|

Exhibit 99.2

|

Tessera® (TSRA) to Acquire DTS® (DTSI)

September 20, 2016

1

Safe Harbor

Forward Looking Statements

This presentation or any statements incorporated by reference herein, including, for example, the potential benefits of the transaction, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking statements are based on Tessera’s current expectations, estimates and projections about its business and industry, management’s beliefs and certain assumptions made by Tessera and DTS, all of which are subject to change. In addition, forward-looking statements also consist of statements involving trend analyses and statements including such words as “will,” “may,” “anticipate,” “believe,” “could,” “would,” “might,” “potentially,” “estimate,” “continue,” “plan,” “expect,” “intend,” and similar expressions or the negative of these terms or other comparable terminology that convey uncertainty of future events or outcomes are intended to identify forward-looking statements. All forward-looking statements address matters that involve risks and uncertainties, many of which are beyond our control, and are not guarantees of future results. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. We believe that these factors include, but are not limited to, the following: 1) uncertainty as to whether Tessera will be able to enter into or consummate the proposed transaction; 2) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the transaction or integrating the businesses of Tessera and DTS; 3) uncertainty as to the long-term value of DTS; 4) unpredictability and severity of natural disasters; 5) the resolution of intellectual property claims; 6) pricing trends, including Tessera’s and DTS’s ability to achieve economies of scale; 7) Tessera’s ability to implement its business strategy; 8) retention of key executives;

9) intense competition from a number of sources; 10) future regulations and policies affecting Tessera’s and DTS’s businesses; 11) general economic and market conditions; 12) the integration of businesses Tessera may acquire or new business ventures Tessera may start; 13) the evolving legal, regulatory and tax regimes under which we operate; 14) the expected amount and timing of cost savings and operating synergies; 15) failure to receive the approval of the stockholders of DTS; 16) recent and proposed changes to U.S. patent laws, rules, and regulations; 17) continued involvement in material legal proceedings; 18) issues with

Tessera’s ability to integrate acquired technologies and 19) other developments in the markets Tessera and DTS operate, as well as management’s response to any of the aforementioned factors. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in our most recent reports on Form 10-K and Form 10-Q and other documents of Tessera and DTS on file with the Securities and Exchange Commission (the “SEC”). Our SEC filings are available publicly on the SEC’s website at www.sec.gov. Any forward-looking statements made or incorporated by reference in this presentation are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

2

Additional Information

Where to Find It

In connection with the proposed transaction, DTS will file a proxy statement with the SEC. Additionally, DTS will file other relevant materials with the SEC in connection with the proposed acquisition of DTS by Tessera pursuant to the terms of an Agreement and Plan of Merger by and among Tessera, DTS and the other parties thereto. The materials to be filed by DTS with the SEC may be obtained free of charge at the SEC’s web site at www.sec.gov. Investors and security holders of DTS are urged to read DTS’s proxy statement and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction because they will contain important information about the transaction and the parties to the transaction.

DTS, Tessera and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of DTS stockholders in connection with the proposed transaction. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of certain of DTS’s executive officers and directors in the solicitation by reading DTS’s proxy statement for its 2016 annual meeting of stockholders and the proxy statement and other relevant materials filed with the SEC in connection with the transaction when they become available. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of certain of Tessera’s executive officers and directors in the solicitation by reading Tessera’s proxy statement for its 2016 annual meeting of stockholders. Information concerning the interests of DTS’s participants in the solicitation, which may, in some cases, be different than those of DTS’s stockholders generally, will be set forth in the proxy statement relating to the transaction when it becomes available. Additional informa tion regarding DTS directors and executive officers is also included in DTS’s proxy statement for its 2016 annual meeting of stockholders.

3

Today’s Speakers

Tom Lacey Robert Andersen Jon Kirchner

CEO, Tessera CFO, Tessera Chairman & CEO, DTS

4

Transformative Acquisition to Drive Profitable Growth

Combined company creates a global innovator in premium audio and imaging solutions

Projected 2016 pro forma revenue of approximately $450M; significantly increases product licensing business to approximately half of total combined company revenue

Acquisition brings 25+ new tier one customer relationships in consumer electronics, mobile, and automotive while broadening our ability to address incredible new opportunities in IoT and AR/VR

Combined company will be one of the world’s leading product and technology licensing companies, with over 450 engineers focused on developing next-generation audio, imaging and semiconductor packaging and interconnect technologies

Enabling Smart Audio and Imaging Everywhere

5

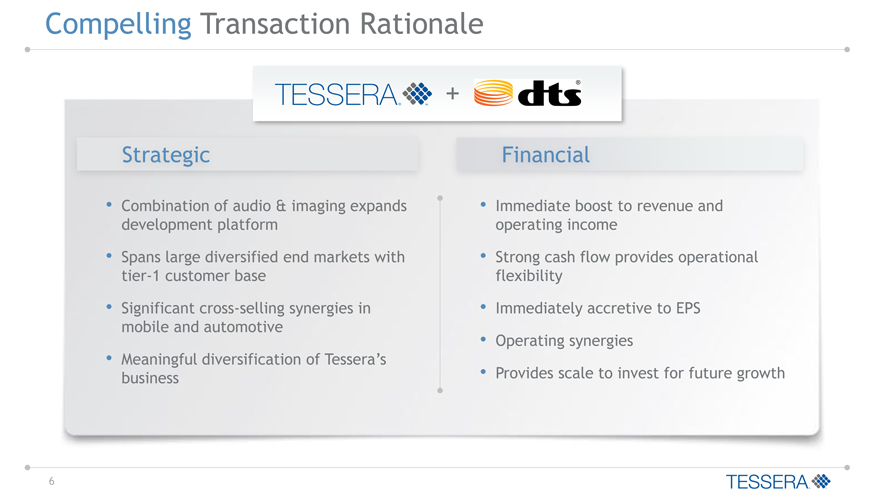

Compelling Transaction Rationale

+

Strategic Financial

Combination of audio & imaging expands •Immediate boost to revenue and

development platform operating income

Spans large diversified end markets with •Strong cash flow provides operational

tier-1 customer base flexibility

Significant cross-selling synergies in •Immediately accretive to EPS

mobile and automotive

Operating synergies

Meaningful diversification of Tessera’s

business •Provides scale to invest for future growth

6

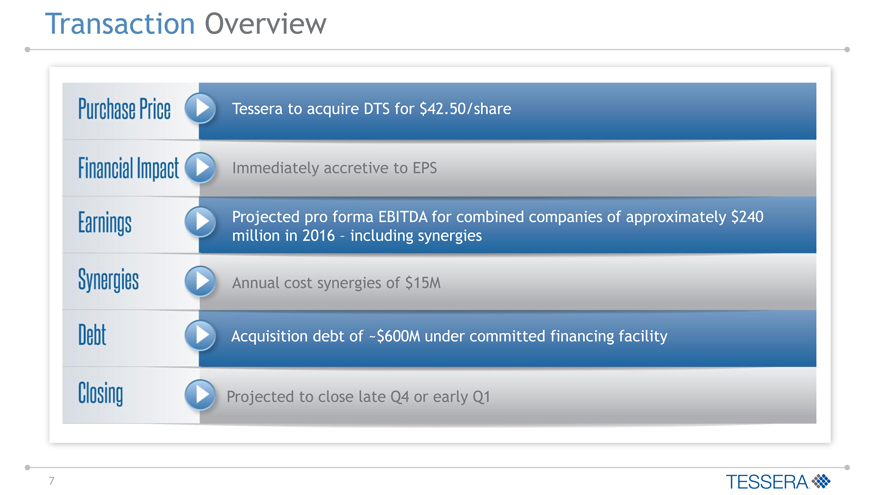

Transaction Overview

Tessera to acquire DTS for $42.50/share

Immediately accretive to EPS

Projected pro forma EBITDA for combined companies of approximately $240 million in 2016 – including synergies

Annual cost synergies of $15M

Acquisition debt of ~$600M under committed financing facility

Projected to close late Q4 or early Q1

7

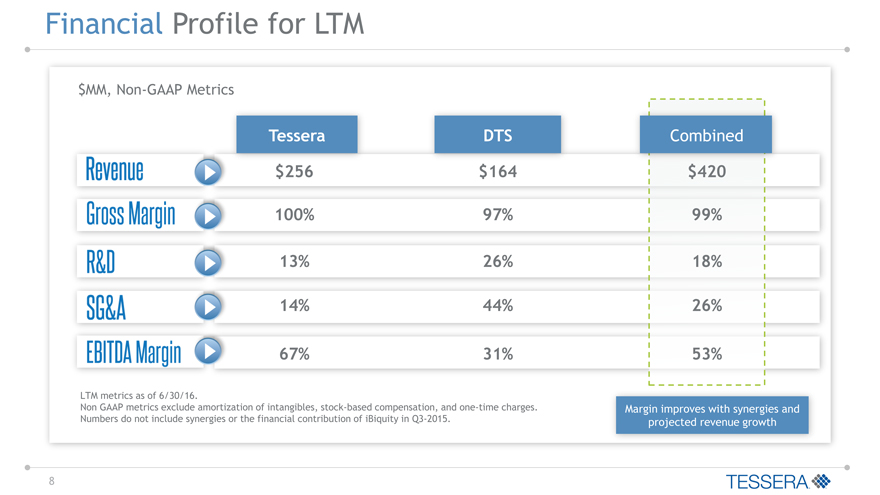

Financial Profile for LTM

$MM, Non-GAAP Metrics

Tessera DTS Combined

$256 $164 $420

100% 97% 99%

13% 26% 18%

14% 44% 26%

67% 31% 53%

LTM metrics as of 6/30/16.

Non GAAP metrics exclude amortization of intangibles, stock-based compensation, and one-time charges. Margin improves with synergies and

Numbers do not include synergies or the financial contribution of iBiquity in Q3-2015. projected revenue growth

8

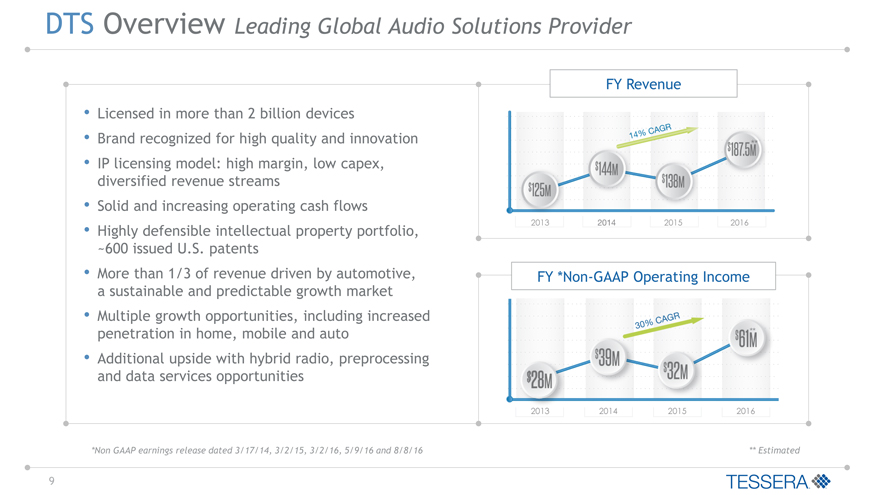

DTS Overview Leading Global Audio Solutions Provider

FY Revenue

• Licensed in more than 2 billion devices

• Brand recognized for high quality and innovation

• IP licensing model: high margin, low capex, diversified revenue streams

• Solid and increasing operating cash flows

• Highly defensible intellectual property portfolio, ~600 issued U.S. patents

• More than 1/3 of revenue driven by automotive, FY *Non-GAAP Operating Income a sustainable and predictable growth market

• Multiple growth opportunities, including increased penetration in home, mobile and auto

• Additional upside with hybrid radio, preprocessing and data services opportunities

*Non GAAP earnings release dated 3/17/14, 3/2/15, 3/2/16, 5/9/16 and 8/8/16 ** Estimated

9

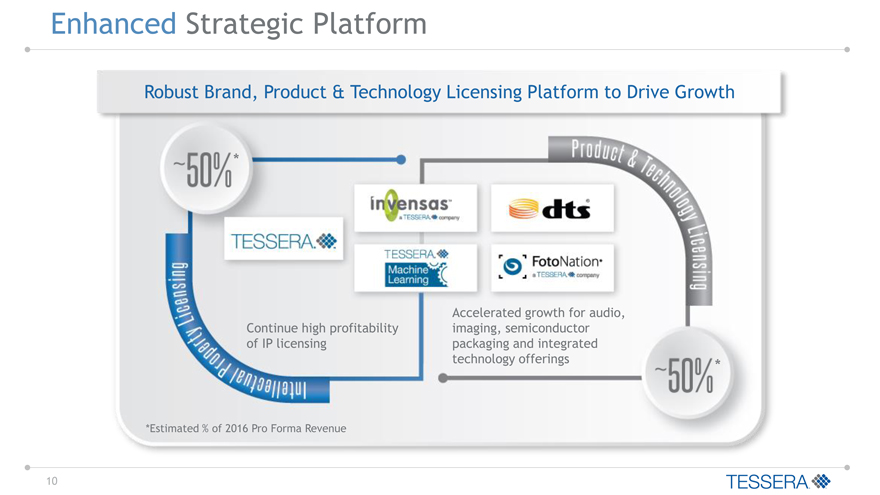

Enhanced Strategic Platform

Robust Brand, Product & Technology Licensing Platform to Drive Growth

*

Accelerated growth for audio, Continue high profitability imaging, semiconductor of IP licensing packaging and integrated technology offerings *

*Estimated % of 2016 Pro Forma Revenue

10

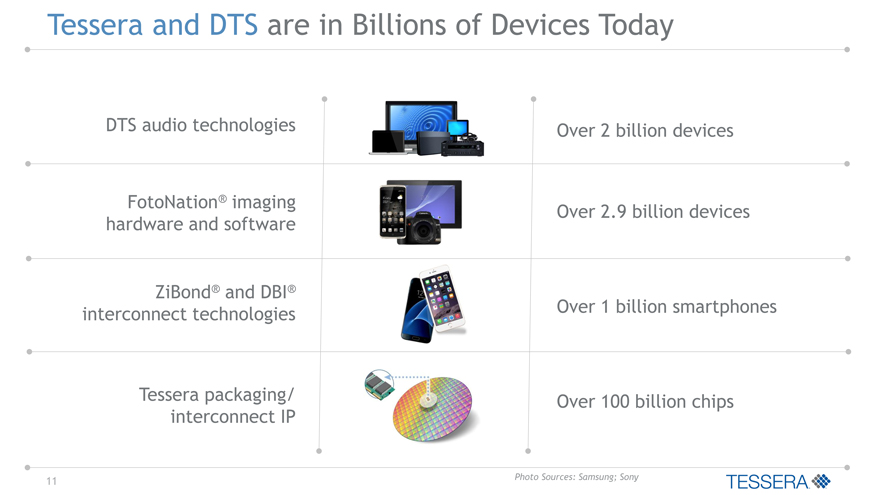

Tessera and DTS are in BillionsofDevicesToday

DTS audio technologies Over2 billion devices

FotoNation® imaging Over2.9 billion devices

hardware and software

ZiBond® and DBI®

interconnect technologies Over1 billion smartphones

Tessera packaging/ Over100 billion chips

interconnect IP

11 Photo Sources: Samsung; Sony

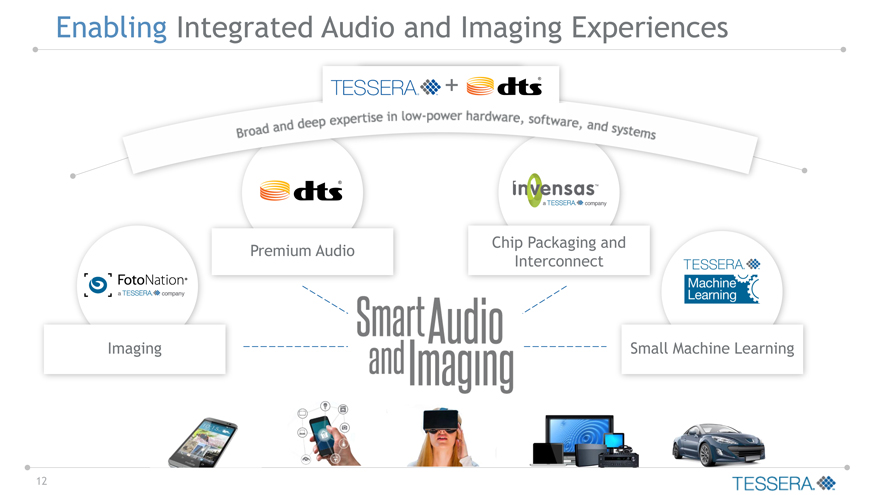

Enabling Integrated Audio and Imaging Experiences +

Chip Packaging and

Premium Audio

Interconnect

Imaging Small Machine Learning

12

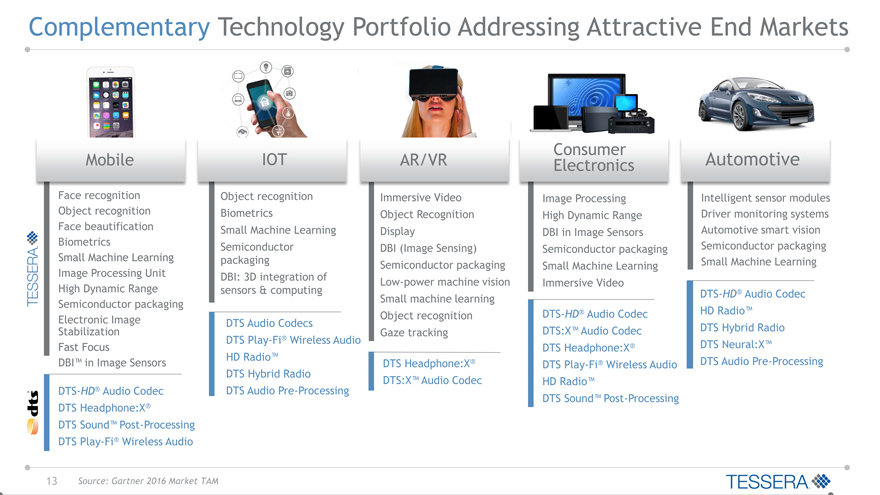

Complementary Technology Portfolio Addressing Attractive End Markets

Consumer

Mobile IOTAR/VRElectronicsAutomotive

Face recognition Object recognition Immersive VideoImage ProcessingIntelligent sensor modules

Object recognition Biometrics Object RecognitionHigh Dynamic RangeDriver monitoring systems

Face beautification Small Machine Learning DisplayDBI in Image SensorsAutomotive smart vision

Biometrics Semiconductor DBI (Image Sensing)Semiconductor packagingSemiconductor packaging

Small Machine Learning packaging Small Machine Learning

Semiconductor packagingSmall Machine Learning

Image Processing Unit DBI: 3D integration of Low-power machine visionImmersive Video

High Dynamic Range sensors & computing Small machine learningDTS-HD® Audio Codec

Semiconductor packaging

Object recognitionDTS-HD® Audio CodecHD Radio ™

Stabilization Electronic Image DTS Audio Codecs Gaze trackingDTS:X™ Audio CodecDTS Hybrid Radio

Fast Focus DTS Play-Fi® Wireless Audio DTS Headphone:X®DTS Neural:X™

DBI™ in Image Sensors HD Radio ™ DTS Headphone:X®DTS Play-Fi® Wireless AudioDTS Audio Pre-Processing

DTS Hybrid RadioDTS:X™ Audio CodecHD Radio ™

DTS-HD® Audio Codec DTS Audio Pre-Processing DTS Sound™ Post-Processing

DTS Headphone:X®

DTS Sound™ Post-Processing

DTS Play-Fi® Wireless Audio

13 Source: Gartner 2016 Market TAM

Enabling Smart Audio and Imaging Everywhere

High Performance, Low-Power

Computational Imaging Audio Technologies

Semiconductor Packaging and Interconnect Low-Power Machine Learning

14

Thank You