Appendix 1: Evaluating Operating Performance

26

8) Represents acquisition expenses and acquisition fees paid to our Advisor that are expensed in our consolidated statements of operations. We fund

such costs with proceeds from our offering and acquisition-related indebtedness, and therefore do not consider these expenses in evaluating our

operating performance and determining MFFO.

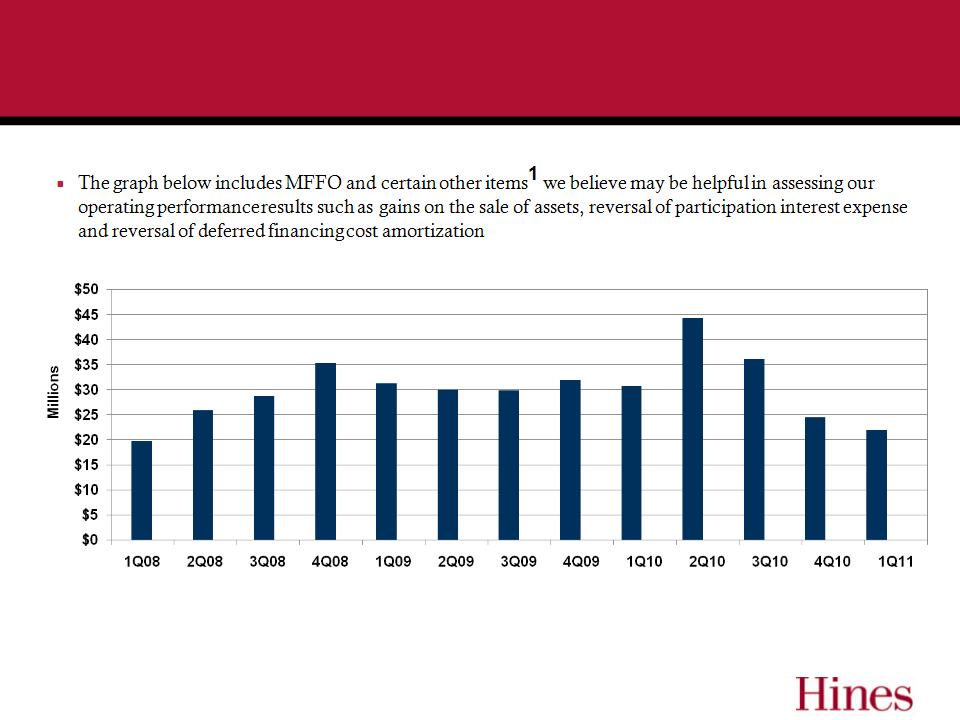

Set forth below is additional information relating to certain items excluded from the analysis above which may be helpful in assessing our operating

results:

• Pursuant to the terms of the Grocery Anchored Portfolio joint venture agreement, for the three months ended March 31, 2011, we received

distributions of approximately $670,000 and for the years ended December 31, 2010, 2009 and 2008, we received distributions of

approximately $1.1 million, $1.7 million and $161,000 in excess of our pro-rata share of the joint venture’s MFFO, respectively.

• On January 22, 2010, we sold Distribution Park Araucaria, an industrial property located in Curitiba, Brazil, which we acquired in December

2008 for $33.0 million. Net proceeds from the sale after deducting transaction costs, fees and taxes were $34.6 million.

• On April 22, 2010, we sold Distributions Park Elouveira and Vinhedo, two industrial properties located in Sao Paulo, Brazil, which we

acquired in December 2008 for $83.1 million. Net proceeds from the sale after deducting transaction costs, fees and taxes were $93.3 million.

• On May 22, 2010, the Core Fund sold 600 Lexington, an office property located in New York, New York, which it acquired in February 2004.

The Core Fund’s total cost basis in 600 Lexington was approximately $103.8 million and the net proceeds from the sale after deducting

transaction costs, taxes and fees were approximately $185.9 million. Our effective ownership in this asset on the date of sale was 11.67%.

• On September 14, 2010, we sold a land parcel located in Houston, Texas, which we acquired in connection with our purchase of Williams

Tower. The sales price of the land parcel was $12.8 million. Proceeds received after closing costs and fees were $11.8 million. We recorded

impairment charges of approximately $811,000 and $3.4 million for the years ended December 31, 2010 and 2009, respectively, which is

included in other losses in the accompanying condensed consolidated statements of operations but have been excluded from MFFO. See

Note 6.

• We received $4.0 million in net proceeds from our sale of the Williams Tower waterwall and park in December 2008.

• We received $1.2 million in net proceeds from our sale of land owned in connection with the Laguna Buildings in December 2009.

• Amortization of deferred financing costs was $709,000, $2.8 million, $2.8 million and $1.7 million for the three months ended March 31, 2011

and for the years ended December 31, 2010, 2009 and 2008, respectively, and was deducted in determining MFFO.

• A portion of our acquisition and asset management fees are paid in equity through the Participation Interest. For the three months ended

March 31, 2011, this amount was $3.9 million. For the years ended December 31, 2010, 2009 and 2008, these amounts were $15.5 million,

$12.4 million and $18.6 million, respectively.

• We received master lease payments of $1.2 million and $7.0 million for the years ended December 31, 2009 and 2008, respectively. These

leases were entered into in conjunction with certain asset acquisitions.

• We incurred organizational and offering expenses of $3.7 million as of December 31, 2008. These expenses are paid to our Advisor and

expensed in our consolidated statement of operations.