Exhibit 99.1

EEI Conference

C. John Wilder

Chief Executive Officer

October 26, 2004

Safe Harbor Statement & Regulation G

This presentation contains forward-looking statements, which are subject to various risks and uncertainties. Discussion of risks and uncertainties that could cause actual results to differ materially from management’s current projections, forecasts, estimates and expectations is contained in the company’s SEC filings. In addition to the risks and uncertainties set forth in the company’s SEC filings, the forward-looking statements in this presentation could be affected by the ability of the company to implement the initiatives that are part of its restructuring, operational improvement and cost reduction program, and the terms under which the company executes those initiatives, the ability of the company to execute the financing necessary to finance its share repurchase plan and the actions of its board of directors with respect to future dividends and other cash distributions to shareholders, which will be based upon a number of factors, including the Company’s profit levels, operating cash flow levels and capital requirements as well as financial and other business conditions existing at the time.

Regulation G

This presentation includes certain non-GAAP financial measures. A reconciliation of these measures to the most directly comparable GAAP measure is included in the appendix of the printed version of the slides and the version included on the company’s website at www.txucorp.com under Investor Resources/Presentations.

1

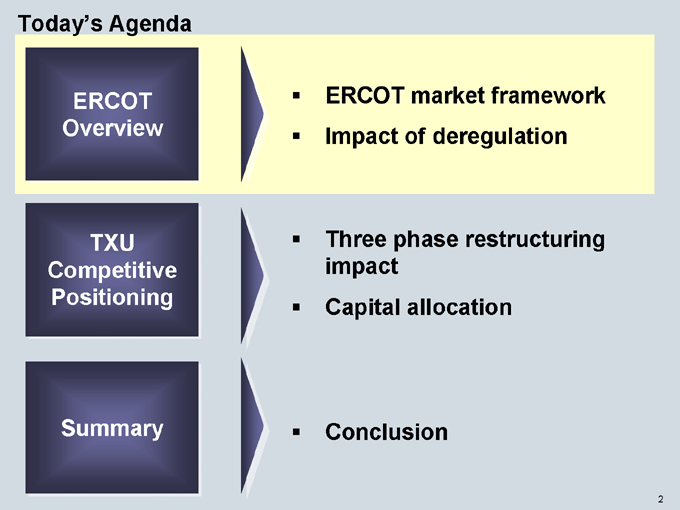

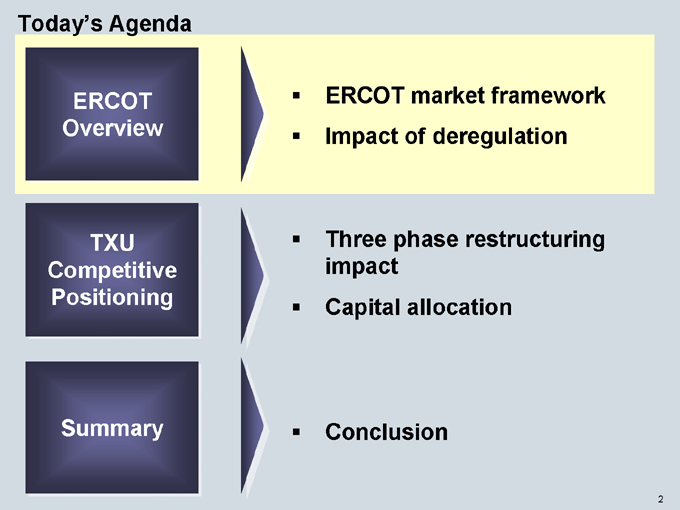

Today’s Agenda

ERCOT Overview

ERCOT market framework

Impact of deregulation

TXU Competitive Positioning

Three phase restructuring impact

Capital allocation

Summary

Conclusion

2

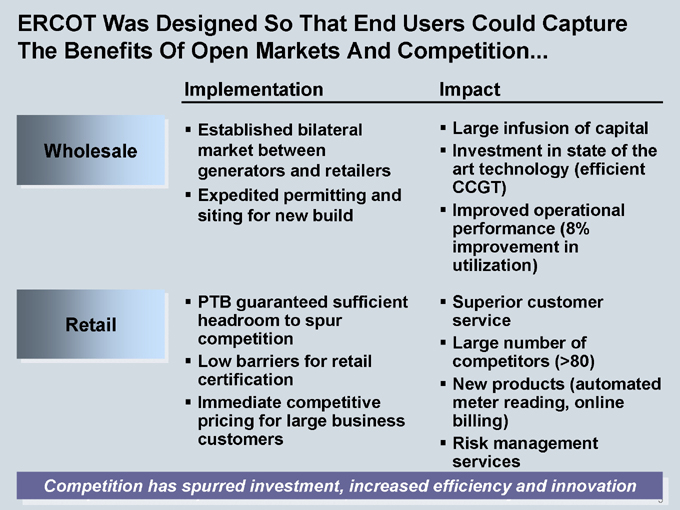

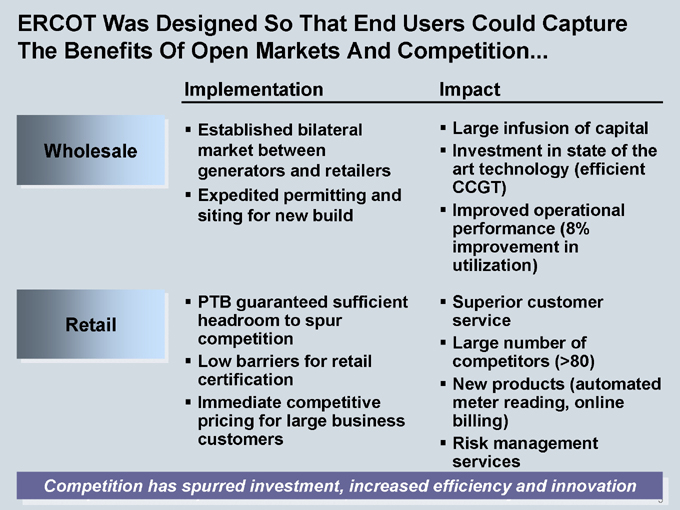

ERCOT Was Designed So That End Users Could Capture The Benefits Of Open Markets And Competition…

Wholesale

Retail

Implementation

Established bilateral market between generators and retailers

Expedited permitting and siting for new build

PTB guaranteed sufficient headroom to spur competition

Low barriers for retail certification

Immediate competitive pricing for large business customers

Impact

Large infusion of capital

Investment in state of the art technology (efficient CCGT)

Improved operational performance (8% improvement in utilization)

Superior customer service

Large number of competitors (>80)

New products (automated meter reading, online billing)

Risk management services

Competition has spurred investment, increased efficiency and innovation

3

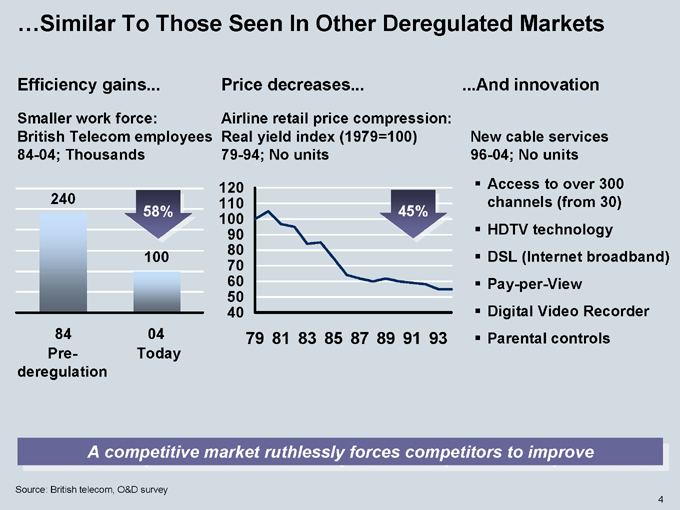

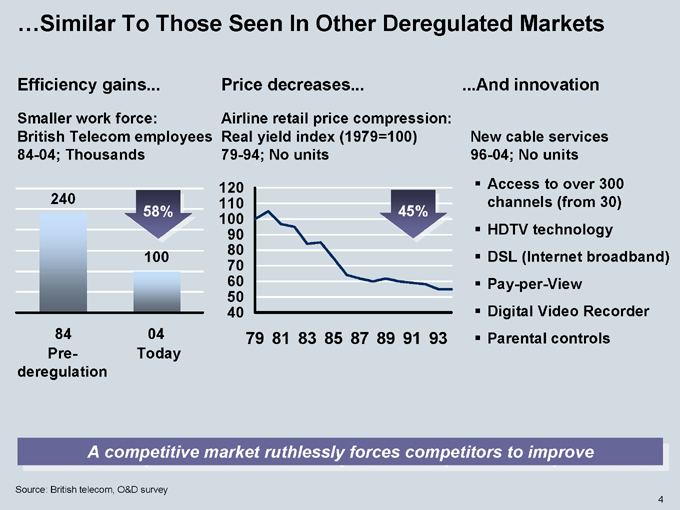

…Similar To Those Seen In Other Deregulated Markets

Efficiency gains…

Smaller work force:

British Telecom employees 84-04; Thousands

Price decreases…

Airline retail price compression:

Real yield index (1979=100) 79-94; No units

…And innovation

New cable services 96-04; No units

240

58%

100

84 Pre-deregulation 04 Today

120 110 100 90 80 70 60 50 40

79 81 83 85 87 89 91 93

45%

Access to over 300 channels (from 30)

HDTV technology

DSL (Internet broadband)

Pay-per-View

Digital Video Recorder

Parental controls

A competitive market ruthlessly forces competitors to improve

Source: British telecom, O&D survey

4

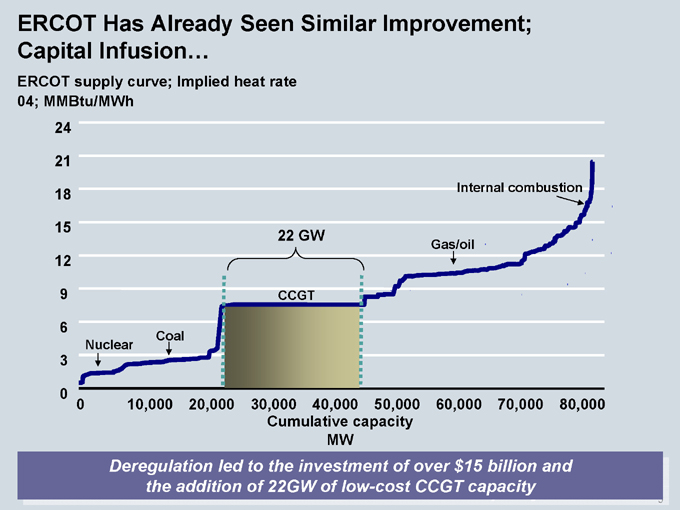

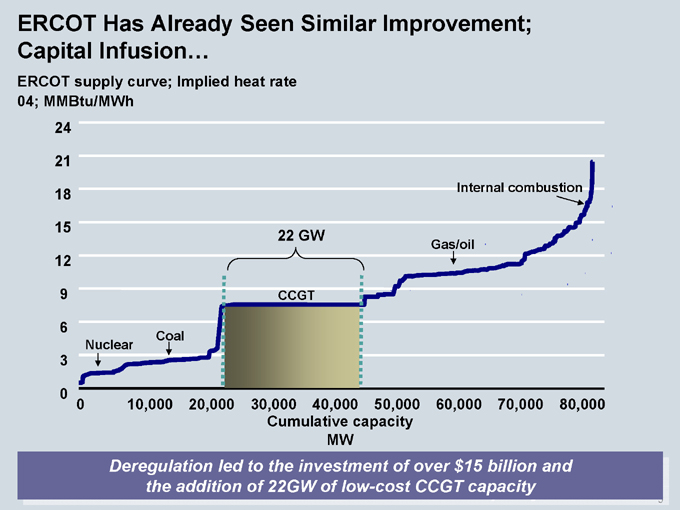

ERCOT Has Already Seen Similar Improvement; Capital Infusion…

ERCOT supply curve; Implied heat rate 04; MMBtu/MWh

24 21 18 15 12 9 6 3 0

0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000

Cumulative capacity MW

Nuclear

Coal

CCGT

22 GW

Gas/oil

Internal combustion

Deregulation led to the investment of over $15 billion and and the addition of 22GW of low-cost CCGT capacity

5

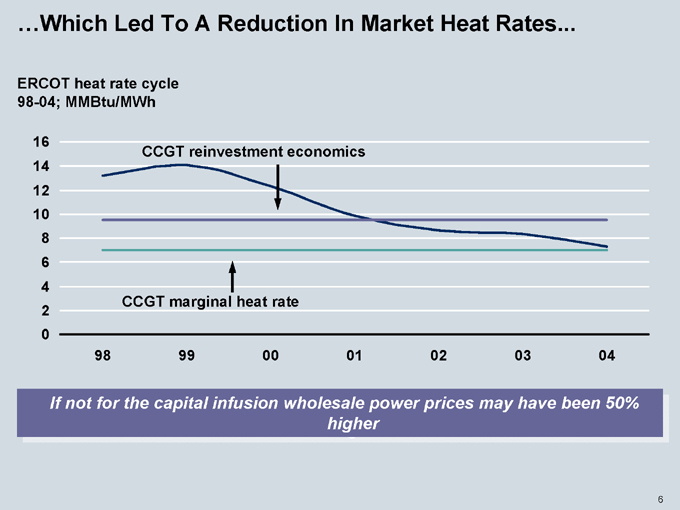

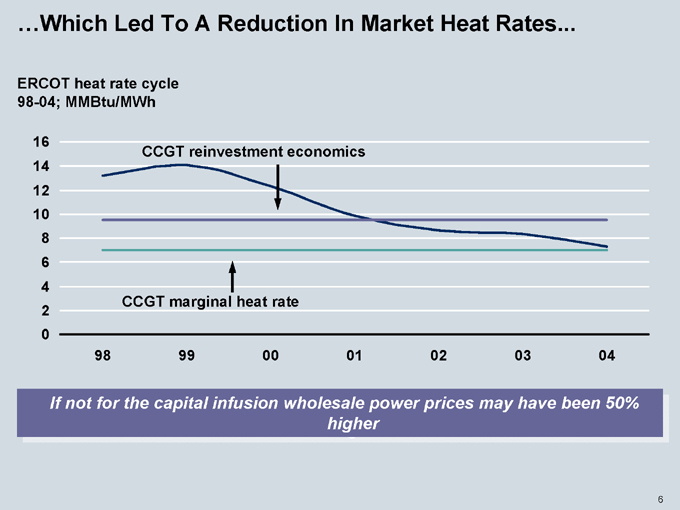

…Which Led To A Reduction In Market Heat Rates…

ERCOT heat rate cycle 98-04; MMBtu/MWh

16 14 12 10 8 6 4 2 0

98 99 00 01 02 03 04

CCGT marginal heat rate

CCGT reinvestment economics

If not for the capital infusion wholesale power prices may have been 50% higher

6

…Strong Retail Competition…

Residential customer switching 04 YTD; Percent

20 19 10 7 6 3 2 2 1 1

TX OH DC NY PA MD MA CT ME CA

ERCOT has the most active de-regulated retail market in the US

Source: KEMA

7

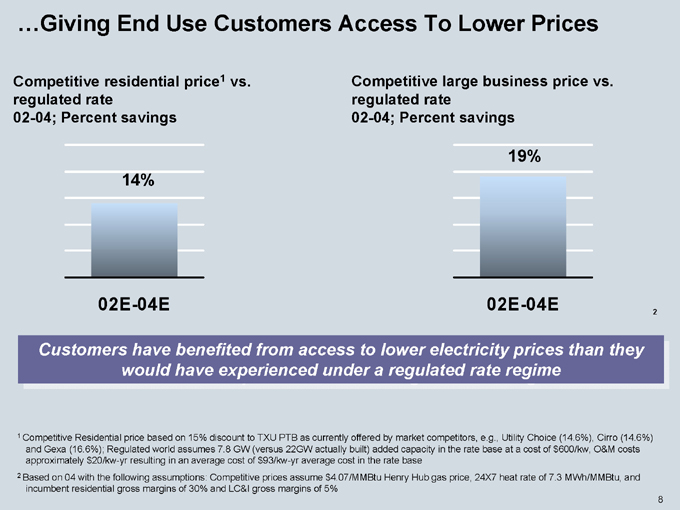

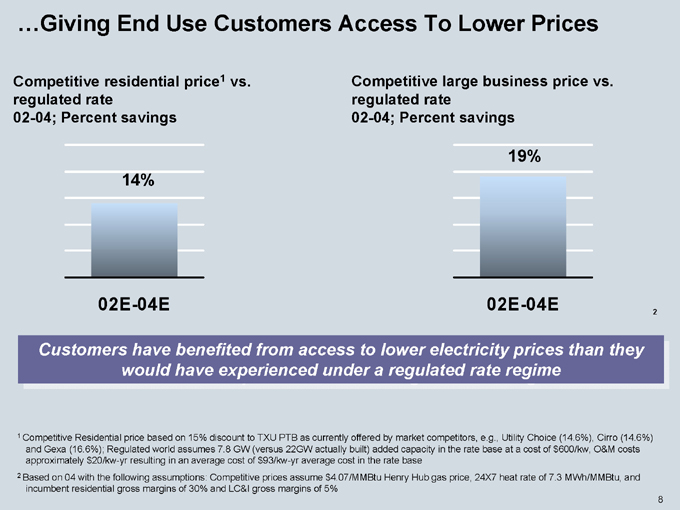

…Giving End Use Customers Access To Lower Prices

Competitive residential price1 vs. regulated rate 02-04; Percent savings

Competitive large business price vs. regulated rate 02-04; Percent savings

14%

19%

02E-04E

02E-04E

2

Customers have benefited from access to lower electricity prices than they would have experienced under a regulated rate regime

1 Competitive Residential price based on 15% discount to TXU PTB as currently offered by market competitors, e.g., Utility Choice (14.6%), Cirro (14.6%) and Gexa (16.6%); Regulated world assumes 7.8 GW (versus 22GW actually built) added capacity in the rate base at a cost of $600/kw, O&M costs approximately $20/kw-yr resulting in an average cost of $93/kw-yr average cost in the rate base

2 Based on 04 with the following assumptions: Competitive prices assume $4.07/MMBtu Henry Hub gas price, 24X7 heat rate of 7.3 MWh/MMBtu, and incumbent residential gross margins of 30% and LC&I gross margins of 5%

8

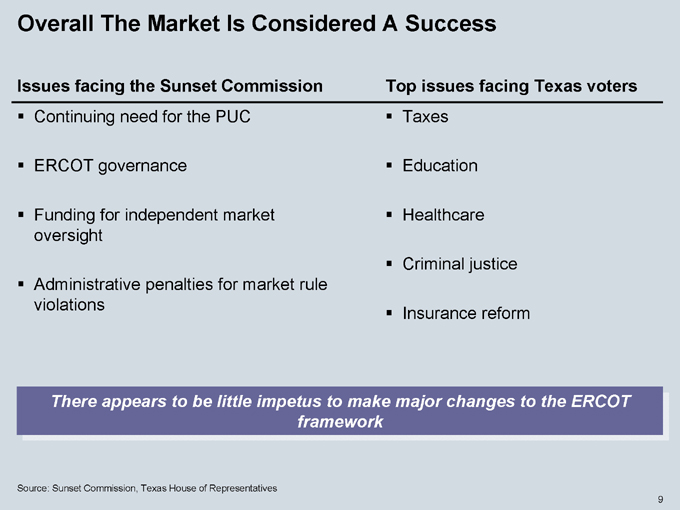

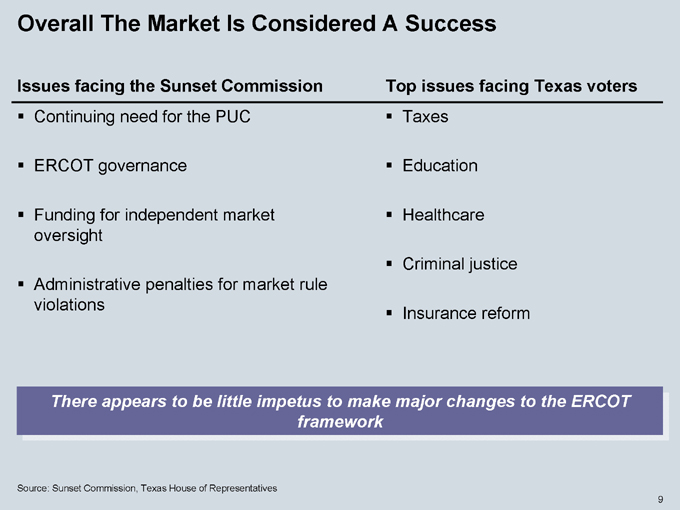

Overall The Market Is Considered A Success

Issues facing the Sunset Commission

Continuing need for the PUC

ERCOT governance

Funding for independent market oversight

Administrative penalties for market rule violations

Top issues facing Texas voters

Taxes

Education

Healthcare

Criminal justice

Insurance reform

There appears to be little impetus to make major changes to the ERCOT framework

Source: Sunset Commission, Texas House of Representatives

9

Today’s Agenda

ERCOT Overview

ERCOT market framework

Impact of deregulation

TXU Competitive Positioning

Three phase restructuring impact

Capital allocation

Summary

Conclusion

10

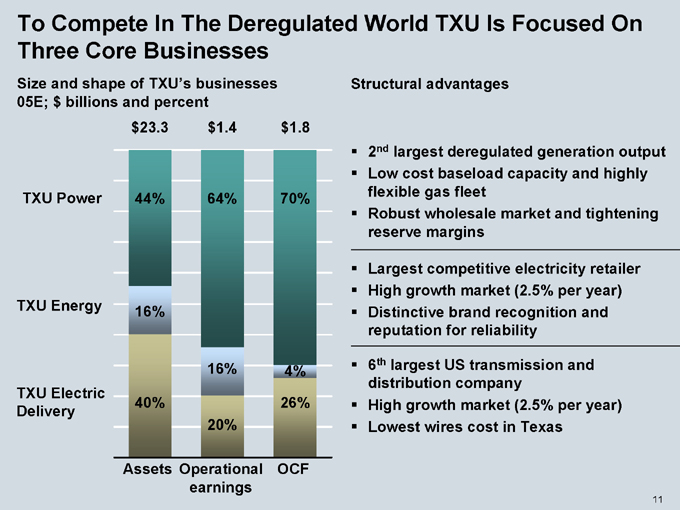

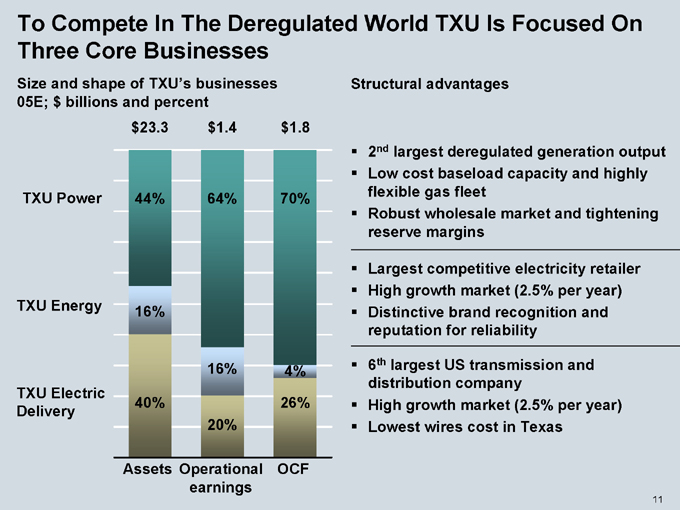

To Compete In The Deregulated World TXU Is Focused On Three Core Businesses

Size and shape of TXU’s businesses 05E; $ billions and percent

TXU Power

TXU Energy

TXU Electric Delivery

Assets

Operational earnings

OCF

40% 20% 26% 16% 16% 4% 44% 64% 70%

$23.3 $1.4 $1.8

Structural advantages

2nd largest deregulated generation output

Low cost baseload capacity and highly flexible gas fleet

Robust wholesale market and tightening reserve margins

Largest competitive electricity retailer

High growth market (2.5% per year)

Distinctive brand recognition and reputation for reliability

6th largest US transmission and distribution company

High growth market (2.5% per year)

Lowest wires cost in Texas

11

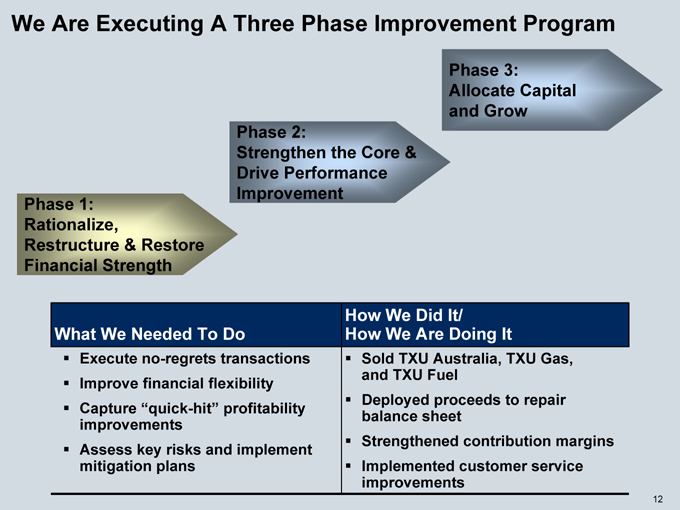

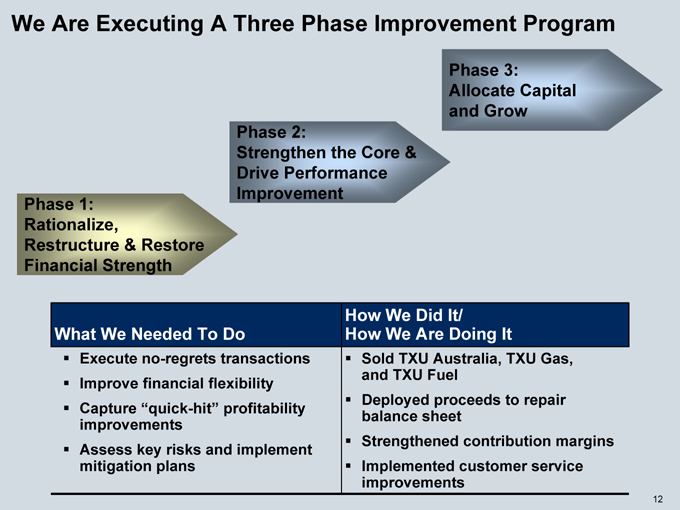

We Are Executing A Three Phase Improvement Program

Phase 1: Rationalize, Restructure & Restore Financial Strength

Phase 2: Strengthen the Core & Drive Performance Improvement

Phase 3: Allocate Capital and Grow

What We Needed To Do

Execute no-regrets transactions

Improve financial flexibility

Capture “quick-hit” profitability improvements

Assess key risks and implement mitigation plans

How We Did It/ How We Are Doing It

Sold TXU Australia, TXU Gas, and TXU Fuel

Deployed proceeds to repair balance sheet

Strengthened contribution margins

Implemented customer service improvements

12

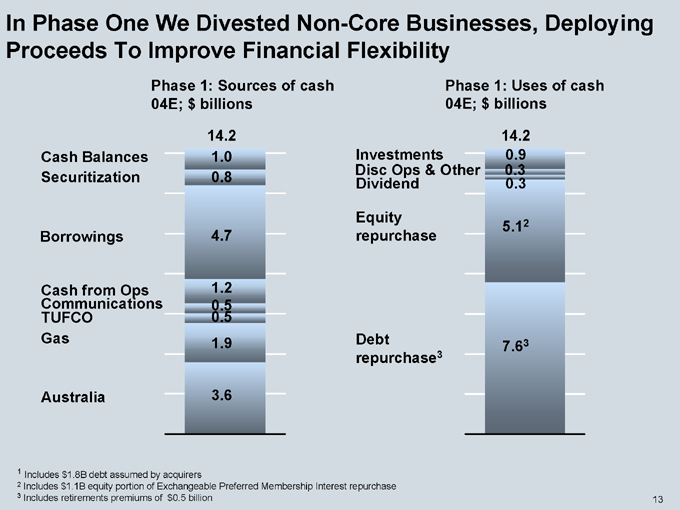

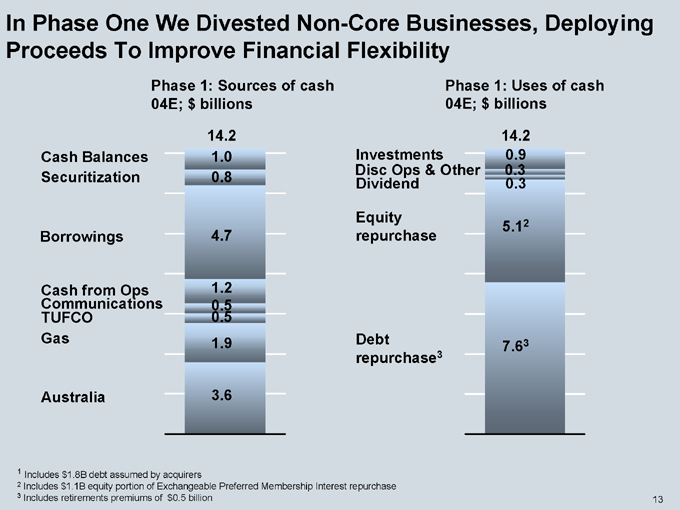

In Phase One We Divested Non-Core Businesses, Deploying Proceeds To Improve Financial Flexibility

Phase 1: Sources of cash 04E; $ billions

Cash Balances Securitization

Borrowings

Cash from Ops Communications TUFCO

Gas

Australia

3.6

1.9

0.5

0.5

1.2

14.2

1.0

0.8

4.7

Phase 1: Uses of cash 04E; $ billions

Investments Disc Ops & Other Dividend

Equity repurchase

Debt repurchase3

14.2

0.9

0.3

0.3

5.12

7.63

1 Includes $1.8B debt assumed by acquirers

2 Includes $1.1B equity portion of Exchangeable Preferred Membership Interest repurchase

3 Includes retirements premiums of $0.5 billion

13

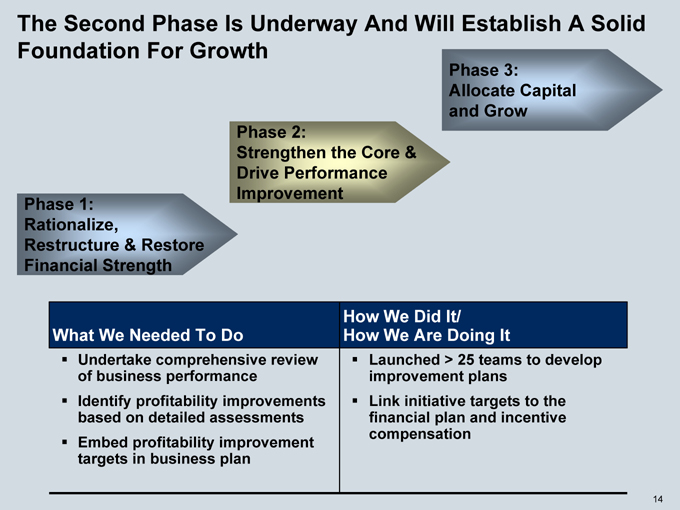

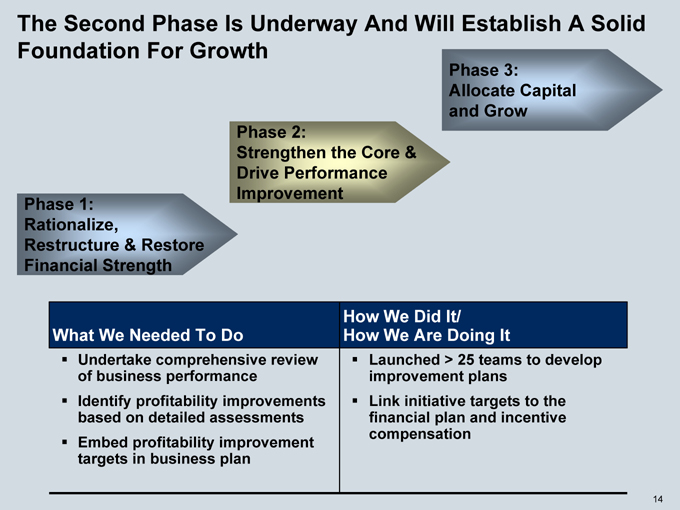

The Second Phase Is Underway And Will Establish A Solid Foundation For Growth

Phase 3: Allocate Capital and Grow

Phase 2: Strengthen the Core & Drive Performance Improvement

Phase 1: Rationalize, Restructure & Restore Financial Strength

What We Needed To Do

Undertake comprehensive review of business performance

Identify profitability improvements based on detailed assessments

Embed profitability improvement targets in business plan

How We Did It/ How We Are Doing It

Launched > 25 teams to develop improvement plans

Link initiative targets to the financial plan and incentive compensation

14

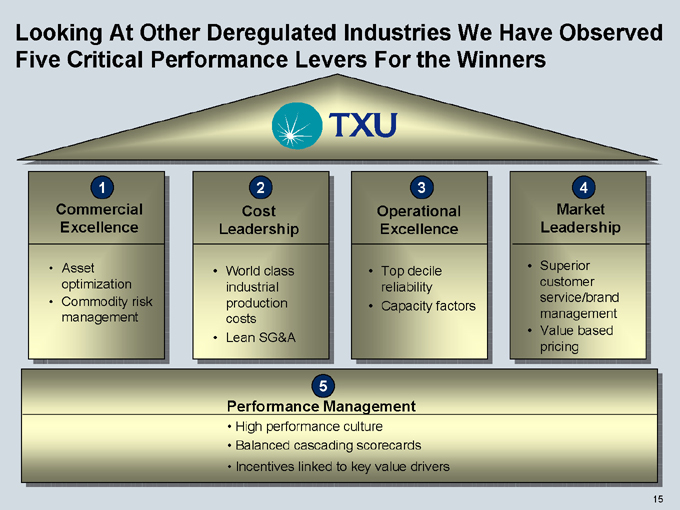

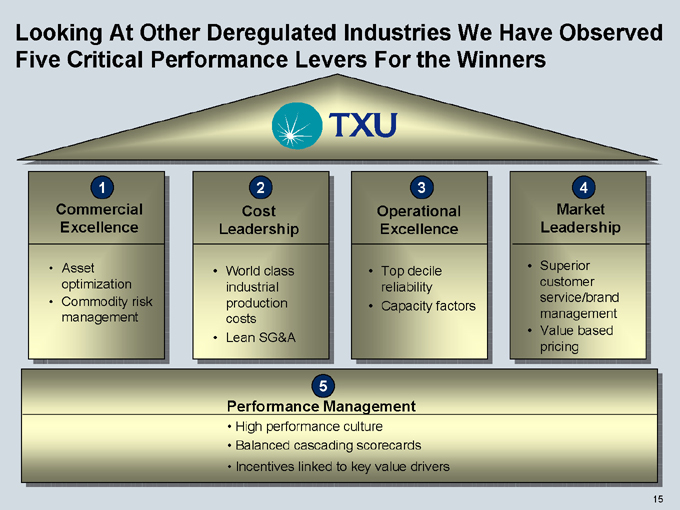

Looking At Other Deregulated Industries We Have Observed Five Critical Performance Levers For the Winners

TXU

1 Commercial Excellence

Asset optimization

Commodity risk management

2 Cost Leadership

World class industrial production costs

Lean SG&A

3 Operational Excellence

Top decile reliability

Capacity factors

4 Market Leadership

Superior customer service/brand management

Value based pricing

5

Performance Management

High performance culture

Balanced cascading scorecards

Incentives linked to key value drivers

15

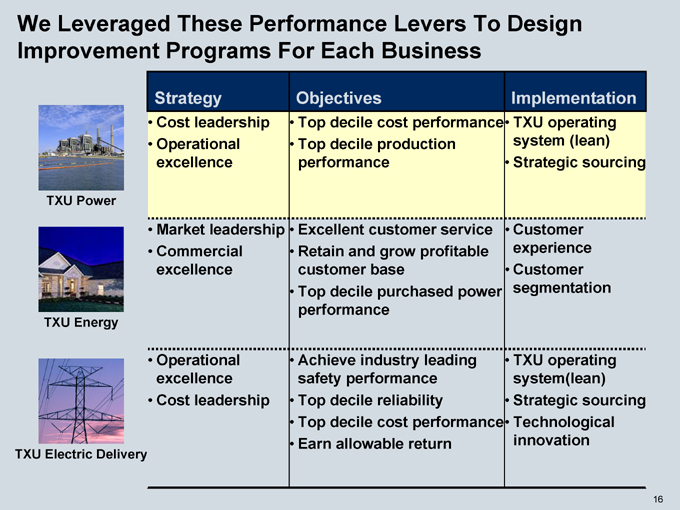

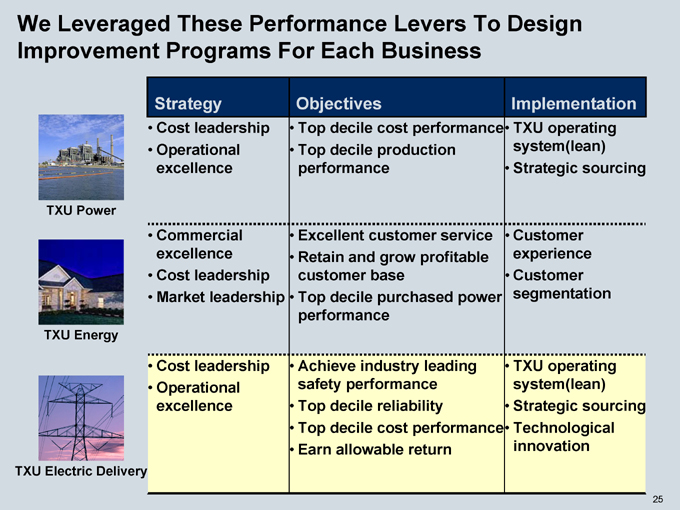

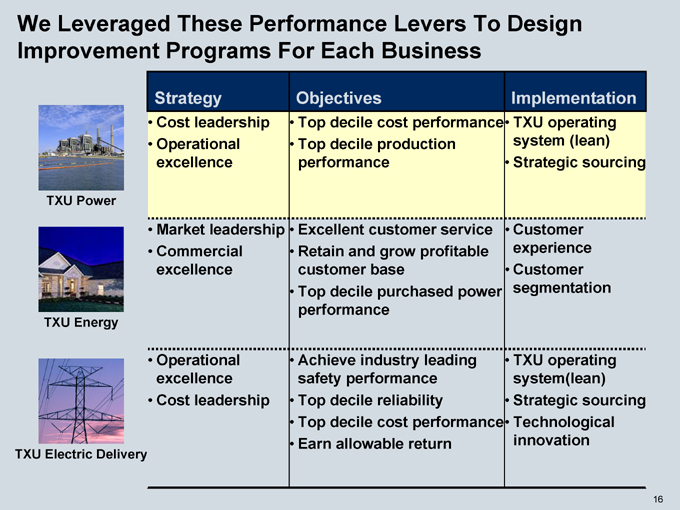

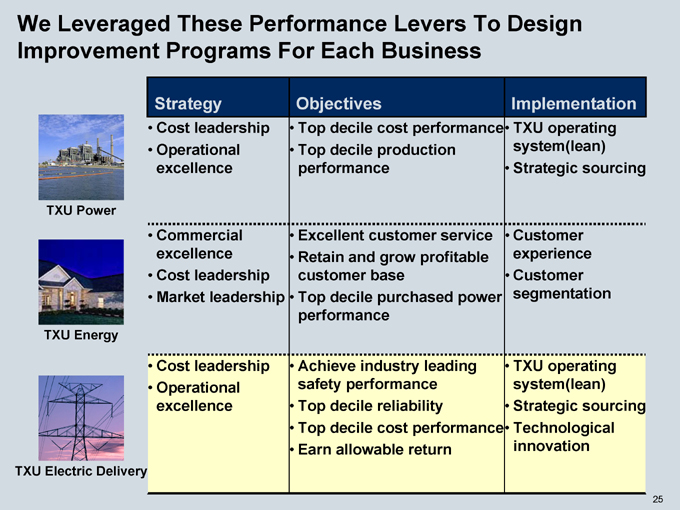

We Leveraged These Performance Levers To Design Improvement Programs For Each Business

TXU Power

TXU Energy

TXU Electric Delivery

Strategy

Cost leadership

Operational excellence

Objectives

Top decile cost performance

Top decile production performance

Implementation

TXU operating system (lean)

Strategic sourcing

Market leadership

Commercial excellence

Excellent customer service

Retain and grow profitable customer base

Top decile purchased power performance

Customer experience

Customer segmentation

Operational excellence

Cost leadership

Achieve industry leading safety performance

Top decile reliability

Top decile cost performance

Earn allowable return

TXU operating system(lean)

Strategic sourcing

Technological innovation

16

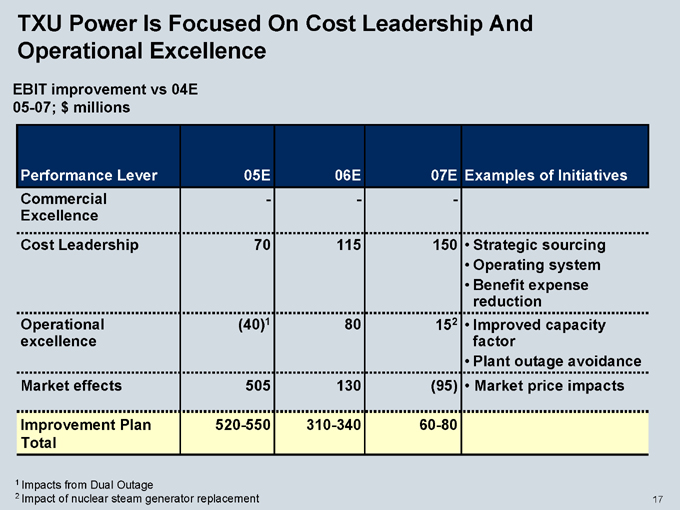

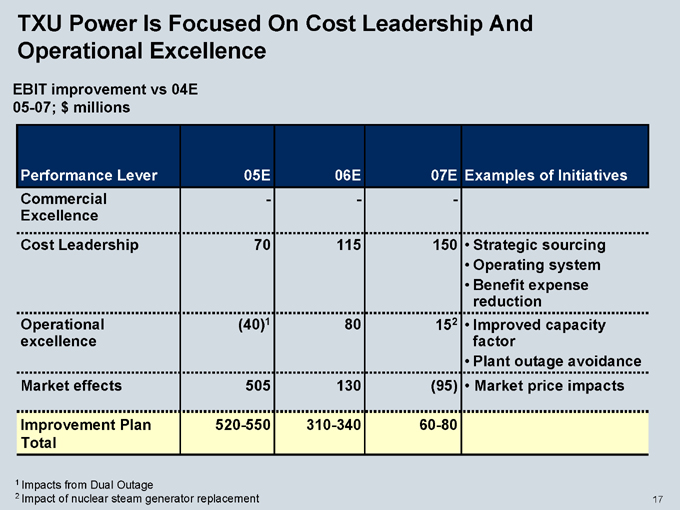

TXU Power Is Focused On Cost Leadership And Operational Excellence

EBIT improvement vs 04E 05-07; $ millions

Performance Lever 05E 06E 07E Examples of Initiatives

Commercial Excellence—- -

Cost Leadership 70 115 150

Strategic sourcing

Operating system

Benefit expense reduction

Operational excellence (40)1 80 152

Improved capacity factor

Plant outage avoidance

Market effects 505 130 (95)

Market price impacts

Improvement Plan Total 520-550 310-340 60-80

1 Impacts from Dual Outage

2 Impact of nuclear steam generator replacement

17

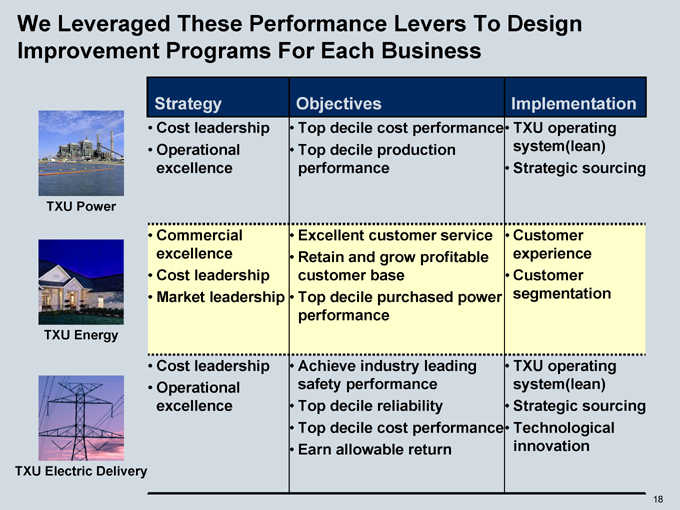

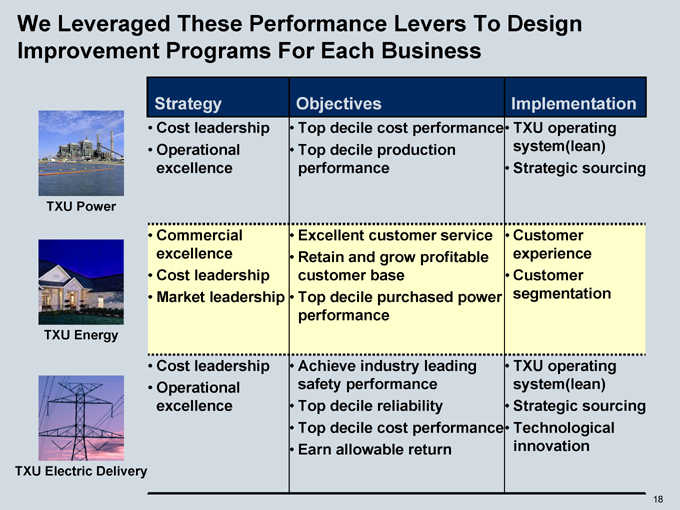

We Leveraged These Performance Levers To Design Improvement Programs For Each Business

TXU Power

Strategy

Cost leadership

Operational excellence

Objectives

Top decile cost performance

Top decile production performance

Implementation

TXU operating system(lean)

Strategic sourcing

TXU Energy

Commercial excellence

Cost leadership

Market leadership

Excellent customer service

Retain and grow profitable customer base

Top decile purchased power performance

Customer experience

Customer segmentation

TXU Electric Delivery

Cost leadership

Operational excellence

Achieve industry leading safety performance

Top decile reliability

Top decile cost performance

Earn allowable return

TXU operating system(lean)

Strategic sourcing

Technological innovation

18

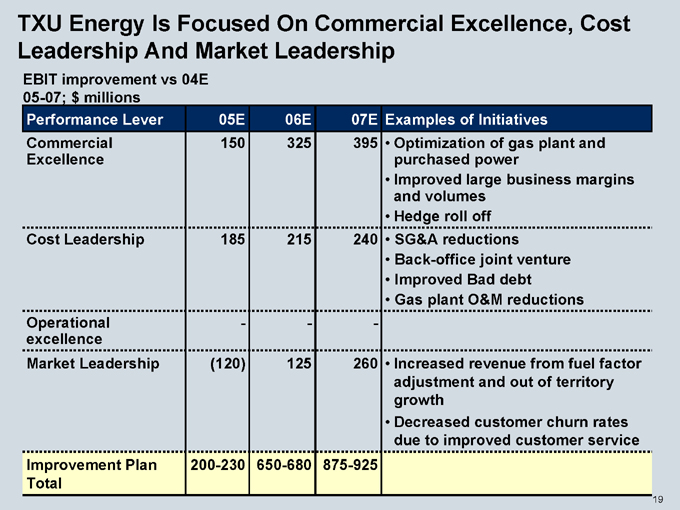

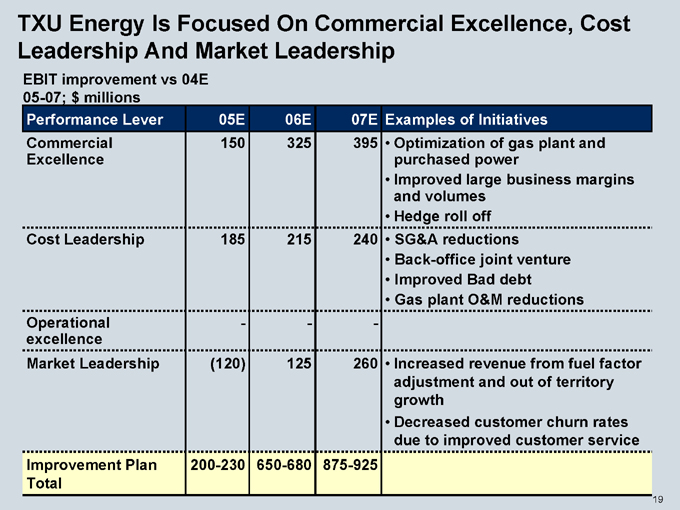

TXU Energy Is Focused On Commercial Excellence, Cost Leadership And Market Leadership

EBIT improvement vs 04E 05-07; $ millions

Performance Lever 05E 06E 07E Examples of Initiatives

Commercial Excellence 150 325 395

Optimization of gas plant and purchased power

Improved large business margins and volumes

Hedge roll off

Cost Leadership 185 215 240

SG&A reductions

Back-office joint venture

Improved Bad debt

Gas plant O&M reductions

Operational excellence—- -

Market Leadership (120) 125 260

Increased revenue from fuel factor adjustment and out of territory growth

Decreased customer churn rates due to improved customer service

Improvement Plan Total 200-230 650-680 875-925

19

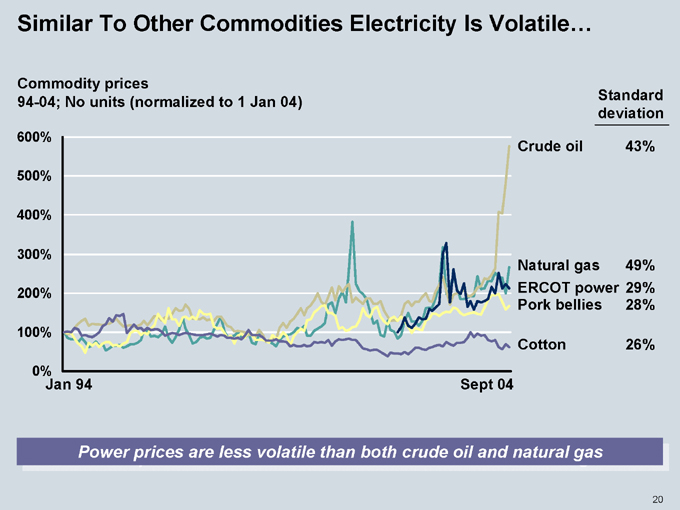

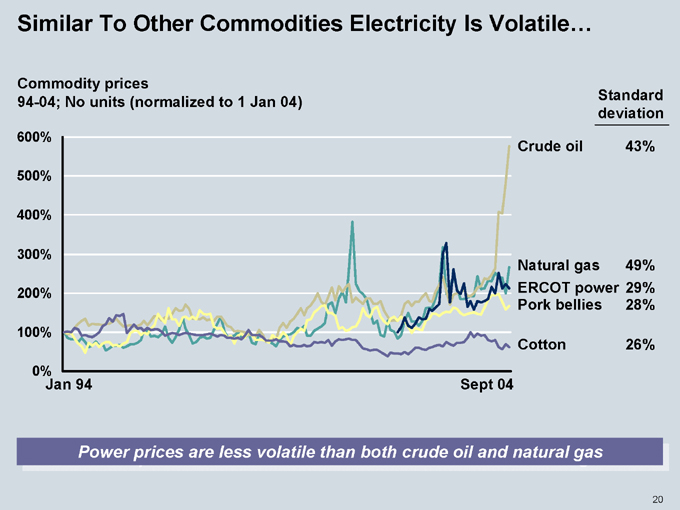

Similar To Other Commodities Electricity Is Volatile…

Commodity prices

94-04; No units (normalized to 1 Jan 04)

Standard deviation

600% 500% 400% 300% 200% 100% 0%

Jan 94

Sept 04

Crude oil 43%

Natural gas 49%

ERCOT power 29% Pork bellies 28%

Cotton 26%

Power prices are less volatile than both crude oil and natural gas

20

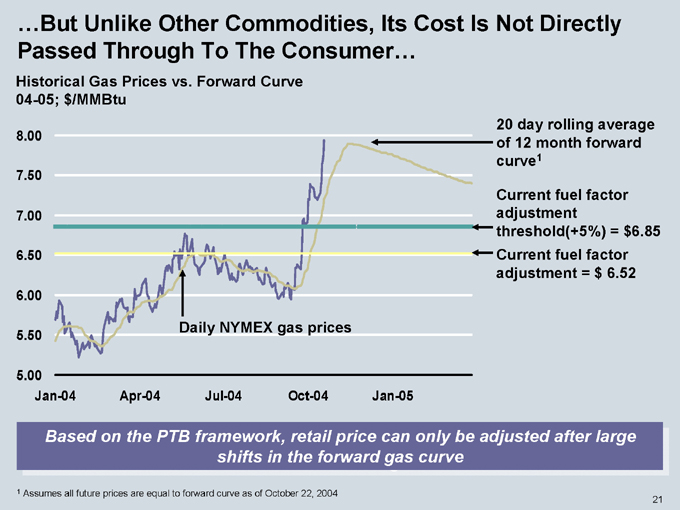

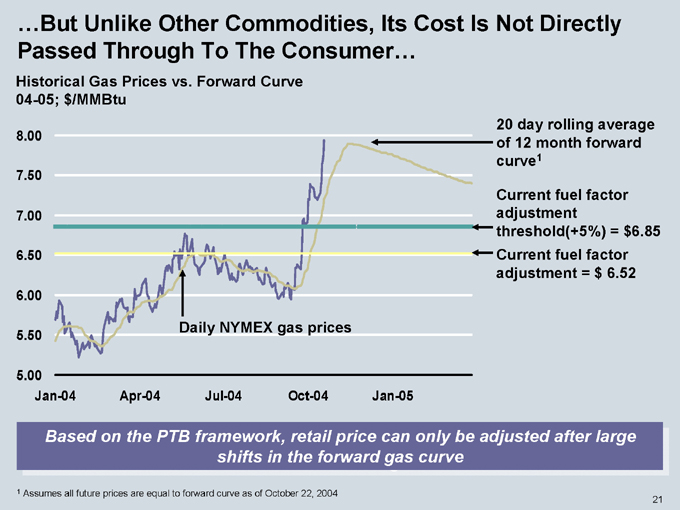

…But Unlike Other Commodities, Its Cost Is Not Directly Passed Through To The Consumer…

Historical Gas Prices vs. Forward Curve 04-05; $/MMBtu

8.00 7.50 7.00 6.50 6.00 5.50 5.00

Jan-04 Apr-04 Jul-04 Oct-04 Jan-05

Daily NYMEX gas prices

20 day rolling average of 12 month forward curve1

Current fuel factor adjustment threshold(+5%) = $6.85 Current fuel factor adjustment = $ 6.52

Based on the PTB framework, retail price can only be adjusted after large shifts in the forward gas curve

1 Assumes all future prices are equal to forward curve as of October 22, 2004

21

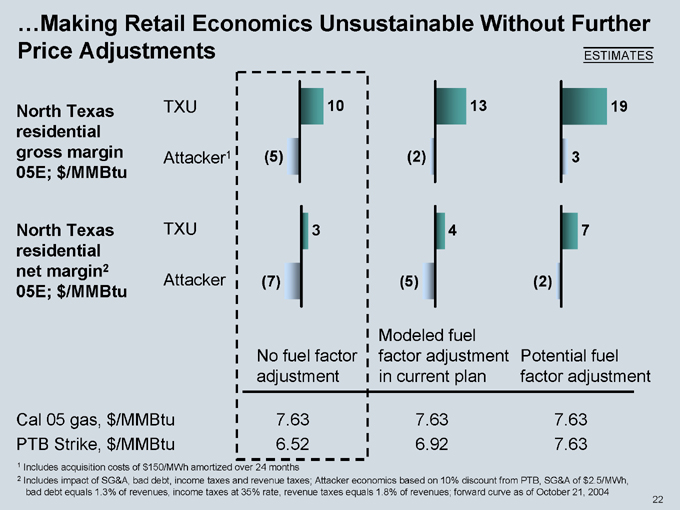

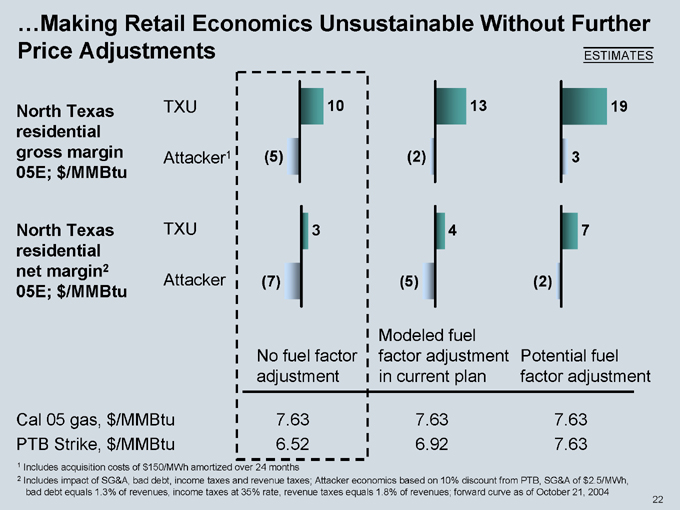

…Making Retail Economics Unsustainable Without Further Price Adjustments

ESTIMATES

North Texas TXU 10 13 19 residential gross margin Attacker1 (5) (2) 3 05E; $/MMBtu

North Texas TXU 3 4 7 residential net margin2

Attacker (7) (5) (2)

05E; $/MMBtu

No fuel factor adjustment

Modeled fuel factor adjustment in current plan

Potential fuel factor adjustment

Cal 05 gas, $/MMBtu 7.63 7.63 7.63 PTB Strike, $/MMBtu 6.52 6.92 7.63

1 Includes acquisition costs of $150/MWh amortized over 24 months

2 Includes impact of SG&A, bad debt, income taxes and revenue taxes; Attacker economics based on 10% discount from PTB, SG&A of $2.5/MWh, bad debt equals 1.3% of revenues, income taxes at 35% rate, revenue taxes equals 1.8% of revenues; forward curve as of October 21, 2004

22

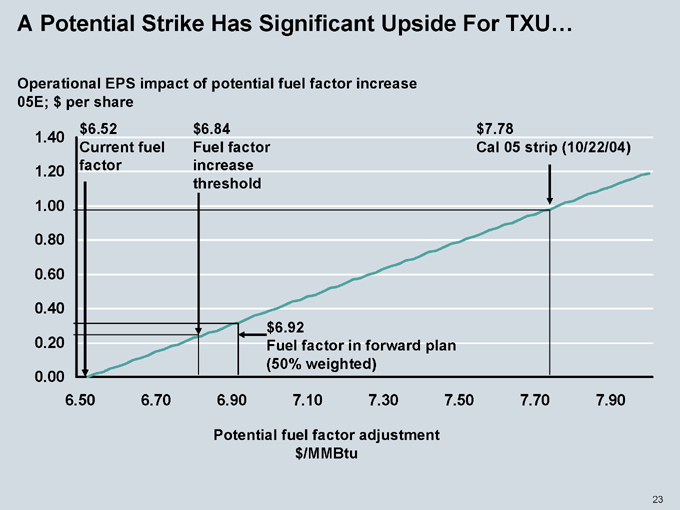

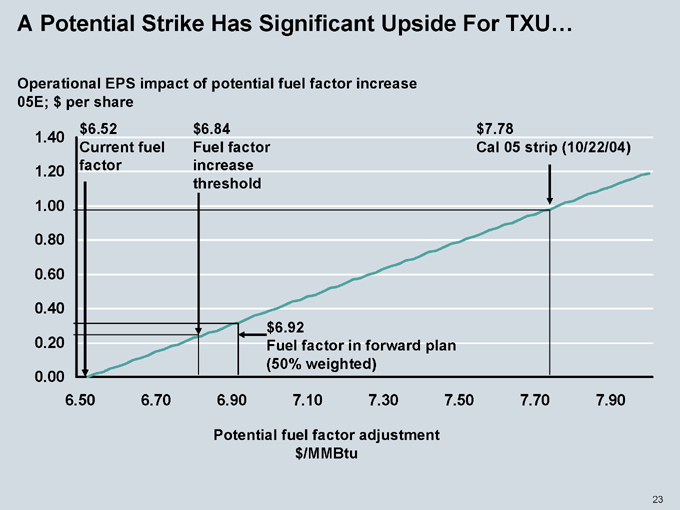

A Potential Strike Has Significant Upside For TXU…

Operational EPS impact of potential fuel factor increase 05E; $ per share

1.40 1.20 1.00 0.80 0.60 0.40 0.20 0.00

6.50 6.70 6.90 7.10 7.30 7.50 7.70 7.90 $6.52 Current fuel factor $6.84 Fuel factor increase threshold $7.78

Cal 05 strip (10/22/04) $6.92

Fuel factor in forward plan (50% weighted)

Potential fuel factor adjustment $/MMBtu

23

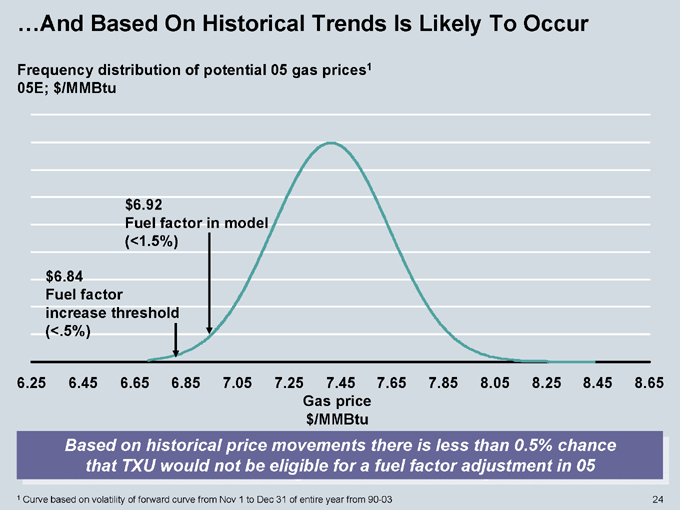

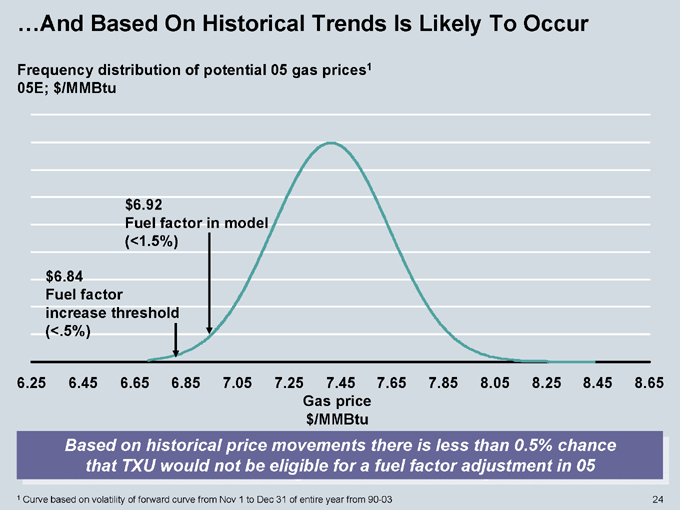

…And Based On Historical Trends Is Likely To Occur

Frequency distribution of potential 05 gas prices1 05E; $/MMBtu $6.92

Fuel factor in model (<1.5%) $6.84 Fuel factor increase threshold (<.5%)

6.25 6.45 6.65 6.85 7.05 7.25 7.45 7.65 7.85 8.05 8.25 8.45 8.65

Gas price $/MMBtu

Based on historical price movements there is less than 0.5% chance that TXU would not be eligible for a fuel factor adjustment in 05

1 Curve based on volatility of forward curve from Nov 1 to Dec 31 of entire year from 90-03

24

We Leveraged These Performance Levers To Design Improvement Programs For Each Business

Strategy

Objectives

Implementation

TXU Power

TXU Energy

TXU Electric Delivery

Cost leadership Operational excellence

Top decile cost performance Top decile production performance

TXU operating system(lean) Strategic sourcing

Commercial excellence Cost leadership Market leadership

Excellent customer service Retain and grow profitable customer base Top decile purchased power performance

Customer experience Customer segmentation

Cost leadership Operational excellence

Achieve industry leading safety performance Top decile reliability Top decile cost performance Earn allowable return

TXU operating system(lean) Strategic sourcing Technological innovation

25

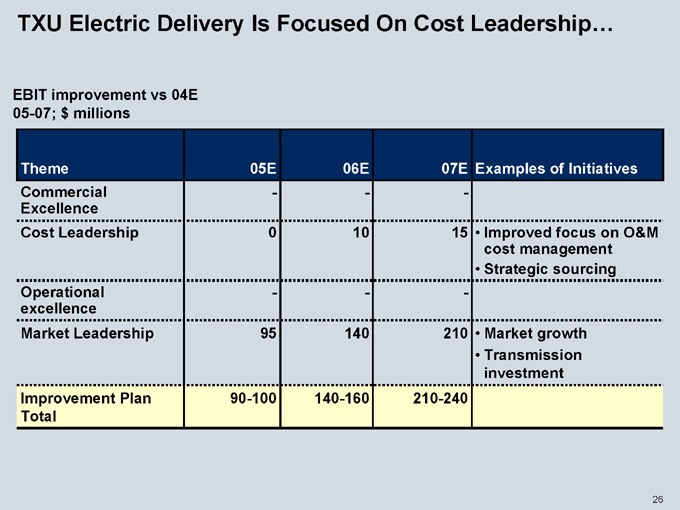

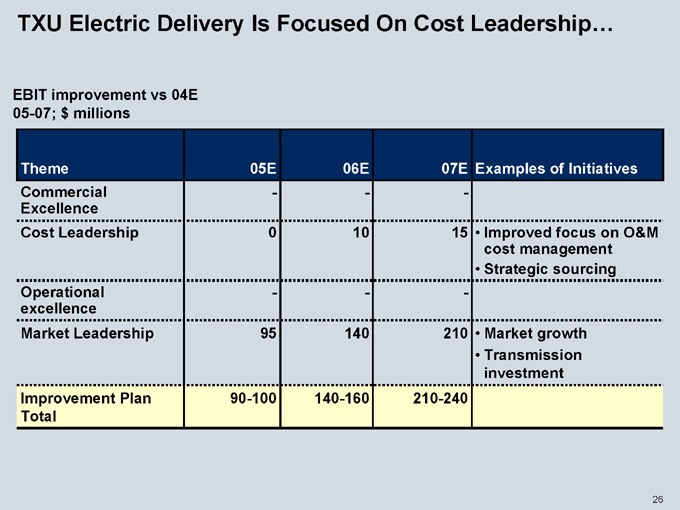

TXU Electric Delivery Is Focused On Cost Leadership…

EBIT improvement vs 04E 05-07; $ millions

Theme 05E 06E 07E Examples of Initiatives

Commercial Excellence Cost Leadership

Operational excellence Market Leadership

Improvement Plan Total

- - -

0 10 15

- - -

95 140 210

90-100 140-160 210-240

Improved focus on O&M cost management Strategic sourcing

Market growth Transmission investment

26

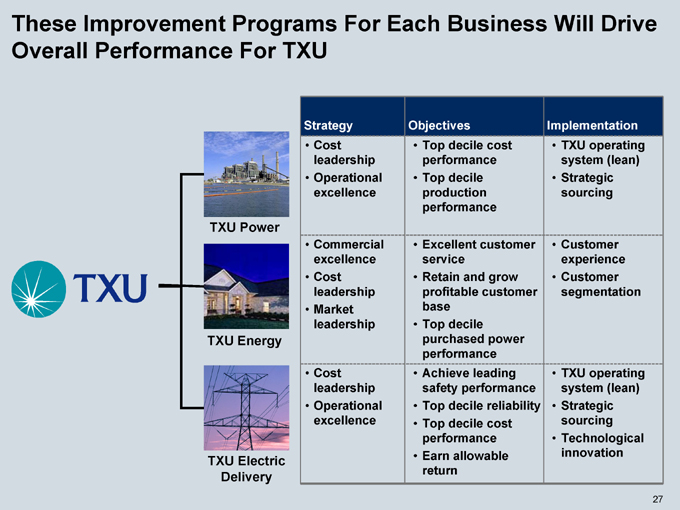

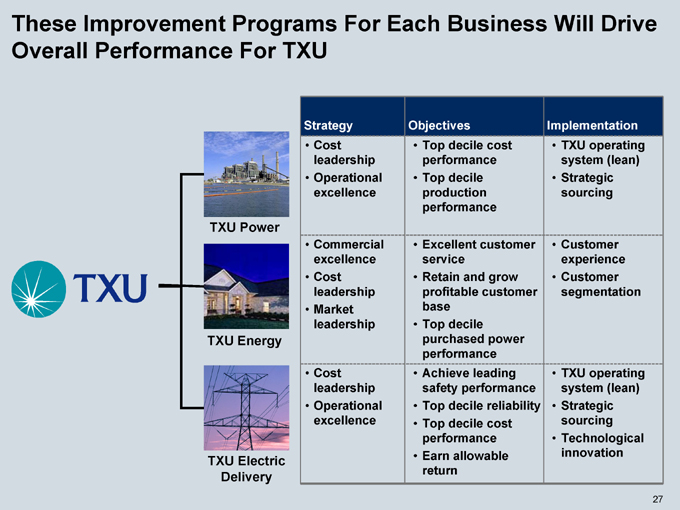

These Improvement Programs For Each Business Will Drive Overall Performance For TXU

TXU Power

TXU Energy

TXU Electric Delivery

Strategy Objectives Implementation

Cost leadership Operational excellence

Commercial excellence Cost leadership Market leadership

Cost leadership Operational excellence

Top decile cost performance Top decile production performance

Excellent customer service Retain and grow profitable customer base Top decile purchased power performance Achieve leading safety performance Top decile reliability Top decile cost performance Earn allowable return

TXU operating system (lean) Strategic sourcing

Customer experience Customer segmentation

TXU operating system (lean) Strategic sourcing Technological innovation

27

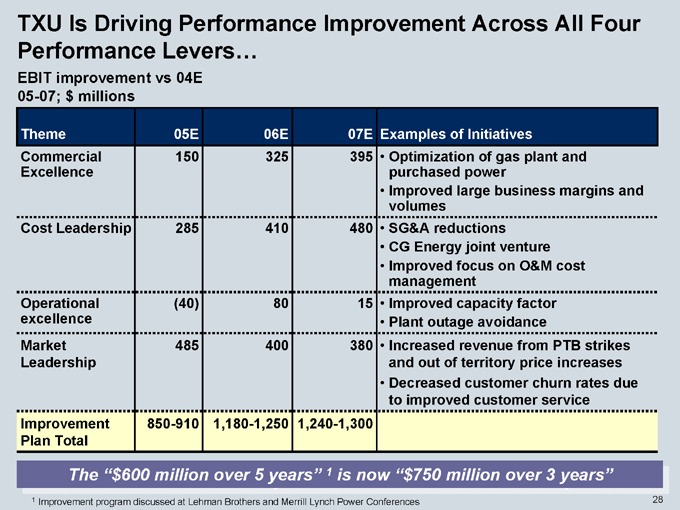

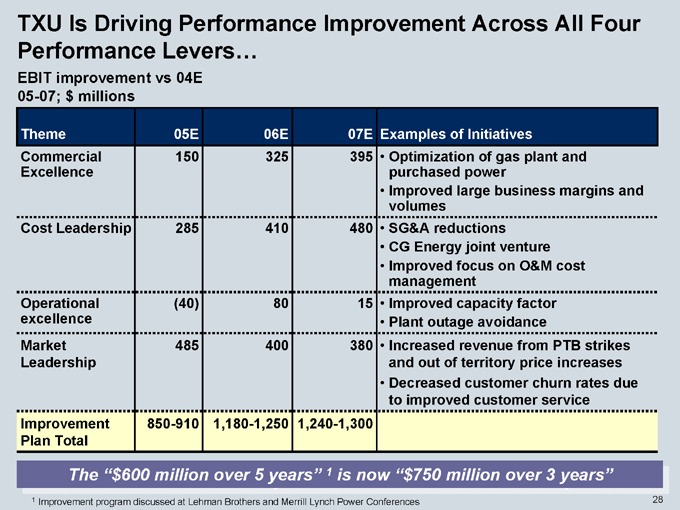

TXU Is Driving Performance Improvement Across All Four Performance Levers…

EBIT improvement vs 04E 05-07; $ millions

Theme 05E 06E 07E Examples of Initiatives

Commercial Excellence

Cost Leadership

Operational excellence Market Leadership

Improvement Plan Total

150 325 395

285 410 480

(40) 80 15

485 400 380

850-910 1,180-1,250 1,240-1,300

Optimization of gas plant and purchased power

Improved large business margins and volumes SG&A reductions CG Energy joint venture Improved focus on O&M cost management Improved capacity factor Plant outage avoidance Increased revenue from PTB strikes and out of territory price increases Decreased customer churn rates due to improved customer service

The “$600 million over 5 years” 1 is now “$750 million over 3 years”

1 Improvement program discussed at Lehman Brothers and Merrill Lynch Power Conferences

28

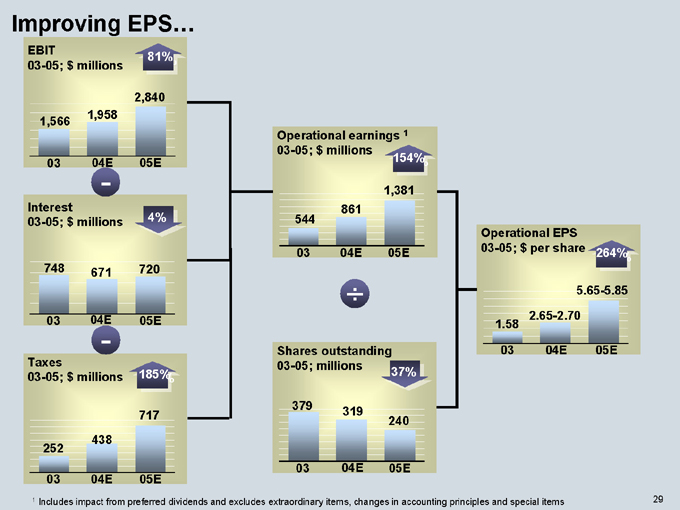

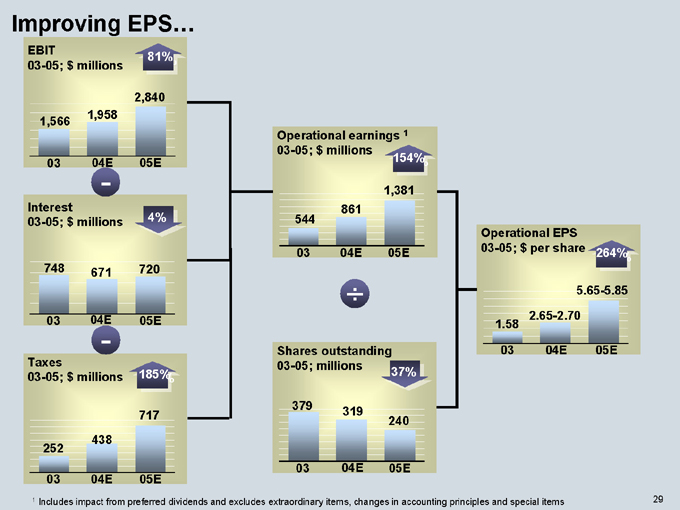

Improving EPS…

EBIT 03-05; $ millions

81%

1,566

1,958

2,840

03 04E 05E

-

Interest

03-05; $ millions

4%

748 671 720

03 04E 05E

-

Taxes

03-05; $ millions

185%

252

438

717

03 04E 05E

Operational earnings 1 03-05; $ millions

154%

544

861

1,381

03 04E 05E

÷

Shares outstanding 03-05; millions

37%

379

319

240

03 04E 05E

Operational EPS 03-05; $ per share

264%

1.58

2.65-2.70

5.65-5.85

03 04E 05E

1 Includes impact from preferred dividends and excludes extraordinary items, changes in accounting principles and special items

29

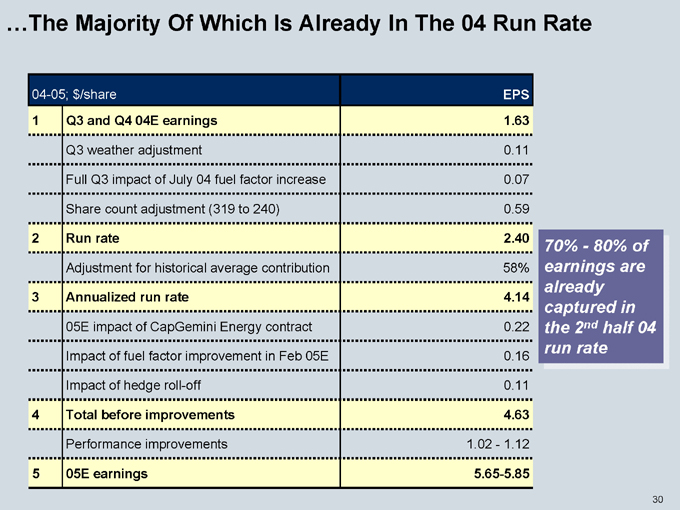

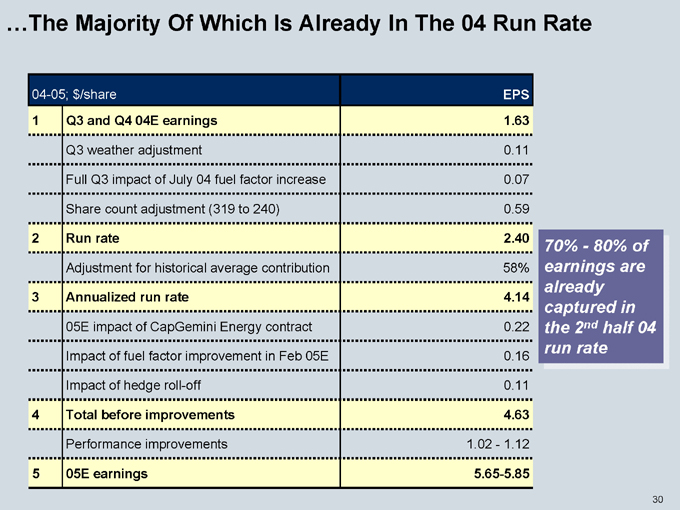

…The Majority Of Which Is Already In The 04 Run Rate

04-05; $/share EPS

1 Q3 and Q4 04E earnings 1.63

Q3 weather adjustment 0.11

Full Q3 impact of July 04 fuel factor increase 0.07

Share count adjustment (319 to 240) 0.59

2 Run rate 2.40

Adjustment for historical average contribution 58%

3 Annualized run rate 4.14

05E impact of CapGemini Energy contract 0.22

Impact of fuel factor improvement in Feb 05E 0.16

Impact of hedge roll-off 0.11

4 Total before improvements 4.63

Performance improvements 1.02—1.12

5 05E earnings 5.65-5.85

70%—80% of earnings are already captured in the 2nd half 04 run rate

30

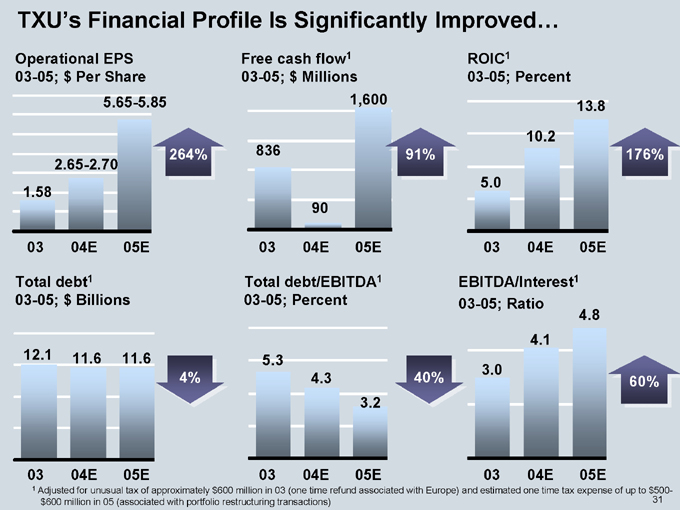

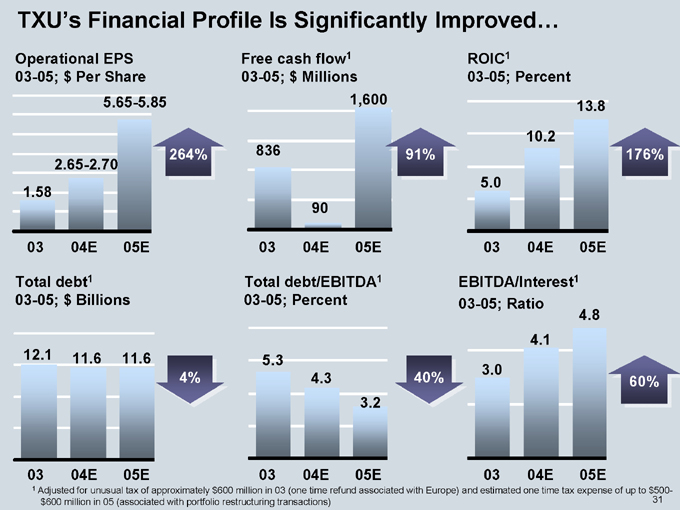

TXU’s Financial Profile Is Significantly Improved…

Operational EPS 03-05; $ Per Share

1.58

2.65-2.70

5.65-5.85

264%

03 04E 05E

Free cash flow1 03-05; $ Millions

836

90

1,600

03 04E 05E

91%

ROIC1 03-05; Percent

5.0

10.2

13.8

176%

03 04E 05E

Total debt1 03-05; $ Billions

12.1 11.6 11.6

03 04E 05E

4%

Total debt/EBITDA1 03-05; Percent

5.3 4.3 3.2

03 04E 05E

40%

EBITDA/Interest1 03-05; Ratio

3.0

4.1

4.8

60%

03 04E 05E

1 Adjusted for unusual tax of approximately $600 million in 03 (one time refund associated with Europe) and estimated one time tax expense of up to $500-$600 million in 05 (associated with portfolio restructuring transactions) 31

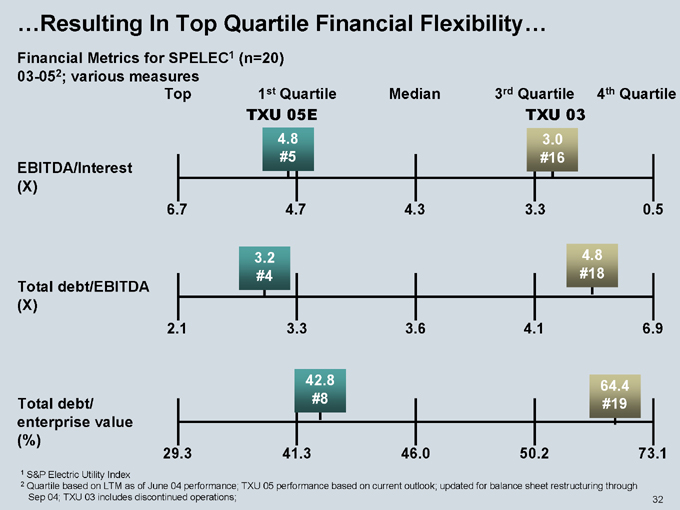

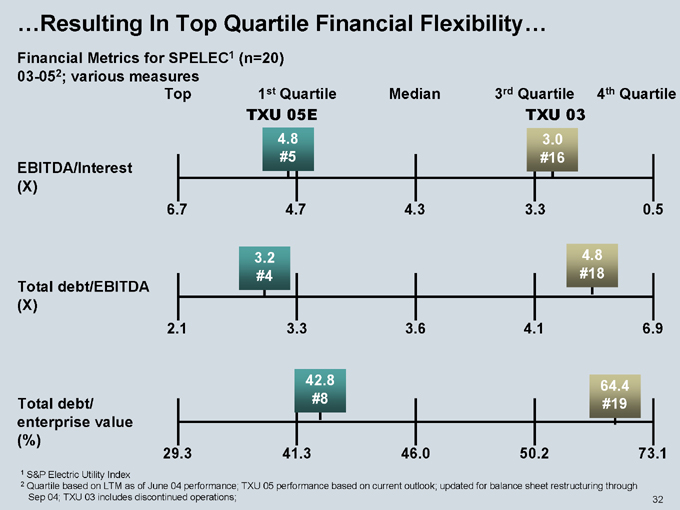

…Resulting In Top Quartile Financial Flexibility…

Financial Metrics for SPELEC1 (n=20) 03-052; various measures

Top 1st Quartile Median 3rd Quartile 4th Quartile

TXU 05E TXU 03

4.8 #5

3.0 #16

EBITDA/Interest (X)

6.7 4.7 4.3 3.3 0.5

Total debt/EBITDA (X)

3.2 #4

4.8 #18

2.1 3.3 3.6 4.1 6.9

Total debt/ enterprise value (%)

42.8 #8

64.4 #19

29.3 41.3 46.0 50.2 73.1

1 S&P Electric Utility Index

2 Quartile based on LTM as of June 04 performance; TXU 05 performance based on current outlook; updated for balance sheet restructuring through Sep 04; TXU 03 includes discontinued operations; 32

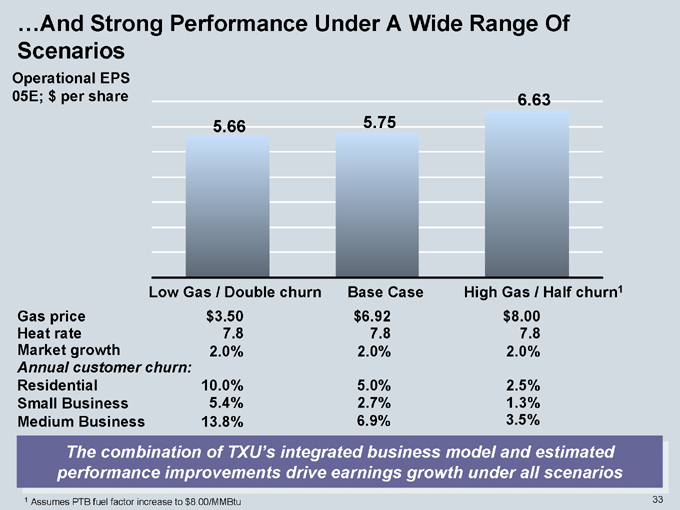

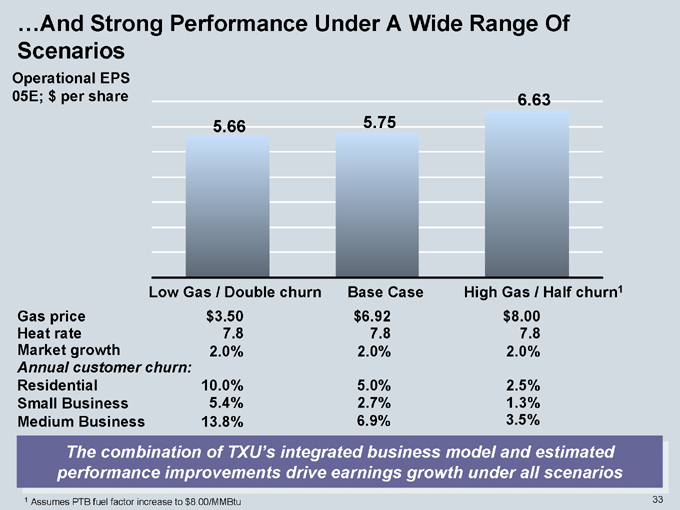

…And Strong Performance Under A Wide Range Of Scenarios

Operational EPS 05E; $ per share

6.63 5.66 5.75

Low Gas / Double churn Base Case High Gas / Half churn1

Gas price $3.50 $6.92 $8.00

Heat rate 7.8 7.8 7.8

Market growth 2.0% 2.0% 2.0%

Annual customer churn:

Residential 10.0% 5.0% 2.5%

Small Business 5.4% 2.7% 1.3%

Medium Business 13.8% 6.9% 3.5%

The combination of TXU’s integrated business model and estimated performance improvements drive earnings growth under all scenarios

1 Assumes PTB fuel factor increase to $8.00/MMBtu 33

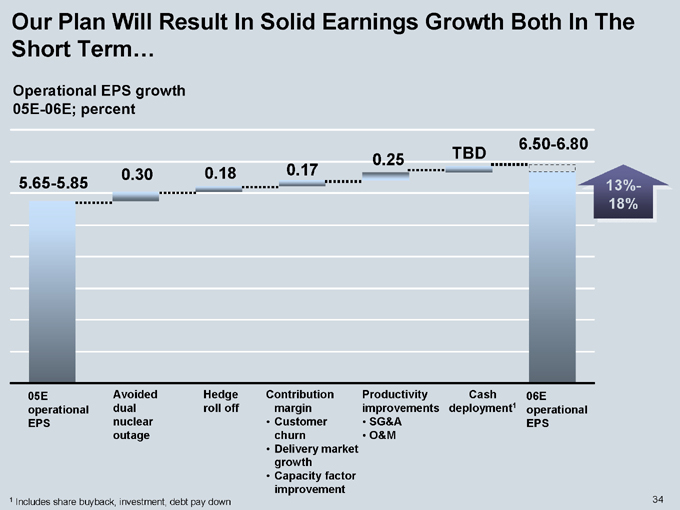

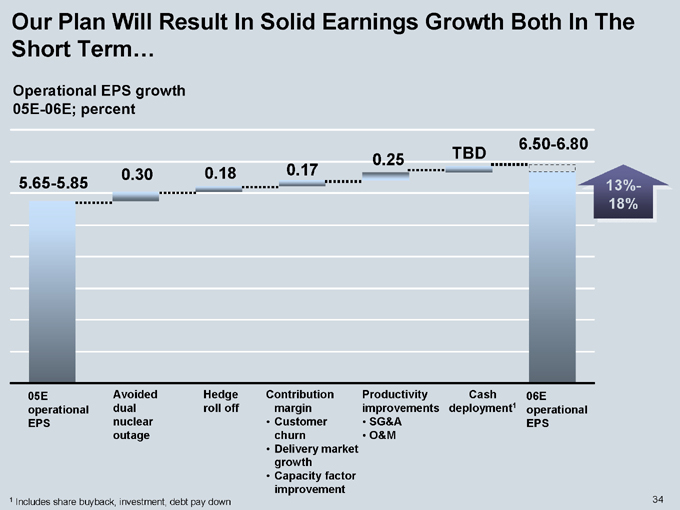

Our Plan Will Result In Solid Earnings Growth Both In The Short Term…

Operational EPS growth 05E-06E; percent

6.50-6.80 0.25 TBD

0.30 0.18 0.17 5.65-5.85

13%-18%

05E operational EPS

Avoided dual nuclear outage

Hedge roll off

Contribution margin

Customer churn

Delivery market growth Capacity factor improvement

Productivity improvements

SG&A O&M

Cash deployment1

06E operational EPS

1 Includes share buyback, investment, debt pay down

34

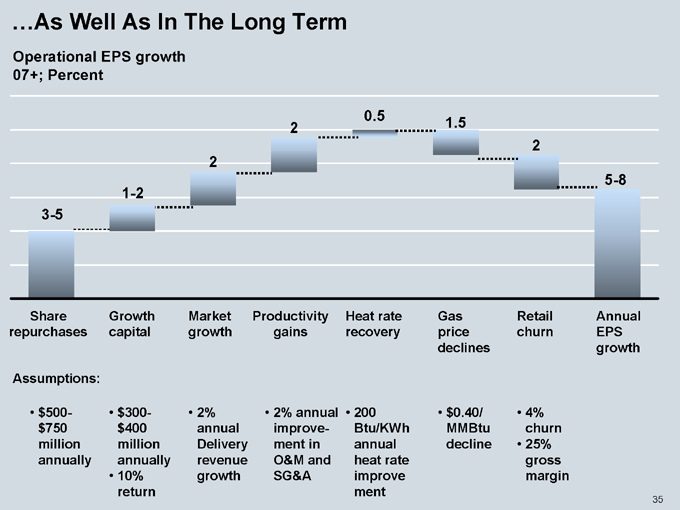

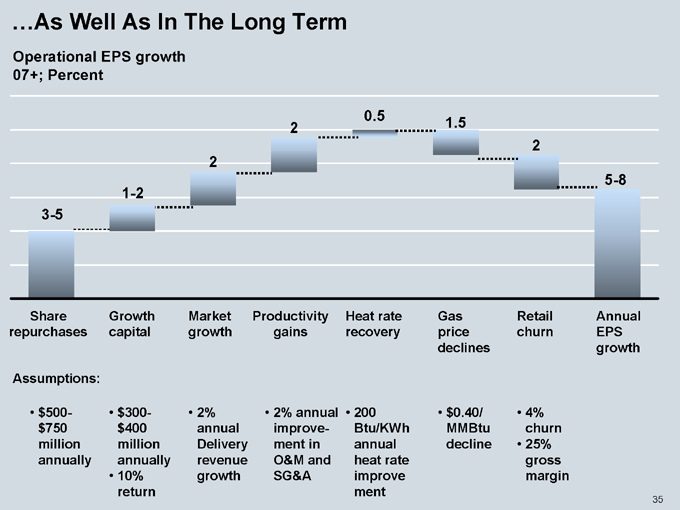

…As Well As In The Long Term

Operational EPS growth 07+; Percent

0.5

2 1.5

2 2

5-8 1-2 3-5

Share repurchases

Growth capital

Market growth

Productivity gains

Heat rate recovery

Gas price declines

Retail churn

Annual EPS growth

Assumptions:

$500-$750 million annually

$300-$400 million annually 10% return

2% annual Delivery revenue growth

2% annual improvement in O&M and SG&A

200 Btu/KWh annual heat rate improvement

$0.40/MMBtu decline

4% churn 25% gross margin

35

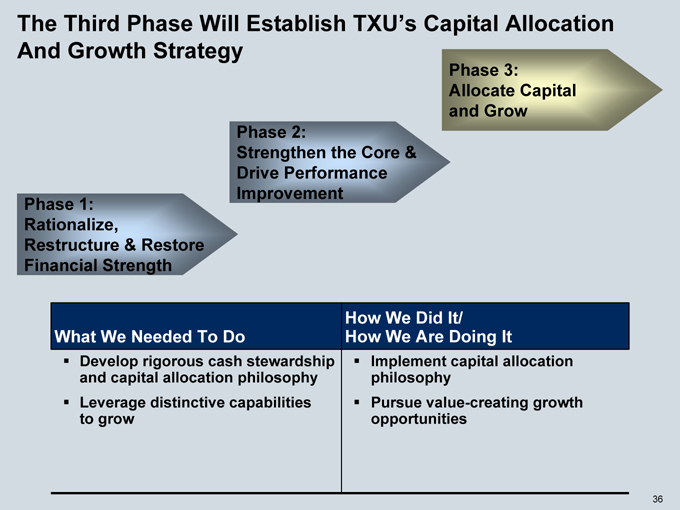

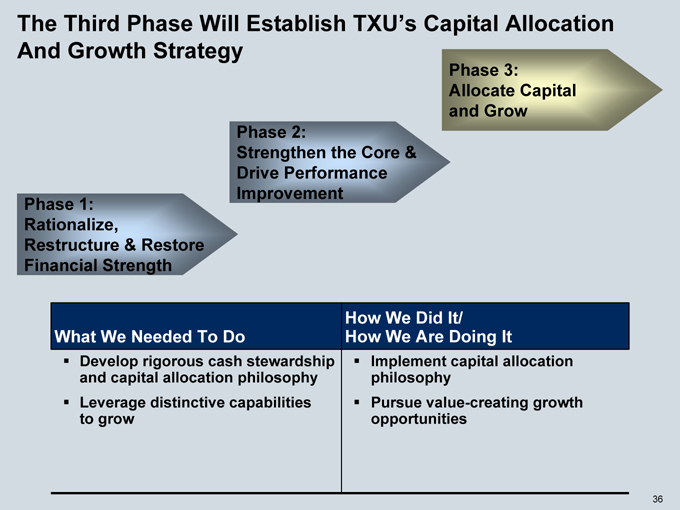

The Third Phase Will Establish TXU’s Capital Allocation And Growth Strategy

Phase 1: Rationalize,

Restructure & Restore Financial Strength

Phase 2:

Strengthen the Core & Drive Performance Improvement

Phase 3: Allocate Capital and Grow

What We Needed To Do

Develop rigorous cash stewardship and capital allocation philosophy Leverage distinctive capabilities to grow

How We Did It/ How We Are Doing It

Implement capital allocation philosophy Pursue value-creating growth opportunities

36

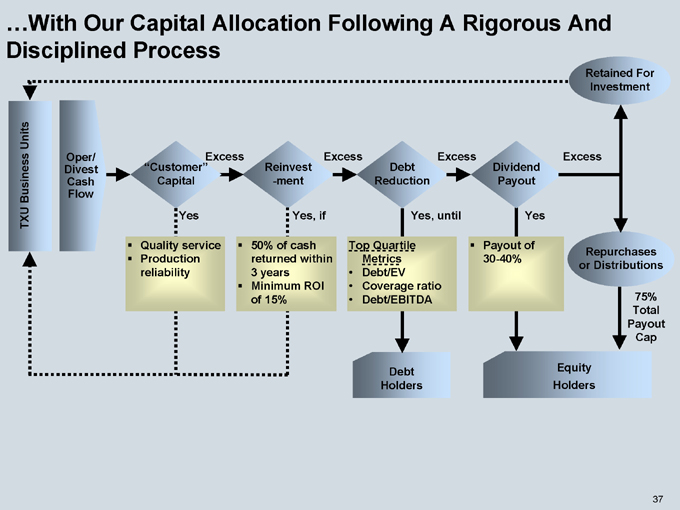

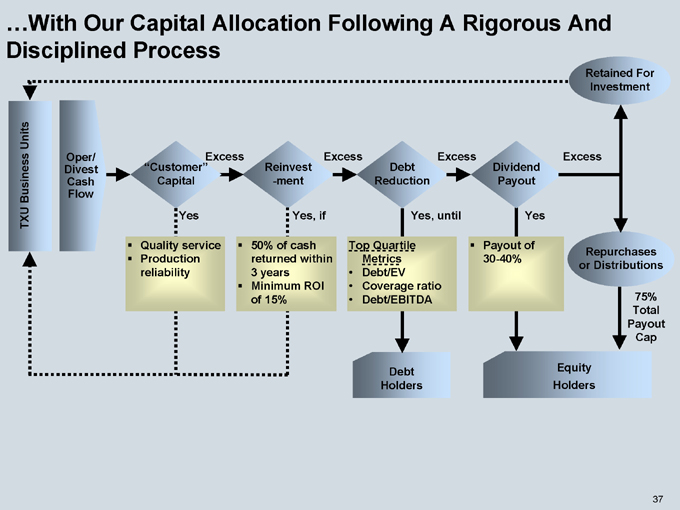

…With Our Capital Allocation Following A Rigorous And Disciplined Process

Retained For Investment

TXU Business Units

Oper/Divest Cash Flow

Excess “Customer” Capital

Reinvestment

Excess

Debt Reduction

Excess

Dividend Payout

Excess

Yes Yes, if Yes, until Yes

Quality service Production reliability

50% of cash returned within 3 years Minimum ROI of 15%

Top Quartile Metrics

Debt/EV Coverage ratio Debt/EBITDA

Payout of 30-40%

Repurchases or Distributions

75% Total Payout Cap

Debt Holders

Equity Holders

37

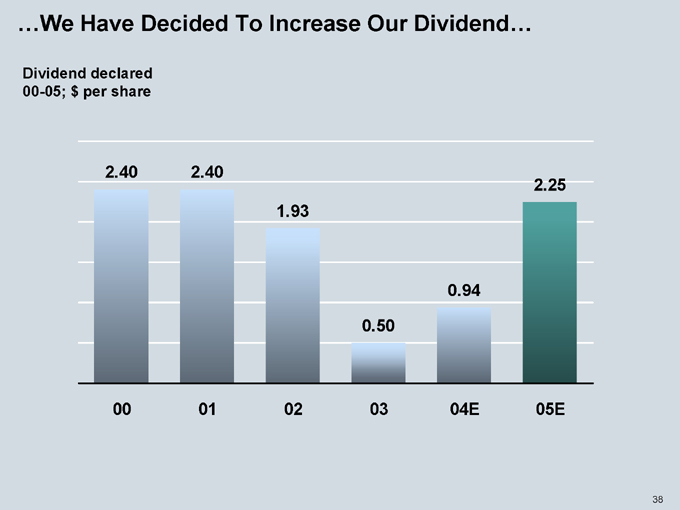

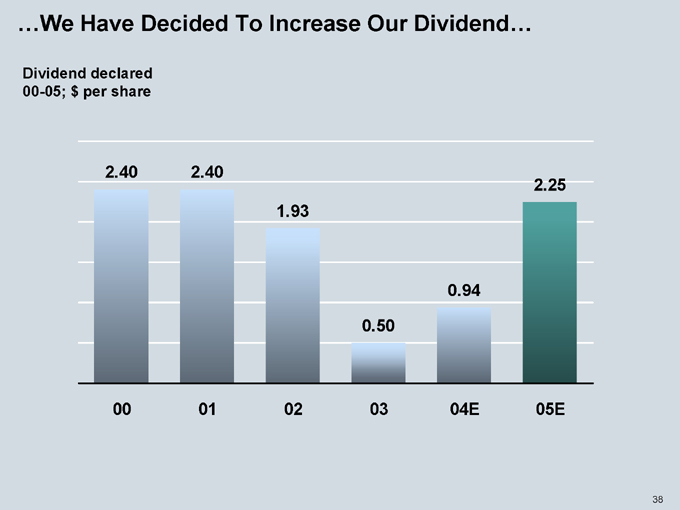

…We Have Decided To Increase Our Dividend…

Dividend declared 00-05; $ per share

2.40 2.40

1.93

0.50

2.25

0.94

00 01 02 03 04E 05E

38

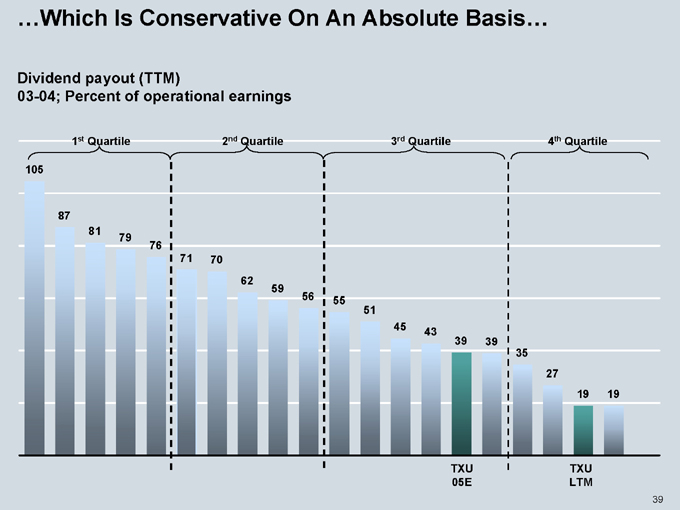

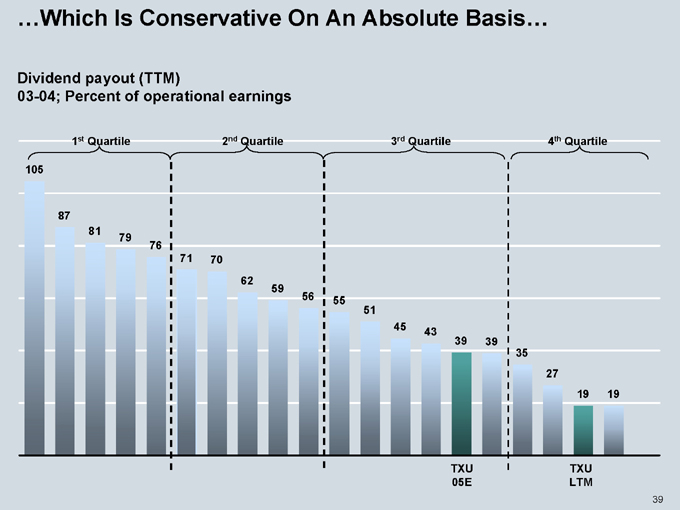

…Which Is Conservative On An Absolute Basis…

Dividend payout (TTM)

03-04; Percent of operational earnings

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

105

87 81 79 76

71 70 62 59

56 55 51

45 43

39 39 35 27

19 19

TXU TXU 05E LTM

39

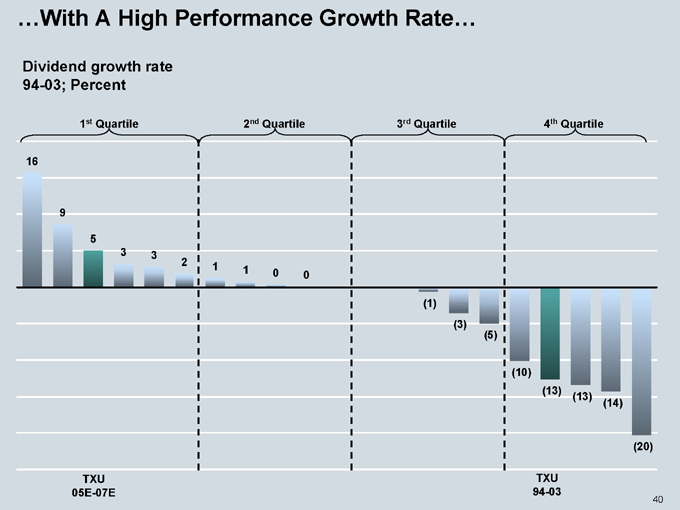

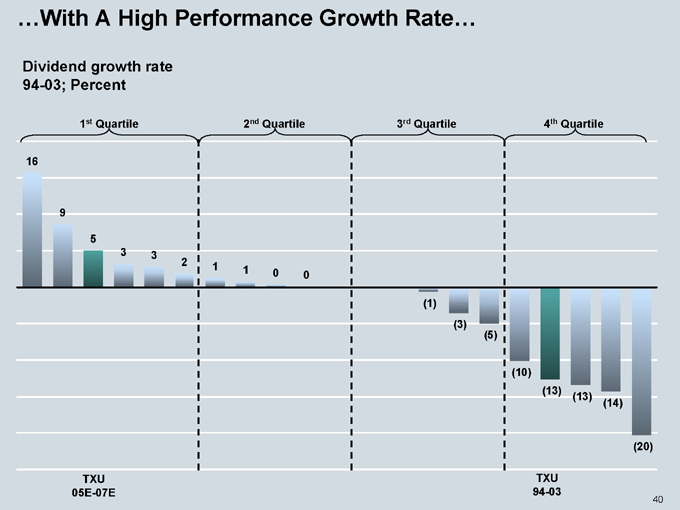

…With A High Performance Growth Rate…

Dividend growth rate 94-03; Percent

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

16

9

5

3

3

2

1

1

0

0

(1)

(3)

(5)

(10)

(13)

(13)

(14)

(20)

TXU TXU

05E-07E 94-03

40

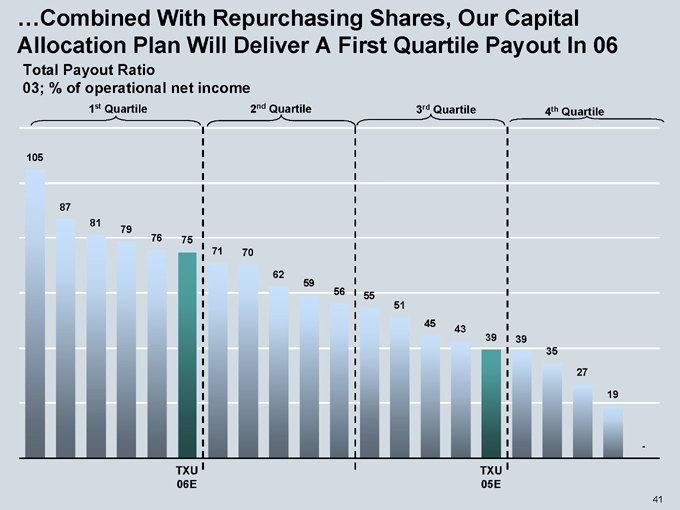

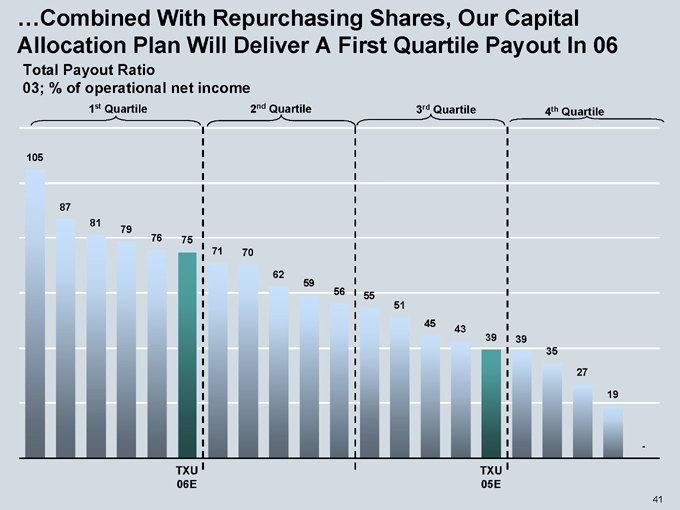

…Combined With Repurchasing Shares, Our Capital Allocation Plan Will Deliver A First Quartile Payout In 06

Total Payout Ratio

03; % of operational net income

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

105

87

81

79

76

75

71

70

62

59

56

55

51

45

43

39

39

35

27

19

-

TXU TXU

06E 05E

41

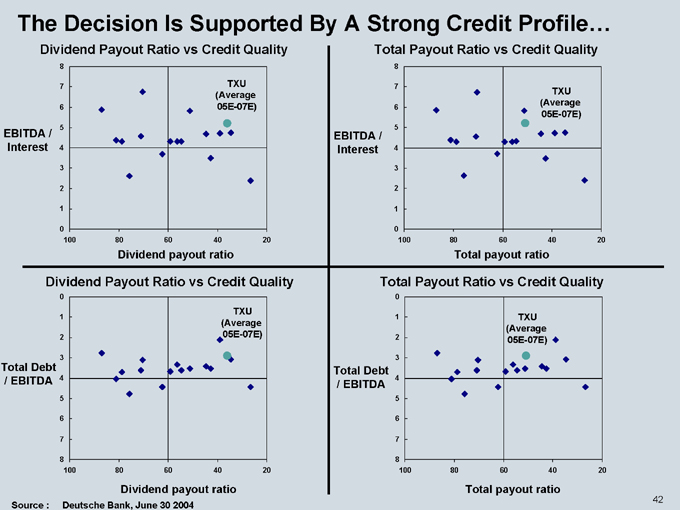

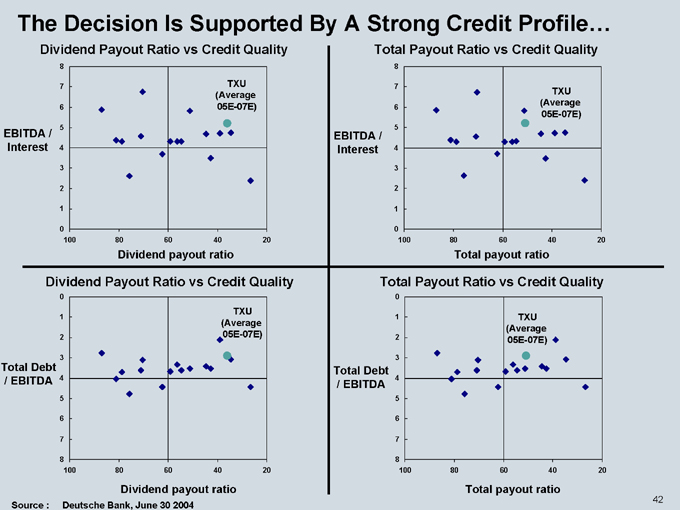

The Decision Is Supported By A Strong Credit Profile…

Dividend Payout Ratio vs Credit Quality

TXU (Average 05E-07E)

EBITDA / Interest

Dividend payout ratio

8

7

6

5

4

3

2

1

0

100 80 60 40 20

Total Payout Ratio vs Credit Quality

TXU (Average 05E-07E)

EBITDA / Interest

Total payout ratio

8

7

6

5

4

3

2

1

0

100 80 60 40 20

Dividend Payout Ratio vs Credit Quality

TXU (Average 05E-07E)

Total Debt / EBITDA

Dividend payout ratio

0

1

2

3

4

5

6

7

8

100 80 60 40 20

Total Payout Ratio vs Credit Quality

TXU (Average 05E-07E)

Total Debt / EBITDA

Total payout ratio

0

1

2

3

4

5

6

7

8

100 80 60 40 20

Source : Deutsche Bank, June 30 2004

42

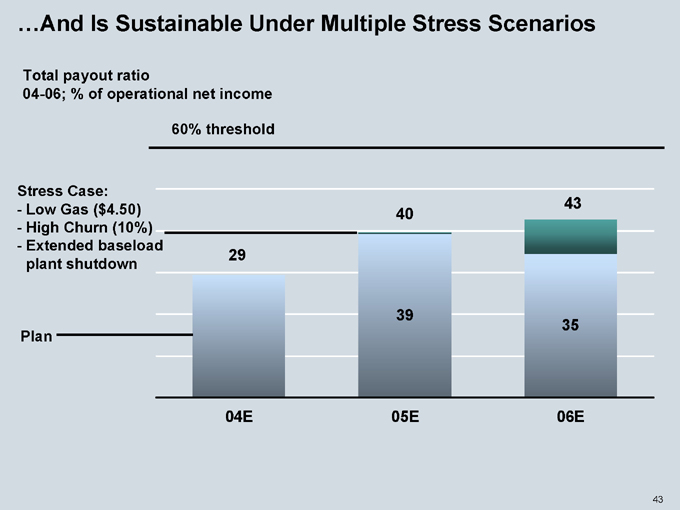

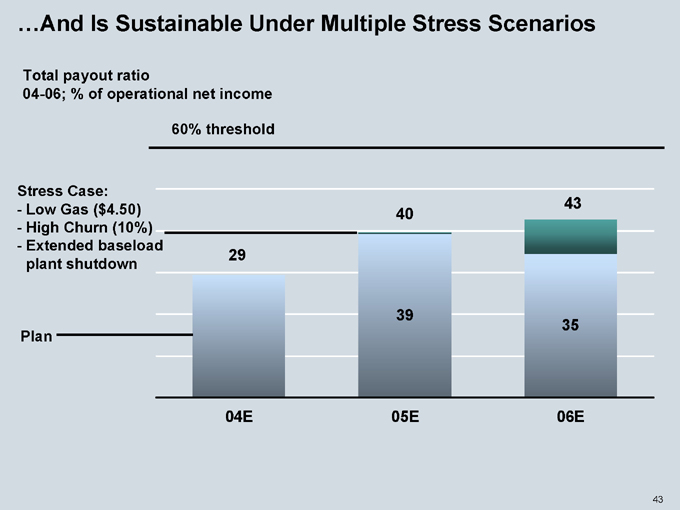

…And Is Sustainable Under Multiple Stress Scenarios

Total payout ratio

04-06; % of operational net income

60% threshold

Stress Case:

Low Gas ($4.50)

High Churn (10%)

Extended baseload plant shutdown

Plan

29 40 43

39 35

04E 05E 06E

43

Today’s Agenda

ERCOT Overview

ERCOT market framework Impact of deregulation

TXU Competitive Positioning

Three phase restructuring impact Capital allocation

Summary

Conclusion

44

TXU: Transformation In Progress

1. Competitive position—Structurally advantaged core businesses in high growth markets with rejuvenated financial profile

2X earnings power

91% increase in cash flow

Double digit ROIC

Top quartile financial flexibility

2. Large upside—$1.2-1.3 billion potential EBIT improvement over the next 3 years relative to 04E

3. Integrated business model—Strong performance under wide range of commodity scenarios

Hedged to gas downside

Ability to capture gas upside

Disciplined capital allocation – Focus on maximizing returns to shareholders

Increased dividend to $2.25 per share

High performance total payout

45

Regulation G Reconciliations

For future periods, TXU is currently unable to estimate the impact of special items or changes in accounting principles or policies on free cash flow, return on invested capital, total debt to capitalization or interest coverage. TXU is therefore currently unable to reconcile the most directly comparable GAAP measure to these items for forecasted periods.

Certain amounts previously reported for the year ended December 31, 2003 have been restated to reflect reporting of TXU Gas and TXU Australia and TXU Energy Company LLC’s cogeneration and wholesale energy sales business in New Jersey as discontinued operations.

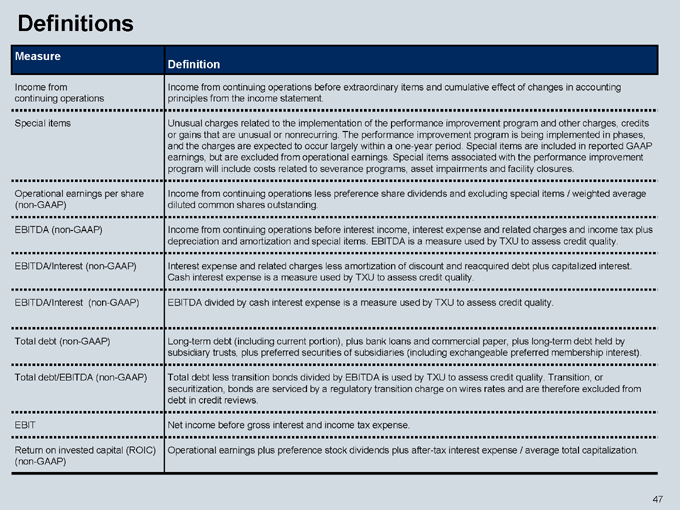

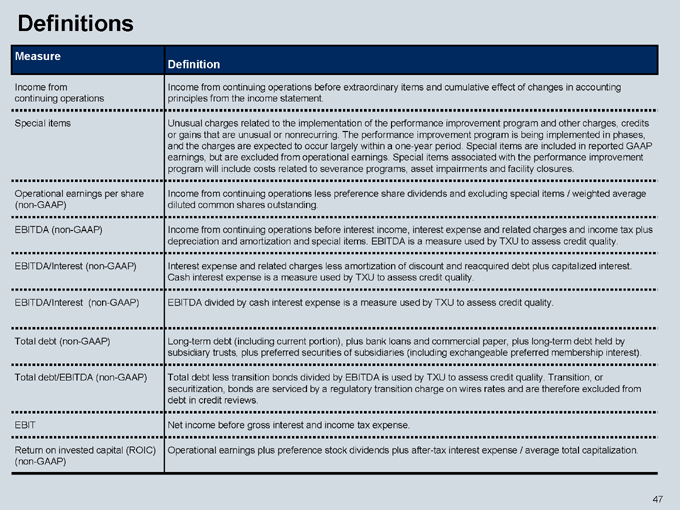

Definitions

Measure Definition

Income from continuing operations

Income from continuing operations before extraordinary items and cumulative effect of changes in accounting principles from the income statement.

Special items

Unusual charges related to the implementation of the performance improvement program and other charges, credits or gains that are unusual or nonrecurring. The performance improvement program is being implemented in phases, and the charges are expected to occur largely within a one-year period. Special items are included in reported GAAP earnings, but are excluded from operational earnings. Special items associated with the performance improvement program will include costs related to severance programs, asset impairments and facility closures.

Operational earnings per share (non-GAAP)

Income from continuing operations less preference share dividends and excluding special items / weighted average diluted common shares outstanding.

EBITDA (non-GAAP)

Income from continuing operations before interest income, interest expense and related charges and income tax plus depreciation and amortization and special items. EBITDA is a measure used by TXU to assess credit quality.

EBITDA/Interest (non-GAAP)

Interest expense and related charges less amortization of discount and reacquired debt plus capitalized interest. Cash interest expense is a measure used by TXU to assess credit quality.

EBITDA/Interest (non-GAAP)

EBITDA divided by cash interest expense is a measure used by TXU to assess credit quality.

Total debt (non-GAAP)

Long-term debt (including current portion), plus bank loans and commercial paper, plus long-term debt held by subsidiary trusts, plus preferred securities of subsidiaries (including exchangeable preferred membership interest).

Total debt/EBITDA (non-GAAP)

Total debt less transition bonds divided by EBITDA is used by TXU to assess credit quality. Transition, or securitization, bonds are serviced by a regulatory transition charge on wires rates and are therefore excluded from debt in credit reviews.

EBIT

Net income before gross interest and income tax expense.

Return on invested capital (ROIC) (non-GAAP)

Operational earnings plus preference stock dividends plus after-tax interest expense / average total capitalization.

47

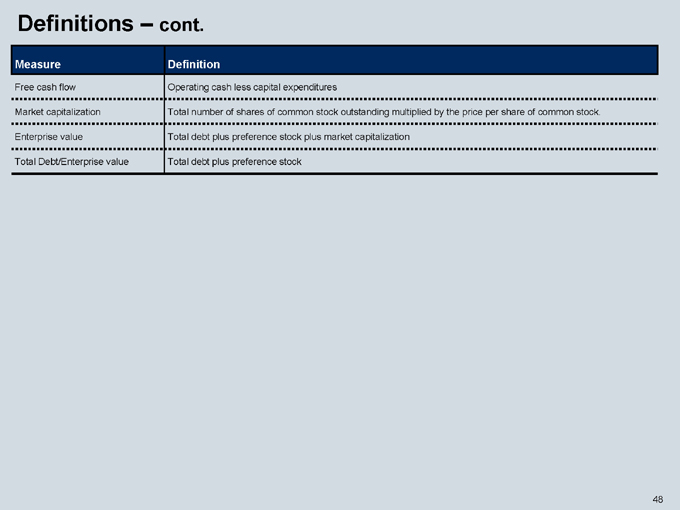

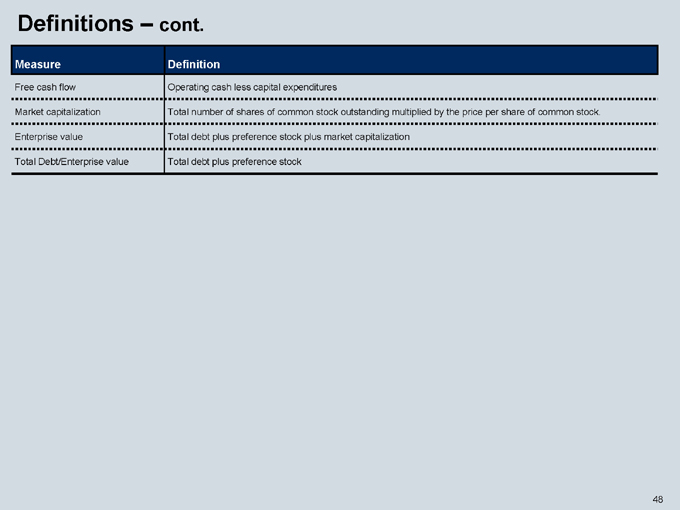

Definitions – cont.

Measure Definition

Free cash flow

Operating cash less capital expenditures

Market capitalization

Total number of shares of common stock outstanding multiplied by the price per share of common stock.

Enterprise value

Total debt plus preference stock plus market capitalization

Total Debt/Enterprise value

Total debt plus preference stock

48

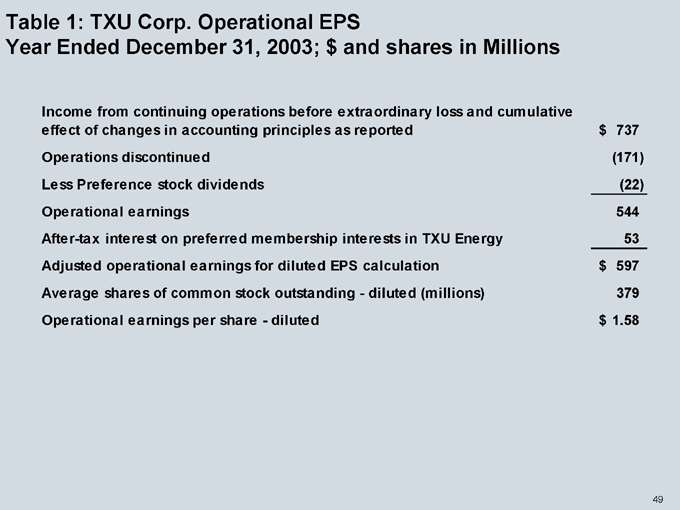

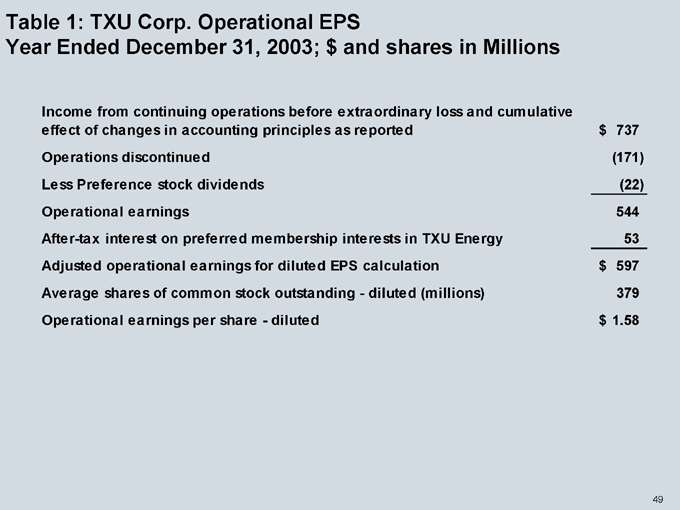

Table 1: TXU Corp. Operational EPS

Year Ended December 31, 2003; $ and shares in Millions

Income from continuing operations before extraordinary loss and cumulative effect of changes in accounting principles as reported $737

Operations discontinued (171)

Less Preference stock dividends (22)

Operational earnings 544

After-tax interest on preferred membership interests in TXU Energy 53

Adjusted operational earnings for diluted EPS calculation $597

Average shares of common stock outstanding—diluted (millions) 379

Operational earnings per share—diluted $1.58

49

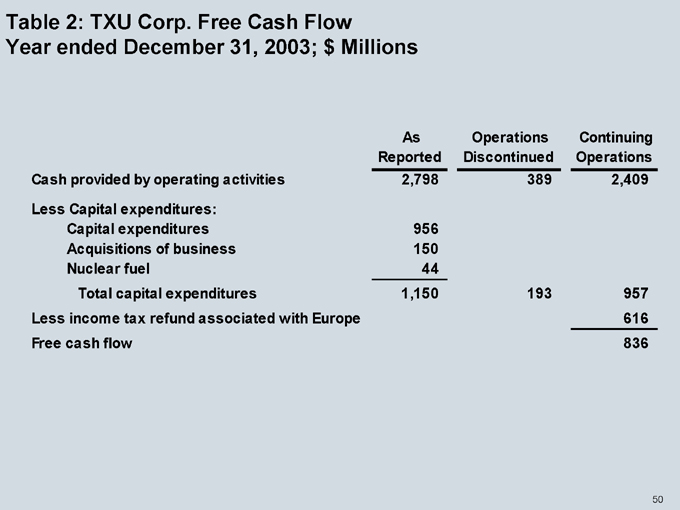

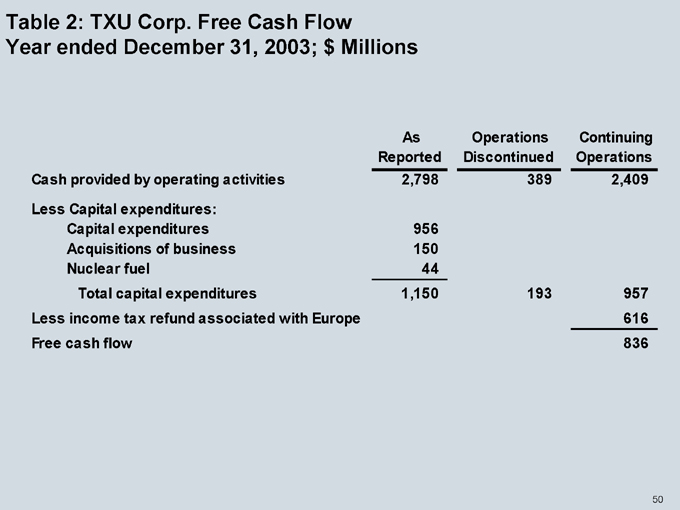

Table 2: TXU Corp. Free Cash Flow

Year ended December 31, 2003; $ Millions

As Reported

Operations Discontinued

Continuing Operations

Cash provided by operating activities 2,798 389 2,409

Less Capital expenditures:

Capital expenditures 956

Acquisitions of business 150

Nuclear fuel 44

Total capital expenditures 1,150 193 957

Less income tax refund associated with Europe 616

Free cash flow 836

50

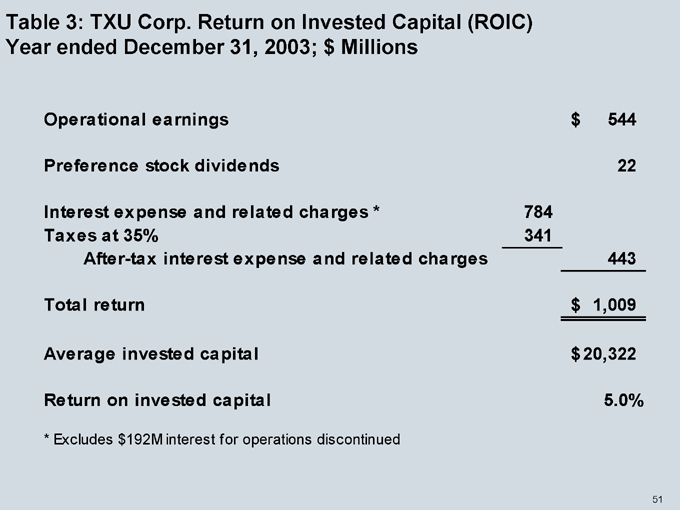

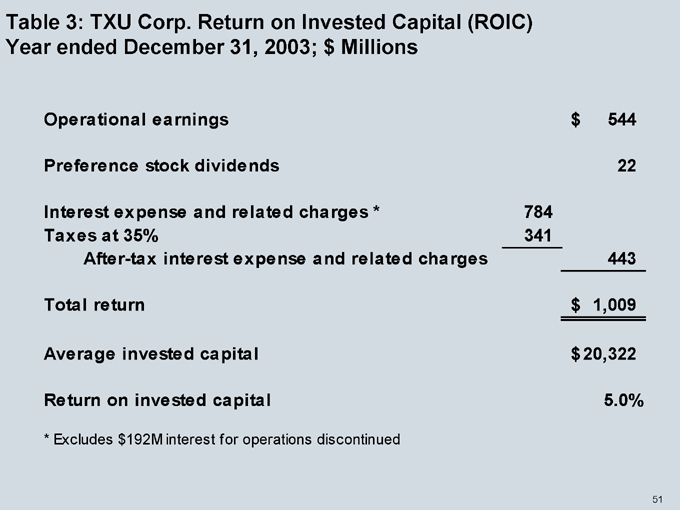

Table 3: TXU Corp. Return on Invested Capital (ROIC)

Year ended December 31, 2003; $ Millions

Operational earnings $544

Preference stock dividends 22

Interest expense and related charges * 784

Taxes at 35% 341

After-tax interest expense and related charges 443

Total return $1,009

Average invested capital $20,322

Return on invested capital 5.0%

* Excludes $192M interest for operations discontinued

51

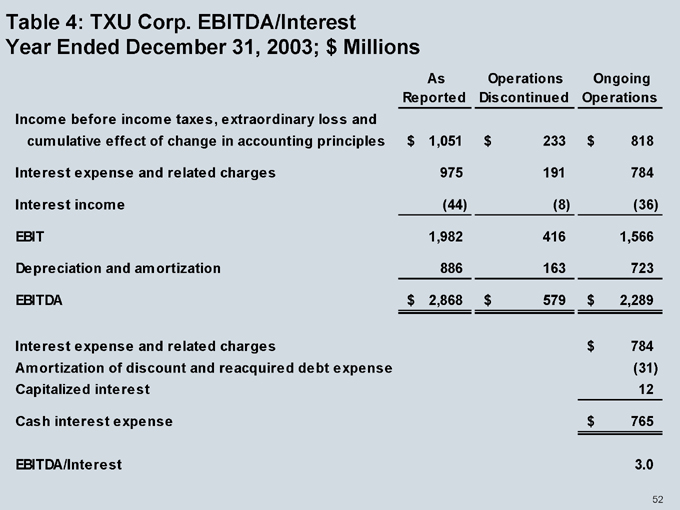

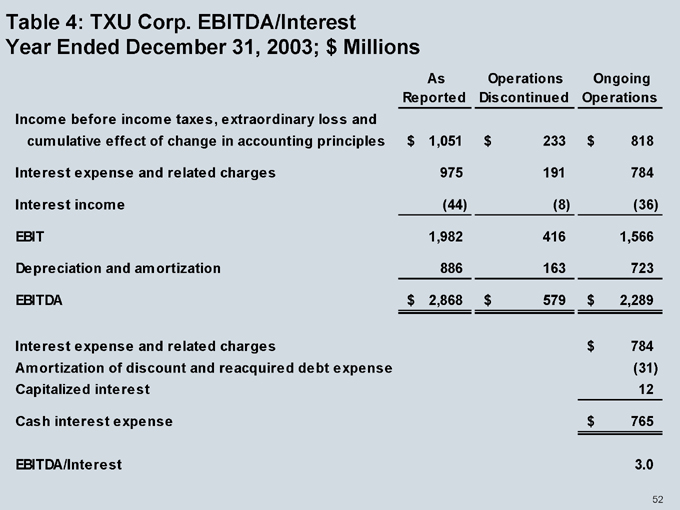

Table 4: TXU Corp. EBITDA/Interest

Year Ended December 31, 2003; $ Millions

As

Reported

Operations

Discontinued

Ongoing

Operations

Income before income taxes, extraordinary loss and cumulative effect of change in accounting principles $1,051 $233 $818

Interest expense and related charges 975 191 784

Interest income (44) (8) (36)

EBIT 1,982 416 1,566

Depreciation and amortization 886 163 723

EBITDA $2,868 $ 579 $ 2,289

Interest expense and related charges $784

Amortization of discount and reacquired debt expense (31)

Capitalized interest 12

Cash interest expense $765

EBITDA/Interest 3.0

52

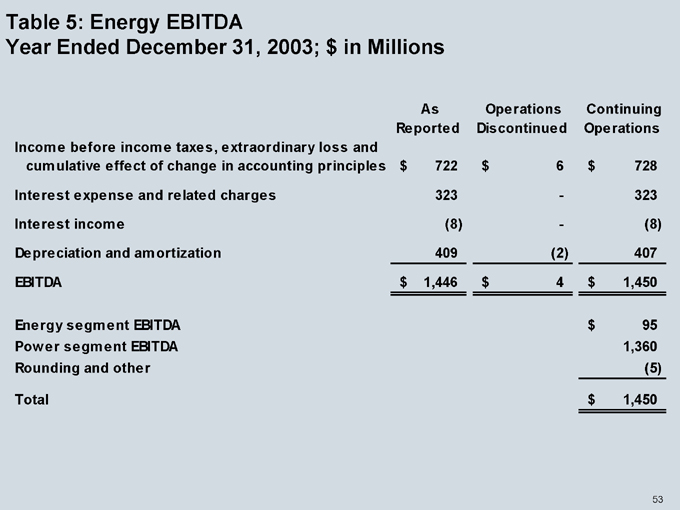

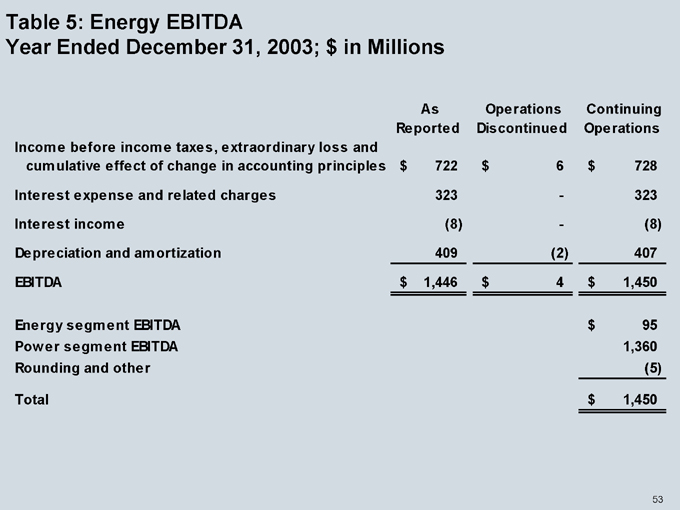

Table 5: Energy EBITDA

Year Ended December 31, 2003; $ in Millions

As Reported

Operations Discontinued

Continuing Operations

Income before income taxes, extraordinary loss and cumulative effect of change in accounting principles $722 $6 $728

Interest expense and related charges 323—323

Interest income (8)—(8)

Depreciation and amortization 409 (2) 407

EBITDA $1,446 $4 $1,450

Energy segment EBITDA $95

Power segment EBITDA 1,360

Rounding and other (5)

Total $1,450

53

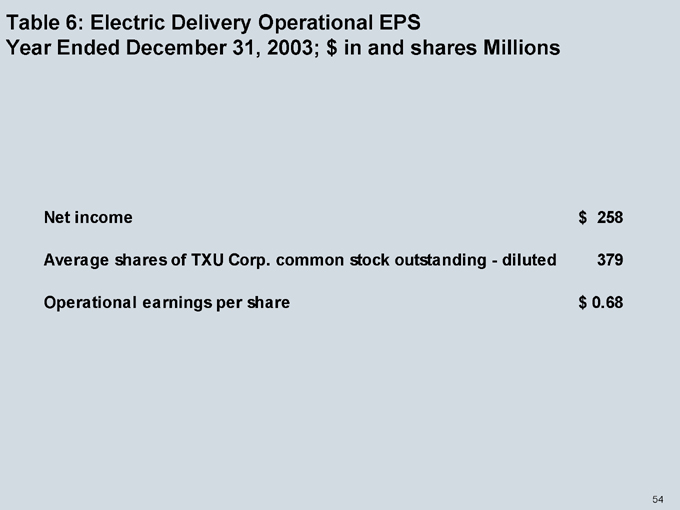

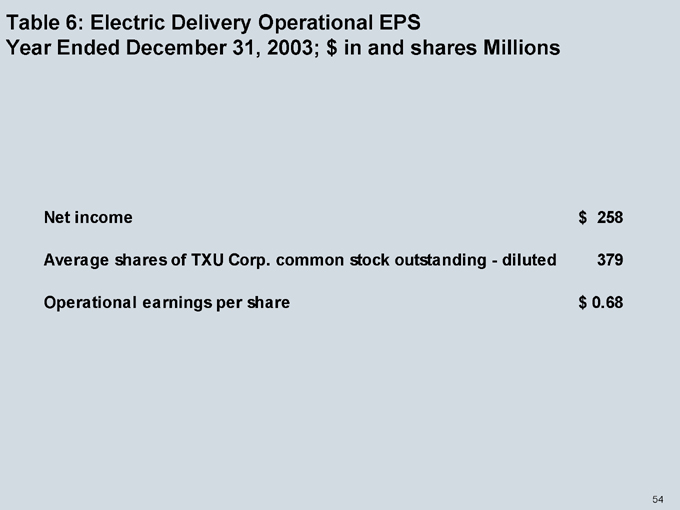

Table 6: Electric Delivery Operational EPS

Year Ended December 31, 2003; $ in and shares Millions

Net income $258

Average shares of TXU Corp. common stock outstanding—diluted 379

Operational earnings per share $0.68

54

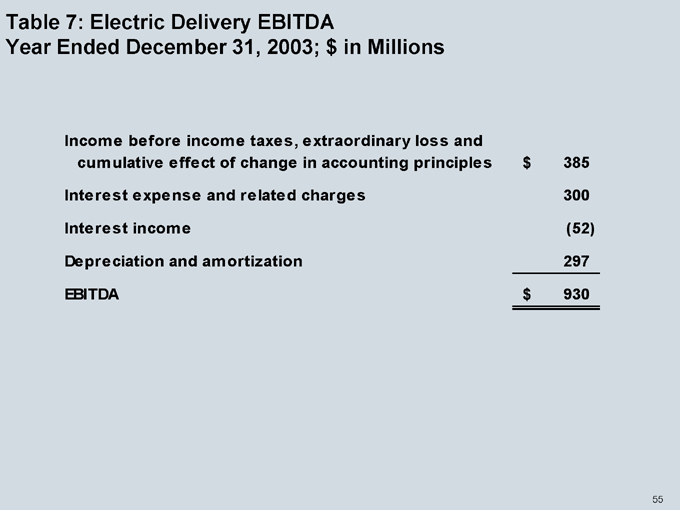

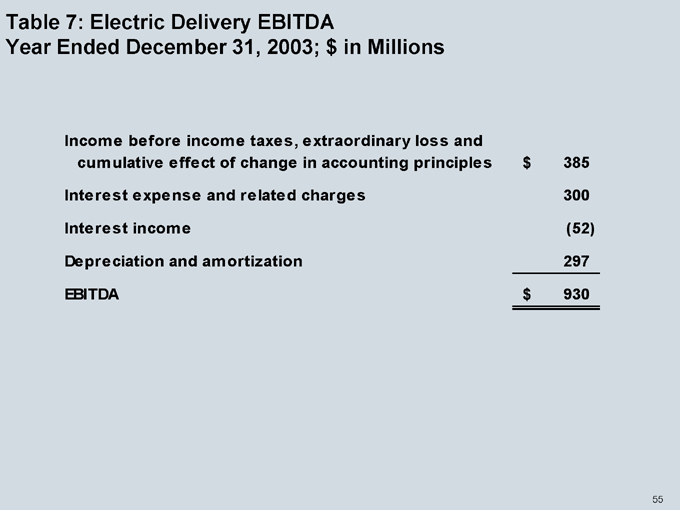

Table 7: Electric Delivery EBITDA

Year Ended December 31, 2003; $ in Millions

Income before income taxes, extraordinary loss and cumulative effect of change in accounting principles $385

Interest expense and related charges 300

Interest income (52)

Depreciation and amortization 297

EBITDA $930

55

Table 8: TXU Corp. Total debt/EBITDA

Year Ended December 31, 2003; $ Millions

Total debt 12,090

EBITDA 2,289

Total debt/EBITDA 5.3

56

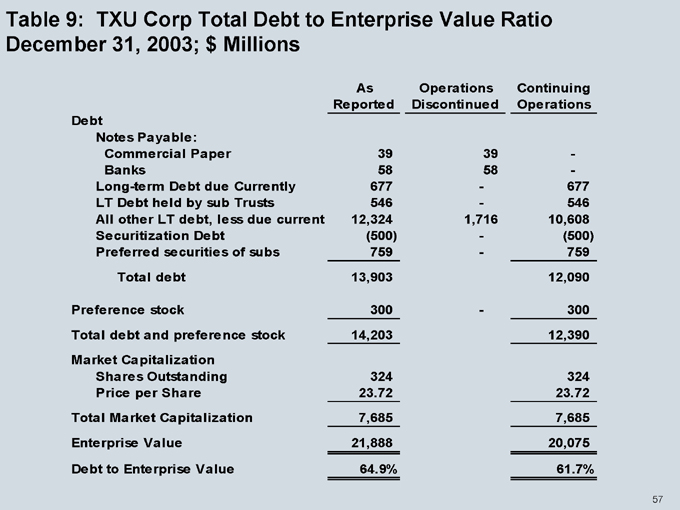

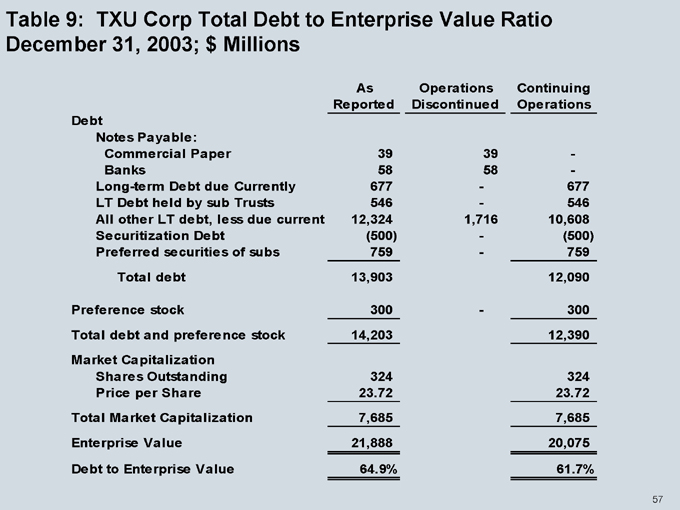

Table 9: TXU Corp Total Debt to Enterprise Value Ratio

December 31, 2003; $ Millions

As Reported

Operations Discontinued

Continuing Operations

Debt

Notes Payable:

Commercial Paper 39 39 -

Banks 58 58 -

Long-term Debt due Currently 677—677

LT Debt held by sub Trusts 546—546

All other LT debt, less due current 12,324 1,716 10,608

Securitization Debt (500)—(500)

Preferred securities of subs 759—759

Total debt 13,903 12,090

Preference stock 300—300

Total debt and preference stock 14,203 12,390

Market Capitalization

Shares Outstanding 324 324

Price per Share 23.72 23.72

Total Market Capitalization 7,685 7,685

Enterprise Value 21,888 20,075

Debt to Enterprise Value 64.9% 61.7%

57