Washington, D.C. 20549

FORM 10-K/A

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2008

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to ____________

Commission File Number: 000-28543

CHINA NEW ENERGY GROUP COMPANY

(Exact name of registrant as specified in its charter)

| Delaware | | 65-0972647 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

20F., Centre Plaza, No. 188 Jiefang Road, Heping District, Tianjin, China.

(Address of principal executive office and zip code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

As of June 30, 2009, the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing price of such shares as reported on the Over-the-Counter Bulletin Board) was approximately $6.2 million. Shares of the Registrant’s common stock held by each executive officer and director have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of April 13, 2010, there were 105,395,032 shares of the Registrant’s common stock outstanding.

Annual Report on FORM 10-K

Fiscal Year Ended December 31, 2008

TABLE OF CONTENTS

| Number | | | | Page |

| PART I | | | | |

| | | | | |

| Item 1. | | Business | | 6 |

| Item 1A. | | Risk Factors | | 21 |

| Item 2. | | Description of Property | | 32 |

| Item 3. | | Legal Proceedings | | 32 |

| Item 4. | | Submission of Matters to a Vote of Security Holders | | 32 |

| | | | | |

| PART II | | | | |

| | | | | |

| Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 32 |

| Item 6. | | Selected Financial Data | | 34 |

| Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 34 |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 43 |

| Item 8. | | Financial Statements and Supplementary Data | | 43 |

| Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 44 |

| Item 9A. | | Controls and Procedures | | 46 |

| Item 9B. | | Other Information | | 47 |

| | | | | |

| PART III | | | | |

| | | | | |

| Item 10. | | Directors, Executive Officers and Corporate Governance | | 48 |

| Item 11. | | Executive Compensation | | 53 |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 55 |

| Item 13. | | Certain Relationships and Related Transactions | | 58 |

| Item 14. | | Principal Accountant Fees and Services | | 60 |

| | | | | |

| PART IV | | | | |

| | | | | |

| Item 15. | | Exhibits, Financial Statement Schedules | | |

FORWARD-LOOKING STATEMENTS

Certain statements contained in this report under “Item 1—Business,” “Item 6—Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Item 9—Directors and Officers of the Registrant” and “Item 10—Executive Compensation” including, without limitation, those concerning our liquidity and capital resources, contain forward-looking statements concerning our operations; financial condition; management forecasts; liquidity; anticipated growth; the economy; future economic performance; future acquisitions and dispositions; potential and contingent liabilities; management’s plans; taxes; and the development and utilization of our intellectual property. Because such statements involve risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions.

Forward-looking statements are not guarantees of performance and by their nature are subject to inherent risks and uncertainties. We caution you therefore that you should not rely on these forward-looking statements. You should understand the risks and uncertainties, discussed in the section on “Risk Factors” and elsewhere in this report, could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements.

Any forward-looking information contained in this report speaks only as of the date of the report. Factors or events may emerge from time to time and it is not possible for us to predict all of them. We undertake no obligation to update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events.

In this report, unless indicated otherwise, references to:

| | · | “China New Energy,” “the company,” “we,” “us,” or “our,” are references to the combined business of China New Energy Group Company and its wholly-owned subsidiaries, Willsky, Wuyuan,Tianjin Investment,SingOcean, Chensheng and Yingkou Zhongneng, Zhanhua Jiutai, Binhai Zhongneng,but do not include the stockholders of China New Energy; |

| | | |

| | · | “Willsky” are references to Willsky Development, Ltd. |

| | · | “Wuyuan” are references to Wuyuan County Zhongran Gas Limited. |

| | · | “Tianjin Investment” are references to China New Energy(Tianjin) Investment & Consulting Co.,Ltd. |

| | | |

| | · | “SingOcean” are references to Tianjin SingOcean Public Utility Development Co., Ltd. |

| | | |

| | · | “Chensheng” are references to Qinhuangdao Chensheng Gas Co. Ltd. |

| | | |

| | · | “Yingkou Zhongneng” are reference to Yingkou Zhongneng Gas Development Company Limited. |

| | · | “Zhanhua Jiutai” are reference to Zhanhua Jiutai Gas Co.Limited. |

| | | |

| | · | “Binhai Zhongneng” are reference to Tianjin Binhai Zhongneng Gas Company Limited. |

| | | |

| | · | “China,” “Chinese” and “PRC,” are references to the People’s Republic of China; |

| | | |

| | · | “BVI” are references to the British Virgin Islands; |

| | · | “RMB” refer to Renminbi, the legal currency of China; |

| | | |

| | · | “U.S. dollar,” “$” and “US$” are to the legal currency of the United States; |

| | · | “SEC” means the Securities and Exchange Commission; and |

| | | |

| | · | “Securities Act” mean the Securities Act of 1933, as amended, and “Exchange Act” mean the Securities Exchange Act of 1934, as amended. |

EXPLANATORY NOTE REGARDING RESTATEMENT

This Amendment No. 1 ("Form 10-K/A") to our Annual Report on Form 10-K for the fiscal year ended December 31, 2008 ("Form 10-K"), which was filed with the SEC on April 15, 2009, amends the Form 10-K to reflect restated amounts and revised disclosures of the Company's consolidated financial statements for the year ended December 31, 2008.

The principal changes to our Report in this amendment are as follows:

1. There were errors in the recording of the fair value of the assets acquired during the acquisition of Chensheng. Therefore, the Group has recorded the increase to the fair value from the book value of several assets, including $1,036,655 of Property, plant and equipment, $3,012 of Inventories, and $63,014 of Goodwill and the decrease in $505,941 in Land use right. Consequently, we recalculated the $96,489 of the depreciation for such increment of those assets and minority interest in Chensheng, which caused a decrease to the minority interest by $77,647 in the consolidated balance sheet and a decrease to the minority interest’s share of net income by $414,763 in the consolidated statement of operations and comprehensive income.

2. There was an error in the elimination of its intercompany accounts. Therefore, we have recorded a decrease in the related party receivable balances by $84,120 and an increase in the general and administrative expenses by $54,196 and the comprehensive income of $29,924.

3. We have reassessed the nature of the preferred stock together with warrants and we reclassified $1,857 and $7,029,961 (total amounting to $7,031,818) from preferred stock and additional paid in capital. Also, we reclassified warrant liabilities of $2,952,273 from additional paid in capital and recognized a $2,553,870 loss from the change in fair value of the warrant liabilities in the income statement and the total amount of the warrant liabilities was $5,506,143 as of December 31, 2008. In addition, we have accrued $900,000 registration right liabilities as of December 31, 2008.

4. There was an error in recording the pre-acquisition cash flow activities of the newly acquired subsidiary, Chensheng and the cash flow activities of disposed subsidiary, Hunchun. We have excluded the cash flow activities of Chensheng and included the cash flow activities of Hunchun under discontinued operations in each section of the cashflow activities. As a result, we made those adjusting entries in the cash flow statement for the year ended December 31, 2008.

5. We have some reclassifications in both Consolidated Balance Sheets and Consolidated Statements of Operations and Comprehensive Income.

6. In addition, management made a determination that the Company’s financial statements in each of its quarterly reports filed in 2009 could not be relied on that it will restate the Company’s financial statements for each of the quarterly reports it filed in 2009. The Company filed a current Report on Form 8-K disclosing these determinations under item 4.02 of Form 8-K concurrent with the filing of this Annual report.

Overview of Our Business

We are a vertically integrated natural gas company engaged in the development of natural gas distribution networks, and the distribution of natural gas to residential, and industrial and commercial customers in small and medium sized cities in China.

We currently own the exclusive rights to develop distribution networks to provide natural gas to industrial, commercial and domestic consumers in the cities of Dashiqiao, Nandaihe, Zhanhua and Wuyuan. Currently, these distribution networks provide natural gas to an aggregate of approximately 64,000 consumers in these cities

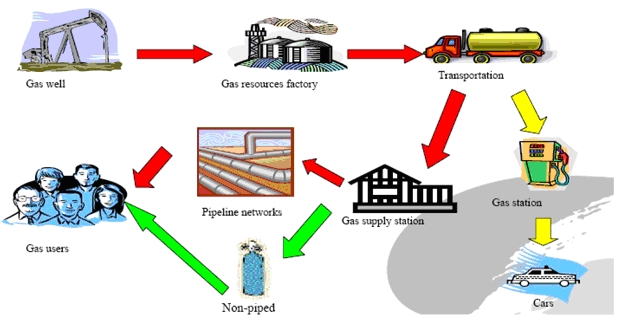

We are able to procure our natural gas by purchasing natural gas from third-party suppliers. Once natural gas is extracted, all water content and impurities are removed. Natural gas is then delivered by truck either to (1) our natural gas supply stations, where the gas is either depressurized and then delivered to households through pipelines or delivered directly to customers in pressurized tanks, or (2) gas stations where the gas is sold for use in motor vehicles.

Our major business activities include development and construction of local gas distribution networks, transportation of natural gas from suppliers to our storage facilities in a given operational location, and operating and maintaining the gas distribution networks.

Acquisition of SingOcean

In 2005, Willsky acquired 99% of the equity of SingOcean, which was formed in the PRC as an equity joint venture to be operated for a period of 50 years until January 18, 2054 with registered capital of $4.5 million (RMB31,897,000). SingOcean set up a branch division in Acheng, Tianjin, called Tianjin Sing Ocean Public Utility Development Co., Ltd. – Acheng Division (“SingOcean – Acheng Division”) and is to be operated for a period of 5 years until December 28, 2010. On December 22, 2009, our wholly-owned subsidiary, SingOcean, completed the sale of its Acheng Division (“Acheng division of SingOcean”) to Harbin Hengsheng Real Estate Development Co., Ltd.

Private Placement

On August 20, 2008, we completed a private placement in which we sold to China Hand Fund I, LLC, or China Hand, and its designees for a purchase price of $9,000,000 1,857,373 shares of our Series A Preferred Stock and warrants to purchase 13,001,608 shares of our common stock at an initial exercise price of $0.187 per share (subject to adjustments) for a period of 5 years following the date of issuance. After the deduction of offering expenses in the amount of approximately $1.92 million we had approximately $7.08 million in net proceeds.

Kuhns Brothers Securities Corporation, or Kuhns Brothers, acted as placement agent in connection with this private placement. As compensation for its services, Kuhns Brothers received a cash fee equal to $900,000, representing 10% of the gross proceeds received from the private placement, as well as warrants to purchase 6,500,804 shares of our common stock, representing 10% of the aggregate number of shares of common stock issuable to China Hand in the private placement upon conversion of the Series A Preferred Stock. We are under a contractual obligation to register the shares of our common stock underlying the Series A Preferred Stock within a pre-defined period. At present, we have not filed a registration statement regarding those shares and, as of October 4, 2008, we began to incur liquidated damages payable to China Hand at a rate of one percent of China Hand’s investment per month.

In connection with this private placement, we agreed to certain make good provisions that will require us to issue to China Hand up to an aggregate of 1,114,424 (557,212 shares for each of 2008 and 2009) additional shares of our Series A Preferred Stock if we do not achieve the targeted after-tax net income, or ATNI, and earnings per share targets for 2008 and 2009. The 2008 after tax net income target is $4.3 million and the 2008 earnings per share target is 0.0261 on a fully-diluted basis. The 2009 after tax net income target, or the 2009 ATNI Target, is $6.0 million and the 2009 earnings per share target, or 2009 EPS Target, is $0.0294 on a fully diluted basis. We were unable to achieve the targeted ATNI for 2008, and therefore, pursuant to the make good provisions, we were obligated to release from the escrow, which was established at the time of the private placement, 557,212 shares of our Series A Preferred Stock for transfer to China Hand,. In connection with the closing of the May 1 private placement (described below), the Company and China Hand executed a Waiver (the “Waiver”) of certain post-closing obligations relating to the August 2008 private placement.

On April 30, 2009, the Company entered into a Securities Purchase Agreement with China Hand and on May 1, 2009, we issued to China Hand 1,116,388 shares of the Company’s Series B Convertible Preferred Stock and 7,814,719 warrants to purchase Common Stock, for aggregate gross proceeds of $5,400,000.

Kuhns Brothers acted as placement agent in connection with the second private placement. As compensation for its services, Kuhns Brothers received a cash fee of $540,000, representing 10% of the gross proceeds received from the private placement, as well as warrants to purchase 3,907,358 shares of the Company’s Common Stock, representing 10% of the aggregate number of shares of Common Stock issuable to China Hand on conversion of the Series B Preferred Stock.

Additionally, the Company agreed to make good provisions that will require the Company to issue to China Hand up to 334,916 additional shares (the “Make Good Shares”) of its Series B Preferred Stock if it did not achieve an audited after-tax net income of $5.0 million for the year ending December 31, 2009 (the “2009 Income Target”); if the Company is successful in achieving the 2009 Income Target, China Hand will transfer 22,327 shares of its Series B Preferred Stock to certain members of the Company’s management, which shares have been deposited into an escrow account. (As the 2009 Income Target was achieved the 22,327 shares of Series B Preferred Stock will be distributed to management at a later date.) The Company also agreed to issue to China Hand 27,910 shares of Series B Preferred Stock if the Company’s Common Stock is not listed for trading on a national securities exchange on or before January 31, 2010 (the “Listing Shares”). (The Company’s common stock has not been listed on a national securities exchange, however, the 27,910 shares of Series B Preferred Stock have not yet been issued to China Hand.)

Also in connection with the closing of the Private Placement, the Company entered into a Securities Escrow Agreement with China Hand and the Escrow Agent, whereby the Company delivered the Make Good Shares and the Listing Shares to the Escrow Agent, which shall be released from escrow to China Hand in accordance with the SPA as described above.

As partial consideration for the Company’s issuance of the Series B Preferred Stock, and in connection with the closing of the Private Placement, the Company and China Hand executed a Waiver (the “Waiver”) of certain post-closing obligations relating to the private placement consummated between the parties on August 20, 2008. Under the Waiver, China Hand waived its rights (i) to 557,212 shares of the Company’s Series A Preferred Stock held in escrow and due to China Hand pursuant to a Securities Purchase Agreement dated August 8, 2008 (the “August SPA”); provided that the Company agreed to deliver to China Hand 241,545 shares of Series A Preferred Stock and to place an additional 241,545 shares of Series A Preferred Stock into escrow, to be delivered to China Hand if the Company’s after-tax net income for the year ending December 31, 2009 is not at or above $5 million (the “Amended Series A Make Good”) (which target was achieved); (ii) under Section 6.18 of the August SPA in favor of the Amended Series A Make Good; (iii) to liquidated damages under Section 6.31 of the August SPA arising from the Company’ s failure to effect a reverse split of its Common Stock prior to March 31, 2009; and (iv) its rights to liquidated damages under a Registration Rights Agreement dated August 20, 2008, provided that the parties enter into the Amended and Restated Registration Rights Agreement.

Equity Swap

On September 16, 2008, we, through our subsidiary SingOcean, entered into an Equity Swap Agreement with Mr. Xiu Hai Tian, whereby we acquired from Mr. Tian a 49% ownership interest in Qinhuangdao Chensheng Gas Co., Ltd. (“Chensheng”), in exchange for our 99% ownership in Hunchun SingOcean. The parties to the Equity Swap Agreement determined that the value of the 49% interest in Chensheng and the 99% interest in Hunchun Sing Ocean were approximately equal and therefore there was no cash or other consideration involved in the transaction from either party.

On December 10, 2008, the Company entered into an Agreement for Equity Transfer with the holders of the remaining 51% outstanding equity in Chensheng. Pursuant to the Agreement for Equity Transfer, the Company agreed to purchase the remaining 51% of the outstanding equity of Chensheng from 17 individuals for an aggregate purchase price of RMB 12.56 million (approximately $1.84 million). The transaction was consummated on December 30, 2008, following which the Company now owns 51% of the equity of Chensheng, and our 99%-owned subsidiary SingOcean now owns 49% of the equity of Chensheng and therefore, the Group ultimately held 99.5% of the equity of Chensheng.

Recent Acquisitions

On December 12, 2009, our indirect wholly-owned subsidiary Chensheng, entered into an Equity Interest Purchase Agreement to acquire all of the outstanding equity interest of Zhanhua Jiutai Gas Co., a PRC company (“Jiutai”), from the 5 shareholders of Jiutai. Under that agreement, Chensheng agreed to purchase 100% of the outstanding equity interest of Jiutai from the Jiutai shareholders for a total purchase price of RMB 16,500,000 (approximately $2,426,343) payable in three installments.

On December 16, 2009, Willsky entered into an Equity Interest Purchase Agreement, to acquire all of the outstanding equity interest of Fuzhou City Lean Zhongran Gas Inc., a PRC company, from Flying Dragon Resource Development Limited. Under that agreement, Willsky agreed to purchase 100% of the outstanding equity interest of Lean Zhongran for a total purchase price of RMB 4,800,000 (approximately $702,782) (which purchase price is based on an appraised value of Lean Zhongran as of September 30, 2009) payable in three installments.

On December 16, 2009, Willsky entered into an Equity Interest Purchase Agreement to acquire all of the outstanding equity interest of Wuyuan County Zhongran Gas Ltd., a PRC company, from Flying Dragon Investment Management Limited. Under the agreement, Willsky agreed to purchase 100% of the outstanding equity interest of Wuyuan for a total purchase price of RMB 6,000,000 (approximately $877,477) (which purchase price is based on an appraised value of Wuyuan as of September 30, 2009) payable in three installments.

On January 5, 2010, Willsky entered into an Equity Interest Purchase Agreement, to acquire all of the outstanding equity interest of Fuzhou Zhongran Flying Dragon Gas Inc., a PRC company, from Flying Dragon Resource Development Limited and Flying Dragon Investment Management Limited. Under that agreement, Willsky agreed to pay a total purchase price of 26,000,000 RMB (which purchase price is based on an appraised value of Fuzhou Zhongran as of September 30, 2009) payable in three installments.

Proposed acquisition

On March 8, 2010 we entered into a Conditional Equity Transfer Agreement with Mr. Tang Zhixiang (“ Mr. Tang”) to acquire from Mr. Tang a 70% equity interest in Beijing Century Dadi Gas Engineering Co., Ltd., a PRC company (“Century Dadi”) and a 70 % equity interest in its affiliated companies including Beijing Dadi Gas Engineering Co. Ltd. (“Dadi Gas”). The total purchase price has not yet been determined but will be based on a multiple of the net profits of Century Dadi and it consolidated subsidiaries for the fiscal year ended December 31, 2009 as determined in accordance with United States generally accepted accounting principles capped at 392,150,000 RMB (approximately $57.5 million). The purchase price will payable in three installments.

Disposal of Assets

On December 22, 2009, SingOcean entered into an Asset Purchase Agreement with Harbin Hengsheng Real Estate Development Co., Ltd. pursuant to which SingOcean agreed to sell to the purchaser certain assets including, certain land use rights, construction in progress, licenses and operating equipment relating to a gas pipeline located at Acheng District, Harbin City for a cash purchase price of RMB 40,000,000 (approximately $6 million). The purchase price is payable in three installments.

On March 17, 2010, SingOcean entered into an Equity Transfer Agreement with Hunan Zhongyouzhiyuan Gas Co., Ltd under which we agreed to sell all of the equity interest of Yingkou Zhengneng Gas Development Co., Ltd. for a cash purchase price of RMB 21,900,000 (approximately $3.2 million dollars). The purchase price is payable in two installments.

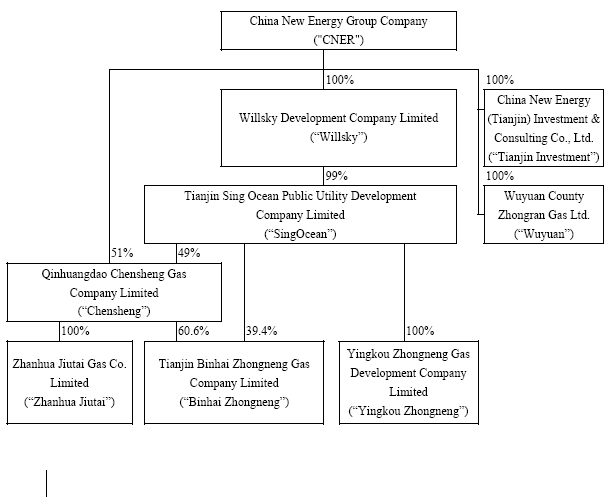

Our Current Organizational Structure

We own all of the issued and outstanding capital stock of Willsky, which in turn owns 99% of the outstanding capital stock of SingOcean. The remaining 1% of SingOcean is owned by Tianjin Huanlong Commercial and Trading Company.

SingOcean owns 100% of the equity of Yingkou Zhongneng, 49% of the equity of Chensheng and 39.4% of the equity of Binhai Zhongneng.

Chensheng owns 100% of the equity of Zhanhua Jiutai and 60.6% of Binhai Zhongneng.

China New Energy owns 100% of the equity of Tianjin Investment and Wuyuan.

These subsidiaries are principally responsible for the construction and operation of the natural gas distribution networks in the cities of Dashiqiao, Nandaihe, Zhanhua, Wuyuan, and Tianjin Binhai New Area,

The following chart reflects our organizational structure as of the date of this report.

Our Industry

China’s Natural Gas Market

Traditionally, the PRC has relied heavily on coal and crude oil as its primary energy sources. According to the China Statistical Yearbook, in 2005, coal, crude oil, hydro-electricity and natural gas accounted for 68.9%, 21.0%, 7.2% and 2.9% respectively, of the PRC’s total energy consumption. In 2006, the ratios were 69.4%, 20.4%, 7.2% and 3.0 %, respectively and in 2007, the ratios were 69.5%, 19.7%, 7.3% and 3.5% respectively. Natural gas has been primarily used as a raw material for chemical fertilizers and to operate oil and gas fields. Accordingly, most natural gas is consumed for production of fertilizer, while the non-production sector accounts for a low percentage of final consumption. In 2005, non-production consumption of natural gas was around 7.9 billion cubic meters, which was just over 15% of total natural gas consumption that reached to 47.9 billion cubic meters (Source: National Bureau of Statistics of China).

The PRC’s heavy reliance on coal is out of line with world consumption rates for the same time period which was 26.5% in 2005 (Source: Energy Information Administration, U.S. Department of Energy). The use of coal, however, causes air pollution and other negative consequences to the environment. In the PRC, the heavy use of unwashed coal has lead to large emissions of sulfur dioxide and particulate matter. The latest air pollution study conducted by the Blacksmith Institute shows that in 2007 two of the 10 most polluted cities in the world are located in the PRC (Source: http://www.blacksmithinstitute.org ). As such, there have been serious environmental concerns in many countries around the world which resulted in a global trend to reduce coal usage.

Recognizing the serious problems caused by heavy reliance on coal usage, the PRC government has aggressively moved to reduce coal usage by substituting coal with other, more environmentally friendly forms of fuel, such as natural gas. In consideration of such trends, the PRC set out a policy to raise the share of natural gas in the country’s energy mix in its Ninth 5-Year Plan (1996-2000). At the local governmental level, in many locations where natural gas supply is available, local governments often require all new residential buildings to incorporate piped gas connections in their designs as a condition to the issuance of the construction or occupancy permits. Before 2000, gas distribution had principally been served by local municipal governments. Since then, the industry has been open to the private sector, whose investments have fostered the wide use of natural gas in the PRC. The natural gas industry has been deemed by the PRC government as a suitable industry for public and private investments.

Demand for Natural Gas in China

Currently, natural gas consumption in the PRC accounts for less than 3% of its total energy consumption. However, driven by environmental pressure from the demand side and improvements in social infrastructure with economic growth, in the west in particular, and stable energy supply, it is anticipated that the use of natural gas will grow very rapidly in the PRC. According to the statistics of the China National Development and Reform Commission, or NDRC, the consumption of natural gas has increased from 24.5 billion cubic meters in 2000 to 55.6 billion cubic meters in 2006, which represented an average growth of 32.42% per year. From the 4th Annual Asia Natural Gas Congress 2008, experts anticipated that the demand for natural gas in China would grow rapidly to 150 billion cubic meters in 2010 and to 240 billion cubic meters in 2015.

China’s Natural Gas Reserves and Gas Pipeline Infrastructure

The PRC abounds in rich natural gas reserves, which are distributed among Xinjiang, Sichuan, and Shaanxi Provinces, as well as Inner Mongolia. According to the Second Oil and Gas Reserve Assessment published by the Geological and Mineral Resources Department of China, natural gas reserves in China are estimated to be 38,000 billion cubic meters with 30,000 billion cubic meters onshore and 8,000 billion cubic meters offshore. These reserves are sufficient for approximately 74 to 120 years of Chinese consumption based on current consumption levels.

Because the PRC’s largest reserves of natural gas are located in western and north-central China, it requires a significant investment in gas transportation infrastructure to carry natural gas to eastern cities and the rest of the PRC. Until recently, the PRC’s natural gas consumption was limited to local natural gas producing provinces because of the lack of national long-distance pipeline infrastructure. Because natural gas transportation was limited to areas near production sites, an economical supply was possible.

The principal method for transportation of natural gas is by means of pipelines. In order to develop the natural gas industry, it is essential that the necessary pipeline infrastructure be in place so that natural gas is easily accessible for distribution at affordable rates.

In its Eleventh Five Year Plan (2006 - 2010), the PRC government re-affirmed its commitment to making significant investments in the expansion of the natural gas pipeline infrastructure over a period of 20 years.

Natural Gas Suppliers

The natural gas supply in China is dominated by the three large state-owned oil and gas holding companies, namely China National Petroleum Corporation Group, or PetroChina, China Petroleum and Chemical Corporation Group, or Sinopec, and China National Offshore Oil Corporation Group, or CNOOC. In 2006, production by PetroChina, Sinopec and CNOOC accounted for 73.7%, 14.1% and 12.2%, respectively, of the total national production. PetroChina and Sinopec own and primarily operate onshore pipelines while CNOOC owns and operates virtually all offshore pipelines (Source: The Institute of Energy Economics of Japan).

Natural Gas Distributors

Before 2000, natural gas distribution had been principally served by local municipal governments. Since then, the natural gas industry has been designated by the PRC government as a suitable industry for public and private investment and has been open to private investment which has fueled the development of the industry and fostered a wider use of natural gas in the PRC. In large cities where the population exceeds 100,000, the natural gas distribution business is dominated by state owned companies, while in cities where the population is less than 100,000, natural gas distribution is carried out by many privately owned companies, most of which operate in just a few locations.

Our Competitive Strengths

We believe that the following competitive strengths enable us to compete effectively and to capitalize on the growth of the market for natural gas in China:

| | · | Advanced Technology and Facilities. We can distribute liquefied natural gas and compressed natural gas within the same type of pipelines, which provides us with a more flexible transportation structure. |

| | · | Complete Industry Access. We have the ability to operate in all sectors of the natural gas industry, including purchasing, transportation, distribution and terminal operation. Gas distribution prices are generally stipulated by the government; however, the price of gas resources is determined by the natural gas markets. |

| | · | Experienced Management. Our management team has broad and extensive experience in the natural gas industry as well as in areas of business development, corporate strategy and planning, marketing and sales, and maintains strong relationships with both the national and local governments in China. |

Our Growth Strategy

Our growth strategy is to grow both organically and through acquisitions, as our recent acquisitions indicate. We are committed to enhancing profitability and cash flows by focusing on second and third tier markets. This strategy helps avoid competition altogether, as currently, less than 15% of the cities in our target market have access to natural gas, and thus there are no competing natural gas companies. We have already acquired exclusive rights for natural gas distribution to three cities in northern China, and anticipate pursuing other such agreements with additional cities.

Our Operations

We purchase natural gas from third-party suppliers. Natural gas is then delivered by truck to either (1) our natural gas supply stations, where the gas is either depressurized and then delivered to households through pipelines or delivered directly to customers in pressurized tanks, or (2) to gas stations where the gas is sold for use in motor vehicles.

The following chart illustrates the natural gas distribution process.

Products and Services

Currently, we generate revenues primarily from the connection fees we charge our customers for connecting to the pipelines in our natural gas distribution networks, and fees for natural gas usage.

Historically, connection fees and fees for natural gas usage have constituted, in the aggregate, 100% of our revenues. We recorded connection fees in the amounts of $11,093,444 and $4,919,392 for the fiscal years ended December 31, 2009 and 2008, respectively, constituting 94% and 90% of total revenues for those years. Sales of natural gas were $680,451 and $571,835 for the fiscal years ended December 31, 2009 and 2008, respectively, constituting 6% and 10% of the total revenues for those years

Connection Fees

We charge residential customers a flat fee for connections to our distribution network. The fee amount, which is subject to approval by the relevant local state pricing bureau, varies by location and is determined based on factors such as estimated capital expenditure, fees charged in surrounding cities, number of users, expected penetration rates, income levels and affordability to local residents. The average connection fee in 2008 was approximately $357 per household (based on an exchange rate for RMB to US$ of approximately 7.8:1) and in 2009 is approximately $351 per household (based on an exchange rate of RMB to US$ of approximately 6.83:1). For industrial customers, the connection fee is determined based on their consumption usage. Connection fees are generally paid immediately after the customer is connected to our pipeline network.

Connection fees generally provide a 75% gross profit margin.

Connection fees and gas usage fees are subject to the approval of the local state pricing bureau. Future price increases are also subject to the same approval process. In considering applications for an increase in gas usage charges, the local state pricing bureau may consider factors such as increases in the wholesale price of gas or operating expenses, inflation, additional capital expenditure, and whether the profit margin remains fair and reasonable.

When entering into master supply contracts for mass connections, we usually require the payment of a deposit from customers while the balance is payable in accordance with the terms set out in the contracts. In the event customers default in the payment of connection fees, we will not start the supply of natural gas until the connection fees are paid.

The deposit received from customers upon the signing of supply contracts generally funds the majority of our capital costs in any new operational location.

Gas Usage Charges

Natural gas usage charges, which may vary by location, are regulated by the local state price bureau and are determined evaluating a number of factors including the wholesale price of gas, operating costs, price of substitute products, internal business model margins and the purchasing power of local residents. Gas usage charges are based on actual usage on a per cubic meter basis.

Our Business Activities

Our major business activities include development and construction of local gas distribution networks, transportation of natural gas from suppliers to our storage facilities in a given operational location, and operating and maintaining the gas distribution networks.

Development

Our business development team actively explores and evaluates potential areas for development of new distribution networks, opportunities for expansion of our existing distribution networks. Because of our relationships with local and regional government officials, we also receive invitations to bid for new and existing projects.

Because of the large infrastructure costs of both constructing and operating a distribution network, we carefully evaluate each potential opportunity. Some of the key factors that we look at when evaluating whether to extend an existing distribution network or to develop a new one include: (1) size and density of the population, (2) economic statistics of the target locations, (3) concentration of industrial and commercial activities, (4) projections of revenue, (5) environmental policies of the regional government, (6) potential for further development, (7) exclusivity of distribution, and (8) required methods of delivery.

If a proposed natural gas distribution project has been approved as a viable project, we will then create a local subsidiary, such as Yingkou Zhongneng, Chensheng, Zhanhua Jiutai and Binhai Zhongneng to bid on and, if successful, administer the project. The local subsidiary is also responsible for negotiating the terms of the distribution agreement with the local government as well as promoting the use of our natural gas to the local communities.

Design, Construction and Operation

Design

The design of the gas pipeline infrastructure for a natural gas distribution project includes the processing stations, the local pipelines and other ancillary facilities such as gas storage tanks. It is carried out by a government approved design institute in accordance with our requirements and specifications. It also takes into account the local population size, the development of the economy, the utilization of energy resources and the environmental conditions. The master design is subject to approval by the local city construction department. The design stage normally takes two to three months.

Construction

Once the design is approved, we invite qualified independent contractors to tender bids for the construction of the distribution network. We generally enter into turnkey contracts with independent contractors for construction, installation and maintenance of the natural gas pipelines. We pay a down payment with the remainder to be paid upon completion of the project. At the time of entering into turnkey contracts, we source raw materials such as piping, gas regulating equipment and machinery. We have strict quality control procedures for the sourcing of supplies for all construction purposes.

Our internal engineers and independent external inspectors monitor the entire construction process to ensure that each stage of construction meets our quality and safety standards and the relevant regulatory requirements.

For a given operational location, although the gas pipeline infrastructure is designed to cover the entire operational location, our construction program focuses on early gas delivery to areas of concentrated customer demand. This ensures that natural gas supply can begin as soon as the essential gas pipeline infrastructure and facilities are completed. Construction work in a target area will gradually extend to cover the whole operational location, which typically takes two to five years.

Operation

Once the gas pipeline infrastructure is in place, we can begin the design and construction of branch pipelines and other non-pipeline means of supplying natural gas to our customers. As soon as the delivery vehicles are in place, we will begin distributing gas from our gas supply stations directly to our customers.

Our Customers

We have three principal types of customers: (1) residential customers (2) industrial customers and (3) commercial customers.

Residential Customers

Natural gas is primarily used by residential owners for cooking and heating. We market directly to property developers, government departments and organizations, and private companies and state-owned enterprises, as these entities enter into master supply contracts with us for the connection of gas to all the units within a residential development. These entities work with the end users to facilitate the collection of the connection fees. Once connected, the end user is solely responsible for payment of the usage charges.

At present, we supply gas to an aggregate of approximately 64,000 end users in Dashiqiao, Nandaihe and Zhanhua. Following is a list of the entities with whom we have entered into master supply agreements and the percentage of connection fees charged to each in fiscal years 2009 and 2008:

| | | Percentage of Connections Fees for the year ended December 31, | |

| Customers | | 2009 | | | 2008 | |

| Yingkou Zhongneng(Dashiqiao gas office) | | | 45 | % | | | 76 | % |

| Nandaihe | | | 24 | % | | | 24 | % |

| Zhanhua | | | 12 | % | | | | |

| Binhai | | | 19 | % | | | | |

| Total | | | 100 | % | | | 100 | % |

Industrial and Commercial Customers

We currently have three commercial customers in Dashiqiao, which are an Education Center, a Spa and a Restaurant, who use natural gas primarily for heating, air conditioning, steam production and cooking. Other potential industrial customers could include owners of hotels, restaurants, office buildings, shopping centers, hospitals, educational establishments, sports and leisure facilities and exhibition halls.

Sales and Marketing

Our marketing department is responsible for developing and maintaining our overall sales and marketing strategy, and the marketing teams of each or our branches or subsidiaries make appropriate detailed marketing plans based on their local areas of operation. Our marketing activities are aimed at creating brand-recognition and developing a reputation as a reliable supplier of natural gas. Our marketing plan includes informing the public of the advantages of using natural gas and stressing that natural gas is a clean and efficient source of energy.

In China, a local government can only grant exclusive distribution rights to one gas company, and the entire gas pipeline network must be operated by this one company. Accordingly, our marketing efforts are also used to help us obtain additional exclusive rights from other local governments. In areas where no gas company has yet been granted exclusive distribution rights, we set up small-scale pipeline networks as models to demonstrate the benefits of using our distribution network.

We also conduct customer satisfaction surveys every six months with property developers and pipeline distribution customers, both wholesale and retail, to collect feedback in areas such as quality of service, pricing and level of professional knowledge. These surveys help ensure that we are providing the highest quality of service to our customers.

Research and Development

We will continue to research new technologies that will reduce waste and leakage in the gas distribution process as well as new technologies that will improve detection and monitoring work in the gas pipeline network.

Our Competition

Since inception, we have focused on supplying natural gas to second and third tier cities where competition is limited, middle class populations are growing, and supplies of natural gas are readily accessible. This strategy is specifically designed to avoid competition. By securing exclusive rights to the development of distribution networks in a city, potential competitors are barred from entry into that market. Once we are able to secure exclusive rights to an area, our prices are regulated according to the regional wholesale price of natural gas.

Regulation

Pricing Regulations

Connection fees and gas usage fees are subject to the approval of the local state pricing bureau. Future price increases are also subject to the same approval process. In considering applications for an increase in gas usage charges, the local state pricing bureau may consider factors such as increases in the wholesale price of gas or operating expenses, inflation, additional capital expenditure, and whether the profit margin remains fair and reasonable.

Operational and Construction Permits

In the PRC, natural gas distribution companies must obtain an operational permit from the local municipal government prior to operation. In addition, a construction permit is required for any construction activities on the distribution network. In both cases, the local municipal government will review the qualifications and experience of the management and technical staff of the distribution company and consider whether the company is capable of maintaining the operational and construction standards.

Yingkou, Chensheng and Zhanhua own the necessary operational permits.

Safety Regulations

Natural gas distributors are also regulated by the Administrative Rules on the City Gas Safety jointly promulgated by the PRC Ministry of Construction, standards set by Standard Bureau and Fire Safety Bureau of PRC Ministry of Public Security in May 1991. According to such rules, the manufacture, storage, transportation, distribution, operation, and usage of natural gas, the design and construction of gas-related projects, and the manufacture of gas-related facilities is subject to relevant safety requirements and qualifications. Fuel service station standards are subject to regulation by the PRC’s Ministry of Construction, General Administration of Quality Supervision, and Bureau of Inspection and Quarantine. Required certificates are issued upon satisfactory inspection of service stations. In addition, there are various standards that must be met for filling stations, including handling and storage of gas, tanker handling, and compressor operation. These standards are regulated by local construction and gas operations authorities. Yingkou, Chensheng and Zhanhua own the necessary qualified inspection and acceptance certificate for a construction project.

Employees

As of December 31, 2009, we employed 130 full-time employees. The following table sets forth the number of our full-time employees by function as of December 31, 2009.

| Functions | | Number of Employees | |

| General and administration | | | 31 | |

| Executive Officers | | | 4 | |

| Marketing and Sales | | | 18 | |

| Technicians and Engineering | | | 14 | |

| Finance and Accounting | | | 18 | |

| Operations | | | 45 | |

| TOTAL | | | 130 | |

As required by applicable PRC law, we have entered into employment contracts with all of our officers, managers and employees. We believe that we maintain a satisfactory working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations.

In addition, we are required by PRC law to cover employees in China with various types of social insurance and believe that we are in material compliance with the relevant PRC laws.

Risk Factors

Risks Related to Our Business

We are dependent on suppliers of natural gas to deliver natural gas to our customers and if there is any failure in our ability to maintain that supply our operations and financial condition will be materially adversely affected.

Part of our business model involves the purchase of natural gas from our suppliers, and the re-sale of such natural gas to our industrial and residential customers for a profit.

We depend on natural gas supply from our suppliers. While we typically enter into multiple-year gas supply contracts with our suppliers, the supply contracts are subject to renewal every twelve months. If key terms of these supply contracts are changed after the annual review, or if our suppliers breach any of the key terms of the supply contracts, we will not be able to deliver natural gas to our customers. While we have not experienced any shortage of supply in the past, we cannot assure you that natural gas will continue to be available to us. In the event that our current suppliers are unable to provide us with the natural gas we require, we may be unable to find alternative sources, or find alternative sources at reasonable prices. In such an event, our business and financial results would be materially and adversely affected.

The price of natural gas is subject to government regulations and market conditions and may fluctuate significantly, which will impact our financial results.

The price of natural gas is subject to governmental regulations and market conditions in China. While our costs for natural gas are subject to control by the PRC government and we have not experienced any significant price fluctuations over the past few years, we cannot assure you that the price of natural gas will not vary significantly in the future. Numerous factors, most of which are beyond our control, drive the price and supply of natural gas. Some of these factors are: general international and domestic political and economic conditions, wars, OPEC actions, industry capacity utilization and government regulations.

Our success depends on our ability to identify and develop operational locations and negotiate and enter into favorable franchise agreements with local governments at the operation locations.

Our success depends on our ability to identify new operational locations in small- and medium-sized cities in China and negotiate and enter into favorable franchise agreements with local governments that grant us long-term exclusive rights to develop the natural gas distribution network and supply natural gas in the operational location. Our failure to identify and develop new operational locations and obtain the exclusive rights to be the developer of natural gas distribution networks and distribute natural gas in such operational locations would curb our revenue growth and may adversely impact our financial condition and operating results.

The nature of our natural gas operations is highly risky and we may be subject to civil liabilities as a result of our gas operations.

Our natural gas operations are subject to potential hazardous accidents in connection with activities involving the gathering, processing, separation, storage and delivery of natural gas, such as pipeline ruptures, explosions, product spills, leaks, hazardous emissions and fires.

We currently have in place the necessary insurance to cover liabilities in the ordinary course of our business.

Potential hazardous accidents can cause personal injury and loss of life, severe damage to and destruction of property and equipment, and pollution or other environmental damage, and may result in suspension of operations at the affected facilities of residential areas. Consequently, we may face civil liabilities in the ordinary course of our business. These liabilities may result in the insurance companies being required to make indemnification payments in accordance with applicable contracts and regulations. Although we have not faced any civil liabilities in the past since we started the current line of business in the ordinary course of our natural gas operations, there is no assurance that we will not face such liabilities in the future. If such liabilities occur in the future, they may affect our operations and financial condition.

Changes in the regulatory environment could adversely affect our business.

The distribution of natural gas to industrial and residential customers is highly regulated in the PRC requiring registrations with the government for the issuance of licenses required by various governing authorities in the PRC, such as the Natural Gas Business License. The costs of complying with regulations may increase which may in turn harm our business. Furthermore, future changes in environmental laws and regulations in the PRC could occur that could result in stricter standards and enforcement, larger fines and liability, and increased capital expenditure requirement and operating costs, any of which could have a material adverse effect on our financial condition or results of operations.

Potential environmental liability could have a material adverse effect on our operations and financial condition.

To the knowledge of our management team, neither the construction of natural gas distribution systems nor the sale and distribution of natural gas constitute activities that require our operations to comply with any particular PRC environmental laws other than the PRC environmental laws of general applicability. Over the past few years, it has not been alleged that we have violated any current environmental laws or regulations by the PRC government; however, there can be no assurance that the PRC government will not amend its current environmental laws and regulations. Our business and operating results could be somewhat affected as we might have to increase some expenditures to comply with changed environmental laws or regulations affecting our operations.

If we fail to effectively manage our growth and expand our operations, our business, financial condition, results of operations and prospects could be adversely affected.

Our future success depends on our ability to expand our business to address growth in demand for our distribution networks and natural gas recovery operations. We currently have exclusive natural gas distribution rights for the cities of Dashiqiao, Nandaihe and Zhanhua. Our ability to accomplish these goals is subject to significant risks and uncertainties, including:

| | · | the need for additional funding to construct the additional distribution networks; |

| | · | delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as problems with equipment vendors and manufacturing services provided by third-party manufacturers; |

| | · | our receipt of any necessary government approvals or permits that may be required to expand our operations in a timely manner or at all; |

| | · | diversion of significant management attention and other resources; and |

| | · | failure to execute our expansion plan effectively. |

To accommodate our growth, we will need to implement a variety of new and upgraded operational and financial systems, procedures, and controls, including improvements to our accounting and other internal management systems, by dedicating additional resources to our reporting and accounting function, and improvements to our record keeping and contract tracking system. We will also need to recruit more personnel and train and manage our growing employee base. Furthermore, our management will be required to maintain and expand our relationships with our existing customers and find new customers for our services. There is no guarantee that our management can succeed in maintaining and expanding these relationships.

If we encounter any of the risks described above, or if we are otherwise unable to establish or successfully operate additional capacity or increase our output, we may be unable to grow our business and revenues, reduce our operating costs, maintain our competitiveness or improve our profitability and, consequently, our business, financial condition, results of operations, and prospects will be adversely affected.

One of our stockholders controls the company and its interests may not be aligned with the interests of our other stockholders.

Vicis Capital Master Fund is the owner of all of our outstanding series B preferred stock. Currently the holder of our series B preferred stock votes together as a single class with the holders of our common stock and the holders of our series A preferred stock, with the holders of the series B preferred stock being entitled to seventy percent (70%) of the total votes on all such matters regardless of the actual number of shares of Series B Preferred Stock then outstanding, and the holders of series A preferred stock and common stock being entitled to their proportionate share of the remaining 30% of the total votes. As a result, Vicis can control our business, including decisions regarding mergers, consolidations and the sale of all or substantially all of our assets, election of directors and other significant corporate actions. This concentration of ownership may also have the effect of discouraging, delaying or preventing a future change of control, which could deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our Company and might reduce the price of our shares.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practices Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We have operations, agreements with third parties and make sales in China, which may experience corruption. Our activities in China create the risk of unauthorized payments or offers of payments by one of our employees, consultants, sales agents or distributors, even though these parties are not always subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and our employees, consultants, sales agents or distributors may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

We depend heavily on key personnel, and turnover of key employees and senior management could harm our business.

Our future business and results of operations depend in significant part upon the continued contributions of our key technical and senior management personnel, including Yangkan Chong, our Chairman, Chief Executive Officer and President, Yu Tak Shing, our Chief Financial Officer, and Dunhong Shi, our Chief Operating Officer. They also depend in significant part upon our ability to attract and retain additional qualified management, technical, operational and support personnel for our operations. If we lose a key employee, if a key employee fails to perform in his or her current position, or if we are not able to attract and retain skilled employees as needed, our business could suffer. Significant turnover in our senior management could significantly deplete the institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the reclamation, technical, and marketing aspects of our business, any part of which could be harmed by turnover in the future.

We may require additional capital and we may not be able to obtain it on acceptable terms or at all.

We believe that our current cash and cash flow from operations will be sufficient to meet our present cash needs. We may, however, require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If these resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

| | · | investors’ perception of, and demand for, securities of Chinese-based companies involved in the natural gas distribution and recovery industry; |

| | · | conditions of the U.S. and other capital markets in which we may seek to raise funds; |

| | · | our future results of operations, financial condition and cash flows; and |

| | · | economic, political and other conditions in China. |

Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could have a material adverse effect on our business, financial condition and results of operations.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. In addition, the independent registered public accounting firm auditing a company’s financial statements will in the future be required to attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting as well as the operating effectiveness of the company’s internal controls. Our internal controls were not effective for the fiscal year ended December 31, 2008 in that we were required to restate our financial statements for the fiscal year ended December 31, 2008 and those set forth in each of our Quarterly Reports on Form 10-Q filed during 2009 due to the identification of a number of significant deficiencies. Although we took certain steps designed to eliminate these significant deficiencies management has concluded that our internal controls were not effective for the fiscal year ended December 31, 2009. We cannot assure you that our internal controls will be effective in the future. Under current law, we will be subject to these attestation requirements beginning with our annual report for the fiscal year ended December 31, 2010. , There can be no positive assurance that we will receive a positive attestation from our independent auditors. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements.

.

We may not be able to effectively integrate acquired enterprises.

As part of our growth strategy we recently acquired a number of other gas businesses. There can be no assurance that the acquired enterprises will integrate effectively into our existing operations or in creating profitable businesses. Delays in integration or unresolved corporate culture issues may delay revenue growth or impact on our financial condition.

Risks Related to Doing Business in China

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

We conduct substantially all of our operations and generate most of our revenue in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

| | · | the higher level of government involvement; |

| | · | the higher level of control over foreign exchange; and |

| | · | the allocation of resources. |

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on us.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in the economic conditions or government policies in China could have a material adverse effect on the overall economic growth and the level of natural gas investments and expenditures in China, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our business and prospects.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiary in the PRC. Our operating subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions.

A slowdown or other adverse developments in the PRC economy may materially and adversely affect our customers, demand for our services and our business.

We are a holding company. All of our operations are conducted in the PRC and all of our revenues are generated from sales in the PRC. Although the PRC economy has grown significantly in recent years, we cannot assure you that such growth will continue. The use of natural gas for commercial and residential consumption in the PRC is relatively new and growing, but we do not know how sensitive we are to a slowdown in economic growth or other adverse changes in the PRC economy which may affect demand for natural gas. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in the PRC may materially reduce the demand for natural gas and materially and adversely affect our business.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

Most of our sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current account,” which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans.

Currently, our PRC operating subsidiary may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements.

However, the relevant PRC government authorities may limit our ability to purchase foreign currencies in the future.

Since a significant amount of our future revenue will be denominated in RMB, any existing and future restrictions on currency exchange may limit our ability to utilize revenue generated in RMB to fund our business activities outside China that are denominated in foreign currencies.

Foreign exchange transactions by PRC operating subsidiaries under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE.

In particular, if our PRC operating subsidiaries borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or MOFCOM, or their respective local counterparts. These limitations could affect their ability to obtain foreign exchange through debt or equity financing.

PRC regulations relating to the establishment of offshore special purpose companies by PRC residents, if applied to us, may subject our PRC resident stockholders to personal liability and limit our ability to acquire PRC companies or to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, SAFE issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, or the SAFE Notice.

The SAFE Notice requires PRC residents to register with the appropriate local SAFE branch before using assets or equity interests in their PRC entities to capitalize offshore special purpose companies, or SPVs, or to raise capital overseas.

A SAFE registration must be amended by a PRC resident if the SPV undergoes a significant event, such as a change in share capital, share transfer, merger, acquisition, spin-off transaction or use of assets in China to guarantee offshore obligations. Moreover, if the SPV was established and owned the onshore assets or equity interests before the implementation of the SAFE Notice, a retroactive SAFE registration is required to have been completed before March 31, 2006.

Our PRC resident shareholders have filed their SAFE registration with the local SAFE branch which has indicated to us that the registrations comply with applicable laws.

We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations implemented on September 8, 2006.

The 2006 PRC Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors also governs the approval process by which a PRC company may participate in an acquisition of its assets or its equity interests. Depending on the structure of the transaction, the new regulation will require the Chinese parties to make a series of applications and supplemental applications to the government agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer, which are designed to allow the government to assess the transaction. Government approvals will have expiration dates by which a transaction must be completed and reported to the government agencies.

However currently, compliance with the new regulations is likely to be less time consuming and less expensive than in the past.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue after this offering that will be exchanged into U.S. dollars and earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB has no longer been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions in an effort to reduce our exposure to foreign currency exchange risk. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Currently, none of our raw materials and major equipment are imported. In the event that the U.S. dollars appreciate against RMB, it will not affect our costs.

Risks Related to the Market for our Stock

The market price of our common stock is volatile, leading to the possibility of its value being depressed at a time when you may want to sell your holdings.

The market price of our common stock is volatile, and this volatility may continue. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include:

| | · | our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors; |

| | · | changes in financial estimates by us or by any securities analysts who might cover our stock; |

| | · | speculation about our business in the press or the investment community; |

| | · | significant developments relating to our relationships with our customers or suppliers; |

| | · | stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in the natural gas industry; |

| | · | customer demand for our products; |

| | · | investor perceptions of the natural gas industry in general and our Company in particular; |

| | · | the operating and stock performance of comparable companies; |

| | · | general economic conditions and trends; |

| | · | announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures; |

| | · | changes in accounting standards, policies, guidance, interpretation or principles; |

| | · | loss of external funding sources; |

| | · | sales of our common stock, including sales by our directors, officers or significant stockholders; and |

| | · | additions or departures of key personnel. |