UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

Form 10-K

| (Mark One) | ||

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the annual period ended | June 30, 2020 | |

| or | ||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from to | ||

Commission file number 000-51539

_________________________________

Cimpress plc

(Exact Name of Registrant as Specified in Its Charter)

_________________________________

| Ireland | 98-0417483 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||

Building D, Xerox Technology Park A91 H9N9,

Dundalk, Co. Louth

Ireland

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: 353 42 938 8500

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Exchange on Which Registered | ||

| Ordinary Shares, nominal value of €0.01 per share | CMPR | NASDAQ Global Select Market | ||

______________________________

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | þ | Accelerated filer | ☐ | Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ | ||||

| Emerging growth company | ☐ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ☐ No þ

The aggregate market value of the ordinary shares held by non-affiliates of the registrant was approximately $2.76 billion on December 31, 2019 (the last business day of the registrant's most recently completed second fiscal quarter) based on the last reported sale price of the registrant's ordinary shares on the NASDAQ Global Select Market.

As of August 7, 2020, there were 25,885,823 Cimpress plc ordinary shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended June 30, 2020. Portions of such proxy statement are incorporated by reference into Items 10, 11, 12, 13, and 14 of Part III of this Annual Report on Form 10-K.

EXPLANATORY NOTE

This Annual Report on Form 10-K is being filed pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), by Cimpress plc, an Irish public limited company, as successor to Cimpress N.V., a Dutch public limited company. On December 3, 2019, Cimpress completed its previously announced cross-border merger pursuant to which Cimpress N.V. merged with and into Cimpress plc, with Cimpress plc surviving the merger (the "Irish Merger"). As a result of the Irish Merger, all of Cimpress N.V.'s outstanding ordinary shares, par value €0.01 per share, were exchanged on a one-for-one basis for newly issued ordinary shares, nominal value of €0.01 per share, of Cimpress plc, and Cimpress plc assumed all of Cimpress N.V.'s rights and obligations. This Report includes the full fiscal year ended June 30, 2020, including the activity of Cimpress N.V. before the Irish Merger.

CIMPRESS PLC

ANNUAL REPORT ON FORM 10-K

For the Year Ended June 30, 2020

TABLE OF CONTENTS

| Page | ||

| Part I | ||

| Item 1. | Business | |

| Item 1A. | Risk Factors | |

| Item 1B. | Unresolved Staff Comments | |

| Item 2. | Properties | |

| Item 3. | Legal Proceedings | |

| Item 4. | Mine Safety Disclosure | |

| Part II | ||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issued Purchases of Equity Securities | |

| Item 6. | Selected Financial Data | |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 8. | Financial Statements and Supplementary Data | |

| Item 9. | Changes in and Disagreements with Accountants and Financial Disclosures | |

| Item 9A. | Controls and Procedures | |

| Item 9B. | Other Information | |

| Part III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | |

| Item 11. | Executive Compensation | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| Item 14. | Principal Accountant Fees and Services | |

| Part IV | ||

| Item 15. | Exhibits and Financial Statement Schedules | |

| Item 16. | Summary | |

| Signatures | ||

PART I.

Item 1. Business

Overview & Strategy

Cimpress is a strategically focused group of more than a dozen businesses that specialize in mass customization, via which we deliver large volumes of individually small-sized customized orders for a broad spectrum of print, signage, photo merchandise, invitations and announcements, writing instruments, packaging, apparel and other categories. Mass customization is a core element of the business model of each Cimpress business. Stan Davis, in his 1987 strategy manifesto “Future Perfect” coined the term mass customization to describe “generating an infinite variety of goods and services, uniquely tailored to customers”. In 2001, Tseng & Jiao defined mass customization as “producing goods and services to meet individual customers’ needs with near mass production efficiency”. We discuss mass customization in more detail further below.

We have grown substantially over the past decade, from $0.7 billion of revenue in fiscal year 2010 to $2.5 billion of revenue in fiscal year 2020, and as we have grown we have achieved important benefits of scale. However, we also believe it is critical for us to “stay small as we get big”. By this we mean that we need to serve customers and act and compete with focus, nimbleness and speed that is typical of smaller, entrepreneurial firms but often not typical of larger firms. This is because we face intense competition across all our businesses, and we must constantly and rapidly improve the value we deliver to customers. To stay small as we get big, our strategy calls for us to pursue a deeply decentralized organizational structure which delegates responsibility, authority and resources to the CEOs and managing directors of our various businesses.

Specifically, our strategy is to invest in and build customer-focused, entrepreneurial mass customization businesses for the long term, which we manage in a decentralized, autonomous manner. We drive competitive advantage across Cimpress through a select few shared strategic capabilities that have the greatest potential to create Cimpress-wide value. We limit all other central activities to only those which absolutely must be performed centrally.

This decentralized structure is beneficial in many ways. We believe that, in comparison to a more centralized structure, decentralization enables our businesses to be more customer focused, to make better decisions faster, to manage a holistic cross-functional value chain required to serve customers well, to be more agile, to be held more accountable for driving investment returns, and to understand where we are successful and where we are not.

The select few shared strategic capabilities into which we invest include our (1) mass customization platform ("MCP"), (2) talent infrastructure in India, (3) central procurement of large-scale capital equipment, shipping services, major categories of our raw materials and other categories of spend, and (4) peer-to-peer knowledge sharing among our businesses. We encourage each of our businesses to leverage these capabilities, but each business is free to choose whether or not to use these services. This optionality, we believe, creates healthy pressure on the central teams who provide such services to deliver compelling value to our businesses.

We limit all other central activities to only those which must be performed centrally. Out of more than 12,900 employees we have fewer than 70 who work in central activities that fall into this category, which includes tax, treasury, internal audit, general counsel, corporate communications, consolidated reporting and compliance, investor relations, capital allocation and the functions of our CEO and CFO. We seek to avoid bureaucratic behavior in the corporate center; however we have developed, through experience, guardrails and accountability mechanisms in key areas of governance including cultural aspects such as a focus on customers or being socially responsible, as well as operational aspects such as the processes by which we set strategy and financial budgets and review performance, or the policies by which we ensure compliance with information privacy laws.

This strategy has proven to be of great value to us during the recent COVID-19 crisis; we could not have reacted as proactively, effectively or quickly had we not put in place our strategy and organizational structure several years ago. Our decentralized model allowed our businesses to respond quickly to local restrictions, customer needs, and the health and safety of our team members, and leaders shared information and best practices across the group. Our shared strategic capabilities in procurement helped us to address supply chain risks and agree to extensions of supplier payments, the mass customization platform helped us to route orders between production facilities when needed due to temporary closures, and our central finance and legal teams secured the financial flexibility to navigate this period of uncertainty.

1

Our Uppermost Financial Objective

Our uppermost financial objective is to maximize our intrinsic value per share. We define intrinsic value per share as (a) the unlevered free cash flow per diluted share that, in our best judgment, will occur between now and the long-term future, appropriately discounted to reflect our cost of capital, minus (b) net debt per diluted share. We define unlevered free cash flow as free cash flow plus interest expense related to borrowings.

This financial objective is inherently long-term in nature. Thus an explicit outcome of this is that we accept fluctuations in our financial metrics as we make investments that we believe will deliver attractive long-term returns on investment.

We ask investors and potential investors in Cimpress to understand our uppermost financial objective by which we endeavor to make all financially evaluated decisions. We often make decisions in service of this priority that could be considered non-optimal were they to be evaluated based on other financial criteria such as (but not limited to) near- and mid-term revenue, operating income, net income, EPS, adjusted EBITDA, and cash flow.

Mass Customization

Mass customization is a business model that allows companies to deliver major improvements to customer value across a wide variety of customized product categories. Companies that master mass customization can automatically direct high volumes of orders into smaller streams of homogeneous orders that are then sent to specialized production lines. If done with structured data flows and the digitization of the configuration and manufacturing processes, setup costs become very small, and small volume orders become economically feasible.

| The chart illustrates this concept. The horizontal axis represents the volume of production of a given product; the vertical axis represents the cost of producing one unit of that product. Traditionally, the only way to manufacture at a low unit cost was to produce a large volume of that product: mass-produced products fall in the lower right-hand corner of the chart. Custom-made products (i.e., those produced in small volumes for a very specific purpose) historically incurred very high unit costs: they fall in the upper left-hand side of the chart. Mass customization breaks this trade off, enabling low-volume, low-cost production of individually unique products. Very importantly, relative to traditional alternatives mass customization creates value in many ways, not just lower cost. Other advantages can include faster production, greater personal relevance, elimination of obsolete stock, better design, flexible shipping options, more product choice, and higher quality. | |

Mass customization delivers a breakthrough in customer value particularly well in markets in which the worth of a physical product is inherently tied to a specific, unique use or application. For instance, there is limited value to a sign that is the same as is used by many other companies: the business owner needs to describe what is unique about his or her business. Likewise, a photo mug is more personally relevant if it shows pictures of someone’s own friends and family. Before mass customization, producing a high-quality custom product required high per-order setup costs, so it simply was not economical to produce a customized product in low quantities.

We believe that the business cards sold by our Vistaprint business provide a concrete example of the potential of our mass customization business model to deliver significant customer value and to develop strong profit franchises in large markets that were previously low growth and commoditized. Millions of very small customers (for example, home-based businesses) rely on Vistaprint to design and procure aesthetically pleasing, high-quality, quickly-delivered and low-priced business cards. The Vistaprint production operations for a typical order of 250 standard business cards in Europe and North America require less than 14 seconds of labor for all of pre-press, printing, cutting and packaging, versus an hour or more for traditional printers. Combined with advantages of scale in graphic design support services, purchasing of materials, our self-service online ordering,

2

pre-press automation, auto-scheduling and automated manufacturing processes, we allow customers to design, configure, and procure business cards at a fraction of the cost of typical traditional printers with very consistent quality and delivery reliability. Customers have very extensive, easily configurable, customization options such as rounded corners, different shapes, specialty papers, “spot varnish”, reflective foil, folded cards, or different paper thicknesses. Achieving this type of product variety while also being very cost efficient took us almost two decades and requires massive volume, significant engineering investments and significant capital. Business cards is a mature market that, at the overall market level, has experienced continual declines over the past two decades. Yet, for Vistaprint, pre-pandemic, this remained a growing category and was highly profitable, and thus provides an example of the power of mass customization. Even though we do not expect many other products to reach this extreme level of automation, we do currently produce many other product categories (such as flyers, brochures, signage, mugs, calendars, pens, t-shirts, hats, embroidered soft goods, rubber stamps, photobooks, labels and holiday cards) via analogous methods whose volume and processes are well along the spectrum of mass customization relative to traditional suppliers and thus provide great customer value and a strong, profitable and growing revenue stream.

In response to the pandemic, our mass customization capabilities allowed us to pivot our manufacturing to focus on and produce products that are more relevant to the current environment. We began producing products such as masks, face shields, and social distancing signage and introduced relevant product templates. We were able to do this without risk of inventory obsolescence on traditional products since our products are made to order. In addition, during periods in which our manufacturing plants needed to be temporarily closed, our mass customization platform allowed us to reroute orders to other manufacturing locations to ensure they were fulfilled timely.

Market and Industry Background

Mass Customization Opportunity

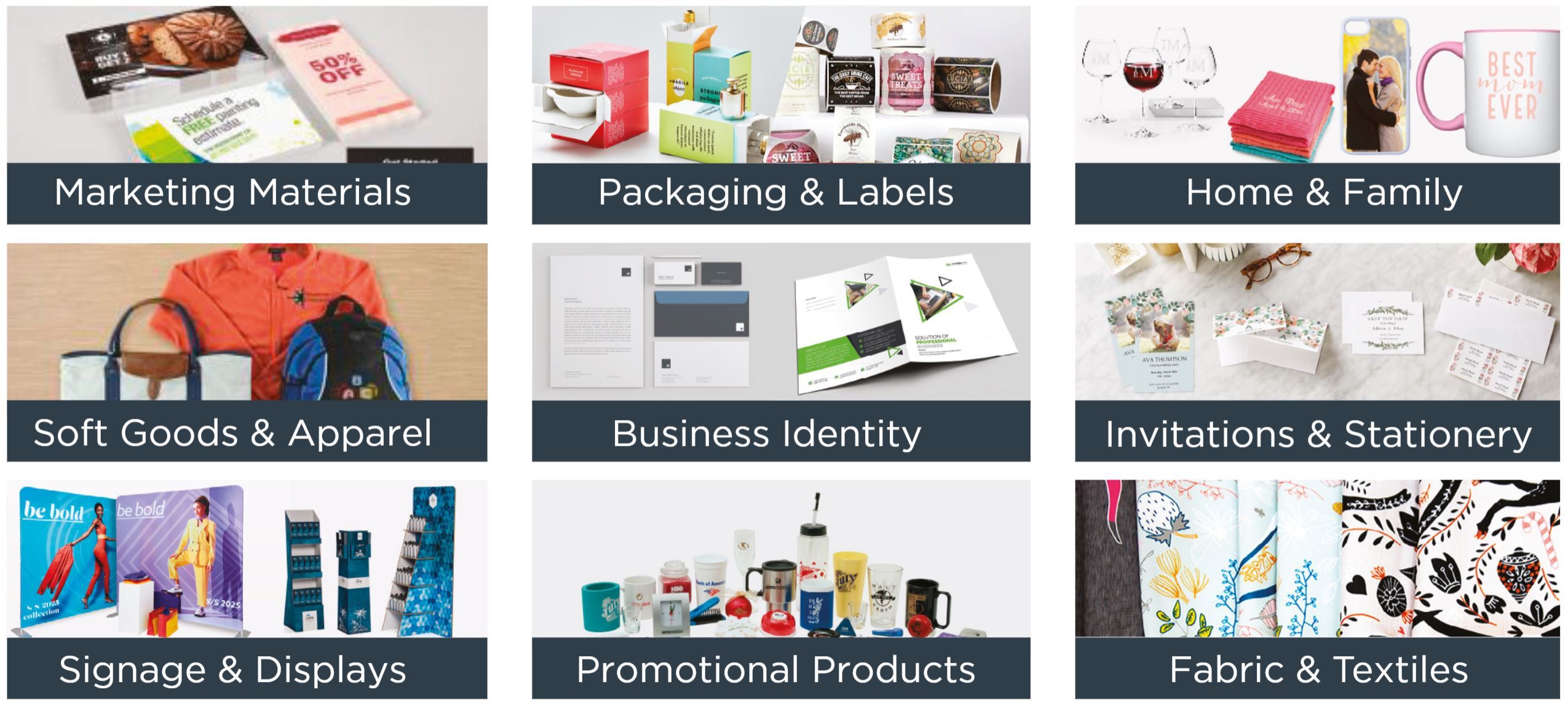

Mass customization is not a market itself, but rather a business model that can be applied across global geographic markets, to customers from varying businesses (micro, small, medium and large), graphic designers, resellers, printers, teams, associations, groups, consumers and families, to which we offer products such as the following:

Large traditional markets undergoing disruptive innovation

The products, geographies and customer applications listed above constitute a large market opportunity that is highly fragmented. We believe that the vast majority of the markets to which mass customization could apply are still served by traditional business models that force customers either to produce in large quantities per order or to pay a high price per unit.

We believe that these large and fragmented markets are moving away from small traditional suppliers that employ job shop business models to fulfill a relatively small number of customer orders and toward businesses

3

such as those owned by Cimpress that aggregate a relatively large number of orders and fulfill them via a focused supply chain and production capabilities at relatively high volumes, thereby achieving the benefits of mass customization. We believe we are early in the process of what will be a multi-decade shift from job-shop business models to mass customization.

Cimpress’ current revenue represents a very small fraction of this market opportunity. We believe that Cimpress and competitors who have built their business around a mass customization model are “disruptive innovators” to these large markets because we enable small-volume production of personalized, high-quality products at an affordable price. Disruptive innovation, a term coined by Harvard Business School professor Clayton Christensen, describes a process by which a product or service takes root initially in simple applications at the bottom of a market (such as free business cards for the most price sensitive of micro-businesses or low-quality white t-shirts) and then moves up market, eventually displacing established competitors (such as those in the markets mentioned above).

We believe that a large opportunity exists for major markets to shift to a mass customization paradigm and, even though we are largely decentralized, the select few shared strategic capabilities into which we centrally invest provide significant scale-based competitive advantages for Cimpress.

We believe this opportunity to deliver substantially better customer value and to therefore disrupt large traditional industries can translate into tremendous future opportunity for Cimpress. Until approximately our fiscal year 2012, we focused primarily on a narrow set of customers within the list above (highly price-sensitive and discount-driven micro businesses and consumers) with a limited product offering. Through acquisitions and via significant investments in our Vistaprint business, we have expanded the breadth and depth of our product offerings, extended our ability to serve our traditional customers and gained a capability to serve a vast range of customer types.

As we continue to evolve and grow Cimpress, our understanding of these markets and their relative attractiveness is also evolving. Our expansion of product breadth and depth as well as new geographic markets has significantly increased the size of our addressable market opportunity. We base our market size and attractiveness estimates upon considerable research and analysis; however, our estimates are only approximate. Despite the imprecise nature of our estimates, we believe that our understanding is directionally correct and that we operate in an enormous aggregate market with significant opportunity for Cimpress to grow as we continue delivering a differentiated and attractive value proposition to customers.

Today, we believe that the revenue opportunity for low-to-medium order quantities (i.e., still within our focus of small-sized individual orders) in the four product categories below is over $100 billion annually in North America and Europe combined and at least $150 billion annually if you include other geographies and consumer products:

| • | Small format marketing materials such as business cards, flyers, leaflets, inserts, brochures and magazines. Businesses of all sizes are the main end users of short-and-medium run lengths (per order quantities below 2,500 units for business cards and below 20,000 units for other materials). |

| • | Large format products such as banners, signs, tradeshow displays, and point-of-sale displays. Businesses of all sizes are the main end users of short-and-medium run lengths (less than 1,000 units). |

| • | Promotional products, apparel and gifts including decorated apparel, bags and textiles, and hard goods such as pens, USB sticks, and drinkware. The end users of short-and-medium runs of these products range from businesses to teams, associations and groups, as well as consumers. |

| • | Packaging products, such as corrugated board packaging, folded cartons, bags and labels. Businesses are the primary end users for short-and-medium runs (below 10,000 units). |

Our Businesses

Cimpress businesses include our organically developed Vistaprint business, plus previously independent businesses either that we have fully acquired or in which we have a majority equity stake. Prior to its acquisition, each of our acquired companies pursued business models that embodied the principles of mass customization. In other words, each provided a standardized set of products that could be configured and customized by customers, ordered in relatively low volumes, and produced via relatively standardized, homogeneous production processes, at prices lower than those charged by traditional producers.

4

Our businesses collectively operate across North America and Europe, as well as in India, Japan, Brazil, China and Australia. Their websites typically offer a broad assortment of tools and features allowing customers to create a product design or upload their own complete design and place an order, either on a completely self-service basis or with varying levels of assistance. Some of our businesses also use offline techniques to acquire customers (e.g., mail order, telesales). The combined product assortment across our businesses is extensive, including offerings in the following product categories: business cards, marketing materials such as flyers and postcards, digital and marketing services, writing instruments, signage, canvas-print wall décor, decorated apparel, promotional products and gifts, packaging, textiles and magazines and catalogs. Also, we have responded to customer needs with new pandemic-related design templates for existing products as well as launching new products like face masks.

The majority of our revenue is driven by standardized processes and enabled by software. We endeavor to design these processes and technologies to readily scale as the number of orders received per day increases. In particular, the more individual jobs we receive in a given time period, the more efficiently we can sort and route jobs with homogeneous production processes to given nodes of our internal production systems or of our third-party supply chain. This sortation and subsequent process automation improves production efficiency. We believe that our strategy of systematizing our service and production systems enables us to deliver value to customers much more effectively than traditional competitors.

Our businesses operate production facilities throughout the geographies listed above. We also work extensively with several hundred external fulfillers located across the globe. We believe that the improvements we have made and the future improvements we intend to make in software technologies that support the design, sortation, scheduling, production and delivery processes provide us with significant competitive advantage. In many cases our businesses can produce and ship an order the same day they receive it. Our supply chain systems and processes seek to drive reduced inventory and working capital as well as faster delivery to customers. In certain of our company-owned manufacturing facilities, software schedules the near-simultaneous production of different customized products that have been ordered by the same customer, allowing us to produce and deliver multi-part orders quickly and efficiently.

We believe that the potential for scale-based advantages is not limited to focused, automated production lines. Other advantages include the ability to systematically and automatically sort through the voluminous “long tail” of diverse and uncommon orders in order to group them into more homogeneous categories, and to route them to production nodes that are specialized for that category of operations and/or which are geographically proximate to the customer. In such cases, even though the daily production volume of a given production node is small in comparison to our highest-volume production lines, the homogeneity and volume we are able to achieve is nonetheless significant relative to traditional suppliers of the long tail product in question; thus, our relative efficiency gains remain substantial. For this type of long-tail production, we rely heavily on third-party fulfillment partnerships, which allow us to offer a very diverse set of products. We acquired most of our capabilities in this area via our investments in Exaprint, Printdeal, Pixartprinting and WIRmachenDRUCK. For instance, the product assortment of each of these four businesses is measured in the tens of thousands, versus Vistaprint where product assortment is dramatically smaller on a relative basis. This deep and broad product offering is important to many customers.

Our businesses are currently organized into the following five reportable segments:

| 1. | Vistaprint: |

| Consists of the operations of our Vistaprint-branded websites in North America, Europe, Australia, New Zealand, India and Japan. This business also includes our Webs business, which is managed with the Vistaprint Digital business, and our Vistaprint Corporate Solutions business which serves medium-sized businesses and large corporations, as well as a legacy revenue stream with retail partners and franchise businesses. |

Our Vistaprint business helps more than 15 million micro businesses (companies with fewer than 10 employees) create attractive, professional-quality marketing products at affordable prices and at low volumes.

5

Upload & Print:

In order to increase customer focus, nimbleness and competitiveness, in fiscal year 2019 we eliminated a management oversight layer and created two sub-groups of upload and print businesses. We refer to these reportable segments as PrintBrothers and The Print Group, each of which focus on serving graphic professionals: local printers, print resellers, graphic artists, advertising agencies and other customers with professional desktop publishing skill sets.

| 2. | PrintBrothers: Consists of our druck.at, Printdeal, and WIRmachenDRUCK businesses. |

|  |

| |

| 3. | The Print Group: Consists of our Easyflyer, Exaprint, Pixartprinting, and Tradeprint businesses. |

|  |

|  |

| 4. | National Pen: |

| Consists of our National Pen business and a few smaller brands operated by National Pen that are focused on customized writing instruments and promotional products, apparel and gifts for small- and medium-sized businesses. |

National Pen serves more than a million small businesses annually across more than 20 countries. Marketing methods are typically direct mail and telesales, as well as a small yet growing e-commerce site.

| 5. | All Other Businesses: |

With the exception of BuildASign, which is a larger and profitable business, this segment consists of small, early-stage businesses by which Cimpress is expanding to new markets. These businesses have been combined into one reportable segment based on materiality. The early-stage businesses in this segment are subject to high degrees of risk, and we expect that each of their business models will rapidly evolve in function of future trials and entrepreneurial pivoting. Our All Other Businesses reportable segment includes the following:

6

| BuildASign is an internet-based provider of canvas-print wall décor, business signage and other large-format printed products, based in Austin, Texas. |

| As the online printing leader in Brazil, Printi offers a superior customer experience with transparent and attractive pricing, reliable service and quality. |

| YSD is a startup operation that provides end-to-end mass customization solutions to brands and intellectual property owners in China, supporting multiple channels including retail stores, websites, WeChat and e-commerce platforms to enhance brand awareness and competitiveness, and develop new markets. |

Central Procurement

Given the scale of purchasing that happens across Cimpress’ businesses, there is significant value to coordinating our negotiations and purchasing to gain the benefit of scale. Our central procurement team negotiates and manages Cimpress-wide contracts for large-scale capital equipment, shipping services and major categories of raw materials (e.g., paper, plates, ink). The Cimpress procurement team is also available on an as-requested basis to help with procurement improvements, tools and approaches across other aspects of our businesses’ purchases.

We are focused on achieving the lowest total cost in our strategic sourcing efforts by concentrating on quality, logistics, technology and cost, while also striving to use responsible sourcing practices within our supply chain. Our efforts include the procurement of high-quality materials and equipment that meet our strict specifications at a low total cost across a growing number of manufacturing locations, with an increasing focus on supplier compliance with our sustainable paper procurement policy as well as our Supplier Code of Conduct. Additionally, we work to develop and implement logistics, warehousing, and outbound shipping strategies to provide a balance of low-cost material availability while limiting our inventory exposure.

As mentioned, the central procurement team played a crucial role when impacts of the pandemic became prevalent in March 2020. The team partnered with Cimpress suppliers to delay more than $30 million of supplier and lease payments previously due before June 30, 2020. These delays were important given our typical working capital trends, as we would have otherwise experienced cash outflows from working capital in the fourth quarter as revenue declined relative to the last fiscal year.

Technology

Our businesses typically rely on proprietary technology to attract and retain our customers, to enable customers to create graphic designs and place orders on our websites, and to aggregate and produce multiple orders in standardized, scalable processes. Technology is core to our competitive advantage, as without it our businesses would not be able to produce custom orders in small quantities while achieving the economics that are more analogous to mass-produced items.

We are building and using our MCP which is a cloud-based collection of software services, APIs, web applications and related technology offerings that can be leveraged independently or together by our businesses and third parties to perform common tasks that are important to mass customization. Cimpress businesses, and increasingly third-party fulfillers to our various businesses, can leverage different combinations of MCP services, depending on what capabilities they need to complement their business-specific technology. MCP is a multi-year investment that remains in its relatively early stages; however, many of our businesses are leveraging some of the technologies that have already been developed and/or shared by other businesses. The capabilities that are available in the MCP today include customer-facing technologies, such as those that enable customers to visualize their designs on various products, as well as manufacturing, supply chain, and logistics technologies that automate various stages of the production and delivery of a product to a customer. The benefits of the MCP include improved speed to market for new product introduction, reduction in fulfillment costs, improvement of product delivery or geographic expansion, improved site experience, automating manual tasks and avoiding IT expense (through a reduction in expenses related to maintaining/licensing software). Over time, we believe we can generate significant customer and shareholder value from increased specialization of production facilities, aggregated scale from multiple businesses, increased product offerings and shared technology development costs.

7

We intend to continue developing and enhancing our MCP-based customer-facing and manufacturing, supply chain and logistics technologies and processes. We develop our MCP technology centrally and we also have software and production engineering capabilities in each of our businesses. Our businesses are constantly seeking to strengthen our manufacturing and supply chain capabilities through engineering improvements in areas like automation, lean manufacturing, choice of equipment, product manufacturability, materials science, process control and color control.

Each of our businesses uses a mix of proprietary and third-party technology that supports the specific needs of that business. Their technology intensity ranges from significant to light, depending on their specific needs. Over the past few years, an increasing number of our businesses have begun to modernize and modularize their business-specific technology to enable them to launch more new products faster, provide a better customer experience, more easily connect to our MCP technologies, and leverage third-party technologies where we do not need to bear the cost of developing and maintaining proprietary technologies. For example, our businesses are increasingly using third-party software for capabilities such as shopping carts or customer reviews, which are areas that we can benefit from providing a standard e-commerce experience, and are better leveraging engineering resources to focus on technology development from which we derive competitive advantage.

In our central Cimpress Technology team and in an increasing number of our decentralized businesses, we have adopted an agile, micro-services-based approach to technology development that enables multiple businesses or use cases to leverage this API technology regardless of where it was originally developed. We believe this development approach can help our businesses serve customers and scale operations more rapidly than could have been done as an individual business outside Cimpress.

Information Privacy and Security

Each Cimpress business is responsible for ensuring that customer, company and team member information is secure and handled in ways that are fully compliant with relevant laws and regulations. Because there are many aspects of this topic that apply to all of our businesses, Cimpress invests in a central security team that defines security policies, deploys security controls, and provides services and embeds security into the development processes of our businesses. This team works in partnership with each of our businesses and the corporate center to measure security maturity and risk, and provides managed security services in a way that allows each business to address their unique challenges, lower their cost, and become more efficient in using their resources.

Shared Talent Infrastructure

We make it easy, low cost, and efficient for Cimpress businesses to set up and grow teams in India via a central infrastructure that provides all the local recruiting, onboarding, day-to-day administration, HR, and facilities management to support these teams, whether for technology, graphic services, or other business functions. Most of our businesses have established teams in India leveraging this central capability, with those teams working directly for the respective Cimpress business. This is another example of scale advantage, albeit with talent, relative to both traditional suppliers and smaller online competitors that we can leverage across Cimpress.

Competition

The markets for the products our businesses produce and sell are intensely competitive, highly fragmented and geographically dispersed, with many existing and potential competitors. We have very low market share relative to the total. Within this highly competitive context, our businesses compete on the basis of breadth and depth of product offerings; price; convenience; quality; technology; design content, tools, and assistance; customer service; ease of use; and production and delivery speed. It is our intention to offer a broad selection of high-quality products as well as related services at low price points and in doing so, offer our customers an attractive value proposition. Our current competition includes a combination of the following:

| • | traditional offline suppliers and graphic design providers |

| • | online printing and graphic design companies |

| • | office superstores, drug store chains, food retailers, and other major retailers targeting small business and consumer markets |

| • | wholesale printers |

8

| • | self-service desktop design and publishing using personal computer software |

| • | email marketing services companies |

| • | website design and hosting companies |

| • | suppliers of customized apparel, promotional products, gifts, and packaging |

| • | online photo product companies |

| • | internet retailers |

| • | online providers of custom printing services that outsource production to third party printers |

| • | providers of digital marketing such as social media and local search directories |

Today’s market has evolved to be much tougher in terms of competition. This evolution, which has been going on for 20 years, has led to major benefits for the customers in terms of lower prices, faster lead times, and easier customer experience. Cimpress and its businesses have proactively driven, and benefited from, this dynamic. The mass customization business model first took off with small format products like business cards, post cards and flyers, and consumer products like holiday cards. As the model has become better understood and more prevalent, and online advertising approaches more common, the competition has become more intense. We are seeing these types of small format products growing at rates slower than some other product categories, and we continue to derive significant profits from these small format products. Conversely, there are other product areas that have only more recently begun to benefit from mass customization, such as signage, promotional products, apparel and gifts, textiles and packaging. Here, we see higher rates of growth, but with a wider variety of profit outcomes as we continue to scale our offering in these areas. There is also a geographic overlay to these trends. For example, in developing markets like India and Brazil where these products are more recently available in an online marketplace, we see stronger growth across all product areas, whereas the market in countries such as Germany is far more mature and therefore more slow growing.

We anticipate that the overall competitive landscape described above will change as a result of the pandemic. We believe that the shift from traditional to mass customized models may accelerate, and that some of the online competitors that offer a more limited product portfolio or lack scale advantages will have less flexibility to navigate changing customer demand levels. Our businesses have done well during past economic recessions, because we serve our customers with a fundamentally more competitive business model than the highly fragmented, sub-scale traditional competitors. Shelter-at-home experiences are making e-commerce and service-at-a-distance experiences like ours more mainstream. As we have done in past economic downturns, we also have an opportunity to serve millions of individuals who take up self-employment or freelance roles because of our ability to serve the needs of those customers.

Social and Environmental Responsibility

Above and beyond compliance with applicable laws and regulations, we expect all parts of Cimpress to conduct business in a socially responsible, ethical manner. Examples of these efforts are:

| • | Environmental - We regularly evaluate ways to minimize the impact of our operations on the environment. In terms of combating climate change, we have established and centrally fund a company-wide carbon emissions reduction program to lower the emissions associated with our operations at a rate slightly exceeding the 1.5oC target pathway, and expect to achieve carbon neutrality by 2040. This commitment expands upon our previous 2°C target, established in alignment with the 2015 United Nations Global Change Conference (COP21 “Paris Climate Accord”), and now includes the emissions from our supply chain (Scope 3). Our plan includes investments in energy-reducing infrastructure and equipment, renewable energy sourcing, and examination of our substrate and logistics choices for further opportunities to reduce total emissions. We are on track to meet this commitment, and we seek to make further improvements each year going forward. |

9

We have converted the vast majority of the paper we print on in our Cimpress-owned production facilities to FSC-certified paper (FSC® C143124, FSC® C125299), the leading certification of responsible forestry practices. This certification confirms that the paper we print on comes from responsibly managed forests that meet high environmental and social standards. Currently over 85% of the paper that we print on in our facilities is FSC-certified, and we seek to move that to 100% over time. We have also committed to influencing our third-party suppliers to materially expand their use of responsibly forested paper for the products that they customize on our behalf, as well as using either FSC-certified corrugate or packaging materials containing recycled content from post-consumer sources to help ensure our packaging does not contribute to deforestation.

We also have just committed to improve the profile of our plastic-based packaging and products in line with the targets set by the New Plastics Economy Global Commitment, co-sponsored by the United Nations Environment Programme. This includes a focus on reduced plastic usage, increased recyclability, and support of products that contain recycled materials.

| • | Fair labor practices - We make recruiting, retention, and other performance management related decisions based solely on merit, based on an individual’s ability to do their job with excellence and in alignment with the company’s strategic and operational objectives. We do not tolerate discrimination on any basis protected by human rights laws or anti-discrimination regulations, and we strive to do more in this regard than the law requires. We are committed to a work environment where team members are treated with respect and fairness, and have invested in education and awareness programs for team members to make further improvements in this area. We value individual differences, unique perspectives and the distinct contributions that each one of us can make to the company. |

| • | Team member health and safety - We require safe working conditions at all times to ensure our team members and other parties are protected, and require legal compliance at a minimum at all times. We require training on – and compliance with – safe work practices and procedures at all manufacturing facilities to ensure the safety of team members and visitors to our plant floors. Given the global impacts of the COVID-19 pandemic, we have held our team member health and safety as a top priority, and have implemented measures such as remote working for members who are able to, restrictions on team member travel to be essential only, and increased safety measures at our manufacturing and customer service centers including additional cleaning and sanitary protocols. |

| • | Ethical supply chain - It is important to us that our supply chain reflects our commitment to doing business with the highest standards of ethics and integrity. Each Cimpress business is responsible to ensure its supply chain does not allow for unacceptable practices such as environmental crimes, child labor, slavery or unsafe working conditions. |

More information can be found at www.cimpress.com in our Corporate Social Responsibility section, including links to reports and documents such as our supplier code of conduct, compliance with the UK anti-slavery act and our supply chain transparency disclosure.

Intellectual Property

We seek to protect our proprietary rights through a combination of patents, copyrights, trade secrets, trademarks and contractual restrictions. We enter into confidentiality and proprietary rights agreements with our employees, consultants and business partners, and control access to, and distribution of, our proprietary information. We have registered, or applied for the registration of, a number of U.S. and international domain names, trademarks, and copyrights. Additionally, we have filed U.S. and international patent applications for certain of our proprietary technology.

Seasonality

Our profitability has historically been highly seasonal. Our second fiscal quarter, ending December 31, includes the majority of the holiday shopping season and has become our strongest quarter for sales of our consumer-oriented products, such as holiday cards, calendars, canvas prints, photobooks, and personalized gifts.

In fiscal 2020, operating income for our second quarter was greater than our operating income for the entire year, due in part to impairments recognized during our third quarter as well as negative impacts from the COVID-19

10

pandemic and related restrictions. Operating income during the second fiscal quarter represented 55%, and 46% of annual operating income in the years ended June 30, 2019 and 2018, respectively.

Employees

As of June 30, 2020, we had approximately 12,000 full-time and approximately 1,000 temporary employees worldwide.

Corporate Information

Cimpress plc was incorporated on July 5, 2017 as a private company limited by shares under the laws of Ireland and on November 18, 2019 was re-registered as a public limited company under the laws of Ireland. On December 3, 2019, Cimpress completed the Irish Merger pursuant to which Cimpress N.V. merged with and into Cimpress plc, with Cimpress plc surviving the merger and becoming the publicly traded parent company of the Cimpress group of entities. Cimpress N.V., the predecessor company to Cimpress plc, was incorporated under the laws of the Netherlands on June 5, 2009. The registered office of Cimpress plc is at Building D, Xerox Technology Park, Dundalk, Co. Louth, Ireland, and its telephone number at the registered office is +353-42-938-8500.

Available Information

We make available, free of charge through our United States website, the reports, proxy statements, amendments and other materials we file with or furnish to the SEC as soon as reasonably practicable after we electronically file or furnish such materials with or to the SEC. The address of our United States website is www.cimpress.com. We are not including the information contained on our website, or information that can be accessed by links contained on our website, as a part of, or incorporating it by reference into, this Annual Report on Form 10-K.

Item 1A. Risk Factors

Our future results may vary materially from those contained in forward-looking statements that we make in this Report and other filings with the SEC, press releases, communications with investors, and oral statements due to the following important factors, among others. Our forward-looking statements in this Report and in any other public statements we make may turn out to be wrong. These statements can be affected by, among other things, inaccurate assumptions we might make or by known or unknown risks and uncertainties or risks we currently deem immaterial. Consequently, no forward-looking statement can be guaranteed. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Risks Related to Our Business

If our long-term growth strategy is not successful, our business and financial results could be harmed.

We may not achieve our long-term objectives, and our investments in our business may fail to impact our results and growth as anticipated. Some of the factors that could cause our business strategy to fail to achieve our objectives include the following, among others:

| • | our failure to adequately execute our strategy or anticipate and overcome obstacles to achieving our strategic goals |

| • | our failure to develop or deploy our mass customization platform or the failure of the platform to drive the efficiencies and competitive advantage we expect |

| • | our failure to manage the growth, complexity, and pace of change of our business and expand our operations |

| • | our failure to address and mitigate the impacts of the COVID-19 pandemic on our business |

| • | our failure to acquire, at a value-accretive price or at all, businesses that enhance the growth and development of our business or to effectively integrate the businesses we do acquire into our business |

11

| • | our inability to purchase or develop technologies and other key assets and capabilities to increase our efficiency, enhance our competitive advantage, and scale our operations |

| • | the failure of our current supply chain to provide the resources we need at the standards we require and our inability to develop new or enhanced supply chains |

| • | our failure to acquire new customers and enter new markets, retain our current customers, and sell more products to current and new customers |

| • | our failure to address performance issues in some of our businesses and markets |

| • | our failure to sustain growth in relatively mature markets |

| • | our failure to promote, strengthen, and protect our brands |

| • | our failure to effectively manage competition and overlap within our brand portfolio |

| • | the failure of our current and new marketing channels to attract customers |

| • | our failure to realize expected returns on our capital allocation decisions |

| • | unanticipated changes in our business, current and anticipated markets, industry, or competitive landscape |

| • | our failure to attract and retain skilled talent needed to execute our strategy and sustain our growth |

| • | general economic conditions |

If our strategy is not successful, then our revenue, earnings, cash flow, and value may not grow as anticipated, be negatively impacted, or decline, our reputation and brands may be damaged, and the price of our shares may decline. In addition, we may change our strategy from time to time, which can cause fluctuations in our financial results and volatility in our share price.

The COVID-19 pandemic has had a major adverse impact, and is expected to continue to have a major adverse impact, on our operations, financial results, customers, markets, and employees.

The COVID-19 pandemic has negatively impacted our business in a number of material ways, and we expect these impacts to continue. These impacts include, but are not limited to, the following:

| • | material declines in demand for our products and services, leading to major adverse effects on our revenue, earnings, cash flows, and other financial results |

| • | disruptions in our operations, with many of our employees subject to shelter-in-place orders and other safety measures restricting them from leaving their homes |

| • | large investments of time and resources as our management team focuses on mitigating the effects of the pandemic on our business operations while protecting the health of our employees |

Depending on the duration and development of the pandemic, including the possibility of future "waves" of increased infection rates, we could see additional impacts in the future. For example, although our supply chain has not been materially impacted to date, in the future we could experience supply chain disruptions due to restrictions on the operations of our suppliers and travel restrictions including border closures in some jurisdictions. In addition, although we have amended our senior secured credit facility to suspend our financial maintenance covenants for a period of time, if the adverse effects on our financial results continue beyond the suspension period, we could have difficulty complying with our credit facility covenants, which could have a number of negative effects on our business and operations, ranging from limitations on our ability to borrow under the facility to causing us to default under our indebtedness.

12

We cannot predict how the COVID-19 pandemic will develop, how long it and its impacts on economic activity and our business, operations, and markets will continue, or whether the pandemic will lead to a prolonged economic downturn. Although we expect the pandemic to continue to materially adversely impact customers, and therefore our financial results, and prolonged impacts could begin to materially impact suppliers and employees, the extent of the impacts will depend on future developments that are highly uncertain and impossible to predict.

We may not succeed in promoting and strengthening our brands, which could prevent us from acquiring new customers and increasing revenues.

A primary component of our business strategy is to promote and strengthen our brands to attract new and repeat customers, and we face significant competition from other companies in our markets who also seek to establish strong brands. To promote and strengthen our brands, we must incur substantial marketing expenses and establish a relationship of trust with our customers by providing a high-quality customer experience, which requires us to invest substantial amounts of our resources. Our ability to provide a high-quality customer experience is also dependent on external factors over which we may have little or no control, such as the reliability and performance of our suppliers, third-party fulfillers, third-party carriers, and communication infrastructure providers. If we are unable to promote our brands or provide customers with a high-quality customer experience, we may fail to attract new customers, maintain customer relationships, and sustain or increase our revenues.

We manage our business for long-term results, and our quarterly and annual financial results often fluctuate, which may lead to volatility in our share price.

Our revenue and operating results often vary significantly from period to period due to a number of factors, and as a result comparing our financial results on a period-to-period basis may not be meaningful. We prioritize our uppermost financial objective of maximizing our intrinsic value per share even at the expense of shorter-term results and do not manage our business to maximize current period reported financial results, such as (but not limited to) near- and mid-term revenue, operating income, net income, EPS, adjusted EBITDA, and cash flow. Many of the factors that lead to period-to-period fluctuations are outside of our control; however, some factors are inherent in our business strategies. Some of the specific factors that could cause our operating results to fluctuate from quarter to quarter or year to year include among others:

| • | investments in our business in the current period intended to generate longer-term returns, where the costs in the near term will not be offset by revenue or cost savings until future periods, if at all |

| • | the effects of the COVID-19 pandemic on our customers, suppliers, business, and operations |

| • | variations in the demand for our products and services, in particular during our second fiscal quarter, which may be driven by seasonality, performance issues in some of our businesses and markets, or other factors |

| • | currency and interest rate fluctuations, which affect our revenue, costs, and fair value of our assets and liabilities |

| • | our hedging activity |

| • | our ability to attract and retain customers and generate purchases |

| • | shifts in revenue mix toward less profitable products and brands |

| • | the commencement or termination of agreements with our strategic partners, suppliers, and others |

| • | our ability to manage our production, fulfillment, and support operations |

| • | costs to produce and deliver our products and provide our services, including the effects of inflation and the rising costs of raw materials such as paper |

| • | our pricing and marketing strategies and those of our competitors |

| • | expenses and charges related to our compensation arrangements with our executives and employees |

13

| • | costs and charges resulting from litigation |

| • | significant increases in credits, beyond our estimated allowances, for customers who are not satisfied with our products or delivery |

| • | changes in our effective income tax rate |

| • | costs to acquire businesses or integrate our acquired businesses |

| • | financing costs |

| • | impairments of our tangible and intangible assets including goodwill |

| • | the results of our minority investments and joint ventures |

Some of our expenses, such as office leases, depreciation related to previously acquired property and equipment, and personnel costs, are relatively fixed, and we may be unable to, or may not choose to, adjust operating expenses to offset any revenue shortfall. Accordingly, any shortfall in revenue may cause significant variation in operating results in any period. Our operating results may sometimes be below the expectations of public market analysts and investors, in which case the price of our ordinary shares may decline.

We may not be successful in developing and deploying our mass customization platform or in realizing the anticipated benefits of the platform.

A key component of our strategy is the development and deployment of a mass customization platform, which is a cloud-based collection of software services, APIs, web applications and related technology offerings that can be leveraged independently or together by our businesses and third parties to perform common tasks that are important to mass customization. The process of developing new technology is complex, costly, and uncertain and requires us to commit significant resources before knowing whether our businesses will adopt components of our mass customization platform or whether the platform will make us more effective and competitive. As a result, there can be no assurance that we will find new capabilities to add to the growing set of technologies that make up our platform, that our diverse businesses will realize value from the platform, or that we will realize expected returns on the capital expended to develop the platform.

In addition, we are aware that other companies are developing platforms that could compete with ours. If a competitor were to create a more attractive or easier to adopt platform that has the potential to drive more scale advantage than ours does, our competitive position could be harmed.

Our global operations, decentralized organizational structure, and expansion place a significant strain on our management, employees, facilities, and other resources and subject us to additional risks.

We are a global company with production facilities, offices, and localized websites in many countries across six continents, and we manage our businesses and operations in a decentralized, autonomous manner. We expect to establish operations, acquire or invest in businesses, and sell our products and services in additional markets and geographic regions, including emerging markets, where we may have limited or no experience. We may not be successful in all markets and regions in which we invest or where we establish operations, which may be costly to us. We are subject to a number of risks and challenges that relate to our global operations, decentralization, and expansion, including, among others:

| • | difficulty managing operations in, and communications among, multiple businesses, locations, and time zones |

| • | difficulty complying with multiple tax laws, treaties, and regulations and limiting our exposure to onerous or unanticipated taxes, duties, and other costs |

| • | our failure to improve and adapt our financial and operational controls and systems to manage our decentralized businesses and comply with our obligations as a public company |

14

| • | the challenge of complying with disparate laws in multiple countries, such as local regulations that may impair our ability to conduct our business as planned, protectionist laws that favor local businesses, and restrictions imposed by local labor laws |

| • | our inexperience in marketing and selling our products and services within unfamiliar markets, countries, and cultures |

| • | challenges of working with local business partners |

| • | our failure to properly understand and develop graphic design content and product formats and attributes appropriate for local tastes |

| • | disruptions caused by political and social instability that may occur in some countries |

| • | exposure to corrupt business practices that may be common in some countries or in some sales channels and markets, such as bribery or the willful infringement of intellectual property rights |

| • | difficulty repatriating cash from some countries |

| • | difficulty importing and exporting our products across country borders and difficulty complying with customs regulations in the many countries where we sell products |

| • | disruptions or cessation of important components of our international supply chain |

| • | failure of local laws to provide a sufficient degree of protection against infringement of our intellectual property |

There is considerable uncertainty about the economic and regulatory effects of the United Kingdom's exit from the European Union (commonly referred to as "Brexit"). The UK is one of our largest markets in Europe, but we currently ship many products to UK customers from EU countries. If Brexit results in greater restrictions on imports and exports between the UK and the EU or increased regulatory complexity, then our operations and financial results could be negatively impacted.

In addition, we are exposed to fluctuations in currency exchange rates that may impact items such as the translation of our revenue and expenses, remeasurement of our intercompany balances, and the value of our cash and cash equivalents and other assets and liabilities denominated in currencies other than the U.S. dollar, our reporting currency. The hedging activities we engage in may not mitigate the net impact of currency exchange rate fluctuations, and our financial results may differ materially from expectations as a result of such fluctuations.

Failure to protect our information systems and the confidential information of our customers, employees, and business partners against security breaches or thefts could damage our reputation and brands, subject us to litigation and enforcement actions, and substantially harm our business and results of operations.

Our business involves the receipt, storage, and transmission of customers' personal and payment information, as well as confidential information about our business, employees, suppliers, and business partners, some of which is entrusted to third-party service providers, partners, and vendors. Our information systems and those of third parties with which we share information are vulnerable to an increasing threat of cyber security risks, including physical and electronic break-ins, computer viruses, and phishing and other social engineering scams, among other risks, and these vulnerabilities may be heightened during the COVID-19 pandemic when many of our employees are working from home and a number of our offices are largely empty. As security threats evolve and become more sophisticated and more difficult to detect and defend against, a hacker or thief may defeat our security measures, or those of our third-party service provider, partner, or vendor, and obtain confidential or personal information. We or the third party may not discover the security breach and theft of information for a significant period of time after the breach occurs. We may need to expend significant resources to protect against security breaches and thefts of data or to address problems caused by breaches or thefts, and we may not be able to anticipate cyber attacks or implement adequate preventative measures. Any compromise or breach of our information systems or the information systems of third parties with which we share information could, among other things:

15

| • | damage our reputation and brands |

| • | expose us to losses, remediation costs, litigation, enforcement actions, and possible liability |

| • | result in a failure to comply with legal and industry privacy regulations and standards |

| • | lead to the misuse of our and our customers' and employees' confidential or personal information |

| • | cause interruptions in our operations |

| • | cause us to lose revenue if existing and potential customers believe that their personal and payment information may not be safe with us |

We are subject to the laws of many states, countries, and regions and industry guidelines and principles governing the collection, use, retention, disclosure, sharing, and security of data that we receive from and about our customers and employees. Any failure or perceived failure by us to comply with any of these laws, guidelines, or principles could result in actions against us by governmental entities or others, a loss of customer confidence, and damage to our brands, any of which could have an adverse effect on our business. In addition, the regulatory landscape is constantly changing, as various regulatory bodies throughout the world enact new laws concerning privacy, data retention, data transfer and data protection, such as the California Consumer Privacy Act that recently became effective. Complying with these varying and changing requirements could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business and operating results.

Acquisitions and strategic investments may be disruptive to our business.

An important way in which we pursue our strategy is to selectively acquire businesses, technologies, and services and make minority investments in businesses and joint ventures. The time and expense associated with finding suitable businesses, technologies, or services to acquire or invest in can be disruptive to our ongoing business and divert our management's attention. In addition, we have needed in the past, and may need in the future, to seek financing for acquisitions and investments, which may not be available on terms that are favorable to us, or at all, and can cause dilution to our shareholders, cause us to incur additional debt, or subject us to covenants restricting the activities we may undertake.

Our acquisitions and strategic investments may fail to achieve our goals.

An acquisition, minority investment, or joint venture may fail to achieve our goals and expectations for a number of reasons including the following:

| • | The business we acquired or invested in may not perform as well as we expected. |

| • | We may overpay for acquired businesses, which can, among other things, negatively affect our intrinsic value per share. |

| • | We may fail to integrate acquired businesses, technologies, services, or internal systems effectively, or the integration may be more expensive or take more time than we anticipated. |

| • | The management of our acquired businesses, minority investments, and joint ventures may be more expensive or may take more resources than we expected. |

| • | We may not realize the anticipated benefits of integrating acquired businesses into our mass customization platform. |

| • | We may encounter cultural or language challenges in integrating an acquired business or managing our minority investment in a business. |

| • | We may not be able to retain customers and key employees of the acquired businesses, and we and the businesses we acquire or invest in may not be able to cross sell products and services to each other's customers. |

16

We generally assume the liabilities of businesses we acquire, which could include liability for an acquired business' violation of law that occurred before we acquired it. In addition, we have historically acquired smaller, privately held companies that may not have as strong a culture of legal compliance or as robust financial controls as a larger, publicly traded company like Cimpress, and if we fail to implement adequate training, controls, and monitoring of the acquired companies, we could also be liable for post-acquisition legal violations.

Our acquisitions and minority investments can negatively impact our financial results.

Acquisitions and minority investments can be costly, and some of our acquisitions and investments may be dilutive, leading to reduced earnings. Acquisitions and investments can result in increased expenses including impairments of goodwill and intangible assets if financial goals are not achieved, assumptions of contingent or unanticipated liabilities, amortization of acquired intangible assets, and increased tax costs.

In addition, the accounting for our acquisitions and minority investments requires us to make significant estimates, judgments, and assumptions that can change from period to period, based in part on factors outside of our control, which can create volatility in our financial results. For example, we often pay a portion of the purchase price for our acquisitions in the form of an earn out based on performance targets for the acquired companies or enter into obligations or options to purchase noncontrolling interests in our acquired companies or minority investments, which can be difficult to forecast. If in the future our assumptions change and we determine that higher levels of achievement are likely under our earn outs or future purchase obligations, we will need to pay and record additional amounts to reflect the increased purchase price. These additional amounts could be significant and could adversely impact our results of operations.

Furthermore, provisions for future payments to sellers based on the performance or valuation of the acquired businesses, such as earn outs and options to purchase noncontrolling interests, can lead to disputes with the sellers about the achievement of the performance targets or valuation or create inadvertent incentives for the acquired company's management to take short-term actions designed to maximize the payments they receive instead of benefiting the business. In addition, strong performance of the underlying business could result in material payments pursuant to earn-out provisions or future purchase obligations that may or may not reflect the fair market value of the asset at that time.

If we are unable to attract new and repeat customers in a cost-effective manner, our business and results of operations could be harmed.

Our success depends on our ability to attract new and repeat customers in a cost-effective manner. Our various businesses rely on a variety of methods to do this including drawing visitors to our websites, promoting our products and services through search engines such as Google, Bing, and Yahoo!, email, direct mail, advertising banners and other online links, broadcast media, telesales and word-of-mouth customer referrals. If the search engines on which we rely modify their algorithms or terminate their relationships with us, or if the prices at which we may purchase listings increase, then our costs could increase, and fewer customers may click through to our websites. If links to our websites are not displayed prominently in online search results, if fewer customers click through to our websites, if our direct mail marketing campaigns are not effective, or if the costs of attracting customers using any of our current methods significantly increase, then our ability to efficiently attract new and repeat customers would be reduced, our revenue and net income could decline, and our business and results of operations would be harmed.

Seasonal fluctuations in our business place a strain on our operations and resources.

Our profitability has historically been highly seasonal. Our second fiscal quarter includes the majority of the holiday shopping season and accounts for a disproportionately high portion of our earnings for the year, primarily due to higher sales of home and family products such as holiday cards, calendars, photo books, and personalized gifts. In addition, our National Pen business has historically generated nearly all of its profits during the December quarter. Our operating income during the second fiscal quarter represented 217%, 55%, and 46% of annual operating income in the years ended June 30, 2020, 2019, and 2018. In anticipation of increased sales activity during our second fiscal quarter holiday season, we typically incur significant additional capacity related expenses each year to meet our seasonal needs, including facility expansions, equipment purchases and leases, and increases in the number of temporary and permanent employees. Lower than expected sales during the second quarter have a disproportionately large impact on our operating results and financial condition for the full fiscal

17

year. In addition, if our manufacturing and other operations are unable to keep up with the high volume of orders during our second fiscal quarter or we experience inefficiencies in our production, then our costs may be significantly higher, and we and our customers can experience delays in order fulfillment and delivery and other disruptions. If we are unable to accurately forecast and respond to seasonality in our business, our business and results of operations may be materially harmed.

Our hedging activity could negatively impact our results of operations, cash flows, or leverage.

We have entered into derivatives to manage our exposure to interest rate and currency movements. If we do not accurately forecast our results of operations, execute contracts that do not effectively mitigate our economic exposure to interest rates and currency rates, elect to not apply hedge accounting, or fail to comply with the complex accounting requirements for hedging, our results of operations and cash flows could be volatile, as well as negatively impacted. Also, our hedging objectives may be targeted at improving our non-GAAP financial metrics, which could result in increased volatility in our GAAP results. Since some of our hedging activity addresses long-term exposures, such as our net investment in our subsidiaries, the gains or losses on those hedges could be recognized before the offsetting exposure materializes to offset them. This could result in our having to borrow to settle a loss on a derivative without an offsetting cash inflow, potentially causing volatility in our cash or debt balances and therefore our leverage.

Our businesses face risks related to interruption of our operations and lack of redundancy.

Our businesses' production facilities, websites, infrastructure, supply chain, customer service centers, and operations may be vulnerable to interruptions, and we do not have redundancies or alternatives in all cases to carry on these operations in the event of an interruption. In addition, because our businesses are dependent in part on third parties for the implementation and maintenance of certain aspects of our communications and production systems, we may not be able to remedy interruptions to these systems in a timely manner or at all due to factors outside of our control. Some of the events that could cause interruptions in our businesses' operations or systems are the following, among others: