Exhibit 99.3

EXCELLON RESOURCES INC.

10 King Street East, Suite 200, Toronto, Ontario Canada M5C 1C3

Notice of Annual Meeting of Shareholders &

Management Information Circular

May 13, 2021

4:00 p.m. (EDT)

Excellon Resources Inc.

10 King Street East, Suite 200

Toronto, Ontario

TABLE OF CONTENTS

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | ii |

| | |

| MANAGEMENT INFORMATION CIRCULAR | 1 |

| SOLICITATION OF PROXIES | 1 |

| NOTICE AND ACCESS | 1 |

| APPOINTMENT OF PROXYHOLDER | 2 |

| REVOCATION OF PROXIES | 2 |

| VOTING OF PROXIES | 2 |

| INFORMATION FOR NON-REGISTERED SHAREHOLDERS | 3 |

| INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON | 4 |

| VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES | 4 |

| PARTICULARS OF MATTERS TO BE ACTED UPON | 5 |

| 1. ELECTION OF DIRECTORS | 5 |

| 2. RE-APPOINTMENT OF AUDITORS | 10 |

| OTHER BUSINESS | 10 |

| STATEMENT OF EXECUTIVE COMPENSATION | 10 |

| DIRECTORS COMPENSATION | 21 |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 24 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 27 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 27 |

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES | 27 |

| ADDITIONAL INFORMATION | 33 |

| SCHEDULE “A” | 34 |

EXCELLON RESOURCES INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual meeting (the “Meeting”) of shareholders of Excellon Resources Inc. (“Excellon”, the “Company” or the “Corporation”) will be held at the offices of Excellon Resources Inc., 10 King Street East, Suite 200, Toronto, Ontario on May 13, 2021 at 4:00 p.m. (Toronto time), for the following purposes:

| 1. | to receive the audited consolidated financial statements of the Corporation for the year ended December 31, 2020 (with comparative statements relating to the preceding fiscal period) together with the report of the auditors thereon; |

| | | |

| 2. | to elect directors; |

| | | |

| 3. | to re-appoint PricewaterhouseCoopers LLP, Chartered Accountants, as auditors of the Corporation and to authorize the directors to fix their remuneration; and |

| | | |

| 4. | to transact such further or other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

Accompanying this notice is the Circular, a form of proxy and a request form to receive annual and interim financial statements and management discussion and analysis. The accompanying Circular provides information relating to the matters to be addressed at the meeting and is incorporated into this Notice.

As a result of the novel coronavirus (“COVID-19”), the Company is proactively implementing measures to prioritize the health and well-being of its employees, customers, suppliers, partners, securityholders, communities and other stakeholders. The Company takes its responsibility seriously to help slow the spread of the COVID-19 pandemic and reduce its impact on stakeholders and their health. Therefore, the Company will hold the Meeting in a virtual-only format, which will be conducted via live audio webcast. The Company urges all shareholders to vote by proxy in advance of the Meeting and shareholders will only be able to attend and participate in the Meeting online via live audio webcast via:

From a PC, Mac, iPad, iPhone or Android device:

https://us02web.zoom.us/webinar/register/WN_6i4cCsZ6QNqwvbfDrOqCzg

Webinar ID: 895 2770 9706

Passcode: 957431

Or join by phone:

| Canada | | United States | | United Kingdom | | Switzerland | | Germany |

+1 778 907 2071

+1 204 272 7920

+1 438 809 7799

+1 587 328 1099

+1 647 374 4685

+1 647 558 0588 | | +1 669 900 9128

+1 253 215 8782

+1 301 715 8592

+1 312 626 6799

+1 346 248 7799

+1 646 558 8656 | | +44 203 901 7895

+44 131 460 1196

+44 203 051 2874

+44 203 481 5237

+44 203 481 5240 | | +41 44 529 92 72

+41 22 591 00 05

+41 22 591 01 56

+41 31 528 09 88

+41 43 210 70 42

+41 43 210 71 08 | | +49 69 7104 9922

+49 30 5679 5800

+49 69 3807 9883

+49 695 050 2596 |

| Webinar ID: | 895 2770 9706 |

| Password: | 957431 |

International numbers available: https://us02web.zoom.us/u/kGP4HwHiP

Shareholders attending the Meeting by video or telephone conference will be able to listen to the meeting but will not be able to vote at the Meeting.

Shareholders are entitled to vote at the Meeting either in person or by proxy in accordance with the procedures described in the Circular accompanying this Notice. Those who are unable to attend the meeting are requested to read, complete, sign and mail the enclosed form of proxy in accordance with the instructions set out in the proxy and in the Circular accompanying this Notice.

DATED at Toronto, Ontario, this March 16, 2021.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | (signed) “André Y. Fortier” |

| | André Y. Fortier |

| | Chairman |

EXCELLON RESOURCES INC.

MANAGEMENT INFORMATION CIRCULAR

(Containing information as at March 16, 2021 unless indicated otherwise)

SOLICITATION OF PROXIES

This Management Information Circular (the “Circular”) is furnished in connection with the solicitation of proxies by the management of Excellon Resources Inc. (“Excellon”, the “Company” or the “Corporation”) for use at the Annual Meeting of holders (“Shareholders”) of common shares (“Common Shares”) of the Corporation and any adjournment thereof to be held at 4:00 p.m. (Toronto time) on Thursday, May 13, 2021 (the “Meeting”) at the place and for the purposes set forth in the accompanying notice of Meeting. The enclosed proxy is being solicited by the management of the Corporation. While it is expected that the solicitation will be primarily by mail, proxies may be solicited personally, by facsimile or by telephone by the regular employees of the Corporation at nominal cost. All costs of solicitation by management will be borne by the Corporation. The Corporation may also retain, and pay a fee to, one or more professional proxy solicitation firms to solicit proxies from Shareholders.

The contents and the sending of this Circular have been approved by the directors of the Corporation. All dollar amounts referenced are expressed in Canadian dollars. All references to the Corporation shall include its subsidiaries as the context may require.

NOTICE AND ACCESS

The Corporation has elected to use the notice-and-access process (“Notice-and-Access”) that came into effect on February 11, 2013 under National Instrument 54-101 – Communications with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) and National Instrument 51-102 – Continuous Disclosure Obligations, for distribution of this Circular and other meeting materials to registered Shareholders of the Corporation and Non-Registered Holders (as defined herein).

Notice-and-Access allows issuers to post electronic versions of meeting materials, including circulars, annual financial statements and management discussion and analysis, online, via SEDAR and one other website, rather than mailing paper copies of such meeting materials to Shareholders. The Corporation anticipates that utilizing the Notice-and-Access process will substantially reduce both postage and printing costs.

Meeting materials including the Circular and the Corporation’s audited financial statements for the year ended December 31, 2020 and the Corporation’s management discussion and analysis for the year ended December 31, 2020, are available on https://docs.tsxtrust.com/2110 and on the Corporation’s SEDAR profile at www.sedar.com.

Although the Circular and related materials (collectively, the “Meeting Materials”) will be posted electronically online, as noted above, the registered Shareholders and Non-Registered Holders (subject to the provisions set out below under the heading “Voting by Beneficial Holders of Common Shares of the Corporation”) will receive a “notice package” (the “Notice-and-Access Notification”), by prepaid mail, which includes the information prescribed by NI 54-101, and a proxy form or voting instruction form from their respective intermediaries. Shareholders should follow the instructions for completion and delivery contained in the proxy or voting instruction form. Shareholders are reminded to review the Circular before voting.

Management of the Corporation does not intend to pay for intermediaries to forward the Notice-and-Access Notification to OBOs (as defined herein) under NI 54-101, and therefore an OBO will not receive the Notice-and-Access Notification unless the OBO’s intermediary assumes the cost of delivery.

Shareholders will not receive a paper copy of the Meeting Materials unless they request paper copies from the Corporation. Requests for paper copies of the Meeting Materials must be received at least five (5) business days in advance of the proxy deposit date and time, being 4:00 p.m. on May 4, 2021 and the Corporation will mail the requested materials within three (3) business days of the request. Shareholders with questions about Notice-and-Access may contact the TSX Trust’s toll free at 1-866-600-5869 or email tmxeinvestorservices@tmx.com.

APPOINTMENT OF PROXYHOLDER

The individuals named as proxyholders in the accompanying form of proxy are directors and/or officers of the Corporation. A REGISTERED SHAREHOLDER WISHING TO APPOINT SOME OTHER PERSON (WHO NEED NOT BE A SHAREHOLDER) TO REPRESENT HIM OR HER AT THE MEETING HAS THE RIGHT TO DO SO, EITHER BY STRIKING OUT THE NAMES OF THOSE PERSONS NAMED IN THE ACCOMPANYING FORM OF PROXY AND INSERTING THE DESIRED PERSON’S NAME IN THE BLANK SPACE PROVIDED IN THE FORM OF PROXY AND SIGNING AND DATING THE PROXY, OR BY COMPLETING ANOTHER FORM OF PROXY. A proxy will not be valid unless the completed form of proxy is received by TSX Trust Company, 100 Adelaide Street West, Suite 301, Toronto, Ontario, M5H 4H1 not less than forty eight (48) hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting or, with respect to any matters to be dealt with at any adjournment of the Meeting, before the time of the re-commencement of the adjourned Meeting. Proxies delivered after such time(s) will not be accepted.

REVOCATION OF PROXIES

A Shareholder who has given a proxy may revoke it prior to its use by an instrument in writing executed by the Shareholder or by his attorney duly authorized in writing or, where the Shareholder is a corporation, by a duly authorized officer or attorney of such corporation, and delivered to 10 King Street East, Suite 200, Toronto, Ontario, M5C 1C3 (Attention: Corporate Secretary) at any time up to and including the last business day preceding the day of the Meeting, or if adjourned, preceding any reconvening thereof, or to the Chairperson of the Meeting on the day of the Meeting or, if adjourned, any reconvening thereof, or in any other manner provided by law. A revocation of a proxy does not affect any matter on which a vote has been taken prior to the revocation.

VOTING OF PROXIES

The Common Shares represented by a properly executed proxy in favour of persons designated as proxyholders in the enclosed form of proxy will:

| (a) | be voted or withheld from voting in accordance with the instructions of the person appointing the proxyholder on any ballot that may be called for; and |

| (b) | where a choice with respect to any matter to be acted upon has been specified in the form of proxy, be voted in accordance with the specifications made on such proxy. |

SUCH SHARES WILL BE VOTED IN FAVOUR OF EACH MATTER FOR WHICH NO CHOICE HAS BEEN SPECIFIED, OR WHERE BOTH CHOICES HAVE BEEN SPECIFIED, AS DIRECTED BY THE SHAREHOLDER.

The enclosed form of proxy, when properly completed and delivered and not revoked, confers discretionary authority upon the person appointed proxyholder thereunder to vote with respect to amendments or variations of matters identified in the notice of Meeting, and with respect to any other matters which may properly come before the Meeting. In the event that amendments or variations to matters identified in the notice of Meeting are properly brought before the Meeting or any further or other business is properly brought before the Meeting, it is the intention of the persons designated by management as proxyholders in the enclosed form of proxy to vote in accordance with their best judgment on such matters or business. At the time of the printing of this Circular, the management of the Corporation knows of no such amendment, variation or other matter that may be presented to the Meeting.

INFORMATION FOR NON-REGISTERED SHAREHOLDERS

Only registered Shareholders or proxyholders duly appointed by registered Shareholders are permitted to vote at the Meeting. Most Shareholders of the Corporation are “non-registered” shareholders because the Common Shares they own are not registered in their names but are instead registered in the name of a brokerage firm, bank or other intermediary or in the name of a clearing agency. Shareholders who do not hold their Common Shares in their own name (referred to herein as “Beneficial Shareholders”) should note that only registered Shareholders are entitled to vote at the Meeting. If Common Shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases those Common Shares will not be registered in such Shareholder’s name on the records of the Corporation. Such Common Shares will more likely be registered under the name of the Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such Common Shares are registered under the name of CDS & Co. (the registration name for CDS Clearing and Depositary Services Inc., which company acts as nominee for many Canadian brokerage firms). Common Shares held by brokers (or their agents or nominees) on behalf of a broker’s client can only be voted (for or against resolutions) at the direction of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting Common Shares for the brokers’ clients. Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting.

Existing regulatory policy requires brokers and other intermediaries to seek voting instructions from Beneficial Shareholders in advance of Shareholders’ meetings. The various brokers and other intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their Common Shares are voted at the Meeting. Often the form of proxy supplied to a Beneficial Shareholder by its broker is identical to the form of proxy provided by the Corporation to the registered Shareholders. However, its purpose is limited to instructing the registered Shareholder (i.e. the broker or agent of the broker) how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate the responsibility for obtaining instructions from clients to Broadridge Financial Solutions Inc. (“Broadridge”). Broadridge typically prepares a machine-readable voting instruction form, mails those forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the forms to Broadridge, or otherwise communicate voting instructions to Broadridge (by way of the internet or telephone, for example). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting. A Beneficial Shareholder who receives a Broadridge voting instruction form cannot use that form to vote Common Shares directly at the Meeting. The voting instruction form must be returned to Broadridge (or instructions respecting the voting of Common Shares must be communicated to Broadridge well in advance of the Meeting) in order to have the Common Shares voted.

The Notice-and-Access Notification is being sent to both registered Shareholders and Beneficial Shareholders. Beneficial Shareholders fall into two categories – those who object to their identity being known to the issuers of securities which they own (“Objecting Beneficial Owners”, or “OBO’s”) and those who do not object to their identity being made known to the issuers of the securities they own (“Non-Objecting Beneficial Owners”, or “NOBO’s”). Subject to the provisions of NI 54-101, issuers may request and obtain a list of their NOBO’s from intermediaries via their transfer agents. If you are a Beneficial Shareholder, and the Corporation or its agent has sent these materials directly to you, your name, address and information about your holdings of Common Shares have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding the Common Shares on your behalf.

The Corporation’s OBO’s can expect to be contacted by Broadridge or their broker or their broker’s agents as set out above.

Although Beneficial Shareholders may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of their broker, a Beneficial Shareholder may attend the Meeting as proxyholder for the registered Shareholder and vote the Common Shares in that capacity. Beneficial Shareholders who wish to attend the Meeting and indirectly vote their Common Shares as proxyholder for the registered Shareholder should enter their own names in the blank space on the proxy or voting instruction card provided to them and return the same to their broker (or the broker’s agent) in accordance with the instructions provided by such broker.

All references to Shareholders in this Circular and the accompanying form of proxy and notice of Meeting are to registered Shareholders unless specifically stated otherwise.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Other than as set forth in this Circular, no person who has been a director or executive officer of the Corporation at any time since January 1, 2020, being the beginning of the Corporation’s last completed financial year, nor any proposed nominee for election as a director of the Corporation, nor any associate or affiliate of any of the foregoing, has or has had any material interest, directly or indirectly, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The Corporation is authorized to issue an unlimited number of Common Shares without par value. The Corporation consolidated its Common Shares on the basis of one new post-consolidation Common Share for every five existing pre-consolidation Common Shares effective September 10, 2020 (the “Consolidation”) which is reflected in this Circular. As at March 16, 2021, the Corporation had 32,372,114 issued and outstanding Common Shares. Only Shareholders of record at the close of business (Toronto time) on March 24, 2021 (the “Record Date”) who either personally attend the Meeting or who have completed and delivered a form of proxy in the manner and subject to the provisions described above shall be entitled to vote or to have their Common Shares voted at the Meeting.

Other than as set out below, to the knowledge of the directors and executive officers of the Corporation, there are no persons or companies who beneficially own, or exercise control or direction over, directly or indirectly, Common Shares carrying more than ten percent (10%) of the voting rights attached to all outstanding Common Shares:

| Name and Municipality of Residence | | Number of Common Shares | | | Percentage of Common Shares | |

Eric Sprott(1) Toronto | | | 4,293,143 | | | | 13.4 | % |

| (1) | As stated on an Early Warning Report filed by Mr. Sprott on December 9, 2020 |

PARTICULARS OF MATTERS TO BE ACTED UPON

1. ELECTION OF DIRECTORS

There are eight (8) directors to be elected at the Meeting. The term of office of each of the present directors expires immediately prior to the election of directors at the Meeting. The persons named below will be presented for election at the Meeting as management’s nominees and management proxyholders will vote FOR the election of these nominees, unless otherwise instructed on the proxy form. Management does not contemplate that any of these nominees will be unable to serve as a director and all proposed directors have confirmed their willingness to continue to serve as directors. Each director elected will hold office until the next annual general meeting of the Corporation or until his or her successor is elected or appointed, unless his or her office is earlier vacated in accordance with the Articles of the Corporation or the provisions of the Business Corporations Act (Ontario) (“OBCA”).

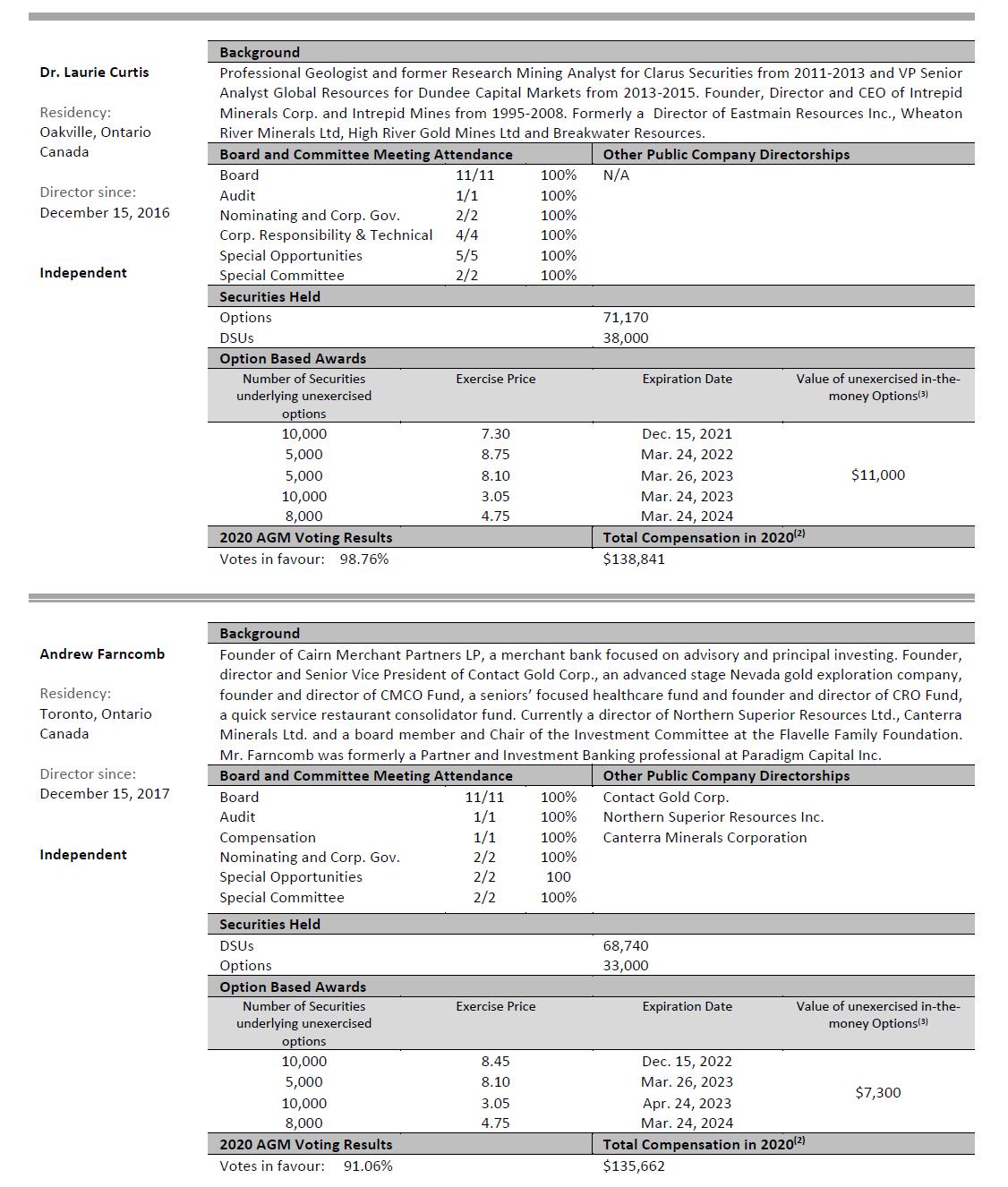

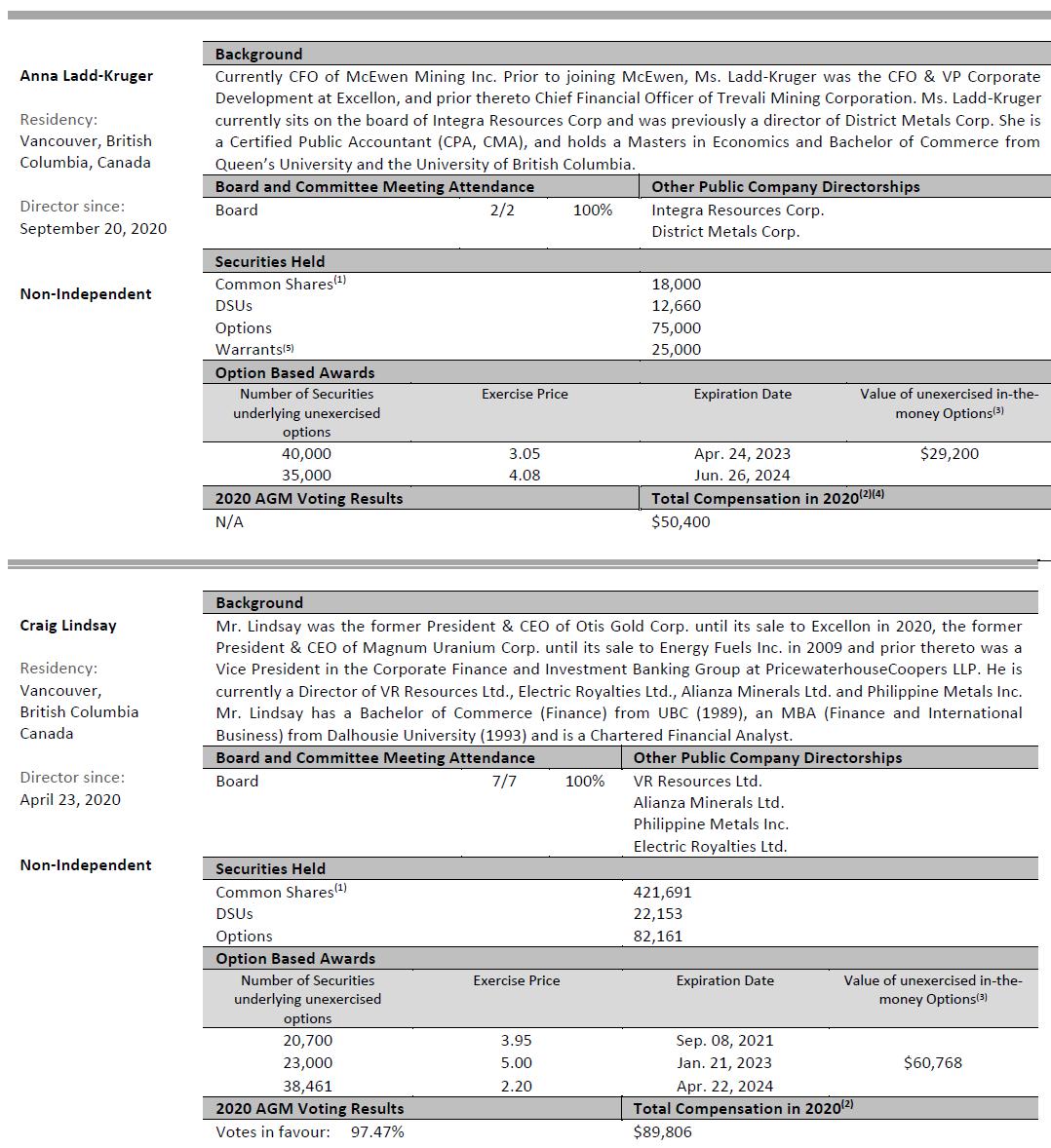

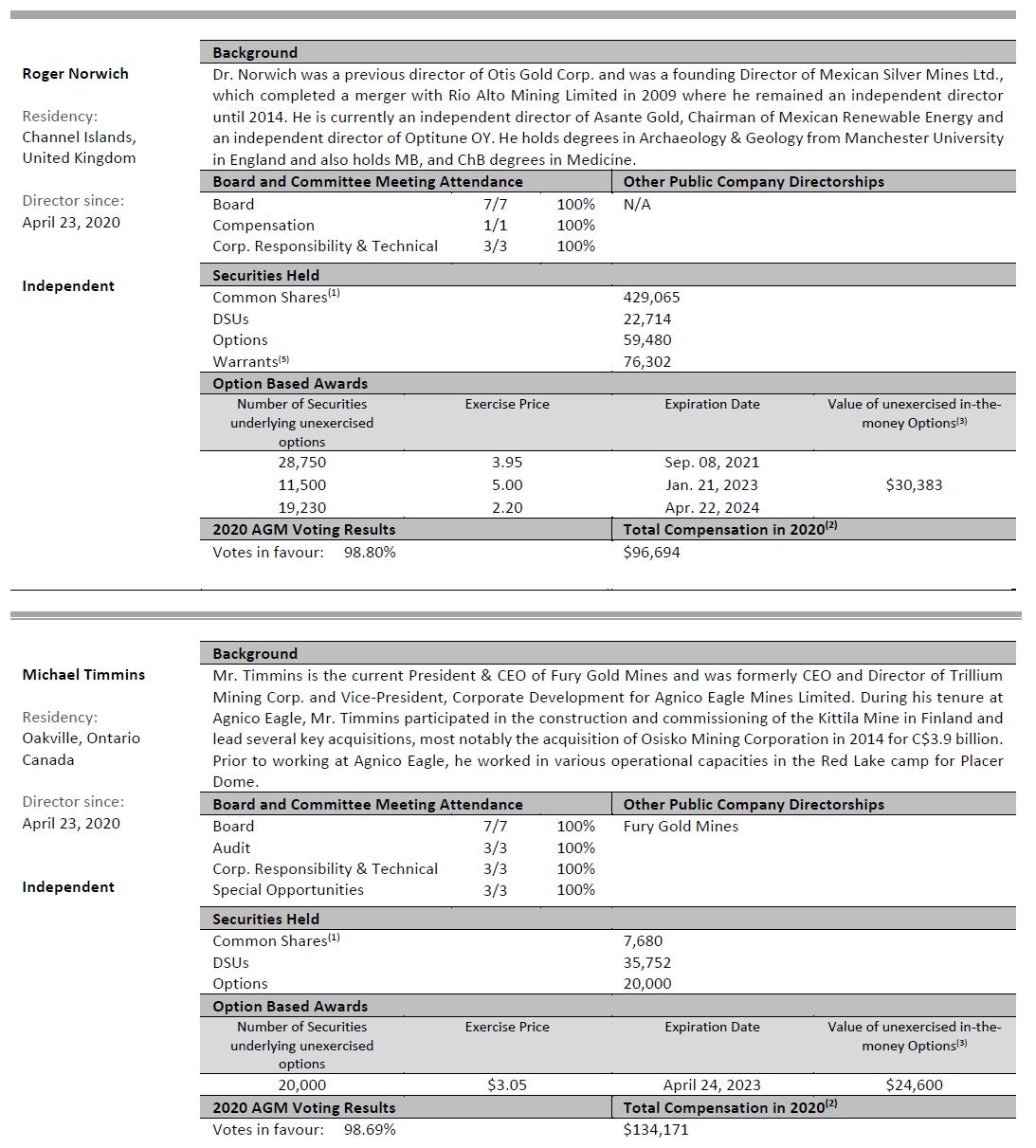

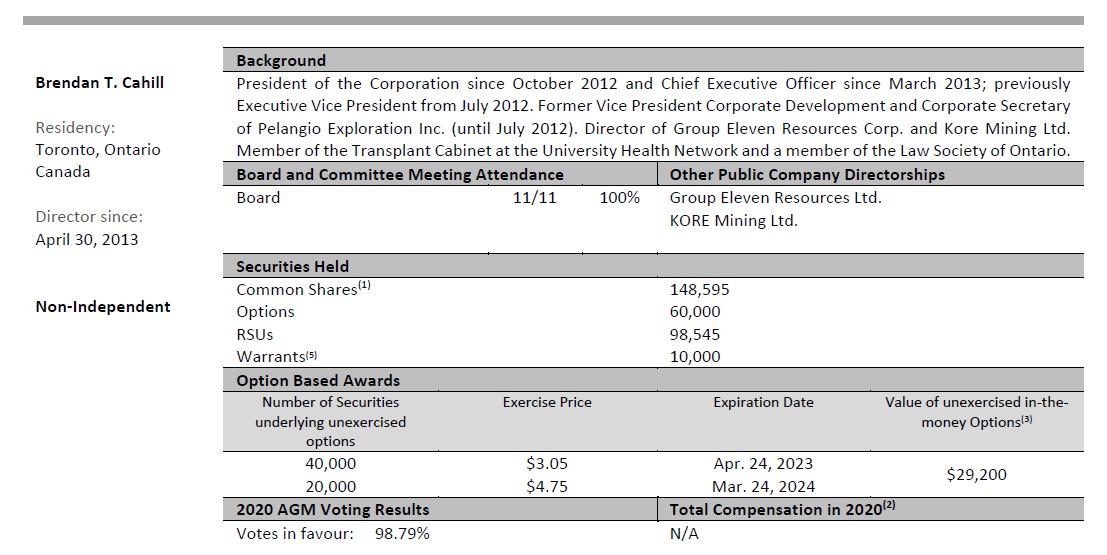

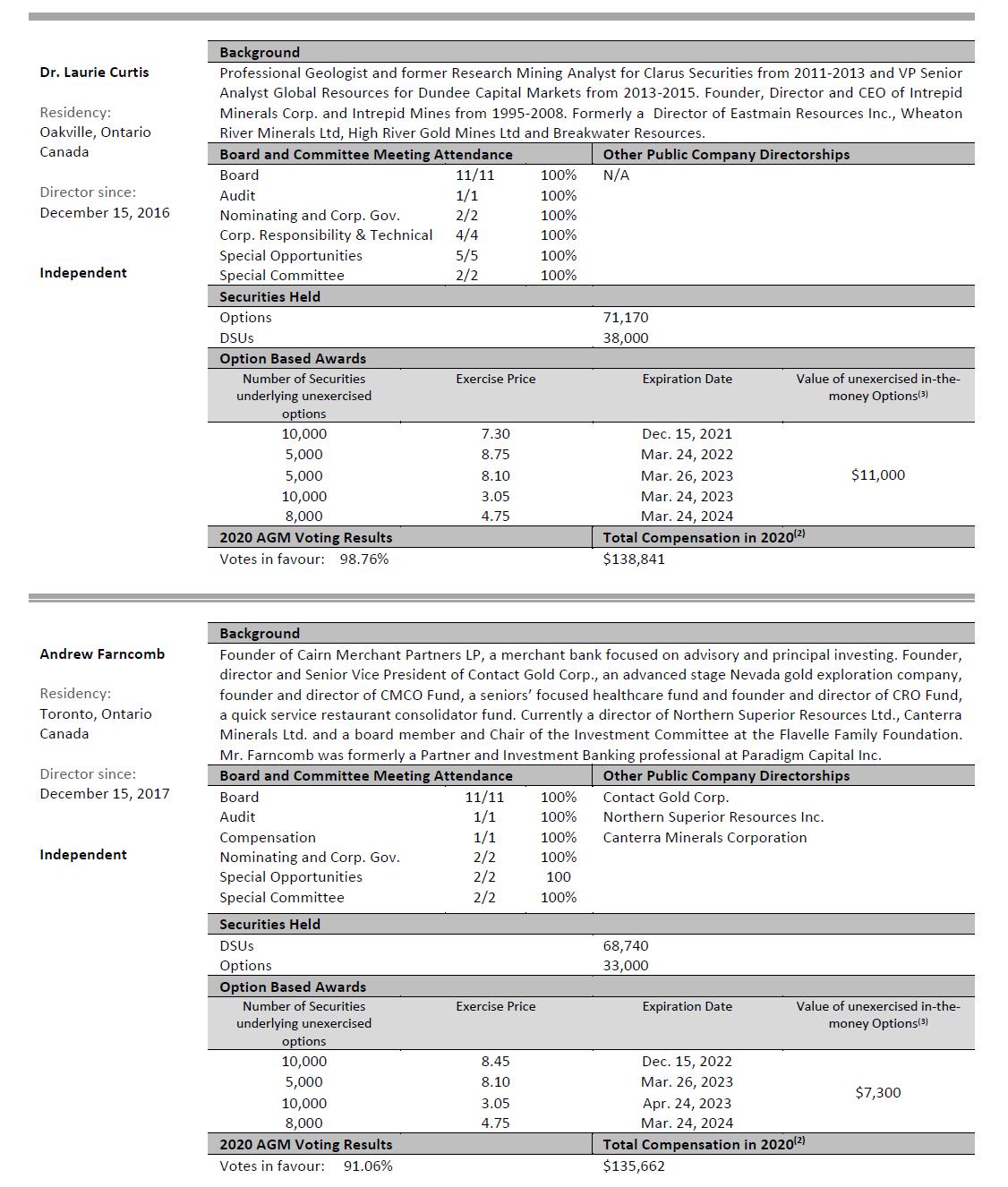

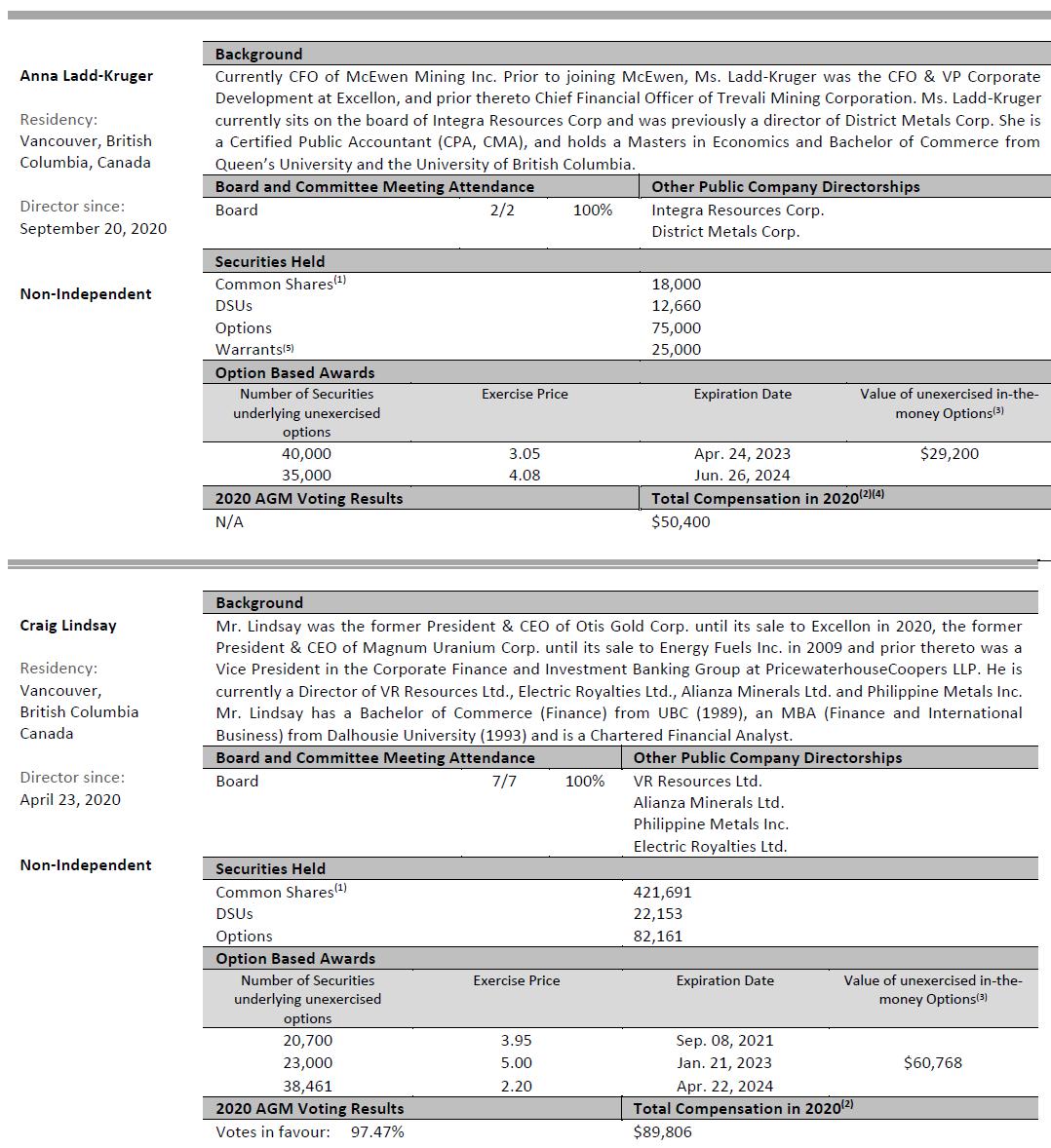

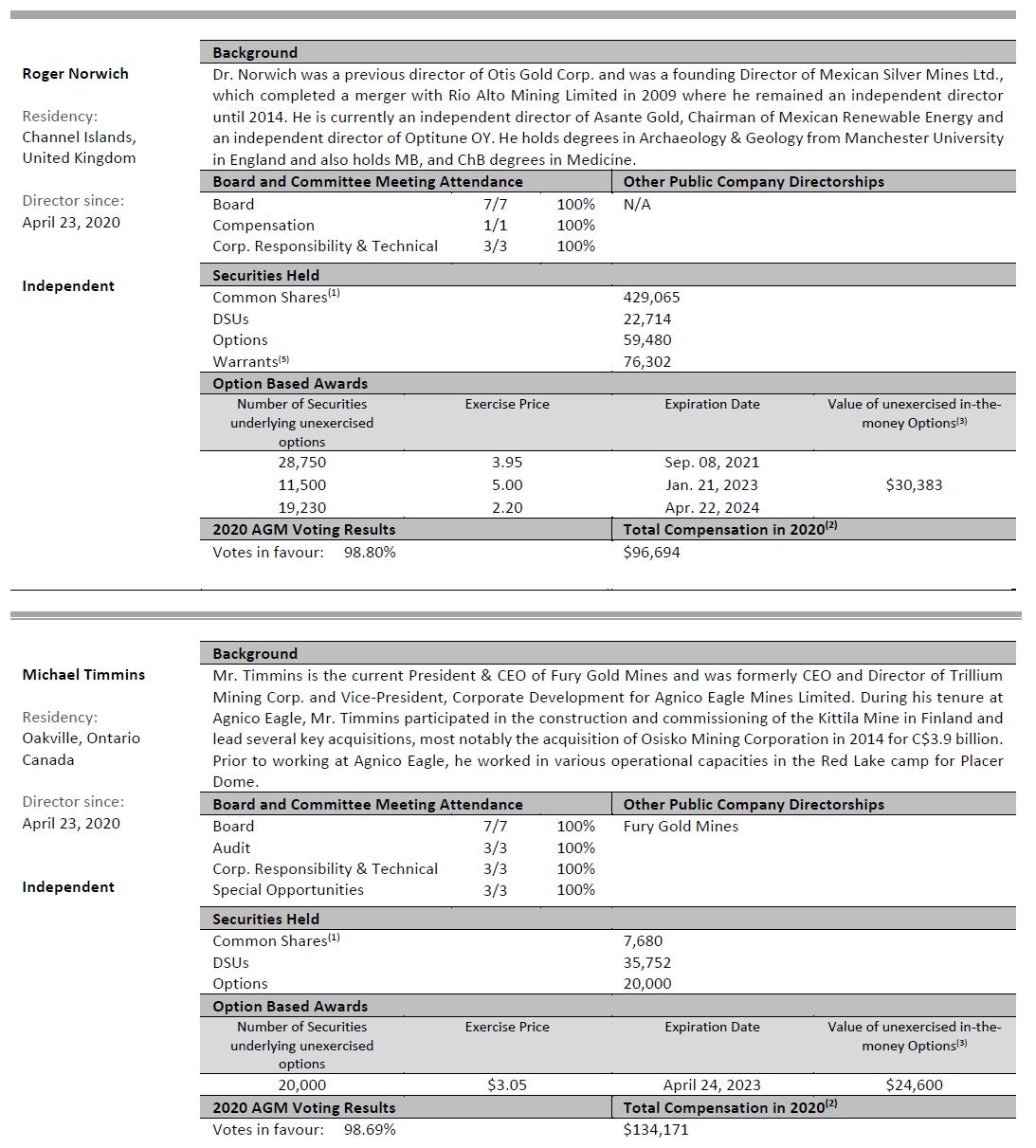

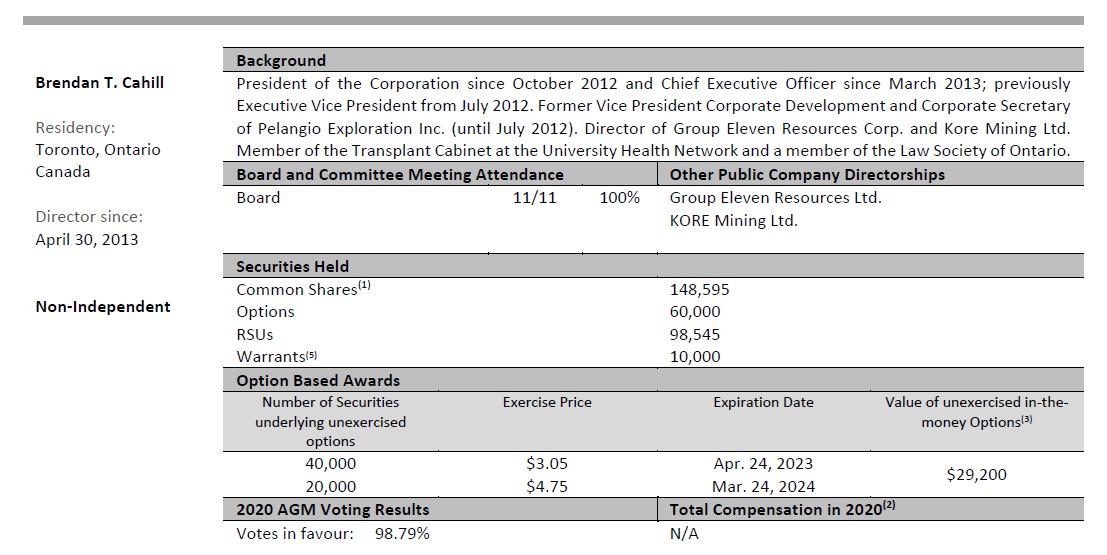

The following table and notes thereto sets out information as at March 16, 2021 on each person proposed to be nominated by management for election as a director.

| (1) | Adjusted for the Consolidation. |

| (2) | Total Compensation, above, is calculated by summing cash fees paid, the value of DSUs as of the date of grant and a Black-Scholes valuation of Options as of the date of grant. |

| (3) | Based on the closing price of $3.78 per Common Shares on December 31, 2020. |

| (4) | Compensation in her capacity as a director only. |

| (5) | Warrants are converted at a ratio of 5:1 per Common Share. |

Majority Voting Policy

On March 25, 2014 (as amended and restated on May 10, 2016), the Board adopted a majority voting policy (the “Majority Voting Policy”) with immediate effect. A copy of the Majority Voting Policy is available on the Corporation’s website at www.excellonresources.com.

The Majority Voting Policy requires that any nominee for director who receives a greater number of votes “withheld” than “for” his or her election, in an uncontested election, shall immediately tender his or her resignation to the Chairperson of the Board for consideration by the Nominating and Corporate Governance Committee (the “NCGC”). The NCGC shall consider the resignation in accordance with the Majority Voting Policy and shall recommend to the Board whether or not it should be accepted. The Board shall act on the recommendations of the NCGC within 90 days following the Shareholders’ meeting and disclose its decision by way of press release. No director who, in accordance with the Majority Voting Policy, is required to tender his or her resignation, shall participate in the NCGC’s deliberations or recommendation. However, such director shall remain active and engaged in all other Board and committee activities, deliberations and decisions during the NCGC process. If a majority of the members of the NCGC received a majority of votes “withheld” in the same election, or the number of NCGC members who received a majority of votes “withheld” in the same election is greater than quorum of the NCGC, the independent directors then serving on the Board who received a greater number of votes “for” their election than votes “withheld” will appoint an ad hoc Board committee from amongst themselves to consider the resignations. If a resignation is accepted, the Board may, in accordance with the provisions of the OBCA, (i) leave the vacancy in the Board unfilled until the next annual meeting of Shareholders, (ii) reduce the size of the Board, (iii) fill the vacancy created by the resignation by appointing a new director whom the Board considers to merit the confidence of Shareholders, or (iv) call a special meeting of Shareholders to consider new board nominee(s) to fill the vacant position(s).

Each of the current directors has agreed to abide by the provisions of the Majority Voting Policy and any subsequent candidate nominated by management will, as a condition of such nomination, be required to abide by the Majority Voting Policy. In the event that any director who received a majority of votes “withheld” does not tender his or her resignation in accordance with the Majority Voting Policy, he or she will not be re-nominated by the Board.

Corporate Cease Trade Orders or Bankruptcies

To the best of the Corporation’s knowledge, none of the nominees is, as at the date of this Circular, or has been, within 10 years before the date hereof, a director, chief executive officer or chief financial officer of any company, including the Corporation, that: (i) was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, in any case that was in effect for more than 30 consecutive days (an “order”) that was issued while the nominee was acting in the capacity as director, chief executive officer or chief financial officer; or (ii) was subject to an order that was issued after the nominee ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

Personal Bankruptcies

To the best of the Corporation’s knowledge, except as noted below, none of the nominees is, as at the date of this Circular, or has been within the 10 years before the date hereof, (i) a director or executive officer of any company, including the Corporation, that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or (ii) has become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the nominee.

Penalties and Sanctions

To the best of the Corporation’s knowledge, none of the nominees has been subject to: (i) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (ii) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

2. RE-APPOINTMENT OF AUDITORS

PricewaterhouseCoopers LLP were first appointed auditors of the Corporation on October 22, 2009. Unless such authority is withheld, the persons named in the accompanying proxy intend to vote FOR the re-appointment of PricewaterhouseCoopers LLP, as the auditors of the Corporation to hold office until its successor is appointed and to authorize the directors to fix their remuneration.

OTHER BUSINESS

Management of the Corporation knows of no matters to come before the Meeting other than those referred to in the notice of Meeting accompanying this Circular. However, if any other matters properly come before the Meeting, it is the intention of the management proxyholders to vote on the same in accordance with their best judgment on such matters.

STATEMENT OF EXECUTIVE COMPENSATION

Named Executive Officers

The following describes the particulars of compensation for a) the CEO, b) the CFO, c) each of the three most highly compensated executive officers of the Corporation, including any of its subsidiaries, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and the CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000 for that financial year; and d) each individual who would be a named executive officer but for the fact that the individual was neither an executive officer of the Corporation or its subsidiaries, nor acting in a similar capacity, at the end of that financial year (each a “Named Executive Officer” or “NEO”). For the financial year ended December 31, 2020, the Named Executive Officers of the Corporation were:

Brendan Cahill, President & Chief Executive Officer

Alfred Colas, Chief Financial Officer

Anna Ladd-Kruger, Former Chief Financial Officer & VP Corporate Development

Ben Pullinger, Senior Vice President Geology & Corporate Development

Ronald Mariño, Vice President Finance

Craig Ford, Former Vice President, Corporate Responsibility

Compensation Policy Objectives

Excellon Resources believes that recruiting and retaining highly competent executives is critical to the Company’s success in achieving its strategic objectives and delivering value to shareholders.

The objectives of the Company’s compensation strategy are to:

| ● | Offer competitive compensation that allows the Company to successfully attract, retain and motivate qualified executives; |

| ● | Provide incentives to executives to maximize productivity and enhance enterprise value by aligning the interests of the executives with those of the Shareholders; |

| ● | Foster the teamwork and entrepreneurial spirit necessary to support the Company’s growth objectives; |

| ● | Establish a direct link between all elements of compensation and the performance of the Corporation and its subsidiaries, and individual performance; |

| ● | Integrate compensation incentives with the development and successful execution of strategic and operating plans; and |

| ● | To enhance Shareholder value. |

The Compensation Committee of the Corporation is composed of André Y. Fortier (Chair), Andrew Farncomb and Roger Norwich, each of whom is considered independent for the purposes of National Policy 58-201 – Corporate Governance Guidelines (“NP 58-201”). Each member of the Compensation Committee has held senior executive and board positions with other publicly traded companies where they have had direct involvement in the development and implementation of compensation policies and practices for employees at all levels, including executive officers. The Board believes that the Compensation Committee members possess all of the knowledge, experience and the profile needed in order to fulfill the mandate of the Compensation Committee.

For the fiscal year ended December 31, 2020, the Compensation Committee was responsible for making recommendations to the Board with respect to the compensation of the Corporation’s directors, Named Executive Officers and employees. The Compensation Committee works in conjunction with the Chairperson and the President on the review and assessment of the performance of executive officers and other employees in accordance with the Corporation’s compensation practices. The Board reviews the Compensation Committee’s recommendations to ensure that total compensation paid to all Named Executive Officers is fair and reasonable and is consistent with the Corporation’s compensation program.

In June 2020, the Compensation Committee engaged an independent compensation consultant, Bedford Consulting Group Inc. (“Bedford”), reflecting the (still) most currently available public disclosure of peer compensation practices. Bedford provided written recommendations to the Compensation Committee as to executive compensation (including CEO compensation), and also as to director compensation. Bedford also formulated and provided a review of compensation practices of the following companies: Americas Gold and Silver Corporation, Avino Silver & Gold Mines Ltd., Fiore Gold Ltd., GoGold Resources Inc., Great Panther Mining Limited, Jaguar Mining Inc., Mandalay Resources Corporation, Northern Vertex Mining Corp., Premier Gold Mines Limited and Sierra Metals Inc.

The executive compensation program comprises fixed and variable elements of compensation; base salary, indirect compensation (benefits), discretionary bonus, and long-term incentives in the form of DSUs, RSUs and stock options. In determining actual compensation levels, the Compensation Committee considers the total compensation program, rather than any single element in isolation. Total compensation levels are designed to reflect both the marketplace (to ensure competitiveness) and the responsibility of each position (to ensure internal equity). The Compensation Committee believes these elements of compensation, when combined, form an appropriate mix of compensation, and provide competitive salary, link the majority of the executives’ compensation to corporate and individual performance (which induces and rewards behaviour that creates long-term value for Shareholders and other stakeholders), and encourage retention with time-based vesting attached to long-term equity-based incentives.

The compensation level of the President is designed to recognize his personal contributions and leadership. At the end of each fiscal year, the Compensation Committee evaluates the performance of the President, and the Compensation Committee in consultation with the Chairperson formally evaluates the performance of the President. Using both financial and non-financial measures, the Compensation Committee may recommend to the Board an increase to the President’s total compensation to levels that are consistent with corporate and individual performance.

Similarly, the Compensation Committee reviews and ensures that the directors’ compensation packages are competitive in light of the responsibility and the time commitment required from directors. Based on such reviews, the Committee makes recommendations to the Board with respect to changes to executive compensation and director compensation.

2020 Compensation Grants

Compensation for NEOs is composed of different elements. These include elements relating to factors that do not directly correlate to the market price of the Common Shares, such as base salary, as well as elements that more closely correlate to the Corporation’s performance and financial condition, such as short-term and long-term incentives. The elements of executive compensation are designed to attract and retain top quality executives to manage and grow the business through both adverse and favourable economic cycles. In recent years, in the context of difficult equity and commodity markets, the Corporation has significantly weighted compensation to corporate performance metrics, specifically regarding safety, cost performance and certain specific corporate and strategic objectives.

During 2020, RSU grants comprised a significant component of compensation for executives. These RSUs had 100% performance based vesting thresholds as follows: Corporate Growth (based on increase in the Corporation’s net asset value (“NAV”) – 50%; Stock Performance (relative to the Global X Silver Miners ETF (SIL), of which the Corporation is a component stock from time-to-time) – 30%; and Retention – 20%. The Corporation Growth component may be multiplied 2X based on corporate NAV growth in excess of 200% from June 30, 2020. The Corporation expects RSU grants to continue to be performance-metric based, with a focus on Corporate Growth and Stock Performance.

Further to the above, RSU and Option grants to NEOs for 2020 were as follows:

| Name/Title | | RSUs (#) | | | Options (#) | |

Brendan Cahill

President & CEO | | | 66,788 | (1) | | | 40,000 | |

Alfred Colas(2)

CFO | | | 30,000 | | | | 30,000 | |

Anna Ladd-Kruger

Former CFO & VP Corporate Development | | | 40,000 | | | | 40,000 | |

Ben Pullinger

Senior Vice President Geology and Corporate Development | | | 40,000 | | | | 40,000 | |

Craig Ford

Former Vice President, Corporate Responsibility | | | 25,000 | | | | NIL | |

Ronald Mariño

Vice President Finance | | | 15,000 | | | | 15,000 | |

| (1) | 26,788 RSUs were granted in respect of salary and 40,000 RSUs in respect of annual compensation grants. |

| (2) | Not employed by the Corporation in 2019; grants made on hire and reflected as 2020 compensation, below. |

The mix of total direct compensation potentially payable to our Named Executive Officers is as follows:

Base Salaries

Base salaries for the executive officers are designed to be competitive and are adjusted for the realities of the market. Initial base salaries are determined through market comparables, formal job evaluation, commercially available salary survey data, experience level, leadership and management skills, responsibilities and proven or expected performance. The Compensation Committee, in consultation with the Chairperson, reviews the recommendations of the President and recommends to the Board the base salaries for executive officers taking into consideration the individual’s performance, contributions to the success of the Corporation, and internal equities among positions. No specific weightings are assigned to each factor; instead a subjective determination is made based on a general assessment of the individual relative to such factors.

Effective July 1, 2020, the Board increased the CEO’s salary to $350,000 per annum, with $100,000 of such salary to be issued quarterly in the form of RSUs vesting on January 1st of the second calendar year after the date of grant. This arrangement was designed to link a material portion of the CEO’s base salary with the Corporation’s share price performance (and underlying operational, financial, etc. performance). At that time, the Compensation Committee also recommended the increase in the cash component of the (now former) CFO & VP Corporate Development’s annual salary to $300,000.

The Board of Directors and Compensation Committee review executive compensation on an ongoing basis, with the expectation that salaries will be modified in consideration of commodity prices, market and the Corporation’s financial position.

Discretionary Bonus

A discretionary bonus is intended to provide incentives to executive officers to enhance the growth and development of the Corporation, to encourage and motivate executive officers to achieve short-term goals, and to reward individual contribution to the achievement of corporate objectives. The bonus can be based as a percentage of annual salary or a fixed dollar amount and is awarded at the discretion of the Board as recommended by the Compensation Committee.

After a review of 2019 and early 2020 performance on a corporate and individual basis, as well as equity and commodity market conditions, the Compensation Committee decided to grant discretionary cash bonuses for certain NEOs in 2020.

Long-Term Incentives

The Corporation’s long-term equity portion of executive compensation is designed to align the interests of executive officers with that of Shareholders by encouraging equity ownership through awards of stock options (“Options”), DSUs and RSUs, to motivate executives and other key employees to contribute to an increase in corporate performance and Shareholder value, and to attract talented individuals and encourage the retention of executive officers and other key employees by vesting Options, DSUs and RSUs over a period of time.

Stock Options

The Corporation grants Options to its NEOs. The timing of the grant, and number of Common Shares made subject to option is recommended by the Chairperson and the President, reviewed and approved (or revised, if thought appropriate) by the Compensation Committee in consultation with the Chairperson, and implemented by a resolution of the Board. The review of proposed option grants by the Compensation Committee (which is composed of independent directors) and the implementation thereof by the Board (which is comprised of a majority of independent directors) provides the independent directors with significant input into such compensation decisions. Consideration in determining option grants is given to, amongst other things, the total number of Options outstanding, the current and future expected contribution to the advancement of corporate objectives, the position of the individual, tenure, and previous option grants to selected individuals. No specific weightings are assigned to each factor; instead a subjective determination is made based on an assessment of the individual relative to such factors. Grants of Options also comprise a portion of the compensation package offered to attract and retain new directors and executive officers to the Corporation. Options granted by the Board are priced at the closing price of the Common Shares on the TSX on the last trading day prior to the date of grant. Please see “Securities Authorized for Issuance under Equity Compensation Plans – Stock Option Plan” for further information.

During the fiscal year ended December 31, 2020, 75,000 Options were granted to directors and 395,500 Options were granted to executives, employees and consultants of the Corporation for an aggregate total of 470,500 Options.

Deferred Share Units

The Board adopted the DSU Plan effective as of December 11, 2013, as amended on March 25, 2014 and approved by Shareholders on April 29, 2014. The DSU Plan was further amended and restated as of June 26, 2020. The purpose of the DSU Plan is to promote the alignment of interests between the directors and Shareholders while enabling directors, officers and employees to participate in the long-term success of the Corporation through the grant of DSUs. The Board’s current policy is that DSUs will be granted to directors, officers and employees. Upon vesting, each DSU Award entitles the DSU Participant to receive, subject to adjustment as provided for in the DSU Plan, a lump sum cash payment or, at the Corporation’s discretion, Common Shares equal to the whole number of DSUs credited to the DSU Participant plus a cash settlement for any fraction of a DSU. For the purposes of the DSU Plan, the value of the DSU on the Settlement Date is the market price, being the volume-weighted average price of the Common Shares on the TSX for the five trading days immediately preceding such Settlement Date, but if the Common Shares did not trade on such trading days, the market price shall be average of the bid and ask prices in respect of the Common Shares at the close of trading on such trading day. The DSU Plan is posted on the Corporation’s website at www.excellonresources.com.

During the fiscal year ended December 31, 2020, 217,264 DSUs were granted to directors of the Corporation.

Restricted Share Units

The Board adopted the RSU Plan effective as of December 11, 2013, as amended on March 25, 2014 and approved by Shareholders on April 29, 2014. The RSU Plan was further amended and restated as of June 26, 2020. The purpose of the RSU Plan is to assist the Corporation in attracting and retaining individuals with experience and exceptional skill, to allow selected executives, key employees, consultants and directors of the Corporation to participate in the long-term success of the Corporation and to promote a greater alignment of interests between the participants designated under the RSU Plan and the Shareholders of the Corporation. Under the RSU Plan, RSUs may be granted at the discretion of the Board as a bonus to executives taking into account a number of factors, including the amount and term of RSUs previously granted, base salary and bonuses and competitive market factors. The Board establishes the vesting conditions for each Grant at the time of grant.

Upon vesting, each RSU entitles the RSU Participant to receive, subject to adjustments as provided for in the RSU Plan, one Common Share. For the purposes of the RSU Plan, the value of the RSU on vesting is the market price, being the closing volume-weighted average price of the Common Shares on the TSX for the five trading days immediately preceding such vesting date, but if the Common Shares did not trade on such trading days, the market price shall be average of the bid and ask prices in respect of the Common Shares at the close of trading on such trading day. The RSU Plan contemplates various entitlements in the event of a change of control. The RSU Plan is posted on the Corporation’s website at www.excellonresources.com.

During the fiscal year ended December 31, 2020, 337,331 RSUs were granted to executives, employees and consultants of the Corporation, as further described above in respect of NEOs.

Indirect Compensation

The primary benefits offered to the Named Executive Officers include participation in group health, dental, extended medical coverage, and life insurance, including long-term disability, paid vacation and payment of any professional dues on the individual’s behalf, which benefits are generally available to all employees of the Corporation.

Pension Plan Benefits

The Corporation does not provide retirement benefits for directors, executive officers or employees.

Share Ownership Requirements

The Corporation has not imposed minimum share ownership requirements, in line with industry practices for similar companies of its size.

Risks Associated with Compensation Practices

As of the date of this Circular, the Corporation’s directors had not, collectively, considered the implications of any risks associated with the Corporation’s compensation policies applicable to its executive officers.

Financial Instruments

The Corporation has not, to date, adopted a policy restricting its executive officers and directors from purchasing financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, which are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by executive officers or directors. As of the date of this Circular, entitlement to grants of incentive Options under the Corporation’s Stock Option Plan, the DSU Plan or the RSU Plan are the only equity-based security elements awarded to executive officers and directors.

Summary Compensation Table

The table below is a summary of total compensation paid to the NEOs for each of the Corporation’s three most recently completed financial years ending December 31, 2020:

| Summary Compensation Table |

| | | | | | | | | | | | | | Non-Equity Incentive Plan Compensation | | | | | | | | |

| Name and | | | | | | | | Share-based | | | Option-based | | | Annual | | | Long-term | | Pension | | All Other | | Total | |

| Principal | | | | | Salary | | | Awards(1) | | | Awards(2) | | | Incentive | | | Incentive | | Value | | Compensation | | Compensation | |

| Position | | Year | | | ($) | | | ($) | | | ($) | | | Plans | | | Plans | | ($) | | ($) | | ($) | |

Brendan Cahill(3) President & CEO and Director | | | 2020 | | | | 225,000 | | | | 266,000 | | | | 58,180 | | | | 100,000 | | | NIL | | NIL | | NIL | | | 649,180 | |

| | | 2019 | | | | 200,000 | | | | 226,000 | | | | NIL | | | | NIL | | | NIL | | NIL | | NIL | | | 426,000 | |

| | | 2018 | | | | 200,000 | | | | 100,000 | | | | 60,610 | | | | NIL | | | NIL | | NIL | | NIL | | | 360,610 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Alfred Colas(4) CFO | | | 2020 | | | | 52,083 | | | | 107,400 | | | | 52,746 | | | | NIL | | | NIL | | NIL | | NIL | | | 212,229 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Anna Ladd-Kruger(5) Former CFO & VP Corporate Development | | | 2020 | | | | 212,500 | | | | 166,000 | | | | 58,180 | | | | 100,000 | | | NIL | | NIL | | NIL | | | 536,680 | |

| | | 2019 | | | | 137,500 | | | | 192,000 | | | | 105,665 | | | | NIL | | | NIL | | NIL | | NIL | | | 435,165 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ben Pullinger SVP Geology & Corporate Development | | | 2020 | | | | 250,000 | | | | 166,000 | | | | 58,180 | | | | 100,000 | | | NIL | | NIL | | NIL | | | 574,180 | |

| | | 2019 | | | | 208,333 | | | | 115,200 | | | | NIL | | | | NIL | | | NIL | | NIL | | NIL | | | 323,533 | |

| | | 2018 | | | | 200,000 | | | | NIL | | | | 51,519 | | | | NIL | | | NIL | | NIL | | NIL | | | 251,519 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Craig Ford Vice President, Corporate Responsibility | | | 2020 | | | | 245,700 | | | | 178,750 | | | | NIL | | | | NIL | | | NIL | | NIL | | NIL | | | 424,450 | |

| | | 2019 | | | | 263,492 | | | | 156,000 | | | | NIL | | | | NIL | | | NIL | | NIL | | NIL | | | 419,492 | |

| | | 2018 | | | | 234,440 | | | | 159,750 | | | | NIL | | | | NIL | | | NIL | | NIL | | NIL | | | 394,190 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ronald Mariño Vice President Finance | | | 2020 | | | | 175,000 | | | | 62,250 | | | | 21,818 | | | | 40,000 | | | NIL | | NIL | | NIL | | | 299,068 | |

| | | 2019 | | | | 175,000 | | | | 100,750 | | | | NIL | | | | 15,000 | | | NIL | | NIL | | NIL | | | 290,750 | |

| | | 2018 | | | | 175,000 | | | | NIL | | | | 45,458 | | | | NIL | | | NIL | | NIL | | NIL | | | 220,458 | |

| (1) | RSUs are granted with performance, share price and time vesting criteria. The valuation of RSUs reflects the value on the date of grant. Certain portions of option-based compensation were granted on April 24, 2020 in respect of 2019, as further discussed under “2020 Compensation Grants”, above. |

| | | |

| (2) | The values reported represent an estimate of the grant date fair market value of the options awarded during the year. For 2020, the fair value was estimated at the grant date based on the Black-Scholes option pricing model assuming a risk-free interest rate of 1.71%, no dividend yield, expected life of 5 years and an expected price volatility of 77.63%. For 2019, the fair value was estimated at the grant date based on the Black-Scholes option pricing model assuming a risk-free interest rate of 1.71%, no dividend yield, expected life of 5 years and an expected price volatility of 77.63%. For 2018, the fair value was estimated at the grant date based on the Black-Scholes option pricing model assuming a risk-free interest rate of 1.97%, no dividend yield, expected life of 5 years and an expected price volatility of 77.92%. The calculation of fair market value is based on the Black-Scholes pricing model, selected as it is widely used in estimating option-based compensation values by Canadian public companies. The Black-Scholes model is a pricing model, which may or may not reflect the annual value of the options. The options may never be exercised and actual gain, if any, on exercise will depend on the value of the Common Shares on the date of exercise. |

| | | |

| (3) | As discussed above, Mr. Cahill’s Base Salary increased from $300,000 to $350,000 effective July 1, 2020, with $100,000 of such salary issued quarterly in the form of RSUs vesting on January 1st of the second calendar year after the date of grant. The RSU component of Base Salary is reflected in Share-Based Awards. |

| | | |

| (4) | Mr. Colas joined the Corporation as Chief Financial Officer on October 19, 2020 and received 30,000 RSUs and 30,000 Stock Options in connection with his appointment. |

| | | |

| (5) | Ms. Ladd-Kruger joined the Corporation as Chief Financial Officer & Vice President Corporate Development on June 26, 2019 and received 40,000 RSUs and 35,000 Stock Options (adjusted for the Consolidation) in connection with her appointment. Ms. Ladd-Kruger ceased to be Chief Financial Officer & Vice President Corporate Development on September 30, 2020. |

Incentive Plan Awards

Outstanding Share-Based Awards and Option-Based Awards

Option-based awards outstanding in respect of each NEO as at December 31, 2020 were as follows:

| | | Option Based Award | | | Share-based Awards | |

| Name | | Number of securities underlying unexercised options (#) | | | Option exercise price ($) | | | Option expiration date | | | Value of unexercised in-the-money options ($)(1) | | | Number of shares or units of shares that have not vested (#) | | | Market or payout value of share-based awards that have not vested ($)(2) | |

Brendan Cahill President, CEO and Director | | | 40,000 | | | | 3.05 | | | | 04/24/2023 | | | | 29,200 | | | | 98,546 | | | | 372,505 | |

| | | 20,000 | | | | 4.75 | | | | 03/24/2024 | | | | NIL | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Alfred Colas CFO | | | 30,000 | | | | 3.69 | | | | 10/19/2023 | | | | 2,700 | | | | 30,000 | | | | 113,400 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Anna Ladd-Kruger Former CFO & VP Corporate Development | | | 40,000 | | | | 3.05 | | | | 04/24/2023 | | | | 29,200 | | | | NIL | | | | NIL | |

| | | 35,000 | | | | 4.80 | | | | 06/26/2024 | | | | NIL | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ben Pullinger SVP Geology & Corporate Development | | | 40,000 | | | | 3.05 | | | | 04/24/2023 | | | | 29,200 | | | | 65,110 | | | | 246,116 | |

| | | 17,000 | | | | 4.75 | | | | 03/24/2024 | | | | NIL | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Craig Ford Former Vice President, Corporate Responsibility | | | 5,000 | | | | 8.75 | | | | 03/31/2021 | | | | NIL | | | | NIL | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ronald Mariño VP Finance | | | 5,000 | | | | 8.75 | | | | 03/24/2022 | | | | NIL | | | | 33,889 | | | | 128,100 | |

| | | | 15,000 | | | | 3.05 | | | | 04/24/2023 | | | | 10,950 | | | | | | | | | |

| | | | 15,000 | | | | 4.75 | | | | 03/24/2024 | | | | NIL | | | | | | | | | |

| (1) | The “Value of unexercised in-the-money options” reflects the aggregate dollar amount of (vested and unvested) unexercised in-the-money options held at the end of the year. The amount is calculated based on the difference between the closing price of the Common Shares on the TSX on December 31, 2020 ($3.78) and the exercise price of the options. The options may never be exercised and actual gain, if any, on exercise will depend on the value of the Common Shares on the date of exercise. |

| | | |

| (2) | The “Market or payout value of share-based awards that have not vested” reflects the aggregate dollar amount of unvested and unexercised share-based awards held at the end of the year. The amount is calculated based on the closing price of the Common Shares on the TSX on December 31, 2020 ($3.78). |

Value Vested or Earned During the Year

For the year ended December 31, 2020, the following table sets forth for each Named Executive Officer the value that would have been realized if the option-based incentive plan awards had been exercised on their vesting date, and the value earned under the non-equity incentive plan.

| Name | | Option-Based Awards – Value Vested During the Year ($)(1) | | | Share-based awards – Value Vested During the Year ($)(2) | | | Non-Equity Incentive Plan Compensation – Value Earned During the Year ($) | |

| Brendan Cahill | | | 5,300 | | | | 203,243 | | | | 100,000 | |

| Alfred Colas | | | NIL | | | | N/A | | | | NIL | |

| Anna Ladd-Kruger | | | 5,300 | | | | 118,000 | | | | 100,000 | |

| Ben Pullinger | | | 5,300 | | | | 112,395 | | | | 100,000 | |

| Craig Ford | | | NIL | | | | 161,462 | | | | NIL | |

| Ronald Mariño | | | 1,988 | | | | 70,800 | | | | 40,000 | |

| | (1) | The value of options which vested during the fiscal year ended December 31, 2020 was calculated based on the difference between the closing price of the Common Shares on the TSX on the vesting date and the exercise price of the options. The options may never be exercised and actual gain, if any, on exercise will depend on the value of the Common Shares on the date of exercise. |

| | (2) | The value of share-based awards which vested during the fiscal year ended December 31, 2020 was calculated based on the volume-weighted average price of the Common Shares on the TSX for the five trading days prior to the vesting date. Share-based awards in this column represent RSUs that were paid out in common shares vesting in 2020. |

Employment Agreements

Of the NEOs, the Corporation has employment agreements in place with its President & CEO, CFO, SVP Geology & Corporate Development and VP Finance as of the date hereof. All of the executive employment agreements provide for base salary, discretionary bonuses and stock option awards, as approved by the Board, paid vacation and enrolment in the Corporation’s benefits plan, which benefits are generally available to all employees of the Corporation, and provide payment on termination without just cause or in the event of change of control of the Corporation as described below.

Termination and Change of Control Benefits

“Change of Control” for the Corporation is defined in the Corporation’s employment agreements with the CFO, SVP Geology & Corporate Development and VP Finance, as:

| (a) | “the completion of a transaction or series of transactions constituting an acquisition, merger, amalgamation, consolidation, transfer, sale, arrangement, reorganization, recapitalization, reconstruction or other similar event by virtue of which the Shareholders of the Corporation immediately prior to such transaction or series of transactions hold less than 50% of the voting Common Shares of the successor company following completion of such transaction or series of transactions; or |

| (b) | the disposal of all or substantially all of the assets of the Corporation; or |

| (c) | a transaction or series of transactions, as a result of which a majority of the directors of the Corporation are removed from office at any annual or special meeting of Shareholders, or a majority of the directors of the Corporation resign from office over a period of 60 days or less, and the vacancies created thereby are filled by nominees proposed by any person other than directors or management of the Corporation in place immediately prior to the removal or resignation of the directors.” |

In the case of the President & CEO, a “Change of Control” is defined as follows:

| | (a) | “the completion of a transaction or series of transactions constituting an acquisition, merger, amalgamation, consolidation, transfer, sale, arrangement, reorganization, recapitalization, reconstruction or other similar event by virtue of which the Shareholders of the Corporation immediately prior to such transaction or series of transactions hold less than 60% of the voting Common Shares or successor company following completion of such transaction or series of transactions, or |

| | (b) | the disposition of all or substantially all of the business or assets of the Corporation to another person or persons pursuant to one or a series of transactions, |

| | (c) | a transaction or series of transactions as a result of which a majority of the directors of the Corporation are removed from office at any annual or special meeting of Shareholders, or a majority of the directors of the Corporation resign from office over a period of 60 days or less, and the vacancies created thereby are filled by nominees proposed by any person other than directors or management of the Corporation in place immediately prior to the removal or resignation of the directors, |

| (d) | at any time a person, directly or indirectly, beneficially owns more than 30% of the voting Common Shares, or |

| (e) | at any time persons, acting jointly or in concert, directly or indirectly, beneficially own in the aggregate more than 30% of the voting Common Shares.” |

Brendan Cahill, President & Chief Executive Officer: Under the terms of his employment agreement, within six months of a Change of Control, if Mr. Cahill’s employment is terminated (whether with or without just cause) or he chooses to terminate his employment at his sole discretion, Mr. Cahill is entitled to receive a lump sum payment equal to three times the sum of (i) his base salary at the time of termination of employment plus (ii) the bonus paid to him for the previous year. In addition, Mr. Cahill’s group insurance benefit coverage, other than long and short-term disability, will continue until the earlier of 12 months following termination and the day he commences employment with another employer. In the event of the termination of Mr. Cahill’s employment without just cause either before or in the absence of a Change of Control or beyond a six month period following a Change of Control, Mr. Cahill is entitled to receive a lump sum payment of three times his base salary.

Alfred Colas, Chief Financial Officer: Under the terms of his employment agreement, within six months of a Change of Control, if Mr. Colas’ employment is terminated without just cause or he chooses to terminate his employment at his sole discretion, Mr. Colas’ is entitled to receive a lump sum payment equal to two times the sum of (i) his base salary at the time of the Change of Control plus (ii) any cash bonus paid to him in the year preceding the Change of Control, (iii) the equivalent annual value of the Benefit Plan. In addition, all outstanding equity compensation granted to Mr. Colas will vest immediately.

Ben Pullinger, Senior Vice President Geology & Corporate Development: Under the terms of his employment agreement, within six months of a Change of Control, if Mr. Pullinger’s employment is terminated without just cause or he chooses to terminate his employment at his sole discretion, Mr. Pullinger is entitled to receive (i) a payment equal to two years’ base salary, (ii) a payment equal to the aggregate cash bonus, if any, payable in the preceding two (2) calendar years and (iii) group insurance benefit coverage, other than long and short-term disability, will continue until the earlier of 24 months following termination and the day he commences employment with another employer. In the event of the termination of Mr. Pullinger’s employment without just cause either before or in the absence of a Change of Control or beyond a six month period following a Change of Control, Mr. Pullinger is entitled to receive (i) a lump sum payment equal to his base salary and (ii) group insurance benefit coverage, other than long and short-term disability, will continue until the earlier of 12 months following termination and the day he commences employment with another employer.

Ronald Mariño, Vice President Finance: Under the terms of his employment agreement within six months of a Change of Control, if Mr. Mariño’s employment is terminated without just cause or he chooses to terminate his employment at his sole discretion, Mr. Mariño is entitled to receive a lump sum payment equal to 1.5 times his base salary. In addition, Mr. Mariño’s group insurance benefit coverage, other than long and short-term disability, will continue until the earlier of 12 months following termination and the day he commences employment with another employer.

The table below sets out the estimated incremental payments, payables and benefits due to each of the NEOs for termination on a change of control, assuming termination on December 31, 2020:

| Name | | Triggering Event | | Base Salary | | | Value of Option-Based Awards if Exercised on Termination(1) | | | All Other Compensation(2) | | | Total | |

| | | | | $ | | | $ | | | $ | | | $ | |

| Brendan Cahill | | Change of control | | | 1,050,000 | | | | 29,200 | | | | 372,505 | | | | 1,451,705 | |

| | | Termination without just cause | | | 700,000 | | | | 29,200 | | | | NIL | | | | 729,200 | |

| Alfred Colas | | Change of control | | | 500,000 | | | | 2,700 | | | | 113,400 | | | | 616,100 | |

| | | Termination without just cause | | | 250,000 | | | | 2,700 | | | | NIL | | | | 252,700 | |

| Ben Pullinger | | Change of control | | | 500,000 | | | | 29,200 | | | | 246,116 | | | | 775,316 | |

| | | Termination without just cause | | | 250,000 | | | | 29,200 | | | | NIL | | | | 279,200 | |

| Ronald Mariño | | Change of control | | | 262,500 | | | | 10,950 | | | | 166,294 | | | | 401,550 | |

| | | Termination without just cause | | | NIL | (3) | | | 10,950 | | | | NIL | | | | 10,950 | |

| | (1) | The value of unexercised options was calculated based on the difference between the closing price of the Common Shares on the TSX on December 31, 2020 ($3.78) and the exercise price of the options. Where the difference is negative, the options are not in-the-money and no value is reported. The options may never be exercised and actual gain, if any, on exercise will depend on the value of the Common Shares on the date of exercise. |

| | (2) | Reflects the value attributable to DSUs or RSUs, as applicable, at vesting on the Triggering Event. The amount payable for continuing benefit coverage is dependent upon the Named Executive Officer obtaining alternative employment within the time period discussed above and cannot be determined at this time. |

| | (3) | Subject to standard statutory payments under applicable employment legislation. |

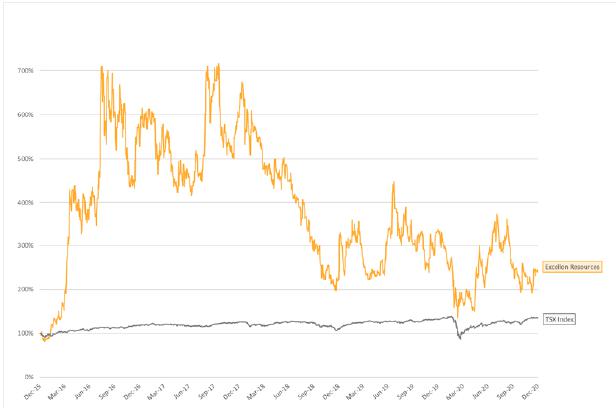

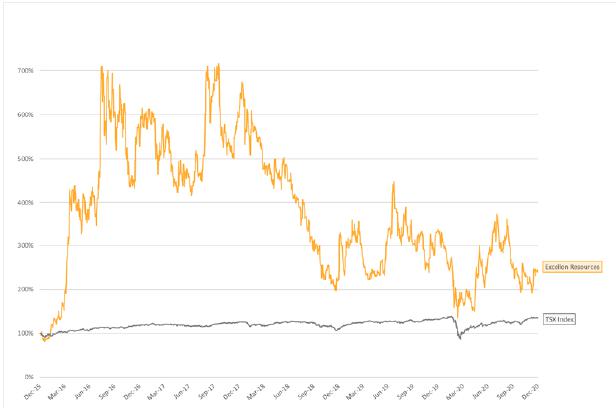

Performance Graph

The following graph compares the yearly change in the cumulative total Shareholder return over the five most recently completed financial years, assuming a $100 investment in the Common Shares on December 31, 2015 against the return of the S&P/TSX Composite Index, assuming the reinvestment of dividends, where applicable, for the comparable period.

| | | 31-Dec-15 | | | 31-Dec-16 | | | 31-Dec-17 | | | 31-Dec-18 | | | 31-Dec-19 | | | 31-Dec-20 | |

| Excellon Resources Inc. | | | 100 | | | | 529 | | | | 594 | | | | 223 | | | | 332 | | | | 244 | |

| S&P/TSX Composite Index | | | 100 | | | | 118 | | | | 125 | | | | 110 | | | | 131 | | | | 134 | |

The S&P/TSX Composite Index is an index of the stock prices of the largest companies on the TSX as measured by market capitalization. Stocks included in this index cover all sectors of the economy and the S&P/TSX Composite Index has traditionally been heavily weighted towards financial stocks. In addition, global commodity prices, world economic conditions, and general market conditions are significant factors affecting stock market performance, which are beyond the control of the Corporation’s officers.

DIRECTORS COMPENSATION

Summary Compensation Table

The following table sets forth all compensation paid, awarded or earned by the non-executive directors of the Corporation during the year ended December 31, 2020.

| Directors Compensation Table |

| Name | | | Fees Earned ($)(1) | | | | Share-Based Awards ($) | | | | Option-Based Awards(2) ($) | | | Non-Equity Incentive Plan Compensation

($) | | | Pension Value ($) | | | All Other Compensation

($) | | | Total ($) | |

| André Fortier | | | NIL | | | | 158,000 | | | | 14,545 | | | NIL | | | N/A | | | NIL | | | 172,545 | |

| Laurie Curtis | | | 22,648 | | | | 101,648 | | | | 14,545 | | | NIL | | | N/A | | | NIL | | | 138,841 | |

| Andrew Farncomb | | | 7,813 | | | | 113,304 | | | | 14,545 | | | NIL | | | N/A | | | NIL | | | 135,662 | |

| Anna Ladd-Kruger | | | NIL | | | | 50,400 | | | | NIL | | | NIL | | | N/A | | | NIL | | | 50,400 | |

| Craig Lindsay | | | NIL | | | | 89,806 | | | | NIL | | | NIL | | | N/A | | | NIL | | | 89,806 | |

| Roger Norwich | | | 4,722 | | | | 91,972 | | | | NIL | | | NIL | | | N/A | | | NIL | | | 96,694 | |

| Michael Timmins | | | NIL | | | | 134,171 | | | | 29,090 | | | NIL | | | N/A | | | NIL | | | 163,261 | |

| Alan McFarland(3) | | | NIL | | | | 20,578 | | | | 7,273 | | | NIL | | | N/A | | | NIL | | | 27,851 | |

| Oliver Fernández(3) | | | NIL | | | | 13,340 | | | | 14,545 | | | NIL | | | N/A | | | NIL | | | 27,885 | |

| Daniella Dimitrov(3) | | | NIL | | | | 20,264 | | | | 7,273 | | | NIL | | | N/A | | | NIL | | | 27,537 | |

| Jacques McMullen(3) | | | NIL | | | | 18,694 | | | | 7,273 | | | NIL | | | N/A | | | NIL | | | 25,967 | |

| | (1) | During 2020, non-executive directors of the board elected to receive all or a portion of cash board fees in DSUs, with approximately 91% of cash fees being issued in the form of DSUs, resulting in the total issuance of 90,822 DSUs in respect of such fees. Board fees paid in DSUs are aggregated with annual compensation grants in the Share-Based Awards column. |

| | (2) | The values reported represent an estimate of the grant date fair market value of the options awarded during the year. For 2020, the fair value was estimated at the grant date based on the Black-Scholes option pricing model assuming a risk-free interest rate of 0.66%, no dividend yield, expected life of 3 years and an expected price volatility of 72.80%. The options may never be exercised and actual gain, if any, on exercise will depend on the value of the Common Shares on the date of exercise. |

The Board, on recommendation of the Compensation Committee, determines director compensation. The objective in determining such director compensation is to ensure that the Corporation can attract and retain experienced and qualified individuals to serve as directors. The Corporation compensates its non-executive directors through the payment of directors’ fees (on an annual retainer, committee chair and committee member) and through the grant of incentive Options, DSUs and RSUs. As of the year ended December 31, 2020, non-executive directors received the following annual retainers and other fees for their services as directors (which may be payable in DSUs or 50/50 DSUs/cash at the director’s option):

| Director Retainer (base) | | $ | 45,000 | |

| Chairperson (retainer) | | $ | 75,000 | |

| Audit Committee Chair (Member) | | $ | 15,000 ($7,500) | |

| Corporate Responsibility & Technical Committee Chair (Member) | | $ | 10,000 ($5,000) | |

| Compensation Committee Chair (Member) | | $ | 10,000 ($5,000) | |

| Nominating & Corporate Governance Committee Chair (Member) | | $ | 10,000 ($5,000) | |

All retainers are paid pro rata on a quarterly basis. Directors are also reimbursed for out-of-pocket expenses incurred in attending meetings and otherwise carrying out their duties as directors of the Corporation. In addition, directors are eligible to participate in the Corporation’s Stock Option Plan, DSU Plan and RSU Plan, and historically the Corporation has granted options to members of the Board. As of the date of this Circular, the Corporation had awarded outstanding options to purchase 847,437 Common Shares, of which 335,641 were granted to non-executive directors, representing approximately 40% of outstanding options. Of the total current outstanding options, 148,937 are held by former optionholders of Otis, including 141,641 held by two former directors of Otis that are now Excellon directors.

Incentive Plan Awards

Share-Based Awards, Option-Based Awards and Non-Equity Incentive Plan Compensation

The following table sets out option-based awards outstanding for each non-executive director based on a closing price of $3.78 for the Common Shares on the TSX as of December 31, 2020.

| | | Option Based Award | | | Share-based Awards | |

Director

Name | | Number of securities underlying unexercised options (#) | | | Option exercise price

($) | | | Option expiration date | | Value of unexercised in-the-money options ($)(1) | | | Number of shares or units of shares that have not vested

(#) | | | Market or payout value of share-based awards that have not vested ($)(2) | |

| André Y. Fortier | | | 5,000 | | | | 8.75 | | | 03/24/2022 | | | 7,300 | | | | 159,724 | | | | 603,757 | |

| | | | 5,000 | | | | 8.10 | | | 03/26/2023 | | | | | | | | | | | | |

| | | | 5,000 | | | | 3.05 | | | 04/24/2023 | | | | | | | | | | | | |

| | | | 8,000 | | | | 4.75 | | | 03/24/2024 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Laurie Curtis | | | 10,000 | | | | 7.30 | | | 12/15/2021 | | | 7,300 | | | | 71,170 | | | | 269,023 | |

| | | | 5,000 | | | | 8.75 | | | 03/24/2022 | | | | | | | | | | | | |

| | | | 5,000 | | | | 8.10 | | | 03/26/2023 | | | | | | | | | | | | |

| | | | 10,000 | | | | 3.05 | | | 04/24/2023 | | | | | | | | | | | | |

| | | | 8,000 | | | | 4.75 | | | 03/24/2024 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Andrew Farncomb | | | 10,000 | | | | 8.45 | | | 12/15/2022 | | | 7,300 | | | | 68,740 | | | | 259,837 | |

| | | | 5,000 | | | | 8.10 | | | 03/26/2023 | | | | | | | | | | | | |

| | | | 10,000 | | | | 3.05 | | | 04/24/2023 | | | | | | | | | | | | |

| | | | 8,000 | | | | 4.75 | | | 03/24/2024 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Anna Ladd-Kruger | | | 40,000 | | | | 3.05 | | | 04/24/2023 | | | 29,200 | | | | 12,660 | | | | 47,855 | |

| | | | 35,000 | | | | 4.8 | | | 06/26/2024 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Craig Lindsay | | | 20,700 | | | | 3.95 | | | 09/08/2021 | | | 60,768 | | | | 22,153 | | | | 83,738 | |

| | | | 23,000 | | | | 5.00 | | | 01/21/2023 | | | | | | | | | | | | |

| | | | 38,461 | | | | 2.20 | | | 04/22/2024 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Roger Norwich | | | 28,750 | | | | 3.95 | | | 09/08/2021 | | | 30,383 | | | | 22,714 | | | | 85,859 | |

| | | | 11,500 | | | | 5.00 | | | 01/21/2023 | | | | | | | | | | | | |

| | | | 19,230 | | | | 2.20 | | | 04/22/2024 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Michael Timmins | | | 20,000 | | | | 3.05 | | | 04/24/2023 | | | 14,600 | | | | 35,752 | | | | 135,143 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Alan R. McFarland(3) | | | NIL | | | | NIL | | | NIL | | | NIL | | | | NIL | | | | NIL | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Oliver Fernández(3) | | | NIL | | | | NIL | | | NIL | | | NIL | | | | NIL | | | | NIL | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Daniella Dimitrov(3) | | | NIL | | | | NIL | | | NIL | | | NIL | | | | NIL | | | | NIL | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Jacques McMullen(3) | | | NIL | | | | NIL | | | NIL | | | NIL | | | | NIL | | | | NIL | |

| | (1) | The value of unexercised in-the-money options reflects the aggregate dollar amount of (vested and unvested) unexercised options held at the end of the year. The amount is calculated based on the difference between the closing price of the Common Shares on the TSX on December 31, 2020 ($3.78) and the exercise price of the options. The options may never be exercised and actual gain, if any, on exercise will depend on the value of the Common Shares on the date of exercise. |

| | (2) | Reflects the aggregate dollar amount of unvested and unexercised share-based awards held at the end of the year. The amount is calculated based on the closing price of the Common Shares on the TSX on December 31, 2020 ($3.78). |

Value Vested or Earned During the Year

For the year ended December 31, 2020, the following table sets forth, for each non-executive director, the value that would have been realized if the option-based incentive plan awards had been exercised on their vesting date.

Director

Name | | Option-Based Awards – Value Vested During the Year ($)(1) | | | Share-Based Awards – Value Vested During the Year ($) | | | Non-Equity Incentive Plan Compensation – Value Earned During the Year ($) |

| André Y. Fortier | | | 1,325 | | | | NIL | | | N/A |

| Laurie Curtis | | | 1,325 | | | | NIL | | | N/A |

| Andrew Farncomb | | | 1,325 | | | | NIL | | | N/A |

| Anna Ladd-Kruger | | | 5,300 | | | | NIL | | | N/A |

| Craig Lindsay | | | NIL | | | | NIL | | | N/A |

| Roger Norwich | | | NIL | | | | NIL | | | N/A |

| Michael Timmins | | | 2,650 | | | | NIL | | | N/A |

| Alan R. McFarland(2) | | | NIL | | | | 290,343 | | | N/A |

| Oliver Fernández(2) | | | NIL | | | | 288,027 | | | N/A |

| Daniella Dimitrov(2) | | | NIL | | | | 137,163 | | | N/A |

| Jacques McMullen(2) | | | NIL | | | | 127,895 | | | N/A |

| | (1) | The value of options which vested during the fiscal year ended December 31, 2020 was calculated based on the difference between the closing price of the Common Shares on the TSX on the vesting date and the exercise price of the options. The options may never be exercised and actual gain, if any, on exercise will depend on the value of the Common Shares on the date of exercise. |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table provides information regarding the Corporation’s equity compensation plans as of December 31, 2020, under which securities of the Corporation are authorized for issuance to directors, officers, employees and consultants of the Corporation and its affiliates:

Equity Compensation Plan Information

| Plan Category | | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights(1) | | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans | |

| Equity compensation plans approved by Shareholders | | | 1,789,717 | (2) | | $ | 4.21 | | | | 1,444,142 | |

| Equity compensation plans not approved by Shareholders | | | NIL | | | | NIL | | | | NIL | |

| Total | | | 1,789,717 | | | $ | 4.21 | | | | 1,444,142 | |

| | (1) | In respect of the 847,437 Options outstanding only, as an exercise price in respect of the DSUs and RSUs is not applicable. |

| | (2) | Does not include Otis securities. |

Burn Rate

Pursuant to section 613 of the TSX Company Manual, the following table sets out the burn rate under each of the Corporation’s Equity Compensation Plans during each of the past three calendar years, with the burn rate reflecting the number of securities granted under each plan as a percentage of the weighted average number of issued and outstanding Common Shares during the year:

| | | 2018 | | | 2019 | | | 2020(1) | |

| | | | Issued | | | | Burn Rate (%) | | | | Issued | | | | Burn Rate (%) | | | | Issued | | | | Burn Rate (%) | |