As filed with the Securities and Exchange Commission on April 28, 2010

Registration No. 333-148854

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 6

to

Form S-11

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Hines Real Estate Investment Trust, Inc.

(Exact name of registrant as specified in governing instruments)

2800 Post Oak Boulevard Suite 5000 Houston, Texas 77056-6118 (888) 220-6121 (Address, including zip code, and telephone number, including, area code, of principal executive offices) | Charles N. Hazen 2800 Post Oak Boulevard Suite 5000 Houston, Texas 77056-6118 (888) 220-6121 (Name and address, including zip code, and telephone number, including area code, of agent for service) |

With a copy to:

Judith D. Fryer, Esq.

Greenberg Traurig, LLP

200 Park Avenue

New York, New York 10166

(212) 801-9200

Approximate date of commencement of proposed sale to the public: as soon as practicable after this registration statement becomes effective.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

This Post-Effective Amendment No. 6 consists of:

| | • | Sticker Supplement No. 8 dated April 27, 2010, which will be affixed to the bottom five inches of the cover page of our prospectus dated April 30, 2009 (the “Prospectus”), so that it will not cover the bullet risk factors on the cover page. This supplement supplements, modifies or supersedes certain information in the Prospectus and supersedes and replaces supplements No. 1 though No. 7, dated May 19, 2009 through December 8, 2009. The Prospectus superseded and replaced the original prospectus for this offering, dated July 1, 2008, and all prior supplements to such prospectus; |

| | • | our Prospectus, previously filed pursuant to Rule 424(b)(3), dated April 30, 2009 and re-filed herewith; |

| | • | Part II, included herewith; and |

| | • | signatures, included herewith. |

This Post-Effective Amendment No. 6 is identical to Post-Effective Amendment No. 5, which was filed on April 28, 2010, except that the section entitled “Updates to the Incorporation by Reference Section” now includes a bullet that references a Current Report on Form 8-K (filed on April 28, 2010) which includes pro forma consolidated financial statements of Hines REIT.

HINES REAL ESTATE INVESTMENT TRUST, INC.

STICKER SUPPLEMENT NO. 8

Sticker Supplement No. 8 dated April 27, 2010, to our prospectus dated April 30, 2009 (the “Prospectus”), updates information in the “Questions and Answers about this Offering,” “Prospectus Summary,” “Risk Factors,” “Management,” “Management Compensation, Expense Reimbursements and Operating Partnership Participation Interest,” “Our Real Estate Investments,” “Investment Objectives and Policies with Respect to Certain Activities,” “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Plan of Distribution,” “The Operating Partnership,” “ERISA Considerations,” “Legal Proceedings,” “Reports to Shareholders,” “Experts,” “Incorporation by Reference” and “Financial Statements” sections of the Prospectus. This supplement No. 8 supplements, modifies or supersedes certain information in the Prospectus and supersedes and replaces prior supplements No. 1 through No. 7, dated May 19, 2009 though December 8, 2009, to our Prospectus, and must be read in conjunction with the Prospectus.

HINES REAL ESTATE INVESTMENT TRUST, INC.

SUPPLEMENT NO. 8 DATED APRIL 27, 2010

TO THE PROSPECTUS DATED APRIL 30, 2009

This prospectus supplement (this “Supplement”) is part of and should be read in conjunction with the prospectus of Hines Real Estate Investment Trust, Inc., dated April 30, 2009 (the “Prospectus”). The Prospectus superseded and replaced the original prospectus for this offering, dated July 1, 2008, and all supplements to the prior prospectus. This Supplement supersedes and replaces all prior supplements to this Prospectus. Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus.

TABLE OF CONTENTS

| | Supplement No. 8 Page Number | Prospectus Page Number |

| | | | |

| A. | Status of Our Current Public Offering | 3 | N.A |

| B. | Distributions Authorized by Our Board of Directors and Change in the Distribution Rate | 4 | xi, 7, 22 |

| C. | Modifications to Our Share Redemption Program | 4 | 8-10, 137, 138 |

| D. | Consideration of a Liquidity Event | 6 | xi, xii |

| E. | Updates to the Questions and Answers About This Offering Section | 6 | ii, v, viii, x |

| F. | Updates to the Prospectus Summary Section | 10 | 2 |

| G. | Updates to the Risk Factors Section | 10 | 9, 10, 13, 15-19, 23, 25-27, 30, 32, 33, 35 |

| H. | Updates to the Management Section | 16 | 39, 44, 49, 50, 52, 53, 58-63, 66 |

| I. | Updates to the Management Compensation, Expense Reimbursements and Operating Partnership Participation Section | 31 | 71 |

| J. | Updates to Our Real Estate Investments Section | 32 | 71-87, 91 |

| K. | Updates to the Investment Objectives and Policies with Respect to Certain Activities Section | 44 | 101, 104, 106-108 |

| L. | Updates to the Selected Financial Data Section | 46 | 110 |

| M. | Updates to the Management’s Discussion and Analysis of Financial Condition and Results of Operations Section | 63 | 111 |

| N. | Updates to the Description of Capital Stock Section | 63 | 136, 137 |

| O. | Updates to the Plan of Distribution Section | 64 | 149 |

| P. | Updates to the Operating Partnership Section | 64 | 151 |

| Q. | Updates to the ERISA Considerations Section | 65 | 175 |

| R. | Updates to the Legal Proceedings Section | 66 | 175 |

| S. | Updates to the Reports to Shareholders Section | 66 | 175 |

| T. | Updates to the Experts Section | 66 | 177 |

| U. | Updates to the Incorporation by Reference Section | 66 | 177 |

| V. | Updates to the Financial Statements Section | 67 | F-1 |

| W. | Appendix D - Hines History, Experience and Timeline | 68 | D-1 |

A. Status of Our Current Public Offering

As of April 22, 2010, we had received gross proceeds of approximately $505.3 million from the sale of approximately 50.0 million of our common shares in our current public offering, including approximately $117.7 million relating to approximately 12.1 million shares issued under our dividend reinvestment plan. As of April 22, 2009, approximately $382.3 million in shares remained available under our dividend reinvestment plan (“DRP Shares”).

In consideration of market conditions and other factors, on November 30, 2009, our board of directors determined to cease new sales of primary offering shares and we have not accepted any subscriptions for such shares dated after December 31, 2009. Our board of directors is considering various future capital raising strategies, and may resume capital raising in the future under a new primary offering. Hines REIT will continue to sell the DRP Shares offered pursuant to the Prospectus. The Prospectus and this Supplement should therefore be read in light of the fact that new sales of primary offering shares ceased after December 31, 2009, and only DRP Shares continue to be sold pursuant to the Prospectus.

B. Distributions Authorized by Our Board of Directors and Change in the Distribution Rate

With the authorization of our board of directors, we have declared distributions for each of the months from May 2009 through April 2010. The May and June 2009 distributions were calculated based on shareholders of record each day during such months in an amount equal to $0.00175233 per share, per day. The distributions for the months of May and June 2009 were aggregated with our distributions from April 2009 and paid on July 1, 2009. The distributions for each of the months from July 2009 through April 2010 were calculated based on shareholders of record each day during such months in an amount equal to $0.00165699 per share, per day, which represents a decrease of $0.00009534 per share, per day compared to those declared in May and June 2009. The distributions for the months of July, August and September 2009 were paid in October 2009. The distributions for the months of October, November and December 2009 were paid in January 2010. The distributions for the months of January, February and March 2010 were paid in April 2010. Distributions for the month of April 2010 will be paid in July 2010. All distributions were or will be paid in cash or reinvested in stock for those participating in our dividend reinvestment plan.

C. Modifications to Our Share Redemption Program

Our board of directors and our officers remain focused on carefully managing our cash position and maintaining appropriate levels of liquidity to meet our operating and capital needs in an environment where access to capital in the equity and debt markets remains constrained. To that end, on November 30, 2009, our board of directors determined that it is in our best interest to suspend our share redemption program until further notice, except with respect to redemption requests made in connection with the death or disability (as defined in the Code) of a shareholder (referred to herein as “Special Redemption Requests”). Special Redemption Requests will be considered for redemption by our board of directors on a quarterly basis, and the fulfillment of any Special Redemption Requests will be subject to the discretion of our board of directors in determining whether we have sufficient funds available for redemptions and will be subject to the other limitations of the share redemption program, as described below.

As a result of these changes, any reference to our share redemption program in the Prospectus is hereby updated to reflect that our share redemption program has been suspended until further notice, except with respect to Special Redemption Requests. Further, any description of the terms of our share redemption program in the Prospectus should be read in conjunction with and is superseded by the following disclosure, which deletes and replaces the “Description of Capital Stock - Share Redemption Program” section of the Prospectus:

Share Redemption Program

Our shares are currently not listed on a national securities exchange and we currently do not intend to list our shares. In order to provide our shareholders with some liquidity, we instituted a share redemption program. However, on November 30, 2009, our board of directors determined that it is in our best interest to suspend our share redemption program until further notice, except with respect to redemption requests made in connection with the death or disability (as defined in the Code) of a shareholder. All unfunded requests for redemptions, which were not made in connection with the death or disability of a shareholder, were cancelled. Such redemption requests may be resubmitted at such point in the future, if any, at which our board of directors determines to reopen our share redemption progr am. Any such future redemption requests will be subject to the conditions and limitations of our share redemption program, as in effect if or when we recommence our general share redemption program.

Prior to the time, if any, as our shares are listed on a national securities exchange, subject to the conditions and limitations described herein, any shares that have been held by the shareholder for at least one year since the date of their acquisition, and were (i) purchased from us, (ii) received through a non-cash transaction, not in the secondary market or (iii) purchased from another shareholder prior to January 11, 2009, may be presented in whole or in part to us for redemption in connection with Special Redemption Requests. In connection with such requests, we may, in our discretion, waive the one-year holding period requirement as well as the limitations on the number of shares that will be redeemed as summarized below. In addition, in the event a shareholder is having all his shares redeemed, the one-year holding requirement will be waived for shares purchased under our dividend reinvestment plan. We will not pay the Advisor or its affiliates any fees to complete any transactions under our share redemption program.

To the extent our board of directors determines that we have sufficient available cash flow for redemptions, we intend to redeem Special Redemption Requests for cash on a quarterly basis; however, our board of directors may determine from time to time to adjust the timing of redemptions upon 30 days’ notice, which will be provided in the form of a current report on Form 8-K filed with the U.S. Securities and Exchange Commission (“SEC”) and made available on our website (www.HinesREI.com). Unless our board of directors determines otherwise, the funds available for redemption will be limited to the lesser of the amount required to redeem 10% of the shares outstanding as of the same date in the prior calendar year or the amount of proceeds received from our dividend reinvestment plan in t he prior quarter.

Our board of directors may terminate, suspend or amend our share redemption program and discontinue redemptions of Special Redemption Requests at any time upon 30 days’ written notice without shareholder approval if our directors believe such action is in our best interests, or if they determine the funds otherwise available to fund our share redemption program are needed for other purposes. The written notice will take the form of a current report on Form 8-K filed with the SEC and made available on our website.

During the years ended December 31, 2009, 2008 and 2007, we redeemed $152.5 million, $58.7 million and $10.6 million in shares, respectively. During these years, all shareholder requests for redemptions were fully funded out of proceeds from our dividend reinvestment plan. During 2009, we experienced a significant increase in share redemptions, all of which were funded out of proceeds from our dividend reinvestment plan and our primary offering. Cash used to fund redemptions reduces our liquidity available to fund acquisitions of real estate investments and other cash needs. We cannot assure you that we will be able to fully fund Special Redemption Requests in the future.

Our current share redemption price for Special Redemption Requests is $9.15 per share. The redemption price was determined by our board of directors. Our board’s determination of the redemption price was subjective and was primarily based on our estimated per-share net asset value as determined by our management. Our management estimated our per-share net asset value using valuations of our real estate assets and notes payable as of December 31, 2008, which were determined by independent third parties (except for assets acquired within the last year for which we used aggregate cost). Management estimated the values of our other assets and liabilities as of December 31, 2008, and then made various adjustments and estimations in order to account for our operations and other factors occurring or expected to occur between December 31, 2008 and the effective date of this pricing change. In addition, our board of directors also considered our historical and anticipated results of operations and financial condition, our current and anticipated distribution payments, yields and offering prices of other real estate companies we deem to be substantially similar to us, our current and anticipated capital and debt structure, and our management’s and Advisor’s recommendations and assessment of our prospects and expected execution of our investment and operating strategies.

The valuations of our real estate assets and notes payable, as well as the methodology utilized by our management in estimating our per-share net asset value, were based on a number of assumptions and estimates that may not be accurate or complete. No liquidity discounts or discounts relating to the fact that we are currently externally managed were applied to our estimated per-share valuation, and no attempt was made to value Hines REIT as an enterprise. Likewise, the valuation was not reduced by potential selling commissions or other costs of sale, which would impact proceeds in the case of a liquidation. The redemption price may not be indicative of the price our shareholders could receive if they sold our shares, if our shares were actively traded or if we were liquidated.

Our board of directors may adjust the per-share redemption price for Special Redemption Requests from time to time upon 30 days’ written notice based on our then-current estimated per-share net asset value at the time of the adjustment, and such other factors as it deems appropriate, including the then-current offering price of our shares (if any) and the other factors described above, our then-current dividend reinvestment plan price and general market conditions. At any time we are engaged in an offering of shares, the per-share price for shares purchased under our redemption program will always be equal to or lower than the applicable per-share offering price. Real estate asset and notes payable values fluctuate, which in the future may result in an increase or decrease in our net asset value. Thus, future adjustments to our per - -share net asset value could result in a higher or lower redemption price. The members of our board of directors must, in accordance with their fiduciary duties, act in a manner they believe is in the best interests of our shareholders when making any decision to adjust the redemption price offered under our share redemption program. Our board of directors will announce any price adjustment and the time period of its effectiveness as a part of our regular communications with shareholders. Please see “Reports to Shareholders.”

All Special Redemption Requests must be made in writing and received by us at least five business days prior to the end of the quarter. You may also withdraw your request to have your shares redeemed. Withdrawal requests must also be made in writing and received by us at least five business days prior to the end of the quarter. If our board determines to redeem Special Redemption Requests for a particular quarter and the number of our shares subject to Special Redemption Requests exceeds the limitations described above, or our board of directors determines that available cash flow is insufficient to meet such requests, the Special Redemption Requests will be reduced on a pro rata basis. We cannot guarantee that we will accommodate all requests made in any quarter. If we cannot accommodate all requests in a given quarter, you c an withdraw your Special Redemption Request or request in writing that we honor it in a successive quarter. Such pending Special Redemption Requests will generally be honored on a pro-rata basis with any new Special Redemption Requests we receive in the applicable period.

Commitments by us to repurchase shares will be communicated either telephonically or in writing to each shareholder who submitted a Special Redemption Request at or promptly (no more than five business days) after the fifth business day following the end of each quarter. We will redeem the shares subject to these commitments, and pay the redemption price associated therewith, within three business days following the delivery of such commitments. You will not relinquish your shares until we redeem them. Please see “Risk Factors — Investment Risks — Your ability to have your shares redeemed is limited under our share redemption program, and if you are able to have your shares redeemed, it may be at a price that is less than the price you paid for the shares and the then-current market value of the shares....” and &# 8220;Risk Factors — Investment Risks — There is currently no public market for our common shares, and we do not intend to list the shares on a stock exchange. Therefore, it will likely be difficult for you to sell your shares and, if you are able to sell your shares, you will likely sell them at a substantial discount. The price of our common shares may be adjusted to a price less than the price you paid for your shares.”

The shares we redeem under our share redemption program will be cancelled and will have the status of authorized but unissued shares. We will not resell such shares to the public unless such sales are first registered with the Securities and Exchange Commission under the Securities Act and under appropriate state securities laws or are exempt under such laws. We will terminate our share redemption program in the event that our shares ever become listed on a national securities exchange or in the event a secondary market for our common shares develops.

D. Consideration of a Liquidity Event

As discussed on pages xi and xii of the Prospectus, our board may consider and authorize us to execute exit strategies at both the asset level and portfolio level, but only if any such exit strategy is deemed to be in our best interests. Due to the uncertainties of market conditions in the future, we believe setting finite dates for possible, but uncertain, liquidity events may result in actions that are not necessarily in the best interests or within the expectations of our shareholders. Therefore, we believe it is more appropriate to allow us and our board of directors the flexibility to consider multiple options at times that our board of directors deems appropriate. Although we are not obligated to execute a particular liquidity event by a set date, we expect our board of directors may begin to consider possible exit strate gies for all or a portion of our portfolio between late 2015 and the end of 2019. There can be no assurances that our board of directors will consider any such exit strategy, that we will successfully execute any exit strategy, or that any such exit strategy, if executed, will be beneficial to our shareholders.

The following is added to the end of the first paragraph under the heading “Disposition Policies” on page 106 of the Prospectus:

Although we are not obligated to sell any of our investments or execute a liquidity event by a set date, we expect that our board of directors may begin to consider possible liquidity events between late 2015 and the end of 2019. There can be no assurances that our board of directors will consider any such exit strategy, that we will successfully execute any exit strategy, or that any such exit strategy, if executed, will be beneficial to our shareholders.

E. Updates to the Questions and Answers About This Offering Section

1. The first four questions and answers beginning on page ii of the Prospectus are deleted in their entirety and replaced with the following disclosure:

| Q: | What is Hines Real Estate Investment Trust, Inc., or Hines REIT? |

| | |

| A: | Hines REIT is a real estate investment trust, or “REIT,” that has invested and intends to continue to invest primarily in institutional-quality office properties located in the United States. In addition, we have invested and may invest in other real estate investments including, but not limited to, properties located outside of the United States, non-office properties, loans and ground leases. |

| | |

| | • We commenced operations in November 2004. As of April 22, 2010, we had raised almost $2.5 billion of gross proceeds through public offerings of our common shares, including gross proceeds of approximately $505.3 million from the sale of approximately 50.0 million shares of our common stock in this offering. As of April 22, 2010, approximately $382.3 million in shares remained available under our dividend reinvestment plan. We invest the net offering proceeds into our real estate investments, and, as of December 31, 2009, owned interests in 63 properties. These properties consist of 45 U.S. office properties, one mixed-use office and retail complex in Toronto, Ontario, one industrial property in Dallas, Texas, four industrial properties in Brazil and a portfolio of 12 grocery-anchored shopping centers located in five states in the southeastern United States. On January 22, 2010 we sold one industrial property located in Curitiba, Brazil and on April 22, 2010, we sold two industrial properties located in Sao Paulo, Brazil. |

| | |

| | • We are externally managed by our advisor, Hines Advisors Limited Partnership (our “Advisor”), which is responsible for identifying our investment opportunities and managing our day-to-day operations. Our advisor is an affiliate of our sponsor, Hines Interests Limited Partnership (“Hines”). |

| | |

| Q: | Who is Hines Interests Limited Partnership? |

| | |

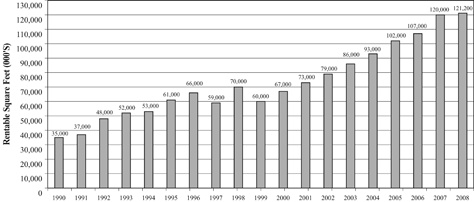

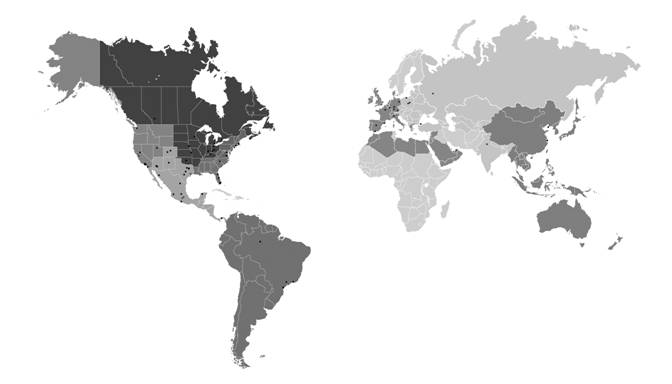

| A: | Hines is a fully integrated global real estate investment and management firm and, with its predecessor, has been investing in real estate and providing acquisition, development, financing, property management, leasing and disposition services for over 50 years. Hines provides investment management services to numerous investors and partners including pension plans, domestic and foreign institutional investors, high net worth individuals and retail investors. Hines is owned and controlled by Gerald D. Hines and his son Jeffrey C. Hines. As of December 31, 2009, Hines and its affiliates had ownership interests in a real estate portfolio of 214 projects, valued at approximately $22.2 billion. Please see “Management — Hines and our Property Management and Leasing Agreements — The Hines Organization� 221; for more information regarding Hines. |

| | |

| Q: | What competitive advantages does Hines REIT achieve through its relationship with Hines and its affiliates? |

| | |

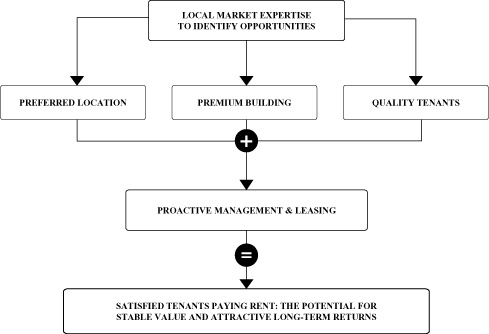

| A: | We believe our relationship with Hines and its affiliates provides us the following benefits: |

| | |

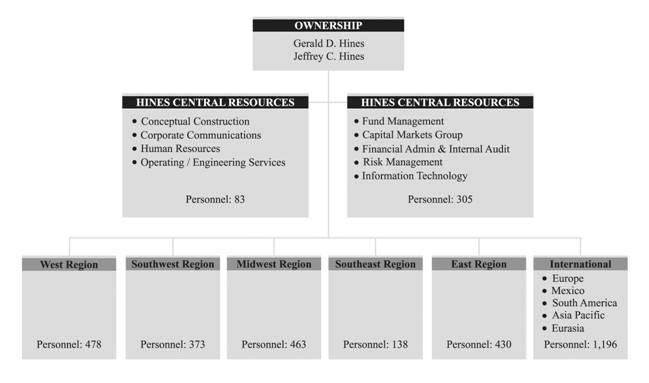

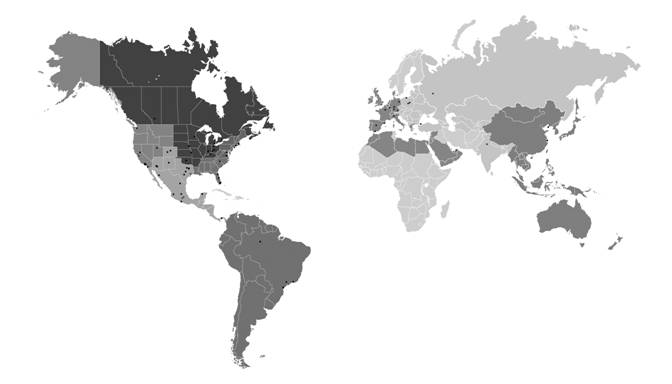

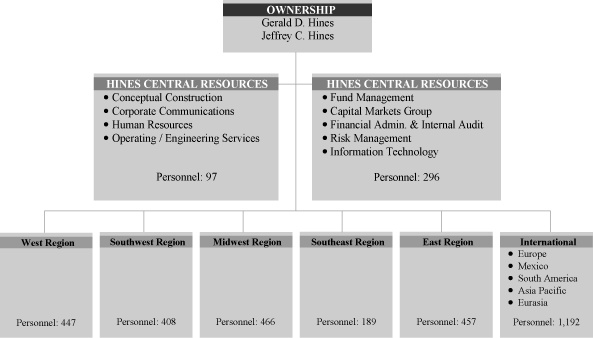

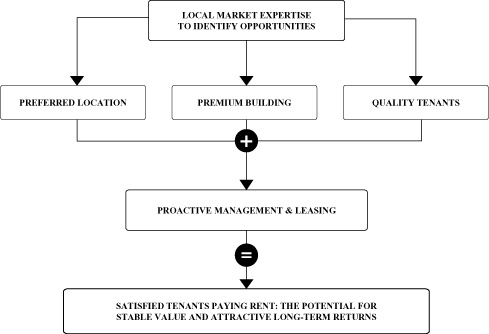

| | • Global Presence — Our relationship with Hines and its affiliates as our sponsor, advisor and property manager allows us to have access to an organization that has extraordinary depth and breadth around the world with, as of December 31, 2009, approximately 3,450 employees (including approximately 1,200 employees outside of the United States) located in 65 cities across the United States and 16 foreign countries. This provides us a significant competitive advantage in drawing upon the experiences resulting from the vast and varied real estate cycles and strategies that varied economies and markets experience. |

| | |

| | • Local Market Expertise — Hines’ global platform is built from the ground up based on Hines’ philosophy that real estate is essentially a local business. Hines provides us access to a team of real estate professionals who live and work in individual major markets around the world. These regional and local teams are fully integrated to provide a full range of real estate investment and management services including sourcing investment opportunities, acquisitions, development, re-development, financing, property management, leasing, asset management, disposition, accounting and financial reporting. |

| | |

| | • Centralized Resources — Hines’ headquarters in Houston, Texas provides the regional and local teams with, as of December 31, 2009, a group of approximately 388 personnel who specialize in areas such as capital markets, corporate finance, construction, engineering, operations, marketing, human resources, cash management, risk management, tax and internal audit. These experienced personnel provide a repository of knowledge, experience and expertise and an important control point for preserving performance standards and maintaining operating consistency for the entire organization. |

| | |

| | • Tenure of Personnel — Hines has one of the most experienced executive management teams in the real estate industry with, as of December 31, 2008, an average tenure within the organization of 29 years. This executive team provides stability to the organization and provides experience through numerous real estate cycles during such time frame. This impressive record of tenure is attributable to a professional culture of quality and integrity and long-term compensation plans that align personal wealth creation with real estate and investor performance and value creation. |

| | |

| | • Long-Term Track Record — Hines has more than 50 years of experience in creating and successfully managing capital and real estate investments for numerous third-party investors. As stated above, as of December 31, 2009, Hines and its affiliates had approximately 3,450 employees (including approximately 1,200 employees outside of the United States) located in regional and local offices in 65 cities in the United States and in 16 foreign countries around the world. Since its inception in 1957, Hines, its predecessor and their respective affiliates have acquired or developed more than 895 real estate projects representing approximately 283 million square feet |

| | |

| | • Please see “Risk Factors — Potential Conflicts of Interest Risks” and “Conflicts of Interest” for a discussion of certain risks and potential disadvantages of our relationship with Hines. |

| | |

* * * *

2. The first sentence in the answer to the question “Why should I invest in office real estate?” on page v of the Prospectus is replaced in its entirety with the following:

Institutional investors have historically allocated a substantial portion of the real estate component of their investment portfolio to office real estate in an effort to obtain income and portfolio diversification.

* * * *

3. The response to the question “What assets do you currently own?” beginning on page viii is replaced in its entirety with the following:

A: Our portfolio consisted of the following assets at December 31, 2009:

Direct Investments

| Property | City | | Leasable Square Feet | | | Percent Leased | | | Our Effective Ownership(1) | |

321 North Clark | Chicago, Illinois | | | 886,752 | | | | 74 | % | | | 100 | % |

Distribution Park Araucaria | Curitiba, Brazil | | | 459,587 | (2) | | | 100 | % | | | 100 | % |

Citymark | Dallas, Texas | | | 218,695 | | | | 95 | % | | | 100 | % |

4055/4055 Corporate Drive | Dallas, Texas | | | 643,429 | | | | 100 | % | | | 100 | % |

JPMorgan Chase Tower | Dallas, Texas | | | 1,243,667 | | | | 87 | % | | | 100 | % |

345 Inverness Drive | Denver, Colorado | | | 175,284 | | | | 100 | % | | | 100 | % |

Arapahoe Business Park | Denver, Colorado | | | 309,450 | | | | 74 | % | | | 100 | % |

Raytheon/DIRECTV Buildings | El Segundo, California | | | 550,579 | | | | 100 | % | | | 100 | % |

Watergate Tower IV | Emeryville, California | | | 344,433 | | | | 100 | % | | | 100 | % |

Williams Tower | Houston, Texas | | | 1,480,623 | | | | 82 | % | | | 100 | % |

2555 Grand | Kansas City, Missouri | | | 595,607 | | | | 100 | % | | | 100 | % |

One Wilshire | Los Angeles, California | | | 661,553 | | | | 97 | % | | | 100 | % |

3 Huntington Quadrangle | Melville, New York | | | 407,731 | | | | 83 | % | | | 100 | % |

Airport Corporate Center | Miami, Florida | | | 1,021,397 | | | | 86 | % | | | 100 | % |

Minneapolis Office/Flex Portfolio | Minneapolis, Minnesota | | | 766,430 | | | | 82 | % | | | 100 | % |

3400 Data Drive | Rancho Cordova, California | | | 149,703 | | | | 100 | % | | | 100 | % |

Daytona Buildings | Redmond, Washington | | | 251,313 | | | | 100 | % | | | 100 | % |

Laguna Buildings | Redmond, Washington | | | 460,661 | | | | 78 | % | | | 100 | % |

1515 S Street | Sacramento, California | | | 349,185 | | | | 100 | % | | | 100 | % |

1900 and 2000 Alameda | San Mateo, California | | | 253,187 | | | | 95 | % | | | 100 | % |

Distribution Park Elouveira | Sao Paolo, Brazil | | | 534,794 | (3) | | | 100 | % | | | 100 | % |

Distribution Park Vinhedo | Sao Paolo, Brazil | | | 609,474 | (3) | | | 100 | % | | | 100 | % |

Seattle Design Center | Seattle, Washington | | | 390,684 | | | | 81 | % | | | 100 | % |

5th and Bell | Seattle, Washington | | | 197,135 | | | | 98 | % | | | 100 | % |

Atrium on Bay | Toronto, Ontario | | | 1,077,467 | | | | 98 | % | | | 100 | % |

| Total for Directly-Owned Properties | | | 14,038,820 | | | | 91 | % | | | | |

| | | | | | | | | | | | | | |

| Indirect Investments | | | | | | | | | | | | | |

Core Fund One Atlantic Center | Atlanta, Georgia | | | 1,100,312 | | | | 76 | % | | | 23.20 | % |

The Carillon Building | Charlotte, North Carolina | | | 471,507 | | | | 77 | % | | | 23.20 | % |

Charlotte Plaza | Charlotte, North Carolina | | | 625,026 | | | | 93 | % | | | 23.20 | % |

One North Wacker | Chicago, Illinois | | | 1,373,754 | | | | 97 | % | | | 23.20 | % |

Three First National Plaza | Chicago, Illinois | | | 1,423,353 | | | | 89 | % | | | 18.56 | % |

333 West Wacker | Chicago, Illinois | | | 853,243 | | | | 77 | % | | | 18.51 | % |

One Shell Plaza | Houston, Texas | | | 1,230,395 | | | | 100 | % | | | 11.60 | % |

Two Shell Plaza | Houston, Texas | | | 565,553 | | | | 95 | % | | | 11.60 | % |

425 Lexington Avenue | New York, New York | | �� | 700,034 | | | | 100 | % | | | 11.67 | % |

499 Park Avenue | New York, New York | | | 291,480 | | | | 81 | % | | | 11.67 | % |

600 Lexington Avenue | New York, New York | | | 289,386 | | | | 94 | % | | | 11.67 | % |

Renaissance Square | Phoenix, Arizona | | | 965,508 | | | | 88 | % | | | 23.20 | % |

Riverfront Plaza | Richmond, Virginia | | | 951,590 | | | | 95 | % | | | 23.20 | % |

Johnson Ranch Corporate Centre | Roseville, California | | | 179,990 | | | | 45 | % | | | 18.51 | % |

Roseville Corporate Center | Roseville, California | | | 111,418 | | | | 76 | % | | | 18.51 | % |

Summit at Douglas Ridge | Roseville, California | | | 185,128 | | | | 62 | % | | | 18.51 | % |

Olympus Corporate Centre | Roseville, California | | | 193,178 | | | | 54 | % | | | 18.51 | % |

Douglas Corporate Center | Roseville, California | | | 214,606 | | | | 76 | % | | | 18.51 | % |

Wells Fargo Center | Sacramento, California | | | 502,365 | | | | 96 | % | | | 18.51 | % |

| Property | City | | Leasable Square Feet | | | Percent Leased | | | Our Effective Ownership(1) | |

| Indirect Investments | | | | | | | | | | | | | |

525 B Street | San Diego, California | | | 449,183 | | | | 94 | % | | | 23.20 | % |

The KPMG Building | San Francisco, California | | | 379,328 | | | | 100 | % | | | 23.20 | % |

101 Second Street | San Francisco, California | | | 388,370 | | | | 83 | % | | | 23.20 | % |

720 Olive Way | Seattle, Washington | | | 300,710 | | | | 80 | % | | | 18.51 | % |

1200 19th Street | Washington, D.C. | | | 337,239 | | | | 60 | % | | | 11.67 | % |

Warner Center | Woodland Hills, California | | | 808,274 | | | | 90 | % | | | 18.51 | % |

| Total for Core Fund Properties | | | 14,890,930 | | | | 88 | % | | | | |

| | | | | | | | | | | | | | |

| Grocery-Anchored Portfolio | | | | | | | | | | | | | |

Bellaire Boulevard Center | Bellaire, Texas | | | 35,081 | | | | 97 | % | | | 70 | % |

Champions Village | Houston, Texas | | | 384,581 | | | | 91 | % | | | 70 | % |

King’s Crossing | Kingwood, Texas | | | 126,397 | | | | 97 | % | | | 70 | % |

Oak Park Village | San Antonio, Texas | | | 64,287 | | | | 100 | % | | | 70 | % |

Cherokee Plaza | Atlanta, Georgia | | | 99,749 | | | | 100 | % | | | 70 | % |

University Palms Shopping Center | Oviedo, Florida | | | 99,172 | | | | 88 | % | | | 70 | % |

Commons at Dexter Lakes | Memphis, Tennessee | | | 228,496 | | | | 94 | % | | | 70 | % |

Mendenhall Commons | Memphis, Tennessee | | | 79,871 | | | | 99 | % | | | 70 | % |

Thompson Bridge Commons | Gainsville, Georgia | | | 92,587 | | | | 95 | % | | | 70 | % |

Sandy Plains Exchange | Marietta, Georgia | | | 72,784 | | | | 95 | % | | | 70 | % |

Shoppes at Parkland | Parkland, Florida | | | 145,652 | | | | 93 | % | | | 70 | % |

Heritage Station | Wake Forest, North Carolina | | | 68,641 | | | | 87 | % | | | 70 | % |

| Total for Grocery-Anchored Portfolio | | | 1,497,298 | | | | 94 | % | | | 70 | % |

| | | | | | | | | | | | | | |

| Other | | | | | | | | | | | | | |

Distribution Park Rio(4) | Rio de Janeiro, Brazil | | | 693,115 | | | | 99 | % | | | 50 | % |

| Total for All Properties | | | 31,120,163 | | | | 90 | %(5) | | | | |

____________

| (1) | This percentage shows the effective ownership of the Operating Partnership in the properties listed. On December 31, 2009, Hines REIT owned a 96.7% interest in the Operating Partnership as its sole general partner. Affiliates of Hines owned the remaining 3.3% interest in the Operating Partnership. In addition, we owned an approximate 28.7% non-managing general partner interest in the Core Fund as of December 31, 2009. The Core Fund does not own 100% of its properties; its ownership interest in its properties ranges from 40.3% to 80.7%. |

| | |

| (2) | This property was sold on January 22, 2010 for $38.4 million (69.9 million BRL translated at a rate of 1.818 BRL per $1 USD). |

| | |

| (3) | These properties were sold on April 22, 2010 for an aggregate price of $102.5 million (181.0 million BRL translated at a rate of 1.765 BRL per $1 USD). |

| | |

| (4) | We own a 50% indirect interest in Distribution Park Rio, an industrial property located in Rio de Janeiro, Brazil, through a joint venture with Hines Calpers Brazil (“HCB”), an affiliate of Hines. We formed the joint venture in June 2007 with an initial investment of $28.9 million. |

| | |

| (5) | This amount represents the percentage leased assuming we own a 100% interest in each of these properties. The percentage leased based on our effective ownership interest in each property is 90%. |

| | |

* * * *

4. The first sentence of the answer to the question “Why do you invest in the Core Fund?” on page x of the Prospectus is deleted and replaced with the following:

The Core Fund has preferential rights to invest in high quality Class A office properties in the United States.

* * * *

5. The last bullet point in the answer to the question “What investment or ownership interests does Hines or any of its affiliates have in the Company?” on page x is deleted in its entirety and replaced with the following:

| | •an interest in the Operating Partnership, which is adjusted monthly in a manner intended to approximate the economic equivalent of the reinvestment by Hines of what would otherwise be cash payments of acquisition fees and asset management fees. As of December 31, 2009, the fair value of this participation interest in the Operating Partnership represented approximately $57.8 million. Please see “The Operating Partnership — The Participation Interest” for a description of this interest. |

* * * *

6. The questions “How can I have my shares redeemed?” and “What is your current share redemption price?” on page xi are deleted in their entirety and replaced with the following:

Q. Will I have an opportunity to have my shares redeemed?

A. Our shares redemption program has been suspended, other than in connection with death or disability. Shares that are eligible for redemption may be redeemed at a price of $9.15 per share. Our board of directors may change this redemption price from time to time and may otherwise amend, further suspend or terminate our share redemption program at any time upon at least 30 days’ notice which notice shall be in the form of a report on Form 8-K filed with the U.S. Securities and Exchange Commission and made available on our website (www.HinesREI.com).

* * * *

7. The answer to the question “Will I be notified of how my investment is doing?” on page xii of the Prospectus is deleted in its entirety and replaced with the following:

| A: | Yes, periodic updates on the performance of your investment will be made available to you, including: |

| | |

| | •distribution statements; |

| | |

| | •periodic prospectus supplements during the offering; |

| | |

| | •an annual report; |

| | |

| | •an annual IRS Form 1099-DIV, if required; and |

| | |

| | •three quarterly financial reports. |

| | |

| | We will make this information available to you via one or more of the following methods: |

| | |

| | •electronic delivery; or |

| | |

| | •posting on our web site, located at www.hinesrei.com, along with any required notice. |

| | |

| | In addition, to the extent required by law or regulation or, in our discretion, we may make certain of this information available to you via U.S. mail or other courier. |

F. Update to the Prospectus Summary Section

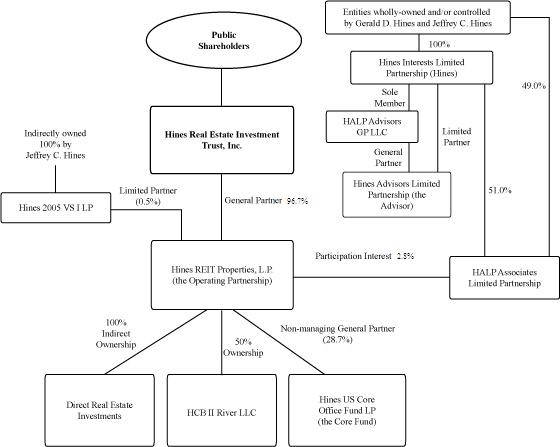

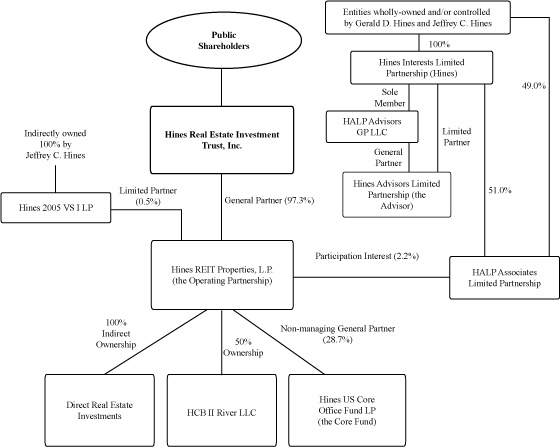

The disclosure under the heading “Our Structure” on page 2 of the Prospectus is deleted in its entirety and replaced with the following:

The following chart illustrates our general structure and our management relationship with Hines and its affiliates as of December 31, 2009:

G. Updates to the Risk Factors Section

1. The first two risk factors beginning on page 9 of the Prospectus are deleted in their entirety and replaced with the following:

There is currently no public market for our common shares, and we do not intend to list the shares on a stock exchange. Therefore, it will likely be difficult for you to sell your shares and, if you are able to sell your shares, you will likely sell them at a substantial discount. The price of our common shares may be adjusted to a price less than the price you paid for your shares.

There is no public market for our common shares, and we do not expect one to develop. We currently have no plans to list our shares on a national securities exchange or over-the-counter market, or to include our shares for quotation on any national securities market. Additionally, our charter contains restrictions on the ownership and transfer of our shares, and these restrictions may inhibit your ability to sell your shares. We have a share redemption program, but it is limited in terms of the amount of shares that may be redeemed and is currently open only to requests made in connection with the death or disability (as defined in the Code) of a shareholder. Our board of directors may further limit, suspend or terminate our share redemption program upon 30 days’ written notice, in the form of a current report on Form 8-K filed with the U.S. Securities and Exchange Commission (“SEC”) and made available on our website (www.HinesREI.com). It may be difficult for you to sell your shares promptly or at all. If you are able to sell your shares, you may only be able to sell them at a substantial discount from the price you paid. This may be the result, in part, of the fact that the amount of funds available for investment are reduced by funds used to pay selling commissions, the dealer manager fee and acquisition fees in connection with our public offerings. Unless our aggregate investments increase in value to compensate for these up-front fees and expenses, which may not occur, it is unlikely that you will be able to sell your shares, whether pursuant to our share redemption program or otherwise, without incurring a substantial loss. You may also experience substantial losses in connection with a liquidation event or if we dispose of our assets. We cannot assure you that your shares will ever appreciate in value to equal th e price you paid for your shares. Thus, shareholders should consider our common shares as illiquid and a long-term investment, and you must be prepared to hold your shares for an indefinite length of time. Further, the price of our shares may be adjusted periodically to reflect changes in our net asset value as well as other factors, including changes in fees and expenses and therefore future adjustments may result in an offering price lower than the price you paid for your shares and a redemption price lower than our current redemption price. We reduced the price of our shares effective January 26, 2009 and our redemption price effective March 1, 2009. Please see “Description of Capital Stock — Restrictions on Transfer” herein for a more complete discussion on certain restrictions regarding your ability to transfer your shares.

Our share redemption program is currently suspended, except with respect to requests made in connection with the death or disability of a shareholder. We do not know when or if our general share redemption program will be resumed. Your ability to have your shares redeemed is subject to additional limitations under our share redemption program, and if you are able to have your shares redeemed, it may be at a price that is less than the price you paid for the shares and the then-current market value of the shares. Unless our board of directors determines otherwise, funds available for redemption will be limited to the lesser of the amount required to redeem 10% of the shares outstanding as of the same date in the prior calendar year or the amount of proceeds received from our dividend reinvestment p lan in the prior quarter. Cash used to fund redemptions may reduce our liquidity available to fund acquisitions of real estate investments and other cash needs.

You should understand that our share redemption program contains significant restrictions and limitations, and

is currently open only to requests made in connection with the death or disability (as defined in the Code) of a shareholder. We do not know when or if our general share redemption program will be resumed. In addition, irrespective of the amount of time you have held your securities, only the following shares are currently eligible for redemption in connection with the death or disability of a shareholder: (i) shares purchased directly from us, (ii) shares received through a non-cash transaction, not in the secondary market and (iii) shares purchased from another shareholder prior to January 11, 2009. Subject to the restrictions and limitations of our share redemption program, we expect to redeem shares to the extent our board of directors determines we have sufficient available cash to do so. Please see “Description of Capital S tock — Share Redemption Program.”

Unless our board of directors determines otherwise, the funds available for redemption will be limited to the lesser of the amount required to redeem 10% of the shares outstanding as of the same date in the prior calendar year or proceeds received from our dividend reinvestment plan in the prior quarter. Cash used to fund redemptions reduces our liquidity available to fund acquisitions of real estate investments and other cash needs.

Our board of directors reserves the right to further amend, suspend or terminate the share redemption program at any time in its discretion upon 30 days’ written notice, in the form of a current report on Form 8-K filed with the SEC and made available on our website. Shares for which requests to redeem are made in connection with the death or disability of a shareholder are currently redeemed at a price of $9.15 per share. However, our board of directors may change the redemption price from time to time upon 30 days’ written notice based on our then-current estimated net asset value at the time of the adjustment and such other factors as it deems appropriate, including the then-current offering price of our shares (if any), our then-current dividend reinvestment plan price and general market conditions. The methodology use d in determining the redemption price is subject to a number of limitations and to a number of assumptions and estimates which may not be accurate or complete. The redemption price may not be indicative of the price our shareholders would receive if our shares were actively traded, if we were liquidated or if they otherwise sold their shares. Therefore, in making a decision to purchase common shares, you should not assume that you will be able to sell all or any portion of your shares back to us pursuant to our share redemption program or at a price that reflects the then-current market value of the shares.

* * * *

2. The following disclosure is added immediately following the third bullet point under the risk factor “Due to the risks involved in the ownership of real estate, there is no guarantee of any return on your investment in Hines REIT, and you may lose some or all of your investment” on page 10 of the Prospectus, as one of the factors that could affect income from properties, our ability to sell properties and yields from investments in properties and are generally outside of our control:

| | • | changes to existing environmental regulation to address, among other things, climate change. |

* * * *

3. The disclosure under the risk factor “Hines REIT’s interest in the Operating Partnership will be diluted by the Participation Interest in the Operating Partnership held by HALP Associates Limited Partnership, and your interest in Hines REIT may be diluted if we issue additional shares” on page 13 of the Prospectus is deleted in its entirety and replaced with the following:

Hines REIT owned a 96.7% general partner interest in the Operating Partnership as of December 31, 2009. An affiliate of Hines, HALP Associates Limited Partnership owns a Participation Interest in the Operating Partnership, which was issued as consideration for an obligation by Hines and its affiliates to perform future services in connection with our real estate operations. This interest in the Operating Partnership, as well as the number of shares into which it may be converted, increases on a monthly basis. As of December 31, 2009, the percentage interest in the Operating Partnership attributable to the Participation Interest was 2.8%, and such interest was convertible into 6.3 million common shares, subject to the fulfillment of certain conditions. The Participation Interest will increase to the extent leverage is us ed because the use of leverage will allow us to acquire more assets. Please see “The Operating Partnership — The Participation Interest” for a summary of this interest. Each increase in this interest will dilute your indirect investment in the Operating Partnership and, accordingly, reduce the amount of distributions that would otherwise be payable to you in the future. Please see “The Operating Partnership — Hypothetical Impact of the Participation Interest.”

Additionally, shareholders do not have preemptive rights to acquire any shares issued by us in the future. Therefore, investors purchasing our common shares in this offering may experience dilution of their equity investment if we:

| | • | sell shares in this offering or sell additional shares in the future, including those issued pursuant to the dividend reinvestment plan and shares issued to our officers and directors or employees of the Advisor and its affiliates under our Employee and Director Incentive Share Plan; |

| | • | sell or issue securities that are convertible into shares, such as interests in the Operating Partnership; |

| | • | issue shares in a private offering; |

| | • | issue common shares to the Advisor or affiliates in lieu of any cash fees; |

| | • | issue common shares upon the exercise of options granted, if any, to our independent directors, or employees of the Company or the Advisor; or |

| | • | issue shares to sellers of properties acquired by us in connection with an exchange of partnership units from the Operating Partnership. |

* * * *

4. The third paragraph under the risk factor “If Hines REIT, the Operating Partnership or the Core Fund is required to register as an investment company under the Investment Company Act, the additional expenses and operational limitations associated with such registration may reduce your investment return or impair our ability to conduct our business as planned” that begins on page 15 of the Prospectus is deleted in its entirety and replaced with the following disclosure:

We have received an opinion from our counsel, Greenberg Traurig, LLP, dated November 24, 2009 that is based on certain assumptions and representations and taking into consideration our current assets and the percentage which could be deemed “investment securities,” as of the date of the opinion, we were not an investment company.

* * * *

5. The disclosure under the risk factor “The ownership limit in our charter may discourage a takeover attempt” on page 16 of the Prospectus is deleted in its entirety and replaced with the following:

Our charter provides that no holder of shares, other than Hines, affiliates of Hines or any other person to whom our board of directors grants an exemption, may directly or indirectly own more than 9.9% in value of the aggregate of our outstanding shares or more than 9.9% of the number or value, whichever is more restrictive, of the outstanding shares of any class or series of our outstanding securities.

This ownership limit may deter tender offers for our outstanding shares, which offers may be attractive to our shareholders, and thus may limit the opportunity for shareholders to receive a premium for their shares that might otherwise exist if an investor attempted to assemble a block of common shares in excess of 9.9% in value of the aggregate of our outstanding shares or more than 9.9% of the number or value, whichever is more restrictive, of the outstanding shares of any class or series or otherwise to effect a change of control in us. Please see the “Description of Capital Stock — Restrictions on Transfer” section of this prospectus for additional information regarding the restrictions on transfer of our common shares.

* * * *

6. The first bullet point under the risk factor “We will not be afforded the protection of the Maryland General Corporation Law relating to business combinations” that begins on page 16 of the Prospectus is deleted in its entirety and replaced with the following:

| | • | any person who beneficially owns 10% or more of the voting power of our outstanding voting stock (an “interested shareholder”); |

7. The disclosure under the risk factor on page 17 of the Prospectus “Any indirect investment we make will be consistent with the investment objectives and policies described in this prospectus and will, therefore, be subject to similar business and real estate risks. The Core Fund, which has investment objectives and policies similar to ours, is subject to many of the same business and real estate risks as we are” is deleted in its entirety and replaced with the following:

For example, the Core Fund:

| | • | will be affected by general economic and regulatory factors it cannot control or predict; |

| | • | depends on its tenants for its revenue and relies on certain significant tenants; |

| | • | may not have funding or capital resources for future tenant improvements; |

| | • | also operates in a competitive business with competitors who have significant financial resources and operational flexibility; |

| | • | will make illiquid investments and be subject to general economic and regulatory factors, including environmental laws, which it cannot control or predict; |

| | • | will be subject to property taxes and operating expenses that may increase; |

| | • | is subject to risks as a result of joint ownership of real estate with Hines and other Hines programs or third parties; |

| | • | is also dependent upon Hines and its key employees for its success; |

| | • | is subject to risks associated with terrorism, uninsured losses and high insurance costs; and |

| | • | used borrowings and leverage, which may result in foreclosures and unexpected debt-service requirements and indirectly negatively affect our ability to pay dividends to our shareholders; |

To the extent the operations and ability of the Core Fund, or any other entity through which we indirectly invest in real estate, to make distributions is adversely affected by any of these risks, our operations and ability to pay distributions to you will be adversely affected.

* * * *

8. The first two full risk factors on page 18 of the Prospectus are deleted in their entirety and replaced with the following:

Geographic concentration of our portfolio may make us particularly susceptible to adverse economic developments in the real estate markets of those areas.

In the event that we have a concentration of real estate investments in a particular geographic area, our operating results and ability to make distributions are likely to be impacted by economic changes affecting the real estate markets in that area. Your investment will be subject to greater risk to the extent that we lack a geographically diversified portfolio of properties. For example, based on our pro-rata share of the market value of the real estate investments in which we owned interests as of December 31, 2009, approximately 12% of our portfolio consists of properties located in Los Angeles, 12% of our portfolio consists of properties located in Chicago and 10% of our portfolio consists of properties located in Houston. Consequently, our financial condition and ability to make distributions could be materially and advers ely affected by any significant adverse developments in those markets.

Industry concentration of our tenants may make us particularly susceptible to adverse economic developments in these industries.

In the event we have a concentration of tenants in a particular industry, our operating results and ability to make distributions may be adversely affected by adverse developments in these industries and we will be subject to a greater risk to the extent that our tenants are not diversified by industry. For example, based on our pro rata share of space leased to tenants as of December 31, 2009, 19% of our space is leased to tenants in the manufacturing industry, 15% is leased to tenants in the finance and insurance industries, 15% is leased to tenants in the legal industry and 10% is leased to tenants in the information and technology industries.

* * * *

9. The disclosure under the risk factor “If we purchase assets at a time when the commercial real estate market is experiencing substantial influxes of capital investment and competition for properties, the real estate we purchase may not appreciate or may decrease in value” beginning on page 18 of the Prospectus is deleted in its entirety and replaced with the following:

During various cycles, the commercial real estate market has experienced a substantial influx of capital from investors. This substantial flow of capital, combined with significant competition for real estate, may have resulted in inflated purchase prices for such assets. We and the Core Fund have recently purchased assets in such environments, and to the extent either of us purchases real estate in the future in such an environment, and therefore, we are subject to the risks that the value of our assets may not appreciate or may decrease significantly below the amount we paid for such assets if the real estate market ceases to attract the same level of capital investment in the future as it has recently attracted, or if the number of companies seeking to acquire such assets decreases. If any of these circumstances occur or the values of our investments are otherwise negatively affected, the value of your investment may be lower.

* * * *

10. The last line of the second paragraph under the risk factor “We may need to incur borrowings that would otherwise not be incurred to meet minimum REIT distribution requirements” and the five bullet points that follow that line on page 19 of the Prospectus are hereby deleted in their entirety.

* * * *

11. The disclosure under the risk factor “The failure of any bank in which we deposit our funds could reduce the amount of cash we have available to pay distributions and make additional investments” on page 23 of the Prospectus is deleted in its entirety and replaced with the following:

The Federal Deposit Insurance Corporation, or FDIC, only insures amounts up to $250,000 per depositor per insured bank, until January 2014, when it will revert back to $100,000 per depositor per insured bank. We currently have cash and cash equivalents and restricted cash deposited in certain financial institutions in excess of federally insured levels. If any of the banking institutions in which we have deposited funds ultimately fails, we may lose any amount of our deposits over these amounts. The loss of our deposits could reduce the amount of cash we have available to distribute or invest and could result in a decline in the value of an investment in our shares.

* * * *

12. The following disclosure is added immediately after the third bullet point under the risk factor “Our operations will be directly affected by general economic and regulatory factors we cannot control or predict” beginning on page 25 of the Prospectus, as one of the factors we cannot control or predict that may affect our operations:

| | • | the potential effects, if any, of climate change; |

* * * *

13. The last sentence of the second paragraph under the risk factor “Volatility in debt markets could impact future acquisitions and values of real estate assets potentially reducing cash available for distribution to our shareholders” on page 26 of the Prospectus is deleted in its entirety and replaced with the following:

Although this may benefit us for future acquisitions, it has negatively impacted the current value of our existing assets and could make it more difficult for us to sell any of our investments at attractive prices if we were to determine to do so.

* * * *14. The disclosure is under the risk factor “We may have difficulty selling real estate investments, and our ability to distribute all or a portion of the net proceeds from such sale to our shareholders may be limited” on page 26 of the Prospectus is deleted in its entirety and replaced with the following:

Equity real estate investments are relatively illiquid. We will have a limited ability to vary our portfolio in response to changes in economic or other conditions. We will also have a limited ability to sell assets in order to fund working capital and similar capital needs such as share redemptions. We expect to generally hold a property for the long term. When we sell any of our properties, we may not realize a gain on such sale or the amount of our taxable gain could exceed the cash proceeds we receive from such sale. We may not distribute any proceeds from the sale of properties to our shareholders; for example, we may use such proceeds to:

| | | |

| | • | purchase additional properties; |

| | | |

| | • | repay debt; |

| | | |

| | • | buy out interests of any co-venturers or other partners in any joint venture in which we are a party; |

| | | |

| | • | purchase shares under our share redemption program; |

| | | |

| | • | fund distributions; |

| | | |

| | • | create working capital reserves; or |

| | | |

| | • | make repairs, maintenance, tenant improvements or other capital improvements or expenditures to our other properties. |

Our ability to sell our properties may also be limited by our need to avoid a 100% penalty tax that is imposed on gain recognized by a REIT from the sale of property characterized as dealer property. In order to avoid such characterization and to take advantage of certain safe harbors under the Code, we may determine to hold our properties for a minimum period of time, generally two years.

* * * *

15. The first sentence of the third paragraph under the risk factor “Potential liability as the result of, and the cost of compliance with, environmental matters could adversely affect our operations” on page 27 of the Prospectus is deleted in its entirety and replaced with the following:

Environmental laws, including any changes to existing environmental laws to address climate change, also may impose restrictions on the manner in which properties may be used or businesses may be operated, and these restrictions may require expenditures.

* * * *

16. The title of the first risk factor under the heading “Potential Conflicts of Interest Risks” on page 30 of the Prospectus is hereby deleted in its entirety and replaced with the following:

We compete with affiliates of Hines for real estate investment opportunities. Some of these affiliates have preferential rights to accept or reject certain investment opportunities in advance of our right to accept or reject such opportunities.

* * * *

17. The first sentence under the risk factor “Certain of our officers and directors face conflicts of interest relating to the positions they hold with other entities” on page 32 of the Prospectus is deleted in its entirety and replaced with the following:

Certain of our officers and directors are also officers and directors of the Advisor and other entities controlled by Hines such as the managing general partner of the Core Fund or the Advisor of Hines Global REIT, Inc.

* * * *

18. The second paragraph under the risk factor “If we fail to qualify as a REIT, our operations and our ability to pay dividends to our shareholders would be adversely impacted” on page 33 of the Prospectus is deleted in its entirety and replaced with the following:

Investments in foreign real property may be subject to foreign currency gains and losses. Generally, foreign currency gains will be excluded from income for purposes of determining our satisfaction of the REIT gross revenue tests; however, under certain circumstances (for example, if we regularly trade in foreign securities) such gains will be treated as non-qualifying income. To reduce the risk of foreign currency gains adversely affecting our REIT qualification, we may be required to defer the repatriation of cash from foreign jurisdictions or to employ other structures that could affect the timing, character or amount of income we receive from our foreign investments. No assurance can be given that we will be able to manage our foreign currency gains in a manner that enables us to qualify as a REIT or to avoid U.S. federal and other taxes on our income as a result of foreign currency gains.

* * * *

19. The title of the third risk factor on page 35 of the Prospectus is deleted in its entirety and replaced with the following:

Entities through which we hold foreign real estate investments will, in most cases, be subject to foreign taxes, notwithstanding our status as a REIT.

H. Updates to the Management Section

1. The disclosure under “Management — Our Officers and Directors” beginning on page 39 of the Prospectus is hereby deleted in its entirety and replaced with the following:

Other than our independent directors, each of our officers and directors is affiliated with Hines and subject to conflicts of interest. Please see “Conflicts of Interest” and “Risk Factors — Potential Conflicts of Interest Risks.” As described below, because of the inherent conflicts of interest existing as the result of these relationships, our independent directors will monitor the performance of all Hines affiliates performing services for us, and these board members have a fiduciary duty to act in the best interests of our Company in connection with our relationships with Hines affiliates. However, we cannot assure you that our independent directors will be successful in eliminating, or decreasing the impact of the risks resulting from, the conflicts of interest we face with Hines and its affilia tes. Indeed, our independent directors will not monitor or approve all decisions made by Hines that impact us, such as the allocation of investment opportunities.

The following sets forth information about our directors and executive officers:

| Name | Age | Position and Office with Hines REIT |

| Jeffrey C. Hines | 54 | Chairman of the Board of Directors |

| C. Hastings Johnson | 61 | Director |

| Charles M. Baughn | 55 | Director |

| George A. Davis | 71 | Independent Director |

| Thomas A. Hassard | 59 | Independent Director |

| Stanley D. Levy | 46 | Independent Director |

| Paul B. Murphy Jr. | 50 | Independent Director |

| Charles N. Hazen | 49 | President and Chief Executive Officer |

| Sherri W. Schugart | 44 | Chief Financial Officer |

| Edmund A. Donaldson | 40 | Chief Investment Officer |

| Frank R. Apollo | 43 | Senior Vice President — Finance, Treasurer and Secretary |

| Kevin L. McMeans | 45 | Asset Management Officer |

| Ryan T. Sims | 38 | Chief Accounting Officer |

Jeffrey C. Hines. Mr. Hines joined Hines in 1981. He has served as the Chairman of our board of directors, as Chairman of the managers of the general partner of our Advisor, and as a member of the management board of the Core Fund since August 2003. Mr. Hines has also been the Chairman of the board of directors of Hines Global REIT, Inc., which we refer to as Hines Global, and Chairman of the managers of the general partner of the advisor of Hines Global since December 2008. He is also the co-owner and President and Chief Executive Officer of the general partner of Hines and is a member of Hines’ Executive Committee. Mr. Hines is responsible for overseeing all firm policies and procedures as well as day-to-day operations. He became President in 19 90 and Chief Executive Officer in January 2008 and has overseen a major expansion of the firm’s personnel, financial resources, domestic and foreign market penetration, products and services. He has been a major participant in the development of the Hines domestic and international acquisition program that secured more than $2.0 billion in properties and currently oversees a portfolio of 214 projects valued at approximately $22.2 billion. Over the past ten years, Hines has sponsored funds which acquired or developed $19.7 billion in real estate, $6.9 billion of which related to properties outside of the United States. Mr. Hines graduated from Williams College with a B.A. in Economics and received his M.B.A. from Harvard Business School.

We believe that Mr. Hines’ career, spanning more than 29 years in the commercial real estate industry, including his service as Chairman of our board of directors, his leadership of Hines and the depth of his knowledge of Hines and its affiliates, qualifies him to serve on our board of directors.

C. Hastings Johnson. Mr. Johnson joined Hines in 1978. He has served as a member of our board of directors, as a member of the managers of the general partner of our Advisor, and as a member of the management board of the Core Fund since July 2004. Mr. Johnson has also been a member of the board of directors of Hines Global and a member of the managers of the general partner of the advisor of Hines Global since December 2008. In addition, he has served as Vice Chairman of the general partner of Hines since January 2008 and Chief Financial Officer of the general partner of Hines since 1992. In these roles, he is responsible for the financial policies,

equity financing and the joint venture relationships of Hines in the U.S. and internationally. He is also a member of Hines’ Executive Committee. Prior to becoming Chief Financial Officer of the general partner of Hines, he led the development or redevelopment of numerous projects and initiated the Hines domestic and international acquisition program and currently oversees a portfolio of 214 projects valued at approximately $22.2 billion. Over the past ten years, Hines has sponsored funds which acquired or developed $19.7 billion in real estate, $6.9 billion of which related to properties outside of the United States. Total debt and equity capital committed to equity projects sponsored by Hines during Mr. Johnson’s tenure as Chief Financial Officer has exceeded $46 billion. Mr. Johnson graduated from the Georgia Institute of Technology with a B.S. in Industrial Engineering and received his M.B.A . from the Harvard Business School.

We believe that Mr. Johnson’s significant experience in the commercial real estate industry, including his 32 year tenure at Hines and his vast knowledge of Hines’ financial and investment policies, qualifies him to serve on our board of directors.

Charles M. Baughn. Mr. Baughn has served as a member of our board of directors since April 2008 and as a manager of the general partner of our Advisor since August 2003. He served as Chief Executive Officer for us and the general partner of our Advisor from August 2003 through April 1, 2008. In addition, Mr. Baughn has been a member of the board of directors of Hines Global and a manager of the general partner of the advisor of Hines Global since December 2008. He has also served as an Executive Vice President and CEO — Capital Markets Group of the general partner of Hines since April 2001 and, as such, is responsible for overseeing Hines’ capital markets group, which raises, places and manages equity and debt for Hines projects, a memb er of Hines’ Executive Committee and the Chief Executive Officer and a director of our Dealer Manager. Mr. Baughn is also a member of the management board of the Core Fund. Mr. Baughn joined Hines in 1984. During his tenure at Hines, he has contributed to the development or redevelopment of over nine million square feet of office and special use facilities in the southwestern United States. He graduated from the New York State College of Ceramics at Alfred University with a B.A. and received his M.B.A. from the University of Colorado. Mr. Baughn holds Series 7, 24 and 63 securities licenses.

We believe that Mr. Baughn’s experience in the commercial real estate industry during his 26 year career with Hines, including his familiarity with Hines’ financial and investment policies, qualifies him to serve on our board of directors.

George A. Davis. Mr. Davis, an independent director since June 2004, is the founder and sole owner of Advisor Real Estate Investment Ltd., a real estate consulting company unaffiliated with our Advisor. Prior to founding Advisor Real Estate Investment Ltd. in April 1999, he served as the Chief Real Estate Investment Officer for the New York State Teacher’s Retirement System (“NYSTRS”) reporting directly to the Executive Director of the system. In addition, Mr. Davis also served as a member of the Investment Committee, which ultimately determined the real estate investment strategy undertaken by NYSTRS. Mr. Davis graduated from Dartmouth College with a B.A. in Biology.

We believe that the extensive real estate investment experience Mr. Davis acquired through his roles as founder and owner of his real estate consulting company and his role as Chief Real Estate Investment Officer for NYTRS qualifies him to serve on our board of directors.

Thomas A. Hassard. Mr. Hassard, an independent director since June 2004, served as the Managing Director for Real Estate Investments for the Virginia Retirement System for almost 20 years before retiring in December 2004. His responsibilities included managing the real estate investments of the system, monitoring performance and reporting to the system’s investment advisory committee and board of trustees. From 2004 through 2006, Mr. Hassard served on the board of directors of Strategic Hotels & Resorts, Inc. (f/k/a Strategic Hotel Capital, Inc.), a public company that owns and asset manages upscale and luxury hotels that are subject to long-term management contracts. Mr. Hassard graduated from Western New England College with a B.S. in Busine ss Administration.

We believe that the significant experience in real estate investing Mr. Hassard acquired during his almost 20 year tenure as the Managing Director for Real Estate Investments for the Virginia Retirement System qualifies him to serve on our board of directors.

Stanley D. Levy. Mr. Levy, an independent director since June 2004, currently serves as Chief Risk Officer of Community Bancorp, a venture formed to purchase failed banks from the FDIC. Mr. Levy’s responsibilities include oversight of credit origination and loan management. Mr. Levy joined Community Bancorp in March 2010. Prior to joining Community Bancorp, Mr. Levy served for 9 years as Chief Operating Officer of The Morgan Group, Inc., a national multi-family development and management firm based in Houston. His responsibilities include arranging debt and equity financing, managing the property acquisition and disposition process, and oversight of all financial aspects of the firm and its projects. Prior to joining The Morgan Group, Mr. Levy spent 15 years with JPMorgan Chase, most recently, as Managing Director of Real Estate and Lodging Investment Banking for the Southern Region. In this capacity, he managed client activities in a variety of investment banking and financing transactions. Mr. Levy graduated with honors from the University of Texas with a B.B.A. in Finance. He also serves on the Board of Directors of the Emery/Weiner School. We believe that Mr. Levy’s current position as Chief Operating Officer of a national real estate firm, as well as his extensive real estate investment banking background, qualify him to serve on our board of directors.

We believe that Mr. Levy’s current position as Chief Risk Officer of Community Bancorp with responsibilities including credit approval and oversight of loan management, as well as his role at JPMorgan Chase which included oversight of all financial operations, accounting and capital markets as well as his involvement in the financing, acquisitions and sales of all real estate, qualify him to serve on our board of directors.