UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

| | |

| For the fiscal year ended December 31, 2006 | | Commission file number 001-31906 |

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

HIGHLAND HOSPITALITY CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| MARYLAND | | 57-1183293 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

8405 Greensboro Drive, Suite 500, McLean, Virginia 22102

Telephone Number (703) 336-4901

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class

| | Name of Exchange On Which Registered

|

Common Stock, $.01 par value | | New York Stock Exchange |

Series A Cumulative Redeemable Preferred Stock, $.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Exchange Act of 1934. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes x No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Securities Exchange Act of 1934:

| | | | |

| Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ¨ No x

As of June 30, 2006, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $808,783,000, based on the closing price reported on the New York Stock Exchange. As of February 23, 2007, there were 61,414,744 shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Form 10-K incorporates by reference certain portions of the Registrant’s proxy statement for its 2007 annual meeting of stockholders to be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year covered by this report.

HIGHLAND HOSPITALITY CORPORATION

INDEX

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and as such may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally identified by our use of words, such as “intend,” “plan,” “may,” “should,” “will,” “project,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “opportunity,” and similar expressions, whether in the negative or affirmative. All statements regarding our expected financial position, business and financing plans are forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include those discussed in “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this Form 10-K. These risks and uncertainties should be considered in evaluating any forward-looking statement contained in this report or incorporated by reference herein.

All forward-looking statements speak only as of the date of this report or, in the case of any document incorporated by reference, the date of that document. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are qualified by the cautionary statements in this section. We undertake no obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this report.

3

PART I

Item 1. Business

Overview

Highland Hospitality Corporation is a self-advised real estate investment trust (“REIT”) that was incorporated in the state of Maryland and owns upscale full-service, premium limited-service, and extended-stay properties located in major convention, business, resort and airport markets in the United States. We commenced operations on December 19, 2003 when we completed our initial public offering (“IPO”) and concurrently acquired our first three hotel properties. As of February 27, 2007, we owned 27 hotel properties with 8,382 rooms located in 14 states and the District of Columbia.

Substantially all of our assets are held by, and all of our operations are conducted through, Highland Hospitality, L.P., our operating partnership (the “Operating Partnership”). In order for us to qualify as a REIT, neither our company nor the Operating Partnership can operate hotels directly. Therefore, the Operating Partnership, which is owned approximately 99% by us and approximately 1% by other limited partners, leases its hotels to subsidiaries of HHC TRS Holding Corporation (collectively, “HHC TRS”), which is a wholly owned subsidiary of the Operating Partnership. HHC TRS then engages hotel management companies to operate the hotels pursuant to management contracts. HHC TRS is treated as a taxable REIT subsidiary for federal income tax purposes.

Our corporate office is located at 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102. Our telephone number is (703) 336-4901.

Recent Investment Activity

During 2006 and early 2007, we acquired the following six hotel properties for an aggregate purchase price of approximately $381.1 million:

| | • | | in February 2006, the 673-room Nashville Renaissance hotel, a full-service upscale hotel located in Nashville, Tennessee, for a purchase price of approximately $80.3 million; |

| | • | | in March 2006, the 240-room Melrose hotel, an independent full-service hotel located in Washington, DC, for a purchase price of approximately $77.0 million; |

| | • | | in March 2006, the 585-room Pointe Hilton Tapatio Cliffs resort, an upscale all-suite resort located in Phoenix, Arizona, for a purchase price of approximately $81.9 million; |

| | • | | in June 2006, the 210-room Courtyard Gaithersburg Washingtonian Center hotel, an upscale limited-service hotel located in Gaithersburg, Maryland, for a purchase price of approximately $30.1 million; |

| | • | | in September 2006, the 444-room Ritz-Carlton Atlanta Downtown hotel, a full-service luxury hotel located in Atlanta, Georgia, for a purchase price of approximately $77.4 million; and |

| | • | | in February 2007, the 143-room Crowne Plaza Chicago-Silversmith hotel, a full-service upscale hotel located in Chicago, Illinois, for a purchase price of approximately $34.5 million. |

Also during 2006, we disposed of the following two hotel properties for aggregate net sales proceeds of approximately $70.3 million:

| | • | | in June 2006, the 283-room Marriott Mount Laurel hotel, located in Mount Laurel, New Jersey, for net sales proceeds of approximately $31.8 million; and |

| | • | | in August 2006, the 332-room Barceló Tucancun Beach resort, located in Cancun, Mexico, for net sales proceeds of approximately $38.5 million. |

4

Business Strategy

We intend to evaluate our portfolio on a regular basis to determine if our hotel properties continue to satisfy our current investment criteria. We believe that the following investment criteria and strategies promote our continued growth and our total return to stockholders:

Diversification—We seek to invest in and maintain a diversified hotel portfolio by brand, management company, and product mix.

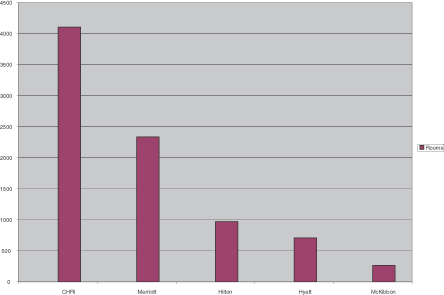

All five major brand companies in the United States (Marriott, Hilton, Hyatt, Starwood and Intercontinental) offer highly regarded upscale and upper-upscale brands which fit well within our acquisition strategy. We believe that a portfolio diversified by brand both mitigates risk in the event that certain brand becomes out of favor and also provides us leverage in negotiating hotel management and license agreements. Additionally, we believe that diverse brand relationships create value opportunities and pipeline potential through referrals of acquisition opportunities from the brand management and franchise management teams. The following chart reflects our hotel property rooms by brand as of February 27, 2007:

5

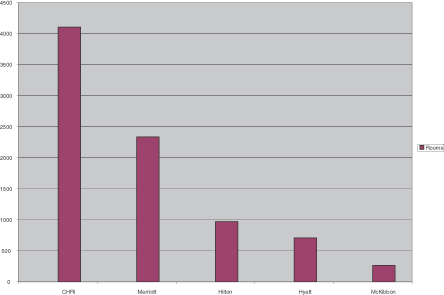

We believe that employing and retaining a diverse mix of quality management companies provides us with the ability to drive value with our preferred manager (Crestline Hotels and Resorts, Inc.) and other third party management companies. Diversification in our management companies allows us to diversify the risk of strategic or management direction changes in a certain management company and allows us to compare revenue and operating metrics, cost control initiatives, and other benchmarking strategies. The following chart reflects our hotel property rooms by management company as of February 27, 2007:

Finally, we believe that a broad range of product types, including both full-service and limited-service hotels, along with corporate, convention and resort hotels, and urban and suburban locations, is necessary to avoid a concentrated risk in any certain product type.

External Growth—We seek to focus our future investments in the top 25 metropolitan statistical areas (“MSAs”) in the United States. Specifically, we invest in upscale full-service, premium limited-service and extended-stay hotels located in major convention, business, resort and airport markets. We believe that these types of hotels currently offer the opportunity for better risk-adjusted returns than hotels in other sectors in the industry. As of February 27, 2007, approximately 67% of our hotel rooms were located in the top 25 MSA markets. Within our target sectors, we seek to acquire hotel properties that have superior locations within their respective markets, are in markets with high barriers-to-entry, are market leaders or are new, or relatively new, properties and well maintained. We also consider investments in hotel properties that possess sound operating fundamentals but are underperforming in their respective markets and would benefit from renovation, re-branding or a change in management.

We seek to invest in hotels operating under national franchise brands such as Marriott, Hilton, Hyatt, Renaissance, Sheraton, Westin, Crowne Plaza, Courtyard by Marriott, Residence Inn by Marriott, Embassy Suites, Homewood Suites, and Hilton Garden Inn. However, our ability to operate a hotel under these brands is subject to the franchisor’s approval of any application we would submit to operate a particular facility under such brand and our execution of a franchise agreement with the franchisor.

In addition, on occasion, we will seek to invest in individual independent hotels located in certain urban areas of the top 25 MSAs in the United States. While the national brands mentioned above provide for a significant contribution of revenue through brand loyalty programs, national sales and other marketing programs, we believe that hotels of up to 250 rooms in top gateway markets are not necessarily in need of a brand marketing program to be successful. In certain cases, we believe that an independent hotel can produce a higher yield by taking advantage of today’s independent internet search and booking engines, along with third party websites, without paying royalty fees on all room revenues.

6

Stabilized Assets—We believe that over the next several years, existing upscale full-service, premium limited-service and extended-stay hotels located in major convention, business, resort and airport markets in the United States will offer the opportunity for better risk-adjusted returns than hotels in other sectors in the industry. Within our target sectors, we seek to acquire hotel properties that meet the following criteria:

| | • | | Strong location in its market—hotel properties located in markets with high barriers to entry, adjacent to a convention center, that serve as an integral component of a master development or mixed-use project or reside on a superior beachfront location or within a protected area that prohibits further development; |

| | • | | Hard to duplicate hotel property—hotel properties developed using public financing that could not have been financed entirely in the private sector or possessing a unique competitive advantage that distinguishes them from other hotels in their markets; |

| | • | | Market leaders—hotel properties that are proven leaders in market share, setting the rates in the market and providing superior meeting space, services or amenities; and |

| | • | | Good condition—hotel properties that are new, or relatively new, or recently renovated and well-maintained. |

Because we believe hotel properties that possess these characteristics currently can be acquired at prices below replacement costs, we expect these hotel properties to provide stable returns over the long term.

Renovation, Repositioning and Re-branding Opportunities—We believe that there are opportunities to acquire hotel properties that possess sound operating fundamentals, but are underperforming in their respective markets and would benefit from renovation, repositioning or re-branding efforts. We intend to pursue opportunities for:

| | • | | Re-branding—we investigate opportunities to re-brand certain hotels by determining which brands are available in the market, seeking to quantify the potential improvement in revenue generation and profitability and undertaking a cost/benefit analysis of investing capital to bring the property into compliance with the standards of the selected brand; |

| | • | | Renovation—we consider properties that are in prime locations and are structurally sound, but have been neglected and can be purchased at attractive prices and renovated and reintroduced into the market at a cost significantly lower than what would have been spent to acquire a stabilized property or to develop a new hotel of similar quality; or |

| | • | | New management—we consider hotel properties that are underperforming due to poor management where we can acquire the properties at an attractive price and replace management with qualified managers. |

Internal Growth—We work with our hotel management companies to aggressively pursue ways to enhance the profitability of our hotels. We seek to negotiate management agreements that align our managers’ interests with ours, which is to generate revenue growth while producing acceptable operating profits. We work with our managers to identify cost-savings opportunities and projects that result in a positive return on investment.

Strategic Alliance Agreement

On December 19, 2003, we entered into a seven-year strategic alliance agreement with Barceló Crestline Corporation (“Barceló Crestline”) pursuant to which (i) Barceló Crestline agrees to refer to us (on an exclusive basis) hotel acquisition opportunities in the United States presented to Barceló Crestline or its subsidiaries, other than opportunities that primarily relate to third-party management arrangements offered to Barceló Crestline, and (ii) we agree to offer Barceló Crestline or its subsidiaries the right to manage hotel properties that we acquire in the United States, unless (a) a majority of our independent directors in good faith concludes for valid business reasons that another management company should manage the acquired hotel, or (b) the hotel is encumbered by a

7

management agreement that would extend beyond the date of our acquisition of the hotel and a termination fee is payable to terminate the existing management agreement (unless Barceló Crestline pays such termination fee). Crestline Hotels & Resorts, Inc., which is a wholly owned subsidiary of Barceló Crestline, currently manages 15 of our 27 hotel properties.

Lease Agreements

In order for us to qualify as a REIT, neither our company nor the Operating Partnership or its subsidiaries can operate our hotels directly. Our Operating Partnership, or subsidiaries of our Operating Partnership, as lessors, leases our hotels to HHC TRS, or subsidiaries of HHC TRS, as TRS lessees, and the TRS lessees enter into agreements with third-party management companies to manage the hotels. Each lease for the hotels has a non-cancelable term of ten years, subject to earlier termination upon the occurrence of certain contingencies described in the lease.

During the term of each lease, the TRS lessees are obligated to pay (i) the greater of a fixed annual base rent or percentage rent and (ii) certain other additional charges. Base rent accrues and is paid monthly. Percentage rent is calculated by multiplying fixed percentages by gross room revenues, food and beverage revenues, and other revenues for each of the hotels and is paid quarterly.

Management Agreements

Our hotels are managed and operated by third parties pursuant to management agreements with our TRS lessees. The initial terms of our management agreements are generally 10 to 20 years, subject, in some cases, to renewal options. We have five different management companies operating our hotels. The management companies generally have sole responsibility and exclusive authority for all activities necessary for the day-to-day operation of the hotels, including establishing all room rates, processing reservations, procuring inventories, supplies and services, and promoting and publicizing the hotels. In addition, the management companies provide all managerial and other employees for the hotels, oversee the operation and maintenance of the hotels, prepare reports, budgets and projections, and provide other administrative and accounting support services to the hotels.

Each management company receives a base management fee generally between 2% and 4% of hotel revenues. The management companies are also eligible to receive an incentive management fee, if hotel operating income, as defined in the management agreements, exceeds certain performance thresholds. The incentive management fee is generally calculated as a percentage of hotel operating income after we have received a priority return on our investment in the hotel. The management agreements also allow the management companies to charge our hotels for services that are generally furnished on a centralized basis. Such services include: (1) the development and operation of certain computer systems and reservation services; (2) regional management and administrative services, regional marketing and sales services, regional training services, manpower development and relocation of regional personnel; and (3) such additional central or regional services as may from time to time be more efficiently performed on a regional or group basis rather than at an individual hotel. Costs and expenses incurred in providing these services are generally allocated among all hotels managed by the management company or its affiliates.

Generally, our management agreements limit our ability to sell, lease or otherwise transfer the hotels by requiring that the transferee assume the related management agreements and meet specified other conditions, including the condition that the transferee not be a competitor of the management company. In addition, the management agreements provide for termination rights in the case of a management company’s failure to meet certain financial performance criteria.

Franchise Agreements

Of our 27 hotel properties, 14 currently operate pursuant to franchise agreements from national hotel companies. The initial terms of our franchise agreements are generally 20 to 30 years. Ten of our hotel properties

8

are managed by Hyatt Corporation, Marriott International, Inc., or Hilton Hotels Corporation. The management agreements for these ten hotel properties allow the hotel property to operate under the respective brand. With respect to our other three hotel properties, The Churchill hotel, The Melrose hotel, and The Silversmith hotel operate as independent hotels.

We anticipate that most of the additional hotel properties that we acquire will operate pursuant to franchise agreements or management agreements that allow our hotel properties to operate under nationally recognized brands. We believe that the public’s perception of quality associated with a franchisor is an important feature in the operation of a hotel. Franchisors provide a variety of benefits for franchisees, which include national advertising, publicity and other marketing programs designed to increase brand awareness, training of personnel, continuous review of quality standards, and centralized reservation systems.

The franchise agreements are entered into by our TRS lessees. The franchise agreements generally specify certain management, operational, record keeping, accounting, reporting and marketing standards and procedures with which the TRS lessees must comply. The franchise agreements obligate the TRS lessees to comply with the franchisors’ standards and requirements with respect to training of operational personnel, safety, maintaining specified insurance, the types of services and products ancillary to guest room services that may be provided, display of signs, and the type, quality and age of furniture, fixtures and equipment included in guest rooms, lobbies and other common areas.

The franchise agreements provide for termination at the franchisor’s option upon the occurrence of certain events, including the TRS lessees’ failure to pay royalties and fees or perform its other covenants pursuant to the franchise agreement, bankruptcy, abandonment of the franchise, commission of a felony, assignment of the franchise without the consent of the franchisor, or failure to comply with applicable law in the operation of the relevant hotel. The franchise agreements will not renew automatically upon expiration. The TRS lessees are responsible for making all payments pursuant to the franchise agreements to the franchisors. Pursuant to the franchise agreements, the TRS lessees pay a royalty fee generally between 4% and 5% of room revenues, plus additional fees for marketing, central reservation systems, and other franchisor costs that amount to between 3% and 4% of room revenues from the hotels.

Tax Status

We have elected to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code. To qualify as a REIT, we must meet a number of organizational and operational requirements, including a requirement that we currently distribute at least 90% of our REIT taxable income (excluding net capital gains) to our stockholders. It is our current intention to adhere to these requirements and maintain our qualification for taxation as a REIT. As a REIT, we generally will not be subject to federal corporate income tax on that portion of our taxable income that is currently distributed to stockholders. If we fail to qualify for taxation as a REIT in any taxable year, we will be subject to federal income taxes at regular corporate rates (including any applicable alternative minimum tax) and may not be able to qualify as a REIT for four subsequent taxable years. Even if we qualify for taxation as a REIT, we may be subject to certain state and local taxes on our income and property, and to federal income and excise taxes on our undistributed taxable income. In addition, taxable income from non-REIT activities managed through taxable REIT subsidiaries is subject to federal, state and local income taxes.

Seasonality

Demand in the lodging industry is affected by recurring seasonal patterns. For non-resort properties, demand is generally lower in the winter months due to decreased travel and higher in the spring and summer months during the peak travel season. For resort properties, demand is generally higher in the winter months. We expect that our operations will generally reflect non-resort seasonality patterns. Accordingly, we expect that we will have lower revenue, operating income and cash flow in the first and fourth quarters and higher revenue, operating income and cash flow in the second and third quarters. These general trends are, however, expected to be greatly influenced by overall economic cycles.

9

Competition

The hotel industry is highly competitive with various participants competing on the basis of price, level of service and geographic location. Each of our hotels is located in a developed area that includes other hotel properties. The number of competitive hotel properties in a particular area could have a material adverse effect on occupancy, average daily rate (“ADR”) and revenue per available room (“RevPAR”) of our hotels or at hotel properties acquired in the future. We believe that brand recognition, location, the quality of the hotel, consistency of services provided, and price are the principal competitive factors affecting our hotels.

Environmental Matters

In connection with the ownership and operation of the hotels, we are subject to various federal, state and local laws, ordinances and regulations relating to environmental protection. Under these laws, a current or previous owner or operator of real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances on, under, or in such property. Such laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of hazardous or toxic substances. In addition, the presence of contamination from hazardous or toxic substances, or the failure to remediate such contaminated property properly, may adversely affect the owner’s ability to borrow using such property as collateral. Furthermore, a person who arranges for the disposal or treatment of a hazardous or toxic substance at a property owned by another, or who transports such substance to or from such property, may be liable for the costs of removal or remediation of such substance released into the environment at the disposal or treatment facility. The costs of remediation or removal of such substances may be substantial, and the presence of such substances may adversely affect the owner’s ability to sell such real estate. In connection with the ownership of the hotels, we may be potentially liable for such costs.

We believe that our hotels are in compliance, in all material respects, with all federal, state and local environmental ordinances and regulations regarding hazardous or toxic substances and other environmental matters, the violation of which would have a material adverse effect on us. We have not received written notice from any governmental authority of any material noncompliance, liability or claim relating to hazardous or toxic substances or other environmental matters in connection with any of our present hotel properties.

Employees

As of February 27, 2007, we employed 16 persons, all of whom work at our corporate office in McLean, Virginia. All persons employed in the day-to-day operations of the hotels are employees of the management companies engaged by the TRS lessees to operate such hotels.

Executive Officers

The following table lists our executive officers as of February 27, 2007:

| | | | |

Name

| | Age

| | Position

|

James L. Francis | | 44 | | President, Chief Executive Officer and Director |

Tracy M.J. Colden | | 45 | | Executive Vice President, General Counsel and Secretary |

Patrick W. Campbell | | 44 | | Executive Vice President and Chief Investment Officer |

Douglas W. Vicari | | 47 | | Executive Vice President and Chief Financial Officer |

James L. Francis is our President and Chief Executive Officer. Mr. Francis served as the Chief Operating Officer, Chief Financial Officer and Treasurer of Barceló Crestline Corporation from June 2002 until the completion of our initial public offering and as Executive Vice President and Chief Financial Officer of Crestline Capital Corporation from December 1998 to June 2002. From June 1997 to December 1998, Mr. Francis held the position of Assistant Treasurer and Vice President Corporate Finance for Host Marriott Corporation.

10

Tracy M.J. Colden is our Executive Vice President, General Counsel and Secretary. Ms. Colden served as the Executive Vice President, General Counsel and Secretary of Barceló Crestline Corporation from June 2002 until the completion of our initial public offering and as Senior Vice President, General Counsel and Secretary of Crestline Capital Corporation from December 1998 to June 2002. From January 1996 to December 1998, Ms. Colden held various positions with Host Marriott Corporation, the last of which was Assistant General Counsel.

Patrick W. Campbell is our Executive Vice President and Chief Investment Officer. Mr. Campbell served as Senior Vice President of Acquisitions of Crestline Hotels & Resorts, Inc. from January 2003 until the completion of our initial public offering and as Vice President of Business Development of Crestline Capital Corporation from July 2000 to December 2002. From May 1998 to June 2000, Mr. Campbell held the position of Vice President of Acquisitions and Development with Bristol Hotels & Resorts, Inc., prior to its being acquired by Bass PLC (now Intercontinental Hotels Group).

Douglas W. Vicari is our Executive Vice President and Chief Financial Officer, a position he has held since September 2003. From August 1998 to July 2003, Mr. Vicari served as Senior Vice President and Chief Financial Officer of Prime Hospitality Corporation.

Available Information

We maintain an Internet site, www.highlandhospitality.com, which contains additional information concerning Highland Hospitality Corporation. We make available free of charge through our Internet site our filings with the Securities and Exchange Commission as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the Securities and Exchange Commission. We also post on this website our Code of Business Conduct and Ethics, Principles of Corporate Governance, and the charters of our Audit, Compensation Policy, and Nominating and Corporate Governance Committees of our board of directors. We intend to disclose on our website any changes to, or waivers from, our Code of Business Conduct and Ethics. Information on our Internet site is neither part of nor incorporated into this Form 10-K.

11

Item 1A. Risk Factors

Risks Related to Our Organization and Structure

Our failure to qualify as a REIT under the federal tax laws would result in adverse tax consequences.

The U.S. federal income tax laws governing REITs are complex.

We intend to operate in a manner that will qualify us as a real estate investment trust, or REIT, under the U.S. federal income tax laws. The REIT qualification requirements are extremely complex, however, and interpretations of the U.S. federal income tax laws governing qualification as a REIT are limited. Accordingly, we cannot be certain that we will be successful in operating so we can qualify as a REIT. At any time, new laws, interpretations, or court decisions may change the federal tax laws or the U.S. federal income tax consequences of our qualification as a REIT.

Failure to qualify as a REIT would subject us to U.S. federal income tax and would subject us and our stockholders to other adverse consequences.

We believe that we have qualified for taxation as a REIT for federal income tax purposes commencing with our taxable year ended December 31, 2003. We intend to continue to operate as a REIT during future years, however, no assurance can be provided that we will qualify as a REIT. As a REIT, we generally will not be subject to federal income tax on our income that we distribute currently to our stockholders. Many of the REIT requirements are highly technical and complex. The determination that we are a REIT requires an analysis of various factual matters and circumstances that may not be totally within our control. For example, to qualify as a REIT, at least 95% of our gross income must come from sources that are itemized in the REIT tax laws. We generally are prohibited from owning more than 10% of the voting securities or more than 10% of the value of the outstanding securities of any one issuer, subject to certain exceptions, including an exception with respect to certain debt instruments and corporations electing to be taxable REIT subsidiaries. We are also required to distribute to stockholders at least 90% of our REIT taxable income (excluding capital gains). The fact that we hold most of our assets through the Operating Partnership further complicates the application of the REIT requirements. Even a technical or inadvertent mistake could jeopardize our REIT status. Furthermore, Congress or the Internal Revenue Service might make changes to the tax laws and regulations, or the courts might issue new rulings that make it more difficult, or impossible, for us to remain qualified as a REIT.

If we fail to qualify as a REIT for federal income tax purposes, and are unable to avail ourselves of certain savings provisions set forth in the Internal Revenue Code, we would be subject to federal income tax at regular corporate rates. As a taxable corporation, we would not be allowed to take a deduction for distributions to stockholders in computing our taxable income or pass through long term capital gains to individual stockholders at favorable rates. We also could be subject to the federal alternative minimum tax and possibly increased state and local taxes. We would not be able to elect to be taxed as a REIT for four years following the year we first failed to qualify unless the IRS were to grant us relief under certain statutory provisions. If we failed to qualify as a REIT, we would have to pay significant income taxes, which would reduce our net earnings available for investment or distribution to our stockholders. This likely would have a significant adverse effect on our results of operations and the value of our common shares. In addition, we would no longer be required to pay any distributions to stockholders and all of our distributions to stockholders would be taxable as regular corporate dividends to the extent of our current and accumulated earnings and profits. This means that stockholders taxed as individuals currently would be taxed on those dividends at capital gains rates and corporate stockholders generally would be entitled to the dividends received deduction with respect to such dividends, subject in each case, to applicable limitations under the Internal Revenue Code. If we fail to qualify as a REIT for federal income tax purposes and are able to avail ourselves of one or more of the statutory savings provisions in order to maintain our REIT status, we would nevertheless be required to pay penalty taxes of $50,000 or more for each such failure.

Failure to make required distributions would subject us to U.S. federal income tax.

In order to qualify as a REIT, each year we must pay out to our stockholders in distributions at least 90% of our taxable income, other than any net capital gains. To the extent that we satisfy this distribution requirement,

12

but distribute less than 100% of our taxable income, we will be subject to federal corporate income tax on our undistributed taxable income. In addition, we will be subject to a 4% nondeductible excise tax if the actual amount that we pay out to our stockholders in a calendar year is less than a minimum amount specified under federal tax laws. Our only source of funds to make these distributions comes from distributions that we receive from our Operating Partnership. Accordingly, we may be required to borrow money or sell assets to make distributions sufficient to enable us to pay out enough of our taxable income to satisfy the distribution requirement and to avoid corporate income tax and the 4% nondeductible excise tax in a particular year.

Our taxable REIT subsidiary lessees are subject to federal, state and local income taxes.

HHC TRS Holding Corporation, the sole owner of all of the lessees of our hotel properties organized as limited liability companies, or TRS lessees, is subject to U.S. federal income tax on its taxable income, which will consist of the revenues from the hotels leased by the TRS lessees, net of the operating expenses for such hotels and rent payments to us. Accordingly, although our ownership of the TRS lessees, through HHC TRS Holding Corporation, will allow us to participate in the operating income from our hotels in addition to receiving rent, that operating income will be fully subject to U.S. federal income tax. The after-tax net income of HHC TRS Holding Corporation is available for distribution to us.

We will incur a 100% excise tax on transactions with our TRS lessees that are not conducted on an arm’s-length basis. For example, to the extent that the rent paid by one of our TRS lessees to us exceeds an arm’s-length rental amount, such amount potentially will be subject to the excise tax. We intend that all transactions between us and our TRS lessees will be conducted on an arm’s-length basis and, therefore, that the rent paid by our TRS lessees to us will not be subject to the excise tax.

If our hotel leases are not respected as true leases for U.S. federal income tax purposes, we would fail to qualify as a REIT.

To qualify as a REIT, we must satisfy two gross income tests, under which specified percentages of our gross income must be passive income, like rent. For the rent paid pursuant to the leases, which constitutes substantially all of our gross income, to qualify for purposes of the gross income tests, the leases must be respected as true leases for U.S. federal income tax purposes and not be treated as service contracts, joint ventures or some other type of arrangement. We believe that the leases will be respected as true leases for U.S. federal income tax purposes. There can be no assurance, however, that the Internal Revenue Service will agree with this view.

If HHC TRS Holding Corporation fails to qualify as a taxable REIT subsidiary, we would fail to qualify as a REIT.

We are able to lease our hotel properties to the TRS lessees, relying on an exception from the general prohibition against leasing to a related-party tenant. This exception permits a REIT to lease hotel properties to its taxable REIT subsidiaries. As our TRS lessees are wholly owned by HHC TRS Holding Corporation, they are disregarded as separate entities for U.S. federal income tax purposes and the leases are treated as if made with HHC TRS Holding Corporation. So long as HHC TRS Holding Corporation qualifies as a taxable REIT subsidiary of ours, we can lease the hotel properties to HHC TRS Holding Corporation and receive rents that qualify as rents from real property for the REIT gross income test purposes. We believe that HHC TRS Holding Corporation qualifies to be treated as a taxable REIT subsidiary for U.S. federal income tax purposes. We cannot assure you, however, that the Internal Revenue Service will not challenge its status as a taxable REIT subsidiary for U.S. federal income tax purposes, or that a court would not sustain such a challenge. If the Internal Revenue Service were successful in disqualifying HHC TRS Holding Corporation from treatment as a taxable REIT subsidiary, we would fail to meet the asset tests applicable to REITs and substantially all of our income would fail to qualify for the gross income tests and, accordingly, we would fail to qualify as a REIT.

13

Despite our REIT status, we remain subject to various taxes.

Notwithstanding our status as a REIT, we are subject, through our ownership interest in our Operating Partnership and HHC TRS Holding Corporation, to certain U.S. federal, state and local taxes on our income and property. Moreover, if we have net income from “prohibited transactions,” that income will be subject to a 100% tax. In general, prohibited transactions are sales or other dispositions of property held primarily for sale to customers in the ordinary course of business. The determination as to whether a particular sale is a prohibited transaction depends on the facts and circumstances related to that sale. While we will undertake sales of assets if those assets become inconsistent with our long-term strategic or return objectives, we do not believe that those sales should be considered prohibited transactions, but there can be no assurance that the IRS would not contend otherwise. The need to avoid prohibited transactions could cause us to forego or defer sales of properties that might otherwise be in our best interest to sell.

If our Operating Partnership failed to qualify as a partnership for U.S. federal income tax purposes, we would cease to qualify as a REIT and suffer other adverse consequences.

We believe that our Operating Partnership qualifies to be treated as a partnership for U.S. federal income tax purposes. As a partnership, it is not subject to U.S. federal income tax on its income. Instead, each of its partners, including us, is required to pay tax on its allocable share of the Operating Partnership’s income. No assurance can be provided, however, that the Internal Revenue Service will not challenge its status as a partnership for U.S. federal income tax purposes, or that a court would not sustain such a challenge. If the Internal Revenue Service were successful in treating our Operating Partnership as a corporation for tax purposes, we would fail to meet the gross income tests and certain of the asset tests applicable to REITs and, accordingly, cease to qualify as a REIT. Also, the failure of our Operating Partnership to qualify as a partnership would cause it to become subject to U.S. federal and state corporate income tax, which would reduce significantly the amount of cash available for debt service and for distribution to its partners, including us.

Provisions of our charter may limit the ability of a third party to acquire control of our company.

Our ownership limitations may restrict or prevent you from engaging in certain transfers of our common stock.

In order to maintain our REIT qualification, no more than 50% in value of our outstanding stock may be owned, directly or indirectly, by five or fewer individuals (as defined in the U.S. federal income tax laws to include various kinds of entities) during the last half of any taxable year. To preserve our REIT qualification, our charter contains an aggregate share ownership limit and a common share ownership limit. Generally, any shares of our stock owned by affiliated owners will be added together for purposes of the aggregate share ownership limit, and any shares of common stock owned by affiliated owners will be added together for purposes of the common share ownership limit. Our charter provides that no person may directly or indirectly own more than 9.9% of the value of our outstanding shares of stock or more than 9.9% of the number of our outstanding shares of common stock. These ownership limitations may prevent an acquisition of control of our company by a third party without our board of directors’ approval, even if our stockholders believe the change of control is in their interest.

If anyone transfers shares in a way that would violate the aggregate share ownership limit or the common share ownership limit, or prevent us from continuing to qualify as a REIT under the U.S. federal income tax laws, we will consider the transfer to be null and void from the outset, and the intended transferee of those shares will be deemed never to have owned the shares or those shares instead will be transferred to a trust for the benefit of a charitable beneficiary and will be either redeemed by us or sold to a person whose ownership of the shares will not violate the aggregate share ownership limit or the common share ownership limit. Anyone who acquires shares in violation of the aggregate share ownership limit, the common share ownership limit or the other restrictions on transfer in our charter bears the risk of suffering a financial loss when the shares are redeemed or sold if the market price of our stock falls between the date of purchase and the date of redemption or sale.

14

Authority to issue stock.

Our charter authorizes our board of directors to issue up to 500,000,000 shares of common stock and up to 100,000,000 shares of preferred stock, to classify or reclassify any unissued shares of common stock or preferred stock and to set the preferences, rights and other terms of the classified or reclassified shares. Issuances of additional shares of stock may have the effect of delaying or preventing a change in control of our company, including transactions at a premium over the market price of our stock, even if stockholders believe that a change of control is in their interest.

Provisions of Maryland law may limit the ability of a third party to acquire control of our company.

Certain provisions of the Maryland General Corporation Law, or the MGCL, may have the effect of inhibiting a third party from making a proposal to acquire us or of impeding a change of control under circumstances that otherwise could provide the holders of shares of our common stock with the opportunity to realize a premium over the then prevailing market price of such shares, including:

| | • | | “business combination” provisions that, subject to limitations, prohibit certain business combinations between us and an “interested stockholder” (defined generally as any person who beneficially owns 10% or more of the voting power of our shares or an affiliate thereof) for five years after the most recent date on which the stockholder becomes an interested stockholder, and thereafter imposes special appraisal rights and special stockholder voting requirements on these combinations; and |

| | • | | “control share” provisions that provide that “control shares” of our company (defined as shares which, when aggregated with other shares controlled by the stockholder, entitle the stockholder to exercise one of three increasing ranges of voting power in electing directors) acquired in a “control share acquisition” (defined as the direct or indirect acquisition of ownership or control of “control shares”) have no voting rights except to the extent approved by our stockholders by the affirmative vote of at least two-thirds of all the votes entitled to be cast on the matter, excluding all interested shares. |

We have opted out of these provisions of the MGCL, in the case of the business combination provisions of the MGCL by resolution of our board of directors, and in the case of the control share provisions of the MGCL pursuant to a provision in our bylaws. However, our board of directors may by resolution elect to opt in to the business combination provisions of the MGCL and we may, by amendment to our bylaws, opt in to the control share provisions of the MGCL in the future.

Additionally, Title 3, Subtitle 8 of the MGCL permits our board of directors, without stockholder approval and regardless of what is currently provided in our charter or bylaws, to implement takeover defenses (for example, a classified board). These provisions may have the effect of inhibiting a third party from making an acquisition proposal for our company or of delaying, deferring or preventing a change in control of our company under the circumstances that otherwise could provide the holders of our common stock with the opportunity to realize a premium over the then current market price.

Risks Related to Our Business

The ability of our board of directors to change our major corporate policies may not be in your interest.

Our board of directors determines our major corporate policies, including our acquisition, financing, growth, operations and distribution policies. Our board may amend or revise these and other policies from time to time without the vote or consent of our stockholders.

Our success depends on key personnel whose continued service is not guaranteed.

We depend on the efforts and expertise of our President and Chief Executive Officer, our Executive Vice President and Chief Investment Officer, our Executive Vice President, General Counsel and Corporate Secretary and our Executive Vice President and Chief Financial Officer to manage our day-to-day operations and strategic business direction. The loss of any of their services could have an adverse effect on our operations.

15

We have conflicts of interest that may have affected the terms of our acquisition of our three initial properties and the related management agreements, as well as other management agreements we have subsequently entered into. We will have conflicts going forward with our chairman and one other director with respect to the management of our hotels by Barceló Crestline and the disposition of hotels acquired from Barceló Crestline.

There were conflicts of interest relating to the negotiation of the agreements pursuant to which we acquired interests in our three initial properties from Barceló Crestline. Bruce D. Wardinski, our chairman, was also the President and Chief Executive Officer of Barceló Crestline and served on an advisory committee of Barceló Corporación Empresarial, S.A., the parent company of Barceló Crestline. James L. Francis, another director and our President and Chief Executive Officer, was also the Chief Operating Officer and Chief Financial Officer of Barceló Crestline. In addition, two of our other senior executive officers were employees of Barceló Crestline at the time we negotiated and executed our agreements with Barceló Crestline to acquire our three initial properties, all of which are managed by a wholly owned subsidiary of Barceló Crestline under management contracts with our TRS lessees. Since then, subsidiaries of Barceló Crestline have also entered into similar agreements with our subsidiaries to manage 12 of our other 24 hotel properties. As a result, the agreements pursuant to which we acquired our initial properties and Barceló Crestline has agreed to manage the properties were not negotiated in an arm’s-length manner and the terms may be less favorable to us than we could have received from a third party.

Additionally, at the time of our IPO, we entered into a seven-year strategic alliance agreement with Barceló Crestline that requires Barceló Crestline, subject to certain exceptions, to refer to us, on an exclusive basis, any hotel investment opportunity which is presented to Barceló Crestline, and requires us to offer Barceló Crestline the opportunity to manage U.S. hotels that we acquire in the future unless a majority of our independent directors conclude in good faith for valid business reasons that another management company should manage one or more of such hotels. In addition to Mr. Wardinski, W. Reeder Glass, who became a director following the completion of the initial public offering, was at the time of his appointment and is also currently a director of Barceló Crestline and serves as Barceló Crestline’s designee pursuant to its right to nominate one director under the strategic alliance agreement. As a result, our board of directors may experience similar conflicts of interest with respect to any future acquisition of a hotel property by us from Barceló Crestline or its affiliates or in considering whether to engage Barceló Crestline to manage any of our hotel properties in the future.

In addition, because Barceló Crestline would receive a special allocation of taxable gain under the U.S. federal income tax rules relating to contributions of appreciated property to a partnership, if we dispose of one of more of our three initial properties in a taxable transaction, our board of directors may experience conflicts of interest with respect to any disposition of one or more of our three initial properties.

Our returns depend on management of our hotels by third parties.

In order to qualify as a REIT, we cannot operate our hotel properties or participate in the decisions affecting the daily operations of our hotels. Our TRS lessees may not operate the leased hotels and, therefore, they must enter into management agreements with eligible independent contractors which are not our subsidiaries or otherwise controlled by us to manage the hotels. Thus, independent hotel operators, under a management agreement with our TRS lessees, will control the daily operations of our hotels.

Under the terms of the management agreements that we have entered into with these management companies to date, our ability to participate in operating decisions regarding the hotels is limited. We depend on these independent management companies to adequately operate our hotels as provided in the management agreements. We do not have the authority to require any hotel to be operated in a particular manner or to govern any particular aspect of the daily operations of any hotel (for instance, setting room rates). Thus, even if we believe our hotels are being operated inefficiently or in a manner that does not result in satisfactory occupancy rates, revenue per available room, or RevPAR, and average daily rates, we may not be able to force the management company to change its method of operation of our hotels. We can only seek redress if a management company violates the terms of the applicable management agreement with a TRS lessee, and then

16

only to the extent of the remedies provided for under the terms of the management agreement. As a result, failure by our hotel managers to fully perform the duties agreed to in our management agreements could adversely affect our results of operations. In addition, our hotel managers manage, and in some cases own or have invested in, hotels that compete with our hotels, which may result in conflicts of interest. As a result, our hotel managers have in the past made and may in the future make decisions regarding competing lodging facilities that are not or would not be in our best interests. Additionally, in the event that we need to replace any of our management companies, we may be required by the terms of the management agreement to pay substantial termination fees and may experience significant disruptions at the affected hotels.

Our TRS lessee structure subjects us to the risk of increased hotel operating expenses.

Our leases with our TRS lessees will provide for the payment of rent based in part on revenues from our hotels. Our operating risks include not only changes in hotel revenues and changes to our lessee’s ability to pay the rent due under the leases, but also increased hotel operating expenses, including but not limited to the following:

| | • | | wage and benefit costs; |

| | • | | repair and maintenance expenses; |

| | • | | other operating expenses. |

Any increases in these operating expenses can have a significant adverse impact on our earnings and cash flow.

Operating our hotels under franchise agreements could adversely affect our distributions to our stockholders.

Our hotels will operate under franchise agreements, and we are subject to the risks that are found in concentrating our hotel investments in several franchise brands. These risks include reductions in business following negative publicity related to one of our brands.

The maintenance of the franchise licenses for our hotels is subject to our franchisors’ operating standards and other terms and conditions. Our franchisors periodically inspect our hotels to ensure that we and our lessees and management companies follow their standards. Failure by us, one of our TRS lessees or one of our management companies to maintain these standards or other terms and conditions could result in a franchise license being canceled. If a franchise license terminates due to our failure to make required improvements or to otherwise comply with its terms, we may also be liable to the franchisor for a termination payment, which varies by franchisor and by hotel. As a condition of our continued holding of a franchise license, a franchisor could also possibly require us to make capital expenditures, even if we do not believe the capital improvements are necessary or desirable or will result in an acceptable return on our investment. Nonetheless, we may risk losing a franchise license if we do not make franchisor-required capital expenditures.

If a franchisor terminates the franchise license, we may try either to obtain a suitable replacement franchise or to operate the hotel without a franchise license. The loss of a franchise license could materially and adversely affect the operations or the underlying value of the hotel because of the loss of associated name recognition, marketing support and centralized reservation systems provided by the franchisor. A loss of a franchise license for one or more hotels could materially and adversely affect our revenues. This loss of revenues could, therefore, also adversely affect our financial condition, results of operations and cash available for distribution to stockholders.

17

Our ability to make distributions to our stockholders may be affected by factors in the lodging industry.

Operating risks.

Our hotel properties are subject to various operating risks common to the lodging industry, many of which are beyond our control, including the following:

| | • | | competition from other hotel properties in our markets; |

| | • | | over-building of hotels in our markets, which adversely affects occupancy and revenues at our hotels; |

| | • | | dependence on business and commercial travelers and tourism; |

| | • | | increases in energy costs and other expenses affecting travel, which may affect travel patterns and reduce the number of business and commercial travelers and tourists; |

| | • | | increases in operating costs due to inflation and other factors that may not be offset by increased room rates; |

| | • | | changes in governmental laws and regulations, fiscal policies and zoning ordinances and the related costs of compliance with laws and regulations, fiscal policies and ordinances; |

| | • | | adverse effects of national, regional and local economic and market conditions; |

| | • | | adverse effects of a downturn in the lodging industry; and |

| | • | | risks generally associated with the ownership of hotel properties and real estate, as we discuss in detail below. |

These factors could reduce the net operating profits of our TRS lessees, which in turn could adversely affect our ability to make distributions to our stockholders.

We face competition for the acquisition of hotels, and we may not be able to complete acquisitions that we have identified.

One component of our business strategy is expansion through acquisitions, and we may not be successful in completing acquisitions that are consistent with our strategy. We compete with institutional pension funds, private equity investors, other REITs, owner-operators of hotels, franchise-owned hotels and others who are engaged in the acquisition of hotels. These competitors may affect the supply/demand dynamics and, accordingly, increase the price we must pay for hotels we seek to acquire, and these competitors may succeed in acquiring those hotels themselves. Also, our potential acquisition targets may find our competitors to be more attractive acquirors because they may have greater marketing and financial resources, may be willing to pay more, or may have a more compatible operating philosophy. In addition, the number of entities competing for suitable hotels may increase in the future, which would increase demand for these hotels and the prices we must pay to acquire them. If we pay higher prices for hotels, our profitability may be reduced. Also, once we have identified potential acquisitions, such acquisitions are subject to the satisfactory completion of due diligence, the negotiation and execution of definitive agreements and the satisfaction of customary closing conditions, and we cannot assure you that we will be able to reach acceptable terms with the sellers or that these conditions will be satisfied.

Seasonality of hotel business.

The hotel industry is seasonal in nature. This seasonality can be expected to cause quarterly fluctuations in our revenues. Our quarterly earnings may be adversely affected by factors outside our control, including weather conditions and poor economic factors. As a result, we may have to enter into short-term borrowings in certain quarters in order to offset these fluctuations in revenues and to make distributions to our stockholders.

18

Investment concentration in particular segments of single industry.

Our entire business is hotel-related. Therefore, a downturn in the lodging industry, in general, and the segments in which we operate, in particular, will have a material adverse effect on our lease revenues and the net operating profits of our TRS lessees and amounts available for distribution to our stockholders.

Capital expenditures.

Our hotel properties have an ongoing need for renovations and other capital improvements, including replacements, from time to time, of furniture, fixtures and equipment. The franchisors of our hotels also require periodic capital improvements as a condition of keeping the franchise licenses. In addition, our lenders require that we set aside annual amounts for capital improvements to our hotel properties. These capital improvements may give rise to the following risks:

| | • | | possible environmental problems; |

| | • | | construction cost overruns and delays; |

| | • | | a possible shortage of available cash to fund capital improvements and the related possibility that financing for these capital improvements may not be available to us on affordable terms; and |

| | • | | uncertainties as to market demand or a loss of market demand after capital improvements have begun. |

The costs of all these capital improvements could adversely affect our financial condition and amounts available for distribution to our stockholders.

The increasing use of Internet travel intermediaries by consumers may adversely affect our profitability.

Some of our hotel rooms will be booked through Internet travel intermediaries such as Travelocity.com, Expedia.com and Priceline.com. As these Internet bookings increase, these intermediaries may be able to obtain higher commissions, reduced room rates or other significant contract concessions from us and our management companies. Moreover, some of these Internet travel intermediaries are attempting to offer hotel rooms as a commodity, by increasing the importance of price and general indicators of quality (such as “three-star downtown hotel”) at the expense of brand identification. These agencies hope that consumers will eventually develop brand loyalties to their reservations system rather than to our lodging brands. Although most of the business for our hotels is expected to be derived from traditional channels, if the amount of sales made through Internet intermediaries increases significantly, room revenues may flatten or decrease and our profitability may be adversely affected.

The threat of terrorism has harmed the hotel industry generally and these harmful effects may continue or worsen, particularly if there are further terrorist events.

The threat of terrorism has had a negative impact on hotel operations and caused a significant decrease in hotel occupancy and average daily rates due to disruptions in business and leisure travel patterns and concerns about travel safety. Hotels in major metropolitan areas and near airports, such as many of our hotels, have been harmed due to concerns about air travel safety and a significant overall decrease in the amount of air travel, particularly transient business travel, which includes the corporate and premium business segments that generally pay the highest average room rates. Future terrorist acts in the U.S. and abroad, terrorism alerts or outbreaks of hostilities could have a negative effect on travel, and correspondingly, on our business.

The attacks of September 11, 2001 had a dramatic adverse impact on business and leisure travel, hotel occupancy and RevPAR. While there have been recent improvements, the uncertainty associated with the continuing war on terrorism, the U.S.-led military action in Iraq and Afghanistan, and the possibility of future attacks may negatively affect business and leisure travel patterns and, accordingly, the performance of our business.

19

Uninsured and underinsured losses could adversely affect our operating results and our ability to make distributions to our stockholders.

We maintain comprehensive insurance on each of our hotel properties, including terrorism, liability, fire and extended coverage, of the type and amount we believe are customarily obtained for or by hotel owners. There are no assurances that current coverage will continue to be available at reasonable rates. Because various types of catastrophic losses, such as those that may arise out of earthquakes and floods, may not be insurable at reasonable rates, we may not always obtain insurance against these losses. In the event of a substantial loss, our insurance coverage, if any, may not be sufficient to cover the full current market value or replacement cost of our lost investment. Should an uninsured loss or a loss in excess of insured limits occur, we could lose all or a portion of the capital we have invested in a hotel or resort, as well as the anticipated future revenue from the hotel or resort. In that event, we might nevertheless remain obligated for any mortgage debt or other financial obligations related to the property. Inflation, changes in building codes and ordinances, environmental considerations and other factors might also keep us from using insurance proceeds to replace or renovate a hotel after it has been damaged or destroyed. Under those circumstances, the insurance proceeds we receive might be inadequate to restore our economic position on the damaged or destroyed property.

Noncompliance with governmental regulations could adversely affect our operating results.

Environmental matters.

Our hotel properties are subject to various federal, state and local environmental laws. Under these laws, courts and government agencies have the authority to require us, as owner of a contaminated property, to clean up the property, even if we did not know of or were not responsible for the contamination. These laws also apply to persons who owned a property at the time it became contaminated. In addition to the costs of cleanup, environmental contamination can affect the value of a property and, therefore, an owner’s ability to borrow funds using the property as collateral or to sell the property. Under the environmental laws, courts and government agencies also have the authority to require that a person who sent waste to a waste disposal facility, such as a landfill or an incinerator, pay for the clean-up of that facility if it becomes contaminated and threatens human health or the environment. A person that arranges for the disposal or transports for disposal or treatment a hazardous substance at a property owned by another may be liable for the costs of removal or remediation of hazardous substances released into the environment at that property.

Furthermore, various court decisions have established that third parties may recover damages for injury caused by property contamination. For instance, a person exposed to asbestos while staying in a hotel may seek to recover damages if he or she suffers injury from the asbestos. Lastly, some of these environmental laws restrict the use of a property or place conditions on various activities. An example would be laws that require a business using chemicals (such as swimming pool chemicals at a hotel property) to manage them carefully and to notify local officials that the chemicals are being used.

We could be responsible for the costs discussed above. The costs to clean up a contaminated property, to defend against a claim, or to comply with environmental laws could be material and could adversely affect the funds available for distribution to our stockholders. We may have material environmental liabilities of which we are unaware. We can make no assurances that (1) future laws or regulations will not impose material environmental liabilities or (2) the current environmental condition of our hotel properties will not be affected by the condition of the properties in the vicinity of our hotel properties (such as the presence of leaking underground storage tanks) or by third parties unrelated to us.

Americans with Disabilities Act and other changes in governmental rules and regulations.

Under the Americans with Disabilities Act of 1990, or the ADA, all public accommodations must meet various federal requirements related to access and use by disabled persons. Compliance with the ADA’s requirements could require removal of access barriers, and non-compliance could result in the U.S. government

20

imposing fines or in private litigants winning damages. If we are required to make substantial modifications to our hotels, whether to comply with the ADA or other changes in governmental rules and regulations, our financial condition, results of operations and ability to make distributions to our stockholders could be adversely affected.

Unanticipated expenses and insufficient demand for hotels we open in new geographic markets could adversely affect our profitability and our ability to make distributions to our stockholders.

As part of our business plan, we may develop or acquire new hotels in geographic areas in which our management may have little or no operating experience and in which potential customers may not be familiar with our franchise brands. As a result, we may have to incur costs relating to the opening, operation and promotion of those new hotel properties that are substantially greater than those incurred in other areas. These hotels may attract fewer customers than our existing hotels, while at the same time, we may incur substantial additional costs with these new hotel properties. As a result, the results of operations at new hotel properties may be less than those of our existing hotels. Unanticipated expenses and insufficient demand at a new hotel property, therefore, could adversely affect our profitability and our ability to make distributions to our stockholders.

Our ability to maintain distributions to our stockholders is subject to fluctuations in our financial performance, operating results and capital improvements requirements.

As a REIT, we are required to distribute at least 90% of our taxable income (excluding net capital gains) each year to our stockholders. In the event of future downturns in our operating results and financial performance or unanticipated capital improvements to our hotels, including capital improvements which may be required by our franchisors, we may be unable to declare or pay distributions to our stockholders. The timing and amount of distributions are in the sole discretion of our board of directors which will consider, among other factors, our financial performance, debt service obligations and debt covenants, and capital expenditure requirements. We cannot assure you that we will continue to generate sufficient cash in order to fund distributions.

Among the factors which could adversely affect our results of operations and our distributions to stockholders are the failure of our TRS lessees to make required rent payments because of reduced net operating profits or operating losses; increased debt service requirements and capital expenditures at our hotels, including capital expenditures required by the franchisors of our hotels. Among the factors which could reduce the net operating profits of our TRS lessees are decreases in hotel revenues and increases in hotel operating expenses. Hotel revenue can decrease for a number of reasons, including increased competition from new supply of hotel rooms and decreased demand for hotel rooms. These factors can reduce both occupancy and room rates at our hotels.

We lease all of our hotels to our TRS lessees. These TRS lessees are subject to hotel operating risks, including risks of sustaining operating losses after payment of hotel operating expenses, including management fees. These risks can affect adversely the net operating profits of our TRS lessees, our operating expenses, and our ability to make distributions to our stockholders.

The hotel business is capital intensive and our inability to obtain financing could limit our growth.

Our hotel properties will require periodic capital expenditures and renovation to remain competitive. Acquisitions or development of additional hotel properties will require significant capital expenditures. We may not be able to fund capital improvements or acquisitions solely from cash provided from our operating activities because we must distribute at least 90% of our taxable income (net of capital gains) each year to maintain our REIT tax status. As a result, our ability to fund capital expenditures, acquisitions or hotel development through retained earnings is very limited. Consequently, we rely upon the availability of debt or equity capital to fund hotel acquisitions and improvements. Our ability to grow through acquisitions or development of hotels could be hampered by a number of factors, many of which are outside of our control, including, without limitation, declining general market conditions, unfavorable market perception of our growth potential, decreases in our

21

current and estimated future earnings, excessive cash distributions or decreases in the market price of our common stock. In addition, our ability to access additional capital may also be limited by the terms of our existing indebtedness, which, among other things, restricts our incurrence of debt and the payment of distributions. The occurrence of any of these above-mentioned factors, individually or in combination, could prevent us from being able to obtain the external capital we require on terms that are acceptable to us or at all and the failure to obtain necessary external capital could have a material adverse affect on our ability to finance our future growth.

General Risks Related to the Real Estate Industry

Illiquidity of real estate investments could significantly impede our ability to respond to adverse changes in the performance of our properties and harm our financial condition.

Because real estate investments are relatively illiquid, our ability to promptly sell one or more hotel properties in our portfolio in response to changing economic, financial and investment conditions is limited. The real estate market is affected by many factors that are beyond our control, including:

| | • | | adverse changes in national, regional and local economic and market conditions; |

| | • | | changes in interest rates and in the availability, cost and terms of debt financing; |

| | • | | changes in governmental laws and regulations, fiscal policies and zoning ordinances and the related costs of compliance with laws and regulations, fiscal policies and ordinances; |

| | • | | the ongoing need for capital improvements, particularly in older structures; |

| | • | | changes in operating expenses; and |

| | • | | civil unrest, acts of God, including earthquakes, floods and other natural disasters, which may result in uninsured losses, and acts of war or terrorism, including the consequences of terrorist acts such as those that occurred on September 11, 2001. |

We may decide to sell our hotels in the future. We cannot predict whether we will be able to sell any hotel property for the price or on the terms set by us, or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We also cannot predict the length of time needed to find a willing purchaser and to close the sale of a hotel property.

We may be required to expend funds to correct defects or to make improvements before a hotel property can be sold. We cannot assure you that we will have funds available to correct those defects or to make those improvements. In acquiring a hotel property, we may agree to lock-out provisions that materially restrict us from selling that property for a period of time or impose other restrictions, such as a limitation on the amount of debt that can be placed or repaid on that property. These factors and any others that would impede our ability to respond to adverse changes in the performance of our properties could have a material adverse effect on our operating results and financial condition, as well as our ability to pay distributions to stockholders.

Increases in our property taxes would adversely affect our ability to make distributions to our stockholders.

Each of our hotels will be subject to real and personal property taxes. These taxes on our hotel properties may increase as tax rates change and as the properties are assessed or reassessed by taxing authorities. If property taxes increase, our ability to make distributions to our stockholders would be adversely affected.

Future debt service obligations could adversely affect our overall operating results and may require us to sell assets to meet our payment obligations.