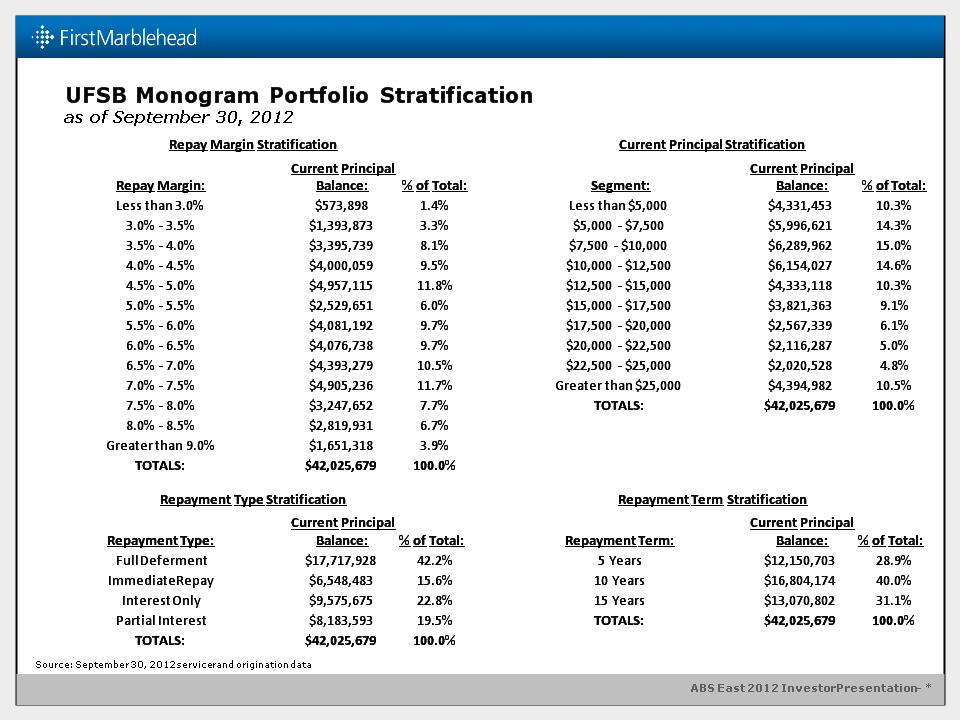

ABS East 2012 Investor Presentation - * UFSB Monogram Portfolio Stratification as of September 30, 2012 Repay Margin Stratification Repay Margin Stratification Repay Margin Stratification Repay Margin: Current Principal Balance: % of Total: Less than 3.0% $573,898 1.4% 3.0% - 3.5% $1,393,873 3.3% 3.5% - 4.0% $3,395,739 8.1% 4.0% - 4.5% $4,000,059 9.5% 4.5% - 5.0% $4,957,115 11.8% 5.0% - 5.5% $2,529,651 6.0% 5.5% - 6.0% $4,081,192 9.7% 6.0% - 6.5% $4,076,738 9.7% 6.5% - 7.0% $4,393,279 10.5% 7.0% - 7.5% $4,905,236 11.7% 7.5% - 8.0% $3,247,652 7.7% 8.0% - 8.5% $2,819,931 6.7% Greater than 9.0% $1,651,318 3.9% TOTALS: $42,025,679 100.0% Current Principal Stratification Current Principal Stratification Current Principal Stratification Segment: Current Principal Balance: % of Total: Less than $5,000 $4,331,453 10.3% $5,000 - $7,500 $5,996,621 14.3% $7,500 - $10,000 $6,289,962 15.0% $10,000 - $12,500 $6,154,027 14.6% $12,500 - $15,000 $4,333,118 10.3% $15,000 - $17,500 $3,821,363 9.1% $17,500 - $20,000 $2,567,339 6.1% $20,000 - $22,500 $2,116,287 5.0% $22,500 - $25,000 $2,020,528 4.8% Greater than $25,000 $4,394,982 10.5% TOTALS: $42,025,679 100.0% Repayment Type Stratification Repayment Type Stratification Repayment Type Stratification Repayment Type: Current Principal Balance: % of Total: Full Deferment $17,717,928 42.2% Immediate Repay $6,548,483 15.6% Interest Only $9,575,675 22.8% Partial Interest $8,183,593 19.5% TOTALS: $42,025,679 100.0% Repayment Term Stratification Repayment Term Stratification Repayment Term Stratification Repayment Term: Current Principal Balance: % of Total: 5 Years $12,150,703 28.9% 10 Years $16,804,174 40.0% 15 Years $13,070,802 31.1% TOTALS: $42,025,679 100.0% Source: September 30, 2012 servicer and origination data