UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10−Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: September 30, 2009

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to _____________

Commission File Number: 333-83375

CHINA NEW ENERGY GROUP COMPANY

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | | 65-0972647 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

20/F, Center Plaza, No.188 Jie Fang Road

He Ping District, Tianjin, 300042

People's Republic of China

(Address of principal executive offices, Zip Code)

(86 22) 5829 9778

(Registrant’s telephone number, including area code)

_____________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | | Accelerated filer ¨ |

| Non-accelerated filer o | (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares outstanding of each of the issuer’s classes of stock, as of November 13, 2009 , 2009 is as follows:

| Class of Securities | | Shares Outstanding |

| Common Stock, $0.001 par value | | 100,000,041 |

| Series A Convertible Preferred Stock, $0.001 par value | | 1,857,373 |

| Series B Convertible Preferred Stock, $0.001 par value | | 1,116,388 |

Quarterly Report on FORM 10-Q

Three and Nine Months Ended September 30, 2009

TABLE OF CONTENTS

PART I

FINANCIAL INFORMATION

| ITEM 1. | | FINANCIAL STATEMENTS | | 2 | |

| ITEM 2. | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 21 | |

| ITEM 3. | | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 29 | |

| ITEM 4. | | CONTROLS AND PROCEDURES | | 30 | |

| | | | | | |

| PART II | |

| OTHER INFORMATION | |

| | | | | | |

ITEM 1. | | LEGAL PROCEEDINGS | | 31 | |

| ITEM 6. | | EXHIBITS | | | |

PART I

FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS. |

China New Energy Group Company

Condensed Consolidated Financial Statements

For the three and nine months ended

September 30, 2009

(Stated in US dollars)

| | | Page | |

| Condensed Consolidated Balance Sheets (Unaudited) | | | 3 | |

| | | | | |

| Condensed Consolidated Statements of Operations and Comprehensive Income (Unaudited) | | | 4 | |

| | | | | |

| Condensed Consolidated Statements of Cash Flows (Unaudited) | | | 5 | |

| | | | | |

| Notes to Consolidated Financial Statements (Unaudited) | | | 6 | |

CHINA NEW ENERGY GROUP COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

(Stated in US Dollars)

| | | September 30, | | | December 31, | |

| | | 2009 | | | 2008 | |

| | | (Unaudited) | | | | |

| ASSETS | | | | | | |

| CURRENT ASSETS | | | | | | |

| Cash and cash equivalents | | $ | 4,878,751 | | | $ | 5,612,356 | |

| Restricted cash | | | 196,873 | | | | 221,152 | |

| Accounts receivable | | | 3,925,491 | | | | 2,183,087 | |

| Other receivables | | | 2,159,614 | | | | 2,254,997 | |

| Inventories, net | | | 285,787 | | | | 254,585 | |

| Prepayment | | | 784,953 | | | | 1,558,361 | |

| Other current assets | | | 94,017 | | | | 3,340 | |

| Total current assets | | | 12,325,486 | | | | 12,087,878 | |

| | | | | | | | | |

| Property, plant and equipment, net | | | 7,676,229 | | | | 6,844,262 | |

| Construction in progress | | | 8,447,645 | | | | 5,589,551 | |

| Related party receivable | | | - | | | | 84,120 | |

| Intangible assets | | | 1,804,658 | | | | 1,814,316 | |

| TOTAL ASSETS | | $ | 30,254,018 | | | $ | 26,420,127 | |

| | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Accounts payable | | $ | 276,117 | | | $ | 111,660 | |

| Accrued expenses | | | 277,271 | | | | 256,071 | |

| Accruals and other payable-Third Party | | | 526,837 | | | | 3,144,043 | |

| Tax payable | | | 523,770 | | | | 693,116 | |

| Related party payable | | | 97,888 | | | | - | |

| Dividend payable on preferred stock | | | 744,946 | | | | 194,000 | |

| TOTAL CURRENT LIABILITIES | | | 2,446,829 | | | | 4,398,890 | |

| | | | | | | | | |

| China New Energy's Stockholders' equity: | | | | | | | | |

| Preferred Stock: 10,000,000 shares authorized, $0.001 par value, 2,973,761 and 1,857,373 shares issued and outstanding as of September 30, 2009 and December 31, 2008, respectively | | | 2,973 | | | | 1,857 | |

| Common Stock: 500,000,000 shares authorized, $0.001 par value, 100,000,041 shares issued and outstanding as of September 30,2009 and December 31, 2008, respectively | | | 100,000 | | | | 100,000 | |

| Additional paid in capital | | | 27,269,163 | | | | 19,725,482 | |

| Accumulated (deficit) | | | (2,382,613 | ) | | | (619,357 | ) |

| Statutory surplus reserve fund | | | 1,903,034 | | | | 1,903,034 | |

| Accumulated other comprehensive income | | | 693,939 | | | | 730,168 | |

| Total China New Energy's Stockholders' equity | | | 27,586,496 | | | | 21,841,184 | |

| | | | | | | | | |

| Non-controlling interest | | | 220,693 | | | | 180,053 | |

| TOTAL EQUITY | | | 27,807,189 | | | | 22,021,237 | |

| TOTAL LIABILITIES AND EQUITY | | | 30,254,018 | | | $ | 26,420,127 | |

The accompanying notes are an integral part of these condensed consolidated financial statements

CHINA NEW ENERGY GROUP COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME – (UNAUDITED)

(Stated in US Dollars)

| | | For the Three months ended | | | For the nine months ended | |

| | | September 30, | | | September 30, | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Revenues: | | | | | | | | | | | | |

| Connection services | | $ | 2,659,930 | | | $ | 2,092,445 | | | $ | 5,433,912 | | | $ | 3,846,773 | |

| Natural gas | | | 157,344 | | | | 161,413 | | | | 518,970 | | | | 390,214 | |

| | | | 2,817,274 | | | | 2,253,858 | | | | 5,952,882 | | | | 4,236,987 | |

| Cost of Sales: | | | | | | | | | | | | | | | | |

| Connection services | | | 683,068 | | | | 454,061 | | | | 1,376,630 | | | | 833,644 | |

| Natural gas | | | 367,411 | | | | 121,565 | | | | 649,622 | | | | 295,257 | |

| | | | 1,050,479 | | | | 575,626 | | | | 2,026,252 | | | | 1,128,901 | |

| Gross Profit | | | 1,766,795 | | | | 1,678,232 | | | | 3,926,630 | | | | 3,108,086 | |

| | | | | | | | | | | | | | | | | |

| Operating Expenses: | | | | | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 802,011 | | | | 346,094 | | | | 1,962,698 | | | | 813,975 | |

| | | | | | | | | | | | | | | | | |

| Total operating expenses | | | 802,011 | | | | 346,094 | | | | 1,962,698 | | | | 813,975 | |

| | | | | | | | | | | | | | | | | |

| Operating income | | | 964,784 | | | | 1,332,138 | | | | 1,963,932 | | | | 2,294,111 | |

| | | | | | | | | | | | | | | | | |

| Other Income (Expenses): | | | | | | | | | | | | | | | | |

| Interest Income | | | 10,680 | | | | - | | | | 20,307 | | | | - | |

| Interest (expense) | | | (3,699 | ) | | | - | | | | (4,370 | ) | | | - | |

| Other Income | | | 5,558 | | | | 3,702 | | | | 5,651 | | | | 9,974 | |

| Total other income | | | 12,539 | | | | 3,702 | | | | 21,588 | | | | 9,974 | |

| | | | | | | | | | | | | | | | | |

| Income from continuing operations, before tax | | | 977,323 | | | | 1,335,840 | | | | 1,985,520 | | | | 2,304,085 | |

| | | | | | | | | | | | | | | | | |

| Income Taxes | | | 461,013 | | | | 391,358 | | | | 828,800 | | | | 705,244 | |

| | | | | | | | | | | | | | | | | |

| Income from continuing operations, net of tax | | | 516,310 | | | | 944,482 | | | | 1,156,720 | | | | 1,598,841 | |

| | | | | | | | | | | | | | | | | |

| Income (loss) from discontinued operations, net of tax | | | - | | | | (7,116 | ) | | | - | | | | 223,410 | |

| Net Income | | | 516,310 | | | | 937,366 | | | | 1,156,720 | | | | 1,822,251 | |

| | | | | | | | | | | | | | | | | |

| Net (Income) attributable to non controlling interest | | | (25,104 | ) | | | (37,009 | ) | | | (18,200 | ) | | | (46,277 | ) |

| | | | | | | | | | | | | | | | | |

| Net Income attributable to China New Energy Group | | $ | 491,206 | | | $ | 900,357 | | | $ | 1,138,520 | | | $ | 1,775,974 | |

| | | | | | | | | | | | | | | | | |

| Other Comprehensive income: | | | | | | | | | | | | | | | | |

| Net Income | | | 516,310 | | | | 937,366 | | | | 1,156,720 | | | | 1,822,251 | |

| Foreign currency translation | | | (42,159 | ) | | | 37,114 | | | | (41,854 | ) | | | 377,403 | |

| Comprehensive income attributable to the Non-controlling interest | | | 251 | | | | - | | | | (12,026 | ) | | | - | |

| Comprehensive income attributable to China New Energy Group | | $ | 474,402 | | | $ | 974,480 | | | $ | 1,102,840 | | | $ | 2,199,654 | |

| | | | | | | | | | | | | | | | | |

| Income (Loss) per share – Basic & diluted: | | | | | | | | | | | | | | | | |

| Income (Loss) from continuing operations attributable to the Company's common stockholders | | $ | 0.00 | | | $ | (0.06 | ) | | $ | (0.02 | ) | | $ | (0.05 | ) |

| Discontinued operations attributable to the Company's common stockholders | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Net income (loss) attributable to the Company's common stockholders | | $ | 0.00 | | | $ | (0.06 | ) | | $ | (0.02 | ) | | $ | (0.05 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | | | | | | | | |

| Basic | | | 100,000,041 | | | | 100,000,041 | | | | 100,000,041 | | | | 98,321,560 | |

| Diluted | | | 209,495,669 | | | | 132,839,829 | | | | 200,655,139 | | | | 110,255,834 | |

The accompanying notes are an integral part of these condensed consolidated financial statements

CHINA NEW ENERGY GROUP COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS – (UNAUDITED)

(Stated in US Dollars)

| | | For The Nine Months Ended | |

| | | September 30, | |

| | | 2009 | | | 2008 | |

| Cash flows from operating activities: | | | | | | |

| Net income attributable to China New Energy Group Company | | $ | 1,138,520 | | | $ | 1,775,974 | |

| Income attributable to non-controlling interest | | | 18,200 | | | | 27,371 | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | | | | | | |

| Depreciation | | | 277,476 | | | | 125,592 | |

| Amortization | | | 9,572 | | | | 6,429 | |

| | | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (1,741,568 | ) | | | (374,181 | ) |

| Other receivables | | | 205,909 | | | | (650,954 | ) |

| Inventories | | | (31,228 | ) | | | 174,757 | |

| Prepayment | | | 772,557 | | | | - | |

| Other current assets | | | (90,613 | ) | | | - | |

| Accounts payable | | | 164,360 | | | | (398,948 | ) |

| Accrued expenses | | | 21,251 | | | | - | |

| Accruals and other payable-Third Party | | | (710,835 | ) | | | (790,089 | ) |

| Taxes payable | | | (169,093 | ) | | | (397,601 | ) |

| | | | | | | | | |

| Net cash used in operating activities | | | (135,492 | ) | | | (501,650 | ) |

| | | | | | | | | |

| Cash flows from investing activities | | | | | | | | |

| Addition of construction in progress | | | (2,857,106 | ) | | | (960,375 | ) |

| Addition of fixed assets | | | (1,110,147 | ) | | | (97,692 | ) |

| Payments made to acquire subsidiary | | | (1,838,946 | ) | | | - | |

| Acquisition of an associated company | | | - | | | | 483,512 | |

| | | | | | | |

| Net cash used in investing activities | | | (5,806,199 | ) | | | (574,555 | ) |

| | | | | | | | | |

| Cash flows from financing activities | | | | | | | | |

| Repayment of cash advanced from director | | | - | | | | (210,711 | ) |

| Issued preferred stock | | | 4,752,140 | | | | 9,000,000 | |

| Payment of offering costs associated with preferred stock | | | - | | | | (1,507,144 | ) |

| Contribution from former non-controlling interest | | | 439,060 | | | | - | |

| Loan from related parties | | | 24,279 | | | | - | |

| | | | | | | | | |

| Net cash flows provided by financing activities | | | 5,215,479 | | | | 7,282,145 | |

| | | | | | | | | |

| Effect of exchange rate changes in cash | | | (7,393 | ) | | | (1,308,366 | ) |

| | | | | | | | | |

| Net (decrease) increase in cash | | | (733,605 | ) | | | 4,897,574 | |

| | | | | | | | | |

| Cash- beginning of year | | | 5,612,356 | | | | 2,311,028 | |

| | | | | | | | | |

| Cash- end of year | | $ | 4,878,751 | | | $ | 7,208,602 | |

| | | | | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | | | |

| | | | | | | | | |

| Interest paid in cash | | $ | 4,370 | | | | - | |

| Income taxes paid in cash | | $ | 522,594 | | | | - | |

| | | | | | | | | |

| Supplemental disclosure of non-cash investing and financing activities: | | | | | | | | |

| | | | | | | | | |

| Accrued dividend of preferred stock | | $ | 550,946 | | | | - | |

The accompanying notes are an integral part of these condensed consolidated financial statements

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The financial statements are prepared in accordance with the accounting principles generally accepted in the United States of America (“US GAAP”). This basis differs from that used in the statutory accounts of our subsidiaries in China, which were prepared in accordance with the accounting principles and relevant financial regulations applicable to enterprises in the PRC. All necessary adjustments have been made to present the financial statements in accordance with US GAAP.

The interim condensed consolidated financial statements included herein, presented in accordance with United States generally accepted accounting principles and stated in US dollars, have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to make the information presented not misleading. These statements reflect all adjustments, consisting of normal recurring adjustments, which, in the opinion of management, are necessary for fair presentation of the information contained therein. It is suggested that these interim condensed consolidated financial statements be read in conjunction with the financial statements of the Company for the year ended December 31, 2008 and notes thereto included in the Form 10-K of China New Energy Group Company filed on April 15, 2009. The Company follows the same accounting policies in the preparation of interim reports.

Results of operations for the interim periods are not indicative of annual results.

Going Concern

As shown in accompanying condensed consolidated financial statements, the Company had an accumulated deficit incurred through September 30, 2009, which raise substantial doubt about the Company’s ability to continue as a going concern. The condensed consolidated financial statements do not include any adjustments relating to recoverability and classification of recorded assets, or the amounts and classification of liability that might be necessary in the event the Company cannot continue in existence.

The timing and amount of capital requirements will depend on a number of factors, including demand for products and services and the availability of opportunities for expansion through affiliations and other business relationships. Management intends to seek new capital from new equity securities issuances to provide funds needed to increase liquidity, fund internal growth, and fully implement its business plan.

2. Discontinued operations

Effective September 26, 2008, the Company entered into an asset swap in which it disposed of the subsidiary Hunchun Sing Ocean including substantially all of its assets. In accordance with FASB ASC No. 360, “Accounting for the Impairment of Long-Lived Assets”, Hunchun Sing Ocean operation is being accounted for as discountinued operations and, accordingly, its operating results are segregated and reported as discountinued operations in the accompanying consolidated statement of operations in 2009 and 2008.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

3. Organization and Nature of Business

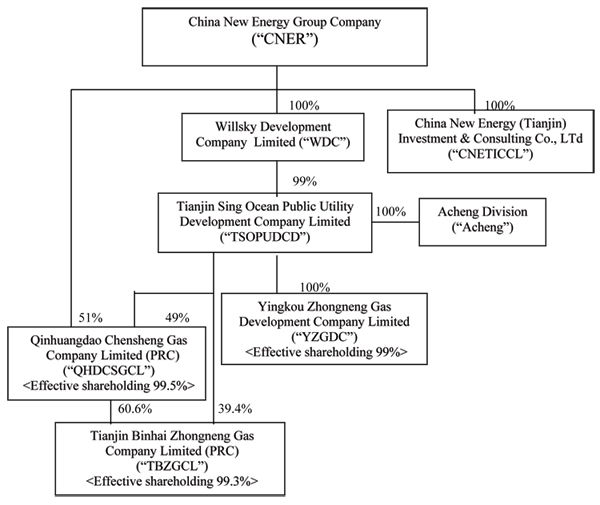

China New Energy Group Company (the “Company”) was incorporated on March 28, 2008 in the state of Delaware USA. The principal activity of the Company is investment holding. Details of the Company’s subsidiaries and its subsidiary’s branch companies and subsidiary (which together with the company are collectively referred to as the “Group”) and their principal activities as of September 30, 2009 were as follows:

| | | | | % of shareholding attributable to the Company |

| Name | | Place of Registration | | Direct | | Indirect | | Effective |

| Willsky Development Ltd. | | BVI | | 100% | | - | | 100% |

| | | | | | | | | |

| China New Energy (Tianjin) Investment & Consulting Co., Ltd (“CNETICCL”) | | The PRC | | 100% | | - | | 100% |

| | | | | | | | | |

Tianjin Sing Ocean Public Utility Development Co. Ltd. (“TSOPUDCD”) | | The PRC | | - | | 99% | | 99% |

| | | | | | | | | |

QinHuangDao ChenSheng Gas Co., Ltd. (“QHDCSGCL”) | | The PRC | | 51% | | 48.5% | | 99.5% |

| | | | | | | | | |

| Yingkou Zhongneng Gas Development Co., Ltd (“YZGDCL”) | | The PRC | | - | | 99% | | 99% |

| | | | | | | | | |

| Tianjin Binhai Zhongneng Gas Co., Ltd. (“TBZGCL”) | | The PRC | | - | | 99.3% | | 99.3% |

Willsky Development LTD. was incorporated on May 31, 2005 in the British Virgin Islands. On March 28, 2008, Travel Hunt Holdings, Inc. completed a reverse acquisition transaction with Willsky Development whereby Travel Hunt Holdings, Inc. issued to the shareholder of Willsky Development 94,908,650 shares of Travel Hunt Holdings, Inc. common stock in exchange for all of the issued and outstanding capital stock of Willsky Development. Simultaneous with the consummation of the share exchange agreement, the shareholder of Willsky, Eternal International Holding Group Ltd, a Hong Kong corporation, or Eternal International, distributed 85,417,785 shares of Travel Hunt Holdings, Inc. common stock as a dividend. Accordingly, following this distribution, Eternal International beneficially owns approximately 9.49% of Travel Hunt Holdings, Inc. outstanding capital stock. Willsky Development thereby became Travel Hunt Holdings, Inc.’s wholly-owned subsidiary and the former shareholders of Willsky Development became Travel Hunt Holdings, Inc. controlling stockholders.

For accounting purposes, the acquisition was accounted for as a recapitalization effected by a share exchange, and the transaction treated as a reverse acquisition with Willsky Development as the acquirer and Travel Hunt Holdings, Inc. as the acquired party. The assets and liabilities of the acquired entity (Willsky) were brought forward at their book value and no goodwill was recognized.

On May 27, 2008, we changed our name from Travel Hunt Holdings, Inc. to China New Energy Group Company.

Tianjin Sing Ocean Public Utility Development Co. Ltd. (“TSOPUDCD”) is an equity joint venture established in the PRC to be operated for a period of 50 years until January 18, 2054. It is a subsidiary of the Company and it’s consolidated into the Company’s financial statements. It has a branch division in Acheng, Tianjin Sing Ocean Public Utility Development Co., Ltd (“TSOPUDCL-AD”) and established in the PRC to be operated for a period of 5 years until December 28, 2010 and 50 years until January 18, 2054.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

3. Organization and Nature of Business - continued

QinHuangDao ChenSheng Gas Co, Ltd. (QHDCSGCL) - On September 16, 2008, we, through our 99%-owned subsidiary Tianjin Sing Ocean Public Utility Development Co., Ltd., entered into an Equity Swap Agreement with Mr. Xiu Hai Tian, whereby we acquired from Mr. Xiu a 49% ownership interest in Chensheng Gas, in exchange for our 99% ownership in Hunchun Sing Ocean. The parties to the Equity Swap Agreement determined that the value of the 49% interest in Chensheng Gas and the 99% interest in Hunchun Sing Ocean were approximately equal and therefore there was no cash or other consideration involved in the transaction from either party.

On December 10, 2008, the Company entered into an Agreement for Equity Transfer with the holders of the remaining 51% outstanding equity in Chensheng Gas. Pursuant to the Agreement for Equity Transfer, the Company agreed to purchase the remaining 51% of the outstanding equity of Chensheng Gas from 17 individuals for an aggregate purchase price of RMB 12.56 million (approximately $1.84 million). The transaction was consummated on December 30, 2008, following which the Company now owns 51% of the equity of Chensheng Gas, and our 99%-owned subsidiary Tianjin Sing Ocean now owns 49% of the equity of Chensheng Gas and therefore, the Group ultimately hold Chensheng 99.5%.

Yingkou Zhongneng Gas Development Co., Ltd (YZGDCL) is a 100% owned subsidiary of our 99%-owned subsidiary Tianjin Sing Ocean Public Utility Development and therefore, the Group ultimately owned 99% of YZGDCL. YZGDCL established in the PRC to operate a natural gas distribution network in the city of Dashiqiao.

China New Energy (Tianjin) Investment & Consulting Co., Ltd (CNETICCL) is a 100% owned subsidiary of the Company and established in the PRC for investment holding purposes.

On June 26, 2009, our 99.5%-owned subsidiary Qinhuangdao Chensheng Gas Co., Ltd. contributed $1,462,501 (RMB10,000,000) in cash in which 60.6% of the shareholding and our 99%-owned subsidiary Sing Ocean contributed $950,626 (RMB6,500,000) in assets in which 39.4% of the shareholding to establish a subsidiary, Tianjin Binhai Zhongneng Gas Co., Ltd. (TBZGCL), in Da Gang District, Tianjin, China, for constructing and developing the gas projects of Private Economic Park and Taiping County in Dagang District, Tianjin. As a result, the group hold 99.3% of the TBZGCL.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

4. Summary of Significant Accounting Policies

(a) Basis of Consolidation

The condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation.

We recognize revenue upon meeting the recognition requirements of Staff Accounting Bulletin (“SAB”) No. 104, Revenue Recognition. Natural gas revenues are recorded based on the amount of product delivered to customers through pipelines and checked by gas meters.

Connection fees, which relate to the hookup from the street pipeline to the customer, are charged to both residential and commercial customers. This revenue segment accounts for a majority of the Company’s revenue. The connection fees are recognized as revenue upon the completion of the jobs by the contractor, the installation being checked and accepted by the Company’s technical staff, and acceptance by the customer.

The accompanying financial statements are presented in United States dollars. The functional currency of the Company is US$, the functional currency of Willsky Development Ltd is HK$, and the functional currency of all the PRC subsidiaries is Renminbi (RMB). The Company’s consolidated balance sheet accounts are translated into U.S. dollars at the year-end exchange rates and all revenue and expenses are translated into U.S. dollars at the average exchange rates prevailing during the periods in which these items arise. Translation gains and losses are deferred and accumulated as a component of other comprehensive income in stockholders’ equity. Transaction gains and losses that arise from exchange rate fluctuations from transactions denominated in a currency other than the functional currency are included in the statement of operations as incurred. The translation and transaction gains and losses were immaterial for the nine months ended September 30, 2009 and 2008.

The PRC government imposes significant exchange restrictions on fund transfers out of the PRC that are not related to business operations. These restrictions have not had a material impact on the Company because it has not engaged in any significant transactions that are subject to the restrictions.

(d) Use of Estimates

In preparing consolidated financial statements in conformity with US GAAP, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported periods.

(e) Reclassifications

Certain prior year amounts on the financial statements have been reclassified to conform to current classifications. Such reclassifications had no effect on net income (loss).

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

4. Summary of Significant Accounting Policies - continued

(f) Recently Issued Accounting Guidance

Effective July 1, 2009, the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) became the single official source of authoritative, nongovernmental generally accepted accounting principles (“GAAP”) in the United States. The historical GAAP hierarchy was eliminated and the ASC became the only level of authoritative GAAP, other than guidance issued by the Securities and Exchange Commission. Our accounting policies were not affected by the conversion to ASC.

In June 2009, the Financial Accounting Standards Board ("FASB") amended its guidance on accounting for variable interest entities ("VIE"). The new accounting guidance will result in a change in our accounting policy effective January 1, 2010. Among other things, the new guidance requires a qualitative rather than a quantitative analysis to determine the primary beneficiary of a VIE; requires continuous assessments of whether an enterprise is the primary beneficiary of a VIE; enhances disclosures about an enterprise's involvement with a VIE; and amends certain guidance for determining whether an entity is a VIE. Under the new guidance, a VIE must be consolidated if the enterprise has both (a) the power to direct the activities of the VIE that most significantly impact the entity's economic performance, and (b) the obligation to absorb losses or the right to receive benefits from the VIE that could potentially be significant to the VIE. The Company is evaluating the impact that this change in accounting policy will have on our consolidated financial statements. Based on our initial assessment, we anticipate that certain entities that are consolidated under our current accounting policy may not be consolidated subsequent to the effective date of the new guidance. The Company does not expect this change in accounting policy to have a material impact on our consolidated financial statements.

In June 2009, the FASB issued an amendment to the accounting and disclosure requirements for transfers of financial assets. The guidance requires additional disclosures for transfers of financial assets and changes the requirements for derecognizing financial assets. The guidance is effective for fiscal years beginning after November 15, 2009. The Company is currently assessing the impact of the guidance on its consolidated financial position and results of operations.

In October 2009, the FASB issued amendments to the accounting and disclosure for revenue recognition. These amendments, effective for fiscal years beginning on or after June 15, 2010 (early adoption is permitted), modify the criteria for recognizing revenue in multiple element arrangements and the scope of what constitutes a non-software deliverable. The Company is currently assessing the impact on its consolidated financial position and results of operations.

No other new accounting pronouncements, applicable to the Company, have been issued.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Basic earnings per share is computed by dividing income available to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted earnings per share reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock, or resulted in the issuance of common stock that shared in the earnings of the entity.

Components of basic and diluted earnings per share were as follows:

| | | For the three months ended | | | For the nine months ended | |

| | | September 30 | | | September 30 | | | September 30 | | | September 30 | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Numerator for basic and diluted EPS: | | | | | | | | | | | | |

| Net Income attributable to China New Energy Group | | $ | 491,206 | | | $ | 900,357 | | | $ | 1,138,520 | | | $ | 1,775,974 | |

| | | | | | | | | | | | | | | | | |

| Deemed dividend on Preferred stock issued | | | - | | | | (7,031,818 | ) | | | (2,350,829 | ) | | | (7,031,818 | ) |

| Dividend on Preferred stock | | | (226,946 | ) | | | (59,000 | ) | | | (550,946 | ) | | | (59,000 | ) |

| | | | | | | | | | | | | | | | | |

| Net income (loss) attributed to common stockholders | | | 264,260 | | | | (6,190,461 | ) | | | (1,763,255 | ) | | | (5,314,844 | ) |

| | | | | | | | | | | | | | | | | |

| Denominator for basic and diluted EPS: | | | | | | | | | | | | | | | | |

| Weighted average shares of common stock outstanding | | | 100,000,041 | | | | 100,000,041 | | | | 100,000,041 | | | | 98,321,560 | |

| Weighted average shares of preferred stock outstanding | | | 104,081,635 | | | | 29,677,590 | | | | 86,906,435 | | | | 9,964,738 | |

| Dilutive effect of options, warrants, and contingently issuable shares | | | 5,413,993 | | | | 3,162,198 | | | | 13,748,663 | | | | 1,969,535 | |

| Common stock and common stock equivalents | | | 209,495,669 | | | | 132,839,829 | | | | 200,655,139 | | | | 110,255,833 | |

| | | | | | | | | | | | | | | | | |

| Earnings per share: | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.00 | | | $ | (0.06 | ) | | $ | (0.02 | ) | | $ | (0.05 | ) |

| Diluted | | $ | 0.00 | | | $ | (0.06 | ) | | $ | (0.02 | ) | | $ | (0.05 | ) |

For the three months and nine months ended September 30, 2009 and 2008, no potential common shares are included in the computation of any diluted per-share amount because it results in an anti-dilutive effect.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Inventories consist of the following:

| | | September 30 | | | December 31 | |

| | | 2009 | | | 2008 | |

| Raw materials | | $ | 285,787 | | | $ | 254,585 | |

| Work in progress | | | - | | | | - | |

| Finished goods | | | - | | | | - | |

| | | | | | | | | |

| | | $ | 285,787 | | | $ | 254,585 | |

7. Plant and Equipment, net

| | | September 30, | | | December 31, | |

| | | 2009 | | | 2008 | |

| At cost | | | | | | |

| Office equipment | | $ | 101,359 | | | $ | 33,893 | |

| Motor vehicles | | | 279,948 | | | | 187,137 | |

| Gas transportation vehicles | | | 424,856 | | | | 424,937 | |

| Gas station | | | 2,263,850 | | | | 2,102,612 | |

| Underground gas pipelines | | | 5,511,610 | | | | 4,723,520 | |

| | | | 8,581,623 | | | | 7,472,099 | |

| | | | | | | | | |

| Less: accumulated depreciation | | | (905,394 | ) | | | (627,837 | ) |

| | | | | | | | | |

| | | $ | 7,676,229 | | | $ | 6,844,262 | |

The gas pipelines, gas station, and other constructed assets belong to the Company, not to the municipalities or other units that contract with the Company to provide the hookups and the gas distribution to the households. Depreciation is provided for these assets as they are used in operations.

The Company recorded the depreciation of office equipment and motor vehicles under general and administrative expenses, and the depreciation of gas transportation vehicles, gas station and underground gas pipelines under the cost of sales.

Depreciation expense for the nine months ended September 30, 2009 and 2008 was $277,476 and $125,592 respectively.

Depreciation expenses for the three months ended September 30, 2009 and 2008 was $97,289 and $42,526 respectively.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

8. Intangible Assets, net

| | | September 30, | | | December 31, | |

| | | 2009 | | | 2008 | |

| At cost | | | | | | |

| Land use rights | | $ | 587,316 | | | $ | 587,429 | |

| Goodwill | | | 1,263,518 | | | | 1,263,491 | |

| | | | 1,850,834 | | | | 1,850,920 | |

| | | | | | | | | |

| Less: accumulated amortization | | | (46,176 | ) | | | (36,604 | ) |

| | | | | | | | | |

| | | $ | 1,804,658 | | | $ | 1,814,316 | |

Amortization expense for the nine months ended September 30, 2009 and 2008 was $9,572 and $6,429, respectively.

Amortization expense for the three months ended September 30, 2009 and 2008 was $3,180 and $2,172, respectively

Estimated amortization for the next five years and thereafter is as follows:

| Remainder of 2009 | | $ | 3,191 | |

| 2010 | | | 12,765 | |

| 2011 | | | 12,765 | |

| 2012 | | | 12,765 | |

| 2013 | | | 12,765 | |

| Thereafter | | | 486,889 | |

| | | | | |

| Total | | $ | 541,140 | |

At September 30, 2009 and December 31, 2008, restricted cash of $196,873 and $221,152 respectively represented the cash held by Escrow agent for the expenses relating to investor and public relations.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The Company, its subsidiary and branch divisions are subject to income taxes on an entity basis on income arising in, or derived, from the tax jurisdiction in which they operated. As the Company had no income generated in the United States, there was no tax expense or tax liability due to the Internal Revenue Service of the United States as of September 30, 2009. A subsidiary of the Company was incorporated under the international Business Companies Act of the British Virgin Islands and, accordingly is exempted from payment of British Virgin Islands income taxes. Pursuant to the PRC Income Tax Laws, the prevailing statutory rate of enterprise income tax is 25% for TSOPUDCD, YZGDCL, and CNETICCL, whereas QHDCSGCL is being taxed on 1% of its gross sales for the first half of year 2009 and 25% on net income started from July, 2009 and 0.8% of it gross sales for the year of 2008.

The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of FASB ASC No. 740.10. The income tax expense was $828,800 and $705,244 for the nine months ended September 30, 2009 and 2008, respectively. The Company has recorded no deferred tax assets or liabilities as of September 30, 2009 and 2008, since the management intends to maintain a full valuation allowance.

| | | For The Three Months Ended | | | For The Nine Months Ended | |

| | | September 30, | | | September 30, | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Current tax | | $ | 461,013 | | | $ | 391,358 | | | $ | 828,800 | | | $ | 705,244 | |

| Change in deferred tax assets-NOL | | | 205,514 | | | | 57,398 | | | | 397,124 | | | | 129,223 | |

| Change in deferred tax assets | | | 11,168 | | | | - | | | | 8,237 | | | | - | |

| Change in valuation allowance | | | (216,682 | ) | | | (57,398 | ) | | | (405,361 | ) | | | (129,223 | ) |

| | | | | | | | | | | | | | | | | |

| Total | | $ | 461,013 | | | $ | 391,358 | | | $ | 828,800 | | | $ | 705,244 | |

All of the Company’s income before income taxes is from PRC sources. Actual income tax expenses reported in the consolidated statements of income and comprehensive income differ from the amounts computed by applying the PRC statutory income tax rate of 25% for the fiscal year of 2009 and 2008 respectively to income before income taxes for the three and nine months ended September 30, 2009 and 2008 for the following reasons:

| | | For The Three Months Ended | | | For The Nine Months Ended | |

| | | September 30, | | | September 30, | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Profit before income taxes | | $ | 977,323 | | | $ | 1,335,840 | | | $ | 1,985,520 | | | $ | 2,304,085 | |

| | | | | | | | | | | | | | | | | |

| Computed “expected” income tax expense at 25% | | | 244,331 | | | | 333,960 | | | | 496,380 | | | | 576,021 | |

| Income tax expense taxed on QHDCSGCL at 1% of gross sales | | | - | | | | - | | | | (72,941 | ) | | | - | |

| Tax effect on net taxable temporary differences | | | 11,168 | | | | - | | | | 8,237 | | | | - | |

| Effect of cumulative tax losses | | | 205,514 | | | | 57,398 | | | | 397,124 | | | | 129,223 | |

| | | | | | | | | | | | | | | | |

| | | $ | 461,013 | | | $ | 391,358 | | | $ | 828,800 | | | $ | 705,244 | |

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

11. Related Party Transactions

As of September 30, 2009 and December 31, 2008, the Group has the following balances with related parties:

| | | September 30, | | | December 31, | |

| | | 2009 | | | 2008 | |

| | | | | | | |

| Tianjin Huanlong Commercial and Trading Company, shareholder of the subsidiary | | $ | (97,888 | ) | | $ | - | |

| Qu Qiangxi, ex-shareholder of the subsidiary | | | - | | | | 84,120 | |

| | | | | | | | | |

| | | $ | (97,888 | ) | | $ | 84,120 | |

The balances have no stated terms for repayment and are not interest bearing.

12. Concentrations and Credit Risk

The Group operates principally in the PRC and grants credit to its customers in this geographic region. Although the PRC is economically stable, it is always possible that unanticipated events in foreign countries could disrupt the Company's operations. Financial instruments that potentially subject the Group to a concentration of credit risk consist of cash and accounts receivable.

For the nine months period ended September 30, 2009 and 2008, one customer accounted for approximately 12% and four customers accounted for approximately 57% of the Company’s sales respectively.

For the three months period ended September 30, 2009 and 2008, three customers accounted for approximately 46% and five customers accounted for approximately 76% of the Company’s sales respectively.

At September 30, 2009, two major customers accounted for 14% and 13% of net accounts receivable respectively. At December 31, 2008, two major customers accounted for 19% and 11% of net accounts receivable respectively.

At September 30, 2009, three major suppliers accounted for 53%, 12% and 11% of net accounts payable respectively. At December 31, 2008, two major suppliers accounted for 49% and 12% of net accounts payable respectively.

The Company does not require collateral to support financial instruments that are subject to credit risk.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

13. Commitments and Contingencies

Operating Leases - In the normal course of business, the Company leases the property under operating lease agreements. The Company rents property for offices space. The operating lease agreements generally contain renewal options that may be exercised at the Company’s discretion after the completion of the base rental terms. The Company was obligated under operating leases requiring minimum rentals as follows:

| As of September 30, | | | |

| | | | |

| Remainder of 2009 | | $ | 43,329 | |

| 2010 | | | 141,678 | |

| 2011 | | | - | |

| 2012 | | | - | |

| 2013 | | | - | |

| Thereafter | | | - | |

| | | | | |

| Total minimum lease payments | | $ | 185,007 | |

During the nine months ended September 30, 2009 and 2008, rental expenses included in general and administrative expenses were $102,409 and $8,214, respectively.

During the three months ended September 30, 2009 and 2008, rental expenses included in general and administrative expenses were $39,816 and $0, respectively.

As of September 30, 2009, the Company did not have any contingent liabilities.

The Company is obligated to provide uninterrupted piped gas to connected users and to ensure the safety in the process of piped gas operations. The volume of gas to be supplied by the Company will grow with the increase of gas users. The Company has selected three qualified gas resource suppliers to ensure the stable operation to meet its obligation.

Deposits in banks in the PRC are not insured by any government entity or agency, and are consequently exposed to risk of loss. Management believes the probability of a bank failure, causing loss to the Company, is remote.

14. Environmental Matters

The Company does not anticipate any material future cash requirements to environmental issues. If circumstances change, the Company will record the estimated charges to return the sites to their original condition.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

15. Business and geographical segments

The Company’s operations are classified into two principal reportable segments which are provision of gas pipe connection services and provision of natural gas. Separate management of each segment is required because each business unit is subject to different production and technology strategies .

Reportable Segments

| | | For the nine months ended September 30, 2009 | | | For the nine months ended September 30, 2008 | | | For the nine months ended September 30 | |

| | | Connection | | | Natural | | | | | | Connection | | | Natural | | | | | | 2009 | | | 2008 | |

| | | services | | | gas | | | Corporate | | | services | | | gas | | | Corporate | | | Total | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| External revenue | | $ | 5,433,912 | | | | 518,970 | | | | - | | | | 3,846,773 | | | | 390,214 | | | | - | | | | 5,952,882 | | | | 4,236,987 | |

| Interest income | | | 20,307 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 20,307 | | | | - | |

| Interest expense | | | (4,370 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (4,370 | ) | | | - | |

| Depreciation and amortization | | | 31,318 | | | | 255,730 | | | | - | | | | 125,592 | | | | 6,429 | | | | - | | | | 287,048 | | | | 132,021 | |

| Net profit/(loss) after tax | | | 4,073,220 | | | | (201,135 | ) | | | (2,715,365 | ) | | | 3,059,406 | | | | (37,064 | ) | | | (1,200,091 | ) | | | 1,156,720 | | | | 1,822,251 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenditures for long-lived assets | | | 3,967,253 | | | | - | | | | - | | | | 1,058,067 | | | | - | | | | - | | | | 3,967,253 | | | | 1,058,067 | |

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

15. Business and geographical segments - continued

Reportable Segments

| | | For the three months ended September 30, 2009 | | | For the three months ended September 30, 2008 | | | For the three months ended September 30 | |

| | | Connection | | | Natural | | | | | | Connection | | | Natural | | | | | | 2009 | | | 2008 | |

| | | services | | | gas | | | Corporate | | | services | | | gas | | | Corporate | | | Total | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| External revenue | | $ | 2,659,930 | | | | 157,344 | | | | - | | | | 2,092,445 | | | | 161,413 | | | | - | | | | 2,817,274 | | | | 2,253,858 | |

| Interest income | | | 10,680 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 10,680 | | | | - | |

| Interest expense | | | (3,699 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (3,699 | ) | | | - | |

| Depreciation and amortization | | | 31,318 | | | | 69,151 | | | | - | | | | 125,592 | | | | (80,894 | ) | | | - | | | | 100,469 | | | | 44,698 | |

| Net profit/(loss) after tax | | | 2,153,098 | | | | (7,031 | ) | | | (1,629,757 | ) | | | 1,878,198 | | | | (116,817 | ) | | | (824,015 | ) | | | 516,310 | | | | 937,366 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenditures for long-lived assets | | | 367,571 | | | | - | | | | - | | | | 409,260 | | | | - | | | | - | | | | 367,571 | | | | 409,260 | |

| | | As at September 30, 2009 | | | As at December 31, 2008 | | | As at September 30, | | | As at December 31, | |

| | | Connection | | | Natural | | | | | | Connection | | | Natural | | | | | | 2009 | | | 2008 | |

| | | services | | | gas | | | Corporate | | | services | | | gas | | | Corporate | | | Total | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Assets | | | 15,724,243 | | | | 8,229,739 | | | | 6,300,036 | | | | 13,930,906 | | | | 7,395,087 | | | | 5,094,134 | | | | 30,254,018 | | | | 26,420,127 | |

The Company’s operations are located in the PRC. All revenue is from customers in the PRC. All of the company’s assets are located in the PRC. Accordingly, no analysis of the Company’s sales and assets by geographical market is presented.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

16. Issuance of Series B Convertible Preferred Stock Securities Purchase Agreement

On April 30, 2009, China New Energy Group Company (the “Company”) entered into a Series B Convertible Preferred Stock Securities Purchase Agreement (the “SPA”) with China Hand Fund I L.P. (“China Hand”).

Pursuant to the SPA, on May 1, 2009, the Company issued and sold to China Hand, and China Hand purchased from the Company, 1,116,388 shares of the Company’s Series B Convertible Preferred Stock (“Series B Preferred Stock”) and warrants (the “Warrants”) to purchase 7,814,719 shares of its Common Stock at an initial exercise price of $0.187 per share (subject to adjustments) for a period of five (5) years following the date of issuance for an aggregate purchase price of $5,400,000 (the “Private Placement”).

Kuhns Brothers Securities Corporation (“Kuhns Brothers”) acted as placement agent in connection with the Private Placement. As compensation for its services, Kuhns Brothers received a cash fee equal to $540,000, representing 10% of the gross proceeds received from the Private Placement, as well as warrants to purchase 3,907,358 shares of the Company’s Common Stock (the “Agent Warrants”), representing 10% the aggregate number of shares of common stock issuable to China Hand in the Private Placement upon conversion of the Preferred Stock.

In connection with the signing of the SPA, on April 30, 2009, the Company also entered into a Closing Escrow Agreement by and among the Company, China Hand and Escrow LLC (the “Escrow Agent”), pursuant to which China Hand agreed to deposit all funds due to the Company under the SPA in escrow until such time as all closing conditions of the SPA have been satisfied and the Escrow Agent shall have received notice, executed by both the Company and China Hand, instructing the Escrow Agent to release such funds to the Company. The Closing Escrow Agreement terminates upon the release of all funds from escrow as described above, or upon the 90th day following the date of the Closing Escrow Agreement if no such instruction to disburse funds is received by the Escrow Agent, on which date all such funds will be returned to China Hand. In May, the Company received all the funds amounting to $5,400,000 from the Escrow Agent.

Make Good Provision

Additionally, the Company agreed to make good provisions that will require the Company to issue to China Hand up to 334,916 additional shares (the “Make Good Shares”) of its Series B Preferred Stock if it does not achieve an audited after-tax net income of $5.0 million for the year ending December 31, 2009 (the “2009 Income Target”); if the Company is successful in achieving the 2009 Income Target, China Hand will transfer 22,327 shares of its Series B Preferred Stock to certain members of the Company’s management, which shares have been deposited into an escrow account. The Company also agreed to issue to China Hand 27,910 shares of Series B Preferred Stock if the Company’s Common Stock is not listed for trading on a national securities exchange on or before January 31, 2010 (the “Listing Shares”).

Amendment and Restatement of Certain Registration Rights

In connection with the closing of the Private Placement, the Company and China Hand amended and restated that certain registration rights agreement between the Company and China Hand dated August 20, 2008. Pursuant to the Amended and Restated Registration Rights Agreement (the “Amended and Restated Registration Rights Agreement”), among other things, the Company agreed to register all of the shares of common stock underlying the securities issued to China Hand in the Private Placement, as well as the private placement that was consummated on August 20, 2008 (collectively, the “Shares”) within a pre-defined period. Under the terms of the Amended and Restated Registration Rights Agreement, the Company is obligated to file a registration statement (the “Registration Statement”) under the Securities Act of 1933 covering the resale of the Shares by May 30, 2009. The Company is subject to registration delay payments in amounts prescribed by the Amended and Restated Registration Rights Agreement if it is unable to file the Registration Statement, cause it to become effective or maintain its effectiveness as required by the Amended and Restated Registration Rights Agreement. Registration delay payments will accrue at a rate of $54,000 per month or one percent (1%) of the gross proceeds of the Private Placement; provided that the maximum aggregate amount of the registration delay payments pursuant to the Amended and Restated Registration Rights Agreement is $810,000, or fifteen percent (15%) of the gross proceeds of the Private Placement. Subsequently, the Company signed a wavier agreement with China Hand on April 30, 2009 which waived the above terms and conditions.

CHINA NEW ENERGY GROUP COMPANY

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The Company evaluated subsequent events through the time of filing this Quarterly Report on Form 10-Q on November 16,. 2009. No significant events occurred subsequent to the balance sheet date but prior to the filing of this report that would have a material impact on our Condensed Consolidated Financial Statements.

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

Special Note Regarding Forward Looking Statements

This Quarterly Report on Form 10-Q, including the following “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements that are based on the beliefs of our management, and involve risks and uncertainties, as well as assumptions, that, if they ever materialize or prove incorrect, could cause actual results to differ materially from those expressed or implied by such forward-looking statements. The words “believe,” “expect,” “anticipate,” “project,” “targets,” “optimistic,” “intend,” “aim,” “will” or similar expressions are intended to identify forward-looking statements. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including statements regarding new and existing products, technologies and opportunities; statements regarding market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China; any statements of belief or intention; any of the factors and risks mentioned in the “Risk Factors” sections of our Annual Report on Form 10-K filed with the Securities and Exchange Commission on April 15, 2009, and any statements of assumptions underlying any of the foregoing. All forward-looking statements included in this report are based on information available to us on the date of this report. We assume no obligation and do not intend to update these forward-looking statements, except as required by law.

Use of Terms

Except as otherwise indicated by the context, all references in this Quarterly Report to (i) “China New Energy,” the “Company,” “we,” “us” or “our” are references to China New Energy Group Company and its wholly-owned subsidiaries, Willsky Development, Ltd., or Willsky Development, Tianjin SingOcean Public Utility Development Co., Ltd., or SingOcean, Qinhuangdao Chensheng Gas Co. Ltd., or Chensheng Gas, Tianjin SingOcean Public Utility Development Co., Ltd. - Acheng Division, or Acheng SingOcean, Yingkou Zhongneng Gas Development Co., Ltd., or Yingkou Zhongneng (formerly Tianjin SingOcean Public Utility Development Co., Ltd. - Dashiqiao Division, or Dashiqiao SingOcean), and China New Energy (Tianjin) Investment and Consulting Co., Ltd, or Tianjin CNE, and Tianjin Binhai Zhongneng Gas Company, or Binhai Zhongneng, but do not include the stockholders of China New Energy; (ii) “SEC” are to the Securities and Exchange Commission; (iii) “Securities Act” are to the Securities Act of 1933, as amended; (iv) “Exchange Act” are to the Securities Exchange Act of 1934, as amended; (v) “RMB” are to Renminbi, the legal currency of China; (vi) “U.S. dollar,” “$” and “US$” are to the legal currency of the United States; (vii) “BVI” are to the British Virgin Islands; and (viii) “China” and “PRC” are to the People’s Republic of China.

Overview of Our Business

We are a natural gas company engaged in the development of natural gas distribution networks, and the distribution of natural gas to residential, industrial and commercial customers in small and medium sized cities in China.

We currently own the exclusive rights to develop distribution networks to provide natural gas to industrial, commercial and residential consumers in the cities of Dashiqiao, Acheng and Nandaihe. Currently, these distribution networks provide natural gas to an aggregate of approximately 61,000 consumers in these cities.

We procure our natural gas by purchasing natural gas from third-party suppliers. Once natural gas is extracted by the supplier, all water content and impurities are removed. Natural gas is then delivered by truck to either (1) our natural gas supply stations, where the gas is either depressurized and then delivered to households through pipelines or delivered directly to customers in pressurized tanks, or (2) to gas stations where the gas is sold for use in motor vehicles.

Our major business activities include development and construction of local gas distribution networks, transportation of natural gas from suppliers to our storage facilities in a given operational location, and operating and maintaining the gas distribution networks.

Our Current Organizational Structure

Willsky Development LTD. was incorporated on May 31, 2005 in the British Virgin Islands. On March 28, 2008, Travel Hunt Holdings, Inc. completed a reverse acquisition transaction with Willsky Development whereby Travel Hunt Holdings, Inc. issued to the shareholder of Willsky Development 94,908,650 shares of Travel Hunt Holdings, Inc. common stock in exchange for all of the issued and outstanding capital stock of Willsky Development. Simultaneous with the consummation of the share exchange agreement, the shareholder of Willsky, Eternal International Holding Group Ltd, a Hong Kong corporation, or Eternal International, distributed 85,417,785 shares of Travel Hunt Holdings, Inc. common stock as a dividend. Accordingly, following this distribution, Eternal International beneficially owns approximately 9.49% of Travel Hunt Holdings, Inc. outstanding capital stock. Willsky Development thereby became Travel Hunt Holdings, Inc.’s wholly-owned subsidiary and the former shareholders of Willsky Development became Travel Hunt Holdings, Inc. controlling stockholders.

For accounting purposes, the acquisition was accounted for as a recapitalization effected by a share exchange, and the transaction treated as a reverse acquisition with Willsky Development as the acquirer and Travel Hunt Holdings, Inc. as the acquired party. The assets and liabilities of the acquired entity (Willsky) were brought forward at their book value and no goodwill was recognized.

On May 27, 2008, we changed our name from Travel Hunt Holdings, Inc. to China New Energy Group Company.

Tianjin Sing Ocean Public Utility Development Co. Ltd. (“TSOPUDCD”) is an equity joint venture established in the PRC to be operated for a period of 50 years until January 18, 2054. It is a subsidiary of the Company and it’s consolidated into the Company’s financial statements. It has a branch division in Acheng, Tianjin Sing Ocean Public Utility Development Co., Ltd (“TSOPUDCL-AD”) and established in the PRC to be operated for a period of 5 years until December 28, 2010 and 50 years until January 18, 2054.

QinHuangDao ChenSheng Gas Co, Ltd. (QHDCSGCL) - On September 16, 2008, we, through our 99%-owned subsidiary Tianjin Sing Ocean Public Utility Development Co., Ltd., entered into an Equity Swap Agreement with Mr. Xiu Hai Tian, whereby we acquired from Mr. Xiu a 49% ownership interest in Chensheng Gas, in exchange for our 99% ownership in Hunchun Sing Ocean. The parties to the Equity Swap Agreement determined that the value of the 49% interest in Chensheng Gas and the 99% interest in Hunchun Sing Ocean were approximately equal and therefore there was no cash or other consideration involved in the transaction from either party.

On December 10, 2008, the Company entered into an Agreement for Equity Transfer with the holders of the remaining 51% outstanding equity in Chensheng Gas. Pursuant to the Agreement for Equity Transfer, the Company agreed to purchase the remaining 51% of the outstanding equity of Chensheng Gas from 17 individuals for an aggregate purchase price of RMB 12.56 million (approximately $1.84 million). The transaction was consummated on December 30, 2008, following which the Company now owns 51% of the equity of Chensheng Gas, and Tianjin Sing Ocean now owns 49% of the equity of Chensheng Gas.

Yingkou Zhongneng Gas Development Co., Ltd (YZGDCL) is a subsidiary of the Company and established in the PRC to operate a natural gas distribution network in the city of Dashiqiao.

China New Energy (Tianjin) Investment & Consulting Co., Ltd (CNETICCL) is a subsidiary of the Company and established in the PRC for investment holding purposes.

On June 26, 2009, our subsidiary, Qinhuangdao Chensheng Gas Co., Ltd. and Sing Ocean contributed $1,462,501 (RMB10,000,000) in cash and $950,626 (RMB6,500,000) in assets respectively to establish a wholly-owned subsidiary, Tianjin Binhai Zhongneng Gas Co., Ltd., in Da Gang District, Tianjin, China, for constructing and developing the gas projects of Private Economic Park and Taiping County in Dagang District, Tianjin.

The following chart reflects our organizational structure as of the date of this report.

Reportable Operating Segments

For the nine months ended September 30, 2009, we had sales revenue of $5.95 million of which $5.43 MM or 91% was from connection services while $0.52 million or 9% was from gas sales.

Our revenue for the nine months ended September 30, 2009, is mainly contributed by the connection services segment as the company concentrates our efforts to provide our services to property developers. Thus, the gas consumption will begin when the properties are sold in the market. Currently, the volume of gas sales to connected households is not high. This phenomenon does affect our revenue structure.

Third Quarter Financial Performance Highlights

The following are some financial highlights for the three months ended September 30, 2009:

| | · | Revenues: Our revenues were approximately $2.82 MM for the three months ended September 30, 2009, an increase of 25% from the same period of 2008. |

| | · | Gross Margin: Gross margin was 63% for the three months ended September 30, 2009, compared to gross margin of 74 % for the three months ended Septembetr 30, 2008 representing a straight decrease of 11% or a percentage increase of 5% for the same period in 2008. |

| | · | Operating Expense: Operating expense (including selling, general and administrative expense) was $0.80 MM for the three months ended September 30, 2009, an increase of 132% from the same period of 2008. |

| | · | Net Income: Net income was approximately $0.492 MM for the three months ended September 30, 2009, a decrease of 45% from the same period of 2008. |

| | · | Fully diluted net income per share: Fully diluted net income per share was $0.01 for the three months ended September 30, 2009, as compared to net loss per share $0.06 for the same period of 2008. |

Taxation

As a Delaware company, the Company is subject to United States taxation, but no provision for income taxes was made for the nine months ended September 30, 2009 and 2008 as the Company did not have reportable taxable income for the period.

Willsky Development Company, a wholly-owned subsidiary of the Company, is subject to BVI taxation, but no provision for income taxes was made for the nine months ended September 30, 2009 and 2008 as Willsky Development Company did not have reportable taxable income for the period.

China New Energy (Tianjin) Investment & Consulting Co.,Ltd is subject to the tax laws of the PRC at the prevailing statutory rate of enterprise income tax of 25%.

Tianjin Sing Ocean Public Utility Development Company is subject to the tax laws of the PRC at the prevailing statutory rate of enterprise income tax of 25%.

Acheng is a division of Tianjin Sing Ocean Public Utility Development Company: thus, it is not subject to separate statutory income tax.

Yingkou Zhongneng Gas Development Company is subject to the tax laws of the PRC, the prevailing statutory rate of enterprise income tax is 25%.

Qinhuangdao Chensheng Gas Company is subject to the tax laws of the PRC being taxed on 0.8% of annual sales. Starting from January 1, 2009, the tax rate was changed to 1% on annual sales. It was further amended and effective on July 1, 2009, the tax rate was changed to 25% on net income.

Tianjin Binhai Zhongneng Gas Company is subject to the tax laws of the PRC at the prevailing statutory rate of enterprise income tax of 25%.

On April 22, 2009, the State Administration of Taxation issued the Notice Concerning Relevant Issues Regarding Cognizance of Chinese Investment Controlled Enterprises Incorporated Offshore as Resident Enterprises pursuant to Criteria of de facto Management Bodies, or the Notice, further interpreting the application of the New EIT Law and its implementation with respect to non-Chinese enterprises or group controlled offshore entities. Pursuant to the Notice, an enterprise incorporated in an offshore jurisdiction and controlled by a Chinese enterprise or group will be classified as a “non-domestically incorporated resident enterprise” if (i) its senior management in charge of daily operations reside or perform their duties mainly in China; (ii) its financial or personnel decisions are made or approved by bodies or persons in China; (iii) its main properties, accounting books, corporate seal, board and shareholder minutes are kept in China; and (iv) directors with voting rights or senior management often reside in China. Such resident enterprise would be subject to an EIT rate of 25% on its worldwide income and must pay a withholding tax at a rate of 10% when paying dividends to its non-PRC shareholders. However, it remains unclear as to whether the Notice is applicable to an offshore enterprise incorporated by a Chinese natural person. Nor are detailed measures available on the imposition of tax on non-domestically incorporated resident enterprises. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

However, as our case substantially meets the foregoing criteria, there is a likelihood that we are deemed to be a resident enterprise by Chinese tax authorities. If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as subject to PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on financing proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its Implementing Rules dividends paid to us from our PRC subsidiaries would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares. We are actively monitoring the possibility of “resident enterprise” treatment and are evaluating appropriate organizational changes to avoid this treatment, to the extent possible.

Results of Operations

Comparison of Three Months Ended September 30, 2009 and September 30, 2008

The following table summarizes the results of our operations during the three-month periods ended September 30, 2009 and 2008, and provides information regarding the dollar and percentage increase or (decrease) from the three-month period ended September 30, 2008 to the three-month period ended September 30, 2009.

(All amounts, other than percentages, in thousands of U.S. dollars)

| | | Three Months Ended September 30, 2009 | | | Three Months Ended September 30, 2008 | | | Percentage Change Increase (Decrease) | |

| Revenues | | $ | 2,817 | | | | 2,254 | | | | 25 | % |

| | | | | | | | | | | | | |

| Cost of Sales | | | 1,050 | | | | 576 | | | | 82 | % |

| | | | | | | | | | | | | |

| Gross Profit | | | 1,767 | | | | 1,678 | | | | 5 | % |

| | | | | | | | | | | | | |

| Selling, General &Administrative Expenses | | | 802 | | | | 346 | | | | 132 | % |

| | | | | | | | | | | | | |

| Operating Income | | | 965 | | | | 1,332 | | | | (28 | )% |

| | | | | | | | | | | | | |

| Other Income and (Expenses) | | | | | | | | | | | | |

| Interest income | | | 11 | | | | - | | | | - | |

| Interest (Expense) | | | (4 | ) | | | - | | | | - | |

| Other Income (Expense) | | | 6 | | | | 4 | | | | 50 | % |

| | | | | | | | | | | | | |

| Income from Continuing Operations Before Income Taxes | | | 977 | | | | 1,336 | | | | (27 | )% |

| | | | | | | | | | | | | |

| Income Taxes | | | 461 | | | | 391 | | | | 18 | % |

| | | | | | | | | | | | | |

| (Loss) From Discontinued Operations | | | - | | | | (7 | ) | | | - | |

| | | | | | | | | | | | | |

| Non controlling interest | | | (25 | ) | | | (37 | ) | | | (32 | )% |

| Net Income | | $ | 491 | | | | 900 | | | | (45 | )% |

Revenues. Revenues are derived primarily from connection fees and sales of natural gas. Revenues increased $0.56 MM, or 25% to $2.82 MM for the three months ended September 30, 2009 from $2.25 MM for the same period in 2008. This increase was mainly attributable to an increase in number of connection households.

Cost of Sales. Cost of sales consists primarily of connection costs and purchase of natural gas from our suppliers and depreciation.

Our cost of sales increased by $0.47 MM, or 82%, to $1.05 MM for the three months ended September 30, 2009 from $0.58 MM during the same period in 2008. Such increase was mainly attributable to a corresponding increase in the number of households connected to our distribution network and we recorded the depreciation of the operation under cost of sales for the three months ended September 30, 2009.

Gross Profit. Our gross profit increased by $0.09 MM, or 5%, to $1.77 MM for the three months ended September 30, 2009 from $1.68 MM during the same period in 2008. Gross profit as a percentage of revenues. or gross profit margin, was 63% for the three months ended September 30, 2009. The gross profit margin during the same period in 2008 was 74%. Such decrease in gross profit margin was mainly due to cost reallocation of the depreciation.

Selling, General & Administrative Expenses (S&G&A Expenses). SG&A expenses, include office expenses, entertainment and travelling, salaries and other expenses. SG&A expenses increased by $0.46 MM, or 132%, to $0.80 MM for the three months ended September 30, 2009 from $0.35 MM during the same period in 2008. As a percentage of revenues, SG&A expenses increased to 28% for the three months ended September 30, 2009 from 15% for the same period in 2008. This increase was mainly due to the fact that we are preparing to expand our company. Management believes that the relatively high SG&A expenses will continue as we endeavor to expand our business.

Net Income. Net income decreased $0.41 MM, or 45% to a net income of $0.49 MM for the three months ended September 30, 2009 from net income of $0.90 MM for the same period of 2008, mainly due to the increase in SG&A expenses.

Comparison of Nine Months Ended September 30, 2009 and September 30, 2008

The following table summarizes the results of our operations during the nine-month periods ended September 30, 2009 and ended September 30, 2008, and provides information regarding the dollar and percentage increase or (decrease) from the nine-month period ended September 30, 2008 to the nine-month period ended September 30, 2009.

(All amounts, other than percentages, in thousands of U.S. dollars)

| | | Nine Months Ended September 30, 2009 | | | Nine Months Ended September 30, 2008 | | | Percentage Change Increase (Decrease) | |

| Revenues | | $ | 5,953 | | | | 4,237 | | | | 40 | % |

| | | | | | | | | | | | | |

| Cost of Sales | | | 2,026 | | | | 1,129 | | | | 79 | % |

| | | | | | | | | | | | | |

| Gross Profit | | | 3,927 | | | | 3,108 | | | | 26 | % |

| | | | | | | | | | | | | |

| Selling, general and Administrative Expenses | | | 1,963 | | | | 814 | | | | 141 | % |

| | | | | | | | | | | | | |

| Operating Income (Expenses) | | | 1,964 | | | | 2,294 | | | | (14 | %) |

| | | | | | | | | | | | | |

| Other Income and (Expenses) | | | | | | | | | | | | |

| Interest income | | | 20 | | | | - | | | | - | |

| Interest (Expense) | | | (4 | ) | | | - | | | | - | |

| Other Income (Expense) | | | 6 | | | | 10 | | | | (43 | %) |

| | | | | | | | | | | | | |

| Income (Loss) from Continuing Operations Before Income Taxes | | | 1,986 | | | | 2,304 | | | | (14 | %) |

| | | | | | | | | | | | | |

| Income Taxes | | | 829 | | | | 705 | | | | 18 | % |

| | | | | | | | | | | | | |

| Income From Discontinued Operations | | | - | | | | 223 | | | | - | |

| | | | | | | | | | | | | |

| Non controlling interest | | | (18 | ) | | | (46 | ) | | | (61 | %) |

| Net Income | | $ | 1,139 | | | | 1,776 | | | | (36 | %) |

Revenues. Revenues are derived primarily from connection fees and sales of natural gas. Revenues increased $1.72 MM or 40% to $5.95 MM for the nine months ended September 30, 2009 from $4.24 MM for the same period in 2008. This increase was mainly attributable to an increase in number of connected households and an increase in natural gas consumption.

Cost of Sales. Cost of sales consists primarily of the purchase of natural gas from our suppliers and connection costs. Our cost of sales increased $0.90 MM, or 79%, to $2.03 MM for the nine months ended September 30, 2009 from $1.13 MM during the same period in 2008. Such increase was mainly attributable to a corresponding increase in the number of households connected to our network and increase in natural gas consumption by our customers. As a percentage of revenues, the cost of sales increased to 34% during the nine months ended September 30, 2009, from 27% in the same period in 2008, which was mainly attributable to an increase in the number of connected households.

Gross Profit. Our gross profit increased $0.82 MM, or 26%, to $3.93 MM for the nine months ended September 30, 2009 from $3.11 MM during the same period in 2008. Gross profit as a percentage of revenues was 66% for the nine months ended September 30, 2009, a decrease of 7% from 73% during the same period in 2008. This percentage decrease was mainly due to an increase in our connection costs.

Selling, General and Administrative Expenses. Selling, general and administrative expenses, which include sales representative commissions, promotion fees, salesperson salaries and expenses, depreciation charges and other fees, increased $1.15 MM, or 141%, to $1.96 MM for the nine months ended September 30, 2009 from $0.81 MM during the same period in 2008. As a percentage of revenues, general and administrative expenses increased to 33% for the nine months ended September 30, 2009 from 19% for the same period in 2008. This increase was mainly due to the fact that we are endeavoring to expand our business. Management believes that the relatively high SG&A expenses will continue as we endeavor to expand our business.

Net Income. Net income decreased $0.64 MM, to $1.14 MM for the nine months ended September 30, 2009 from $1.78 MM for the same period of 2008, as a result of the factors described above.

Liquidity and Capital Resources

As of September 30, 2009, we had cash and cash equivalents of approximately $4.9 million. The following table provides detailed information about our net cash flow for all financial statement periods presented in this report.

Cash Flow

(All amounts in thousands of U.S. dollars)

| | | Nine Months Ended September 30, | |

| | | 2009 | | | 2008 | |

| Net cash provided by (used in) operating activities | | $ | (135 | ) | | $ | (502 | ) |

| Net cash used in investing activities | | | (5,806 | ) | | | (575 | ) |

| Net cash provided by financing activities | | | 5,215 | | | | 7,282 | |

| Effect of exchange rate changes in cash | | | (7 | ) | | | (1,308 | ) |

| Net increase (decrease) in cash | | $ | (734 | ) | | $ | 4,898 | |

Operating Activities

Net cash used in operating activities was $0.14 MM for the nine months ended September 30, 2009, compared to net cash used in operating activities of $0.50 MM during the same period of 2008. This decrease in funds used in our operating activities was primarily due to an increase of accounts receivable, as well as a decrease in prepayment and other payables.

Investing Activities

Our main use of cash in investing activities was mainly for the construction of gas pipelines and acquisition of assets.