UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

| (Mark One) | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended: June 30, 2008 | ||

OR | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission file number: 001-31825

THE FIRST MARBLEHEAD CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 04-3295311 (I.R.S. Employer Identification No.) | |

The Prudential Tower 800 Boylston Street, 34th Floor Boston, Massachusetts (Address of principal executive offices) | 02199-8157 (Zip Code) |

Registrant's telephone number, including area code:(617) 638-2000

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $.01 par value (Title of each class) | New York Stock Exchange (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

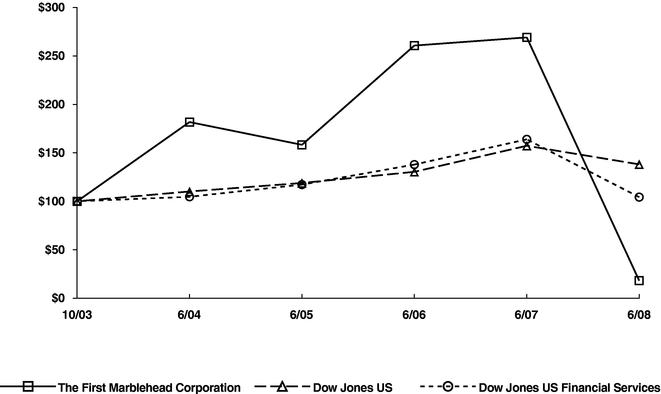

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant (without admitting that any person whose shares are not included in the calculation is an affiliate) was approximately $1,006,053,875 based on the last reported sale price of the common stock on the New York Stock Exchange on December 31, 2007. For the purposes of the immediately preceding sentence, the term "affiliate" refers to each director, executive officer and greater than 10% stockholder of the registrant as of December 31, 2007.

Number of shares of the registrant's common stock outstanding as of August 15, 2008: 98,943,063.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended June 30, 2008. Pursuant to Paragraph G(3) of the General Instructions to Form 10-K, information required by items 10, 11, 12, 13 and 14 of Part III have been omitted from this report (except for information required with respect to our executive officers and code of ethics, which is set forth under "Executive Officers" and "Code of Ethics" in Part I of this report) and are incorporated by reference to the definitive proxy statement to be filed with the Securities and Exchange Commission.

THE FIRST MARBLEHEAD CORPORATION

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended June 30, 2008

TABLE OF CONTENTS

FIRST MARBLEHEAD, ASTRIVE, LAUREL COLLEGIATE LOANS, MONTICELLO STUDENT LOANS and ASTRIVE ADVANTAGE are either registered trademarks or trademarks of The First Marblehead Corporation. All other trademarks, service marks or trade names appearing in this annual report are the property of their respective owners.

All share and per share information in this annual report gives effect to a three-for-two stock split of our common stock which was effected in the form of a stock dividend in December 2006.

This annual report includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Section 27A of the Securities Act of 1933, as amended, or the Securities Act. For this purpose, any statements contained herein regarding our strategy, future operations, future financial position, future revenues and funding transactions, projected costs, market position, prospects, plans and objectives of management, other than statements of historical facts, are forward-looking statements. The words "anticipates," "believes," "estimates," "expects," "intends," "may," "observe," "plans," "projects," "will," "would" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed or implied in our forward-looking statements. Matters subject to forward-looking statements involve known and unknown risks and uncertainties, including economic, regulatory, competitive and other factors, which may cause actual results, levels of activity, performance or the timing of events to be materially different than those expressed or implied by forward-looking statements. Important factors that could cause or contribute to such differences include our "critical accounting estimates" described in Item 7 of Part II of this annual report, and factors including, but not limited to, those set forth under the caption "Risk Factors" in Item 1A of Part I of this annual report. Although we may elect to update forward-looking statements in the future, we specifically disclaim any obligation to do so, even if our estimates change, and readers should not rely on those forward-looking statements as representing our views as of any date subsequent to August 28, 2008.

We use the terms "First Marblehead," "we," "us" and "our" in this annual report to refer to the business of The First Marblehead Corporation and its subsidiaries.

Overview

The First Marblehead Corporation provides outsourcing services for private education lending in the United States. We help meet the growing demand for private education loans by offering services to national and regional financial institutions and educational institutions for designing and implementing student loan programs. In addition, our subsidiary, Union Federal Savings Bank, which we refer to as Union Federal, is a federally chartered thrift that has offered private student loans directly to consumers and currently offers residential retail mortgages, retail savings products, time deposit products and demand deposit accounts. As a result of our ownership of Union Federal, we are a savings and loan holding company subject to regulation, supervision and examination by the U.S. Office of Thrift Supervision, which we refer to as the OTS. Our proprietary loan programs are Astrive Student Loans, Monticello Student Loans and Laurel Collegiate Loans.

Our business is focused on private loan programs primarily for undergraduate, graduate and professional education, and, to a lesser degree, on continuing education programs, the primary and secondary school market, career training and study abroad programs. Private education loans are not guaranteed by the U.S. government and are funded by private sector lenders. They are intended to be used by borrowers who have first utilized other sources of education funding, including federally guaranteed loan programs, grants and other aid.

We enable our clients to offer student and parent borrowers competitive loan products, while managing the complexities and risks of these products. We offer a continuum of services, from the initial phases of program design through application processing and support to the ultimate disposition of the loans through securitization transactions that we would structure and administer. In addition to offering a fully integrated suite of services, we have begun to offer stand-alone loan origination services, marketing services and portfolio management services on a fee-for-service basis. We have developed loan processing and support systems that are designed to accommodate new clients, additional loan products and potential increases in loan volume. We also own a proprietary database of more than 20 years of historical information on private student loan performance, which helps us to facilitate the structuring and pricing of loan programs and to supervise the servicing and default management processes for the securitized loans. In addition, we believe that our proprietary database increases the efficiency of the securitizations of our clients' loans by enabling us to provide to participants in the securitization process historical payment, default and recovery data on which to base estimates as to credit losses and reserves.

Student loan asset-backed securitizations have historically been our sole source of permanent financing for our clients' private student loan programs. We have been unable to access the securitization market since September 2007 as a result of market disruptions that began in the second quarter of fiscal 2008, accelerated during the third quarter of fiscal 2008 and persist as of August 28, 2008. In addition, The Education Resources Institute, Inc., or TERI, voluntarily filed on April 7, 2008 a petition for relief under Chapter 11 of the United States Bankruptcy Code, or the Bankruptcy Code, in the United States Bankruptcy Court for the District of Massachusetts, or the Bankruptcy Court. We refer to the proceeding as the TERI Reorganization. The TERI Reorganization, together with our inability to access the securitization market, has impacted our client relationships, resulted in the termination of certain material client agreements, reduced our facilitated loan volume and challenged our business prospects. We have refined our business model in an attempt to overcome the challenges currently facing us; however, our near-term financial performance and future growth depend in large part on our ability to structure securitizations and our ability to transition to a fee-based model.

The following table presents certain financial and operating information for the fiscal years ended June 30, 2008, 2007 and 2006. For additional information about our financial performance for each of the last three fiscal years, including our total assets, we refer you to the audited consolidated financial statements and accompanying notes attached as Appendix A to this annual report.

| | Fiscal year ended June 30, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | |||||||

| | (dollars in thousands) | |||||||||

Total revenues | $ | (28,409 | ) | $ | 880,704 | $ | 569,035 | |||

Net income (loss) | $ | (235,076 | ) | $ | 371,331 | $ | 235,960 | |||

Approximate number of student loan applications processed | 1,696,000 | 1,325,000 | 938,000 | |||||||

Approximate number of schools with loans facilitated | 5,600 | 5,800 | 5,600 | |||||||

Principal amount of student loans facilitated | $ | 5,004,000 | $ | 4,292,528 | $ | 3,362,565 | ||||

Principal amount of student loans facilitated that were also available to us for securitization | $ | 4,520,034 | $ | 3,873,048 | $ | 2,920,048 | ||||

Principal and accrued interest balance of student loans securitized | $ | 2,027,079 | $ | 3,750,043 | $ | 2,762,368 | ||||

Principal balance of student loans facilitated and available to us at year end for later securitization | $ | 3,399,483 | (1) | $ | 831,912 | $ | 663,800 | |||

- (1)

- Includes $1.125 billion principal amount of loans with respect to which our purchase rights terminated subsequent to June 30, 2008 in the context of the TERI Reorganization.

In February 2008, we announced a reduction in our overall cost structure on an annualized basis by approximately 15 to 20 percent, which included a reduction in force of 120 employees. As a result of the expected reduction in facilitated loan volumes, we took significant further steps to reduce our expense structure. In May 2008, we reduced headcount by approximately 500 additional employees, which coupled with other cost-saving initiatives, is expected to result in further cost-savings on an annualized basis of approximately $200 million.

We have recently developed alternatives to the loan guaranty and loan origination services that TERI has historically provided to our clients. We have developed a private label loan program that would not require a guaranty from a third party, and we have begun to offer outsourced loan origination services, marketing services and portfolio management services on a fee-for-service, stand-alone basis. These initiatives will be critical in order to grow our revenues and client base in the future. Compared to past TERI-guaranteed loan programs, the new private label loan program has been designed to have more selective underwriting criteria, higher borrower pricing and a greater proportion of immediate-repayment loans, or loans for which payment of principal and interest begins shortly after final disbursement, and interest-only loans, or loans for which payment of interest begins shortly after disbursement but payment of principal is deferred during enrollment. We are uncertain of the level of interest from former, current or prospective clients with regard to the new program or the offered services. Union Federal is not, as of August 28, 2008, able to meaningfully fund loan origination in the private label loan program due to its current lack of funding capacity.

Private Student Lending Overview

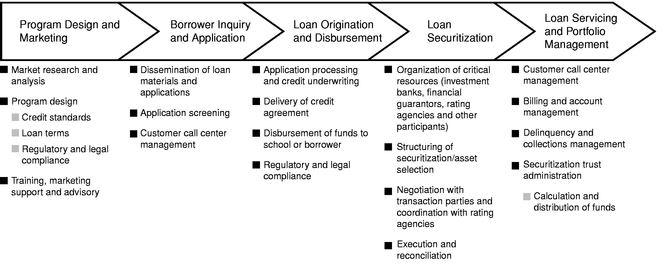

The lifecycle of a private student loan, which can be over 20 years long, consists of a series of processes and involves many distinct parties. Because the activities of these parties are largely uncoordinated but heavily regulated, the processes associated with designing, implementing, financing and administering student loan programs are complex, resource intensive and costly.

2

Set forth below is a chart outlining the series of processes in the private student loan lifecycle:

Program Design and Marketing

Lenders and educational institutions face an array of choices in attempting to satisfy their strategic and financial goals, as well as the needs of student borrowers. If an institution decides to initiate a loan program, it typically needs to make significant investments in staffing and infrastructure in order to support the program. In designing loan programs, the factors that these organizations generally consider include:

- •

- borrower creditworthiness criteria, including acceptable credit scores, credit bureau ratings and cosigner requirements, as well as factors such as employment and income history and any past derogatory credit events;

- •

- borrower eligibility criteria, including enrollment status, academic progress and citizenship or residency;

- •

- loan limits, including minimum and maximum loan amounts on both an annual and aggregate basis;

- •

- interest rates, including the frequency and method of adjustment;

- •

- amount of fees charged to the borrower, including origination, guaranty and late fees;

- •

- repayment terms, including maximum repayment term, minimum monthly payment amounts, rate reduction incentive programs, and deferment and forbearance options;

- •

- appropriate loss reserve levels to ensure repayment of defaulted principal and interest payments;

- •

- loan servicing, default management and collection arrangements;

- •

- asset financing or loan disposition alternatives; and

- •

- legal compliance with numerous federal laws and regulations, including but not limited to the Truth-in-Lending Act, the Fair Credit Reporting Act, the Equal Credit Opportunity Act, the Federal Trade Commission, or FTC, Act, the FTC Telemarketing Sales Rule, and numerous state laws that replicate and, in some cases, expand upon the requirements of federal laws.

In creating their loan marketing programs, institutions face choices in the channels and media available to them to reach potential student borrowers, including financial aid offices, online

3

advertising, direct mail campaigns, e-mail campaigns, telemarketing, and print, radio and television advertising.

Borrower Inquiry and Application

Prospective and current students and their families confront a complicated process in applying for financial aid. Because private student loans are often used to bridge the gap between the cost of attending an educational institution and available funds, including family resources and federal and state loans and grants, many borrowers must navigate multiple application processes. In order to respond to questions about these processes from student borrowers, lenders and educational institutions must invest in an appropriate infrastructure, including a staff of customer service personnel who have a thorough understanding of both the terms and advantages and disadvantages of their private loan program, federal financial aid options and the financial aid process as a whole. In addition to a customer service function, these institutions must respond to requests for loan materials and loan applications.

Loan Origination and Disbursement

Once a loan provider has received a loan application and determined that it is complete, it must then evaluate the information provided by the applicant against the eligibility and creditworthiness criteria of the private loan program. This underwriting process, which is subject to a variety of state and federal regulations, typically involves communication with credit bureaus in order to generate a credit score for the applicant and either an approval or denial of the loan.

If the applicant satisfies the private loan program criteria, the loan provider then prepares a legal instrument, known as a credit agreement, reflecting the terms and conditions under which the loan will be made. If the borrower signs and returns the credit agreement, the loan provider either (a) contacts the school to confirm the student's enrollment status and financial need and then disburses funds either to the borrower or, more commonly, directly to the school, or (b) receives evidence of the borrower's enrollment directly from the student, and disburses funds to the borrower.

Loan Securitization

Although some lenders originate loans and then hold them for the life of the loan, other lenders originate and then seek to dispose of the loans, either through a sale of whole loans or by means of a securitization. Whole loans can be purchased by other financial institutions, which may add them to an existing portfolio, or by entities that serve to warehouse the loans for some period of time, pending eventual securitization. Securitization historically provided several benefits to lenders and developed into a diverse, flexible funding mechanism, well-suited to the financing of student loan pools. Securitization historically enabled lenders to sell potentially otherwise illiquid assets in both the public and private securities markets, and helped lenders manage concentration risk and meet applicable regulatory capital adequacy requirements. The conditions of the debt capital markets generally, and the asset-backed securities, or ABS, market specifically, deteriorated during the second fiscal quarter of 2008. That deterioration accelerated during the third quarter of fiscal 2008 and persists as of August 28, 2008. As a result, the new issuance volume of student loan-backed securities totaled approximately $23.6 billion for the six months ended June 30, 2008. Of that total, approximately $23.5 billion were backed by federally guaranteed student loans and only $0.1 billion were backed by private student loans. According to industry sources, the new issuance volume of student loan-backed securities totaled approximately $67 billion in calendar 2007, $86 billion in calendar 2006 and $74 billion in calendar 2005. These balances include both federally guaranteed and private student loans.

4

In a student loan securitization, loans are typically purchased, pooled and deposited in a special purpose, bankruptcy remote entity. The special purpose entity issues and sells to investors securities collateralized by the student loans. Following the sale of these ABS, a trustee, or a servicer on behalf of a trustee, collects the payments of principal and interest generated by the underlying loans and makes disbursements to the asset-backed investors and service providers according to the terms of the documents governing the transaction.

Securitization has historically enabled the reallocation or transfer of risk through the use of derivative products such as interest rate swaps or caps, a senior-subordinated liability securities structure, financial guaranty insurance for the securities issued, loan guaranties from third party debt guarantors, the tiering of securities maturities and the issuance of several different types of securities matching projected pool repayment characteristics. Although this flexibility added to the complexity of the funding process, it also enabled the securitizer to reduce the cost of financing, thereby improving the economics of the loan program and/or improving loan terms by passing incremental savings back to the borrower. In market conditions as they exist on the date of this annual report, many of these structural elements may not be available to an issuer.

Securitizations require a high level of specialized knowledge and experience regarding both the capital markets generally, and the repayment characteristics and defaults on the part of student borrowers specifically. The process of issuing ABS requires compliance with state and federal securities laws, as well as coordination among originating lenders, securities rating agencies, attorneys, securities dealers, loan guarantors, structural advisors, trust management providers and auditors.

Loan Servicing and Portfolio Management

While student loans are outstanding, lenders or special purpose entities must provide administrative services relating to the loans, even if their terms permit borrowers to defer payments of principal and interest while enrolled in school. These administrative services include processing deferment and forbearance requests, sending out account statements and accrual notices, responding to borrower inquiries, and collecting and crediting payments received from borrowers. Many lenders, and all special purpose entities, outsource their servicing responsibilities to third party providers. In addition to administrative duties, servicers also play an active role in default prevention activities. Servicers generally rely on collection agencies to establish and maintain contact with defaulted borrowers, manage loans that are delinquent and collect defaulted loans. Loans are ultimately extinguished through scheduled repayment, prepayment or default. Once the borrower makes the final loan payment, the servicer sends a notice to the borrower and the credit bureaus confirming that the loan has been repaid in full.

Our Service Offerings

We offer prospective clients the opportunity to outsource some or all of the key components of their loan programs to us by providing a full complement of services, including program design, marketing, application processing, underwriting, loan documentation and disbursement, technical support, customer support and facilitation of loan securitization. In addition to offering a fully integrated suite of services, we have recently begun to offer certain services on a stand alone, fee-for-service basis.

We primarily offer services in connection with private label loan products offered through two marketing channels:

- •

- "direct to consumer," which generally refers to programs that lenders market directly to prospective student borrowers and their families; and

- •

- "school channel," which generally refers to programs that lenders market indirectly to prospective student borrowers and their families through educational institutions.

5

In either case, lenders may engage third parties that are not lenders but which market loans on behalf of lenders that fund the loans. We refer to these third parties as loan marketers, and we refer to the lenders that fund the loans as program lenders.

In the past, we offered our clients a fully integrated suite of outsourcing services, but we did not charge separate fees for many of those services. Moreover, although we received fees in the past for providing loan processing services to TERI in connection with TERI-guaranteed loans, and fees from certain of our clients for marketing coordination services, those fees represented reimbursement of the direct expenses we incurred. Accordingly, we did not earn a profit on those fees. Although we provided those various services without charging a separate fee, or at "cost" in the case of processing services for TERI-guaranteed loans and marketing coordination services, we generally entered into agreements with private label lenders giving us the exclusive right to securitize the student loans that they did not intend to hold. We received structural advisory fees and residuals for facilitating securitizations of those loans.

As a result, the primary driver of our results of operations and financial condition has historically been the volume of loans for which we provided outsourcing services from loan origination through securitization. We have been unable to access the securitization market as a result of market disruptions that began in the second quarter of fiscal 2008, accelerated during the third quarter of fiscal 2008 and persist as of August 28, 2008. That inability, together with the TERI Reorganization, has impacted our client relationships, resulted in the termination of certain material client agreements, reduced our facilitated loan volume and challenged our business prospects. The volume of loans for which we structured securitizations decreased to approximately $2.0 billion in fiscal 2008 from approximately $3.8 billion in fiscal 2007 and approximately $2.8 billion in fiscal 2006.

We have adapted our business model to address the challenges facing our company. We have worked over the past several months to develop all facets of a new private label loan program that would not require a guaranty from a third party, as well as outsourced loan origination services, marketing services and portfolio management services on a stand-alone basis. As a result, we are able to offer both a fully integrated suite of services for private student loan programs, as well as services on a fee-for-service basis. We expect in the future to enter into arrangements with private label lenders under which we provide fee-based outsourcing services but may not have the exclusive right to securitize the student loans that they fund. As in the past, however, we expect our level of profitability to continue to depend in the future on our ability to earn structural advisory fees and residuals for facilitating securitizations. We also generate fees as the administrator of the trusts that have purchased the private label loans. See "Management's Discussion and Analysis of Financial Condition and Results of Operations."

We continue to believe that private student loans are an important and growing source of college funding. College attendance is high, the overall cost of college continues to rise and government supported loans are limited. Added pressure for funding education may also result from declining home values and the unavailability of home-equity loans that have been a source of funding for education in the past. We believe that borrowers will need responsible private student loan solutions after exhausting all available scholarships, grants and government aid. Moreover, the College Cost Reduction and Access Act of 2007 has significantly reduced the profit margins of traditional non-governmental providers of federal loans, and we believe that we will continue to see competitors and potential competitors exit the student loan industry. Although significant uncertainty exists regarding the success or market acceptance of our new products and services, and our ability to access the securitization market, we believe that our experience in the private student loan industry, coupled with the liquidity provided by the recent equity investment by affiliates of GS Capital Partners, or GSCP, position us to be successful in the future.

6

Program Design and Marketing

We help clients design their private loan programs. Our design approach begins with a standard set of pricing options, legal agreements and third party relationships that we can then customize for our clients in order to satisfy their particular needs. In addition, we assist certain clients with the design and execution of their marketing programs.

Program Design

We have developed relationships with lenders and other organizations in the past through active marketing by our sales force and business development executives. Our private label clients have typically been lenders or educational loan marketers that desired to supplement their existing federal loan or other consumer lending programs with a private loan offering. Our approach is designed to be flexible enough, however, to facilitate private student loan programs for a range of clients, who, in turn, serve a variety of consumers. We can offer specialized knowledge, experience and capabilities to assist in the development of a private loan program to meet our prospective clients' needs, while minimizing their resource commitment and managing their credit risk.

Historically, one of the key components of our private label programs had been the opportunity for our lender clients to mitigate their credit risk through a loan repayment guarantee by TERI. TERI guaranteed repayment of the borrowers' loan principal, together with capitalized and/or accrued interest on defaulted loans. If the lender disposed of the loan in a securitization, the guaranty remained in place and served to enhance the terms on which ABS were offered to investors. The new private loan program that we have developed does not include a third party guaranty, although it does contemplate the funding and maintenance of loss reserves by lenders through segregated fees to be paid by the borrower.

Our prospective private label clients would fall into two categories:

- •

- Make and sell. In this category, lenders would select credit criteria and loan terms tailored to meet their needs, outsource to us some or all operating aspects of loan origination and customer support, and typically hold the loans on their balance sheets for some limited period of time. We would then attempt to facilitate a securitization to enable lenders to dispose of the loans, from which we would expect to generate structural advisory fees and residuals. See "—Securitization."

- •

- Make and hold. In this category, clients would outsource to us some or all operating aspects of loan origination, loan marketing or portfolio management, but would finance the loans on their balance sheets and generally continue to hold the loans through the scheduled repayment, prepayment or default. Historically, unless clients securitized their make and hold loans through us, the revenues we generated on these loans were limited to the processing fees that we received from TERI, which represented reimbursement of the direct expenses we incurred in originating the loans. We expect in the future to enter into make and hold arrangements with lenders pursuant to which we would directly charge fees for our services to the clients at the time we perform such services.

7

The following table presents information regarding the aggregate principal balance of private label loans that we processed during the fiscal years ended June 30, 2008, 2007 and 2006:

| | Fiscal year ended June 30, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | |||||||

| | (dollars in billions) | |||||||||

Approximate "make and sell" volume processed | $ | 4.4 | $ | 3.8 | $ | 2.8 | ||||

Approximate "make and hold" volume processed | 0.5 | 0.4 | 0.4 | |||||||

Approximate total volume processed | $ | 4.9 | $ | 4.2 | $ | 3.2 | ||||

Marketing

We have historically provided marketing coordination services intended to enable our lender and loan marketer clients to increase loan volume and resulting program revenue. We have established an in-house department that works in collaboration with clients, third party agencies and vendors to support the development, execution and analysis of direct response marketing programs, including direct mail, direct response television, and Internet-based marketing campaigns. These programs have been designed to drive direct-to-consumer loan program volume and generate know-how that inform marketing optimization and refinement.

Our marketing services group has also coordinated marketing for our proprietary loan programs, including Astrive Student Loans, Monticello Student Loans and Laurel Collegiate Loans, which provide valuable insights with regard to product features and the effectiveness of various marketing channels and tactics. Through our proprietary brands, we intend to provide a full spectrum of undergraduate, graduate, K-12 and school-certified private loans.

We augmented our direct-to-consumer programs during fiscal 2008 to build on our experience. As our proprietary brands have become better known, we have been able to broaden the support and services that we offer to students and their parents. In July 2008, we launched a website,www.AstriveAdvantage.com, to help students maximize their buying power by providing discounts on items such as textbooks, computers, printers and other education-related expenses. We also intend to enter into arrangements with third party vendors that provide value-added services to students or parents as they seek to maximize their financial aid packages and execute a smart borrowing strategy.

Finally, we continue to invest in ourwww.SmartBorrowing.orgwebsite. We established this website to provide an education-based environment for students and parents to gather information about financing their college education. We designed it based on the smart borrowing principle that students should first consider scholarships, grants and federal and state aid options before seeking alternative private student loans.

Borrower Inquiry and Application

We have developed proprietary processing platforms, applications and infrastructure, supplemented by customized vendor solutions, for use in providing loan application services. We expect to provide application services as either an integrated part of the new private label program, or as a fee for service on a stand-alone basis. We enable borrowers to submit applications by web, telephone, facsimile or mail. In fiscal 2008, we received via the Internet approximately 68% of the approximately 1,680,000 private label loan applications that we processed. In fiscal 2007, we received via the Internet approximately 62% of the approximately 1,305,000 private label loan applications that we processed. In fiscal 2006, we received via the Internet approximately 58% of the approximately 914,000 private label loan applications that we processed. We have designed our online systems to be E-sign compliant for delivery of consumer disclosures, and we have implemented electronic signature capabilities.

8

Once a potential borrower submits an application for processing, our system automatically generates and sends a confirmation notice, typically via e-mail, to the applicant. Our customized third party credit decision software can be configured for each client's specific program parameters, and analyzes, often within minutes, the submitted application. Application data are automatically sent to credit bureaus, which generate and return a credit report. The credit decision software then applies the credit report data and all scoring parameters associated with the loan type, and a credit decision is generated. This automated underwriting process allows us to deliver a loan application decision with respect to a significant majority of applications. Applications with either incomplete information, information mismatches or with scores close to cut-off can be sent automatically to a credit analyst for review. At this point in the process, we are able to communicate the initial determination to the applicant, including through e-mail, informing him or her whether the application is conditionally approved, rejected or in review. The applicant receives instructions as to next steps and is provided a website navigation link to check his or her loan status. To avoid unauthorized disclosure, access requires use of security protocols established during the application process. Simultaneously, our customer service platforms, including our automated voice response unit, online status and customer service applications, are updated.

To help applicants through the loan application process, we have an internal customer service department comprised of 27 full-time employees as of August 28, 2008. We have in the past supplemented our internal department with contract customer service employees and outsourced customer service representatives as necessary to meet client needs. Our internal customer service department is divided into five areas:

- •

- Inbound and Outbound Customer Service, which provides end-to-end service and support for borrower inquiries throughout the application process;

- •

- Customer Resource Group, which provides specially trained credit analysts for borrower support on advanced needs loan processing and issue resolution;

- •

- Customer Support Services, which provides dedicated account representatives trained to support our clients;

- •

- Priority Services, which provides specially trained representatives to support schools; and

- •

- Telesales, which provides inbound application-capture services.

The performance of each customer service area is monitored closely and detailed performance metrics, such as abandonment rates and service levels, are tracked daily. We use outsourced customer service representatives primarily to support inbound status-related inquiries.

Loan Origination and Disbursement

In past private label loan programs, we assisted the lenders in selecting the underwriting criteria to be used in deciding whether a student loan would be made to an applicant. However, each lender had ultimate control over the selection of these criteria, and in providing our services, we were obligated by contract to comply with them. Once a loan application was approved, we generated a credit agreement, a legal contract between the borrower and lender which contained the terms and conditions of the loan, for the borrower based on lender- and product-specific templates. For those lenders and borrowers that preferred electronic document delivery, an automated e-mail was sent to the borrower, which contained a navigation link to prompt the borrower to access a secure website to retrieve the credit agreement and certain regulatory disclosures. The credit agreement could be viewed, downloaded and printed by the borrower and faxed or mailed back to us. For those borrowers who preferred paper documentation, we printed and mailed a pre-filled credit agreement to the borrower for him or her to sign and return to us by mail. Approximately 86% of approved applicants during fiscal 2008, 86% of

9

approved applicants during fiscal 2007 and 79% of approved applicants during fiscal 2006 requested on their application that their credit agreement be provided electronically.

We have collaborated with our clients in the past to comply with applicable laws and regulations in loan documentation, disclosure and processing. We have assumed responsibility for compliance with federal and Massachusetts law regarding loan documentation and disclosure and, in turn, worked with lenders to prepare lender specific credit agreement templates. We maintained and utilized these templates, reflecting applicable legal requirements and lender preferences. We also delivered each lender's privacy policy and prepared and delivered truth-in-lending and various state law disclosures to borrowers.

In past private label loan programs, once we obtained all applicant data, including the signed credit agreement, evidence of enrollment and any income verification, we disbursed the loan funds on behalf of the lender, with funds made available to us by the lenders. Depending on the loan program and type of disbursement, funds were either sent to the borrower, directly to the school or to a central disbursing agent such as New York Higher Education Services Corporation or ELM Resources, which then passed the funds along to the school.

We monitor developments in state and federal requirements for loan processing and implement changes to our systems and processes based on our analysis and input we receive from lenders and industry groups. For example, we designed and made available to lenders a customer identification program in connection with their past private label loan programs. This identification program was designed to meet USA PATRIOT Act requirements that lenders gather identifying data, verify applicant identity and maintain records of the process. We also completed similar process improvements in the area of secure access to pending loan information, in order to comply with federal privacy and state identity theft laws. Contractual liability for identification of state law process requirements has historically rested with the lenders, unless we undertook to comply with a particular requirement.

We expect to provide in the future loan origination and disbursement services similar to those that we have provided in past private label loan programs. In August 2008, Union Federal formed an operating subsidiary through which it plans to provide outsourced student loan origination and marketing services. See "—Union Federal Savings Bank."

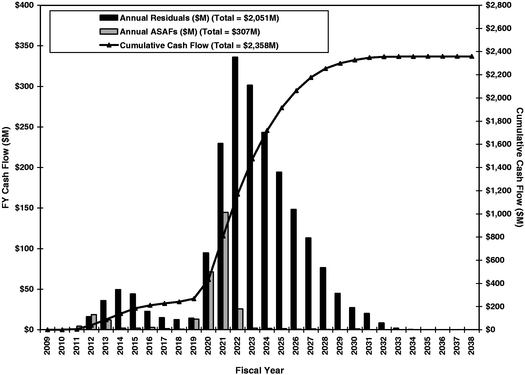

Securitization

In addition to providing loan program design, marketing coordination, application and origination services, we have historically also served as an intermediary between our clients and the capital markets. We have formed bankruptcy remote, qualified special purpose statutory trusts to purchase private label loans from the originating lenders. The proceeds from bonds issued by the trusts have been used to purchase student loans, which have been used as security for repayment of the bonds. The securitizations that we have structured and administered have provided our lender clients with the ability to limit credit and interest rate risk, and generate liquidity for their private student loan programs. In addition to structural advisory and administrative and other fees, we have been entitled to a residual interest in the securitization trusts as part of our compensation in connection with past securitizations.

We have been a leader in facilitating the securitization of private student loans, having structured and facilitated 38 securitizations consisting entirely of private student loans, more than any other entity. We have securitized loan pools using various financing structures, including both public offerings registered with the Securities and Exchange Commission, or SEC, and private placements, and have utilized various ABS, including commercial paper, London Interbank Offered Rate, or LIBOR, floating rate notes, auction-rate debt and senior-subordinated and third party credit enhanced debt. In connection with our "make and sell" private label programs, we historically entered into agreements with the originating lenders giving us the exclusive right to securitize their program loans.

10

The extensive database provided by our private label repayment statistics dating back to 1986 has been another key to optimizing the financing of the student loan pools our clients generated. We have used this data to estimate the default, recovery and prepayment characteristics of the different types of loans that constitute a loan pool. We believe the historical data and our use of standard consumer credit score-based risk assessments give added comfort to the rating agencies, insurance providers, underwriters and securities investors, resulting in a more cost-effective securitization.

Recent Developments. The conditions of the debt capital markets generally, and the ABS market specifically, rapidly deteriorated during the second quarter of fiscal 2008. That deterioration accelerated during the third quarter of fiscal 2008 and persists as of August 28, 2008. Asset-backed securitizations have historically been our sole source of permanent financing for our clients' private student loan programs, and our business has been and continues to be materially adversely impacted by the current market dynamics, including an inability to access the securitization market and interim financing facilities. We have pursued alternative means to finance our clients' loans, however, other sources of funding have not been available on acceptable terms, if available at all. Recent conditions in the capital markets have generally resulted in a substantial widening of credit spreads and significantly more restrictive covenants, which has affected the pricing, terms and conditions of the alternative funding mechanisms we have pursued.

We did not complete a securitization transaction during the second, third or fourth quarters of fiscal 2008, and we do not expect to complete a securitization in the first quarter of fiscal 2009. During fiscal 2007, we closed one securitization transaction in each of the first, second and third quarters and closed two securitization transactions in the fourth quarter. As a result, our securitization volumes materially decreased in fiscal 2008 compared to fiscal 2007, and we expect pricing terms in any near-term future securitizations to be substantially less favorable than in the past. In the near-term, we also expect investors to have limited or no demand for subordinate tranches of asset-backed securities in securitization transactions, if any, that we are able to facilitate.

Securitization-related Revenues. We have received several types of fees in connection with our past securitization services:

- •

- Structural advisory fees. We have charged structural advisory fees that were to be paid in two portions:

- •

- Up-front. We received a portion of the structural advisory fees at the time the securitization trust purchased the loans; and

- •

- Additional. We are entitled to receive a portion of the structural advisory fees over time, based on the amount of loans outstanding in the trust from time to time over the life of the trust.

- •

- Residuals. We also have the right to receive a portion of the residual interests that these trusts create. This interest is junior in priority to the rights of the holders of the debt sold in the securitizations as well as the additional structural advisory fees above. Our residual interest is derived almost exclusively from the services we have performed in connection with each securitization rather than from a direct cash contribution to the securitization trust.

In exchange for these structural advisory fees, we have structured the securities sold in the securitization, coordinated the attorneys, accountants, trustees, loan servicers, loan originators and other transaction parties and prepared cash flow modeling for the rating agencies.

We also receive administrative fees from the trusts as further described below under "—Loan Servicing and Portfolio Management."

We do not expect to facilitate a securitization transaction in the first quarter of fiscal 2009, and we are uncertain as of August 28, 2008 whether the fee structure that we have historically used will be

11

available in future securitization transactions. In particular, market conditions may dictate that we reduce or forgo our up-front structural advisory fee in connection with securitizations, if any, that we are able to facilitate. For a discussion of our revenue recognition policies and the judgments and assumptions we use to estimate the fair value of our additional structural advisory fees and residuals receivable, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Executive Summary—Recognition and Valuation of Service Revenue" and "Management's Discussion and Analysis of Financial Condition and Results of Operations—Executive Summary—Application of Critical Accounting Policies and Estimates—Service Revenue and Receivables."

In recent years, we have derived a significant portion of our revenue and substantially all of our income from structuring securitizations on behalf of securitization trusts. We earned $320.4 million in securitization-related fees from the trusts used to securitize student loans during fiscal 2008. Securitization-related fees from trusts represented approximately 78% of our total revenue in fiscal 2007 and approximately 74% of our total revenue in fiscal 2006. These trusts purchased private student loans from several lenders, including JPMorgan Chase Bank, N.A., which we refer to as JPMorgan Chase, Bank of America, N.A., which we refer to as Bank of America, RBS Citizens, N.A., which we refer to as RBS, and Union Federal. Although we did not receive fees directly from these lender clients, structural advisory fees and residuals from securitizations of the private label loans of JPMorgan Chase and Bank of America, represented approximately 34% and 20%, respectively, of our total securitization-related fees from the trusts used to securitize student loans during fiscal 2008, and approximately 29% and 15%, respectively, of our total revenue in fiscal 2007. Our agreements with JPMorgan Chase and Bank of America, and certain of our agreements with RBS, terminated in the context of the TERI Reorganization. See "—Relationship with The Education Resources Institute—TERI Reorganization." Historically, we structured and supported private student loan programs for a number of companies that assisted lenders such as RBS in marketing their programs to customers. Structural advisory fees and residuals from securitization of loans marketed under our proprietary brand, Astrive, and funded by either RBS or Union Federal represented approximately 19% of our total securitization-related fees from the trusts used to securitize student loans in fiscal 2008, and approximately 12% of our total revenue for fiscal 2007.

Loan Servicing and Portfolio Management

As our trust assets under management have grown, we have adapted our approach to loan servicing and portfolio management to improve performance and reduce borrower confusion regarding repayment terms and conditions. Borrower confusion can result in payment delinquency and default. Utilizing proprietary risk scores, we instituted an "early awareness" program for high risk borrowers in February 2008 that reminds borrowers and cosigners of their responsibilities and, if necessary, offers payment options. We believe that this program is an important strategy in reducing early stage delinquencies.

Our portfolio management group coordinates third party agencies for timely servicing and customer contact. Once a loan enters repayment, we coordinate servicing through eight loan servicers. The Pennsylvania Higher Education Assistance Agency, or PHEAA, services a majority of the loans we have facilitated. In addition, we have agreements with a total of eleven outside collection agencies relating to default prevention and recovery services. Once a loan defaults, we channel the loan to one of the collection agencies based on their particular expertise.

In connection with our private label programs, clients may opt either to outsource the servicing and collections of their loans to organizations with which they have existing relationships or contract for these services through us. For securitized loans, these servicing and default prevention agreements, which typically extend over the life of the loan pool, are assigned to the purchasing trust.

12

As administrator of the trusts that have purchased private label loans, we monitor the performance of the loan servicers and third party collection agencies. In this capacity, we confirm compliance with servicing guidelines and review default prevention and collection activities. We receive administrative fees from the trusts, ranging from 5 to 20 basis points per year of the student loan balance in the trust, for daily management and for the services we provide in obtaining information from the loan servicer and reporting this and other information to the parties related to the securitization.

In the past, the loan servicer provided servicing and default prevention activities through the first 60 days of loan delinquency. Beginning in May 2008, we began outsourcing default prevention activities to specialized third party collection agencies beginning at 31 days, to better manage portfolio delinquency. During the first 30 days of any loan delinquency, the servicer performs collections activities in accordance with contractual requirements outlined in the servicing guidelines of the loan program. These guidelines establish certain required collection activities, such as attempted telephone contacts to borrowers and cosigners within prescribed delinquency intervals, as well as requirements for the mailing of delinquency notices and skip trace activities for borrowers whose addresses have changed.

Once the loan has been delinquent for 30 days, we provide pre-claims assistance to supplement collections activity performed by the servicer. We assign delinquent accounts to one of several external collection agencies, which work to cure the account by bringing it current. During this period, the servicer remains responsible for invoicing and posting payments. We monitor these external collection agencies that perform pre-claims default prevention activities and share their performance with their peers. Our strategy is to award the highest percentage of new accounts to the agency whose performance has been strongest in the prior period. In addition to this incentive, we provide performance bonuses to agencies performing above established performance expectations for cure rates. If a delinquent loan becomes less than 30 days past due, collection efforts are returned to the servicer for routine processing.

Loans are ultimately extinguished through scheduled repayment, prepayment or default. Once the borrower makes the final loan payment, the servicer sends a notice to the borrower and the credit bureaus confirming that the loan has been repaid in full.

Union Federal Savings Bank

In November 2006, we acquired Union Federal, a community savings bank located in North Providence, Rhode Island. Union Federal is a federally chartered thrift that offers residential retail mortgage loans, retail savings products, time deposit products and demand deposit accounts. Union Federal has also funded a portion of our proprietary student loan programs in the past, although it is not doing so as of August 28, 2008. Union Federal held approximately $497.3 million of variable-rate private student loans as of June 30, 2008, of which loans with a principal balance of approximately $246.9 million were pledged as collateral under a warehouse facility provided by a conduit lender. In addition, Union Federal held approximately $10.8 million of mortgage loans as of June 30, 2008. We derived approximately $19.1 million of net interest income during fiscal 2008 from Union Federal, primarily from the student loan portfolio.

As a result of disruptions in the ABS market, we have been unable to facilitate the securitization of student loans originated by Union Federal since September 2007. Regulators will not permit Union Federal to serve as a meaningful funding lender in our new private loan program until it has sufficient cash and cash equivalents.

In May 2008, Union Federal formed a new, wholly owned operating subsidiary, FM Loan Origination Services, LLC, or FMLOS. Through FMLOS, we plan to provide outsourced student loan marketing services and certain student loan origination services on a fee-for-service basis. As a subsidiary of a federal financial institution, FMLOS provides us with greater regulatory flexibility than

13

we had previously. Union Federal has received regulatory approvals from the OTS and the Federal Deposit Insurance Corporation, or FDIC, relating to the formation and operation of FMLOS and entered into a loan marketing agreement in July 2008 pursuant to which it markets a third party lender's private label loans under one of our proprietary brands. The third party lender has agreed to pay Union Federal a marketing fee based on disbursed loan volume.

Relationship with The Education Resources Institute, Inc.

TERI is the nation's oldest and largest guarantor of private student loans. As a not-for-profit corporation, TERI's main operating purpose is to provide students with access to educational opportunities through educational finance and counseling services. To help accomplish this, TERI has in the past offered guaranty products for student loan programs pursuant to which TERI agreed to reimburse lenders for all unpaid principal and interest on their defaulted student loans, in exchange for a fee based on the loan type and risk profile of the borrower. Since its inception in 1985, TERI has guaranteed approximately $22.6 billion of private education loans for students at more than 7,500 schools nationally and internationally.

Historical Relationship. In 2001, we acquired a copy of TERI's historical loan database and TERI's loan processing operations, but not its investment assets or guaranty liabilities. We issued promissory notes totaling $7.9 million and paid approximately $1.0 million in cash to TERI in connection with this transaction. TERI remains, however, an independent, private, not-for-profit organization with its own management and board of directors.

In connection with the 2001 transaction, we entered into a series of agreements with respect to loan processing services, database updates and the securitization of TERI-guaranteed loans. These included a master servicing agreement, a database sale and supplementation agreement and a master loan guaranty agreement. In October 2004, we renewed our agreements with TERI, in each case for an additional term through June 2011. Pursuant to the master servicing agreement, TERI engaged us to provide loan origination, pre-claims, claims and default management services. Under TERI's agreements with lenders, lenders delegated their loan origination functions to TERI, and TERI had the right to subcontract these functions to us. Pursuant to the database sale and supplementation agreement, TERI provided updated information to us about the performance of the student loans it had guaranteed, so that we could continue to supplement and enhance our database.

Under the terms of the master loan guaranty agreement, we granted TERI a right of first refusal to provide a third party loan guaranty under existing and future private label loan programs facilitated by us, as well as new loan programs jointly created by TERI and us. In addition, we agreed to provide a beneficial interest for TERI in a portion of the residual value of securitization trusts that purchase TERI-guaranteed loans. The master loan guaranty agreement generally provided that the guaranty fees earned by TERI upon the disbursement of student loans would be placed by TERI in segregated reserve accounts that were held as collateral to secure TERI's obligation to purchase defaulted student loans. These accounts were generally held by third party financial institutions for the benefit of the program lender until the student loans could be securitized, at which point the accounts were pledged to the securitization trust that purchased the loans. The master loan guaranty agreement, as it had been implemented through guaranty agreements with individual lenders, entitled TERI to retain a portion of its guaranty fees as an administrative fee rather than place them in the pledged accounts.

In August 2006, we entered into a supplement to the master loan guaranty agreement that provided as follows:

- •

- For each securitization closing between August 1, 2006 and June 30, 2007, TERI was entitled to elect to adjust the amount of its administrative fee, and adjust the amount deposited into the pledged account, within specified parameters. As a result, the amount of the administrative fee applicable to securitizations closing between August 1, 2006 and June 30, 2007 could have

14

- •

- For each securitization for which TERI elected to adjust the administrative fee, we made a corresponding adjustment to our relative ownership percentages of the residual interests in the applicable securitization trust. To the extent TERI elected to increase the amount of its administrative fee above 150 basis points, such an adjustment resulted in an increase in our ownership percentage, and a decrease in the ownership interest of TERI, by a percentage that resulted in an equivalent dollar reduction in the fair value of TERI's residual ownership interest at the time of the securitization.

ranged from 150 basis points to 240 basis points, at TERI's election and subject to the parameters of each securitization trust.

In September 2007, we entered into an additional supplement to the master loan guaranty agreement. This additional supplement provided that for each fiscal year between July 1, 2007 and June 30, 2011, TERI was entitled to make an annual election to adjust the amount of its administrative fee, and the amount deposited into the pledged account, within the parameters set forth in the August 2006 supplement. TERI's election would apply to all securitizations of TERI-guaranteed loans completed during the applicable fiscal year. TERI elected to receive an administrative fee of 240 basis points for any securitization transaction we completed in fiscal 2008. We agreed to attempt in good faith to structure our securitization transactions to accommodate TERI's election. TERI received an administrative fee of 182 basis points for the securitization transactions that we completed in the first quarter of fiscal 2008.

Through June 2006, we paid TERI a monthly fee of approximately $62,000 pursuant to the database sale and supplementation agreement. Beginning in July 2006, monthly payments pursuant to the database sale and supplementation agreement were reduced to approximately $21,000. TERI also maintained a right to access the data we own solely for use in its guaranty business.

We received processing fees from TERI of approximately $126.5 million during fiscal 2008. Processing fees from TERI represented approximately 15% of our total revenue during fiscal 2007 and 19% of our total revenue during fiscal 2006.

TERI Reorganization. On April 7, 2008, TERI filed a voluntary petition for relief under Chapter 11 of the Bankruptcy Code. The TERI Reorganization has had, and will likely continue to have, a material negative effect on our client relationships, facilitated loan volume, loans available for securitization, ability to fully realize the cost reimbursement and guaranty obligations of TERI, and the value of our service receivables.

Certain of our agreements with clients provided for termination rights in the event of the filing by TERI of a voluntary petition under federal bankruptcy laws. In April 2008, we received notice that Bank of America elected to terminate its agreements due to the TERI Reorganization. Structural advisory fees and residuals from securitization of loans originated by Bank of America represented approximately 15% of our total revenue for fiscal 2007, and loans originated and available for securitization by Bank of America represented approximately 18% of our total loans available for securitization for fiscal 2008. We have the right to facilitate the securitization of Bank of America loans originated prior to the termination, subject to the terms and conditions of our note purchase agreements with Bank of America.

We also received notice in April 2008 that RBS elected to terminate certain agreements with us and our clients. We provided services to RBS in connection with various private student loan programs, which we refer to as RBS Programs, including RBS Programs marketed by third party loan marketers, and RBS Programs marketed under RBS' private label brands. Subject to the terms and conditions of note purchase agreements between RBS and us, we had the right to facilitate securitization of RBS Program loans. We had also entered into agreements with RBS and loan marketers pursuant to which we coordinated the marketing of certain RBS Programs. As a result of the terminations, neither RBS

15

nor we has any further obligations to sell or purchase certain RBS Program loans, and the affected program marketers were required to cease all marketing activities with regard to their RBS Programs. In total, loans subject to the terminated note purchase agreements or attributable to the terminated RBS Programs represented approximately 22% of our total loans available for securitization for fiscal 2008. Note purchase agreements between RBS and us relating to a limited number of the terminated RBS Programs remain in effect, such that RBS and we have continuing obligations to sell and purchase loans that were originated pursuant to these RBS Programs prior to termination. Such loans represented approximately 15% of our total principal amount of loans available for securitization for fiscal 2008.

In July 2008, the Bankruptcy Court entered an order granting a motion by TERI to terminate the loan origination agreement and guaranty agreement between TERI and JPMorgan Chase. TERI and JPMorgan Chase entered into a stipulation in connection with the motion, providing for certain agreements among the parties with regard to the terminations. Pursuant to the stipulation, TERI agreed to return to JPMorgan Chase a portion of the guaranty fees previously paid by JPMorgan Chase to TERI with regard to TERI-guaranteed loans funded and owned by JPMorgan Chase, and JPMorgan Chase waived and relinquished any further guaranty claims against TERI with regard to the program loans. We had the right to facilitate securitization of the program loans, subject to the terms and conditions of our note purchase agreement with JPMorgan Chase. As a result of the termination of the guaranty agreement, the note purchase agreement also terminated. As a result, JPMorgan Chase no longer has any further obligations to sell, and we no longer have any obligation to securitize, program loans pursuant to the note purchase agreement, including program loans originated by JPMorgan Chase prior to the termination of the note purchase agreement. These program loans represented approximately 16% of our total principal amount of loans facilitated and available for securitization as of June 30, 2008.

As a result of the TERI Reorganization and our inability to access the securitization market, the clients that have not terminated their agreements have suspended their marketing of TERI-guaranteed loan programs or instructed TERI to stop accepting applications for TERI-guaranteed loans. These actions, together with the tightening of our clients' loan underwriting criteria, resulted in a significant reduction in our facilitated loan volumes during the fourth quarter of fiscal 2008. We expect that the guaranty agreements or loan origination agreements that most of our clients have with TERI will be terminated in the context of the TERI Reorganization. Termination of a client's guaranty agreement or loan origination agreement with TERI would generally result in the termination of our agreements with the client. As a result, we expect to lose additional clients in the future as the TERI Reorganization evolves.

In April and May 2008, the Bankruptcy Court issued interim orders prohibiting TERI from withdrawing any amounts from its segregated reserve accounts until further order by the Bankruptcy Court. In June 2008, the Bankruptcy Court entered an order approving a motion by TERI to purchase defaulted loans, pursuant to the terms of the applicable guaranty agreements, using cash in pledged accounts, which we refer to as Pledged Accounts, established for the benefit of certain securitization trusts. The order was granted subject to the following:

- •

- The committee of unsecured creditors, which we refer to as the Creditors Committee, or any other person or entity had the right to challenge the validity, perfection, priority or enforceability of the trusts' security interests in (i) the Pledged Accounts within 14 days following the order, (ii) funds transferred to the Pledged Accounts after the filing of TERI's petition for reorganization, which we refer to as Post-Petition Transfers, within 45 days following the order and (iii) collateral securing TERI's guaranty obligations other than the Pledged Accounts and the Post-Petition Transfers (such as recoveries on loans that have previously defaulted) within 60 days following the order.

16

- •

- Recoveries that have not been transferred to a Pledged Account will be placed in a segregated account and held in such account until the earliest of (i) the 61st day following the order and (ii) the entry of an order by the Bankruptcy Court directing the disposition, transfer or other use of funds in such account.

The order did not permit TERI to purchase any defaulted loans with funds from TERI's general operating accounts.

The Bankruptcy Court, with the assent of all affected parties, subsequently extended until October 1, 2008 all parties' rights to challenge the trusts' security interests in the collateral securing TERI's guaranty obligations other than the Pledged Accounts. Extension of the objection deadline will allow the Creditors Committee additional time to review and discuss its potential objections with the affected parties.

Transition Services Agreement. In June 2008, in the context of the TERI Reorganization, the Bankruptcy Court entered an order approving a motion by TERI to reject the master servicing agreement, the master loan guaranty agreement and the database sale and supplementation agreement, as well as the marketing services agreement pursuant to which we provided certain marketing-related services to TERI. As a result of the order, each of the agreements, as amended or supplemented to date, was terminated effective as of May 31, 2008. The order also approved a motion by TERI to enter into a transition services agreement with us, the terms of which are summarized below.

As a result of the terminations, among other things:

- •

- We will not receive processing fees from TERI pursuant to the master servicing agreement for any period after May 31, 2008. During the first eleven months of fiscal 2008, we received $125.9 million in processing fees from TERI pursuant to the master servicing agreement. Effective on June 1, 2008, we instead began receiving fees from TERI as set forth in the transition services agreement.

- •

- We are not obligated to use TERI as a third party provider of borrower default guaranties for our clients' private label loan programs.

- •

- TERI will no longer reimburse us pursuant to the master servicing agreement for internal or external expenses relating to default prevention activities.

- •

- We will no longer be obligated to pay for, and no longer have the right to receive, updated performance data with regard to TERI-guaranteed loans not held by Union Federal or the securitization trusts facilitated by us. We have rights independent of TERI to performance data with respect to over $12 billion of securitized loans.

Pursuant to the transition services agreement:

- •

- We agreed to provide origination services to TERI in connection with the processing and funding of "pipeline" loans for which an application is received on or before the later of (i) termination of the transition services agreement and (ii) the date that is 60 days after all lenders suspend or terminate their programs with TERI. We will charge TERI a fee equal to the amount of the origination fee that the lender is obligated to pay TERI pursuant to the lender's loan origination agreement with TERI.

- •

- We agreed to provide guaranty claims review and processing services to TERI with regard to TERI-guaranteed loans held by securitization trusts facilitated by us and TERI-guaranteed loans not held by securitization trusts facilitated by us. We charge TERI a fixed fee per loan for such services, but with regard to TERI-guaranteed loans held by securitization trusts facilitated by us, such fees will be payable as an offset against TERI's residual interests in securitization trusts. We do not expect such fees to be material in amount.

17

- •

- We provide oversight and administration services with regard to collections on defaulted loans. TERI agreed to continue to remit payments owed to third party collection agencies, which amounts the collection agencies generally net out of recoveries being remitted to TERI. With respect to TERI-guaranteed loans held by securitization trusts facilitated by us, to cover our administrative costs, TERI has agreed to pay us a fixed percentage of gross dollars recovered, or the Administrative Fee, plus a fixed fee that TERI would have otherwise retained from amounts recovered. Our right to these fees survives the termination of the transition services agreement. To the extent that the Bankruptcy Court enters an order or otherwise determines that the securitization trusts have a first priority, valid, enforceable perfected security interest in all "Recoveries" (as defined in the applicable deposit and security agreements), TERI will not be required to pay to us the Administrative Fee after the date of such order. As a result, our compensation for providing oversight and administration services with regard to collections on defaulted loans would be limited to the fixed fee that TERI would have otherwise retained from amounts recovered.

- •

- We agreed to provide TERI with (i) the data comprising the Loan Database (as defined in the database sale and supplementation agreement) to the extent such data is or has been received by TERI solely in connection with its business as a loan guarantor and is stored, maintained or held by us and is data owned by TERI and (ii) a copy of certain additional data to which TERI is entitled under its existing agreements.

- •

- Notwithstanding the termination of the database sale and supplementation agreement, (i) we continue to possess all right, title and interest in our Delivered Database (as defined in the database sale and supplementation agreement), subject to certain restrictions and (ii) the Loan Database (as defined in the database sale and supplementation agreement) transferred by us to TERI pursuant to the transition services agreement shall remain subject to certain restrictions.

- •

- We agreed to maintain certain infrastructure-related services and support, including availability of internal and external network connectivity and maintenance of existing interfaces for certain business applications, and to cooperate regarding independent provision by TERI of certain business software and systems. TERI agreed to a fixed monthly rate with respect to certain services and a fixed hourly rate for certain other services.

We are authorized to continue providing and receiving reimbursement for guaranty claims review and processing services, as well as collections oversight and administration services, for TERI-guaranteed loans held by securitization trusts facilitated by us at the rates set forth in the transition services agreement after termination of the transition services agreement. In the event that we maintain default prevention activities in respect of TERI-guaranteed loans held by securitization trusts facilitated by us, to the extent that we demonstrate that such efforts resulted in an increase in the value of a trust's residual interests, then the costs of such default prevention activities will be offset against TERI's residual interest in such trust to fairly apportion the costs to TERI as a beneficiary. We do not expect to receive any cash from such arrangement for an extended period of time.

The transition services agreement had an initial term through July 31, 2008, subject to extension through September 30, 2008. We have agreed to TERI's request to extend the agreement through September 30, 2008. We expect to receive approximately $600,000 to $800,000 per month pursuant to the transition services agreement during its term, although TERI has the right to terminate any specific service provided pursuant to the transition services agreement upon 10 business days notice to us.

Competition

We coordinate a range of services in connection with private loan programs, including program design, loan marketing, application processing, credit underwriting, customer service, loan documentation, disbursement, technical support, legal and compliance support and advisory services in connection with loan marketing and financing. We differentiate ourselves from other service providers

18