July 29, 2015 Dear Investor, Just over 20 years ago I founded our company and I am happy to report that Cimpress is doing very well. In order to target strong returns for our long-term shareholders over the next 20 years, our management team, our supervisory board and I have spent considerable time to think about and to improve the means by which we evaluate investment decisions and financial performance in line with our financial objective to maximize intrinsic value per share. In light of these recent discussions I write to you to convey how we have evolved and to describe our plans to align our investor communications with our internal investment methodologies. We will review the contents of this letter at our upcoming annual investor meeting in New York on August 5, 2015, when we will also provide details on a number of our investment projects. This letter and our upcoming investor day represent our understanding and investment methods as of the present. These philosophies and practices will naturally evolve as we develop our business, and we commit to keeping you abreast of those future evolutions. Looking Back A central objective of our strategy since the inception of the company has been the pursuit of greater scale because we believe that it is the single biggest driver of competitive advantage for our business model and that the market opportunity for mass customization remains enormous. In 2011 we sought to reverse a multi-year trend of falling organic growth rates by improving the competitiveness of our products and our operational capabilities. To do so we committed to invest much more money in our customer value proposition (e.g. higher quality products and services, better user experience, increased pricing and marketing transparency, and significantly improved customer service and service availability), manufacturing capabilities, marketing, technology, product development, and the expansion into adjacencies in new geographies, photo-merchandise products, digital services and high value customers. We fell short of the five-year organic revenue aspirations that we set in 2011 but met or exceeded our goals for manufacturing and customer value improvements. We also delivered profit margins in our core traditional business that were much more in line with our original aspiration, despite the revenue shortfall. We learned a great deal about how to operate as a larger company, what we do well, how we believe we can win, the competitive landscape beyond the traditional Vistaprint positioning of deep promotional discounts, where we want to play and what capabilities we need to build and/or acquire. We believe this will help us provide high returns to long-term shareholders, rewarding career opportunities for our employees, benefits to our society, and highly valued, competitively priced products and services to our customers.

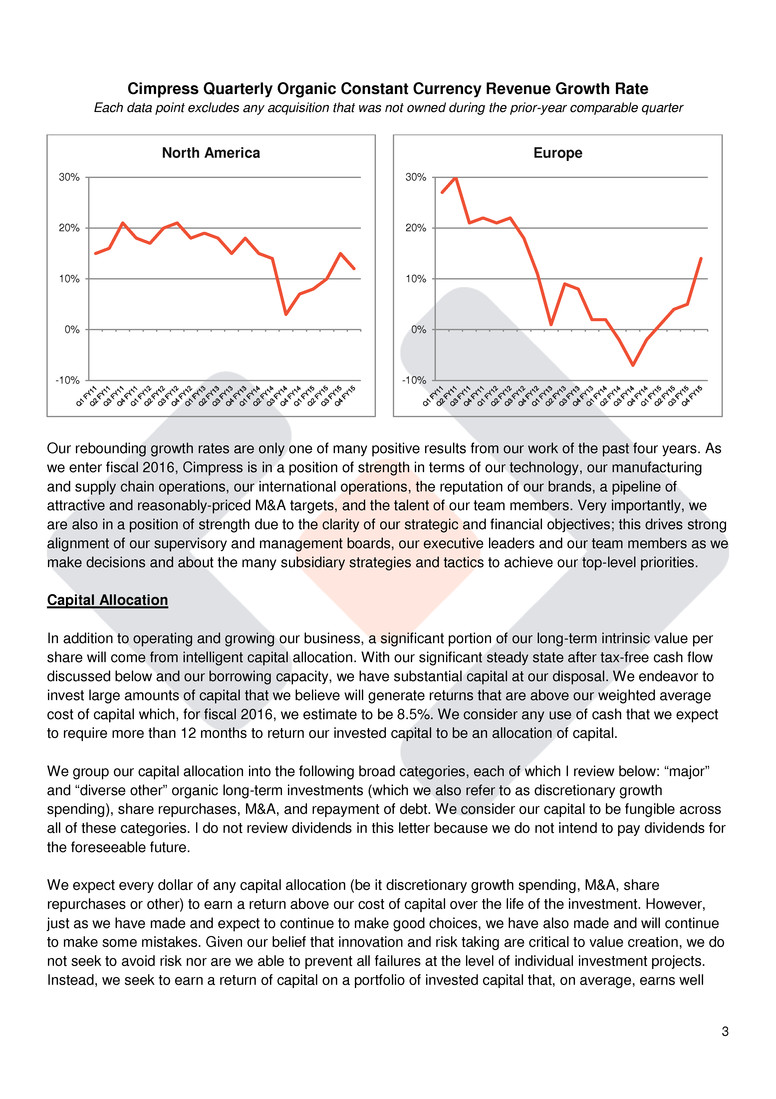

2 One year ago, at our investor day in August 2014, we unveiled a revised strategy developed in light of what we had learned since 2011. We continue our pursuit of scale-based competitive advantage, consistent with strategies we have pursued for many years, but the revised strategy announced last year included the following changes: • Clarification of our strategic and financial objectives: o Strategically, to be the world leader in mass customization By mass customization, we mean producing, with the reliability, quality and affordability of mass production, small individual orders where each and every one embodies the personal relevance inherent to customized physical products. o Financially, maximizing intrinsic value per share This is our uppermost financial objective, to which we subordinate all other financial objectives. We define intrinsic value per share as (a) the unlevered free cash flow per share that, in our best judgment, will occur between now and the long-term future, appropriately discounted to reflect our cost of capital, minus (b) net debt per share. We have chosen intrinsic value per share because we are fundamentally committed to building Cimpress for the long term and we feel that intrinsic value per share best measures long-term financial success. • Repositioning our Vistaprint value proposition to be more attractive to higher expectations customers. • Launching a multi-year project to build a software-based mass customization platform intended to leverage the benefits of scale so as to drive competitive advantage by enabling a broader and deeper selection of products and product attributes, better conformance to our customer’s expectations and reduced unit costs. • Pursuing M&A that would contribute to and benefit from our shared mass customization platform (MCP), and bring our platform capabilities to market via a portfolio of focused brands. In the year since announcing this revised strategy we have begun to gain significant momentum in terms of implementing our plans and we plan to continue forward in this strategic direction for the foreseeable future. Where We Are Today We believe our long-term per-share value creation opportunity is as great or greater than we thought back in 2011. We see a multi-decade opportunity to become a much larger and more valuable (on a per share basis) global company by driving the transition of personalized products from local job-shop, low-volume, offline suppliers who control the vast majority of very large markets to an online mass customized business model. The charts below illustrate that we are making progress: our quarterly year-over-year constant currency growth rates excluding acquisitions and joint ventures in their first year have returned to more than 10% in our two major geographic regions, North America and Europe. Although not charted below, we see good growth trends as well in Australia/NZ and in Brazil, India and Japan.

3 Cimpress Quarterly Organic Constant Currency Revenue Growth Rate Each data point excludes any acquisition that was not owned during the prior-year comparable quarter Our rebounding growth rates are only one of many positive results from our work of the past four years. As we enter fiscal 2016, Cimpress is in a position of strength in terms of our technology, our manufacturing and supply chain operations, our international operations, the reputation of our brands, a pipeline of attractive and reasonably-priced M&A targets, and the talent of our team members. Very importantly, we are also in a position of strength due to the clarity of our strategic and financial objectives; this drives strong alignment of our supervisory and management boards, our executive leaders and our team members as we make decisions and about the many subsidiary strategies and tactics to achieve our top-level priorities. Capital Allocation In addition to operating and growing our business, a significant portion of our long-term intrinsic value per share will come from intelligent capital allocation. With our significant steady state after tax-free cash flow discussed below and our borrowing capacity, we have substantial capital at our disposal. We endeavor to invest large amounts of capital that we believe will generate returns that are above our weighted average cost of capital which, for fiscal 2016, we estimate to be 8.5%. We consider any use of cash that we expect to require more than 12 months to return our invested capital to be an allocation of capital. We group our capital allocation into the following broad categories, each of which I review below: “major” and “diverse other” organic long-term investments (which we also refer to as discretionary growth spending), share repurchases, M&A, and repayment of debt. We consider our capital to be fungible across all of these categories. I do not review dividends in this letter because we do not intend to pay dividends for the foreseeable future. We expect every dollar of any capital allocation (be it discretionary growth spending, M&A, share repurchases or other) to earn a return above our cost of capital over the life of the investment. However, just as we have made and expect to continue to make good choices, we have also made and will continue to make some mistakes. Given our belief that innovation and risk taking are critical to value creation, we do not seek to avoid risk nor are we able to prevent all failures at the level of individual investment projects. Instead, we seek to earn a return of capital on a portfolio of invested capital that, on average, earns well -10% 0% 10% 20% 30% North America -10% 0% 10% 20% 30% Europe

4 above our cost of capital. In support of this objective, we vary hurdle rates based on our judgment of the risks to various types of investment. The compensation committee of our supervisory board anticipates developing, for FY17 and beyond, a performance-based long-term incentive executive compensation program which incorporates the cost of capital. Our Capital Allocation For FY15 and FY16 Major Organic Long-Term Investments These are large, discrete, internally developed projects that we believe can, over the longer term, provide us with materially important competitive capabilities and/or positions in new markets. These investments tend to have a relatively high degree of risk but also the potential for strong future returns. The investments typically take the form of operating expenses, start-up losses, equity investments and capital expenditures. The following are the Major Organic Long-Term Investments we had for FY15, all of which we will continue to have for FY16: Investment Area Description Marketplace and Plant Network Component of MCP The core of our corporate strategy, i.e. our vision for our mass customization platform, is to connect diverse manufacturing, supply chain, document processing and technological assets into an integrated constellation of capabilities that enables scale-based advantage due to the aggregation of volume from many different brands or “merchants”. We refer to the software, service operations and other supporting capabilities that enable this linkage into an integrated platform as the “marketplace and plant network” component of MCP. Columbus “Columbus” is the project name for a multi-year project to expand our MCP capabilities and thus our business unit revenues in the market for decorated apparel, soft goods, promotional products and similar items. Most of World (MoW) This category represents the cost of our expansion into Japan, China, Brazil, India and, possibly in the future, to other parts of the world other than North America, Europe or Australia/NZ. Equity investments that we have made in MoW are also discussed below under the category of “M&A and Similar Equity Investments”. Post-Merger Integration Over the past few years we have spent increasingly large amounts of capital on M&A. As such, we have also been increasing our investment in tracking and managing the process of integrating acquired companies into Cimpress. Diverse Other Organic Long-Term Investments These are a wide variety of other organic investments intended to maintain or improve our competitive position and to support growth. Each subsidiary group in this category itself combines together many investment choices that are individually relatively small in nature but large in aggregate. Compared to major investments and M&A, generally speaking these are less risky investments because they are individually smaller in size and based on more “knowable” forecasts and, often, shorter payback time horizons.

5 Investment Area Description Selection We consistently develop new products and, importantly, we expand the selection of product attributes (such as formats, substrates, finishing options, delivery speeds, available quantities, etc.). Expansion of Production and IT Capacity This comprises capital expenditures and similar upfront costs we invest to expand or improve our capacity for established products with relatively knowable demand expectations. It does not include capacity for our Major Organic LT Investments, which is instead included directly in those categories. Replacement Capital Expenditures The replacement of capital equipment at the end of its useful life. Advertising for our Vistaprint Business Unit Our largest business unit, Vistaprint, has a long history and extensive data on the cash flow characteristics of newly acquired customers. Based on analysis of that data, we regularly invest in customer acquisition costs that require more than twelve months to pay back. Technology for our Vistaprint Business Unit Vistaprint differentiates itself in the market by an extensive set of technologies, such as but not limited to browser-based design, cross-selling, customer service systems, design-assistance, merchandising and analytics, and we regularly upgrade that technology. Note that technology for the manufacturing and supply chain capabilities that serve the Vistaprint unit are not part of this category: they are instead included in the marketplace and plant network component of MCP that is discussed above. Headcount and Related Costs to Enable Scalability and to Improve Performance, as well as Miscellaneous Small Investments We consistently seek to “hire ahead of the curve” the talent that works in our technology, manufacturing, service, marketing, finance, legal and other functions. In other words, we employ people who we need to grow the business further, but who we do not need if we were to stay in a steady state. Share Repurchase or Issuance We consider share repurchases to be an important category of capital allocation. We make our share repurchase decisions by comparing the increase to intrinsic value per share that we believe we would gain from a share repurchase against the increase we believe we would gain from deploying the same amount of capital to other uses. Over the past seven years we allocated $519M of capital to repurchase 16.7 million shares at an average price per share of $31.10. Our fully diluted weighted average shares outstanding for the fiscal year ended June 30, 2015 was 33.8 million shares. If we had not made the above share purchases that number would have been over 50 million. Conversely, we have and may also issue shares for purposes such as the compensation and retention of our team members and we have from time to time used shares in M&A to incentivize management. In the future we might use our equity more broadly. We are willing to issue shares at prices that are at or below our estimate of our intrinsic value per share if we believe the return for the use of the equity will be higher than any loss of value by issuing shares below their intrinsic value. Our choice to repurchase or issue shares is guided by the above principles and by a variety of other debt covenant, securities and legal subjects. Because of the complexity of these criteria, periods in which we issue or buy back shares, or in which we do not do so, should not be considered as an indication of our views on our intrinsic value per share relative to the share price.

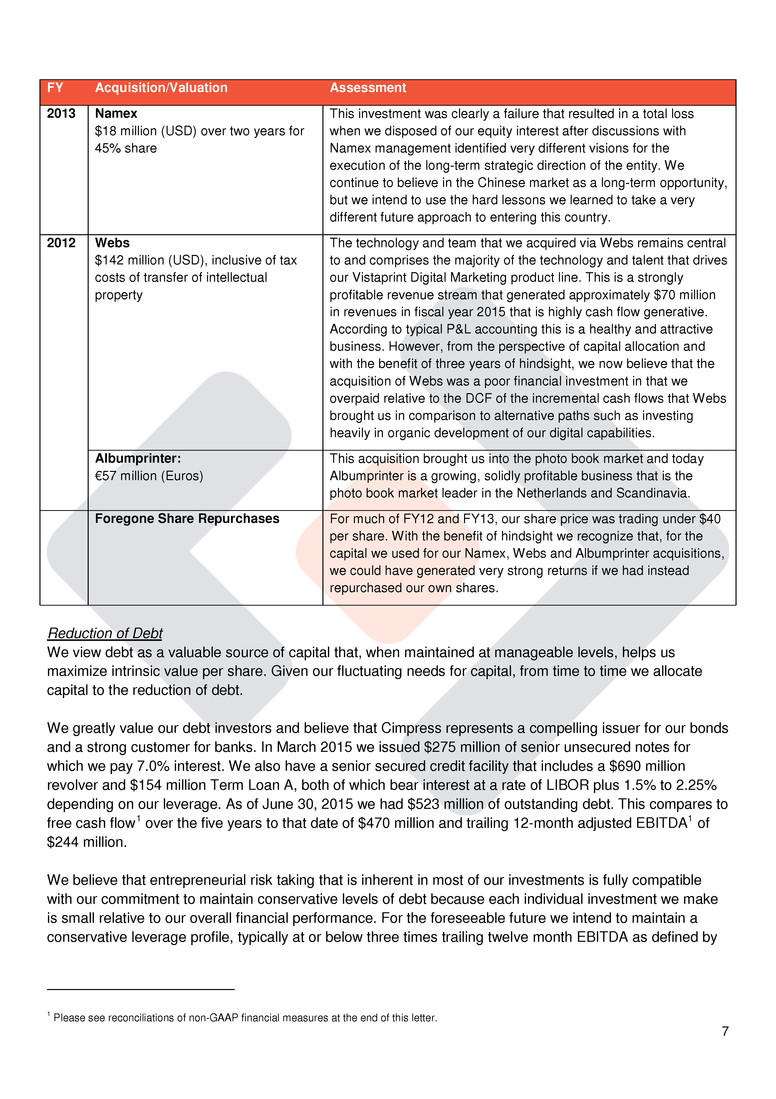

6 M&A and Similar Equity Investments In connection with our multi decade outlook, we believe acquisitions will play a significant role in the value creation we seek. Acquisitions represent a relatively high-risk investment, but we believe they can, if successful, also produce strong returns on large amounts of capital and, importantly, fortify our pre-existing business position. Looking back at the last four years of M&A, we have learned a lot and have used those insights to develop more rigorous deal screening, negotiation, due diligence and integration processes which we believe will improve our odds of success. We seek to have each acquisition have a projected return at the time of the deal that is at least equal to our cost of capital using reasonable assumptions of the stand-alone business. For each acquisition we undertake, we also expect to be able to extract measurable revenue and cost synergies after the integration period such that our anticipated returns per deal equal or exceed a 15% return on capital hurdle. For acquisitions and joint ventures outside of Europe, North America and Australia, we use a 25% return on capital hurdle to reflect the materially higher risk typically associated with those markets. To date our acquisitions have produced mixed results relative to these objectives. The following summarizes our current view on acquisitions and joint venture investments we have made in the past several fiscal years. FY Acquisition/Valuation Assessment 2015 Exagroup, druck.at, Easyflyer.fr Acquired 100% of druck.at and Easyflyer and 70% of Exagroup for €124 million (Euros), inclusive of certain deferred payments These acquisitions are very recent, but going well so far. They are highly complementary to our FY14 acquisitions (see below) of Pixartprinting and Printdeal in the European upload and print market, and we believe these firms bring strong capabilities and brands to Cimpress. We hope and expect to make future equity investments in these recent acquisitions as payment of performance-based earn- outs and to bring us to 100% ownership. Printi $18 million (USD) for a total of a 49.99% share We are pleased with the progress of this business, its high growth rate and its trajectory toward profitability. We anticipate increasing our equity to a majority position in fiscal year 2019 in accordance with a call option that we entered into at the time of our original investment. Fotoknudsen €14 million (Euros) This was a small tuck in acquisition that helped solidify Albumprinter’s market position in the Nordic markets for photo books and other photo merchandise. We are very happy with progress to date. 2014 Pixartprinting and Printdeal €152 million (Euros), including an FY 2016 deferred payment, plus follow on performance-based payments of approximately €25 million (Euros) in FY 2015 and FY 2016 Via these two acquisitions we purchased two national leaders in a fast growing segment of the mass customization market which we refer to as “upload and print”. Customers in this segment do not use online graphic design templates but, rather, design offline using desktop publishing software then upload graphic files via an e- commerce website. To date we are very happy with both Pixartprinting and Printdeal. Vistaprint Japan $14 million (USD) total: $10 million in FY 2014 for 51% share including a FY 2014 equity investment in our JV partner, Plaza Create, then $4 million in FY 2015 We are pleased with the progress of this business and its trajectory toward becoming a growing and profitable business.

7 FY Acquisition/Valuation Assessment 2013 Namex $18 million (USD) over two years for 45% share This investment was clearly a failure that resulted in a total loss when we disposed of our equity interest after discussions with Namex management identified very different visions for the execution of the long-term strategic direction of the entity. We continue to believe in the Chinese market as a long-term opportunity, but we intend to use the hard lessons we learned to take a very different future approach to entering this country. 2012 Webs $142 million (USD), inclusive of tax costs of transfer of intellectual property The technology and team that we acquired via Webs remains central to and comprises the majority of the technology and talent that drives our Vistaprint Digital Marketing product line. This is a strongly profitable revenue stream that generated approximately $70 million in revenues in fiscal year 2015 that is highly cash flow generative. According to typical P&L accounting this is a healthy and attractive business. However, from the perspective of capital allocation and with the benefit of three years of hindsight, we now believe that the acquisition of Webs was a poor financial investment in that we overpaid relative to the DCF of the incremental cash flows that Webs brought us in comparison to alternative paths such as investing heavily in organic development of our digital capabilities. Albumprinter: €57 million (Euros) This acquisition brought us into the photo book market and today Albumprinter is a growing, solidly profitable business that is the photo book market leader in the Netherlands and Scandinavia. Foregone Share Repurchases For much of FY12 and FY13, our share price was trading under $40 per share. With the benefit of hindsight we recognize that, for the capital we used for our Namex, Webs and Albumprinter acquisitions, we could have generated very strong returns if we had instead repurchased our own shares. Reduction of Debt We view debt as a valuable source of capital that, when maintained at manageable levels, helps us maximize intrinsic value per share. Given our fluctuating needs for capital, from time to time we allocate capital to the reduction of debt. We greatly value our debt investors and believe that Cimpress represents a compelling issuer for our bonds and a strong customer for banks. In March 2015 we issued $275 million of senior unsecured notes for which we pay 7.0% interest. We also have a senior secured credit facility that includes a $690 million revolver and $154 million Term Loan A, both of which bear interest at a rate of LIBOR plus 1.5% to 2.25% depending on our leverage. As of June 30, 2015 we had $523 million of outstanding debt. This compares to free cash flow1 over the five years to that date of $470 million and trailing 12-month adjusted EBITDA1 of $244 million. We believe that entrepreneurial risk taking that is inherent in most of our investments is fully compatible with our commitment to maintain conservative levels of debt because each individual investment we make is small relative to our overall financial performance. For the foreseeable future we intend to maintain a conservative leverage profile, typically at or below three times trailing twelve month EBITDA as defined by 1 Please see reconciliations of non-GAAP financial measures at the end of this letter.

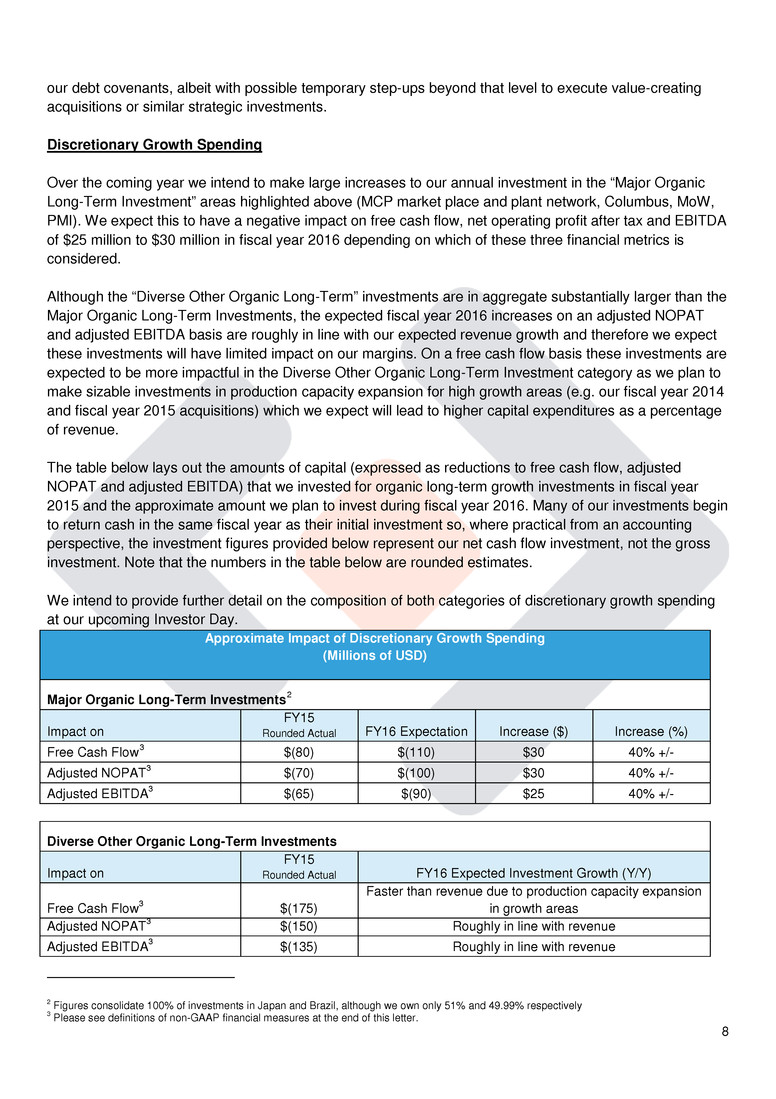

8 our debt covenants, albeit with possible temporary step-ups beyond that level to execute value-creating acquisitions or similar strategic investments. Discretionary Growth Spending Over the coming year we intend to make large increases to our annual investment in the “Major Organic Long-Term Investment” areas highlighted above (MCP market place and plant network, Columbus, MoW, PMI). We expect this to have a negative impact on free cash flow, net operating profit after tax and EBITDA of $25 million to $30 million in fiscal year 2016 depending on which of these three financial metrics is considered. Although the “Diverse Other Organic Long-Term” investments are in aggregate substantially larger than the Major Organic Long-Term Investments, the expected fiscal year 2016 increases on an adjusted NOPAT and adjusted EBITDA basis are roughly in line with our expected revenue growth and therefore we expect these investments will have limited impact on our margins. On a free cash flow basis these investments are expected to be more impactful in the Diverse Other Organic Long-Term Investment category as we plan to make sizable investments in production capacity expansion for high growth areas (e.g. our fiscal year 2014 and fiscal year 2015 acquisitions) which we expect will lead to higher capital expenditures as a percentage of revenue. The table below lays out the amounts of capital (expressed as reductions to free cash flow, adjusted NOPAT and adjusted EBITDA) that we invested for organic long-term growth investments in fiscal year 2015 and the approximate amount we plan to invest during fiscal year 2016. Many of our investments begin to return cash in the same fiscal year as their initial investment so, where practical from an accounting perspective, the investment figures provided below represent our net cash flow investment, not the gross investment. Note that the numbers in the table below are rounded estimates. We intend to provide further detail on the composition of both categories of discretionary growth spending at our upcoming Investor Day. Approximate Impact of Discretionary Growth Spending (Millions of USD) Major Organic Long-Term Investments2 Impact on FY15 Rounded Actual FY16 Expectation Increase ($) Increase (%) Free Cash Flow3 $(80) $(110) $30 40% +/- Adjusted NOPAT3 $(70) $(100) $30 40% +/- Adjusted EBITDA3 $(65) $(90) $25 40% +/- Diverse Other Organic Long-Term Investments Impact on FY15 Rounded Actual FY16 Expected Investment Growth (Y/Y) Free Cash Flow3 $(175) Faster than revenue due to production capacity expansion in growth areas Adjusted NOPAT3 $(150) Roughly in line with revenue Adjusted EBITDA3 $(135) Roughly in line with revenue 2 Figures consolidate 100% of investments in Japan and Brazil, although we own only 51% and 49.99% respectively 3 Please see definitions of non-GAAP financial measures at the end of this letter.

9 Steady State Cash Flow Per Share Given the significant investments and acquisitions that we need and expect to make as we execute on our multi-decade opportunity, over the past year we've spent significant time thinking about a concept we refer to as our steady state after-tax free cash flow. We define “steady state” as having a sustainable and defensible business over the long term capable of growing after-tax free cash flow per share at the rate of inflation. Steady state cash flow is an estimate that is inherently based on many subjective business judgments and approximations, so you should consider our statements about this number to be directional, definitely not specific. Over time we expect steady state cash flow per share growth to track our organic constant currency revenue growth plus/minus any margin expansion/contraction and value creation/destruction from acquisitions and changes in debt or shares outstanding. Estimates of steady state are important for us and shareholders to understand because the difference between the actual after-tax free cash flow and an estimate of steady state after-tax free cash flow represent an estimate of discretionary growth spending that we invest in the anticipation of earning a return above our cost of capital. We hope this provides a useful conceptual and factual framework for investors to make their own analysis of our value, and note that it is consistent with our internal methodology. The following table analyzes our free cash flow from fiscal year 2015 using the discretionary investments estimated above (in millions, $USD): We believe that our Major Organic Long-Term investments were purely for incremental growth in new projects and not needed for a steady state cash flow. As such the $210 million in the above table represents a floor to our steady state free cash flow in fiscal year 2015. The $385 million is a theoretical maximum FY15 steady state cash flow; however we believe that some of these Diverse Other Long-Term Investments were required to maintain a steady state. As such we believe our true steady state free cash flow for fiscal year 2015 lay somewhere in between $210 and $385 million. Our analysis of the steady state concept is relatively new and is inherently subjective but over time we will seek to become more precise about our public estimates of the prior fiscal year’s steady state free cash flow. Actual Free Cash Flow Relative to Steady State A fair question for a shareholder to ask is why is there such a difference between actual and steady state free cash flow? The answer is that we have identified areas from the ground up where we believe we can invest and feel confident we will earn a return above our cost of capital. This is good for long-term shareholders because those investments should create more intrinsic value per share than if we produced actual free cash flow equal to steady state free cash flow. We anticipate that we will be able to invest 4 Please see reconciliations of non-GAAP financial measures at the end of this letter. FY 2015 Free Cash Flow4 as reported $144 Adjustments for pro-forma of recent M&A and non-steady state working capital change $(14) Pro forma Free Cash Flow normalized for M&A and WC through June 2015 $130 Add back Major Long Term Investments $80 Free Cash Flow without Major LT Investments $210 Add back Diverse Other LT Investments $175 Free Cash Flow with neither Major nor Diverse Other Investments $385

10 significant capital for many years with similar return profiles. Over the long term, we anticipate that we will have leveraged the significant discretionary growth spending we plan over the coming years such that we can eventually maintain organic constant currency growth rates while lowering our discretionary growth spend. Our General View as of Today Regarding Organic Constant Currency Revenue Growth The Vistaprint business unit has grown over the last two years at single-digit constant-currency growth rates, and we expect it to continue to do so in the near-term. We believe Vistaprint has the potential to return to growth rates above 10% over the coming years as we execute our strategy. For the smaller, rapidly growing businesses outside our Vistaprint business unit reporting segment, we expect to continue to capitalize on the growth opportunities we see. The collection of other business units is growing at strong double-digit constant-currency growth rates. For the foreseeable future, we believe these businesses will continue to grow faster than the Vistaprint business unit. To be clear, however, because we are focused on maximizing our long-term intrinsic value per share and intend to allocate capital in accordance with that objective, we are not targeting these potential revenue growth rates for any particular quarter or year. Investor Guidance In order to help investors create their own models of Cimpress’ intrinsic value per share, we plan to provide the following information on an annual basis: Forward Looking Retrospective o A review of how we think about value creation and how we plan to apply those concepts to our business o Our general view of potential organic constant currency revenue growth rates for our various businesses o Our discretionary growth spending plans for the upcoming fiscal year o If any of the above changes materially during the year we intend to update this information at appropriate times o Our views on steady state after tax-free cash flow for the most-recently completed fiscal year o Some analysis of our historical discretionary growth spending to highlight our successes/failures and to update our return expectations Effective immediately we will not provide guidance beyond that which is enumerated above. This is because we want to communicate our forward-looking views in a manner that is consistent with how we internally seek to maximize our intrinsic value per share and because we think that focusing all of our efforts exclusively on the principles outlined in this letter will help attract shareholders who are best aligned with our clearly stated financial priority. Effective with our Q1 fiscal year 2016 earnings release (i.e. for the quarter ending September 30, 2015) we will stop reporting many of the operational metrics we have previously reported on because, given the

11 changes we have made over the relatively recent past, they are no longer relevant to how our top management and our supervisory board views and measures our business. We understand that these changes may require a transition in modeling and even in mindset for some investors and analysts who are used to having the type of forward-looking guidance and retrospective operating metrics that we provided previously. However, we believe the changes are critical to maximize long-term intrinsic value per share. Conclusion For those of you who have taken the time to read this letter, thank you for your attention and consideration. Our Supervisory Board, our executive team and I all take very seriously our responsibility as stewards of our investors’ capital. We believe that this explicit enumeration of our business philosophies, priorities and investment frameworks is the best way to empower each investor to decide if Cimpress is an attractive company with whom to entrust his or her money. Sincerely, Robert Keane President & CEO Cimpress N.V.

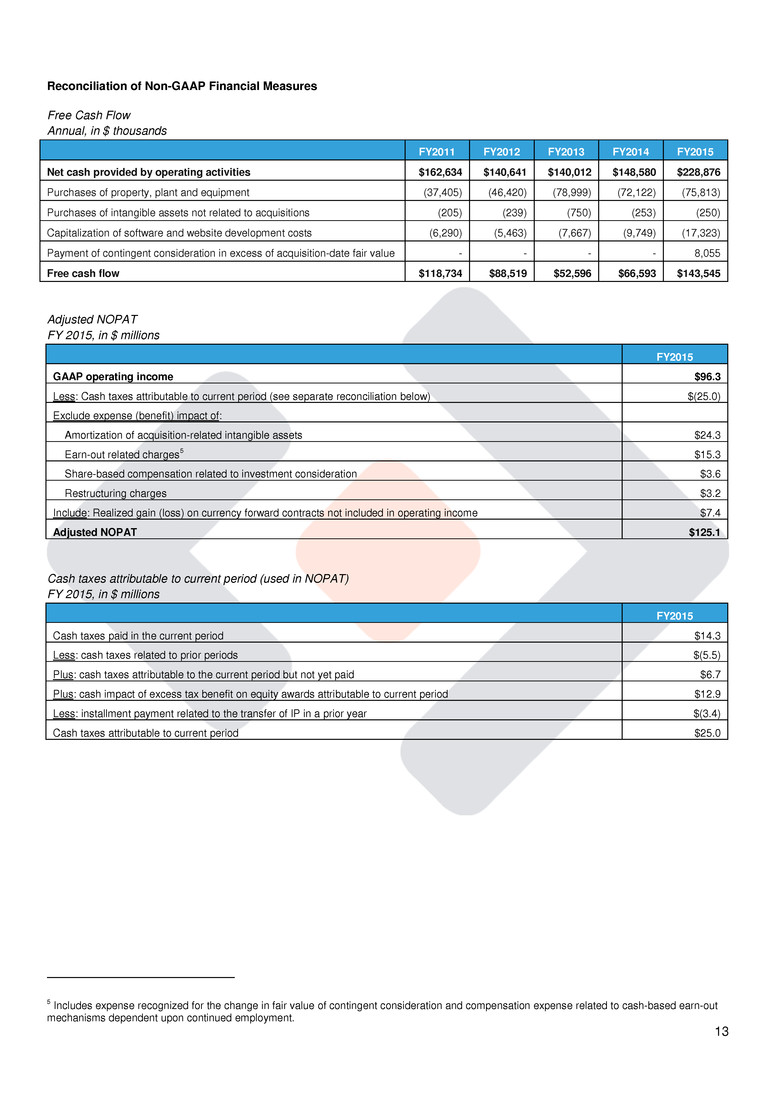

12 About non-GAAP financial measures To supplement Cimpress’ consolidated financial statements presented in accordance with U.S. generally accepted accounting principles, or GAAP, Cimpress has used the following measures defined as non-GAAP financial measures by Securities and Exchange Commission, or SEC, rules: free cash flow, adjusted NOPAT, adjusted EBITDA and constant-currency revenue growth excluding revenue from acquisitions in the first year of ownership. • Free cash flow is defined as net cash provided by operating activities less purchases of property, plant and equipment, purchases of intangible assets not related to acquisitions, and capitalization of software and website development costs, plus payment of contingent consideration in excess of acquisition-date fair value. • Adjusted NOPAT is defined as GAAP Operating Income minus cash taxes attributable to the current period (see definition below), with the following adjustments: exclude the impact of M&A related items including amortization of acquisition- related intangibles, the change in fair value of contingent consideration, and expense for deferred payments or equity awards that are treated as compensation expense; exclude the impact of unusual items such as discontinued operations, restructuring charges, and impairments; and include realized gains or losses from currency forward contracts that are not included in operating income as we do not apply hedge accounting. • As part of our calculation of Adjusted NOPAT, we subtract the cash taxes attributable to the current period operations, which we define as the actual cash taxes paid or to be paid adjusted for any non-operational items and excluding the excess tax benefit from equity awards. • Adjusted EBITDA is defined as net income excluding interest expense (net), income tax expense, depreciation and amortization expense, share-based compensation expense, changes in unrealized loss (gain) on derivative instruments included in net income, non-cash loss in equity interests, loss on disposal of Namex investment, changes in fair value of contingent consideration, expense for deferred payments or equity awards that are treated as compensation expense, currency gains or losses on contingent consideration liability, and non-cash gains or losses on intercompany loans. • Constant-currency revenue growth is estimated by translating all non-U.S. dollar denominated revenue generated in the current period using the prior year period’s average exchange rate for each currency to the U.S. dollar and excludes the impact of gains and losses on effective currency hedges recognized in revenue in the prior year periods. • Constant-currency revenue growth excluding revenue from acquisitions and joint ventures during the first year of ownership excludes the impact of currency as defined above and revenue from: o Albumprinter for the period from Q2 fiscal 2012 through Q3 fiscal 2013; o Webs for the period from Q3 fiscal 2012 through Q3 fiscal 2013; o Digipri from the period from Q3 fiscal 2014 through Q3 fiscal 2015; o Printdeal and Pixartprinting from the period from Q4 fiscal 2014 through Q3 fiscal 2015; o FotoKnudsen from the period from Q1 fiscal 2015 through Q4 fiscal 2015; o Printi from the period from Q2 fiscal 2015 through Q4 fiscal 2015; and o Easyflyer (FL Print), Exagroup, and druck.at from the Q4 fiscal 2015 period. The presentation of non-GAAP financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. For more information on these non-GAAP financial measures, please see the tables captioned “Reconciliations of Non-GAAP Financial Measures” in this release. The tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliation between these financial measures. Cimpress’ management believes that these non-GAAP financial measures provide meaningful supplemental information in assessing our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results, which could be non-cash charges or discrete cash charges that are infrequent in nature. These non-GAAP financial measures also have facilitated management’s internal comparisons to Cimpress’ historical performance and our competitors’ operating results.

13 Reconciliation of Non-GAAP Financial Measures Free Cash Flow Annual, in $ thousands FY2011 FY2012 FY2013 FY2014 FY2015 Net cash provided by operating activities $162,634 $140,641 $140,012 $148,580 $228,876 Purchases of property, plant and equipment (37,405) (46,420) (78,999) (72,122) (75,813) Purchases of intangible assets not related to acquisitions (205) (239) (750) (253) (250) Capitalization of software and website development costs (6,290) (5,463) (7,667) (9,749) (17,323) Payment of contingent consideration in excess of acquisition-date fair value - - - - 8,055 Free cash flow $118,734 $88,519 $52,596 $66,593 $143,545 Adjusted NOPAT FY 2015, in $ millions FY2015 GAAP operating income $96.3 Less: Cash taxes attributable to current period (see separate reconciliation below) $(25.0) Exclude expense (benefit) impact of: Amortization of acquisition-related intangible assets $24.3 Earn-out related charges5 $15.3 Share-based compensation related to investment consideration $3.6 Restructuring charges $3.2 Include: Realized gain (loss) on currency forward contracts not included in operating income $7.4 Adjusted NOPAT $125.1 Cash taxes attributable to current period (used in NOPAT) FY 2015, in $ millions FY2015 Cash taxes paid in the current period $14.3 Less: cash taxes related to prior periods $(5.5) Plus: cash taxes attributable to the current period but not yet paid $6.7 Plus: cash impact of excess tax benefit on equity awards attributable to current period $12.9 Less: installment payment related to the transfer of IP in a prior year $(3.4) Cash taxes attributable to current period $25.0 5 Includes expense recognized for the change in fair value of contingent consideration and compensation expense related to cash-based earn-out mechanisms dependent upon continued employment.

14 Reconciliation of Non-GAAP Financial Measures (continued) Adjusted EBITDA FY 2015, in $ thousands FY2015 GAAP Net income $89,312 Interest expense (net) $16,705 Income tax expense $10,441 Depreciation and amortization $97,487 Share-based compensation expense $24,075 Unrealized (gain) loss on derivative instruments included in net income $(1,868) Change in fair value of contingent consideration $15,234 Currency (gain) loss on contingent consideration liability $(2,008) Non-cash currency (gain) loss on intercompany loans $(5,219) Adjusted EBITDA $244,198 Constant-currency revenue growth excluding revenue from acquisitions and joint ventures during the first year of ownership North America Europe Reported revenue growth Currency impact Revenue growth in constant currency Impact of acquisitions and joint ventures in the first year of ownership Revenue growth in constant currency ex. acquisitions and joint ventures in the first year of ownership Reported revenue growth Currency impact Revenue growth in constant currency Impact of acquisitions and joint ventures in the first year of ownership Revenue growth in constant currency ex. acquisitions and joint ventures in the first year of ownership Q1 FY11 16% -1% 15% - 15% 18% 9% 27% - 27% Q2 FY11 16% - 16% - 16% 22% 8% 30% - 30% Q3 FY11 21% - 21% - 21% 22% -1% 21% - 21% Q4 FY11 18% - 18% - 18% 38% -16% 22% - 22% Q1 FY12 17% - 17% - 17% 31% -10% 21% - 21% Q2 FY12 20% - 20% - 20% 36% 1% 37% -15% 22% Q3 FY12 23% - 23% -2% 21% 29% 5% 34% -16% 18% Q4 FY12 20% 1% 21% -3% 18% 18% 12% 30% -19% 11% Q1 FY13 22% - 22% -3% 19% 12% 11% 23% -22% 1% Q2 FY13 20% - 20% -2% 18% 11% 3% 14% -5% 9% Q3 FY13 15% - 15% - 15% 8% - 8% - 8% Q4 FY13 18% - 18% - 18% 3% -1% 2% - 2% Q1 FY14 14% 1% 15% - 15% 6% -4% 2% - 2% Q2 FY14 13% 1% 14% - 14% 1% -3% -2% - -2% Q3 FY14 2% 1% 3% - 3% -4% -3% -7% - -7% Q4 FY14 6% 1% 7% - 7% 50% -7% 43% -45% -2% Q1 FY15 8% - 8% - 8% 46% -1% 45% -44% 1% Q2 FY15 9% 1% 10% - 10% 30% 11% 41% -37% 4% Q3 FY15 14% 1% 15% - 15% 28% 16% 44% -39% 5% Q4 FY15 11% 1% 12% - 12% 16% 19% 35% -21% 14%

15 About Cimpress Cimpress N.V. (Nasdaq: CMPR) is the world leader in mass customization. For 20 years, the company has focused on developing software and manufacturing capabilities that transform traditional markets in order to make customized products accessible and affordable to everyone. Cimpress’ portfolio of brands includes Vistaprint, Albelli, Drukwerkdeal, Exaprint, Pixartprinting and others. That portfolio serves multiple customer segments across many applications for mass customization. The company produces more than 80 million unique products a year via its network of computer integrated manufacturing facilities. To learn more, visit www.cimpress.com. Cimpress and the Cimpress logo are trademarks of Cimpress N.V. or its subsidiaries. All other brand and product names appearing on this announcement may be trademarks or registered trademarks of their respective holders. Risks Related to Our Business This investor letter contains statements about our future expectations, plans, and prospects of our business that constitute forward- looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995, including but not limited to our expectations for the growth and development of our business and our acquired companies, our intrinsic value per share and returns to our shareholders, the development and success of our mass customization platform, our expected future investments in our business and acquisitions, and the anticipated results of our past and future investments and acquisitions, including but not limited to our discussion under the heading “Discretionary Growth Spending.” Forward-looking projections and expectations are inherently uncertain, are based on assumptions and judgments by management, and may turn out to be wrong. Our actual results may differ materially from those indicated by these forward-looking statements as a result of various important factors, including but not limited to flaws in the assumptions and judgments upon which our forecasts are based; our failure to execute our strategy; our inability to make the investments in our business that we plan to make or the failure of those investments to have the effects that we expect; our failure to manage the growth and complexity of our business and expand our operations; our failure to promote and strengthen our brands; our failure to develop our mass customization platform or to realize the anticipated benefits of such a platform; our failure to acquire new customers and enter new markets, retain our current customers, and sell more products to current and new customers; costs and disruptions caused by acquisitions and strategic investments; the failure of the businesses we acquire or invest in to perform as expected; the willingness of purchasers of marketing services and products to shop online; unanticipated changes in our markets, customers, or business; competitive pressures; our failure to maintain compliance with the covenants in our revolving credit facility and senior notes or to pay our debts when due; changes in the laws and regulations or in the interpretations of laws or regulations to which we are subject, including tax laws, or the institution of new laws or regulations that affect our business; general economic conditions; and other factors described in our Form 10-Q for the fiscal quarter ended March 31, 2015 and the other documents we periodically file with the U.S. Securities and Exchange Commission. In addition, the statements and projections in this press release represent our expectations and beliefs as of the date of this press release, and subsequent events and developments may cause these expectations, beliefs, and projections to change. We specifically disclaim any obligation to update any forward-looking statements. These forward-looking statements should not be relied upon as representing our expectations or beliefs as of any date subsequent to the date of this press release.