LETTER FROM ROBERT JANUARY 29, 2025 Dear Investor, We continue to focus on the initiatives outlined in my annual letter of July 31, 2024 and our September 10, 2024 investor day and remain confident in Cimpress' ability to deliver attractive, multi-year improvements to earnings and cash flow. I will share the sources of confidence below. That being said, we delivered disappointing financial results in our second quarter and therefore our FY2025 results will be lower than we originally expected. We had planned for adjusted EBITDA to decline slightly in Q2 FY2025 due to the non-recurrence of $12 million of one-time favorable items in the year-ago period as well as the shortened holiday buying season compared to last year. We also experienced additional unplanned one-time headwinds to profitability. In Canada there was a postal strike during the holiday peak that kept our customers from buying holiday cards given the uncertainty of deliverability, which reduced profits by about $1.8 million, and we had a $2.9 million charge for a land duty tax in Australia related to our 2019 redomiciliation to Ireland that we are appealing. All together these items weighed on year-over-year profitability by over $16 million. Additionally, consolidated revenue was lower than plan in Q2 driven primarily by underperformance in the U.S. for business cards and seasonally important consumer-focused products, such as holiday cards at Vista and canvas prints at BuildASign. Our strong growth in more complex products that we described at our September investor day remained robust and met or exceeded plan. This was not enough to overcome the shortfall from high gross margin products and increased advertising and operating costs. More details about the financial and operational results by segment are provided below. Summary financial results for Q2 FY2025 compared to Q2 FY2024: • Revenue grew 2% on both a reported and organic constant-currency basis. • Operating income decreased $26.7 million year over year to $80.9 million. • Adjusted EBITDA decreased $34.2 million year over year to $132.3 million. • Operating cash flow increased $1.6 million year over year to $176.5 million, largely the benefit of lower cash interest expense and higher inflows from other working capital items. • Adjusted free cash flow decreased $16.4 million year over year to $133.5 million, driven by the operating cash flow results and planned higher capital expenditures during the quarter. • We repurchased 533,868 Cimpress shares for $42.4 million during the second quarter at an average price of $79.35 per share, bringing our year-to-date total to 657,193 shares for $53.0 million at an average price of $80.62 per share. • Net leverage at December 31, 2024 was 3.1 times trailing-twelve month EBITDA as calculated under our credit agreement, flat from Q1 FY2025. • Our liquidity position is strong with cash and marketable securities of $224.4 million as of December 31, 2024. Our $250 million revolving credit facility remained undrawn at the end of the quarter. • We repriced the $1.032 billion USD tranche of our Term Loan B and upsized it by $49 million to pay down the remainder of our €46 million Euro tranche. These actions will reduce our annual cash interest by approximately $5 million. Segment Commentary Vista revenue grew 3% in Q2 on a reported and organic constant-currency basis. Revenue was on plan in Europe, and on plan globally for focus categories like promotional products, apparel, signage, and packaging and labels that showed continued strength with year-over-year bookings growth rates that ranged from high-single-digit to high- teens. This strength was offset by year-over-year declines in bookings from the seasonally important consumer products (-3%) and business cards and stationery (-4%) driven by the North American market. We estimate that the aforementioned Canadian postal strike had a $3 million impact to revenue in Q2, most notably in the consumer category. Please see non-GAAP reconciliations at the end of this document. Page 2 of 30

For holiday products in the U.S., more intensive discounting from competitors, significantly higher advertising costs in performance channels and fewer buying days during the holiday season combined to lower our revenue versus last year most notably in holiday cards. Industry tracking data for the U.S. market signaled a similar decline in revenue for most consumer competitors for holiday cards, photo products and related items. Vista Q2 segment EBITDA declined 14% year over year, down $15.4 million to $92.4 million. Gross margin declined by 220 basis points during the period, largely the result of the non-recurrence of one-time benefits in the year-ago period and product mix shifts largely driven by the declines in North American consumer products and business cards, each of which have high gross margins. As mentioned earlier, we estimate the Canadian postal strike drove a $1.8 million impact on gross profit and segment EBITDA. Vista's advertising as a percent of revenue increased 90 basis points compared to the year-ago period. While this delivered good financial returns overall, the cost of advertising inventory during the peak consumer weeks in North America was more expensive than last year and Vista's performance in organic search and free channels was weaker, contributing to the shortfall in revenue, gross profit, and EBITDA. PrintBrothers and The Print Group (our combined Upload & Print businesses) grew Q2 revenue year over year by 5% and 7%, respectively (6% combined) and on an organic constant-currency basis by 6% and 7%, respectively (7% combined). Order growth and increased fulfillment for other Cimpress businesses drove revenue strength across the businesses. Lower per-order quantities partially offset those strengths. We continue to see the market shift to smaller orders as being a positive for us overall because we excel at serving very large numbers of customers for small individual orders whereas traditional printers struggle to compete for such orders. Q2 segment EBITDA declined during the quarter for PrintBrothers, down $5.5 million, mostly a result of lapping $4.1 million of one-time COGS and operating expense benefits in the prior year. The Print Group EBITDA expanded by $1.2 million with continued gross margin expansion, partially offset by the non-recurrence of a $1.3 million prior-year benefit in operating expenses related to variable long-term incentive compensation. Combined Upload & Print EBITDA declined $4.3 million year over year. National Pen Q2 FY2025 revenue grew 1% on a reported and organic constant-currency basis, driven by growth in e-commerce, cross-Cimpress fulfillment for other Cimpress businesses, and telesales. These growing channels were offset by revenue declines in mail order where National Pen continued to optimize for efficiency of direct mail advertising. Segment EBITDA declined $2.1 million year over year, driven by higher inbound freight costs and product mix shifts that weighed on gross margin. All Other Businesses Q2 revenue grew 1% year over year on a reported basis and 3% on an organic constant- currency basis as BuildASign continued to increase fulfillment for other Cimpress businesses, offset by declines in home decor sales year over year. As described below, we are expanding our production capabilities in this segment across multiple more complex products that have strong revenue growth, including substantial cross-Cimpress fulfillment for Vista. Segment EBITDA decreased by $3.7 million due in part to temporary production inefficiencies related to these new capabilities and the non-recurrence of a $1.4 million prior-year benefit in operating expenses related to variable long-term incentive compensation at BuildASign. Central and Corporate Costs excluding unallocated share-based compensation increased $5.8 million year over year in Q2 FY2025, driven by increased volume-driven operating costs and the one-time, $2.9 million land duty tax assessment mentioned above. In light of lower than expected Q2 results we have initiated multiple actions to improve performance, reduce operating expenses and/or to slow their growth and to optimize our pricing. Beyond these immediate actions, we believe that over the next several years we have significant further opportunity to get additional leverage from our operating expense base. Part of this will be achieved through leverage of the investments we have been making in recent years in improved product experience and technology modernization. Additionally, we are increasingly leveraging AI and see many more opportunities to improve the efficiency of software engineering, manufacturing automation, customer service, graphic design, category management, marketing, and general & administrative functions while increasing the velocity of customer-facing improvements. Please see non-GAAP reconciliations at the end of this document. Page 3 of 30

Why We Remain Confident In my July 31st letter to investors and in our September 10th investor day we detailed a number of areas where Cimpress has been making multi-year progress that make us confident about our future. This progress continued in Q2 FY2025 and we remain on the same strategic and operational path we have been on for several years: strengthening the value we deliver to our customers, improving our efficiency and accelerating the velocity with which we drive improvements. That drives our confidence that, despite occasional near-term financial volatility like we saw in the last quarter, we can drive attractive multi-year growth in revenue, adjusted EBITDA and per-share cash flows over the coming years. In the remainder of this section, we review specific examples of this progress. Strong Growth in New Product Categories • For more than five years we have been successfully expanding into product categories for mass customized print products that have higher complexity of production processes and/or supply chains than our legacy products. • Examples of these higher-growth products are packaging, roll labels, large format signage, logo apparel, promotional products, labels, catalogs, magazines, booklets and books. The TAM of these product categories is multiple times larger than that of our mature legacy categories such as business cards, postcards, flyers, simple signs, photo merchandise and holiday cards. • In total, these higher-growth categories now drive well over $1.5 billion of annual Cimpress revenues and are growing at double digit rates. For example, in H1 Vista's bookings from product categories other than business cards and consumer grew 11% year over year. • Though some of these higher-growth categories have lower gross margins (i.e., expressed as a percent of revenue) than some of our legacy product categories, they typically generate higher customer lifetime gross profit (i.e., expressed as dollars) compared to our legacy products since they have higher average order values and higher repeat order rates. We also have clear opportunities to reduce per-unit cost from today's levels as their volumes grow. • We have a robust pipeline of promising new products in these higher-growth categories that will launch during the remainder of the fiscal year. These new products are one of the drivers of our previously described expectation for increased capital expenditures in FY2025. Cross-Cimpress Fulfillment • As of today the vast majority of our production volume is split across multiple facilities within Cimpress, meaning that often we produce the same product categories in multiple locations. Because our scale-based manufacturing advantages typically occur on a product-by-product basis, we have the opportunity to lower cost and improve quality, speed and utilization of our invested capital by aggregating volume into focused production hubs. We have launched multiple cross-Cimpress fulfillment pilot projects to do so, enabled by our investments in MCP capabilities over the last years. • The following are examples of cross-Cimpress fulfillment pilot projects from the past six months: ◦ Using fulfillment from Pixartprinting, Vista Europe was able to significantly reduce prices on roll labels while maintaining its gross margin as a percentage of revenue; volume increased 150% year-over-year in H1. ◦ In Vista North America, fulfillment of promotional products from National Pen and signage from BuildASign, measured as the cost of goods excluding shipping, grew 125% year-over-year to more than $8 million in Q2, making Vista more competitive in the high growth categories of promotional products and large format signage. ◦ We are moving production of high-volume flyers for Vista's European customers from Vista's Dutch production facility to our Upload & Print businesses, since our Upload & Print businesses have production lines that are better suited for these order quantities and that are closer to end- customers. More than half of the volume has already shifted and 100% should shift by the end of FY2025. ◦ The transfer of Vista's high-volume flyers to Upload & Print and signage to BuildASign is freeing up production space in Vista's Dutch and Canadian facilities that is now being used for new, highly automated production lines for custom paper bags that Vista will fulfill for multiple Cimpress businesses. ◦ In total, the amount of production costs that our businesses are fulfilling on each other's behalf has more than doubled year over year. Please see non-GAAP reconciliations at the end of this document. Page 4 of 30

◦ We believe we have many more cross-Cimpress fulfillment opportunities like this in the coming years. • In the early stages of this type of production consolidation we sometimes see reduced absorption of manufacturing fixed costs in the facility from which we transfer volume, but this will allow us to avoid capital and other overhead for plant expansion as we utilize that space for focused production hubs for other products. Bringing Upload & Print to the U.S. Market • Cimpress has been very successful in Europe with our Upload & Print businesses, generating approximately $1 billion of annual revenue with EBITDA margins in the mid-teens and attractive free cash flow generation. Our Upload & Print business model serves customers who have strong graphic design skills and who need access to production of a wide variety of products, including great strength in our growth product categories that require more complex production processes. • We are proud to announce today that, based on that European experience, Pixartprinting will open for business in the U.S. in Q4 FY2025. Pixartprinting will leverage its modern, flexible technology stack (built on MCP) and its very strong production capabilities that it will bring to market via a new state-of-the art Upload & Print production facility in western Pennsylvania. This North American Upload & Print production facility is one of the drivers of our previously described expectation for increased capital expenditures in FY2025. • Pixartprinting's U.S. expansion will also leverage cross-Cimpress fulfillment from BuildASign, National Pen and Vista North America to have a broader and deeper product line. • Pixartprinting's Pennsylvania facility will be another example of a focused production hub that fulfills not just for Pixartprinting, but also for Vista and other parts of Cimpress, providing access to new products. Vista-Specific Progress While Vista benefits from the previously described examples, there are a few additional Vista-specific items to note: • Revenue from consumer products was lower year over year in Q2 FY2025, inclusive of the Canadian postal strike. However, consumer product bookings have been growing modestly in non-holiday quarters and this has continued in January 2025. • Vista continued its multi-year track record of improving gross profit per customer in Q2. First order gross profit for new customers was the highest on record, reflective of the dynamics of the higher-growth categories previously described. • In Q2, Vista grew bookings at rates that ranged from high-single-digits to high-teens in promotional products, apparel, signage, and packaging and labels, supported by new product introductions and improved product recommendations and design experiences. • Vista continued to evolve its media mix for better returns across our marketing funnel. In the U.S., evolving advertising spend drove brand salience to its highest level in more than two years. Outlook Our multi-year financial outlook remains healthy despite the turbulence we experienced in the most recent quarter. We remain committed to our multi-year guidance of achieving mid-single digit revenue growth (possibly a bit higher), a faster growth rate of adjusted EBITDA, and a conversion rate of adjusted EBITDA to adjusted free cash flow of approximately 45% to 50%, with fluctuations from year to year. We don't expect to achieve this for FY2025 in light of results through the first half of this year and the very strong EBITDA and cash flow we delivered in the FY2024 comparison period. Our multi-year outlook is now based upon our current FY2025 expectations, which are as follows: • Revenue ◦ H2 FY2025: at least 3% on a reported basis (assuming recent currency rates) and 4% on an organic constant-currency basis. Year-over-year bookings growth in January 2025 month to date is consistent with this revised outlook, including Vista where bookings growth is higher than Q2. ◦ FY2025: at least 3% on a reported basis and 4% on an organic constant-currency basis. • Operating income ◦ H2 FY2025: at least $113.7 million, an increase of at least 7% over H2 FY2024. ◦ FY2025: at least $233.9 million, a decrease of no more than 5% compared to FY2024. Please see non-GAAP reconciliations at the end of this document. Page 5 of 30

• Adjusted EBITDA ◦ H2 FY2025: at least $220 million, an increase of at least 3% over H2 FY2024. ◦ FY2025: at least $440 million, a decrease of no more than 6% compared to FY2024. • Net cash provided by operating activities ◦ H2 FY2025: at least $109 million. We experienced strong seasonal inflows from working capital in Q2 FY2025 and, as usual, we expect to have outflows from working capital in Q3. For the second half of the year, we expect the impact of changes in working capital to be less favorable than last year. ◦ FY2025: at least $289 million. • Adjusted free cash flow ◦ H2 FY2025: at least $50 million. This includes an expectation of approximately $30 million of capital expenditures and $31 million of capitalized software expense. ◦ FY2025: at least $157 million. This includes an expectation of approximately $74 million of capital expenditures and $62 million of capitalized software expense. • Net leverage ◦ We remain committed to our net leverage target of 2.5x TTM EBITDA as calculated under our credit agreement. ◦ We expect to end FY2025 with net leverage that is approximately 3.0x given the above expectations for FY2025 profitability and free cash flow. The outlook commentary above does not consider potential changes to trade laws or tariffs that may be implemented by the new U.S. administration, if any. Conclusion We have improved our business dramatically over the last years and we continued to progress in Q2 against our well established operational objectives, even though our Q2 financial results don't reflect that progress. We are hard at work to extend our long history of profitable growth and to further improve the per-share value we deliver to you who have entrusted your capital to us. Sincerely, Robert S. Keane Founder, Chairman & CEO Cimpress will host a public earnings call tomorrow, January 30, 2025 at 8:00 am ET, which you can join via the link on the events section of ir.cimpress.com. You may presubmit questions by emailing ir@cimpress.com, and you may also ask questions via chat during the live call. Please see non-GAAP reconciliations at the end of this document. Page 6 of 30

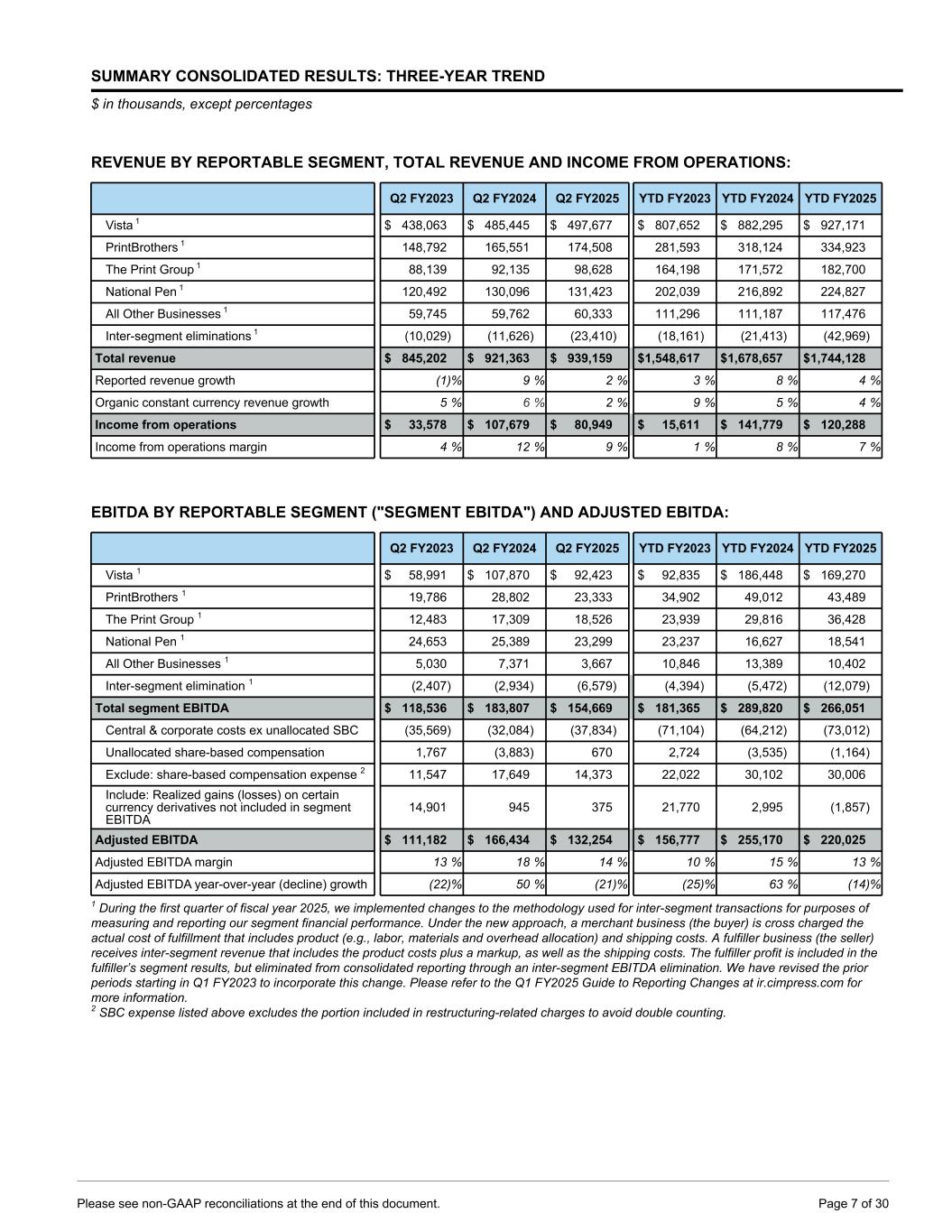

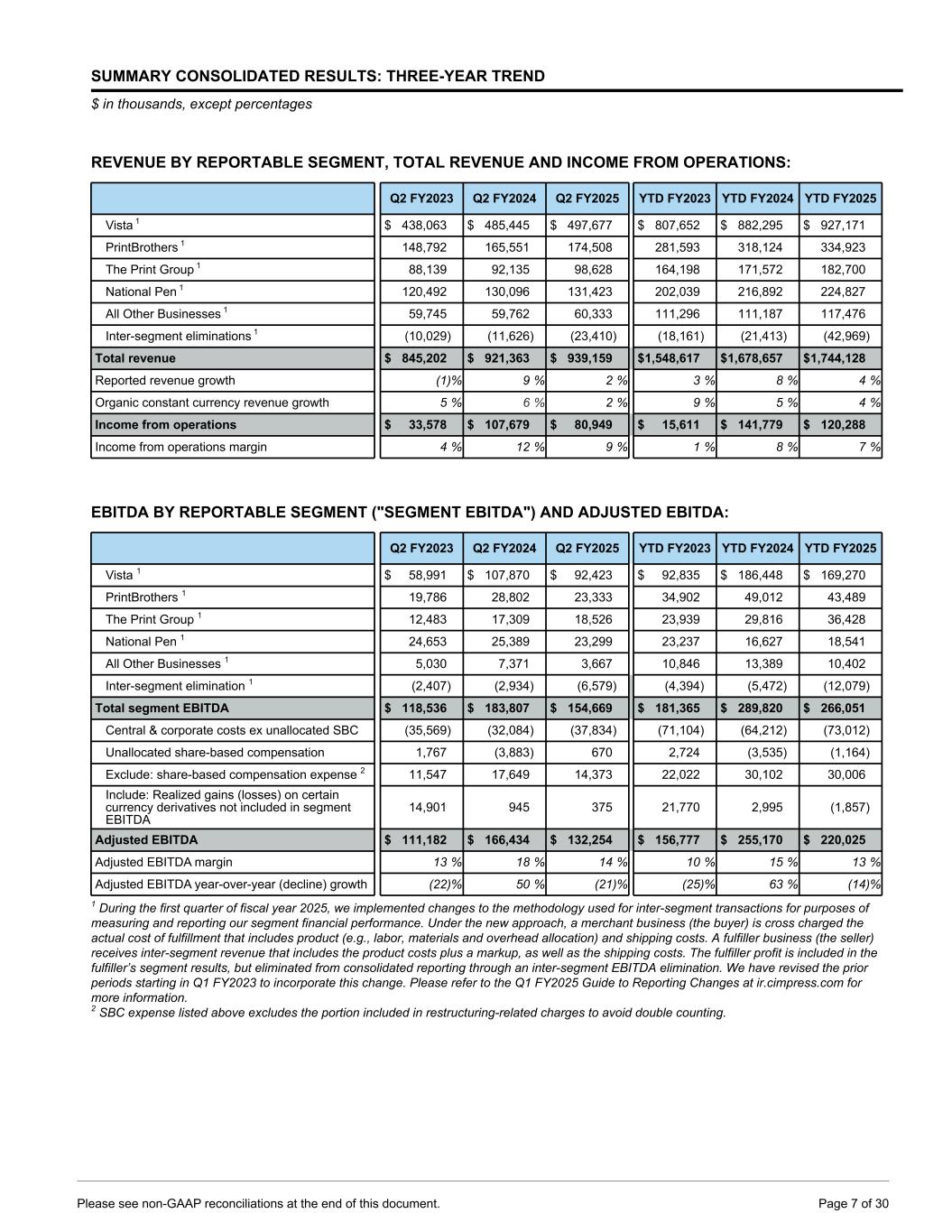

SUMMARY CONSOLIDATED RESULTS: THREE-YEAR TREND $ in thousands, except percentages REVENUE BY REPORTABLE SEGMENT, TOTAL REVENUE AND INCOME FROM OPERATIONS: Q2 FY2023 Q2 FY2024 Q2 FY2025 YTD FY2023 YTD FY2024 YTD FY2025 Vista 1 $ 438,063 $ 485,445 $ 497,677 $ 807,652 $ 882,295 $ 927,171 PrintBrothers 1 148,792 165,551 174,508 281,593 318,124 334,923 The Print Group 1 88,139 92,135 98,628 164,198 171,572 182,700 National Pen 1 120,492 130,096 131,423 202,039 216,892 224,827 All Other Businesses 1 59,745 59,762 60,333 111,296 111,187 117,476 Inter-segment eliminations 1 (10,029) (11,626) (23,410) (18,161) (21,413) (42,969) Total revenue $ 845,202 $ 921,363 $ 939,159 $ 1,548,617 $ 1,678,657 $ 1,744,128 Reported revenue growth (1) % 9 % 2 % 3 % 8 % 4 % Organic constant currency revenue growth 5 % 6 % 2 % 9 % 5 % 4 % Income from operations $ 33,578 $ 107,679 $ 80,949 $ 15,611 $ 141,779 $ 120,288 Income from operations margin 4 % 12 % 9 % 1 % 8 % 7 % EBITDA BY REPORTABLE SEGMENT ("SEGMENT EBITDA") AND ADJUSTED EBITDA: Q2 FY2023 Q2 FY2024 Q2 FY2025 YTD FY2023 YTD FY2024 YTD FY2025 Vista 1 $ 58,991 $ 107,870 $ 92,423 $ 92,835 $ 186,448 $ 169,270 PrintBrothers 1 19,786 28,802 23,333 34,902 49,012 43,489 The Print Group 1 12,483 17,309 18,526 23,939 29,816 36,428 National Pen 1 24,653 25,389 23,299 23,237 16,627 18,541 All Other Businesses 1 5,030 7,371 3,667 10,846 13,389 10,402 Inter-segment elimination 1 (2,407) (2,934) (6,579) (4,394) (5,472) (12,079) Total segment EBITDA $ 118,536 $ 183,807 $ 154,669 $ 181,365 $ 289,820 $ 266,051 Central & corporate costs ex unallocated SBC (35,569) (32,084) (37,834) (71,104) (64,212) (73,012) Unallocated share-based compensation 1,767 (3,883) 670 2,724 (3,535) (1,164) Exclude: share-based compensation expense 2 11,547 17,649 14,373 22,022 30,102 30,006 Include: Realized gains (losses) on certain currency derivatives not included in segment EBITDA 14,901 945 375 21,770 2,995 (1,857) Adjusted EBITDA $ 111,182 $ 166,434 $ 132,254 $ 156,777 $ 255,170 $ 220,025 Adjusted EBITDA margin 13 % 18 % 14 % 10 % 15 % 13 % Adjusted EBITDA year-over-year (decline) growth (22) % 50 % (21) % (25) % 63 % (14) % 1 During the first quarter of fiscal year 2025, we implemented changes to the methodology used for inter-segment transactions for purposes of measuring and reporting our segment financial performance. Under the new approach, a merchant business (the buyer) is cross charged the actual cost of fulfillment that includes product (e.g., labor, materials and overhead allocation) and shipping costs. A fulfiller business (the seller) receives inter-segment revenue that includes the product costs plus a markup, as well as the shipping costs. The fulfiller profit is included in the fulfiller’s segment results, but eliminated from consolidated reporting through an inter-segment EBITDA elimination. We have revised the prior periods starting in Q1 FY2023 to incorporate this change. Please refer to the Q1 FY2025 Guide to Reporting Changes at ir.cimpress.com for more information. 2 SBC expense listed above excludes the portion included in restructuring-related charges to avoid double counting. Please see non-GAAP reconciliations at the end of this document. Page 7 of 30

SUMMARY CONSOLIDATED RESULTS: THREE-YEAR TREND (CONTINUED) $ in thousands CASH FLOW AND OTHER METRICS: Q2 FY2023 Q2 FY2024 Q2 FY2025 YTD FY2023 YTD FY2024 YTD FY2025 Net cash provided by (used in) operating activities $ 81,126 $ 174,946 $ 176,519 $ 55,875 $ 217,200 $ 180,903 Net cash provided by (used in) investing activities (5,526) (19,569) (37,559) (106,569) (30,395) (63,061) Net cash provided by (used in) financing activities (100,935) (12,090) (58,660) (112,715) (47,155) (94,076) Adjusted free cash flow1 53,721 149,961 133,522 1,504 160,889 107,904 Cash interest, net1 32,806 39,591 16,837 45,792 60,481 48,373 COMPONENTS OF ADJUSTED FREE CASH FLOW: Q2 FY2023 Q2 FY2024 Q2 FY2025 YTD FY2023 YTD FY2024 YTD FY2025 Adjusted EBITDA $ 111,182 $ 166,434 $ 132,254 $ 156,777 $ 255,170 $ 220,025 Cash restructuring payments (1,896) (1,223) (225) (9,827) (6,938) (358) Cash (paid) received for income tax (6,909) (10,640) (13,215) (11,166) (26,434) (11,386) Other changes in net working capital and other reconciling items 11,555 59,966 74,542 (34,117) 55,883 20,995 Purchases of property, plant and equipment (14,732) (11,390) (26,418) (26,490) (33,955) (43,419) Capitalization of software and website development costs (13,916) (13,947) (16,677) (29,246) (28,344) (31,248) Proceeds from sale of assets 1,243 352 98 1,365 5,988 1,668 Adjusted free cash flow before cash interest, net $ 86,527 $ 189,552 $ 150,359 $ 47,296 $ 221,370 $ 156,277 Cash interest, net1 (32,806) (39,591) (16,837) (45,792) (60,481) (48,373) Adjusted free cash flow1 $ 53,721 $ 149,961 $ 133,522 $ 1,504 $ 160,889 $ 107,904 1 Cash interest, net is cash interest payments, partially offset by cash interest received on our cash and marketable securities. Please see non-GAAP reconciliations at the end of this document. Page 8 of 30

INCOME STATEMENT HIGHLIGHTS Revenue ($M) & Reported Revenue Growth (Decline) $845 $742 $789 $757 $921 $781 $833 $805 $939 (1)% 13% 9% 8% 9% 5% 6% 6% 2% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Gross Profit ($M) & Gross Margin (%) $390 $347 $376 $359 $458 $376 $404 $382 $450 46% 47% 48% 47% 50% 48% 49% 47% 48% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 GAAP Operating Income (Loss) ($M) & Margin (%) (Quarterly) $34 ($12) $54 $34 $108 $39 $66 $39 $81 4% (2)% 7% 5% 12% 5% 8% 5% 9% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Adjusted EBITDA ($M) & Margin (%) (Quarterly) $111 $69 $114 $89 $166 $94 $119 $88 $132 13% 9% 14% 12% 18% 12% 14% 11% 14% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Organic Constant-Currency Revenue Growth 5% 16% 9% 4% 6% 4% 6% 6% 2% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Contribution Profit ($M) & Contribution Margin (%) $259 $236 $267 $236 $319 $260 $286 $254 $303 31% 32% 34% 31% 35% 33% 34% 32% 32% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 GAAP Operating Income (Loss) ($M) & Margin (%) (TTM) ($40) ($24) $57 $109 $183 $235 $247 $253 $226 (1)% (1)% 2% 3% 6% 7% 8% 8% 7% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Adjusted EBITDA ($M) & Margin (%) (TTM) $228 $264 $340 $383 $438 $463 $469 $468 $434 8% 9% 11% 12% 14% 14% 14% 14% 13% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Please see non-GAAP reconciliations at the end of this document. Page 9 of 30

CASH FLOW Cash Flow from Operations ($M) (Quarterly) $81 $13 $62 $42 $175 $8 $125 $4 $177 Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Adjusted Free Cash Flow & Cash Interest, Net ($M) (Quarterly) $54 ($13) $35 $11 $150 ($17) $117 ($26) $134$33 $17 $40 $21 $40 $19 $39 $32 $17 FCF Cash interest, net Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Capital Expenditures & Capitalization of Software & Website Development Costs ($M) (Quarterly) (1) $15 $11 $16 $23 $11 $10 $11 $17 $26 $14 $15 $14 $14 $14 $15 $15 $15 $17 $29 $26 $30 $37 $25 $25 $26 $32 $43 Capital expenditures Capitalized software Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 (1) Values may not sum to total due to rounding. Cash Flow from Operations ($M) (TTM) $96 $156 $130 $198 $292 $287 $351 $313 $314 Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Adjusted Free Cash Flow & Cash Interest, Net ($M) (TTM) $(8) $59 $23 $87 $183 $179 $261 $225 $208 $92 $96 $103 $110 $117 $119 $118 $129 $106 FCF Cash interest, net Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Capital Expenditures & Capitalization of Software & Website Development Costs ($M) (TTM) $54 $49 $54 $65 $61 $61 $55 $49 $64 $62 $60 $58 $57 $57 $57 $58 $58 $61 $116 $109 $112 $122 $118 $118 $113 $107 $125 Capital expenditures Capitalized software Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Please see non-GAAP reconciliations at the end of this document. Page 10 of 30

CAPITAL STRUCTURE Net Debt (1) ($M) Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Cash / equivalents $ 111 $ 115 $ 130 $ 125 $ 274 $ 154 $ 204 $ 153 $ 224 Marketable securities $ 102 $ 75 $ 43 $ 23 $ 17 $ 6 $ 5 $ — $ — HY notes $ (600) $ (600) $ (548) $ (527) $ (522) $ (522) $ (522) $ (525) $ (525) Term loans $ (1,100) $ (1,103) $ (1,099) $ (1,087) $ (1,098) $ (1,088) $ (1,085) $ (1,084) $ (1,078) Revolver $ — $ — $ — $ — $ — $ — $ — $ — $ — Other debt $ (7) $ (8) $ (7) $ (6) $ (6) $ (5) $ (10) $ (9) $ (7) Net debt $ (1,494) $ (1,520) $ (1,481) $ (1,473) $ (1,335) $ (1,454) $ (1,408) $ (1,465) $ (1,386) (1) Excludes debt issuance costs, debt premiums and discounts. Values may not sum to total due to rounding. Weighted Average Shares Outstanding (Millions) (2) 26.2 26.3 26.3 26.5 26.6 26.2 25.3 25.2 25.0 26.2 26.3 26.6 27.1 27.2 26.2 26.6 25.2 25.9 Basic Diluted Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 (2) Basic and diluted shares are the same in certain periods where we reported a GAAP net loss. Consolidated Net Leverage Ratios (3) 5.52 4.83 3.90 3.51 2.87 3.01 2.97 3.13 3.12 3.34 2.97 2.49 2.29 1.78 1.95 1.90 2.04 1.96 Consolidated net leverage Senior secured net leverage Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 (3) Consolidated Net Leverage Ratios as calculated per our credit agreement definitions. Please see non-GAAP reconciliations at the end of this document. Page 11 of 30

SEGMENT RESULTS VISTA (QUARTERLY) Revenue ($M) & Reported Revenue Growth (Decline) Quarterly (1) $438 $397 $410 $397 $485 $418 $442 $429 $498 (2)% 14% 11% 7% 11% 5% 8% 8% 3% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Gross Profit ($M) & Gross Margin (%) Quarterly (1) $233 $222 $233 $223 $278 $235 $253 $235 $274 53% 56% 57% 56% 57% 56% 57% 55% 55% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Segment EBITDA ($M) & Segment EBITDA Margin (%) Quarterly (1) $59 $64 $81 $79 $108 $77 $85 $77 $92 13% 16% 20% 20% 22% 18% 19% 18% 19% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Organic Constant-Currency Revenue Growth Quarterly (1) 2% 16% 12% 6% 9% 5% 8% 8% 3% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Advertising ($M) & as % of Revenue Quarterly (1)(2) $77 $57 $60 $58 $80 $63 $71 $65 $86 $57 $47 $42 $46 $55 $48 $51 $48 $62 $20 $10 $18 $11 $25 $15 $19 $17 $24 18% 15% 15% 15% 16% 15% 16% 15% 17% Lower-funnel ($M) Mid- & upper-funnel ($M) Total as % of revenue Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 (1) During Q1 FY2025, we recast our segment results back to Q1 FY2023 to reflect a reporting change to inter-segment activity. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. (2) Values may not sum to total due to rounding. Please see non-GAAP reconciliations at the end of this document. Page 12 of 30

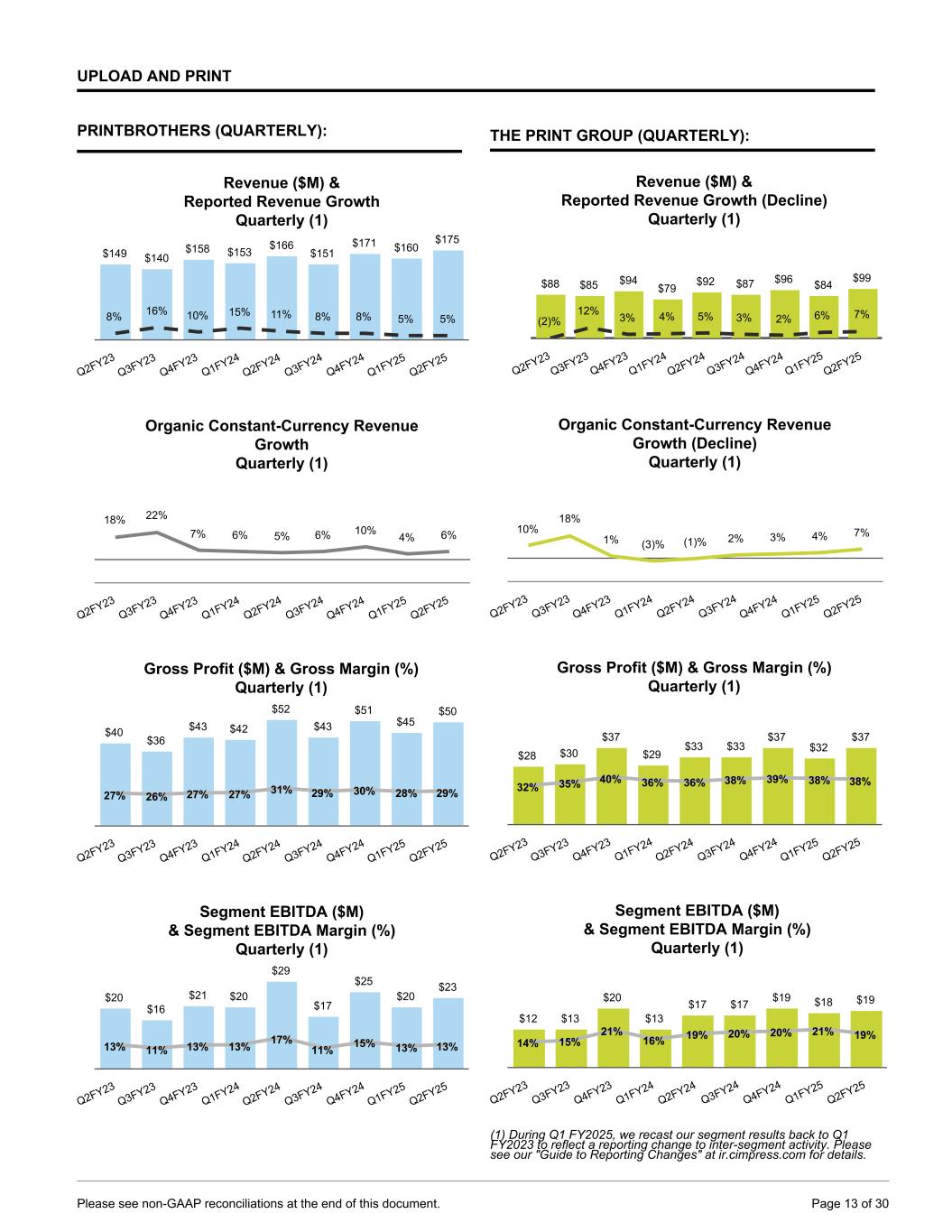

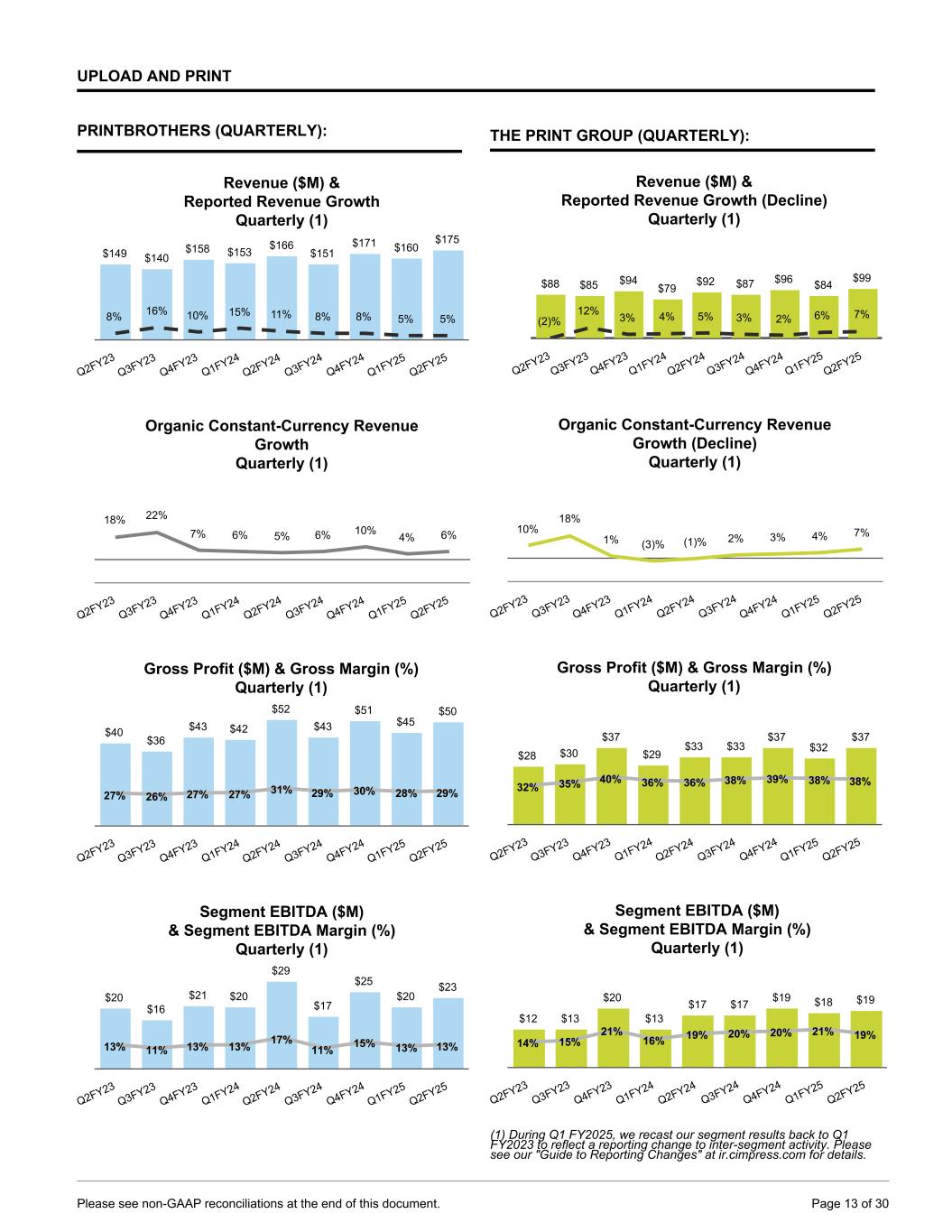

UPLOAD AND PRINT PRINTBROTHERS (QUARTERLY): Revenue ($M) & Reported Revenue Growth Quarterly (1) $149 $140 $158 $153 $166 $151 $171 $160 $175 8% 16% 10% 15% 11% 8% 8% 5% 5% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Organic Constant-Currency Revenue Growth Quarterly (1) 18% 22% 7% 6% 5% 6% 10% 4% 6% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Gross Profit ($M) & Gross Margin (%) Quarterly (1) $40 $36 $43 $42 $52 $43 $51 $45 $50 27% 26% 27% 27% 31% 29% 30% 28% 29% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Segment EBITDA ($M) & Segment EBITDA Margin (%) Quarterly (1) $20 $16 $21 $20 $29 $17 $25 $20 $23 13% 11% 13% 13% 17% 11% 15% 13% 13% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 THE PRINT GROUP (QUARTERLY): Revenue ($M) & Reported Revenue Growth (Decline) Quarterly (1) $88 $85 $94 $79 $92 $87 $96 $84 $99 (2)% 12% 3% 4% 5% 3% 2% 6% 7% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 0 Organic Constant-Currency Revenue Growth (Decline) Quarterly (1) 10% 18% 1% (3)% (1)% 2% 3% 4% 7% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Gross Profit ($M) & Gross Margin (%) Quarterly (1) $28 $30 $37 $29 $33 $33 $37 $32 $37 32% 35% 40% 36% 36% 38% 39% 38% 38% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Segment EBITDA ($M) & Segment EBITDA Margin (%) Quarterly (1) $12 $13 $20 $13 $17 $17 $19 $18 $19 14% 15% 21% 16% 19% 20% 20% 21% 19% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 (1) During Q1 FY2025, we recast our segment results back to Q1 FY2023 to reflect a reporting change to inter-segment activity. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. Please see non-GAAP reconciliations at the end of this document. Page 13 of 30

NATIONAL PEN (QUARTERLY): Revenue ($M) & Reported Revenue Growth (Decline) Quarterly (1) $120 $81 $83 $87 $130 $89 $84 $93 $131 (3%) 12% 9% 6% 8% 9% 1% 8% 1% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Gross Profit ($M) & Gross Margin (%) Quarterly (1) $65 $41 $41 $45 $71 $47 $43 $50 $70 54% 51% 50% 51% 55% 53% 52% 53% 54% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Organic Constant-Currency Revenue Growth Quarterly (1) 3% 14% 10% 4% 5% 9% 1% 7% 1% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Segment EBITDA (Loss) ($M) & Segment EBITDA (Loss) Margin (%) Quarterly (1) $25 ($3) $3 ($9) $25 $4 $9 ($5) $23 20% (4%) 4% (10%) 20% 5% 11% (5%) 18% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 (1) During Q1 FY2025, we recast our segment results back to Q1 FY2023 to reflect a reporting change to inter-segment activity. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. Please see non-GAAP reconciliations at the end of this document. Page 14 of 30

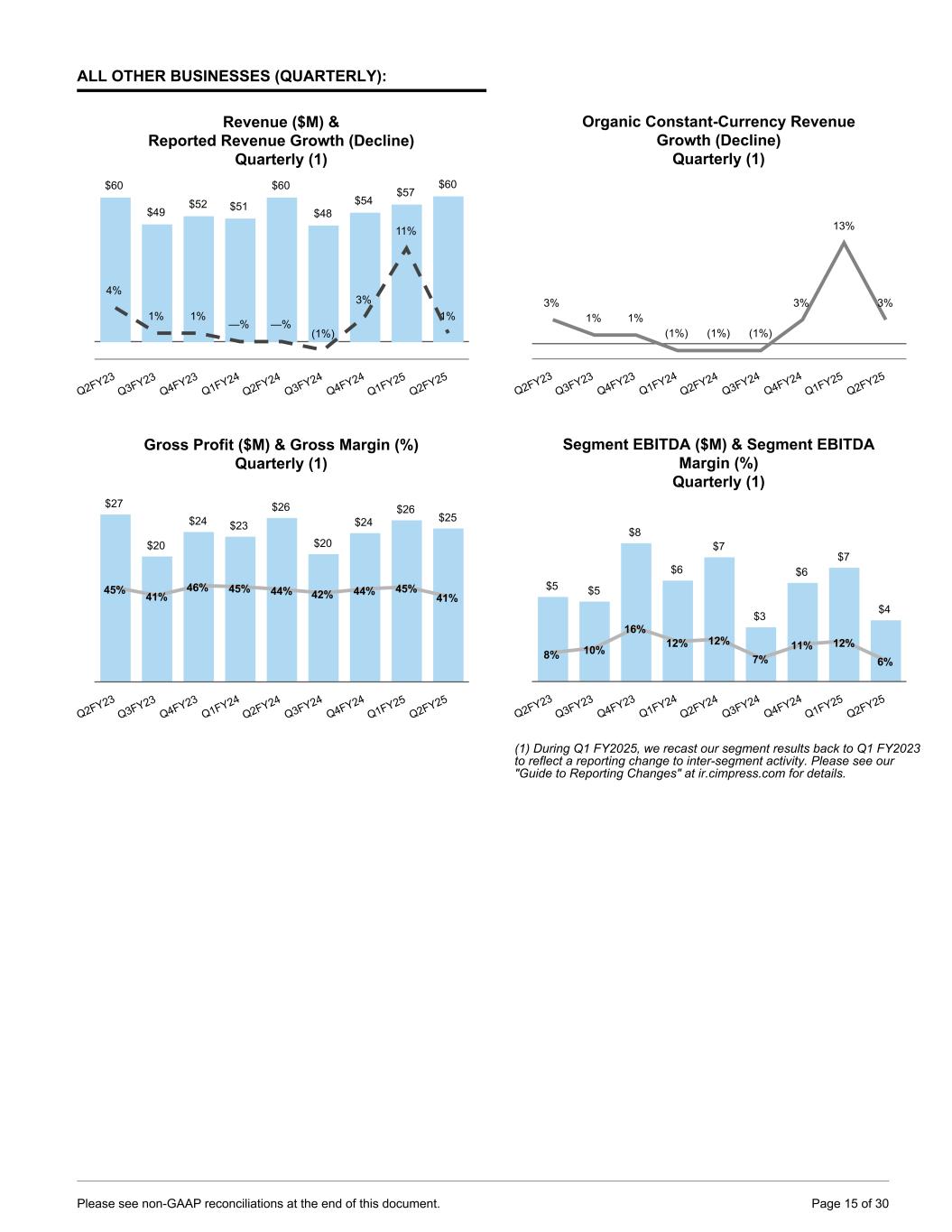

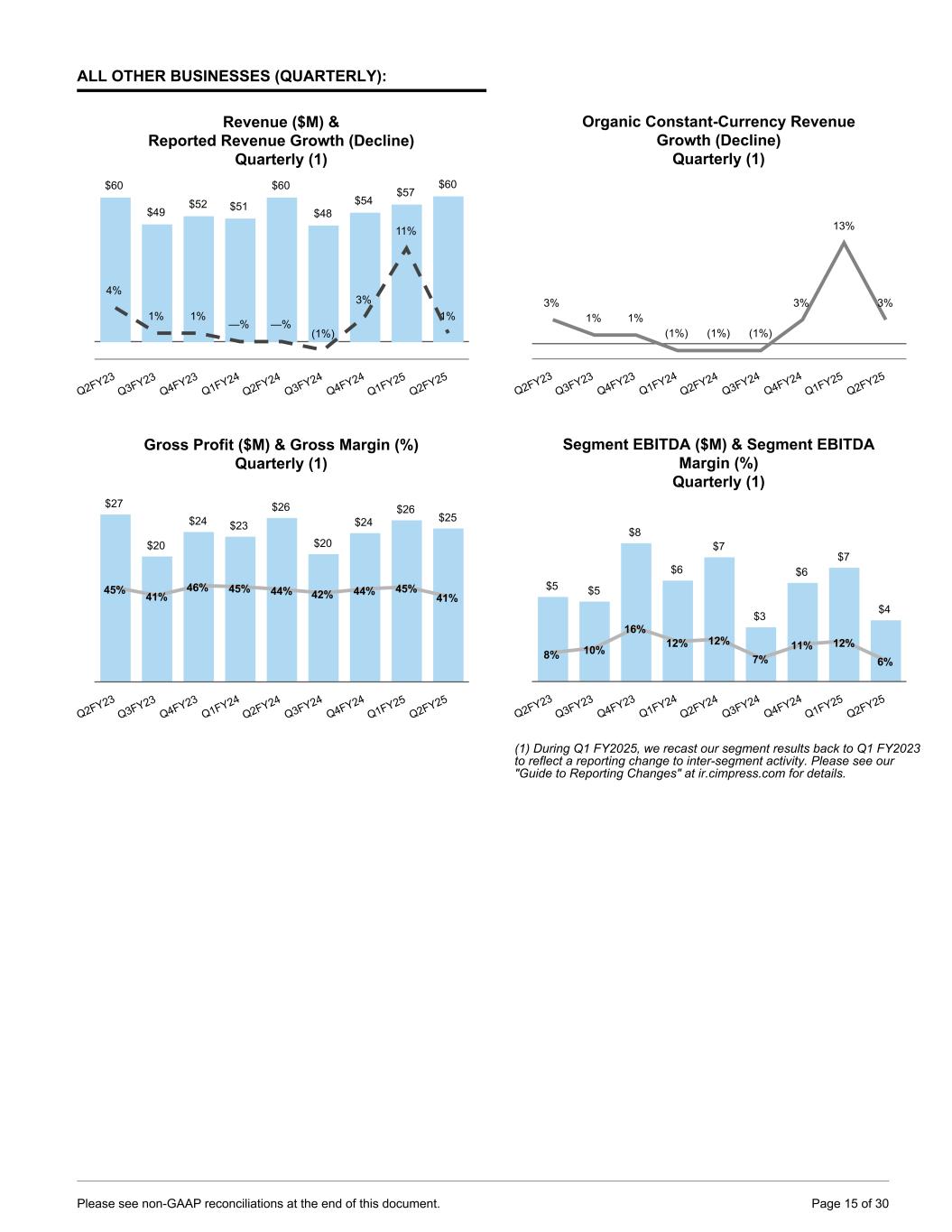

ALL OTHER BUSINESSES (QUARTERLY): Revenue ($M) & Reported Revenue Growth (Decline) Quarterly (1) $60 $49 $52 $51 $60 $48 $54 $57 $60 4% 1% 1% —% —% (1%) 3% 11% 1% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Gross Profit ($M) & Gross Margin (%) Quarterly (1) $27 $20 $24 $23 $26 $20 $24 $26 $25 45% 41% 46% 45% 44% 42% 44% 45% 41% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Organic Constant-Currency Revenue Growth (Decline) Quarterly (1) 3% 1% 1% (1%) (1%) (1%) 3% 13% 3% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Segment EBITDA ($M) & Segment EBITDA Margin (%) Quarterly (1) $5 $5 $8 $6 $7 $3 $6 $7 $4 8% 10% 16% 12% 12% 7% 11% 12% 6% Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 (1) During Q1 FY2025, we recast our segment results back to Q1 FY2023 to reflect a reporting change to inter-segment activity. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. Please see non-GAAP reconciliations at the end of this document. Page 15 of 30

CENTRAL AND CORPORATE COSTS Central and Corporate Costs ($M) Quarterly (1) $13 $16 $12 $12 $12 $12 $12 $14 $15 $17 $17 $17 $17 $17 $19 $19 $18 $20 $6 $6 $3 $3 $3 $3 $3 $3 $3 $(2) $(4) $(1) $— $4 $5 $3 $2 ($1) $34 $34 $31 $32 $36 $39 $38 $37 $37 Corporate Costs Central Operating Costs MCP Investment Unallocated SBC Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Central and Corporate Costs ($M) TTM (1) $50 $54 $53 $52 $52 $48 $49 $50 $54 $68 $68 $68 $68 $68 $71 $73 $74 $77 $25 $24 $21 $18 $15 $12 $12 $12 $12 $1 $(5) $(8) $(7) $(2) $7 $11 $14 $9 $143 $142 $134 $131 $133 $138 $145 $151 $152 Corporate Costs Central Operating Costs MCP Investment Unallocated SBC Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 (1) Values may not sum to total due to rounding. Please see non-GAAP reconciliations at the end of this document. Page 16 of 30

CURRENCY IMPACTS Directional Net Currency Impacts Compared to Prior-Year Periods Y/Y Impact from Currency* Financial Measure Q2 FY2025 YTD FY2025 Revenue Negative Neutral Operating income Neutral Positive Net income Positive Positive Adjusted EBITDA Negative Negative Adjusted free cash flow Negative Negative *Net income includes both realized and unrealized gains or losses from currency hedges and intercompany loan balances. Adjusted EBITDA includes only realized gains or losses from certain currency hedges. Adjusted free cash flow includes realized gains or losses on currency hedges as well as the currency impact of the timing of receivables, payments and other working capital settlements. Revenue, operating income and segment EBITDA do not reflect any impacts from currency hedges or balance sheet translation. Net Currency Impacts on Segment EBITDA Compared to Prior-Year Periods Y/Y Impact from Currency* Segment EBITDA Q2 FY2025 YTD FY2025 Vista ($1.3)M Neutral Upload & Print Neutral $0.6M National Pen $0.7M $1.3M All Other Businesses Neutral Neutral Adjusted EBITDA ($0.7)M ($2.1)M *Realized gains or losses on currency hedges that we include in adjusted EBITDA are not allocated to segment-level EBITDA. Other Income (Expense), Net ($M) ($17) $1 $7 $6 $— ($4) ($1) ($11) $32 Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 *Other income (expense), net includes both realized and unrealized gains or (losses) from currency hedges and intercompany loan balances. Realized Gains (Losses) on Certain Currency Derivatives Intended to Hedge EBITDA ($M) $15 $5 $3 $2 $1 $— $— ($2) $— Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 *Realized gains (losses) on certain currency derivatives intended to hedge EBITDA is a component of Other income (expense), net. We add these realized gains or (losses) to adjusted EBITDA. Please see non-GAAP reconciliations at the end of this document. Page 17 of 30

CIMPRESS PLC CONSOLIDATED BALANCE SHEETS (unaudited in thousands, except share and per share data) December 31, 2024 June 30, 2024 Assets Current assets: Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 224,429 $ 203,775 Marketable securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 4,500 Accounts receivable, net of allowances of $7,727 and $7,219, respectively . . . . . . . . . . . . . . . . . 58,863 64,576 Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103,313 97,016 Prepaid expenses and other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 109,036 88,112 Total current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 495,641 457,979 Property, plant and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 278,510 265,177 Operating lease assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78,461 78,681 Software and website development costs, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92,180 92,212 Deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90,227 95,059 Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 777,608 787,138 Intangible assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65,940 76,560 Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39,352 39,351 Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,917,919 $ 1,892,157 Liabilities, noncontrolling interests and shareholders’ deficit Current liabilities: Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 340,916 $ 326,656 Accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 285,084 245,931 Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48,379 46,118 Short-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,625 12,488 Operating lease liabilities, current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,814 19,634 Other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,954 13,136 Total current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 727,772 663,963 Deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,898 24,701 Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,579,213 1,591,807 Operating lease liabilities, non-current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62,645 61,895 Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60,372 76,305 Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,452,900 2,418,671 Redeemable noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,710 22,998 Shareholders’ deficit: Preferred shares, nominal value €0.01 per share, 100,000,000 shares authorized; none issued and outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — Ordinary shares, nominal value €0.01 per share, 100,000,000 shares authorized; 42,789,205 and 43,051,269 shares issued; 24,817,958 and 25,080,022 shares outstanding, respectively . . 601 604 Treasury shares, at cost, 17,971,247 for both periods presented . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,363,550) (1,363,550) Additional paid-in capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 576,880 570,283 Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 277,562 272,881 Accumulated other comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (45,962) (30,364) Total shareholders’ deficit attributable to Cimpress plc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (554,469) (550,146) Noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 778 634 Total shareholders' deficit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (553,691) (549,512) Total liabilities, noncontrolling interests and shareholders’ deficit . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,917,919 $ 1,892,157 Page 18 of 30

CIMPRESS PLC CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited in thousands, except share and per share data) Three Months Ended December 31, Six Months Ended December 31, 2024 2023 2024 2023 Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 939,159 $ 921,363 $ 1,744,128 $ 1,678,657 Cost of revenue (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 489,256 463,423 911,992 862,206 Technology and development expense (1) . . . . . . . . . . . . . . . . . . . . . . . 82,878 79,961 164,739 154,291 Marketing and selling expense (1, 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 223,861 211,843 427,708 404,031 General and administrative expense (1) . . . . . . . . . . . . . . . . . . . . . . . . . 56,936 48,793 108,868 97,134 Amortization of acquired intangible assets . . . . . . . . . . . . . . . . . . . . . . . 5,116 9,181 10,271 19,067 Restructuring expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163 483 262 149 Income from operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80,949 107,679 120,288 141,779 Other income (expense), net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31,678 (391) 20,186 6,028 Interest expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (29,165) (30,588) (60,580) (59,788) (Loss) gain on early extinguishment of debt . . . . . . . . . . . . . . . . . . . . . . (696) 349 (517) 1,721 Income before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82,766 77,049 79,377 89,740 Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,151 16,795 30,146 24,917 Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61,615 60,254 49,231 64,823 Add: Net (income) attributable to noncontrolling interests . . . . . . . . . . (558) (2,149) (723) (2,164) Net income attributable to Cimpress plc . . . . . . . . . . . . . . . . . . . . . . . . . $ 61,057 $ 58,105 $ 48,508 $ 62,659 Basic net income per share attributable to Cimpress plc . . . . . . . . . . . $ 2.45 $ 2.18 $ 1.94 $ 2.36 Diluted net income per share attributable to Cimpress plc . . . . . . . . . . $ 2.36 $ 2.14 $ 1.86 $ 2.31 Weighted average shares outstanding — basic . . . . . . . . . . . . . . . . . . . 24,965,612 26,609,929 25,066,729 26,539,349 Weighted average shares outstanding — diluted . . . . . . . . . . . . . . . . . . 25,906,151 27,179,073 26,145,452 27,129,264 ____________________________________________ (1) Share-based compensation is allocated as follows: Three Months Ended December 31, Six Months Ended December 31, 2024 2023 2024 2023 Cost of revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 208 $ 229 $ 431 $ 396 Technology and development expense . . . . . . . . . . . . . . . . . . . . . . . . . . 4,962 5,700 10,058 9,909 Marketing and selling expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,502 3,089 4,217 5,307 General and administrative expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,701 8,631 15,300 14,490 (2) Marketing and selling expense components are as follows: Three Months Ended December 31, Six Months Ended December 31, 2024 2023 2024 2023 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 131,155 $ 122,899 $ 245,187 $ 230,625 Payment processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,118 16,441 30,410 30,762 All other marketing and selling expense . . . . . . . . . . . . . . . . . . . . . . . . . 76,588 72,503 152,111 142,644 Page 19 of 30

CIMPRESS PLC CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited in thousands) Three Months Ended December 31, Six Months Ended December 31, 2024 2023 2024 2023 Operating activities Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 61,615 $ 60,254 $ 49,231 $ 64,823 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35,211 39,089 70,757 79,031 Share-based compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,373 17,649 30,006 30,102 Deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 422 (997) 3,373 (2,115) Loss (gain) on early extinguishment of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . 383 (349) 123 (1,721) Unrealized (gain) loss on derivatives not designated as hedging instruments included in net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (30,650) 11,129 (12,313) 4,868 Effect of exchange rate changes on monetary assets and liabilities denominated in non-functional currency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 922 (12,548) (9,448) (10,663) Other non-cash items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,042 459 3,370 (770) Changes in operating assets and liabilities, net of effects of businesses acquired: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,270 4,730 5,495 2,521 Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,747 5,710 (6,562) 5,309 Prepaid expenses and other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10,142) (3,333) (13,572) 881 Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48,503 77,226 11,557 55,017 Accrued expenses and other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36,823 (24,073) 48,886 (10,083) Net cash provided by operating activities 176,519 174,946 180,903 217,200 Investing activities Purchases of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (26,418) (11,390) (43,419) (33,955) Capitalization of software and website development costs . . . . . . . . . . . . . . . . . (16,677) (13,947) (31,248) (28,344) Proceeds from the sale of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98 352 1,668 5,988 Proceeds from maturity of held-to-maturity investments . . . . . . . . . . . . . . . . . . . — 5,416 4,500 25,916 Proceeds from the settlement of derivatives designated as hedging instruments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,438 — 5,438 — Net cash used in investing activities (37,559) (19,569) (63,061) (30,395) Financing activities Proceeds from issuance of 7.375% Senior Notes due 2032 . . . . . . . . . . . . . . . . — — 525,000 — Payments for early redemption or purchase of 7.0% Senior Notes due 2026 . — (4,656) (522,135) (24,471) Proceeds from borrowings of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41,191 347 41,191 520 Payments of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (44,659) (3,891) (49,156) (7,675) Payments of debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,106) — (11,551) — Payments of withholding taxes in connection with equity awards . . . . . . . . . . . (3,822) (1,784) (16,770) (10,188) Payments of finance lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,208) (2,112) (4,158) (4,880) Purchase of noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,058) — (4,058) — Purchase of ordinary shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (42,367) — (52,987) — Proceeds from issuance of ordinary shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 369 6 1,369 88 Distributions to noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (821) (549) Net cash used in financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (58,660) (12,090) (94,076) (47,155) Effect of exchange rate changes on cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8,822) 5,722 (3,112) 4,245 Net increase in cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71,478 149,009 20,654 143,895 Cash and cash equivalents at beginning of period . . . . . . . . . . . . . . . . . . . . . . . . 152,951 125,199 203,775 130,313 Cash and cash equivalents at end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 224,429 $ 274,208 $ 224,429 $ 274,208 Page 20 of 30

ABOUT NON-GAAP FINANCIAL MEASURES: To supplement Cimpress’ consolidated financial statements presented in accordance with U.S. generally accepted accounting principles, or GAAP, Cimpress has used the following measures defined as non-GAAP financial measures by Securities and Exchange Commission, or SEC, rules: Constant-currency revenue growth, constant-currency revenue growth excluding revenue from acquisitions and divestitures made during the last twelve months, adjusted EBITDA, adjusted free cash flow and cash interest, net: • Constant-currency revenue growth is estimated by translating all non-U.S. dollar denominated revenue generated in the current period using the prior year period’s average exchange rate for each currency to the U.S. dollar. • Constant-currency revenue growth excluding revenue from acquisitions and divestitures made during the past twelve months excludes the impact of currency as defined above. The organic constant-currency growth rate excludes Depositphotos/VistaCreate revenue from Q2 FY2022 through Q1 FY2023, and the revenue from several small acquired businesses for the first year after acquisition. • Adjusted EBITDA is defined as GAAP operating income (loss) plus depreciation and amortization plus share-based compensation expense plus proceeds from insurance not already included in operating income plus earn-out related charges plus certain impairments and other adjustments plus restructuring related charges plus realized gains or losses on currency derivatives less the gain or loss on purchase or sale of subsidiaries as well as the disposal of assets. • Adjusted free cash flow is defined as net cash provided by (used in) operating activities less purchases of property, plant and equipment, purchases of intangible assets not related to acquisitions, and capitalization of software and website development costs, plus payment of contingent consideration in excess of acquisition-date fair value, gains on proceeds from insurance, and proceeds from the sale of assets. • Cash interest, net is cash paid for interest, less cash received for interest. These non-GAAP financial measures are provided to enhance investors' understanding of our current operating results from the underlying and ongoing business for the same reasons they are used by management. For example, for acquisitions we believe excluding the costs related to the purchase of a business (such as amortization of acquired intangible assets, contingent consideration, or impairment of goodwill) provides further insight into the performance of the underlying acquired business in addition to that provided by our GAAP operating income. As another example, as we do not apply hedge accounting for certain derivative contracts, we believe inclusion of realized gains and losses on these contracts that are intended to be matched against operational currency fluctuations provides further insight into our operating performance in addition to that provided by our GAAP operating income. We do not, nor do we suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. For more information on these non-GAAP financial measures, please see the tables captioned “Reconciliations of Non-GAAP Financial Measures” included at the end of this document. The tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliation between these financial measures. Page 21 of 30

CONSTANT-CURRENCY REVENUE GROWTH RATES (Quarterly) Total Company Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Reported revenue growth (1) % 13 % 9 % 8 % 9 % 5 % 6 % 6 % 2 % Currency impact 7 % 3 % — % (4) % (3) % (1) % — % — % — % Revenue growth in constant currency 6 % 16 % 9 % 4 % 6 % 4 % 6 % 6 % 2 % Impact of TTM acquisitions, divestitures & JVs (1) % — % — % — % — % — % — % — % — % Revenue growth in constant currency ex. TTM acquisitions, divestitures & JVs 5 % 16 % 9 % 4 % 6 % 4 % 6 % 6 % 2 % Vista Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Reported revenue growth 1 (2) % 14 % 11 % 7 % 11 % 5 % 8 % 8 % 3 % Currency impact 1 4 % 2 % 1 % (1) % (2) % — % — % — % — % Revenue growth in constant currency 1 2 % 16 % 12 % 6 % 9 % 5 % 8 % 8 % 3 % Impact of TTM acquisitions, divestitures & JVs — % — % — % — % — % — % — % — % — % Revenue growth in constant currency ex. TTM acquisitions, divestitures & JVs 1 2 % 16 % 12 % 6 % 9 % 5 % 8 % 8 % 3 % PrintBrothers Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Reported revenue growth 1 8 % 16 % 10 % 15 % 11 % 8 % 8 % 5 % 5 % Currency impact 1 13 % 6 % (3) % (9) % (6) % (2) % 2 % (1) % 1 % Revenue growth in constant currency 1 21 % 22 % 7 % 6 % 5 % 6 % 10 % 4 % 6 % Impact of TTM acquisitions (3) % — % — % — % — % — % — % — % — % Revenue growth in constant currency excl. TTM acquisitions 1 18 % 22 % 7 % 6 % 5 % 6 % 10 % 4 % 6 % The Print Group Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Reported revenue growth 1 (2) % 12 % 3 % 4 % 5 % 3 % 2 % 6 % 7 % Currency impact 1 12 % 6 % (2) % (7) % (6) % (1) % 1 % (2) % — % Revenue growth in constant currency 1 10 % 18 % 1 % (3) % (1) % 2 % 3 % 4 % 7 % National Pen Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Reported revenue growth 1 (3) % 12 % 9 % 6 % 8 % 9 % 1 % 8 % 1 % Currency impact 1 6 % 2 % 1 % (2) % (3) % — % — % (1) % — % Revenue growth in constant currency 1 3 % 14 % 10 % 4 % 5 % 9 % 1 % 7 % 1 % 1During Q1 FY2025, we recast our segment results back to Q1 FY2023 to reflect a reporting change to inter-segment activity. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. Note: Total company revenue growth in constant currency excluding TTM acquisitions, divestitures and joint ventures for all periods excludes the impact of currency. The organic constant-currency growth rate excludes the revenue from several small acquired businesses for the first year after acquisition. Values may not sum to total due to rounding. Page 22 of 30

CONSTANT-CURRENCY REVENUE GROWTH RATES (CONT.) (Quarterly) All Other Businesses Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Reported revenue growth 1 4 % 1 % 1 % — % — % (1) % 3 % 11 % 1 % Currency impact 1 (1) % — % — % (1) % (1) % — % — % 2 % 2 % Revenue growth in constant currency 1 3 % 1 % 1 % (1) % (1) % (1) % 3 % 13 % 3 % Impact of TTM acquisitions and divestitures — % — % — % — % — % — % — % — % — % Revenue growth in constant currency excl. TTM acquisitions & divestitures 1 3 % 1 % 1 % (1) % (1) % (1) % 3 % 13 % 3 % Upload and Print ($M) Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 PrintBrothers reported revenue 1 $ 148.8 $ 139.7 $ 157.8 $ 152.6 $ 165.6 $ 150.7 $ 170.8 $ 160.4 $ 174.5 The Print Group reported revenue 1 $ 88.1 $ 84.5 $ 94.2 $ 79.4 $ 92.1 $ 87.1 $ 96.1 $ 84.1 $ 98.6 Upload and Print inter-segment eliminations 1 $ (0.2) $ (0.1) $ (0.1) $ (0.1) $ (0.2) $ (0.1) $ (0.1) $ (0.1) $ (0.2) Total Upload and Print revenue in USD 1 $ 236.7 $ 224.1 $ 251.9 $ 231.9 $ 257.5 $ 237.7 $ 266.7 $ 244.4 $ 272.9 Upload and Print Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Reported revenue growth 1 4 % 15 % 7 % 11 % 9 % 6 % 6 % 5 % 6 % Currency impact 1 12 % 5 % (2) % (8) % (6) % (1) % 1 % (1) % 1 % Revenue growth in constant currency 1 16 % 20 % 5 % 3 % 3 % 5 % 7 % 4 % 7 % Impact of TTM acquisitions (1) % 1 % — % — % — % — % — % — % — % Revenue growth in constant currency excl. TTM acquisitions 1 15 % 21 % 5 % 3 % 3 % 5 % 7 % 4 % 7 % 1 During Q1 FY2025, we recast our segment results back to Q1 FY2023 to reflect a reporting change to inter-segment activity. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. Note: Total company revenue growth in constant currency excluding TTM acquisitions, divestitures and joint ventures for all periods excludes the impact of currency. The organic constant-currency growth rate excludes Depositphotos/VistaCreate revenue from Q2 FY2022 through Q1 FY2023, and the revenue from several small acquired businesses for the first year after acquisition. CONSTANT-CURRENCY REVENUE GROWTH RATES (YTD) Total Company YTD Q2FY23 YTD Q2FY24 YTD Q2FY25 Reported revenue growth 3 % 8 % 4 % Currency impact 7 % (3) % — % Revenue growth in constant currency 10 % 5 % 4 % Impact of TTM acquisitions, divestitures & JVs (1) % — % — % Revenue growth in constant currency ex. TTM acquisitions, divestitures & JVs 9 % 5 % 4 % Values may not sum to total due to rounding. Page 23 of 30

CONSTANT-CURRENCY REVENUE GROWTH RATES (CONT.) (YTD) Vista YTD Q2FY23 YTD Q2FY24 YTD Q2FY25 Reported revenue growth 1 % 9 % 5 % Currency impact 4 % (1) % — % Revenue growth in constant currency 6 % 8 % 5 % Impact of TTM acquisitions, divestitures & JVs (1) % — % — % Revenue growth in constant currency ex. TTM acquisitions, divestitures & JVs 5 % 8 % 5 % PrintBrothers YTD Q2FY23 YTD Q2FY24 YTD Q2FY25 Reported revenue growth 7 % 13 % 5 % Currency impact 15 % (7) % — % Revenue growth in constant currency 22 % 6 % 5 % Impact of TTM acquisitions, divestitures & JVs (2) % — % — % Revenue growth in constant currency ex. TTM acquisitions, divestitures & JVs 20 % 6 % 5 % The Print Group YTD Q2FY23 YTD Q2FY24 YTD Q2FY25 Reported revenue growth 1 % 4 % 6 % Currency impact 15 % (7) % — % Revenue growth in constant currency 16 % (2) % 6 % National Pen YTD Q2FY23 YTD Q2FY24 YTD Q2FY25 Reported revenue growth 4 % 7 % 4 % Currency impact 7 % (3) % (1) % Revenue growth in constant currency 11 % 5 % 3 % All Other Businesses YTD Q2FY23 YTD Q2FY24 YTD Q2FY25 Reported revenue growth 5 % — % 6 % Currency impact — % (1) % 1 % Revenue growth in constant currency 5 % (1) % 7 % Impact of TTM acquisitions, divestitures & JVs — % — % — % Revenue growth in constant currency ex. TTM acquisitions, divestitures & JVs 5 % (1) % 7 % Values may not sum to total due to rounding. Page 24 of 30

EBITDA (LOSS) BY REPORTABLE SEGMENT ("SEGMENT EBITDA") (Quarterly, in millions) Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Vista 1 $ 59.0 $ 63.8 $ 81.2 $ 78.6 $ 107.9 $ 76.8 $ 84.8 $ 76.8 $ 92.4 PrintBrothers 1 19.8 16.1 20.7 20.2 28.8 17.2 25.3 20.2 23.3 The Print Group 1 12.5 12.6 19.5 12.5 17.3 17.2 19.4 17.9 18.5 National Pen 1 24.7 (3.5) 3.5 (8.8) 25.4 4.2 8.9 (4.8) 23.3 All Other Businesses 1 5.0 4.7 8.2 6.0 7.4 3.3 5.8 6.7 3.7 Inter-segment eliminations 1 (2.4) (2.1) (2.1) (2.5) (2.9) (3.2) (3.7) (5.5) (6.6) Total segment EBITDA $ 118.5 $ 91.6 $ 131.0 $ 106.0 $ 183.8 $ 115.6 $ 140.6 $ 111.4 $ 154.7 Central and corporate costs ex. unallocated SBC (35.6) (38.4) (31.9) (32.1) (32.1) (34.9) (34.7) (35.2) (37.8) Unallocated SBC 1.8 3.9 1.2 0.3 (3.9) (4.5) (3.4) (1.8) 0.7 Exclude: share-based compensation included in segment EBITDA 11.5 7.2 10.4 12.5 17.6 18.4 17.1 15.6 14.4 Include: Realized gains (losses) on certain currency derivatives not included in segment EBITDA 14.9 4.8 3.2 2.1 0.9 (0.3) (0.2) (2.2) 0.4 Adjusted EBITDA3,,4 $ 111.2 $ 69.1 $ 113.9 $ 88.7 $ 166.4 $ 94.2 $ 119.4 $ 87.8 $ 132.3 Depreciation and amortization (40.9) (39.8) (40.9) (39.9) (39.1) (37.1) (35.7) (35.5) (35.2) Share-based compensation expense2 (11.5) (7.2) (10.4) (12.5) (17.6) (18.4) (17.1) (15.6) (14.4) Certain impairments and other adjustments 0.9 0.5 (5.0) (0.5) (0.6) 0.3 (0.4) 0.6 (1.2) Restructuring-related charges (11.2) (30.1) (0.6) 0.3 (0.5) (0.1) (0.1) (0.1) (0.2) Realized (gains) losses on currency derivatives not included in operating income (14.9) (4.8) (3.2) (2.1) (0.9) 0.3 0.2 2.2 (0.4) Total income (loss) from operations $ 33.6 $ (12.2) $ 53.9 $ 34.1 $ 107.7 $ 39.2 $ 66.3 $ 39.3 $ 80.9 Operating income (loss) margin 4 % (2) % 7 % 5 % 12 % 5 % 8 % 5 % 9 % Operating income (loss) year-over-year growth (61) % 57 % 298 % 290 % 221 % 422 % 23 % 15 % (25) % Upload and Print Combined EBITDA ($M) Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 PrintBrothers reported segment EBITDA 1 $ 19.8 $ 16.1 $ 20.7 $ 20.2 $ 28.8 $ 17.2 $ 25.3 $ 20.2 $ 23.3 The Print Group reported segment EBITDA 1 $ 12.5 $ 12.6 $ 19.5 $ 12.5 $ 17.3 $ 17.2 $ 19.4 $ 17.9 $ 18.5 Upload and Print inter-segment eliminations 1 $ (0.1) $ — $ — $ — $ — $ — $ — $ — $ (0.1) Total Upload and Print combined EBITDA in USD 1 $ 32.2 $ 28.6 $ 40.2 $ 32.7 $ 46.1 $ 34.4 $ 44.7 $ 38.0 $ 41.8 1 During Q1 FY2025, we recast our segment results back to Q1 FY2023 to reflect a reporting change to inter-segment activity. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. 2SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting. 3This metric uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions, divestitures or the annualized benefit from actioned cost saving initiatives; however, our debt covenants allow for the inclusion of pro-forma impacts to adjusted EBITDA. 4Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to noncontrolling interests. This is to most closely align to our debt covenant and cash flow reporting. Values may not sum to total due to rounding. Page 25 of 30

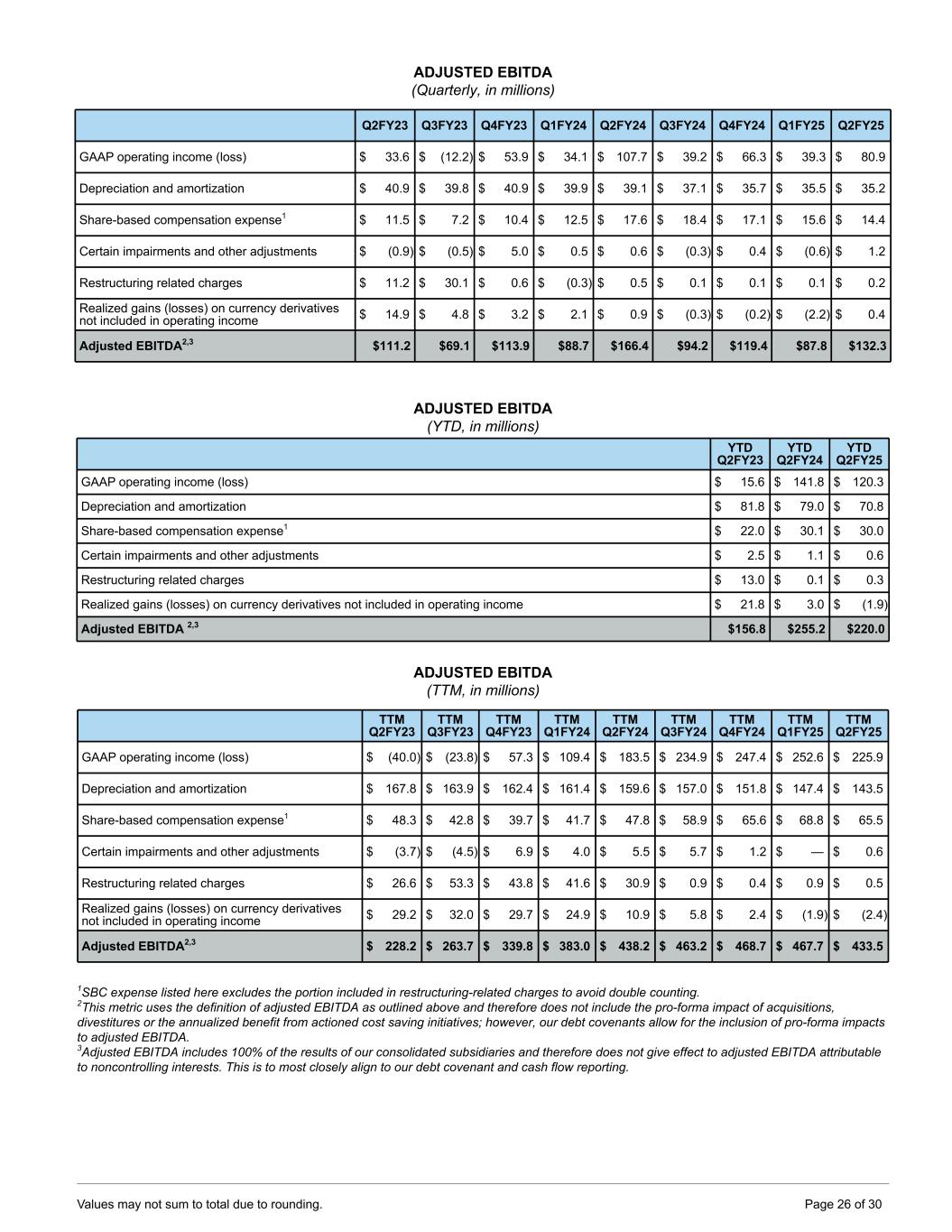

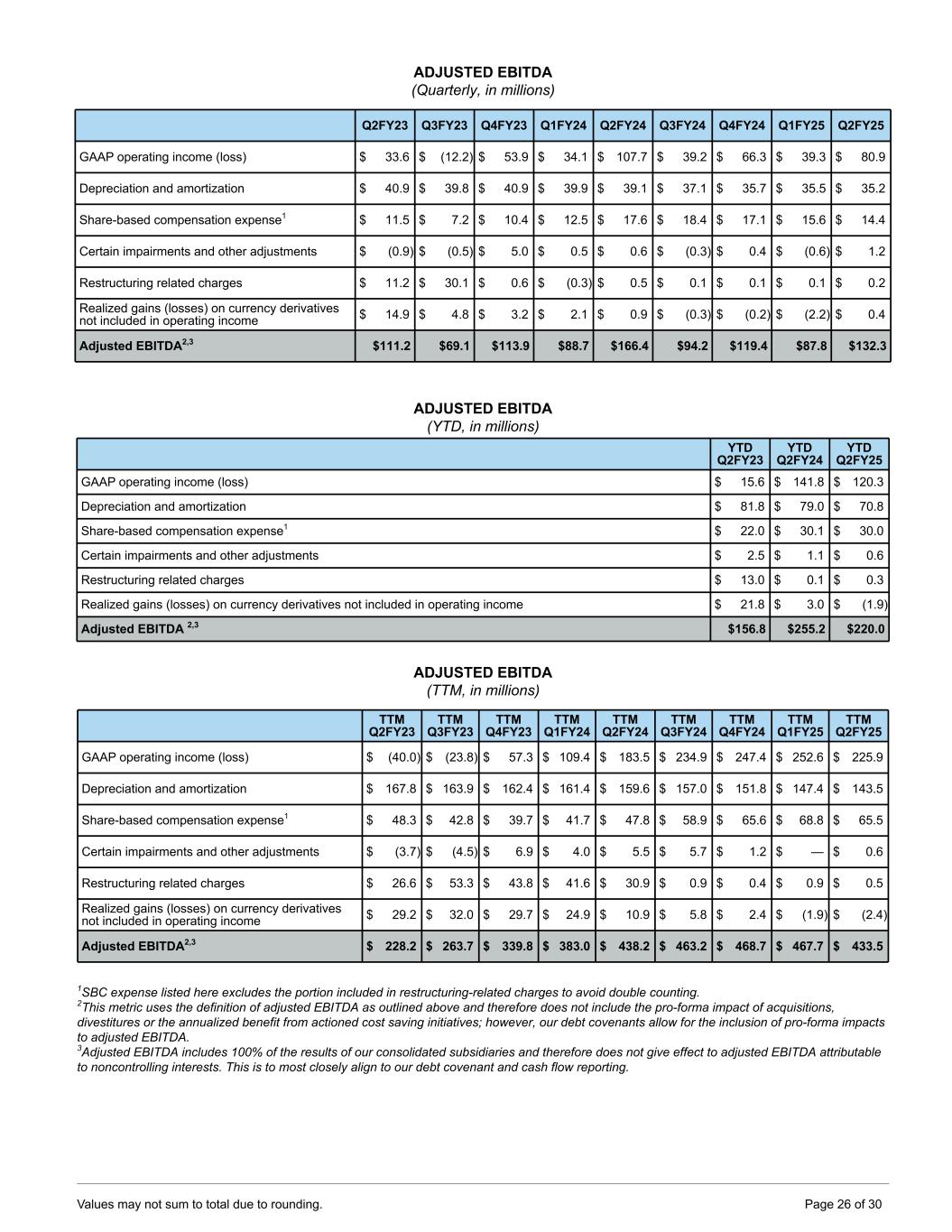

ADJUSTED EBITDA (Quarterly, in millions) Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 GAAP operating income (loss) $ 33.6 $ (12.2) $ 53.9 $ 34.1 $ 107.7 $ 39.2 $ 66.3 $ 39.3 $ 80.9 Depreciation and amortization $ 40.9 $ 39.8 $ 40.9 $ 39.9 $ 39.1 $ 37.1 $ 35.7 $ 35.5 $ 35.2 Share-based compensation expense1 $ 11.5 $ 7.2 $ 10.4 $ 12.5 $ 17.6 $ 18.4 $ 17.1 $ 15.6 $ 14.4 Certain impairments and other adjustments $ (0.9) $ (0.5) $ 5.0 $ 0.5 $ 0.6 $ (0.3) $ 0.4 $ (0.6) $ 1.2 Restructuring related charges $ 11.2 $ 30.1 $ 0.6 $ (0.3) $ 0.5 $ 0.1 $ 0.1 $ 0.1 $ 0.2 Realized gains (losses) on currency derivatives not included in operating income $ 14.9 $ 4.8 $ 3.2 $ 2.1 $ 0.9 $ (0.3) $ (0.2) $ (2.2) $ 0.4 Adjusted EBITDA2,3 $111.2 $69.1 $113.9 $88.7 $166.4 $94.2 $119.4 $87.8 $132.3 ADJUSTED EBITDA (YTD, in millions) YTD Q2FY23 YTD Q2FY24 YTD Q2FY25 GAAP operating income (loss) $ 15.6 $ 141.8 $ 120.3 Depreciation and amortization $ 81.8 $ 79.0 $ 70.8 Share-based compensation expense1 $ 22.0 $ 30.1 $ 30.0 Certain impairments and other adjustments $ 2.5 $ 1.1 $ 0.6 Restructuring related charges $ 13.0 $ 0.1 $ 0.3 Realized gains (losses) on currency derivatives not included in operating income $ 21.8 $ 3.0 $ (1.9) Adjusted EBITDA 2,3 $156.8 $255.2 $220.0 ADJUSTED EBITDA (TTM, in millions) TTM Q2FY23 TTM Q3FY23 TTM Q4FY23 TTM Q1FY24 TTM Q2FY24 TTM Q3FY24 TTM Q4FY24 TTM Q1FY25 TTM Q2FY25 GAAP operating income (loss) $ (40.0) $ (23.8) $ 57.3 $ 109.4 $ 183.5 $ 234.9 $ 247.4 $ 252.6 $ 225.9 Depreciation and amortization $ 167.8 $ 163.9 $ 162.4 $ 161.4 $ 159.6 $ 157.0 $ 151.8 $ 147.4 $ 143.5 Share-based compensation expense1 $ 48.3 $ 42.8 $ 39.7 $ 41.7 $ 47.8 $ 58.9 $ 65.6 $ 68.8 $ 65.5 Certain impairments and other adjustments $ (3.7) $ (4.5) $ 6.9 $ 4.0 $ 5.5 $ 5.7 $ 1.2 $ — $ 0.6 Restructuring related charges $ 26.6 $ 53.3 $ 43.8 $ 41.6 $ 30.9 $ 0.9 $ 0.4 $ 0.9 $ 0.5 Realized gains (losses) on currency derivatives not included in operating income $ 29.2 $ 32.0 $ 29.7 $ 24.9 $ 10.9 $ 5.8 $ 2.4 $ (1.9) $ (2.4) Adjusted EBITDA2,3 $ 228.2 $ 263.7 $ 339.8 $ 383.0 $ 438.2 $ 463.2 $ 468.7 $ 467.7 $ 433.5 1SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting. 2This metric uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions, divestitures or the annualized benefit from actioned cost saving initiatives; however, our debt covenants allow for the inclusion of pro-forma impacts to adjusted EBITDA. 3Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to noncontrolling interests. This is to most closely align to our debt covenant and cash flow reporting. Values may not sum to total due to rounding. Page 26 of 30

ADJUSTED FREE CASH FLOW (Quarterly, in millions) Q2FY23 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Net cash (used in) provided by operating activities $ 81.1 $ 12.6 $ 61.8 $ 42.3 $ 174.9 $ 8.4 $ 125.1 $ 4.4 $ 176.5 Purchases of property, plant and equipment $ (14.7) $ (11.0) $ (16.3) $ (22.6) $ (11.4) $ (10.5) $ (10.5) $ (17.0) $ (26.4) Capitalization of software and website development costs $ (13.9) $ (14.9) $ (13.6) $ (14.4) $ (13.9) $ (15.0) $ (14.9) $ (14.6) $ (16.7) Proceeds from sale of assets1 $ 1.2 $ 0.5 $ 2.8 $ 5.6 $ 0.4 $ 0.4 $ 17.1 $ 1.6 $ 0.1 Adjusted free cash flow1 $ 53.7 $ (12.8) $ 34.7 $ 10.9 $ 150.0 $ (16.6) $ 116.8 $ (25.6) $ 133.5 Reference: Value of finance leases $ 6.2 $ 5.8 $ 5.9 $ 0.4 $ 1.8 $ 2.2 $ 0.1 $ 0.3 $ 0.5 Cash restructuring payments $ 1.9 $ 5.0 $ 22.3 $ 5.7 $ 1.2 $ 0.5 $ 0.2 $ 0.1 $ 0.2 Cash paid for interest $ 35.8 $ 20.0 $ 43.2 $ 24.2 $ 42.4 $ 23.9 $ 41.7 $ 35.2 $ 19.5 Cash received for interest $ (3.0) $ (3.0) $ (3.4) $ (3.3) $ (2.8) $ (5.0) $ (3.0) $ (3.7) $ (2.7) Cash interest, net2 $ 32.8 $ 17.0 $ 39.7 $ 20.9 $ 39.6 $ 18.9 $ 38.8 $ 31.5 $ 16.8 ADJUSTED FREE CASH FLOW (YTD, in millions) YTD Q2FY23 YTD Q2FY24 YTD Q2FY25 Net cash provided by operating activities $ 55.9 $ 217.2 $ 180.9 Purchases of property, plant and equipment $ (26.5) $ (34.0) $ (43.4) Capitalization of software and website development costs $ (29.2) $ (28.3) $ (31.2) Proceeds from sale of assets1 $ 1.4 $ 6.0 $ 1.7 Adjusted free cash flow1 $ 1.5 $ 160.9 $ 107.9 Reference: Value of finance leases $ 8.6 $ 2.2 $ 0.8 Cash restructuring payments $ 9.8 $ 6.9 $ 0.4 Cash paid for interest $ 50.8 $ 66.6 $ 54.8 Cash received for interest $ (5.0) $ (6.2) $ (6.4) Cash interest, net2 $ 45.8 $ 60.5 $ 48.4 1 During the quarter ended September 30, 2023 we revised our definition of adjusted free cash flow to include proceeds from the sale of assets. We have recast all periods in the chart above to include the benefit from the proceeds from sale of assets. 2 Cash interest, net is cash interest payments, partially offset by cash interest received on our cash and marketable securities. Prior to Q3 FY2023, we showed only the cash interest payments related to our borrowing activity in this chart in our earnings materials. We have recast all periods in the chart above to include the interest received. Values may not sum to total due to rounding. Page 27 of 30

ADJUSTED FREE CASH FLOW (TTM, in millions) TTM Q2FY23 TTM Q3FY23 TTM Q4FY23 TTM Q1FY24 TTM Q2FY24 TTM Q3FY24 TTM Q4FY24 TTM Q1FY25 TTM Q2FY25 Net cash provided by operating activities $ 95.5 $ 156.3 $ 130.3 $ 197.8 $ 291.6 $ 287.4 $ 350.7 $ 312.9 $ 314.4 Purchases of property, plant and equipment $ (54.0) $ (49.4) $ (53.8) $ (64.6) $ (61.2) $ (60.7) $ (54.9) $ (49.4) $ (64.4) Capitalization of software and website development costs $ (62.4) $ (59.6) $ (57.8) $ (56.9) $ (56.9) $ (57.0) $ (58.3) $ (58.5) $ (61.2) Proceeds from sale of assets1 $ 13.3 $ 12.2 $ 4.7 $ 10.2 $ 9.3 $ 9.2 $ 23.6 $ 19.5 $ 19.2 Adjusted free cash flow1 $ (7.6) $ 59.5 $ 23.4 $ 86.5 $ 182.8 $ 179.0 $ 261.1 $ 224.5 $ 208.1 Reference: Value of new finance leases $ 12.1 $ 17.7 $ 20.3 $ 18.3 $ 13.9 $ 10.3 $ 4.6 $ 4.5 $ 3.2 Cash restructuring payments $ 9.8 $ 14.9 $ 37.1 $ 34.9 $ 34.3 $ 29.7 $ 7.6 $ 2.0 $ 1.0 Cash paid for interest $ 99.2 $ 105.4 $ 114.0 $ 123.1 $ 129.8 $ 133.7 $ 132.3 $ 143.3 $ 120.4 Cash received for interest $ (6.9) $ (9.0) $ (11.5) $ (12.7) $ (12.6) $ (14.7) $ (14.2) $ (14.5) $ (14.4) Cash interest, net2 $ 92.4 $ 96.3 $ 102.5 $ 110.4 $ 117.2 $ 119.1 $ 118.1 $ 128.7 $ 106.0 1 During the quarter ended September 30, 2023 we revised our definition of adjusted free cash flow to include proceeds from the sale of assets. We have recast all periods in the chart above to include the benefit from the proceeds from sale of assets. 2 Cash interest, net is cash interest payments, partially offset by cash interest received on our cash and marketable securities. Prior to Q3 FY2023, we showed only the cash interest payments related to our borrowing activity in this chart in our earnings materials. We have recast all periods in the chart above to include the interest received. CONSTANT-CURRENCY REVENUE GROWTH OUTLOOK H2 FY2025 (at least...) FY2025 (at least...) Reported revenue growth (using recent currency rates) 3% 3% Currency impact 1% 1% Impact of TTM acquisitions, divestitures & JVs (as of January 29, 2025) —% —% Organic constant-currency revenue growth 4% 4% ADJUSTED EBITDA OUTLOOK (in millions) H2 FY2025 (at least...) FY2025 (at least...) GAAP operating income (loss) $113.7 $233.9 Depreciation and amortization $72.6 $143.3 Share-based compensation expense1 $30.3 $60.3 Certain impairments and other adjustments2 $— $0.6 Restructuring related charges $— $0.3 Realized gains (losses) on currency derivatives not included in operating income $3.4 $1.6 Adjusted EBITDA 2,3 $220.0 $440.0 1SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting. 2This metric uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions, divestitures or the annualized benefit from actioned cost saving initiatives; however, our debt covenants allow for the inclusion of pro-forma impacts to adjusted EBITDA. 3Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to noncontrolling interests. This is to most closely align to our debt covenant and cash flow reporting. Values may not sum to total due to rounding. Page 28 of 30

ADJUSTED FREE CASH FLOW OUTLOOK (in millions) H2 FY2025 (at least...) FY2025 (at least...) Net cash provided by operating activities $109.0 $289.0 Purchases of property, plant and equipment ($30.0) ($74.0) Capitalization of software and website development costs ($31.0) ($62.0) Proceeds from sale of assets $2.0 $4.0 Adjusted free cash flow $50.0 $157.0 Values may not sum to total due to rounding. Page 29 of 30