This document is Cimpress’ fourth quarter and fiscal year 2017 earnings commentary. This document contains slides and accompanying comments in the “notes” section below each slide. 1Cimpress N.V. Q4 FY2017 Earnings Presentation

Please read the above safe harbor statement. Additionally, a detailed reconciliation of GAAP and non-GAAP measures is posted in the appendix of the Q4 and fiscal 2017 earnings presentation that accompanies these remarks. 2Cimpress N.V. Q4 FY2017 Earnings Presentation

This presentation is organized into the categories shown on the left-hand side of this slide. Robert Keane, CEO, and Sean Quinn, CFO, will host a live question and answer conference call tomorrow, July 27, 2017 at 7:30 a.m. U.S. Eastern daylight time which you can access through a link at ir.cimpress.com. Please note that starting with our first quarter fiscal year 2018 results, we will be reporting our quarterly earnings results one week later than we have historically. 3Cimpress N.V. Q4 FY2017 Earnings Presentation

As a reminder and as context for the initiatives and examples discussed in the remainder of this presentation, Cimpress' uppermost priorities are described above. Extending our history of success into the next decade and beyond in line with these top-level priorities is important to us. Even as we report results on a quarterly basis it is important for investors to understand that we manage to a much longer-term time horizon and that we explicitly forgo short-term actions and metrics except to the extent those short-term actions and metrics support our long- term goals. 4Cimpress N.V. Q4 FY2017 Earnings Presentation

We delivered another year of strong revenue growth, due to organic growth and acquisitions. Our compound annual growth rate from our IPO in fiscal 2006 to 2017 has been 27%. Our long history of the organic portion of our revenue growth reflects our success to date in disrupting markets via mass customization. As proud as we are of this track record, we continue to believe we are in the early stages of this market transformation, and our overall revenue share is small compared to the large, hyper-fragmented global market for mass customized products. 5Cimpress N.V. Q4 FY2017 Earnings Presentation

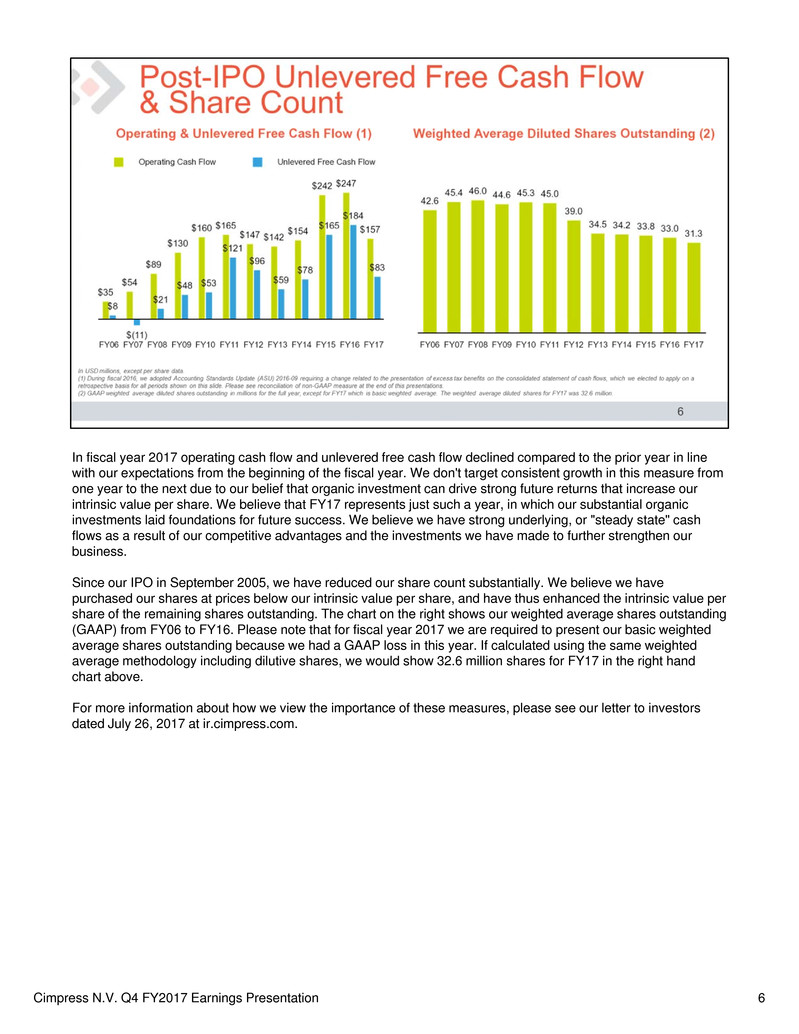

In fiscal year 2017 operating cash flow and unlevered free cash flow declined compared to the prior year in line with our expectations from the beginning of the fiscal year. We don't target consistent growth in this measure from one year to the next due to our belief that organic investment can drive strong future returns that increase our intrinsic value per share. We believe that FY17 represents just such a year, in which our substantial organic investments laid foundations for future success. We believe we have strong underlying, or "steady state" cash flows as a result of our competitive advantages and the investments we have made to further strengthen our business. Since our IPO in September 2005, we have reduced our share count substantially. We believe we have purchased our shares at prices below our intrinsic value per share, and have thus enhanced the intrinsic value per share of the remaining shares outstanding. The chart on the right shows our weighted average shares outstanding (GAAP) from FY06 to FY16. Please note that for fiscal year 2017 we are required to present our basic weighted average shares outstanding because we had a GAAP loss in this year. If calculated using the same weighted average methodology including dilutive shares, we would show 32.6 million shares for FY17 in the right hand chart above. For more information about how we view the importance of these measures, please see our letter to investors dated July 26, 2017 at ir.cimpress.com. 6Cimpress N.V. Q4 FY2017 Earnings Presentation

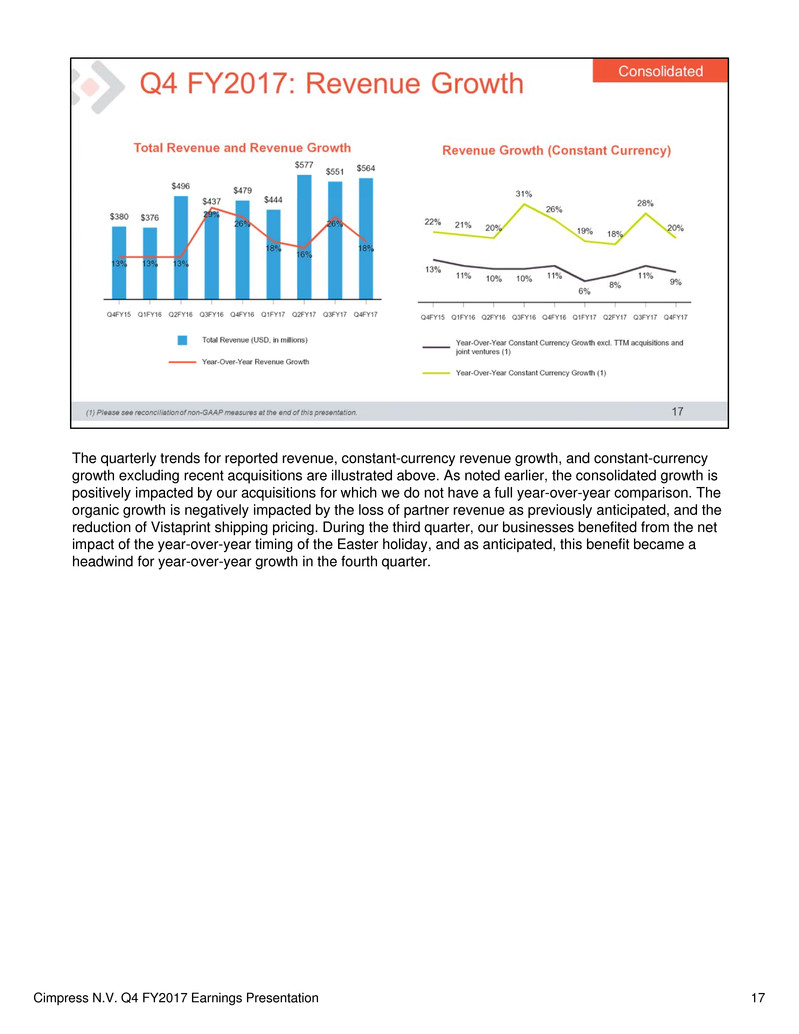

Total revenue for the fourth quarter was $564.3 million, reflecting an 18% increase year over year in USD and a 20% increase in constant currencies. Excluding the revenue from the addition of our acquisitions in the past four quarters, constant-currency revenue growth was 9%. Our fourth quarter consolidated constant currency revenue growth decelerated versus growth in the third quarter in line with expectations, primarily as a result of the year- over-year timing of the Easter holiday. Our year-over-year revenue growth continued to be negatively impacted by the loss of partner revenue as previously anticipated although to a lesser extent than prior quarters in this fiscal year, and by the reduction of Vistaprint shipping pricing which we have described in the past. Our Q4 GAAP operating income declined significantly year over year with headwinds from planned increases in organic investment spend, an increase in the earn-out liability for the WIRmachenDRUCK acquisition resulting from its continued strong performance, increased share-based compensation including acquisition-related costs in the quarter, the loss of certain partner revenue and profits previously described, and unfavorable changes in currency that were offset by year-over-year changes in realized gains on our hedging program presented in other income, net. These impacts were partially offset by net restructuring savings from our previously announced actions. Our Q4 adjusted NOPAT was influenced by many of the same trends in operating income but the year- over-year decline was less pronounced since the earn-out impact and the acquisition-related share-based compensation costs are excluded from adjusted NOPAT and realized gains from our hedging program are included in adjusted NOPAT. For the full year, our operating income declined predominantly due to the same items described above for the quarter except for the commentary on our restructuring where, for the full year, the savings we realized only partially offset the restructuring charges. The decline in operating income was partially offset by a reduction in impairment charges. Please see additional detail later in this presentation for the drivers of our GAAP operating and net income. 7Cimpress N.V. Q4 FY2017 Earnings Presentation

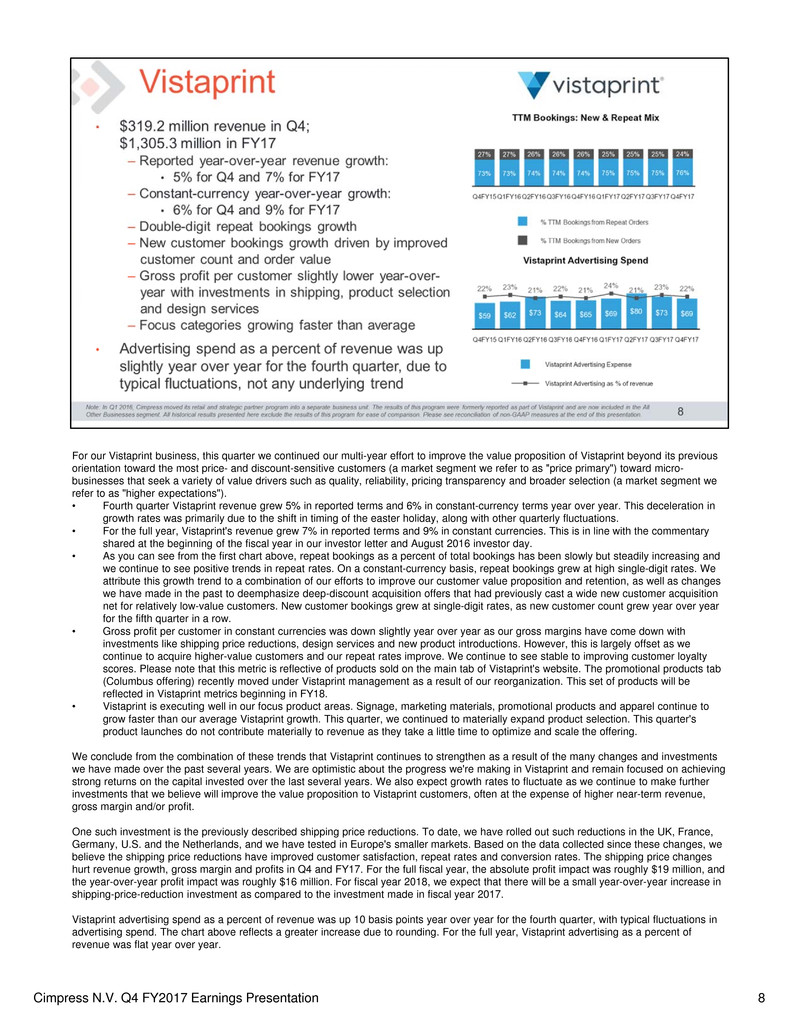

For our Vistaprint business, this quarter we continued our multi-year effort to improve the value proposition of Vistaprint beyond its previous orientation toward the most price- and discount-sensitive customers (a market segment we refer to as "price primary") toward micro- businesses that seek a variety of value drivers such as quality, reliability, pricing transparency and broader selection (a market segment we refer to as "higher expectations"). • Fourth quarter Vistaprint revenue grew 5% in reported terms and 6% in constant-currency terms year over year. This deceleration in growth rates was primarily due to the shift in timing of the easter holiday, along with other quarterly fluctuations. • For the full year, Vistaprint's revenue grew 7% in reported terms and 9% in constant currencies. This is in line with the commentary shared at the beginning of the fiscal year in our investor letter and August 2016 investor day. • As you can see from the first chart above, repeat bookings as a percent of total bookings has been slowly but steadily increasing and we continue to see positive trends in repeat rates. On a constant-currency basis, repeat bookings grew at high single-digit rates. We attribute this growth trend to a combination of our efforts to improve our customer value proposition and retention, as well as changes we have made in the past to deemphasize deep-discount acquisition offers that had previously cast a wide new customer acquisition net for relatively low-value customers. New customer bookings grew at single-digit rates, as new customer count grew year over year for the fifth quarter in a row. • Gross profit per customer in constant currencies was down slightly year over year as our gross margins have come down with investments like shipping price reductions, design services and new product introductions. However, this is largely offset as we continue to acquire higher-value customers and our repeat rates improve. We continue to see stable to improving customer loyalty scores. Please note that this metric is reflective of products sold on the main tab of Vistaprint's website. The promotional products tab (Columbus offering) recently moved under Vistaprint management as a result of our reorganization. This set of products will be reflected in Vistaprint metrics beginning in FY18. • Vistaprint is executing well in our focus product areas. Signage, marketing materials, promotional products and apparel continue to grow faster than our average Vistaprint growth. This quarter, we continued to materially expand product selection. This quarter's product launches do not contribute materially to revenue as they take a little time to optimize and scale the offering. We conclude from the combination of these trends that Vistaprint continues to strengthen as a result of the many changes and investments we have made over the past several years. We are optimistic about the progress we're making in Vistaprint and remain focused on achieving strong returns on the capital invested over the last several years. We also expect growth rates to fluctuate as we continue to make further investments that we believe will improve the value proposition to Vistaprint customers, often at the expense of higher near-term revenue, gross margin and/or profit. One such investment is the previously described shipping price reductions. To date, we have rolled out such reductions in the UK, France, Germany, U.S. and the Netherlands, and we have tested in Europe's smaller markets. Based on the data collected since these changes, we believe the shipping price reductions have improved customer satisfaction, repeat rates and conversion rates. The shipping price changes hurt revenue growth, gross margin and profits in Q4 and FY17. For the full fiscal year, the absolute profit impact was roughly $19 million, and the year-over-year profit impact was roughly $16 million. For fiscal year 2018, we expect that there will be a small year-over-year increase in shipping-price-reduction investment as compared to the investment made in fiscal year 2017. Vistaprint advertising spend as a percent of revenue was up 10 basis points year over year for the fourth quarter, with typical fluctuations in advertising spend. The chart above reflects a greater increase due to rounding. For the full year, Vistaprint advertising as a percent of revenue was flat year over year. 8Cimpress N.V. Q4 FY2017 Earnings Presentation

Our Upload and Print segment met our expectations during the year and fourth quarter. • Q4 segment revenue grew 11% in reported terms and 14% in constant currencies. Our growth in constant currencies has moderated as we passed the anniversary of some of the slower-growing acquisitions, and we also have seen some moderation in the growth rates of prior-year acquisitions, as generally expected. The shift in timing of the easter holiday also weighed on growth rates this quarter as previously described. We remain confident in our ability to drive strong returns in this segment overall. • For the full year, revenue in this segment grew 13% in constant currencies excluding acquisitions for all periods for which there was not a full year-over-year comparison. Inclusive of M&A in the past year, segment revenue grew 36% in reported terms and 39% in constant currencies. • As a reminder, Q4 was the first quarter that WIRmachenDRUCK results were included in the organic number. The performance across the Upload and Print group varies, with some businesses performing above the expectations built into the original deal models, some performing in line, and two for which we have reset expectations and therefore impaired in previous periods. To date the aggregate free cash flow of the full portfolio of Upload and Print businesses has exceeded our aggregate deal model plans, and we expect it to continue to do so in the future. 9Cimpress N.V. Q4 FY2017 Earnings Presentation

As previously announced, the National Pen acquisition closed on December 30, 2016. Revenue during the fourth quarter was $53.9 million. We did not own this business in the year-ago period. On a pro forma basis, revenue declined 5% year-over-year in US dollars, and 2% in constant currencies. National Pen discontinued a small portion of its business before the acquisition closed, which had a negative impact on revenue growth the past two quarters. Adjusting for the discontinued operations, revenue grew 1% in constant currencies year over year. For the six months we have owned National Pen, revenue declined 6% in US dollars, 4% in constant currencies including the discontinued operations, and 1% in constant currencies excluding the discontinued operations. We expect National Pen's revenue growth to be suppressed in the near term as the management team has made changes to its marketing team and approach, which we believe are the right value-creating economic decisions even though they hurt near-term revenue growth. In this second quarter of ownership, we kept National Pen focused on delivering against its plan and the financial results in our deal model. As noted on our February 2, 2017 webcast regarding National Pen, there are a few targeted areas where synergies are straightforward and compelling enough to act on quickly, for example, in the area of shipping expenses. We have made good progress against these goals, and we expect to share more details at our upcoming investor day on August 8, 2017. As described last quarter, some of the near and longer-term revenue and cost synergies we expect from this acquisition will enhance our financial results in other segments. As an example, revenue from National Pen products sold by Vistaprint and our Upload and Print businesses will be reported in those respective segments. 10Cimpress N.V. Q4 FY2017 Earnings Presentation

Our All Other Businesses segment includes Albumprinter, Most of World businesses in Japan, India, Brazil and China, and our Corporate Solutions business, which is focused on partnerships with third- party merchants and mid-sized businesses. For the fourth quarter, segment revenue grew 6% in reported terms and 7% in constant currencies after five consecutive quarters of constant-currency revenue declines. For the full year, revenue for this segment decreased 7% in both reported terms and in constant currencies. As described previously, two meaningful partnerships ended in FY16 (one in Corporate Solutions business and one in Albumprinter) and drove the year-over-year revenue decline in this segment for the full year. The fourth quarter impact was not as pronounced, which allowed underlying growth in other parts of this segment to start to show. We will not have any further headwinds from the loss of these two partners as we have passed the anniversary of each partner loss. Corporate Solutions continues to build foundations for new growth opportunities and remains early in this process. The Most of World businesses continue strong growth off a relatively small base. Our objective in both of these young businesses remains the same: to build foundations for the long term in these large and heterogeneous markets. In both of these businesses we continue to operate at a significant operating loss as previously described and as planned, and expect to continue to do so in the next several years. Cimpress has recently entered into a definitive agreement to divest its Albumprinter business. Please refer to slide 14 for further discussion. 11Cimpress N.V. Q4 FY2017 Earnings Presentation

Our Cimpress Technology team continues to build and deploy our mass customization platform (MCP), which is a growing set of software services and standards that deliver business and customer functionality to our various businesses. The objective of MCP is to build, over time, a large collection of services that: • Increase selection (i.e., the breadth and depth of delivery speed options, substrate choices, product formats, special finishes, etc. which we offer to our customers) • Improve conformance (i.e., the degree to which we deliver products to customers as specified, on time) • Reduce cost (i.e., the total cost of delivering any given selection in conformance with specification) • Enhance the quality of customer experience As part of its review of the evolution of our overall strategy, our letter to investors dated July 26, 2017 describes in more detail the current priorities and objectives we have for the mass customization platform. In short, as part of our decentralization, we narrowed the organizational focus of the central team dedicated to the development of our platform, moving many team members that were previously part of the central MCP team into businesses where they can better respond to customer needs. The team that remains central is focused purely on technology and standards, and continues to make steady progress against our plans. We remain early in the journey toward our vision for MCP, but we are encouraged by the steady progress we are making. We will provide examples of recent successes and areas of future MCP investment in our investor day on August 8, 2017. 12Cimpress N.V. Q4 FY2017 Earnings Presentation

Please note the following in regard to adjusted Net Operating Profit (NOP) by segment: • Year-over-year currency fluctuations have an impact on these numbers, especially since we do not allocate the gains from hedging contracts to the segment level like we do for consolidated adjusted NOPAT. These gains were material for this fiscal year. • In Q3 2017, our reorganization to decentralize our business resulted in a change in the classification of many costs that were previously part of corporate or central technology teams. Our reorganization has significantly improved the cross-segment comparability of these numbers and as of Q3 2017, we have recast prior-period results to reflect the transfer of these costs. The Vistaprint business was the primary recipient of these cost centers, though there were smaller changes in other segments. In April we published a document on ir.cimpress.com which shows these changes going back to Q1 2015 for convenience in updating your models. The numbers on the slide above show adjusted NOP by segment post reorganization. • Please note that the by-segment NOP remains only our best approximation. We expect to continue to refine operating unit reporting over the coming year as our post-reorganization operating routines and reporting systems are further developed and improved. This may necessitate some changes in the allocation of costs. The performance of each segment was broadly in line with our expectations. Q4 adjusted Net Operating Profit by segment is as follows: • Vistaprint: down by $10.5 million year over year primarily due to the roll-out of planned investments including shipping price reductions, expanded design services and new product introduction, which account for much of the profit drag year over year. These negative impacts were partly offset by savings from our recent reorganization for teams that were moved into Vistaprint. Adjusted NOP margin decreased from 16% to 12% year over year. New product and service introductions carry both start-up costs, as well as a mix shift toward lower-than-average gross margin products. We see opportunity to learn and optimize related costs as we begin to scale these offerings over time. • Upload and Print: up by $2.7 million year over year due to improved profits in several businesses, partially offset by increased investments in group management, technology, and marketing. Adjusted NOP margin for this segment was flat year over year. • National Pen: adjusted NOP was $1.0 million, or 2% of revenue. We expect National Pen to continue its pre-acquisition seasonal profit pattern that means most profits are made in the December quarter. • All Other Businesses: up by $1.5 million year over year due primarily to Albumprinter profit growth. The year-over-year reduction of certain partner profits was approximately $1 million for the quarter, which is a smaller impact than in previous quarters. Adjusted NOP margin improved from (39)% to (31)% year over year. Q4 corporate and global functions expenses were up by $4.7 million year over year, primarily due to planned increases in software development resources, as well as the $3.9 million year-over-year accounting impact of our performance share units, which is booked centrally in our segment reporting. This was partially offset by lower ongoing operating costs in these functions as a result of the restructuring announced in January. For the full year, Adjusted Net Operating Profit by segment is as follows: • Vistaprint: down by $47.8 million year over year primarily due to planned increases in investments and negative currency impacts, as well as inefficient production during our second quarter as announced at the time. Adjusted NOP margin decreased year over year from 18% to 13%. • Upload and Print: up by $5.2 million year over year due to increased profits in multiple businesses, and a full year of profits from WIRmachenDRUCK, partially offset by increases in planned investments. Though adjusted NOP grew in absolute dollars, adjusted NOP margin decreased from 14% to 11% year over year. • National Pen: adjusted NOP was a loss of $2.2 million for the first six months of ownership. Adjusted NOP margin was (2)%. • All Other Businesses: down by $21.8 million year over year due primarily to a reduction of certain partner profits of approximately $18 million for the year, as well as increased planned investments in Corporate Solutions and Albumprinter. This was partially offset by a reduction in the net investment in our Most of World businesses. Adjusted NOP margin declined from (6)% to (24)% year over year. Full year corporate and global functions expenses were up by $20.2 million year over year, primarily due to planned increases in software development resources, as well as the $13.7 million year-over-year accounting impact of our performance share units, which is booked centrally in our segment reporting, partially offset by savings related to our recent restructuring in the back half of the year. As a percent of revenue, corporate and global functions expenses were 5% in FY17, the same as in FY16, despite the increased cost of our performance share units held centrally. 13Cimpress N.V. Q4 FY2017 Earnings Presentation

We recently entered into several agreements that impact our capital structure, balance sheet and/or financial results: • As announced via 8-K on July 14, 2017, subsequent to the end of the fourth quarter, we amended and increased our credit agreement for long-term flexibility. Our prior agreement was set to expire in 2019. The new credit facility is $1.045 billion (a $745 million revolving credit facility and a $300 million term loan), due July 2022. The key terms are listed on slide 22, mainly unchanged versus the previous agreement. • We have recently entered into a definitive agreement to divest our Albumprinter business, including its FotoKnudsen subsidiary. Although Albumprinter’s capabilities clearly fall within the sphere of mass customization, we believe we can more attractively invest the capital it will take out of the transaction. We expect the sale of Albumprinter to be completed in the first quarter of fiscal year 2018. The asset is "held for sale" on our balance sheet as of June 30, 2017. We expect to receive approximately €92 million of total cash proceeds from this divestiture during the quarter ending September 30, 2017, prior to any fees and pre-closing dividends. • In the quarter ending June 30, 2017 we signed a definitive agreement with two co-founders of Printi by which we deferred a previously agreed contractual call-right that would have otherwise increased our shareholding to 90% in the second half of fiscal year 2018. Under the revised agreement, we agreed to move to slightly more than 50% ownership in fiscal year 2018 and deferred a 100% ownership position to as late as 2023. As a result of the new agreement, the co-founders will remain as co-CEOs of Printi, whereas under the prior agreement they would most likely have left the company within a year of Cimpress moving to 90% ownership. We believe that retaining these highly talented leaders as co-owners will engage and motivate themselves and the Printi team in a way which will translate into greater returns to capital and greater customer value than if we had not forgone our right to increase our share to 90% of Printi next year. 14Cimpress N.V. Q4 FY2017 Earnings Presentation

For the past two years, Robert Keane has written a letter to investors describing our top level objectives, strategy, capital philosophy, plans and results. Today we published a new letter reporting our fiscal year 2017 investment spend and describing planned spending for fiscal year 2018. We strongly encourage you to read this document. It describes our strategy to achieve our uppermost objectives to be the world leader in mass customization and to maximize intrinsic value per share. It includes important detail that is not part of this earnings presentation or our earnings press release, including all of our forward-looking commentary about revenue growth expectations by reportable segment and our investment plans for fiscal year 2018. A significant portion of our upcoming investor day on August 8, 2017 will be spent reviewing these investments as well. 15Cimpress N.V. Q4 FY2017 Earnings Presentation

No notes here - transition slide 16Cimpress N.V. Q4 FY2017 Earnings Presentation

The quarterly trends for reported revenue, constant-currency revenue growth, and constant-currency growth excluding recent acquisitions are illustrated above. As noted earlier, the consolidated growth is positively impacted by our acquisitions for which we do not have a full year-over-year comparison. The organic growth is negatively impacted by the loss of partner revenue as previously anticipated, and the reduction of Vistaprint shipping pricing. During the third quarter, our businesses benefited from the net impact of the year-over-year timing of the Easter holiday, and as anticipated, this benefit became a headwind for year-over-year growth in the fourth quarter. 17Cimpress N.V. Q4 FY2017 Earnings Presentation

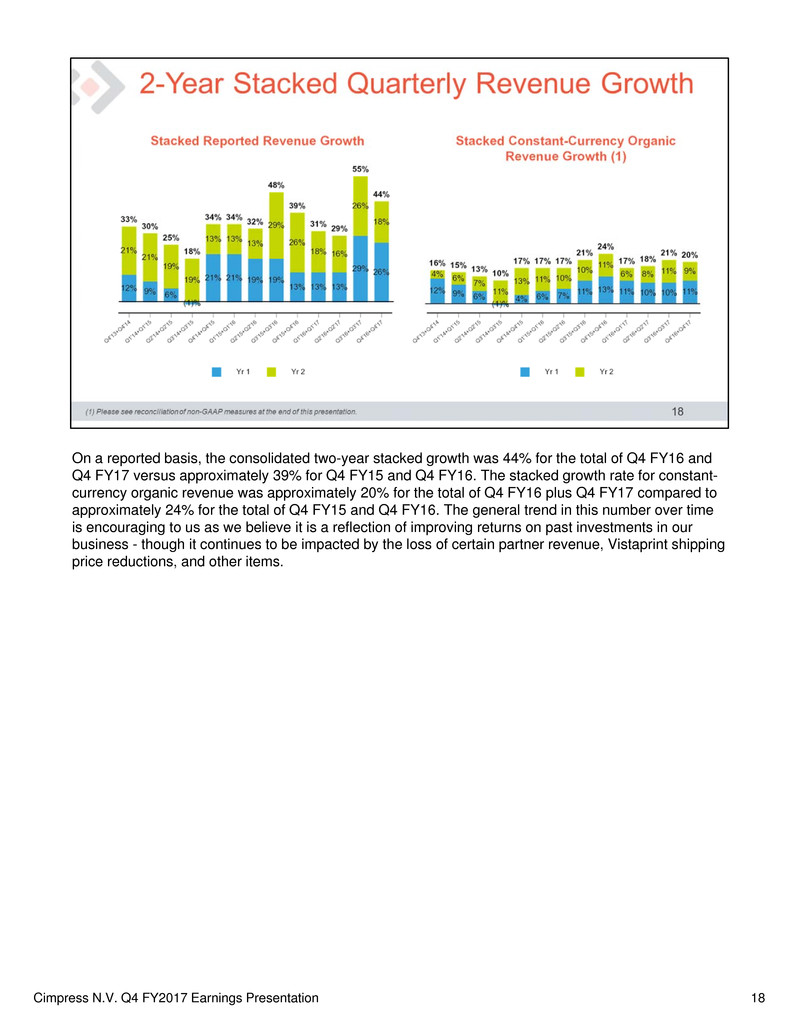

On a reported basis, the consolidated two-year stacked growth was 44% for the total of Q4 FY16 and Q4 FY17 versus approximately 39% for Q4 FY15 and Q4 FY16. The stacked growth rate for constant- currency organic revenue was approximately 20% for the total of Q4 FY16 plus Q4 FY17 compared to approximately 24% for the total of Q4 FY15 and Q4 FY16. The general trend in this number over time is encouraging to us as we believe it is a reflection of improving returns on past investments in our business - though it continues to be impacted by the loss of certain partner revenue, Vistaprint shipping price reductions, and other items. 18Cimpress N.V. Q4 FY2017 Earnings Presentation

The quarterly trends for various measures of income and profit are illustrated above. For the past several years, up until and including fiscal year 2017, adjusted NOPAT was the measure that we used to assess our near-term financial performance relative to near-term budgets. Internally, we have changed the primary financial metric that we use to set our annual budgets from adjusted NOPAT to unlevered free cash flow ("UFCF"). In our external reporting, we will no longer provide adjusted NOPAT on a consolidated basis; however, our primary measure of profitability will continue to be adjusted net operation profit as we use for our segments today. The following year-over-year items negatively influenced GAAP operating income in the fourth quarter and full year: • Increased organic investments in fiscal year 2017 compared to fiscal year 2016, which materially weigh on profitability. These investments include costs that impact our gross profit such as shipping price reductions, expanded design services, and new product introductions. For the full year, the increase in organic investments impacted operating income by $45 million. • Restructuring charges related to the reorganization announced on January 25, 2017. The year-over-year increase was $0.8 million for the fourth quarter and $26.3 million for the full year. In our full-year results, the savings we realized from the restructuring partially offset the restructuring charges. • A year-over-year increase in acquisition-related charges as follows: First, earn-out related charges primarily associated with the prior year acquisition of WIRmachenDRUCK of $10.5 million for the fourth quarter and $34.0 million for the full year. This increase brings the fair value of the earn-out to the maximum amount of €40 million, with a small time-based discount. Second, an increase in acquisition-related amortization of intangible assets of $2.2 million for the quarter and $5.6 million for the year. Finally, the acceleration of the vesting of equity awards from two unrelated acquisition-related employment contracts led to a year-over-year increase in share-based compensation costs of $3.4 million in the fourth quarter and $4.8 million for the full-year. The full- year acquisition-related impacts are partially offset by a year-over year decrease in impairment charges of $21.3 million related to acquisitions. • An increase in share-based compensation expense due to the implementation of our previously described long-term incentive program at the beginning of fiscal year 2017. The year-over-year increase was $3.9 million for the fourth quarter and $13.7 million for the full year, excluding share-based compensation related to restructuring and acquisition-related investment consideration, which are included in the respective impacts listed above. • A profit decline due to the termination of two partner contracts as previously described. The year-over-year impact of this was approximately $1 million for the fourth quarter, and $18 million for the full year. • Unfavorable year-over-year currency fluctuations that were offset below the line by year-over-year changes in realized gains from hedging contracts in other income, net. The profit impacts described above that also impact adjusted NOPAT are the increased organic investments, the increase in share-based compensation related to our new long-term incentive program, and the reduction in partner profits. Because the restructuring charges are excluded from adjusted NOPAT, there is a positive impact from restructuring savings during the quarter and year. Cash taxes attributable to the current year were relatively flat year over year for the quarter and year. In the year and the quarter, the following below-the-line non-operational items also influenced our GAAP net income: Our "Other income (expense), net" was a net gain of $10.4 million for the full year and a net loss of $11.5 million for the quarter. • The vast majority of this was currency related. Please see the next slide for a detailed explanation of the underlying currency drivers. "Total interest expense, net" was $44 million for the full year and $12.9 million in the quarter. • The accounting treatment of our leased office facility in Massachusetts results in a portion of the lease payments flowing through our interest expense line. These expenses replace those of the lease from our former leased facility at a similar total expense, but the former lease was 100% booked in operating expenses. The new lease payments started in September 2015, so we have passed the anniversary of this different accounting treatment, and there is no longer a year-over-year impact (the cost was $1.9 million in Q4 FY17 and $2.0 million in Q4 FY16). We include this lease-related interest expense in our adjusted NOPAT calculation. • The remaining portion of $11.0 million in the quarter is primarily related to our Senior Unsecured Notes and borrowings under our credit facility. 19Cimpress N.V. Q4 FY2017 Earnings Presentation

Below is additional color on the impact of currency movements on our P&L this quarter. First, the currency impacts that affect both GAAP results and adjusted NOPAT: • Our year-over-year revenue growth rate expressed in USD was negatively impacted by about 200 basis points for both the fourth quarter and full year. Our largest currency exposure for revenue is the Euro, though the significant movement in the British Pound year over year is the major driver of the currency impact. • There are many natural expense offsets in our business, and therefore the net currency exposure to our bottom line is less pronounced than it is to revenue. • For certain currencies where we do have a net exposure because revenue and certain costs are not well matched, we enter into currency derivative contracts to hedge the risk. Realized gains or losses from these hedges are recorded in Other income (expense), net and offset some of the impact of currency elsewhere in our P&L. The realized gain on hedging contracts was $3.2 million for the fourth quarter and $16.5 million for the full year. Second, the currency impacts that further impact our GAAP results but that are excluded from our adjusted NOPAT are: • Other net currency losses of approximately $15 million for the fourth quarter and approximately $10 million for the full year, primarily related to unrealized non-cash net losses on intercompany loans and currency hedges. 20Cimpress N.V. Q4 FY2017 Earnings Presentation

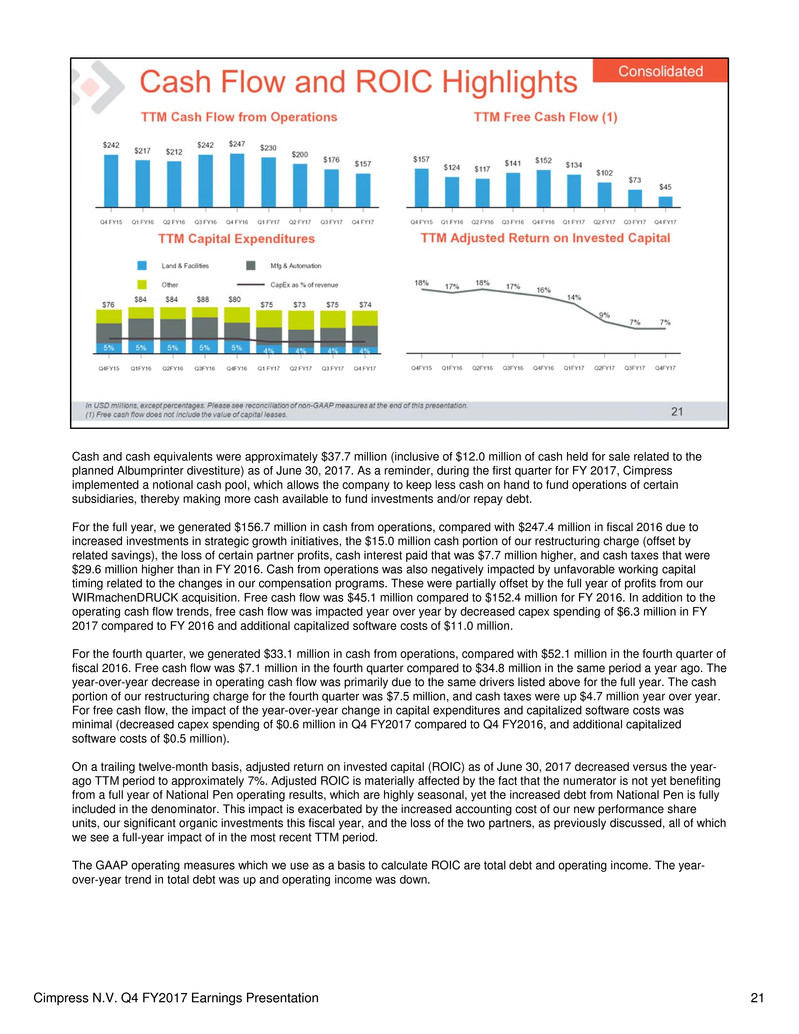

Cash and cash equivalents were approximately $37.7 million (inclusive of $12.0 million of cash held for sale related to the planned Albumprinter divestiture) as of June 30, 2017. As a reminder, during the first quarter for FY 2017, Cimpress implemented a notional cash pool, which allows the company to keep less cash on hand to fund operations of certain subsidiaries, thereby making more cash available to fund investments and/or repay debt. For the full year, we generated $156.7 million in cash from operations, compared with $247.4 million in fiscal 2016 due to increased investments in strategic growth initiatives, the $15.0 million cash portion of our restructuring charge (offset by related savings), the loss of certain partner profits, cash interest paid that was $7.7 million higher, and cash taxes that were $29.6 million higher than in FY 2016. Cash from operations was also negatively impacted by unfavorable working capital timing related to the changes in our compensation programs. These were partially offset by the full year of profits from our WIRmachenDRUCK acquisition. Free cash flow was $45.1 million compared to $152.4 million for FY 2016. In addition to the operating cash flow trends, free cash flow was impacted year over year by decreased capex spending of $6.3 million in FY 2017 compared to FY 2016 and additional capitalized software costs of $11.0 million. For the fourth quarter, we generated $33.1 million in cash from operations, compared with $52.1 million in the fourth quarter of fiscal 2016. Free cash flow was $7.1 million in the fourth quarter compared to $34.8 million in the same period a year ago. The year-over-year decrease in operating cash flow was primarily due to the same drivers listed above for the full year. The cash portion of our restructuring charge for the fourth quarter was $7.5 million, and cash taxes were up $4.7 million year over year. For free cash flow, the impact of the year-over-year change in capital expenditures and capitalized software costs was minimal (decreased capex spending of $0.6 million in Q4 FY2017 compared to Q4 FY2016, and additional capitalized software costs of $0.5 million). On a trailing twelve-month basis, adjusted return on invested capital (ROIC) as of June 30, 2017 decreased versus the year- ago TTM period to approximately 7%. Adjusted ROIC is materially affected by the fact that the numerator is not yet benefiting from a full year of National Pen operating results, which are highly seasonal, yet the increased debt from National Pen is fully included in the denominator. This impact is exacerbated by the increased accounting cost of our new performance share units, our significant organic investments this fiscal year, and the loss of the two partners, as previously discussed, all of which we see a full-year impact of in the most recent TTM period. The GAAP operating measures which we use as a basis to calculate ROIC are total debt and operating income. The year- over-year trend in total debt was up and operating income was down. 21Cimpress N.V. Q4 FY2017 Earnings Presentation

We provide commentary on EBITDA for our debt investors. Please note that we do not manage our overall business performance to EBITDA; however, we actively monitor it for purposes of ensuring compliance with debt covenants. Based on our debt covenant definitions, our total leverage ratio was 3.45 as of June 30, 2017, and our senior secured leverage ratio (which is senior secured debt to trailing twelve month EBITDA) was 2.38. Our debt covenants give pro forma effect for acquired businesses that closed within the trailing twelve month period ending June 30, 2017. As often described, we are willing to temporarily go above our long-term total leverage ratio target of 3x TTM EBITDA for the right opportunity and with a path to de-lever below that target within a reasonable period of time. We continue to expect to manage our leverage back to approximately 3x TTM EBITDA or below by the end of calendar 2017, and we made some progress on that front in the fourth quarter compared to the third quarter. We anticipate that when our divestiture of Albumprinter closes in the first quarter of FY 2018, we will put a substantial portion of the net proceeds toward debt repayment. As announced via 8-K on July 14, 2017, subsequent to the end of the quarter, we amended and increased our credit agreement for long- term flexibility. Our prior agreement was set to expire in 2019. The new credit facility is $1.045 billion (a $745 million revolving credit facility and a $300 million term loan), due July 2022. The key terms are listed below, mainly unchanged versus the previous agreement. When including all acquired company EBITDA only as of the dates of acquisition, our adjusted EBITDA for Q4 FY2017 was $59.2 million, up 1.0% from Q4 FY2016 and our TTM adjusted EBITDA was $238.4 million, down 16.0% from the year-ago TTM period. This compares to the trends in operating income discussed on slide 19, in which increased organic investments are weighing down profitability this year. In addition to the exclusion of depreciation and amortization (including acquisition-related amortization of intangible assets) which was up significantly year over year in the TTM period, the TTM EBITDA metrics exclude goodwill and other impairment charges, restructuring charges, as well as the share-based compensation costs that are included in our TTM GAAP operating income. During the quarter, we did not repurchase any Cimpress shares. During the full year, we repurchased 593,763 Cimpress shares for $50.0 million inclusive of transaction costs, at an average price per share of $84.22. We have various covenants that prevent us from borrowing up to the maximum size of the credit facility as of June 30, 2017. Purchases of our ordinary shares, payments of dividends, and corporate acquisitions and dispositions are subject to more restrictive consolidated leverage ratio thresholds than our financial covenants when calculated on a pro forma basis in certain scenarios. Also, regardless of our leverage ratio, the credit agreement limits the amount of purchases of our ordinary shares, payments of dividends, corporate acquisitions and dispositions, investments in joint ventures or minority interests, and consolidated capital expenditures that we may make. These limitations can include annual limits that vary from year to year and aggregate limits over the term of the credit facility. Therefore, our ability to make desired investments may be limited during the term of our credit facility. We are currently in compliance with all of our debt covenants. Key financial covenants pertaining to our senior secured credit facility are: • Total leverage ratio not to exceed 4.5x TTM EBITDA (this steps up temporarily to 4.75x for 12 months after a material acquisition) • Senior leverage ratio not to exceed 3.25x TTM EBITDA (this steps up temporarily to 3.5x for 12 months after a material acquisition) • Interest coverage ratio of at least 3.0x TTM EBITDA 22Cimpress N.V. Q4 FY2017 Earnings Presentation

In summary, FY17 was a strong year for the reasons outlined above. We believe the capital we are allocating across our business and the organizational and strategic changes we have implemented in fiscal year 2017 are solidifying our leadership position in mass customization and continuing to increase our intrinsic value per share. At our investor day on August 8, 2017, we plan to share more details about the progress we've made in fiscal 2017, as well as our plans for fiscal 2018. We hope you will be able to attend in person or via webcast. 23Cimpress N.V. Q4 FY2017 Earnings Presentation

Cimpress N.V. Q4 FY2017 Earnings Presentation Q&A Session Please go to ir.cimpress.com for the live Q&A call at 7:30 am EST on July 27, 2017 Q4 & Fiscal Year 2017 Financial and Operating Results Supplement

Cimpress N.V. Q4 FY2017 Earnings Presentation 26(1) Please see non-GAAP reconciliation to reported revenue growth rates at the end of this presentation. Revenue Growth Rates Consolidated FY15 FY16 FY17 Consolidated, constant-currency growth 23% 24% 21% Constant-currency growth excluding TTM Acquisitions 9% 11% 8% 27 Reported Revenue by Segment Quarterly, USD in millions Q4 FY2017 Vistaprint 57% of total revenue 5% y/y growth 6% y/y constant currency growth Upload and Print 29% of total revenue 11% y/y growth 14% y/y constant currency growth National Pen 9% of total revenue 100% y/y growth 100% y/y constant currency growth All Other Businesses 5% of total revenue 6% y/y growth 7% y/y constant currency growth (1) For a description of acquisition and joint ventures that are excluded from constant currency growth, please see reconciliation to reported revenue growth rates at the end of this presentation. $576.9

Cimpress N.V. Q4 FY2017 Earnings Presentation 28 Reported Revenue Growth (1) National Pen was acquired on December 30, 2016, and therefore reported revenue growth cannot be calculated as a percentage since we did not own this business in the year-ago period. 29 Organic Constant Currency Revenue Growth (excl. TTM acquisitions) N/A N/A (1) National Pen was acquired on December 30, 2016, and therefore organic constant currency revenue growth cannot be calculated as a percentage since we did not own this business in the year-ago period.

Cimpress N.V. Q4 FY2017 Earnings Presentation 30 Quarterly, USD in millions Share-Based Compensation Note: Share-based compensation excludes SBC-related tax adjustment. Q4 FY17 includes incremental expense for the accelerated vesting of the Printi shares due to current period amendment to the arrangement. In Q3FY17 there was a $6.3M acceleration of share-based compensation expense related to our restructuring activities undertaken in that period. Q1 FY17 includes modification expense related to the RSA granted as part of the Tradeprint acquisition. Starting in Q1 FY17 results include the effect of our new shareholder-approved LTI program which includes performance share units which have a different accounting treatment than restricted share units. Consolidated FY15 $24.1 FY16 $23.8 FY17 $48.6 31 Balance Sheet Highlights Balance sheet highlights, USD in millions, at period end 6/30/2016 9/30/2016 12/31/2016 3/31/2017 6/30/2017 Total assets $1,463.9 $1,456.3 $1,663.9 $1,637.9 $1,679.9 Cash and cash equivalents $77.4 $53.6 $49.6 $43.5 $25.7 Total current assets $200.8 $175.2 $242.0 $216.8 $246.0 Property, plant and equipment, net $493.2 $495.2 $505.3 $513.1 $511.9 Goodwill and intangible assets $683.0 $680.2 $821.5 $796.1 $790.9 Total liabilities $1,232.5 $1,243.9 $1,522.3 $1,510.6 $1,559.2 Current liabilities $335.9 $331.7 $436.0 $429.5 $449.5 Long-term debt $656.8 $654.3 $830.0 $860.2 $847.7 Shareholders’ Equity attributable to Cimpress NV $165.7 $147.2 $99.5 $84.4 $75.0 Treasury shares (in millions) 12.5 12.4 13.0 12.9 12.7 Consolidated Note: June 30, 2017 cash and cash equivalents excludes $12.0M of cash classified as part of "held for sale"

Cimpress N.V. Q4 FY2017 Earnings Presentation Appendix Including a Reconciliation of GAAP to Non-GAAP Financial Measures 33 About Non-GAAP Financial Measures • To supplement Cimpress' consolidated financial statements presented in accordance with U.S. generally accepted accounting principles, or GAAP, Cimpress has used the following measures defined as non-GAAP financial measures by Securities and Exchange Commission, or SEC, rules: adjusted EBITDA, free cash flow, unlevered free cash flow, trailing twelve month return on invested capital, adjusted NOPAT, constant-currency revenue growth and constant-currency revenue growth excluding revenue from acquisitions and joint ventures from the past twelve months. Please see the next two slides for definitions of these items. • These non-GAAP financial measures are provided to enhance investors' understanding of our current operating results from the underlying and ongoing business for the same reasons they are used by management. For example, as we have become more acquisitive over recent years we believe excluding the costs related to the purchase of a business (such as amortization of acquired intangible assets, contingent consideration, or impairment of goodwill) provides further insight into the performance of the underlying acquired business in addition to that provided by our GAAP operating income. As another example, as we do not apply hedge accounting for our currency forward contracts, we believe inclusion of realized gains and losses on these contracts that are intended to be matched against operational currency fluctuations provides further insight into our operating performance in addition to that provided by our GAAP operating income. We do not, nor do we suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. • For more information on these non-GAAP financial measures, please see the tables captioned “Reconciliations of Non-GAAP Financial Measures” included at the end of this release. The tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliation between these financial measures.

Cimpress N.V. Q4 FY2017 Earnings Presentation 34 Non-GAAP Financial Measures Definitions Non-GAAP Measure Definition Free Cash Flow FCF = Cash flow from operations – capital expenditures – purchases of intangible assets not related to acquisitions – capitalized software expenses + payment of contingent consideration in excess of acquisition-date fair value + gains on proceeds from insurance Unlevered Free Cash Flow Unlevered Free Cash Flow = Free Cash Flow as defined above + cash paid during the period for interest - interest expense associated with Waltham lease Adjusted Net Operating Profit After Tax (Adjusted NOPAT) Adjusted NOPAT = GAAP operating income - cash taxes attributable to the current period (see definition below) + the impact of M&A related items including acquisition-related amortization and depreciation, the change in fair value of contingent consideration, and expense for deferred payments or equity awards that are treated as compensation expense + the impact of unusual items such asdiscontinued operations, restructuring related charges, and impairments - interest expense related to our Waltham office lease + realized gains or losses from currency derivatives that are not included in operating income as we do not apply hedge accounting Cash Taxes Attributable to the Current Period included in Adjusted NOPAT As part of our calculation of adjusted NOPAT, we subtract the cash taxes attributable to the current period operations, which we define as the actual cash taxes paid or to be paid adjusted for any non-operational items and excluding the excess tax benefit from equity awards. Adjusted NOP by Segment (1) Adjusted Net Operating Profit as defined above in adjusted NOPAT definition, less cash taxes and realized gains/losses from currency derivatives which are not allocated to segments. Trailing Twelve Month Return on Invested Capital ROIC = adjusted NOPAT / (debt + redeemable non-controlling interest + total shareholders equity – excess cash)Adjusted NOPAT is defined above.Excess cash is cash and equivalents > 5% of last twelve month revenues; if negative, capped at zeroOperating leases have not been converted to debt Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) Adjusted EBITDA = Operating Income + depreciation and amortization (excluding depreciation and amortization related to our Waltham office lease) + share-based compensation expense + proceeds from insurance + earn-out related charges + certain impairments + restructuring related charges + realized gains or losses on currency derivatives - interest expense related to our Waltham office lease Constant-Currency Revenue Growth Constant-currency revenue growth is estimated by translating all non-U.S. dollar denominated revenue generated in the current period using the prior year period’s average exchange rate for each currency to the U.S. dollar Constant Currency Revenue Growth, excluding TTM Acquisitions Constant-currency revenue growth excluding revenue from trailing twelve month acquisitions excludes the impact of currency as defined above and revenue from acquisitions for which there is not a full-quarter year-over-year comparison. Two-year stacked constant-currency organic revenue growth Two-year stacked growth is computed by adding the revenue growth from the current period referenced and that of the same fiscal period ended twelve months prior. Constant-currency revenue growth excluding revenue from trailing twelve month acquisitions is defined directly above. (1) As defined by SEC rules, Adjusted Net Operating Profit by segment is our segment profitability measure, therefore is not considered a non-GAAP measure. We include the reconciliation here for clarity. 35 Reconciliation: Free Cash Flow Q4 FY16 Q4 FY17 Net cash provided by operating activities $52,138 $33,092 Purchases of property, plant and equipment ($17,794) ($17,241) Purchases of intangible assets not related to acquisitions ($23) ($87) Capitalization of software and website development costs ($8,140) ($8,629) Payment of contingent consideration in excess of acquisition-date fair value $8,613 $— Proceeds from insurance related to investing activities $— $— Free cash flow $34,794 $7,135 Quarterly, In thousands Reference: Value of capital leases $291 $2,323

Cimpress N.V. Q4 FY2017 Earnings Presentation 36 Reconciliation: Free Cash Flow TTM, In thousands TTM Q4FY15 TTM Q1FY16 TTM Q2FY16 TTM Q3FY16 TTM Q4FY16 TTM Q1FY17 TTM Q2FY17 TTM Q3FY17 TTM Q4FY17 Net cash provided by operating activities $242,022 $216,509 $212,151 $242,142 $247,358 $229,532 $199,702 $175,782 $156,736 Purchases of property, plant and equipment ($75,813) ($83,522) ($84,410) ($88,349) ($80,435) ($75,361) ($73,146) ($74,710) ($74,157) Purchases of intangible assets not related to acquisitions ($250) ($522) ($507) ($502) ($476) ($145) ($162) ($133) ($197) Capitalization of software and website development costs ($17,323) ($18,694) ($22,001) ($22,990) ($26,324) ($29,726) ($33,307) ($36,818) ($37,307) Payment of contingent consideration in excess of acquisition-date fair value $8,055 $8,055 $8,055 $6,806 $8,613 $8,613 $8,613 $8,613 $— Proceeds from insurance related to investing activities $— $2,075 $3,624 $3,624 $3,624 $1,549 $— $— $— Free cash flow $156,691 $123,901 $116,912 $140,731 $152,360 $134,462 $101,700 $72,734 $45,075 Reference: Value of capital leases $13,193 $12,385 $6,449 $11,301 $7,535 $7,219 $9,430 $12,390 $14,422 37 Reconciliation: Free Cash Flow and Unlevered Free Cash Flow Annual, In thousands FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 Net cash provided by operating activities $34,637 $54,377 $89,032 $129,654 $159,973 $165,149 $146,749 $141,808 $153,739 $242,022 $247,358 $156,736 Purchases of property, plant and equipment ($24,929) ($62,982) ($62,740) ($76,286) ($101,326) ($37,405) ($46,420) ($78,999) ($72,122) ($75,813) ($80,435) ($74,157) Purchases of intangible assets not related to acquisitions $— $— ($1,250) $— $— ($205) ($239) ($750) ($253) ($250) ($476) ($197) Capitalization of software and website development costs ($2,656) ($4,189) ($5,696) ($7,168) ($6,516) ($6,290) ($5,463) ($7,667) ($9,749) ($17,323) ($26,324) ($37,307) Payment of contingent consideration in excess of acquisition-date fair value $— $— $— $— $— $— $— $— $— $8,055 $8,613 $— Proceeds from insurance related to investing activities $— $— $— $— $— $— $— $— $— $— $3,624 $— Free cash flow $7,052 ($12,794) $19,346 $46,200 $52,131 $121,249 $94,627 $54,392 $71,615 $156,691 $152,360 $45,075 Plus: cash paid during the period for interest $1,089 $1,789 $1,635 $1,391 $883 $219 $1,487 $4,762 $6,446 $8,520 $37,623 $45,275 Less: interest expense for Waltham lease $— $— $— $— $— $— $— $— $— $— ($6,287) ($7,727) Unlevered Free Cash Flow $8,141 ($11,005) $20,981 $47,591 $53,014 $121,468 $96,114 $59,154 $78,061 $165,211 $183,696 $82,623 Reference: Value of capital leases $— $— $— $— $— $— $— $— $300 $13,193 $7,535 $14,422

Cimpress N.V. Q4 FY2017 Earnings Presentation 38 Reconciliation: Adjusted NOPAT Quarterly, In thousands Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 GAAP operating (loss) income $15,236 $12,085 $67,609 ($17,531) $16,030 ($27,808) $33,705 ($41,943) ($9,656) Less: Cash taxes attributable to current year (see below) ($7,656) ($6,833) ($4,362) ($8,392) ($12,649) ($7,419) ($6,704) ($4,698) ($12,283) Exclude expense (benefit) impact of: Acquisition-related amortization and depreciation $7,374 $9,782 $9,655 $10,879 $10,518 $10,213 $10,019 $13,508 $12,662 Earn-out related charges (1) $385 $289 $3,413 $883 $1,793 $16,247 $7,010 $4,882 $12,245 Share-based compensation related to investment consideration $473 $802 $1,735 $1,168 $1,130 $4,103 $601 $375 $4,559 Certain impairments (2) $— $— $3,022 $37,582 $1,216 $— $— $9,556 $— Restructuring related charges $2,528 $271 $110 $— $— $— $1,100 $24,790 $810 Less: Interest expense associated with Waltham lease $— ($350) ($2,001) ($1,975) ($1,961) ($1,970) ($1,956) ($1,897) ($1,904) Include: Realized gains on currency derivatives not included in operating income $1,487 $316 $3,319 $1,391 $837 $1,888 $6,839 $4,591 $3,156 Adjusted NOPAT $19,827 $16,362 $82,500 $24,005 $16,914 ($4,746) $50,614 $9,164 $9,589 (1) Includes expense recognized for the change in fair value of contingent consideration and compensation expense related to cash-based earn-out mechanisms dependent upon continued employment. (2) Includes the impact of impairments or abandonments of goodwill and other long-lived assets as defined by ASC 350 - "Intangibles-Goodwill and Other" or ASC 360- "Property, plant, and equipment." (3) For Q3 FY16, cash taxes paid in the current period includes a cash tax refund of $8,479, which is subsequently eliminated from cash taxes attributable to the current period as it relates to a refund of prior years' taxes generated as a result of prior year excess share-based compensation deduction. Therefore the impact is not included in adjusted NOPAT for the current period. Cash taxes paid in the current period (3) $3,639 $4,709 $6,036 $344 $8,661 $8,555 $11,754 $15,658 $13,375 Less: cash taxes (paid) received and related to prior periods (3) ($925) $359 ($2,463) $4,760 ($1,722) ($4,227) ($5,097) ($2,862) $1,867 Plus: cash taxes attributable to the current year but not yet (received) paid $3,703 $921 $718 $2,343 $5,316 ($350) $528 ($2,508) ($3,320) Plus: cash impact of excess tax benefit on equity awards attributable to current year $2,094 $1,709 $936 $1,705 $1,224 $4,264 $342 $44 $3,353 Less: cash tax (paid) received related to NOPAT exclusion items $— $— $— $— $— $— $— ($1,537) $856 Less: cash taxes paid related to the transfer of IP ($855) ($865) ($865) ($760) ($830) ($823) ($823) ($4,097) ($3,848) Cash taxes attributable to current period $7,656 $6,833 $4,362 $8,392 $12,649 $7,419 $6,704 $4,698 $12,283 39 (1) Includes expense recognized for the change in fair value of contingent consideration and compensation expense related to cash-based earn-out mechanisms dependent upon continued employment. (2) Includes the impact of impairments or abandonments of goodwill and other long-lived assets as defined by ASC 350- "Intangibles-Goodwill and Other" or ASC 360- "Property, plant, and equipment." (3) For TTM Q3FY16, Q4FY16, Q1FY17, and Q2FY17 cash taxes paid in the current period includes a cash tax refund of $8,479, which is subsequently eliminated from cash taxes attributable to the current period as it relates to a refund of prior years' taxes generated as a result of prior year excess share-based compensation deduction. Therefore the impact is not included in adjusted NOPAT for the current period. Reconciliation: Adjusted NOPAT TTM, In thousands TTM Q4FY15 TTM Q1FY16 TTM Q2FY16 TTM Q3FY16 TTM Q4FY16 TTM Q1FY17 TTM Q2FY17 TTM Q3FY17 TTM Q4FY17 GAAP operating (loss) income $96,324 $91,550 $99,271 $77,399 $78,193 $38,300 $4,396 ($20,016) ($45,702) Less: Cash taxes attributable to current year (see below) ($24,988) ($26,508) ($23,517) ($27,243) ($32,236) ($32,822) ($35,164) ($31,470) ($31,104) Exclude expense (benefit) impact of: Acquisition-related amortization and depreciation $24,264 $27,138 $31,325 $37,690 $40,834 $41,265 $41,629 $44,258 $46,402 Earn-out related charges (1) $15,275 $11,887 $11,599 $4,970 $6,378 $22,336 $25,933 $29,932 $40,384 Share-based compensation related to investment consideration $3,569 $3,874 $4,509 $4,178 $4,835 $8,136 $7,002 $6,209 $9,638 Certain impairments (2) $— $— $3,022 $40,604 $41,820 $41,820 $38,798 $10,772 $9,556 Restructuring related charges $3,202 $3,473 $3,429 $2,909 $381 $110 $1,100 $25,890 $26,700 Less: Interest expense associated with Waltham lease $0 ($350) ($2,351) ($4,326) ($6,287) ($7,907) ($7,862) ($7,784) ($7,727) Include: Realized gains on currency derivatives not included in operating income $7,450 $7,783 $6,924 $6,513 $5,863 $7,435 $10,955 $14,155 $16,474 Adjusted NOPAT $125,096 $118,847 $134,211 $142,694 $139,781 $118,673 $86,787 $71,946 $64,621 Cash taxes paid in the current period (3) $14,285 $13,698 $17,473 $14,728 $19,750 $23,596 $29,314 $44,628 $49,342 Less: cash taxes (paid) received and related to prior periods (3) ($5,476) ($2,257) ($4,132) $1,731 $934 ($3,652) ($6,286) ($13,908) ($10,319) Plus: cash taxes attributable to the current period but not yet paid $6,667 $6,652 $6,762 $7,685 $9,298 $8,027 $7,837 $2,986 ($5,650) Plus: cash impact of excess tax benefit on equity awards attributable to current period $12,932 $11,845 $6,854 $6,444 $5,574 $8,129 $7,535 $5,874 $8,003 Plus: cash tax impact of NOPAT exclusion items $— $— $— $— $— $— $— ($1,537) ($681) Less: installment payment related to the transfer of IP in a prior year ($3,420) ($3,430) ($3,440) ($3,345) ($3,320) ($3,278) ($3,236) ($6,573) ($9,591) Cash taxes attributable to current period $24,988 $26,508 $23,517 $27,243 $32,236 $32,822 $35,164 $31,470 $31,104

Cimpress N.V. Q4 FY2017 Earnings Presentation 40 Adjusted NOP by segment may be different than the major investment assessment that we publish via letter to investors at year end, where we do estimate and allocate some of the costs included in the “Corporate and global functions” expense category. (1) Includes expense recognized for the change in fair value of contingent consideration and compensation expense related to cash-based earn-out mechanisms dependent upon continued employment. (2) Includes the impact of impairments or abandonments of goodwill and other long-lived assets as defined by ASC 350- "Intangibles-Goodwill and Other" or ASC 360- "Property, plant, and equipment." Note: As part of the reorganization announced in January 2017, several groups that previously were part of our corporate and global functions, including significant portions of our technology, manufacturing and supply chain, finance, legal and other related groups, have been decentralized into our operating segments. The majority of the groups transferred into our operating segments joined Vistaprint and to a smaller extent our Upload and Print businesses. During the fourth quarter of fiscal 2017, we identified errors related to our unaudited segment profitability disclosures that were recast and reported during the third quarter of fiscal 2017. As part of this process we transferred, in error, certain costs from our Corporate and global functions cost center to our Vistaprint segment. We have revised our adjusted net operating profit for all prior periods presented. We have determined that these errors were not material, individually or in the aggregate, to any of the previously issued financial statements. Reconciliation: Adjusted NOP by Segment Quarterly, In thousands Adjusted Net Operating Profit (NOP): Q4 FY15 Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 Vistaprint $37,775 $35,658 $84,541 $45,151 $47,677 $24,648 $66,393 $37,003 $37,149 Upload and Print $11,073 $10,652 $14,986 $15,557 $17,448 $13,612 $16,959 $13,144 $20,118 National Pen N/A N/A N/A N/A N/A N/A N/A ($3,226) $1,001 All Other Businesses ($620) ($1,112) $6,851 ($3,895) ($10,768) ($9,612) ($1,968) ($9,945) ($9,222) Total $48,228 $45,198 $106,378 $56,813 $54,357 $28,648 $81,384 $36,976 $49,046 Corporate and global functions ($22,231) ($22,319) ($22,835) ($25,807) ($25,631) ($27,863) ($30,905) ($27,705) ($30,330) Acquisition-related amortization and depreciation ($7,374) ($9,782) ($9,655) ($10,879) ($10,518) ($10,213) ($10,019) ($13,508) ($12,662) Earn-out related charges (1) ($386) ($289) ($3,413) ($883) ($1,793) ($16,247) ($7,010) ($4,882) ($12,245) Share-based compensation related to investment consideration ($473) ($802) ($1,735) ($1,168) ($1,130) ($4,103) ($601) ($375) ($4,559) Certain impairments (2) $— $— ($3,022) ($37,582) ($1,216) $— $— ($9,556) $— Restructuring related charges ($2,528) ($271) ($110) $— $— $— ($1,100) ($24,790) ($810) Interest expense for Waltham lease $— $350 $2,001 $1,975 $1,961 $1,970 $1,956 $1,897 $1,904 Total (loss) income from operations $15,236 $12,085 $67,609 ($17,531) $16,030 ($27,808) $33,705 ($41,943) ($9,656) 41 Reconciliation: ROIC (1) Excess cash is cash and equivalents > 5% of last twelve month revenues; if negative, capped at zero. (2) Average invested capital represents a four quarter average of total debt, redeemable non-controlling interests and total shareholder equity, less excess cash TTM, In thousands except percentages Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Total Debt $514,095 $655,317 $547,726 $696,647 $678,511 $682,521 $876,113 $891,453 $876,656 Redeemable Non-Controlling Interest $57,738 $65,120 $64,833 $64,871 $65,301 $64,949 $41,824 $42,604 $45,412 Total Shareholders Equity $249,419 $110,072 $158,054 $151,783 $166,076 $147,488 $99,819 $84,725 $75,212 Excess Cash (1) ($28,874) ($33,271) $— $— $— $— $— $— $— Invested Capital $792,378 $797,238 $770,613 $913,301 $909,888 $894,958 $1,017,756 $1,018,782 $997,280 Average Invested Capital (2) $680,412 $712,325 $742,206 $818,383 $847,760 $872,190 $933,976 $960,346 $982,194 TTM Q4FY15 TTM Q1FY16 TTM Q2FY16 TTM Q3FY16 TTM Q4FY16 TTM Q1FY17 TTM Q2FY17 TTM Q3FY17 TTM Q4FY17 TTM Adjusted NOPAT $125,096 $118,847 $134,211 $142,694 $139,781 $118,673 $86,787 $71,946 $64,621 Average Invested Capital (2) (From above) $680,412 $712,325 $742,206 $818,383 $847,760 $872,190 $933,976 $960,346 $982,194 TTM Adjusted ROIC 18% 17% 18% 17% 16% 14% 9% 7% 7%

Cimpress N.V. Q4 FY2017 Earnings Presentation 42 Reconciliation: Adjusted EBITDA Quarterly, In thousands Q4 FY15 Q1 FY16 Q2 FY16 Q3 FY16 Q4 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 GAAP Operating income (loss) $15,236 $12,085 $67,609 ($17,531) $16,030 ($27,808) $33,705 ($41,943) ($9,656) Depreciation and amortization $27,808 $30,226 $31,805 $34,561 $35,527 $35,541 $36,977 $44,522 $42,616 Waltham lease depreciation adjustment $— ($328) ($1,045) ($1,030) ($1,030) ($1,030) ($1,030) ($1,030) ($1,030) Share-based compensation expense $2,783 $5,919 $5,956 $5,897 $5,619 $11,571 $11,277 $6,541 $12,982 Proceeds from Insurance $— $1,584 $1,553 $— $824 $650 $— $157 $— Interest expense associated with Waltham lease $— ($350) ($2,001) ($1,975) ($1,961) ($1,970) ($1,956) ($1,897) ($1,904) Earn-out related charges $386 $289 $3,413 $883 $1,793 $16,247 $7,010 $4,882 $12,245 Certain Impairments $— $— $3,022 $37,582 $1,216 $— $— $9,556 $— Restructuring related charges $2,528 $271 $110 $— $— $— $1,100 $24,790 $810 Realized gains on currency derivatives not included in operating income $1,487 $316 $3,319 $1,391 $837 $1,888 $6,839 $4,591 $3,156 Adjusted EBITDA (1,2) $50,228 $50,012 $113,741 $59,778 $58,855 $35,089 $93,922 $50,168 $59,219 Note: In Q3 FY16 the definition of adjusted EBITDA used in external reporting was modified to include certain impairment charges and adjust for depreciation related to our Waltham lease resulting in a change to adjusted EBITDA for Q1 and Q2 FY16. Also note that for Q3 FY17, the SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting. (1) This presentation uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions; however, the senior unsecured notes' covenants allow for the inclusion of pro-forma impacts to adjusted EBITDA. (2) Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to non-controlling interests. This is to most closely align to our debt covenant and cash flow reporting. 43 Reconciliation: Adjusted EBITDA TTM, In thousands TTM Q4FY15 TTM Q1FY16 TTM Q2FY16 TTM Q3FY16 TTM Q4FY16 TTM Q1FY17 TTM Q2FY17 TTM Q3FY17 TTM Q4FY17 GAAP Operating income (loss) $96,324 $91,550 $99,271 $77,399 $78,193 $38,300 $4,396 ($20,016) ($45,702) Depreciation and amortization $97,487 $103,254 $112,164 $124,400 $132,119 $137,434 $142,606 $152,567 $159,656 Waltham lease depreciation adjustment $— ($328) ($1,373) ($2,403) ($3,433) ($4,135) ($4,120) ($4,120) ($4,120) Share-based compensation expense $21,547 $21,724 $21,296 $20,555 $23,391 $29,043 $34,364 $35,008 $42,371 Proceeds from Insurance $— $1,584 $3,137 $3,137 $3,961 $3,027 $1,474 $1,631 $807 Interest expense associated with Waltham lease $— ($350) ($2,351) ($4,326) ($6,287) ($7,907) ($7,862) ($7,784) ($7,727) Earn-out related charges $15,276 $11,888 $11,600 $4,971 $6,378 $22,336 $25,933 $29,932 $40,384 Certain Impairments $— $— $3,022 $40,604 $41,820 $41,820 $38,798 $10,772 $9,556 Restructuring related charges $2,528 $2,799 $2,909 $2,909 $381 $110 $1,100 $25,890 $26,700 Realized gains on currency derivatives not included in operating income $7,450 $7,783 $6,924 $6,513 $5,863 $7,435 $10,955 $14,155 $16,474 Adjusted EBITDA (1,2) $240,612 $239,904 $256,599 $273,759 $282,386 $267,463 $247,644 $238,034 $238,398 Note: In Q3 FY16 the definition of adjusted EBITDA used in external reporting was modified to include certain impairment charges and adjust for depreciation related to our Waltham lease resulting in a change to adjusted EBITDA for Q1 and Q2 FY16. Also note that for Q3 FY17 (and Q4 FY17), the SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting. (1) This deck uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions; however, the senior unsecured notes' covenants allow for the inclusion of pro-forma impacts to adjusted EBITDA. (2) Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to non-controlling interests. This is to most closely align to our debt covenant and cash flow reporting.

Cimpress N.V. Q4 FY2017 Earnings Presentation 44 Reconciliation: Constant-Currency/ex. TTM Acquisitions Revenue Growth Rates Quarterly Vistaprint Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Reported revenue growth (1) 5% 2% 3% 8% 11% 7% 7% 11% 5% Currency Impact 6% 6% 5% 2% 1% 1% 2% 1% 1% Revenue growth in constant currency 11% 8% 8% 10% 12% 8% 9% 12% 6% Upload and Print Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Reported revenue growth 74% 98% 112% 201% 94% 72% 63% 22% 11% Currency Impact 26% 21% 16% 2% (2)% 1% 3% 5% 3% Revenue growth in constant currency 100% 118% 128% 203% 92% 73% 66% 27% 14% Impact of TTM Acquisitions (66)% (87)% (97)% (178)% (71)% (61)% (55)% (14)% —% Revenue growth in constant currency excl. TTM acquisitions 34% 31% 31% 25% 21% 12% 11% 13% 14% All Other Businesses Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Reported revenue growth (5)% (6)% (4)% (7)% (8)% (17)% (7)% (8)% 6% Currency Impact 12% 14% 12% 4% —% (2)% —% (1)% 1% Revenue growth in constant currency 7% 7% 8% (3)% (8)% (19)% (7)% (9)% 7% Impact of TTM Acquisitions (11)% (4)% —% —% —% —% —% —% —% Revenue growth in constant currency excl. TTM acquisitions (4)% 4% 8% (3)% (8)% (19)% (7)% (9)% 7% Note: In Q4 FY2015, we recognized deferred revenue related to group buying activities, a net $3.7 million headwind to Vistaprint year-over-year growth rate in Q4FY16. 45 Reconciliation: Constant-Currency/ex. Discontinued Operations Revenue Growth Rates Quarterly National Pen Q3FY17 Q4FY17 FY 2017 (six months) Reported revenue growth (1) 100% 100% 100% Impact of acquisition (100)% (100)% (100)% Year-over-year growth without the acquisition —% —% —% Impact of pro forma actual revenue growth (8)% (5)% (6)% Pro forma revenue growth in U.S. dollars (8)% (5)% (6)% Currency Impact 3% 3% 2% Pro forma revenue growth in constant currency (5)% (2)% (4)% Impact of discontinued operations 3% 3% 3% Pro forma revenue growth in constant currency, excluding discontinued operations (2)% 1% (1)% (1) National Pen's reported revenue growth was 100% since we did not own this business in the year-ago period.

Cimpress N.V. Q4 FY2017 Earnings Presentation 46 Quarterly Reconciliation: Constant-Currency/ex. TTM Acquisition Revenue Growth Rates Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Reported Revenue Growth 21% 19% 19% 13% 13% 13% 29% 26% 18% 16% 26% 18% Currency Impact —% 4% 7% 9% 8% 7% 2% —% 1% 2% 2% 2% Revenue Growth in Constant Currency 21% 23% 26% 22% 21% 20% 31% 26% 19% 18% 28% 20% Impact of TTM Acquisitions & JVs (15)% (16)% (15)% (9)% (10)% (10)% (21)% (15)% (13)% (10)% (17)% (11)% Revenue growth in constant currency ex. TTM acquisitions & JVs 6% 7% 11% 13% 11% 10% 10% 11% 6% 8% 11% 9% Reported revenue growth rate ex. TTM acquisitions & JVs 6% 3% 4% 3% 3% 3% 8% 11% 6% 6% 9% 7% Note: Q4 FY2017 total company revenue growth in constant currency excluding TTM acquisitions and joint ventures excludes the impact of currency and revenue from National Pen. 47 Annual Reconciliation: Constant-Currency/ex. TTM Acquisition Revenue Growth Rates Total Company FY14 FY15 FY16 FY17 Reported Revenue Growth 9% 18% 20% 19% Currency Impact (1)% 5% 4% 2% Revenue Growth in Constant Currency 8% 23% 24% 21% Impact of TTM Acquisitions & JVs (4)% (14)% (13)% (13)% Revenue growth in constant currency ex. TTM acquisitions & JVs 4% 9% 11% 8% FY2017, by Reportable Segments Vistaprint Upload & Print National Pen All Other Businesses Reported Revenue Growth 7% 36% 100% (7)% Currency Impact 2% 3% —% —% Revenue Growth in Constant Currency 9% 39% 100% (7)% Impact of TTM Acquisitions & JVs - (26)% (100)% —% Revenue growth in constant currency ex. TTM acquisitions & JVs 9% 13% —% (7)%

Cimpress N.V. Q4 FY2017 Earnings Presentation 48 Reconciliation: Two-year Stacked Constant-Currency Organic Revenue Growth Quarterly Q4FY1 3 Q1FY1 4 Q2FY1 4 Q3FY1 4 Q4FY1 4 Q1FY1 5 Q2FY1 5 Q3FY1 5 Q4FY1 5 Q1FY1 6 Q2FY1 6 Q3FY1 6 Q4FY1 6 Q1FY1 7 Q2FY1 7 Q3FY1 7 Q4FY1 7 Reported Revenue Growth 12% 9% 6% (1)% 21% 21% 19% 19% 13% 13% 13% 29% 26% 18% 16% 26% 18% Currency Impact —% —% —% —% (2)% —% 4% 7% 9% 8% 7% 2% —% 1% 2% 2% 2% Revenue Growth in Constant Currency 12% 9% 6% (1)% 19% 21% 23% 26% 22% 21% 20% 31% 26% 19% 18% 28% 20% Impact of TTM Acquisitions & JVs —% —% —% —% (15)% (15)% (16)% (15)% (9)% (10)% (10)% (21)% (15)% (13)% (10)% (17)% (11)% Revenue growth in constant currency ex. TTM acquisitions & JVs 12% 9% 6% (1)% 4% 6% 7% 11% 13% 11% 10% 10% 11% 6% 8% 11% 9% 2 Year Stacked Q4'13+ Q4'14 Q1'14+ Q1'15 Q2'14+ Q2'15 Q3'14+ Q3'15 Q4'14+ Q4'15 Q1'15+ Q1'16 Q2'15+ Q2'16 Q3'15+ Q3'16 Q4'15+ Q4'16 Q1'16+ Q1'17 Q2'16+ Q2'17 Q3'16+ Q3'17 Q4'16+ Q4'17 Year 1 12% 9% 6% (1)% 4% 6% 7% 11% 13% 11% 10% 10% 11% Year 2 4% 6% 7% 11% 13% 11% 10% 10% 11% 6% 8% 11% 9% Year 1 + Year 2 16% 15% 13% 10% 17% 17% 17% 21% 24% 17% 18% 21% 20% Note: Q4 FY2017 total company revenue growth in constant currency excluding TTM acquisitions and joint ventures excludes the impact of currency and revenue from National Pen.