TABLE OF CONTENTS Page OUR UPPERMOST FINANCIAL OBJECTIVE AND OUR STRATEGY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 LETTER FROM CEO ROBERT KEANE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 SUMMARY CONSOLIDATED RESULTS: 3-YEAR TREND . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 SUMMARY CONSOLIDATED RESULTS: QUARTERLY TREND . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 INCOME STATEMENT HIGHLIGHTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 CASH FLOW AND RETURN ON INVESTED CAPITAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 ADJUSTED EBITDA, DEBT AND SHARE REPURCHASES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 SEGMENT RESULTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 VISTAPRINT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 UPLOAD AND PRINT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 NATIONAL PEN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 ALL OTHER BUSINESSES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 CENTRAL AND CORPORATE COSTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 CURRENCY IMPACTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 HOUSEKEEPING ITEMS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 FINANCIAL STATEMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 BALANCE SHEET . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 INCOME STATEMENT. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 CASH FLOW STATEMENT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 ABOUT NON-GAAP MEASURES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24 NON-GAAP RECONCILIATIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 ABOUT CIMPRESS, SAFE HARBOR STATEMENT AND CONTACT INFORMATION . . . . . . . . . . . . . . . . . . . . . . . . 33 Page 2 of 33

CIMPRESS' UPPERMOST FINANCIAL OBJECTIVE Our uppermost financial objective is to maximize our intrinsic value per share (“IVPS”). We define IVPS as (a) the unlevered free cash flow per diluted share that, in our best judgment, will occur between now and the long-term future, appropriately discounted to reflect our cost of capital, minus (b) net debt per diluted share. We define unlevered free cash flow as free cash flow plus cash interest expense related to borrowing. We endeavor to make all financial decisions in service of this priority. As such, we often make decisions that could be considered non-optimal were they to be evaluated based on other criteria such as (but not limited to) near- and mid-term operating income, net income, EPS, Adjusted Net Operating Profit (Adjusted NOP), Adjusted EBITDA, and cash flow. IVPS is inherently long term in nature. Thus an explicit outcome of this is that we accept fluctuations in our financial metrics as we make investments that we believe will deliver attractive long-term returns on investment. OUR STRATEGY Cimpress invests in and builds customer-focused, entrepreneurial, mass customization businesses for the long term, which we manage in a decentralized, autonomous manner. We drive competitive advantage across Cimpress through a select few shared strategic capabilities that have the greatest potential to create company-wide value. We limit all other central activities to only those which absolutely must be performed centrally. Page 3 of 33

LETTER FROM ROBERT Dear Investor, In Q1 FY2019 we delivered disappointing revenue growth, solid cash flows and good progress on our operational initiatives relative to our own expectations. As our public documents and investor events make clear, we focus on the long term and we do not believe that one quarter's financial results – whether good or bad – make or break a great company. In the past quarter we advanced as planned on many important technology, product, customer service, and cost-reduction initiatives, and we executed the largest acquisition in our company's history. Those things being said, our first quarter revenue performance was nonetheless disappointing, with growth lower than what we should have achieved given the investments we have been making and the size of our market opportunity. We believe our revenue growth should and can be as outlined in my annual letter to you of August 1, 2018 which, subject to the important caveat that we are not targeting any specific revenue growth rates for any particular period, described our revenue expectations of our various reporting segments. This quarter we delivered growth below those expectations for our two largest reporting segments, Vistaprint and Upload and Print, and only just above the bottom of the range for National Pen. Via initiatives underway across Cimpress, we are working to resolve the underlying issues and to deliver the revenue growth expectations previously outlined in that letter. The following are a few key highlights of our financial results for the first quarter of fiscal year 2019: • Consolidated revenue grew 5% year over year, and organic constant-currency revenue grew 8%, compared to 27% and 12%, respectively, in Q1 FY2018. • Operating income and Adjusted NOP both decreased year over year, which was the net result of negative and positive factors that included the following: ◦ Both measures were negatively impacted by the accelerated expense timing of $14.0 million in National Pen due to the previously disclosed adoption of a new accounting standard. Operating income was additionally impacted by the non-recurrence of a one-time gain of $47.5 million related to the divestiture of the Albumprinter business in the year-ago period. ◦ Positive factors for both measures included year-over-year growth in gross profit, net restructuring savings, currency benefits, and efficiency in operating expenses. • Cash flow from operations was $22.2 million and free cash flow was $(10.1) million, improving year over year, respectively, from $16.4 million and $(13.0) million. • Our leverage ratio increased slightly from 2.75 times trailing-twelve-month EBITDA at the end of June, 2018 to 2.81 at the end of September, 2018, as our debt increased in conjunction with our investment in VIDA. Subsequent to the end of the quarter, we closed our previously announced acquisition of BuildASign, which resulted in a cash outflow of $274.2 million. We are excited about the addition of this profitable, growing internet-based provider of canvas-print wall decor, business signage and other large-format printed products. We believe we have an opportunity to deliver strong returns on this investment and have already begun executing on expected near- term synergies. We describe more detail about this investment on page 20 of this document. In closing, we were disappointed with our revenue growth this quarter and are taking actions to address this while also extending the consistent progress we have been making in the operational and strategic initiatives that we discussed at our annual investor day in August. Sincerely, Robert S. Keane Founder & CEO Please see non-GAAP reconciliations at the end of this document. Page 4 of 33

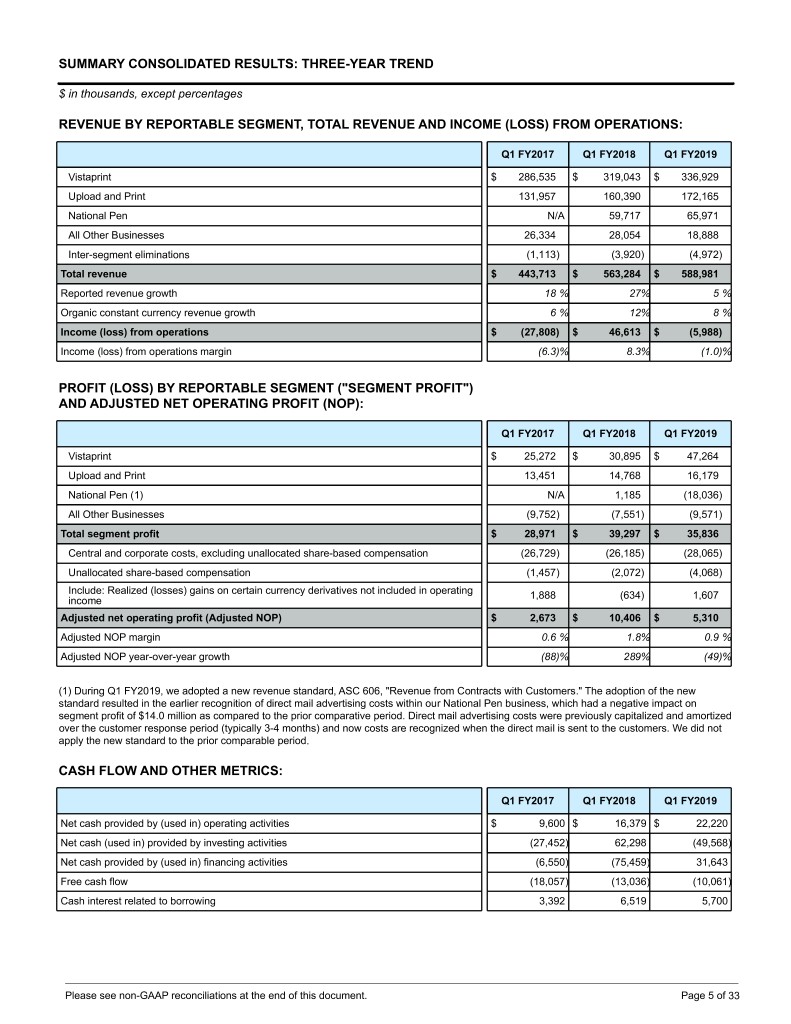

SUMMARY CONSOLIDATED RESULTS: THREE-YEAR TREND $ in thousands, except percentages REVENUE BY REPORTABLE SEGMENT, TOTAL REVENUE AND INCOME (LOSS) FROM OPERATIONS: Q1 FY2017 Q1 FY2018 Q1 FY2019 Vistaprint $ 286,535 $ 319,043 $ 336,929 Upload and Print 131,957 160,390 172,165 National Pen N/A 59,717 65,971 All Other Businesses 26,334 28,054 18,888 Inter-segment eliminations (1,113) (3,920) (4,972) Total revenue $ 443,713 $ 563,284 $ 588,981 Reported revenue growth 18 % 27% 5 % Organic constant currency revenue growth 6 % 12% 8 % Income (loss) from operations $ (27,808) $ 46,613 $ (5,988) Income (loss) from operations margin (6.3)% 8.3% (1.0)% PROFIT (LOSS) BY REPORTABLE SEGMENT ("SEGMENT PROFIT") AND ADJUSTED NET OPERATING PROFIT (NOP): Q1 FY2017 Q1 FY2018 Q1 FY2019 Vistaprint $ 25,272 $ 30,895 $ 47,264 Upload and Print 13,451 14,768 16,179 National Pen (1) N/A 1,185 (18,036) All Other Businesses (9,752) (7,551) (9,571) Total segment profit $ 28,971 $ 39,297 $ 35,836 Central and corporate costs, excluding unallocated share-based compensation (26,729) (26,185) (28,065) Unallocated share-based compensation (1,457) (2,072) (4,068) Include: Realized (losses) gains on certain currency derivatives not included in operating 1,888 (634) 1,607 income Adjusted net operating profit (Adjusted NOP) $ 2,673 $ 10,406 $ 5,310 Adjusted NOP margin 0.6 % 1.8% 0.9 % Adjusted NOP year-over-year growth (88)% 289% (49)% (1) During Q1 FY2019, we adopted a new revenue standard, ASC 606, "Revenue from Contracts with Customers." The adoption of the new standard resulted in the earlier recognition of direct mail advertising costs within our National Pen business, which had a negative impact on segment profit of $14.0 million as compared to the prior comparative period. Direct mail advertising costs were previously capitalized and amortized over the customer response period (typically 3-4 months) and now costs are recognized when the direct mail is sent to the customers. We did not apply the new standard to the prior comparable period. CASH FLOW AND OTHER METRICS: Q1 FY2017 Q1 FY2018 Q1 FY2019 Net cash provided by (used in) operating activities $ 9,600 $ 16,379 $ 22,220 Net cash (used in) provided by investing activities (27,452) 62,298 (49,568) Net cash provided by (used in) financing activities (6,550) (75,459) 31,643 Free cash flow (18,057) (13,036) (10,061) Cash interest related to borrowing 3,392 6,519 5,700 Please see non-GAAP reconciliations at the end of this document. Page 5 of 33

COMPONENTS OF FREE CASH FLOW: Q1 FY2017 Q1 FY2018 Q1 FY2019 Adjusted EBITDA $ 35,089 $ 45,841 $ 42,457 Cash restructuring payments — (4,082) (1,231) Cash taxes (8,555) (5,369) (5,449) Other changes in net working capital (ex. earn-out payments) and other reconciling items (13,542) (13,492) (7,857) Purchases of property, plant and equipment (19,319) (20,457) (21,026) Purchases of intangible assets not related to acquisitions (26) (24) (22) Capitalization of software and website development costs (8,312) (8,934) (11,233) Free cash flow before cash interest related to borrowing (14,665) (6,517) (4,361) Cash interest related to borrowing (3,392) (6,519) (5,700) Free cash flow (18,057) (13,036) (10,061) Q1 FY2019 COMPONENTS OF FREE CASH FLOW (USD MILLIONS) $42.5 ($1.2) ($5.4) ($7.9) ($21.0) ($11.2) ($4.4) ($5.7) ($10.1) Cash taxes Cash interest Free cash flow Adjusted EBITDA Capital expenditures Restructuring payments Capitalization of software Other NWC changes & other items Free cash flow before interest related to borrowing Please see non-GAAP reconciliations at the end of this document. Page 6 of 33

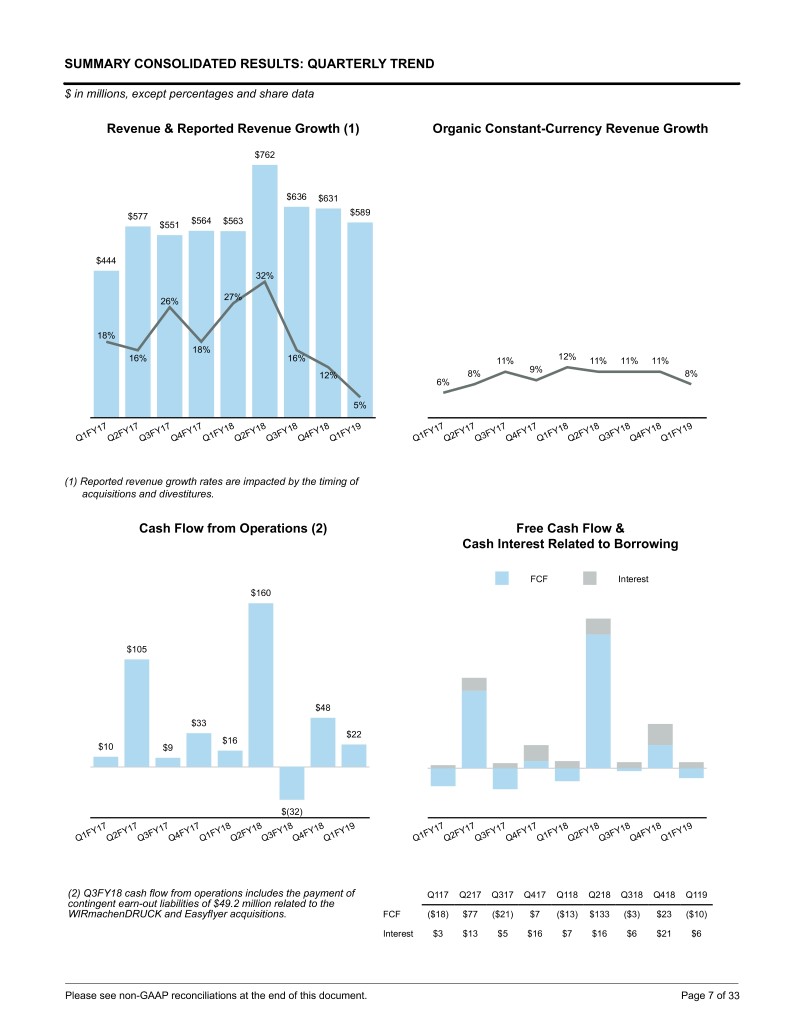

SUMMARY CONSOLIDATED RESULTS: QUARTERLY TREND $ in millions, except percentages and share data Revenue & Reported Revenue Growth (1) Organic Constant-Currency Revenue Growth $762 $636 $631 $577 $589 $551 $564 $563 $444 32% 26% 27% 18% 18% 16% 16% 11% 12% 11% 11% 11% 9% 12% 8% 8% 6% 5% Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Q1FY17Q2FY17Q3FY17Q4FY17Q1FY18Q2FY18Q3FY18Q4FY18Q1FY19 (1) Reported revenue growth rates are impacted by the timing of acquisitions and divestitures. Cash Flow from Operations (2) Free Cash Flow & Cash Interest Related to Borrowing FCF Interest $160 $105 $48 $33 $22 $16 $10 $9 $(32) Q1FY17Q2FY17Q3FY17Q4FY17Q1FY18Q2FY18Q3FY18Q4FY18Q1FY19 Q1FY17Q2FY17Q3FY17Q4FY17Q1FY18Q2FY18Q3FY18Q4FY18Q1FY19 (2) Q3FY18 cash flow from operations includes the payment of Q117 Q217 Q317 Q417 Q118 Q218 Q318 Q418 Q119 contingent earn-out liabilities of $49.2 million related to the WIRmachenDRUCK and Easyflyer acquisitions. FCF ($18) $77 ($21) $7 ($13) $133 ($3) $23 ($10) Interest $3 $13 $5 $16 $7 $16 $6 $21 $6 Please see non-GAAP reconciliations at the end of this document. Page 7 of 33

SUMMARY CONSOLIDATED RESULTS: QUARTERLY TREND (CONT.) $ in millions, except percentages and share data GAAP Operating Income (Loss) Net Income (Loss) Attributable to Cimpress & Adjusted Net Operating Profit GAAP OI (Loss) Adjusted NOP $94 $35 $30 $73 $23 $57 $47 $34 $36 $22 $25 $22 ($2) $14 $17 $10 ($7) $3 $5 ($15) ($6) ($10) ($29) ($35) ($28) ($43) ($42) Q1FY17Q2FY17Q3FY17Q4FY17Q1FY18Q2FY18Q3FY18Q4FY18Q1FY19 Q1FY17Q2FY17Q3FY17Q4FY17Q1FY18Q2FY18Q3FY18Q4FY18Q1FY19 Debt (1) Weighted Average Shares Outstanding (Millions) (2) Long-Term Short-Term Basic Diluted $891 $876 $877 $864 $821 $813 $827 32.6 31.6 32.3 32.3 31.1 31.2 30.7 30.8 30.9 $682 $701 31.6 31.3 31.1 31.2 31.2 31.0 30.7 30.8 30.9 Q1FY17Q2FY17Q3FY17Q4FY17Q1FY18Q2FY18Q3FY18Q4FY18Q1FY19 Q1FY17Q2FY17Q3FY17Q4FY17Q1FY18Q2FY18Q3FY18Q4FY18Q1FY19 (1) Debt net of issuance costs and discounts. (2) Basic and diluted shares are the same in certain periods where we reported a GAAP net loss. Please see non-GAAP reconciliations at the end of this document. Page 8 of 33

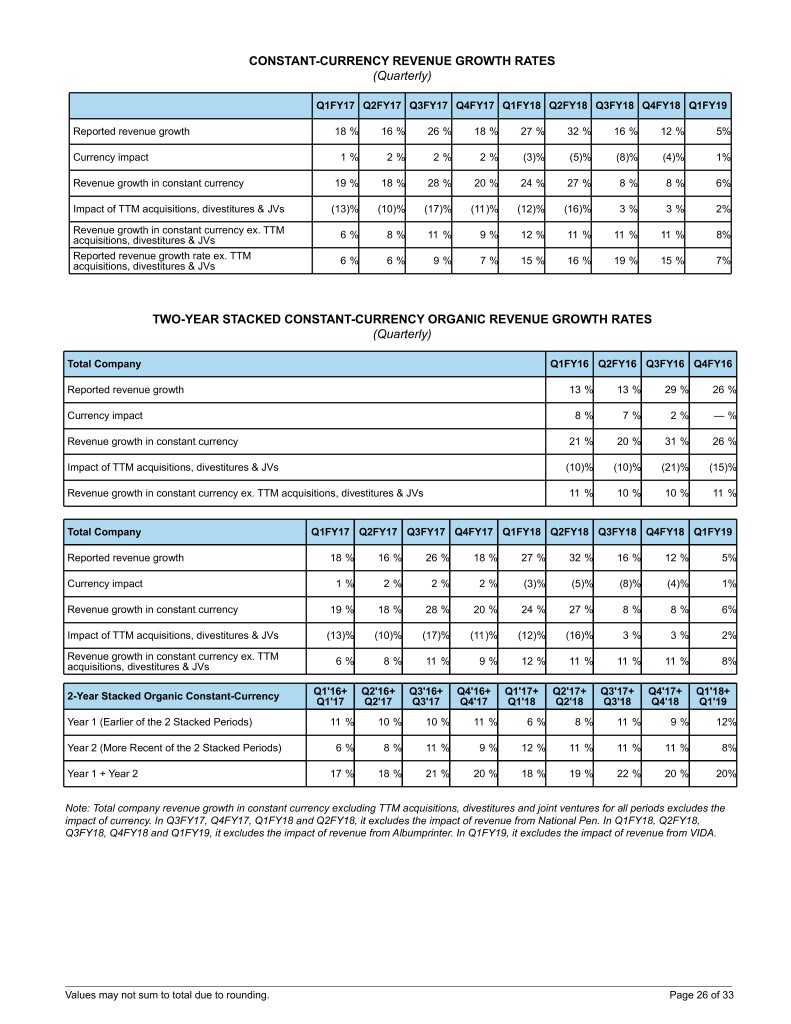

INCOME STATEMENT HIGHLIGHTS Our reported revenue growth in Q1 of 5% was negatively 2-Year Stacked Reported Revenue Growth impacted by currency changes and the net result of acquisitions and divestitures. Organic constant-currency Earlier period Later period revenue growth was 8% in Q1, a decline from 12% last year and below our expectations. We discuss components 55% 48% of this revenue weakness in the segment commentary of 44% 45% 42% 26% 31% 29% 18% 30% 32% this document. In summary, we saw revenue weakness 27% 32% 16% 5% 18% 16% 12% across all of our segments. 29% 26% 26% 27% 13% 13% 18% 16% 18% Q1 FY2019 GAAP operating income decreased $52.6 million year over year. The following year-over-year items negatively influenced this result: Q1'16+Q1'17Q2'16+Q2'17Q3'16+Q3'17Q4'16+Q4'17Q1'17+Q1'18Q2'17+Q2'18Q3'17+Q3'18Q4'17+Q4'18Q1'18+Q1'19 • A $47.5 million profit decline due to the non-recurrence of a one-time gain associated with the Q1 FY2018 divestiture of the Albumprinter business. • A $14.0 million year-over-year increase in advertising 2-Year Stacked Organic Constant-Currency expense in Q1 FY2019 compared to Q1 FY2018 as a Revenue Growth result of adopting the new U.S. GAAP revenue recognition standard that results in the earlier recognition Earlier period Later period of direct mail expenses in our National Pen business. This is an expense timing impact only that will create 21% 20% 22% 20% 20% fluctuations in year-over-year profit trends throughout this 17% 18% 18% 19% 11% 9% 11% 8% fiscal year, but has no bearing on the cash flow of this 6% 8% 12% 11% 11% 12% business (either quarterly or on a full-year basis). 11% 10% 10% 11% 6% 8% 11% 9% Excluding the above items, GAAP operating income would have increased by $9 million year-over-year. Approximately Q1'16+Q1'17Q2'16+Q2'17Q3'16+Q3'17Q4'16+Q4'17Q1'17+Q1'18Q2'17+Q2'18Q3'17+Q3'18Q4'17+Q4'18Q1'18+Q1'19 $8 million of year-over-year operating expense savings from the Vistaprint restructuring implemented in FY2018 helped to drive this improvement. GAAP Operating Income (Loss) & Margin (%) Adjusted NOP decreased year over year in Q1, primarily due to the same reasons as GAAP operating income. $73 However, the decrease in Adjusted NOP excludes the gain $47 on the sale of a subsidiary, and includes realized gains or $34 10% $17 $22 losses on our currency hedges. The net year-over-year 8% 6% (2)% (1)% 3% 4% impact of currency on Adjusted NOP was positive in Q1. (6)% (8)% ($10) ($6) ($28) (commentary and charts continue on next page) ($42) Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Adjusted Net Operating Profit & Margin (%) $94 $57 $36 12% $25 10% $22 $14 $10 $3 6% $5 3% 4% 4% 1% 2% 1% Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Please see non-GAAP reconciliations at the end of this document. Page 9 of 33

GAAP net income (loss) per diluted share for the first quarter was $(0.47), versus $0.72 in the same quarter a year ago. In addition to the factors described above, GAAP GAAP Operating Income (Loss) & net income for Q1 was influenced by non-operational, non- Adjusted Net Operating Profit cash year-over-year currency impacts in other (expense) (TTM) income, net (details on page 19), and year-over-year changes in our tax provision (details on page 20). TTM OI (Loss) TTM Adjusted NOP $165 Gross profit (revenue minus the cost of revenue) grew $151 $151 $160 $140 year over year by $7.0 million in the first quarter. $122 $158 $103 $103 $96 $126 Gross margin (revenue minus the cost of revenue $105 expressed as a percent of revenue) in the first quarter was $68 48.6%, down slightly from 49.6% in the same quarter a $38 $29 year ago. The decline in gross margin was primarily due to $4 ($20) the divestiture of Albumprinter in our All Other Businesses ($46) segment. 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY Contribution profit (revenue minus the cost of revenue, Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 advertising and payment processing) declined year over year by $11.4 million in Q1. This was driven primarily by the negative impact of $14.0 million on the National Pen business from the Q1 FY2019 adoption of the new Gross Profit & Gross Margin accounting standard and $6.0 million of Q1 FY2018 Albumprinter contribution profit that did not recur due to its Gross Profit Gross Margin % divestiture. Excluding these two items, contribution profit would have increased year over year. $402 $317 $315 Contribution margin (revenue minus the cost of revenue, $300 $282 $285 $280 $287 $231 the cost of advertising and payment processing, expressed as a percent of revenue) in the first quarter was 27.7%, 52.0% 52.1% 51.2% 50.5% 49.6% 52.7% 49.8% 49.8% 48.6% down from 31.0% in the same quarter a year ago. Excluding the impact of the new accounting standard and 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY the Albumprinter divestiture, the decline in contribution Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 margin would have been less pronounced year over year. Advertising as a percent of revenue increased year over year for the first quarter from 17.0% to 19.0%. Excluding Contribution Profit & Contribution Margin the year-over-year impact of adopting the new accounting standard and Albumprinter advertising expense and revenue from Q1 FY2018, advertising as a percent of Contribution Profit Contribution Margin % revenue would have declined slightly year over year. $261 $206 $197 $186 $198 $173 $175 $163 $144 34.3% 32.5% 34.1% 31.4% 32.9% 31.0% 31.2% 32.6% 27.7% 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Please see non-GAAP reconciliations at the end of this document. Page 10 of 33

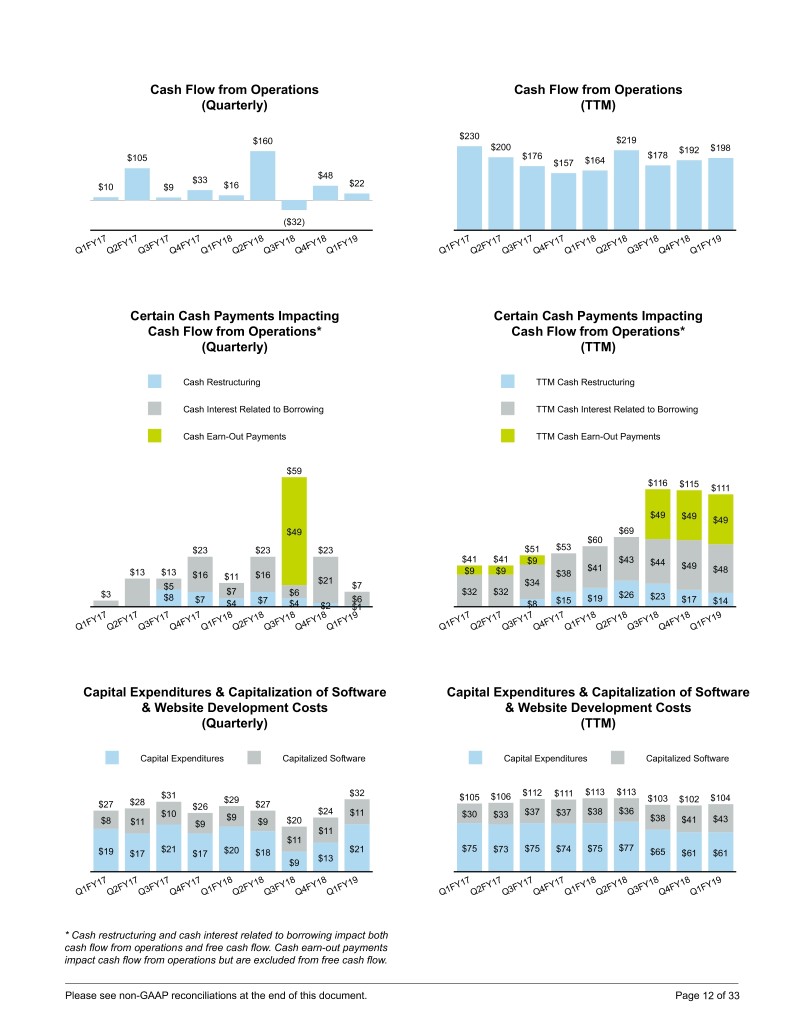

CASH FLOW & RETURN ON INVESTED CAPITAL We generated $22.2 million of cash from operations in Free Cash Flow & Q1 FY2019, compared with $16.4 million in the year-ago Cash Interest Related to Borrowing period. We had benefits from working capital changes, net (Quarterly) restructuring savings and revenue growth, partially offset by the divestiture of Albumprinter. The negative year-over- FCF Interest year timing impact on National Pen's profitability from the previously described accounting rule change is mostly offset in working capital as this change impacts the timing of expense recognition but doesn't impact the timing of cash flows. The chart "Certain Cash Payments Impacting Cash Flow from Operations" on the next page illustrates the impact of interest expense, restructuring payments and earn-outs on our operating cash flow. 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY Free cash flow was $(10.1) million in the first quarter of Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY2019 compared to $(13.0) million in the same period a year ago. Free cash flow benefited from similar factors as our operating cash flow. These benefits were partially offset by the combination of capital expenditures and capitalized Q117 Q217 Q317 Q417 Q118 Q218 Q318 Q418 Q119 software and development costs, which increased in the FCF ($18) $77 ($21) $7 ($13) $133 ($3) $23 ($10) first quarter compared to the year-ago period. Interest $3 $13 $5 $16 $7 $16 $6 $21 $6 Internally, our most important annual performance metric is Free Cash Flow & unlevered free cash flow, which we define as free cash Cash Interest Related to Borrowing flow plus cash interest expense related to borrowing. The (TTM) top two charts at the right illustrate these components on a quarterly and trailing-twelve-month basis. Trailing-twelve- month cash from operations, free cash flow and unlevered FCF Interest free cash flow improved year over year driven by realized net restructuring savings, revenue growth including a full year of National Pen's results, decreased net investment $49 $48 spend, and lower cash taxes. $32 $44 $32 $43 $34 The GAAP operating measures that we use as a basis to $134 $38 $41 $139 $142 $102 $106 $124 $73 calculate Adjusted Return on Invested Capital (Adjusted $45 $50 ROIC) are total debt, total shareholders' equity, and 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY operating income. The year-over-year trend in operating Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 income was significantly impacted by the gain on the sale of Albumprinter in the year-ago period, which is excluded from the ROIC calculation. Debt increased compared to the year-ago period. On a trailing-twelve-month basis, Adjusted Adjusted Return on Invested Capital ROIC as of September 30, 2018 improved significantly (TTM) compared to the prior-year Q1 TTM period. As of Q2 FY2018, Adjusted ROIC reflected a full year of National Pen operating results. The Q1 FY2019 calculation is not TTM Adjusted ROIC adjusted for the previously described accounting change at TTM Adjusted ROIC ex SBC National Pen that impacts the timing of certain advertising expense recognition. 18% 18% 17% 16% 13% 14% 15% 9% 8% 9% 14% 12% 13% 10% 10% 6% 5% 6% 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Please see non-GAAP reconciliations at the end of this document. Page 11 of 33

Cash Flow from Operations Cash Flow from Operations (Quarterly) (TTM) $230 $160 $219 $200 $192 $198 $105 $176 $178 $157 $164 $48 $33 $10 $9 $16 $22 ($32) 17 17 17 17 18 18 18 18 19 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Certain Cash Payments Impacting Certain Cash Payments Impacting Cash Flow from Operations* Cash Flow from Operations* (Quarterly) (TTM) Cash Restructuring TTM Cash Restructuring Cash Interest Related to Borrowing TTM Cash Interest Related to Borrowing Cash Earn-Out Payments TTM Cash Earn-Out Payments $59 $116 $115 $111 $49 $49 $49 $49 $69 $60 $23 $23 $23 $51 $53 $41 $41 $9 $43 $44 $41 $49 $48 $13 $13 $16 $16 $9 $9 $38 $11 $21 $5 $7 $34 $7 $32 $32 $3 $6 $26 $23 $8 $7 $7 $6 $15 $19 $17 $14 $4 $4 $2 $1 $8 17 17 17 17 18 18 18 18 19 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Capital Expenditures & Capitalization of Software Capital Expenditures & Capitalization of Software & Website Development Costs & Website Development Costs (Quarterly) (TTM) Capital Expenditures Capitalized Software Capital Expenditures Capitalized Software $112 $113 $113 $31 $32 $105 $106 $111 $28 $29 $103 $102 $104 $27 $26 $27 $10 $24 $11 $30 $33 $37 $37 $38 $36 $9 $38 $43 $8 $11 $9 $9 $20 $41 $11 $11 $21 $21 $75 $75 $74 $75 $77 $19 $17 $17 $20 $18 $73 $65 $61 $61 $13 $9 17 17 17 17 18 18 18 18 19 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 * Cash restructuring and cash interest related to borrowing impact both cash flow from operations and free cash flow. Cash earn-out payments impact cash flow from operations but are excluded from free cash flow. Please see non-GAAP reconciliations at the end of this document. Page 12 of 33

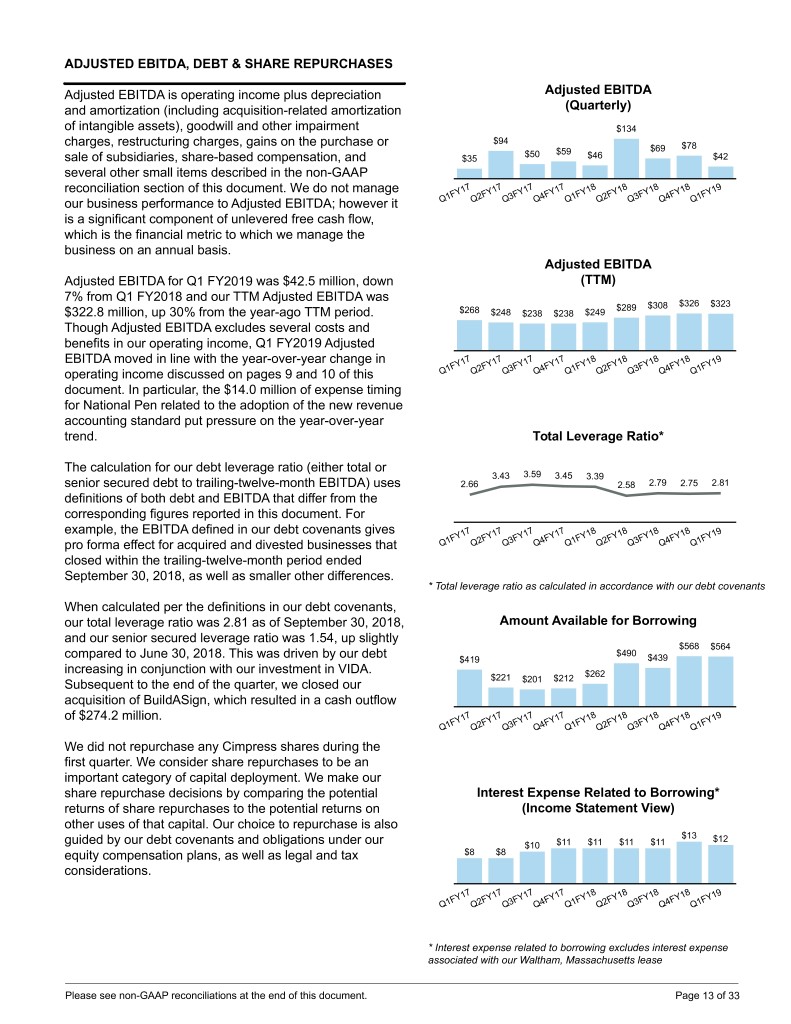

ADJUSTED EBITDA, DEBT & SHARE REPURCHASES Adjusted EBITDA is operating income plus depreciation Adjusted EBITDA and amortization (including acquisition-related amortization (Quarterly) of intangible assets), goodwill and other impairment $134 $94 charges, restructuring charges, gains on the purchase or $78 $59 $69 sale of subsidiaries, share-based compensation, and $35 $50 $46 $42 several other small items described in the non-GAAP 7 7 7 7 8 8 8 8 9 reconciliation section of this document. We do not manage Y1 Y1 Y1 Y1 Y1 Y1 Y1 Y1 Y1 1F 2F 3F 4F 1F 2F 3F 4F 1F our business performance to Adjusted EBITDA; however it Q Q Q Q Q Q Q Q Q is a significant component of unlevered free cash flow, which is the financial metric to which we manage the business on an annual basis. Adjusted EBITDA Adjusted EBITDA for Q1 FY2019 was $42.5 million, down (TTM) 7% from Q1 FY2018 and our TTM Adjusted EBITDA was $289 $308 $326 $323 $322.8 million, up 30% from the year-ago TTM period. $268 $248 $238 $238 $249 Though Adjusted EBITDA excludes several costs and benefits in our operating income, Q1 FY2019 Adjusted EBITDA moved in line with the year-over-year change in 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY operating income discussed on pages 9 and 10 of this Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 document. In particular, the $14.0 million of expense timing for National Pen related to the adoption of the new revenue accounting standard put pressure on the year-over-year trend. Total Leverage Ratio* The calculation for our debt leverage ratio (either total or 3.43 3.59 3.45 3.39 senior secured debt to trailing-twelve-month EBITDA) uses 2.66 2.58 2.79 2.75 2.81 definitions of both debt and EBITDA that differ from the corresponding figures reported in this document. For example, the EBITDA defined in our debt covenants gives 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY pro forma effect for acquired and divested businesses that Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 closed within the trailing-twelve-month period ended September 30, 2018, as well as smaller other differences. * Total leverage ratio as calculated in accordance with our debt covenants When calculated per the definitions in our debt covenants, our total leverage ratio was 2.81 as of September 30, 2018, Amount Available for Borrowing and our senior secured leverage ratio was 1.54, up slightly $568 $564 $490 compared to June 30, 2018. This was driven by our debt $419 $439 increasing in conjunction with our investment in VIDA. $221 $262 Subsequent to the end of the quarter, we closed our $201 $212 acquisition of BuildASign, which resulted in a cash outflow of $274.2 million. 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 We did not repurchase any Cimpress shares during the first quarter. We consider share repurchases to be an important category of capital deployment. We make our share repurchase decisions by comparing the potential Interest Expense Related to Borrowing* returns of share repurchases to the potential returns on (Income Statement View) other uses of that capital. Our choice to repurchase is also $13 $12 guided by our debt covenants and obligations under our $10 $11 $11 $11 $11 equity compensation plans, as well as legal and tax $8 $8 considerations. 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 * Interest expense related to borrowing excludes interest expense associated with our Waltham, Massachusetts lease Please see non-GAAP reconciliations at the end of this document. Page 13 of 33

SEGMENT RESULTS VISTAPRINT Revenue ($M) & Reported Revenue Growth Even though we expect fluctuations in the growth rates of Quarterly our businesses from quarter to quarter, we are $429 $381 $358 disappointed with Vistaprint's Q1 FY2019 constant $287 $323 $321 $319 $357 $337 13% currency revenue growth. Drivers of the slower constant- 7% 7% 11% 5% 11% 11% 11% 6% currency growth included a decline in new customer 17 17 17 17 18 18 18 18 19 bookings due in part to marketing experimentation, FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 increasing mobile traffic that negatively impacts conversion rates, the effects from the expanded roll out of a major technology change, and lower growth rates for some of our newer products as we work to optimize their profitability. In our Q4 FY2018 earnings document and at investor day in Organic Constant-Currency Revenue Growth August 2018, we described some of these topics and the Quarterly impact that they can have on our revenue growth. 12% 10% However, their effects during the first quarter were more 8% 9% 6% 9% 7% 9% 7% negative than we had expected. 17 17 17 17 18 18 18 18 19 The Vistaprint team is working to address these issues FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 while avoiding actions that would boost near-term revenues at the expense of long-term value or customer satisfaction. The issues relating to the technology change come from many small reductions to performance versus the legacy system which we believe we can address through iterative 2-Year Stacked Organic Constant-Currency optimization and testing. We believe that the technology Revenue Growth change provides us with a better foundation over the mid- and long-term future because it will allow us to much more Earlier period Later period easily introduce new products and test variations of the user experience. 22% 18% 18% 18% 19% 16% 17% 15% 17% 12% 6% 9% 7% 7% Despite weaker revenue growth, segment profit in Q1 8% 9% 10% 9% 12% 12% FY2019 increased by $16.4 million year over year, and 8% 8% 10% 8% 9% 6% 10% 7 7 7 7 8 8 8 8 9 '1 '1 '1 '1 '1 '1 '1 '1 '1 segment profit margin was up 440 basis points compared 1 2 3 4 1 2 3 4 1 Q Q Q Q Q Q Q Q Q + + + + + + + + + 6 6 6 6 7 7 7 7 8 to the year-ago period. A combination of the following '1 '1 '1 '1 '1 '1 '1 '1 '1 1 2 3 4 1 2 3 4 1 factors drove this improvement: Q Q Q Q Q Q Q Q Q • Approximately $8 million of year-over-year operating expense savings from our November 2017 restructuring initiative • Progress in improving the gross margin of products Segment Profit ($M) & Segment Profit Margin that have been recently introduced Quarterly • Slightly favorable currency movements (as a reminder, we do not allocate realized gains or losses $99 $67 $58 $54 $38 $38 $47 from hedging contracts to segment operating results) $25 $31 23% 9% 18% 16% 15% 14% These positive impacts to segment profits were partially 12% 12% 10% 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY offset by continued mix shifts toward newer products that Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 have a structurally lower gross margin than our more established product lines. In Robert Keane's letter to investors of August 1, 2018, we stated that, subject to the important caveat that we are not Vistaprint Advertising ($M) & as % of Revenue targeting any specific revenue growth rates for any $80 $89 particular period, we expected Vistaprint to grow at $69 $73 $69 $73 $77 $77 $73 approximately 9% to 10% for the foreseeable future. Via initiatives underway at Vistaprint, both the strategic ones 24% 21% 23% 21% 23% 21% 22% 22% 22% which we discussed during our August investor day and the 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY tactical ones which our team is now pursuing in light of our Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 disappointing Q1 revenue, we are working to achieve revenue growth in line with that expectation. Please see non-GAAP reconciliations at the end of this document. Page 14 of 33

UPLOAD AND PRINT BUSINESSES We are disappointed with the Upload and Print organic Revenue ($M) & Reported Revenue Growth constant-currency revenue growth, which was substantially Quarterly below the growth in the same quarter last year. $193 $184 $193 $162 $160 $172 $152 $142 The Q1 revenue underperformance was related in part to $132 the fact that some of our businesses have continued to 72% 63% experience the increased price-focused competition which 22% 22% 26% 29% 19% we described in the last quarterly earnings document. We 10% 7% responded by reducing prices during the quarter, which has 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY noticeably improved order volume but has hurt revenue Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 and profitability. We highlighted last quarter that this would create fluctuations in our growth and profit, but Q1 FY2019 revenue was nonetheless below our expectations. We continue to believe we remain poised to outperform and Organic Constant-Currency Revenue Growth outlast competitors in the long term due to our geographic Quarterly diversity, product selection, customer service, profitability and scale. Despite the pricing pressures, segment profit in Q1 FY2019 16% 16% 12% 13% 14% 12% was up year over year by $1.4 million, growth of 9.6%. 11% 10% 9% Segment profit grew just slightly faster than constant- currency revenues thanks to tight control of operating 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY expenses, partially offset by increased investments in Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 technology and currency impacts. We are investing in technology because we believe it can materially improve the customer value proposition of each 2-Year Stacked Organic Constant-Currency business. Because we expect to eventually deploy many Revenue Growth common technology components across most or all of our Upload and Print businesses, we also believe that our ability to amortize the investment across a relatively large Earlier period Later period revenue base will allow us to develop technology-driven advantages that are difficult for smaller-scale competitors to match. The current benefits from this investment remain 43% 42% 38% 35% relatively small, but we expect them to grow through 12% 11% 13% 28% 27% 25% 25% FY2019 and beyond. 14% 24% 16% 16% 12% 10% 9% 31% 31% 25% 21% In Robert Keane's letter to investors of August 1, 2018, we 12% 11% 13% 14% 16% 7 7 7 7 8 8 8 8 9 stated that, subject to the important caveat that we are not '1 '1 '1 '1 '1 '1 '1 '1 '1 1 2 3 4 1 2 3 4 1 Q Q Q Q Q Q Q Q Q + + + + + + + + + targeting any specific revenue growth rates for any 6 6 6 6 7 7 7 7 8 '1 '1 '1 '1 '1 '1 '1 '1 '1 1 2 3 4 1 2 3 4 1 particular period, we expected our Upload and Print Q Q Q Q Q Q Q Q Q segment to moderate over time, but for the foreseeable future to drive low-double-digit constant-currency growth. We continue to expect revenue growth in line with that expectation. Segment Profit ($M) & Segment Profit Margin Quarterly $25 $22 $20 $17 $17 $15 $16 $13 $13 12% 12% 13% 10% 11% 9% 9% 9% 9% 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Please see non-GAAP reconciliations at the end of this document. Page 15 of 33

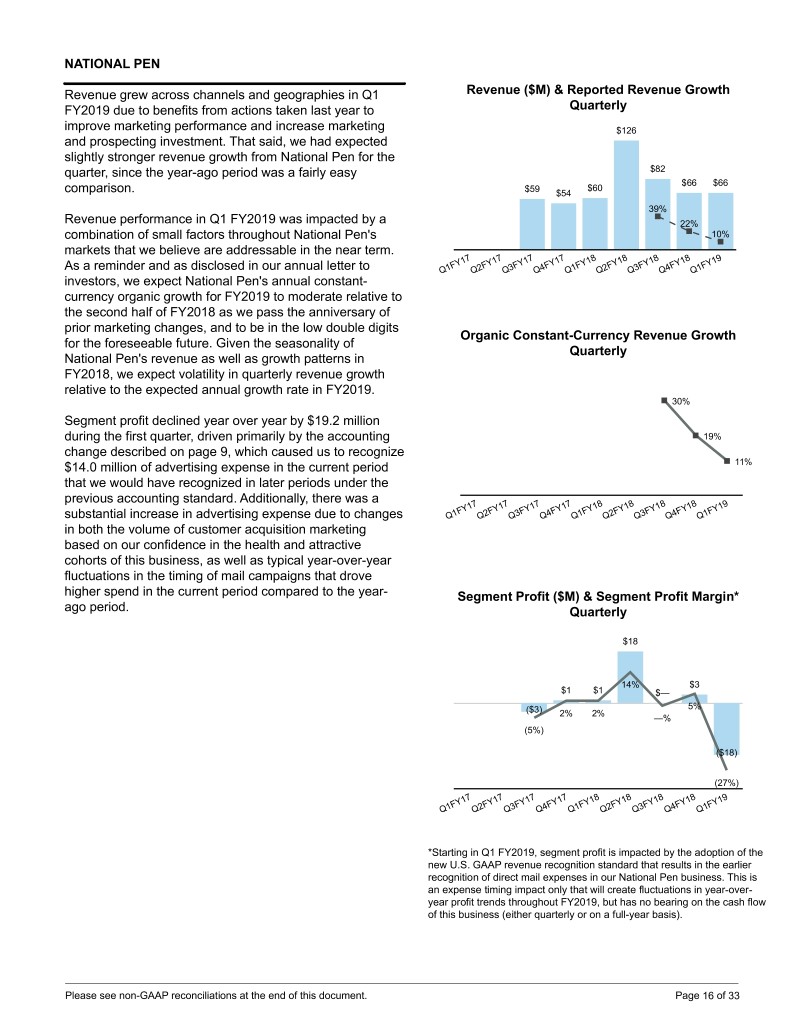

NATIONAL PEN Revenue grew across channels and geographies in Q1 Revenue ($M) & Reported Revenue Growth FY2019 due to benefits from actions taken last year to Quarterly improve marketing performance and increase marketing $126 and prospecting investment. That said, we had expected slightly stronger revenue growth from National Pen for the quarter, since the year-ago period was a fairly easy $82 $66 $66 $60 comparison. $59 $54 39% Revenue performance in Q1 FY2019 was impacted by a 22% combination of small factors throughout National Pen's 10% markets that we believe are addressable in the near term. 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY As a reminder and as disclosed in our annual letter to Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 investors, we expect National Pen's annual constant- currency organic growth for FY2019 to moderate relative to the second half of FY2018 as we pass the anniversary of prior marketing changes, and to be in the low double digits Organic Constant-Currency Revenue Growth for the foreseeable future. Given the seasonality of Quarterly National Pen's revenue as well as growth patterns in FY2018, we expect volatility in quarterly revenue growth relative to the expected annual growth rate in FY2019. 30% Segment profit declined year over year by $19.2 million during the first quarter, driven primarily by the accounting 19% change described on page 9, which caused us to recognize $14.0 million of advertising expense in the current period 11% that we would have recognized in later periods under the previous accounting standard. Additionally, there was a 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY substantial increase in advertising expense due to changes Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 in both the volume of customer acquisition marketing based on our confidence in the health and attractive cohorts of this business, as well as typical year-over-year fluctuations in the timing of mail campaigns that drove higher spend in the current period compared to the year- Segment Profit ($M) & Segment Profit Margin* ago period. Quarterly $18 14% $3 $1 $1 $— 5% ($3) 2% 2% —% (5%) ($18) (27%) 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 *Starting in Q1 FY2019, segment profit is impacted by the adoption of the new U.S. GAAP revenue recognition standard that results in the earlier recognition of direct mail expenses in our National Pen business. This is an expense timing impact only that will create fluctuations in year-over- year profit trends throughout FY2019, but has no bearing on the cash flow of this business (either quarterly or on a full-year basis). Please see non-GAAP reconciliations at the end of this document. Page 16 of 33

ALL OTHER BUSINESSES Please note that the reported revenue growth in this Revenue ($M) & Reported Revenue Growth segment reflects our August 31, 2017 divestiture of Quarterly Albumprinter and our July 2, 2018 acquisition of VIDA, whereas the organic constant-currency growth rate Historical Revenue (including Albumprinter) excludes Albumprinter starting in Q1 FY2018 and VIDA for Revenue (excluding Albumprinter) all periods. All of our businesses in this segment are growing revenues Albumprinter Revenue strongly, albeit each off small bases. Our objective for Reported Revenue Growth these young businesses remains the same: to build foundations in large and potentially long-term attractive $45 markets. In all of these businesses we continue to operate $28 $29 $28 $26 $30 at an operating loss as previously described and as $21 $19 $20 $19 $17 $16 $13 planned, and we expect to continue to do so in many of $15 $15 $11 $13 these businesses in the next several years. At VIDA, an 6% 7% early stage business included in our results for the first time (7)% (8)% this quarter, we are intentionally reducing marketing spend (17)% and focusing more on the rapid development and (33)% (33)% (33)% improvement of their customer value proposition. (53)% Q1 FY2019 segment loss deepened by $2.0 million year 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY over year, primarily due to the divestiture of Albumprinter, Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 which contributed $1.7 million of profit in Q1 FY2018, as well as the Q1 FY2019 inclusion of operating losses from our VIDA business, partially offset by decreased losses in other businesses. Segment loss margin moved year over Organic Constant-Currency Revenue Growth* year from (27)% last year to (51)% in Q1 FY2019 largely Quarterly due to the loss of Albumprinter revenue. 53% 40% 46% 24% 29% 7% BUSINESSES IN THIS REPORTABLE SEGMENT (7)% (9)% (19)% This segment consists of multiple small, rapidly evolving 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY early-stage businesses. These businesses are subject to Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 high degrees of risk and we expect that each of their business models will rapidly evolve in function of customer feedback, testing, and entrepreneurial pivoting. * The trend of organic constant currency revenue growth in the chart above is not indicative of the growth trends in the existing businesses Vistaprint Corporate Solutions serves medium- within this segment. Prior to Q1 FY2018, organic growth included sized businesses and large corporations, as well Albumprinter which was material to this segment and grew more slowly as a legacy revenue stream with retail partners than the other businesses that remain. Additionally, our organic growth in and franchise businesses. Q4 FY2016 and throughout FY2017 was impacted by the loss of two retail Printi, the online printing leader in Brazil, offers a partners in those periods as we have explained in the past. superior customer experience with transparent and attractive pricing, reliable service and quality. Printi is also expanding into the US market. Segment Loss ($M) & Margin (%) of Loss Vistaprint India operates a derivative of the Quarterly Vistaprint business model, albeit with higher service levels and quality, fully domestic, Indian content, pricing that is a slight premium to many (5%) traditional offline alternatives, and almost no discounting. ($2) (27%) Vistaprint Japan operates a derivative of the (32%) Vistaprint business model with a differentiated (41%) position relative to competitors who tend to focus (47%) (50%) (51%) on upload and print, not the self-service, micro- (37%) (36%) ($8) business customer which Vistaprint Japan serves. ($9) ($9) ($9) ($9) ($10) ($10) ($10) VIDA is an innovative startup that brings manufacturing access and an e-commerce marketplace to artists, thereby enabling artists to 17 17 17 17 18 18 18 18 19 FY FY FY FY FY FY FY FY FY convert ideas into beautiful, original products for Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 customers, ranging from custom fashion, jewelry and accessories to home accent pieces. Please see non-GAAP reconciliations at the end of this document. Page 17 of 33

CENTRAL AND CORPORATE COSTS Central and corporate costs expanded 14% year over Central and Corporate Costs ($M) year in Q1 FY2019 from $28.3 million to $32.1 million. We Quarterly saw an approximately $1.3 million year-over-year increase in fees associated with acquisitions or divestitures (VIDA Corporate Costs and BuildASign in Q1 FY2019 and Albumprinter in Q1 FY2018). Central Operating Costs MCP Investment Unallocated share-based compensation (SBC) expense almost doubled year over year largely due to the Q1 Unallocated SBC FY2019 inclusion of SPSUs (described in the table below) $36 which were not included in the same quarter last year. $34 $32 $31 $33 $30 $9 $4 $28 $28 $28 $7 Excluding both unallocated SBC and the M&A-related $5 $7 $1 $5 $2 $2 fees, central and corporate costs were basically flat year- $7 $6 $6 $6 over-year. Underlying that was, in turn, an increase in our $5 $7 $7 $6 $6 central technology investments and central operating costs which were largely offset by efficiencies elsewhere $9 $8 $11 $11 $11 $10 $10 $10 $10 in our corporate costs. $12 $12 $11 What are Central and Corporate Costs? $9 $9 $10 $9 $10 $10 The GAAP accounting value of performance share units (PSUs) across Cimpress, minus what we cross-charge either to our businesses or to Q1FY17Q2FY17Q3FY17Q4FY17Q1FY18Q2FY18Q3FY18Q4FY18Q1FY19 the above central cost categories. We cross- charge the cash grant value of a long-term incentive award. However, the total value of the Unallocated Supplemental PSUs (SPSUs) as described in the Share next paragraph remain in Unallocated SBC. Central and Corporate Costs Based Beginning in Q2 FY2018, Unallocated SBC Excluding Unallocated Share-Based Comp* Comp includes expense related to certain SPSU awards ($M and as a % of Total Revenue) that include a multi-year financial performance condition. They are subject to mark-to-market $28 accounting throughout the performance vesting $27 $27 $27 period if the performance condition is probable of $26 $26 $26 $26 $26 being achieved, so we expect the related costs to be volatile depending on share price fluctuations. Software engineering and related costs to expand 6% MCP the functionality of our Mass Customization Investment Platform (MCP). 5% 5% 5% 5% Our operationally oriented shared-service 4% 4% 4% organizations of (1) global procurement, (2) the 3% technical maintenance and hosting of the MCP, and (3) privacy, and information security management, plus the administrative costs of our Central Cimpress India offices where numerous Cimpress Operating businesses have dedicated business-specific Costs team members. Even if we did not manage our Central Operating Costs on a shared basis they Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 would still be required to operate our businesses, and we believe that, if decentralized, they would cost the same or more as under our shared model, albeit without as many current and * We present this cost category excluding the Unallocated SBC to potential future synergies. help our investors see the potential for scale leverage in these Corporate activities, including the office of the central costs without the volatility and accounting complexities of CEO, the supervisory board, directors and the Unallocated SBC. For avoidance of doubt, we view SBC as a Corporate officers insurance, treasury, tax, capital allocation, cost, and believe investors should too. As a reminder we charge Costs financial consolidation, audit, corporate legal, our businesses a cost based on the cash value of long-term internal company-wide communications, investor incentive grants, which excludes some of these accounting relations and corporate strategy. complexities, and which is included in each segment's results each period. You can find additional information on the LTI overview document posted on ir.cimpress.com. All numbers rounded to nearest million and may not sum to total Central and Corporate Costs when combined with the rounded Unallocated SBC figures in the chart above. Please see non-GAAP reconciliations at the end of this document. Page 18 of 33

CURRENCY IMPACTS Y/Y Impact from Currency* Changes in currency rates negatively impacted our year- Financial Measure Q1 FY2019 over-year reported revenue growth rate by over 100 basis Revenue unfavorable points for Q1 FY2019. There are many natural expense Operating income favorable offsets in local currencies in our business and, therefore, Net income favorable the net currency impact to our bottom line is less pronounced than it is to revenue. As such, we look at Segment profit mixed by segment constant-currency organic growth rates to understand Adjusted NOP favorable revenue trends in the absence of currency movements but Adjusted EBITDA favorable typically evaluate our bottom line inclusive of currency Free cash flow favorable movements. * Net income includes both realized and unrealized gains or losses from currency hedges and intercompany loan balances. Our most significant net currency exposures by volume are Adjusted NOP and adjusted EBITDA include only realized gains the Euro and the British Pound. We enter into currency or losses from certain currency hedges. Free cash flow includes derivative contracts to hedge the risk for certain currencies realized gains or losses on currency hedges as well as the where we have a net Adjusted EBITDA exposure. We currency impact of the timing of receivables, payments and hedge our Adjusted EBITDA exposures because a slightly other working capital settlements. Revenue, operating income different but similar EBITDA measure is the primary metric and segment profit do not reflect any impacts from currency used in our debt covenants. We do not apply hedge hedges or balance sheet translation. accounting to these hedges, which increases the volatility of the gains or losses that are included in our net income Other Income (Expense), Net from quarter to quarter. Realized and unrealized gains or losses from these hedges are recorded in Other income $31 (expense), net, along with other currency-related gains or losses. The realized gains or losses on our Adjusted EBITDA hedging contracts are added back to our Adjusted NOP to show the economic impact of our hedging $10 activities. $5 Our Other income (expense), net was $10.3 million for the ($2) ($2) first quarter of FY2019. The vast majority of this is currency ($7) ($8) related, as follows: ($11) ($16) • Approximately $9 million of Q1 gains were primarily related to unrealized non-cash net gains on intercompany activity and currency hedges. These are Q1FY17Q2FY17Q3FY17Q4FY17Q1FY18Q2FY18Q3FY18Q4FY18Q1FY19 included in our net income, but excluded from our Adjusted NOP. • Realized gains on certain currency hedges of $1.6 million for the first quarter. These realized gains affect both our Realized Gains (Losses) on net income and Adjusted NOP. Certain Currency Derivatives Overall, for the reasons described above, year-over-year fluctuations in currencies create different impacts on the $7 various financial results you see throughout this document. $5 At the top right of this page is a table describing these $3 $2 $2 directional net currency impacts when compared to the prior-year period. ($1) ($2) ($4) ($5) Q1FY17Q2FY17Q3FY17Q4FY17Q1FY18Q2FY18Q3FY18Q4FY18Q1FY19 Please see non-GAAP reconciliations at the end of this document. Page 19 of 33

HOUSEKEEPING ITEMS Please note the following housekeeping items: • As described earlier, on October 1, 2018, we closed our BuildASign acquisition and we will begin to report its financial results in our Q2 FY2019 earnings document. BuildASign will be included in the All Other Businesses reportable segment. Below are a few facts about the acquisition that may be helpful to shareholders as you make assumptions to project future results: ◦ Revenue: BuildASign's unaudited revenue in the trailing-twelve month period ended August 31, 2018 was approximately $129 million, and grew in excess of 20%. We expect growth to modulate over time, but to continue to grow at double-digit rates for the foreseeable future. ◦ Profitability: In the year prior to our purchase (thus pre-synergy), BuildASign's EBITDA margin was in the mid-to-high teens as a percent of revenue. ◦ Capital expenditures: Due to its higher growth, the current capital intensity of the business is slightly higher than the Cimpress average overall, but we believe it is similar to the average when adjusted for growth rate. ◦ Seasonality: BuildASign has a seasonal peak to its business during the December quarter, which has historically resulted in higher revenue and profits during this quarter than in other quarters. ◦ Currency: BuildASign serves customers exclusively in North America (primarily U.S.), with a U.S. cost base. ◦ Synergy potential: We have already begun to work on near-term synergies in the area of procurement savings (shipping, materials, equipment) and tax planning, both of which we expect to deliver meaningful recurring cash savings throughout our first year of ownership. Longer term, we also expect BuildASign to leverage MCP micro services and to use MCP to transact with other Cimpress businesses on an inter- company wholesale basis. • We expect Q2 FY2019 will be the last quarter in which we realize year-over-year savings as a result of the Vistaprint restructuring initiative last November. Due to the timing of the actions taken during Q2 FY2018, we expect the remaining savings to be relatively modest compared to the quarterly impact in recent quarters. • The Q1 FY2019 adoption of the new accounting standard, "Revenue from Contracts with Customers" (as codified under ASC 606) causes us to expense direct-response advertising costs in the National Pen business as incurred versus capitalizing and expensing them historically over a period of 3-4 months. We applied the new standard under the modified retrospective method, and as such, we did not apply the new standard to the prior comparable period. This drove increased expense in Q1 FY2019 relative to the prior-year method. We expect the reverse to happen during Q2 FY2019, which will have the impact of lowering our advertising expense relative to the prior-year method. As noted earlier, this accounting change impacts the timing of expense recognition and the adoption of the standard will not impact the cash flow of the business over a full- year period. • On August 21, 2018, the U.S. Internal Revenue Service issued guidance regarding amendments to Section 162 (m) of the Internal Revenue Code contained in the Tax Cuts and Jobs Act ("U.S. Tax Act"), which limit tax deductions for compensation granted to certain executives. Historically, certain compensation awards issued to our top executives, such as stock options, were considered "performance based" as defined under Section 162 (m) of the Internal Revenue Code and, therefore, were not subject to the annual $1 million deduction limitation per individual, as defined under prior law. The U.S. Tax Act eliminated the "performance-based" exception for these types of awards to the extent they were not "grandfathered" in and granted under a written binding agreement in effect on November 2, 2017. The new guidance changes our prior interpretation of which of our share-based compensation awards will meet the "grandfather" requirement and we now believe more of our prior grants will be subject to the annual $1 million deduction limitation. This will negatively impact our GAAP and cash taxes in the year of vest or exercise (no earlier than fiscal year 2022). As a result of this guidance, we recorded a tax charge of $5.6 million during the quarter ended September 30, 2018 related to the write-off of deferred tax assets associated with the non-deductibility of certain share-based compensation. • We often receive questions from shareholders regarding tariffs recently imposed by the U.S. on Chinese goods and the proposed changes to NAFTA. We source from China, both directly and indirectly, many of the products which we decorate, and we produce most of the orders for our U.S. customers in Canada and Mexico. Our current assessment is that the recent changes and proposals are likely to create a negative but relatively small financial impact to Cimpress, primarily related to our promotional products, apparel and gifts products that Vistaprint and National Pen sell to U.S. customers. This has been a fast-developing topic, and we will continue to monitor, analyze and, when possible, mitigate negative impacts to Cimpress and to our customers. Please see non-GAAP reconciliations at the end of this document. Page 20 of 33

CIMPRESS N.V. CONSOLIDATED BALANCE SHEETS (unaudited in thousands, except share and per share data) September 30, June 30, 2018 2018 Assets Current assets: Cash and cash equivalents. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 48,068 $ 44,227 Accounts receivable, net of allowances of $7,164 and $6,898, respectively . . . . . . . . . . . . 63,131 55,621 Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78,407 60,602 Prepaid expenses and other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73,855 78,846 Total current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 263,461 239,296 Property, plant and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 486,284 483,664 Software and website development costs, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59,046 56,199 Deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68,364 67,087 Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 547,109 520,843 Intangible assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 218,257 230,201 Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58,598 54,927 Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,701,119 $ 1,652,217 Liabilities, noncontrolling interests and shareholders’ equity Current liabilities: Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 159,072 $ 152,436 Accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 196,017 186,661 Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,204 27,697 Short-term debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39,806 59,259 Other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53,054 54,971 Total current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 478,153 481,024 Deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49,109 51,243 Lease financing obligation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104,579 102,743 Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 823,836 767,585 Other liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71,912 69,524 Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,527,589 1,472,119 Commitments and contingencies Redeemable noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91,426 86,151 Shareholders’ equity: Preferred shares, par value €0.01 per share, 100,000,000 shares authorized; none issued and outstanding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — Ordinary shares, par value €0.01 per share, 100,000,000 shares authorized; 44,080,627 shares issued; and 30,893,727 and 30,876,193 shares outstanding, respectively . . . . . . . 615 615 Treasury shares, at cost, 13,186,900 and 13,204,434 shares, respectively. . . . . . . . . . . . . (685,801) (685,577) Additional paid-in capital. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 403,005 395,682 Retained earnings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 434,871 452,756 Accumulated other comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (70,586) (69,814) Total shareholders’ equity attributable to Cimpress N.V.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82,104 93,662 Noncontrolling interests. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 285 Total shareholders' equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82,104 93,947 Total liabilities, noncontrolling interests and shareholders’ equity. . . . . . . . . . . . . . . . . . . . . . $ 1,701,119 $ 1,652,217 Page 21 of 33

CIMPRESS N.V. CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited in thousands, except share and per share data) Three Months Ended September 30, 2018 2017 Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 588,981 $ 563,284 Cost of revenue (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 302,471 283,755 Technology and development expense (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57,063 62,103 Marketing and selling expense (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 182,788 166,093 General and administrative expense (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41,176 38,778 Amortization of acquired intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,301 12,633 Restructuring expense (1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 170 854 (Gain) on sale of subsidiaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (47,545) (Loss) income from operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,988) 46,613 Other income (expense), net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,252 (16,312) Interest expense, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13,777) (13,082) (Loss) Income before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9,513) 17,219 Income tax expense (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,481 (6,187) Net (loss) income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14,994) 23,406 Add: Net loss (income) attributable to noncontrolling interest. . . . . . . . . . . . . . . . . . . . . . . . . 355 (43) Net (loss) income attributable to Cimpress N.V. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (14,639) $ 23,363 Basic net (loss) income per share attributable to Cimpress N.V. . . . . . . . . . . . . . . . . . . . . . . $ (0.47) $ 0.75 Diluted net (loss) income per share attributable to Cimpress N.V. . . . . . . . . . . . . . . . . . . . . . $ (0.47) $ 0.72 Weighted average shares outstanding — basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,883,617 31,220,311 Weighted average shares outstanding — diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,883,617 32,332,162 ____________________________________________ (1) Share-based compensation is allocated as follows: Three Months Ended September 30, 2018 2017 Cost of revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 115 $ 40 Technology and development expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,208 1,856 Marketing and selling expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,363 985 General and administrative expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,230 3,928 Restructuring expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 103 Page 22 of 33

CIMPRESS N.V. CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited, in thousands) Three Months Ended September 30, 2018 2017 Operating activities Net (loss) income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (14,994) $ 23,406 Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,718 42,384 Share-based compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,916 6,912 Deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,963) (16,589) Gain on sale of subsidiaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (47,545) Change in contingent earn-out liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 827 Unrealized (gain) loss on derivatives not designated as hedging instruments included in net (loss) income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,766) 6,066 Effect of exchange rate changes on monetary assets and liabilities denominated in non- functional currency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,856) 8,386 Other non-cash items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 745 23 Changes in operating assets and liabilities: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Accounts receivable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,291) (8,839) Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (11,316) (8,985) Prepaid expenses and other assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 783 (4,893) Accounts payable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,586 (1,621) Accrued expenses and other liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,658 16,847 Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,220 16,379 Investing activities Purchases of property, plant and equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (21,026) (20,457) Proceeds from the sale of subsidiaries, net of transactions costs and cash divested . . . . . . — 93,779 Business acquisitions, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (18,000) (110) Purchases of intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (22) (24) Capitalization of software and website development costs. . . . . . . . . . . . . . . . . . . . . . . . . . . (11,233) (8,934) Proceeds from the sale of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 318 217 Other investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 395 (2,173) Net cash (used in) provided by investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (49,568) 62,298 Financing activities Proceeds from borrowings of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 245,096 179,532 Payments of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (206,692) (234,678) Payments of debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,458) (3,251) Payments of withholding taxes in connection with equity awards. . . . . . . . . . . . . . . . . . . . . . (1,766) (1,190) Payments of capital lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,182) (4,658) Purchase of ordinary shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (40,674) Proceeds from issuance of ordinary shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 6,070 Issuance of loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (12,000) Proceeds from sale of noncontrolling interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 35,390 Other financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 645 — Net cash provided by (used in) financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31,643 (75,459) Effect of exchange rate changes on cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (454) 1,843 Change in cash held for sale. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 12,042 Net increase in cash and cash equivalents. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,841 17,103 Cash and cash equivalents at beginning of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44,227 25,697 Cash and cash equivalents at end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 48,068 $ 42,800 Page 23 of 33

ABOUT NON-GAAP FINANCIAL MEASURES: To supplement Cimpress’ consolidated financial statements presented in accordance with U.S. generally accepted accounting principles, or GAAP, Cimpress has used the following measures defined as non-GAAP financial measures by Securities and Exchange Commission, or SEC, rules: Constant-currency revenue growth, constant- currency revenue growth excluding revenue from acquisitions and divestitures made in the last twelve months, Adjusted Net Operating Profit, Adjusted EBITDA, free cash flow and Trailing-Twelve-Month Return on Invested Capital: • Constant-currency revenue growth is estimated by translating all non-U.S. dollar denominated revenue generated in the current period using the prior year period’s average exchange rate for each currency to the U.S. dollar. • Q1 FY2019 constant-currency revenue growth excluding revenue from acquisitions and divestitures made during the past twelve months excludes the impact of currency as defined above and revenue from Albumprinter and VIDA for all periods. • Adjusted Net Operating Profit is defined as GAAP operating income plus interest expense associated with our Waltham, Massachusetts lease, excluding M&A related items such as acquisition-related amortization and depreciation, changes in the fair value of contingent consideration, and expense for deferred payments or equity awards that are treated as compensation expense, plus the impact of certain unusual items such as discontinued operations, restructuring charges, impairments, or gains related to the purchase or sale of subsidiaries, plus certain realized gains or losses on currency derivatives that are not included in operating income. • Adjusted EBITDA is defined as operating income plus depreciation and amortization (excluding depreciation and amortization related to our Waltham, Massachusetts office lease) plus share-based compensation expense plus proceeds from insurance plus earn-out related charges plus certain impairments plus restructuring related charges plus realized gains or losses on currency derivatives less interest expense related to our Waltham, Massachusetts office lease less gain on purchase or sale of subsidiaries. • Free cash flow is defined as net cash provided by operating activities less purchases of property, plant and equipment, purchases of intangible assets not related to acquisitions, and capitalization of software and website development costs, plus payment of contingent consideration in excess of acquisition-date fair value, plus gains on proceeds from insurance. • Trailing-Twelve-Month Return on Invested Capital is Adjusted NOPAT or Adjusted NOPAT excluding share- based compensation, divided by debt plus redeemable noncontrolling interest plus shareholders equity, less excess cash. Adjusted NOPAT is defined as Adjusted NOP from above, less cash taxes. Adjusted NOPAT excluding share-based compensation adds back all share-based compensation expense that has not already been added back to Adjusted NOPAT. Excess cash is cash and equivalents greater than 5% of last twelve month revenues and, if negative, is capped at zero. Operating leases have not been converted to debt for purposes of this calculation. These non-GAAP financial measures are provided to enhance investors' understanding of our current operating results from the underlying and ongoing business for the same reasons they are used by management. For example, as we have become more acquisitive over recent years we believe excluding the costs related to the purchase of a business (such as amortization of acquired intangible assets, contingent consideration, or impairment of goodwill) provides further insight into the performance of the underlying acquired business in addition to that provided by our GAAP operating income. As another example, as we do not apply hedge accounting for our currency forward contracts, we believe inclusion of realized gains and losses on these contracts that are intended to be matched against operational currency fluctuations provides further insight into our operating performance in addition to that provided by our GAAP operating income. We do not, nor do we suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. For more information on these non-GAAP financial measures, please see the tables captioned “Reconciliations of Non-GAAP Financial Measures” included at the end of this release. The tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliation between these financial measures. Page 24 of 33

REVENUE GROWTH RATES BY SEGMENT (Quarterly) Vistaprint Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Reported revenue growth 7% 7% 11% 5% 11 % 13 % 11 % 11 % 6% Currency impact 1% 2% 1% 1% (1)% (4)% (4)% (2)% 1% Revenue growth in constant currency 8% 9% 12% 6% 10 % 9 % 7 % 9 % 7% Upload and Print Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Reported revenue growth 72 % 63 % 22 % 10% 22 % 26 % 29 % 19 % 7% Currency impact 1 % 3 % 5 % 4% (6)% (10)% (17)% (9)% 2% Revenue growth in constant currency 73 % 66 % 27 % 14% 16 % 16 % 12 % 10 % 9% Impact of TTM acquisitions (61)% (55)% (14)% —% — % — % — % — % —% Revenue growth in constant currency excl. TTM 12 % 11 % 13 % 14% 16 % 16 % 12 % 10 % 9% acquisitions National Pen Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Reported revenue growth1 N/A N/A 100 % 100 % 100 % 100 % 39 % 22 % 10% Currency impact N/A N/A — % — % — % — % (9)% (3)% 1% Revenue growth in constant currency N/A N/A 100 % 100 % 100 % 100 % 30 % 19 % 11% Impact of TTM acquisitions N/A N/A (100)% (100)% (100)% (100)% — % — % —% Revenue growth in constant currency excl. TTM N/A N/A — % — % — % — % 30 % 19 % 11% acquisitions Pro Forma National Pen Growth Rates: Pro forma revenue growth in U.S. dollars N/A N/A (8)% (5)% (5)% 33 % N/A N/A N/A Currency impact N/A N/A 3 % 3 % (2)% (5)% N/A N/A N/A Pro forma revenue growth in constant currency N/A N/A (5)% (2)% (7)% 28 % N/A N/A N/A Impact of discontinued operations N/A N/A 3 % 3 % 4 % — % N/A N/A N/A Pro forma revenue growth in constant currency, N/A N/A (2)% 1 % (3)% 28 % N/A N/A N/A excluding discontinued operations All Other Businesses Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Reported revenue growth (17)% (7)% (8)% 6% 7 % (53)% (33)% (33)% (33)% Currency impact (2)% — % (1)% 1% (2)% — % — % 2 % 6 % Revenue growth in constant currency (19)% (7)% (9)% 7% 5 % (53)% (33)% (31)% (27)% Impact of TTM acquisitions and divestitures — % — % — % —% 35 % 77 % 86 % 77 % 56 % Revenue growth in constant currency excl. TTM (19)% (7)% (9)% 7% 40 % 24 % 53 % 46 % 29 % acquisitions & divestitures 1National Pen's reported revenue growth was 100% from Q3 FY17 to Q2 FY18 since we did not own this business in the corresponding year-ago periods. Values may not sum to total due to rounding. Page 25 of 33