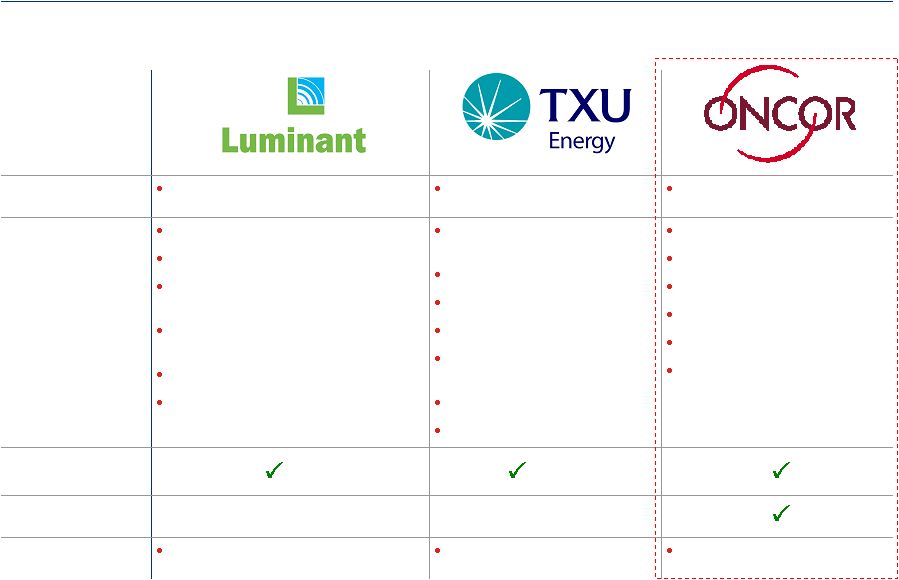

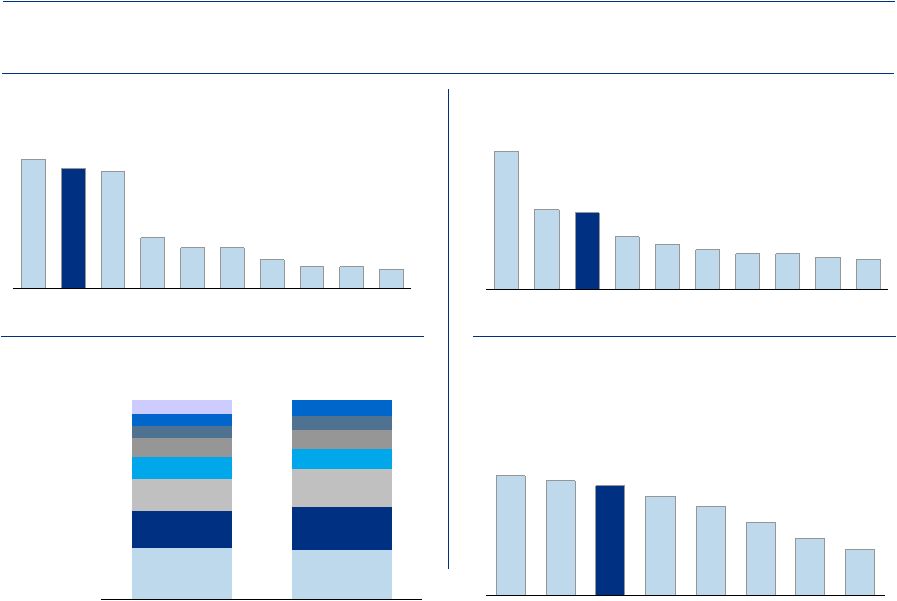

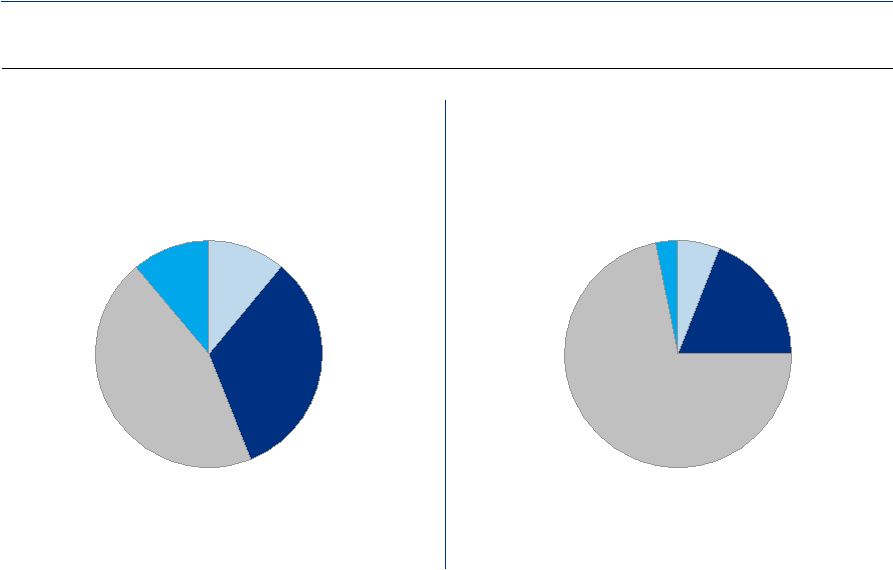

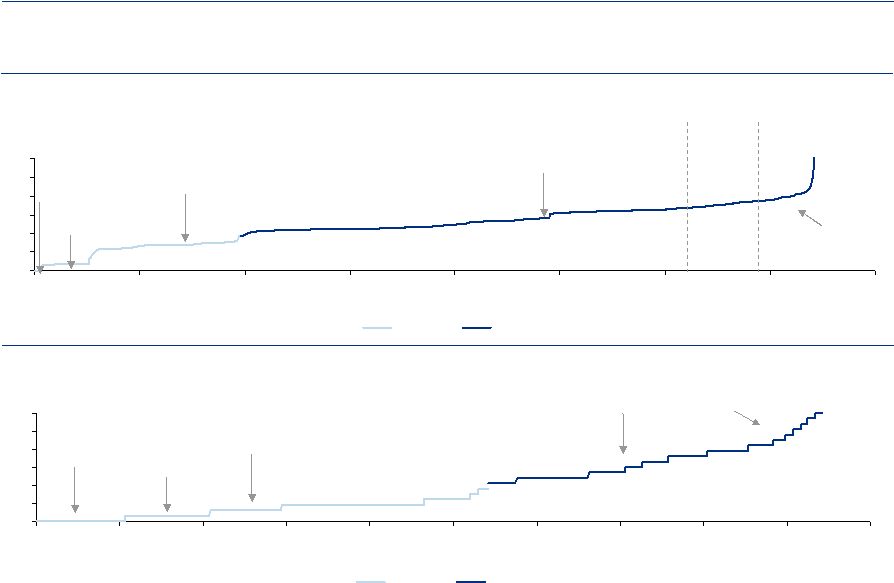

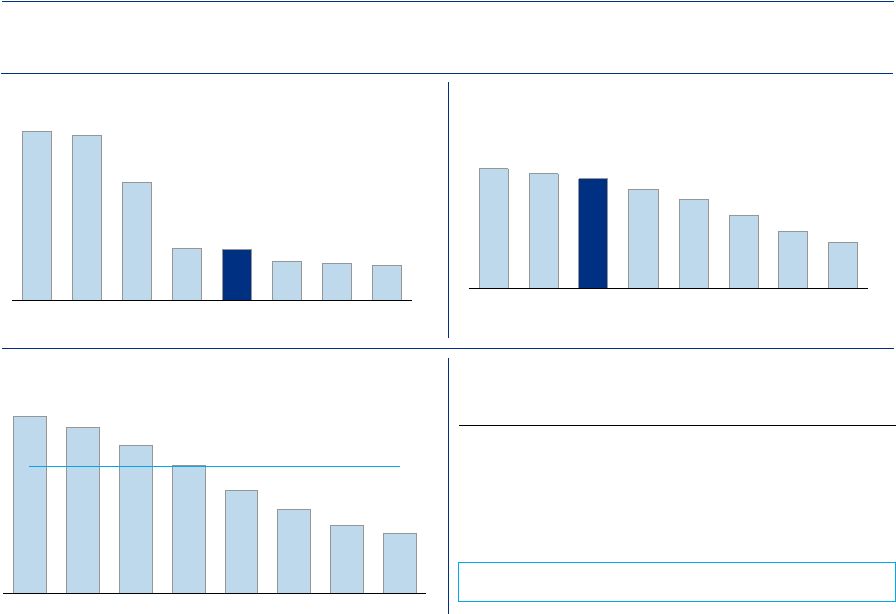

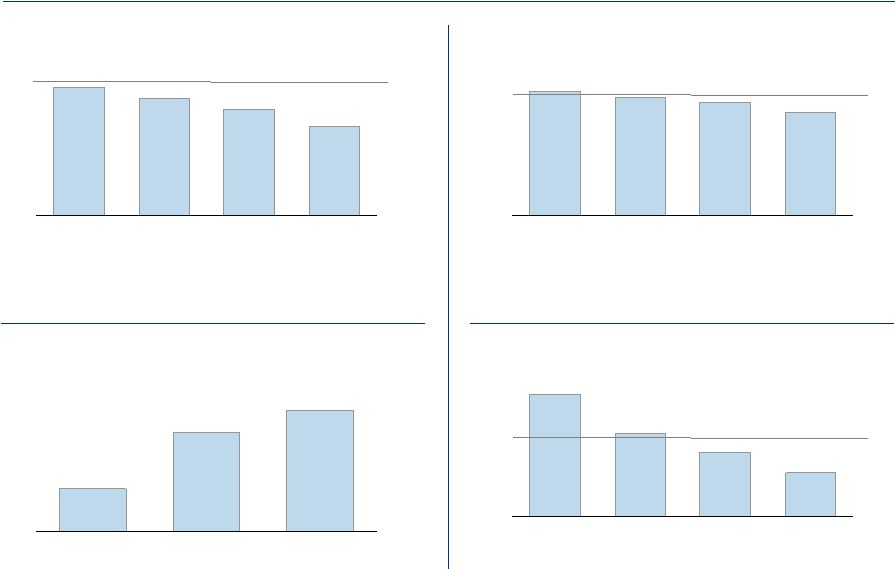

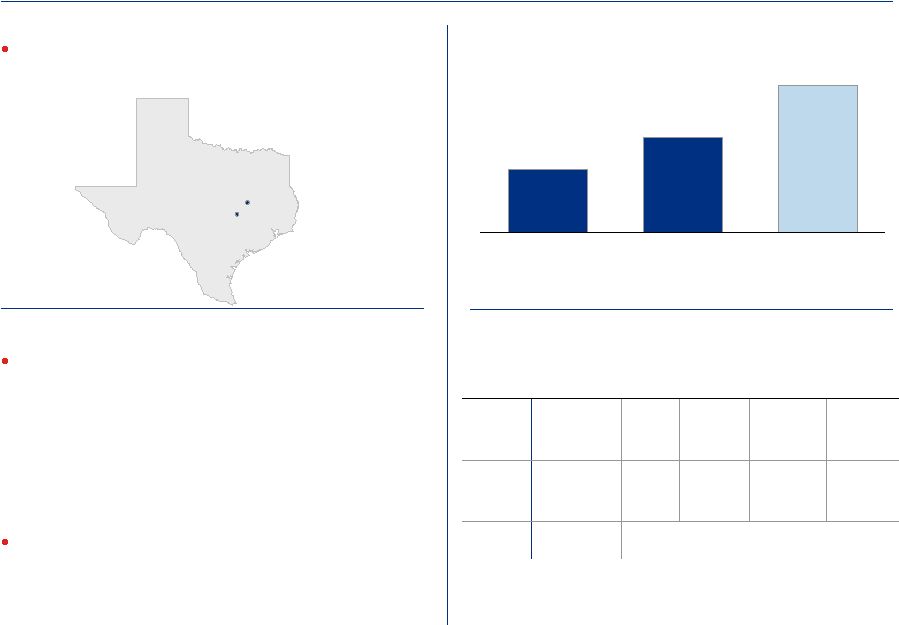

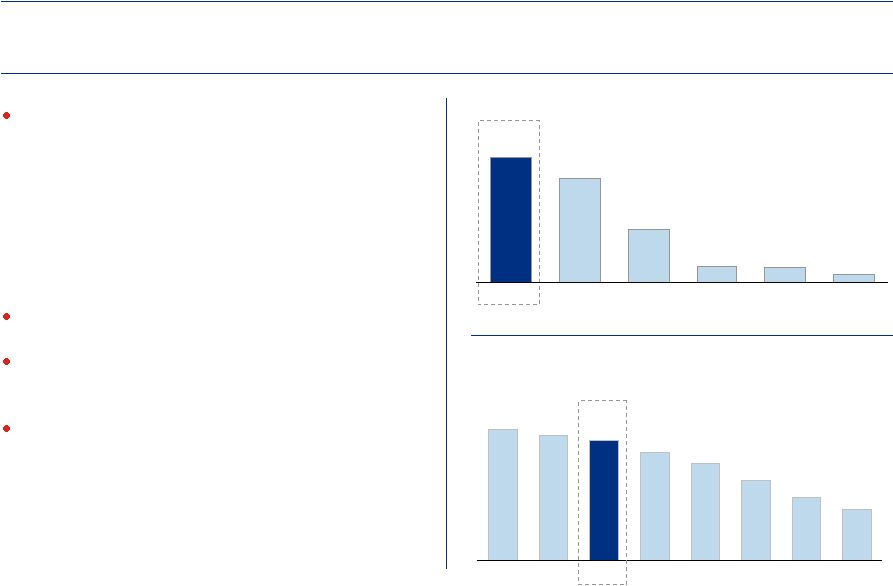

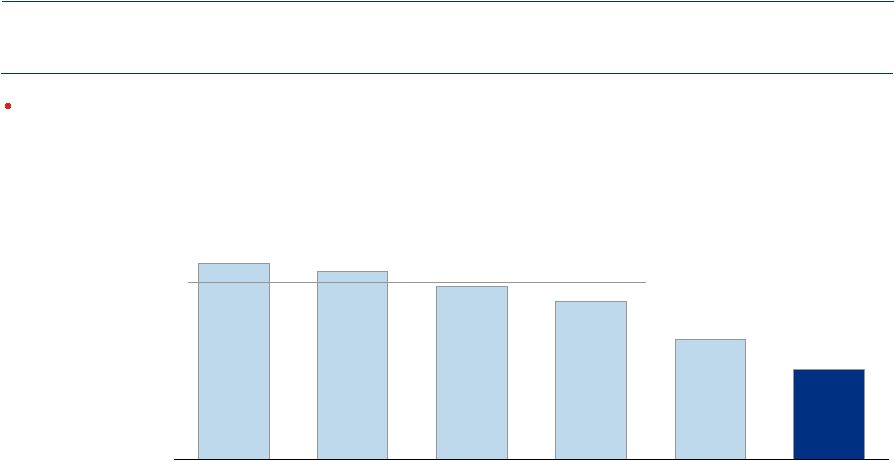

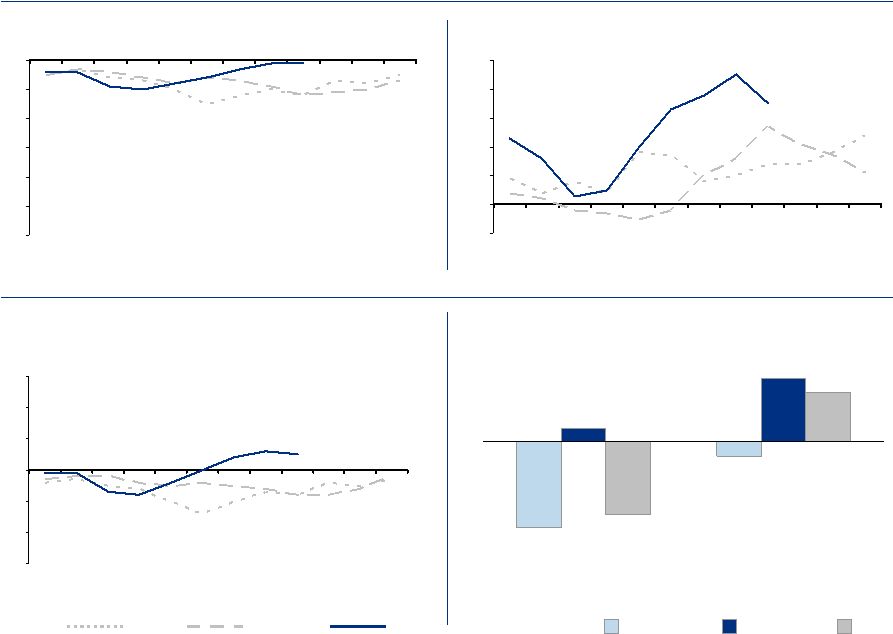

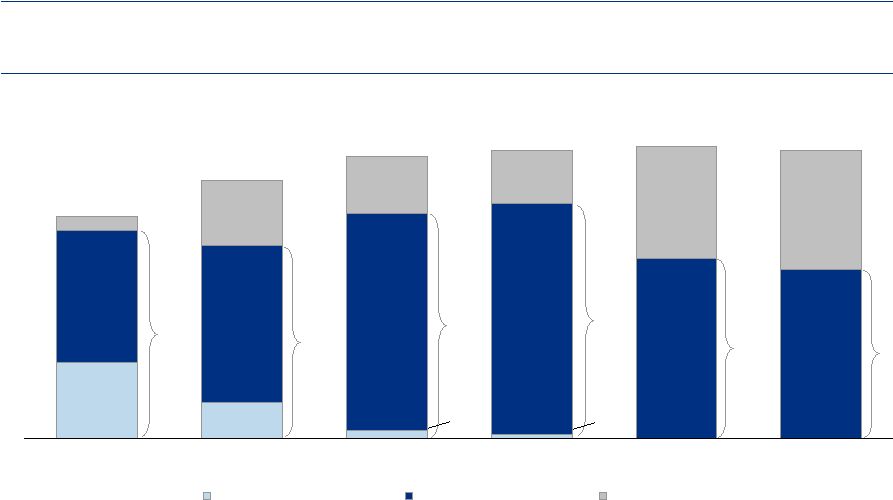

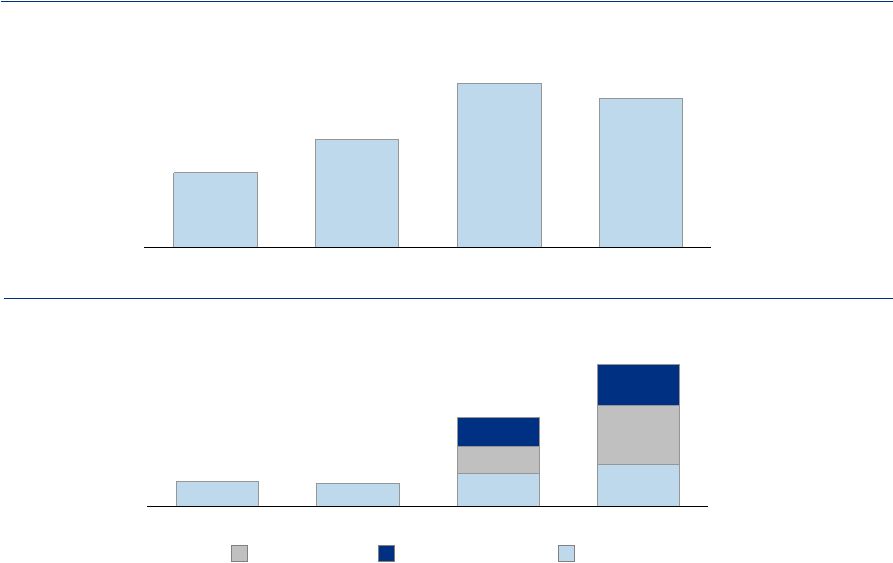

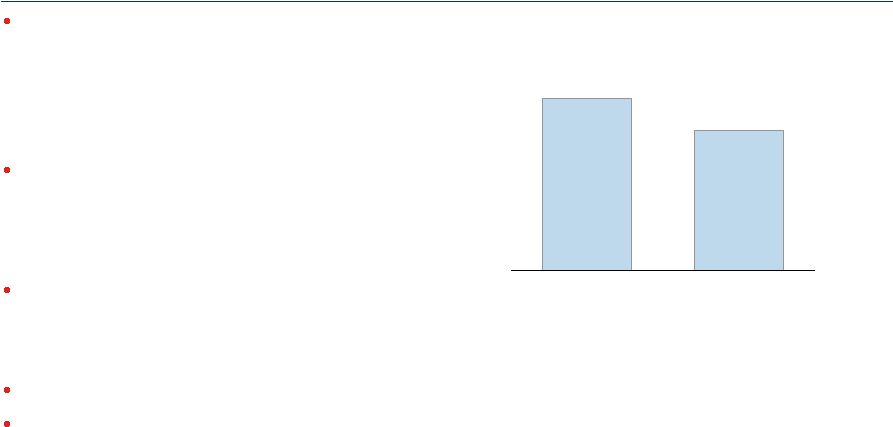

6 Investment Rationale TCEH is well positioned to capitalize on the strong underlying fundamentals in the Texas electricity markets. Attractive Generation Supply / Demand Outlook Strong regional demand growth of 2.0% to 2.5% per year Further tightening of reserve margins, requiring completion of pending facilities and further development of alternative solutions such as DSM and new generation technologies – Coal and nuclear capacity additions impacted by long development lead times and siting, permitting and environmental issues Gas generation expected to remain on the margin Attractive Underlying Commodity Outlook (i.e., Natural Gas) Marginal North American gas expected from Rockies and Appalachia; not LNG Substantial escalation of E&P drilling and services costs continues to increase cost of marginal North American gas supply Political and environmental forces increasing demand for natural gas fueled power generation Attractive Retail Market Dynamics Long-term demand growth of 2.0% to 2.5% Competitive pricing and differentiated service expected to improve customer retention Luminant Largest baseload generator in Texas Additional baseload units currently under construction will add over 2,200 MW of low-cost baseload capacity Substantial hedging program (~75% of natural gas position hedged through 2013 (1) ) expected to enhance cash flow stability Track record of top decile performance and reliability on a national basis A wholesale business supporting the largest generation fleet in ERCOT TXU Energy Large scale competitive retailer with strong incumbent position in the Dallas / Ft. Worth market Strong brand recognition and superior service Constructive market fundamentals driven by population growth in key markets Opportunity for significant out-of-territory growth (primarily in Houston and South Texas) (1) Includes impact of estimated short position associated with fixed price contracts and other retail activities. |