the $1 million deduction limitation. One of the requirements of “performance-based” compensation for purposes of Section 162(m) is that the material terms of the plan under which compensation may be paid be disclosed to and approved by our public stockholders. For purposes of Section 162(m), the material terms include (1) the employees eligible to receive compensation, (2) a description of the business criteria on which the performance goals may be based and (3) the maximum amount of compensation that can be paid to an employee under the performance goals. Each of these aspects of the Existing Plan, as proposed to be amended in the form of the Restated Plan, is discussed below, and stockholder approval of this Proposal 4 is intended to constitute approval of the material terms of the Restated Plan for purposes of the stockholder approval requirements of Section 162(m). We have refined the business criteria on which the performance goals under the Restated Plan may be based and those criteria are described in more detail below.

Stockholder approval of the Restated Plan is only one of several requirements under Section 162(m) that must be satisfied for amounts realized under the Restated Plan to qualify for the “performance-based” compensation exemption under Section 162(m), and submission of the material terms of the Restated Plan performance goals for stockholder approval should not be viewed as a guarantee that we will be able to deduct all compensation under the Restated Plan. Nothing in this Proposal 4 precludes us or the plan administrator from making any payment or granting awards that do not qualify for tax deductibility under Section 162(m).

18

Other Amendments. The Restated Plan makes certain changes to the Existing Plan intended to reflect compensation and governance best practices or to conform the plan to our current practices as follows:

| | • | | Share Counting Provisions. In general, when awards granted under the Restated Plan are forfeited, expire or are settled in cash, or when the shares subject to a restricted stock award are forfeited by the holder or repurchased by us, the shares reserved for those awards will be returned to the share reserve and be available for future awards in an amount corresponding to the reduction in the share reserve previously made with respect to such award. However, the following shares will not be returned to the share reserve under the Restated Plan: shares of common stock that are delivered by the grantee or withheld by us as payment of the exercise price in connection with the exercise of an option or stock appreciation right (“SAR”) or payment of the tax withholding obligation in connection with any award; shares purchased on the open market with the cash proceeds from the exercise of options or SARs; and shares subject to a SAR that are not issued in connection with the stock settlement of the SAR on its exercise. |

| | • | | Limitations on Dividend Payments on Performance Awards. The Restated Plan provides that dividends and dividend equivalents may not be paid on awards subject to performance vesting conditions unless and until such conditions are met. |

| | • | | Annual Director Limit. The Restated Plan establishes an annual limit on the awards that may be granted to a non-employee director in any one calendar year. |

| | • | | No In-the-Money Option or Stock Appreciation Right Grants. The Restated Plan prohibits the grant of options or stock appreciation rights (“SARs”) with an exercise or base price less than 100% of the fair market value of our common stock on the date of grant. |

| | • | | Restricted Stock Units. The Restated Plan clarifies that deferred stock awards historically granted under Existing Plan are intended to be restricted stock units, and the Restated Plan has been conformed to reflect the same and to revise the references to “deferred stock” therein to “restricted stock units.” |

| | • | | Forfeiture, Recoupment and Clawbacks. The Restated Plan provides that the Board of Directors or the Compensation Committee may require that awards granted pursuant to the Restated Plan be subject to the provisions of any claw-back policy adopted by the company, including any claw-back policy adopted to comply with the Dodd-Frank Act and related rules. As described elsewhere in this proxy statement, the Company has adopted a clawback policy that applies to our executive officers. |

The Restated Plan is not being amended in any material respect other than to reflect the changes described above.

Equity Incentive Awards Are Critical to Long-Term Stockholder Value Creation

The table below presents information about the number of shares that were subject to various outstanding equity awards under the Existing Plan, and the shares remaining available for issuance under such plan, each at February 27, 2015. The Existing Plan is the only equity incentive plan we currently have in place other than our Employee Stock Purchase Plan and our International Employee Stock Purchase Plan.

| | | | | | | | | | | | |

| | | Number of

Shares (1) | | | As a % of Shares

Outstanding (2) | | | Dollar Value (3) | |

Options outstanding | | | 1,474,433 | | | | 3 | % | | $ | 59,065,786 | |

Restricted shares outstanding | | | 53,750 | | | | 0 | % | | $ | 2,153,225 | |

Restricted stock units outstanding | | | 921,646 | (4) | | | 2 | % | | $ | 36,921,139 | |

Shares remaining available for grant | | | 4,751,249 | | | | 9 | % | | $ | 190,335,035 | |

Weighted average exercise price of outstanding options | | | | | | | | | | $ | 19.53 | |

Weighted average remaining term of outstanding options | | | | | | | | | | | 7.60 | |

| (1) | For purposes of calculating the shares that remain available for grants, each stock option or SAR is treated as using one available share for each share of our common stock actually subject to the grant and each “full |

19

| | value award” is treated as using 1.5 shares for each share of our common stock delivered in settlement of such “full value award.” |

| (2) | Based on 52,782,899 shares of our common stock outstanding as of February 27, 2015. |

| (3) | Based on the closing price of our common stock on February 27, 2015 of $40.06 per share. |

| (4) | Includes outstanding performance-based restricted stock units at the “maximum” level. |

In determining whether to approve the Restated Plan, including maintaining the share reserve under the Restated Plan at the same level as the share reserve under the Existing Plan, our Board of Directors considered the following:

| | • | | The number of shares of our common stock that may be issued pursuant to awards granted under the Restated Plan shall not exceed, in the aggregate, 19,192,997 shares, which is the same as the existing share reserve under the Existing Plan |