SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registranto

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

x Definitive Additional Materials

o Soliciting Material Pursuant to § 240.14a-12

CHINACAST EDUCATION CORPORATION

(Name of Registrant as Specified in Its Charter)

_________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | o | Fee paid previously with preliminary materials. |

| | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, schedule or registration statement no.: |

Investor Presentation NASDAQ : CAST www.chinacasteducation.com China’s One of the Largest US Publicly - Listed Post - Secondary Education Company

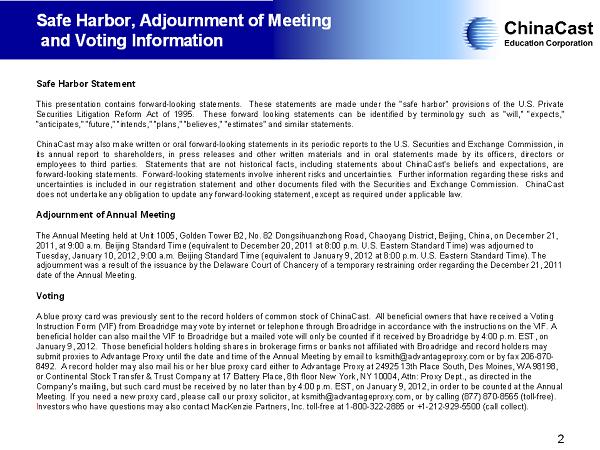

2 Safe Harbor, Adjournment of Meeting and Voting Information Safe Harbor Statement This presentation contains forward - looking statements . These statements are made under the “safe harbor” provisions of the U . S . Private Securities Litigation Reform Act of 1995 . These forward looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements . ChinaCast may also make written or oral forward - looking statements in its periodic reports to the U . S . Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties . Statements that are not historical facts, including statements about ChinaCast’s beliefs and expectations, are forward - looking statements . Forward - looking statements involve inherent risks and uncertainties . Further information regarding these risks and uncertainties is included in our registration statement and other documents filed with the Securities and Exchange Commission . ChinaCast does not undertake any obligation to update any forward - looking statement, except as required under applicable law . Adjournment of Annual Meeting The Annual Meeting held at Unit 1005, Golden Tower B2, No. 82 Dongsihuanzhong Road, Chaoyang District, Beijing, China, on Dec emb er 21, 2011, at 9:00 a.m. Beijing Standard Time (equivalent to December 20, 2011 at 8:00 p.m. U.S. Eastern Standard Time) was adjour ned to Tuesday, January 10, 2012, 9:00 a.m. Beijing Standard Time (equivalent to January 9, 2012 at 8:00 p.m. U.S. Eastern Standard Tim e). The adjournment was a result of the issuance by the Delaware Court of Chancery of a temporary restraining order regarding the Dec emb er 21, 2011 date of the Annual Meeting. Voting A blue proxy card was previously sent to the record holders of common stock of ChinaCast. All beneficial owners that have re cei ved a Voting Instruction Form (VIF) from Broadridge may vote by internet or telephone through Broadridge in accordance with the instructio ns on the VIF. A beneficial holder can also mail the VIF to Broadridge but a mailed vote will only be counted if it received by Broadridge by 4:0 0 p.m. EST, on January 9, 2012. Those beneficial holders holding shares in brokerage firms or banks not affiliated with Broadridge and reco rd holders may submit proxies to Advantage Proxy until the date and time of the Annual Meeting by email to ksmith@advantageproxy.com or by f ax 206 - 870 - 8492. A record holder may also mail his or her blue proxy card either to Advantage Proxy at 24925 13th Place South, Des Moin es, WA 98198, or Continental Stock Transfer & Trust Company at 17 Battery Place, 8th floor New York, NY 10004, Attn: Proxy Dept., as direct ed in the Company's mailing, but such card must be received by no later than by 4:00 p.m. EST, on January 9, 2012, in order to be count ed at the Annual Meeting. If you need a new proxy card, please call our proxy solicitor, at ksmith@advantageproxy.com, or by calling (877) 870 - 85 65 (toll - free). I nvestors who have questions may also contact MacKenzie Partners, Inc. toll - free at 1 - 800 - 322 - 2885 or +1 - 212 - 929 - 5500 (call collect).

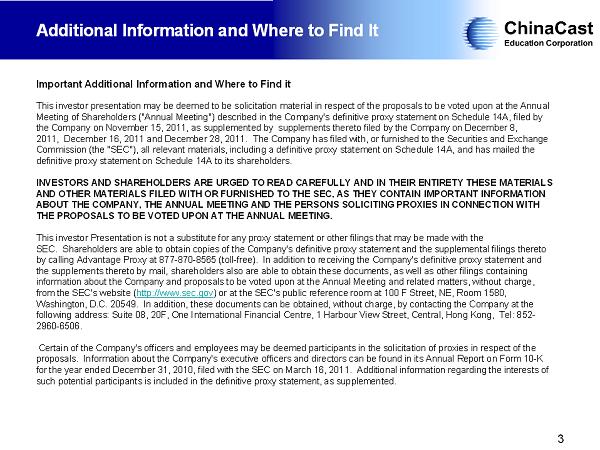

3 Additional Information and Where to Find It Important Additional Information and Where to Find it This investor presentation may be deemed to be solicitation material in respect of the proposals to be voted upon at the Annu al Meeting of Shareholders ("Annual Meeting") described in the Company's definitive proxy statement on Schedule 14A, filed by the Company on November 15, 2011, as supplemented by supplements thereto filed by the Company on December 8, 2011, December 16, 2011 and December 28, 2011. The Company has filed with, or furnished to the Securities and Exchange Commission (the "SEC"), all relevant materials, including a definitive proxy statement on Schedule 14A, and has mailed the definitive proxy statement on Schedule 14A to its shareholders. INVESTORS AND SHAREHOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THESE MATERIALS AND OTHER MATERIALS FILED WITH OR FURNISHED TO THE SEC, AS THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, THE ANNUAL MEETING AND THE PERSONS SOLICITING PROXIES IN CONNECTION WITH THE PROPOSALS TO BE VOTED UPON AT THE ANNUAL MEETING. This investor Presentation is not a substitute for any proxy statement or other filings that may be made with the SEC. Shareholders are able to obtain copies of the Company's definitive proxy statement and the supplemental filings thereto by calling Advantage Proxy at 877 - 870 - 8565 (toll - free). In addition to receiving the Company's definitive proxy statement and the supplements thereto by mail, shareholders also are able to obtain these documents, as well as other filings containing information about the Company and proposals to be voted upon at the Annual Meeting and related matters, without charge, from the SEC's website ( http://www.sec.gov ) or at the SEC's public reference room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. In addition, these documents can be obtained, without charge, by contacting the Company at the following address: Suite 08, 20F, One International Financial Centre, 1 Harbour View Street, Central, Hong Kong, Tel: 852 - 2960 - 6506. Certain of the Company's officers and employees may be deemed participants in the solicitation of proxies in respect of the proposals. Information about the Company's executive officers and directors can be found in its Annual Report on Form 10 - K for the year ended December 31, 2010, filed with the SEC on March 16, 2011. Additional information regarding the interests of such potential participants is included in the definitive proxy statement, as supplemented.

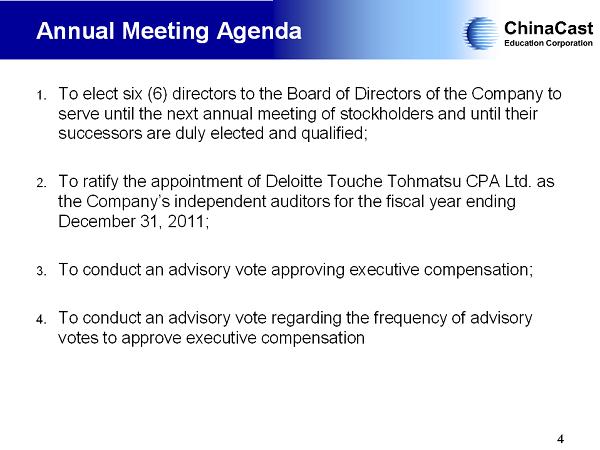

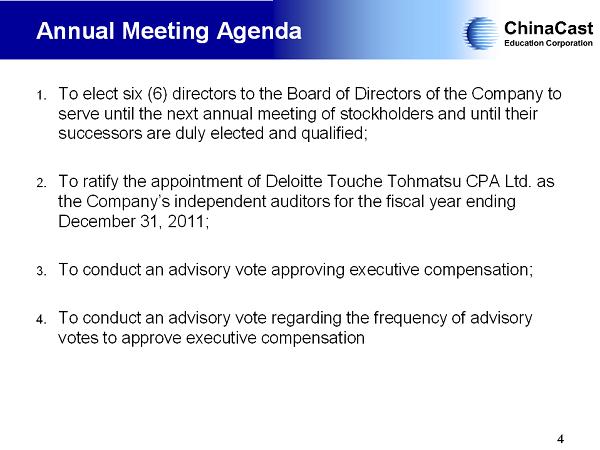

Annual Meeting Agenda 1. To elect six (6) directors to the Board of Directors of the Company to serve until the next annual meeting of stockholders and until their successors are duly elected and qualified; 2. To ratify the appointment of Deloitte Touche Tohmatsu CPA Ltd. as the Company’s independent auditors for the fiscal year ending December 31, 2011; 3. To conduct an advisory vote approving executive compensation; 4. To conduct an advisory vote regarding the frequency of advisory votes to approve executive compensation 4

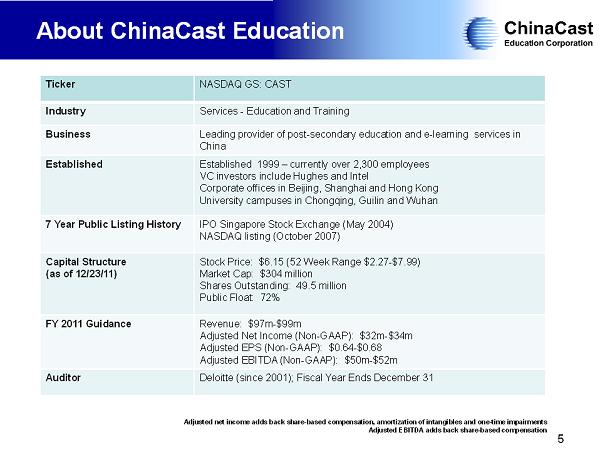

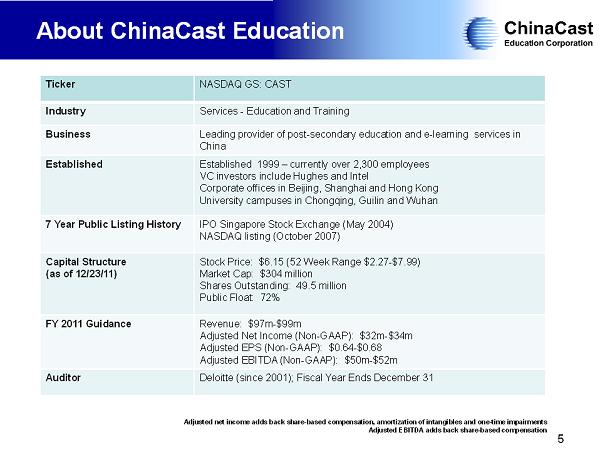

About ChinaCast Education 5 Ticker NASDAQ GS: CAST Industry Services - Education and Training Business Leading provider of post - secondary education and e - learning services in China Established Established 1999 – currently over 2,300 employees VC investors include Hughes and Intel Corporate offices in Beijing, Shanghai and Hong Kong University campuses in Chongqing, Guilin and Wuhan 7 Year Public Listing History IPO Singapore Stock Exchange (May 2004) NASDAQ listing (October 2007) Capital Structure (as of 12/23/11) Stock Price: $6.15 (52 Week Range $2.27 - $7.99) Market Cap: $304 million Shares Outstanding: 49.5 million Public Float: 72% FY 2011 Guidance Revenue: $97m - $99m Adjusted Net Income (Non - GAAP): $32m - $34m Adjusted EPS (Non - GAAP): $0.64 - $0.68 Adjusted EBITDA (Non - GAAP): $50m - $52m Auditor Deloitte (since 2001); Fiscal Year Ends December 31 Adjusted net income adds back share - based compensation, amortization of intangibles and one - time impairments Adjusted EBITDA adds back share - based compensation

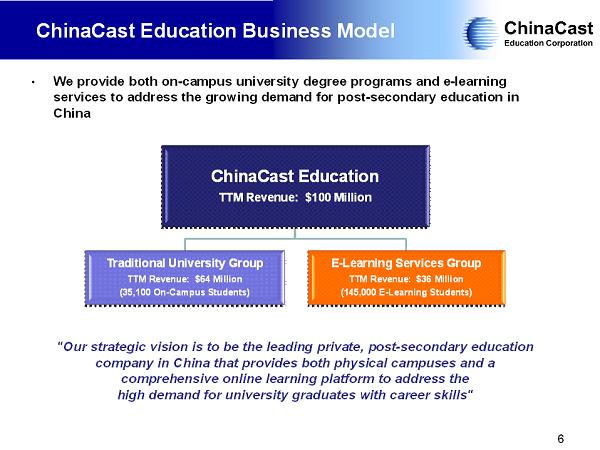

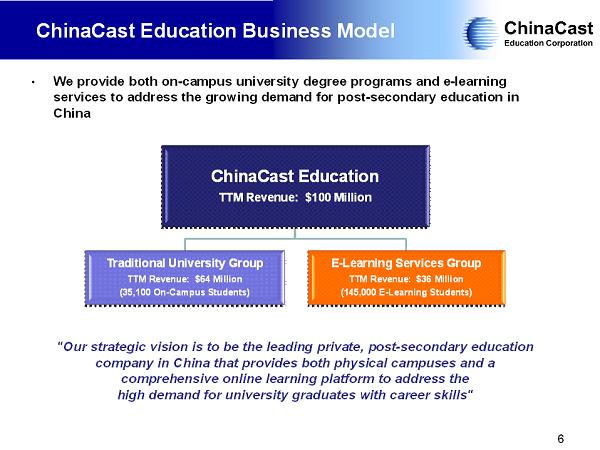

ChinaCast Education Business Model 6 ChinaCast Education TTM Revenue: $100 Million Traditional University Group TTM Revenue: $64 Million (35,100 On - Campus Students) E - Learning Services Group TTM Revenue: $36 Million (145,000 E - Learning Students) • We provide both on - campus university degree programs and e - learning services to address the growing demand for post - secondary education in China "Our strategic vision is to be the leading private, post - secondary education company in China that provides both physical campuses and a comprehensive online learning platform to address the high demand for university graduates with career skills"

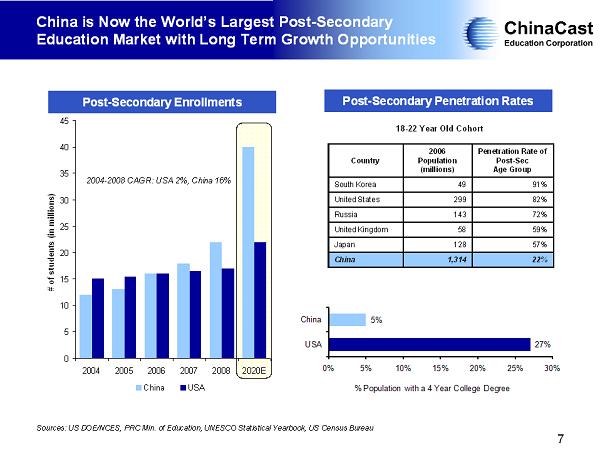

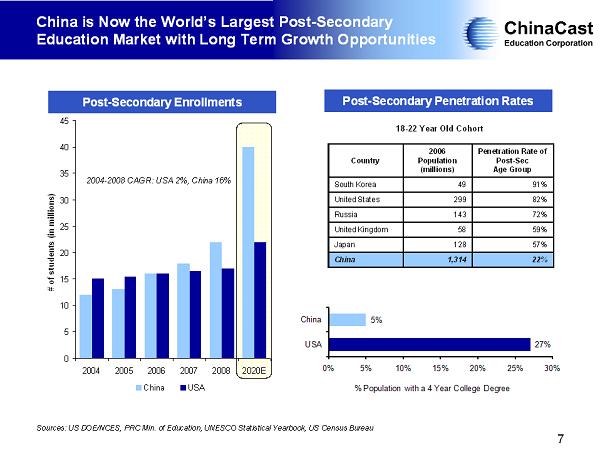

China is Now the World’s Largest Post - Secondary Education Market with Long Term Growth Opportunities 7 Post - Secondary Enrollments Post - Secondary Penetration Rates Country 2006 Population (millions) Penetration Rate of Post - Sec Age Group South Korea 49 91% United States 299 82% Russia 143 72% United Kingdom 58 59% Japan 128 57% China 1,314 22% Sources: US DOE/NCES, PRC Min. of Education, UNESCO Statistical Yearbook, US Census Bureau 27% 5% 0% 5% 10% 15% 20% 25% 30% USA China % Population with a 4 Year College Degree 2004-2008 CAGR: USA 2%, China 16% 0 5 10 15 20 25 30 35 40 45 2004 2005 2006 2007 2008 2020E # of students (in millions) China USA 18 - 22 Year Old Cohort

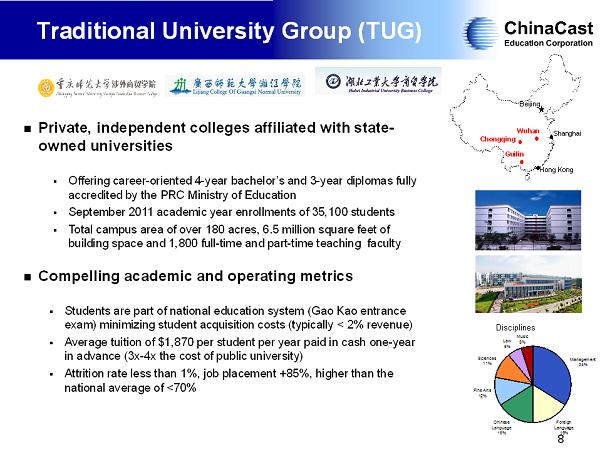

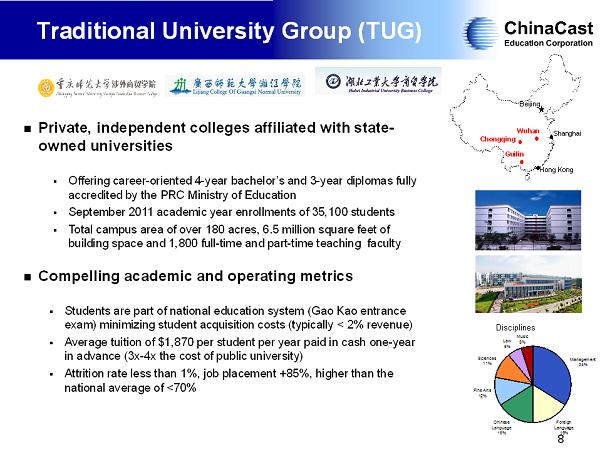

Disciplines 8 Traditional University Group (TUG) Private, independent colleges affiliated with state - owned universities ▪ Offering career - oriented 4 - year bachelor’s and 3 - year diplomas fully accredited by the PRC Ministry of Education ▪ September 2011 academic year enrollments of 35,100 students ▪ Total campus area of over 180 acres, 6.5 million square feet of building space and 1,800 full - time and part - time teaching faculty Compelling academic and operating metrics ▪ Students are part of national education system (Gao Kao entrance exam) minimizing student acquisition costs (typically < 2% revenue ) ▪ Average tuition of $1,870 per student per year paid in cash one - year in advance (3x - 4x the cost of public university) ▪ Attrition rate less than 1 %, job placement +85%, higher than the national average of <70 % Management 34% Foreign Language 16% Chinese Language 16% Fine Arts 12% Sciences 11% Law 6% Music 5% Beijing Hong Kong Chongqing Guilin Shanghai Wuhan

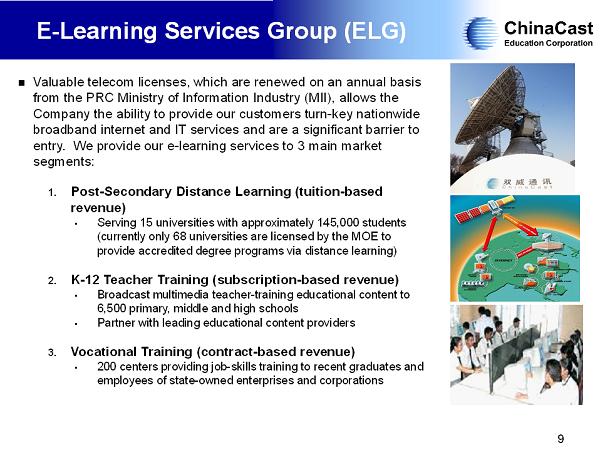

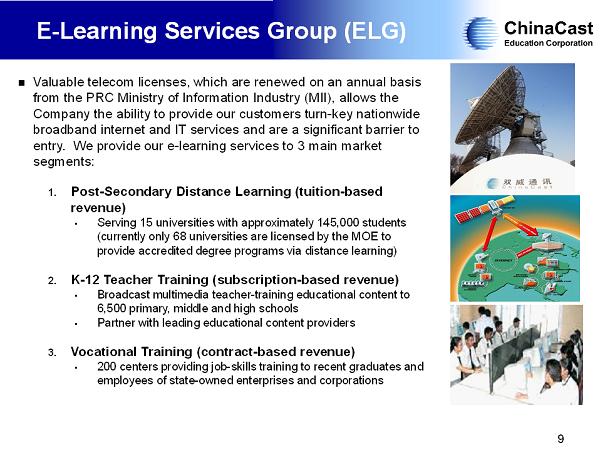

Valuable telecom licenses, which are renewed on an annual basis from the PRC Ministry of Information Industry (MII), allows the Company the ability to provide our customers turn - key nationwide broadband internet and IT services and are a significant barrier to entry. We provide our e - learning services to 3 main market segments: 1. Post - Secondary Distance Learning (tuition - based revenue) • Serving 15 universities with approximately 145,000 students (currently only 68 universities are licensed by the MOE to provide accredited degree programs via distance learning) 2. K - 12 Teacher Training (subscription - based revenue) • Broadcast multimedia teacher - training educational content to 6,500 primary, middle and high schools • Partner with leading educational content providers 3. Vocational Training (contract - based revenue) • 200 centers providing job - skills training to recent graduates and employees of state - owned enterprises and corporations 9 E - Learning Services Group (ELG)

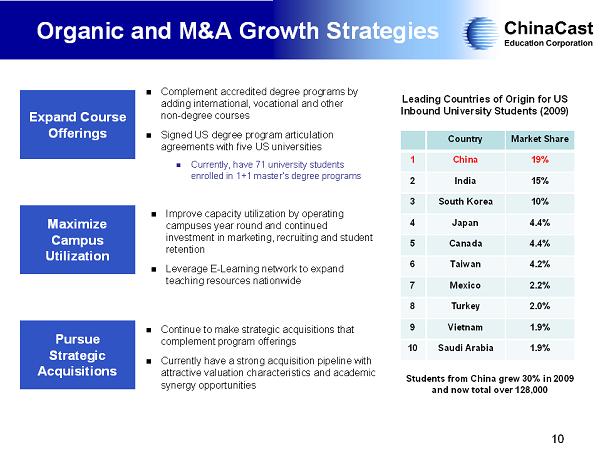

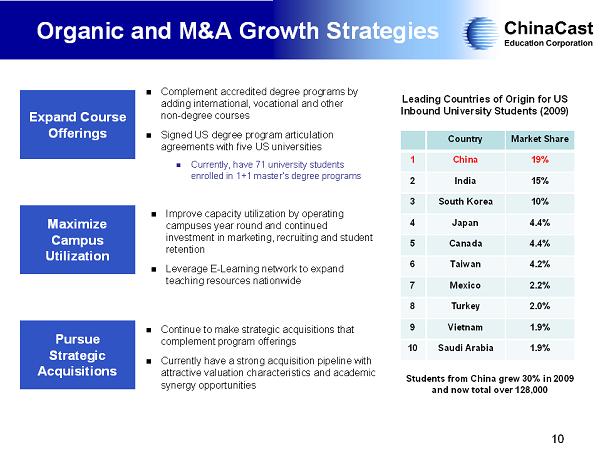

10 Organic and M&A Growth Strategies Expand Course Offerings Maximize Campus Utilization Pursue Strategic Acquisitions Complement accredited degree programs by adding international, vocational and other non - degree courses Signed US degree program articulation agreements with five US universities Currently, have 71 university students enrolled in 1+1 master’s degree programs Improve capacity utilization by operating campuses year round and continued investment in marketing, recruiting and student retention Leverage E - Learning network to expand teaching resources nationwide Continue to make strategic acquisitions that complement program offerings Currently have a strong acquisition pipeline with attractive valuation characteristics and academic synergy opportunities Country Market Share 1 China 19% 2 India 15% 3 South Korea 10% 4 Japan 4.4% 5 Canada 4.4% 6 Taiwan 4.2% 7 Mexico 2.2% 8 Turkey 2.0% 9 Vietnam 1.9% 10 Saudi Arabia 1.9% Leading Countries of Origin for US Inbound University Students (2009) Students from China grew 30% in 2009 and now total over 128,000

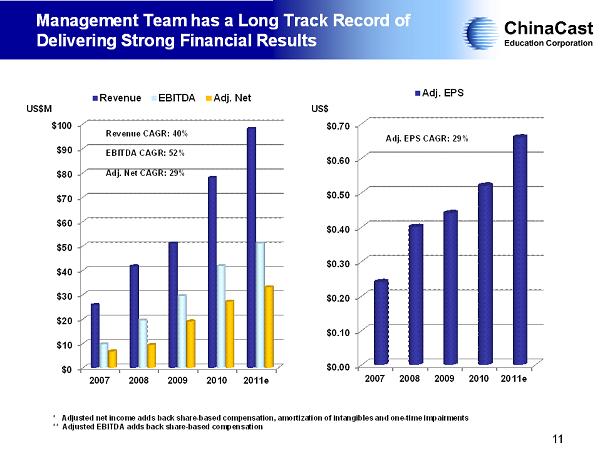

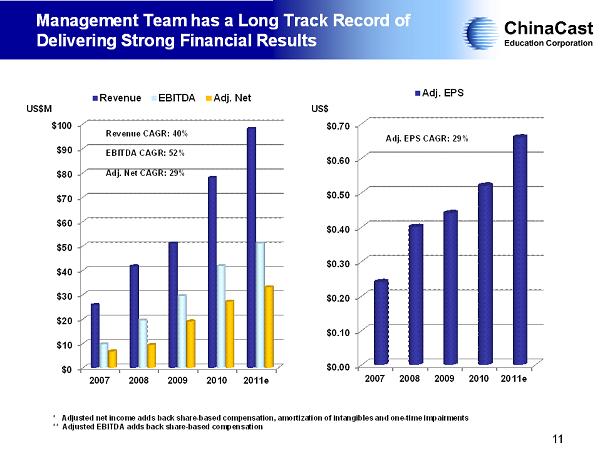

11 Management Team has a Long Track Record of Delivering Strong Financial Results $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 2007 2008 2009 2010 2011e Revenue EBITDA Adj. Net US$M $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 2007 2008 2009 2010 2011e Adj. EPS * Adjusted net income adds back share - based compensation, amortization of intangibles and one - time impairments ** Adjusted EBITDA adds back share - based compensation US$ Revenue CAGR: 40% EBITDA CAGR: 52% Adj. Net CAGR: 29% Adj. EPS CAGR: 29%

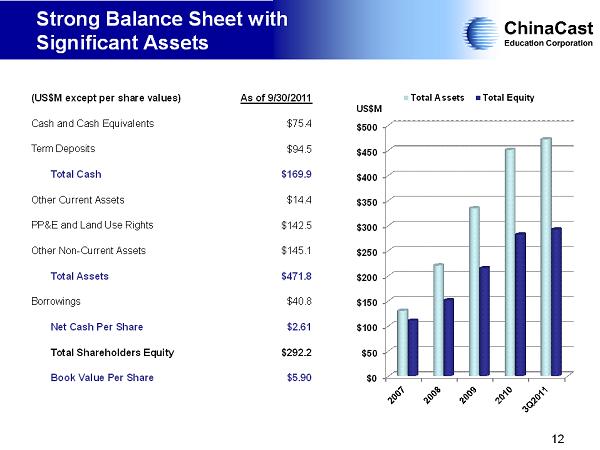

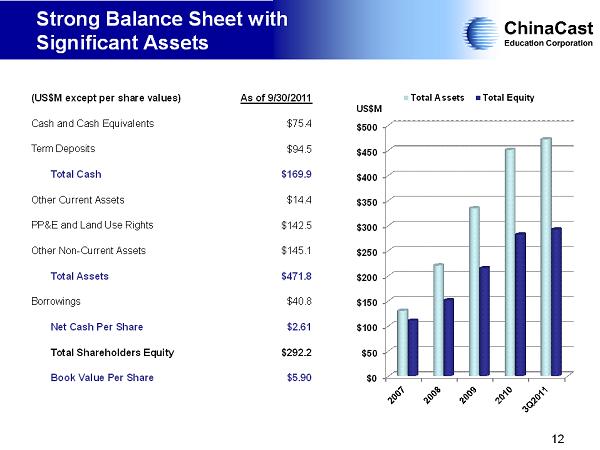

12 Strong Balance Sheet with Significant Assets (US$M except per share values) As of 9/30/2011 Cash and Cash Equivalents $75.4 Term Deposits $94.5 Total Cash $169.9 Other Current Assets $14.4 PP&E and Land Use Rights $142.5 Other Non - Current Assets $145.1 Total Assets $471.8 Borrowings $40.8 Net Cash Per Share $2.61 Total Shareholders Equity $292.2 Book Value Per Share $5.90 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 Total Assets Total Equity US$M

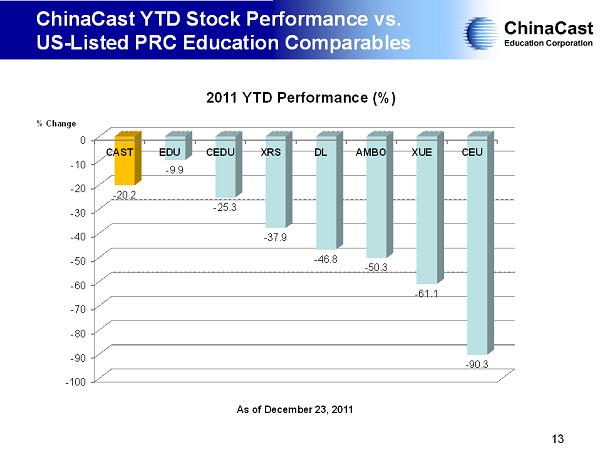

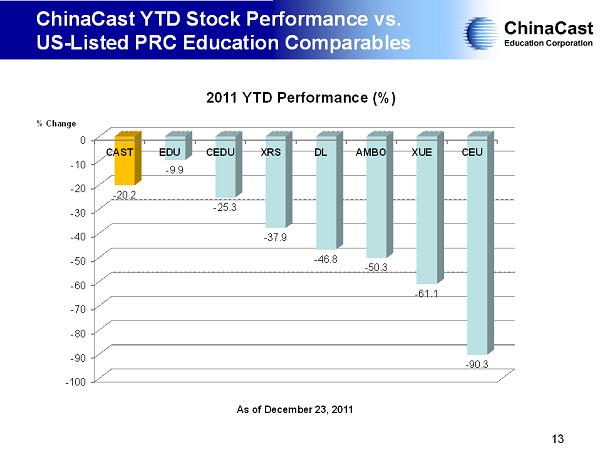

13 ChinaCast YTD Stock Performance vs. US - Listed PRC Education Comparables -100 -90 -80 -70 -60 -50 -40 -30 -20 -10 0 CAST EDU CEDU XRS DL AMBO XUE CEU - 20.2 - 9.9 - 25.3 - 37.9 - 46.8 - 50.3 - 61.1 - 90.3 2011 YTD Performance (%) As of December 23, 2011 % Change

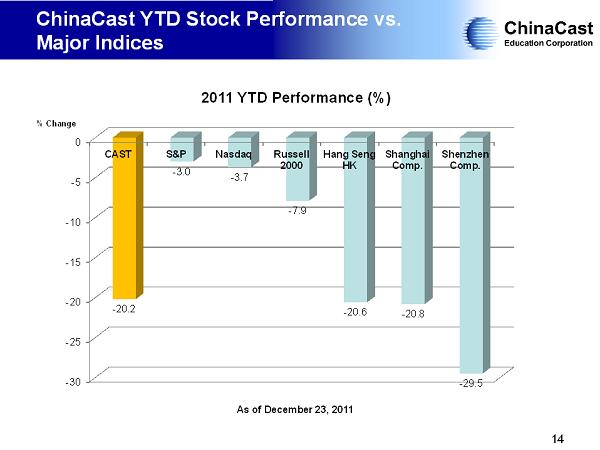

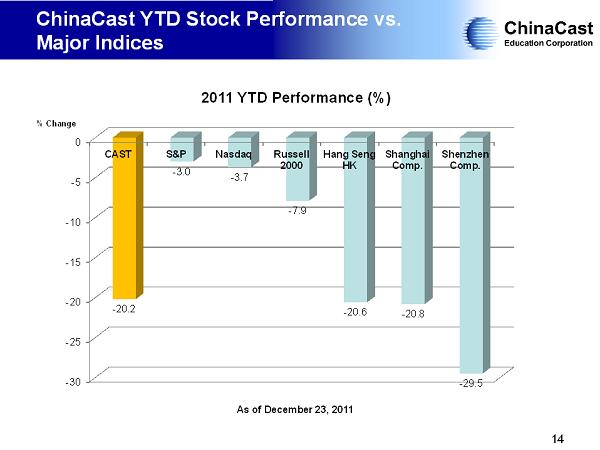

14 ChinaCast YTD Stock Performance vs. Major Indices -30 -25 -20 -15 -10 -5 0 CAST S&P Nasdaq Russell 2000 Hang Seng HK Shanghai Comp. Shenzhen Comp. - 20.2 - 3.0 - 3.7 - 7.9 - 20.6 - 20.8 - 29.5 2011 YTD Performance (%) As of December 23, 2011 % Change

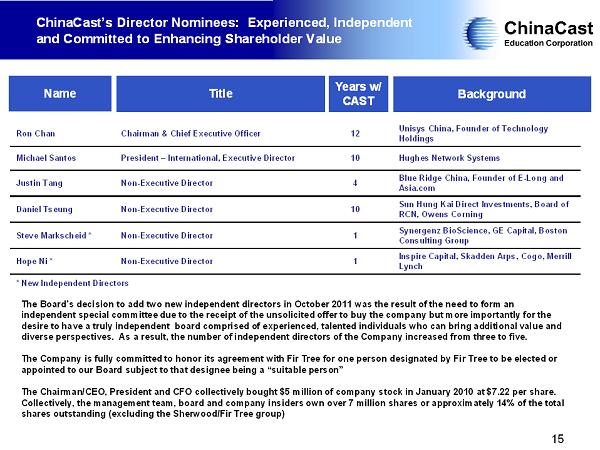

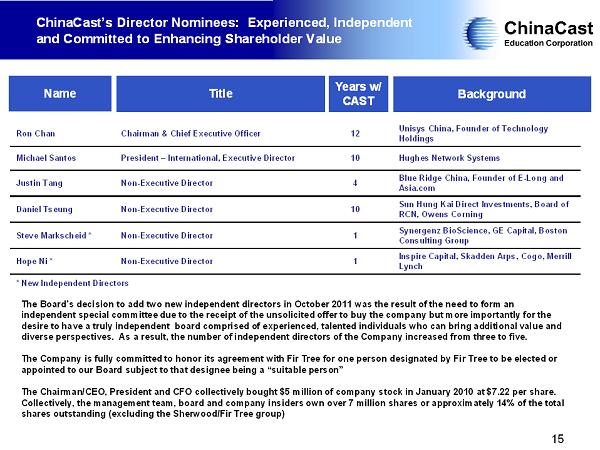

15 ChinaCast’s Director Nominees: Experienced, Independent and Committed to Enhancing Shareholder Value Name Title Background Ron Chan Chairman & Chief Executive Officer 12 Unisys China, Founder of Technology Holdings Michael Santos President – International, Executive Director 10 Hughes Network Systems Justin Tang Non - Executive Director 4 Blue Ridge China, Founder of E - Long and Asia.com Daniel Tseung Non - Executive Director 10 Sun Hung Kai Direct Investments, Board of RCN, Owens Corning Steve Markscheid * Non - Executive Director 1 Synergenz BioScience, GE Capital, Boston Consulting Group Hope Ni * Non - Executive Director 1 Inspire Capital, Skadden Arps , Cogo , Merrill Lynch Years w/ CAST * New Independent Directors The Board’s decision to add two new independent directors in October 2011 was the result of the need to form an independent special committee due to the receipt of the unsolicited offer to buy the company but more importantly for the desire to have a truly independent board comprised of experienced, talented individuals who can bring additional value and diverse perspectives. As a result, the number of independent directors of the Company increased from three to five. The Company is fully committed to honor its agreement with Fir Tree for one person designated by Fir Tree to be elected or appointed to our Board subject to that designee being a “suitable person” The Chairman/CEO, President and CFO collectively bought $5 million of company stock in January 2010 at $7.22 per share. Collectively, the management team, board and company insiders own over 7 million shares or approximately 14% of the total shares outstanding (excluding the Sherwood/Fir Tree group)

16 ChinaCast Has the Right Board Nominees to Implement Its Strategic Growth Plan to Enhance Long Term Shareholder Value Continue to invest in growing our domestic and international post - secondary degree programs in China – the world’s largest market in terms of number of university students Capitalize on additional acquisition opportunities - there is a large pool of private universities in China and a fragmented market which provides an excellent consolidation opportunity for companies with access to capital Return excess cash via share buybacks and/or dividends using a measured, prudent approach Support the Independent Special Committee’s evaluation process to explore all strategic alternatives which we believe may represent the best opportunity to unlock shareholder value for all investors given the prolonged negative market sentiment regarding US - listed Chinese companies

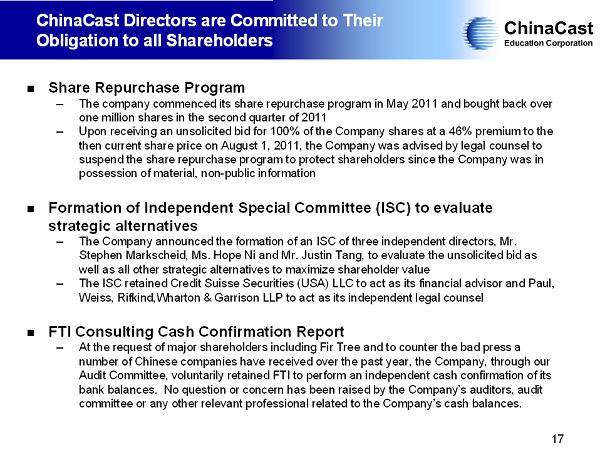

17 ChinaCast Directors are Committed to Their Obligation to all Shareholders Share Repurchase Program – The company commenced its share repurchase program in May 2011 and bought back over one million shares in the second quarter of 2011 – Upon receiving an unsolicited bid for 100% of the Company shares at a 46% premium to the then current share price on August 1, 2011, the Company was advised by legal counsel to suspend the share repurchase program to protect shareholders since the Company was in possession of material, non - public information Formation of Independent Special Committee (ISC) to evaluate strategic alternatives – The Company announced the formation of an ISC of three independent directors, Mr. Stephen Markscheid, Ms. Hope Ni and Mr. Justin Tang, to evaluate the unsolicited bid as well as all other strategic alternatives to maximize shareholder value – The ISC retained Credit Suisse Securities (USA) LLC to act as its financial advisor and Paul, Weiss, Rifkind,Wharton & Garrison LLP to act as its independent legal counsel FTI Consulting Cash Confirmation Report – At the request of major shareholders including Fir Tree and to counter the bad press a number of Chinese companies have received over the past year, the Company, through our Audit Committee, voluntarily retained FTI to perform an independent cash confirmation of its bank balances. No question or concern has been raised by the Company’s auditors, audit committee or any other relevant professional related to the Company’s cash balances.

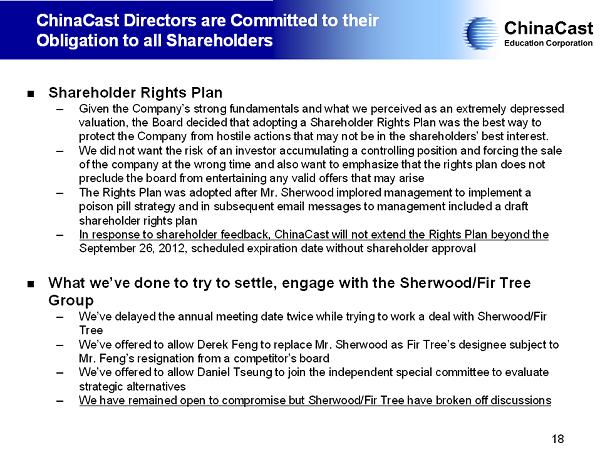

ChinaCast Directors are Committed to their Obligation to all Shareholders Shareholder Rights Plan – Given the Company’s strong fundamentals and what we perceived as an extremely depressed valuation, the Board decided that adopting a Shareholder Rights Plan was the best way to protect the Company from hostile actions that may not be in the shareholders’ best interest. – We did not want the risk of an investor accumulating a controlling position and forcing the sale of the company at the wrong time and also want to emphasize that the rights plan does not preclude the board from entertaining any valid offers that may arise – The Rights Plan was adopted after Mr. Sherwood implored management to implement a poison pill strategy and in subsequent email messages to management included a draft shareholder rights plan – In response to shareholder feedback, ChinaCast will not extend the Rights Plan beyond the September 26, 2012, scheduled expiration date without shareholder approval What we’ve done to try to settle, engage with the Sherwood/Fir Tree Group – We’ve delayed the annual meeting date twice while trying to work a deal with Sherwood/Fir Tree – We’ve offered to allow Derek Feng to replace Mr. Sherwood as Fir Tree’s designee subject to Mr. Feng’s resignation from a competitor’s board – We’ve offered to allow Daniel Tseung to join the independent special committee to evaluate strategic alternatives – We have remained open to compromise but Sherwood/Fir Tree have broken off discussions 18

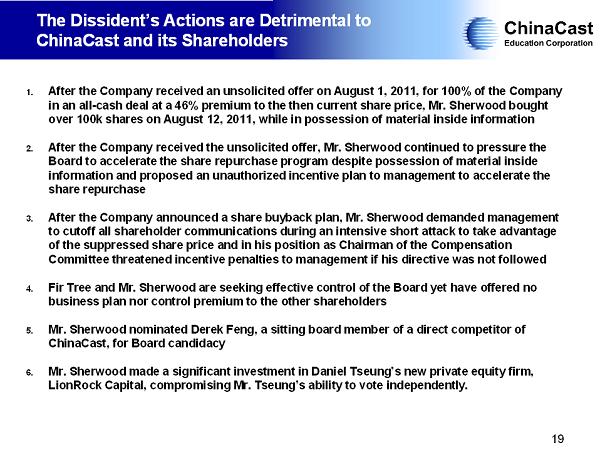

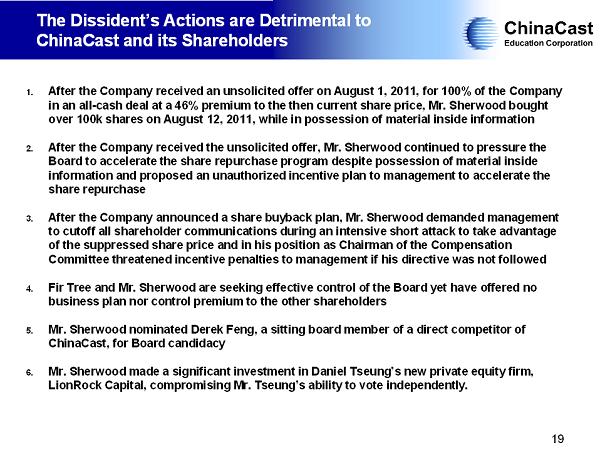

19 The Dissident’s Actions are Detrimental to ChinaCast and its Shareholders 1. After the Company received an unsolicited offer on August 1, 2011, for 100% of the Company in an all - cash deal at a 46% premium to the then current share price, Mr. Sherwood bought over 100k shares on August 12, 2011, while in possession of material inside information 2. After the Company received the unsolicited offer, Mr. Sherwood continued to pressure the Board to accelerate the share repurchase program despite possession of material inside information and proposed an unauthorized incentive plan to management to accelerate the share repurchase 3. After the Company announced a share buyback plan, Mr. Sherwood demanded management to cutoff all shareholder communications during an intensive short attack to take advantage of the suppressed share price and in his position as Chairman of the Compensation Committee threatened incentive penalties to management if his directive was not followed 4. Fir Tree and Mr. Sherwood are seeking effective control of the Board yet have offered no business plan nor control premium to the other shareholders 5. Mr. Sherwood nominated Derek Feng, a sitting board member of a direct competitor of ChinaCast, for Board candidacy 6. Mr. Sherwood made a significant investment in Daniel Tseung’s new private equity firm, LionRock Capital, compromising Mr. Tseung’s ability to vote independently.

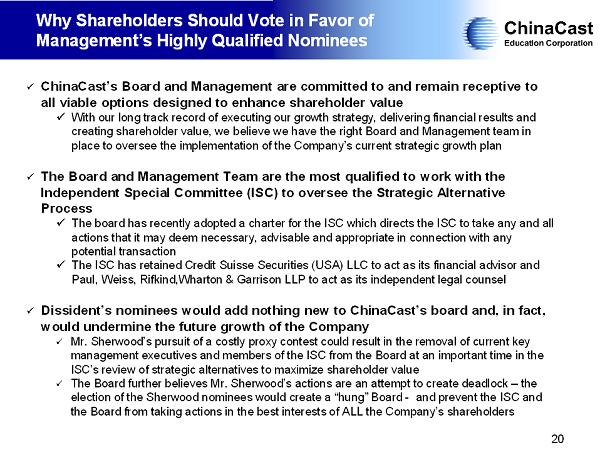

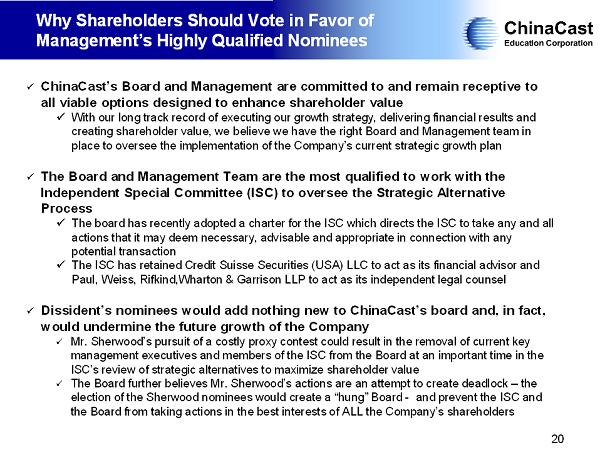

20 Why Shareholders Should Vote in Favor of Management’s Highly Qualified Nominees x ChinaCast’s Board and Management are committed to and remain receptive to all viable options designed to enhance shareholder value x With our long track record of executing our growth strategy, delivering financial results and creating shareholder value, we believe we have the right Board and Management team in place to oversee the implementation of the Company’s current strategic growth plan x The Board and Management Team are the most qualified to work with the Independent Special Committee (ISC) to oversee the Strategic Alternative Process x The board has recently adopted a charter for the ISC which directs the ISC to take any and all actions that it may deem necessary, advisable and appropriate in connection with any potential transaction x The ISC has retained Credit Suisse Securities (USA) LLC to act as its financial advisor and Paul, Weiss, Rifkind,Wharton & Garrison LLP to act as its independent legal counsel x Dissident’s nominees would add nothing new to ChinaCast’s board and, in fact, would undermine the future growth of the Company x Mr. Sherwood’s pursuit of a costly proxy contest could result in the removal of current key management executives and members of the ISC from the Board at an important time in the ISC’s review of strategic alternatives to maximize shareholder value x The Board further believes Mr. Sherwood’s actions are an attempt to create deadlock – the election of the Sherwood nominees would create a “hung” Board - and prevent the ISC and the Board from taking actions in the best interests of ALL the Company’s shareholders