- SHG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

CORRESP Filing

Shinhan Financial (SHG) CORRESPCorrespondence with SEC

Filed: 9 Nov 12, 12:00am

November 9, 2012

Ms. Stephanie J. Ciboroski

Senior Assistant Chief Accountant

Division of Corporate Finance

Securities and Exchange Commission

100 F Street N.E.

Washington, D.C. 20549

| Re: | Shinhan Financial Group Co., Ltd. |

| Form 20-F for Fiscal Year Ended December 31, 2011 |

| Filed April 30, 2012 |

| File No. 001-31798 |

Dear Ms. Ciboroski:

We are writing in response to your letter, dated September 27, 2012, containing the comments of the Staff of the Securities and Exchange Commission (the “Commission”) on the annual report on Form 20-F filed with the Commission on April 30, 2012 with respect to the fiscal year ended December 31, 2011 (“2011 Form 20-F”).

Our responses to the Staff’s comments are set forth in this letter and each response follows the text of the paragraph of the comment letter to which it relates. Unless otherwise specified, the page number references herein are to the page numbers on Form 20-F.

***********

Form 20-F for Fiscal Year Ended December 31, 2011

Description of Assets and Liabilities, page 63

Potential Problem Loans, page 74

| 1. | We note your disclosure that as of December 31, 2011 you had (Won)686 billion of loans which caused you to have serious doubt as to the ability of the borrowers to comply with their respective loan repayment terms. We also note your disclosure in your 2010 Form 20-F that you had (Won)228 billion of loans rated as normal or precautions under the guidelines of the Financial Services Commission, which represent loans that are current as to the payment of principal and interest but carry serious doubt as to the ability of the borrower to repay in the near future. We further note that those amounts were classified as impaired under US GAAP. Please tell us whether you have revised your methodology for determining the amount of potential problem loans for this disclosure. Additionally, given the substantial increase in the level of potential problem loans from year to year, please discuss the change in this amount from year to year, along with the drivers for this change. As part of this expanded disclosure, you may find it helpful to provide a rollforward of potential problem loans. |

| Securities and Exchange Commission | 2 | November 9, 2012 |

Response:

In response to the Staff’s comments, we note the following:

Prior to 2011, we classified as “potential problem loans” those loans that are “troubled debt restructurings” as defined under U.S. GAAP but not deemed to be impaired as they are classified under the guidelines of the Financial Services Commission of Korea as “normal” or “precautionary”. Under the Financial Services Commission’s guidelines, as set forth on page 123 of our 2011 Form 20-F, “normal” loans are loans made to customers whose financial position, future cash flows and nature of business are deemed financially sound and for whom no problems in recoverability are expected, and “precautionary” loans are loans made to customers whose financial position, future cash flows and nature of business show potential weakness, although there is no immediate risk of non-repayment.

During 2011, in order to enable a more systematic and real-time monitoring of loans with a significant potential of non-repayment, we changed our methodology for determining potential problem loans to include all loans which have caused our management to have serious doubt as to the ability of the borrowers to comply with their respective loan repayment terms. Such determination is made by our loan planning department based on quantitative indexes, including, among others: (i) whether the borrower’s total borrowings have exceeded its total revenues in the past two years, (ii) whether the borrower is experiencing capital deficit, (iii) whether there have been adverse developments in the borrower’s financial ratios such as the debt-to-equity ratio and the interest coverage ratio, (iv) whether there have been adverse developments in the borrower’s credit ratings, and (iv) whether there are any other early warning signals. In addition, depending on the nature of the industry (particularly, those industries that are experiencing a general business downturn) to which the borrower belongs and the market position of the borrower within such industry, we may classify as potential problem loans loans to such borrower based on qualitative feedback periodically received from our loan officers and industry specialists, even if such loans do not fall under the quantitative thresholds for potential problem loans outlined above.

Based on the foregoing analysis, for our rollforward modeling purposes, we classify our potential problem loans into five categories depending on the nature of the perceived problem: (i) due to deterioration in financial ratios, (ii) due to deterioration in liquidity, (iii) due to deterioration in business and management, (iv) (if the borrower is affiliated with a larger parent company) due to deterioration in the parent company and (v) others.

| Securities and Exchange Commission | 3 | November 9, 2012 |

We believe that our newly adopted internal guidelines for determining potential problem loans are more expansive and useful than the previous guidelines in that the former enables us to detect and respond to signs of potential non-repayment for these loans on a more timely basis.

As of December 31, 2010 and 2011, our potential problem loans, which were computed using our new methodology, amounted to Won 675 billion and Won 686 billion, respectively. The positive change in the amount of our potential problem loans by Won 11 billion from December 31, 2010 to December 31, 2011 reflects the subtraction of Won 378 billion in loans due to repayment or net improvements in the credit profiles of the borrowers and the addition of Won 389 billion due to quantitative and qualitative factors noted above.

The following table sets forth the change in our potential problem loans during 2011.

| In billions of Won | ||||

Beginning balance (as of December 31, 2010) | 675 | |||

Subtraction: | ||||

Due to repayment | (31 | ) | ||

Due to net improvement in credit profile | (347 | ) | ||

|

| |||

Subtotal | (378 | ) | ||

|

| |||

Addition: | ||||

Due to deterioration in financial ratios(1) | 179 | |||

Due to deterioration in liquidity(2) | 26 | |||

Due to deterioration in business and management(3) | 6 | |||

Due to deterioration in parent company(4) | 35 | |||

Others(5) | 143 | |||

|

| |||

Subtotal: | 389 | |||

|

| |||

Total: | 686 | |||

|

| |||

Notes:

| 1. | Deterioration in financial ratios principally refers to deterioration in the debt-to-equity ratio and the interest coverage ratio. This line item also includes loans whose borrower has experienced capital deficit for two or more consecutive years and loans in the amount of Won 3 billion or more where the borrower has a credit rating of BB or less. |

| 2. | Reflects consideration of liquidity support (or absence thereof or reduction therein) from the parent company, the government and/or the creditors. |

| 3. | Reflects consideration of suspended business operations or business closures. |

| 4. | Reflects consideration of deterioration of financial ratios, liquidity and business and management at the parent company level. |

| 5. | Reflects consideration, primarily, of feedback from loan officers and industry specialists. |

Loan Aging Schedule, page 78

| 2. | We note your loan aging schedule and that the amounts over 3 months past due are approximately (Won)1,416 billion. We note that this amount is not consistent with the amount of loans that were placed on non-accrual of (Won)2,012 billion as disclosed on page 67 even though both amounts represent loans over 90 days past due. Please reconcile these amounts for us and tell us the specific reasons for the differences in these amounts. |

| Securities and Exchange Commission | 4 | November 9, 2012 |

Response:

In response to the Staff’s comments, we note that while the amount of Won 1,416 billion represents loans that were over three months past due as of December 31, 2011, loans accounted for an a nonaccrual basis as set forth on page 67 represent either loans that are “troubled debt restructurings” as defined under IFRS or loans for which payment of interest and/or principal became past due by 90 days or more, which in the aggregate (after adjusting for any overlap due to loans that satisfy both prongs so as to avoid double counting) amounted to Won 2,012 billion.

We undertake to include a disclosure substantially to the foregoing effect in future filings.

Non-Performing Loans, page 78

| 3. | We note your disclosure that non-performing loans are defined as loans past due by more than 90 days, which is consistent with the definition used in your 2010 Form 20-F. We also note that the amount of non-performing loans as of December 31, 2010 was reported as (Won)1,001 billion in the 2010 Form 20-F, but as (Won)1,427 billion in your 2011 Form 20-F. Please tell us the factors driving the increase in non-performing loans for 2010 reported in the 2011 Form 20-F. |

Response:

In response to the Staff’s comment, we note that the increase in the amount of non-performing loans in 2010 reported in our 2011 Form 20-F was due to the difference in charge-off policies and treatment of restructured credit card loans (namely, credit card loans whose terms became modified after the borrower had initially become unable to pay) under U.S. GAAP and IFRS. Under U.S. GAAP, we charged off Won 185 billion of unsecured retail loans and credit card loans past due by more than six months in accordance with the Uniform Retail Credit Classification and Account Management Policy, as enacted by the Federal Financial Institution Examination Council. But since the adoption of IFRS, we have not additionally carried out any similar charge-off. Accordingly, unsecured retail loans and credit card loans past due by more than six months in the amount of Won 185 billion were included in the balance of our non-performing loans as of December 31, 2010. In addition, under U.S. GAAP, the number of days past due of restructured credit card loans was calculated from the date the terms of the loans were restructured, and therefore, only a portion of the restructured credit card loans, or Won 31 billion in 2010, was treated as non-performing (namely, past due by more than 90 days). In comparison, under IFRS the number of days past due is calculated from the first date of non-payment regardless of subsequent modification of terms, and therefore, the entire restructured credit card loans in the amount of Won 272 billion in 2010 were treated as non-performing.

| Securities and Exchange Commission | 5 | November 9, 2012 |

The table below sets forth the effects of the difference in accounting policies relating to (i) charge-off of unsecured retail loans and credit card loans and (ii) calculation of days past due for restructured credit card loans under U.S. GAAP and IFRS in 2010:

| U.S. GAAP | IFRS | Difference | ||||||||||

| (in billions of Won) | ||||||||||||

Non-performing loans (loans past due by more than 90 days) | ₩ | 970 | ₩ | 970 | ₩ | 0 | ||||||

Charge-off of non-performing unsecured retail loans and credit card loans | 0 | 185 | 185 | |||||||||

Restructured Credit card loans | 31 | 272 | 241 | |||||||||

|

|

|

|

|

| |||||||

Total | ₩ | 1,001 | ₩ | 1,427 | ₩ | 426 | ||||||

|

|

|

|

|

| |||||||

We undertake to further expand disclosure relating to restructured credit card loans in the discussion of non-performing loans in future filings.

Liquidity Risk Management, page 114

| 4. | We note your disclosure that the Financial Services Commission requires Korean banks to maintain a Won liquidity ratio of at least 100.0% and this is defined as Won liquid assets (including marketable securities) due within one month divided by Won liabilities due within one month and you have noted that your assets exceed your liabilities. However, it is not clear how these amounts are being calculated and what assets and liabilities are included. It is also not clear how this information ties into the information provided on page F-53, which shows the maturity of your assets and liabilities. Please tell us and include in future filings, the assets and liabilities that are included in the calculation, and how this information relates to the information that you have provided in the notes to the financial statements. |

Response:

In response to the Staff’s comments, we note the following:

Won liquid assets and Won liquid liabilities

Under the Banking Regulations promulgated by the Financial Services Commission of Korea, Won liquid assets and liabilities that are used to compute the Won liquidity ratio consist of all assets and liabilities, respectively, on the balance sheet and in off-balance sheet derivative transactions that have remaining maturities of less than one month, except that (i) Won-denominated trading and available-for-sale securities with remaining terms of one month or more are included as Won liquid assets at their fair market value to the extent that such securities are marketable and have not been provided as collateral, and (ii) Won-denominated demand deposits with no fixed maturity are included as Won liquid liabilities in an amount equal to the sum of (x) the standard deviation of the monthly weighted average balance during the preceding 12-month period multiplied by 2.33 (such product, the “non-core” deposits) and (y) 15% of “core” deposit (meaning the monthly average balance of the most recent month prior to the time of determination), less the “non-core” deposits.

| Securities and Exchange Commission | 6 | November 9, 2012 |

The monthly weighted average balance for the preceding 12-month period is calculated using the following formula:

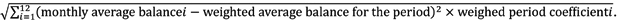

The standard deviation of the monthly weighted average balance during the preceding 12-month period is calculated using the following formula:

The weighed period coefficients for the applicable month are set forth below:

Applicable Month | Weighed Period Coefficient | |||

t-11 month | 1/78 | |||

t-10 month | 2/78 | |||

t-9 month | 3/78 | |||

t-8 month | 4/78 | |||

t-7 month | 5/78 | |||

t-6 month | 6/78 | |||

t-5 month | 7/78 | |||

t-4 month | 8/78 | |||

t-3 month | 9/78 | |||

t-2 month | 10/78 | |||

t-1 month | 11/78 | |||

t month | 12/78 | |||

|

| |||

Sum | 1 | |||

With respect to Won-denominated demand deposits with no fixed maturity, we recognize that a portion of the balance of such demand deposits may be withdrawn at any time and therefore categorize them as core deposits and non-core deposits as defined above.

| Securities and Exchange Commission | 7 | November 9, 2012 |

The table below sets forth the Won liquid assets and liabilities, together with a breakdown of their respective components, as of December 31, 2011.

Won-Denominated Accounts | 0-1 Months | 1-3 Months | 3-6 Months | 6-12 Month | 1-3 Years | Over 3 years | Substandard or below | Total | ||||||||||||||||||||||||

| (In billions of Won, except percentages) | ||||||||||||||||||||||||||||||||

Assets: | ₩ | 56,609 | ₩ | 21,980 | ₩ | 30,131 | ₩ | 42,563 | ₩ | 23,711 | ₩ | 48,798 | ₩ | 1,676 | ₩ | 225,470 | ||||||||||||||||

Cash and deposit | 6,131 | — | 770 | — | — | 10 | — | 6,911 | ||||||||||||||||||||||||

Available-for-sale securities | 32,509 | — | — | — | — | 4,597 | 72 | 37,178 | ||||||||||||||||||||||||

Loans | 6,037 | 15,843 | 26,158 | 36,952 | 19,079 | 36,338 | 1,604 | 142,011 | ||||||||||||||||||||||||

Other assets | 1,970 | — | — | — | — | 6,848 | — | 8,819 | ||||||||||||||||||||||||

Derivative assets | 7,179 | 5,937 | 2,785 | 3,989 | 3,836 | 779 | — | 24,504 | ||||||||||||||||||||||||

Merchant banking account assets | 2,784 | 200 | 419 | 1,622 | 796 | 227 | — | 6,048 | ||||||||||||||||||||||||

Liabilities: | 46,635 | 19,706 | 17,007 | 52,865 | 17,144 | 52,723 | 206,081 | |||||||||||||||||||||||||

Deposits (including certificates of deposit) | 25,732 | 12,996 | 12,814 | 45,498 | 6,711 | 39,447 | 143,199 | |||||||||||||||||||||||||

Borrowings | 1,306 | 165 | 99 | 171 | 681 | 1,582 | 4,004 | |||||||||||||||||||||||||

Debt securities | 401 | 250 | 1,320 | 2,975 | 6,130 | 4,646 | 15,722 | |||||||||||||||||||||||||

Other liabilities | 6,442 | — | — | — | — | 5,235 | 11,677 | |||||||||||||||||||||||||

Derivatives liabilities | 7,444 | 6,295 | 2,773 | 4,221 | 3,622 | 682 | 25,037 | |||||||||||||||||||||||||

Merchant banking account liabilities | 5,310 | — | 1 | — | — | 1,131 | 6,441 | |||||||||||||||||||||||||

Liquidity gap | 9,974 | |||||||||||||||||||||||||||||||

Liquidity ratio | 121.39 | % | ||||||||||||||||||||||||||||||

Limit | 100.00 | % | ||||||||||||||||||||||||||||||

Reconciliation of information on page 114 and page F-53

The breakdown of financial instruments by contractual maturities for purposes of analyzing liquidity risk as set forth on page F-53 was prepared based on the relevant line items presented in our statement of financial position. In comparison, the breakdown of financial instruments by contractual maturities for purposes of analyzing liquidity gap as set forth on page 114 was prepared based on the Banking Regulations promulgated by the Financial Services Commission of Korea. For the most part, the criteria used for determining the remaining maturities on these two sections are the same, except as described below.

The principal difference relates to demand deposits. Under IFRS 7, all demand deposits are categorized as having maturities of less than one month; however, under the Banking Regulations, demand deposits are categorized as having maturities of less than one month in an amount equal to the sum of (x) the non-core deposits and (y) 15% of core deposits. Shinhan Bank’s total demand deposit balance as of December 31, 2011 was Won 45,831 billion, of which Won 44,711 was classified as core deposits and Won 7,939 billion was classified as Won liquid liabilities (namely, liabilities with maturities of less than one month based on the formula under the Banking Regulations). As for the consolidated balance of demand deposits under IFRS 7 as of December 31, 2011, since substantially all of demand deposits are held by Shinhan Bank, the difference between Shinhan Bank’s demand deposits and our demand deposits on a consolidated basis under IFRS 7 is insignificant.

In addition, unlike the disclosure on page 114, the disclosure on page F-53 includes cash flows of interest (in addition to cash flows of principal) and foreign currency-denominated amounts (in addition to Won amounts) and has been prepared on a consolidated basis.

We undertake to clarify or expand the referenced disclosure substantially to the foregoing effect in future filings.

| Securities and Exchange Commission | 8 | November 9, 2012 |

Contractual Obligations, Commitments and Guarantees, page 197

| 5. | We note from your table of contractual obligations that it is not clear whether you have included interest expense on your interest-bearing deposits, borrowings and debt securities issued. To the extent that your table or footnotes do not already include estimated contractual interest payments on these borrowings, please tell us what consideration you gave to including interest payments in your table or in your footnotes to the table. Please revise your disclosures accordingly. Additionally, please disclose any assumptions you make to derive estimated contractual interest payments on your floating-rating borrowings. |

Response:

In response to the Staff’s comment, we note that (i) all estimated contractual interest payments due on our interest-bearing deposits, borrowings and debt securities issued are already reflected in the table of contractual obligations disclosed on page 197 of our 2011 Form 20-F, and (ii) the estimated contractual interest payments on borrowings and debt securities that are on a floating rate basis as of December 31, 2011 were computed as if the interest rate used on the last applicable date (for example, the interest payment date for such floating rate loans immediately preceding the determination date) were the interest rate applicable throughout the remainder of the term. We undertake to add a footnote disclosure to the foregoing effect.

For background information, we note that the differences between the aggregate principal amounts of the borrowings and the borrowing amounts shown on the contractual cash obligations (which amounts include both the aggregate principal and interest amounts) are relatively small given that borrowings generally mature within a relatively short term (namely, less than one year) and therefore carry relatively low interest rates (for example, the average interest rate on the borrowings in 2011 was 2.46% per annum). Specifically, (i) call money, which amounted to Won 1,309 billion as of December 31, 2011, have maturities typically of only one or two days and therefore the interest payments due were of de minimis amounts, (ii) interbank loans from The Bank of Korea, which amounted to Won 796 billion as of December 31, 2011, had an average maturity of approximately one month and carried a particularly low average interest rate of 1.5% per annum in 2011 since the full face amount of all such loans are collateralized by marketable securities, (iii) commercial papers issued by Shinhan Card, which amounted to Won 1,500 billion as of December 31, 2011, pay the entire amount of interest upfront at the time of the issue and therefore have no contractual cash obligations to pay additional interest over the life of such securities, and (iv) other foreign currency borrowings, which amounted to Won 3,300 billion as of December 31, 2011, generally consist of foreign currency-denominated borrowings arranged through professional arrangers in the international financial markets, other commercial papers and domestic import usances, each of which typically carries a low interest rate and a term of less than one year.

| Securities and Exchange Commission | 9 | November 9, 2012 |

Notes to the Consolidated Financial Statements

Note 3 – Significant Accounting Policies, page F-11

(r) Employee benefits, page F-23

| 6. | We note your disclosure on page F-24 that you recognize all actuarial gains and losses arising from actuarial assumption changes and experiential adjustments in other comprehensive income when incurred. This appears to be inconsistent with your disclosure on page 173, where you note that you recognize all actuarial gains and losses arising from defined benefit plans in profit or loss. Please clarify your policy and revise future filings as appropriate. |

Response:

In response to the Staff’s comments, we note that the disclosure on page 173 is correct (namely that “we recognize all actuarial gains and losses arising from defined benefit plans in profit or loss”) and the corresponding disclosure on page F-24 should have been corrected to conform to the disclosure on page 173. We undertake to correct this inadvertent error in future filings.

(v) Insurance Contracts, page F-25

| 7. | We note your disclosed policies related to your insurance contracts under IFRS. In light of the fact that your disclosed insurance policies appear to differ from the policies disclosed in your 2010 Form 20-F where you applied US GAAP, please tell us why you have not recorded a reconciling item between US GAAP and IFRS related to the differences in these accounting policies. |

Response:

In response to the Staff’s comment, we note that the effect of the transition from U.S. GAAP to IFRS relating to insurance contracts is included in the “Other” reconciling item. As a banking holding company, the banking business is most significant as a percentage of our revenues, and accordingly, our disclosure on transition effects focused mainly on reconciling items related to our banking business, such as allowance for loan losses, fair value of financial guarantee contract and allowance for loss on guarantees and acceptances, classification and fair value measurement of non-marketable equity securities. As a result, most reconciliation items unrelated to our banking businesses are included in “Other’. As for the insurance contracts, their effect on our total assets, liabilities and equities was Won (40) billion, Won 841 billion and Won 801 billion, respectively, as of the date of transition to IFRS.

| Securities and Exchange Commission | 10 | November 9, 2012 |

Note 4 – Financial Risk Management, page F-29

Due from Banks and Loans by Past Due or Impairment, page F-35

| 8. | We note your disclosure of the credit quality of your loan portfolio broken out between Grade 1 and Grade 2. We also note your disclosure that the credit quality of the loan portfolio was based on internal credit ratings, and that banks and government were classified as Grade 1 regardless of credit rating. Please respond to the following: |

| • | In light of your elaborate credit review and monitoring process discussed on pages 96-102, please expand the categories utilized for purposes of this disclosure. In this regard, we note that as of December 31, 2011, 79% of your loans were categorized as Grade 1 and it is unclear how Grade 1 equates to your more elaborate credit rating process described elsewhere in your document. |

Response:

In response to the Staff’s comments, we note that the disclosure of credit categories Grade 1 and Grade 2 on page F-35 relates to our exposure to loans that are neither past due nor impaired which are made by us and our subsidiaries on a consolidated basis, whereas the discussion of credit ratings on pages 96-102 relates to the credit ratings assigned to all types of loans (whether past due, impaired or neither) made principally by Shinhan Bank and Shinhan Card for purposes of approving loan applications and monitoring thereafter. The disclosure on page F-35 follows the guidelines set forth by IFRS 7, which requires that disclosure of risks in the notes to the financial statements be made on a consolidated basis; since each of our subsidiaries has a slightly different credit risk management system for different types of loans, we have adopted credit categories (namely, Grade 1 and Grade 2) that would apply commonly to all the loans made by us and our subsidiaries. We further note that the foregoing discussion also applies to due from banks.

| • | In your new expanded disclosure, for each credit category disclosed (Grade 1, Grade 2, Grade 3, Grade 4, etc.), please discuss the characteristics of the category and how it equates to your expectation of the likelihood of loss. |

| Securities and Exchange Commission | 11 | November 9, 2012 |

Response:

In light of our response in the immediately preceding bullet point, we respectfully note that we do not believe expansion of credit categories beyond Grade 1 and Grade 2 is necessary or appropriate. As for the distinctions between Grade 1 and Grade 2, (i) in the case of non-retail loans that are neither past due nor impaired, we categorize them as Grade 1 if the borrower has an internal credit rating of BBB- or above, while we categorize as Grade 2 all other such loans if the borrower has an internal credit rating of lower than BBB-, and (ii) in the case of retail loans that are neither past due nor impaired, we first assign them to different “pools” based on the borrower’s probability of default (which is largely determined based on the nature of the borrower and of the loan) and categorize such pools as Grade 1 if the probability of default for such pools is less than 2.25% (which is the probability of default for non-retail loans with an internal credit rating of BB+) and as Grade 2 if the probability of default for such pools is 2.25% or greater. Therefore, Grade 1 loans generally have a less likelihood of loss compared to Grade 2 loans. We also categorize due from banks in the same manner.

We undertake to expand and/or clarify the relevant footnotes to the foregoing effect.

| • | Explain why you have classified banks and government loans as Grade 1, regardless of the credit rating determined based on your internal rating process. |

Response:

In response to the Staff’s comment, we wish to note that for clarification purposes, we will amend in future filings our statement in note 1 on page F-36 that “[B]anks and government loans were classified as Grade 1 regardless of credit rating” to “[B]anks and government loans made by Shinhan Bank were classified based on sovereign ratings.” We further elaborate as follows:

Under the guidelines set forth by the Financial Supervisory Commission of Korea, all major commercial banks in Korea, including Shinhan Bank, follow the standardized approach under Basel II for purposes of computing Bank of International Settlement (BIS) ratios for risk classifications of loans to banks and governments. Under this standardized approach under Basel II, risk classification for loans to banks and governments are determined on the basis of sovereign credit ratings, and not internal credit ratings assigned by the lending bank that are specific to the individual banks and governments. More specifically, this approach involves classifying loans to banks and governments in a given jurisdiction as either Grade 1 or Grade 2 based on the sovereign credit ratings for the government of such jurisdiction as determined by the Organization for Economic Co-operation and Development (“OECD”). Based on this standardized approach, all of Shinhan Bank’s loans to banks and governments as of December 30, 2010 and 2011 qualified as Grade 1. As for our subsidiaries other than Shinhan Bank, risk classification of loans to banks and governments is made based on their respective internal credit ratings as these subsidiaries are not subject to the aforesaid guidelines of the Financial Supervisory Commission relating to Basel II risk classification. We also note that for purposes of making a decision whether to extend a loan to banks and governments as compared to disclosing their risk classifications, we assess our internal credit rating of the relevant bank or government on an individual basis.

| Securities and Exchange Commission | 12 | November 9, 2012 |

We undertake to expand and/or clarify the relevant footnotes to the foregoing effect.

Credit Rating, page F-38

| 9. | We note your disclosure of debt securities by credit rating and the related credit qualities of debt securities according to the credit ratings by external rating agencies. Please clarify how you categorize your securities based on credit rating. For example, is it based on the lowest credit rating received on the security by any of those credit rating agencies? Additionally, in light of the differences in credit ratings between the Korean credit rating agencies, where AAA equals to AA- to AA+ based on the US credit rating agencies scale, please clarify which rating agency scale you are using for purpose of this disclosure. Lastly, in light of the growing amount of securities that are classified as “Lower than A-,” please consider providing further information about this category, such as the percentage of that balance that is considered below investment grade. |

Response:

In response to the Staff’s comments, we note that for purposes of our disclosure of credit ratings on page F-38, we use the lowest among the credit ratings assigned by domestic rating agencies and international rating agencies after “mapping” the domestic ratings to corresponding international ratings for comparative purposes. As of December 31, 2009, 2010 and 2011, the balance of securities classified as “Lower than A-” and considered below investment grade was Won 26 billion, Won 96 billion and Won 32 billion, respectively. As of December 31, 2009, 2010 and 2011, securities considered below investment grade constituted 2.2%, 6.6% and 1.5% of our securities classified as “Lower than A-”, respectively. We undertake to include disclosure further categorizing our securities that are rated “Lower than A-” into to “BBB+ to BBB-” and “Lower than BBB-” categories in future filings.

Interest Rate Risk Management from Non-Trading Positions, page F-46

| 10. | We note your discussion of interest rate risk for your non-trading portfolio and the disclosure of non-trading positions for interest rate VaR and Earnings at Risk (EaR) on page F-47. Please respond to the following: |

| • | Clarify what the amounts disclosed as VaR and EaR at the different periods represent and what they should be compared to for context. For example, do the VaR numbers disclosed represent the non-trading VaR related to interest rate, and thus are they somewhat comparable to the analysis of the ten-day 99% confidence level-based VaR for managing risk for trading positions on page F44? |

Response:

In response to the Staff’s comments, we note that the interest rate value at risk (VaR) and earnings at risk (EaR) disclosed on page F-46 represent the maximum amounts by which net assets and net interest income, respectively, may decrease or increase as of the dates indicated and have been computed based on the standardized guideline proposed by the Basel Committee.

| Securities and Exchange Commission | 13 | November 9, 2012 |

More specifically, the VaR disclosed on page F-46 was computed by using the following formula involving the interest rate gap under different maturity time buckets, the modified duration proxy as proposed by the Basel Committee and the standard interest rate shock of 200 basis points:

Interest rate VaR = [Interest rate gap for maturityi * Modified duration proxy of maturityi] * 200 basis points

[Interest rate gap for maturityi * Modified duration proxy of maturityi] * 200 basis points

where:

Maturityi is 0 to 1 month, 1 to 3 months, 3 to 6 months, 6 to 12 months, 1 to 2 years, 2 to 3 years, 3 to 4 years, 4 to 5 years, 5 to 7 years, 7 to 10 years, 10 to 15 years, 15 to 20 years and more than 20 years;

Interest rate gap means the difference between the amount of interest sensitive assets and the amount of interest sensitive liabilities for each maturity time bucket, which is classified based on the respective interest rate reset dates (namely, (i) in the case of floating rate loans, the periodic interest rate determination dates and (ii) in the case of fixed rate loans, the interest rate reset dates, if any, or the maturity date (in the case of rollovers)); and

Modified duration proxy means the sensitivity in bond prices relating to movements in interest rates, which may substitute for interest rate gap for maturityi to calculate interest rate VaR under the standardized guidelines proposed by the Basel Committee.

As for the EaR disclosed on page F-46, it was computed by using the following formula involving the interest rate gap under different maturity time buckets, the middle-of-time band as proposed by the Basel Committee and the standard interest rate shock of 200 basis points:

Interest rate EaR = [Interest rate gap for maturityi * (1 – Middle-of-time band of maturityi] * 200 basis points

[Interest rate gap for maturityi * (1 – Middle-of-time band of maturityi] * 200 basis points

where:

Maturityi is 0 to 1 month, 1 to 3 months, 3 to 6 months and 6 to 12 months;

Interest rate gap means the difference between the amount of interest sensitive assets and the amount of interest sensitive liabilities for each maturity time bucket, which is classified based on the respective interest rate reset dates (namely, (i) in the case of floating rate loans, the periodic interest rate determination dates and (ii) in the case of fixed rate loans, the interest rate reset dates, if any, or the maturity date (in the case of rollovers)); and

| Securities and Exchange Commission | 14 | November 9, 2012 |

Middle-of-time band means the mid-point of each maturity i used to calculate the period during the next year where interest rate shocks can affect net interest income for purposes of computing interest rate EaR.

As for comparability, we do not believe that the interest rate VaR can be meaningfully compared to the ten-day 99% confidence level-based VaR for managing risk for trading positions (the “market risk VaR”) on page F-44 principally because (i) the underlying assets are different (namely, non-trading interest-bearing assets as well as liabilities in the case of the interest rate VaR, compared to trading assets in the case of the market risk VaR), and (ii) the interest rate VaR is sensitive to interest rate movements only while the market risk VaR is sensitive to other elements such as foreign currency exchange rate, stock market prices and option volatility. Even if comparison is being made between the interest rate VaR and the interest rate portion only of the market risk VaR, we still do not believe such comparison will be meaningful since the interest rate VaR examines the impact of interest rate movements on both assets and liabilities (which will likely have offsetting effects), whereas the interest rate portion of the market VaR examines the impact of interest rate movements on assets only. As for interest rate EaR, there is no comparable metric because we do not analyze any market risk EaR.

| • | Clarify how VaR and EaR relate to each other and describe any differences between the outputs of the two models. As part of your response, please provide an illustration, such as explaining why VaR for Shinhan Bank increases between December 31, 2010 and December 31, 2011 and EaR decreases between the two dates. We note that the opposite trend occurs at Shinhan Investment. |

Response:

Interest rate VaR represents the maximum anticipated loss in net present value (computed as the present value of interest-earning assets minus the present value of interest-bearing liabilities), whereas interest rate EaR represents the maximum anticipated loss in net earnings (computed as interest income minus interest expenses) for the immediately following one-year period, in each case, as a result of negative movements in interest rates. Therefore, interest rate VaR is a more expansive concept than interest rate EaR in that the former covers all interest-earning assets and all interest-bearing liabilities, whereas the latter covers only those interest-earning assets and interest-bearing liabilities that are exposed to interest rate volatility for a one-year period. Hence, for interest rate VaRs, the duration gap (namely, the weighted average duration of all interest-earning assets minus the weighted average duration of all interest-bearing liabilities) can be a more critical risk factor than the relative sizes of the relevant assets and liabilities in influencing the interest rate VaRs. In comparison, for interest rate EaRs, the relative sizes of the relevant assets and liabilities in the form of the “one year or less interest rate” gap (namely, the volume of interest-earning assets with maturities of less than one year minus the volume of interest-bearing liabilities with maturities of less than one year) is the most critical factor in influencing the interest rate EaRs.

| Securities and Exchange Commission | 15 | November 9, 2012 |

By way of illustration, in the case of Shinhan Bank, the interest rate VaR increased from December 31, 2010 to December 31, 2011, largely due to an increase in the volumes of interest-earning loans and securities with maturities of one year or more (namely, an increase on the asset side), which resulted in an increase in the positive duration gap, whereas the interest rate EaR decreased from December 31, 2010 to December 31, 2011 largely due to an increase in the volume of interest-bearing deposits with maturities of three months or less (namely, an increase on the liabilities side), which resulted in a decrease in the positive “one year or less” interest rate gap. In contrast, in the case of Shinhan Investment, both interest rate VaR and EaR increased from December 31, 2010 to December 31, 2011 due to (i) in the case of VaR, an increase in the volume of long-term debt securities (namely, an increase on the asset side), which resulted in an increase in the positive duration gap, and (ii) in the case of EaR, an increase in the volume of short-term borrowings (namely, an increase on the liabilities side), which resulted in an increase in the negative “one year or less” interest rate gap. Both interest rate VaR and EaR are stated at their absolute values.

| • | Clarify the assumptions used in the non-trading VaR disclosures and discuss the interest rate VaR limits you refer to at the top of page F-47. |

Response:

In response to the Staff’s comments, we first note that the tabular disclosure of non-trading VaR disclosures on page F-47 has been prepared based on the standardized guidelines of the Basel Committee (which methodology has been described in detail in our response to the first bullet point of Comment 10), whereas our discussion of non-trading VaR in the top paragraph is based on our internal methodology specific to Shinhan Bank as described below. The tabular disclosure, which includes disclosures for our major subsidiaries, was prepared based on the standardized guidelines in order to ensure uniform application of the methodology for purposes of enabling comparability among these subsidiaries.

To elaborate on the internal methodology used for Shinhan bank, we utilize a historical simulation model to compute the non-trading interest rate VaR for Shinhan Bank based on the distribution of net present values (NPVs) under various historical interest rate scenarios after deducting the NPV in the lowest 0.1 percentile from the average NPV, which yields a 99.9% confidence-level interest rate VaR. The formula for computing the non-trading interest rate VaR of Shinhan Bank is as follows:

Interest rate VaR = Average NPV – 0.1 percentile NPV

| Securities and Exchange Commission | 16 | November 9, 2012 |

where:

0.1 percentile NPV means the NPV in the lowest 0.1 percentile in the distribution of NPVs generated through simulation using various historical interest rates scenarios; and

Average NPV means the average price of the distribution of NPVs generated through simulation using various historical interest rates scenarios.

The interest rate VaR limits referred at the top of page F-47 are measured as the sum of (i) the average of the monthly non-trading interest rate VARs as a percentage of interest-bearing assets over a period of one year and (ii) the standard deviation at the 99% confidence level (namely, 2.33 times the standard deviation of the monthly non-trading interest rate VARs as a percentage of interest-bearing assets). We monitor on a monthly basis whether the non-trading positions for interest rate VaRs exceed the interest rate VaR limits.

| • | Discuss the different scenarios in changes to interest rates (increases, decreases, shocks, etc.) considered in your VaR and EaR analyses and how you arrived at a positive increase in all periods. |

Response:

All the interest rate VaRs and EaRs disclosed on page F-46 were computed using the standard interest rate shock scenario of 200 basis points. In such disclosure, we stated the absolute values of VaRs and EaRs after factoring in both increases and decreases in interest rates.

| • | Clarify whether there are any capital requirements for the non-trading book, similar to how you have done for the trading positions on page F-44. |

Response:

Unlike in the case of trading positions as set forth in page F-44, there is no regulatory requirement for requisite capital in relation to non-trading positions. We internally manage risk capital, which represents the amount of capital required to offset the impact from the actual occurrence of a potential risk of loss related to non-trading positions by maintaining the ratio of available capital compared to risk capital at appropriate levels based on the interest rate VaR limits discussed under the third bullet above.

| Securities and Exchange Commission | 17 | November 9, 2012 |

Financial Instruments Measured at Fair Value, page F-57

| 11. | We note your discussion of Level 3 instruments but were unable to locate the disclosures required by paragraph 27B(e) of IFRS 7. Please revise future filings to provide this disclosure or tell us how you determined that this disclosure is not required. |

Response:

In response to the Staff’s comment, we note that for the following reasons we did not disclose the effect of changing one or more of the inputs to reasonably possible alternative assumptions on fair value measurements in Level 3 required by paragraph 27B(e) of IFRS 7: (i) financial instruments classified as Level 3 represented only an insignificant portion of our consolidated financial instruments whether in terms of assets or liabilities and therefore changing one or more of the inputs to reasonably possible alternative assumptions for fair value measurement would not change their fair value significantly in terms of profit or loss and total assets or total liabilities, (ii) providing the referenced disclosure would require us to expend an unduly onerous amount of time and effort, and (iii) even if we were able to provide the referenced disclosure, such disclosure would have had a substantial degree of unreliability.

We further note that our level 3 financial instruments mostly consist of equity-linked securities and related derivative products and available-for-sale financial products, and accordingly, the sensitivity analysis required for the referenced disclosure will have limited usefulness for the following reasons:

| A. | Equity-linked securities and related derivative products. These products are structured as back-to-back transactions or hedging derivative transactions where the assets and liabilities for such products mirror each other. Therefore, for purposes of sensitivity analysis, changes in the fair value of assets would be offset by changes in the fair value of liabilities, and therefore would have substantially no impact on the net asset value. |

| B. | Non-marketable stock. For these products, we use the discounted cash flow methodology to arrive at their fair value. However, we believe that too many assumptions are involved in determining the future cash flow of a company and therefore a sensitivity analysis required for the referenced disclosure will be of limited use. For example, for a certain non-listed stock to which a fair value of Won 30,931 per share was assigned based on a valuation report prepared by independent outside experts, the minimum value at the 95% confidence level was Won 5,704 per share while the maximum value at the 95% confidence level was Won 70,558 per share. Given this wide range between the minimum and maximum fair values, we believe a sensitivity analysis would be of limited use. |

| Securities and Exchange Commission | 18 | November 9, 2012 |

Note 6 – Business Combinations, page F-66

| 12. | We note your disclosure that you acquired controlling ownership over Shinhan Vina Bank, formerly a jointly controlled entity, by acquiring an additional 50% of the outstanding and voting interests for (Won)105,940 million. We also note your disclosure that you applied the pooling method instead of the acquisition method, since the transaction was regarded as a “business combination of entities under common control” in accordance with IFRS 3. With respect to this transaction please tell us the following: |

| • | Tell us your basis, citing specific accounting literature, for determining that this entity was under common control at the date of acquisition, given that it was a jointly controlled entity prior to the transaction. |

Response:

In response to the Staff’s comment, we note that the transaction in question involved a two-step process: (i) acquisition of the remaining 50% outstanding and voting interest in Shinhan Vina Bank on November 11, 2011, as a result of which Shinhan Vina Bank became our wholly-owned subsidiary, and (ii) merger of Shinhan Vina Bank into Shinhan Bank Vietnam, our wholly-owned subsidiary, on November 28, 2011. In accordance with IFRS, we applied the acquisition method to the acquisition of the remaining interest on November 11, 2011, whereas we applied the pooling method to the merger on November 28, 2011 since the two entities being merged were entities under our common control. Since the merger of Shinhan Bank Vietnam and Shinhan Vina Bank was a business combination of entities under common control, IFRS 3 is not applicable to such merger in accordance with Appendix B, Application Guidance of IFRS 3.

We undertake to expand and/or clarify the relevant disclosure to the foregoing effect.

| • | You disclosed that you recorded goodwill on this transaction, even though you are accounting for this transaction under the pooling method. Please tell us your basis for recognizing goodwill for a transaction accounted for under the pooling method. |

Response:

In response to the Staff’s comment, we note that we recorded goodwill only with respect to the acquisition of the outstanding interest on November 11, 2011, to which we applied the acquisition method, and not with respect to the merger on November 28, 2011, to which we applied the pooling method, in each case, as discussed above.

| • | Tell us your basis, citing specific accounting literature, for recognizing a (Won)44,243 million gain as a result of remeasuring to fair value the 50% equity interest in Shinhan Vina Bank held by the Group prior to the business combination. |

| Securities and Exchange Commission | 19 | November 9, 2012 |

Response:

In response to the Staff’s comment, we note that we recognized the referenced gain in connection with the acquisition of the remaining interest on November 11, 2011 in accordance with paragraph 42 of IFRS 3, which provides that under the acquisition method, the acquiree’s interest is remeasured at fair value as of the acquisition date and the difference between such remeasured fair value and the original value of such interest prior to such remeasurement is recognized as income or expense of the acquiror for the current reporting period.

We undertake to expand and/or clarify the relevant disclosure to the foregoing effect.

Note 7 – Operating Segments, page F-69

| 13. | We note the presentation of your operating segments and that your “Others” segment consists of leasing, asset management and other businesses. We also note that the “Others” segment represents 53% of the total net income for the year ended December 31, 2011, but only 2% of total assets. Please respond to the following: |

| • | Tell us and expand your disclosure to discuss why this segment represents such a significant portion of your net income, but only a nominal amount of your total assets. |

Response:

In response to the Staff’s comment, we note that the “other businesses” portion of our “Others” segment includes our holding company’s income for the period on a non-consolidated basis, which consists of dividends from its subsidiaries on account of the holding company’s ownership of stock in its subsidiaries, interest income from loans extended to its subsidiaries and fees and commissions received from its subsidiaries for the use of the group brands and logos, as partially offset by interest expense and administrative costs. In 2011, income from our “Others” segment was Won 1,748 billion, of which income of our holding company on a non-consolidated basis accounted for Won 1,673 billion. In 2011, our holding company received Won 1,837 billion in dividends from its subsidiaries. All of the holding company’s separate income attributable to dividends received from subsidiaries and fees and commissions received for use of the group brands and logos and a portion of its interest income were eliminated upon consolidation as they related to transactions with consolidated subsidiaries.

While we have disclosed all income generated by each of our operating segments, we have disclosed only those assets belonging to categories that we believe are material to the business activities of our operating segments. These categories consist of trading assets, loans, available-for-sale financial assets and held-to-maturity financial assets. The stock of subsidiaries held by our holding company had a book value of Won 25,050 billion as of December 31, 2011, as recorded in the holding company’s separate balance sheet as of such date. However, such book value was not included in the assets of the “Others” segment as disclosed on page F-71 because it was neither related to the business activities of our operating segments nor classified as a trading asset, a loan, an available-for-sale financial asset or a held-to-maturity financial asset.

| Securities and Exchange Commission | 20 | November 9, 2012 |

We undertake to expand our disclosure to include the income of our holding company on a non-consolidated basis in the referenced pages in future filings.

| • | Given the significance of this segment’s net income to your total net income, please tell us how you concluded that none of the businesses included within this segment met the criteria for separate reporting, pursuant to the guidance in paragraph 13 of IFRS 8. |

Response:

In response to the Staff’s comment, we respectfully note that we have concluded separate reporting is not required for any of the businesses included in the “Others” segment (which consist of the separate business of our holding company and our leasing, asset management and other businesses) because (i) the separate business of our holding company does not meet the definition of an “operating segment” as provided in paragraph 5 of IFRS 8 and separate reporting for such business is otherwise not meaningful due to elimination during the consolidation process, and (ii) none of our leasing, asset management and other businesses meets the quantitative thresholds provided in paragraph 13 of IFRS 8.

To elaborate, we have concluded that separate reporting is not required for the separate business of our holding company for the following reasons. First, paragraph 5 of IFRS 8 provides that an “operating segment” is a segment that “engages in business activities from which it may earn revenues and incur expenses”. Since our holding company’s business activities mainly relate to carrying out management support functions for its subsidiaries, we have concluded that such activities do not constitute business activities that “earn revenues” or “incur expenses”. In addition, since substantially all of the separate income for our holding company, which principally consists of dividends from its subsidiaries and, to a lesser extent, interest income from loans extended to its subsidiaries and fees and commissions received from its subsidiaries for the use of the group brands and logos, is eliminated during the consolidation process, we have concluded that separate reporting for such income will not be meaningful.

| Securities and Exchange Commission | 21 | November 9, 2012 |

As for income from our leasing, assets management and other businesses included in the “Others” segment, none of these businesses meets the quantitative thresholds provided in paragraph 13 of IFRS 8. Paragraph 13 of IFRS 8 requires separate reporting of an operating segment if (a) its reported revenue, including both sales to external customers and intersegment sales or transfers, is 10% or more of the combined revenue, internal and external, of all operating segments; (b) the absolute amount of its reported profit or loss is 10% or more of the greater, in absolute amount of (i) the combined reported profit of all operating segments that did not report a loss and (ii) the combined reported loss of all operating segments that reported a loss; or (c) its assets are 10% or more of the combined assets of all operating segments. None of our leasing, assets management and other businesses accounted for 10% or more of the combined revenue, the combined reported profit, the combined reported losses or the combined assets of all of our operating segments in 2010 or 2011. Therefore, we have concluded that separate reporting is not required for any of such businesses.

| • | Describe the factors driving the large consolidation adjustment related to net other income (expense). |

Response:

In response to the Staff’s comment, we note that the primary factor driving the consolidation adjustment relating to net other income of Won 1,810 billion in 2011 was our holding company’s separate income from dividends from its subsidiaries in the amount of Won 1,837 billion as discussed above.

| • | We note your disclosure on page 189 that for segment purposes, each segment reflects provisions for loan losses that are allocated based on the ending balances of loans for each segment in order to show a meaningful comparison of performance within such segment and compared to other segments. Please tell us whether this presentation is consistent with the way that the CODM reviews this information for purposes of making decisions about allocating resources to the segment and assessing its performance, as required by paragraph 25 of IFRS 8. |

Response:

In response to the Staff’s comment, we note that we allocate provision for loan losses as follows: (i) first, each of our operating segments is allocated up to 100% of the expected loss from loans made by such segment (namely, with respect to a particular loan, 80% of the expected loss for such loan on a daily basis based on the daily ending balance of such loan and the remaining 20% upon the occurrence of insolvency for such loan, and (ii) the difference between the actual incurred loss and the expected loss for a given operating segment is in the “Others (Banking)” segment. Accordingly, the total provision of losses recorded for our banking business is a sum of expected loss for each banking segment and any amounts by which actual incurred loss exceeds expected loss allocated for a loan for which a borrower has become insolvent, which is recorded as provision of loan losses for the “Others (Banking)” segment.

| Securities and Exchange Commission | 22 | November 9, 2012 |

The foregoing results are submitted on a periodic basis to the chief operating decision maker (“CODM”) for review. The CODM utilizes such results to assess various performance indicators, such as income, margin ratios and delinquency ratios, for each banking segment as well as the banking business as a whole, and identify and implement measures to help segments that have not achieved their respective business plans.

We undertake to include a disclosure substantially to the foregoing effect in future filings.

Note 11 – Derivatives, page F-74

| 14. | We note your disclosure that you have cash flow, fair value and net investment hedges. Please tell us how you applied the mandatory exception for hedge accounting under paragraphs B4-B6 of IFRS 1 since it is not clear from your disclosures. |

Response:

In response to the Staff’s comment, we note that (i) cash flow hedges and fair value hedges to which we applied the “long haul” method under Korean GAAP met the conditions set forth in paragraphs 88-101 of IAS 39 and therefore, the mandatory exception for hedge accounting under paragraphs B4-B6 of IFRS 1 does not apply to such hedges, (ii) there were no net investment hedge as of the IFRS transition date, so the question of the mandatory exception is irrelevant with respect to net investment hedges, and (iii) fair value hedges to which we applied the “short-cut” method under Korean GAAP did not meet the conditions set forth in paragraph 88 of IAS 39, and therefore, pursuant to the mandatory exception for hedge accounting under paragraphs B4-B6 of IFRS 1, we applied paragraph 91(2) of IAS 39 to prospectively discontinue such fair value hedges. The “short-cut” method and “long haul” method of hedge accounting relate to available-for-sale debt securities and issued bonds. To the extent any such instrument does not meet the requirements for application of the “short-cut” method of hedge accounting, the “long haul” method of hedge accounting applies. For hedging relationships that meet the requirements for application of the “short-cut” method of hedge accounting, we assume that such hedging relationships are highly effective and do not perform a periodic review of the effectiveness of such hedging relationships required under the “long haul” method of hedge accounting.

Please also tell us the following:

| • | Tell us the hedging relationships (hedging instruments and hedged items) and types of hedges (i.e. cash flow, fair value etc.) that were discontinued upon your transition to IFRS. |

| Securities and Exchange Commission | 23 | November 9, 2012 |

Response:

In response to the Staff’s comment, we note that, as discussed above, upon transition to IFRS, in accordance with the mandatory exception for hedge accounting under paragraphs B4-B6 of IFRS 1, we discontinued fair value hedges to which we had applied the “short-cut” method of hedge accounting under Korean GAAP. The types of hedges so discontinued principally consist of interest rate swaps for (i) fixed-rate long-term borrowings that were carried at cost and (ii) certain fixed-rate debt securities that were classified as available-for-sale securities, in each case, that were entered to manage changes in fair value attributable to market interest risk.

| • | Tell us your current accounting treatment of the derivatives and hedged items that were discontinued upon your transition to IFRS. |

Response:

In response to the Staff’s comment, we note the following changes in accounting treatment with respect to the derivatives and hedged items discussed above that were discontinued upon our transition to IFRS. First, if, prior to the IFRS transition date, adjustments to the basis of the carrying amounts of the hedged items were made during the hedging period, we amortize such basis adjustments over the remaining hedging period based on an effective interest rate recalculated on the date the hedge relationship ceased and such amortization is reflected in the income statement. Second, if, as of the IFRS transition date, the hedged item and the hedging instrument met the requirements under IAS 39 for purposes of hedge accounting, we have re-designated the hedging relationship on the IFRS transition date in order to protect against the changes in fair value due to changes in market interest rate. Other than as set forth above, we account for such items in compliance with the respective applicable accounting treatments required under IFRS.

Note 16 – Investments in Associates, page F-85

| 15. | We note your disclosure in footnote (5) related to your UAMCO, Ltd. investment that you applied the equity method accounting since the investee is classified as a subsidiary by the Banking Act. Please provide your analysis of the factors in paragraphs 6-10 of IAS 28 supporting why you believe you have significant influence over the entity, despite you 17.5% ownership percentage. |

Response:

In response to the Staff’s comment, we note that under IAS 28 the equity method of accounting should apply to investments in associates and joint ventures if the investor exercises significant influence over the investee. Pursuant to paragraphs 6-10 of IAS 28, significant influence by an investor is generally evidenced in one or more of the following ways:

| 1. | representation on the board of directors or equivalent governing body of the investee; |

| Securities and Exchange Commission | 24 | November 9, 2012 |

| 2. | participation in the policy-making processes, including in respect to decisions about dividends or distributions; |

| 3. | material transactions between the investor and the investee; |

| 4. | interchange of managerial personnel; or |

| 5. | provision of essential technical information. |

We have concluded that Shinhan Bank exercises significant influence over UAMCO Co., Ltd. (“UAMCO”) in accordance with IAS 28 because our relationship with UAMCO meets three of the five aforementioned conditions. In satisfaction of conditions (1) and (2) above, Shinhan Bank has the right to appoint a member of UAMCO’s director recommendation committee (which is comprised of four members) and a member of the board of directors (which is comprised of five members), and through such appointments exercise significant influence over the decision-making and staffing processes relating to UAMCO’s financial and business policies. In addition, in satisfaction of condition (3) above, Shinhan Bank routinely sells certain of its non-performing loans to UAMCO, which was established to liquidate non-performing assets purchased from Korean commercial and policy banks, including Shinhan Bank.

We undertake to expand and/or clarify the relevant disclosure to the foregoing effect.

Note 24 – Borrowings, page F-95

| 16. | We note the disclosure of the range of interest rates on your borrowings and debt securities issued on pages F-95 through F-97 and that in certain situations, the interest rate ranges are very wide (0.00 – 12.00%). In order to increase the transparency of this disclosure, please expand your disclosure in future filings to also provide an indication of the weighted-average interest rate on your borrowings and debt securities issued. |

Response:

In response to the Staff’s comment, we respectfully note that the referenced disclosure relating to the range of interest rates for various types of borrowing and debt securities is not a requirement under IFRS 7, but that we have voluntarily made the disclosure. We further note that, notwithstanding the wide range of interest rates for certain types of borrowings and debt securities, certain other types have a specific single interest rate or a relatively narrow range of interest rates, and therefore, disclosing the range of interests for each of the borrowing categories mentioned on pages F-95 through F-97 are useful. For example, borrowings in Won from Bank of Korea have a narrow range of 1.00% to 1.25% while overdraft due to banks have only a single interest rate of 5.4%. Moreover, on page 177, we disclose the weighted-average interest rate on each of our borrowings and debt securities issued on an aggregated basis. We also respectfully note that providing further breakdown of the interest rate ranges as requested will require us to unduly expend a significant amount of time and resources.

| Securities and Exchange Commission | 25 | November 9, 2012 |

Note 28 – Liability Under Insurance Contracts, page F-101

(g) Liability Adequacy Test, page F-106

| 17. | We note your discussion of the liability adequacy test performed, as well as the discussion of assumptions outlined on page F-107. In light of the wide range of assumptions (15 – 155% for the mortality rate, 0.3% – 46.1% for the surrender ratio, etc.), and the sensitivity of those assumptions on the liability adequacy test, please tell us and disclose a weighted-average assumption used in order to make the disclosures more transparent. Additionally, please explain how the sensitivity analysis on page F-107 was performed based on the range of assumptions disclosed. For example, tell us whether it was based on the weighted-average assumption, or whether multiple calculations were performed and then summed to arrive at the disclosure. |

Response:

In response to the Staff’s first comment, we note that we conduct the liability adequacy test (“LAT”) in accordance with the Insurance Act. Under this regulation, we are required to conduct LATs in consideration of different ages, sex, payment method, maturities, sales channels and other factors if these factors would yield material differences in the LAT outcome. For example, we measure mortality rates as the rate of premium paid on risk premium based on the experience-based rate by classes of sales channel, product and transition period of the past five years, and we measure surrender ratios by classes of sales channel, products and transition period for the past five years. Accordingly, we acknowledge that we use a wide range of segmented assumptions, but we believe such usage is necessary to improve the accuracy of the LATs. As for the disclosure of weighted-average assumptions for purposes of LATs, we respectfully note that, while such disclosure will be useful if they can be reliably calculated, the determination of the weighted value, which is necessary for the computation of weighted averages, is practically difficult and unreliable due to the significant variations among insurance contracts, especially in terms of the many elements that make up an insurance contract. For example, suppose that the task is to compute the weighted average surrender ratio for the following two types of insurance contracts: (i) the first contract, which is a life insurance contract and carries a monthly insurance premium of Won 30,000 and will pay insurance proceeds of Won 1 billion upon death of the insured (a 45 year old female) within 20 years after signing the insurance contract and whose surrender ratio after five years is 5%, and (ii) the second contract, which is a health insurance contract and carries a monthly insurance premium of Won 40,000 and will pay insurance proceeds of up to Won 0.5 billion until upon discovery of cancer for the insured (a 40 year old male) and whose surrender ratio after 10 years is 10%. For these two scenarios, we do not believe there is a clear-cut, reasonable and reliable method to compute the average weighted surrender ratio and we respectfully note that the same difficulty applies to a substantial number of our insurance contracts.

| Securities and Exchange Commission | 26 | November 9, 2012 |

With respect to the Staff’s second point regarding the sensitivity analysis, we note that we did not use weighted-average assumptions for conducting the analysis, but performed multiple calculations and summed up the results of such calculations to arrive at the referenced disclosure. We further note that when we conduct a sensitivity analysis, we factor in the impact a change in the assumptions for a particular factor will have on the assumptions for other factors. For example, when we conduct a sensitivity analysis with respect to an increase in mortality rates for life insurances, we consider the effective decrease in premium paid and premium income resulting from an increase in the occurrence of death of the insured.

Note 30 – Equity, page F-109

(c) Hybrid Bond, page F-111

| 18. | We note that you issued hybrid securities in October 2011 and May 2012 that are considered equity under IFRS given that you have the unconditional right to extend the maturity under the same terms and conditions. Please tell us the following with respect to these instruments: |

| • | Citing specific literature, tell us why you believe these instruments are considered equity under IFRS. |

Response:

In response to the Staff’s comment, we note that we have relied on paragraphs 16 and 19 of IAS 32 to determine that the referenced hybrid instruments are equity under IFRS. Under paragraph 16 of IAS 32, in order to qualify as an equity instrument, a financial instrument may not have a contractual obligation to (i) deliver cash or another financial asset to another entity or (ii) exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavorable to the issuing entity. In addition, under paragraph 19 of IAS 32, if an entity has an unconditional right to avoid delivering cash or another financial asset to settle a contractual obligation, the obligation generally does not meet the definition of a financial liability.

Our hybrid securities contain the following terms. First, these securities generally have maturities of 30 years and provide no early redemption put right to the security holders, but the issuer (namely, us) has the call option to redeem such securities after five years following the issue date. Furthermore, at maturity, the issuer may extend at its option the maturities of these securities without notice to the security holders. In effect, the issuer has the discretion to avoid repaying principal indefinitely. Accordingly, the hybrid securities are not financial obligations under paragraph 19 of IAS 32.

| Securities and Exchange Commission | 27 | November 9, 2012 |

Second, the issuer may, at its option, suspend indefinitely payment of all or part of interest on the hybrid securities if the common shareholders resolve not to receive dividends on the common shares, and upon such suspension, the issuer is effectively relieved from the obligation to pay such amount of interest. The issuer is only obligated to pay interest in the event the common shareholders resolve to receive dividends on the common shares, at which time interest begins to accrue until the date on which the common shareholders resolve not to receive dividends on the common shares. The issuer must pay such accrued interest to the security holders on the first interest payment date that comes due following the lifting of the suspension of the interest payment. But since the common shareholders may continue to resolve not to receive dividends on the common shares, in which case the issuer may indefinitely suspend payment of interest, we believe that in accordance with paragraph 19 of IAS 32 the issuer has an unconditional right to avoid delivering cash or another financial asset to settle a contractual obligation, and therefore the obligations of the issuer under our hybrid securities do not meet the definition of a financial liability; accordingly, in accordance with paragraph 16 of IAS 32, we believe our hybrid securities qualify as an equity instrument as the issuer in effect does not have an obligation to deliver cash or another financial asset to another entity.

For the foregoing reasons, we believe that determination of the hybrid securities as equity under IFRS is appropriate. We undertake to expand our disclosure to the foregoing effect.

| • | Clarify whether the hybrid securities accumulate interest during the period that interest is deferred. If yes, clarify whether interest accrues on a compound basis on the interest that has been deferred. |

Response:

In response to the Staff’s comment, we note that interest on the hybrid securities cannot be deferred. Interest accrues on our hybrid securities only from the date the shareholders resolve to receive distributions on the common shares to the date the shareholders resolve not to receive distributions on the common shares, at which time the issuer must pay the accrued interest on the hybrid securities to the security holders. No interest accrues on our hybrid securities from the date the shareholders resolve not to receive distributions on the common stock.

| • | Clarify whether interest accrues on the hybrid securities regardless of whether dividends are paid on common stock. |

Response:

In response to the Staff’s comment, we note that if dividend is not declared on common shares, the issuer does not have an obligation to pay interest. Therefore, if it is resolved at a shareholders’ meeting that dividend will not be declared on common shares, interest does not accrue from the date of such resolution. Interest accrues from the date the shareholders resolve to receive distributions on the common shares to the date the shareholders resolve not to receive distributions on the common shares, at which time the issuer must pay the accrued interest on the hybrid securities to the security holders.

| Securities and Exchange Commission | 28 | November 9, 2012 |

| • | Tell us the terms of any redemption provisions. For example, are there particular call dates or prices, or are you able to redeem the hybrid securities at any time after five years at par? |

Response:

In response to the Staff’s comment, we note that the security holder does not have any right of early redemption whatsoever. As for the issuer, it has a call option to demand early redemption of the outstanding hybrid securities at their face value at any time following the fifth anniversary of the issue date, provided that (i) (x) the hybrid securities being so redeemed will be replaced with equity, or (y) following such redemption, the issuer’s equity is sufficient to cover the issuer’s risk, and (ii) an advance approval from the head of the Financial Services Commission of Korea has been obtained in respect of such redemption. In addition, redemption may occur at maturity subject to meeting the conditions noted above; however, as discussed above, the issuer may extend the maturity date indefinitely without notice to security holders, provided that all other terms and conditions remain equal.

| • | Tell us whether there any provisions that could result in cash redemption, regardless of how remote the scenario may be. |

Response:

In response to the Staff’s comment, we note that cash redemption is possible if the conditions set forth under the immediately preceding bullet point in relation to the issuer’s right of early redemption are satisfied.

| • | Tell us whether the hybrid security holders are given any additional rights (voting, put rights, decision making, etc.) while the hybrid securities are deferring interest. |

Response:

In response to the Staff’s comment, we note that there are no such provisions.

Note 42 – Earnings per Share, page F-128

(b) Diluted Earnings per Share, page F-129