HINES REAL ESTATE INVESTMENT TRUST, INC.

This prospectus supplement (this “Supplement”) is part of and should be read in conjunction with the prospectus of Hines Real Estate Investment Trust, Inc., dated July 1, 2008 (the “Prospectus”). This Supplement supersedes and replaces all prior supplements to this Prospectus. Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus.

As of October 6, 2008, we have received gross proceeds of approximately $80.6 million from the sale of approximately 7.7 million of our common shares in our current public offering, including approximately $17.4 million relating to approximately 1.7 million shares issued under our dividend reinvestment plan. As of October 6, 2008, approximately $2,936.8 million in shares remained available for sale pursuant to the offering, exclusive of approximately $482.6 million in shares available under our dividend reinvestment plan.

With the authorization of our board of directors, we have declared distributions for the months of July, August, September and October 2008. The distributions will be calculated based on shareholders of record each day during such months in an amount equal to $0.00175233 per share, per day. On October 1, 2008, the distributions for the months of July, August and September were paid in cash or reinvested in stock for those participating in our dividend reinvestment plan. The distributions for the month of October will be paid in cash or reinvested in stock in January 2009.

Our four independent directors serve on the conflicts committee of our board of directors. This committee is required to review and approve all matters the board believes may involve a conflict of interest between us and Hines or its affiliates.

2. The paragraph under “Our Real Estate Investments — Certain Rights of the Institutional Co-Investors and the Institutional Co-Investor Advisor — Redemption Right” on page 85 is hereby deleted and replaced with the following:

For each asset in which the Institutional Co-Investors or other funds advised by the Institutional Co-Investor Advisor acquire interests pursuant to the Institutional Co-Investor Advisor’s co-investment rights, the Core Fund must establish a three-year period ending no later than the twelfth anniversary of the date such asset is acquired during which the entity through which the Institutional Co-Investors make their investment will redeem or acquire such Institutional Co-Investors’ interest in such entity at net asset value, unless the Institutional Co-Investor Advisor elects to extend this period. The Institutional Co-Investor Advisor may extend the liquidation period for any investment to a later three year period by giving notice to the applicable investment vehicle not less than one year prior to the start of the liquidation period.

Commitments by us to repurchase shares will be communicated either telephonically or in writing to each shareholder who submitted a request at or promptly (no more than five business days) after the fifth business day following the end of each month.

1. The sixth paragraph under “Plan of Distribution — Underwriting Terms” on page 141 is hereby deleted and replaced with the following:

We entered into a selected dealer agreement with the Dealer Manager, the Advisor and Ameriprise Financial Services, Inc. (“Ameriprise”), pursuant to which Ameriprise was appointed as a soliciting dealer in this offering. Subject to certain limitations set forth in the agreement, we, the Dealer Manager and the Advisor, jointly and severally, agreed to indemnify Ameriprise against losses, liability, claims, damages and expenses caused by certain untrue or alleged untrue statements, or omissions or alleged omissions of material fact made in connection with the offering, certain filings with the Securities and Exchange Commission or certain other public statements, or the breach by us, the Dealer Manager or the Advisor or any employee or agent acting on their behalf, of any of the representations, warranties, covenants, terms and conditions of the agreement. In addition, Hines separately agreed to provide a limited indemnification to Ameriprise for these losses on a joint and several basis with the other entities, and we separately agreed to indemnify and reimburse Hines for any amounts Hines is required to pay pursuant to this indemnification. Please see “Conflicts of Interest.”

2. The first sentence of footnote (4) to the table under “Plan of Distribution — Underwriting Terms” on page 142 is hereby deleted and replaced with the following:

Participating broker-dealers may receive from the Dealer Manager additional reimbursements to defray technology costs and other marketing and distribution related costs and expenses.

3. The third bulleted statement on page 143 of the Prospectus in the “Plan of Distribution — Underwriting Terms” section is hereby deleted and replaced with the following:

The following is hereby inserted at the end of the “Material Tax Considerations” section on page 169:

On July 30, 2008, the American Housing Rescue and Foreclosure Prevention Act of 2008 (the “Housing Act”) was enacted. The following is a brief summary of certain provisions of the Housing Act.

The foregoing is not an exhaustive list of changes made by the Housing Act. You are urged to consult your tax advisors regarding the specific tax consequences to you of the changes resulting from the enactment of Housing Act.

Appendix C to the Prospectus is hereby deleted and replaced in its entirety with the following:

HINES REAL ESTATE INVESTMENT TRUST, INC.

HINES REAL ESTATE SECURITIES, INC.

1. Information We May Collect.

We may collect Nonpublic Personal Information about you from the following sources:

2. Why We Collect Nonpublic Personal Information.

3. Use and Disclosure of Information.

We may disclose all of the Nonpublic Personal Information we collect about you as described above to the following types of third parties:

4. Protecting Your Information.

Our employees are required to follow the procedures we have developed to protect the integrity of your information. These procedures include:

5. Former Customers.

We treat information concerning our former customers the same way we treat information about our current customers.

6. Keeping You Informed.

We will provide notice of our Privacy Policy annually, as long as you maintain an ongoing relationship with us. If we decide to change our Privacy Policy, we will post those changes on our Web Site so our users and customers are always aware of what information we collect, use and disclose. If at any point we decide to use or disclose your Nonpublic Personal Information in a manner different from that stated at the time it was collected, we will notify you in writing, which may or may not be by e-mail. If you object to the change to our Privacy Policy, then you must contact us using the information provided in the notice. We will otherwise use and disclose a user’s or a customer’s Nonpublic Personal Information in accordance with the Privacy Policy that was in effect when such information was collected.

7. Questions About Our Privacy Policy.

If you have any questions about our Privacy Policy, please contact us via telephone at 888.220.6121 or email at HinesREITprivacy@Hines.com.

This Privacy Policy applies to Hines Real Estate Investment Trust, Inc. and Hines Real Estate Securities, Inc. Federal law gives you the right to limit some but not all marketing from our affiliates. Federal law also requires us to give you this notice to tell you about your choice to limit marketing from our affiliates. You may tell us not to share information about your creditworthiness with our affiliated companies, except where such affiliate is performing services for us. We may still share with them other information about your experiences with us. You may limit our affiliates in the Hines group of companies, such as our securities affiliates from marketing their products or services to you based on your personal information that we collect and share with them. This information includes you account and investment history with us and your credit score.

If you want to limit our sharing of your information with our affiliates, you may contact us:

HINES REAL ESTATE SECURITIES, INC.

___ Do not share information about my creditworthiness with your affiliates for their everyday business purposes.

___ Do not allow your affiliates to use my personal information to market to me.

Your choice to limit marketing offers from our affiliates will apply for at least 5 years from when you tell us your choice. Once that period expires, you will receive a renewal notice that will allow you to continue to limit marketing offers from our affiliates for at least another 5 years. If you have already made a choice to limit marketing offers from our affiliates, you do not need to act again until you receive a renewal notice. If you have not already made a choice, unless we hear from you, we can begin sharing your information 30 days from the date we sent you this notice. However, you can contact us at any time to limit our sharing as set forth above.

Residents of some states may have additional privacy rights. We adhere to all applicable state laws.

Hines Real Estate Investment Trust, Inc.

Up to $3,500,000,000 in Common Shares Offered to the Public

We are a Maryland corporation sponsored by Hines Interests Limited Partnership, or Hines, a fully integrated global real estate investment and management firm that has acquired, developed, owned, operated and sold real estate for over 50 years. We invest primarily in institutional-quality office properties located throughout the United States. In addition, we have invested or may invest in other real estate investments including, but not limited to, properties outside of the United States, non-office properties, loans and ground leases. As of May 1, 2008, we had direct and indirect interests in 45 properties. These properties consist of 43 office properties located throughout the United States, one mixed-use office and retail property in Toronto, Ontario, and one industrial property in Rio de Janeiro, Brazil. We have elected to be taxed as a real estate investment trust for U.S. federal income tax purposes.

Through our affiliated Dealer Manager, Hines Real Estate Securities, Inc., we are offering up to $3,000,000,000 in our common shares to the public on a best efforts basis. We are also offering up to $500,000,000 in our common shares to be issued pursuant to our dividend reinvestment plan. We will initially offer shares to the public at a price of $10.66. Our board of directors may change this price from time to time during the offering, but not more frequently than quarterly. Shares sold under our dividend reinvestment plan will initially be sold for $10.13. Our board of directors may likewise change this price from time to time, but not more frequently than quarterly. You must initially invest at least $2,500. This offering will terminate on or before July 1, 2010, unless extended by our board of directors.

We encourage you to carefully review the complete discussion of risk factors beginning on page 9 before purchasing our common shares. This investment involves a high degree of risk. You should purchase these securities only if you can afford the complete loss of your investment. Significant risks relating to your investment in our common shares include:

| • | The amount of dividends we may pay, if any, is uncertain. Due to the risks involved in the ownership of real estate, there is no guarantee of any return on your investment in Hines REIT, and you may lose money. |

| • | There is currently no public market for our common shares, and we currently do not intend to list our shares on a stock exchange or to include them for quotation on a national securities market. Therefore, it will likely be difficult for you to sell your shares, and if you are able to sell your shares, you will likely sell them at a substantial discount. |

| • | There are restrictions and limitations on your ability to have all or any portion of your shares redeemed under our share redemption program. |

| • | We have not identified any specific assets to acquire or investments to make with all of the proceeds of this offering. You will not have the opportunity to review the assets we will acquire or the investments we will make with the proceeds from this offering prior to your investment. |

| • | We rely on affiliates of Hines for our day-to-day operations and the selection of real estate investments. We pay substantial fees to these affiliates for these services. These affiliates are subject to conflicts of interest as a result of this and other relationships they have with us and other programs sponsored by Hines. We also compete with affiliates of Hines for tenants and investment opportunities, and some of those affiliates will have priority with respect to many of those investment opportunities. |

| • | We are Hines’ only publicly-offered investment program and one of Hines’ first REITs. Because Hines’ other programs and investments have been conducted through privately-held entities not subject to either the up-front commissions, fees or expenses associated with this offering or to all of the laws and regulations we are subject to, you should not assume that the prior performance of Hines will be indicative of our future results. |

| | | Price to the Public | | | Selling Commission | | | Dealer Manager Fee | | | Proceeds to Us | |

| Per Share | | $ | 10.66 | | | $ | 0.75 | | | $ | 0.23 | | | $ | 9.68 | |

| Maximum Offering | | $ | 3,000,000,000 | | | $ | 210,000,000 | | | $ | 66,000,000 | | | $ | 2,724,000,000 | |

| Dividend Reinvestment Plan | | $ | 500,000,000 | | | $ | — | | | $ | — | | | $ | 500,000,000 | |

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. THE ATTORNEY GENERAL OF NEW YORK HAS NOT PASSED ON OR ENDORSED THE MERITS OF THIS OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

The use of projections or forecasts in this offering is prohibited. Any representations to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequence that may flow from an investment in the common shares is not permitted.

Dated July 1, 2008

SUITABILITY STANDARDS

The common shares we are offering are suitable only as a long-term investment for persons of adequate financial means. There currently is no public market for our common shares, and we currently do not intend to list our shares on a stock exchange or on a national market. Therefore, it will likely be difficult for you to sell your shares and, if you are able to sell your shares, you will likely sell them at a substantial discount. You should not buy these shares if you need to sell them immediately, will need to sell them quickly in the future or cannot bear the loss of your entire investment.

In consideration of these factors, we have established suitability standards for all persons who may purchase shares from us in this offering. Investors with investment discretion over assets of an employee benefit plan covered under ERISA should carefully review the information entitled “ERISA Considerations.” These suitability standards require that a purchaser of shares have either:

| • | a minimum annual gross income of at least $70,000 and a minimum net worth (excluding the value of the purchaser’s home, home furnishings and automobiles) of at least $70,000; or |

| • | a minimum net worth (excluding the value of the purchaser’s home, home furnishings and automobiles) of at least $250,000. |

Several states have established suitability standards different from those we have established. Shares will be sold only to investors in these states who meet the special suitability standards set forth below.

Alabama, Iowa, Kentucky, Michigan, Missouri, Ohio, Oregon and Pennsylvania — In addition to our suitability requirements, investors must have a liquid net worth of at least 10 times their investment in our shares.

Kansas — In addition, the Office of the Securities Commission of the State of Kansas recommends that Kansas investors not invest, in the aggregate, more than 10% of their liquid net worth in this and similar direct participation investments. Liquid net worth is defined as “that portion of net worth which consists of cash, cash equivalents and readily marketable securities.”

Tennessee — In addition to our suitability requirements, a Tennessee investor’s maximum investment in our company and our affiliates cannot exceed 10% of such Tennessee resident’s net worth.

For purposes of determining suitability of an investor, net worth in all cases shall be calculated excluding the value of an investor’s home, furnishings and automobiles.

In the case of sales to fiduciary accounts (such as an IRA, Keogh Plan, or pension or profit-sharing plan), these suitability standards must be met by the beneficiary, the fiduciary account or by the donor or grantor who directly or indirectly supplies the funds for the purchase of the shares if the donor or grantor is the fiduciary. These suitability standards are intended to help ensure that, given the long-term nature of an investment in our common shares, our investment objectives and the relative illiquidity of our shares, our shares are an appropriate investment for those of you desiring to become shareholders. Each participating broker-dealer must make every reasonable effort to determine that the purchase of common shares is a suitable and appropriate investment for each shareholder based on information provided by the shareholder in the subscription agreement or otherwise. Each participating broker-dealer is required to maintain records of the information used to determine that an investment in common shares is suitable and appropriate for each shareholder for a period of six years.

In the case of gifts to minors, the suitability standards must be met by the custodian account or by the donor.

Subject to the restrictions imposed by state law, we will sell our common shares only to investors who initially invest at least $2,500. This initial minimum purchase requirement applies to all potential investors, including tax-exempt entities. A tax-exempt entity is generally any entity that is exempt from federal income taxation, including:

| • | a pension, profit-sharing, retirement or other employee benefit plan that satisfies the requirements for qualification under Section 401(a), 414(d) or 414(e) of the Internal Revenue Code of 1986, as amended (the “Code”); |

| • | a pension, profit-sharing, retirement or other employee benefit plan that meets the requirements of Section 457 of the Code; |

| • | trusts that are otherwise exempt under Section 501(a) of the Code; |

| • | a voluntary employees’ beneficiary association under Section 501(c)(9) of the Code; or |

| • | an IRA that meets the requirements of Section 408 or Section 408A of the Code. |

The term “plan” includes plans subject to Title I of ERISA, other employee benefit plans and IRAs subject to the prohibited transaction provisions of Section 4975 of the Code, governmental or church plans that are exempt from ERISA and Section 4975 of the Code, but that may be subject to state law requirements, or other employee benefit plans.

In order to satisfy the initial minimum purchase requirements for retirement plans, unless otherwise prohibited by state law, a husband and wife may jointly contribute funds from their separate IRAs. You should note that an investment in our common shares will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Code. Except in Maine, Minnesota, Nebraska and Washington (where any subsequent subscriptions by investors must be made in increments of at least $1,000), investors who have satisfied the initial minimum purchase requirement may make additional purchases through this or future offerings in increments of at least five shares, except for purchases made pursuant to our dividend reinvestment plan which may be in increments of less than five shares.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information inconsistent with that contained in this prospectus. We are offering to sell, and seeking offers to buy, our common shares only in jurisdictions where such offers and sales are permitted.

TABLE OF CONTENTS

| SUITABILITY STANDARDS | |

| QUESTIONS AND ANSWERS ABOUT THIS OFFERING | |

| PROSPECTUS SUMMARY | |

| Hines Real Estate Investment Trust, Inc. | |

| Our Board | |

| Our Advisor | |

| Our Property Manager | |

| Our Structure | |

| Management Compensation, Expense Reimbursements and Operating Partnership Participation Interest | |

| Description of Capital Stock | |

| Distribution Objectives | |

| Dividend Reinvestment Plan | |

| Share Redemption Program | |

| RISK FACTORS | |

| Investment Risks | |

| There is currently no public market for our common shares, and we do not intend to list the shares on a stock exchange. Therefore, it will likely be difficult for you to sell your shares and, if you are able to sell your shares, you will likely sell them at a substantial discount | |

| Your ability to have your shares redeemed is limited under our share redemption program, and if you are able to have your shares redeemed, it may be at a price that is less than the price you paid for the shares and the then-current market value of the shares | |

| Due to the risks involved in the ownership of real estate, there is no guarantee of any return on your investment in Hines REIT, and you may lose some or all of your investment | |

| You will not have the benefit of an independent due diligence review in connection with this offering | |

| We have invested a significant percentage of our total current investments, and we may invest a portion of the net proceeds of this offering, in the Core Fund. Because of our current and possible future Core Fund investments, it is likely that Hines affiliates will retain significant control over a significant percentage of our investments even if our independent directors remove our Advisor | |

| The fees we pay in connection with this offering were not determined on an arm’s-length basis and therefore may not be on the same terms we could achieve from a third party | |

| We will pay substantial compensation to Hines, the Advisor and their affiliates, which may be increased or decreased during this offering or future offerings by our independent directors | |

| We will pay the Advisor a fee on any line of credit made available to us, whether or not we utilize all or any portion of such line of credit | |

| You will not have the opportunity to evaluate the investments we will make with the proceeds of this offering before you purchase our shares, and we may not have the opportunity to evaluate or approve investments made by entities in which we invest, such as the Core Fund | |

| This offering is being conducted on a “best efforts” basis, and the risk that we will not be able to accomplish our business objectives will increase if only a small number of shares are purchased in this offering | |

| If we are only able to sell a small number of shares in this offering, our fixed operating expenses such as general and administrative expenses (as a percentage of gross income) would be higher than if we are able to sell a greater number of shares | |

| If we sell less than the maximum offering amount for this offering, the acquisition fees payable to the Advisor (as a percentage of net proceeds) will be higher than if we are able to sell a greater number of shares | |

| The offering price of our common shares may not be indicative of the price at which our shares would trade if they were actively traded | |

| The price of our common shares may be adjusted to a price less than the price you paid for your shares | |

| The price you pay for our common shares in this offering may depend upon the broker-dealer or financial advisor executing the transaction | |

| Hines REIT’s interest in the Operating Partnership will be diluted by the Participation Interest in the Operating Partnership held by HALP Associates Limited Partnership, and your interest in Hines REIT may be diluted if we issue additional shares | |

| The redemption of interests in the Operating Partnership held by Hines and its affiliates (including the Participation Interest) as required in our Advisory Agreement may discourage a takeover attempt if our Advisory Agreement would be terminated in connection therewith | |

| The Participation Interest would increase at a faster rate with frequent dispositions of properties followed by acquisitions using proceeds from such dispositions | |

| Hines’ ability to cause the Operating Partnership to purchase the Participation Interest and any OP Units it and its affiliates hold in connection with the termination of the Advisory Agreement may deter us from terminating the Advisory Agreement | |

| We may issue preferred shares or separate classes or series of common shares, which issuance could adversely affect the holders of the common shares issued pursuant to this offering | |

| We are not registered as an investment company under the Investment Company Act of 1940, and therefore we will not be subject to the requirements imposed on an investment company by such Act. Similarly, the Core Fund is not registered as an investment company | |

| If Hines REIT, the Operating Partnership or the Core Fund is required to register as an investment company under the Investment Company Act, the additional expenses and operational limitations associated with such registration may reduce your investment return or impair our ability to conduct our business as planned | |

| The ownership limit in our charter may discourage a takeover attempt | |

| We will not be afforded the protection of the Maryland General Corporation Law relating to business combinations | |

| Business and Real Estate Risks | |

| Any indirect investment we make will be consistent with the investment objectives and policies described in this prospectus and will, therefore, be subject to similar business and real estate risks. The Core Fund, which has investment objectives and policies similar to ours, is subject to many of the same business and real estate risks as we are | |

| We are different in some respects from other programs sponsored by Hines, and therefore the past performance of such programs may not be indicative of our future results | |

| Geographic concentration of our portfolio may make us particularly susceptible to adverse economic developments in the real estate markets of those areas | |

| Delays in purchasing properties with proceeds received from this offering may result in a lower rate of return to investors | |

| If we purchase assets at a time when the commercial real estate market is experiencing substantial influxes of capital investment and competition for properties, the real estate we purchase may not appreciate or may decrease in value | |

| In our initial quarters of operations, dividends we paid to our shareholders were partially funded with advances or borrowings from our Advisor. We may use similar advances, borrowings, deferrals or waivers of fees from our Advisor or affiliates, or other sources in the future to fund dividends to our shareholders. We cannot assure you that in the future we will be able to achieve cash flows necessary to repay such advances or borrowings and pay dividends at our historical per-share amounts, or to maintain dividends at any particular level, if at all | |

| We may need to incur borrowings that would otherwise not be incurred to meet REIT minimum distribution requirements | |

| We expect to acquire additional properties in the future, which, if unsuccessful, could adversely impact our ability to pay dividends to our shareholders | |

| We are subject to risks as the result of joint ownership of real estate with other Hines programs or third parties | |

| Our ability to redeem all or a portion of our investment in the Core Fund is subject to significant restrictions | |

| If the Core Fund is forced to sell its assets in order to satisfy mandatory redemption requirements, our investment in the Core Fund may be materially adversely affected | |

| If we invest in a limited partnership as a general partner, we could be responsible for all liabilities of such partnership | |

| Because of our inability to retain earnings, we will rely on debt and equity financings for acquisitions. If we do not have sufficient capital resources from such financings, our growth may be limited | |

| Our use of borrowings to partially fund acquisitions and improvements on properties could result in foreclosures and unexpected debt service expenses upon refinancing, both of which could have an adverse impact on our operations and cash flow | |

| We have acquired and may acquire various financial instruments for purposes of “hedging” or reducing our risks, which may be costly and ineffective and will reduce our cash available for distribution to our shareholders | |

| Our success will be dependent on the performance of Hines as well as key employees of Hines | |

| We operate in a competitive business, and many of our competitors have significant resources and operating flexibility, allowing them to compete effectively with us | |

| We depend on tenants for our revenue, and therefore our revenue is dependent on the success and economic viability of our tenants. Our reliance on single or significant tenants in certain buildings may decrease our ability to lease vacated space | |

| The bankruptcy or insolvency of a major tenant may adversely impact our operations and our ability to pay dividends | |

| Unfavorable changes in economic conditions could adversely impact occupancy or rental rates | |

| Uninsured losses relating to real property may adversely impact the value of our portfolio | |

| We may be unable to obtain desirable types of insurance coverage at a reasonable cost, if at all, and we may be unable to comply with insurance requirements contained in mortgage or other agreements due to high insurance costs | |

| Terrorist attacks and other acts of violence or war may affect the markets in which we operate, our operations and our profitability | |

| Our operations will be directly affected by general economic and regulatory factors we cannot control or predict | |

| Volatility in debt markets could impact future acquisitions and values of real estate assets potentially reducing cash available for distribution to our shareholders | |

| We may have difficulty selling real estate investments, and our ability to distribute all or a portion of the net proceeds from such sale to our shareholders may be limited | |

| Potential liability as the result of, and the cost of compliance with, environmental matters could adversely affect our operations | |

| All of our properties will be subject to property taxes that may increase in the future, which could adversely affect our cash flow | |

| Our costs associated with complying with the Americans with Disabilities Act may affect cash available for distributions | |

| If we set aside insufficient working capital reserves, we may be required to defer necessary or desirable property improvements | |

| We are subject to additional risks from our international investments | |

| Investments in properties outside the United States may subject us to foreign currency risks, which may adversely affect distributions and our REIT status | |

| Retail properties depend on anchor tenants to attract shoppers and could be adversely affected by the loss of a key anchor tenant | |

| If we make or invest in loans, our loans may be impacted by unfavorable real estate market conditions, which could decrease the value of our loan investments | |

| If we make or invest in loans, our loans will be subject to interest rate fluctuations, which could reduce our returns as compared to market interest rates as well as the value of the loans in the event we sell the loans | |

| Delays in liquidating defaulted loans could reduce our investment returns | |

| We may make or invest in mezzanine loans, which involve greater risks of loss than senior loans secured by real properties | |

| Our investment policies may change without shareholder approval, which could not only alter the nature of your investment but also subject your investment to new and additional risks | |

| Potential Conflicts of Interest Risks | |

| We compete with affiliates of Hines for real estate investment opportunities. Some of these affiliates have preferential rights to accept or reject certain investment opportunities in advance of our right to accept or reject such opportunities. Many of the preferential rights we have to accept or reject investment opportunities are subordinate to the preferential rights of at least one affiliate of Hines | |

| We may compete with other entities affiliated with Hines for tenants | |

| Employees of the Advisor and Hines will face conflicts of interest relating to time management and allocation of resources and investment opportunities | |

| Hines may face conflicts of interest if it sells properties it acquires or develops to us | |

| Hines may face a conflict of interest when determining whether we should dispose of any property we own that is managed by Hines because Hines may lose fees associated with the management of the property | |

| Hines may face conflicts of interest in connection with the management of our day-to-day operations and in the enforcement of agreements between Hines and its affiliates | |

| Certain of our officers and directors face conflicts of interest relating to the positions they hold with other entities | |

| Our officers and directors have limited liability | |

| Our UPREIT structure may result in potential conflicts of interest | |

| Tax Risks | |

| If we fail to qualify as a REIT, our operations and our ability to pay dividends to our shareholders would be adversely impacted | |

| If the Operating Partnership is classified as a “publicly traded partnership” under the Code, our operations and our ability to pay dividends to our shareholders could be adversely affected | |

| Dividends to tax-exempt investors may be classified as unrelated business taxable income | |

| Investors may realize taxable income without receiving cash dividends | |

| Foreign investors may be subject to FIRPTA tax on sale of common shares if we are unable to qualify as a “domestically controlled” REIT | |

| In certain circumstances, we may be subject to federal and state income taxes as a REIT or other state or local income taxes, which would reduce our cash available to pay dividends to our shareholders | |

| Entities through which we hold foreign real estate investments will, in most cases, be subject to foreign taxes, notwithstanding our status as a REIT | |

| Recently enacted tax legislation may make REIT investments comparatively less attractive than investments in other corporate entities | |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | |

| ESTIMATED USE OF PROCEEDS | |

| MANAGEMENT | |

| Management of Hines REIT | |

| Our Officers and Directors | |

| Our Board of Directors | |

| Committees of the Board of Directors | |

| Audit Committee | |

| Conflicts Committee | |

| Compensation Committee | |

| Nominating and Corporate Governance Committee | |

| Compensation Committee Interlocks and Insider Participation | |

| Compensation of Directors | |

| Employee and Director Incentive Share Plan | |

| Limited Liability and Indemnification of Directors, Officers, Employees and Other Agents | |

| The Advisor and the Advisory Agreement | |

| Duties of Our Advisor | |

| Term of the Advisory Agreement | |

| Compensation | |

| Reimbursements by the Advisor | |

| Indemnification | |

| Removal of the Advisor | |

| Hines and Our Property Management and Leasing Agreements | |

| The Hines Organization | |

| Our Property Management and Leasing Agreements | |

| The Dealer Manager | |

| MANAGEMENT COMPENSATION, EXPENSE REIMBURSEMENTS AND OPERATING PARTNERSHIP PARTICIPATION INTEREST | |

| OUR REAL ESTATE INVESTMENTS | |

| Overview | |

| Market and Industry Concentration | |

| Lease Expiration | |

| Our Significant Investments | |

| Our Permanent Debt and Revolving Credit Facility | |

| Permanent Debt Secured by Our Significant Properties | |

| Met Life Credit Facility | |

| HSH Credit Facility | |

| Our Revolving Credit Facility | |

| Purpose and Structure of the Core Fund | |

| Description of the Non-Managing General Partner Interest and Certain Provisions of the Core Fund Partnership Agreement | |

| Non-Managing General Partner Interest | |

| Summary of Certain Provisions of the Core Fund Partnership Agreement | |

| Certain Rights of the Institutional Co-Investors and the Institutional Co-Investor Advisor | |

| Co-Investment Rights | |

| Redemption Right | |

| Buy/Sell Right | |

| Certain Rights of IK US Portfolio Invest GmbH & Co. KG | |

| Our Joint Venture with Affiliates | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| CONFLICTS OF INTEREST | |

| Competitive Activities of Hines and its Affiliates | |

| Description of Certain Other Hines Ventures | |

| Investment Opportunity Allocation Procedure | |

| Competitive Activities of Our Officers and Directors, the Advisor and Other Hines Affiliates | |

| Fees and Other Compensation Payable to Hines and its Affiliates | |

| Joint Venture Conflicts of Interest | |

| Affiliated Dealer Manager and Property Manager | |

| No Arm’s-Length Agreements | |

| Lack of Separate Representation | |

| Additional Conflicts of Interest | |

| Certain Conflict Resolution Procedures | |

| INVESTMENT OBJECTIVES AND POLICIES WITH RESPECT TO CERTAIN ACTIVITIES | |

| Primary Investment Objectives | |

| Acquisition and Investment Policies | |

| International Investments | |

| Joint Venture Investments | |

| Borrowing Policies | |

| Financing Strategy and Policies | |

| Disposition Policies | |

| Investment Limitations | |

| Investments in Real Estate Financings | |

| Investments in Mezzanine Loans | |

| Issuing Securities for Property | |

| Affiliate Transaction Policy | |

| Certain Other Policies | |

| Change in Investment Objectives, Policies and Limitations | |

| SELECTED FINANCIAL DATA | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| Executive Summary | |

| Critical Accounting Policies | |

| Recent Accounting Pronouncements | |

| Financial Condition, Liquidity and Capital Resources | |

| General | |

| Cash Flows from Operating Activities | |

| Cash Flows from Investing Activities | |

| Cash Flows from Financing Activities | |

| Results of Operations | |

| Related-Party Transactions and Agreements | |

| Off-Balance Sheet Arrangements | |

| Contractual Obligations | |

| Subsequent Events | |

| Quantitative and Qualitative Disclosures About Market Risk | |

| DESCRIPTION OF CAPITAL STOCK | |

| Common Shares | |

| Preferred Shares | |

| Meetings and Special Voting Requirements | |

| Restrictions on Transfer | |

| Distribution Objectives | |

| Share Redemption Program | |

| Restrictions on Roll-Up Transactions | |

| Shareholder Liability | |

| Dividend Reinvestment Plan | |

| Business Combinations | |

| Control Share Acquisitions | |

| PLAN OF DISTRIBUTION | |

| General | |

| Underwriting Terms | |

| Volume Discounts | |

| The Subscription Process | |

| Admission of Shareholders | |

| Subscription Agreement | |

| Determinations of Suitability | |

| Minimum Investment | |

| Termination Date | |

| THE OPERATING PARTNERSHIP | |

| General | |

| Purposes and Powers | |

| Operations | |

| Amendments | |

| Transferability of Our General Partner Interest | |

| Voting Rights | |

| The Participation Interest | |

| Hypothetical Impact of the Participation Interest | |

| Repurchase of OP Units and the Participation Interest | |

| Repurchase of OP Units and/or the Participation Interest held by Hines and its Affiliates if Hines or its Affiliates Cease to be Our Advisor | |

| Capital Contributions | |

| Term | |

| Tax Matters | |

| Distributions | |

| Indemnity | |

| MATERIAL TAX CONSIDERATIONS | |

| General | |

| Requirements for Qualification as a REIT | |

| Organizational Requirements | |

| Operational Requirements — Gross Income Tests | |

| Operational Requirements — Asset Tests | |

| Operational Requirements — Annual Distribution Requirement | |

| Operational Requirements — Recordkeeping | |

| Recently Enacted Relief Provisions | |

| Taxation as a REIT | |

| Failure to Qualify as a REIT | |

| Taxation of Shareholders | |

| Distributions | |

| Dispositions of the Shares | |

| Our Failure to Qualify as a REIT | |

| Backup Withholding | |

| Taxation of Tax Exempt Entities | |

| Taxation of Foreign Investors | |

| Distributions | |

| Sales of Shares | |

| State and Local Taxes | |

| Tax Aspects of the Operating Partnership | |

| Tax Treatment of the Operating Partnership | |

| Tax Treatment of Partners | |

| Treatment of Distributions and Constructive Distributions | |

| Tax Basis in Our Operating Partnership Interest | |

| ERISA CONSIDERATIONS | |

| ERISA Considerations for an Initial Investment | |

| Annual Valuations | |

| LEGAL PROCEEDINGS | |

| REPORTS TO SHAREHOLDERS | |

| SUPPLEMENTAL SALES MATERIAL | |

| LEGAL OPINIONS | |

| EXPERTS | |

| PRIVACY POLICY NOTICE | |

| INCORPORATION BY REFERENCE | |

| WHERE YOU CAN FIND MORE INFORMATION | |

| GLOSSARY OF TERMS | |

| FINANCIAL STATEMENTS | F- |

| APPENDIX A — Subscription Agreement | A- |

| APPENDIX B — Dividend Reinvestment Plan | B- |

| APPENDIX C — Privacy Policy | C- |

| APPENDIX D — The Hines Timeline | D- |

QUESTIONS AND ANSWERS ABOUT THIS OFFERING

The following questions and answers about this offering highlight material information regarding us and this offering that is not otherwise addressed in the “Prospectus Summary” section of this prospectus. You should read this entire prospectus, including the section entitled “Risk Factors,” before deciding to purchase any of the common shares offered by this prospectus.

| Q: | What is Hines Real Estate Investment Trust, Inc., or Hines REIT? |

| | |

| A: | Hines REIT is a real estate investment trust, or “REIT,” that has invested and intends to continue to invest primarily in institutional-quality office properties located in the United States. In addition, we have invested and may invest in other real estate investments including, but not limited to, properties located outside of the United States, non-office properties, loans and ground leases. |

| | |

| | We commenced operations in November 2004. As of May 1, 2008, we had raised approximately $1.80 billion of gross proceeds through public offerings of our common shares. We invest the net offering proceeds into our real estate investments, and, as of May 1, 2008, owned interests in 45 properties. These properties consist of 43 institutional-quality office properties throughout the United States, one mixed-use office and retail property in Toronto, Ontario and one industrial property in Rio de Janeiro, Brazil. |

| | |

| | We are externally managed by our advisor, Hines Advisors Limited Partnership (our “Advisor”), which is responsible for identifying our investment opportunities and managing our day-to-day operations. Our advisor is an affiliate of our sponsor, Hines Interests Limited Partnership (“Hines”). |

| | |

| Q: | Who is Hines Interests Limited Partnership? |

| | |

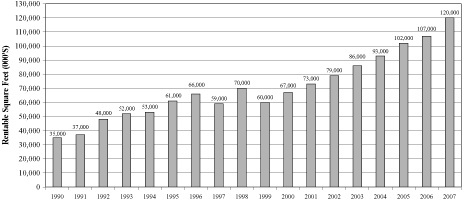

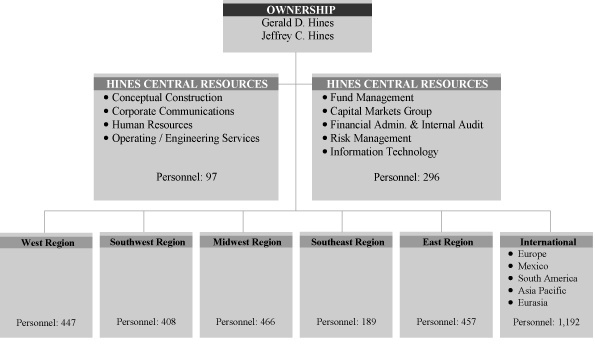

| A: | Hines is a fully integrated global real estate investment and management firm and, with its predecessor, has been investing in real estate and providing acquisition, development, financing, property management, leasing and disposition services for over 50 years. Hines provides investment management services to numerous investors and partners including pension plans, domestic and foreign institutional investors, high net worth individuals and retail investors. Hines is owned and controlled by Gerald D. Hines and his son Jeffrey C. Hines. As of December 31, 2007, Hines and its affiliates had ownership interests in a real estate portfolio of approximately 238 projects, valued at approximately $22.9 billion. Please see “Management — Hines and our Property Management and Leasing Agreements — The Hines Organization” for more information regarding Hines. |

| | |

| Q: | What competitive advantages does Hines REIT achieve through its relationship with Hines and its affiliates? |

| | |

| A: | We believe our relationship with Hines and its affiliates provides us the following benefits: |

| | |

| | •Global Presence — Our relationship with Hines and its affiliates as our sponsor, advisor and property manager allows us to have access to an organization that has extraordinary depth and breadth around the world with approximately 3,550 employees located in 69 cities across the United States and 15 foreign countries. This provides us a significant competitive advantage in drawing upon the experiences resulting from the vast and varied real estate cycles and strategies that varied economies and markets experience. |

| | |

| | •Local Market Expertise — Hines’ global platform is built from the ground up based on Hines’ philosophy that real estate is essentially a local business. Hines provides us access to a team of real estate professionals who live and work in individual major markets around the world. These regional and local teams are fully integrated to provide a full range of real estate investment and management services including sourcing investment opportunities, acquisitions, development, re-development, financing, property management, leasing, asset management, disposition, accounting and financial reporting. |

| | |

| | •Centralized Resources — Hines’ headquarters in Houston, Texas provides the regional and local teams with a group of approximately 393 personnel who specialize in areas such as capital markets, corporate finance, construction, engineering, operations, marketing, human resources, cash management, risk management, tax and internal audit. These experienced personnel provide a repository of knowledge, experience and expertise and an important control point for preserving performance standards and maintaining operating consistency for the entire organization. |

| | |

| | •Tenure of Personnel — Hines has one of the most experienced executive management teams in the real estate industry with an average tenure within the organization of 28 years. This executive team provides stability to the organization and provides experience through numerous real estate cycles during such time frame. This impressive record of tenure is attributable to a professional culture of quality and integrity and long-term compensation plans that align personal wealth creation with real estate and investor performance and value creation. |

| | |

| | •Long-Term Track Record — Hines has more than 50 years of experience in creating and successfully managing capital and real estate investments for numerous third-party investors. As stated above, Hines and its affiliates currently have approximately 3,550 employees located in regional and local offices in 69 cities in the United States and in 15 foreign countries around the world. Since its inception in 1957, Hines, its predecessor and their respective affiliates have acquired or developed more than 800 real estate projects representing approximately 250 million square feet. |

| | |

| | Please see “Risk Factors — Potential Conflicts of Interest Risks” and “Conflicts of Interest” for a discussion of certain risks and potential disadvantages of our relationship with Hines. |

| | |

| Q: | What is a real estate investment trust, or REIT? |

| | |

| A: | In general, a REIT is an entity that: |

| | |

| | •pays distributions to investors of at least 90% of its annual ordinary taxable income; |

| | |

| | •avoids the “double taxation” treatment of income that generally results from investments in a corporation because a REIT is not generally subject to federal corporate income taxes on its taxable income to the extent it currently distributes such income and provided certain income tax requirements are satisfied relating to, among other things, the nature of its income, assets, and share ownership; and |

| | |

| | •combines the capital of many investors to acquire or provide financing for a diversified portfolio of real estate assets under professional management. |

| | |

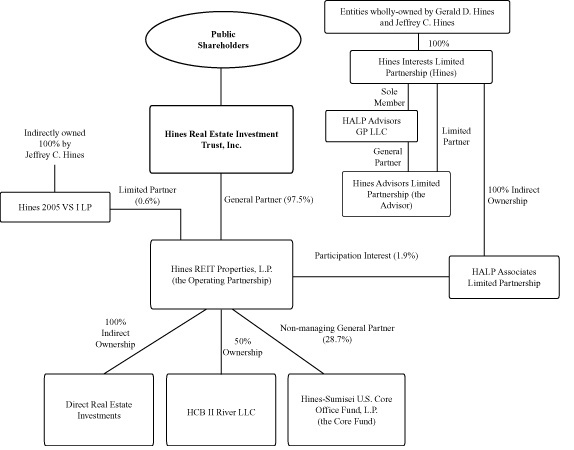

| Q: | How do you structure the ownership and operation of your assets? |

| | |

| A: | We own substantially all of our assets and conduct our operations through an operating partnership called Hines REIT Properties, L.P. We are the sole general partner of Hines REIT Properties, L.P., and as described in more detail below, Hines or its affiliates own limited partner interests and a profits interest in Hines REIT Properties, L.P. To avoid confusion, in this prospectus: |

| | |

| | •we refer to Hines REIT Properties, L.P. as the “Operating Partnership” and partnership interests and the profits interest in the Operating Partnership, respectively, as “OP Units” and the “Participation Interest;" |

| | |

| | •we refer to Hines REIT and the Operating Partnership and their direct and indirect wholly-owned subsidiaries, collectively, as the “Company;” and |

| | |

| | •the use of “we,” “our,” “us” or similar pronouns in this prospectus refers to Hines REIT or the Company as required by the context in which such pronoun is used. |

| | |

| Q: | What are the risks involved in an investment in your shares? |

| | |

| A: | An investment in our common shares is subject to significant risks. Below is a summary of certain of these risks. A more detailed list and description of the risks are contained in the “Risk Factors” and “Conflicts of Interest” sections of this prospectus. You should carefully read and consider all of these risks, and the other risks described in this prospectus, prior to investing in our common shares. |

| | |

| | •The amount of dividends we may pay, if any, is uncertain. Due to the risks involved in the ownership of real estate, there is no guarantee of any return on your investment in Hines REIT, and you may lose money. |

| | |

| | •There is currently no public market for our common shares, and we currently do not intend to list our shares on a stock exchange or include them for quotation on a national securities market. Therefore, it will likely be difficult for you to sell your shares and, if you are able to sell your shares, you will likely sell them at a substantial discount. |

| | |

| | •Your ability to have your shares redeemed is limited under our share redemption program, and if you are able to have your shares redeemed, it may be at a price that is less than the price you paid for the shares and the then-current market value of the shares. |

| | |

| | •We have not identified any specific assets to acquire or investments to make with all of the proceeds from this offering. You will not have the opportunity to review the assets we will acquire or the investments we will make with the proceeds from this offering prior to your investment. |

| | |

| | •We rely on affiliates of Hines for our day-to-day operations and the selection of real estate investments. We pay substantial fees to these affiliates for these services and the fees may increase during the offering. These affiliates are subject to conflicts of interest as a result of this and other relationships they have with us and other programs sponsored by Hines. |

| | |

| | •We are Hines’ only publicly-offered investment program and one of Hines’ first REITs. Because Hines’ other programs and investments have been conducted through privately-held entities not subject to either the up-front commissions, fees or expenses associated with this offering or all of the laws and regulations we are subject to, you should not assume that the prior performance of Hines will be indicative of our future results. |

| | |

| | •We compete with affiliates of Hines for real estate investment opportunities. Some of these affiliates have preferential rights to accept or reject certain investment opportunities in advance of our right to accept or reject such opportunities. Many of the preferential rights we have to accept or reject investment opportunities are subordinate to the preferential rights of at least one affiliate of Hines. |

| | |

| | •We compete with other entities affiliated with Hines for tenants. |

| | |

| | •Hines may face a conflict of interest when determining whether we should dispose of any property we own which is managed by Hines because Hines may lose fees associated with the management of the property. |

| | |

| | •We are a general partner in Hines US Core Office Fund LP (the “Core Fund”); therefore, we could be responsible for all of its liabilities. |

| | |

| | •Our ability to redeem all or a portion of our investment in the Core Fund is subject to significant restrictions, and we may never be able to redeem all or any portion of our investment in the Core Fund. |

| | |

| | •In our initial quarters of operations, dividends we paid to our shareholders were partially funded with advances or borrowings from our Advisor. We may use similar advances, borrowings, deferrals or waivers of fees from our Advisor or others in the future to fund dividends to our shareholders. We cannot assure you that in the future we will be able to achieve cash flows necessary to repay such advances or borrowings and pay dividends at our historical per-share amounts, or to maintain dividends at any particular level, if at all. |

| | |

| | •Real estate investments are subject to a high degree of risk because of general economic or local market conditions, changes in supply or demand, terrorist attacks, competing properties in an area, changes in interest rates, inflationary impact on operating expenses and changes in tax, real estate, environmental or zoning laws and regulations. |

| | |

| | •Our inability to acquire suitable investments, or locate suitable investments in a timely manner, will impact our ability to meet our investment objectives and may affect the amount of dividends we may pay. |

| | |

| | •Hines REIT’s interest in the Operating Partnership will be diluted by the Participation Interest in the Operating Partnership held by HALP Associates Limited Partnership, and your interest in Hines REIT will be diluted if we issue additional shares. |

| | |

| | •Hines’ ability to cause the Operating Partnership to purchase the Participation Interest and any OP Units it or its affiliates hold in connection with the termination of our Advisory Agreement may deter us from terminating our Advisory Agreement. |

| | |

| | •You will not have the benefit of an independent due diligence review in connection with this offering, and the fees we pay in connection with this offering were not determined on an arm’s-length basis. |

| | |

| | •We use debt, which will put us at risk of losing the assets securing such debt should we be unable to make debt service payments or meet other covenants or requirements in the credit agreements. |

| | |

| | •If we lose our REIT tax status, we will be subject to increased taxes and/or penalties, which will reduce the amount of cash we have available to pay dividends to our shareholders. |

| | |

| | •In order to maintain our status as a REIT, we may have to incur additional debt to pay the required dividends to our shareholders. |

| | |

| | •The price of our shares may be adjusted periodically to reflect changes in the net asset value of our assets as well as changes in fees and expenses and therefore future adjustments may result in an offering price lower than the price you paid for your shares. |

| | |

| Q: | Why should I invest in real estate? |

| | |

| A: | Allocating some portion of your investment portfolio to real estate may provide you with portfolio diversification, reduction of overall risk, a hedge against inflation, and attractive risk-adjusted returns. For these reasons, real estate has been embraced as a major asset class for purposes of asset allocations within investment portfolios. According to a survey prepared by the Pension Real Estate Association in February 2007 (the “PREA Survey”), of institutional investors such as public and private plan sponsors, endowments, foundations and other pension funds surveyed that held more than $2 trillion in assets at the time of the survey, real estate equity investments accounted for approximately 6.9% of these institutional investors’ total investment portfolios. This represented an increase from the average allocations to real estate equity investments in prior years, which approximated 6.0% of total investment portfolios in the previous survey. Although institutional investors can invest directly in real estate and on substantially different terms than individual investors, we believe that individual investors can also benefit by adding a real estate component to their investment portfolios. You and your financial advisor, investment advisor or financial planner should determine whether investing in real estate would benefit your investment portfolio. |

| | |

| Q: | Why should I invest in office real estate? |

| | |

| A: | Institutional investors have historically allocated a substantial portion of the real estate component of their investment portfolio to office real estate in an effort to obtain income, portfolio diversification and capital appreciation. We believe that investing in office real estate has the potential to provide both institutional and individual investors a combination of the following: |

| | |

| | •Income. Investing in income producing office real estate, whether directly or through traded or non-traded REITs or other ownership structures, has historically provided an attractive and stable source of income to investors. |

| | |

| | •Portfolio Diversification. Because the performance of investments in office real estate have historically had a low correlation to non-REIT stocks and a negative correlation to bonds, investing in office real estate may provide investors an opportunity to earn better risk-adjusted returns in their investment portfolios over the long term. |

| | |

| | •Capital Appreciation. Office real estate investments have, over the long term, historically provided moderate capital appreciation and have served as a hedge against inflation for many investors. We believe that adding an office real estate component to an investor’s portfolio may enhance the investor’s overall portfolio return. |

| | |

| Q: | What are your investment objectives? |

| | |

| A: | Our primary investment objectives are to: |

| | |

| | •preserve invested capital; |

| | |

| | •invest in a diversified portfolio of office properties; |

| | |

| | •pay regular cash dividends; |

| | |

| | •achieve appreciation of our assets over the long term; and |

| | |

| | •remain qualified as a REIT for federal income tax purposes. |

| | |

| Q: | What percentage of the gross proceeds from this offering will you invest in real estate? |

| | |

| A: | Assuming that we sell all the shares offered in this offering, including all shares we are offering under our dividend reinvestment plan, we expect to use approximately 90-92% of the gross proceeds to make real estate investments. We will use the balance of the gross proceeds to pay sales commissions, dealer manager fees, acquisition fees and to pay third-party acquisition expenses related to those investments. Please see “Estimated Uses of Proceeds." |

| | |

| Q: | Do you have conflicts of interest? |

| | |

| A: | Yes, Hines owns and/or manages many real estate investments and real estate ventures. Hines and its affiliates are not prohibited from engaging in future business activities that may be similar to our operations. Conflicts of interest exist among us, Hines and its affiliates, principally due to the following: |

| | |

| | •Hines and its affiliates are general partners and sponsors of other real estate investment programs with similar and/or non-similar investment objectives. Hines or an affiliate of Hines owes certain legal, fiduciary and financial obligations to both us and these other programs. Because of this and Hines’ other business activities, Hines and other entities affiliated with it may have conflicts of interest with us: |

| | |

| | •in allocating the time of Hines’ employees and other Hines resources among our operations and the operations of other entities; |

| | |

| | •competing with other Hines-affiliated entities for investment opportunities, some of which have priority rights over us to such opportunities, and some of which may result in higher compensation being paid to Hines, its affiliates and certain of its employees (including our directors and officers) than if such opportunities were allocated to us; and |

| | |

| | •competing with other properties owned or managed by Hines for tenant leasing opportunities. |

| | |

| | •We may buy assets from or sell assets to Hines affiliates, including properties developed by Hines, subject to the approval of a majority of our independent directors. Hines and its affiliates, including our officers and directors, may make significant profits from these transactions. |

| | |

| | •Hines, the Advisor and other Hines affiliates will receive substantial fees from us, which have not been negotiated at arm’s-length, which may not be conditioned upon our financial performance and which could be increased or decreased during or after this offering. |

| | |

| | Please see “Risk Factors — Potential Conflicts of Interest Risks” and “Conflicts of Interest” for a discussion of these and other conflicts of interest. |

| | |

| Q: | Do you pay fees to your sponsor? |

| | |

| A: | Yes, we pay fees to Hines and affiliates of Hines for services relating to this offering, our property acquisitions, our financings, the conduct of our day-to-day activities and the management of our properties, which could be increased or decreased during or after this offering. Please see “Prospectus Summary — Management Compensation, Expense Reimbursements and Operating Partnership Participation Interest” below for more information about these fees. |

| Q: | How would you describe your acquisition and operations process? |

| | |

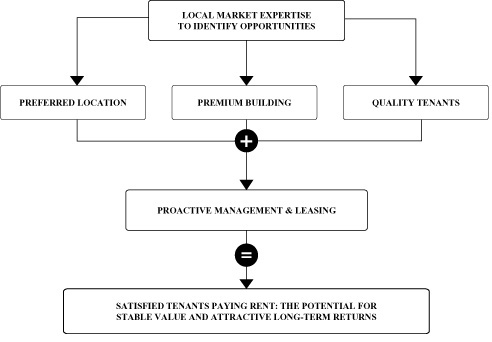

| A: | We generally seek to follow the process used by Hines for many years, which is the following: |

| | Accordingly, we expect to primarily invest in institutional quality office properties that we believe have some of the following attributes: |

| | • | Preferred Location. We believe that location often has the single greatest impact on an asset’s long-term income-producing potential and that assets located in the preferred submarkets in metropolitan areas and situated at preferred locations within such submarkets have the potential to be long-term assets. |

| | • | Premium Buildings. We will seek to acquire assets that generally have design and physical attributes (e.g., quality construction and materials, systems, floorplates, etc.) that are more attractive to a user than those of inferior properties. |

| | • | Quality Tenancy. We will seek to acquire assets that typically attract tenants with better credit who require larger blocks of space because these larger tenants generally require longer term leases in order to accommodate their current and future space needs without undergoing disruptive and costly relocations. |

| | We believe that following an acquisition, the additional component of proactive property management and leasing is the fourth critical element necessary to achieve attractive long-term investment returns for investors. Actively anticipating and quickly responding to tenant comfort and cleaning needs are examples of areas where proactive property management may make the difference in a tenant’s occupancy experience, increasing its desire to remain a tenant and thereby providing a higher tenant retention rate, which over the long term may result in better financial performance of the property. |

| Q: | What assets do you currently own? |

| | |

| A: | Our portfolio consisted of the following assets at May 1, 2008: |

Direct Investments

Property | City | | Leasable Square Feet(3) | | | Percent Leased(3) | | | Our Effective Ownership(1) | |

| 321 North Clark | Chicago, Illinois | | | 885,664 | | | | 99 | % | | | 100 | % |

| JPMorgan Chase Tower | Dallas, Texas | | | 1,242,800 | | | | 91 | % | | | 100 | % |

| Citymark | Dallas, Texas | | | 220,079 | | | | 100 | % | | | 100 | % |

| Raytheon/DirectTV Buildings | El Segundo, California | | | 550,579 | | | | 100 | % | | | 100 | % |

| Watergate Tower IV | Emeryville, California | | | 344,433 | | | | 100 | % | | | 100 | % |

| Williams Tower | Houston, Texas | | | 1,480,623 | | | | 94 | % | | | 100 | % |

| 2555 Grand | Kansas City, Missouri | | | 595,607 | | | | 100 | % | | | 100 | % |

| One Wilshire | Los Angeles, California | | | 661,553 | | | | 99 | % | | | 100 | % |

| 3 Huntington Quadrangle | Melville, New York | | | 407,731 | | | | 87 | % | | | 100 | % |

| Airport Corporate Center | Miami, Florida | | | 1,021,397 | | | | 90 | % | | | 100 | % |

| Minneapolis Office/Flex Portfolio | Minneapolis, Minnesota | | | 766,240 | | | | 85 | % | | | 100 | % |

| 3400 Data Drive | Rancho Cordova, California | | | 149,703 | | | | 100 | % | | | 100 | % |

| Daytona Buildings | Redmond, Washington | | | 251,313 | | | | 93 | % | | | 100 | % |

| Laguna Buildings | Redmond, Washington | | | 464,701 | | | | 100 | % | | | 100 | % |

| 1515 S Street | Sacramento, California | | | 348,881 | | | | 100 | % | | | 100 | % |

| 1900 and 2000 Alameda | San Mateo, California | | | 253,141 | | | | 97 | % | | | 100 | % |

| Seattle Design Center | Seattle, Washington | | | 390,684 | | | | 86 | % | | | 100 | % |

| 5th and Bell | Seattle, Washington | | | 197,135 | | | | 100 | % | | | 100 | % |

| Atrium on Bay | Toronto, Ontario | | | 1,070,287 | | | | 96 | % | | | 100 | % |

| Total for Directly-Owned Properties | | | 11,302,551 | | | | 95 | % | | | | |

| Indirect Investments | | | | | | | | | | | | |

| Core Fund Investments | | | | | | | | | | | | |

| One Atlantic Center | Atlanta, Georgia | | | 1,100,312 | | | | 84 | % | | | 23.27 | % |

| The Carillon Building | Charlotte, North Carolina | | | 470,726 | | | | 98 | % | | | 23.27 | % |

| Charlotte Plaza | Charlotte, North Carolina | | | 625,026 | | | | 95 | % | | | 23.27 | % |

| One North Wacker | Chicago, Illinois | | | 1,373,754 | | | | 98 | % | | | 23.27 | % |

| Three First National Plaza | Chicago, Illinois | | | 1,419,978 | | | | 94 | % | | | 18.62 | % |

| 333 West Wacker | Chicago, Illinois | | | 844,773 | | | | 92 | % | | | 18.57 | % |

| One Shell Plaza | Houston, Texas | | | 1,228,160 | | | | 99 | % | | | 11.64 | % |

| Two Shell Plaza | Houston, Texas | | | 566,982 | | | | 95 | % | | | 11.64 | % |

| 425 Lexington Avenue | New York, New York | | | 700,034 | | | | 100 | % | | | 11.67 | % |

| 499 Park Avenue | New York, New York | | | 288,722 | | | | 100 | % | | | 11.67 | % |

| 600 Lexington Avenue | New York, New York | | | 283,995 | | | | 98 | % | | | 11.67 | % |

| Renaissance Square | Phoenix, Arizona | | | 965,508 | | | | 93 | % | | | 23.27 | % |

| Riverfront Plaza | Richmond, Virginia | | | 949,791 | | | | 100 | % | | | 23.27 | % |

| Johnson Ranch Corporate Center | Roseville, California | | | 179,990 | | | | 72 | % | | | 18.57 | % |

| Roseville Corporate Center | Roseville, California | | | 111,418 | | | | 94 | % | | | 18.57 | % |

| Summit at Douglas Ridge | Roseville, California | | | 185,140 | | | | 87 | % | | | 18.57 | % |

| Olympus Corporate Center | Roseville, California | | | 191,494 | | | | 58 | % | | | 18.57 | % |

| Douglas Corporate Center | Roseville, California | | | 214,606 | | | | 82 | % | | | 18.57 | % |

| Wells Fargo Center | Sacramento, California | | | 502,365 | | | | 95 | % | | | 18.57 | % |

| 525 B Street | San Diego, California | | | 447,159 | | | | 90 | % | | | 23.27 | % |

| The KPMG Building | San Francisco, California | | | 379,328 | | | | 100 | % | | | 23.27 | % |

| 101 Second Street | San Francisco, California | | | 388,370 | | | | 94 | % | | | 23.27 | % |

| 720 Olive Way | Seattle, Washington | | | 300,710 | | | | 93 | % | | | 18.57 | % |

| 1200 19th Street | Washington, D.C. | | | 328,154 | (2) | | | 28 | % | | | 11.67 | % |

| Warner Center | Woodland Hills, California | | | 808,274 | | | | 96 | % | | | 18.57 | % |

| Total for Core Fund Properties | | | 14,854,769 | | | | 93 | % | | | | |

| Other | | | | | | | | | | | | |

| Distribution Park Rio | Rio de Janeiro, Brazil | | | 693,115 | | | | 100 | % | | | 50 | % |

| Total for All Properties | | | 26,850,435 | | | | 93 | % | | | | |

____________

| (1) | This percentage shows the effective ownership of the Operating Partnership in the properties listed. On May 1, 2008, Hines REIT owned a 97.5% interest in the Operating Partnership as its sole general partner. Affiliates of Hines owned the remaining 2.5% interest in the Operating Partnership. As of May 1, 2008, we owned interests in the 25 Core Fund investments through our interest in the Core Fund, in which we owned an approximate 28.7% non-managing general partner interest as of May 1, 2008. The Core Fund does not own 100% of these buildings; its ownership interest in its buildings ranges from 40.6 to 81.0%. In addition, we owned a 50% interest in Distribution Park Rio through a joint venture with an affiliate of Hines. |

| | |

| (2) | This square footage amount includes three floors which are being added to the building and are currently under construction. The construction is expected to be completed in 2009. |

| | |

| (3) | This information is as of March 31, 2008, but includes Williams Tower, which was acquired on May 1, 2008. |

| | |

| Q: | Why do you invest in the Core Fund? |

| | |

| A: | The Core Fund has preferential rights to invest in high quality Class A office properties. We make investments in the Core Fund to provide Hines REIT the opportunity to invest with a number of institutional investors in the Core Fund into such a portfolio. Our investment in the Core Fund allows us to own an indirect interest in a diversified portfolio of Class A office buildings located in markets such as New York City, Washington D.C., Atlanta, Houston, Chicago, Los Angeles, Richmond, Sacramento, San Francisco, San Diego, Charlotte, Phoenix and Seattle. Since the amount of capital required to acquire these types of buildings is substantial, we believe it would take us a significant amount of time, if ever, to be in a position to prudently acquire these types of buildings on our own. We believe that owning an indirect interest in the buildings owned by the Core Fund, together with the properties we acquire directly, will result in a more diversified and stable portfolio of real estate investments for our shareholders. |

| | |

| Q: | What investment or ownership interests does Hines or any of its affiliates have in the Company? |

| | |

| A: | Hines or its affiliates have the following investments and ownership interests in the Company: |

| | |

| | •an investment of $10,200,000 in limited partnership interests of the Operating Partnership by an affiliate of Hines, Hines 2005 VS I LP; and |

| | |

| | •an investment of $10,000 for common shares of Hines REIT by Hines REIT Investor L.P., an affiliate of Hines; |

| | |

| | •an interest in the Operating Partnership, which is adjusted monthly in a manner intended to approximate the economic equivalent of the reinvestment by Hines of approximately one-half of what would otherwise be cash payments of acquisition fees and asset management fees. As of March 31, 2008, this participation interest in the Operating Partnership represented approximately $31.0 million in reinvestment by Hines. Please see “The Operating Partnership — The Participation Interest” for a description of this interest. |

| | |

| Q: | What kind of offering is this? |

| | |

| A: | We are offering a maximum of $3,000,000,000 in our common shares to the public on a “best efforts” basis through Hines Real Estate Securities, Inc., an affiliate of Hines (the “Dealer Manager”), at an initial price of $10.66 per share. We are also offering up to $500,000,000 in our common shares to be issued pursuant to our dividend reinvestment plan at an initial price of $10.13 per share to those shareholders who elect to participate in such plan as described in this prospectus. Our board of directors may change the offering price of our shares, as well as the price for shares issued under our dividend reinvestment plan. |

| | |

| Q: | Who can buy shares? |

| | |

| A: | You can generally buy shares pursuant to this prospectus if you have either: |

| | |

| | •a minimum annual gross income of at least $70,000 and a minimum net worth (not including home, furnishings and personal automobiles) of at least $70,000; or |

| | |

| | •a minimum net worth (not including home, furnishings and personal automobiles) of at least $250,000. |

| | |

| | However, these minimum levels may vary from state to state, so you should carefully read the suitability requirements explained in the “Suitability Standards” section of this prospectus. |

| | |

| Q: | Is there any minimum required investment? |

| | |

| A: | Yes. You must initially invest at least $2,500. Thereafter, subject to restrictions imposed by state law, you may purchase additional shares in whole or fractional share increments subject to a minimum for each additional purchase of $50. You should carefully read the minimum investment requirements explained in the “Suitability Standards” section of this prospectus. |

| | |

| Q: | How do I subscribe for shares? |

| | |

| A: | If you choose to purchase common shares in this offering, you will need to contact your registered broker-dealer or investment advisor and fill out a subscription agreement substantially in the form (or similar to the form) attached to this prospectus as Appendix A for a certain investment amount and pay for the shares at the time you subscribe. |

| | |

| Q: | If I buy shares, will I receive dividends and, if so, how often? |

| | |

| A: | With the authorization of our board of directors, we declare distributions to our shareholders as of daily record dates and aggregate and pay such distributions quarterly. From the date we commenced business operations through June 30, 2006, we declared distributions equal to $0.00164384 per share, per day. From July 1, 2006 through April 30, 2008, we declared distributions equal to $0.00170959 per share, per day. From May 1, 2008 through June 30, 2008, we declared distributions of $0.00175233 per share, per day. Please see “Description of Capital Stock — Distribution Objectives." |

| | |

| Q: | Are dividends I receive taxable? |

| | |

| A: | Yes and no. Generally, dividends that you receive will be considered ordinary income to the extent they are from current or accumulated earnings and profits for tax purposes. Because we anticipate that our dividends will exceed our taxable income, we expect a portion of your dividends will be considered return of capital for tax purposes. These amounts will not be subject to tax immediately but will instead reduce the tax basis of your investment. This in effect defers a portion of your tax until your shares are sold or the Company is liquidated, at which time you will be taxed at capital gains rates on any gains. However, because each investor’s tax implications are different, we suggest you consult with your tax advisor. You and your tax advisor should also review the section of this prospectus entitled “Material Tax Considerations." |

| | |

| Q: | Do you have a dividend reinvestment plan? |

| | |