UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One)

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: June 30, 2005

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-31825

THE FIRST MARBLEHEAD CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | 04-3295311 |

(State or other jurisdiction of | (I.R.S. Employer |

incorporation or organization) | Identification No.) |

The Prudential Tower | |

800 Boylston Street, 34th Floor | |

Boston, Massachusetts | 02199-8157 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (617) 638-2000

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $.01 par value | New York Stock Exchange |

(Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate by check mark whether the registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2). Yes x No o

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant (without admitting that any person whose shares are not included in the calculation is an affiliate) was approximately $1,604,000,000 based on the last reported sale price of the common stock on the New York Stock Exchange on December 31, 2004.

Number of shares of the registrant’s class of common stock outstanding as of July 29, 2005: 64,911,244

DOCUMENTS INCORPORATED BY REFERENCE

Information set forth in items 10, 11, 12, 13 and 14 of Part III (except for information required with respect to our executive officers, which is set forth under “Executive Officers” in Item 1A of Part I of this report, and our Code of Ethics, which is set forth under “Code of Ethics” in Item 1B of Part I of this report) have been omitted from this report and are incorporated by reference to the definitive proxy statement to be filed with the Securities and Exchange Commission relating to the registrant’s 2005 annual meeting of stockholders.

THE FIRST MARBLEHEAD CORPORATION

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended June 30, 2005

TABLE OF CONTENTS

PART I

Item 1. Business

We use the term “First Marblehead,” the “Company,” “we,” “us” and “our” in this Annual Report on Form 10-K to refer to the business of The First Marblehead Corporation and its subsidiaries.

Overview

The First Marblehead Corporation provides outsourcing services for private education lending in the United States. We help meet the growing demand for private education loans by providing national and regional financial institutions and educational institutions, as well as businesses and other enterprises, with an integrated suite of design, implementation and securitization services for student loan programs tailored to meet the needs of their respective customers, students, employees and members. In providing our services, we do not serve as a lender, guarantor or loan servicer, but instead receive fees for the services we provide in connection with processing and facilitating the securitization of our clients’ loans. We focus primarily on loan programs for undergraduate, graduate and professional education, and, to a lesser degree, on the primary and secondary school market. Private education loans are not guaranteed by the U.S. government and are funded by private sector lenders. During fiscal 2005, we facilitated approximately $2.7 billion in loan disbursements for students at over 5,300 schools compared to $1.8 billion in loan disbursements for students at over 4,800 schools in fiscal 2004 and $1.0 billion in loan disbursements for students at over 3,900 schools in fiscal 2003.

We enable our clients to offer student and parent borrowers competitive loan products, while managing the complexities and risks of these products. We provide our clients with a continuum of services, from the initial phases of program design through application processing and support to the ultimate disposition of the loans through securitization transactions that we structure and administer. We have developed loan processing and support systems that are designed to accommodate new clients, additional loan products and incremental loan volume. We also own a proprietary database of more than 19 years of historical information on private student loan performance, which helps us to facilitate the structuring and pricing of our clients’ loan programs and to supervise the servicing and default management processes for the securitized loans. In addition, our proprietary database increases the efficiency of the securitizations of our clients’ loans by enabling us to provide to participants in the securitization process historical payment, default and recovery data on which to base estimates as to credit losses and reserves. We processed over 876,000 loan applications in fiscal 2005 compared to 560,000 loan applications in fiscal 2004 and 252,000 loan applications in fiscal 2003.

We have provided structural, advisory and other services for 27 securitization transactions since our formation in 1991. We facilitated five securitizations in fiscal 2005 and three securitizations in each of fiscal 2004 and 2003. In fiscal 2005, we facilitated student loan securitizations of $2.26 billion compared to $1.25 billion in fiscal 2004 and $560 million in fiscal 2003.

Private Student Lending Overview

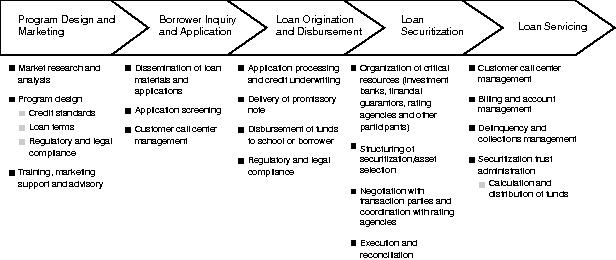

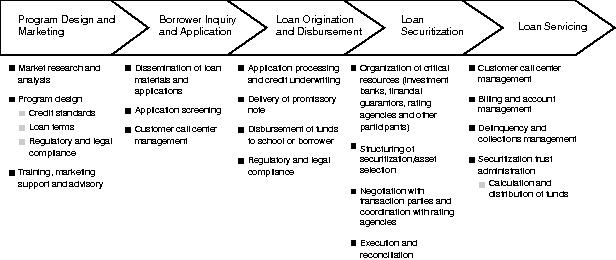

The lifecycle of a private student loan, which can be over 20 years long, consists of a series of processes and involves many distinct parties. Because the activities of these parties are largely uncoordinated but heavily regulated, the processes associated with designing, implementing, financing and administering student loan programs are complex, resource intensive and costly.

1

Set forth below is a chart outlining the series of processes in the private student loan lifecycle:

Program Design and Marketing

Lenders, education loan marketers and educational institutions face an array of choices in attempting to satisfy their strategic and financial goals, as well as the needs of student borrowers. If it decides to initiate a loan program, an organization typically needs to make significant investments in staffing and infrastructure in order to support the program. In designing loan programs, the factors that these organizations generally consider include:

· borrower eligibility criteria, including enrollment status, academic progress and citizenship or residency;

· borrower creditworthiness criteria, including acceptable credit scores, credit bureau ratings and co-signor requirements, as well as factors such as employment and income history and any past derogatory credit events;

· loan limits, including minimum and maximum loan amounts on both an annual and aggregate basis;

· interest rates, including the frequency and method of adjustment;

· amount of fees charged to the borrower, including origination, guarantee and late fees;

· repayment terms, including maximum repayment term, minimum monthly payment amounts, deferment and forbearance options, rate reduction incentive programs and prepayment penalties;

· loan guarantee arrangements to ensure repayment of defaulted principal and interest payments;

· loan servicing, default management and collection arrangements;

· asset financing or loan disposition alternatives; and

· legal compliance with numerous federal laws and regulations, including but not limited to the Truth-in-Lending Act, the Fair Credit Reporting Act, the Equal Credit Opportunity Act, the Federal Trade Commission Act, or the FTC, the FTC Telemarketing Sales Rule, and numerous state laws that replicate and expand upon the requirements of federal laws.

In creating their loan marketing programs, institutions face choices in the channels and media available to them to reach potential student borrowers, including financial aid administrators, online

2

advertising, direct mail campaigns, handouts, email campaigns, telemarketing and print, outdoor, radio and television advertising.

Borrower Inquiry and Application

Prospective and current students and their families confront a complicated process in applying for financial aid. Because private student loans are often used to bridge the gap between school costs and available funds, including family resources and federal and state loans and grants, many borrowers must navigate multiple application processes. In order to respond to questions about these processes from student borrowers, lenders and educational institutions must invest in an appropriate infrastructure, including a staff of customer service personnel who have a thorough understanding of both the terms and competitive advantages of their private loan program and the financial aid process as a whole. In addition to a customer service function, these institutions must respond to requests for loan materials and loan applications.

Loan Origination and Disbursement

Once a loan provider has received a loan application and determined that it is complete, it must then evaluate the information provided by the applicant against the eligibility and creditworthiness criteria of the loan program. This underwriting process, which is subject to a variety of state and federal regulations, typically involves communication with credit bureaus in order to generate a credit score for the applicant and either a denial or approval of the loan.

If the applicant satisfies the loan program criteria, the loan provider then prepares a legal instrument, known as a promissory note, reflecting the terms and conditions under which the loan will be made. If the borrower signs and returns the promissory note, the loan provider either contacts the school to confirm the student’s enrollment status and financial need and then disburses funds either to the borrower or, more commonly, directly to the school, or receives evidence of the borrower’s enrollment directly from the student, and disburses funds to the borrower.

Loan Securitization

Although some lenders originate loans and then hold them for the life of the loan, many lenders originate and then seek to dispose of the loans, either through a sale of whole loans or by means of a securitization. Whole loans are typically purchased by other financial institutions, which add them to an existing portfolio, or by entities that serve to warehouse the loans for some period of time, pending eventual securitization. Securitization provides several benefits to lenders and has developed into a diverse, flexible funding mechanism, well-suited to the financing of student loan pools. According to industry sources, in 2004, the new issuance volume of student loan-backed securities totaled approximately $60.0 billion, which included both federally guaranteed and private student loans. Securitization enables lenders to sell potentially otherwise illiquid assets in both the public and private securities markets, and can help lenders manage concentration risk and meet applicable regulatory capital adequacy requirements.

In a typical student loan securitization, the loans are purchased, pooled and deposited in a special purpose, bankruptcy remote entity. The special purpose entity issues and sells to investors securities collateralized by the student loans. Following the sale of these asset backed securities, a trustee, or a servicer on behalf of a trustee, collects the payments of principal and interest generated by the underlying loans and makes disbursements to the asset backed investors and service providers according to the terms of the documents governing the transaction.

Securitization enables the reallocation or transfer of risk through the use of derivative products such as interest rate swaps or caps, a senior-subordinated liability securities structure, financial guarantee insurance for the securities issued, loan guarantees from third party debt guarantors, the tiering of

3

securities maturities, and the issuance of several different types of securities matching projected pool repayment characteristics. Although this flexibility adds to the complexity of the funding process, it also enables the securitizer to reduce the cost of financing, thereby improving the economics of the loan program and/or improving loan terms by passing incremental savings back to the borrower.

Securitizations require a high level of specialized knowledge and experience regarding both the capital markets generally, and the repayment characteristics and defaults on the part of student borrowers specifically. The process of issuing asset backed securities requires compliance with state and federal securities laws, as well as coordination among originating lenders, attorneys, securities dealers, loan guarantors, structural advisors, trust management providers, auditors and securities rating agencies.

Loan Servicing

While student loans are outstanding, lenders or special purpose entities must provide administrative services relating to the loans, even if their terms permit borrowers to defer payments of principal and interest while enrolled in school. These administrative services include processing deferment and forbearance requests, sending out account statements and accrual notices, responding to borrower inquiries, and collecting and crediting payments received from borrowers. Many lenders, and all special purpose entities, outsource their servicing responsibilities to third party providers. In addition to administrative duties, servicers also play an active role, in conjunction with the guarantor, in default prevention activities. Servicers generally rely on collection agencies to establish and maintain contact with defaulted borrowers, manage loans that are delinquent and collect defaulted loans. Loans are ultimately extinguished through scheduled repayment, prepayment or default. Once the borrower makes the final loan payment, the servicer sends a notice to the borrower and the credit bureaus confirming that the loan has been repaid in full and returns the original promissory note to the borrower.

The First Marblehead Approach

We offer our clients—national and regional financial institutions and educational institutions, as well as businesses and other organizations—a fully integrated suite of outsourcing services in connection with their private student loan programs. In providing our services, we do not serve as a lender, guarantor or loan servicer, but instead receive fees for the services we provide in connection with processing and securitizing our clients’ loans. Using our services, our clients can offer student borrowers access to customized, competitive student loan products while enhancing their fees but minimizing their resource commitment and exposure to credit risk.

Our Service Offerings

We offer prospective clients the opportunity to outsource all of the key components of their loan programs by providing a full complement of services, including program design, application processing, underwriting, loan documentation and disbursement, technical support and customer support. This approach enables our clients to focus their efforts on the initial marketing of their programs.

We offer services in connection with two primary loan products:

· Private label programs that:

· are marketed directly to prospective student borrowers and their families (direct to consumer) by:

· lenders;

· third parties who are not themselves lenders; loans under these programs are made by referral lenders; and

· businesses, unions, affinity groups and other organizations.

4

· are marketed directly to educational institutions (school channel) by:

· lenders; and

· third parties who are not themselves lenders; loans under these programs are made by referral lenders.

· Guaranteed Access to Education, or GATE, programs that educational institutions offer directly to their students.

The following table presents, by marketing channel, the total principal amount of loans we processed during our fiscal years ended June 30, 2005, 2004 and 2003:

| | Fiscal year ended

June 30, | |

Marketing Channel | | | | 2005 | | 2004 | | 2003 | |

| | (in millions) | |

Private label loans | | | | | | | |

Direct to consumer | | $1,651 | | $1,038 | | $545 | |

School channel | | 906 | | 667 | | 420 | |

Total private label loans | | 2,557 | | 1,705 | | 965 | |

GATE loans | | 105 | | 96 | | 76 | |

Total | | $ | 2,662 | | $ | 1,801 | | $ | 1,041 | |

| | | | | | | | | | | | |

In fiscal 2005, we processed approximately $742 million of loans for JP Morgan Chase Bank, N.A., successor by merger to Bank One, N.A., $632 million of loans for Bank of America, N.A. and $603 million of loans for Charter One Bank, N.A. In fiscal 2004, we processed approximately $642 million of loans for JP Morgan Chase Bank, $394 million of loans for Bank of America and $312 million of loans for Charter One Bank. In fiscal 2003, we processed approximately $428 million of loans for JP Morgan Chase Bank, $218 million of loans for Bank of America and $41 million of loans for Charter One Bank.

Although we offer our clients a fully integrated suite of outsourcing services, we do not charge separate fees for many of these services, including program design and marketing and, except with respect to The Education Resources Institute, or TERI, borrower inquiry and application and loan origination and disbursement. While we receive fees for providing loan processing services to TERI in connection with TERI-guaranteed loans, these fees represent reimbursement of the direct expenses we incur. Accordingly, we do not earn a profit on these fees. Although we provide these various services without charging a separate fee, or at “cost” in the case of TERI-guaranteed loans, we generally enter into agreements with the private label lenders giving us the exclusive right to securitize the loans that they do not intend to hold, and we receive structural advisory fees and residuals for facilitating securitizations of these loans. We also have the exclusive right to securitize loans originated by Bank of America in connection with our GATE offerings. Our level of profitability depends on our structural advisory fees and residuals. We may in the future enter into arrangements with private label lenders under which we provide outsourcing services but do not have the exclusive right to securitize the loans that they originate. We also receive fees as the administrator of the trusts that have purchased the private label and GATE loans, and in this capacity monitor the performance of the loan servicers. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The primary driver of our results of operations and financial condition is the volume of loans for which we provide outsourcing services from loan origination through securitization. The volume of loans for which we structured securitizations increased to approximately $2.26 billion in fiscal 2005 from approximately $69 million in fiscal 2001.

5

Program Design and Marketing

We help our clients design their private loan programs. Our loan program design approach begins with a standard set of pricing options, legal agreements and third party relationships that we then carefully customize for our clients in order to satisfy their particular needs.

Private Label Programs

In our private label programs, we have developed strong relationships with lenders and other organizations through active marketing by our field sales force and experienced business development executives. Our private label clients are typically lenders or educational loan marketers that desire to supplement their existing federal loan programs with a private loan offering. Increasingly, these lenders are required by competitive pressures to offer private loan programs. They are attracted to an opportunity potentially to extend their existing brand in the federal loan marketplace to the private loan marketplace.

Beyond federal student loan lenders, our approach is flexible enough to facilitate private student loan programs for a range of clients, who, in turn, serve a variety of consumers. We believe a private label opportunity exists with any business, union, affinity group or other organization that has employees, customers, members or other constituencies who are concerned about education costs. We assist such organizations in partnering with a lender and in designing a program that provides tangible benefits to their constituencies, while simultaneously generating additional revenue. Regardless of whether the client is a commercial bank, marketing company, affinity organization or a large corporation, we contribute our specialized knowledge, experience and capabilities to assist these entities in the development of a private loan program to meet their needs, while minimizing their resource commitment and exposure to credit risk.

One of the key components of our private label programs is the opportunity for our clients to mitigate their credit risk through a loan repayment guarantee by TERI. TERI guarantees repayment of the student borrowers’ loan principal, together with capitalized and/or accrued interest on defaulted loans. For additional information on TERI, see “Strategic Relationship with The Education Resources Institute.” If the lender disposes of the loan in a securitization, this guarantee remains in place and serves to enhance the terms on which asset backed securities are offered to investors.

Private label clients fall into two categories:

· Make and sell. In this category, lenders select credit criteria and loan terms tailored to meet their needs and then outsource to us all operating aspects of loan origination and customer support, and typically hold the loans on their balance sheets for some limited period of time. Lenders that wish to have their loans guaranteed by TERI are required to meet TERI’s underwriting criteria. In the case of clients that do not desire, or do not have the ability, to fund the loans initially, we arrange for a referral lender that will fund the loans on their behalf. In both cases, after the holding period, we will facilitate a securitization to enable lenders to dispose of the loans, from which we generate structural advisory fees and residuals. See “ —Securitization.”

· Make and hold. In this category, clients outsource all operating aspects of loan origination and customer support, but finance the loans on their balance sheets and generally continue to hold the loans through the scheduled repayment, prepayment or default. Clients retain the ability to securitize the loans through us, even if they elect not to do so initially. Unless clients securitize their make and hold loans through us, the revenues we generate on these loans are limited to the processing fees that we receive from TERI, which represent reimbursement of the direct expenses we incur in originating the loans.

6

| | Year ended June 30, | |

| | 2005 | | 2004 | | 2003 | |

Aggregate principal amount of private label loans facilitated | | | $ | 2.6 billion | | | $ | 1.7 billion | | $ | 965 million | |

Aggregate principal amount of “make and sell” private label loans facilitated above that were also available to us for securitization | | | $ | 2.1 billion | | | $ | 1.3 billion | | $ | 593 million | |

Aggregate principal amount of “make and hold” private label loans facilitated above that were not available to us for securitization | | | $ | 486 million | | | $ | 423 million | | $ | 372 million | |

GATE Programs

In our two GATE programs, GATE Student and GATE Universal, we work with schools to design their private loan programs and make the educational experience affordable and accessible to students. We believe that one of the most significant benefits provided by GATE programs is the ability for a participating school to enhance the financial aid packages it offers to prospective students. During fiscal 2005, GATE programs had a borrower approval rate of approximately 89%. With the knowledge that most applicants will be approved, schools can award GATE loans proactively to meet more need and avoid financing gaps in aid packages.

Our GATE business development team collaborates directly with each educational institution client and Bank of America, the exclusive lender for the programs, to evaluate, design and implement the most appropriate GATE program, or series of programs, for the particular school. This analysis takes into account enrollment, financial aid and finance strategies of the school and results in recommended eligibility criteria, rate and fee combinations and underwriting criteria to enhance those strategies. GATE programs are designed so as to facilitate our ability to aggregate and securitize the student loans from all participating schools.

We customize GATE programs within certain pricing parameters and structure the programs to enable a participating school to make loans broadly available to its students. The approval rate of approximately 89% is made possible by having the participating schools provide credit support for the loans to their students. This credit support may be in the form of either a cash reserve or, subject to creditworthiness requirements, a school’s unfunded financial pledge. Our most recent GATE program offering, GATE Universal, stratifies student borrowers according to credit risk in order to minimize either the cash reserve or financial pledge that a school is required to provide in connection with the loan program.

We also monitor each school’s program on an ongoing basis and provide the participating school with periodic updates on its students’ credit performance. We offer assistance in modifying the program over time if the school’s program experience is different than originally anticipated.

For our GATE programs in fiscal 2005, we processed approximately $105 million of loans and structured a securitization for approximately $104 million of loans. In fiscal 2004, we processed approximately $96 million of GATE student loans and structured a securitization of approximately $98 million of GATE student loans. In fiscal 2003, we processed approximately $76 million of GATE student loans and structured a securitization of approximately $73 million of GATE student loans. We have the exclusive right to securitize loans originated by Bank of America in connection with our GATE offerings, and we generate revenue from our GATE programs primarily by receiving structural advisory fees and residuals for facilitating securitizations of these loans.

7

Borrower Inquiry and Application

Private Label Programs

We have developed proprietary processing platforms, applications and infrastructure, supplemented by customized vendor solutions, which we use to provide loan application services for our private label programs. We enable borrowers to submit applications by telephone, facsimile or mail. We also have a proprietary web application process that permits prospective borrowers to submit loan applications online. As a result of increased Internet use and focused marketing efforts, in recent years the proportion of online applications has risen substantially. In fiscal 2005, we received via the Internet approximately 64% of the approximately 849,000 private label loan applications that we processed. In fiscal 2004, we received via the Internet approximately 67% of the approximately 540,000 private label loan applications that we processed. In fiscal 2003, we received via the Internet approximately 56% of the approximately 234,000 private label loan applications that we processed. We intend to continue driving application traffic online, as it represents an opportunity for cost savings by reducing personnel costs associated with call centers and data entry. We have designed our online systems to be E-sign compliant for delivery of consumer disclosures, and we are developing electronic signature capabilities for future implementation.

Once a potential borrower submits an application for processing, our system automatically generates and sends a confirmation email to the applicant. Within minutes, the customized third party credit decision software that we use analyzes the submitted application. Application data is automatically sent to credit bureaus, which generate and return a credit report. The credit decision software then applies the credit report data and all scoring parameters associated with the loan type, and a credit decision is generated. This automated underwriting process allows us to deliver a loan application decision with respect to a significant majority of applications. The remaining applications with either incomplete information or with scores close to cut-off are sent to a credit analyst for review. At this point in the process, we communicate the initial determination to the applicant, primarily through email, informing him or her whether the application is conditionally approved, rejected or in review. The applicant receives instructions as to next steps and is provided a website navigation link to check his or her loan status. Simultaneously, our customer service platforms, including our automated voice response unit, online status and customer service applications, are updated.

To help applicants through the loan application process, we have an internal customer service department comprised of 159 full-time employees, 1 part-time employee and 9 seasonal employees as of June 30, 2005. We augment our internal department with outsourced customer service representatives during peak loan application periods. Our internal customer service department is divided into four areas:

· Inbound and Outbound Customer Service; providing end-to-end service and support for borrower inquiries throughout the application process.

· Lender and Marketer Services; providing dedicated account representatives trained to support our lender and marketer clients.

· Priority Services; providing specially trained representatives to support schools.

· Telesales; providing inbound application-capture services.

The performance of each customer service area is monitored closely and detailed performance metrics such as abandonment rates and service levels are tracked daily.

8

GATE Programs

For our GATE clients, we employ the Pennsylvania Higher Education Assistance Agency, or PHEAA, and a software vendor, V-Tek Systems Corporation, or V-Tek, in a variety of roles to effect application processing and loan origination. Our GATE programs allow schools and students to use the Internet to submit applications. Key steps in the application process allow for:

· certification of borrower loan information, program eligibility and financial need by the schools;

· promissory note preparation and loan disbursement by PHEAA; and

· credit underwriting by Bank of America, the exclusive program lender.

In connection with our GATE programs, PHEAA interfaces directly with participating schools’ financial aid systems by using proprietary software that V-Tek designed for us. This software program supports several electronic delivery formats for schools and student borrowers to submit loan data, resulting in the generation of combined application/promissory notes by PHEAA and credit underwriting by Bank of America. During fiscal 2005, 2004 and 2003, PHEAA received approximately 27,000, 23,000 and 18,000 GATE applications, respectively. Substantially all of these applications were processed via the Internet.

Loan Origination and Disbursement

For our private label loan programs, once a loan application is approved, we generate a promissory note, a legal contract between the borrower and lender which contains the terms and conditions of the loan, for the borrower based on one of over 680 lender and product specific templates. For those lenders and borrowers that prefer electronic document delivery, an automated email is sent to the borrower, which contains a navigation link to prompt the borrower to access a secure website to retrieve the note and required regulatory disclosures. The note can be viewed, downloaded and printed by the borrower and faxed or mailed back to us. For those lenders that do not participate in our electronic delivery system, or for those borrowers that prefer paper documentation, we print and mail a pre-filled promissory note to the borrower for him or her to sign and return to us by mail. During fiscal 2005, 2004 and 2003, approximately 72%, 65% and 52%, respectively, of approved applicants requested on their application that the promissory notes we generated be made available electronically.

We assist the lenders in our loan programs in selecting the underwriting criteria used in deciding whether a student loan will be made to an applicant. However, each lender has ultimate control over the selection of these criteria, and in providing our services, we are obligated by contract to observe them. Lenders that wish to have their loans guaranteed by TERI are required to meet TERI’s underwriting criteria.

Together with TERI, we collaborate with our private label clients to comply with applicable laws and regulations in loan documentation, disclosure and processing. TERI assumes, and delegates to us, responsibility for compliance with federal and Massachusetts law regarding loan documentation and disclosure. We, in turn, work with lenders to prepare lender specific note templates. We maintain and utilize these templates, which reflect applicable legal requirements and lender preferences. We also deliver each lender’s privacy policy and prepare and deliver truth-in-lending and various state law disclosures to borrowers.

We monitor developments in state and federal requirements for loan processing and implement changes to our systems and processes based on our analysis and input we receive from lenders and industry groups. For example, we designed and made available to lenders a customer identification program in connection with our private label loans. This program was designed to meet USA Patriot Act requirements that lenders gather identifying data, verify applicant identity, and maintain records of the process. The requirements present a challenge for lenders whose borrowers apply for loans using an Internet based

9

system, telephone or mail. We have also completed similar process improvements in the area of secure access to pending loan information, in order to comply with federal privacy and state identity theft laws. Contractual liability for identification of state law process requirements rests with the lenders, unless TERI or we undertake to comply with a particular requirement.

For our private label loan programs, once we obtain all applicant data, including the signed note, evidence of enrollment and any income verification, we disburse the loan funds on behalf of TERI, with funds made available to TERI by the lenders. Depending on the loan program and type of disbursement, funds are either sent to the borrower, directly to the school or to a central disbursing agent such as New York Higher Education Services Corporation or ELM Resources, who then pass the funds along to the school. We receive fees from TERI, which consist of reimbursement of expenses that we incur relating to loan processing services that we perform on behalf of TERI. These fees are recognized as services are performed.

PHEAA provides loan origination and disbursement services for our GATE loan programs under our supervision.

Securitization

In addition to providing loan program design, application and origination services, we also serve as an intermediary between our clients and the capital markets. We form bankruptcy remote, qualified special purpose statutory trusts to purchase private label and GATE loans from the originating lenders. The proceeds from bonds issued by the trusts are used to purchase student loans, which are used as security for repayment of the bonds. The securitizations that we structure and administer provide our clients with the ability to limit or eliminate credit and interest rate risk, and generate liquidity for their private student loans. In addition to structural advisory and administrative fees, we are entitled to a residual interest in the securitization trusts as part of our compensation in connection with the securitizations.

We have been a leader in facilitating the securitization of private student loans, having structured and facilitated 27 securitizations consisting entirely of private student loans, more than any other entity. Our capital markets group has a history of innovation, having been the first to employ several of the structures and risk-reducing techniques in this sector that are in use today. We have securitized loan pools using various financing structures, including both public offerings registered with the Securities and Exchange Commission, or SEC, and private placements, and have utilized various asset backed securities, including commercial paper, London Interbank Offered Rate, or LIBOR, floating rate notes, auction-rate debt and senior-subordinated and third party credit enhanced debt. In connection with our “make and sell” private label and GATE programs, we generally enter into agreements with the originating lenders giving us the exclusive right to securitize their program loans.

The extensive database provided by our GATE loan repayment statistics dating back to 1994 and private label repayment statistics dating back to 1986 is another key to optimizing the financing of the student loan pools our clients generate. We use this data to estimate the default, recovery and prepayment characteristics of the different types of loans that constitute a loan pool. We believe the historical data and our wide use of standard consumer credit score based risk assessment give added comfort to the rating agencies, insurance providers, underwriters, and securities investors, resulting in a more cost-effective securitization.

We receive several types of fees in connection with our securitization services:

· Structural advisory fees. We charge structural advisory fees that are paid in two portions:

· Up-front. We receive a portion of the structural advisory fees when the securitization trust purchases the loans, or shortly thereafter; and

10

· Additional. We receive a portion of the structural advisory fees over time, based on the amount of loans outstanding in the trust from time to time over the life of the loans.

For these structural advisory fees, we structure the securities sold in the securitization, coordinate the attorneys, accountants, trustees, loan servicers, loan originators and other transaction parties and prepare cash flow modeling for the rating agencies.

· Residuals. We also have the right to receive a portion of the residual interests that these trusts create. This interest is junior in priority to the rights of the holders of the debt sold in the securitizations.

Our residual interest is derived almost exclusively from the services we have performed in connection with each securitization rather than from a direct cash contribution to the securitization trust.

We also receive administrative fees from the trusts as further described below under “—Loan Servicing.”

For a discussion of our revenue recognition policies and the assumptions we use, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Executive Summary—Recognition and Valuation of Service Revenue” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Application of Critical Accounting Policies and Estimates—Service Revenue.”

In recent years, we have derived a significant portion of our revenue and substantially all of our income from structuring securitizations on behalf of qualified special purpose entities. Revenues from new securitizations involving private label loan trusts represented 76%, 78% and 73% of our total service revenue in fiscal 2005, 2004 and 2003, respectively. In addition, we structure and support private student loan programs for our commercial bank clients, including JP Morgan Chase Bank, Bank of America and Charter One Bank, although we do not receive fees directly from these clients. During fiscal 2005, Charter One Bank was the lender for loans marketed by 26 educational loan marketers. Structural advisory fees and residuals from securitizations of JP Morgan Chase Bank, Bank of America and Charter One private label loans are included in securitization related revenue and represented approximately 30%, 18% and 22%, respectively, of our total service revenue in fiscal 2005, approximately 43%, 9% and 17%, respectively, of our total service revenue in fiscal 2004 and approximately 59%, 4%, and 2%, respectively, of our total service revenue in fiscal 2003.

Loan Servicing

There are currently nine loan servicers for newly originated TERI guaranteed loans, with three of these servicers servicing a majority of the loans we facilitate. Most of our clients enter into a servicing agreement with PHEAA that governs the servicing of their loans prior to securitization. The remaining clients opt either to outsource servicing of their loans to organizations with which they have existing relationships or service their loans using affiliated servicers. For securitized loans, these servicing agreements, which typically extend over the life of the loan pool, are assigned to the purchasing trust.

As administrator of the trusts that have purchased private label and GATE loans, we monitor the performance of the loan servicers. In this capacity, we confirm compliance with servicing guidelines and review default prevention and collection activities. We receive administrative fees from the trusts ranging from 5 to 20 basis points per year of the student loan balance in the trust for daily management of the trusts and for the services we provide in obtaining information from the loan servicer and reporting this and other information to the parties related to the securitization.

During the first 90 days of delinquency, the servicer performs collection activities in accordance with contractual requirements outlined in the servicing guidelines of the loan program. These guidelines

11

establish certain required collection activities, such as attempted telephone contacts to borrowers and co-borrowers within prescribed delinquency intervals, as well as requirements for the mailing of delinquency notices and skip trace activities for borrowers whose addresses have changed.

Once the loan has been delinquent for 90 days, we provide pre-claims assistance. We assign delinquent accounts to one of several external collection agencies, which work to cure the account by bringing it current. During this period, the servicer remains responsible for invoicing and posting payments. We monitor these external collection agencies that perform pre-claims default prevention activities and share their performance with their peers. Our strategy is to award the highest percentage of new accounts to the agency whose performance has been strongest in the prior period. In addition to this incentive, we provide performance bonuses to agencies performing above established performance expectations for cure rates. If a delinquent loan becomes less than 75 days past due, collection efforts are returned to the servicer for routine processing.

Loans are ultimately extinguished through scheduled repayment, prepayment or default. Once the borrower makes the final loan payment, the servicer sends a notice to the borrower and the credit bureaus confirming that the loan has been repaid in full and returns the original promissory note to the borrower.

Strategic Relationship with The Education Resources Institute

TERI is the nation’s oldest and largest guarantor of private student loans. As a not-for-profit corporation, TERI’s main operating purpose is to provide students with access to educational opportunities through educational finance and counseling services. To help accomplish this, TERI offers guarantee products for student loan programs pursuant to which TERI agrees to reimburse lenders for all unpaid principal and interest on their defaulted student loans, in exchange for a fee based on the loan type and risk profile of the borrower. Because TERI is a not-for-profit organization, defaults on TERI-guaranteed student loans have been held to be non-dischargeable in bankruptcy proceedings. Since its inception in 1985, TERI has guaranteed approximately $9.5 billion of private education loans for students at more than 6,800 schools nationally and internationally.

In 2001, we entered into a strategic relationship with TERI, intended to significantly enhance our risk management and loan processing capabilities. We acquired TERI’s historical database and loan processing operations, but not its investment assets or guarantee liabilities. In addition, 161 members of TERI’s staff became our employees. TERI remains, however, an independent, private not-for-profit organization with its own management and board of directors. We issued promissory notes totaling $7.9 million and paid approximately $1.0 million in cash to TERI in connection with the transaction. Under the terms of a master loan guaranty agreement that we entered into with TERI in 2001, we also agreed to provide a beneficial interest for TERI of 25% of the residual value of TERI-guaranteed loans owned by the securitization trusts that purchase the loans, and a right of first refusal to guarantee our private label clients’ existing and future loan programs.

In connection with the transaction, we also entered into a series of agreements with respect to loan processing services, database updates and the securitization of TERI-guaranteed loans. These include a master servicing agreement and a database purchase and supplementation agreement with TERI. Pursuant to the master servicing agreement, TERI engages us to provide loan origination, pre-claims, claims and default management services. Under TERI’s agreements with lenders, lenders delegate their loan origination functions to TERI, and TERI has the right to subcontract these functions. Pursuant to the database purchase and supplementation agreement, TERI provides updated information to us about the performance of the student loans it has guaranteed, so that we can continue to supplement and enhance our database.

We also entered into a master loan guaranty agreement, under which we have granted to TERI a right of first refusal to guarantee our private label clients’ existing and future loan programs. We also agreed to

12

create a market for our private label clients to sell TERI-guaranteed loans through securitizations that we facilitate. Under our agreement, we must use our best efforts to cause a securitization of a limited category of TERI-guaranteed loans at least twice per year, subject to the lender having a specified minimum loan volume at the semi-annual purchase date. In October 2004, we renewed our master servicing agreement, master loan guaranty agreement and certain additional agreements with TERI, in each case for an additional term through June 2011. In addition, we entered into a supplement to the master loan guaranty agreement, under which we granted to TERI a right to elect once each fiscal year to increase the amount of its administration fees by 25 basis points, with a corresponding reduction from 25% to 20% in TERI’s ownership of the residual value of the TERI-guaranteed loans purchased during that year by the securitization trusts and a resulting increase from 75% to 80% in our residual ownership. TERI made such an election for the fiscal year ended June 30, 2005. We currently pay TERI a monthly fee of approximately $62,000 pursuant to the database purchase and supplementation agreement. Beginning in July 2007, monthly payments pursuant to the database sale and supplementation agreement will be reduced to approximately $21,000. TERI also maintains a perpetual right to access the data we own solely for use in its guarantee business.

The master loan guaranty agreement was intended in part to create a framework for structuring future relationships among lenders, TERI and us. The master loan guaranty agreement contemplates several ancillary documents that set forth the various obligations among the parties, including:

· program guidelines for each prospective lender establishing acceptable terms for the origination, underwriting and servicing of program loans, including the borrower eligibility criteria, credit requirements, loan limits, deferral options and repayment terms, as well as the lender’s forms of application and promissory note;

· a form of guaranty agreement between TERI and a prospective lender providing for a full and unconditional guarantee of principal and accrued interest when a program loan becomes more than 180 days delinquent, the borrower dies or the borrower seeks discharge of the loan in a bankruptcy proceeding;

· a form of loan origination agreement between TERI and a prospective lender pursuant to which the lender delegates its loan origination functions to TERI, and TERI agrees to receive loan applications, perform underwriting according to the standards in the program guidelines and approve and deny applications. TERI has agreed to subcontract these loan origination functions to us pursuant to the master servicing agreement described above;

· a form of note purchase agreement between us and a prospective lender setting forth the terms and conditions under which a special purpose entity, such as a securitization trust, that we establish purchases program loans from the lender; and

· a form of deposit and security agreement, or a security agreement alone, providing for the payment of a portion of the guarantee fee under the guaranty agreement between TERI and a prospective lender to an account at a national bank and subject to a security interest to pay guarantee claims.

As contemplated by the master loan guaranty agreement, prospective lenders agree to provide initial loan funding and own the loans until they are purchased in a securitization transaction that we facilitate. The lender provides representations and warranties that support the loan for the securitization pursuant to the requirements of the rating agencies.

During fiscal 2005, 2004 and 2003, processing fees from TERI represented approximately 19%, 18% and 23%, respectively, of our total service revenue.

13

Competition

The private student loan industry is highly competitive with dozens of active participants. Although we are not a lender and therefore do not directly compete with lenders for loan originations, we derive a substantial portion of our revenue from providing to lenders outsourced services for their private student loan programs. Private student loan originators include large financial institutions and their affiliates, such as JP Morgan Chase Bank, Citigroup, Charter One Bank, Bank of America, Wells Fargo & Company and KeyCorp, as well as specialized educational finance providers including SLM Corporation, which is also known as Sallie Mae, and Access Group, Inc. Some of these loan originators are currently our clients.

To the extent that lenders possess or choose now or in the future to develop an internal capability to provide any of the services that we currently provide, they would compete directly with us. For example, a loan originator or education loan marketer could establish a program to securitize the student loans it originates, rather than engage us to structure and facilitate the securitization. Collegiate Funding Services, Inc. recently announced plans to retain and service some of the private student loans that it markets as a move towards expanding the services it provides for the private student loan market. In addition, lenders in the education loan market historically have primarily focused their lending activities on federal loans because of the relative size of the federal loan market and because the federal government guarantees repayment of these loans. The demand for our services could decline if lenders place additional emphasis on the private education loan market and offer the services we provide. We believe the most significant competitive factors in terms of developing private student loans are technical and legal competence, cost, knowledge of the performance of student loans, reliability, quality and speed of service.

We coordinate a range of services in connection with private loan programs, including program design, application processing, credit underwriting, customer service, loan documentation, disbursement, technical support, legal and compliance support and advisory services in connection with loan financing. We differentiate ourselves from other service providers as a result of the range of services we can provide our clients. We are aware of two principal competitors, Sallie Mae, and Servus Financial Corporation, which is an affiliate of Wells Fargo & Company, that offer a similar range of services to other lenders. Our business could be adversely affected if Sallie Mae’s program to market private student loans directly to consumers becomes successful or if Sallie Mae seeks to market more aggressively to third parties the full range of services for private loan programs that we provide. In addition, our clients retain PHEAA as the loan servicer for a significant portion of the loans that serve as collateral in the securitization transactions that we facilitate. If PHEAA expands its service offerings to cover some or all of the services that we facilitate, it could become our competitor.

Many of our current and potential competitors have longer operating histories and significantly greater financial, marketing, technical or other competitive resources, as well as greater name recognition, than we do. As a result, our competitors may be able to adapt more quickly to new or emerging technologies and changes in customer requirements or may be able to devote greater resources to the promotion and sale of their services. In addition, competitors may be able to adopt more aggressive pricing policies in order to attract potential clients. We cannot assure you that we will be able to compete successfully with new or existing competitors. To remain competitive, we will need to continue to invest in information technology, sales and marketing and legal compliance.

Proprietary Systems and Processes

In addition to our proprietary database that tracks historical student loan performance, we maintain advanced proprietary information processing systems. We use these information systems to analyze loan applications efficiently, expedite loan processing and enhance our loan securitization and default management services.

14

Key benefits of our information processing systems include:

· the ability to analyze and assess loan applications based on a variety of underwriting and program factors, including flexibility to adapt to different program parameters required in customized client implementations;

· a transaction/application processing system that includes automated updating of a borrower’s loan status that a borrower can access online or telephonically;

· automated preparation and secure electronic delivery of loan documents, including promissory notes and legal disclosures;

· online certification tools enabling financial aid offices to speed loan disbursement by quickly confirming student borrowers’ enrollment status and financial need;

· online reporting tools enabling our management, lender clients and financial aid offices to track and sort information about student borrowers, including application status and disbursement dates;

· custom built data transmission techniques designed to ensure that data are compiled, integrated and properly migrated both across our enterprise and to external third parties such as servicers, collection and placement agencies and other third party vendors; and

· interface with internal accounting systems intended to ensure proper booking and tracking of loan information for our clients, as well as support our capital markets group in its securitization activities.

We use a number of leading commercial products to secure, protect, manage and back-up these data, including products that provide backup of data and server recovery plans.

Trademarks

First Marblehead owns the following federally registered trademarks: GATE, GATE FAMILY LOAN, GATE Guaranteed Access to Education, prepGATE, and National Collegiate Trust. The federal registrations for our registered trademarks expire at various times between 2007 and 2011, but the registrations may be renewed for additional 10-year terms provided that First Marblehead continues to use the trademarks. First Marblehead also owns the following common law trademarks: FIRST MARBLEHEAD, FIRST MARBLEHEAD (and “diamond” design), “Diamond” design and ASTRIVE (and design). Federal trademark applications to register these common law trademarks are pending with the U.S. Patent and Trademark Office.

Student Loan Market Seasonality

Origination of student loans is generally subject to seasonal trends, with the volume of loan applications increasing with the approach of tuition payment dates. In general, we process the greatest application volume during the summer months, as students and their families seek to borrow money in order to pay tuition costs for the fall semester or the entire school year. We also tend to process increased volume of loan applications during December and January, as students and their families seek to borrow money to pay tuition costs for the spring semester.

Government Regulation

We provide services in connection with the creation, management and disposition of education loans, a form of consumer loan asset. This business is highly regulated at both the state and federal level, through statutes and regulations that focus upon:

· licensure and examination of industry participants;

15

· regulation and disclosure of consumer loan terms;

· regulation of loan origination processing; and

· regulation of loan collection and servicing.

Failure to conform to any of these statutes or regulations may result in civil and/or criminal fines, and may affect the enforceability of the underlying consumer loan assets.

Although we are subject to certain state and federal consumer protection laws, we believe our operations currently do not require us to be licensed or registered with any regulatory body. While we believe that our prior consultations with national and local counsel identified all material licensing, registration and other regulatory requirements then applicable to us, we are conducting a nationwide review of state licensing, registration and other regulatory requirements that may be applicable to us now, based upon the expansion of the scope of the services we provide and the time that has elapsed since our prior review. As a result of this current review, we may determine that licensing or registration is required in jurisdictions where we are not currently licensed or registered.

All of our operations relating to consumer loan processing are located in Massachusetts. In 2001, we received determination letters from the Massachusetts Division of Banks confirming that our business of providing consumer loan origination and underwriting under contract to TERI was exempt from licensing under the Massachusetts Small Loan Act. Our GATE business does not involve our processing loans directly with consumers. The Small Loan Act requires any person that is engaged, for compensation, in the business of making small loans, or in aiding or assisting the borrower or the lender in procuring or making such loans, to obtain a license. Under the statute, the business of making small loans includes the making of loans of $6,000 or less with interest rates and expenses of more than 12% per year. The Massachusetts Division of Banks ruled that our business with TERI is not subject to licensure because, as a provider of loan origination outsourcing services, we do not conduct a lending business with consumers in our own name and our processing centers are not generally open to the public.

We believe our operations in support of the GATE programs are exempt from Massachusetts Small Loan Act licensing for similar reasons. We do not solicit or assist borrowers directly, but rather work with schools and Bank of America in establishing a program operated by them. In addition, the GATE programs do not involve compensation payable to us in connection with the making of loans or in connection with aiding or assisting the borrower or the lender in procuring or making such loans. We derive all of our revenue in connection with the GATE programs from the securitization of loans. Finally, the Small Loan Act is only triggered if rates exceed 12%, which is not presently the case.

We could become subject to the Massachusetts Small Loan Act in the future if, for example, interest rates on the loans that we process exceed 12% and either the Massachusetts legislature modifies the statutory requirements or the Massachusetts Division of Banks revokes its previous determination that our operations are exempt. We could also become subject to licensing laws in Massachusetts and other states if we engage in licensable activities in the future, or if our operations became sufficiently localized in other states to trigger licensing.

However, even if we are not physically present in a state, its regulators may take the position that licensing or registration is required because we provide services by mail, telephone, the Internet or other remote means. If we identify any states in which licensing or registration is required, we intend to proceed with licensing or registration in the affected state. If any state asserts jurisdiction over our business, we will consider whether to challenge the assertion or proceed with licensing or registration in the affected state. Compliance with such requirements could involve additional costs, which could have a material adverse effect on our business. Our failure to comply with these laws could lead to, among other things: (a) curtailment of our ability to continue to conduct business in the relevant jurisdiction, pending processing of our license application or registration, (b) administrative enforcement actions, (c) class

16

action lawsuits, (d) the assertion of legal defenses delaying or otherwise affecting the enforcement of loans and (e) criminal as well as civil liability. This could have a material adverse effect on our business.

While our licensing requirements are currently limited, the consumer assets in which we deal are subject to the full panoply of state and federal regulation, and a defect in such assets could affect our business. Similarly, the growing complexity of regulation of loan origination and collection may affect the cost and efficiency of our operations. We have sought to minimize the risk created by consumer loan regulation in a number of ways. The securitizations that we facilitate currently involve sales solely by FDIC-insured financial institutions which represent and warrant that the assets in question have been originated in compliance with all applicable law and are valid, binding and enforceable in accordance with their terms. Similarly, the securitization trusts benefit from an assignment of representations and warranties made by the lender and by the applicable loan servicer regarding compliance with law in the origination and servicing of loan assets. Thus, our residual interest in securitizations is buffered from regulatory risk to the extent that lenders, TERI and servicing providers stand behind the legal compliance of their activities. TERI may nonetheless have recourse to us to the extent that a regulatory failure in loan origination by us breaches the standards of care under the master servicing agreement between TERI and us.

In addition, in delivering services, we must cause our operations to conform to consumer loan regulation that applies to TERI and the lenders. This regulation includes compliance with the federal Truth-in-Lending Act, the Fair Credit Reporting Act, the USA PATRIOT Act, the Equal Credit Opportunity Act, the Gramm Leach Bliley Act, the Federal Trade Commission Act, the Fair Debt Collection Practices Act, and numerous state laws that replicate and expand upon the requirements of federal law. In addition, there is increasing regulation of the type of electronic loan application processing that we conduct, as well as regulation of access to and use of consumer information databases. A growing number of states are imposing disparate and costly requirements on our operations, including protections against identity theft, privacy protection and data security protection. In addition, the Fair and Accurate Credit Transactions Act of 2003 imposes significant new federal law requirements on loan application processors, including requirements with respect to resolving address inconsistencies, responding to “red flags” of potential identity theft and processing identity theft notices and other requirements that will require both changes to automated loan processing and the creation of manual exception systems. These new requirements will strain systems and personnel that are already undergoing rapid change due to loan volume growth. Failure to comply with these requirements will violate our obligations to the lenders we serve and could subject them to regulatory action and result in termination of our processing contracts.

17

Employees

At June 30, 2005, we had 842 full-time employees, 11 part-time employees and 36 seasonal employees, as follows:

Department | | | | Full-time | | Part-time | | Seasonal | |

Customer service | | | 159 | | | | 1 | | | | 9 | | |

Operations | | | 174 | | | | 3 | | | | 15 | | |

Loan facilitation | | | 129 | | | | 1 | | | | 4 | | |

Information technology | | | 154 | | | | 0 | | | | 2 | | |

Finance and administration | | | 110 | | | | 5 | | | | 2 | | |

Business development | | | 28 | | | | 0 | | | | 1 | | |

Collections and default management | | | 23 | | | | 1 | | | | 0 | | |

Capital markets | | | 13 | | | | 0 | | | | 1 | | |

Marketing | | | 17 | | | | 0 | | | | 0 | | |

Trust administration | | | 18 | | | | 0 | | | | 0 | | |

Executive | | | 17 | | | | 0 | | | | 2 | | |

Total | | | 842 | | | | 11 | | | | 36 | | |

We are not subject to any collective bargaining agreements, and we believe our relationships with our employees are good.

Our Corporate Information

We were formed as a limited partnership in 1991 and were incorporated in Delaware in August 1994. Our principal executive offices are located at The Prudential Tower, 800 Boylston Street, 34th Floor, Boston, Massachusetts 02199. The telephone number of our principal executive offices is (617) 638-2000.

Available Information

Our Internet address is http://www.firstmarblehead.com. The contents of our website are not part of this Annual Report on Form 10-K, and our Internet address is included in this document as an inactive textual reference only. We make our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports available free of charge on our website as soon as reasonably practicable after we file such reports with, or furnish such reports to, the SEC.

18

Item 1A. Executive Officers

The following table sets forth information regarding our executive officers, including their ages as of June 30, 2005.

Name | | | | Age | | Position | | |

Daniel Maxwell Meyers | | 42 | | Chairman of the Board of Directors, President and Chief Executive Officer |

Stephen E. Anbinder | | 67 | | Vice Chairman of the Board of Directors |

Anne P. Bowen | | 53 | | Executive Vice President, Corporate Planning |

Thomas Cesso | | 46 | | Executive Vice President, Chief Information Officer |

Andrew J. Hawley | | 41 | | Executive Vice President, President of First Marblehead Education Resources, Inc. |

John A. Hupalo | | 45 | | Executive Vice President and Group Head, Capital Markets |

Larry A. Lutz | | 48 | | Executive Vice President, Business Development |

John C. Niles | | 42 | | Executive Vice President, International Group |

Donald R. Peck | | 47 | | Executive Vice President, Chief Financial Officer, Treasurer and Secretary |

Set forth below is certain information regarding the business experience of each of the above-named persons.

Daniel Maxwell Meyers co-founded First Marblehead and served as its Managing Partner from 1991 to 1994. Mr. Meyers has served as our Chief Executive Officer and Chairman of the board of directors since our incorporation in 1994 and as our President from November 2004 to September 2005. From 1980 to 1991, Mr. Meyers was involved in arbitrage and derivatives trading at EF Hutton, Prudential Bache Securities, LF Rothschild Unterberg Towbin and Commodities Corporation. He began working on asset backed securities financings in 1986. He currently serves as the Chair of the Board of the Curry School of Education at the University of Virginia. He is also currently a member of the International Institute for Strategic Studies and serves on the Board of the Forum for the Future of Higher Education. Mr. Meyers received an A.B. in Economics from Brandeis University and completed the Owner President Management Program at the Harvard Graduate School of Business Administration.

Stephen E. Anbinder is a co-founder of First Marblehead and has served as Vice Chairman of the board of directors since May 2002. Mr. Anbinder previously served as our President, from December 1995 to May 2002, and Treasurer, from May 2002 to June 2003. From 1980 to 1981 and from 1962 to 1969, Mr. Anbinder held positions with Scudder Stevens & Clark, an investment counseling firm, serving most recently as a Vice President and member of its investment policy committee. From 1970 to 1979, Mr. Anbinder served as a Managing Director of Dillon Read & Company, a securities brokerage firm, where he headed the fixed income capital markets group and was a member of the board of directors. Mr. Anbinder received a B.A. in Literature from Cornell University and an M.B.A. from the Harvard Graduate School of Business Administration.

Anne P. Bowen has served as our Executive Vice President, Corporate Planning since April 2004. From August 2002 to July 2003, Ms. Bowen was a Senior Vice President for State Street Corporation, a financial services firm, where she was responsible for acquisition integration. From October 1999 to July 2002, she served as a Senior Vice President of eBusiness at State Street. From December 1994 to September 1999, Ms. Bowen served as a Senior Vice President of Global Financial Technical Services at State Street. Ms. Bowen served as a Director with Coopers & Lybrand Consulting, Inc. from 1992 to 1994, specializing in the banking practice. From 1978 to 1992, Ms. Bowen served as a Director of Bank of Boston, managing the Corporate Credit, Real Estate and Corporate Audit functions. Ms. Bowen received a B.S. from Boston University and an M.B.A. from Simmons College.

19

Thomas Cesso has been our Executive Vice President, Chief Information Officer since January 2005. During 2004, Mr. Cesso served as Executive Vice President and Chief Executive Officer for Telerate, a global market data firm serving the capital markets, trading and banking communities. Mr. Cesso served as Managing Director and Global Head of Technology of Citigroup Asset Management, an asset management firm, from 2001 to 2004. From 1996 to 2001, Mr. Cesso held positions with Fidelity Investments Systems Company, a provider of technology solutions to the various business units of Fidelity Investments, serving most recently as Vice President of IT Architecture. From 1986 to 1996, Mr. Cesso provided information technology and process development improvement consulting services to Fortune 1000 companies while working at Coopers & Lybrand, Ernst & Young, and Pittiglio, Rabin, Todd & McGrath. Mr. Cesso received a B.S., Masters in Engineering and MBA in Management from Boston University.

Andrew J. Hawley has served as Executive Vice President, President of First Marblehead Education Resources, Inc. since May 2004. From 1994 to April 2004, Mr. Hawley was a Lead Director with Pittiglio, Rabin, Todd & McGrath, a management consulting firm, where he consulted with U.S. companies on operations improvements, growth strategies and organized restructuring. From 1989 to 1992, Mr. Hawley held several positions with Cambridge Strategic Management Group, a strategic consulting firm, with a focus on growth strategies for international companies in Asia, Latin America and Europe. Mr. Hawley received an A.B. from Harvard College and an M.B.A. from Boston College.

John A. Hupalo has served as our Executive Vice President and Group Head, Capital Markets since March 2003. From March 1999 to March 2003, Mr. Hupalo served as a Managing Director in the Education Loan Group of UBS Paine Webber, a diversified financial institution. From 1991 to 1999, Mr. Hupalo served as a Director in the Education Loan Group of Salomon Smith Barney, an investment bank. From 1987 to 1991, Mr. Hupalo served in a similar group at Manufacturers Hanover Securities Corporation. Prior to entering the field of investment banking, Mr. Hupalo worked for a Member of the U.S. Congress and the National Association of Manufacturers. Mr. Hupalo received a B.A. in Political Science from Boston University and an M.B.A. in Finance from New York University’s Stern School of Business.

Larry A. Lutz has served as our Executive Vice President, Business Development since April 2004. Mr. Lutz previously served as our Senior Vice President and Group Head, Business Development, from August 2003 to April 2004, and Senior Business Development Officer, from February 2002 to August 2003. From December 1999 to January 2002, Mr. Lutz served as President and Chief Executive Officer of Career College Loan Company, L.L.C., an education loan development and marketing company. From 1995 to 1999, Mr. Lutz served in various capacities, including Senior Vice President and Chief Business Development Officer with Educaid, the student loan division of Wachovia Bank, N.A. and a national education loan provider. From 1989 to 1995, Mr. Lutz served as Senior Vice President, Chief Marketing Officer with Student Loan Funding Corporation, a regional student loan secondary marketer. Prior to entering the education finance business, Mr. Lutz served in various business development positions in the investment management industry. Mr. Lutz received a B.A. from The Colorado College.

John C. Niles has been our Executive Vice President, International Group, since November 2005. Previously, Mr. Niles served as Executive Vice President, Office of the Chief Operating Officer from August 2003 to November 2005 and served as Senior Vice President and Managing Director, Business Development and Vice President, Operations from April 1996 to August 2003. From 1991 to 1996, Mr. Niles served as Vice President, Operations of LittlePoint Corporation, a biotech/consumer products company. From 1988 to 1991, Mr. Niles served as a Commercial Lending Officer at the Bank of Boston. Mr. Niles received a B.A. in History from St. Lawrence University and completed the Advanced Management Program at the Harvard Graduate School of Business Administration.

20

Donald R. Peck has been our Executive Vice President and Chief Financial Officer since April 2003, Treasurer since July 2003 and Secretary since November 2004. From June 2002 to April 2003, Mr. Peck served as President of Lenox Partners, a finance and legal advisory firm. From July 2001 to May 2002, Mr. Peck served as Chief Financial Officer and General Counsel of Zeborg, Inc., a sourcing solutions firm. From May 2000 to July 2001, Mr. Peck served as Chief Financial Officer and General Counsel of Marketmax, Inc., a retail software firm. From September 1996 to September 1999, Mr. Peck served as Treasurer and General Counsel to Centennial Technologies, Inc., a PCMCIA card manufacturer. From 1997 to 1999, Mr. Peck also served as Secretary of Centennial Technologies. From 1986 to 1996, Mr. Peck was an attorney with the law firm of Nutter, McClennen & Fish LLP. Prior to practicing as an attorney, Mr. Peck held positions with Arthur Andersen LLP, serving most recently as a senior auditor. Mr. Peck serves as Vice Chair of the Board of Overseers of the New England Conservatory of Music. Mr. Peck received a B.S. in Business Administration from the University of Rhode Island and a J.D. from Cornell Law School.

Peter B. Tarr has served as our General Counsel since July 11, 2005 and Vice Chairman of the Board of Directors since August 9, 2005. Jack L. Kopnisky has served as our President and Chief Operating Officer since September 6, 2005.

Item 1B. Code of Ethics